8投资学第八章习题答案

金德环《投资学》课后习题答案

金德环《投资学》课后习题答案习题答案第一章习题答案第二章习题答案练习题1:答案:(1),公司股票的预期收益率与标准差为:Er,,,,,,,0.570.350.2206,,,,,,,,A1/2222,, ,0.5760.3560.22068.72,,,,,,,,,,,,,,A,,(2),公司和,公司股票的收益之间的协方差为:Covrr,0.5762510.50.3561010.5,,,,,,,,,,,,,,,,,AB ,,,,,,0.22062510.590.5,,,,(3),公司和,公司股票的收益之间的相关系数为:Covrr,,,,90.5AB ,,,,,0.55AB,8.7218.90,,AB练习题2:答案:如果,,,的投资投资于,公司,余下,,,投资于,公司的股票,这样得出的资产组合的概率分布如下:钢生产正常年份钢生产异常年份股市为牛市股市为熊市概率 0.5 0.3 0.2 资产组合收益率(,) ,, ,., -2.5 得出资产组合均值和标准差为:Er=0.516+0.32.5+0.2-2.5=8.25,,,,,,,,,,组合1/22222,, ,=0.516-8.25+0.32.5-8.25+0.2-2.5-8.25+0.2-2.5-8.25=7.94,,,,,,,,组合,,1/22222,=0.518.9+0.58.72+20.50.5-90.5=7.94,,,,,,,,,,,,,,,组合,,练习题3:答案:尽管黄金投资独立看来似有股市控制,黄金仍然可以在一个分散化的资产组合中起作用。

因为黄金与股市收益的相关性很小,股票投资者可以通过将其部分资金投资于黄金来分散其资产组合的风险。

练习题4:答案:通过计算两个项目的变异系数来进行比较:0.075 CV==1.88A0.040.09 CV==0.9B0.1考虑到相对离散程度,投资项目B更有利。

练习题5:答案:R(1)回归方程解释能力到底如何的一种测度方法式看的总方差中可被方程解释的方差所it2,占的比例。

投资学习题解答

精选2021版课件

28

第六章 投资风险与投资组合

1.假定某资产组合中包含A、B、C三种 股票,股份数分别为150、200、50,每 股初始市场价分别为20元、15元和30元, 若每股期末的期望值分别为30元、25元 和40元,计算该资产组合的期望收益率。

精选2021版课件

29

第六章 投资风险与投资组合

解:

(1)预期现金流为 0.5×70000+0.5×200000=135000美元。 风险溢价为8%,无风险利率为6%,要求的

回报率为14%。 因此,资产组合的现值为: 135000/1.14=118421美元

精选2021版课件

36

第六章 投资风险与投资组合

(2) 如果资产组合以118421美元买入,给 定预期的收入为135000美元,而预期的收 益率E(r)推导如下:

假定某种无风险资产收益率为6其中风险资产的收益率为9该风险资产收益率的方差为20如果将这两种资产加以组合请计算该资产组合的风险价48第七章证券市场的均衡与价格决定49第七章证券市场的均衡与价格决定3

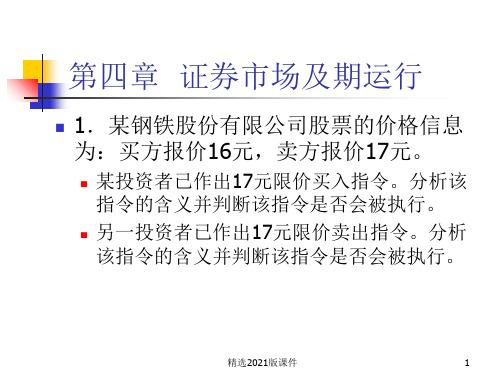

第四章 证券市场及期运行

1.某钢铁股份有限公司股票的价格信息 为:买方报价16元,卖方报价17元。

某投资者已作出17元限价买入指令。分析该 指令的含义并判断该指令是否会被执行。

12/1.06+112/(1.08472*1.08472)=106.51 由n=2, FV=100, PV=106.51, PMT=12, 则有:

TM=8.333% (2)f2 =[(1+s2) (1+s2)/(1+s1)]-1 =(1.08472*1.08472/1.06)-1=0.11=11%

(2)第二年的远期利率是多少?

