财务管理第14章习题及答案

(财务管理案例)财务管理案例解析及参考答案

(财务管理案例)财务管理案例解析及参考答案教师手册:案例解析及参考答案目录第1章 (1)第2章 (3)第3章 (6)第4章 (8)第5章 (9)第6章 (11)第7章 (12)第8章 (15)第9章 (16)第10章 (23)第11章 (26)第12章 (28)第13章 (30)第14章 (32)第15章 (35)第16章 (37)第17章 (38)第18章 (40)第19章 (40)第20章 (42)第21章 (43)第1章案例参考答案:财务管理是企业管理中的重要组成部分,贯穿于企业的生产、销售、经营等每个角落,通过对资金活动及其形成的财务关系进行调节,从而保证企业业务的正常开展、不断改进、实现企业价值最大的目标。

对于本案例的分析如下:1.案例中出现的问题:①财务人员素质不高。

在刘明理找财务处长谈话时,想了解厂里的财务情况与数据,结果身为财务处长还没有讲清楚企业的财务状况,表明财务经理在财务管理中的作用没有充分发挥;通过解读整个案例,显示企业的财务管理很混乱,没有实现财务管理以企业资金运动为重点,对资金取得和有效使用的管理工作。

②财务人员对工作有怨言。

在刘明理找财务处长了解情况时,财务处长发牢骚说到:工厂待遇低,财务处没有福利,财务人员每天工作非常繁忙,有时还要加班,但是却没有相应的奖励;同时财务人员每天要遭受许多埋怨,工厂各个部门对财务处的工作都不满意,经常在厂长办公会上受到批评;案例的最后还提到,一些大学生在一年的实习期后就全部跳槽了,也体现出他们对工作的不满意。

③财务决策不科学。

刘明理在面对账面只有600万元资金,而要解决1800万的申请时,采取的是给5个部门的主管副厂长打电话,核实资金需求的迫切程度,并在600万元的限度内支付了590万元的资金,只留下了10万元资金预备急需。

事实上,企业资金的分配不能只按需求的迫切程度来进行划分,应该运用财务的相关知识进行核算,而且只留下了10万元资金预备急需是相当不合理的。

基础会计第14章题和答案

基础会计第14章题和答案第一章一、填空题1.“基础会计”是介绍会计的()的课程。

答:基本理论基础知识基本方法2.在()多年以前的中国奴隶主王朝——周朝,奴隶主曾设置()一职,负责对每月生活物资的记录与汇总事宜,并进行财物的管理。

答:答:2000―司会‖3.意大利数学家卢卡·巴其阿勒(LucaPacioli)在()一书中,曾系统地介绍了复式记账方法。

答:答:1494年《算术、几何、比及比例概要》4.()年,世界第一个会计师协会——()的成立是会计从私人(企业)核算领域向公共领域发展的重要标志。

答:答:1854英国爱丁堡会计师公会5.现代会计阶段的重要特点可归纳为:计算机代替了手工记账;()成为会计的两个重要的分支。

答:答:财务会计与管理会计6.会计对象就是()过程。

答:答:企业的资金及其运动7.所谓职能是指(),会计的基本职能是()。

答:答:事物的客观功用反映与监督8.会计人员身处经济工作的最前沿,其监督具有最直接的特征,包括对()、()及()的监督。

答:答:事前事中事后9.对大中型企业来说,可以设置()岗位,国有或国有资产占控股地位或主导地位的大中型企业必须设置总会计师,以统管财务会计工作。

答:答:总会计师(或财务总监)10.企业会计人员从事的工作主要包括(),(),(),(),()等方面。

答:答:会计制度的设计确定企业采用的会计政策进行会计核算账账核对、账证核对及账实核对建立内部审计制度11.会计法、()、()等法规、制度是会计规范的主要表现形式。

答:答:会计准则会计制度12.会计核算的基本前提包括()、()、()和()。

答:答:会计主体持续经营会计分期货币计量13.我国的会计准则包括()和()。

答:答:基本会计准则具体会计准则14.会计人员的职责主要包括()、()、()、()、()、()和自觉参加在职继续教育,不断提高思想与业务素质、提高会计工作水平。

答:答:依法如实进行会计核算实行会计监督拟订本单位会计事务处理的具体办法参与拟订经济计划和业务计划编制预算和财务计划并考核分析其执行计划15.会计原则中用来指导会计要素确认和计量的原则主要有()、()、()、()。

财务管理课后习题答案

第二章练习题1.某公司需要用一台设备,买价为9000元,可用8年。

如果租用,那么每年年初需付租金1500元。

假设利率为8%要求:试决定企业应租用还是购置该设备。

解:用先付年金现值计算公式计算8年租金的现值得:V0 = A×PVIFA i,n×〔1 + i〕= 1500×PVIFA8%,8×〔1 + 8%〕= 1500×5.747×〔1 + 8%〕= 9310.14〔元〕因为设备租金的现值大于设备的买价,所以企业应该购置该设备。

2.某企业全部用银行贷款投资兴建一个工程工程,总投资额为5000万元,假设银行借款利率为16%。

该工程当年建成投产。

请答复:1〕该工程建成后投资,分八年等额归还银行借款,每年年末应还多少?2〕假设该工程建成投产后,每年可获净利1500万元,全部用来归还借款的本息,需要多少年才能还清?解:〔1〕查PVIFA表得:PVIFA16%,8。

由PV A n = A·PVIFA i,n得:A = PV A n/PVIFA i,n= 1151.01〔万元〕所以,每年应该还1151.01万元。

〔2〕由PV A n = A·PVIFA i,n得:PVIFA i,n =PV A n/A那么PVIFA16%,n查PVIFA表得:PVIFA16%,5 = 3.274,PVIFA16%,6 = 3.685,利用插值法:年数年金现值系数由以上计算,解得:n = 5.14〔年〕 所以,需要5.14年才能还清贷款。

4. 李东今年30岁,距离退休还有30年。

为使自己在退休后仍然享有现在的生活水平,李东认为退休当年年末他必须攒够至少70万元的存款。

假设年利率是10%,为此达成目标,从现在起的每年年末李东需要存入多少钱?5. 张平于1月1日从银行贷款10万元,合同约定分4年还清,每年年末等额付款。

要求:〔1〕假设年利率为8%,计算每年年末分期付款额 ; 〔2〕计算并填写下表10000a 8000 =a-8000 =10000-(a-8000)a b=(10000-(a-8000))*0.08 =a-b c=1000-(a-8000)-(a-b)a d=c*0.08 =a-d e=c-(a-d)a e*0.08 a-e*0.08 0=e-(a-e*0.08)假设分期付款额是a ,可以列出以上等式。

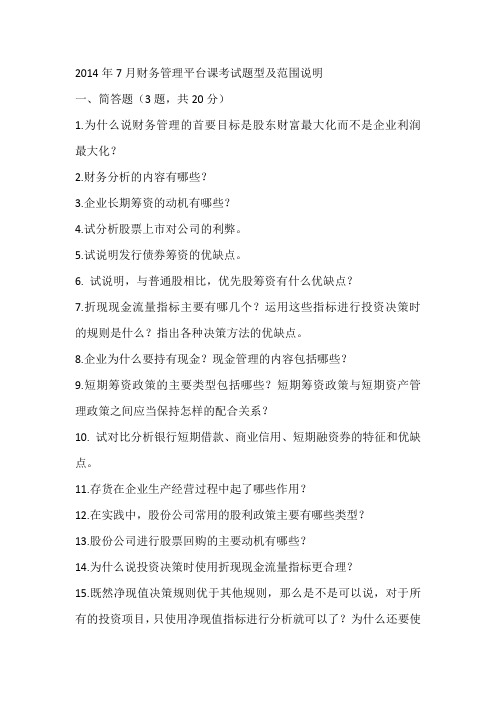

第14章 2014年7月财务管理平台课考试题型及范围说明

2014年7月财务管理平台课考试题型及范围说明一、简答题(3题,共20分)1.为什么说财务管理的首要目标是股东财富最大化而不是企业利润最大化?2.财务分析的内容有哪些?3.企业长期筹资的动机有哪些?4.试分析股票上市对公司的利弊。

5.试说明发行债券筹资的优缺点。

6. 试说明,与普通股相比,优先股筹资有什么优缺点?7.折现现金流量指标主要有哪几个?运用这些指标进行投资决策时的规则是什么?指出各种决策方法的优缺点。

8.企业为什么要持有现金?现金管理的内容包括哪些?9.短期筹资政策的主要类型包括哪些?短期筹资政策与短期资产管理政策之间应当保持怎样的配合关系?10. 试对比分析银行短期借款、商业信用、短期融资券的特征和优缺点。

11.存货在企业生产经营过程中起了哪些作用?12.在实践中,股份公司常用的股利政策主要有哪些类型?13.股份公司进行股票回购的主要动机有哪些?14.为什么说投资决策时使用折现现金流量指标更合理?15.既然净现值决策规则优于其他规则,那么是不是可以说,对于所有的投资项目,只使用净现值指标进行分析就可以了?为什么还要使用获利指数和内含报酬率指标?二、单项选择题(12题,18分)三、判断题(12题,18分)四、计算分析题(4-5题,44分)1、风险、风险价值及其相关计算(离散系数、贝塔)2、个别资金成本、杠杆系数、资本结构决策3、设备更新决策、缩短投资期决策4、短期资金成本5、股利政策备注:1、考试内容不涉及本书第4章、第8章的8.3和8.4、第12章、第13章。

