会计英语课后习题参考答案

(完整版)会计英语课后习题参考答案解析

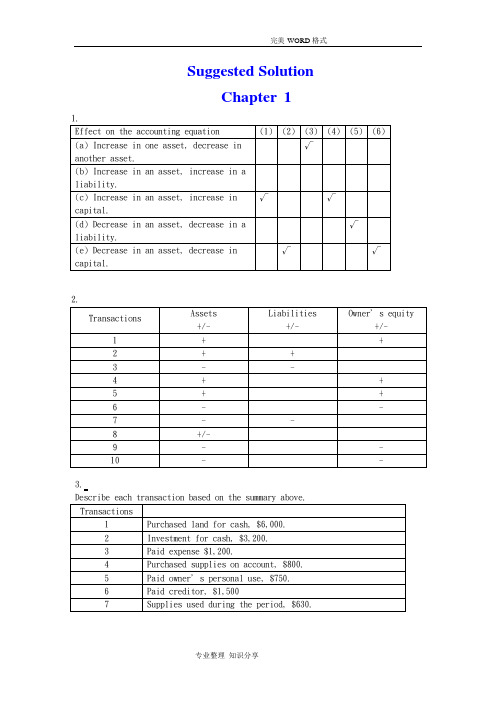

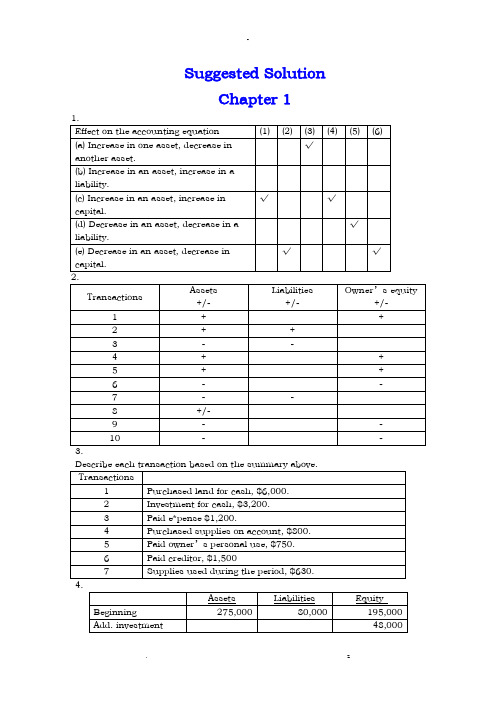

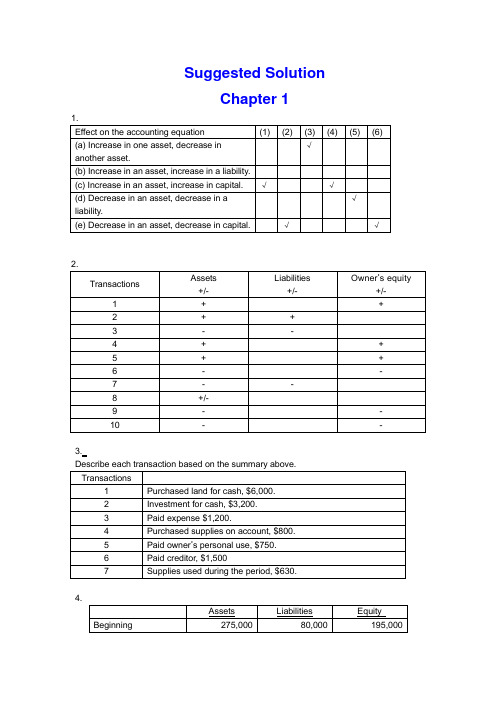

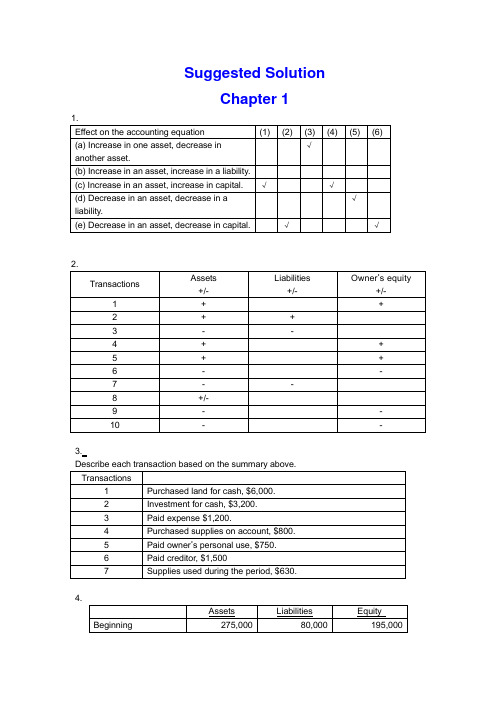

Suggested SolutionChapter 11.3.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ........................... 1,800 b.Revenue ..................................... 4,500Accounts receivable ................... 4,500 c.Owner’s withdrawals ........................ 1,500Salaries Expense ....................... 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000December 31, 2009 Cash 42,500Investment in K 42,500 Investment in K 146,000 Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100 Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400 Income tax payable 21,60020⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25). g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue ....................................... 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory ........................................... 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S) ................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S) ...................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable ................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) .......................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures in year 1 for warranty workCash ................................................... 297,600*Accounts receivable ................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable ............................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Inventory ........................................... 220,000 Deferred gross margin ............................... 90,000 To record sale of goods on accountDeferred gross margin ................................... 12,400 Accounts receivable ................................. 12,400 To record return of goods within the 30-day return period. It is assumed the goods have no value and are disposed of.Deferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash ................................................... 297,600* Accounts receivable ................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable ............................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue ....................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs ............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performancecriterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determinethe percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recordedin revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30%$ 6,0002006 $20,000 × 70%$ 14,0002007 $20,000 × 100%$ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. 5,400 7,550 5,850 2. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings ... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable . 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850 Revenue from long-termcontract .......... 6,000 8,000 6,000 5. To close construction in progress:Progress billings ....... 20,000 Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products,IAS18 defines performance as the point when the seller of the goods hastransferred the risks and rewards of ownership to the buyer. Normally, this meansthat performance is done at the time of sale. Although the seller may haveperformed much of the work prior to the sale (production, selling efforts, etc.),there is still significant risk to the seller that a buyer may not be found.Therefore, from a reliability point of view, revenue recognition is delayed untilthe point of sale. Also, there may be significant risks remaining with the sellerof the product even after the sale. Warranties given by the seller are a riskthat remains with the seller. However, if this risk can be reliably estimatedat the time of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here, performancereally is considered to be a measure of the work done. Revenue is recognizedover the production period as the work is performed. It is intended to reflectthe amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can berecognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set).However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment.As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b. Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130)20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3))3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30)4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000)36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000$ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ………………………. -48,000Payment of income tax ………………………………-13,000Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating-200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing-1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash-400,0005.。

