立宝舒产品介绍精品PPT课件

《宝健产品介绍》课件

2010年,宝健成为国内领先的保健品企业之一,拥 有广泛的销售网络和品牌影响力。

公司愿景与使命

愿景

成为全球保健品行业的领导者,为人 类健康事业做出卓越贡献。

使命

致力于研发、生产和销售高品质的保 健品,帮助人们改善健康、提高生活 质量。

公司核心优势

01

研发实力

宝健拥有一支高素质的研发团队, 不断推出创新型保健品。

良好的用户体验与口碑

注重产品的口感、色泽和香气,让消费者在食用过程中获得愉悦的体验。

针对不同消费人群的特点和需求,提供个性化的产品选择和定制服务。 通过用户口碑和评价,不断改进产品和服务质量,提高消费者的满意度和 忠诚度。

04

宝健产品应用场景与效果

日常保健与保养

增强免疫力

宝健产品中的营养成分有助于提高身体免疫力,预防疾病。

天然有机原料

01 选用来自全球优质产区的天然有机原料,确保产 品的纯净无污染。

02 所有原料均经过严格筛选,确保品质优良,营养 成分丰富。

03 遵循有机农业标准,不使用化学农药、化肥和转 基因技术,确保产品的安全与健康。

科学配方与先进生产工艺

01

由专业营养师和研发团队精心设计,确保产品配方科

学、合理、安全。

会再次购买宝健产品。

调查方法

采用在线问卷的形式,共收集 了1000份有效问卷,涵盖了 不同年龄、性别和教育背景的

用户。

调查内容

包括产品质量、口感、效果、 价格以及售后服务等方面。

典型用户案例分享

案例一

一位50岁的李女士长期服用宝健 产品后,明显感觉到自己的免疫 力有所提高,感冒次数明显减少 。

案例二

针对特定需求,如改善记 忆、提高免疫力或促进消 化,开发出相应的功能性 食品。

眼科药品介绍

眼部给药的吸收途径

结膜 角膜 巩膜

影响角膜吸收的因素溶解度(皮屏障) 亲脂性(基质内皮屏障) 分子大小 电荷解离程度 药液黏度

巩膜通透性好 结膜对分子大小不敏感

托百士滴眼液/眼膏

妥布霉素

主要对G-:如绿脓杆菌、大肠杆菌、 克雷白杆菌、肠杆菌属有效。 G+:金黄色葡萄球菌敏感;链球菌 (包括化脓性链球菌、肺炎球菌、粪 链球菌等)均对本品耐药。 厌氧菌(拟杆菌属)、结核杆菌、立 克次体、病毒和真菌亦对本品耐药。 儿童眼病治疗及围手术期首选药物。

作用,主要通过与细胞内免疫嗜素FK结合蛋白(FKBP)结合而抑制Th 细胞释放IL-2、IL-3、IFN-γ并抑制IL-2R表达。

卡林优滴眼液 吡诺克辛

麝珠明目滴眼液

抗氧化作用,能抑制芳香氨基酸异常代谢生成的醌类物

质,防止晶体内不溶性蛋白质的形成,抑制白内障的发展。

适应症:初期老年性白内障。 麝珠明目滴眼液:消翳明目。用于老年性初、中 期白内障;用于视疲劳,症见眼部疲倦、眼酸胀 痛、眼干涩、视物模糊。

苏为坦:曲伏 卢美根:贝美

特丽洁:拉坦 适利达:@拉坦

使用频率 qd

拉坦噻吗滴眼液

降压机理:增加葡萄膜巩膜旁道的房水流出, 给药后3-4小时开始,8-12小时达到最大作用, 降眼压作用至少可维持24小时。 常见副作用:虹膜色素加深,睫毛变深、变粗、 变长、睫毛数量增加,眼部刺激症状。 围手术期慎用。

压迫内眦减少全身吸 收

视疲劳治疗药物

冰珍清目滴眼液:养肝明目。用于 青少年假性近视及缓解视疲劳。 施图伦(七叶洋地黄双苷滴眼 液):洋地黄苷-睫状体肌收缩力加强;七

9.2力克舒PPT

12.5

10粒 +5粒

1.68

泰诺

19.3 24 8.4 12.8

20粒

2.4 1.28 1.5

新康泰克

10粒

力克舒

13.3 18

24粒

力克舒优点

• 拥有品牌和广告力量 • 非处方药品 • 咖啡因成分增加疗效且消除嗜睡反应,满 足上学、上班、驾车族的需求 • 独有菠萝蛋白酶成分能更快更好的缓解炎 症 ,保证治疗效果 • 适用人群更广(7岁以上人群) • 专为亚洲人设计的配方,用药量更合理 • 利润空间比较高

本次上市会特别优惠活动

• 订90盒 现场返现金100元

• 订货一件(180盒)

现场返现金500元

• 订货两件(360盒)

现场返现金1200元

~谢谢~ ---绍兴代表:陈洁

各感冒药价格对比

名称 用法用量 供货价 零售价 规格 单次服 用价格

白加黑

日用片:口服,成人和12岁以 7.8 上儿童,一次1-2片,一日2次 或白天每6小时服一次。夜用片: 口服,成人和12岁以上儿童, 睡前服1-2片

口服,12岁以上儿童及成人, 一次1-2片,每6小时服1次,24 小时内不超过4次 口服,成人每12小时服1粒,24 小时内不应超过2粒。 口服。成人一次2粒,一日3次。 7~14岁儿童减半,饭后服用。

泰诺

对乙酰氨基酚,盐酸伪麻黄碱, 氢溴酸 右美沙芬,马来酸氯苯那敏 新康泰克 盐酸伪麻黄碱, 马来酸氯苯那敏

力克舒 对乙酰氨基酚,马来酸氯苯那敏,盐酸 氯哌丁,盐酸伪麻黄碱,咖啡因,菠萝

蛋白酶

菠萝蛋白酶

• 菠萝蛋白酶是从菠萝果茎、叶、皮提取出 来的纯天然植物蛋白酶。能水解纤维蛋白 及酪蛋白,可将炎症反应产生的纤维蛋白 或血凝块去掉,改善局部微循环,消除炎 症与水肿。

