会计专业英语期末试题)

会计专业英语期末考试练习卷(new)

1。

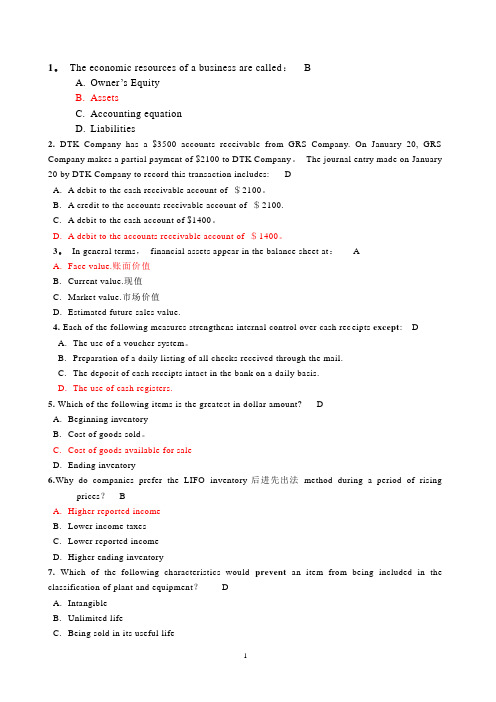

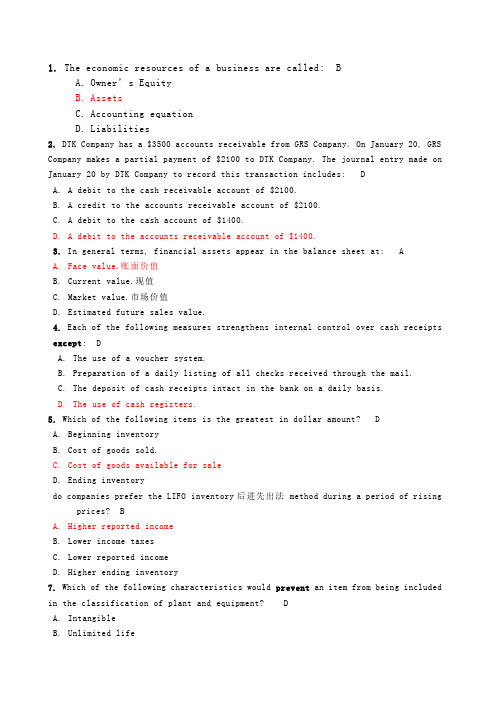

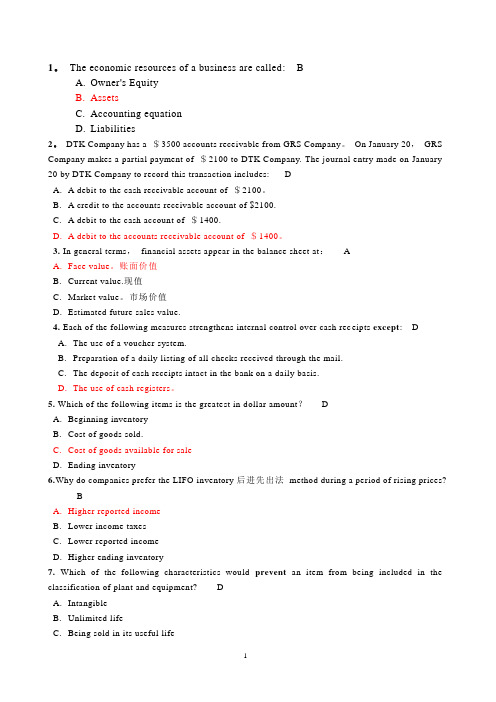

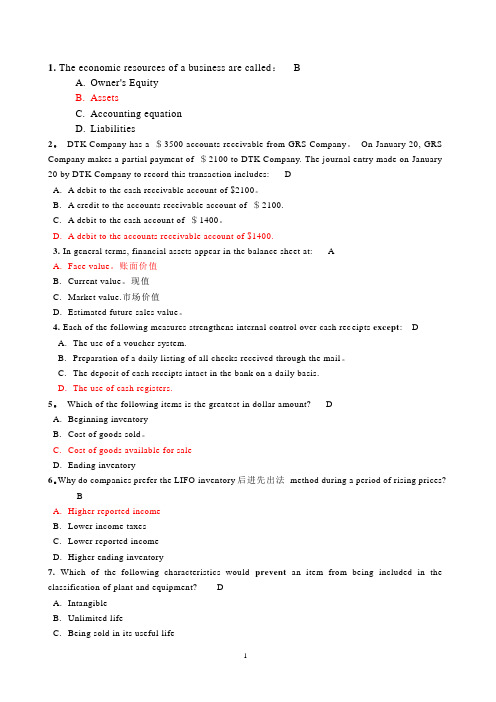

The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2.DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company。

The journal entry made on January20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100。

B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400。

D. A debit to the accounts receivable account of $1400。

3。

In general terms,financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash rec eipts except: DA.The use of a voucher system。

