中国银行业税收简介

银行税务知识点归纳总结

银行税务知识点归纳总结一、银行税务概述税务是国家实行财政收入和调节经济的重要手段,银行作为国家经济的重要组成部分,也承担了相应的税务责任。

银行税务是指银行在经营活动中涉及到的各种税收,主要包括营业税、增值税、所得税、印花税、土地增值税、房产税等。

二、银行税务管理体制和监管机构1.税务管理体制银行税务管理体制分为中央税务机构和地方税务机构两级。

中央税务机构负责统一全国税收征管,制定税收政策和征管规范,主要包括税务总局和各地税务局。

地方税务机构则负责具体的税收征管工作。

2.监管机构银行税务工作主要由国家税务总局和中国银行监督管理委员会负责监督和管理。

国家税务总局负责制定相关税务政策和征收管理办法,监督税收的征收和使用情况;中国银行监督管理委员会则负责监督和管理银行的经营管理活动,包括税务方面的监管。

三、银行税务管理的基本职责银行作为税务主体,有责任按照国家税收法律法规,主动履行纳税义务,并采取措施防范和避免税务风险,提高税收合规性。

1.履行纳税义务银行应主动履行纳税义务,按时足额缴纳各项税款,如营业税、增值税、所得税、印花税等。

2.纳税申报核算银行要按照国家有关规定,及时准确地进行纳税申报核算工作,如填写纳税申报表、签署纳税申报书、提交税务机关审核并缴纳税款等。

3.纳税风险管理银行应根据税收法规和税务机关的要求,积极采取措施防范和避免税务风险,提高税收合规性。

四、银行税收管理的基本制度和政策1.税收管理制度银行税收管理制度主要包括税收征管制度、税收征管程序、税收征管资料和税收征管档案等。

2.税收政策银行应密切关注国家税收政策的变化,合理利用税收优惠政策,降低税收成本,提高资金利用效率和竞争力。

3.税收合规管理银行应建立健全税务管理机制,完善税收合规管理制度,加强税收风险管理和内部控制,确保税务合规。

五、银行税务管理的主要工作1.税收征收管理银行要落实税收征管职责,加强税收征收管理能力建设,提高税收征收质量和效率。

银行业税制研究

利息 、 租金 、 特许权使用 费 、 股息等项所得 。我 国内 资企业实行 的是统一税率 33% 。但是 , 对银行业 的

税 前 扣 除作 了较 严 格 的规 定 ,如 工 资 薪 金 以每 人

事何种金融业务 , 原则上统一按照“ 金融保险业” 税

的税 率 , 营业 税 各 行 业 有 所 差距 , 附表 。 而 见 虽 然 部 分 行 业 较 银 行业 税 率 较 高 ,但 由于其

2、 企业 所得 税 企 业 所 得 税 是 以企业 的纯 收益 额 为征税 对 象

22 华 金 北 融2006 年 第2期

i 兑目

交通 运

输 业

建设 业

3% 一2

一定 的税负 比例 。 综合考虑营业税 、 城市维护建设税 、 印花税 和 教 育 费 附加 ,一 般 银 行 业 的流 转 税 综 合 税 负 在

5 . 5% 以上 。

(二) 我 国银行业税 负与其他行业税 负的比较 我 国银 行 业 的税 负 水 平 同我 国其 他 行 业 比 较, 属于税率较高的 , 所得税各行业均执行 33%

银 行 皿说 制 研 究

人民银行张家口市中心支行课题组

( 中国人 民银 行 张 家 口市 中心 支行 河北 张 家 口市 075000 )

摘 要: 本文通过深入分析 目 前我国银行税负的状况, 在对我国银行业与其他行业、 外资银行以及

国际金融业税负比较的基础上, 归纳出我国银行税制目 前存在的主要问题并据此提出改革我国银行税 制的具体设想。 关键词: 税收制度; 银行业税制; 国民待遇

和教育附加 , 分别为营业税的 7% (市区, 县城 5% ) 和 4% 。为了促进农村信用社改革 , 政府给予农村 信用社一定的税收优惠 , 2005 年 1 月 1 日起 , 从 农