如新产品演示新ppt课件共59页文档

我们来看一看我们日 常使用的清洁用品又 是什么性质的。

这是一块普通的洗衣皂 (雕牌),价格是3元, 试纸显示是紫色,表明 它的性质碱性的。

这是一块强生的婴儿皂, 号称性质温和,适合婴 儿皮肤,价格是7元, 但试纸显示也是紫色, 表明性质也是碱性的。

这是一块安利的蜜糖皂, 价格是30元,试纸显 示也是紫色,表明性质 也是碱性的。

皮脂膜被破坏后,空 气中的细菌就很容易 侵入我们的皮肤,让 我们的皮肤出现很多 问题。

暗疮、出油 干裂、衰老 皱纹、等等

皮脂膜被破坏后可以 再生, 但是需要8到12个小 时。

皮肤要不停地工作, 那么皮肤新公司 (nuskin)的经典产品:

洁肤霸

通过测试,证明这块 洁肤霸是弱酸性的 (ph值5.5),和人 体皮肤的性质一样, 因此不会破坏皮脂膜。

如新产品演示新ppt课件

1、 舟 遥 遥 以 轻飏, 风飘飘 而吹衣 。 2、 秋 菊 有 佳 色,裛 露掇其 英。 3、 日 月 掷 人 去,有 志不获 骋。 4、 未 言 心 相 醉,不 再接杯 酒。 5、 黄 发 垂 髫 ,并怡 然自乐 。

如新产品演示

大家知道我们的皮肤 是什么性质的吗?

干性? 油性? 混合性? 都是物理性质!

你即使能配全这些食物,怕你 也没时间做;没有冰箱放。就 算有冰箱放,你又这么大的胃 吗?为什么会这样?刚才我们 讲了,食物本身的营养成分缺 乏。

演示结束,大家接下来可 以体验一下我们的护肤和 保健的产品,谢谢!

31、只有永远躺在泥坑里的人,才不会再掉进坑里。——黑格尔 32、希望的灯一旦熄灭,生活刹那间变成了一片黑暗。——普列姆昌德 33、希望是人生的乳母。——科策布 34、形成天才的决定因素应该是勤奋。——郭沫若 35、学到很多东西的诀窍,就是一下子不要学很多。——洛克