会计英语期末试题及答案

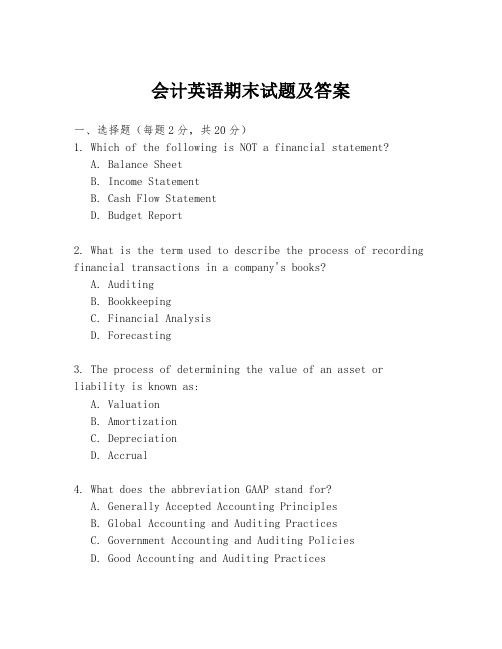

会计英语期末试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Budget Report2. What is the term used to describe the process of recording financial transactions in a company's books?A. AuditingB. BookkeepingC. Financial AnalysisD. Forecasting3. The process of determining the value of an asset orliability is known as:A. ValuationB. AmortizationC. DepreciationD. Accrual4. What does the abbreviation GAAP stand for?A. Generally Accepted Accounting PrinciplesB. Global Accounting and Auditing PracticesC. Government Accounting and Auditing PoliciesD. Good Accounting and Auditing Practices5. The term "revenue recognition" refers to the process of:A. Recording expenses when they are incurredB. Recording revenues when they are earnedC. Allocating costs to products or servicesD. Matching revenues with their related expenses6. Which of the following is a non-current asset?A. InventoryB. Accounts ReceivableC. LandD. Prepaid Expenses7. The matching principle in accounting requires that:A. All expenses must be recorded in the same period as the revenues they generateB. All assets must be listed on the balance sheetC. All liabilities must be paid off within one yearD. All revenues must be recognized in the period they are received8. What is the purpose of adjusting entries?A. To increase the company's reported profitsB. To ensure that financial statements reflect the current financial position of the companyC. To prepare the company for an auditD. To reduce the company's tax liability9. The accounting equation is:A. Assets = Liabilities + EquityB. Liabilities = Assets - EquityC. Equity = Assets - LiabilitiesD. All of the above10. Which of the following is a type of depreciation method?A. FIFOB. LIFOC. Straight-lineD. FIFO and LIFO are both inventory valuation methods答案:1. D2. B3. A4. A5. B6. C7. A8. B9. D10. C二、填空题(每空1分,共10分)11. The primary financial statements include the ______,______, and ______.12. The accounting cycle consists of several steps, including journalizing, ______, posting, and preparing financial statements.13. In accounting, the term "double-entry" refers to the practice of recording each transaction in ______ accounts. 14. The accounting equation shows the relationship between assets, liabilities, and ______.15. The accrual basis of accounting records revenues andexpenses when they are ______, not necessarily when cash is received or paid.答案:11. Balance Sheet, Income Statement, Cash Flow Statement12. footing13. two14. equity15. earned or incurred三、简答题(每题5分,共20分)16. 简述会计信息的四个主要特征。

会计专业英语期末考试练习卷new

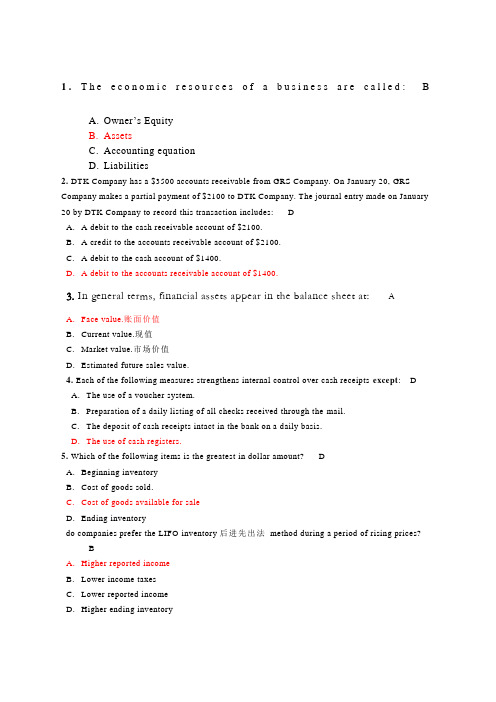

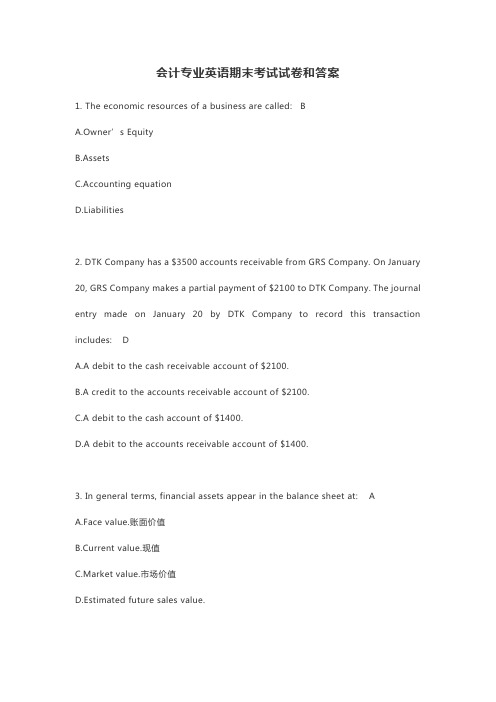

1.T h e e c o n o m i c r e s o u r c e s o f a b u s i n e s s a r e c a l l e d: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100.B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventorydo companies prefer the LIFO inventory后进先出法method during a period of rising prices?BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9. What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10. Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA.B.C.D.13. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析 AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司一、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用二、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bank on December1.(2)Prepare the adjusting journal entry to record accrual of the interest payable on the loanon December 31.(3)Prepare the presentation of the liability to the bank on ME’s December balance sheet. Answer:(1)Debit: cash $250000Credit: current liabilities $250000(2)Debit: Accrual Expense $5000 不确定Credit: Interest Payable $5000(3) P392. The following information relating to the bank checking account is available for Music Hall at July 31:Balance per bank statement at July 31 $20 0000 Balance per depositor’s records 18 860 Outstanding checks 2 000 Deposits in transit 800 Service charge by bank 60 Prepare a bank reconciliation银行对账工作fro Music Hall at July 31.Answer:P423. Please prepare the related entries according to the following accounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these saleswill be uncollectible. Please prepare the adjusting entry to record the estimated uncoll ectible.2) On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3) On July 1, Nick Company paid the $500 amount that had been written off on March 1. Answer:(1)Debit: Uncollectible Accounts Expense坏账损失$12000Credit: Allowance for Doubtful Accounts坏账准备$12000(2)Debit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)Debit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)(1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what we consider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball. 会计准则不像自然法则那样天生就存在等待人类去探索。