2、各题型的分值为大约分值,可能会有所调整(幅度不大),具体见试卷。

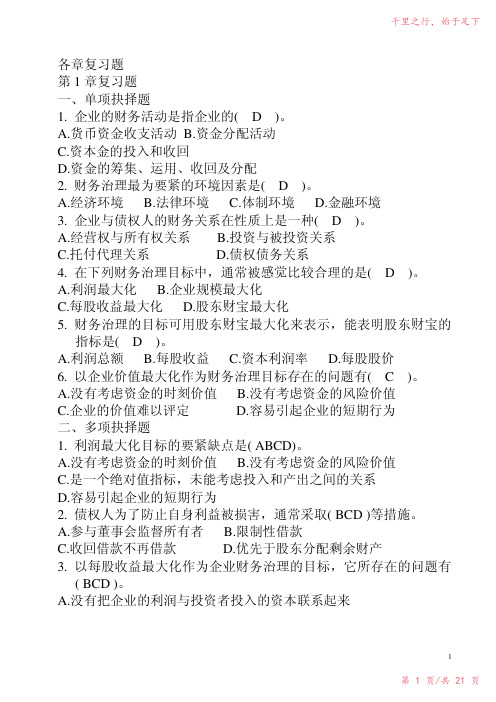

财务管理复习题(附答案)2023年修改整理

各章复习题第1章复习题一、单项抉择题1. 企业的财务活动是指企业的( D )。

A.货币资金收支活动B.资金分配活动C.资本金的投入和收回D.资金的筹集、运用、收回及分配2. 财务治理最为要紧的环境因素是( D )。

A.经济环境B.法律环境C.体制环境D.金融环境3. 企业与债权人的财务关系在性质上是一种( D )。

A.经营权与所有权关系B.投资与被投资关系C.托付代理关系D.债权债务关系4. 在下列财务治理目标中,通常被感觉比较合理的是( D )。

A.利润最大化B.企业规模最大化C.每股收益最大化D.股东财宝最大化5. 财务治理的目标可用股东财宝最大化来表示,能表明股东财宝的指标是( D )。

A.利润总额B.每股收益C.资本利润率D.每股股价6. 以企业价值最大化作为财务治理目标存在的问题有( C )。

A.没有考虑资金的时刻价值B.没有考虑资金的风险价值C.企业的价值难以评定D.容易引起企业的短期行为二、多项抉择题1. 利润最大化目标的要紧缺点是( ABCD)。

A.没有考虑资金的时刻价值B.没有考虑资金的风险价值C.是一个绝对值指标,未能考虑投入和产出之间的关系D.容易引起企业的短期行为2. 债权人为了防止自身利益被损害,通常采取( BCD )等措施。

A.参与董事会监督所有者B.限制性借款C.收回借款不再借款D.优先于股东分配剩余财产3. 以每股收益最大化作为企业财务治理的目标,它所存在的问题有( BCD )。

A.没有把企业的利润与投资者投入的资本联系起来B.没有把企业猎取的利润与所承担的风险联系起来C.没有考虑资金时刻价值因素D.容易诱发企业经营中的短期行为4. 对企业财务治理而言,下列因素中的( ABD )只能加以适应和利用,但不能改变它。

A.国家的经济政策B.金融市场环境C.企业经营规模D.国家的财务法规三、推断题( ×) 1. 股东财宝最大化目标考虑了众多相关利益主体的不同利益。

财务管理随堂练习题及答案(完整版)

第一章总论本次练习有17题,你已做17题,已提交17题,其中答对15题。

当前页有10题,你已做10题,已提交10题,其中答对8题。

1.企业的资金运动包括融资活动、投资活动、分配活动和()A.生产活动B.销售活动C.研发活动D.营运活动答题: A. B. C. D. (已提交)参考答案:D问题解析:2.雇佣工人属于资金运动中的哪一个阶段( )A.融资活动B.投资活动C.生产活动D.营运活动答题: A. B. C. D. (已提交)参考答案:D问题解析:3.独资企业与有限责任企业之间,普通合伙企业与股份有限企业之间,都有一个最大区别,它是()A 所有者的人数不同B企业规模不同C所有者所承担的责任不同 D 所有者的利益分配不同答题: A. B. C. D. (已提交)参考答案:C问题解析:4.股份有限公司的组织结构中权力最大是()A 董事会B 经理层C 监事会D 股东大会答题: A. B. C. D. (已提交)参考答案:D问题解析:5.处于股东和经营管理者之间,是企业重要战略决策的制定者和执行者之一,同时在重大财务领域无需向CEO 负责的是()A 总经理B 独立董事C CFOD 主任会计师答题: A. B. C. D. (已提交)问题解析:6.财务管理的基本内容主要包括( )A.营运资金管理B.长期投资决策C.长期融资决策D.短期投资决策答题: A. B. C. D. >>(已提交)参考答案:ABC问题解析:7.企业财务管理的利润最大化目标在实际运用过程中的缺陷包括()A.利润更多指的是会计概念B.利润概念所指不明C.利润最大化中的利润是个绝对数D.有可能诱使企业的短期行为答题: A. B. C. D. >>(已提交)参考答案:ABCD问题解析:8.金融环境的内容主要包括()A金融市场B货币政策C金融市场机制D金融机构答题: A. B. C. D. >>(已提交)参考答案:ACD问题解析:9.在我国,公司制企业包括()A独资企业B合伙企业C有限责任企业D股份有限企业答题: A. B. C. D. >>(已提交)参考答案:CD问题解析:10.企业的首席财务执行官的主要职责主要包括()A 整理账务B 会计核算与控制C 财务管理与决策D 管理现金答题: A. B. C. D. >>(已提交)参考答案:BC问题解析:11.财务管理的环境包括()A 经济环境B 金融环境C 法律环境D 企业内部环境答题: A. B. C. D. >>(已提交)参考答案:ABCD12.财务管理的核心在于定价或价值评估()答题:对. 错. (已提交)参考答案:√问题解析:13.财务管理的对象就是资金运动所呈现的信息,会计的处理对象是资金运动本身;( )答题:对. 错. (已提交)参考答案:×问题解析:14.在有效资本市场的假设下,股东财富最大化体现为股东所持企业股票的市场价值最大化()答题:对. 错. (已提交)参考答案:√问题解析:15.企业价值最大化与股东财富最大化是一致的()答题:对. 错. (已提交)参考答案:×问题解析:16.市场竞争也是财务的经济环境的一个方面。

第12、13、14章 财务成本固定资产管理

14.2.3 间接费用的分配

间接费用不同于直接材料费与直接人工费, 它并不随着工票或凭证按物料分别实时记 录,因而不象计算直接材料费与直接人工 费可以由物料清单及工艺文件、工作中心 直接而且准确地计算。 新会计制度计算产品成本采用制造成本法, 间接费用只核算到车间一级,由于加工成 本是在工作中心发生,因此,间接费用要 分配到工作中心。

质量 系统 核算

12. 财务管理——思考题

s

思考题

什么是管理会计与财务会计? s 请画出财务子系统业务处理流程。 s 请绘制财务子系统与其他子系统的关系图。

s

第13章 固定资产管理

固定资产是指使用年限超过1年的房屋、建筑 物、机器、机械、运输工具、以及其它与生产、 经营有关的设备、器具与工具等。不属于生产 经营设备的物品,但单位价值在2000元以上, 2000 并且使用年限超过两年的,也属于固定资产, 其余的工具、器具等作为低值易耗品处理。 企业应根据自身情况制订企业的固定资产目录 与分类方法,各类或各项固定资产的折旧年限、 折旧方法,作为企业固定资产核算的依据。

ERP系统涉及的会计事务既有财务会计又 有管理会计,ERP系统的成本管理采用的 是管理会计的方式。

ERP财务管理

2

可将ERP系统的财务管理分为三大部分:

财务管理。它是传统的财务管理,包括账务管 理、应收、应付、工资核算、现金管理、材料、 销售核算等业务,本章即讨该部分内容。 2 成本管理。描述成本核算、成本控制等业务的 有关理论与实现,这部分将在下一章讨论。 2 固定资产管理。描述ERP系统对企业固定资产 的管理,

A产品

累计材料费=D材料费+E材料费B子件C材料Fra bibliotekD材料

E材料

财务管理学每章节计算题与答案分别汇总

财务管理学每章节计算题与答案分别汇总习题与答案第二章1.某人将10 000元投资于一项产业,年报酬率为8%,问9年后的本利和为多少?2.某人存入银行10 000元,年利率为7.18%,按复利计算,多少年后才能达到20 000元?3.某人拟在5年后获得10万元,假如投资报酬率为14%,问现在应投入多少资金?4.某人拟在5年后获得10万元,银行年利率为4%,按复利计算,从现在起每年年末应存入银行多少等额款项?5.某校要建立一项永久性科研基金,每年支付40 000元,若银行利率为8%,问现在应存入多少款项?6.某企业向银行借入一笔款项,银行贷款年利率为10%,每年复利一次。

银行规定前10年不用还本付息,从第11年到第20年,每年年末偿还本息5000万元,计算这笔借款的现值。

7.某君现在存入银行一笔款项,计划从第五年年末起,每年从银行提取10 000元,连续8年提完。

若银行存款年利率为3%,按复利计算,该君现在应存入银行多少钱?8.某公司年初向银行借款106 700元,借款年利率为10%,①银行要求企业每年年末还款20 000元,问企业几年才能还清借款本息?②银行要求分8年还清全部本利额,问企业每年年末应偿还多少等额的本利和?9.某企业初始投资100万元,有效期8年,每年年末收回20万元,求该项目的投资报酬率。

10.某企业基建3年,每年年初向银行借款100万元,年利率为10%,(1)银行要求建成投产3年后一次性还本付息,到时企业应还多钱?(2)如果银行要求企业投产2年后,分3年偿还,问企业平均每年应偿还多钱?11.某企业有一笔6年期的借款,预计到期应归还本利和为480万元。