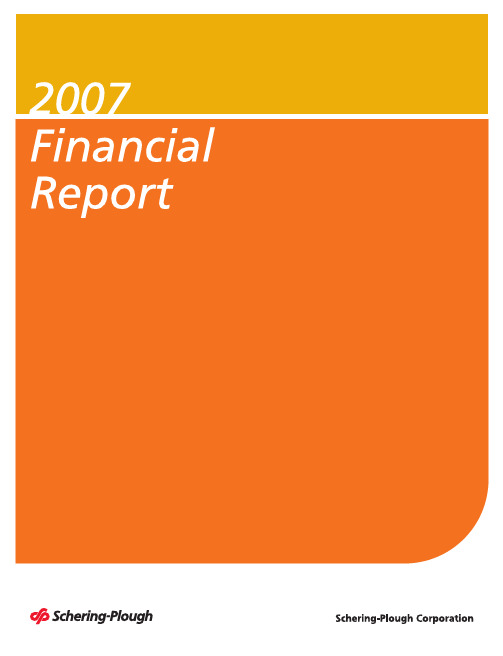

SGP_AR07

Schering-Plough is an innovation-driven,science-centered global health care company.Our goal is to provide a steady flow of valuable medicines and services while earning the trust of the physicians,patients and other customers we serve. Today,our Company is at an exciting point in the transformation begun in2003 under a five-stage Action Agenda.A pivotal step in that transformation came in November2007,when we acquired Organon BioSciences,with its Organon human health and Intervet animal health businesses.Through this combination and other achievements,we are gaining greater depth and breadth across our prescription pharmaceutical,animal health and consumer products.As we work to build the foundation for long-term high performance,we remain committed to business integrity,quality and compliance in everything we do.The trademarks indicated by C APITAL L ETTERS in this publication are the property of, licensed to, promoted or distributed by Schering-PloughCorporation, its subsidiaries or related companies. As used in this publication, the terms “Schering-Plough” and the “Company” refercollectively to Schering-Plough Corporation, the publicly held parent company, and its domestic and international subsidiaries, which areengaged in the discovery, development, manufacturing and marketing of pharmaceutical, animal health and consumer health care products.Copyright © 2008 Schering-Plough Corporation. All Rights Reserved.2007Financial HighlightsDollars in millions,except per share figures2007(1)2006%Change Operating ResultsNet sales(2).................................................$12,690$10,59420% (Loss)/income before income taxes(3)...............................(1,215)1,483Net(loss)/income(3)...........................................(1,473)1,143Diluted(loss)/earnings per common share(3)..........................(1.04)0.71 InvestmentsResearch and development......................................$2,926$2,18834% Acquired in-process research and development.......................3,754—Capital expenditures...........................................61845835% Financial ConditionTotal assets..................................................$29,156$16,071 Shareholders’equity...........................................10,3857,908Other DataCash dividends per common share.................................$0.25$0.22Average shares outstanding used in calculating diluted(loss)/earnings percommon share(in millions)....................................1,5361,491(1)Operating results and other financial information reflect the closing of the Organon BioSciences N.V.(OBS)acquisition onNovember19,2007,including the impacts of purchase accounting in accordance with SFAS141,“Business Combinations.”(2)Net sales and percent change are on a U.S.GAAP basis and do not include the positive impact of sales made by thecholesterol joint venture.(3)2007and2006include Special and acquisition-related charges of$84million and$102million,respectively.For furtherdetails,see Notes to Consolidated Financial Statements.Contents1Financial Highlights2Letter to Shareowners4Management’s Discussion and Analysis of Financial Conditionand Results of Operations31Statements of Consolidated Operations32Statements of Consolidated Cash Flows33Consolidated Balance Sheets 34Statements of Consolidated Shareholders’Equity 35Notes to Consolidated FinancialStatements73Report of IndependentRegistered Public AccountingFirm74Management’s Report onInternal Control overFinancial Reporting75Report of IndependentRegistered Public AccountingFirm77Performance Graph78Selected Financial Data79Quarterly Data(Unaudited)81Reconciliation of Non-U.S.GAAPFinancial Measures83Senior Management84Corporate Information85Board of DirectorsSchering-Plough Corporation and Subsidiaries1To OurShareowners:Fred HassanChairman and Chief Executive OfficerSchering-Plough has come a long way in five years.Whenwe began our Action Agenda in 2003,your Company wasstruggling merely to survive.Today,Schering-Plough isstronger,larger,more diverse and pursuing a broad arrayof exciting growth opportunities.This greater breadth anddepth makes us better able to surmount the new chal-lenges we face.The five-phase Action Agenda has been our roadmap totransform Schering-Plough —to turn it into a companythat can deliver high performance over the long term.Wehave advanced through the Stabilize and Repair phases,through the Turnaround,and now we are in the Build theBase phase.Over this time,Schering-Plough has undergone a remark-able transformation.Highlights include:•Growing sales on an adjusted basis*from $8.6billion in2003to $15.2billion in 2007.Over the past four yearson this adjusted basis,the Company has achieved thehighest rate of sales growth among our peers.•Strengthening the Company’s integrated businessmodel,with human pharmaceuticals,animal healthand consumer health providing important diversity.Each of these segments grew sales by double digits in2007.•Going from not having a single product with sales above$1billion in 2003to having four products with salesabove $1billion (including our cholesterol franchise)atyear-end 2007.•Achieving an impressive reversal of free cash flow*,going from negative free cash flow of nearly $1billionin 2003to a positive $1.5billion in 2007.•Substantially increasing both R&D investments and thenumber of compounds in development.Today,we haveone of the strongest late-stage human pharmaceuticalspipelines among our peer group companies.•Undertaking a targeted geographic expansion drive tobuild strength in new markets,particularly those withhigh growth prospects,such as Russia,China and Brazil.Our great progress has come from focusing intensely on the fundamentals —and taking the long view.Our strat-egy for creating value and transforming Schering-Plough is based on:growing the top line,growing the R&D pipeline,and containing and reducing costs while investing wisely.In our industry,value is created through good science —by discovering,developing and bringing to market inno-vative new medicines that deliver substantive benefits.Schering-Plough is a science-centered company because we know our value is driven by the quality of the science we deliver.By focusing relentlessly on these basics,we built the strength and wherewithal to undertake a major acquisi-tion,our combination with Organon BioSciences N.V .(OBS).The OBS transaction was completed in November 2007at a cost of approximately Euro 11billion.This combination begins an important and exciting chap-ter in our Company’s transformation.With the Organon franchises,we become a world-class leader in women’s health and fertility treatments.These add breadth to our existing human pharmaceutical strengths in cardiovascular care,immunology,respiratory and oncology.Intervet,the animal health unit of OBS,is being combined with Schering-Plough Animal Health to make us one of the largest animal health organizations in the world.Through Organon we also add important R&D strengths and compounds to our pipeline.They include two inno-vative therapies:sugammadex,a novel selective relaxant binding agent that may profoundly change the practice of surgical anesthesia,and asenapine,for treating schizo-phrenia and bipolar disorder.Applications have been filed with regulatory authorities for both treatments.2Schering-Plough Corporation and Subsidiaries*For reconciliation of Non-U.S.GAAP financial measures,see page 81.As we move ahead with the OBS integration,we continue to address the fallout from and overreaction to the ENHANCE trial,a surrogate imaging study that was started by the Merck/Schering-Plough cholesterol joint venture in 2002.This small study used ultrasound scans of neck arteries in a rare patient population to compare our cho-lesterol-lowering treatment V YTORIN versus simvastatin alone.This study was not designed to measure hard clin-ical outcomes such as heart attacks.While the study did not meet its primary endpoint involving the thickness of arterial walls in the neck,it reconfirmed the effectiveness of V YTORIN in reducing LDL(“bad”)cholesterol as well as the overall safety profile of V YTORIN.Many experts believe this single trial should not have any impact on current standards of care;however,the confu-sion about appropriate cholesterol management caused by various interpretations of the study findings has had a negative impact on prescriptions for V YTORIN and Z ETIA. What has not changed is our confidence in these medi-cines and the important role we know they can play in helping many patients achieve their LDL cholesterol goals. Facing this and other challenges in2008,we have begun taking actions to improve productivity,which include sig-nificant reductions in costs.We know we have our work cut out for us.But our Company has been tested before and proven to be a tough,resilient competitor,grounded in a culture of integrity,of taking the right actions for long-term performance,of doing what is right for the patients who use our products.We view the future with confidence and see this as a time of enormous opportunity.We have the additional strength and diversity gained through our combination with OBS. We have our other strong product lines,which include such leading medicines as R EMICADE,N ASONEX,P EG I NTRON and T EMODAR,as well as our cholesterol franchise.Nearly all of our key growth products have long periods of market exclusivity.There is the diversity from having integrated business units—human prescription pharmaceuticals, animal health and consumer health care—and from the geographic presence we have built around the globe. Importantly,there is our R&D product pipeline,which has never been stronger.In addition to sugammadex and asenapine,we are advancing other important compounds, including four designated“fast track”by the U.S.Food& Drug Administration.Our most promising compounds in advanced development include a thrombin receptor antagonist(TRA)for atherothrombosis,vicriviroc for HIV and boceprevir for hepatitis C.In addition,golimumab,licensed outside the U.S.from Centocor,Inc.,has been filed in