会计英语课后习题参考答案解析(可编辑修改word版)

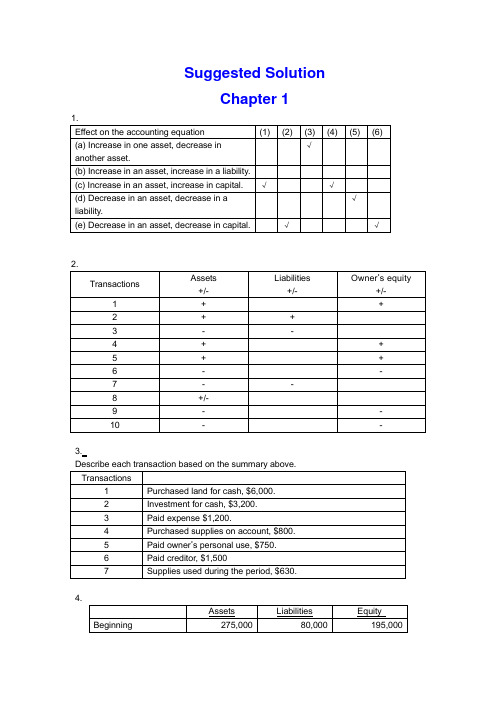

Suggested SolutionChapter 12.3.Describe each transaction based on the summary above.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ............................ 1,800 b.Revenue ......................................Accounts receivable ....................c. 4,5004,500Owner’s withdrawals........................ 1,500Salaries Expense ....................... 1,500d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue Service revenue 2,1002,100Consultant expense Prepaid consultant 9009004. Unearned revenueService revenue3,0003,0001. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31.Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202.April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73.(a) As a whole: the ending inventory=685(b)applied separately to each product: the ending inventory=6254.The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c)first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2.(a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000 (b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003.(1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004.Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005.a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory198,000 Cr: Accounts Payable198,000 June 11: Dr: Accounts Payable198,000Cr: Notes Payable198,000 June 12: Dr: Cash300,000Cr: Notes Payable300,000 b. Dr: Interest Expenses (for notes on June 11) 12,100 Cr: Interest Payable12,100 Dr: Interest Expenses (for notes on June 12) 8,175 Cr: Interest Payable8,175 c. Balance sheet presentation:dFor Western: Dr: Notes Payable 300,000 Interest Payable 8,175 Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability2,400Income tax payable21,600 20⨯9 Deferred income tax is an asset600 Income tax payable 26,100 (2) 20⨯8: Dr: Tax expense24,000Cr: Income tax payable 21,600 Deferred income tax2,400 20⨯9: Dr: Tax expense25,500 Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense24,000 Balance sheet: income tax payable21,600 20⨯9: Income statement: tax expense25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))Notes Payable498,000 Accrued Interest on Notes Payable20,275 . For Green:Dr: Notes Payable198,000 Interest Payable12,100 Interest Expense 7,700 Cr: Cash 217,800b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61.Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000 The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2.July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3.a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d.Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of dec laration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000 To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ............................................... 480,000 Cash/Accounts payable................................ 480,000 To record purchase of inventoryInventory ............................................... 124,000 Cash/Accounts payable................................ 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue........................................ 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory............................................ 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S).................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S)....................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable.................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ..........................Cash/Accounts payable................................ 18,60018,600To record expenditures in year 1 for warranty workCash .................................................... 297,600*Accounts receivable.................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable................................ 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, thefollowing journal entries would be used to record the transactions for the two years:Year 1Inventory ...............................................Cash/Accounts payable................................ To record purchase of inventory 480,000480,000Inventory ...............................................Cash/Accounts payable................................ To record refurbishment of inventory 124,000124,000Accounts receivable .....................................Inventory............................................ 310,000220,000Deferred gross margin................................To record sale of goods on account90,000Deferred gross margin ...................................Accounts receivable.................................. 12,40012,400To record return of goods within the 30-day return period.goods have no value and are disposed of.It is assumed theDeferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable................................ 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .................................................... 297,600* Accounts receivable.................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable................................ 8,400 To record warranty costs incurred in year 2 related to year 1 sales. Thewarranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue........................................ 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs.............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after thewarranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale.The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is notsubstantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on theassumption that we could measure the risk that remains with the seller, andmake a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated totalcosts to determine the percentage of completion) is to estimate the percentageof completion of the project at the end of each year. This is done in thefollowing table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculatedas above, the next step is to allocate the appropriate amount of revenue toeach year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction projectwould be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. . 5,400 7,550 5,8502. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings .... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable .. 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850Revenue from long-termcontract ........... 6,000 8,000 6,0005.To close construction in progress:Progress billings ....... 20,000Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a.The three criteria of revenue recognition are performance, measurability,and collectibility.Performance means that the seller or service provider has performed thework. Depending on the nature of the product or service, performance maymean quite different points of revenue recognition. For example, for thesale of products, IAS18 defines performance as the point when the seller ofthe goods has transferred the risks and rewards of ownership to the buyer.Normally, this means that performance is done at the time of sale. Althoughthe seller may have performed much of the work prior to the sale(production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability pointof view, revenue recognition is delayed until the point of sale. Also,there may be significant risks remaining with the seller of the producteven after the sale. Warranties given by the seller are a risk that remainswith the seller. However, if this risk can be reliably estimated at thetime of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue is recognized over the production period as the work is performed. It is intended to reflect the amount of effort expended by the seller(contractor). Although legal title won’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognizeduntil the extent of performance is known.Measurability means that the seller or service provider must be able toreliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it isappropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b.Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able tosell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15+ $3)) 3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000 Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000Enterprise net profit $3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a)Cash received from customers = 816,000(b)Cash payments for purchases of merchandise. =468,000(c)Cash payments for operating expenses. = 268,200(d)Income taxes paid. =36,9003.Cash sales..................................... $9,000Payment of accounts payable ………………………. -48,000Payment of income tax ……………………………… -13,000Payment of inter est ……………………………..….. -16,000 Collection of accounts receivable .................. 93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating - 200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing - 1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash - 400,0005.。