国家开放大学《投资学》章节测试题参考答案

国家开放大学《投资学》章节测试题参考答案第一章导论一、单项选择题。

1.投资和投机的本质区别表现在()。

A. 交易动机B. 交易对象C. 交易时间D. 交易方式2.狭义的投资是指()。

A. 实物投资B. 证券投资C. 风险投资D. 创业投资3.投资风险与收益之间呈()。

A. 同比例变化B. 不确定性C. 反方向变化D. 同方向变化4.区分直接投资和间接投资的基本标志是在于()。

A. 投资者是否拥有控制权B. 投资者的投资渠道C. 投资者的投资方式D. 投资者的资本数量二、多项选择题。

5.一项投资活动至少要包括以下()方面。

A. 投资客体B. 投资主体C. 投资目的D. 投资渠道E. 投资主体6.投资的特征有()。

A. 经济性B. 时间性C. 风险性D. 收益性E. 安全性7.实物投资的特点有()。

A. 投资回收期较长B. 与生产过程紧密联系C. 流动性较差D. 与经营过程紧密联系E. 投资变现速度较慢8.金融投资包含以下()投资形式。

A. 外汇B. 汇票C. 股指期货D. 彩票E. 存款第二章投资的经济关系一、单项选择题。

1.总产出通常用()来衡量。

A. 国家生产总值B. 物价指数C. 国民生产总值D. 国内生产总值2.假设新增投资为100,边际消费倾向为0.8,那么由此新增投资带来的收入的增量为()。

A. 80B. 675C. 125D. 5003.用来衡量通货膨胀的程度的指标是()。

A. 城市居民消费价格指数B. 工业品出产价格指数C. 固定资产投资价格指数D. 消费价格指数二、多项选择题。

4.投资的供给效应对经济增长的作用表现为()。

A. 重置投资B. 乘数效应C. 加速效应D. 净投资5.经济周期通常可以分为()阶段。

A. 平静B. 扩张C. 爆发D. 衰退6.失业可以分为()。

A. 自愿失业B. 隐蔽性失业C. 非自愿失业D. 显性失业第三章项目投资估值理论一、单项选择题。

1.单利计算法忽略了()的时间价值。

威廉夏普 投资学课后习题答案解析第八章

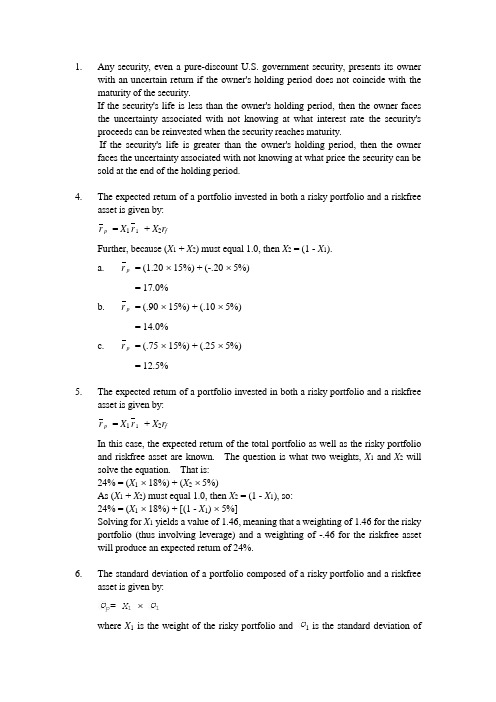

1. Any security, even a pure-discount U.S. government security, presents its ownerwith an uncertain return if the owner's holding period does not coincide with the maturity of the security.If the security's life is less than the owner's holding period, then the owner faces the uncertainty associated with not knowing at what interest rate the security's proceeds can be reinvested when the security reaches maturity.If the security's life is greater than the owner's holding period, then the owner faces the uncertainty associated with not knowing at what price the security can be sold at the end of the holding period.4. The expected return of a portfolio invested in both a risky portfolio and a riskfreeasset is given by:= X1r1+ X2r fpFurther, because (X1 + X2) must equal 1.0, then X2 = (1 - X1).a. r p = (1.20 ⨯ 15%) + (-.20 ⨯ 5%)= 17.0%b. r p = (.90 ⨯ 15%) + (.10 ⨯ 5%)= 14.0%c. r p = (.75 ⨯ 15%) + (.25 ⨯ 5%)= 12.5%5. The expected return of a portfolio invested in both a risky portfolio and a riskfreeasset is given by:= X1r1+ X2r fpIn this case, the expected return of the total portfolio as well as the risky portfolio and riskfree asset are known. The question is what two weights, X1 and X2 will solve the equation. That is:24% = (X1⨯ 18%) + (X2⨯ 5%)As (X1 + X2) must equal 1.0, then X2 = (1 - X1), so:24% = (X1⨯ 18%) + [(1 - X1) ⨯ 5%]Solving for X1 yields a value of 1.46, meaning that a weighting of 1.46 for the risky portfolio (thus involving leverage) and a weighting of -.46 for the riskfree asset will produce an expected return of 24%.6. The standard deviation of a portfolio composed of a risky portfolio and a riskfreeasset is given by:=X1⨯1pwhere X1 is the weight of the risky portfolio and 1 is the standard deviation ofthe risky portfolio. As X1 = (1 - weight of the riskfree asset), then:a. X1 = 1 - (-.30) = 1.30, thus:= 1.30 ⨯ 20%p= 26.0%b. X1 = 1 - .10 = .90, thus:= .90 ⨯ 20%p= 18.0%c. X1 = 1 - .30 = .70, thus:= .70 ⨯ 20%= 14.0%p7. The standard deviation of a portfolio invested in a risky portfolio and a riskfreeasset is given by:= X1⨯1pAs the standard deviation of Oyster's total portfolio is 20%, solving for the proportion invested in the risky portfolio (X1) gives:20% = X1⨯ 25%X1= .80The expected return of a portfolio invested in both a risky portfolio (with proportion X1) and a riskfree asset with proportion X2 or (1 - X1) is:r p = (.80 ⨯ 12%) + [(1 - .80) ⨯ 7%]= 11.0%8. Both Hick and Patsy are correct. Borrowing at the riskfree rate to invest more thanone's initial wealth in a risky portfolio is equivalent to purchasing the risky portfolio on margin. Further, borrowing at the riskfree rate is equivalent to takinga short position in the riskfree asset and investing the proceeds of the short sale inthe risky portfolio.9. The efficient set becomes all the portfolios that can be constructed through acombination of a single risky portfolio and lending or borrowing at the riskfree rate.The efficient set will therefore consist of all portfolios along a ray emanating from the riskfree asset, tangent to the curved Markowitz efficient set (that is, the efficient set without riskfree borrowing or lending), and continuing on out into risk-return space. The tangency point represents the optimal combination of risky assets for the investor.10. Riskfree borrowing and lending permits the investor to create any combination ofportfolios allocated between a risky portfolio (contained in the feasible set of risky portfolios) and the riskfree asset. These combinations lie on rays emanating from the riskfree asset. The more a ray is tilted to the northwest, the more desirable is the associated set of portfolios to the investor.Because the feasible set of risky portfolios is concave, the ray combining the riskfree asset and a risky portfolio, tilted as far as possible to the northwest, mustbe tangent to the feasible set of risky portfolios at only one point. This ray is the efficient set under riskfree borrowing and lending. All other portfolios in the feasible set of risky portfolios (including the "old"efficient set) will lie to the south and/or east of this "new" efficient set and, therefore, are dominated by the portfolios of the new efficient set. That is, these other portfolios offer less expected return and/or more risk than the portfolios lying on the efficient set generated under riskfree borrowing and lending.12. The feasible set now becomes the area between two rays, each emanating from theriskfree asset. The ray to the northwest is the efficient set. The ray to the southeast will connect the riskfree asset and generally the lowest expected return asset. Any combination of risk and return between these two rays can be created by appropriately combining a risky portfolio with riskfree borrowing or lending.13. The efficient set will be the same for both investors because it representsinvestment opportunities, not preferences. (Of course, the two investors may have different expectations regarding available expected returns and risks.)The more risk-averse investor's indifference curves will be more steeply slopedthan the indifference curves of the less risk-averse investor.The optimal portfolio of the more risk-averse investor will lie to the southwest ofthe less risk-averse investor's optimal portfolio. Both optimal portfolios, of course, will lie on the efficient set. The more risk-averse investor's optimal portfolio likely will lie to the southwest of the tangency portfolio, implying lending at the riskfree rate. Conversely, the less risk-averse investor's optimal portfolio likely will lie to the northeast of the tangency portfolio, implying borrowing at the riskfree rate.14. a. The riskfree asset has a zero variance and has zero covariance with otherassets. Thus, examining the variance-covariance matrix, the third security must be the riskfree asset.b. r p = (X 1 ⨯ r 1) + (X 2 ⨯ r 2)= (.50 ⨯ 10.1%) + (.50 ⨯ 7.8%)= 9.0%σσp i n i j ij j n X X =⎡⎣⎢⎤⎦⎥==∑∑1112/= (X 1X 1 11 +X 2X 2 22 + 2X 1X 2 12)½= {[(.50)² ⨯ 210] + [(.50)² ⨯ 90]+ (2) ⨯ (.50) ⨯ (.50) ⨯ (60)}½= [52.5 + 22.5 + 30]½ = [105]½ = 10.2% c. r tp = (.75 ⨯ r p ) + (.25 ⨯ r 3) = (.75 ⨯ 9.0%) + (.25 ⨯ 5.0%)= 8.0%= .75 ⨯p= .75 ⨯ 10.2%tp= 7.7%15. The efficient set would be composed of the southwest portion of the curvedMarkowitz efficient set (that is, the efficient set without riskfree borrowing or lending) up to the tangency portfolio (when both riskfree borrowing and lending are permitted), where it would then become a ray emanating from the tangency portfolio and extending out into risk-return space. If this ray were extended to the southwest, it would intersect the return axis at the riskfree rate.16. The effect is to increase both expected return and risk.The investor is leveraging his or her invested position. Since the optimal risky portfolio has a higher expected return than the riskfree asset, the expected return on the leveraged risky portfolio is higher than that of the unleveraged portfolio.However, because the risky portfolio's return is variable, the leveraged risky portfolio's return is more variable and hence more risky than the return on the unleveraged risky portfolio.17. Your optimal risky portfolio would not change (assuming the feasible investmentopportunities did not change). It would remain the only risky portfolio lying on the efficient set. However, your allocations to the riskfree asset and the risky portfolio would change as your risk preferences changed. As you became less risk averse, you would decrease (increase) your riskfree lending (borrowing) and move to the northeast along the efficient set.18. The efficient set becomes divided into three segments. The first segment is astraight line between the lending rate on the return axis and tangent to the curved Markowitz efficient set (that is, the efficient set without riskfree borrowing or lending). The second segment lies to the northeast of the first. It is a straight line tangent to the curved Markowitz efficient set, extending northeast into risk-return space. While this line does not extend to the return axis, if it did it would intersect the axis at the borrowing rate. The third segment lies between the first two. It is the portion of the curved Markowitz efficient set that lies between the two tangency portfolios.。

《投资学》课后习题参考答案

习题参考答案第2章答案:一、选择1、D2、C二、填空1、公众投资者、工商企业投资者、政府2、中国人民保险公司;中国国际信托投资公司3、威尼斯、英格兰4、信用合作社、合作银行;农村信用合作社、城市信用合作社;5、安全性、流动性、效益性三、名词解释:财务公司又称金融公司,是一种经营部分银行业务的非银行金融机构。

其最初是为产业集团内部各分公司筹资,便利集团内部资金融通,但现在经营领域不断扩大,种类不断增加,有的专门经营抵押放款业务,有的专门经营耐用消费品的租购和分期付款业务,大的财务公司还兼营外汇、联合贷款、包销证券、不动产抵押、财务及投资咨询服务等。

信托公司是指以代人理财为主要经营内容、以委托人身份经营现代信托业务的金融机构。

信托公司的业务一般包括货币信托(信托贷款、信托存款、养老金信托、有价证券投资信托等)和非货币信托(债权信托、不动产信托、动产信托等)两大类。

保险公司是一类经营保险业务的金融中介机构。

它以集合多数单位或个人的风险为前提,用其概率计算分摊金,以保险费的形式聚集资金建立保险基金,用于补偿因自然灾害或以外事故造成的经济损失,或对个人因死亡伤残给予物质补偿。

四、简答1、家庭个人是金融市场上的主要资金供应者,其呈现出的主要特点如下:(1)投资目标简单;(2)投资活动更具盲目性(3)投资规模较小,投资方向分散,投资形式灵活。

企业作为非金融投资机构,其行为呈现出了以下的显著特点:(1)资金需求者地位突现;(2)投资目标的多元化;(3)投资比较稳定;(4)短期投资交易量大。

2、商业银行在经济运行中主要的职能如下:(1)信用中介职能;(2)支付中介职能;(3)调节媒介职能;(4)金融服务职能;(5)信用创造职能;总的来说,商业银行业务可以归为以下三类:(1)负债业务:是指资金来源的业务;(2)资产业务:是商业银行运用资金的业务;(3)中间业务和表外业务:中间业务指银行不需要运用自己的资金而代客户承办支付和其他委托事项,并据以收取手续费的业务第3章答案:一、选择题1、D2、D3、B二、填空题1、会员制证券交易所和公司制证券交易所、会员制、公司制。

投资学教程(上财版)第8章习题集

《投资学》第8章习题集一、判断题1、债券的发行期限是债券发行时就确定的债券还本期限。

()2、一组信用质量相同、但期限不同的债券的到期收益率和剩余期限的关系用图形描画出来的曲线,就是收益率曲线。

()3、隆起收益率曲线的含义是:随着债券剩余期限长度的减少,债券到期收益率先上升后降低。

()4、利率期限结构研究的是其他因素相同、期限不同债券的收益率和到期期限之间的关系()5、附息债券的价值就等于剥离后的若干个零息债券的价值之和。

()6、无偏预期理论认为,远期利率是人们对未来到期收益率的普遍预期。

()7、在流动性偏好理论下,长期利率一般都比短期利率高。

()8、市场分割理论认为,投资者一般都会比较固定地投资于*个期限的债券,这就形成了以期限为划分标识的细分市场。

()9、简单的说,久期是债券还本的加权平均年限。

()10、附息债券的久期等于其剩余期限。

()11、修正久期可以反映债券价格对收益率变动的敏感程度。

()12、其他条件不变时,债券的到期日越远,久期也随之增加,但增加的幅度会递减。

()13、其他条件不变,到期收益率越高,久期越长。

()14、随着收益率变动幅度的增加,用久期来测算债券价格变化的精确度在减小。

()15、一般而言,债券价格与利率的关系并不是线性的。

()16、凸性系数是债券价格对收益率的一阶导数除以2倍的债券价格。

()17、久期与债券价格相对于收益率的一阶导相关,因此称为一阶利率风险。

()18、当收益率(利率)变动较小时,债券价格的变动近似线性,只需要考虑凸性。

()19、债券组合管理大致可以分为两类:消极的债券组合管理和积极的债券组合管理。

()20、有效债券市场是指债券的当前价格能够充分反映所有有关的、可得信息的债券市场。

()21、如果债券市场是有效的,投资者将找不到价格被错估的债券,也不必去预测市场利率的变化。

()22、常见的消极的债券组合管理包括:免疫组合和指数化投资。

()23、市场利率变动对债券投资收益的影响包括:影响债券的市场价格,影响债券利息的再投资收益。

投资学习题习题及答案

第一章投资环境1.假设你发现一只装有100亿美元的宝箱。

a.这是实物资产还是金融资产?b.社会财富会因此而增加吗?c.你会更富有吗?d.你能解释你回答b、c时的矛盾吗?有没有人因为这个发现而受损呢?a. 现金是金融资产,因为它是政府的债务。