the EU for treating rheumatoid arthritis,psoriatic arthritis and ankylosing spondylitis.One important reason we are confident about this Com-pany’s future is our people.The colleagues who drive Schering-Plough are the reason for our progress to date. And they will be the reason for our success in the future. Throughout our journey,we have benefited from the careful oversight and diligent service of our Board of Directors.We welcome Craig B.Thompson,M.D.,to our Board.He is Director of the Abramson Cancer Center and Professor of Medicine at the University of Pennsylvania School of Medicine.We also thank Philip Leder,M.D.,who will be retiring from the Board in May2008,for his wise counsel during the past five years and his leadership in chairing our Science and Technology Committee since it was established in2005.Finally,we want to thank our shareowners for the trust they have put in us to lead and grow this Company.We will continue to strive to prove that their faith is deserved.Sincerely,Fred HassanChairman and Chief Executive OfficerApril11,2008Schering-Plough Corporation and Subsidiaries3Management’s Discussion and Analysis of Financial Condition and Results of OperationsEXECUTIVE SUMMARYOverview of Schering-PloughSchering-Plough is an innovation-driven science-centered global health care company.Schering-Plough discovers, develops and manufactures pharmaceuticals for three customer markets—human prescription,animal health,and consumer.While most of the research and development activity is directed toward prescription products,there are important applications of this central research and development platform into the animal health products and the consumer health care products.Schering-Plough also accesses external innovation via partnering,in-licensing and acquisition for all three customer markets.Strategy—Focused on ScienceEarlier this decade,Schering-Plough experienced a number of business,regulatory,and legal challenges.In April2003, the Board of Directors named Fred Hassan as the new Chairman of the Board and Chief Executive Officer of Schering-Plough Corporation.With support from the Board,he initiated a strategic plan,with the goal of stabilizing,repairing and turning around Schering-Plough in order to build long-term shareholder value.He also installed a new senior executive team.That strategic plan,the Action Agenda,is a six-to eight-year,five-phase plan.Schering-Plough is currently in the fourth phase of the Action Agenda—Build the Base.During the Build the Base phase,Schering-Plough continues to focus on its strategy of value creation across a broad front,and believes the Organon BioSciences N.V.(OBS)acquisition was a major,transformative accomplishment in this regard.The OBS acquisition added further diversification of marketed products,including two new therapeutic areas(Women’s Health and Central Nervous System),as well as significant strength in Animal Health products and pipeline.Other accomplishments in2007include:•growing the business,for example there was double digit sales growth in all three product groups,Human Pharmaceuticals,Animal Health and Consumer Health Care;•penetrating new markets,including China,Brazil and Russia;•expanding the product portfolio for Schering-Plough’s three customer groups—human pharmaceutical,animal health and consumer health care;and•discovering and developing or acquiring new products.A key component of the Action Agenda is applying science to meet unmet medical needs.Research and development activities focus on mechanisms to treat serious diseases.As a result,a core strategy of Schering-Plough is to invest substantial funds in scientific research with the goal of creating therapies and treatments that address important unmet medical needs and also have commercial value.Schering-Plough has been successful in advancing its pipeline into several late-stage projects that will require sizable resources to complete.Consistent with this core strategy,Schering-Plough is increasing its investment in research and development.As Schering-Plough continues to develop the later phase growth-drivers of the pipeline(e.g.,sugammadex,thrombin receptor antagonist,golimumab,vicriviroc, boceprevir and asenapine),it anticipates higher spending on clinical trial activities.Schering-Plough’s progressing early pipeline includes drug candidates across a wide range of therapeutic areas with more than20compounds now approaching or in Phase I development.As part of the Action Agenda,Schering-Plough continues to work to enhance infrastructure,upgrade processes and systems and strengthen talent—both the recruitment of talented individuals and the development of key employees. While these efforts are being implemented on a companywide basis,Schering-Plough is focusing especially on research and development to support Schering-Plough’s science-based business.Further,with the integration of the OBS employees into Schering-Plough much new talent has been added.In addition,as part of the integration of OBS, Schering-Plough has also announced that there will be some workforce reduction to eliminate redundancies.4Schering-Plough Corporation and Subsidiaries2007Results—Highlights of Schering-Plough’s performance in2007are as follows:•Closed the acquisition of OBS on November19,2007for a purchase price of approximately Euro11billion.•Schering-Plough’s net sales in2007were$12.7billion,an increase of$2.1billion,or20percent,as compared to the 2006period.2007net sales included$626million of sales of products acquired as part of the OBS acquisition.•Net loss available to common shareholders in2007was$1.6billion,as compared to net income available to common shareholders of$1.1billion in2006.Included in the2007net loss is approximately$4.0billion of charges related to purchase accounting for the OBS acquisition,including a$3.8billion acquired in-process research and development charge.Cash flow provided by operating activities was$2.6billion in2007.•Global sales of Schering-Plough’s cholesterol franchise products,V YTORIN and Z ETIA,made by the cholesterol joint venture with Merck&Company,Inc.(Merck)continued to grow in2007and contributed significantly to Schering-Plough’s improved operating results and cash flow(see note below about2008developments).In addition,increased sales of pharmaceutical products such as R EMICADE,T EMODAR and N ASONEX also contributed favorably to Schering-Plough’s overall operating results and cash flow.The additional strength that Schering-Plough developed,in2007and during the four years since Mr.Hassan and the new management team began the Action Agenda,is key for Schering-Plough in the current environment.The pharmaceutical industry continues to be subject to ever-more critical scrutiny,where events can be mischaracterized and drive amplified reactions.Schering-Plough believes that new scientific data are best presented and discussed at appropriate scientific and medical forums.Early2008Developments Relating to the Cholesterol FranchiseAs explained in more detail in Item3,“Legal Proceedings,”“ENHANCE Matter,”of Schering-Plough’s200710-K,in early2008,Schering-Plough encountered such a challenge when results of a Merck/Schering-Plough cholesterol joint venture clinical trial,called ENHANCE,and joint venture products Z ETIA and V YTORIN,became the subject of much media scrutiny prior to fuller discussions of the trial results at appropriate medical forums.A discussion is scheduled for the American College of Cardiology meeting on March30,2008.Medical experts and health advisory groups have long recognized high LDL cholesterol(often known as“bad cholesterol”)as a significant cardiovascular risk factor and recommended increasingly aggressive treatment of high cholesterol for certain patients.Lowering LDL cholesterol,along with a healthy diet and lifestyle changes,remains the cornerstone of lipid treatment for patients at risk for heart disease.Clinical studies,including ENHANCE,have demonstrated that V YTORIN lowers patients’LDL cholesterol more than rosuvastatin,atorvastatin and simvastatin at the doses studied and was able to get more patients to their LDL cholesterol goals(as defined by ATP III).While it is too early to tell the impact of the joint venture’s ENHANCE trial results on the joint ventures’cholesterol business,Schering-Plough’s diversified group of products and geographic areas,as well as its highly experienced executive team,gives Schering-Plough additional strength that will be helpful in weathering this situation.Strategic AlliancesAs is typical in the pharmaceutical industry,Schering-Plough licenses manufacturing,marketing and/or distribution rights to certain products to others,and also manufactures,markets and/or distributes products owned by others pursuant to licensing and joint venture arrangements.Any time that third parties are involved,there are additional factors relating to the third party and outside the control of Schering-Plough that may create positive or negative impacts on Schering-Plough.V YTORIN,Z ETIA and R EMICADE are subject to such arrangements and are key to Schering-Plough’s current business and financial performance.In addition,any potential strategic alternatives may be impacted by the change of control provisions in those arrangements, which could result in V YTORIN and Z ETIA being acquired by Merck or R EMICADE reverting back to Centocor.The change in control provision relating to V YTORIN and Z ETIA is included in the contract with Merck,filed as Exhibit10(r)to Schering-Plough’s200710-K, and the change of control provision relating to R EMICADE is contained in the contract with Centocor,filed as Exhibit10(v)to Schering-Plough’s200710-K.Cholesterol FranchiseSchering-Plough’s cholesterol franchise products,V YTORIN and Z ETIA,are managed through a joint venture between Schering-Plough and Merck for the treatment of elevated cholesterol levels in all markets outside of Japan.Z ETIA isSchering-Plough Corporation and Subsidiaries5Schering-Plough’s novel cholesterol absorption inhibitor.V YTORIN is the combination of Z ETIA and Zocor(simvastatin),a statin medication