计量课后习题第七章答案

计量经济学课后思考题答案

第五章 异方差性思考题5.1 简述什么是异方差?为什么异方差的出现总是与模型中某个解释变量的变化有关?答 :设模型为),....,,(....n 21i X X Y i i 33i 221i =μ+β++β+β=,如果其他假定均不变,但模型中随机误差项的方差为),...,,()(n 21i Var 2i i =σ=μ,则称i μ具有异方差性。

由于异方差性指的是被解释变量观测值的分散程度是随解释变量的变化而变化的,所以异方差的出现总是与模型中某个解释变量的变化有关。

5.2 试归纳检验异方差方法的基本思想,并指出这些方法的异同。

答:各种异方差检验的共同思想是,基于不同的假定,分析随机误差项的方差与解释变量之间的相关性,以判断随机误差项的方差是否随解释变量变化而变化。

其中,戈德菲尔德-跨特检验、怀特检验、ARCH 检验和Glejser 检验都要求大样本,其中戈德菲尔德-跨特检验、怀特检验和Glejser 检验对时间序列和截面数据模型都可以检验,ARCH 检验只适用于时间序列数据模型中。

戈德菲尔德-跨特检验和ARCH 检验只能判断是否存在异方差,怀特检验在判断基础上还可以判断出是哪一个变量引起的异方差。

Glejser 检验不仅能对异方差的存在进行判断,而且还能对异方差随某个解释变量变化的函数形式进行诊断。

5.3 什么是加权最小二乘法?它的基本思想是什么?答:以一元线性回归模型为例:12i i i Y X u ββ=++经检验i μ存在异方差,公式可以表示为22var()()i i i u f X σσ==。

选取权数 i w ,当2i σ 越小 时,权数i w 越大。

当 2i σ越大时,权数i w 越小。

将权数与 残差平方相乘以后再求和,得到加权的残差平方和:2i 21i 2i i X Y w e w )(**β-β-=∑∑,求使加权残差平方和最小的参数估计值**ˆˆ21ββ和。

这种求解参数估计式的方法为加权最小二乘法。

庞皓计量经济课后答案第七章

统计学2班第六次作业1、⑴①模型一:t t t PDI A A PCE μ++=21tt PDI E C P 008106.14269.216ˆ+-= t (-6.619723)(67.05920)996455.02=R F=4496.936 DW=1.366654美国个人消费支出受个人可支配收入影响,通过回归可知,个人可支配收入PDI 每增加一个单位,个人消费支出平均增加1.008106个单位。

②模型二:t t t t PCE B PDI B B PCE υ+++=-13211037158.0982382.02736.233ˆ-++-=t t t PCE PDI E C P T (-5.120436)(6.970817) (0.257997)996542.02=R F=2017.064 DW=1.570195美国个人消费支出PCE 不仅受当期个人可支配收入PDI 影响,还受滞后一期个人消费支出PCE t-1自身影响。

⑵从模型一得MPC=1.008106从模型二可得短期MPC=0.982382.从库伊特模型)()1(110---+++-=t t t t t Y X Y λμμλβλα可得1-t PEC 为λ的系数即037158.0=λ因为,长期MPC 即长期乘数为:∑=si iβ,根据库伊特模型)10(0<<=λλββii ,。

当s →∞时,λβλλβλβλβλβββββ-=--==+++=++=∞∞=∞=∑∑111 (00)102210100i ii i 所以长期MPC=02023.1037158.01982382.0=-=MPC2、Y :固定资产投资 X :销售额⑴ 设定模型为:t t t X Y μβα++=*,*t Y 为被解释变量的预期最佳值运用局部调整假定,模型转换为:*1*1*0*t t t t Y X Y μββα+++=- 其中:t t δμμδβδββδαα=-===**1*0*,1,,1271676.0629273.010403.15ˆ-++-=t t t Y X Y T (-3.193613) (6.433031) (2.365315)987125.02=R F=690.0561 DW=1.518595t t δμμδβδββδαα=-===**1*0*,1,, ,728324.0271676.011*1=-=-=βδ7381.20728324.010403.15*-=-==δαα,864.0728324.0629273.0*0===δββ∴局部调整模型估计结果为:tt X Y 864.07381.20ˆ*+-= 经济意义:该地区销售额每增加1亿元,未来预期最佳新增固定资产投资为0.846亿元采用德宾h 检验如下0:,0:10≠=ρρH H29728.1114858.0*21121)21.5185951()ˆ(1)21(2*1=--=--=βnVar n d h 在显著性水平05.0=α下,查标准正态分布表得临界值96.1025.02==h h α,因此拒绝原假设96.129728.1025.0=<=h h ,因此接受原假设,说明自回归模型不存在一阶自相关。