会计专业英语课后答案 Answer for lesson3

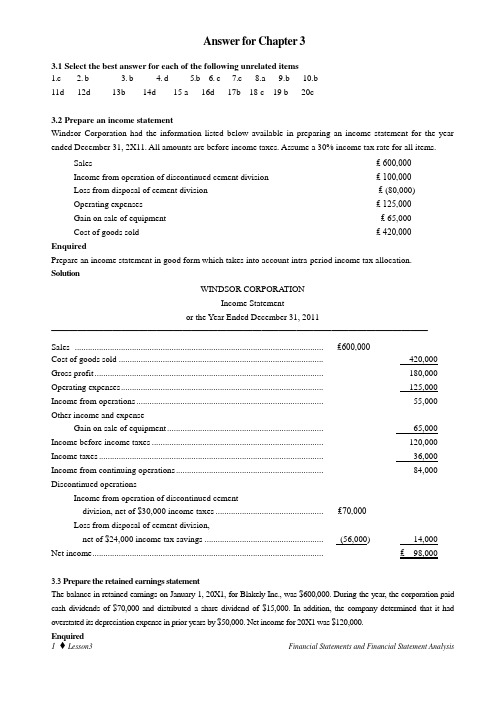

Answer for Chapter 33.1 Select the best answer for each of the following unrelated items1.c2. b3. b4. d5.b6. c7.c8.a9.b 10.b11d 12d 13b 14d 15 a 16d 17b 18 c 19 b 20c3.2Prepare an income statementWindsor Corporation had the information listed below available in preparing an income statement for the year ended December 31, 2X11. All amounts are before income taxes. Assume a 30% income tax rate for all items.Sales ₤ 600,000Income from operation of discontinued cement division ₤ 100,000Loss from disposal of cement division ₤ (80,000)Operating expenses ₤ 125,000Gain on sale of equipment ₤ 65,000Cost of goods sold ₤ 420,000EnquiredPrepare an income statement in good form which takes into account intra-period income tax allocation.SolutionWINDSOR CORPORA TIONIncome Statementor the Year Ended December 31, 2011 ———————————————————————————————————————————Sales ................................................................................................................. ₤600,000Cost of goods sold ............................................................................................. 420,000 Gross profit ........................................................................................................ 180,000 Operating expenses ............................................................................................ 125,000 Income from operations ..................................................................................... 55,000 Other income and expenseGain on sale of equipment ....................................................................... 65,000 Income before income taxes .............................................................................. 120,000 Income taxes ...................................................................................................... 36,000 Income from continuing operations ................................................................... 84,000 Discontinued operationsIncome from operation of discontinued cementdivision, net of $30,000 income taxes ................................................. ₤70,000Loss from disposal of cement division,net of $24,000 income tax savings ...................................................... (56,000) 14,000 Net income ......................................................................................................... ₤98,0003.3 Prepare the retained earnings statementThe balance in retained earnings on January 1, 20X1, for Blakely Inc., was $600,000. During the year, the corporation paid cash dividends of $70,000 and distributed a share dividend of $15,000. In addition, the company determined that it had overstated its depreciation expense in prior years by $50,000. Net income for 20X1 was $120,000.EnquiredPrepare the retained earnings statement for 20X1.SolutionBLAKEL Y INC.Retained Earnings StatementFor the Y ear Ended December 31, 20X1Balance, January 1 as reported $600,000 Correction for understatement of net incomein prior period (depreciation expense error) 50,000 Balance, January 1, as adjusted 650,000 Add: Net income 120,000770,000 Less: Cash dividends $70,000Share dividend 15,000 85,000 Balance, December 31 $685,0003.4 Prepare fiancial statementsThese financial statement items (in thousands) are for Chen Company at year-end, July 31, 2X11.Salaries payable ¥4,580 Note payable (long-term) ¥3,300Salaries expense 45,700 Cash 22,200Utilities expense 19,100 Accounts receivable 9,780Equipment 22,000 Accumulated depreciation 6,000Accounts payable 4,100 Dividends 4,000 Commission revenue 56,100 Depreciation expense 4,000Rent revenue 6,500 Retained earnings (1/1/2X11) 30,000Share capital-ordinary 16,200Enquired(a) Prepare an income statement and a retained earnings statement for the year.(b) Prepare a classified statement of financial position at July 31, 2X11.Solution(a) CHEN COMPANYIncome StatementFor the Year Ended July 31, 2X11 ———————————————————————————————————————————RevenuesCommission revenue .................................................................................... ¥56,100Rent revenue ................................................................................................. 6,500 Total revenues ...................................................................................... ¥62,600 ExpensesSalaries expense ............................................................................................ 45,700Utilities expense ........................................................................................... 19,100Depreciation expense .................................................................................... 4,000Total expense........................................................................................ 68,800 Net loss ................................................................................................................... ¥ (6,200)CHEN COMPANYRetained Earnings StatementFor the Year Ended July 31, 2X11 ———————————————————————————————————————————Retained Earnings, August 1, 2X10 ............................................................................. ¥30,000 Less: Net loss ..................................................................................................... ¥6,200 Dividends ...................................................................................................... 4,000 10,200 Retained Earnings , July 31, 2X11 .......................................................................... ¥18,800(b) CHEN COMPANYStatement of Financial PositionJuly 31, 2X11 ———————————————————————————————————————————AssetsProperty, plant, and equipmentEquipment..................................................................................................... ¥22,000Less: Accumulated depreciation ................................................................... 6,000 ¥16,000 Current assetsAccounts receivable ...................................................................................... 