银行工作中的纳税政策解读与应用

银行工作中的纳税政策解读与应用近年来,随着经济的发展和金融行业的日益壮大,银行业务的复杂性和多样性不断增加。

作为金融机构的重要一员,银行不仅需要熟悉和掌握各种金融产品和服务,还需要了解和应用相关的法律法规,包括纳税政策。

本文将对银行工作中的纳税政策进行解读与应用。

一、纳税政策的背景和重要性纳税政策是国家为了调节经济发展和社会公平而制定的税收规定和政策。

税收是国家的重要财政收入来源,也是国家宏观调控的重要手段之一。

对于银行来说,纳税政策不仅影响到银行自身的税负,还关系到客户的税务问题,因此熟悉和应用纳税政策对银行工作来说至关重要。

二、银行业务中的纳税政策解读1. 存款利息税收政策根据我国税法规定,个人存款利息超过1万元的部分需要缴纳利息税。

银行作为存款利息的支付者,需要在支付利息时扣除相应的利息税。

银行工作中需要了解和掌握存款利息税收政策,正确计算并扣除利息税。

2. 贷款利息税收政策对于个人来说,贷款利息可以在一定程度上抵扣个人所得税。

银行在发放贷款时,需要根据客户的贷款利息情况提供相关的税务凭证,以便客户在个人所得税申报时进行抵扣。

银行工作中需要了解个人所得税法规定的贷款利息抵扣政策,并为客户提供相应的支持和服务。

3. 公司所得税政策银行作为金融机构,也是纳税人之一,需要按照国家的税法规定缴纳公司所得税。

银行工作中需要了解公司所得税的计算方法和申报程序,并确保按时足额缴纳税款。

三、银行工作中的纳税政策应用1. 客户税务咨询服务作为金融机构,银行可以为客户提供相关的税务咨询服务,帮助客户了解和应用纳税政策。

例如,针对个人客户,银行可以解释存款利息税收政策和个人所得税抵扣政策,帮助客户正确理解和处理税务问题。

针对企业客户,银行可以协助客户了解和申报公司所得税,提供相关的税务凭证和报表。

2. 税务合规监测银行作为金融机构,需要严格遵守国家的税法规定,确保纳税合规。

银行工作中需要建立完善的税务合规监测机制,及时掌握和应用最新的纳税政策,确保银行的税务申报和缴纳工作符合法律法规的要求。

商业银行的税务情况

商业银行的税务情况商业银行是一种以盈利为目标的金融机构,为客户提供各种银行业务,如存款、贷款、理财等。

随着全球金融市场的发展,商业银行在国际业务中扮演着重要的角色。

税务情况是商业银行运营过程中的一个重要方面。

本文将探讨商业银行的税务情况,包括税收种类、税收规模、税务政策等方面。

一、税收种类商业银行在日常运营过程中需要缴纳多种税收,主要有以下几种:1. 企业所得税:根据商业银行的盈利状况,按照法定税率对企业利润进行征税。

2. 城市维护建设税和教育费附加:按照一定比例计算企业缴纳的企业所得税金额。

3. 印花税:商业银行在办理汇票、支票、债券等交易时,需要按照交易金额的一定比例缴纳印花税。

4. 增值税:商业银行在提供服务时,按照服务收入的一定比例缴纳增值税。

二、税收规模由于商业银行通常规模庞大,业务繁多,其税收规模也十分可观。

以中国为例,近年来,随着中国金融市场的快速发展,商业银行的利润不断增长,税收水平也在逐年上升。

根据中国税务部门的数据,2019年全国范围内商业银行的企业所得税总额超过1000亿元,占全国企业所得税总额的一大部分。

同时,商业银行还需要缴纳其他各项税收,如城市维护建设税、印花税等,总体税收规模庞大。

三、税务政策税务政策对商业银行的税务情况具有重要影响。

国家税务部门会定期出台有关税收的法律法规,在商业银行的税务申报、缴纳和纳税筹划等方面提供指导。

同时,税务政策也会根据经济形势和行业发展的需要进行调整。

商业银行需要密切关注税务政策的变化,合理规划税务筹划,以降低税负和避免税务风险。

四、税务合规商业银行作为金融机构,必须严格遵守税法,确保税务合规。

在税务申报和缴纳过程中,商业银行需要做好准确的会计核算和信息报送,确保税收数据的准确性和及时性。

同时,商业银行还应积极配合税务部门的税务检查和审计工作,及时纠正存在的问题,并按照要求补缴欠缴税款。

五、税务风险管理商业银行需要重视税务风险管理,加强内部税务控制,避免税务风险对企业经营造成不利影响。

我国银行业税收状况分析及对税制改革的建议

我国银行业税收状况分析及对税制改革的建议摘要本文分析了我国银行业税收状况,包括当前的税收政策和税收收入状况。

通过对税收政策的分析,发现存在一些问题和挑战,例如税负过重、税制不够完善和扭曲银行业发展方向等。

本文还提出了一些对税制改革的建议,以促进银行业的可持续发展,提高税收收入。