为归还借款,拟在各年提取等额的偿债基金,并按年利率5%计算利息,问每年应提取多少偿债基金?12.某企业库存A商品1000台,每台1000元。

按正常情况,每年可销售200台,5年售完。

年贴现率为10%。

如果按85折优惠,1年内即可售完。

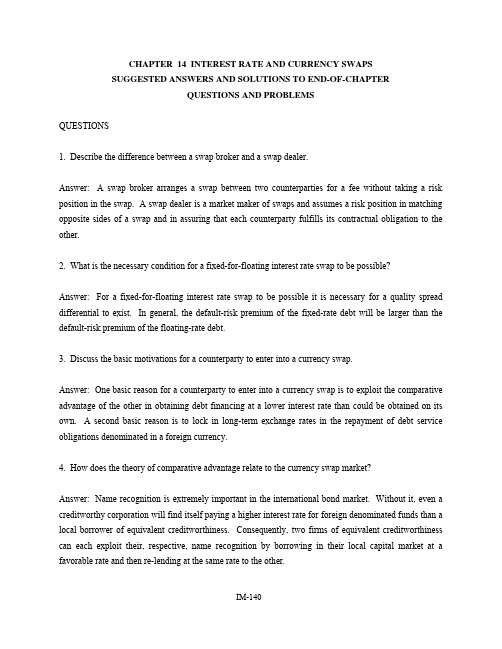

Solution_国际财务管理_切奥尔尤恩_课后习题答案_第十四章

CHAPTER 14 INTEREST RATE AND CURRENCY SWAPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Describe the difference between a swap broker and a swap dealer.Answer: A swap broker arranges a swap between two counterparties for a fee without taking a risk position in the swap. A swap dealer is a market maker of swaps and assumes a risk position in matching opposite sides of a swap and in assuring that each counterparty fulfills its contractual obligation to the other.2. What is the necessary condition for a fixed-for-floating interest rate swap to be possible?Answer: For a fixed-for-floating interest rate swap to be possible it is necessary for a quality spread differential to exist. In general, the default-risk premium of the fixed-rate debt will be larger than the default-risk premium of the floating-rate debt.3. Discuss the basic motivations for a counterparty to enter into a currency swap.Answer: One basic reason for a counterparty to enter into a currency swap is to exploit the comparative advantage of the other in obtaining debt financing at a lower interest rate than could be obtained on its own. A second basic reason is to lock in long-term exchange rates in the repayment of debt service obligations denominated in a foreign currency.4. How does the theory of comparative advantage relate to the currency swap market?Answer: Name recognition is extremely important in the international bond market. Without it, even a creditworthy corporation will find itself paying a higher interest rate for foreign denominated funds than a local borrower of equivalent creditworthiness. Consequently, two firms of equivalent creditworthiness can each exploit their, respective, name recognition by borrowing in their local capital market at a favorable rate and then re-lending at the same rate to the other.5. Discuss the risks confronting an interest rate and currency swap dealer.Answer: An interest rate and currency swap dealer confronts many different types of risk. Interest rate risk refers to the risk of interest rates changing unfavorably before the swap dealer can lay off on an opposing counterparty the unplaced side of a swap with another counterparty. Basis risk refers to the floating rates of two counterparties being pegged to two different indices. In this situation, since the indexes are not perfectly positively correlated, the swap bank may not always receive enough floating rate funds from one counterparty to pass through to satisfy the other side, while still covering its desired spread, or avoiding a loss. Exchange-rate risk refers to the risk the swap bank faces from fluctuating exchange rates during the time it takes the bank to lay off a swap it undertakes on an opposing counterparty before exchange rates change. Additionally, the dealer confronts credit risk from one counterparty defaulting and its having to fulfill the defaulting party’s obligation to the other counterparty. Mismatch risk refers to the difficulty of the dealer finding an exact opposite match for a swap it has agreed to take. Sovereign risk refers to a country imposing exchange restrictions on a currency involved in a swap making it costly, or impossible, for a counterparty to honor its swap obligations to the dealer. In this event, provisions exist for the early termination of a swap, which means a loss of revenue to the swap bank.6. Briefly discuss some variants of the basic interest rate and currency swaps diagramed in the chapter.Answer: Instead of the basic fixed-for-floating interest rate swap, there are also zero-coupon-for-floating rate swaps where the fixed rate payer makes only one zero-coupon payment at maturity on the notional value. There are also floating-for-floating rate swaps where each side is tied to a different floating rate index or a different frequency of the same index. Currency swaps need not be fixed-for-fixed; fixed-for-floating and floating-for-floating rate currency swaps are frequently arranged. Moreover, both currency and interest rate swaps can be amortizing as well as non-amortizing.7. If the cost advantage of interest rate swaps would likely be arbitraged away in competitive markets, what other explanations exist to explain the rapid development of the interest rate swap market?Answer: All types of debt instruments are not always available to all borrowers. Interest rate swaps can assist in market completeness. That is, a borrower may use a swap to get out of one type of financing and to obtain a more desirable type of credit that is more suitable for its asset maturity structure.8. Suppose Morgan Guaranty, Ltd. is quoting swap rates as follows: 7.75 - 8.10 percent annually against six-month dollar LIBOR for dollars and 11.25 - 11.65 percent annually against six-month dollar LIBOR for British pound sterling. At what rates will Morgan Guaranty enter into a $/£ currency swap?Answer: Morgan Guaranty will pay annual fixed-rate dollar payments of 7.75 percent against receiving six-month dollar LIBOR flat, or it will receive fixed-rate annual dollar payments at 8.10 percent against paying six-month dollar LIBOR flat. Morgan Guaranty will make annual fixed-rate £ payments at 11.25 percent against receiving six-month dollar LIBOR flat, or it will receive annual fixed-rate £ payments at 11.65 percent against paying six-month dollar LIBOR flat. Thus, Morgan Guaranty will enter into a currency swap in which it would pay annual fixed-rate dollar payments of 7.75 percent in return for receiving semi-annual fixed-rate £ payments at 11.65 percent, or it will receive annual fixed-rate dollar payments at 8.10 percent against paying annual fixed-rate £ payments at 11.25 percent.9. A U.S. company needs to raise €50,000,000. It plans to raise this money by issuing dollar-denominated bonds and using a currency swap to convert the dollars to euros. The company expects interest rates in both the United States and the euro zone to fall.a. Should the swap be structured with interest paid at a fixed or a floating rate?b. Should the swap be structured with interest received at a fixed or a floating rate?CFA Guideline Answer:a. The U.S. company would pay the interest rate in euros. Because it expects that the interest rate in the euro zone will fall in the future, it should choose a swap with a floating rate on the interest paid in euros to let the interest rate on its debt float down.b. The U.S. company would receive the interest rate in dollars. Because it expects that the interest rate in the United States will fall in the future, it should choose a swap with a fixed rate on the interest received in dollars to prevent the interest rate it receives from going down.*10. Assume a currency swap in which two counterparties of comparable credit risk each borrow at the best rate available, yet the nominal rate of one counterparty is higher than the other. After the initial principal exchange, is the counterparty that is required to make interest payments at the higher nominal rate at a financial disadvantage to the other in the swap agreement? Explain your thinking.Answer: Superficially, it may appear that the counterparty paying the higher nominal rate is at a disadvantage since it has borrowed at a lower rate. However, if the forward rate is an unbiased predictor of the expected spot rate and if IRP holds, then the currency with the higher nominal rate is expected to depreciate versus the other. In this case, the counterparty making the interest payments at the higher nominal rate is in effect making interest payments at the lower interest rate because the payment currency is depreciating in value versus the borrowing currency.PROBLEMS1. Alpha and Beta Companies can borrow for a five-year term at the following rates:Alpha BetaMoody’s credit rating Aa BaaFixed-rate borrowing cost 10.5% 12.0%Floating-rate borrowing cost LIBOR LIBOR + 1%a. Calculate the quality spread differential (QSD).b. Develop an interest rate swap in which both Alpha and Beta have an equal cost savings in their borrowing costs. Assume Alpha desires floating-rate debt and Beta desires fixed-rate debt. No swap bank is involved in this transaction.Solution:a. The QSD = (12.0% - 10.5%) minus (LIBOR + 1% - LIBOR) = .5%.b. Alpha needs to issue fixed-rate debt at 10.5% and Beta needs to issue floating rate-debt at LIBOR + 1%. Alpha needs to pay LIBOR to Beta. Beta needs to pay 10.75% to Alpha. If this is done, Alpha’s floating-rate all-in-cost is: 10.5% + LIBOR - 10.75% = LIBOR - .25%, a .25% savings over issuing floating-rate debt on its own. Beta’s fixed-rate all-in-cost is: LIBOR+ 1% + 10.75% - LIBOR = 11.75%, a .25% savings over issuing fixed-rate debt.2. Do problem 1 over again, this time assuming more realistically that a swap bank is involved as an intermediary. Assume the swap bank is quoting five-year dollar interest rate swaps at 10.7% - 10.8% against LIBOR flat.Solution: Alpha will issue fixed-rate debt at 10.5% and Beta will issue floating rate-debt at LIBOR + 1%. Alpha will receive 10.7% from the swap bank and pay it LIBOR. Beta will pay 10.8% to the swap bank and receive from it LIBOR. If this is done, Alpha’s floating-rate all-in-cost is: 10.5% + LIBOR - 10.7% = LIBOR - .20%, a .20% savings over issuing floating-rate debt on its own. Beta’s fixed-rate all-in-cost is: LIBOR+ 1% + 10.8% - LIBOR = 11.8%, a .20% savings over issuing fixed-rate debt.3. Company A is a AAA-rated firm desiring to issue five-year FRNs. It finds that it can issue FRNs at six-month LIBOR + .125 percent or at three-month LIBOR + .125 percent. Given its asset structure, three-month LIBOR is the preferred index. Company B is an A-rated firm that also desires to issue five-year FRNs. It finds it can issue at six-month LIBOR + 1.0 percent or at three-month LIBOR + .625 percent. Given its asset structure, six-month LIBOR is the preferred index. Assume a notional principal of $15,000,000. Determine the QSD and set up a floating-for-floating rate swap where the swap bank receives .125 percent and the two counterparties share the remaining savings equally.Solution: The quality spread differential is [(Six-month LIBOR + 1.0 percent) minus (Six-month LIBOR + .125 percent) =] .875 percent minus [(Three-month LIBOR + .625 percent) minus (Three-month LIBOR + .125 percent) =] .50 percent, which equals .375 percent. If the swap bank receives .125 percent, each counterparty is to save .125 percent. To affect the swap, Company A would issue FRNs indexed to six-month LIBOR and Company B would issue FRNs indexed three-month LIBOR. Company B might make semi-annual payments of six-month LIBOR + .125 percent to the swap bank, which would pass all of it through to Company A. Company A, in turn, might make quarterly payments of three-month LIBOR to the swap bank, which would pass through three-month LIBOR - .125 percent to Company B. On an annualized basis, Company B will remit to the swap bank six-month LIBOR + .125 percent and pay three-month LIBOR + .625 percent on its FRNs. It will receive three-month LIBOR - .125 percent from the swap bank. This arrangement results in an all-in cost of six-month LIBOR + .825 percent, which is a rate .125 percent below the FRNs indexed to six-month LIBOR + 1.0 percent Company B could issue on its own. Company A will remit three-month LIBOR to the swap bank and pay six-month LIBOR + .125 percent on its FRNs. It will receive six-month LIBOR + .125 percent from the swap bank. This arrangement results in an all-in cost of three-month LIBOR for Company A, which is .125 percent less than the FRNs indexed to three-month LIBOR + .125 percent it could issue on its own. The arrangements with the two counterparties net the swap bank .125 percent per annum, received quarterly.*4. A corporation enters into a five-year interest rate swap with a swap bank in which it agrees to pay the swap bank a fixed rate of 9.75 percent annually on a notional amount of €15,000,000 and receive LIBOR. As of the second reset date, determine the price of the swap from the corporation’s viewpoint assuming that the fixed-rate side of the swap has increased to 10.25 percent.Solution: On the reset date, the present value of the future floating-rate payments the corporation will receive from the swap bank based on the notional value will be €15,000,000. The present value of a hypothetical bond issue of €15,000,000 with three remaining 9.75 percent coupon payments at the newfixed-rate of 10.25 percent is €14,814,304. This sum represents the present value of the remaining payments the swap bank will receive from the corporation. Thus, the swap bank should be willing to buy and the corporation should be willing to sell the swap for €15,000,000 - €14,814,304 = €185,696.5. Karla Ferris, a fixed income manager at Mangus Capital Management, expects the current positively sloped U.S. Treasury yield curve to shift parallel upward.Ferris owns two $1,000,000 corporate bonds maturing on June 15, 1999, one with a variable rate based on 6-month U.S. dollar LIBOR and one with a fixed rate. Both yield 50 basis points over comparable U.S. Treasury market rates, have very similar credit quality, and pay interest semi-annually.Ferris wished to execute a swap to take advantage of her expectation of a yield curve shift and believes that any difference in credit spread between LIBOR and U.S. Treasury market rates will remain constant.a. Describe a six-month U.S. dollar LIBOR-based swap that would allow Ferris to take advantage of her expectation. Discuss, assuming Ferris’ expectation is correct, the change in the swap’s value and how that change would affect the value of her portfolio. [No calculations required to answer part a.] Instead of the swap described in part a, Ferris would use the following alternative derivative strategy to achieve the same result.b. Explain, assuming Ferris’ expectation is correct, how the following strategy achieves the same result in response to the yield curve shift. [No calculations required to answer part b.]Date Nominal Eurodollar Futures Contract ValueSettlement12-15-97 $1,000,00003-15-98 1,000,00006-15-98 1,000,00009-15-98 1,000,00012-15-98 1,000,00003-15-99 1,000,000c. Discuss one reason why these two derivative strategies provide the same result.CFA Guideline Answera.The Swap Value and its Effect on Ferris’ PortfolioBecause Karla Ferris believes interest rates will rise, she will want to swap her $1,000,000 fixed-rate corporate bond interest to receive six-month U.S. dollar LIBOR. She will continue to hold her variable-rate six-month U.S. dollar LIBOR rate bond because its payments will increase as interest rates rise. Because the credit risk between the U.S. dollar LIBOR and the U.S. Treasury market is expected to remain constant, Ferris can use the U.S. dollar LIBOR market to take advantage of her interest rate expectation without affecting her credit risk exposure.To execute this swap, she would enter into a two-year term, semi-annual settle, $1,000,000 nominal principal, pay fixed-receive floating U.S. dollar LIBOR swap. If rates rise, the swap’s mark-to-market value will increase because the U.S. dollar LIBOR Ferris receives will be higher than the LIBOR rates from which the swap was priced. If Ferris were to enter into the same swap after interest rates rise, she would pay a higher fixed rate to receive LIBOR rates. This higher fixed rate would be calculated as the present value of now higher forward LIBOR rates. Because Ferris would be paying a stated fixed rate that is lower than this new higher-present-value fixed rate, she could sell her swap at a premium. This premium is called the “replacement cost” value of the swap.b. Eurodollar Futures StrategyThe appropriate futures hedge is to short a combination of Eurodollar futures contracts with different settlement dates to match the coupon payments and principal. This futures hedge accomplishes the same objective as the pay fixed-receive floating swap described in Part a. By discussing how the yield-curve shift affects the value of the futures hedge, the candidate can show an understanding of how Eurodollar futures contracts can be used instead of a pay fixed-receive floating swap.If rates rise, the mark-to-market values of the Eurodollar contracts decrease; their yields must increase to equal the new higher forward and spot LIBOR rates. Because Ferris must short or sell the Eurodollar contracts to duplicate the pay fixed-receive variable swap in Part a, she gains as the Eurodollar futures contracts decline in value and the futures hedge increases in value. As the contracts expire, or if Ferris sells the remaining contracts prior to maturity, she will recognize a gain that increases her return. With higher interest rates, the value of the fixed-rate bond will decrease. If the hedge ratios are appropriate, the value of the portfolio, however, will remain unchanged because of the increased value of the hedge, which offsets the fixed-rate bond’s decrease.c. Why the Derivative Strategies Achieve the Same ResultArbitrage market forces make these two strategies provide the same result to Ferris. The two strategies are different mechanisms for different market participants to hedge against increasing rates. Some money managers prefer swaps; others, Eurodollar futures contracts. Each institutional marketparticipant has different preferences and choices in hedging interest rate risk. The key is that market makers moving into and out of these two markets ensure that the markets are similarly priced and provide similar returns. As an example of such an arbitrage, consider what would happen if forward market LIBOR rates were lower than swap market LIBOR rates. An arbitrageur would, under such circumstances, sell the futures/forwards contracts and enter into a received fixed-pay variable swap. This arbitrageur could now receive the higher fixed rate of the swap market and pay the lower fixed rate of the futures market. He or she would pocket the differences between the two rates (without risk and without having to make any [net] investment.) This arbitrage could not last.As more and more market makers sold Eurodollar futures contracts, the selling pressure would cause their prices to fall and yields to rise, which would cause the present value cost of selling the Eurodollar contracts also to increase. Similarly, as more and more market makers offer to receive fixed rates in the swap market, market makers would have to lower their fixed rates to attract customers so they could lock in the lower hedge cost in the Eurodollar futures market. Thus, Eurodollar forward contract yields would rise and/or swap market receive-fixed rates would fall until the two rates converge. At this point, the arbitrage opportunity would no longer exist and the swap and forwards/futures markets would be in equilibrium.6. Rone Company asks Paula Scott, a treasury analyst, to recommend a flexible way to manage the company’s financial risks.Two years ago, Rone issued a $25 million (U.S.$), five-year floating rate note (FRN). The FRN pays an annual coupon equal to one-year LIBOR plus 75 basis points. The FRN is non-callable and will be repaid at par at maturity.Scott expects interest rates to increase and she recognizes that Rone could protect itself against the increase by using a pay-fixed swap. However, Rone’s Board of Directors prohibits both short sales of securities and swap transactions. Scott decides to replicate a pay-fixed swap using a combination of capital market instruments.a. Identify the instruments needed by Scott to replicate a pay-fixed swap and describe the required transactions.b. Explain how the transactions in Part a are equivalent to using a pay-fixed swap.CFA Guideline Answera. The instruments needed by Scott are a fixed-coupon bond and a floating rate note (FRN).The transactions required are to:· issue a fixed-coupon bond with a maturity of three years and a notional amount of $25 million, and· buy a $25 million FRN of the same maturity that pays one-year LIBOR plus 75 bps.b. At the outset, Rone will issue the bond and buy the FRN, resulting in a zero net cash flow at initiation. At the end of the third year, Rone will repay the fixed-coupon bond and will be repaid the FRN, resulting in a zero net cash flow at maturity. The net cash flow associated with each of the three annual coupon payments will be the difference between the inflow (to Rone) on the FRN and the outflow (to Rone) on the bond. Movements in interest rates during the three-year period will determine whether the net cash flow associated with the coupons is positive or negative to Rone. Thus, the bond transactions are financially equivalent to a plain vanilla pay-fixed interest rate swap.7. A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates €25,000,000 a year, received in equivalent semiannual installments of €12,500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can convert the euros to pounds. The current exchange rate is €1.5/£. The fixed rate on a plain vaninilla currency swap in pounds is 7.5 percent per year, and the fixed rate on a plain vanilla currency swap in euros is 6.5 percent per year.a. Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the objective.b. Determine the semiannual cash flows from this swap.CFA Guideline Answera. The semiannual cash flow must be converted into pounds is €25,000,000/2 = €12,500,000. In order to create a swap to convert €12,500,000, the equivalent notional principals are · Euro notional principal = €12,500,000/(0.065/2) = €384,615,385· Pound notional principal = €384,615,385/€1.5/£ = £256,410,257b. The cash flows from the swap will now be· Company makes swap payment = €384,615,385(0.065/2) = €12,500,000· Company receives swap payment = £256,410,257(0.075/2) = £9,615,385The company has effectively converted euro cash receipts to pounds.8. Ashton Bishop is the debt manager for World Telephone, which needs €3.33 billion Euro financing for its operations. Bishop is considering the choice between issuance of debt denominated in: ∙ Euros (€), or∙ U.S. dollars, accompanied by a combined interest rate and currency swap.a. Explain one risk World would assume by entering into the combined interest rate and currency swap.Bishop believes that issuing the U.S.-dollar debt and entering into the swap can lower World’s cost of debt by 45 basis points. Immediately after selling the debt issue, World would swap the U.S. dollar payments for Euro payments throughout the maturity of the debt. She assumes a constant currency exchange rate throughout the tenor of the swap.Exhibit 1 gives details for the two alternative debt issues. Exhibit 2 provides current information about spot currency exchange rates and the 3-year tenor Euro/U.S. Dollar currency and interest rate swap.Exhibit 1World Telephone Debt DetailsCharacteristic Euro Currency Debt U.S. Dollar Currency DebtPar value €3.33 billion $3 billionTerm to maturity 3 years 3 yearsFixed interest rate 6.25% 7.75%Interest payment Annual AnnualExhibit 2Currency Exchange Rate and Swap InformationSpot currency exchange rate $0.90 per Euro ($0.90/€1.00)3-year tenor Euro/U.S. Dollarfixed interest rates 5.80% Euro/7.30% U.S. Dollarb. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap.Note: Your response should show both the correct currency ($ or €) and amount for each cash flow. Answer problem b in the template provided.Template for problem bc. State whether or not World would reduce its borrowing cost by issuing the debt denominated in U.S. dollars, accompanied by the combined interest rate and currency swap. Justify your response with one reason.CFA Guideline Answera. World would assume both counterparty risk and currency risk. Counterparty risk is the risk that Bishop’s counterparty will default on payment of principal or interest cash flows in the swap.Currency risk is the currency exposure risk associated with all cash flows. If the US$ appreciates (Euro depreciates), there would be a loss on funding of the coupon payments; however, if the US$ depreciates, then the dollars will be worth less at the swap’s maturity.b.0 YearYear32 Year1 YearWorld paysNotional$3 billion €3.33 billion PrincipalInterest payment €193.14 million1€193.14 million €193.14 million World receives$3.33 billion €3 billion NotionalPrincipalInterest payment $219 million2$219 million $219 million1 € 193.14 million = € 3.33 billion x 5.8%2 $219 million = $3 billion x 7.3%c. World would not reduce its borrowing cost, because what Bishop saves in the Euro market, she loses in the dollar market. The interest rate on the Euro pay side of her swap is 5.80 percent, lower than the 6.25 percent she would pay on her Euro debt issue, an interest savings of 45 bps. But Bishop is only receiving 7.30 percent in U.S. dollars to pay on her 7.75 percent U.S. debt interest payment, an interest shortfall of 45 bps. Given a constant currency exchange rate, this 45 bps shortfall exactly offsets the savings from paying 5.80 percent versus the 6.25 percent. Thus there is no interest cost savings by sellingthe U.S. dollar debt issue and entering into the swap arrangement.MINI CASE: THE CENTRALIA CORPORATION’S CURRENCY SWAPThe Centralia Corporation is a U.S. manufacturer of small kitchen electrical appliances. It has decided to construct a wholly owned manufacturing facility in Zaragoza, Spain, to manufacture microwave ovens for sale in the European Union. The plant is expected to cost €5,500,000, and to take about one year to complete. The plant is to be financed over its economic life of eight years. The borrowing capacity created by this capital expenditure is $2,900,000; the remainder of the plant will be equity financed. Centralia is not well known in the Spanish or international bond market; consequently, it would have to pay 7 percent per annum to borrow euros, whereas the normal borrowing rate in the euro zone for well-known firms of equivalent risk is 6 percent. Alternatively, Centralia can borrow dollars in the U.S. at a rate of 8 percent.Study Questions1. Suppose a Spanish MNC has a mirror-image situation and needs $2,900,000 to finance a capital expenditure of one of its U.S. subsidiaries. It finds that it must pay a 9 percent fixed rate in the United States for dollars, whereas it can borrow euros at 6 percent. The exchange rate has been forecast to be $1.33/€1.00 in one year. Set up a currency swap that will benefit each counterparty.*2. Suppose that one year after the inception of the currency swap between Centralia and the Spanish MNC, the U.S. dollar fixed-rate has fallen from 8 to 6 percent and the euro zone fixed-rate for euros has fallen from 6 to 5.50 percent. In both dollars and euros, determine the market value of the swap if the exchange rate is $1.3343/€1.00.Suggested Solution to The Centralia Corporation’s Currency Swap1. The Spanish MNC should issue €2,180,500 of 6 percent fixed-rate debt and Centralia should issue $2,900,000 of fixed-rate 8 percent debt, since each counterparty has a relative comparative advantage in their home market. They will exchange principal sums in one year. The contractual exchange rate for the initial exchange is $2,900,000/€2,180,500, or $1.33/€1.00. Annually the counterparties will swap debt service: the Spanish MNC will pay Centralia $232,000 (= $2,900,000 x .08) and Centralia will pay the Spanish MNC €130,830 (= €2,180,500 x .06). The contractual exchange rate of the first seven annual debt service exchanges is $232,000/€130,830, or $1.7733/€1.00. At maturity, Centralia and the Spanish MNC will re-exchange the principal sums and the final debt service payments. The contractual exchange rate of the final currency exchange is $3,132,000/€2,311,330 = ($2,900,000 + $232,000)/(€2,180,500 + €130,830), or $1.3551/€1.00.*2. The market value of the dollar debt is the present value of a seven-year annuity of $232,000 and a lump sum of $2,900,000 discounted at 6 percent. This present value is $3,223,778. Similarly, the market value of the euro debt is the present value of a seven-year annuity of €130,830 and a lump sum of €2,180,500 discounted at 5.50 percent. This present value is €2,242,459. The dollar value of the swap is $3,223,778 - €2,242,459 x 1.3343 = $231,665. The euro value of the swap is €2,242,459 - $3,223,778/1.3343 = -€173,623.。