英语会计期末考试题及答案

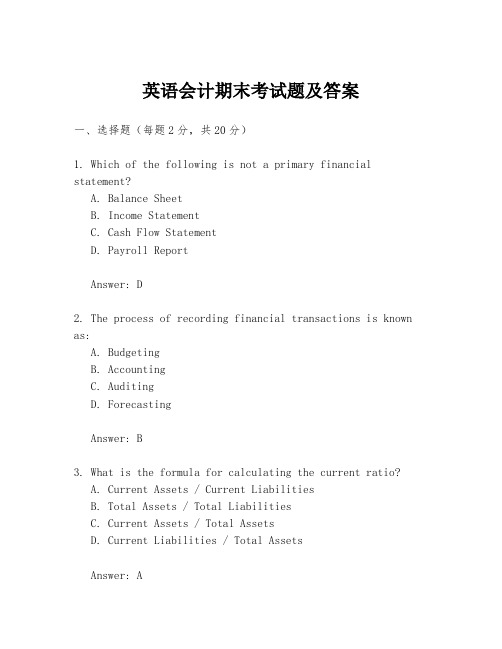

英语会计期末考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a primary financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D2. The process of recording financial transactions is known as:A. BudgetingB. AccountingC. AuditingD. ForecastingAnswer: B3. What is the formula for calculating the current ratio?A. Current Assets / Current LiabilitiesB. Total Assets / Total LiabilitiesC. Current Assets / Total AssetsD. Current Liabilities / Total AssetsAnswer: A4. Which of the following is not an accounting principle?A. Going ConcernB. Accrual BasisC. Cash BasisD. ConsistencyAnswer: C5. What is the purpose of depreciation?A. To increase the value of assetsB. To allocate the cost of a tangible asset over its useful lifeC. To reduce taxesD. To increase profitsAnswer: B二、填空题(每题1分,共10分)6. The _________ is a summary of a company's financial position at a particular point in time.Answer: Balance Sheet7. An _________ is a liability that is due within one year. Answer: Current Liability8. The _________ is the difference between the cost of an asset and its accumulated depreciation.Answer: Book Value9. The _________ is the process of determining the value of a company's assets.Answer: Valuation10. _________ is a method of accounting where revenues and expenses are recognized when they are earned or incurred.Answer: Accrual Accounting三、简答题(每题5分,共20分)11. Explain the difference between a debit and a credit in accounting.Answer: In accounting, a debit is an entry that increases assets or expenses and decreases liabilities, equity, or revenues. Conversely, a credit is an entry that increases liabilities, equity, or revenues and decreases assets or expenses.12. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to verify the accuracy of the accounting entries by ensuring that the total debits equal the total credits.13. Describe the accounting equation.Answer: The accounting equation is Assets = Liabilities + Owner's Equity. It represents the basic principle that the total assets of a company are financed by its liabilities and the owner's equity.14. What is the purpose of an income statement?Answer: An income statement is used to summarize acompany's revenues, expenses, and net income over a specific period of time, providing an overview of the company's financial performance.四、计算题(每题10分,共20分)15. Given the following data for a company, calculate the current ratio and the debt-to-equity ratio.- Current Assets: $50,000- Current Liabilities: $20,000- Total Liabilities: $80,000- Owner's Equity: $120,000Answer:- Current Ratio = Current Assets / Current Liabilities = $50,000 / $20,000 = 2.5- Debt-to-Equity Ratio = Total Liabilities / Owner's Equity = $80,000 / $120,000 = 0.6716. A company purchased equipment for $100,000 and expects it to have a useful life of 5 years with no residual value. Calculate the annual depreciation expense using the straight-line method.Answer:- Annual Depreciation Expense = (Cost of Equipment - Residual Value) / Useful Life- Annual Depreciation Expense = ($100,000 - $0) / 5 = $20,000五、案例分析题(每题15分,共30分)17. A small business has the following transactions for the month of January:- Purchased inventory on credit for $15,000.- Sold goods for $25,000 cash.- Paid $5,000 in salaries.- Received $10,000 in advance for services to be provided in the future.Prepare the journal entries for these transactions.Answer:- Purchase of Inventory:- Debit: Inventory $15,000- Credit: Accounts Payable $15,000- Sale of Goods:- Debit: Cash $25,000- Credit: Sales Revenue $25,000。

会计专业英语期末考试练习卷new)

1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100.B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法 method during a period of risingprices? BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9.What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10. Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析 AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司一、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营 The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用二、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bankon December 1.(2)Prepare the adjusting journal entry to record accrual of the interest payableon the loan on December 31.(3)Prepare the presentation of the liability to the bank on ME’s December balancesheet.Answer:(1)D ebit: cash $250000Credit: current liabilities $250000(2)D ebit: Accrual Expense $5000 不确定Credit: Interest Payable $5000(3) P392. The following information relating to the bank checking account is available for Music Hall at July 31:Balance per bank statement at July 31 $20 0000Balance per depositor’s records 18 860 Outstanding checks 2 000Deposits in transit 800Service charge by bank 60Prepare a bank reconciliation银行对账工作 fro Music Hall at July 31.Answer:P423. Please prepare the related entries according to the following accounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales will be uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2) On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3) On July 1, Nick Company paid the $500 amount that had been written off on March 1.Answer:(1)D ebit: Uncollectible Accounts Expense坏账损失 $12000Credit: Allowance for Doubtful Accounts坏账准备 $12000(2)D ebit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)D ebit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)(1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what we consider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

会计英语期末考试试题

会计英语期末考试试题一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets + Liabilities = EquityD. Equity = Assets - Liabilities2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget Report3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The decrease in the value of a tangible asset due to wear and tear.C. The process of allocating the cost of an asset over its useful life.D. The sale of an asset at a reduced price.4. What is the purpose of an audit?A. To verify the accuracy of financial statements.B. To provide tax advice to a company.C. To prepare financial statements.D. To manage a company's cash flow.5. Which of the following is an example of a current asset?A. InventoryB. LandC. MachineryD. Building6. What is the accounting term for the cost of goods sold?A. COGSB. CGSC. COSD. COTS7. In accounting, what is the term for the net income of a business after all expenses have been deducted?A. Gross ProfitB. Net ProfitC. Operating ProfitD. Earnings Before Tax8. What is the process of adjusting the accounts at the end of an accounting period to show the correct financial position of a company?A. Closing the accountsB. Posting the accountsC. Adjusting entriesD. Balancing the accounts9. Which of the following is a non-current liability?A. Accounts PayableB. Notes PayableC. Long-term DebtD. Sales Tax Payable10. What does the acronym GAAP stand for?A. Globally Accepted Accounting PrinciplesB. Generally Accepted Accounting PracticesC. Government Accounting and Auditing PrinciplesD. Global Accounting and Auditing Principles二、简答题(每题5分,共20分)1. Explain the difference between a debit and a credit in accounting.2. Describe the purpose of a trial balance in the accounting process.3. What are the main components of a balance sheet?4. How does the matching principle affect the calculation of net income?三、计算题(每题10分,共30分)1. Calculate the net income for a company with the following figures:- Revenue: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $50,000- Depreciation: $20,000- Interest Expense: $10,0002. A company has the following assets at the end of the year: - Cash: $10,000- Accounts Receivable: $15,000- Inventory: $20,000- Equipment: $50,000 (with accumulated depreciation of $10,000)Calculate the total current assets and total assets.3. If a company has a balance of $75,000 in its retained earnings account at the beginning of the year and a net income of $30,000, calculate the ending balance of retained earnings.四、案例分析题(共30分)A company has just completed its fiscal year and is preparing its financial statements. The following information is available:- Sales Revenue: $1,500,000- Cost of Goods Sold: $900,000- Selling and Administrative Expenses: $200,000- Depreciation Expense: $50,000- Interest Expense: $30,000- Taxes Payable: $100,000- Dividends Paid: $50,000Based on the information provided, prepare an income statement for the company. Explain any assumptions made during the preparation of the income statement.五、论述题(共30分)Discuss the importance of ethical behavior in the field of accounting. Provide examples of ethical dilemmas that an accountant might face and how they can be resolved.请注意,本试题仅为示例,实际考试内容和格式可能会有所不同。