1. 引言银行业作为我国金融业的重要组成部分,对国家经济发展的推动起着重要作用。

税收作为国家财政收入的重要来源之一,也对银行业有着重要影响。

因此,分析我国银行业税收状况,并提出针对性的税制改革建议,对于银行业和国家财政都具有重要意义。

2. 当前的税收政策当前,我国的银行业税收政策主要包括企业所得税和增值税。

企业所得税是根据银行业的营业收入和利润进行征收,税率在25%~35%之间,根据不同的情况有所浮动。

增值税主要针对银行业的服务和产品征收,税率一般为6%。

总体来说,银行业税收负担相对较高。

3. 税收收入状况根据统计数据,我国银行业税收收入在近年来逐步增加。

然而,税收收入增长速度相对缓慢,与银行业的发展并不相称。

这主要是由于税收政策的限制和税负过重导致的。

此外,银行业税收中存在不少优惠政策和减免政策,降低了税收收入。

4. 税制改革的建议为了提高银行业税收收入和促进银行业的可持续发展,需要对税制进行改革。

以下是一些建议:4.1 降低税负当前银行业税负过重,影响了银行业的发展。

建议适当降低企业所得税税率,特别是对利润较低的小微银行。

这将减轻银行业的负担,鼓励其加大投资和创新。

4.2 完善税收制度当前的税收制度相对不够完善,存在扭曲银行业发展方向的问题。

建议政府加大对税收制度的改革力度,采取差别化税率,根据银行业的风险程度和盈利能力进行征收。

此外,建议制定更明确的税收政策和法规,减少对银行业的干预。

4.3 加强税收管理税收管理的效率和公正性是保障税收收入的重要因素。

建议加强对银行业税收的监督和管理,减少税收漏税和逃税。

此外,建议加强与银行业的合作,建立更加透明和高效的税收征收机制。

中美银行业税制的比较与借鉴

中美银行业税制的比较与借鉴2007年银行业已全面开放,比较中外银行税负,认为国内银行税负过重、内外资银行税制不同、税制设计粗糙等,借鉴国外税法,提出银行税制改革的建议。

标签:中外银行业税制比较金融是现代经济的核心,银行又是金融的核心。

随着我国金融市场的开放。

银行企业的竞争将愈加激烈,而银行业税制是影响银行竞争力的重要因素。

一、我国现行银行税制中国银行业适用的税种主要有企业所得税、房产税、车船使用税三种直接税和营业税、印花税、契税、城市维护建设税、教育费附加等间接税。

二、外国的银行税制1.美国银行税制美国是以所得税为主体税种的国家,联邦和其50个州各有自己的税法,联邦政府的税收主要依靠所得税,州政府主要依靠销售税,地方政府主要依靠财产税。

就银行而言,在联邦和所在州及地方政府设置的各个税种中,公司所得税是其主要税种。

目前,美国联邦政府开征的税种有:个人所得税、社会保障税、公司所得税、遗产与赠与税、消费税和关税。

州政府开征的税种主要有:销售税、个人所得税、公司所得税、消费税、财产税、遗产与赠与税、资源税和社会保障税。

地方政府开征的税种主要有:财产税、销售税、消费税、个人所得税、公司所得税和社会保障税。

2.部分国家的银行业税制三、中国银行业应采取的对策通过以上比较,借鉴国外成功经验,中国银行业可采取下列对策:1.改革营业税、所得税第一,降低税率。

营业税税率可以降至2%,与国外银行业税负水平1.5%~2%相当。

第二,改变计税依据。

营业税的税基是贷款利息收入,但当贷款增加,或者说利息收入增加时,银行利润却并不一定会增加,甚至会减少。

因此,应将当前的以全额贷款利息收入为计税依据,改为以银行存贷款利息收入差额计征营业税。

第三,调整企业所得税扣除项目。

应按国际通行的财务、会计准则设计,不合理的税前扣除规定应当修改。

原则上与银行经营有关的支出和费用都应当在所得税前据实扣除,对工资和坏账核销等银行业影响较大的扣除项目,应进行适当调整,计税工资的规定应当取消,坏账核销标准应适当放宽,贷款坏账准备金的提取要按国际通行的五级分类标准进行。

我国银行业税收状况分析及对税制改革的建议

我国银行业税收状况分析及对税制改革的建议[摘要]随着金融市场的开放,银行业所面临的竞争日趋激烈,税制不完善、税负不公平已经成为制约我国银行业发展的不利因素。

本文对我国银行业税收状况进行了分析,并对税制的改革和完善提出了建议。

[关键词]银行业税收制度完善随着我国金融市场逐步对外开放,外资金融机构更多地在设立分支机构、业务经营方面享有国民待遇。

国家对国内金融业的税收政策是否合理、税负水平的高低会关系到金融业的生存发展以及经营效益的好坏。

我国银行业涉及的税种主要有营业税、企业所得税、个人所得税、城市维护建设税等,本文主要针对我国银行业税收制度问题进行比较分析,提出完善我国银行业税制的建议以更好地促进金融市场的发展。