developed by Merck.The financial commitment to compete in the cholesterol reduction market is shared with Merck,and profits from the sales of V YTORIN and Z ETIA are also shared with Merck.The operating results of the joint venture with Merck are recorded using the equity method of accounting.The cholesterol-reduction market is the single largest pharmaceutical category in the world.V YTORIN and Z ETIA are competing in this market,and on a combined basis,these products continued to grow in terms of sales and market share during2007(see note above about2008developments).A material change in the sales or market share of Schering-Plough’s cholesterol franchise would have a significant impact on Schering-Plough’s consolidated results of operations and cash flows.In order to maintain and enhance its infrastructure and business,Schering-Plough must continue to increase profits.This increased profitability is largely dependent upon the performance of Schering-Plough’s cholesterol franchise.Japan is not included in the joint venture with Merck.In the Japanese market,Bayer Healthcare is co-marketing Schering-Plough’s cholesterol-absorption inhibitor,Z ETIA,which was approved in Japan in April2007as a monotherapy and co-administered with a statin for use in patients with hypercholesterolemia,familial hypercholesterolemia or homozygous sitosterolemia.Z ETIA was launched in Japan during June2007.Schering-Plough’s sales of Z ETIA in Japan under the co-marketing agreement with Bayer Healthcare are recognized in net sales.License Arrangements with CentocorR EMICADE is prescribed for the treatment of inflammatory diseases such as rheumatoid arthritis,early rheumatoid arthritis, psoriatic arthritis,Crohn’s disease,ankylosing spondylitis,plaque psoriasis and ulcerative colitis.R EMICADE is Schering-Plough’s second largest marketed pharmaceutical product line(after the cholesterol franchise).R EMICADE is licensed from and manufactured by Centocor,Inc.,a Johnson&Johnson company.During2005,Schering-Plough exercised an option under its contract with Centocor for license rights to develop and commercialize golimumab,a fully human monoclonal antibody currently in Phase III trials.Schering-Plough has exclusive marketing rights to both products outside of the U.S., Japan and certain Asian markets.In December2007,Schering-Plough and Centocor revised their distribution agreement regarding the development,commercialization and distribution of both R EMICADE and golimumab,extending Schering-Plough’s rights to exclusively market R EMICADE to match the duration of Schering-Plough’s exclusive marketing rights for golimumab.Effective upon regulatory approval of golimumab in the EU,Schering-Plough’s marketing rights for both products will now extend for15years after the first commercial sale of golimumab within the EU.Centocor will receive a progressively increased share of profits on Schering-Plough’s distribution of both products in the Schering-Plough marketing territory between2010and2014,and the share of profits will remain fixed thereafter for the remainder of the term.The changes to the duration of R EMICADE marketing rights and the profit sharing arrangement for the products are all conditioned on approval of golimumab being granted prior to September1,2014.Schering-Plough may indepen-dently develop and market golimumab for a Crohn’s disease indication in its territories,with an option for Centocor to participate.In addition,Schering-Plough and Centocor agreed to utilize an autoinjector device in the commercialization of golimumab and further agreed to share its development costs.For the rights to this device,Schering-Plough made an upfront payment of$21million,which is included in research and development expenses for the year ended December31,2007.Manufacturing,Sales and MarketingSchering-Plough supports commercialized products with manufacturing,sales and marketing efforts.Schering-Plough is also moving forward with additional investments to enhance its infrastructure and business,including capital expen-ditures for the drug development process(where products are moved from the drug discovery pipeline to markets), information technology systems,and post-marketing studies and monitoring.Schering-Plough continually reviews the business,including manufacturing operations,to identify actions that will enhance long-term competitiveness.However,Schering-Plough’s manufacturing cost base is relatively fixed,and actions to significantly reduce Schering-Plough’s manufacturing infrastructure,including OBS’manufacturing operations acquired during2007,involve complex issues.As a result,shifting products between manufacturing plants can take many years due to construction and regulatory requirements,including revalidation and registration requirements.From time to time,actions are taken to enhance Schering-Plough’s overall manufacturing efficiency.For example,during 2006,Schering-Plough closed a manufacturing plant in Puerto Rico and in2007began the process of closing a small manufacturing facility in the Asia Pacific region.Schering-Plough continues to review the carrying value of manufac-turing assets for indications of impairment.Future events and decisions may lead to additional asset impairments or related costs.6Schering-Plough Corporation and SubsidiariesRegulatory and Competitive EnvironmentSchering-Plough is subject to the jurisdiction of various national,state and local regulatory agencies.Regulatory compliance is complex and costly,impacting the timing needed to bring new drugs to market and to market drugs for new indications.Schering-Plough engages in clinical trial research in many countries around the world.Research activities must comply with stringent regulatory standards and are subject to inspection by U.S.,the EU,and local country regulatory authorities.Schering-Plough is subject to pharmacovigilance reporting requirements in many countries and other jurisdictions,including the U.S.,the EU,and the EU member states.Clinical trials and post-marketing surveillance of certain marketed drugs of competitors within the industry have raised safety concerns that have led to recalls, withdrawals or adverse labeling of marketed products.A number of intermediaries are involved between drug manufacturers,such as Schering-Plough,and patients who use the drugs.These intermediaries impact the patient’s ability,and their prescriber’s ability,to choose and pay for a particular drug.These intermediaries include health care providers,such as hospitals and clinics;payors and their representatives,such as employers,insurers,managed care organizations and governments;and others in the supply chain,such as pharmacists and wholesalers.Further,in the U.S.,many of Schering-Plough’s pharmaceutical products are subject to increasingly competitive pricing as certain of the intermediaries(including managed care groups,institutions and government agencies)seek price discounts.In most international markets,Schering-Plough operates in an environment of government mandated cost-containment programs.Also,the pricing,sales and marketing programs and arrangements,and related business practices of Schering-Plough and other participants in the health care industry are under increasing scrutiny from federal and state regulatory,investigative,prosecutorial and administrative entities. The market for pharmaceutical products is competitive.Schering-Plough’s operations may be affected by technological advances of competitors,industry consolidation,patents granted to competitors,loss of patent protection due to challenges by competitors,competitive combination products,new products of competitors,new information from clinical trials of marketed products or post-marketing surveillance and generic competition as Schering-Plough’s products mature.OBS AcquisitionOn November19,2007,Schering-Plough acquired OBS for a purchase price of approximately Euro11billion in cash,or approximately$16.1billion.Commencing from the acquisition date,OBS’assets acquired and liabilities assumed,as well as the results of OBS’operations,are included in Schering-Plough’s consolidated financial statements.There were approximately one and one-half months of results of operations relating to OBS included in Schering-Plough’s Statement of Consolidated Operations for the year ended December31,2007.The impact of purchase accounting,based on a preliminary valuation,resulted in the following non-cash charges in 2007:•Acquired In-Process Research and Development(IPR&D),which was a one-time charge of approximately$3.8billion.•Amortization of inventory adjusted to fair value,of which approximately$1.1billion will be charged to Cost of Sales ($258million in2007)approximately over a one year period from the acquisition date.•Amortization of acquired intangible assets adjusted to fair value,of which$6.8billion will be amortized over a weighted average life of15years to Cost of Sales($65million in2007).•Incremental depreciation relating to the adjustment in fair value on property,plant and equipment of$885million that will be depreciated primarily to Cost of Sales over the lives of the applicable property($3million in2007).The$3.8billion acquired IPR&D charge was associated with research projects in the women’s health,central nervous system and anesthesia therapeutic areas of human health as well as research projects in animal health.The amount was determined by using discounted cash flow projections of identified research projects for which technological feasibility had not been established and for which there was no alternative future use.The discount rates used ranged from 14percent to18percent.The projected launch dates following FDA or other regulatory approval are years2008through 2013,at which time Schering-Plough expects these projects to begin to generate cash flows.All of the research and development projects considered in the valuation are subject to the normal risks and uncertainties associated with demonstrating the safety and efficacy required to obtain FDA or other regulatory approvals.Schering-Plough Corporation and Subsidiaries7。