9,780Cash ............................................................................................................ 22,20031,980 Total assets ............................................................................................ ¥47,980Equity and LiabilitiesEquityShare capital-ordinary………………………………………………… ¥16,200Retained earnings ......................................................................................... 18,800 ¥35,000 Long-term liabilitiesNote payable ................................................................................................. 3,300 Current liabilitiesAccounts payable .......................................................................................... ¥4,100Salaries payable ............................................................................................ 4,580 8,680 Total equity and liabilities ....................................................................................... ¥47,9803.5 Prepare a statement of cash flowsA comparative statement of financial position for Mann Company appears below:MANN COMPANYComparative Statement of Financial PositionDec. 31, 2Y11 Dec. 31, 2Y10AssetsEquipment €60,000 €32,000Accumulated depreciation—equipment (20,000) (14,000) Long-term investments -0- 18,000 Prepaid expenses 6,000 9,000 Inventory 25,000 18,000 Accounts receivable 18,000 14,000 Cash 27,000 10,000 Total assets €116,000€87,000Equity and LiabilitiesShare capital-ordinary € 40,000€23,000 Retained earning 22,000 10,000 Bonds payable 37,000 47,000 Accounts payable 17,000 7,000 Total equity and liabilities €116,000€87,000 Additional information:1. Net income for the year ending December 31, 2Y11 was €27,000.2. Cash dividends of €15,000 were declared and paid during the year.3. Long-term investments that had a cost of €18,000 were sold for €14,000.4. Sales for 2Y11 were €120,000.EnquiredPrepare a statement of cash flows for the year ended December 31, 2Y11, using the indirect method.SolutionMANN COMPANYStatement of Cash FlowsFor the Year Ended December 31, 2Y11Cash flows from operating activitiesNet income .................................................................................................. €27,000Adjustments to reconcile net income to net cash provided byoperating activities:Depreciation expense ....................................................................... € 6,000Loss on sale of long-term investments ............................................... 4,000Increase in accounts receivable ........................................................ (4,000)Decrease in prepaid expenses ........................................................... 3,000Increase in inventories ...................................................................... (7,000)Increase in accounts payable ............................................................ 10,000 12,000Net cash provided by operating activities ........................................ 39,000 Cash flows from investing activitiesSale of long-term investments .................................................................... 14,000Purchase of equipment ................................................................................ (28,000)Net cash used by investing activities ................................................ (14,000) Cash flows from financing activitiesIssuance of ordinary shares ......................................................................... 17,000Retirement of bonds payable ...................................................................... (10,000)Payment of cash dividends ......................................................................... (15,000)Net cash used by financing activities ............................................... (8,000) Net increase in cash .............................................................................................. 17,000 Cash at beginning of period .................................................................................. 10,000 Cash at end of period ............................................................................................€27,0003.6 Perform vertical analysisDecember 31, 2X12December 31, 2X11Inventory€ 780,000 € 600,000 Accounts receivable 510,000 400,000 Total assets 3,000,0002,500,000EnquiredUsing these data from the comparative statement of financial position of Luca Company perform vertical analysis. Solution Dec. 31, 2012Dec. 31, 2011Amount Percentage*Amount Percentage**Inventory€ 780,000 26% € 600,000 24% Accounts receivable 510,000 17% 400,000 16% Total assets 3,000,000100.0%2,500,000100.0%€€780,000.263,000,000=€€600,000.242,500,000=€€510,000.173,000,000=€€400,000.162,500,000=3.7 Perform horizontal analysisComparative information taken from the Wells Company financial statements is shown below: 2X12 2X11 (a) Notes receivable $ 20,000 $ -0-(b) Accounts receivable 175,000 140,000 (c) Retained earnings 30,000 (40,000) (d) Income taxes payable 45,000 20,000 (e) Sales900,000 750,000 (f)Operating expenses170,000200,000EnquiredUsing horizontal analysis, show the percentage change from 2X11 to 2X12 with 2X11 as the base year. Solution (a) Base year is zero. Not possible to compute. (b) $35,000 ÷ $140,000 = 25% increase(c) Base year is negative. Not possible to compute. (d) $25,000 ÷ $20,000 = 125% increase (e)$150,000 ÷ $750,000 = 20% increase***(f) $30,000 ÷ $200,000 = 15% decrease3.8 Perform horizontal analysisThe following items were taken from the financial statements of Ritz, Inc., over a four-year period:Item 2Y12 2Y11 2Y10 2Y09Net Sales €800,000€650,000€600,000€500,000Cost of Goods Sold 580,000 460,000 420,000 400,000Gross Profit €220,000€190,000€180,000€100,000EnquiredUsing horizontal analysis and 2Y09 as the base year, compute the trend percentages for net sales, cost of goods sold, and gross profit. Explain whether the trends are favorable or unfavorable for each item.SolutionItem 2Y12 2Y11 2Y10 2Y09Net Sales 160% 130% 120% 100%Cost of Goods