会计专业英语习题答案

会计专业英语习题答案

会计专业英语习题答案Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5a. owner's equityb.liabilityc.assetd.assete.owner'sequity f. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ...... $297,200 Net income for the month ................ $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000 Leo Perkins, capital, April 30, 2006 .... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120 Operating expenses:Wages expense .......................... $100,100Rent expense ............................. 35,000Supplies expense ........................ 4,550Miscellaneous expense.................. 3,150Total operating expenses ............. 142,800 Net income .................................. $89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. The ratio of liabilities to stockholders’ equity increased from2002 to 2003, indicating an increase in risk for creditors.However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction T ype Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash...................................... 40,000Ira Janke, Capital ................... 40,000 (2) Supplies ................................. 1,800Cash................................... 1,800 (3) Equipment ............................... 24,000Accounts Payable ................... 15,000Cash................................... 9,000 (4) Operating Expenses ................... 3,050Cash................................... 3,050 (5) Accounts Receivable .................. 12,000Service Revenue ..................... 12,000 (6) Accounts Payable ...................... 7,500Cash................................... 7,500 (7) Cash...................................... 9,500Accounts Receivable ............... 9,500 (8) Ira Janke, Drawing ..................... 5,000Cash................................... 5,000 (9) Operating Expenses ................... 1,050Supplies .............................. 1,0502-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000– $8,000). Such a negative balance means that the liabilities of Seth’s business exceed the assets.b. Y es. The balance sheet prepared at December 31will balance, with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. T he increase of $28,750 in the cash accountdoes not indicate earnings of that amount.Earnings will represent the net change in allassets and liabilities from operatingtransactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug.1 Rent Expense ........................... 1,500Cash................................... 1,5002 Advertising Expense (700)Cash (700)4 Supplies ................................. 1,050Cash................................... 1,0506 Office Equipment ....................... 7,500Accounts Payable ................... 7,5008 Cash...................................... 3,600Accounts Receivable ............... 3,60012 Accounts Payable ...................... 1,150Cash................................... 1,15020 Gayle McCall, Drawing ................ 1,000Cash................................... 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................. 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct.27 Supplies .......................... 15 1,320Accounts Payable ............ 21 1,320Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ✓...... ...... 585 ......27 .......................... 43 1,320 ...... 1,905 ...... Accounts Payable 21 2006Oct. 1 Balance ................ ✓...... ...... ..... 6,15027 .......................... 43 ...... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ........................................... 13,375 Accounts Receivable .......................... 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000 Accounts Payable .............................. 11,180 Unearned Rent ................................. 4,250 Erin Capelli, Capital ........................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense ................................ 42,000 Advertising Expense ........................... 7,200 Miscellaneous Expense ....................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................ 15,000Wages Expense ..................... 15,000b. Prepaid Rent ............................ 4,500Cash................................... 4,5002-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .......................... $37,028 $35,925 .......................... $ 1,1033.1%2. Cost of sales ................ (29,658)(28,111) ......................... 1,5475.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ................. $ (45) $1,300$(1,345)(103.5%)b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000.While sales increased by $1,103 million, a 3.1%increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrativeexpenses also increased by $901 million, a 13.8%increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease,and created a $45 million loss in 2000. Little over ayear later, Kmart filed for bankruptcy protection. It hasnow emerged from bankruptcy, hoping to return toprofitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated.Net income will be overstated.b. Prepaid insurance (or assets) will be overstated.Owner’s equity will be overstated.3-5a.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,2153-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,5703-7a.Salary Expense ................................ 9,360Salaries Payable ........................ 9,360 b.Salary Expense ................................ 12,480Salaries Payable ........................ 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over-Under-stated stated stated stated1. Revenue for the year would be $ 0 $6,900 $ 0 $ 02. Expenses for the year would be 0 0 0 3,7403. Net income for the year would be 0 6,900 3,740 04. Assets at December 31 would be 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Own er’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable .......................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenuesare recognized only when the cash is received.Therefore, earned but unbilled revenues would not berecognized in the accounts, and no adjusting entrywould be necessary.3-13a. Fees earned (or revenues) will be understated. Netincome will be understated.b. Accounts (fees) receivable (or assets) will beunderstated. Owner’s equity will be understated.3-14Depreciation Expense ........................... 5,200Accumulated Depreciation ............ 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of theequipment to the periods benefiting from its use. Itdoes not necessarily relate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not avaluation method. That is, depreciation allocates thecost of a fixed asset over its useful life. Depreciationdoes not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ......................... 7,500Accumulated Depreciation ............ 7,500 b. (1) D epreciation expense would be understated. Netincome would be overstated.(2) A ccumulated depreciation would be understated,and total assets would be overstated. Owner’sequity would be overstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment 5 5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $(511,242)(12.2)c. Dell is more profitable than Gateway. Specifically,Dell’s cost of goods sold of 82.1% is significantly less(4.3%) than Gateway’s cost of goods sold of 86.4%.In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments TrialBalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 120 Totals 200 200 24 24213 213 20ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 120 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 18 2122 67 67 164 164 224-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense ............................ $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ...........................49Net income ...................................... $18ITHACA SERVICES CO.Statement of Owner’s EquityFor the Year Ended January 31, 2006 Terry Dagley, capital, February 1, 2005 .... $112 Net income for the year ....................... $18 Less withdrawals . (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............... $ 8 Accounts payable $26 Accounts receivable 57 .. Wages payable 1 Supplies ........... 3 Total liabilities . $ 27 Prepaid insurance 6Total current assets $ 74Property, plant, and Owner’s Equityequipment: Terry Dagley, capital (12)Land ............... $50Equipment ........ $32Less accum. depr. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $1494-72006Jan.31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment 531 Wages Expense (1)Wages Payable (1)4-82006Jan.31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense ............................ $56,800Rent expense ............................... 21,270Utilities expense ............................ 11,500Depreciation expense ..................... 8,000Insurance expense ......................... 4,100Supplies expense .......................... 3,100Miscellaneous expense .................... 2,250Total operating expenses ....... 107,020Net loss ..........................................$ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006 Suzanne Jacob, capital, November 1, 2005$173,750Net income for year ........................... $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 × 12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006AssetsLiabilitiesCurrent assetsCurrent liabilities:Cash $31,500Accounts payable ........... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies ............ 1,800 Unearned fees ............... Prepaid insurance 7,200 Total liabilitiesPrepaid rent ....... 4,800Total current assets $67,150 Owner’s E Property, plant, and equipment: Vernon Posey,capital 114,200Equipment ....... $80,600Less accumulated depreciation 21,100 59,500Total liabilities andTotal assets $126,650 owner’s equity ...............4-14Accounts Receivable ............................ 4,100Fees Earned ......................... 4,100 Supplies Expense ...................... 1,300Supplies .............................. 1,300 Insurance Expense ..................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................. 2,800Accumulated Depreciation—Equipment 2,800 Wages Expense ........................ 1,000Wages Payable ...................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detectingand correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................. 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................. 25,000b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034)($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December31, 2002 and 2001. In addition, the current ratio is below one at the end of both years. While the working capital and current ratios have improved from 2001 to 2002, creditors would likely be concerned about the ability of 7 Eleven to meet its short-term credit obligations. This concern would warrant further investigation to determine whether this is a temporaryissue (for example, an end-of-the-periodphenomenon) and the company’s plans to address itsworking capital shortcomings.4-20a. (1) Sales Salaries Expense ................ 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ................... 10,250Fees Earned ............................. 10,250b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense ................ 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ................... 10,2504-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) W ages Expense ........................ 45,000Cash ...................................... 45,000(2) Wages Expense ......................... 18,000Wages Payable .......................... 18,000(3) Income Summary .......................1,120,800Wages Expense ......................... 1,120,800(4) Wages Payable .......................... 18,000Wages Expense ......................... 18,000(5) Wages Expense ......................... 43,000Cash ...................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number ofcredit sales supported by promissory notes, a notesreceivable ledger should be maintained. Failure tomaintain a subsidiary ledger when there are asignificant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation ofduties is violated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining theaccounts receivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsiblefor approving credit.e. Appropriate. A promissory note is a formal creditinstrument that is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of DaysPast DueJanzen Industries August 29 93 days (2 + 30+ 31 + 30)Kuehn Company September 3 88 days (27 + 31+ 30)Mauer Inc. October 21 40 days (10 +30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov.30 Uncollectible Accounts Expense ..... 53,315*Allowances for Doubtful Accounts 53, *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible AccountsAge Interval Balance Percent AmountNot past due .............. $450,000 2% $9,0001–30 days past due...... 110,000 4 4,40031–60 days past due .... 51,000 6 3,06061–90 days past due .... 12,500 20 2,50091–180 days past due .. 7,500 60 4,500Over 180 days past due 5,500 80 4,400 Total .................... $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ..... 29,435*.A llowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ........... 7,130Accounts Receivable .................. 7,130b.Uncollectible Accounts Expense ............ 7,130Accounts Receivable .................. 7,130Ex. 8–8Feb.20 Accounts Receivable—Darlene Brogan 12,100 Sales .................................. 12,10020 Cost of Merchandise Sold ............ 7,260Merchandise Inventory .............. 7,260May30 Cash...................................... 6,000Accounts Receivable—Darlene Brogan 6,030 Allowance for Doubtful Accounts .... 6,100Accounts Receivable—Darlene Brogan 6,1Aug. 3Accounts Receivable—Darlene Brogan 6,100 Allowance for Doubtful Accounts . 6,1003 Cash...................................... 6,100Accounts Receivable—Darlene Brogan 6,1$223,900 [$212,800 + $112,350 –($4,050,000 × 21/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100Ex. 8–11a. August 8b. $24,480c. (1) N otes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,(2) C ash......................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)1. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account receivable.7. Payment received from customer for dishonored noteplus interest earned after due date.Ex. 8–132005Dec.13 Notes Receivable ....................... 25,000Accounts Receivable—Visage Co. 25,31 Interest Receivable ..................... 75*Interest Revenue (75)31 Interest Revenue (75)Income Summary (75)2006。

