证券投资学英文版答案

投资学第7版Test Bank答案完整可编辑

Multiple Choice Questions1. The term structure of interest rates is:A) The relationship between the rates of interest on all securities.B) The relationship between the interest rate on a security and its time to maturity.C) The relationship between the yield on a bond and its default rate.D) All of the above.E) None of the above.Answer: B Difficulty: EasyRationale: The term structure of interest rates is the relationship between two variables, years and yield to maturity (holding all else constant).2. The yield curve shows at any point in time:A) The relationship between the yield on a bond and the duration of the bond.B) The relationship between the coupon rate on a bond and time to maturity of thebond.C) The relationship between yield on a bond and the time to maturity on the bond.D) All of the above.E) None of the above.Answer: C Difficulty: Easy3. An inverted yield curve implies that:A) Long-term interest rates are lower than short-term interest rates.B) Long-term interest rates are higher than short-term interest rates.C) Long-term interest rates are the same as short-term interest rates.D) Intermediate term interest rates are higher than either short- or long-term interestrates.E) none of the above.Answer: A Difficulty: EasyRationale: The inverted, or downward sloping, yield curve is one in which short-term rates are higher than long-term rates. The inverted yield curve has been observedfrequently, although not as frequently as the upward sloping, or normal, yield curve.4. An upward sloping yield curve is a(n) _______ yield curve.A) normal.B) humped.C) inverted.D) flat.E) none of the above.Answer: A Difficulty: EasyRationale: The upward sloping yield curve is referred to as the normal yield curve, probably because, historically, the upward sloping yield curve is the shape that has been observed most frequently.5. According to the expectations hypothesis, a normal yield curve implies thatA) interest rates are expected to remain stable in the future.B) interest rates are expected to decline in the future.C) interest rates are expected to increase in the future.D) interest rates are expected to decline first, then increase.E) interest rates are expected to increase first, then decrease.Answer: C Difficulty: EasyRationale: An upward sloping yield curve is based on the expectation that short-term interest rates will increase.6. Which of the following is not proposed as an explanation for the term structure ofinterest rates?A) The expectations theory.B) The liquidity preference theory.C) The market segmentation theory.D) Modern portfolio theory.E) A, B, and C.Answer: D Difficulty: EasyRationale: A, B, and C are all theories that have been proposed to explain the term structure.7. The expectations theory of the term structure of interest rates states thatA) forward rates are determined by investors' expectations of future interest rates.B) forward rates exceed the expected future interest rates.C) yields on long- and short-maturity bonds are determined by the supply and demandfor the securities.D) all of the above.E) none of the above.Answer: A Difficulty: EasyRationale: The forward rate equals the market consensus expectation of future short interest rates.8. Which of the following theories state that the shape of the yield curve is essentiallydetermined by the supply and demands for long-and short-maturity bonds?A) Liquidity preference theory.B) Expectations theory.C) Market segmentation theory.D) All of the above.E) None of the above.Answer: C Difficulty: EasyRationale: Market segmentation theory states that the markets for different maturities are separate markets, and that interest rates at the different maturities are determined by the intersection of the respective supply and demand curves.9. According to the "liquidity preference" theory of the term structure of interest rates, theyield curve usually should be:A) inverted.B) normal.C) upward slopingD) A and B.E) B and C.Answer: E Difficulty: EasyRationale: According to the liquidity preference theory, investors would prefer to be liquid rather than illiquid. In order to accept a more illiquid investment, investors require a liquidity premium and the normal, or upward sloping, yield curve results.Use the following to answer questions 10-13:Suppose that all investors expect that interest rates for the 4 years will be as follows:10. What is the price of 3-year zero coupon bond with a par value of $1,000?A) $863.83B) $816.58C) $772.18D) $765.55E) none of the aboveAnswer: B Difficulty: ModerateRationale: $1,000 / (1.05)(1.07)(1.09) = $816.5811. If you have just purchased a 4-year zero coupon bond, what would be the expected rateof return on your investment in the first year if the implied forward rates stay the same?(Par value of the bond = $1,000)A) 5%B) 7%C) 9%D) 10%E) none of the aboveAnswer: A Difficulty: ModerateRationale: The forward interest rate given for the first year of the investment is given as 5% (see table above).12. What is the price of a 2-year maturity bond with a 10% coupon rate paid annually? (Parvalue = $1,000)A) $1,092B) $1,054C) $1,000D) $1,073E) none of the aboveAnswer: D Difficulty: ModerateRationale: [(1.05)(1.07)]1/2 - 1 = 6%; FV = 1000, n = 2, PMT = 100, i = 6, PV =$1,073.3413. What is the yield to maturity of a 3-year zero coupon bond?A) 7.00%B) 9.00%C) 6.99%D) 7.49%E) none of the aboveAnswer: C Difficulty: ModerateRationale: [(1.05)(1.07)(1.09)]1/3 - 1 = 6.99.Use the following to answer questions 14-16:The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.14. What is, according to the expectations theory, the expected forward rate in the thirdyear?A) 7.00%B) 7.33%C) 9.00%D) 11.19%E) none of the aboveAnswer: C Difficulty: ModerateRationale: 881.68 / 808.88 - 1 = 9%15. What is the yield to maturity on a 3-year zero coupon bond?A) 6.37%B) 9.00%C) 7.33%D) 10.00%E) none of the aboveAnswer: C Difficulty: ModerateRationale: (1000 / 808.81)1/3 -1 = 7.33%16. What is the price of a 4-year maturity bond with a 12% coupon rate paid annually? (Parvalue = $1,000)A) $742.09B) $1,222.09C) $1,000.00D) $1,141.92E) none of the aboveAnswer: D Difficulty: DifficultRationale: (1000 / 742.09)1/4 -1 = 7.74%; FV = 1000, PMT = 120, n = 4, i = 7.74, PV = $1,141.9217. The market segmentation theory of the term structure of interest ratesA) theoretically can explain all shapes of yield curves.B) definitely holds in the "real world".C) assumes that markets for different maturities are separate markets.D) A and B.E) A and C.Answer: E Difficulty: EasyRationale: Although this theory is quite tidy theoretically, both investors and borrows will depart from their "preferred maturity habitats" if yields on alternative maturities are attractive enough.18. An upward sloping yield curveA) may be an indication that interest rates are expected to increase.B) may incorporate a liquidity premium.C) may reflect the confounding of the liquidity premium with interest rateexpectations.D) all of the above.E) none of the above.Answer: D Difficulty: EasyRationale: One of the problems of the most commonly used explanation of termstructure, the expectations hypothesis, is that it is difficult to separate out the liquidity premium from interest rate expectations.19. The "break-even" interest rate for year n that equates the return on an n-periodzero-coupon bond to that of an n-1-period zero-coupon bond rolled over into a one-year bond in year n is defined asA) the forward rate.B) the short rate.C) the yield to maturity.D) the discount rate.E) None of the above.Answer: A Difficulty: EasyRationale: The forward rate for year n, fn, is the "break-even" interest rate for year n that equates the return on an n-period zero- coupon bond to that of an n-1-periodzero-coupon bond rolled over into a one-year bond in year n.20. When computing yield to maturity, the implicit reinvestment assumption is that theinterest payments are reinvested at the:A) Coupon rate.B) Current yield.C) Yield to maturity at the time of the investment.D) Prevailing yield to maturity at the time interest payments are received.E) The average yield to maturity throughout the investment period.Answer: C Difficulty: ModerateRationale: In order to earn the yield to maturity quoted at the time of the investment, coupons must be reinvested at that rate.21. Which one of the following statements is true?A) The expectations hypothesis indicates a flat yield curve if anticipated futureshort-term rates exceed the current short-term rate.B) The basic conclusion of the expectations hypothesis is that the long-term rate isequal to the anticipated long-term rate.C) The liquidity preference hypothesis indicates that, all other things being equal,longer maturities will have lower yields.D) The segmentation hypothesis contends that borrows and lenders are constrained toparticular segments of the yield curve.E) None of the above.Answer: D Difficulty: ModerateRationale: A flat yield curve indicates expectations of existing rates. Expectations hypothesis states that the forward rate equals the market consensus of expectations of future short interest rates. The reverse of C is true.22. The concepts of spot and forward rates are most closely associated with which one ofthe following explanations of the term structure of interest rates.A) Segmented Market theoryB) Expectations HypothesisC) Preferred Habitat HypothesisD) Liquidity Premium theoryE) None of the aboveAnswer: B Difficulty: ModerateRationale: Only the expectations hypothesis is based on spot and forward rates. A andC assume separate markets for different maturities; liquidity premium assumes higheryields