会计英语试卷含答案.doc

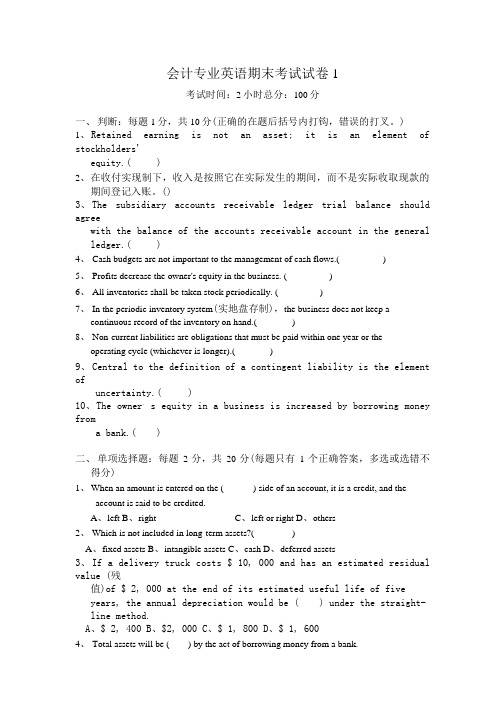

会计专业英语期末考试试卷1考试时间:2小时总分:100分一、判断:每题1分,共10分(正确的在题后括号内打钩,错误的打叉。

)1、R etained earning is not an asset; it is an element of stockholders'equity.( )2、在收付实现制下,收入是按照它在实际发生的期间,而不是实际收取现款的期间登记入账。

()3、The subsidiary accounts receivable ledger trial balance should agreewith the balance of the accounts receivable account in the general ledger.( )4、Cash budgets are not important to the management of cash flows.( )5、Profits decrease the owner's equity in the business. ( )6、All inventories shall be taken stock periodically. ( )7、In the periodic inventory system(实地盘存制),the business does not keep acontinuous record of the inventory on hand.( )8、Non-current liabilities are obligations that must be paid within one year or theoperating cycle (whichever is longer).( )9、Central to the definition of a contingent liability is the element ofuncertainty.( )10、T he owner, s equity in a business is increased by borrowing money froma bank.( )二、单项选择题:每题2分,共20分(每题只有1个正确答案,多选或选错不得分)1、W hen an amount is entered on the ( ) side of an account, it is a credit, and theaccount is said to be credited.A、leftB、rightC、left or rightD、others2、Which is not included in long-term assets?( )A、fixed assetsB、intangible assetsC、cashD、deferred assets3、If a delivery truck costs $ 10, 000 and has an estimated residual value (残值)of $ 2, 000 at the end of its estimated useful life of fiveyears, the annual depreciation would be ( ) under the straight-line method.A、$ 2, 400B、$2, 000C、$ 1, 800D、$ 1, 6004、Total assets will be ( ) by the act of borrowing money from a bank.A、decreasedB、increasedC、remained (保持不变)D、uncertain5、The owners of a corporation (股份公司)are termed (称为)( )A、stockholdersB、investorsC、creditorsD、none of above (都不是)6、()是指会计忽略通货膨胀影响,对货币价值变动不作调整。

会计专业英语期末考试练习卷

1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100.B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventorydo companies prefer the LIFO inventory后进先出法 method during a period of rising prices? BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9.What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10. Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA.B.C.D.13. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析 AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司一、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营 The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用二、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bankon December 1.(2)Prepare the adjusting journal entry to record accrual of the interest payableon the loan on December 31.(3)Prepare the presentation of the liability to the bank on ME’s December balancesheet.Answer:(1)D ebit: cash $250000Credit: current liabilities $250000(2)D ebit: Accrual Expense $5000 不确定Credit: Interest Payable $5000(3) P392. The following information relating to the bank checking account is available for Music Hall at July 31:Balance per bank statement at July 31$20 0000Balance per depositor’s records18 860 Outstanding checks 2 000Deposits in transit800Service charge by bank60Prepare a bank reconciliation银行对账工作 fro Music Hall at July 31.Answer:P423. Please prepare the related entries according to the following accounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales will be uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2) On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3) On July 1, Nick Company paid the $500 amount that had been written off on March 1.Answer:(1)D ebit: Uncollectible Accounts Expense坏账损失 $12000Credit: Allowance for Doubtful Accounts坏账准备 $12000(2)D ebit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)D ebit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)(1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what we consider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