b. 不对。

现金并不能直接增加经济的生产能力。

c. 是。

你可以比以前买入更多的产品和服务。

d. 如果经济已经是按其最大能力运行了,现在你要用这1 0 0亿美元使购买力有一额外增加,则你所增加的购买商品的能力必须以其他人购买力的下降为代价,因此,经济中其他人会因为你的发现而受损。

nni Products 是一家新兴的计算机软件开发公司,它现有计算机设备价值30000美元,以及由Lanni的所有者提供的20000美元现金。

在下面地交易中,指明交易涉及的实物资产或(和)金融资产。

在交易过程中有金融资产的产生或损失吗?nni公司向银行贷款。

它共获得50000美元的现金,并且签发了一张票据保证3年内还款。

nni公司使用这笔现金和它自有的20000美元为其一新的财务计划软件开发提供融资。

nni公司将此软件产品卖给微软公司(Microsoft),微软以它的品牌供应给公众,Lanni公司获得微软的股票1500股作为报酬。

nni公司以每股80元的价格卖出微软的股票,并用所获部分资金还贷款。

a. 银行贷款是L a n n i公司的金融债务;相反的,L a n n i的借据是银行的金融资产。

L a n n i获得的现金是金融资产,新产生的金融资产是Lanni 公司签发的票据(即公司对银行的借据)。

b. L a n n i公司将其金融资产(现金)转拨给其软件开发商,作为回报,它将获得一项真实资产,即软件成品。

没有任何金融资产产生或消失;现金只不过是简单地从一方转移给了另一方。

c. L a n n i公司将其真实资产(软件)提供给微软公司以获得一项金融资产—微软的股票。

由于微软公司是通过发行新股来向L a n n i支付的,这就意味着新的金融资产的产生。

投资学8~9章课后习题

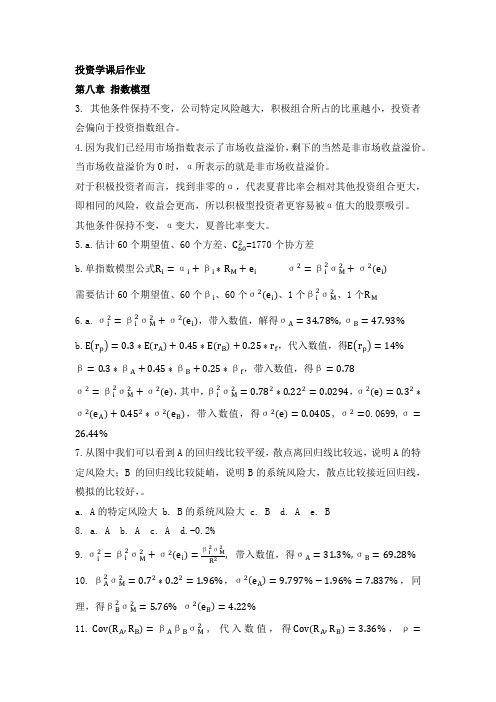

投资学课后作业 第八章 指数模型3. 其他条件保持不变,公司特定风险越大,积极组合所占的比重越小,投资者会偏向于投资指数组合。

4.因为我们已经用市场指数表示了市场收益溢价,剩下的当然是非市场收益溢价。

当市场收益溢价为0时,α所表示的就是非市场收益溢价。

对于积极投资者而言,找到非零的α,代表夏普比率会相对其他投资组合更大,即相同的风险,收益会更高,所以积极型投资者更容易被α值大的股票吸引。

其他条件保持不变,α变大,夏普比率变大。

5.a.估计60个期望值、60个方差、C 602=1770个协方差b.单指数模型公式R i =αi +βi ∗R M +e i σ2=βi 2σM 2+σ2(e i ) 需要估计60个期望值、60个βi 、60个σ2(e i )、1个βi 2σM 2、1个R M6.a. σi2=βi 2σM 2+σ2(e i ),带入数值,解得σA=34.78%,σB=47.93%b.E r p =0.3∗E r A +0.45∗E r B +0.25∗r f ,代入数值,得E r p =14% β=0.3∗βA +0.45∗βB+0.25∗βf ,带入数值,得β=0.78σ2=βi 2σM2+σ2 e ,其中,βi 2σM2=0.782∗0.222=0.0294,σ2 e =0.32∗σ2 e A +0.452∗σ2 e B ,带入数值,得σ2 e =0.0405, σ2=0.0699,σ=26.44%7.从图中我们可以看到A 的回归线比较平缓,散点离回归线比较远,说明A 的特定风险大;B 的回归线比较陡峭,说明B 的系统风险大,散点比较接近回归线,模拟的比较好,。

a. A 的特定风险大b. B 的系统风险大c. Bd. Ae. B 8. a. A b. A c. A d.-0.2% 9. σi2=βi 2σM2+σ2e i =βi 2σM2R2, 带入数值,得σA =31.3%,σB=69.28%10. βA 2σM2=0.72∗0.22=1.96%,σ2 e A =9.797%−1.96%=7.837%,同理,得βB 2σM2=5.76% σ2 e B =4.22%11.Cov R A ,R B =βA βB σM2, 代入数值,得Cov R A ,R B =3.36%,ρ=Cov R A,R B,带入数值,得ρ=0.155σAσB12. Cov R A,R M=βAβMσM2, 代入数值,得Cov R A,R M=2.8%,同理,得Cov R M,R B=4.8%13.组合P的方差σp2=0.62∗σA2+0.42∗σB2+0.6∗0.4∗σAσB,带入数值,得σp2=0.1282 σP=35.8%βP=0.6∗0.7+0.4∗1.2=0.9, βP2σM2=3.24%,σ2e P=9.58%, Cov R P,R M=0.3614.基本思想与13题一样,这里就不再列出式子而直接写答案了:标准差为21.55%,与市场的协方差为0.3,非系统风险2.40%,系统风险19.15%16.αA=0.11−0.06−0.8∗0.12−0.06=0.02αB=0.14−0.06−1.5∗0.12−0.06=−0.01,通过比较,我会选择α大的股票17.a.b.α=-(0.61*1.6%+1.13*4.4%+1.69*3.4%+1.7*4.0%)=-16.9% β=2.08最优组合是指数组合的权重为1.047c.夏普比率为0.3662,积极组合的贡献为0.0184d.投资于短期国债的比例为0.5685,投资于股票组合的比例为(1-0.5685)第九章 资本资产定价模型8. 贴现率i=r f +β(r M −r f ),带入数值,得i=22.4% NPV= (CI −CO )t (1+i)t100,带入数值,得NPV=18.09美元,当NPV<=0时,i<=0.3573, 则β最大为3.47 9.a.各为2和0.3b.期望收益率各为18%和9%c.整体经济的证券市场线的斜率为1,纵坐标截距为6%d.每只股票的截距分别为-0.06和0.003e.8.7%10.不可能,因为A 的β比B 的要大,但是A 的收益却比B 的要小,这样的组合是无效的。

投资学课后习题及答案

投资学课后习题及答案投资学课后习题及答案投资学练习导论习题1证券投资是指投资者购买_______、________、________等有价证券以及这些有价证券的_______以获取________、_________及________的投资行为和投资过程,是直接投资的重要形式。

(填空)2 ____是投资者为实现投资目标所遵循的基本方针和基本准则。

(单选) A证券投资政策 B证券投资分析 C证券投组合 D评估证券投资组合的业绩3 一般来说,证券投资与投机的区别主要可以从________等不同角度进行分析。

(多选) A 动机 B对证券所作的分析方法 C投资期限 D投资对象E风险倾向4在证券市场中,难免出现投机行为,有投资就必然有投机。

适度的投机有利于证券市场发展(判断)第一至第四章习题1在股份有限公司利润增长时,参与优先股股东除了按固定股息率取得股息外,还可以分得___________。

(填空)2 累积优先股是一种常见的、发行很广泛的优先股股票。

其特点是股息率______,而且可以 ________计算。

(填空)3________不是优先股的特征之一。

(单选)A约定股息率 B股票可由公司赎回 C具有表决权 D优先分派股息和清偿剩余资产。

4 股份有限公司最初发行的大多是_____,通过这类股票所筹集的资金通常是股份有限公司股本的基础。

(单选) A特别股 B优先股 CB股 D普通股5 当公司前景和股市行情看好、盈利增加时,可转换优先股股东的最佳策略是_______ 。

(单选)A转换成参与优先股 B转换成公司债券 C转换成普通股 D转换成累积优先股6 下列外资股中,不属于境外上市外资股的是________。

(单选)A H股 BN股 CB股 DS股7 股份制就是以股份公司为核心,以股票发行为基础,以股票交易为依托。

(判断) 8 可赎回优先股是指允许拥有该股票的股东在一个合理的价格范围内将资金赎回。

(判断) 9________是指在管理层和股东之间发生冲突的可能性,它是由管理层在利益回报方面的控制以及管理人员的低效业绩所产生的问题。

投资学课后练习答案(贺显南版)