for longer maturities.Use the following to answer question 23:23. Given the bond described above, if interest were paid semi-annually (rather thanannually), and the bond continued to be priced at $850, the resulting effective annual yield to maturity would be:A) Less than 12%B) More than 12%C) 12%D) Cannot be determinedE) None of the aboveAnswer: B Difficulty: ModerateRationale: FV = 1000, PV = -850, PMT = 50, n = 40, i = 5.9964 (semi-annual);(1.059964)2 - 1 = 12.35%.24. Interest rates might declineA) because real interest rates are expected to decline.B) because the inflation rate is expected to decline.C) because nominal interest rates are expected to increase.D) A and B.E) B and C.Answer: D Difficulty: EasyRationale: The nominal rate is comprised of the real interest rate plus the expectedinflation rate.25. Forward rates ____________ future short rates because ____________.A) are equal to; they are both extracted from yields to maturity.B) are equal to; they are perfect forecasts.C) differ from; they are imperfect forecasts.D) differ from; forward rates are estimated from dealer quotes while future short ratesare extracted from yields to maturity.E) are equal to; although they are estimated from different sources they both are usedby traders to make purchase decisions.Answer: C Difficulty: EasyRationale: Forward rates are the estimates of future short rates extracted from yields to maturity but they are not perfect forecasts because the future cannot be predicted with certainty; therefore they will usually differ.26. The pure yield curve can be estimatedA) by using zero-coupon bonds.B) by using coupon bonds if each coupon is treated as a separate "zero."C) by using corporate bonds with different risk ratings.D) by estimating liquidity premiums for different maturities.E) A and B.Answer: E Difficulty: ModerateRationale: The pure yield curve is calculated using zero coupon bonds, but coupon bonds may be used if each coupon is treated as a separate "zero."27. The on the run yield curve isA) a plot of yield as a function of maturity for zero-coupon bonds.B) a plot of yield as a function of maturity for recently issued coupon bonds trading ator near par.C) a plot of yield as a function of maturity for corporate bonds with different riskratings.D) a plot of liquidity premiums for different maturities.E) A and B.Answer: B Difficulty: Moderate28. The market segmentation and preferred habitat theories of term structureA) are identical.B) vary in that market segmentation is rarely accepted today.C) vary in that market segmentation maintains that borrowers and lenders will notdepart from their preferred maturities and preferred habitat maintains that marketparticipants will depart from preferred maturities if yields on other maturities areattractive enough.D) A and B.E) B and C.Answer: E Difficulty: ModerateRationale: Borrowers and lenders will depart from their preferred maturity habitats if yields are attractive enough; thus, the market segmentation hypothesis is no longerreadily accepted.29. The yield curveA) is a graphical depiction of term structure of interest rates.B) is usually depicted for U. S. Treasuries in order to hold risk constant acrossmaturities and yields.C) is usually depicted for corporate bonds of different ratings.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: The yield curve (yields vs. maturities, all else equal) is depicted for U. S.Treasuries more frequently than for corporate bonds, as the risk is constant acrossmaturities for Treasuries.Use the following to answer questions 30-32:30. What should the purchase price of a 2-year zero coupon bond be if it is purchased at thebeginning of year 2 and has face value of $1,000?A) $877.54B) $888.33C) $883.32D) $893.36E) $871.80Answer: A Difficulty: DifficultRationale: $1,000 / [(1.064)(1.071)] = $877.5431. What would the yield to maturity be on a four-year zero coupon bond purchased today?A) 5.80%B) 7.30%C) 6.65%D) 7.25%E) none of the above.Answer: C Difficulty: ModerateRationale: [(1.058) (1.064) (1.071) (1.073)]1/4 - 1 = 6.65%32. Calculate the price at the beginning of year 1 of a 10% annual coupon bond with facevalue $1,000 and 5 years to maturity.A) $1,105B) $1,132C) $1,179D) $1,150E) $1,119Answer: B Difficulty: DifficultRationale: i = [(1.058) (1.064) (1.071) (1.073) (1.074)]1/5 - 1 = 6.8%; FV = 1000, PMT = 100, n = 5, i = 6.8, PV = $1,131.9133. Given the yield on a 3 year zero-coupon bond is 7.2% and forward rates of 6.1% in year1 and 6.9% in year 2, what must be the forward rate in year 3?A) 8.4%B) 8.6%C) 8.1%D) 8.9%E) none of the above.Answer: B Difficulty: ModerateRationale: f3 = (1.072)3 / [(1.061) (1.069)] - 1 = 8.6%34. An inverted yield curve is oneA) with a hump in the middle.B) constructed by using convertible bonds.C) that is relatively flat.D) that plots the inverse relationship between bond prices and bond yields.E) that slopes downward.Answer: E Difficulty: EasyRationale: An inverted yield curve occurs when short-term rates are higher thanlong-term rates.35. Investors can use publicly available financial date to determine which of the following?I)the shape of the yield curveII)future short-term ratesIII)the direction the Dow indexes are headingIV)the actions to be taken by the Federal ReserveA) I and IIB) I and IIIC) I, II, and IIID) I, III, and IVE) I, II, III, and IVAnswer: A Difficulty: ModerateRationale: Only the shape of the yield curve and future inferred rates can be determined.The movement of the Dow Indexes and Federal Reserve policy are influenced by term structure but are determined by many other variables also.36. Which of the following combinations will result in a sharply increasing yield curve?A) increasing expected short rates and increasing liquidity premiumsB) decreasing expected short rates and increasing liquidity premiumsC) increasing expected short rates and decreasing liquidity premiumsD) increasing expected short rates and constant liquidity premiumsE) constant expected short rates and increasing liquidity premiumsAnswer: A Difficulty: ModerateRationale: Both of the forces will act to increase the slope of the yield curve.37. The yield curve is a component ofA) the Dow Jones Industrial Average.B) the consumer price index.C) the index of leading economic indicators.D) the producer price index.E) the inflation index.Answer: C Difficulty: EasyRationale: Since the yield curve is often used to forecast the business cycle, it is used as one of the leading economic indicators.38. The most recently issued Treasury securities are calledA) on the run.B) off the run.C) on the market.D) off the market.E) none of the above.Answer: A Difficulty: EasyUse the following to answer questions 39-42:Suppose that all investors expect that interest rates for the 4 years will be as follows:39. What is the price of 3-year zero coupon bond with a par value of $1,000?A) $889.08B) $816.58C) $772.18D) $765.55E) none of the aboveAnswer: A Difficulty: ModerateRationale: $1,000 / (1.03)(1.04)(1.05) = $889.0840. If you have just purchased a 4-year zero coupon bond, what would be the expected rateof return on your investment in the first year if the implied forward rates stay the same?(Par value of the bond = $1,000)A) 5%B) 3%C) 9%D) 10%E) none of the aboveAnswer: B Difficulty: ModerateRationale: The forward interest rate given for the first year of the investment is given as 3% (see table above).41. What is the price of a 2-year maturity bond with a 5% coupon rate paid annually? (Parvalue = $1,000)A) $1,092.97B) $1,054.24C) $1,028.51D) $1,073.34E) none of the aboveAnswer: C Difficulty: ModerateRationale: [(1.03)(1.04)]1/2 - 1 = 3.5%; FV = 1000, n = 2, PMT = 50, i = 3.5, PV =$1,028.5142. What is the yield to maturity of a 3-year zero coupon bond?A) 7.00%B) 9.00%C) 6.99%D) 4%E) none of the aboveAnswer: D Difficulty: ModerateRationale: [(1.03)(1.04)(1.05)]1/3 - 1 = 4%.Use the following to answer questions 43-46:The following is a list of prices for zero coupon bonds with different maturities and par value of $1,000.43. What is, according to the expectations theory, the expected forward rate in the thirdyear?A) 7.23B) 9.37%C) 9.00%D) 10.9%E) none of the aboveAnswer: B Difficulty: ModerateRationale: 862.57 / 788.66 - 1 = 9.37%44. What is the yield to maturity on a 3-year zero coupon bond?A) 6.37%B) 9.00%C) 7.33%D) 8.24%E) none of the aboveAnswer: D Difficulty: ModerateRationale: (1000 / 788.66)1/3 -1 = 8.24%45. What is the price of a 4-year maturity bond with a 10% coupon rate paid annually? (Parvalue = $1,000)A) $742.09B) $1,222.09C) $1,035.66D) $1,141.84E) none of the aboveAnswer: C Difficulty: DifficultRationale: (1000 / 711.00)1/4 -1 = 8.9%; FV = 1000, PMT = 100, n = 4, i = 8.9, PV =$1,035.6646. You have purchased a 4-year maturity bond with a 9% coupon rate paid annually. Thebond has a par value of $1,000. What would the price of the bond be one year from now if the implied forward rates stay the same?A) $995.63B) $1,108.88C) $1,000.00D) $1,042.78E) none of the aboveAnswer: A Difficulty: DifficultRationale: (925.16 / 711.00)]1/3 - 1.0 = 9.17%; FV = 1000, PMT = 90, n = 3, i = 9.17, PV = $995.63Use the following to answer question 47:47. Given the bond described above, if interest were paid semi-annually (rather thanannually), and the bond continued to be priced at $917.99, the resulting effective annual yield to maturity would be:A) Less than 10%B) More than 10%C) 10%D) Cannot be determinedE) None of the aboveAnswer: B Difficulty: ModerateRationale: FV = 1000, PV = -917.99, PMT = 45, n = 36, i = 4.995325 (semi-annual);(1.4995325)2 - 1 = 10.24%.Use the following to answer questions 48-50:48. What should