2006年是金融业WTO过渡期的最后一年,面临实力雄厚、经验丰富、产品众多的外资金融机构的挑战,我国银行业需要得到政府政策的扶持。

然而,税制的不完善和较重的税收负担制约着我国银行业的发展。

(一)我国银行业税收状况分析1.流转税状况分析(1)税率设计不合理。

我国银行业的营业税税率为5%,高于交通运输业、建筑业、邮电通讯业、文化体育业3%的税率,此外还要承担城市维护建设税、教育附加等。

在国外,金融业务一般纳入增值税的征收范围,可以取得进项税额的扣除,而且大多数国家对核心金融业是免征增值税的。

由于营业税本身带着重复征税、不量能征税的根本性弊端,以营业税为主体税种对金融业征税,无形中加重了金融业的经济负担,直接减少其收益率,不利于金融业的资本积累和长期稳健发展。

(2)主体税种的选择不科学,金融业流转税收入占绝大比重。

2003年中国金融业7,450,373万元的税收收入中,作为主要税种的营业税和企业所得税的收入分别为4,079,418万元和2,054,521万元,占全部金融业税收收入的比重为55%和28%,金融业流转税收入占绝大比重,金融业的企业所得税远远低于营业税在金融业税收中的份额。

(3)内外资银行间税负不公。

商业银行税收筹划

合理的纳税筹划是减轻企业税负的必要途径是银行实现经营目标的手段之—是增强企业竞争力的必然选择 现行税收政策为银行实施纳税筹划提供了可能

What 什么是税收筹划?

税务筹划是指纳税人以税收政策为依据,在对企业发展战略和经营情况全面分析的基础上,通过对生产经营和投融资活动进行科学合理的周密安排,对纳税方案进行优化选择,以达到合法降低税收成本的经济行为。 税收筹划是指纳税人在税收法律许可的范围内,当存在多种纳税方案可供选择时,以税收政策为导向,通过投资、理财、组织、经营等事项的事先安排和策划以达到税后财务利益最大化的经济行为。税收筹划是指纳税人为达到减轻税负和实现税收零风险的目的,在税法所允许的范围内,对企业的经营、投资、理财、组织和交易等各项活动进行事先计划和安排的过程。

例如: 有A公司三年期债券与三年期国债同时发行,某商业银行拟投资其中一种债券。这两种债券均为每年付息一次,A公司债券利率5%,国债的利率为4%。假设A公司债券没有信用风险折价。

表面上看A债券的投资收益率高于国债,但是由于A债券利息收入需要交纳25%的企业所得税。 因此 A债券的税后收益率= 5%×(1—25%) = 3.75% 低于国债的税后收益率4%(国债利息收入免税)。 因此,B商业银行应当选择投资国债。

二、银行业税收状况

银行业是税负水平较高的行业之一,税收在商业银行总成本中占较大比重。中国银行业现行税收体系是在1994年税制改革时确定的,按照这一税收体系,目前我国商业银行在运营中经常涉及的税种主要有11个。

银行业缴纳的主要税种

企业所得税营业税增值税城市维护建设税印花税城镇土地使用税房产税契税车船税车辆购置税代扣代缴的个人所得税教育费附加 经常性税费共有12项,其中,营业税与企业所得税约占银行业所纳税额的90%。