简约生物医药公司企业宣传产品介绍PPT动态资料

坚持以血液制品研发为 核心,努力成为中国最 好、国际一流的生物制 药公司。 同学们都扶着栏杆在过道上看雨,看那一漾一漾的水波荡起的层层涟漪,仿佛自己心中也下了一场春雨。细细的雨点打在窗户上,静静的,只留下一条淡淡的水痕。渐渐的,窗户上也凝起了些许莹透的水珠,像是负着雨的重,缓缓地向下滑去。

企业文化

质量第一

树立品牌

创造价值

企业文化

企业精神

同学们都扶着栏杆在过道上看雨,看 那一漾 一漾的 水波荡 起的层 层涟漪 ,仿佛 自己心 中也下 了一场 春雨。 细细的 雨点打 在窗户 上,静 静的, 只留下 一条淡 淡的水 痕。渐 渐的, 窗户上 也凝起 了些许 莹透的 水珠, 像是负 着雨的 重,缓 缓地向 下滑去 。

06 资质证书 QUALIFICATION CERTIFICATE

07

企业荣誉

CORPORATE HONOR

08 企业合作 ENTERPRISE COOPERATION

01 公司简介

COMPANY PROFILE

企业简介

同学们都扶着栏杆在过道上看雨,看 那一漾 一漾的 水波荡 起的层 层涟漪 ,仿佛 自己心 中也下 了一场 春雨。 细细的 雨点打 在窗户 上,静 静的, 只留下 一条淡 淡的水 痕。渐 渐的, 窗户上 也凝起 了些许 莹透的 水珠, 像是负 着雨的 重,缓 缓地向 下滑去 。

同学们都扶着栏杆在过道上看雨,看 那一漾 一漾的 水波荡 起的层 层涟漪 ,仿佛 自己心 中也下 了一场 春雨。 细细的 雨点打 在窗户 上,静 静的, 只留下 一条淡 淡的水 痕。渐 渐的, 窗户上 也凝起 了些许 莹透的 水珠, 像是负 着雨的 重,缓 缓地向 下滑去 。

艰苦奋斗

创新求变

安利的产品示范讲稿

讲解模式总结------家居护理系列与个人护理系列产品讲解示范模式要求:1.选择一个好的环境来进行产品示范(示范在什么样的环境中进行直接影响效果)2.在示范之前,要准备好所有要讲解示范的产品及工具产品以系列为单位来进行摆放:A.家洁(乐新及压取器、碟新及配比瓶、洗碗棉、速洁及喷雾瓶、透丽及喷雾瓶、丽宝、典雅、家居亮洁剂、空气清新)B.衣洁(洗衣粉,丝白、纤细丝白及量杯盖、预洗喷、预洗洁衣液、皮革亮洁剂)C.雅蜜(沐浴露及沐浴花、香皂、润肤露)D.丽齿健(牙膏、口喷、漱口水)E.丝婷(洁净调理二合一、滋润调理、清爽调理、去屑调理洗发露、柔顺润泽护发素、去屑调理护发素、彩洗,彩护,深层修护润发乳、保湿顺发喷雾、自然造型摩丝、清爽造型锗哩、持久造型定型水)产品示范道具一定要齐备、美观、干净。