the purchase price of a 2-year zero coupon bond be if it is purchased at thebeginning of year 2 and has face value of $1,000?A) $877.54B) $888.33C) $883.32D) $894.21E) $871.80Answer: D Difficulty: DifficultRationale: $1,000 / [(1.055)(1.06)] = $894.2149. What would the yield to maturity be on a four-year zero coupon bond purchased today?A) 5.75%B) 6.30%C) 5.65%D) 5.25%E) none of the above.Answer: A Difficulty: ModerateRationale: [(1.05) (1.055) (1.06) (1.065)]1/4 - 1 = 5.75%50. Calculate the price at the beginning of year 1 of an 8% annual coupon bond with facevalue $1,000 and 5 years to maturity.A) $1,105.47B) $1,131.91C) $1,084.25D) $1,150.01E) $719.75Answer: C Difficulty: DifficultRationale: i = [(1.05) (1.055) (1.06) (1.065) (1.07)]1/5 - 1 = 6%; FV = 1000, PMT = 80, n = 5, i = 6, PV = $1084.2551. Given the yield on a 3 year zero-coupon bond is 7% and forward rates of 6% in year 1and 6.5% in year 2, what must be the forward rate in year 3?A) 7.2%B) 8.6%C) 8.5%D) 6.9%E) none of the above.Answer: C Difficulty: ModerateRationale: f3 = (1.07)3 / [(1.06) (1.065)] - 1 = 8.5%Use the following to answer questions 52-61:52. What should the purchase price of a 1-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $966.37B) $912.87C) $950.21D) $956.02E) $945.51Answer: D Difficulty: DifficultRationale: $1,000 / (1.046) = $956.0253. What should the purchase price of a 2-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $966.87B) $911.37C) $950.21D) $956.02E) $945.51Answer: B Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)] = $911.3754. What should the purchase price of a 3-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $887.42B) $871.12C) $879.54D) $856.02E) $866.32Answer: E Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)] = $866.3255. What should the purchase price of a 4-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $887.42B) $821.15C) $879.54D) $856.02E) $866.32Answer: B Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)(1.055)] = $821.1556. What should the purchase price of a 5-year zero coupon bond be if it is purchased todayand has face value of $1,000?A) $776.14B) $721.15C) $779.54D) $756.02E) $766.32Answer: A Difficulty: DifficultRationale: $1,000 / [(1.046)(1.049)(1.052)(1.055)(1.058)] = $776.1457. What is the yield to maturity of a 1-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: A Difficulty: ModerateRationale: 4.6% (given in table)58. What is the yield to maturity of a 5-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: C Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)(1.055)(1.058)]1/5 -1 = 5.2%59. What is the yield to maturity of a 4-year bond?A) 4.69%B) 4.95%C) 5.02%D) 5.05%E) 5.08%Answer: C Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)(1.055)]1/4 -1 = 5.05%60. What is the yield to maturity of a 3-year bond?A) 4.6%B) 4.9%C) 5.2%D) 5.5%E) 5.8%Answer: B Difficulty: ModerateRationale: [(1.046)(1.049)(1.052)]1/3 -1 = 4.9%61. What is the yield to maturity of a 2-year bond?A) 4.6%B) 4.9%C) 5.2%D) 4.7%E) 5.8%Answer: D Difficulty: ModerateRationale: [(1.046)(1.049)]1/2 -1 = 4.7%Essay Questions62. Discuss the three theories of the term structure of interest rates. Include in yourdiscussion the differences in the theories, and the advantages/disadvantages of each.Difficulty: ModerateAnswer:The expectations hypothesis is the most commonly accepted theory of term structure.The theory states that the forward rate equals the market consensus expectation of future short-term rates. Thus, yield to maturity is determined solely by current and expected future one-period interest rates. An upward sloping, or normal, yield curve wouldindicate that investors anticipate an increase in interest rates. An inverted, or downward sloping, yield curve would indicate an expectation of decreased interest rates. Ahorizontal yield curve would indicate an expectation of no interest rate changes.The liquidity preference theory of term structure maintains that short-term investorsdominate the market; thus, in general, the forward rate exceeds the expected short-term rate. In other words, investors prefer to be liquid to illiquid, all else equal, and willdemand a liquidity premium in order to go long term. Thus, liquidity preference readily explains the upward sloping, or normal, yield curve. However, liquidity preferencedoes not readily explain other yield curve shapes.Market segmentation and preferred habitat theories indicate that the markets fordifferent maturity debt instruments are segmented. Market segmentation maintains that the rates for the different maturities are determined by the intersection of the supply and demand curves for the different maturity instruments. Market segmentation readilyexplains all shapes of yield curves. However, market segmentation is not observed in the real world. Investors and issuers will leave their preferred maturity habitats if yields are attractive enough on other maturities.The purpose of this question is to ascertain that students understand the variousexplanations (and deficiencies of these explanations) of term structure.63. Term structure of interest rates is the relationship between what variables? What isassumed about other variables? How is term structure of interest rates depictedgraphically?Difficulty: ModerateAnswer:Term structure of interest rates is the relationship between yield to maturity and term to maturity, all else equal. The "all else equal" refers to risk class. Term structure ofinterest rates is depicted graphically by the yield curve, which is usually a graph of U.S.governments of different yields and different terms to maturity. The use of U.S.governments allows one to examine the relationship between yield and maturity,holding risk constant. The yield curve depicts this relationship at one point in time only.This question is designed to ascertain that students understand the relationshipsinvolved in term structure, the restrictions on the relationships, and how therelationships are depicted graphically.64. Although the expectations of increases in future interest rates can result in an upwardsloping yield curve; an upward sloping yield curve does not in and of itself imply the expectations of higher future interest rates. Explain.Difficulty: ModerateAnswer:The effects of possible liquidity premiums confound any simple attempt to extractexpectation from the term structure. That is, the upward sloping yield curve may be due to expectations of interest rate increases, or due to the requirement of a liquiditypremium, or both. The liquidity premium could more than offset expectations ofdecreased interest rates, and an upward sloping yield would result.The purpose of this question is to assure that the student understands the confounding of the liquidity premium with the expectations hypothesis, and that the interpretations of term structure are not clear-cut.。

投资学第7版TestBank答案04

Multiple Choice Questions1. Which one of the following statements regarding open-end mutual funds isfalse?A) The funds redeem shares at net asset value.B) The funds offer investors professional management.C) The funds offer investors a guaranteed rate of return.D) B and C.E) A and B.Answer: C Difficulty: ModerateRationale: No investment offers a guaranteed rate of return.2. Which one of the following statements regarding closed-end mutual fundsis false?A) The funds always trade at a discount from NAV.B) The funds redeem shares at their net asset value.C) The funds offer investors professional management.D) A and B.E) None of the above.Answer: D Difficulty: ModerateRationale: Closed-end funds are sold at the prevailing market price.3. Which of the following functions do mutual fund companies perform for theirinvestors?A) Record keeping and administrationB) Diversification and divisibilityC) Professional managementD) Lower transaction costsE) All of the above.Answer: E Difficulty: EasyRationale: Mutual funds are attractive to investors because they offer all of the listed services.4. Multiple Mutual Funds had year-end assets of $457,000,000 and liabilitiesof $17,000,000. There were 24,300,000 shares in the fund at year-end.What was Multiple Mutual's Net Asset Value?A) $18.11B) $18.81C) $69.96D) $7.00E) $181.07Answer: A Difficulty: ModerateRationale: (457,000,000 - 17,000,000) / 24,300,000 = $18.115. Growth Fund had year-end assets of $862,000,000 and liabilities of$12,000,000. There were 32,675,254 shares in the fund at year-end. What was Growth Fund's Net Asset Value?A) $28.17B) $25.24C) $19.62D) $26.01E) $21.56Answer: D Difficulty: ModerateRationale: (862,000,000 - 12,000,000) / 32,675,254 = $26.016. Diversified Portfolios had year-end assets of $279,000,000 andliabilities of $43,000,000. If Diversified's NAV was $42.13, how many shares must have been held in the fund?A) 43,000,000B) 6,488,372C) 5,601,709D) 1,182,203E) None of the above.Answer: C Difficulty: ModerateRationale: ($279,000,000 - 43,000,000) / $42.13 = 5,601,708.996.7. Pinnacle Fund had year-end assets of $825,000,000 and liabilities of$25,000,000. If Pinnacle's NAV was $32.18, how many shares must have been held in the fund?A) 21,619,346,92B) 22,930,546.28C) 24,860,161.59D) 25,693,645.25E) None of the above.Answer: C Difficulty: ModerateRationale: ($825,000,000 - 25,000,000) / $32.18 = 24,860,161.59.8. Most actively managed mutual funds, when compared to a market index suchas the Wilshire 5000,A) beat the market return in all years.B) beat the market return in most years.C) exceed the return on index funds.D) do not outperform the marketE) None of the above is a correct statement.Answer: D Difficulty: EasyRationale: Most actively managed