Sold 145% 115% 105% 100%Gross Profit 220% 190% 180% 100%The trend in net sales is increasing and favorable. The cost of goods sold trend is increasing which could be unfavorable, but the sales are increasing each year at a faster pace than cost of goods sold. This is apparent by examining the gross profit percentages, which show a favorable, increasing trend.3.9 Analysis the liquidity of the Howell CompanyHowell Company has the following selected accounts after posting adjusting entries:Accounts Payable € 55,000Notes Payable, 3-month 80,000Accumulated Depreciation—Equipment 14,000Salary Payable 27,000Notes Payable, 5-year, 8% 30,000Estimated Warranty Liability 34,000Salary Expense 6,000Interest Payable 3,000Mortgage Payable 200,000Sales Tax Payable 21,000Enquired(a) Prepare the current liability section of Howell Company's statement of financial position, assuming $25,000of the mortgage is payable next year. List liabilities in magnitude order, with largest first.(b) Comment on Howell 's liquidity, assuming total current assets are €450,000.Solution(a) HOWELL COMPANYCurrent LiabilitiesNotes payable, 3-month € 80,000Accounts payable 55,000Estimated warranty liability 34,000Salary payable 27,000Long-term debt due within one year 25,000Sales tax payable 21,000Interest payable 3,000Total Current Liabilities €245,000(b) The liquidity position looks favorable. If all current liabilities are paid out of current assets, there would stillbe €205,000 of current assets. The current assets are almost twice the current liabilities and it appears as though Howell Company has sufficient current resources to meet current obligations when due.3.10 Calculate the debt to total assets and times interest earned ratiosFranco Corporation reports the following selected financial statement information at December 31, 2X11: Total Assets $110,000Total Liabilities 65,000Net Income 18,000Interest Income 1,600Interest Expense 900Tax Expense 300EnquiredCalculate the debt to total assets and times interest earned ratios.SolutionDebt to total assets: $65,000 ÷ $110,000 = 59%Times interest earned: ($18,000 + $900 + $300) ÷ $900 = 21.33 times3.11 Compute the receivables turnover and the average collection periodBerman Company reported the following financial information:12/31/2X11 12/31/2X10Accounts receivable $ 320,000 $ 360,000Net credit sales 2,550,000 2,420,000EnquiredCompute (a) the receivables turnover and (b) the average collection period for 2X11.Solution(a) Receivables turnover = $2,550,000 ÷ $340,000 = 7.5 times(b) Average collection period = 365 ÷ 7.5 = 49 days3.12 Calculate the net income and EPSBanks Company is considering two alternatives to finance its purchase of a new $4,000,000 office building.(a) Issue 400,000 ordinary shares at $10 per share.(b) Issue 8%, 10-year bonds at par ($4,000,000).Income before interest and taxes is expected to be $3,000,000. The company has a 30% tax rate and has 600,000 ordinary shares outstanding prior to the new financing.EnquiredCalculate each of the following for each alternative:(1) Net income.(2) Earnings per share.Solution(a) Issue Shares (b) Issue BondsIncome before interest and taxes $3,000,000 $3,000,000Interest (8% × $4,000,000) —320,000Income before income taxes 3,000,000 2,680,000Income tax expense 900,000 804,000(1) Net income $2,100,000 $1,876,000Shares outstanding 1,000,000 600,000(2) Earnings per share $2.10 $3.133.13 Compute the return on ordinary shareholders’ equity ratioThe following information is available for Ritter Corporation:2Y11 2Y10 Average ordinary shareholders’ equity$1,500,000 $1,000,000Average total shareholders’ equity 2,000,000 1,500,000Ordinary dividends declared and paid 72,000 50,000Preference dividends declared and paid 30,000 30,000Net income 330,000 270,000EnquiredCompute the return on ordinary shareholders’ equity ratio for both years. Briefly commen t on your findings.Solution2Y10 2Y11Return on ordinaryshareholders’ equity ratio:$270,000 – $30,000 $330,000 – $30,000————————— = 24% ————————— = 20%$1,000,000 $1,500,000Ritter’s return on common stockholders’ equity ratio decreased approximately 17% during 2011. Ritter’s earnings increased during 2011 by 22%, but its average ordinary shareholders’ equity increased by 50%, causing the return on ordinary shareholders’ equity to declin e by 17%.3.14 Calculate book value per shareBellingham Corporation has the following equity balances at December 31, 2X11.Share Capital–Ordinary, $1 par $ 3,500Share Premium–Ordinary 24,500Retained Earnings 62,500Total $90,500EnquiredCalculate book value per share.SolutionNumber of shares outstanding: $3,500/$1 = 3,500Book value per share: $90,500/3,500 = $25.863.15 Calculate financial ratiosSelected information from the comparative financial statements of Fryman Company for the year ended December 31 appears below:2X11 2X10Inventory $ 140,000 $160,000Accounts receivable (net) 180,000 200,000Total assets 1,200,000 800,000Long-term debt 400,000 300,000Current liabilities 140,000 110,000Net credit sales 1,330,000 700,000Cost of goods sold 900,000 530,000Interest expense 50,000 25,000Income tax expense 60,000 29,000Net income 150,000 85,000EnquiredAnswer the following questions relating to the year ended December 31, 2X11. Show computations.1. Inventory turnover for 2X11 is __________.2. Times interest earned in 2X11 is __________.3. The debt to total assets ratio for 2X11 is __________.4. Receivables turnover for 2X11 is __________.5. Return on assets for 2X11 is __________.Solution$900,0001. Inventory turnover for 2011 is 6 times. ———————————— = 6 times.($140,000 + $160,000) ÷ 2$150,000 + $60,000 + $50,0002. Times interest earned in 2011 is 5.2 times. —————————————— = 5.2 times.$50,000$140,000 + $400,0003. The debt to total assets ratio for 2011 is 45%. —————————— = 45%.$1,200,000$1,330,0004. Receivables turnover for 2011 is 7 times. ———————————— = 7 times.($180,000 + $200,000) ÷ 2$150,0005. Return on assets for 2011 is 15%. ————————————— = 15%.($1,200,000 + $800,000) ÷ 2。