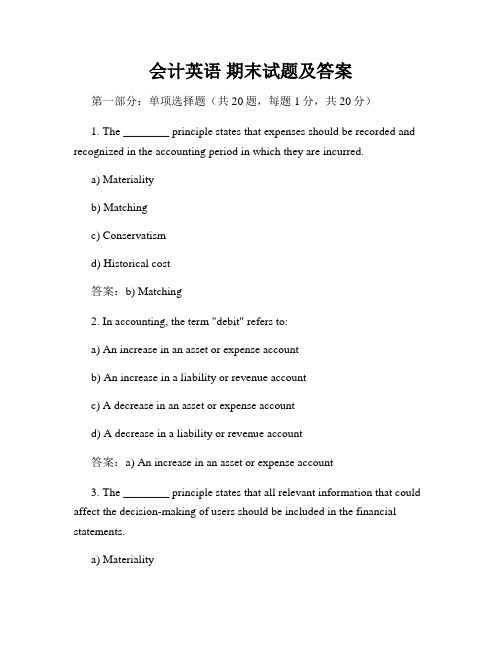

会计英语 期末试题及答案

会计英语期末试题及答案第一部分:单项选择题(共20题,每题1分,共20分)1. The ________ principle states that expenses should be recorded and recognized in the accounting period in which they are incurred.a) Materialityb) Matchingc) Conservatismd) Historical cost答案:b) Matching2. In accounting, the term "debit" refers to:a) An increase in an asset or expense accountb) An increase in a liability or revenue accountc) A decrease in an asset or expense accountd) A decrease in a liability or revenue account答案:a) An increase in an asset or expense account3. The ________ principle states that all relevant information that could affect the decision-making of users should be included in the financial statements.a) Materialityb) Faithful representationc) Comparabilityd) Relevance答案:d) Relevance4. The balance sheet reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:b) Assets, liabilities, and equity5. Which of the following statements about the accrual basis of accounting is true?a) Revenues and expenses are recognized when cash is received or paidb) Transactions are recorded when they occur, regardless of when cash is received or paidc) Only cash transactions are recorded in the financial statementsd) Liabilities and expenses are recognized when they are incurred, and revenues are recognized when cash is received答案:b) Transactions are recorded when they occur, regardless of when cash is received or paid6. The financial statement that shows a company's revenues, expenses, and net income or loss for a specific period of time is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:a) Income statement7. A decrease in an asset account is recorded as a ________.a) Debitb) Creditc) Liabilityd) Equity答案:b) Credit8. The accounting equation can be expressed as:a) Assets = Liabilities + Equityb) Assets + Liabilities = Equityc) Equity = Assets + Liabilitiesd) Liabilities + Equity = Assets答案:a) Assets = Liabilities + Equity9. The financial statement that shows the changes in equity during the accounting period is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:d) Statement of retained earnings10. Which of the following is an example of an intangible asset?a) Landb) Buildingsc) Inventoryd) Goodwill答案:d) Goodwill11. The ________ principle states that assets should be recorded at their original cost.a) Objectivityb) Consistencyc) Historical costd) Materiality答案:c) Historical cost12. The statement of cash flows reports:a) Revenues, expenses, and net incomeb) Assets, liabilities, and equityc) Cash flows from operating, investing, and financing activitiesd) Changes in equity during the accounting period答案:c) Cash flows from operating, investing, and financing activities13. Which of the following is a current liability?a) Accounts payableb) Bond payable due in 10 yearsc) Mortgage payable due in 5 yearsd) Long-term note payable答案:a) Accounts payable14. The ________ principle states that the financial statements should be prepared assuming that the entity will continue to operate indefinitely.a) Going concernb) Revenue recognitionc) Materialityd) Consistency答案:a) Going concern15. Which financial statement reports the financial position of a company at a specific point in time?a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:c) Balance sheet16. The ________ states that an entity should use the same accounting methods and procedures from period to period.a) Materialityb) Going concernc) Consistencyd) Historical cost答案:c) Consistency17. What type of account is "Accounts Receivable"?a) Assetb) Liabilityc) Revenued) Expense答案:a) Asset18. The financial statement that shows the cash inflows and outflows from operating, investing, and financing activities is the:a) Income statementb) Statement of cash flowsc) Balance sheetd) Statement of retained earnings答案:b) Statement of cash flows19. If a company has a current ratio greater than 1, it means that:a) The company has more assets than liabilitiesb) The company has more liabilities than assetsc) The company is profitabled) The company can pay its current liabilities with its current assets答案:d) The company can pay its current liabilities with its current assets20. Which of the following is considered an external user of financial statements?a) Company managementb) Employeesc) Suppliersd) Creditors答案:d) Creditors第二部分:填空题(共10题,每题2分,共20分)1. The periodicity assumption assumes that a company's activities can be divided into ________ periods of equal length.答案:accounting2. The ________ principle states that an entity should recognize revenues when they are earned, regardless of when cash is received.答案:revenue recognition3. The adjusting entry to record the use of supplies during an accounting period would include a ________ to the Supplies Expense account.答案:debit4. The adjusting entry to recognize revenue that has been earned but not yet collected would include a ________ to the Accounts Receivable account.答案:credit5. The ________ principle requires that expenses be reported in the same period as the revenue that is earned as a result of those expenses.答案:matching6. The financial statement that reports the financial position of a company at a specific point in time is the ________.答案:balance sheet7. The accounting equa tion can be expressed as: ________ = Assets − Liabilities.答案:Equity8. The financial statement that shows the changes in equity during the accounting period is the ________.答案:statement of retained earnings9. The adjusting entry to record the portion of prepaid rent that has been used during an accounting period would include a ________ to the Rent Expense account.答案:debit10. The unearned revenue account is a ________ account.答案:liability第三部分:简答题(共4题,每题10分,共40分)1. What is the matching principle in accounting? Why is it important?答案:The matching principle in accounting states that expenses should be recorded and recognized in the accounting period in which they are incurred, regardless of when the cash is paid. This principle is important to ensure that the expenses are properly matched with the revenues that theyhelp generate. By matching expenses with revenues, the financial statements provide a more accurate representation of the company's financial performance during a specific period. This helps users of the financial statements make informed decisions based on reliable financial information.2. Explain the difference between an asset and a liability. Provide an example of each.答案:An asset is a resource owned by a company that has economic value and is expected to provide future benefits. Examples of assets include cash, accounts receivable, inventory, and property, plant, and equipment.A liability, on the other hand, is an obligation or debt owed by a company to external parties. It represents an economic sacrifice that the company is required to make in the future. Examples of liabilities include accounts payable, loans payable, and accrued expenses.3. What is the purpose of the statement of cash flows? How is it prepared?答案:The purpose of the statement of cash flows is to provide information about the cash inflows and outflows from operating, investing, and financing activities during a specific period. It helps users understand how a company generates and uses its cash resources.The statement of cash flows is prepared using the indirect method or the direct method. In the indirect method, the net income from the income statement is adjusted for non-cash items and changes in working capital to arrive at the net cash provided by operating activities. Cash flows from investing and financing activities are directly reported. In the direct method,the actual cash receipts and payments are directly reported in each category of cash flows.4. What is the purpose of the adjusting entries? Provide two examples of adjusting entries and explain their impact on the financial statements.答案:The purpose of adjusting entries is to ensure that the revenues and expenses are properly recognized in the accounting period in which they are incurred, and that the balance sheet accounts reflect the true financial position of the company at the end of the period.Two examples of adjusting entries are:- Accrued expenses: An adjusting entry is made to recognize expenses that have been incurred but not yet paid or recorded. For example, at the end of the accounting period, salaries for the last few days of the period may not have been paid. An adjusting entry is made to recognize the expense for the unpaid salaries, which increases the expenses on the income statement and decreases the retained earnings on the balance sheet.- Prepaid expenses: An adjusting entry is made to recognize expenses that have been paid in advance but have not yet been used. For example, if a company pays rent for the next three months in advance, an adjusting entry is made to allocate a portion of the prepaid rent to the current accounting period. This decreases the prepaid rent on the balance sheet and increases the rent expense on the income statement.。