mutual funds fail to equal the return earned by index funds, possibly due to higher transactions costs.9. Pools of money invested in a portfolio that is fixed for the life of thefund are calledA) closed-end funds.B) open-end funds.C) unit investment trusts.D) REITS.E) redeemable trust certificates.Answer: C Difficulty: EasyRationale: Unit investment trusts are funds that invest in a portfolio, often fixed-income securities, and hold it to maturity.10. Investors in closed-end funds who wish to liquidate their positions mustA) sell their shares through a broker.B) sell their shares to the issuer at a discount to Net Asset Value.C) sell their shares to the issuer at a premium to Net Asset Value.D) sell their shares to the issuer for Net Asset Value.E) hold their shares to maturity.Answer: A Difficulty: ModerateRationale: Closed-end fund shares are sold on organized exchanges through a broker.11. Closed end funds are frequently issued at a ______ to NAV and subsequentlytrade at a __________ to NAV.A) discount, discountB) discount, premiumC) premium, premiumD) premium, discountE) No consistent relationship has been observed.Answer: D Difficulty: ModerateRationale: Closed-end funds are typically issued at a premium to Net Asset Value and subsequently trade at a discount.12. At issue, offering prices of open-end funds will often beA) less than NAV due to loads and commissions.B) greater than NAV due to loads and commissions.C) less than NAV due to limited demand.D) greater than NAV due to excess demand.E) less than or greater than NAV with no apparent pattern.Answer: B Difficulty: DifficultRationale: Open-end funds are redeemable on demand at NAV so they should never sell for less than NAV. However, loads and commissions can increase the price above NAV.13. Which of the following statements about Real Estate Investment Trusts istrue?A) REITS invest in real estate or loans secured by real estate.B) REITS raise capital by borrowing from banks and issuing mortgages.C) REITS are similar to open-end funds, with shares redeemable at NAV.D) All of the above are true.E) Both A and B are true.Answer: E Difficulty: ModerateRationale: Real Estate Investment Trusts invest in real estate orreal-estate-secured loans. They may raise capital from banks and by issuing mortgages. They are similar to closed-end funds and shares are typically exchange traded.14. In 2004 the proportion of mutual funds specializing in common stocks wasA) 21.7%B) 28.0%C) 54.1%D) 73.4%E) 63.5%Answer: C Difficulty: ModerateRationale: See Table 4.1.15. In 2004 the proportion of mutual funds specializing in bonds wasA) 15.9%B) 28.0%C) 54.1%D) 73.4%E) 63.5%Answer: A Difficulty: ModerateRationale: See Table 4.1.16. In 2004 the proportion of mutual funds specializing in money marketsecurities wasA) 21.7%B) 28.0%C) 54.1%D) 73.4%E) 23.6%Answer: C Difficulty: ModerateRationale: See Table 4.1.17. Management fees and other expenses of mutual funds may includeA) front-end loads.B) back-end loads.C) 12b-1 charges.D) A and B only.E) A, B and C.Answer: E Difficulty: EasyRationale: All of the listed expenses may be included in the cost of owning a mutual fund.18. The Profitability Fund had NAV per share of $17.50 on January 1, 2005.On December 31 of the same year the fund's NAV was $19.47. Incomedistributions were $0.75 and the fund had capital gain distributions of $1.00. Without considering taxes and transactions costs, what rate of return did an investor receive on the Profitability fund last year?A) 11.26%B) 15.54%C) 16.97%D) 21.26%E) 9.83%Answer: D Difficulty: ModerateRationale: R = ($19.47 - 17.50 + .75 + 1.00) / $17.50 = 21.26%19. The Yachtsman Fund had NAV per share of $36.12 on January 1, 2005. OnDecember 31 of the same year the fund's NAV was $39.71. Incomedistributions were $0.64 and the fund had capital gain distributions of $1.13. Without considering taxes and transactions costs, what rate of return did an investor receive on the Yachtsman Fund last year?A) 22.92%B) 17.68%C) 14.39%D) 18.52%E) 14.84%Answer: E Difficulty: ModerateRationale: R = ($39.71 - 36.12 + .64 + 1.13) / $36.12 = 14.84%20. Investors' Choice Fund had NAV per share of $37.25 on January 1, 2005.On December 31 of the same year the fund's rate of return for the year was 17.3%. Income distributions were $1.14 and the fund had capital gain distributions of $1.35. Without considering taxes and transactions costs, what ending NAV would you calculate for Investors' Choice?A) $41.20B) $33.88C) $43.69D) $42.03E) $46.62Answer: A Difficulty: ModerateRationale: .173 = (P - $37.25 + 1.14 + 1.35) / $37.25; P = $41.2021. Which of the following is not an advantage of mutual funds?A) They offer a variety of investment styles.B) They offer small investors the benefits of diversification.C) They treat income as "passed through" to the investor for tax purposes.D) A, B and C are all advantages of mutual funds.E) Neither A nor B nor C are advantages of mutual funds.Answer: C Difficulty: EasyRationale: A disadvantage of mutual funds is that investment income is passed through for tax purposes and investors may therefore lose the ability to engage in tax management.22. Which of the following would increase the net asset value of a mutual fundshare, assuming all other things remain unchanged?A) an increase in the number of fund shares outstandingB) an increase in the fund's accounts payableC) a change in the fund's managementD) an increase in the value of one of the fund's stocksE) a decrease in the fund's 12b-1 feeAnswer: D Difficulty: Easy23. Which of the following characteristics apply to unit investment trusts?I)Most are invested in fixed-income portfolios.II)They are actively managed portfolios.III)The sponsor pools securities, then sells public shares in the trust.IV)The portfolio is fixed for the life of the fund.A) I and IVB) I and IIC) I, III, and IVD) I, II, and IIIE) I, II, III, and IVAnswer: C Difficulty: Moderate24. Jargon Rapid Growth is a mutual fund that has traditionally accepted fundsfrom new investors and issued new shares at net asset value. Jeremy Jargon manages the fund himself and has become concerned that its level of assets has become too high for his management abilities. He issues a statement that Jargon will no longer accept funds from new investors, but will continue to accept additional investments from current shareholders.Which of the following is true about Jargon Rapid Growth fund?A) Jargon used to be an open-end fund but has now become a closed-end fund.B) Jargon has always been an open-end fund and will remain an open-endfund.C) Jargon has always been a closed-end fund and will remain a closed-endfund.D) Jargon is an open-end fund but would change to a closed-end fund ifit wouldn't accept additional funds from current investors.E) Jargon is violating SEC policy by refusing to accept new investors.Answer: B Difficulty: Moderate25. As of December 31, 2004, which class of mutual funds had the largest amountof assets invested?A) stock fundsB) bond fundsC) mixed asset classes such as asset allocation fundsD) money market fundsE) global fundsAnswer: A Difficulty: EasyRationale: See Table 4.1.26. Commingled funds areA) amounts invested in equity and fixed-income mutual funds.B) funds that may be purchased at intervals of 3, 6, or 12 month intervalsat the discretion of management.C) amounts invested in domestic and global equities.D) closed-end funds that may be repurchased only once every two years atthe discretion of mutual fund management.E) partnerships of investors that pool their funds, which are then managedfor a fee.Answer: E Difficulty: Easy27. Which of the following is true regarding equity mutual funds?I)They invest primarily in stock.II)They may hold fixed-income securities as well as stock.III)Most hold money market securities as well as stock.IV)Two types of equity funds are income funds and growth funds.A) I and IVB) I, III, and IVC) I, II, and IVD) I, II, and IIIE) I, II, III, and IVAnswer: E Difficulty: Moderate28. The fee that mutual funds use to help pay for advertising and promotionalliterature is called aA) front-end load fee.B) back-end load fee.C) operating expense fee.D) 12b-1 fee.E) structured fee.Answer: D Difficulty: Easy29. Patty O'Furniture purchased 100 shares of Green Isle mutual fund at a netasset value of $42 per share. During the year Patty received dividend income distributions of $2.00 per share and capital gains distributions of $4.30 per share. At the end of the year the shares had a net asset value of $40 per share. What was Patty's rate of return on this investment?A) 5.43%B) 10.24%C) 7.19%D) 12.44%E) 9.18%Answer: B Difficulty: ModerateRationale: R = ($40-42+2+4.3)/$42 = 10.238%30. Assume that you purchased 200 shares of Super Performing mutual fund ata net asset value of $21 per share. During the year you received dividendincome distributions of $1.50 per share and capital gains distributions of $2.85 per share. At the end of the year the shares had a net asset value of $23 per share. What was your rate of return on this investment?A) 30.24%B) 25.37%C) 27.19%D) 22.44%E) 29.18%Answer: A Difficulty: ModerateRationale: R = ($23-21+1.5+2.85)/$21 = 30.238%31. Assume that you purchased shares of High Flying mutual fund at a net assetvalue of $12.50 per share. During the year you received dividend income distributions of $0.78 per share and capital gains distributions of $1.67 per share. At the end of the year the shares had a net asset value of $13.87 per share. What was your rate of return on this investment?A) 29.43%B) 30.56%C) 31.19%D) 32.44%E) 29.18%Answer: B Difficulty: ModerateRationale: R = ($13.87-12.50+0.78+1.67)/$12.50 = 30.56%32. Assume that you purchased shares of a mutual fund at a net asset valueof $14.50 per share. During the year you received dividend incomedistributions of $0.27 per share and capital gains distributions of $0.65 per share. At the end of the year the shares had a net asset value of $13.74 per share. What was your rate of return on this investment?A) 2.91%B) 3.07%C) 1.10%D) 1.78%E) -1.18%Answer: C Difficulty: ModerateRationale: R = ($13.74-14.50+0.27+0.65)/$14.50 = 1.103%33. Assume that you purchased shares of a mutual fund at a net asset valueof $10.00 per share. During the year you received dividend incomedistributions of $0.05 per share and capital gains distributions of $0.06 per share. At the end of the year the shares had a net asset value of $8.16 per share. What was your rate of return on this investment?A) -18.24%B) -16.1%C) 16.10%D) -17.3%E) 17.3%Answer: D Difficulty: ModerateRationale: R = ($8.16-10.00+0.05+0.06)/$10.00 = -17.3%34. A mutual fund had year-end assets of $560,000,000 and liabilities of$26,000,000. There were 23,850,000 shares in the fund at year end. What was the mutual fund's Net Asset Value?A) $22.87B) $22.39C) $22.24D) $17.61E) $19.25Answer: B Difficulty: ModerateRationale: (560,000,000 - 26,000,000) / 23,850,000 = $22.38935. A mutual fund had year-end assets of $250,000,000 and liabilities of$4,000,000. There were 3,750,000 shares in the fund at year-end. What was the mutual fund's Net Asset Value?A) $92.53B) $67.39C) $63.24D) $65.60E) $17.46Answer: D Difficulty: ModerateRationale: (250,000,000 - 4,000,000) / 3,750,000 = $65.6036. A mutual fund had year-end assets of $700,000,000 and liabilities of$7,000,000. There were 40,150,000 shares in the fund at year-end. What was the mutual fund's Net Asset Value?A) $9.63B) $57.71C) $16.42D) $17.87E) $17.26Answer: E Difficulty: ModerateRationale: (700,000,000 - 7,000,000) / 40,150,000 = $17.2637. A mutual fund had year-end assets of $465,000,000 and liabilities of$37,000,000. If the fund NAV was $56.12, how many shares must have been held in the fund?A) 4,300,000B) 6,488,372C) 8,601,709D) 7,626,515E) None of the above.Answer: D Difficulty: ModerateRationale: ($465,000,000 - 37,000,000) / $56.12 = 7,626,515.38. A mutual fund had year-end assets of $521,000,000 and liabilities of$63,000,000. If the fund NAV was $26.12, how many shares must have been held in the fund?A) 17,534,456B) 16,488,372C) 18,601,742D) 17,542,515E) None of the above.Answer: A Difficulty: ModerateRationale: ($521,000,000 - 63,000,000) / $26.12 = 17,534,456.39. A mutual fund had year-end assets of $327,000,000 and liabilities of$46,000,000. If the fund NAV was $30.48, how many shares must have been held in the fund?A) 11,354,751B) 8,412,642C) 10,165,476D) 9,165,414E) 9,219,160Answer: E Difficulty: ModerateRationale: ($327,000,000 - 46,000,000) / $30.48 = 9,219,160.40. A mutual fund had NAV per share of $19.00 on January 1, 2005. On December31 of the same year the fund's NAV was $19.14. Income distributions were$0.57 and the fund had capital gain distributions of $1.12. Without considering taxes and transactions costs, what rate of return did an investor receive on the fund last year?A) 11.26%B) 10.54%C) 7.97%D) 8.26%E) 9.63%Answer: E Difficulty: ModerateRationale: R = ($19.14 - 19.00 + .57 + 1.12) / $19.00 = 9.63%41. A mutual fund had NAV per share of $26.25 on January 1, 2005. On December31 of the same year the fund's rate of return for the year was 16.4%. Incomedistributions were $1.27 and the fund had capital gain distributions of $1.85. Without considering taxes and transactions costs, what ending NAV would you calculate?A) $27.44B) $33.88C) $24.69D) $42.03E) $16.62Answer: A Difficulty: ModerateRationale: .164 = (P - $26.25 + 1.27 + 1.85) / $26.25; P = $27.43542. A mutual fund had NAV per share of $16.75 on January 1, 2005. On December31 of the same year the fund's rate of return for the year was 26.6%. Incomedistributions were $1.79 and the fund had capital gain distributions of $2.80. Without considering taxes and transactions costs, what ending NAV would you calculate?A) $17.44B) $13.28C) $14.96D) $17.25E) $16.62Answer: E Difficulty: ModerateRationale: .266 = (P - $16.75 + 1.79 + 2.80) / $16.75; P = $16.61543. A mutual fund had NAV per share of $36.15 on January 1, 2005. On December31 of the same year the fund's rate of return for the year was 14.0%. Incomedistributions were $1.16 and the fund had capital gain distributions of $2.12. Without considering taxes and transactions costs, what ending NAV would you calculate?A) $37.93B) $34.52C) $44.69D) $47.25E) $36.28Answer: A Difficulty: ModerateRationale: .14 = (P - $36.15 + 1.16 + 2.12) / $36.15; P = $37.93144. Differences between hedge funds and mutual funds are thatA) hedge funds are only subject to minimal SEC regulation.B) hedge funds are typically open only to wealthy or institutionalinvestors.C) hedge funds managers can pursue strategies not available to mutualfunds such as short selling, heavy use of derivatives, and leverage.D) hedge funds attempt to exploit temporary misalignments in securityvaluations.E) all of the aboveAnswer: E Difficulty: Moderate45. Of the following types of mutual funds, an investor that wishes to investin a diversified portfolio of stocks worldwide (including the U.S.) should chooseA) international funds.B) global funds.C) regional funds.D) emerging market funds.E) none of the above.Answer: B Difficulty: Moderate46. Of the following types of mutual funds, an investor that wishes to investin a diversified portfolio of foreign stocks (excluding the U.S.) should chooseA) International fundsB) Global fundsC) Regional fundsD) Emerging market fundsE) None of the aboveAnswer: A Difficulty: Moderate47. Of the following types of EFTs, an investor that wishes to invest in adiversified portfolio that tracks the S&P 500 should chooseA) SPY.B) DIA.C) QQQ.D) IWM.E) VTI.Answer: A Difficulty: Moderate48. Of the following types of EFTs, an investor that wishes to invest in adiversified portfolio that tracks the Dow Jones Industrials should chooseA) SPY.B) DIA.C) QQQ.D) IWM.E) VTI.Answer: B Difficulty: Moderate49. Of the following types of EFTs, an investor that wishes to invest in adiversified portfolio that tracks the Nasdaq 100 should chooseA) SPY.B) DIA.C) QQQ.D) IWM.E) VTI.Answer: C Difficulty: Moderate50. Of the following types of EFTs, an investor that wishes to invest in adiversified portfolio that tracks the Russell 2000 should chooseA) SPY.B) DIA.C) QQQ.D) IWM.E) VTI.Answer: D Difficulty: Moderate51. Of the following types of EFTs, an investor that wishes to invest in adiversified portfolio that tracks the Wilshire 5000 should chooseA) SPY.B) DIA.C) QQQ.D) IWM.E) VTI.Answer: E Difficulty: Moderate52. A mutual funds had average daily assets of $3.0 billion in 2005. The fundsold $600 million worth of stock and purchased $700 million worth of stock during the year. The funds turnover ratio is ___.A) 27.5%B) 12%C) 15%D) 25%E) 20%Answer: E Difficulty: Moderate Rationale: 600,000,000 / 3,000,000,000 = 20%53. A mutual funds had average daily assets of $2.0 billion on 2005. The fundsold $500 million worth of stock and purchased $600 million worth of stock during the year. The funds turnover ratio is ___.A) 27.5%B) 12%C) 15%D) 25%E) 20%Answer: D Difficulty: ModerateRationale: 500,000,000 / 2,000,000,000 = 25%54. A mutual funds had average daily assets of $4.0 billion on 2005. The fundsold $1.5 billion worth of stock and purchased $1.6 billion worth of stock during the year. The funds turnover ratio is ____________.A) 37.5%B) 22%C) 15%D) 45%E) 20%Answer: A Difficulty: ModerateRationale: 1,500,000,000 / 4,000,000,000 = 37.5%55. You purchased shares of a mutual fund at a price of $20 per share at thebeginning of the year and paid a front-end load of 5.75%. If the securities in which the find invested increased in value by 11% during the year, and the funds expense ratio was 1.25%, your return if you sold the fund at the end of the year would be ____________.A) 4.33B) 3.44C) 2.45D) 6.87E) None of the aboveAnswer: B Difficulty: DifficultRationale: {[$20 * .9425*(1.11-.0125)]-$20} / $20 = 3.44%56. You purchased shares of a mutual fund at a price of $12 per share at thebeginning of the year and paid a front-end load of 4.75%. If the securities in which the fund invested increased in value by 9% during the year, and the funds expense ratio was 1.5%, your return if you sold the fund at the end of the year would be ____________.A) 4.75B) 3.54C) 2.65D) 2.39E) None of the aboveAnswer: D Difficulty: DifficultRationale: {[$12 * .9525*(1.09-.015)]-$12} / $12 = 2.39%57. You purchased shares of a mutual fund at a price of $17 per share at thebeginning of the year and paid a front-end load of 5.0%. If the securities in which the find invested increased in value by 12% during the year, and the funds expense ratio was 1.0%, your return if you sold the fund at the end of the year would be ____________.A) 4.75B) 5.45C) 5.65D) 4.39E) None of the aboveAnswer: B Difficulty: DifficultRationale: {[$17 * .95*(1.12-.01)]-$17} / $17 = 5.45%Essay Questions58. List and describe the more important types of mutual funds according totheir investment policy and use.Difficulty: ModerateAnswer:Some of the more important fund types, classified by investment policy, are:Money Market Funds - These funds invest in money market securities. They usually offer check-writing features and NAV is fixed at $1 per share, so that there are no tax implications associated with redemption of shares.They provide low risk, relatively low return and high liquidity.Equity Funds - These funds invest primarily