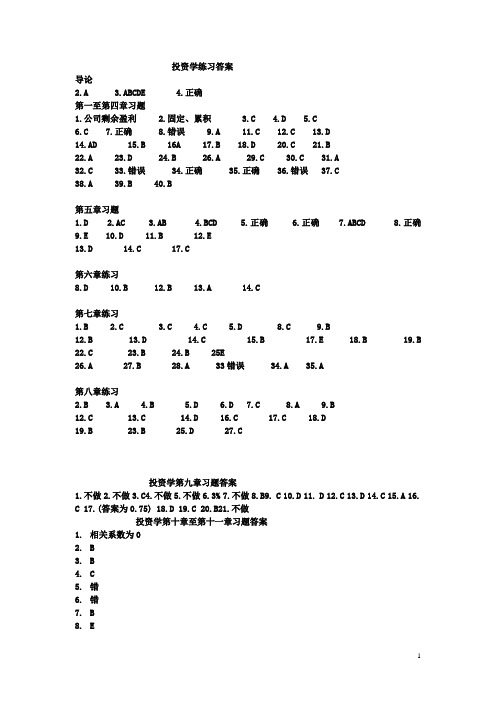

投资学练习答案导论2.A3.ABCDE4.正确第一至第四章习题1.公司剩余盈利2.固定、累积3.C4.D5.C6.C7.正确8.错误9.A 11.C 12.C 13.D14.AD 15.B 16A 17.B 18.D 20.C 21.B22.A 23.D 24.B 26.A 29.C 30.C 31.A32.C 33.错误 34.正确 35.正确 36.错误 37.C38.A 39.B 40.B第五章习题1.D2.AC3.AB4.BCD5.正确6.正确7.ABCD8.正确9.E 10.D 11.B 12.E13.D 14.C 17.C第六章练习8.D 10.B 12.B 13.A 14.C第七章练习1.B2.C3.C4.C5.D 8.C 9.B12.B 13.D 14.C 15.B 17.E 18.B 19.B 22.C 23.B 24.B 25E26.A 27.B 28.A 33错误 34.A 35.A第八章练习2.B3.A4.B5.D6.D7.C8.A9.B12.C 13.C 14.D 16.C 17.C 18.D19.B 23.B 25.D 27.C投资学第九章习题答案1.不做2.不做3.C4.不做5.不做6.3%7.不做8.B9. C 10.D 11. D 12.C 13.D 14.C 15.A 16.C 17.(答案为0.75) 18.D 19.C 20.B21.不做投资学第十章至第十一章习题答案1.相关系数为02. B3. B4. C5.错6.错7. B8. E9. A10.对11.D投资学第十二章至第十三章习题答案1.不做2.高于票面值因为10%大于8%3.具体看课本公式(老师只是讲公式没有给出确切得答案)4.贴现贴现率5.反方向6.C7.C8.对9.对10.不做11.折价平价溢价12.不做13.不做14.不做15.A16.C17.C18.具体看书本323页19.具体看课本325页20.看课本319至32021.不做22.不做第十四章至十五章习题答案1.先行同步滞后2.不做3.开拓拓展成熟衰落4.资产负责表损益表现金流量表5. C6.宏观分析行业分析公司分析7. A8. B9. A10.D11.D12.A13.A14.对15.对十七章注意事项: 注意技术分析得三大假设假设1. 市场行为涵盖一切信息假设2.价格沿趋势运动假设3.历史会重演。

《投资学》习题及其参考答案(中南财经政法大学)

《投资学》习题与其参考答案《投资学》习题第1章投资概述《》一、填空题1、投资所形成的资本可分为和。

2、资本是具有保值或增值功能的。

3、按照资本存在形态不同,可将资本分为、、、等四类。

4、根据投资所形成资产的形态不同,可以将投资分为、、三类。

5、按研究问题的目的不同,可将投资分成不同的类别。

按照投资主体不同,投资可分为、、、四类。

6、从生产性投资的每一次循环来,一个投资运动周期要经历、、、等四个阶段。

二、判断题1、资本可以有各种表现形态,但必须有价值。

()2、无形资本不具备实物形态,却能带来收益,在本质上属于真实资本范畴。

()3、证券投资是以实物投资为基础的,是实物投资活动的延伸。

()4、直接投资是实物投资。

()5、投机在证券交易中既有积极作用,又有消极作用。

()6、投资所有者主体、投资决策主体、投资实施主体、投资存量经营主体是可以分离的。

()三、多项选择题1、投资主体包括()A.投资所有者主体B.投资决策主体C.投资实施主体D.投资存量经营主体E.投资收益主体2、下列属于真实资本有()A.机器设备B.房地产C.黄金D.股票E.定期存单3、下列属于直接投资的有()A.企业设立新工厂B.某公司收购另一家公司51%的股权C.居民个人购买1000股某公司股票D.发放长期贷款而不参与被贷款企业的经营活动E.企业投资于政府债券4、下列属于非法投机活动是()A.抢帽子B.套利C.买空卖空D.操纵市场E.内幕交易四、名词解释投资投资主体产业投资证券投资直接投资间接投资五、简答题1、怎样全面、科学的理解投资的内涵?2、投资有哪些特点?3、投资的运动过程是怎样的?4、投资学的研究对象是什么?5、投资学的研究内容是什么?6、试比较主要西方投资流派理论的异同?第2章市场经济与投资决定一、填空题1、投资制度主要由、、等三大要素构成。