示范之前一定要作好充分的准备(如水盆,擦手的毛巾、其他产品等)3.讲解注意事项:◆语言要简洁、精练,不罗嗦,每款产品讲解5分钟内完成,切勿超时。

◆形象气质能够代言安利产品,穿着得体。

男士西装领带,打啫喱;女士职业装,淡妆;◆表情自然,热情积极,有兴奋度,声音洪亮,要保证会场最后面的朋友都能听清。

◆要交代清楚实验示范的目的(即为什么要这样示范、如为什么示范沐浴露要用食盐)新老朋友配合◆只有亲自作过示范后,才可以给别人做,保证示范成功。

自己没有用出的功效不要大讲特讲,不要夸大产品功效◆被邀请配合示范的人要适合参与该产品的示范(如碟新示范最好请家庭妇女来参与,最好男女搭配,示范动作要标准,姿势富有美感。

)◆尽量让新人接触产品,有体验产品的机会4.具体操作可参考产品示范书与产品示范VCD讲解要点:(五个环节,缺一不可)1.导入(通过导入来下危机,也使接下来讲解自然、生活化)2.中文及英文产品全称3.功效与示范(主要功效一定要讲到,如LOC 去污、避味……)4.产品成分及包含专利成分5.使用方法与价格分析6.促单,说明注意事项安利产品的八大魅力一.环保性无磷我们只有一个地球。

环保健康医疗产品推荐-绝对精美PPT模板

请输入您的标题

输入您的文II字内容

80 60

49% 38% 40 20

这里可以添加主要内容 这里可以添加主要内容 这里可以添加主要内容

67%

60%

业务一

计划数

业务二

业务三

实际数

业务四

4

请输入第四章标题

这里可以用一段简短的话描述出本章中心内容、章 节导语、小节标题;如无必要也可以删除。

请输入您的标题

输入您的文II字内容输入您的文II

字内容输入您的文II字内容输入

您的文II字内容输入您的文II字内

容输入您的文II字内容

W

劣势(Weaknesses)

输入您的文II字内容输入您的文II字 内容输入您的文II字内容输入您的 文II字内容输入您的文II字内容输入 您的文II字内容

T

风险(Threats)

标题 文II 字

输入您的文II字内容 输入您的文II字内容

标题 文II 字

标题文II 字

标题 文II 字

输入您的文II字内容 输入您的文II字内容

标题 文II 字

输入您的文II字内容 输入您的文II字内容

标题 文II 字

输入您的文II字内容 输入您的文II字内容

请输入您的标题

90%

协助领 导工作

70%

您的文II字。

4

请在这里输入您的文II字;请在这里输入您的文II 字;请在这里输入您的文II字;请在这里输入您的

文II字。

5

请在这里输入您的文II字;请在这里输入您的文II字;

请在这里输入您的文II字;请在这里输入您的文II字。

请输入您的标题

01

请在这里输入您的 文II字;请在这里 输入您的文II字; 请在这里输入您的 文II字;请在这里 输入您的文II字。

名师推荐保健品品牌推广课

功效二

稳心胶囊能扩张外周血管,理通毛细血管,改善微循环 有位女士头疼20多年,去过很多医院,找过很多名医,都无法治

疗她的头痛病,最后给下的结论是“神经性头疼”,无法治疗,后 来服用稳心胶囊一天,头就不疼了。

8/18/2019

功效三

稳心胶囊能扩张冠状动脉,改善心肌缺血,调节心律,效果明显 有位男士去朋友家聚餐,因心脏病突然复发晕倒,当时朋友们帮忙

该产品继承了我国多少年以来优秀的心脑保健养生文化;吸收 了近代心脑血管医学研究的最新成果;总结了近年以来我国保健品 研制开发的经验教训;融入了现代西方医疗保健的合理化因素,被 人们传说为“心脑保健品”“生命的守护神”等荣誉称号 。

并于2010年荣获中华人民共和国知识产权局颁发的发明“专利” 证书。

8/18/2019

功效五

能活血理气。对瘀血阻络所导致的心悸、胸闷‘四肢无力、易疲劳 等有明显的治疗效果

有位女士40岁左右,经常感觉胸闷无力,走路不到500米就气喘吁吁, 无法坚持。后经服用稳心胶囊10天左右,症状基本消失,就这样坚 持服药不到两个疗程,一次走路五公里不会气喘,一口气上五层楼 也不感到心慌……

8/18/2019

二、产品功效一

稳心胶囊能够活血化瘀,理气通络,缓解和客服脑缺血症状,提 高记忆力

郑州有一名小学生,上课时总是精力不集中,易困,经常在课 堂上睡觉,老师布置的作业总是完不成,记忆力减退,自从吃了稳 心胶囊后,上课不睡觉,精神状态极佳,平时读十遍课文也记不住, 服用产品后,只需三遍就可以背下来,考试成绩比服用产品前提高 30%

拨打120急救中心,在等待期间给病人服用了四粒稳心乐安胶囊, 20分钟左右,急救中心人员还未到,病人就慢慢苏醒过来了……

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

专利保护的“水脂质凝胶技术” 全球拥有39个国家的专利

立宝舒的共聚焦激光扫描图像

甘油三酯液滴

甘油三酯膜

立宝舒的扩散

数据来源于: Stave, J. Krüger, O., Guthoff, R. 1998

立宝舒的共聚焦激光扫描图像 立宝舒

保护性的甘油三酯层覆盖在角膜上皮的干燥点

脂质缺乏型干眼

▪ 脂质层的异常是造成干眼症的一个主要原因

▪ 包括:

▪ 睑板腺功能障碍 ▪ 睑缘炎 ▪ 办公室眼病综合症 ▪ 与戴隐形眼镜有关的脂质异常

(T. Kaercher 1998)

▪ 当发现了泪膜的三层 ▪ 水和油不相容 ▪ 泪膜的三层却包含水和油 ▪ 含三种泪膜成分的人工泪液一直在研究探索

德国埃森大学和海德堡大学眼科专家研究结果 (Heiligenhaus et al 1995)

脂质缺乏的高发生率

表一:泪膜三相缺乏的发生情况 ( n=110)