in stock, although they may hold other types of securities at the manager's discretion. They may also hold some money market securities to provide liquidity for shareredemption. Typical objectives are capital gain, growth, growth andincome, income, and income and security.Bond Funds - These funds specialize in fixed-income securities such as corporate bonds, Treasury bonds, mortgage-backed securities or municipal bonds. These funds may specialize by maturity or credit risk as well.Balanced Funds - These funds may substitute for an investor's entireportfolio. They hold a mix of fixed-income and equity securities. Income funds try to maintain safety of principal but achieve liberal current income, while balanced funds seek to minimize risk.Asset Allocation Funds- These funds also hold both stocks and bonds, but vary the proportions in accord with the portfolio manager's forecast of the relative performance of each sector. These funds are engaged in market timing and are therefore higher risk.Index Funds - These funds try to match the performance of a broad market index. They buy shares in securities included in a particular index in proportion to the security's representation in that index. Index funds are a low-cost way for small investors to pursue a passive investment strategy.Specialized Sector Funds - These funds concentrate on a particularindustry or industries. Held alone, they are not well diversified and may be higher risk.The question is designed to test the student's knowledge of the various types of funds available and their suitability for different needs.59. Discuss the taxation of mutual fund income.Difficulty: DifficultAnswer:Investment returns of mutual funds are granted "pass-through status" under the U.S. tax code, meaning that taxes are paid only by the investor in the mutual fund, not by the fund itself. The income is treated as passed through to the investor as long as all income is distributed toshareholders.Investors will pay taxes at the appropriate rate depending on the type of income. One drawback is that investors cannot time the sale ofsecurities for maximum tax advantage, unless the funds are held intax-deferred retirement accounts.The purpose of the question is to determine whether students understand the tax differences of owning mutual funds as compared to individualinvestments.60. What is an Exchange-traded fund? Give two examples of specific ETFs. Whatare some advantages they have over ordinary open-end mutual funds? What are some disadvantages?Difficulty: DifficultAnswer:ETFs allow investors to trade index portfolios. Some examples are spiders (SPDR), which track the S&P500 index, diamonds (DIA), which track the Dow Jones Industrial Average, and qubes (QQQ), which track the NASDAQ 100 index.Other examples are listed in Table 4-3. (It is anticipated that there may soon be ETFs that track actively managed funds as well ad the current ones that track indexes.)Advantages -1.ETFs may be bought and sold during the trading day at prices that reflectthe current value of the underlying index. This is different fromordinary open-end mutual funds, which are bought or sold only at theend of the day NAV.2.ETFs can be sold short.3.ETFs can be purchased on margin.4.ETFs may have tax advantages. Managers are not forced to sellsecurities from a portfolio to meet redemption demands, as they would be with open-end funds. Small investors simply sell their ETF shares to other traders without affecting the composition of the underlying portfolio. Institutional investors who want to sell their shares receive shares of stock in the underlying portfolio.5.ETFs may be cheaper to buy than mutual funds because they are purchasedfrom brokers. The fund doesn't have to incur the costs of marketing itself, so the investor incurs lower management fees.。

投资学第7版Test-Bank答案03

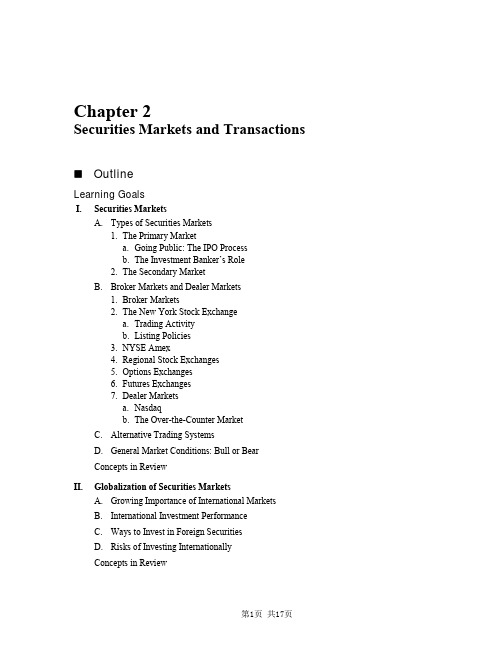

Multiple Choice Questions1. A purchase of a new issue of stock takes placeA) in the secondary market.B) in the primary market.C) usually with the assistance of an investment banker.D) A and B.E) B and C.Answer: E Difficulty: EasyRationale: Funds from the sale of new issues flow to the issuing corporation, making this aprimary market transaction. Investment bankers usually assist by pricing the issue and finding buyers.2. The following statements regarding the specialist are true:A) Specialists maintain a book listing outstanding unexecuted limit orders.B) Specialists earn income from commissions and spreads in stock prices.C) Specialists stand ready to trade at quoted bid and ask prices.D) Specialists cannot trade in their own accounts.E) A, B, and C are all true.Answer: E Difficulty: ModerateRationale: The specialists' functions are all of the items listed in A, B, and C. In addition,specialists trade in their own accounts.3. Investment bankersA) act as intermediaries between issuers of stocks and investors.B) act as advisors to companies in helping them analyze their financial needs and find buyersfor newly issued securities.C) accept deposits from savers and lend them out to companies.D) A and B.E) A, B, and C.Answer: D Difficulty: ModerateRationale: The role of the investment banker is to assist the firm in issuing new securities, both in advisory and marketing capacities. The investment banker does not have a role comparable to a commercial bank, as indicated in C.4. In a "firm commitment"A) the investment banker buys the stock from the company and resells the issue to the public.B) the investment banker agrees to help the firm sell the stock at a favorable price.C) the investment banker finds the best marketing arrangement for the investment bankingfirm.D) B and C.E) A and B.Answer: A Difficulty: Moderate5. The secondary market consists ofA) transactions on the AMEX.B) transactions in the OTC market.C) transactions through the investment banker.D) A and B.E) A, B, and C.Answer: D Difficulty: ModerateRationale: The secondary market consists of transactions on the organized exchanges and in the OTC market. The investment banker is involved in the placement of new issues in the primary market.6. The use of the Internet to trade and underwrite securitiesA) is illegal under SEC regulations.B) is regulated by the New York Stock Exchange.C) decreases underwriting costs for a new security issue.D) increases underwriting costs for a new security issue.E) is regulated by the National Association of Securities Dealers.Answer: C Difficulty: ModerateRationale: The SEC permits trading and underwriting of securities over the Internet, but has required firms participating in this activity to take steps to safeguard investment funds. This form of underwriting is expected to grow quickly due to its lower cost.7. Initial margin requirements are determined byA) the Securities and Exchange Commission.B) the Federal Reserve System.C) the New York Stock Exchange.D) B and C.E) A and BAnswer: B Difficulty: ModerateRationale: The Board of Governors of the Federal Reserve System determines initial margin requirements. The New York Stock Exchange determines maintenance margin requirements on NYSE-listed stocks; however, brokers usually set maintenance margin requirements above those established by the NYSE.8. You purchased XYZ stock at $50 per share. The stock is currently selling at $65. Your gainsmay be protected by placing a __________A) stop-buy orderB) limit-buy orderC) market orderD) limit-sell orderE) none of the above.Answer: D Difficulty: ModerateRationale: With a limit-sell order, your stock will be sold only at a specified price, or better.Thus, such an order would protect your gains. None of the other orders are applicable to this situation.9. You sold ABC stock short at $80 per share. Your losses could be minimized by placing a__________:A) limit-sell orderB) limit-buy orderC) stop-buy orderD) day-orderE) none of the above.Answer: C Difficulty: ModerateRationale: With a stop-buy order, the stock would be purchased if the price increased to a specified level, thus limiting your loss. None of the other orders are applicable to this situation.10. Which one of the following statements regarding orders is false?A) A market order is simply an order to buy or sell a stock immediately at the prevailing marketprice.B) A limit sell order is where investors specify prices at which they are willing to sell asecurity.C) If stock ABC is selling at $50, a limit-buy order may instruct the broker to buy the stock ifand when the share price falls below $45.D) A day order expires at the close of the trading day.E) None of the above.Answer: E Difficulty: ModerateRationale: All of the order descriptions above are correct.11. Restrictions on trading involving insider information apply to the following exceptA) corporate officers and directors.B) relatives of corporate directors and officers.C) major stockholders.D) All of the above are subject to insider trading restrictions.E) None of the above is subject to insider trading restrictions.Answer: D Difficulty: ModerateRationale: A, B, and C are corporate insiders and are subject to restrictions on trading on inside information. Further, the Supreme Court held that traders may not trade on nonpublicinformation even if they are not insiders.12. The cost of buying and selling a stock consists of __________.A) broker's commissionsB) dealer's bid-asked spreadC) a price concession an investor may be forced to make.D) A and B.E) A, B, and C.Answer: E Difficulty: ModerateRationale: All of the above are possible costs of buying and selling a stock.13. Assume you purchased 200 shares of XYZ common stock on margin at $70 per share from yourbroker. If