会计英语课后习题参考答案资料

Suggested SolutionChapter 13.4.5.(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ................................................... 1,800 b.Revenue ................................................................... 4,500Accounts receivable ...................................... 4,500c.Owner’s withdrawals ................................................ 1,500Salaries Expense ............................................ 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash 42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000 Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 208 Deferred income tax is a liability 2,400Income tax payable 21,600 209 Deferred income tax is an asset 600 Income tax payable 26,100(2) 208: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 209: Dr: Tax expense 25,500 Deferred income tax 600Cr: Income tax payable 26,100 (3) 208: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 209: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Sales revenue ......................................................................... 310,000 To record sale of goods on accountCost of goods sold ........................................................................ 220,000 Inventory ................................................................................. 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ......................................................................... 15,500* Allowance for sales returns (B/S) ........................................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ......................................................................... 31,000* Provision for warranties (B/S) ................................................. 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns .......................................................... 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ....................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures in year 1 for warranty workCash .............................................................................................. 297,600*Accounts receivable ............................................................... 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) ....................................................... 8,400 Cash/Accounts payable .......................................................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Inventory ................................................................................. 220,000 Deferred gross margin ............................................................ 90,000 To record sale of goods on accountDeferred gross margin .................................................................. 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within the 30-day return period. It is assumed the goods haveno value and are disposed of.Deferred warranty costs (B/S) ...................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .............................................................................................. 297,600* Accounts receivable ............................................................... 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................................................ 8,400 Cash/Accounts payable .......................................................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin .................................................................. **77,600Cost of goods sold ........................................................................ 220,000 Sales revenue ......................................................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ......................................................................... 27,000* Deferred warranty costs ......................................................... 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty periodhas expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that itwill eventually earn on the sales. The performance criteria might also be invoked here.The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determine the percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under thepercentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress .................. 5,400 7,550 5,850 Cash, payables, etc. ..... 5,400 7,550 5,850 2. Progress billings:Accounts receivable ............ 3,100 4,900 12,000 Progress billings ............ 3,100 4,900 12,000 3. Collections on billings:Cash .................................... 2,400 4,000 12,400 Accounts receivable ...... 2,400 4,000 12,400 4. Recognition of profit:Construction in progress ..... 600 450 150Construction expense.......... 5,400 7,550 5,850 Revenue from long-termcontract ...................... 6,000 8,000 6,000 5. To close construction in progress:Progress billings .................. 20,000 Construction in progress .20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000 Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products, IAS18 defines performance as the point when the seller of the goods has transferred therisks and rewards of ownership to the buyer. Normally, this means that performance is done at the time of sale. Although the seller may have performed much of the work prior to the sale (production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability point of view,revenue recognition is delayed until the point of sale. Also, there may be significant risks remaining with the seller of the product even after the sale. Warranties given by the seller are a risk that remains with the seller. However, if this risk can be reliably estimated at the time of sale, revenue can be recognized at the point of sale.Performance is quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue isrecognized over the production period as the work is performed. It is intended toreflect the amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able toestimate how much of the work has been done (perhaps because he or she can’treliably estimate how much work must still be done), then profit would not berecognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliablyestimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account.This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection ofamounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenuerecognition.b. Because of the performance criterion of revenue recognition, it would seem to bemost appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example,that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because,in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowingthe selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser tobuy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100) $ 20,000 Additional lessons ((200 × 8) × $30) 48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3)) 3,600 Additional lessons ((200 × 8) × $3)) 4,800Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division 2,100,000 Enterprise net profit $ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ……………………….-48,000 Payment of income tax ………………………………-13,000 Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ……………………….. -34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000Add: increases in current liabilities 180,000Net cash flows from operating -200,000Investing activitiesSale of land -50,000Purchase of PPE -1,500,000Net cash flows from investing -1,550,000Financing activitiesIssuance of common shares 400,000Payment of cash dividend -50,000Issuance of non-current liabilities 1,000,000Net cash flows from financing 1,350,000 Net changes in cash -400,000 5.。