计量经济学第七章答案详解

练习题7.1参考解答(1)先用第一个模型回归,结果如下:22216.4269 1.008106 t=(-6.619723) (67.0592)R 0.996455 R 0.996233 DW=1.366654 F=4496.936PCE PDI =-+==利用第二个模型进行回归,结果如下:122233.27360.9823820.037158 t=(-5.120436) (6.970817) (0.257997)R 0.996542 R 0.996048 DW=1.570195 F=2017.064t t t PCE PDI PCE -=-++==(2)从模型一得到MPC=1.008106;从模型二得到,短期MPC=0.982382,长期MPC= 0.982382+(0.037158)=1.01954 练习题7.2参考答案(1)在局部调整假定下,先估计如下形式的一阶自回归模型:*1*1*0*t t t t u Y X Y +++=-ββα 估计结果如下:122ˆ15.104030.6292730.271676 se=(4.72945) (0.097819) (0.114858)t= (-3.193613) (6.433031) (2.365315)R =0.987125 R =0.985695 F=690.0561 DW=1.518595t t t Y X Y -=-++根据局部调整模型的参数关系,有****11 ttu u αδαβδββδδ===-=将上述估计结果代入得到: *1110.2716760.728324δβ=-=-=*20.738064ααδ==-*0.864001ββδ==故局部调整模型估计结果为:*ˆ20.7380640.864001ttYX =-+ 经济意义解释:该地区销售额每增加1亿元,未来预期最佳新增固定资产投资为0.864001亿元。

运用德宾h 检验一阶自相关:(121(1 1.34022d h =-=-⨯=在显著性水平05.0=α上,查标准正态分布表得临界值21.96h α=,由于21.3402 1.96h h α=<=,则接收原假设0=ρ,说明自回归模型不存在一阶自相关。

计量课后习题第七章答案

习题7.1 解释概念(1)分类变量 (2)定量变量 (3)虚拟变量 ( 4)虚拟变量陷阱 (5)交互项(6)结构不稳定 (7)经季节调整后的时间序列答:(1)分类变量:在回归模型中,我们对具有某种特征或条件的情形赋值1,不具有某种特征或条件的情形赋值0,这样便定义了一个变量D :1,0,D ⎧=⎨⎩具有某种特征不具有某种特征我们称这样的变量为分类变量。

(2)具有数值特征的变量,如工资、工作年数、受教育年数等,这些变量就称为定量变量。

(3)在回归模型中,我们对具有某种特征或条件的情形赋值1,不具有某种特征或条件的情形赋值0,这样便定义了一个变量D :1,0,D ⎧=⎨⎩具有某种特征不具有某种特征 我们称这样的变量为虚拟变量(dummy variable )。

(4)虚拟变量陷阱是指回归方程包含了所有类别(特征)对应的虚拟变量以及截距项,从而导致了完全共线性问题。

(5)交互项是指虚拟变量与定量变量相乘,或者两个定量变量相乘或是两个虚拟变量相乘,甚至更复杂的形式。

比如模型:12345i i i i i i i household lwage female married female married u βββββ=++++⋅+female married ⋅就是交互项。

(6)如果利用不同的样本数据估计同一形式的计量模型,可能会得到1β、2β不同的估计结果。

如果估计的参数之间存在着显著性差异,就称为模型结构不稳定。

(7)一些重要的经济时间序列,如果是受到季节性因素影响的数据,利用季节虚拟变量或者其他方法将其中的季节成分去除,这一过程被称为经季节调整的时间序列。

7.2 如果你有连续几年的月度数据,为检验以下假设,需要引入多少个虚拟变量?如何设定这些虚拟变量?(1)一年中的每一个月份都表现出受季节因素影响;(2)只有2、7、8月表现出受季节因素影响。

答:(1)对于一年中的每个月份都受季节因素影响这一假设,需要引入三个虚拟变量。

庞皓计量经济学课后答案第七章

统计学2班第六次作业1、⑴①模型一:t t t PDI A A PCE μ++=21t tPDI E C P 008106.14269.216ˆ+-= t (-6.619723)(67.05920)996455.02=R F=4496.936 DW=1.366654美国个人消费支出受个人可支配收入影响,通过回归可知,个人可支配收入PDI 每增加一个单位,个人消费支出平均增加1.008106个单位。