90

85

80

70

78%

60

50

29

40

30 20

9

26%

6

10

8%

0

脂质层缺乏 粘液层缺乏 水液层缺乏 二或三相缺乏

脂质缺乏的高发生率-国内

杯状细胞

泪膜的脂质层

▪ 脂质层包含磷脂、甘油三酯、蜡质等 ▪ 睑板腺分泌的脂质主要是非极性脂 (约占60%) ▪ 其余部分包括极性脂, 少量的游离脂肪酸,胆固醇

酯和游离胆固醇脂等重要的组成

脂质层

▪ 脂质层的缺损伴随有泪液蒸发速率的提高

▪ “人类脂质层缺损时,…, 泪液蒸发速率提高4倍。”

(Craig et al 1997)

立宝舒®

卡波姆眼用凝胶

人工泪液的选择原则

▪根据病因进行人工泪液的选择

脂质缺乏型干眼应补充 含脂质成分的人工泪液 水样液缺乏型干眼应补充 含水成分的人工泪液 粘蛋白缺乏型干眼应补充 含有粘蛋白的人工泪液

混合型干眼也越来越困扰我们

药品现状……

▪人工泪液产品很多

每个厂家均宣传自己的产品最接近天然泪液

▪目前市场上其实只有两种类型的人工泪液

▪ 甘油

▪ 甘油是制药行业常用的辅料,在滴眼液中常用作调节渗

透压的物质,2.6%的甘油与血浆等渗

▪ 甘油化学名称是丙三醇,是醇类物质(酒精的化学名称

是乙二醇),能够溶解于水,非脂质成分,不能够补充 泪膜的脂质层

甘油非甘油三酯

甘油三酯&甘油

甘油三酯分布在泪膜脂质层示意图

甘油三酯是泪膜脂质层中固有的物质 能够补充泪膜的脂质层,减缓泪液的蒸发

甘油三酯&甘油

甘油分布在泪膜水样层和粘蛋白层示意图

甘油是滴眼液中常用的渗透压调节剂 甘油不能补充泪膜的脂质层,对泪液蒸发速率无影响

立宝舒 — 结构

carbomer 链

▪ 在切变力的作用下,聚合

体骨架的粘合性被破坏

粘度降低 释放出水和脂质

甘油三酯

水分子 卡波姆(carbomer) 形成一个链状的凝固体

立宝舒的使用

▪ 适合全天使用

立宝舒通过眨眼和眼球运动释放甘油三酯和水

▪ 临床研究

临床研究 1

Thießen, C., Berger, E & Torens, S. 1999

▪ 单一应用立宝舒后的非侵入性泪膜破裂时间 DMP 48.5.98

▪研究类型 ▪研究人数

▪ 研究期间

单一中心,单盲法,随机的 20人 (一只眼接受治疗,另外一只眼不接受治疗) 2天

0.2%

立宝舒® 是---

唯一含有脂质成分的人工泪液

▪全球第一个含有脂质成分的人工泪液 ▪甘油三酯是泪液中的自然成分 ▪甘油三酯是非极性脂质 ▪适合用于脂质缺乏干眼的治疗

甘油三酯&甘油

▪ 甘油三酯

▪ 甘油三酯是酯类物质,是甘油酯化的产物,不溶于水,

是泪膜脂质层中固有的酯类物质。甘油三酯是非极性酯, 是决定蒸发速率的脂质

触变性

甘油三酯以微滴形式存在于凝胶中

立宝舒– 剂型

▪ 眼凝胶剂型的所有优点…

高粘度 ( 4800 cPa) 眼表储留时间长

持续作用时间是滴眼液的7倍

立宝舒 — 专利

▪ 立宝舒是新一代眼凝胶

▪ 凝胶技术发明人专利 ▪ 德国专利号:DE 195 11 322 C2 ▪ 欧洲专利:EP 0 817 610 B1

中……

博士伦率先做出了贡献

▪ 立宝舒

立宝舒

▪ 商品名:立宝舒®

零售价:58.8元

▪ 通用名:卡波姆眼用凝胶

▪ 规 格:10g/支

2008年中国上市

▪ 剂 型: 眼用凝胶制剂

▪ 适应证: 替代泪液用于“干眼症”的治疗

▪ 博士伦产品,德国进口

▪ 进口药品注册证号:H20060023

▪ 2003年在欧洲上市

立宝舒的“第一”

▪ … 尤为独特的是:

立宝舒是第一个:

含有脂质成分的人工泪液

包含所有三层泪膜成分的人工泪液

立宝舒适合所有类型的干眼治疗

立宝舒 – 成分

▪ 包含与自然泪膜相类似数量的物质:

脂质

(大约.)

水(大约.)

粘蛋白(大约.)

天然泪液

立宝舒

1%

中等链甘油三酯

1%

90%

水(大约.)

93%

Hale Waihona Puke 0.1% 卡波姆▪ 天津医大眼科中心 赵少贞教授

通过泪膜镜的分级判断门诊随机干眼病人的脂质缺乏情况

▪ 脂质不同程度缺乏的患者越来越多(100例 约44%) ▪ 混合型干眼患者增多

泪膜的脂质层

▪ 由睑板腺分泌

▪ 腺体分泌至管道系统

睑板腺

▪ 油脂在眼睑温度下变为液体,

被运送至睑缘,从上下眼睑

的睑板腺口分泌出来

开口

脂质层的作用是防止泪液的蒸发

单含水分的人工泪液 含有水和粘蛋白成分的人工泪液

…没有含有脂质成分的人工泪液 对于脂质缺乏的干眼无相应的人工泪液

立宝舒含有脂质成分

关于干眼

关注脂质层缺乏的发病率!

脂质缺乏的高发生率-国外

▪ 研究表明:

脂质层的缺乏是比我们预期更为常见的造成干眼症的原因:

78%的干眼症病例有脂质层缺损(110例)

非侵入性泪膜破裂时间

健康受试者的NIBUT(n=10) 干眼症患者的NIBUT (n=10)

NIBUT [sec]

NIBUT [sec]

数据来源于: Stave, J. Krüger, O., Guthoff, R. 1998

立宝舒的脂质技术

▪ 立宝舒的脂质成分掺入到泪膜的自然脂质层中

(Förster and Stolze, Video B&l 1997)

▪ 甚至没有脂质层的患者在经立宝舒的治疗后也

可检测出脂质层

(T.Kaercher,A.Wickenhuser,chmann und R.Welt 2004)