会计专业英语教程-练习参考答案

会计专业英语教程课后练习参考答案Chapter 1Solutions to Self-TestST1-1 ABCDST1-2 BCDST1-3 CDSolutions to Questions for DiscussionOmittedSolutions to ExercisesOmittedChapter 2Solutions to Self-TestST2-1 CST2-2 CST2-3 AST2-4 DST2-5 BST2-6 BST2-7 ABDSolutions to ExercisesEx2-1 A.S B.W C.W D.W E.S F.W G.W H.SEx2-2A. Allowance for Doubtful Accounts 51,840Accounts Receivable 51,840B. Allowance for Doubtful Accounts 15,660Accounts Receivable 14,850Interest Receivable 810C. Accounts Receivable 7,020Allowance for Doubtful Accounts 7,020Cash 7,020Accounts Receivable 7,020D. Bad Debts Expense 20,520Allowance for Doubtful Accounts 20,520Ex2-3A. Jan. 4, Inventory 23,900Accounts Payable 23,900Jan. 9, Accounts Receivable 36,800Sales 36,800Cost of Goods Sold 27,200Inventory 27,200B. 124,600+23,900-27, 200=121,300C. Omitted.Chapter 3Solutions to Self-TestST3-1 CST3-2 CST3-3 DChapter 4Solutions to Self-TestST4-1 ABST4-2 ACST4-3 ABCDSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx4-1 OmittedEx4-2 OmittedEx4-3A. 1,000,000×7.2%×5=360,000B. 1,000,000×7.2%=72,000C. 1,000,000×7.2%×1/12=6,000Ex4-4A. June 1, Cash 20,000Notes Payable (Holden Investments) 20,000 July 19, Office Equipment 18,000Notes Payable (Western Supply) 18,000 Sept. 1, Cash 240,000Discount on Notes Payable 4,800Notes Payable (Midwest Bank) 244,800 Oct. 1, Inventory 162,000Discount on Notes Payable 405Notes Payable (Earthware Imports) 162,405Oct. 19, Interest Payable 350Interest Expense 100Cash 450For the replacement of an old note with a new one, the company needs to take notes in the memo records.B. Oct. 31, Interest Expense 195Discount on Notes Payable 135Interest Payable 60Oct. 31, Interest Expense 3,200Discount on Notes Payable 3,200Ex4-5 20,000,000×12%-(20,000,000×12%×35%)=2,400,000-840,000=1,560,000 Or 20,000,000×12%×(1-35%)=1,560,000Chapter 5Solutions to Self-TestST5-1 CST5-2 BST5-3 BST5-4 CST5-5 DST5-6 CST5-7 AST5-8 DST5-9 DSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx5-1 BEx5-2 AEx5-3 CEx5-4 DEx5-5 AEx5-6 DEx5-7 CEx5-8 BEx5-9 AEx5-10 BEx5-11 CEx5-12 BEx5-13 CEx5-14 DEx5-15 CChapter 6Solutions to Self-TestST6-1 AST6-2 CSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx6-1a. The balance sheetThe balance sheetAssets LiabilitiesCash 100,000 Accounts payable 55,000 Buildings and equipment 600,000 Notes payable 400,000Owner’s EquityShare capital 150,000Retained earnings 95,000 Total assets 700,000 Total liabilities and owner’s equity 700,000 b. No, because most businesses have more transactions.Ex6-2Pale CompanyIncome StatementItem Amount of this periodI. Total sales 591,762 Including: Sales 591,762 II. Total cost of salesIncluding: Cost of sales 482,355 Taxes and associate chargesSelling expenses and distribution 98,576 Administrative expenses 1,257 Financial expenseImpairment lossGain/(loss) from investment (“-” means loss)11,218III. Business pr ofit (“-” means loss) 20,792 Add: non-business income 9,033 Less: non-business expenseIV. Total profit (“-” means loss) 29,825 Less: Tax expense 522 V. Net profit (“-” means loss) 29,303Chapter 7Solutions to Self-TestST7-1 Direct-labor-hour basisOverhead recovery rate = £12000/1,600=£7.50 per direct-labor-hourMachine-hour basisOverhead recovery rate = £8000/1,000=£8.00 per direct-labor-hourOverheads charged to jobsJob 1 Job 2££Direct-labor-hour basis£7.5×800 6,000£7.5×800 6,000Machine-hour basis£8.0×700 5,600£8.0×300 2,400Total 11,600 8,400Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx7-1 (a) Direct-labor-hour baissOverhead recovery rate=£50,000/2000=£25 per machine-hour.A £25×1500=£37500B £25×500=£12500(b) Machine-hour basisOverhead recovery rate=£50,000/1200=£41.6667 per machine-hour.A £41.6667×800=£33333B £41.6667×400=£16667Ex7-2The budget may be summarized as:Sales revenue £196,000Direct materials £38,000Direct labor £32,000Total overheads £77,000 (2,400+3,000+27,600+36,000+8,000)Profit £49,000The job may be priced on the basis that both overheads and profit should be apportioned to it on the basis of direct labor cost, as follows:Direct materials £4,000Direct labor £3,600Overheads £8,663 (£77,000×3,600/32,000)Profit £5,513 (£49,000×3,600/32,000)£21,776This answer assumes that variable