2、一般而言,投资制度分为和两类。

3、投资主体可以按照多种标准进行分类,一种较为常用的分类方法是根据其进行投资活动的目标,把投资主体划分为和。

投资学教程上财版第8章习题集

《投资学》第8 章习题集一、判断题1、债券的刊行限期是债券刊行时就确立的债券还本限期。

()2、一组信誉质量同样、但限期不一样的债券的到期利润率和节余限期的关系用图形描绘出来的曲线,就是利润率曲线。

()3、隆起利润率曲线的含义是:跟着债券节余限期长度的减少,债券到期利润领先上升后降低。

()4、利率限期结构研究的是其余要素同样、限期不一样债券的利润率和到期限期之间的关系()5、附息债券的价值就等于剥离后的若干个零息债券的价值之和。

()6、无偏预期理论以为,远期利率是人们对未到达期利润率的广泛预期。

()7、在流动性偏好理论下,长久利率一般都比短期利率高。

()8、市场切割理论以为,投资者一般都会比较固定地投资于某个限期的债券,这就形成了以限期为区分表记的细分市场。

()9、简单的说,久期是债券还本的加权均匀年限。

()10、附息债券的久期等于其节余限期。

()11、修正久期能够反应债券价钱对利润率改动的敏感程度。

()12、其余条件不变时,债券的到期日越远,久期也随之增添,但增添的幅度会递减。

()13、其余条件不变,到期利润率越高,久期越长。

()14、跟着利润率改动幅度的增添,用久期来测算债券价钱变化的精准度在减小。

()15、一般而言,债券价钱与利率的关系其实不是线性的。

()16、凸性系数是债券价钱对利润率的一阶导数除以 2 倍的债券价钱。

()17、久期与债券价钱相对于利润率的一阶导有关,所以称为一阶利率风险。

()18、当利润率(利率)改动较小时,债券价钱的改动近似线性,只要要考虑凸性。

()19、债券组合管理大概能够分为两类:悲观的债券组合管理和踊跃的债券组合管理。

()20、有效债券市场是指债券的目前价钱能够充足反应全部有关的、可得信息的债券市场。

()21、假如债券市场是有效的,投资者将找不到价钱被错估的债券,也不用去展望市场利率的变化。

()22、常有的悲观的债券组合管理包含:免疫组合和指数化投资。

()23、市场利率改动对债券投资利润的影响包含:影响债券的市场价钱,影响债券利息的再投资利润。

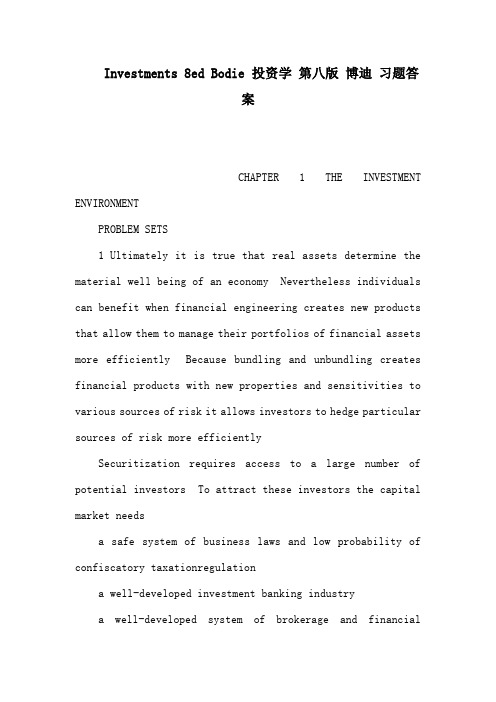

Investments 8ed Bodie 投资学 第八版 博迪 习题答案

Investments 8ed Bodie 投资学第八版博迪习题答案CHAPTER 1 THE INVESTMENT ENVIRONMENTPROBLEM SETS1 Ultimately it is true that real assets determine the material well being of an economy Nevertheless individuals can benefit when financial engineering creates new products that allow them to manage their portfolios of financial assets more efficiently Because bundling and unbundling creates financial products with new properties and sensitivities to various sources of risk it allows investors to hedge particular sources of risk more efficientlySecuritization requires access to a large number of potential investors To attract these investors the capital market needsa safe system of business laws and low probability of confiscatory taxationregulationa well-developed investment banking industrya well-developed system of brokerage and financialtransactions andwell-developed media particularly financial reportingThese characteristics are found in indeed make for a well-developed financial market3 Securitization leads to disintermediation that is securitization provides a means for market participants to bypass intermediaries For example mortgage-backed securities channel funds to the housing market without requiring that banks or thrift institutions make loans from their own portfolios As securitization progresses financial intermediaries must increase other activities such as providing short-term liquidity to consumers and small business and financial services4 Financial assets make it easy for large firms to raise the capital needed to finance their investments in real assets If General Motors for example could not issue stocks or bonds to the general public it would have a far more difficult time raising capital Contraction of the supply of financial assets would make financing more difficult thereby increasing the cost of capital A higher cost of capital results in less investment and lower real growth5 Even if the firm does not need to issue stock in any particular year the stock market is still important to the financial manager The stock price provides important information about how the market values the firms investment projects For example if the stock price rises considerably managers might conclude that the market believes the firms future prospects are bright This might be a useful signal to the firm to proceed with an investment such as an expansion of the firms businessIn addition the fact that shares can be traded in the secondary market makes the shares more attractive to investors since investors know that when they wish to they will be able to sell their shares This in turn makes investors more willing to buy shares in a primary offering and thus improves the terms on which firms can raise money in the equity market6 a Cash is a financial asset because it is the liability of the federal governmentb No The cash does not directly add to the productive capacity of the economyc Yesd Society as a whole is worse off since taxpayers as a group will make up for the liability7 a The bank loan is a financial liability for Lanni Lannis IOU is the banks financial asset The cash Lanni receives is a financial asset The new financial asset created is Lannis promissory note that is Lannis IOU to the bankb Lanni transfers financial assets cash to the software developers In return Lanni gets a real asset the completed software No financial assets are created or destroyed cash is simply transferred from one party to anotherc Lanni gives the real asset the software to Microsoft in exchange for a financial asset 1500 shares of Microsoft stock If Microsoft issues new shares in order to pay Lanni then this would represent the creation of new financial assetsd Lanni exchanges one financial asset 1500 shares of stock for another 120000 Lanni gives a financial asset 50000 cash to the bank and gets back another financial asset its IOU The loan is "destroyed" in the transaction since itis retired when paid off and no longer exists8 aAssets LiabilitiesShareholders equity Cash 70000 Bank loan50000 Computers 30000 Shareholders equity 50000 Total 100000 Total 100000 Ratio of real assets to total assets 30000100000 030bAssets LiabilitiesShareholders equity Software product 70000Bank loan 50000 Computers 30000Shareholders equity 50000 Total 100000Total 100000 Valued at costRatio of real assets to total assets 100000100000 10 cAssets LiabilitiesShareholders equity Microsoft shares 120000Bank loan 50000 Computers 30000Shareholders equity 100000 Total 150000Total 150000 Ratio of real assets to total assets 30000150000 020Conclusion when the firm starts up and raises working capital it is characterized by a low ratio of real assets tototal assets When it is in full production it has a high ratio of real assets to total assets When the project "shuts down" and the firm sells it off for cash financial assets once again replace real assets9 For commercial banks the ratio is 1075104109 0010For non-financial firms the ratio is 1329525164 0528 The difference should be expected primarily because the bulk of the business of financial institutions is to make loans which are financial assets for financial institutions10 a Primary-market transactionb Derivative assetsc Investors who wish to hold gold without the complication and cost of physical storage11 a A fixed salary means that compensation is at least in the short run independent of the firms success This salary structure does not tie the managers immediate compensation to the success of the firm However the manager might view this as the safest compensation structure and therefore value it more highlyb A salary that is paid in the form of stock in the firm means that the manager earns the most when the shareholders wealth is imized This structure is therefore most likely to align the interests of managers and shareholders If stock compensation is overdone however the manager might view it as overly risky since the managers career is already linked to the firm and this undiversified exposure would be exacerbated with a large stock position in the firmc Call options on shares of the firm create great incentives for managers to contribute to the firms success In some cases however stock options can lead to other agency problems For example a manager with numerous call options might be tempted to take on a very risky investment project reasoning that if the project succeeds the payoff will be huge while if it fails the losses are limited to the lost value of the options Shareholders in contrast bear the losses as wellas the gains on the project and might be less willing to assume that risk12 Even if an individual shareholder could monitor and improve managers performance and thereby increase the value of the firm the payoff would be small since the ownership share in a large corporation would be very small For example if you own 10000 of GM stock and can increase the value of the firm by 5 a very ambitious goal you benefit by only 005 10000 500 In contrast a bank that has a multimillion-dollar loan outstanding to the firm has a big stake in making sure that the firm can repay the loan It is clearly worthwhile for the bank to spend considerable resources to monitor the firm13 Mutual funds accept funds from small investors and invest on behalf of these investors in the national and international securities marketsPension funds accept funds and then invest on behalf of current and future retirees thereby channeling funds from one sector of the economy to anotherVenture capital firms pool the funds of private investors and invest in start-up firmsBanks accept deposits from customers and loan those funds to businesses or use the funds to buy securities of largecorporations14 Treasury bills serve a purpose for investors who prefer a low-risk investment The lower average rate of return compared to stocks is the price investors pay for predictability of investment performance and portfolio value15 With a top-down investing style you focus on asset allocation or the broad composition of the entire portfolio which is the major determinant of overall performance Moreover top-down management is the natural way to establish a portfolio with a level of risk consistent with your risk tolerance The disadvantage of an exclusive emphasis on top-down issues is that you may forfeit the potential high returns that could result from identifying and concentrating in undervalued securities or sectors of the market With a bottom-up investing style you try to benefit from identifying undervalued securities The disadvantage is that you tend to overlook the overall composition of your portfolio which may result in a non-diversified portfolio or a portfolio with a risk level inconsistent with your level of risk tolerance In addition this technique tends to require more active management thus generating more transaction costs Finally your analysis may be incorrect in which case you will have fruitlessly expended effort and money attempting to beat a simple buy-and-hold strategy16 You should be skeptical If the author actually knows how to achieve such returns one must question why the author would then be so ready to sell the secret to others Financialmarkets are very competitive one of the implications of this fact is that riches do not come easily High expected returns require bearing some risk and obvious bargains are few and far between Odds are that the only one getting rich from the book is its author17 a The SEC website defines the difference between saving and investing in terms of the investment alternatives or the financial assets the individual chooses to acquire According to the SEC website saving is the process of acquiring a safe financial asset and investing is the process of acquiring risky financial assetsb The economists definition of savings is the difference between income and consumption Investing is the process of allocating ones savings among available assets both real assets and financial assets The SEC definitions actually represent according the economists definition two kinds of investment alternatives18 As is the case for the SEC definitions see Problem 17 the SIA defines saving and investing as acquisition of alternative kinds of financial assets According to the SIA saving is the process of acquiring safe assets generally from a bank while investing is the acquisition of other financialassets such as stocks and bonds On the other hand the definitions in the chapter indicate that saving means spending less than ones income Investing is the process of allocating ones savings among financial assets including savings account deposits and money market accounts saving according to the SIA other financial assets such as stocks and bonds investing according to the SIA as well as real assetsCHAPTER 2 ASSET CLASSES ANDFINANCIAL INSTRUMENTSPROBLEM SETS1 Preferred stock is like long-term debt in that it typically promises a fixed payment each year In this way it is a perpetuity Preferred stock is also like long-term debt in that it does not give the holder voting rights in the firm Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments Failure to make payments does not set off corporate bankruptcy With respect to the priority of claims to the assets of the firm in the event of corporate bankruptcy preferred stock has a higher priority than common equity but a lower priority than bonds2 Money market securities are called cash equivalentsbecause of their great liquidity The prices of money market securities are very stable and they can be converted to cash ie sold on very short notice and with very low transaction costs3 The spread will widen Deterioration of the economy increases credit risk that is the likelihood of default Investors will demand a greater premium on debt securities subject to default risk4 On the day we tried this experiment 36 of the 50 stocks met this criterion leading us to conclude that returns on stock investments can be quite volatile5 a You would have to pay the asked price of11831 11896875 of par 11896875b The coupon rate is 11750 implying coupon payments of 11750 annually or more precisely 5875 semiannually Current yield Annual coupon incomeprice1175011896875 00988 9886 P 10000102 9803927 The total before-tax income is 4 After the 70 exclusion for preferred stock dividends the taxable income is 030 4 120Therefore taxes are 030 120 036After-tax income is 400 – 036 364Rate of return is 3644000 9108 a General Dynamics closed today at 7459 which was 017 higher than yesterdays price Yesterdays closing price was 7442b You could buy 50007459 6703 sharesc Your annual dividend income would be 6703 092 6167d The price-to-earnings ratio is 16 and the price is 7459 Therefore7459Earnings per share 16 Earnings per share 4669 a At t 0 the value of the index is 90 50 100 3 80At t 1 the value of the index is 95 45 110 3 83333 The rate of return is 8333380 1 