会计专业英语期末试题及答案

会计专业英语期末试题及答案1、In many cities, a low-carbon lifestyle has become(). [单选题] *A. more popular and more popularB. more and more popular(正确答案)C. the most popularD. most and most popular2、We all wondered()Tom broke up with his girlfriend. [单选题] *A. thatB. whatC. whoD. why(正确答案)3、He went to America last Friday. Alice came to the airport to _______ him _______. [单选题] *A. take; offB. see; off(正确答案)C. send; upD. put; away4、The rain is very heavy _______ we have to stay at home. [单选题] *A. butB. becauseC. so(正确答案)D. and5、______! It’s not the end of the world. Let’s try it again.()[单选题] *A. Put upB. Set upC. Cheer up(正确答案)D. Pick up6、--_______ do you have to do after school?--Do my homework, of course. [单选题] *A. What(正确答案)B. WhenC. WhereD. How7、39.—What do you ________ my new dress?—Very beautiful. [单选题] * A.look atB.think aboutC.think of(正确答案)D.look through8、They may not be very exciting, but you can expect ______ a lot from them.()[单选题] *A. to learn(正确答案)B. learnC. learningD. learned9、The hall in our school is _____ to hold 500 people. [单选题] *A. big enough(正确答案)B. enough bigC. very smallD. very big10、What do you think of the idea that _____ honest man who married and brought up a large family did more service than he who continued single and only talked of _____ population. [单选题] *A. a, /B. an, /C. a, theD. an, the(正确答案)11、20.Jerry is hard-working. It’s not ______ that he can pass the exam easily. [单选题] * A.surpriseB.surprising (正确答案)C.surprisedD.surprises12、You wouldn't have seen her if it _____ not been for him . [单选题] *A. hasB. had(正确答案)C. haveD.is having13、My home is about _______ away from the school. [单选题] *A. three hundred metreB. three hundreds metresC. three hundred metres(正确答案)D. three hundreds metre14、30.I want to find ______ and make much money. [单选题] *A.worksB.jobC.a job(正确答案)D.a work15、Many people prefer the bowls made of steel to the _____ made of plastic. [单选题] *A. itB. ones(正确答案)C. oneD. them16、The red jacket is _______ than the green one. [单选题] *A. cheapB. cheapestC. cheaper(正确答案)D. more cheap17、Grandfather lives with us. We all _______ him when he gets ill. [单选题] *A. look after(正确答案)B. look atC. look forD. look like18、By the end of this month, all this _____. [单选题] *A. is changedB.will changeC. will have changed(正确答案)D. has changed19、Customers see location as the first factor when_____a decision about buying a house. [单选题] *A.makeB.to makeC.making(正确答案)D.made20、Can I _______ your order now? [单选题] *A. makeB. likeC. giveD. take(正确答案)21、Which animal do you like _______, a cat, a dog or a bird? [单选题] *A. very muchB. best(正确答案)C. betterD. well22、Now people can _______ with their friends far away by e-mail, cellphone or letter. [单选题] *A. keep onB. keep in touch(正确答案)C. keep upD. keep off23、If we want to keep fit, we should try to _______ bad habits. [单选题] *A. keepB. haveC. getD. get rid of(正确答案)24、Her ideas sound right, but _____ I'm not completely sure. [单选题] *A. somehow(正确答案)B. somewhatC. somewhereD. sometime25、The flowers _______ sweet. [单选题] *A. tasteB. smell(正确答案)C. soundD. feel26、( ) You had your birthday party the other day,_________ [单选题] *A. hadn't you?B. had you?C. did you?D. didn't you?(正确答案)27、The work will be finished _______ this month. [单选题] *A. at the endB. in the endC. by the endD. at the end of(正确答案)28、The students _____ outdoors when the visitors arrived. [单选题] *A. were playing(正确答案)B. have playedC. would playD. could play29、Why don’t you _______ the bad habit of smoking. [单选题] *A. apply forB. get rid of(正确答案)C. work asD. graduate from30、pencil - box is beautiful. But ____ is more beautiful than ____. [单选题] *A. Tom's; my; heB. Tom's; mine; his(正确答案)C. Tom's; mine; himD. Tom's; my; his。

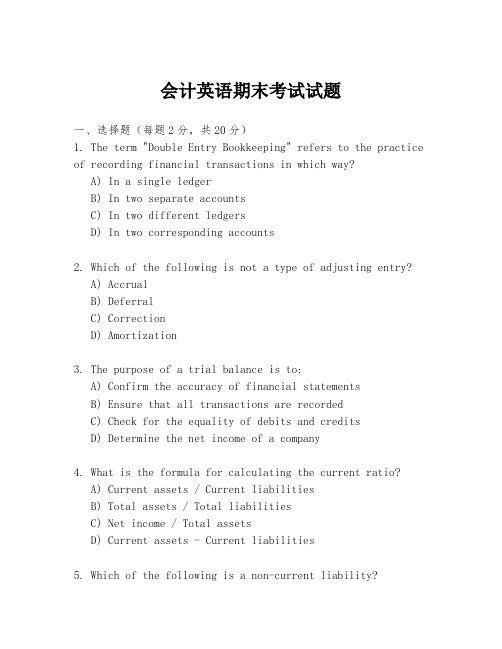

会计英语期末考试试题

会计英语期末考试试题一、选择题(每题2分,共20分)1. The term "Double Entry Bookkeeping" refers to the practice of recording financial transactions in which way?A) In a single ledgerB) In two separate accountsC) In two different ledgersD) In two corresponding accounts2. Which of the following is not a type of adjusting entry?A) AccrualB) DeferralC) CorrectionD) Amortization3. The purpose of a trial balance is to:A) Confirm the accuracy of financial statementsB) Ensure that all transactions are recordedC) Check for the equality of debits and creditsD) Determine the net income of a company4. What is the formula for calculating the current ratio?A) Current assets / Current liabilitiesB) Total assets / Total liabilitiesC) Net income / Total assetsD) Current assets - Current liabilities5. Which of the following is a non-current liability?A) Accounts payableB) Notes payableC) Long-term debtD) Sales tax payable6. The accounting equation can be expressed as:A) Assets = Liabilities + EquityB) Assets + Liabilities = EquityC) Assets - Liabilities = EquityD) Liabilities - Equity = Assets7. What is the purpose of depreciation in accounting?A) To increase the value of assetsB) To allocate the cost of a tangible asset over its useful lifeC) To sell the asset at a lower priceD) To increase the company's net income8. Which of the following is a principle of Generally Accepted Accounting Principles (GAAP)?A) ConsistencyB) MaterialityC) TimelinessD) All of the above9. The statement of cash flows is used to:A) Show the changes in equity over a periodB) Report the financial position of a company at a point in timeC) Report the sources and uses of cash during a periodD) Show the income of a company over a period10. What is the primary purpose of a budget?A) To forecast future financial performanceB) To control costs and allocate resourcesC) To increase sales and revenueD) To prepare financial statements二、简答题(每题5分,共20分)1. 解释会计中的“权责发生制”与“现金收付制”的区别。

会计专业英语期末考试练习卷(new)

1。

The economic resources of a business are called: BA.Owner's EquityB.AssetsC.Accounting equationD.Liabilities2。

DTK Company has a $3500 accounts receivable from GRS Company。

On January 20,GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100。

B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400。

3. In general terms,financial assets appear in the balance sheet at: AA.Face value。

账面价值B.Current value.现值C.Market value。

市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash rec eipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers。

会计专业英语期末考试练习卷(new)

1. The economic resources of a business are called: BA.Owner's EquityB.AssetsC.Accounting equationD.Liabilities2。

DTK Company has a $3500 accounts receivable from GRS Company。

On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100。

B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400。

D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value。

账面价值B.Current value。

现值C.Market value.市场价值D.Estimated future sales value。

4. Each of the following measures strengthens internal control over cash rec eipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail。