会计专业英语教程-练习参考答案

会计专业英语教程课后练习参考答案Chapter 1Solutions to Self-TestST1-1 ABCDST1-2 BCDST1-3 CDSolutions to Questions for DiscussionOmittedSolutions to ExercisesOmittedChapter 2Solutions to Self-TestST2-1 CST2-2 CST2-3 AST2-4 DST2-5 BST2-6 BST2-7 ABDSolutions to ExercisesEx2-1 A.S B.W C.W D.W E.S F.W G.W H.SEx2-2A. Allowance for Doubtful Accounts 51,840Accounts Receivable 51,840B. Allowance for Doubtful Accounts 15,660Accounts Receivable 14,850Interest Receivable 810C. Accounts Receivable 7,020Allowance for Doubtful Accounts 7,020Cash 7,020Accounts Receivable 7,020D. Bad Debts Expense 20,520Allowance for Doubtful Accounts 20,520Ex2-3A. Jan. 4, Inventory 23,900Accounts Payable 23,900Jan. 9, Accounts Receivable 36,800Sales 36,800Cost of Goods Sold 27,200Inventory 27,200B. 124,600+23,900-27, 200=121,300C. Omitted.Chapter 3Solutions to Self-TestST3-1 CST3-2 CST3-3 DChapter 4Solutions to Self-TestST4-1 ABST4-2 ACST4-3 ABCDSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx4-1 OmittedEx4-2 OmittedEx4-3A. 1,000,000×7.2%×5=360,000B. 1,000,000×7.2%=72,000C. 1,000,000×7.2%×1/12=6,000Ex4-4A. June 1, Cash 20,000Notes Payable (Holden Investments) 20,000 July 19, Office Equipment 18,000Notes Payable (Western Supply) 18,000 Sept. 1, Cash 240,000Discount on Notes Payable 4,800Notes Payable (Midwest Bank) 244,800 Oct. 1, Inventory 162,000Discount on Notes Payable 405Notes Payable (Earthware Imports) 162,405Oct. 19, Interest Payable 350Interest Expense 100Cash 450For the replacement of an old note with a new one, the company needs to take notes in the memo records.B. Oct. 31, Interest Expense 195Discount on Notes Payable 135Interest Payable 60Oct. 31, Interest Expense 3,200Discount on Notes Payable 3,200Ex4-5 20,000,000×12%-(20,000,000×12%×35%)=2,400,000-840,000=1,560,000 Or 20,000,000×12%×(1-35%)=1,560,000Chapter 5Solutions to Self-TestST5-1 CST5-2 BST5-3 BST5-4 CST5-5 DST5-6 CST5-7 AST5-8 DST5-9 DSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx5-1 BEx5-2 AEx5-3 CEx5-4 DEx5-5 AEx5-6 DEx5-7 CEx5-8 BEx5-9 AEx5-10 BEx5-11 CEx5-12 BEx5-13 CEx5-14 DEx5-15 CChapter 6Solutions to Self-TestST6-1 AST6-2 CSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx6-1a. The balance sheetThe balance sheetAssets LiabilitiesCash 100,000 Accounts payable 55,000 Buildings and equipment 600,000 Notes payable 400,000Owner’s EquityShare capital 150,000Retained earnings 95,000 Total assets 700,000 Total liabilities and owner’s equity 700,000 b. No, because most businesses have more transactions.Ex6-2Pale CompanyIncome StatementItem Amount of this periodI. Total sales 591,762 Including: Sales 591,762 II. Total cost of salesIncluding: Cost of sales 482,355 Taxes and associate chargesSelling expenses and distribution 98,576 Administrative expenses 1,257 Financial expenseImpairment lossGain/(loss) from investment (“-” means loss)11,218III. Business pr ofit (“-” means loss) 20,792 Add: non-business income 9,033 Less: non-business expenseIV. Total profit (“-” means loss) 29,825 Less: Tax expense 522 V. Net profit (“-” means loss) 29,303Chapter 7Solutions to Self-TestST7-1 Direct-labor-hour basisOverhead recovery rate = £12000/1,600=£7.50 per direct-labor-hourMachine-hour basisOverhead recovery rate = £8000/1,000=£8.00 per direct-labor-hourOverheads charged to jobsJob 1 Job 2££Direct-labor-hour basis£7.5×800 6,000£7.5×800 6,000Machine-hour basis£8.0×700 5,600£8.0×300 2,400Total 11,600 8,400Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx7-1 (a) Direct-labor-hour baissOverhead recovery rate=£50,000/2000=£25 per machine-hour.A £25×1500=£37500B £25×500=£12500(b) Machine-hour basisOverhead recovery rate=£50,000/1200=£41.6667 per machine-hour.A £41.6667×800=£33333B £41.6667×400=£16667Ex7-2The budget may be summarized as:Sales revenue £196,000Direct materials £38,000Direct labor £32,000Total overheads £77,000 (2,400+3,000+27,600+36,000+8,000)Profit £49,000The job may be priced on the basis that both overheads and profit should be apportioned to it on the basis of direct labor cost, as follows:Direct materials £4,000Direct labor £3,600Overheads £8,663 (£77,000×3,600/32,000)Profit £5,513 (£49,000×3,600/32,000)£21,776This answer assumes that variable overheads vary in proportion to direct labor cost.Various other bases of charging overheads and profit loading the job could have been adopted. For example, materials cost could have been included (with direct labor) as the basis for profit-loading, or even apportioning overheads.Ex7-3Sales price per unitAunit OutputB£Total sales revenueC=A×B£Variable costD=B×£20£Total costE=£2500+D£Profit/lossH£100 0 0 0 2500 -250095 10 950 200 2700 -175090 20 1800 400 2900 -110085 30 2550 600 3100 -55080 40 3200 800 3300 -10075 50 3750 1000 3500 25070 60 4200 1200 3700 50065 70 4550 1400 3900 65060 80 4800 1600 4100 70055 90 4950 1800 4300 65050 100 5000 2000 4500 500 An output of 80 units each week will maximize profit at £700 a week. The sales price per units is £60.Chapter 8Solutions to Self-TestST8-1The minimum price is:£Opportunity cost of the car 3,500Cost of the reconditioned engine 300Total 3,800The original cost of the car is irrelevant. The cost of the new engine is relevant because, if thework is done, the garage will have to pay £300 for the engine.The labor cost 15 irrelevant because the same cost will be incurred whether the mechanic undertakes the work or not. This is because the mechanic is being paid to do nothing if this job is not undertaken; thus the additional labor cost arising from this job is zero.ST8-2Product (code name) B14 B17 B22 (£)Selling price per unit 25 20 23Variable cost per unit (10) (8) (12)Contribution per unit 15 12 11Machine time per unit(hours) 4 3 4Contribution per machine-hour 3.75 4.00 2.75Order of priority 2nd1st3rdLabor time per unit (hours) 5 3 6Therefore:Produce 20 unit of product B17 using 60 hours22unit of product B14 using 88 hours148 hoursSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx8-1The minimum price is:Opportunity cost of the car £3,500Cost of the reconditioned engine £300Labor cost (7×£20)£140Total £3,940Ex8-2The relevant costs to be included in the minimum price are:Stock item: A1 £6×500=£3,000B2 £8×800=£6,400We are told that the stock of item A1 is in frequent use and so, if it is used on the