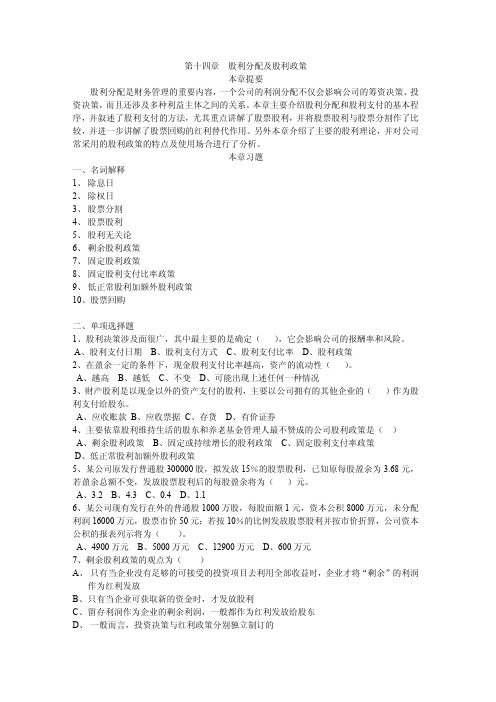

《公司财务》练习题:第十四章股利分配及股利政策

第十四章股利分配及股利政策本章提要股利分配是财务管理的重要内容,一个公司的利润分配不仅会影响公司的筹资决策、投资决策,而且还涉及多种利益主体之间的关系。

本章主要介绍股利分配和股利支付的基本程序,并叙述了股利支付的方法,尤其重点讲解了股票股利,并将股票股利与股票分割作了比较,并进一步讲解了股票回购的红利替代作用。

另外本章介绍了主要的股利理论,并对公司常采用的股利政策的特点及使用场合进行了分析。

本章习题一、名词解释1、除息日2、除权日3、股票分割4、股票股利5、股利无关论6、剩余股利政策7、固定股利政策8、固定股利支付比率政策9、低正常股利加额外股利政策10、股票回购二、单项选择题1、股利决策涉及面很广,其中最主要的是确定(),它会影响公司的报酬率和风险。

A、股利支付日期B、股利支付方式C、股利支付比率D、股利政策2、在盈余一定的条件下,现金股利支付比率越高,资产的流动性()。

A、越高B、越低C、不变D、可能出现上述任何一种情况3、财产股利是以现金以外的资产支付的股利,主要以公司拥有的其他企业的()作为股利支付给股东。

A、应收账款B、应收票据C、存货D、有价证券4、主要依靠股利维持生活的股东和养老基金管理人最不赞成的公司股利政策是()A、剩余股利政策B、固定或持续增长的股利政策C、固定股利支付率政策D、低正常股利加额外股利政策5、某公司原发行普通股300000股,拟发放15%的股票股利,已知原每股盈余为3.68元,若盈余总额不变,发放股票股利后的每股盈余将为()元。

A、3.2B、4.3C、0.4D、1.16、某公司现有发行在外的普通股1000万股,每股面额1元,资本公积8000万元,未分配利润16000万元,股票市价50元;若按10%的比例发放股票股利并按市价折算,公司资本公积的报表列示将为()。