the initial margin is 55%, how much did you borrow from the broker?A) $6,000B) $4,000C) $7,700D) $7,000E) $6,300Answer: E Difficulty: ModerateRationale: 200 shares * $70/share * (1-0.55) = $14,000 * (0.45) = $6,300.14. You sold short 200 shares of common stock at $60 per share. The initial margin is 60%. Yourinitial investment wasA) $4,800.B) $12,000.C) $5,600.D) $7,200.E) none of the above.Answer: D Difficulty: ModerateRationale: 200 shares * $60/share * 0.60 = $12,000 * 0.60 = $7,20015. You purchased 100 shares of ABC common stock on margin at $70 per share. Assume theinitial margin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin.A) $21B) $50C) $49D) $80E) none of the aboveAnswer: B Difficulty: DifficultRationale: 100 shares * $70 * .5 = $7,000 * 0.5 = $3,500 (loan amount); 0.30 = (100P -$3,500)/100P; 30P = 100P - $3,500; -70P = -$3,500; P = $50.16. You purchased 100 shares of common stock on margin at $45 per share. Assume the initialmargin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $30? Ignore interest on margin.A) 0.33B) 0.55C) 0.43D) 0.23E) 0.25Answer: E Difficulty: DifficultRationale: 100 shares * $45/share * 0.5 = $4,500 * 0.5 = $2,250 (loan amount); X = [100($30) - $2,250]/100($30); X = 0.25.17. You purchased 300 shares of common stock on margin for $60 per share. The initial margin is60% and the stock pays no dividend. What would your rate of return be if you sell the stock at $45 per share? Ignore interest on margin.A) 25%B) -33%C) 44%D) -42%E) –54%Answer: D Difficulty: DifficultRationale: 300($60)(0.60) = $10,800 investment; 300($60) = $18,000 X (0.40) = $7,200 loan;Proceeds after selling stock and repaying loan: $13,500 - $7,200 = $6,300; Return = ($6,300 - $10,800)/$10,800 = - 41.67%.18. Assume you sell short 100 shares of common stock at $45 per share, with initial margin at 50%.What would be your rate of return if you repurchase the stock at $40/share? The stock paid no dividends during the period, and you did not remove any money from the account beforemaking the offsetting transaction.A) 20%B) 25%C) 22%D) 77%E) none of the aboveAnswer: C Difficulty: ModerateRationale: Profit on stock = ($45 - $40) * 100 = $500, $500/$2,250 (initial investment) =22.22%.19. You sold short 300 shares of common stock at $55 per share. The initial margin is 60%. Atwhat stock price would you receive a margin call if the maintenance margin is 35%?A) $51B) $65C) $35D) $40E) none of the aboveAnswer: B Difficulty: DifficultRationale: Equity = 300($55) * 1.6 = $26,400; 0.35 = ($26,400 - 300P)/300P; 105P = 26,400 - 300P; 405P = 26,400; P = $65.1820. Assume you sold short 100 shares of common stock at $50 per share. The initial margin is 60%.What would be the maintenance margin if a margin call is made at a stock price of $60?A) 40%B) 33%C) 35%D) 25%E) none of the aboveAnswer: B Difficulty: DifficultRationale: $5,000 X 1.6 = $8,000; [$8,000 - 100($60)]/100($60) = 33%.21. Specialists on stock exchanges perform the following functionsA) Act as dealers in their own accounts.B) Analyze the securities in which they specialize.C) Provide liquidity to the market.D) A and B.E) A and C.Answer: E Difficulty: ModerateRationale: Specialists are both brokers and dealers and provide liquidity to the market; they are not analysts.22. Shares for short transactionsA) are usually borrowed from other brokers.B) are typically shares held by the short seller's broker in street name.C) are borrowed from commercial banks.D) B and C.E) none of the above.Answer: B Difficulty: ModerateRationale: Typically, the only source of shares for short transactions is those held by the short seller's broker in street name; often these are margined shares.23. Which of the following orders is most useful to short sellers who want to limit their potentiallosses?A) Limit orderB) Discretionary orderC) Limit-loss orderD) Stop-buy orderE) None of the aboveAnswer: D Difficulty: ModerateRationale: By issuing a stop-buy order, the short seller can limit potential losses by assuring that the stock will be purchased (and the short position closed) if the price increases to a certain level.24. Shelf registrationA) is a way of placing issues in the primary market.B) allows firms to register securities for sale over a two-year period.C) increases transaction costs to the issuing firm.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: Shelf registration lowers transactions costs to the firm as the firm may register issues for a longer period than in the past, and thus requires the services of the investment banker less frequently.25. NASDAQ subscriber levelsA) permit those with the highest level, 3, to "make a market" in the security.B) permit those with a level 2 subscription to receive all bid and ask quotes, but not to entertheir own quotes.C) permit level 1 subscribers to receive general information about prices.D) include all OTC stocks.E) A, B, and C.Answer: E Difficulty: EasyRationale: NASDAQ links dealers in a loosely organized network with different levels of access to meet different needs.26. You want to buy 100 shares of Hotstock Inc. at the best possible price as quickly as possible.You would most likely place aA) stop-loss orderB) stop-buy orderC) market orderD) limit-sell orderE) limit-buy orderAnswer: C Difficulty: EasyRationale: A market order is for immediate execution at the best possible price.27. You want to purchase XYZ stock at $60 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $3000 to invest, how many shares can you buy?A) 100 sharesB) 200 sharesC) 50 sharesD) 500 sharesE) 25 sharesAnswer: A Difficulty: ModerateRationale: .5 = [(Q * $60)-$3,000] / (Q * $60); $30Q = $60Q-$3,000; $30Q = $3,000; Q=100.28. A sale by IBM of new stock to the public would be a(n)A) short sale.B) seasoned new issue offering.C) private placement.D) secondary market transaction.E) initial public offering.Answer: B Difficulty: EasyRationale: When a firm whose stock already trades in the secondary market issues new shares to the public this is referred to as a seasoned new issue.29. The finalized registration statement for new securities approved by the SEC is calledA) a red herringB) the preliminary statementC) the prospectusD) a best-efforts agreementE) a firm commitmentAnswer: C Difficulty: ModerateRationale: The prospectus is the finalized registration statement approved by the SEC.30. The minimum market value required for an initial listing on the New York Stock Exchange isA) $2,000,000B) $2,500,000C) $1,100,000D) $60,000,000E) 100,000,000Answer: E Difficulty: ModerateRationale: See Table 3.3.31. In 2005, the price of a seat on the NYSE reached a high ofA) $1,000,000B) $4,000,000C) $1,750,000D) $2,225,000E) $3,000,000Answer: B Difficulty: ModerateRationale: See Table 3.2.32. The floor broker is best described asA) an independent member of the exchange who owns a seat and handles overload work forcommission brokers.B) someone who makes a market in one or more securities.C) a representative of a brokerage firm who is on the floor of the exchange to execute trade.D) a frequent trader who performs no public function but executes trades for himself.E) any counter party to a trade executed on the floor of the exchange.Answer: A Difficulty: EasyRationale: The floor broker is an independent member of the exchange who handles work for commission brokers when they have too many orders to handle.33. You sell short 100 shares of Loser Co. at a market price of $45 per share. Your maximumpossible loss isA) $4500B) unlimitedC) zeroD) $9000E) cannot tell from the information givenAnswer: B Difficulty: ModerateRationale: A short seller loses money when the stock price rises. Since there is no upper limit on the stock price, the maximum theoretical loss is unlimited.34. You buy 300 shares of Qualitycorp for $30 per share and deposit initial margin of 50%. Thenext day Qualitycorp's price drops to $25 per share. What is your actual margin?A) 50%B) 40%C) 33%D) 60%E) 25%Answer: B Difficulty: ModerateRationale: AM = [300 ($25) - .5 (300) ($30) ] / [300 ($25)] = .4035. When a firm markets new securities, a preliminary registration statement must be filed withA) the exchange on which the security will be listed.B) the Securities and Exchange Commission.C) the Federal Reserve.D) all other companies in the same line of business.E) the Federal Deposit Insurance Corporation.Answer: B Difficulty: EasyRationale: The SEC requires the registration statement and must approve it before the issue can take place.36. In a typical underwriting arrangement the investment banking firmI)sells shares to the public via an underwriting syndicate.II)purchases the securities from the issuing company.III)assumes the full risk that the shares may not be sold at the offering price.IV)agrees to help the firm sell the issue to the public but does not actually purchase the securities.A) I, II, and IIIB) I, III, and IVC) I and IVD) II and IIIE) I and IIAnswer: A Difficulty: ModerateRationale: A typical underwriting arrangement is made on a firm commitment basis.37. Which of the following is true regarding private placements of primary security offerings?A) Extensive and costly registration statements are required by the SEC.B) For very large issues, they are better suited than public offerings.C) They trade in secondary markets.D) The shares are sold directly to a small group of institutional or wealthy investors.E) They have greater liquidity than public offerings.Answer: D Difficulty: ModerateRationale: Firms can save on registration costs, but the result is that the securities cannot trade in the secondary markets and therefore are less liquid. Public offerings