contract, it will need to be replaced. We are told the stock of item B2 will never be used by the business unless the contract is undertaken. Thus, if the contract is not undertaken, the only reasonable thing for the business to do is sell the stock. This means that the opportunity cost is £8 a unit.Ex8-3(a) Estimated monthly profit from basket making:Without the machine With the machine££Sales (500×£14) 7,000 7000 Less Materials (500×£2)1000 1000 Labor(500×2×£5) 5000 (500×1×£5) 2500 Fix costs 500 3000 Profit 500500(b) The BEP with the machine:unitper ts Variable unit per revenus Sales tsFixed - =cos cos=)+-(5214000,3=429 baskets per month.There seems to be nothing to choose between the two manufacturing strategies regarding profit, at the estimated sales volume. There is, however, a distinct difference between the two strategies regarding the BEP. Without the machine, the actual volume of sales could fall by a half of that which is expected (from 500 to 250) before the business would fail to make a profit. With the machine, however, a 14 per cent fall (from 500 to 429) would be enough to cause the business to fail to make a profit.Ex8-4 (a) BEP =unitper ts Variable unit per revenus Sales tsFixed - =cos cos==++++)3121420(60)000,60000,80(-=12,127 radiosSales value is £763,620 (12,127×£60).(b) The margin of safety is 7,273 radios (that is, 20,000-12,727).The margin would have a sales value of £436,380 (that is, 7,273×£60).Chapter 9Solutions to Self-TestST9-1 (a) and (b)(c) Feasible explanations include the following:Sales volumeSales priceMaterials usageLabor rateLabor efficiencyOverheads(d)£Planning variance(10%×4000) ×£2.24 896 ‘New’ sales volume variance[4000-(10%×4000)-3500] ×£2.24224 Original sales volume variance 1120Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx9-1The original budget, the flexed budget and the actual re as follows:Budget Actual Flexed budgetOutput (production and sales) 1,000 units 1050 units 1050 units£££Sale revenue 100,000 104,300 105,000Raw materials 40,000 41,200 42,000Labor 20,000 12,300 21,000Fixed overheads 20,000 19,400 20,000Operating profit 20,000 22,400 22,000 Reconciliation of the budgeted and actual operating profits for JulyBudgeted profit 20,000Add favorable variances:Sales volume (22,000-20,000) 2,000Direct materials usage {[(1050×40)-40,500]×£1} 1,500Direct labor efficiency{[(1050×2.5)-2,600]×£8} 200Fixed overhead spending (20,000-19,400) 60024,300Less Adverse variances:Sales price variance (105,000-104,300) 700Direct materials price[(40,500×£1)-41,200] 700Direct labor rate[(2,600×£8) -21,300] 500Actual profit 22,400Ex9-2Pilot Ltd(a)and (b)BudgetActualOriginal FlexedOutput (units)(production and sales)5,000 5,400 5,400£££Sales revenue 25,000 27,000 26,460Raw materials (7,500) (8,100) (2,700 kg) (8,770) (2,830 kg) Labor (6,250) (6,750) (1,350 hr) 6,885 (1,300 hr) Fixed overheads (6,000) (6,000) (6,350)Operating profit 5,250 6,150 4,455£Manager accountableSales volume varianceSales price variance Materials usage variance Materials price variance Labor efficiency variance Labor rate variance Fixed overhead variance5250-615027000-26460[(5400×0.5)-2830]×£3(2830×3)-8770[(5400×0.25)-1300]×£5(1300×5)-68856000-6350900 (F)(540) (A)(280) (A)(390) (A)(385) (A)250(F)(350) (A)SalesSalesBuyerProductionPersonnelProductionDepends on the natureof the overheadsTotal net variances 795(A)Note: F-favorable; A-adverseChapter 10Solutions to Self-TestST10-1A. stock price ¥112.00-5% underpricing 5.60Issue price ¥106.40-6% spread 7.45Net to company ¥98.95Number of shares=¥200 million/¥98.95=2.02 millionB. Investment bankers’ revenue=¥7.45×2.02 million=¥15.01 millionC. Underpricing is not a cash flow. It is, however, an opportunity cost to current owners because it means that more shares must be sold to raise ¥200 million and each share will represent a smaller ownership interest in the company.ST10-2Let X equals the end-of-year payment. ¥100,000=X(3.791); X=¥26,378.26. With this annual payment, the NPV on the loan from the bank’s perspective is 0, so its IRR is 10 percent.Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx10-1A.The holding period return is -2.9 percent.B.The bond’s price might have fallen because investor perceptions of its risk rose or becauseinterest rates rose.Ex10-2A.PV=1,000(0.507)=¥507B.PV=1,000(0.257)=¥257. Present value is less because the present sum has more time togrow into ¥1,000.C.PV=5,000(0.893)+3,000(0.797)+10,000(0.322)=¥10,076D.PV=80(6.628)+1,000(0.205)=¥735.24Chapter 11Solutions to Self-TestST11-1 TrueST11-2 TrueST11-3 FalseST11-4 TrueST11-5 FalseST11-6 FalseSolutions to Questions for DiscussionOmittedSolutions to ExercisesEX11-1A.ROE will undoubtedly fall. The numerator of the ratio, net income, will decline because theacquired company is losing money.B.This, however, is not important to the decision. This is another example of the timing problem.If the Internet company has great promise, it may make complete sense to acquire the business even though it is currently losing money. The proper way to evaluate the acquisition is to calculate a time-adjusted figure of merit that takes into account the company’s future performance.EX11-2Leverage ratios provide information about the degree of financial risk management faces in levering the business. Liquidity ratios offer information about the ready financial reserves the company has available to meet unanticipated needs. Control ratios provide insight into the management of important operating assets and liabilities. Finally, the fixed-asset turnover ratio indicates the degree of operating leverage the firm employs and its vulnerability to sales declines. Largely missing from this list is information about the business risks inherent in the markets in which the firm competes.EX11-3Collection period=Accounts receivable/Sales per dayAccounts receivable= Collection perio d×Sales per day=45×¥52 million/365=¥6.4 millio nChapter 12Solutions to Self-TestOmittedSolutions to ExercisesEx12-1A.(3)B.dC.bD.bEx12-2A.dB.dEx12-3A.bB.cC.aChapter 13Solutions to Self-TestOmittedSolutions to ExercisesEx13-1 OmittedEx13-2 OmittedEx13-3 OmittedEx13-4 OmittedEx13-5A.aB.aC.bD.cE.aF.cChapter 14Solutions to Self-TestOmittedSolutions to ExercisesEx14-1A.dB.cC.aD.cEx14-2A.aB.cC.d。