417In the absence of a split Stock C would sell for 110 so the value of the index would be 2503 83333After the split Stock C sells for 55 Therefore we need to find the divisor d such that83333 95 45 55 d d 2340c The return is zero The index remains unchanged becausethe return for each stock separately equals zero10 a Total market value at t 0 is 9000 10000 20000 39000Total market value at t 1 is 9500 9000 22000 40500Rate of return 4050039000 – 1 385The return on each stock is as followsrA 9590 – 1 00556rB 4550 – 1 –010rC 110100 – 1 010The equally-weighted average is[00556 -010 010]3 00185 18511 The after-tax yield on the corporate bonds is 009 1– 030 00630 630Therefore municipals must offer at least 630 yields12 Equation 22 shows that the equivalent taxable yield is r rm 1 – ta 400b 444c 500d 57113 a The higher coupon bondb The call with the lower exercise pricec The put on the lower priced stock14 a You bought the contract when the futures price was 142750 see Figure 212 The contract closes at a price of 1300 which is 12750 less than the original futures price The contract multiplier is 250 Therefore the loss will be12750 250 31875b Open interest is 601655 contracts15 a Since the stock price exceeds the exercise price you will exercise the callThe payoff on the option will be 42 40 2The option originally cost 214 so the profit is 200 214014Rate of return 014214 00654 654b If the call has an exercise price of 4250 you would not exercise for any stock price of 4250 or less The loss on the call would be the initial cost 072c Since the stock price is less than the exercise price you will exercise the putThe payoff on the option will be 4250 4200 050The option originally cost 183 so the profit is 050 183 133Rate of return 133183 07268 726816 There is always a possibility that the option will be in-the-money at some time prior to expiration Investors will pay something for this possibility of a positive payoff17Value of call at expiration Initial Cost Profita 0 4 -4b 0 4 -4 c0 4 -4 d 5 4 1 e 10 46Value of put at expiration Initial Cost Profita 10 6 4b 5 6 -1c 06 -6 d 0 6 -6 e 0 6-618 A put option conveys the right to sell the underlying asset at the exercise price A short position in a futures contract carries an obligation to sell the underlying asset at the futures price19 A call option conveys the right to buy the underlying asset at the exercise price A long position in a futures contract carries an obligation to buy the underlying asset at the futures priceCFA PROBLEMSd2 The equivalent taxable yield is 675 1 034 10233 a Writing a call entails unlimited potential losses as the stock price rises4 a The taxable bond With a zero tax bracket the after-tax yield for the taxable bond is the same as the before-tax yield5 which is greater than the yield on the municipal bondThe taxable bond The after-tax yield for the taxable bond is005 1 – 010 45You are indifferent The after-tax yield for the taxable bond is005 1 – 020 40The after-tax yield is the same as that of the municipal bondd The municipal bond offers the higher after-tax yield for investors in tax brackets above 20If the after-tax yields are equal then 0056 008 1 –tThis implies that t 030 30CHAPTER 3 HOW SECURITIES ARE TRADEDPROBLEM SETSAnswers to this problem will vary2 The SuperDot system expedites the flow of orders from exchange members to the specialists It allows members to send computerized orders directly to the floor of the exchange whichallows the nearly simultaneous sale of each stock in a large portfolio This capability is necessary for program trading3 The dealer sets the bid and asked price Spreads should be higher on inactively traded stocks and lower on actively traded stocks4 a In principle potential losses are unbounded growing directly with increases in the price of IBMb If the stop-buy order can be filled at 128 the imum possible loss per share is 8 If the price of IBM shares goes above 128 then the stop-buy order would be executed limiting the losses from the short sale5 a The stock is purchased for 300 40 12000The amount borrowed is 4000 Therefore the investor put up equity or margin of 8000If the share price falls to 30 then the value of the stock falls to 9000 By the end of the year the amount of the loan owed to the broker grows to4000 108 4320Therefore the remaining margin in the investors account is 9000 4320 4680The percentage margin is now 46809000 052 52Therefore the investor will not receive a margin callThe rate of return on the investment over the year isEnding equity in the account Initial equity Initial equity4680 8000 8000 0415 4156 a The initial margin was 050 1000 40 20000As a result of the increase in the stock price Old Economy Traders loses10 1000 10000Therefore margin decreases by 10000 Moreover Old Economy Traders must pay the dividend of 2 per share to the lender of the shares so that the margin in the account decreases by an additional 2000 Therefore the remaining margin is 20000 – 10000 – 2000 8000b The percentage margin is 800050000 016 16So there will be a margin callc The equity in the account decreased from 20000 to 8000 in one year for a rate of return of 1200020000 060 607 Much of what the specialist does eg crossing orders and maintaining the limit order book can be accomplished by a computerized system In fact some exchanges use an automated system for night trading A more difficult issue to resolve is whether the more discretionary activities of specialists involving trading for their own accounts eg maintaining an orderly market can be replicated by a computer system8 a The buy order will be filled at the best limit-sell order price 5025b The next market buy order will be filled at the next-best limit-sell order price 5150c You would want to increase your inventory There is considerable buying demand at prices just below 50 indicating that downside risk is limited In contrast limit sell orders are sparse indicating that a moderate buy order could result in a substantial price increase9 a You buy 200 shares of Telecom for 10000 These shares increase in value by 10 or 1000 You pay interest of 008 5000 400The rate of return will be012 12b The value of the 200 shares is 200P Equity is 200P –5000 You will receive a margin call when030 when P 3571 or lower10 a Initial margin is 50 of 5000 or 2500b Total assets are 7500 5000 from the sale of the stock and 2500 put up for margin Liabilities are 100P Therefore equity is 7500 – 100P A margin call will be issued when 030 when P 5769 or higher11 The total cost of the purchase is 40 500 20000You borrow 5000 from your broker and invest 15000 of your own funds Your margin account starts out with equity of 15000a i Equity increases to 44 500 – 5000 17000Percentage gain 200015000 01333 1333ii With price unchanged equity is unchangedPercentage gain zeroiii Equity falls to 36 500 – 5000 13000Percentage gain –200015000 –01333 –1333The relationship between the percentage return and the percentage change in the price of the stock is given by return change in price change in price 1333 For example when the stock price rises from 40 to 44 the percentage change in price is 10 while the percentage gain forthe investor isreturn 10 1333b The value of the 500 shares is 500P Equity is 500P –5000 You will receive a margin call when025 when P 1333 or lowerc The value of the 500 shares is 500P But now you have borrowed 10000 instead of 5000 Therefore equity is 500P –10000 You will receive a margin call when025 when P 2667With less equity in the account you are far more vulnerable to a margin callBy the end of the year the amount of the loan owed to the broker grows to5000 108 5400The equity in your account is 500P –5400 Initial equity was 15000 Therefore your rate of return after one year is as followsi 01067 1067ii –00267 –267–01600 –1600The relationship between the percentage return and the percentage change in the price of Intel is given by returnFor example when the stock price rises from 40 to 44 the percentage change in price is 10 while the percentage gain for the investor is1067e The value of the 500 shares is 500P Equity is 500P –5400 You will receive a margin call when025 when P 1440 or lower12 a The gain or loss on the short position is –500 PInvested funds 15000Therefore rate of return –500 P 15000The rate of return in each of the three scenarios isi rate of return –500 15000 –01333 –1333ii rate of return –500 15000 0iii rate of return [–500 –4 ]15000 01333 1333b Total assets in the margin account equal20000 from the sale of the stock 15000 the initial margin 35000Liabilities are 500P You will receive a margin call when 025 when P 56 or higherWith a 1 dividend the short position must now pay on the borrowed shares 1share 500 shares 500 Rate of return is now[ –500 P – 500]15000i rate of return [ –500 4 –500]15000 –01667 –1667ii rate of return [ –500 0 –500]15000 –00333 –333iii rate of return [ –500 –4 – 500]15000 01000 1000Total assets are 35000 and liabilities are 500P 500 A margin call will be issued when025 when P 5520 or higher13 The broker is instructed to attempt to sell your Marriott stock as soon as the Marriott stock trades at a bid price of 38 or less Here the broker will attempt to execute but may not be able to sell at 38 since the bid price is now 3795 The price at which you sell may be more or less than 38 because the stop-loss becomes a market order to sell at current market prices14 a 5550b 5525c The trade will not be executed because the bid price is lower than the price specified in the limit sell orderd The trade will not be executed because the asked price is greater than the price specified in the limit buy order15 a In an exchange market there can be price improvement in the two market orders Brokers for each of the market orders ie the buy order and the sell order can agree to execute a trade inside the quoted spread For example they can trade at 5537 thus improving the price for both customers by 012 or 013 relative to the quoted bid and asked prices The buyer gets the stock for 013 less than the quoted asked price and the seller receives 012 more for the stock than the quoted bid priceb Whereas the limit order to buy at 5537 would not be executed in a dealer market since the asked price is 5550 it could be executed in an exchange market A broker for another customer with an order to sell at market would view the limit buy order as the best bid price the two brokers could agree to the trade and bring it to the specialist who would then execute the trade16 a You will not receive a margin call You borrowed 20000 and with another 20000 of your own equity you bought 1000 shares of Disney at 40 per share At 35 per share the market value of the stock is 35000 your equity is 15000 and the percentage margin is 1500035000 429Your percentage margin exceeds the required maintenance marginYou will receive a margin call when035 when P 3077 or lowerThe proceeds from the short sale net of commission were14 100 – 50 1350A dividend payment of 200 was withdrawn from the account Covering the short sale at 9 per share cost you including commission 900 50 950Therefore the value of your account is equal to the net profit on the transaction1350 – 200 – 950 200Note that your profit 200 equals 100 shares profit per share of 2 Your net proceeds per share was14 selling price of stock–9 repurchase price of stock–2 dividend per share–1 2 trades 050 commission per share2CFA PROBLEMS1 a In addition to the explicit fees of 70000 FBN appears to have paid an implicit price in underpricing of the IPO The underpricing is 3 per share or a total of 300000 implying total costs of 370000b No The underwriters do not capture the part of the costs corresponding to the underpricing The underpricing may be arational marketing strategy Without it the underwriters would need to spend more resources in order to place the issue with the public The underwriters would then need to charge higher explicit fees to the issuing firm The issuing firm may be just as well off paying the implicit issuance cost represented by the underpricing2 d The broker will sell at current market price after the first transaction at 55 or less3 dCHAPTER 4 MUTUAL FUNDS ANDOTHER INVESTMENT COMPANIESPROBLEM SETS1 The unit investment trust should have lower operating expenses Because the investment trust portfolio is fixed once the trust is established it does not have to pay portfolio managers to constantly monitor and rebalance the portfolio as perceived needs or opportunities change Because the portfolio is fixed the unit investment trust also incurs virtually no trading costs2 a Unit investment trusts diversification from large-scale investing lower transaction costs associated with large-scale trading low management fees predictable portfoliocomposition guaranteed low portfolio turnover rateb Open-end mutual funds diversification from large-scale investing lower transaction costs associated with large-scale trading professional management that may be able to take advantage of buy or sell opportunities as they arise record keepingc Individual stocks and bonds No management fee realization of capital gains or losses can be coordinated with investors personal tax situations portfolio can be designed to investors specific risk profile3 Open-end funds are obligated to redeem investors shares at net asset value and thus must keep cash or cash-equivalent securities on hand in order to meet potential redemptions Closed-end funds do not need the cash reserves because there are no redemptions for closed-end funds Investors in closed-end funds sell their shares when they wish to cash out4 Balanced funds keep relatively stable proportions of funds invested in each asset class They are meant as convenient instruments to provide participation in a range of asset classes Life-cycle funds are balanced funds whose asset mix generally depends on the age of the investor Aggressive life-cycle funds with larger investments in equities are。