银行的税法与税收政策

银行的税法与税收政策银行作为金融机构,在经营中必须严格遵守税法和税收政策。

本文将围绕银行的税法与税收政策展开论述,以期为读者提供相关知识和参考。

一、税法对银行的规范1. 企业所得税法企业所得税是指企业按照一定税率缴纳的利润所得税。

银行作为企业,根据企业所得税法,应当按时依法缴纳企业所得税。

银行的纳税义务主要体现在准确计算应纳税所得额和及时申报纳税。

2. 增值税法增值税是指在商品或服务的流转过程中,按照一定比例向国家缴纳的税金。

银行作为金融服务提供商,根据增值税法,需要按照规定的税率缴纳增值税。

银行的增值税纳税主要涉及银行服务费、手续费等。

3. 资产税法资产税是指个人或企业根据其资产规模缴纳的税金。

银行作为金融机构,拥有大量的资产,根据资产税法,银行需要按照法定税率缴纳相应的资产税。

二、银行税收政策的运用1. 利用税收优惠政策支持金融创新为了促进金融创新与发展,政府对银行在创新领域的相关业务给予了一定的税收优惠政策。

银行可以根据税收政策的规定,享受相应的税收减免或者税率优惠,这样既鼓励了银行创新,又为金融市场的发展提供了支持。

2. 优化税收结构,提高税收效率为了鼓励银行加大对实体经济的支持力度,政府推出了一系列的税收政策,以减轻银行在投资与融资方面的税负。

通过调整税收结构,降低部分税种的税率或者提高免税额度,既能引导银行加大对实体经济的融资支持,同时也能够提高税收征收的效率。

3. 加强税收风险管理银行在纳税过程中需要严格遵守税法法规,避免违规操作和偷逃税款。

政府加强对银行纳税情况的监督与管理,通过对银行纳税数据的分析,发现并防范税收风险。

同时,政府也鼓励银行主动配合税务机关的税收稽查和核算工作,确保纳税行为的合规性和真实性。

三、银行需要关注的税收问题1. 跨境业务税收随着全球经济的发展,银行的跨境业务日益增多。

在进行跨境业务时,银行需要关注不同国家或地区间的税收政策差异,遵守相关的税法法规。

此外,还需要合理规划跨境交易的税务筹划,以降低税负并提高效益。

中国银行业税收制度确定性考察

基础交易 , 这会使同样的金融衍生产品呈现税收的差别性待 例计提准备金 ; 部分银行根据其涉 农贷款和 中小企业 贷款 中正

遇, 进 而甚至 引发套税 的问题 。这与金融衍 生产品的蓬勃 发展

很不相适应 , 使征纳双方在都要 耗费大量 的精力对每种新 的金

常类贷款比重较大的实 际情况 , 因此直接 对全部贷款均计提 1 %

、

金 融 衍 生 产 品 税收 制度 基 本 空 白

税收 制度存在 空白点 , 致使纳 税人的纳税义 务不确定 。这 在 银行 以交易者身份 参与金融衍 生产品 交易的 过程 中表现比

较突出。

近年来 , 随 着金融全球 化的趋势 , 金融衍生 产品所 具有 的 提高金融 效率 、 减少 金融 风险的特性 广为 人知 , 中 国的金融 衍 生产品市场获得 了较 快发展 , 银监会于 2 0 0 4 年 2月推出了《 金 融机构衍生产品交易业 务管理 暂行办法》 ,解决了金融机 构从

事金融衍 生产品 交易的法律 障碍问题 , 工、 农、 中、 建4 大行 和 交通银行 、 中信 银行等具有一定规模 的上市银行都纷 纷加入到 金融 衍生产 品的交易大军 中 。衍生 金融产 品的 种类也 日益增 多, 衍生金融产品交 易的额度也增加迅猛。但与此相对应的 , 在 中国银行业 现行税收 制度 中 , 关于金 融衍生 产品的规 定 , 少之

银行所得税情况汇报

银行所得税情况汇报近年来,银行业在我国经济发展中扮演着越来越重要的角色,随之而来的是银行所得税的相关政策和情况备受关注。

在这篇文档中,我们将对银行所得税的情况进行汇报,以便更好地了解相关政策和规定。

首先,我们需要了解的是银行所得税的税率和税基。

根据国家税务总局发布的相关规定,银行所得税的税率为25%,税基是银行的利润总额。

这意味着银行需要按照其实际利润总额的25%进行纳税。

此外,银行所得税的征收遵循年度结算的原则,即银行需要在每个纳税年度结束后进行所得税的结算和缴纳。

其次,我们需要关注的是银行所得税的优惠政策。

根据国家税务总局发布的文件,对于符合条件的金融机构和金融产品,可以享受相应的税收优惠政策。

比如,对于支持农业、小微企业和环保等领域的金融产品,可以享受一定的所得税减免或免征政策。

这些优惠政策的出台,有利于鼓励银行业支持国家重点发展领域,同时也有利于促进金融业的健康发展。

另外,我们还需要了解银行所得税的申报和缴纳程序。

根据相关规定,银行需要在每个纳税年度结束后的3个月内,向税务机关申报并缴纳上一纳税年度的所得税。

在申报和缴纳过程中,银行需要提供相关的财务报表和税务资料,以便税务机关进行核实和审核。

同时,银行还需要严格遵守相关的税收法律法规,确保申报和缴纳的准确性和及时性。

最后,我们需要关注的是银行所得税的监督和管理情况。

国家税务总局和地方税务机关将对银行所得税的申报和缴纳情况进行监督和管理,对于不符合规定的行为将进行相应的处罚和处理。

同时,税务机关也将加强对银行所得税政策的宣传和解释,以便银行能够更好地理解和遵守相关政策和规定。

综上所述,银行所得税是银行业务中一个重要的税收环节,对于银行和金融机构来说,了解并遵守相关的税收政策和规定至关重要。

我们希望通过这份汇报,能够更好地了解银行所得税的相关情况,为银行业的发展和税收管理提供参考和指导。

同时,也希望银行能够积极配合税务机关的监督和管理,共同维护税收秩序,促进经济发展。

我国银行业税收法律结构简析

前者指 的是对 金融机构 课征 的各类税 收 , 主要包括 以金融机 构提 供 的劳 务活动 为征税对 象而课 征的流转 税 、 以金融 机构 的收益所 得 为征税 对象 而课征 的公司所得 税和其 他税种 ; 后者 指 的是对 持 有和遗赠金融资 产及对投资者在金融市场 中进行金融资产交 易征 收 的各 类税收 , 主 要包括 以所 有者 通过持有 金融资产 获取 的收益