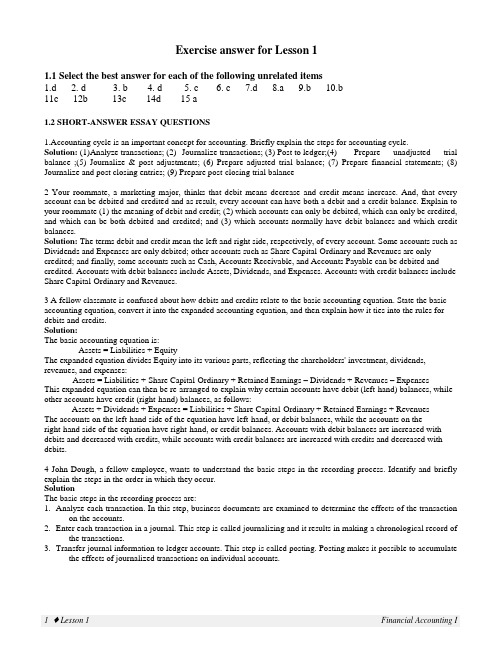

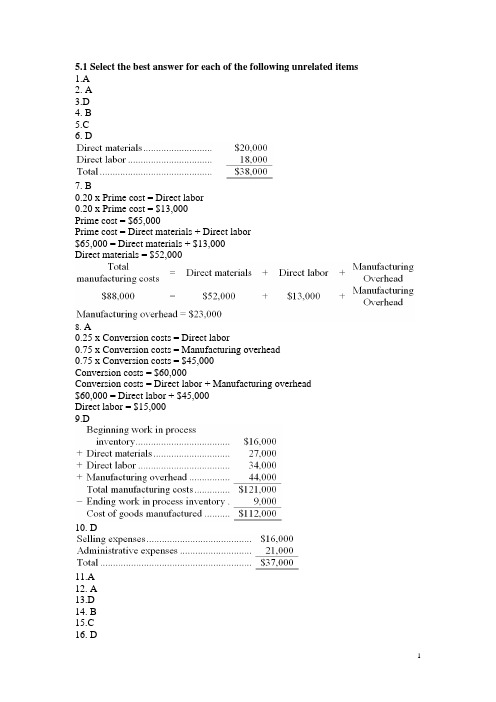

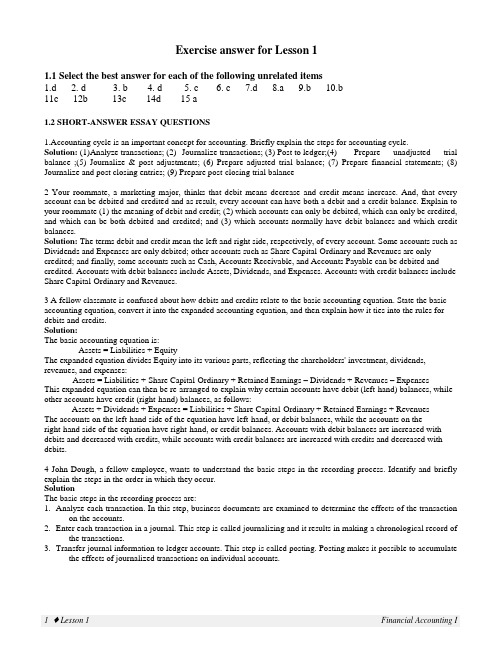

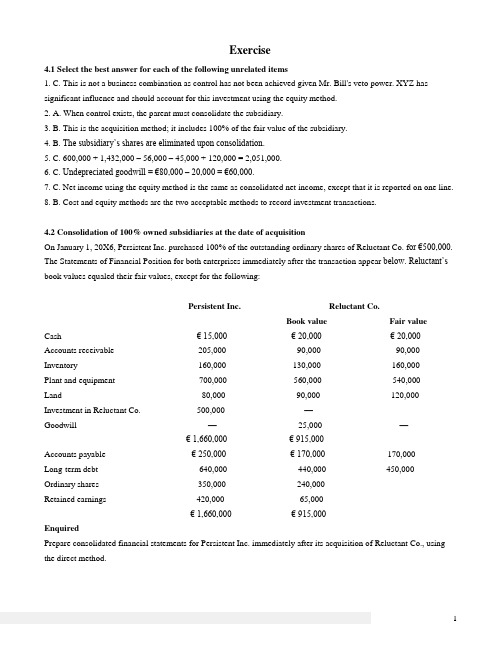

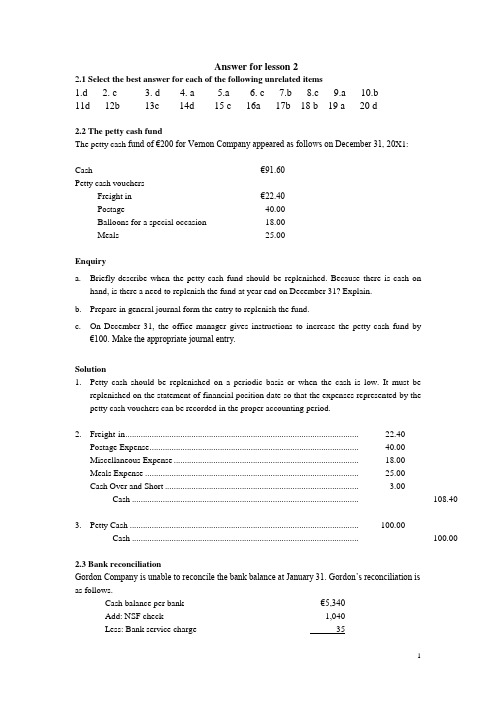

会计英语课后题答案Answer for lesson 1