A、4900万元B、5000万元C、12900万元D、600万元7、剩余股利政策的观点为()A、只有当企业没有足够的可接受的投资项目去利用全部收益时,企业才将“剩余”的利润作为红利发放B、只有当企业可获取新的资金时,才发放股利C、留存利润作为企业的剩余利润,一般都作为红利发放给股东D、一般而言,投资决策与红利政策分别独立制订的8、有权领取股利的股东有资格登记截止的日期是()。

财务管理第14章商业银行现金头寸及流动性管理

1.库存现金:保存在金柜中的通货,包括 纸币和铸币,主要用于柜台上客户取现和 银行自身日常开支。

2.存放在中央银行的资金:包括一般性存 款和存款准备金。一般性存款主要用于满 足转账结算的需要,同时也用来调整库存 现金。

3.存放同业款项:存放在其它银行的存款 ,主要是为了银行间结算与代理业务。

4.托收中现金(Float):商业银行收到客 户存入的支票大多属于向其它付款银行 收取款项的,这种须向其它银行收款的 支票就是托收资产。

商业银行头寸调度的主要渠道有以下几 方面:

1.同业拆借 2.短期证券回购及商业票据交易 3.总行与分支行之间的资金调度 4.通过中央银行融通资金 5.出售中长期证券 6.出售贷款和固定资产

第三节 商业银行流动性管理

一、商业银行流动性管理的概念

(一)流动性的概念

银行的流动性(Liquidity)是指银行满足存款者 的提现需求和借款者的正当贷款需求的能力。商 业银行的流动性体现在资产和负债两个方面。

(二)流动性风险的概念

商业银行的流动性风险有广义和狭义之分。 狭义流动性风险是指商业银行没有足够的现 金来满足客户的提款需求而产生的支付风险;

广义的流动性风险包括狭义流动性风险和由 于银行资金不足而不能满足客户的贷款需求或其 他即时现金需求引起的风险。

案例1 美国大陆伊利诺银行的 流动性危机

(一)案情

最大银行的贷款增长率仅为14.7%。与此同时,银 行的利润率也高于其他竞争银行的平均数。但是 ,银行资产急剧扩张的同时已经隐藏了潜在的危 机。

与其他大银行不同的是,大陆伊利诺银行并没

有稳定的核心存款来源。其贷款主要由出售短期 可转让定期存单、吸收欧洲美元和工商企业及金 融机构的 隔夜存款来支持。在70年末,该行资金 来源既不稳定,资金使用又不慎重,由于大量地 向一些问题企业发放贷款,大陆伊利诺银行的问 题贷款的份额越来越大。

《财务管理》书课后习题答案

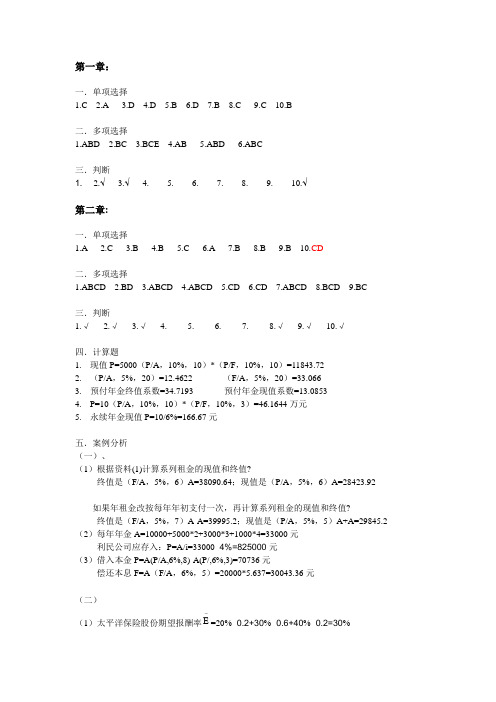

第一章:一.单项选择1.C2.A3.D4.D5.B6.D7.B8.C9.C 10.B二.多项选择1.ABD2.BC3.BCE4.AB5.ABD6.ABC三.判断1. 2.√ 3.√ 4.× 5.× 6.×7.×8.×9.×10.√第二章:一.单项选择1.A2.C3.B4.B5.C6.A7.B8.B9.B 10.CD二.多项选择1.ABCD2.BD3.ABCD4.ABCD5.CD6.CD7.ABCD8.BCD9.BC三.判断1.√2.√3.√4. ×5. ×6. ×7. ×8.√9.√10.√四.计算题1.现值P=5000(P/A,10%,10)*(P/F,10%,10)=11843.722.(P/A,5%,20)=12.4622 (F/A,5%,20)=33.0663.预付年金终值系数=34.7193 预付年金现值系数=13.08534.P=10(P/A,10%,10)*(P/F,10%,3)=46.1644万元5.永续年金现值P=10/6%=166.67元五.案例分析(一)、(1)根据资料(1)计算系列租金的现值和终值?终值是(F/A,5%,6)A=38090.64;现值是(P/A,5%,6)A=28423.92如果年租金改按每年年初支付一次,再计算系列租金的现值和终值?终值是(F/A,5%,7)A-A=39995.2;现值是(P/A,5%,5)A+A=29845.2 (2)每年年金A=10000+5000*2+3000*3+1000*4=33000元利民公司应存入:P=A/i=33000÷4%=825000元(3)借入本金P=A(P/A,6%,8)-A(P/,6%,3)=70736元偿还本息F=A(F/A,6%,5)=20000*5.637=30043.36元(二)(1)太平洋保险股份期望报酬率-E=20%×0.2+30%×0.6+40%×0.2=30%高新实业股份期望报酬率-E =0%×0.2+30%×0.6+60%×0.2=30% σ太平洋=2.0%)30%40(6.0%)30%30(2.0%)30%20(222⨯-+⨯-+⨯-=0.063σ高新实业=2.0%)30%60(6.0%)30%30(2.0%)30%0(222⨯-+⨯-+⨯-=0.190 V 太平洋 =%30063.0=E -σ=0.21 V 高新实业= %30190.0=E -σ=0.63所以,太平洋保险股份风险小。

第14章《项目采购管理》问答练习题(含答案)

第14章《项目采购管理》1、“自制/外购”分析过程中,()时,项目不应从外部进行采购。

A.自制成本高于外购B.与其他项目有资源冲突C.项目需要保密D.技术人员能力不足2、关于采购谈判的描述,不正确的是()。

A.采购谈判过程中以买卖双方签署文件为结束标志B.项目经理应是合同的主谈人C.项目团队可以列席谈判D.合同文本的最终版本应反映所达成的协议3、关于“自制外购”分析的描述,不正确的是()。

A.有能力自行研制某种产品的情况下,也有可能需要外部采购B.决定外购后,需要进一步分析是购买还是租借C总价合同对进行“自制外购”分析过程没有影响D.任何预算限制都有可能影响“自制/外购”分析4、()不属于控制采购过程的工具与技术。

A.工作绩效信息B.合同变更控制系統C.采购绩效审计D.检查与审计5、项目经理赵某负责公司的大数据分析平台项目,搭建该平台需要大规模的计算能力。

经过市场调研,国内A公司可提供大规模计算服务。

赵某在编制项目的采购计划时,正确的做法是:()。

A.直接把A公司的大规模计算服务列入采购计划B.将国际上最先进的高性能计算服务器列入采购计划C.考虑项目管理计划、项目需求文档、活动成本估算等输入D.以A公司的采购政策和工作程序作为采购指导6、控制采购的输入不包括()。

A.合同管理计划B.采购档案C.合同D.采购文件7、采购人员按照()的安排实施采购活动。

A.采购工作说明书B.需求文档C.活动资源需求D.采购计划8、关于控制采购的描述,不正确的是()。

A.控制采购是管理采购关系.监督合同执行情况,并依据需要实施变更和采取纠正措施的过程B.采购是买方行为,卖方不需要控制采购过程C.控制采购过程中,还需要财务管理工作D.控制采购可以保证采购产品质量的拉制9、以下关于工作说明书(SOW)的叙述中,不正确的是()。

A.SOW的内容主要包括服务范围、方法、假定、工作量、变更管理等B.内部的SOW有时可称为任务书C.SOW的变更应由项目变更控制过程进行管理D.SOW通过明确项目应该完成的工作来确定项目范围10、小王作为某项目的项目经理,决定采用投标人会议的方式选择卖方。

《财务管理学》课后答案

(1)股票风险中能够通过构建投资组合被消除的部分称作可分散风险,也被称作公司特别风险,或非系统风险。而不能够被消除的部分则称作市场风险,又被称作不可分散风险,或系统风险,或贝塔风险,是分散化之后仍然残留的风险。(2)二者的区别在于公司特别风险,是由某些随机事件导致的,如个别公司遭受火灾,公司在市场竞争中的失败等。这种风险,可以通过证券持有的多样化来抵消;而市场风险则产生于那些系统影响大多数公司的因素:经济危机、通货膨胀、经济衰退、以及高利率。由于这些因素会对大多数股票产生负面影响,故无法通过分散化投资消除市场风险。

答题要点:

(1)利益相关者的利益与股东利益在本质上是一致的,当企业满足股东财富最大化的同时,也会增加企业的整体财富,其他相关者的利益会得到更有效的满足:(2)股东的财务要求权是“剩余要求权”,是在其他利益相关者利益得到满足之后的剩余权益。(3)企业是各种利益相关者之间的契约的组合。(4)对股东财富最大化需要进行一定的约束。

= 60%×0.30 + 20%×0.50 +(-10%)×0.20

= 26%

(2)计算两家公司的标准差:

中原公司的标准差为:

南方公司的标准差为:

(3)计算两家公司的变异系数:

中原公司的变异系数为:

重要的利益相关者可能会对企业的控制权产生一定影响,只有当企业以股东财富最大化为目标,增加企业的整体财富,利益相关者的利益才会得到有效满足。反之,利益相关者则会为维护自身利益而对控股股东施加影响,从而可能导致企业的控制权发生变更。

第二章思考题

答题要点:

(1)国外传统的定义是:即使在没有风险和没有通货膨胀的条件下,今天1元钱的价值亦大于1年以后1元钱的价值。股东投资1元钱,就失去了当时使用或消费这1元钱的机会或权利,按时间计算的这种付出的代价或投资收益,就叫做时间价值。(2)但并不是所有货币都有时间价值,只有把货币作为资本投入生产经营过程才能产生时间价值。同时,将货币作为资本投入生产过程所获得的价值增加并不全是货币的时间价值,因为货币在生产经营过程中产生的收益不仅包括时间价值,还包括货币资金提供者要求的风险收益和通货膨胀贴水。(3)时间价值是扣除风险收益和通货膨胀贴水后的真实收益率。在没有风险和没有通货膨胀的情况下,银行存款利率、贷款利率、各种债券利率、股票的股利率可以看作是时间价值。

财务管理各章复习思考题参考答案

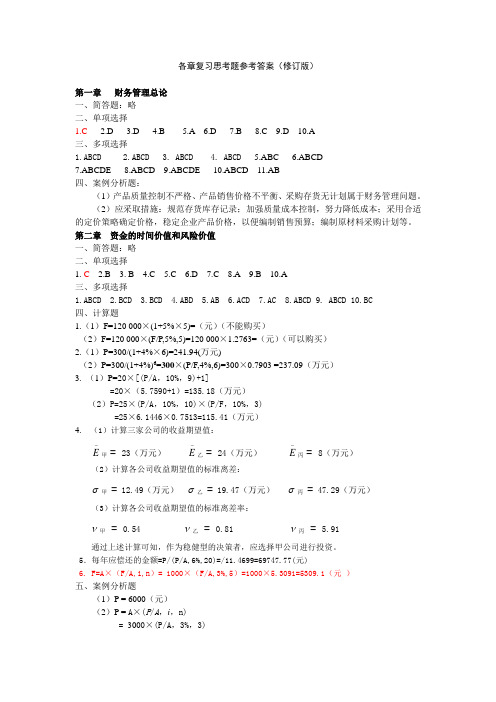

各章复习思考题参考答案(修订版)第一章财务管理总论一、简答题:略二、单项选择1.C2.D3.D4.B5.A6.D7.B8.C9.D 10.A三、多项选择1.ABCD2.ABCD3. ABCD4. ABCD5.ABC6.ABCD7.ABCDE 8.ABCD 9.ABCDE 10.ABCD 11.AB四、案例分析题:(1)产品质量控制不严格、产品销售价格不平衡、采购存货无计划属于财务管理问题。

(2)应采取措施:规范存货库存记录;加强质量成本控制,努力降低成本;采用合适的定价策略确定价格,稳定企业产品价格,以便编制销售预算;编制原材料采购计划等。

第二章资金的时间价值和风险价值一、简答题:略二、单项选择1. C2.B3. B4.C5.C6.D7.C8.A9.B 10.A三、多项选择1.ABCD2.BCD3.BCD4.ABD5.AB6.ACD7.AC8.ABCD9. ABCD 10.BC四、计算题1.(1)F=120 000×(1+5%×5)=(元)(不能购买)(2)F=120 000×(F/P,5%,5)=120 000×1.2763=(元)(可以购买)2.(1)P=300/(1+4%×6)=241.94(万元)(2)P=300/(1+4%)6=300×(P/F,4%,6)=300×0.7903 =237.09(万元)3. (1)P=20×[(P/A,10%,9)+1]=20×(5.7590+1)=135.18(万元)(2)P=25×(P/A,10%,10)×(P/F,10%,3)=25×6.1446×0.7513=115.41(万元)4.(1)计算三家公司的收益期望值:-E甲= 23(万元)-E乙= 24(万元)-E丙= 8(万元)(2)计算各公司收益期望值的标准离差:σ甲= 12.49(万元)σ乙= 19.47(万元)σ丙= 47.29(万元)(3)计算各公司收益期望值的标准离差率:ν甲 = 0.54 ν乙 = 0.81 ν丙 = 5.91通过上述计算可知,作为稳健型的决策者,应选择甲公司进行投资。

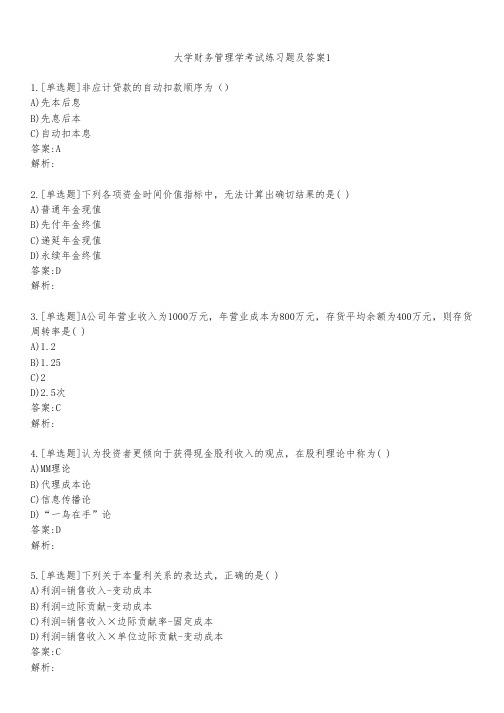

大学财务管理学考试练习题及答案141

大学财务管理学考试练习题及答案11.[单选题]非应计贷款的自动扣款顺序为()A)先本后息B)先息后本C)自动扣本息答案:A解析:2.[单选题]下列各项资金时间价值指标中,无法计算出确切结果的是( )A)普通年金现值B)先付年金终值C)递延年金现值D)永续年金终值答案:D解析:3.[单选题]A公司年营业收入为1000万元,年营业成本为800万元,存货平均余额为400万元,则存货周转率是( )A)1.2B)1.25C)2D)2.5次答案:C解析:4.[单选题]认为投资者更倾向于获得现金股利收入的观点,在股利理论中称为( )A)MM理论B)代理成本论C)信息传播论D)“一鸟在手”论答案:D解析:5.[单选题]下列关于本量利关系的表达式,正确的是( )A)利润=销售收入-变动成本B)利润=边际贡献-变动成本C)利润=销售收入×边际贡献率-固定成本D)利润=销售收入×单位边际贡献-变动成本答案:C解析:6.[单选题]新入行员工从事柜员工作前应进行岗前培训,见习期不得少于( )A)1个月B)2个月C)3个月D)6个月答案:C解析:7.[单选题]企业筹资决策的核心问题是()。

A)资金结构B)资金成本C)筹资数量D)投资收益率答案:B解析:8.[单选题]下列各项中属于应收账款机会成本的是()。

A)应收账款占用资金的利息B)客户资信调查费用C)坏账损失D)收账费用答案:A解析:9.[单选题]上市公司采用固定股利支付率政策的主要优点是( )A)有利于公司股票价格的稳定B)股利支付与公司盈利密切相关C)有利于树立公司的良好形象D)有利于投资者安排收入与支出答案:D解析:10.[单选题]下列各项中,属于速动资产的是( )A)原材料B)机器设备C)应收账款D)库存商品答案:C解析:11.[单选题]应当履行反洗钱义务的特定非金融机构的范围、其履行反洗钱义务和对其监督管理的具体办法,由( )制定。

A)国务院反洗钱行政主管部门B)国务院反洗钱行政主管部门会同国务院有关部门C)国务院反洗钱行政主管部门会同国务院有关金融监督管理机构D)履行反洗钱义务的特定非金融机构答案:B解析:12.[单选题]解散清算与破产清算相同的特征是( )A)清算的性质相同B)被清算企业的法律地位相同C)清算的目的相同D)处理利益关系的侧重点相同答案:C解析:13.[单选题]支付系统中支付信息的保存时间为()A)5年B)10年C)20年D)30年答案:D解析:14.[单选题]非应计贷款的自动扣款的顺序为()A)先息后本B)先本后息C)本息均可D)本息同还答案:B解析:15.[单选题]关于标准离差与标准离差率,下列表述正确的是( )A)标准离差率是期望值与资产收益率的标准差之比B)标准离差反映概率分布中各种可能结果对期望值的偏离程度C)如果方案的期望值相同,标准离差越小,方案的风险越大D)如果方案的期望值不同,标准离差率越小,方案的风险越大答案:B解析:16.[单选题]农商行承兑的单张银行承兑汇票最高金额不得超过( )万元A)100答案:C解析:17.[单选题]根据客户事先申请或个性化要求进行制作,而后向客户发放的银行卡属于()。

《财务管理学》(第四版)练习参考答案(全部)

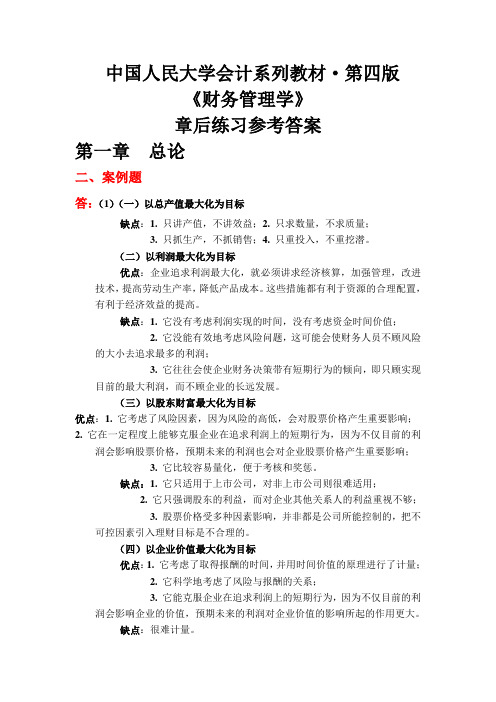

中国人民大学会计系列教材·第四版《财务管理学》章后练习参考答案第一章总论二、案例题答:(1)(一)以总产值最大化为目标缺点:1. 只讲产值,不讲效益;2. 只求数量,不求质量;3. 只抓生产,不抓销售;4. 只重投入,不重挖潜。