投资学(金德环)1-10课后习题解答

E ( Ri ) R f [ E ( Rm ) R f ]i (1) E ( RA ) R f [ E ( Rm ) R f ] A R f [ E ( Rm ) R f ]*0.8 (2) E ( RB ) R f [ E ( Rm ) R f ] B 19% R f [ E ( Rm ) R f ]*1.5 (3) E ( RC ) R f [ E ( Rm ) R f ]C 15% R f [ E ( Rm ) R f ]C (4) E ( RD ) R f [ E ( Rm ) R f ] D 7% R f [ E ( Rm ) R f ]*0 (5) E ( RE ) R f [ E ( Rm ) R f ] E 16.6% R f [ E ( Rm ) R f ]*1.2

证券 A B C

n

贝塔值 0.9 1.3 1.05

权重 0.3 0.1 0.6

p X ii 0.9*0.3 1.3*0.1 1.05*0.6 1.03

i 1

10、请根据CAPM中收益与风险的关系补充下表中 缺失的数据: i E ( Ri ) i i 2 证券名称

0.5*(16 8.25) 2 0.3*(2.5 8.25) 2 0.2*(2.5 8.25) 2 7.94

p

4、项目A的收益为4%,标准差为7.5%,项目B的收益为10 %,标准差为9% ,投资哪个项目?

方法I :变异系数(取小:B) CV 7.5% 1.88; CV 9% 0.9 A B

1刘红忠《投资学(第二版)》答案(1-8章

为:i→资本的流动→Eρ→e。 货币市场与外汇市场之间除了通过利率渠道构成联系外,还可通过物价水平(购买 力平价) 、国际收支流量,以及资产存量与资产结构(货币模型、超调模型、资产组合 模型)等渠道建立联系。货币市场与外汇市场任何一者均衡关系的改变都将影响另外一 者的均衡关系。 9. 答:外汇市场与资本市场之间的传导机制主要包括以下几种: ① 通过利率相互影响的传导机制: 汇率波动→资本流动→国内利率→股票价格变动 股票价格变动→资产组合结构调整效应→国内利率→汇率变动 ② 通过进出口贸易相互影响的传导机制: 汇率波动→贸易条件改变→进出口数量变化→上市公司利润变化→股票价格变动 股票价格变动→投资和消费→国民收入→进出口贸易余额→汇率变动 ③ 通过资本流动相互影响的传导机制: 汇率变动→资本流动→国内资本市场资金供给→股票价格变动 汇率变动→上市公司成本和对外投资→上市公司资产价值→股票价格变动 ④ 通过投资者预期相互影响的传导机制: 汇率波动↔投资者心理预期↔股票价格波动 10. 答:在金融期货交易中,现货和期货的价格变动是同方向的。在金融期货交易中,现货 和期货的价格变动是同方向的。期货价格是在与现货交易价格的对比中,市场参与者预 期的价格变动在期货交易中的体现,而微观主体的预期通过市场交易机制汇聚形成市场 的一种市场性的价格预期。 在两个市场各自的交易过程中,与资产价格相关的源信息以及投资者对这些源信息 的理解、处理、反映和预期,都会进入市场微观结构意义上的定价机制,分别形成现货 价格和期货价格,两者之间正是通过进入市场定价机制的市场预期性信息,从而相互关 联并互为反射。

P4Байду номын сангаас 第一章习题答案

1. 答:交易机制指市场的交易规则和保证规则实施的技术以及规则和技术对定价机制的影 响。它的主要研究内容包括:从市场微观结构的角度去看,价格是在什么样的规则和程 序中形成的,并分析交易机制对资产交易的过程和结果的影响。 2. 答:报价驱动机制与指令驱动机制的区别在于:①价格形成方式不同。在采用做市商制 度的市场上,证券的开盘价格和随后的交易价格是由做市商报出的,而指令驱动制度的 开盘价与随后的交易价格都是竞价形成的。前者从交易系统外部输入价格,后者的成交 价格是在交易系统内部生成的。②信息传递范围与速度不同。采用做市商机制,投资者 买卖指令首先报给做市商,做市商是唯一全面及时知晓买卖信息的交易商,成交量与成 交价随后才会传递给整个市场。在指令驱动机制中,买卖指令、成交量与成交价几乎同 步传递给整个市场。③交易量与价格维护机制不同。在报价驱动机制中,做市商有义务 维护交易量与交易价格。而指令驱动机制则不存在交易量与交易价格的维护机制。④处 理大额买卖指令的能力不同。做市商报价驱动机制能够有效处理大额买卖指令。而在指 令驱动机制中, 大额买卖指令要等待交易对手的买卖盘, 完成交易常常要等待较长时间。 其它交易机制还包括混合交易机制、特殊会员制度等。 3. 答:一般来说,做市商市场的流动性要高于竞价市场,即投资者在竞价市场所面临的执 行风险要大于做市商市场。但是,竞价市场的透明度要好于做市商市场,同时,做市商 市场的平均交易成本要高于竞价市场。 竞价市场的优点:①透明度高。在指令驱动制度中,买卖盘信息、成交量与成交价 格信息等及时对整个市场发布,投资者几乎可以同步了解到交易信息。透明度高,有利 于投资者观察市场。②信息传递速度快、范围广。指令驱动制度几乎可以实现交易信息 同步传递, 整个市场可以同时分享交易信息, 很难发生交易信息垄断。 ③运行费用较低。 投资者买卖指令竞价成交,交易价格在系统内部生成,系统本身表现出自运行特征。这 种指令驱动系统,在处理大量小额交易指令方面,优越性较明显。 竞价市场的缺点: ①处理大额买卖的能力较低。 大额买卖盘必须等待交易对手下单, 投资者也会担心大额买卖指令对价格的可能影响,因而不愿意输入大额买卖指令,而宁 愿分拆开来,逐笔成交。这种情况既影响效率,又会降低市场流动性。②某些不活跃的 股票成交可能继续萎缩。一些吸引力不大的股票,成交本来就不活跃,系统显示的买卖 指令不足,甚至较长时间没有成交记录,这种又会使投资者望而却步,其流动性可能会 进一步下降。③价格波动性。在指令驱动制度下,价格波动性可能较大。买卖指令不均 衡与大额买卖指令都会影响价格变动,更为重要的是,指令驱动制度没有设计价格维护 机制,任由买卖盘带动价格变化。 做市商市场的优点:①成交即时性。投资者可按做市商报价立即进行交易,而不用 等待交易对手的买卖指令,尤其在处理大额买卖指令方面的即时性,比指令驱动制度要 强。②价格稳定性。在指令驱动制度中,证券价格随投资者买卖指令而波动,而买卖指 令常有不均衡现象,过大的买盘会过度推高价格,过大的卖盘会过度推低价格,因而价 格波动较大。而做市商则具有缓和这种价格波动的作用。③矫正买卖指令不均衡现象。 在指令驱动市场上,常常发生买卖指令不均衡的现象。出现这种情况时,做市商可以承 接买单或者卖单,缓和买卖指令的不均衡,并抑制相应的价格波动。④抑制股价操纵。 做市商对某种股票持仓做市,使得股价操纵者有所顾忌,担心做市商抛压,抑制股价。 做市商市场的缺点:①缺乏透明度。在报价驱动制度下,买卖盘信息集中在做市商 手中,交易信息发布到整个市场的时间相对滞后。为抵消大额交易对价格的可能影响,