overheads vary in proportion to direct labor cost.Various other bases of charging overheads and profit loading the job could have been adopted. For example, materials cost could have been included (with direct labor) as the basis for profit-loading, or even apportioning overheads.Ex7-3Sales price per unitAunit OutputB£Total sales revenueC=A×B£Variable costD=B×£20£Total costE=£2500+D£Profit/lossH£100 0 0 0 2500 -250095 10 950 200 2700 -175090 20 1800 400 2900 -110085 30 2550 600 3100 -55080 40 3200 800 3300 -10075 50 3750 1000 3500 25070 60 4200 1200 3700 50065 70 4550 1400 3900 65060 80 4800 1600 4100 70055 90 4950 1800 4300 65050 100 5000 2000 4500 500 An output of 80 units each week will maximize profit at £700 a week. The sales price per units is £60.Chapter 8Solutions to Self-TestST8-1The minimum price is:£Opportunity cost of the car 3,500Cost of the reconditioned engine 300Total 3,800The original cost of the car is irrelevant. The cost of the new engine is relevant because, if thework is done, the garage will have to pay £300 for the engine.The labor cost 15 irrelevant because the same cost will be incurred whether the mechanic undertakes the work or not. This is because the mechanic is being paid to do nothing if this job is not undertaken; thus the additional labor cost arising from this job is zero.ST8-2Product (code name) B14 B17 B22 (£)Selling price per unit 25 20 23Variable cost per unit (10) (8) (12)Contribution per unit 15 12 11Machine time per unit(hours) 4 3 4Contribution per machine-hour 3.75 4.00 2.75Order of priority 2nd1st3rdLabor time per unit (hours) 5 3 6Therefore:Produce 20 unit of product B17 using 60 hours22unit of product B14 using 88 hours148 hoursSolutions to Questions for DiscussionOmittedSolutions to ExercisesEx8-1The minimum price is:Opportunity cost of the car £3,500Cost of the reconditioned engine £300Labor cost (7×£20)£140Total £3,940Ex8-2The relevant costs to be included in the minimum price are:Stock item: A1 £6×500=£3,000B2 £8×800=£6,400We are told that the stock of item A1 is in frequent use and so, if it is used on the contract, it will need to be replaced. We are told the stock of item B2 will never be used by the business unless the contract is undertaken. Thus, if the contract is not undertaken, the only reasonable thing for the business to do is sell the stock. This means that the opportunity cost is £8 a unit.Ex8-3(a) Estimated monthly profit from basket making:Without the machine With the machine££Sales (500×£14) 7,000 7000 Less Materials (500×£2)1000 1000 Labor(500×2×£5) 5000 (500×1×£5) 2500 Fix costs 500 3000 Profit 500500(b) The BEP with the machine:unitper ts Variable unit per revenus Sales tsFixed - =cos cos=)+-(5214000,3=429 baskets per month.There seems to be nothing to choose between the two manufacturing strategies regarding profit, at the estimated sales volume. There is, however, a distinct difference between the two strategies regarding the BEP. Without the machine, the actual volume of sales could fall by a half of that which is expected (from 500 to 250) before the business would fail to make a profit. With the machine, however, a 14 per cent fall (from 500 to 429) would be enough to cause the business to fail to make a profit.Ex8-4 (a) BEP =unitper ts Variable unit per revenus Sales tsFixed - =cos cos==++++)3121420(60)000,60000,80(-=12,127 radiosSales value is £763,620 (12,127×£60).(b) The margin of safety is 7,273 radios (that is, 20,000-12,727).The margin would have a sales value of £436,380 (that is, 7,273×£60).Chapter 9Solutions to Self-TestST9-1 (a) and (b)(c) Feasible explanations include the following:Sales volumeSales priceMaterials usageLabor rateLabor efficiencyOverheads(d)£Planning variance(10%×4000) ×£2.24 896 ‘New’ sales volume variance[4000-(10%×4000)-3500] ×£2.24224 Original sales volume variance 1120Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx9-1The original budget, the flexed budget and the actual re as follows:Budget Actual Flexed budgetOutput (production and sales) 1,000 units 1050 units 1050 units£££Sale revenue 100,000 104,300 105,000Raw materials 40,000 41,200 42,000Labor 20,000 12,300 21,000Fixed overheads 20,000 19,400 