(二)以利润最大化为目标优点:企业追求利润最大化,就必须讲求经济核算,加强管理,改进技术,提高劳动生产率,降低产品成本。

这些措施都有利于资源的合理配置,有利于经济效益的提高。

缺点:1. 它没有考虑利润实现的时间,没有考虑资金时间价值;2. 它没能有效地考虑风险问题,这可能会使财务人员不顾风险的大小去追求最多的利润;3. 它往往会使企业财务决策带有短期行为的倾向,即只顾实现目前的最大利润,而不顾企业的长远发展。

(三)以股东财富最大化为目标优点:1. 它考虑了风险因素,因为风险的高低,会对股票价格产生重要影响;2. 它在一定程度上能够克服企业在追求利润上的短期行为,因为不仅目前的利润会影响股票价格,预期未来的利润也会对企业股票价格产生重要影响;3. 它比较容易量化,便于考核和奖惩。

缺点:1. 它只适用于上市公司,对非上市公司则很难适用;2. 它只强调股东的利益,而对企业其他关系人的利益重视不够;3. 股票价格受多种因素影响,并非都是公司所能控制的,把不可控因素引入理财目标是不合理的。

(四)以企业价值最大化为目标优点:1. 它考虑了取得报酬的时间,并用时间价值的原理进行了计量;2. 它科学地考虑了风险与报酬的关系;3. 它能克服企业在追求利润上的短期行为,因为不仅目前的利润会影响企业的价值,预期未来的利润对企业价值的影响所起的作用更大。

缺点:很难计量。

进行企业财务管理,就是要正确权衡报酬增加与风险增加的得与失,努力实现二者之间的最佳平衡,使企业价值达到最大化。

因此,企业价值最大化的观点,体现了对经济效益的深层次认识,它是现代企业财务管理目标的最优目标。

(2)青鸟天桥的财务管理目标是追求控股股东利益最大化。

中级经济师经济基础第14章财政管理体制

第十四章财政管理体制【本节考点】(1)财政管理体制的含义(熟悉)(2)财政管理体制的内容(掌握)(3)财政管理体制的类型(熟悉)(4)财政管理体制的作用(了解)【本节内容】一、财政管理体制的含义财政管理体制,就是国家管理和规范中央与地方政府之间以及地方各级政府之间划分财政收支范围和财政管理职责与权限的一项根本制度。

(1)、广义的财政管理体制包括预算管理体制、税收管理体制、公共部门财务管理体制等。

(2)、狭义的财政管理体制是指政府预算管理体制。

政府预算管理体制是财政管理体制的中心环节。

【例题1:单选】财政管理体制的中心环节是()。

A.财政收入制度;B.税收管理体制;C.政府预算管理体制;D.公共部门财务管理体制【答案】C二、财政管理体制的内容1.财政分配和管理机构的设置与政府管理体制相适应,目前我国的财政管理机构分为中央、省(自治区、直辖市)、设区的市(自治州)、县(自治县、不设区的市、市辖区)、乡(民族乡、镇)各级财政部门内部又设置不同业务分工的机构,分别负责各项业务管理工作。

2.政府间事权及支出责任的划分财政管理体制作为划分各级政府间财政关系的根本制度,其依据是政府职能界定和政府间事权划分。

政府间财政支出划分是财政管理体制的基础性内容。

政府间事权及支出责任划分一般遵循以下重要原则:3.政府间财政收入的划分税种属性是决定政府间财政收入划分的主要标准。

市场经济成熟国家一般遵循以下几个重要原则:根据国际经验,政府间财政收支划分呈现的基本特征,是收入结构与支出结构的非对称性按排。

即收入结构划分以中央政府为主,支出结构划分则以地方政府为主。

4.政府间财政转移支付制度【例题2:单选】财政管理体制的基础性内容是()A政府间财政收入的划分;B政府间财政支出的划分;C政府间财政转移支付;D政府间财权的划分【答案】B【例题3:单选】决定政府间财政收入划分的主要标准是()A收入的来源;B事权的划分;C支出的性质;D税种的性质【答案】D【例题4:2011年多选】各级政府间事权及支出责任划分遵循的一般原则有()。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

思考题

1.企业集团的融资特征有哪些?

2.企业集团财务管理的要点有那些?

3.简述企业集团的基本组织结构及其新发展。

练习题

一、单项选择题

1、在经营战略上,发展期的企业集团的首要目标是(D )。

A.控制或降低财务风险B.控制或降低经营风险

C.增加利润与现金流入量D.占领市场与扩大市场份额

2、无论是从集团自身能力还是从市场期望看,处于成熟期的企业集团应采取股利支付方式为(B)。

A.无股利支付策略B.高股利支付策略

C.股票股利支付策略D.剩余股利支付策略

3、在股利分配战略上,可采用高股利支付战略的是企业集团发展的(C )。

A.初创期 B.发展期

C.成熟期 D.调整期

4、在成熟期,企业集团财务管理的最核心的任务是(B )。

A.强化价格竞争B.强化成本控制力度,确立成本领先优势

C.实施高股利政策D.研究探索未来投资方向定位

5、.在企业集团初创期,应以( A )融资方式为主筹集资金。

A.股权资本 B.短期负债

C.长期负债 D.项目融资

6、.企业集团总部财务管理的着眼点是(C )。

A.企业集团整体的日常财务事项B.高效而低成本地融资

C.企业集团整体的财务战略与财务政策D.合理安排与调度企业集团资金

二、多项选择题

1、企业集团组建的宗旨或基本目的在于(BC )。

A.实施管理体的集权制B.发挥管理协同优势

C.谋求资源的一体化整合优势D.消除竞争对手

2、企业集团财务管理主体的特征是(ACD )。

A.财务管理主体的多元性B.只能有一个财务管理主体,即母公司

C.有一个发挥中心作用的核心主体D.体现为一种一元中心下的多层级复合结构

3、以下实体具有法人资格的是(BC )。

A.企业集团B.母公司

C.子公司D.分公司

4、下列是集团公司对成员企业的持股比例(假设在任何成员企业里,拥有20%的股权即可成为第一大股东)。

则其中与集团公司可以母子关系相称的是(ABC )。

A.100% B.51% C.30% D.D5%

某大型企业集团财务管理咨询案例

一、项目背景

某大型企业集团创始于1988年,刚成立时公司只有十几个人,是单一为油田服务的劳务性企业。

经过多年的发展,目前公司已经成为总资产26亿元,集机电、化工、建筑安装、房地产于一身的大型企业集团。

2003年,该集团公司对集团的发展战略进行了一次系统的策划,明确了公司的发展方向和目标,提出要将企业做大、做强、并最终使企业能够持续发展的战略目标。

2005年该集团为了更有效地实施战略,又对集团公司管理模式进行了重大变革,原来集团直接管理下属将近二十个二级单位,管理幅度过宽,无法针对各个二级单位的业务特点,实施有针对性的管理,变革后,将业务相同的二级单位合并成一个专业公司,最后整合成机电、化工、建安、房地产、微电子、轮胎五大专业子公司。

集团管理模式变了,急需建立更为规范的母子公司管理模式,同时集团公司领导层也需要更为有效的管理工具对各子公司实施管理,因此该集团再一次聘请了九略管理咨询公司,希望借助九略管理咨询公司在财务内控及预算管理方面的咨询经验,帮助客户建立科学的、可操作的内控流程及全面预算管理体系。

二、分析诊断

九略管理咨询公司项目组进驻客户公司以后,对该集团现有管理模式进行了深入的了解,访谈了数十位中高层领导干部,同时对各个业务模块的销售、生产、采购流程进行了详细现场调研和访谈。

经过深入的调查研究,九略项目组认为该集团在财务内控及预算管理方面存在下述核心问题:

首先,该集团大部分业务操作缺乏规范的流程,主要是依据习惯或各自的经验进行,没有相关的制度规定或流程描述,这使员工在执行过程中不能清晰的了解操作流程,同时也致使财务部门在审核时不能确定是否经由适当的部门实施和是否经过适当的审批程序。

其次,制度缺失情况严重,现有财务内控方面的制度主要是针对某一问题的临时性规定,很不系统,而且大部分没有也没有得到有效贯彻,缺乏一些最基本的财务管理制度,比如货币资金管理制度、固定资产管理制度、低值易耗品管理制度、投资管理制度、成本管理制度等。

第三,该集团以前从来没有实施过预算管理,公司整个经营严重缺乏计划性,由于没有预算管理,因此没有办法对各个下属单位进行有效监督和控制,同时无法对各级领导实行分级授权,导致公司权力高度集中于公司总裁,既降低了公司运转效率,也使公司总裁陷于日常事务性签字,而没有时间精力关注于更重要的方面。

第四,公司高层级财务部门尽管意识到在新的管理模式下,要实施全面预算管理,但公司各个部门以及公司各级领导都对全面预算管理都只有个模糊的概念,公司财务部门也不知道如何在该集团推行全面预算管理。

思考: 针对调研中发现的问题以及企业的需求,提出合理的解决方案。

----------------------------------------------------------------------------------------------------------------------

第十四章企业集团财务管理

一、思考题:参考答案(略)

二、练习题

(一)单项选择题

1、D

2、B

3、C

4、B

5、A

6、C

(二)多项选择题

1、BC

2、ACD

3、BC

4、ABC

三、案例分析:参考答案(略)。