张元萍主编《投资学》课后习题答案

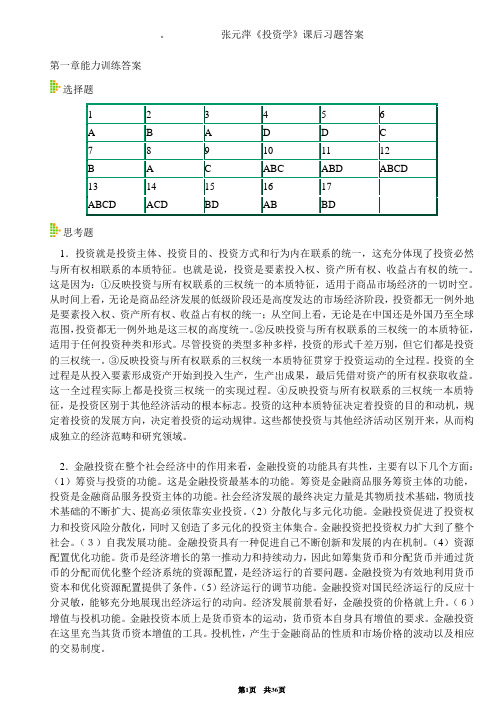

张元萍《投资学》课后习题答案第一章能力训练答案选择题1 2 3 4 5 6A B A D D C7 8 9 10 11 12B AC ABC ABD ABCD13 14 15 16 17ABCD ACD BD AB BD思考题1.投资就是投资主体、投资目的、投资方式和行为内在联系的统一,这充分体现了投资必然与所有权相联系的本质特征。

也就是说,投资是要素投入权、资产所有权、收益占有权的统一。

这是因为:①反映投资与所有权联系的三权统一的本质特征,适用于商品市场经济的一切时空。

从时间上看,无论是商品经济发展的低级阶段还是高度发达的市场经济阶段,投资都无一例外地是要素投入权、资产所有权、收益占有权的统一;从空间上看,无论是在中国还是外国乃至全球范围,投资都无一例外地是这三权的高度统一。

②反映投资与所有权联系的三权统一的本质特征,适用于任何投资种类和形式。

尽管投资的类型多种多样,投资的形式千差万别,但它们都是投资的三权统一。

③反映投资与所有权联系的三权统一本质特征贯穿于投资运动的全过程。

投资的全过程是从投入要素形成资产开始到投入生产,生产出成果,最后凭借对资产的所有权获取收益。

这一全过程实际上都是投资三权统一的实现过程。

④反映投资与所有权联系的三权统一本质特征,是投资区别于其他经济活动的根本标志。

投资的这种本质特征决定着投资的目的和动机,规定着投资的发展方向,决定着投资的运动规律。

这些都使投资与其他经济活动区别开来,从而构成独立的经济范畴和研究领域。

2.金融投资在整个社会经济中的作用来看,金融投资的功能具有共性,主要有以下几个方面:(1)筹资与投资的功能。

这是金融投资最基本的功能。

筹资是金融商品服务筹资主体的功能,投资是金融商品服务投资主体的功能。

社会经济发展的最终决定力量是其物质技术基础,物质技术基础的不断扩大、提高必须依靠实业投资。

(2)分散化与多元化功能。

金融投资促进了投资权力和投资风险分散化,同时又创造了多元化的投资主体集合。

投资学第8章 习题及答案

课后习题1.收益率曲线都有哪些形状?2.简述利率的不确定性和远期利率的关系。

3.简述期望假说理论的主要内容。

4.简述流动性偏好理论的主要内容。

5.简述市场分割理论6.假设面值为1000美元的3年期零息债券的价格是816.30美元,2年期的债券到期收益率为6%。

第三年的远期利率是多少?你怎样构造一个组合的1年期远期贷款,使得其在t=2时执行,t=3时到期?第八章本章习题答案1. 收益率曲线是以期限长短为横坐标、以收益率为纵坐标的直角坐标系上显示出来的。

一般而言,收益率曲线有三种形状:第一类是正收益率曲线(或称为上升收益率曲线),其显示的期限结构特征是短期债券收益率较低,长期债券收益率较高;第二类是反收益曲线(或下降的收益率曲线),其显示的期限结构特征是短期国债收益率较高,而长期国债收益率较低。

这两种收益率曲线转换过程中会出现第三种形态的收益率曲线,成为水平收益曲线,其特征是长、短期国债收益率基本相等。

通常而言,上升的收益率曲线是一种正常的形态,而其他两种则是非正常的。

在图8-1中,图(a)显示的是一条向上倾斜的收益曲线,表明期限越长的债券收益越高,这种曲线的形状就是正收益率曲线。

图(b)显示的是一条平直的收益曲线,表示不同期限的债券收益相等,这通常是正收益率曲线与反收益率曲线转化的过程中出现的暂时的现象。

图(c)显示的是一条向下倾斜的收益曲线,表示期限越长的债券收益越低,这种曲线形状被称为反收益率曲线。

图(d)显示的是拱形的收益曲线,表示对于期限相对较短的债券,收益与期限呈正向关系;期限相对较长的债券,利率与期限呈反向的关系。

从历史资料来看,在经济周期的不同阶段均可以观察到这四条收益曲线。

2. 在一个确定的世界中,有相同到期的不同投资战略一定会提供相同的报酬率。

例如,两个联系的一年零息票投资提供的总收益率,应该与一个等额的两年零息票投资的收益率一样。

因此,在确定条件下,有:)1)(1()1(2122r r y ++=+当r 2未知的时候,假定今天的利率r 1=5%,下一年的期望短期收益是E(r 2)=6%。

8投资学第八章习题答案

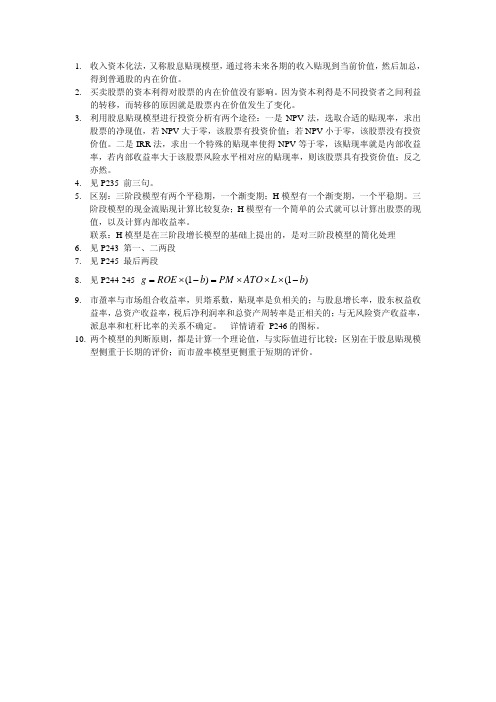

1. 收入资本化法,又称股息贴现模型,通过将未来各期的收入贴现到当前价值,然后加总,得到普通股的内在价值。

2. 买卖股票的资本利得对股票的内在价值没有影响。

因为资本利得是不同投资者之间利益的转移,而转移的原因就是股票内在价值发生了变化。

3. 利用股息贴现模型进行投资分析有两个途径:一是NPV 法,选取合适的贴现率,求出股票的净现值,若NPV 大于零,该股票有投资价值;若NPV 小于零,该股票没有投资价值。

二是IRR 法,求出一个特殊的贴现率使得NPV 等于零,该贴现率就是内部收益率,若内部收益率大于该股票风险水平相对应的贴现率,则该股票具有投资价值;反之亦然。

4. 见P235 前三句。

5. 区别:三阶段模型有两个平稳期,一个渐变期;H 模型有一个渐变期,一个平稳期。

三阶段模型的现金流贴现计算比较复杂;H 模型有一个简单的公式就可以计算出股票的现值,以及计算内部收益率。

联系:H 模型是在三阶段增长模型的基础上提出的,是对三阶段模型的简化处理6. 见P243 第一、二两段7. 见P245 最后两段8. 见P244-245 (1)(1)g ROE b PM ATO L b =×−=×××−9. 市盈率与市场组合收益率,贝塔系数,贴现率是负相关的;与股息增长率,股东权益收益率,总资产收益率,税后净利润率和总资产周转率是正相关的;与无风险资产收益率,派息率和杠杆比率的关系不确定。

详情请看 P246的图标。

10. 两个模型的判断原则,都是计算一个理论值,与实际值进行比较;区别在于股息贴现模型侧重于长期的评价;而市盈率模型更侧重于短期的评价。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1. 收入资本化法,又称股息贴现模型,通过将未来各期的收入贴现到当前价值,然后加总,

得到普通股的内在价值。

2. 买卖股票的资本利得对股票的内在价值没有影响。

因为资本利得是不同投资者之间利益

的转移,而转移的原因就是股票内在价值发生了变化。

3. 利用股息贴现模型进行投资分析有两个途径:一是NPV 法,选取合适的贴现率,求出

股票的净现值,若NPV 大于零,该股票有投资价值;若NPV 小于零,该股票没有投资价值。

二是IRR 法,求出一个特殊的贴现率使得NPV 等于零,该贴现率就是内部收益率,若内部收益率大于该股票风险水平相对应的贴现率,则该股票具有投资价值;反之亦然。

4. 见P235 前三句。

5. 区别:三阶段模型有两个平稳期,一个渐变期;H 模型有一个渐变期,一个平稳期。

三

阶段模型的现金流贴现计算比较复杂;H 模型有一个简单的公式就可以计算出股票的现值,以及计算内部收益率。

联系:H 模型是在三阶段增长模型的基础上提出的,是对三阶段模型的简化处理

6. 见P243 第一、二两段

7. 见P245 最后两段

8. 见P244-245 (1)(1)g ROE b PM ATO L b =×−=×××−

9. 市盈率与市场组合收益率,贝塔系数,贴现率是负相关的;与股息增长率,股东权益收

益率,总资产收益率,税后净利润率和总资产周转率是正相关的;与无风险资产收益率,派息率和杠杆比率的关系不确定。

详情请看 P246的图标。

10. 两个模型的判断原则,都是计算一个理论值,与实际值进行比较;区别在于股息贴现模

型侧重于长期的评价;而市盈率模型更侧重于短期的评价。