会计英语期末试题及答案

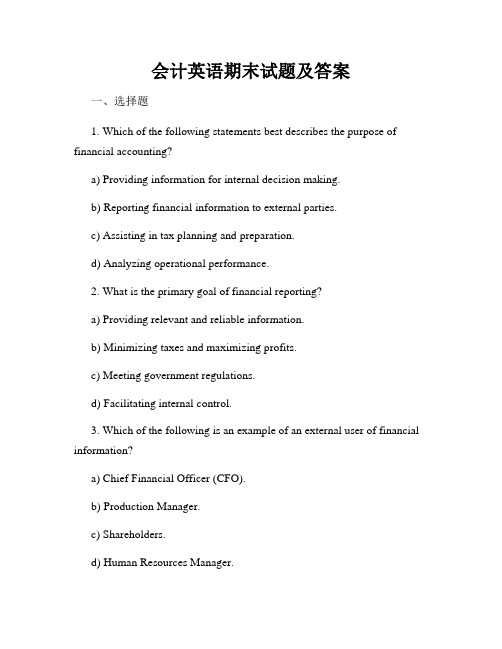

会计英语期末试题及答案一、选择题1. Which of the following statements best describes the purpose of financial accounting?a) Providing information for internal decision making.b) Reporting financial information to external parties.c) Assisting in tax planning and preparation.d) Analyzing operational performance.2. What is the primary goal of financial reporting?a) Providing relevant and reliable information.b) Minimizing taxes and maximizing profits.c) Meeting government regulations.d) Facilitating internal control.3. Which of the following is an example of an external user of financial information?a) Chief Financial Officer (CFO).b) Production Manager.c) Shareholders.d) Human Resources Manager.4. The accounting equation can be stated as:a) Assets = Liabilities + Equity.b) Equity = Assets - Liabilities.c) Liabilities = Assets - Equity.d) Assets = Equity - Liabilities.5. What is the purpose of the income statement?a) To report the company's financial position at a specific point in time.b) To disclose changes in the company's equity during a period of time.c) To report the company's revenues, expenses, and net income for a period of time.d) To provide information about the company's cash flows.二、填空题1. A company's assets are equal to its _______________ minus its liabilities.2. The _______________ principle states that expenses should be recorded in the same accounting period as the revenues they help to generate.3. The financial statements include the _______________, the balance sheet, the statement of cash flows, and the statement of stockholders' equity.4. _______________ involves analyzing and interpreting financial information to make informed business decisions.5. The _______________ is a financial ratio that measures a company's ability to pay its short-term debts.三、解答题1. Explain the difference between accrual accounting and cash accounting.2. Discuss the importance of the balance sheet in financial reporting.3. Describe the purpose and content of the statement of cash flows.4. What is the role of the Generally Accepted Accounting Principles (GAAP) in financial reporting?5. Explain the concept of depreciation and how it is recorded in the financial statements.答案:一、选择题1. b) Reporting financial information to external parties.2. a) Providing relevant and reliable information.3. c) Shareholders.4. a) Assets = Liabilities + Equity.5. c) To report the company's revenues, expenses, and net income for a period of time.二、填空题1. Equity2. Matching3. Income statement4. Financial analysis5. Current ratio三、解答题1. Accrual accounting recognizes revenue and expenses when they are earned or incurred, regardless of when the associated cash flows occur. Cash accounting, on the other hand, records revenue and expenses only when cash is received or paid out. Accrual accounting provides a more accurate picture of a company's financial health and performance.2. The balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. The balance sheet is important for investors, creditors, and other stakeholders to assess the company's liquidity, solvency, and overall financial stability.3. The statement of cash flows reports the cash inflows and outflows from a company's operating activities, investing activities, and financing activities. Its purpose is to provide information about the cash generated and used by the company during a specific period of time. It helps users understand the company's cash flow patterns and assess its ability to generate cash for future operations and investments.4. Generally Accepted Accounting Principles (GAAP) are a set of accounting standards and guidelines that companies must follow when preparing their financial statements. GAAP ensures consistency, comparability, and transparency in financial reporting, allowing users of financial statements to make meaningful and informed decisions. It helps maintain public trust in the financial reporting process.5. Depreciation is the systematic allocation of the cost of a long-term asset over its useful life. It reflects the wearing out, consumption, or expiration of the asset's value over time. Depreciation is recorded as an expense on the income statement and as an accumulated depreciation contra-asset on the balance sheet. It helps match the cost of the asset with the revenue it helps to generate, providing a more accurate reflection of the company's profitability.。

最新会计专业英语期末考试试卷和答案

会计专业英语期末考试试卷和答案1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: DA.A debit to the cash receivable account of $2100.B.A credit to the accounts receivable account of $2100.C.A debit to the cash account of $1400.D.A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法method during a period of rising prices? BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9. What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10. Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司二、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用三、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bank on December 1.(2)Prepare the adjusting journal entry to record accrual of the interest payable on the loan on December 31.Answer:(1)Debit: cash $250000Credit: current liabilities $250000(2)Debit: Accrual Expense $5000 不确定Credit: Interest Payable $50003. Please prepare the related entries according to the following accounting events.1)Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimates that $12,000 of these sales will be uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2)On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3)On July 1, Nick Company paid the $500 amount that had been written off on March 1.Answer:(1)Debit: Uncollectible Accounts Expense坏账损失$12000Credit: Allowance for Doubtful Accounts坏账准备$12000(2)Debit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)Debit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)1) Accounting principles are not like physical laws; they do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what weconsider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

会计专业英语期末测验练习卷(new)