20,000Operating profit 20,000 22,400 22,000 Reconciliation of the budgeted and actual operating profits for JulyBudgeted profit 20,000Add favorable variances:Sales volume (22,000-20,000) 2,000Direct materials usage {[(1050×40)-40,500]×£1} 1,500Direct labor efficiency{[(1050×2.5)-2,600]×£8} 200Fixed overhead spending (20,000-19,400) 60024,300Less Adverse variances:Sales price variance (105,000-104,300) 700Direct materials price[(40,500×£1)-41,200] 700Direct labor rate[(2,600×£8) -21,300] 500Actual profit 22,400Ex9-2Pilot Ltd(a)and (b)BudgetActualOriginal FlexedOutput (units)(production and sales)5,000 5,400 5,400£££Sales revenue 25,000 27,000 26,460Raw materials (7,500) (8,100) (2,700 kg) (8,770) (2,830 kg) Labor (6,250) (6,750) (1,350 hr) 6,885 (1,300 hr) Fixed overheads (6,000) (6,000) (6,350)Operating profit 5,250 6,150 4,455£Manager accountableSales volume varianceSales price variance Materials usage variance Materials price variance Labor efficiency variance Labor rate variance Fixed overhead variance5250-615027000-26460[(5400×0.5)-2830]×£3(2830×3)-8770[(5400×0.25)-1300]×£5(1300×5)-68856000-6350900 (F)(540) (A)(280) (A)(390) (A)(385) (A)250(F)(350) (A)SalesSalesBuyerProductionPersonnelProductionDepends on the natureof the overheadsTotal net variances 795(A)Note: F-favorable; A-adverseChapter 10Solutions to Self-TestST10-1A. stock price ¥112.00-5% underpricing 5.60Issue price ¥106.40-6% spread 7.45Net to company ¥98.95Number of shares=¥200 million/¥98.95=2.02 millionB. Investment bankers’ revenue=¥7.45×2.02 million=¥15.01 millionC. Underpricing is not a cash flow. It is, however, an opportunity cost to current owners because it means that more shares must be sold to raise ¥200 million and each share will represent a smaller ownership interest in the company.ST10-2Let X equals the end-of-year payment. ¥100,000=X(3.791); X=¥26,378.26. With this annual payment, the NPV on the loan from the bank’s perspective is 0, so its IRR is 10 percent.Solutions to Questions for DiscussionOmittedSolutions to ExercisesEx10-1A.The holding period return is -2.9 percent.B.The bond’s price might have fallen because investor perceptions of its risk rose or becauseinterest rates rose.Ex10-2A.PV=1,000(0.507)=¥507B.PV=1,000(0.257)=¥257. Present value is less because the present sum has more time togrow into ¥1,000.C.PV=5,000(0.893)+3,000(0.797)+10,000(0.322)=¥10,076D.PV=80(6.628)+1,000(0.205)=¥735.24Chapter 11Solutions to Self-TestST11-1 TrueST11-2 TrueST11-3 FalseST11-4 TrueST11-5 FalseST11-6 FalseSolutions to Questions for DiscussionOmittedSolutions to ExercisesEX11-1A.ROE will undoubtedly fall. The numerator of the ratio, net income, will decline because theacquired company is losing money.B.This, however, is not important to the decision. This is another example of the timing problem.If the Internet company has great promise, it may make complete sense to acquire the business even though it is currently losing money. The proper way to evaluate the acquisition is to calculate a time-adjusted figure of merit that takes into account the company’s future performance.EX11-2Leverage ratios provide information about the degree of financial risk management faces in levering the business. Liquidity ratios offer information about the ready financial reserves the company has available to meet unanticipated needs. Control ratios provide insight into the management of important operating assets and liabilities. Finally, the fixed-asset turnover ratio indicates the degree of operating leverage the firm employs and its vulnerability to sales declines. Largely missing from this list is information about the business risks inherent in the markets in which the firm competes.EX11-3Collection period=Accounts receivable/Sales per dayAccounts receivable= Collection perio d×Sales per day=45×¥52 million/365=¥6.4 millio nChapter 12Solutions to Self-TestOmittedSolutions to ExercisesEx12-1A.(3)B.dC.bD.bEx12-2A.dB.dEx12-3A.bB.cC.aChapter 13Solutions to Self-TestOmittedSolutions to ExercisesEx13-1 OmittedEx13-2 OmittedEx13-3 OmittedEx13-4 OmittedEx13-5A.aB.aC.bD.cE.aF.cChapter 14Solutions to Self-TestOmittedSolutions to ExercisesEx14-1A.dB.cC.aD.cEx14-2A.aB.cC.d。