虑银 行 业发 展 和投 资的增 长 问题 , 但 这种 过 于坚持 国 家利 益优 先 的做 法 往往 会造 成银 行机 构收 益 的波动 , 进 而对 其投 资积 极 性 产 生 消极 影

所得 税性质 不仅会 给不 同形式 的金融 收入 , 还 会给取得这 种收入 的银行 的税收待遇造成一定 的扭 曲。这些扭 曲的代价 目前 也许还

表1 .1 银行业营业பைடு நூலகம் 、 企业所得税税率发展变 化表 税种/ 年份 1 9 9 4 .1 9 9 6 1 9 9 7 . 2 O o 0 2 0 0 1 2 0 0 2 2 0 o 3 . 2 0 o 7 2 0 0 8 — 2 0 1 3 营业税 5 % 8 % 7 % 6 % 5 % 5 %

( 二) 所 得 税 制

券 交易额) 为征税对象而征 收的交易税 、 对通 过金融 资产交易 获取 的利得 征收 的资本利得 税 , 和以所有 者拥有 或遗赠 的金 融资产 价 值 总额为征税对 象而课征的财产税 。

本文主要讨 论的是前者 , 这 是因为在我 国, 银行业实行 的是一

我 国银行业所 得税 政策的变化与企业所得税制改革 的步伐基

2 5 %

2 0 0 8 年1 月1 日 起, 《 中华人 民共和 国企业 所得税 法 》 开始 正 式生效 , 其 中“ 两 税合并 ” 、 调 整税基 等做 法有效 地减 轻 了 内资 银 行 的所得税税 负水 平 。具 体 而言 , 首先, 内资 银行 所得 税税 率 从 3 3 %下调 至 2 5 %; 其次 , 与过去对 内资银行业务招待 费支 出实行 按

银行业税收政策简介

2021/4/16

税收政策简介

6

1、纳税人:会计制度

▪ 企业会计准则(2007、2010、2014) ▪ 小企业会计准则2013(除外): ▪ 1、股票或债券在市场上公开交易的小企业 ▪ 2、金融机构或其他具有金融性质的小企业 ▪ 3、企业集团内部的母公司和子公司

2021/4/16

税收政策简介

3

1.利息收入(4+5+6+7+8+9)