are better suited for very large issues.38. A specialist on the AMEX Stock Exchange is offering to buy a security for $37.50. A broker inOklahoma City wants to sell the security for his client. The Intermarket Trading System showsa bid price of $37.375 on the NYSE. What should the broker do?A) Route the order to the AMEX Stock Exchange.B) Route the order to the NYSE.C) Call the client to see if she has a preference.D) Route half of the order to AMEX and the other half to the NYSE.E) It doesn't matter - he should flip a coin and go with it.Answer: A Difficulty: ModerateRationale: The broker should try to obtain the best price for his client. Since the client wants to sell shares and the bid price is higher on the AMEX, he should route the order there.39. You sold short 100 shares of common stock at $45 per share. The initial margin is 50%. Yourinitial investment wasA) $4,800.B) $12,000.C) $2,250.D) $7,200.E) none of the above.Answer: C Difficulty: ModerateRationale: 100 shares * $45/share * 0.50 = $4,500 * 0.50 = $2,25040. You sold short 150 shares of common stock at $27 per share. The initial margin is 45%. Yourinitial investment wasA) $4,800.60.B) $12,000.25.C) $2,250.75.D) $1,822.50.E) none of the above.Answer: D Difficulty: ModerateRationale: 150 shares * $27/share * 0.45 = $4,050 * 0.45 = $1,822.5041. You purchased 100 shares of XON common stock on margin at $60 per share. Assume theinitial margin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin.A) $42.86B) $50.75C) $49.67D) $80.34E) none of the aboveAnswer: A Difficulty: DifficultRationale: 100 shares * $60 * .5 = $6,000 * 0.5 = $3,000 (loan amount); 0.30 = (100P -$3,000)/100P; 30P = 100P - $3,000; -70P = -$3,000; P = $42.8642. You purchased 1000 shares of CSCO common stock on margin at $19 per share. Assume theinitial margin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on marginA) $12.86B) $15.75C) $19.67D) $13.57E) none of the aboveAnswer: D Difficulty: DifficultRationale: 1000 shares * $19 * .5 = $19,000 * 0.5 = $9,500 (loan amount); 0.30 = (1000P - $9,500)/1000P; 300P = 1000P - $9,500; -700P = -$9,500; P = $13.5743. You purchased 100 shares of common stock on margin at $40 per share. Assume the initialmargin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $25? Ignore interest on margin.A) 0.33B) 0.55C) 0.20D) 0.23E) 0.25Answer: C Difficulty: DifficultRationale: 100 shares * $40/share * 0.5 = $4,000 * 0.5 = $2,000 (loan amount); X = [100($25) - $2,000]/100($25); X = 0.20.44. You purchased 1000 shares of common stock on margin at $30 per share. Assume the initialmargin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $24? Ignore interest on margin.A) 0.33B) 0.375C) 0.20D) 0.23E) 0.25Answer: B Difficulty: DifficultRationale: 1000 shares * $30/share * 0.5 = $30,000 * 0.5 = $15,000 (loan amount); X =[1000($24) - $15,000]/1000($24); X = 0.375.45. You purchased 100 shares of common stock on margin for $50 per share. The initial margin is50% and the stock pays no dividend. What would your rate of return be if you sell the stock at $56 per share? Ignore interest on margin.A) 28%B) 33%C) 14%D) 42%E) 24%Answer: E Difficulty: DifficultRationale: 100($50)(0.50) = $2,500 investment; gain on stock sale = (56-50)(100) = $600;Return = ($600/$2,500) = 24%.46. You purchased 100 shares of common stock on margin for $35 per share. The initial margin is50% and the stock pays no dividend. What would your rate of return be if you sell the stock at $42 per share? Ignore interest on margin.A) 28%B) 33%C) 14%D) 40%E) 24%Answer: D Difficulty: DifficultRationale: 100($35)(0.50) = $1,750 investment; gain on stock sale = (42-35)(100) = $700;Return = ($700/$1,750) = 40%.47. Assume you sell short 1000 shares of common stock at $35 per share, with initial margin at 50%.What would be your rate of return if you repurchase the stock at $25/share? The stock paid no dividends during the period, and you did not remove any money from the account beforemaking the offsetting transaction.A) 20.47%B) 25.63%C) 57.14%D) 77.23%E) none of the aboveAnswer: C Difficulty: ModerateRationale: Profit on stock = ($35 - $25)(1,000) = $10,000; initial investment = ($35)(1,000)(.5) = $17,500; return =$10,000/$17,500 = 57.14%.48. Assume you sell short 100 shares of common stock at $30 per share, with initial margin at 50%.What would be your rate of return if you repurchase the stock at $35/share? The stock paid no dividends during the period, and you did not remove any money from the account beforemaking the offsetting transaction.A) -33.33%B) -25.63%C) -57.14%D) -77.23%E) none of the aboveAnswer: A Difficulty: ModerateRationale: Profit on stock = ($30 - $35)(100) = -500; initial investment = ($30)(100)(.5) =$1,500; return =$-500/$1,500 = -33.33%.49. You want to purchase GM stock at $40 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $4000 to invest, how many shares can you buy?A) 100 sharesB) 200 sharesC) 50 sharesD) 500 sharesE) 25 sharesAnswer: B Difficulty: ModerateRationale: you can buy ($4000/$40) = 100 shares outright and you can borrow $4,000 to buy another 100 shares.50. You want to purchase IBM stock at $80 from your broker using as little of your own money aspossible. If initial margin is 50% and you have $2000 to invest, how many shares can you buy?A) 100 sharesB) 200 sharesC) 50 sharesD) 500 sharesE) 25 sharesAnswer: C Difficulty: ModerateRationale: You can buy ($2000/$80) = 25 shares outright and you can borrow $2,000 to buy another 25 shares.51. Assume you sold short 100 shares of common stock at $40 per share. The initial margin is 50%.What would be the maintenance margin if a margin call is made at a stock price of $50?A) 40%B) 20%C) 35%D) 25%E) none of the aboveAnswer: B Difficulty: DifficultRationale: $4,000 X 1.5 = $6,000; [$6,000 - 100($50)]/100($50) = 20%.52. Assume you sold short 100 shares of common stock at $70 per share. The initial margin is 50%.What would be the maintenance margin if a margin call is made at a stock price of $85?A) 40.5%B) 20.5%C) 35.5%D) 23.5%E) none of the aboveAnswer: D Difficulty: DifficultRationale: $7,000 X 1.5 = $10,500; [$10,500 - 100($85)]/100($85) = 23.5%.53. You sold short 100 shares of common stock at $45 per share. The initial margin is 50%. Atwhat stock price would you receive a margin call if the maintenance margin is 35%?A) $50B) $65C) $35D) $40E) none of the aboveAnswer: A Difficulty: DifficultRationale: Equity = 100($45) * 1.5 = $6,750; 0.35 = ($6,750 - 100P)/100P; 35P = 6,750 - 100P;135P = 6,750; P = $50.0054. You sold short 100 shares of common stock at $75 per share. The initial margin is 50%. Atwhat stock price would you receive a margin call if the maintenance margin is 30%?A) $90.23B) $88.52C) $86.54D) $87.12E) none of the aboveAnswer: C Difficulty: DifficultRationale: Equity = 100($75) * 1.5 = $11,250; 0.30 = ($11,250 - 100P)/100P; 30P = 11,250 - 100P; 130P = 11,250; P = $86.5455. IPO average first-day returns are largest in ____________.A) The United StatesB) DenmarkC) JapanD) ChinaE) FranceAnswer: D Difficulty: EasyRationale: See Figure 3.3.56. Despite large first-day IPO returns, average first-year returns in the US are approximately____________ percent.A) 6.7B) 18.2C) 26.4D) 4.8E) 9.1Answer: A Difficulty: EasyRationale: See Figure 3.4.57. Average second-year IPO returns in the US are approximately ____________ percent.A) 6.7B) 18.2C) 26.4D) 5.3E) 9.1Answer: D Difficulty: EasyRationale: See Figure 3.4.58. Average third-year IPO returns in the US are approximately ____________ percent.A) 6.7B) 18.2C) 26.4D) 5.3E) 10.3Answer: E Difficulty: EasyRationale: See Figure 3.4.59. The advertisement by the underwriting syndicate to announce an new security issue is referredto as the ____________.A) red herringB) preliminary prospectusC) prospectusD) tombstoneE) headstoneAnswer: D Difficulty: Easy60. The preliminary prospectus is referred to as a ____________.A) red herringB) indentureC) green mailD) tombstoneE) headstoneAnswer: A Difficulty: Easy61. The minimum revenue required for an initial listing on the New York Stock Exchange isA) $2,000,000B) $25,000,000C) $50,000,000D) $75,000,000E) 100,000,000Answer: D Difficulty: ModerateRationale: See Table 3.3.62. The annual dollar volume of trading on the NYSE in 2004 was approximately ____________dollars.A) 12 trillionB) 4 trillionC) 12 billionD) 4 billionE) none of the aboveAnswer: A Difficulty: EasyRationale: See Figure 3.7.63. The ____________ had the largest trading volume of securities in 2004.A) NASDAQB) NYSEC) LondonD) TokyoE) Hong KongAnswer: B Difficulty: EasyRationale: See Figure 3.7.64. The securities act of 1933 ____________.I)requires full disclosure of relevant information relating to the issue of new securitiesII)requires registration of new securitiesIII)requires issuance of a prospectus detailing financial prospects of the firmIV)established the SECV)requires periodic disclosure of relevant financial informationVI)empowers SEC to regulate exchanges, OTC trading, brokers, and dealersA) I, II and IIIB) I, II, III, IV, V, and VIC) I, II and VD) I, II and IVE) IV onlyAnswer: A Difficulty: Easy65. The securities act of 1934 ____________.I)requires full disclosure of relevant information relating to the issue of new securitiesII)requires registration of new securitiesIII)requires issuance of a prospectus detailing financial prospects of the firmIV)established the SECV)requires periodic disclosure of relevant financial informationVI)empowers SEC to regulate exchanges, OTC trading, brokers, and dealersA) I, II and IIIB) I, II, III, IV, V, and VIC) I, II and VD) I, II and IVE) IV, V, and VIAnswer: E Difficulty: Easy。

投资学第7版testbank答案09