会计专业英语期末测验练习卷(new)————————————————————————————————作者:————————————————————————————————日期:1. The economic resources of a business are called: BA.Owner’s EquityB.AssetsC.Accounting equationD.Liabilities2.DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $2100 to DTK Company. The journal entry made on January20 by DTK Company to record this transaction includes: DA. A debit to the cash receivable account of $2100.B. A credit to the accounts receivable account of $2100.C. A debit to the cash account of $1400.D. A debit to the accounts receivable account of $1400.3. In general terms, financial assets appear in the balance sheet at: AA.Face value.账面价值B.Current value.现值C.Market value.市场价值D.Estimated future sales value.4. Each of the following measures strengthens internal control over cash receipts except: DA.The use of a voucher system.B.Preparation of a daily listing of all checks received through the mail.C.The deposit of cash receipts intact in the bank on a daily basis.D.The use of cash registers.5. Which of the following items is the greatest in dollar amount? DA.Beginning inventoryB.Cost of goods sold.C.Cost of goods available for saleD.Ending inventory6.Why do companies prefer the LIFO inventory后进先出法method during a period of risingprices? BA.Higher reported incomeB.Lower income taxesC.Lower reported incomeD.Higher ending inventory7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? DA.IntangibleB.Unlimited lifeC.Being sold in its useful lifeD.Not capable of rendering benefits to the business in the future.8. Which account is not a contra-asset account? BA.Depreciation ExpenseB.Accumulated DepletionC.Accumulated DepreciationD.Allowance for Doubtful Accounts9. What are the two factors that make ownership of an interest in a general partnership particularly risky? AA.Mutual agency and unlimited personal liabilityB.Limited life and unlimited personal liability.C.Limited life and mutual agency.D.Double taxation and mutual agency10.Which of the following types of business owners do not take an active role in the daily management of the business? DA.General partnersB.Limited liability partnersC.Sole proprietors 个体经营者D.Stockholders in a publicly owned corporation11. Analysts can use the footnotes to the financial statements to DA.Help their analysis of financial statementsB.Help their understanding of financial statementsC.Help their checking of financial statements.D.All of the above12. The current liabilities are $30 000, the long-term liabilities are $50 000, and the total assets are $240 000. What is the debt ratio? CA. 0.125B. 0.208C. 0.333D. 3.013. The horizontal analysis is used mainly to AA.Analyzing financial trendsB.Evaluating financial structureC.Assessing the pat performancesD.Measuring the term-paying ability14. Among the following ratios, which is used for long-term solvency analysis?长期偿债能力分析AA.Current ratio 流动比率B.Times-interest-earned ratioC.Operating cycleD.Book value per share15. A profit-making business that is a separate legal entity and in which ownership is divided into shares of stock is known as a DA.Sole proprietorship 个体独资公司B.Single proprietorshipC.Partnership 合伙公司D.Corporation 股份有限公司一、名词解释(10分)(1) Journal entry:日记账Journal entry is a logging of transactions into accounting journal items. It can consist of several items, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be "unbalanced". Journal entries can record unique items or recurring items such as depreciation or bond amortization.(2) Going concern:持续经营The company will continue to operate in the near future, unless substantial evidence to the contrary exists.(3) Matching principle:一致性原则(4) Working capital:营运资金(5) Revenue expenditure:收入费用二、会计业务(共35分)1. On December 1, ME Company borrowed $250 000 from a bank, and promise to repay that amount plus 12% interest (per year) at the end of 6 months.(1)Prepare the general journal entry to record obtaining the loan from the bank on December1.(2)Prepare the adjusting journal entry to record accrual of the interest payable on the loan onDecember 31.(3)Prepare the presentation of the liability to the bank on ME’s December balance sheet.Answer:(1)Debit: cash $250000Credit: current liabilities $250000(2)Debit: Accrual Expense $5000 不确定Credit: Interest Payable $5000(3) P392. The following information relating to the bank checking account is available for Music Hall at July 31:Balance per bank statement at July 31 $20 0000Balance per depositor’s records 18 860 Outstanding checks 2 000 Deposits in transit 800Service charge by bank 60Prepare a bank reconciliation银行对账工作fro Music Hall at July 31.Answer:P423. Please prepare the related entries according to the following accounting events.1) Assume the Healy Furniture has credit sale of $1,200,000 in 2002. Of this amount, $200,000 remains uncollected at December 31. The credit manager estimate s that $12,000 of these sales will be uncollectible. Please prepare the adjusting entry to record the estimated uncollectible.2) On March 1, 2003 the manager of finance of Healy Furniture authorizes a write-off of the $500 balance owed by Nick Company. Please make the entry to record the write-off.3) On July 1, Nick Company paid the $500 amount that had been written off on March 1. Answer:(1)Debit: Uncollectible Accounts Expense坏账损失$12000Credit: Allowance for Doubtful Accounts坏账准备$12000(2)Debit: Allowance for Doubtful Accounts $500Credit: Accounts Receivable $500(3)Debit: Accounts Receivable $500Credit: Allowance for Doubtful Accounts $500Debit: Cash $500Credit: Accounts Receivable $500四、英译汉(40分)(1) Accounting principles are not like physical laws; the y do not exist in nature, awaiting discovery man. Rather, they are developed by man, in light of what we consider to be the most important objectives of financial reporting. In many ways generally accepted accounting principles are similar to the rules established for an organized sport such as football or basketball.会计准则不像自然法则那样天生就存在等待人类去探索。

会计专业英语期末试题 )

期期末测试题Ⅰ、Translate The Following Terms Into Chinese 、1、entity concept 主题概念2、depreciation折旧3、double entry system4、inventories5、stable monetary unit6、opening balance7、current asset 8、financial report9、prepaid expense 10、internal control11、cash flow statement 12、cash basis13、tangible fixed asset 14、managerial accounting15、current liability 16、internal control17、sales return and allowance 18、financial position19、balance sheet 20、direct write-off methodⅡ、Translate The Following Sentences Into Chinese 、1、Accounting is often described as an information system、It is the system that measures business activities, processes into reports and communicates these findings to decision makers、2、The primary users of financial information are investors and creditors、Secondary users include the public, government regulatory agencies, employees, customers, suppliers, industry groups, labor unions, other companies, and academic researchers、3、There are two sources of assets、One is liabilities and the other is owner’s equity、Liabilities are obligations of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets or services in the future、资产有两个来源,一个就是负债,另一个就是所有者权益。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2.The primary users of financial information are investors and creditors. Secondary users include the public, government regulatory agencies, employees, customers, suppliers, industry groups, labor unions, other companies, and academic researchers.

普通日记账(或日记账)是一个链接这借方和个别交易的信用的一本原始条目,是按时间顺序,在一个地方提供一个完整的交易记录。

Ⅲ.Please find the best answers to the following questions.

1.Which of the following statement is false?

d.The FASB determines how accounting is practiced in the United States

2.The principle or concept that holds that an entity will remain in operation for the foreseeable future is the

资产有两个来源,一个是负债,另一个是所有者权益。负债是由过去的交易或事件产生的实体的义务,其结算可能导致未来资产或服务的转让或使用。

4.Accounting elements are basic classification of accounting practices. They are essential units to present the financial position and operating result of an entity. In China, we have six groups of accounting elements. They are assets, liabilities,owner’s equity, revenue, expense and profit (income).

c.Accounting is the informatios activities, processes that information into reports, and communicates the results to decision makers.

7.currentasset8.financialreport

9.prepaid expense10.internal control

11.cash flow statement12.cash basis

13.tangible fixed asset14.managerial accounting

15.current liability16.internal control

a.The partnership form of business organization protects the personal assets of the owner from creditors of the business

b.A proprietorship has a single owner

a.going-concern concept

17.sales return and allowance18.financial position

19.balance sheet20.directwrite-off method

Ⅱ、TranslateThe Following SentencesInto Chinese.

1.Accounting is often described as an information system. It is the system that measures business activities, processes into reports and communicates these findings to decision makers.

会计要素是会计实践的基础分类。它们是保护财务状况和实体经营的重要部分。在中国,我们有六个会计要素。它们是资产,负债,所有者权益,收入,费用和利润(收入)。

5.The general journal (or journal) is a book of original entry that links the debits and credits of individual transactions by providing a complete record of each transaction in one place, in chronological order.

期期末测试题

Ⅰ、TranslateThe FollowingTermsInto Chinese.

1.entity concept 主题概念2.depreciation折旧

3.double entry system4.inventories

5.stable monetary unit6.opening balance