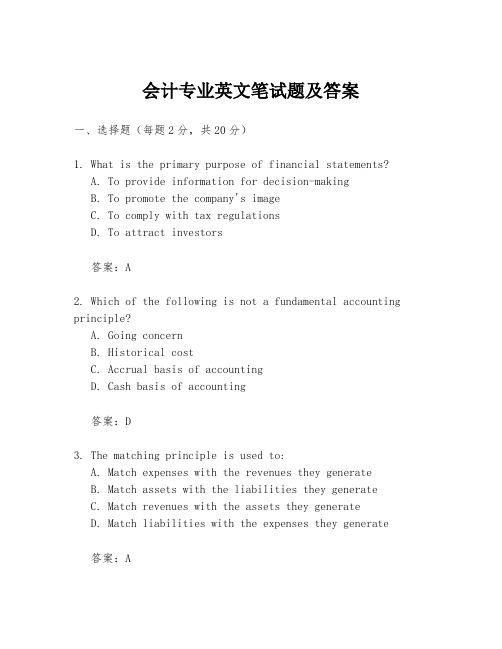

会计专业英文笔试题及答案

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计学英语试题及答案

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

会计英语考试题目及答案

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

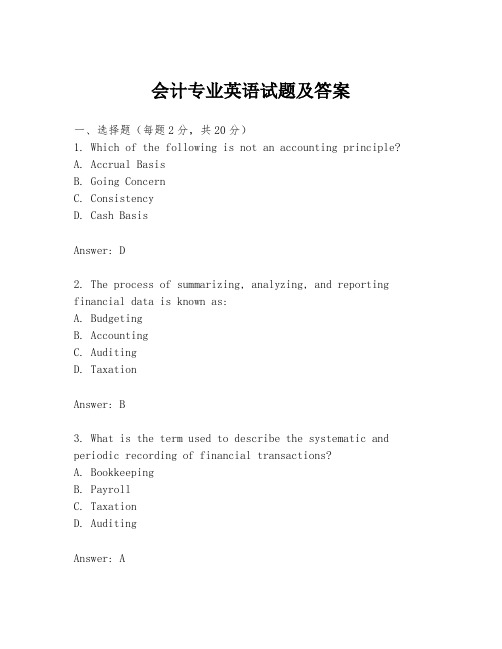

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计专业英语试题含答案