4

(1)存放同业

5

(2)存放中央银行

6

(3)拆出资金

7

(4)发放贷款及垫资

8

(5)买入返售金融资产

9

(6)其他

10

2.手续费及佣金收入

11

(1)结算与清算手续费

12

(2)代理业务手续费

13

(3)信用承诺手续费及佣金

14

(4)银行卡手续费

15

(5)顾问和咨询费

16

征收机关

最高位阶 最近修订文本开始执行日期

1 增值税

国税、海关(代征) 行政法规 暂行条例2009年1月1日,实施细则2011年11月1日

2 消费税

国税、海关(代征) 行政法规 暂行条例2009年1月1日,实施细则2011年11月1日

3 车辆购置税 国税

行政法规 暂行条例2001年1月1日,征管办法2016年2月1日

▪提供基础电信服务,税率为11%。 提供增值电信服务,税率为6%。

▪建筑业、房地产

业、金融业、生活

▪

服务业 税收政策简介

▪金融保险业,税率为6% 房地产和建筑业,税率为11% 酒店、餐饮等生活服务业,税率为为6%

银行业的税收状况

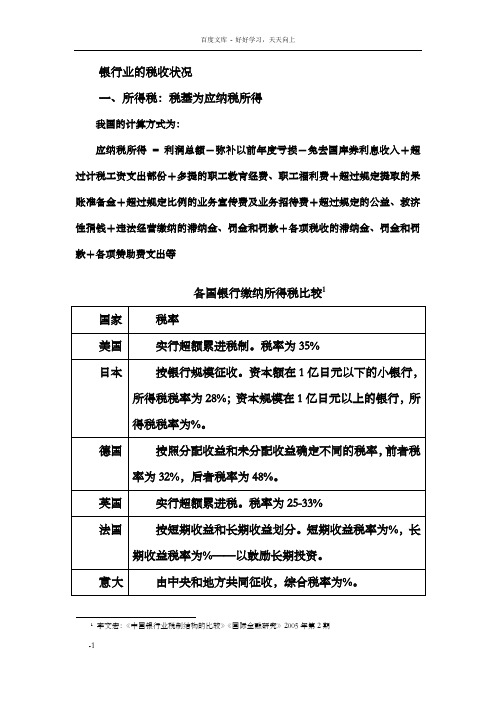

银行业的税收状况一、所得税:税基为应纳税所得我国的计算方式为:应纳税所得= 利润总额-弥补以前年度亏损-免去国库券利息收入+超过计税工资支出部份+多提的职工教育经费、职工福利费+超过规定提取的呆账准备金+超过规定比例的业务宣传费及业务招待费+超过规定的公益、救济性捐钱+违法经营缴纳的滞纳金、罚金和罚款+各项税收的滞纳金、罚金和罚款+各项赞助费支出等各国银行缴纳所得税比较11李文宏:《中国银行业税制结构的比较》《国际金融研究》2005年第2期2007年3月16日,《企业所得税法》在十届全国人大五次会议上进行最终表决并获通过,2008年1月1日起开始实施。

“两税合一”变成现实。

二、营业税及其附加:税基为计税营业收入发达国家普遍实行免税或低税政策。

全世界部份国家银行业缴纳营业税/周转税情况比较我国的计算法方式:⑴营业税税基为计税营业收入。

税率为5%(2004年开始)。

计税营业收入=贷款利息收入+外汇转贷款费收入+手续费收入+外汇有价证券等金融商品的转让净收入等⑵营业税附加:①城市保护建设税:税率为7%,税基为营业税。

②教育费附加:税率为3%,税基为营业税。

——总税率为%。

我国服务行业税负比较(营业税税目税率)我国银行业的税收状况一、1997年税率调整后国有商业银行纳税额变更情况2单位:亿元2《2003中国金融年鉴》。

二、四大国有独资商业银行的实际税率33公平与效率:金融税制与国有商业银行税负《2003中国金融年鉴》专题与调研篇四大国有独资商业银行的实际税率单位:%3、我国金融保险业的税收体系和数额统计4单位:万元,%4李文宏:《中国银行业税制结构的比较》《国际金融研究》2005年第2期4、2002年我国各商业银行缴纳营业税、所得税情况5 5李文宏:《中国银行业税制结构的比较》《国际金融研究》2005年第2期单位:亿元。

银行所得税情况汇报

银行所得税情况汇报根据国家税收政策规定,银行作为金融机构,在获得收入的同时也需要缴纳相应的所得税。

所得税作为国家的税收收入之一,对于银行来说是一项重要的财务成本,因此及时了解银行所得税的情况对于银行的财务管理至关重要。

首先,我们需要了解银行所得税的计算方法。

银行所得税的计算主要是根据银行的利润来确定的。

银行利润主要包括利息收入、手续费及佣金收入、投资收益等。

根据国家税收政策,银行所得税的税率为25%,具体计算公式为,银行所得税=利润总额×25%。

其次,需要了解银行所得税的纳税申报和缴纳情况。

银行在每年的纳税期内,需要按照国家税收政策规定的时间节点,向税务机关进行纳税申报,并在规定的时间内缴纳相应的所得税款项。

银行需要准备完善的财务报表和相关税务资料,确保纳税申报的准确性和及时性。

另外,银行还需要了解税收政策的变化对银行所得税的影响。

国家税收政策会根据宏观经济形势和金融市场的变化进行调整,对银行所得税的税率、减免政策等方面进行调整。

因此,银行需要及时了解税收政策的变化,做好应对措施,确保银行所得税的合规缴纳。

最后,银行还需要关注税务风险和合规管理。

在纳税申报和缴纳过程中,银行需要严格遵守国家税收政策的规定,确保所得税的合规缴纳。

同时,银行还需要关注税务风险,加强税务合规管理,防范税务风险,确保银行所得税的合规性和稳定性。

综上所述,银行所得税是银行在经营过程中需要重点关注的税收成本之一。

银行需要了解所得税的计算方法、纳税申报和缴纳情况、税收政策的变化对所得税的影响,以及税务风险和合规管理等方面的情况,做好税务管理工作,确保银行所得税的合规缴纳和稳定性。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1.1 法律依据

Laws and Regulations • 《中华人民共和国营业税暂行条例》,

1993年12月13日国务院发布,自1994年1月1 日起施行;2008年11月10日修订公布,自 2009年1月1日起施行。 • Provisional Regulations of the PRC on Business Tax,promulgated by the State Council on 13th Dec. 1993, and effective from 1st Jan. 1994; Revised on 10th Nov. 2008 and effective from 1st Jan. 2009.

1.4 计税方法

Computation of tax payable (2)

(1)外汇、有价证券、非货物期货和其他金融商品买卖 业务,以卖出价扣除买入价后的余额为计税营业额。 For buying and selling foreign currencies, marketable securities, non-commodity futures and other financial goods, the turnover shall be the balance of the selling price less the buying price. (2)从事受托收款业务(如代收电话费、水费、电费、燃 气费、学杂费、保险费和税款等),以其受托收取的全 部款项扣除支付给委托方的款项后的余额为计税营业额。 The turnover of the banks engaged in entrusted collection of payments such as payment of the telephone bill, water charge, utility charge, gas charge, tuition fee, insurance premium, taxes, etc. shall be the balance of the total receipts less the sum paid to the entrusting party.

1.2 纳税人 Taxpayers

• 在中国境内提供应税劳务、转让无形资产和销售不动产的单 位和个人。 • All enterprises and individuals engaged in provision of taxable services, transfer of intangible assets or in sales of immovable properties within the territory of the PRC. • 中国境外的银行在中国境内提供应税劳务、转让无形资产和 销售不动产,没有在中国境内设立经营机构的,以其中国境 内的代理人为扣缴义务人;在中国境内无代理人的,以受让 方或购买方为扣缴义务人。 • For overseas banks that have taxable activities within China but have no establishment within China, the agents shall be the withholding agents for their Business Tax payable. In case of no agents, the transferees or the purchasers shall be the withholding agents. • 委托银行发放贷款的,其应纳营业税税款以受托发放贷款的 银行为扣缴义务人。 • For financial institutions entrusted to make loans, the entrusted financial institutions shall be the withholding agents for their Businesaxable Items and Tax Rates

• 银行按照“金融保险业”税目征收营业税, 税率为5%。 • Banks are subject to Business Tax according to the taxable item “Financial and Insurance Business” with 5% tax rate.

2.1 法律依据 Laws and Regulations

• 《中华人民共和国企业所得税法》,2007年3 月16日全国人大通过并公布, 自2008年1月1日 起施行。 • Enterprise Income Tax Act of the PRC, passed and promulgated by the National People's Congress on 16th Mar. 2007, and effective as of 1st Jan. 2008.

1.5 不征税规定

Main Exemptions

• 中国人民银行对金融机构的贷款业务,金融机 构之间相互占用、拆借资金取得的利息收入, 单位、个人将资金存入金融机构取得的利息收 入,不征收营业税。 • No Business Tax is imposed on the loan making business by the People’s Bank of China to the financial institutions, the interest revenue derived from the intrafinancial institution’s use or borrowing of fund, the interest income of units and individuals from savings in financial institutions.

A. 中国对银行业征收的主要税种 The taxes on banks in China

1.营业税 Business Tax 2.企业所得税 Enterprise Income Tax 3.房产税 House Property Tax (Real Estate Tax) 4.城镇土地使用税 City and Township Land Use Tax 5.车船税 Vehicle and Vessel Tax (VVT) 6.印花税 Stamp Tax 7.城市维护建设税 City Maintenance and Construction Tax

1.营业税 Business Tax

• 银行总行集中缴纳的营业税由国家税务局负责征收 管理,所得收入划归中央政府;银行缴纳的其他营 业税由地方税务局负责征收管理,所得收入划归地 方政府。营业税是中国银行业的主体税种之一。 2008年,全国银行营业税收入为1065.9亿元,占当年 全国营业税收入的14.0%和税收总额的2.0%。 • Business Tax consolidatedly paid by the headquarters of various banks is administered by the offices of SAT,and it’s revenue belongs to the central government;the other Business Tax paid by the banks is administered by Local Taxatoin Offices,and it’s revenue belongs to the local governments. Business Tax is one of the principal taxes for banks. In 2008, the total revenue of Business Tax on banks amounts to 106.59 billion Yuan, accounting for 14.0% of the total Business Tax revenue and 2.0% of the total tax revenue of China.

2. 企业所得税 Enterprise Income Tax (EIT)

• 银行缴纳的企业所得税由国家税务局负责征收管理, 所得收入由中央政府与地方政府共享。企业所得税 是银行业的主体税种之一。2008年,全国银行企业所 得税收入为 1959.6亿元,占当年全国企业所得税收入 的16.1%和税收总额的3.5%。 • EIT on banks are administered by the offices of SAT,and it’s revenue is shared with the central government and the local governments. EIT is one of the principal taxes for banks。In 2008, the all revenue of EIT on banks is 195.96 billion Yuan, accounting for 16.1% of the total EIT revenue collected from all enterprises and 3.5% of the total tax revenue of China.

第五主题:银行业税收 V. THE TAXATION OF BANKS

中国银行业税收简介

Overview of the Taxation of Banks in China 刘佐

Liu Zuo

中国国家税务总局税收科学研究所所长

Director-General of the Taxation Science Research Institute State Administration of Taxation (SAT) ,China

中国银行业税收简介

Overview of the Taxation of Banks in China A. 中国对银行业征收的主要税种 The taxes on banks in China