②模型二:t t t t PCE B PDI B B PCE υ+++=-13211037158.0982382.02736.233ˆ-++-=t t tPCE PDI E C P T (-5.120436)(6.970817) (0.257997)996542.02=R F=2017.064 DW=1.570195美国个人消费支出PCE 不仅受当期个人可支配收入PDI 影响,还受滞后一期个人消费支出PCE t-1自身影响。

⑵从模型一得MPC=1.008106从模型二可得短期MPC=0.982382.从库伊特模型)()1(110---+++-=t t t t t Y X Y λμμλβλα可得1-t P E C 为λ的系数即037158.0=λ因为,长期MPC 即长期乘数为:∑=si iβ,根据库伊特模型)10(0<<=λλββi i ,。

当s →∞时,λβλλβλβλβλβββββ-=--==+++=++=∞∞=∞=∑∑111 (001)02210100i ii i所以长期MPC=02023.1037158.01982382.0=-=MPC2、Y :固定资产投资 X :销售额⑴ 设定模型为:t t t X Y μβα++=*,*t Y 为被解释变量的预期最佳值运用局部调整假定,模型转换为:*1*1*0*t t t t Y X Y μββα+++=- 其中:t t δμμδβδββδαα=-===**1*0*,1,,1271676.0629273.010403.15ˆ-++-=t t tY X Y T (-3.193613) (6.433031) (2.365315)987125.02=R F=690.0561 DW=1.518595t t δμμδβδββδαα=-===**1*0*,1,, ,728324.0271676.011*1=-=-=βδ7381.20728324.010403.15*-=-==δαα,864.0728324.0629273.0*0===δββ∴局部调整模型估计结果为:tt X Y 864.07381.20ˆ*+-= 经济意义:该地区销售额每增加1亿元,未来预期最佳新增固定资产投资为0.846亿元采用德宾h 检验如下0:,0:10≠=ρρH H29728.1114858.0*21121)21.5185951()ˆ(1)21(2*1=--=--=βnVar n d h 在显著性水平05.0=α下,查标准正态分布表得临界值96.1025.02==h h α,因此拒绝原假设96.129728.1025.0=<=h h ,因此接受原假设,说明自回归模型不存在一阶自相关。

第七章课后习题

第七章课后习题7-1 利用蒸汽图表,填充下表空白:7-2 湿饱和蒸汽的0.95,1t h u s,再用x p MPa==,试利用水蒸气表求,,,sh-s图求上述参数。

解:利用饱和水和饱和水蒸气表:利用h-s图7-3 过程蒸汽的,试根据水蒸气表求,,,v h s u 和过热度,再用h-s 图求上述参数。

解:据水蒸气表,时、、利用 h-s 图。

7-4 已知水蒸气的压力0.5p MPa =、比体积30.35/v m kg =,问这是不是过热蒸汽?如果不是,那么是饱和蒸汽还是湿蒸汽?用水蒸气表求出其他参数。

解:利用水蒸气表时,,因所以该水蒸气不是过热蒸气而是饱和湿蒸汽。

据同一表查得:。

7-5 某锅炉每小时生产10 000kg 的蒸汽,蒸汽的表压力 1.9e p MPa = 、温度1350t C =︒。

设锅炉给水的温度240t C =︒,锅炉的效率0.78B η= ,煤的发热量(热值)42.9710/P Q KJ kg =⨯,求每小时锅炉的煤耗量是多少?锅炉内水的加热、汽化以及蒸汽的过热都在定压下进行。

锅炉效率 的定义为 B η=水和蒸汽所吸收的热量燃料燃烧时可提供的热量未被水和蒸汽吸收的热量是锅炉的热损失,其中主要是烟囱排烟带走的热能。

解:由查未饱和水和过热蒸汽表,得每生产 1kg 蒸汽需要吸入热量设每小时锅炉耗煤 mkg ,则7-6 1kg 113,450p MPa t C ==︒的蒸汽,可逆绝热膨胀至20.004p MPa =,试用h-s 图求终点状态参数2222,,,t v h s ,并求膨胀功w 和技术功t w 。

解:由 h-s 图查得:、、、。

膨胀功:技术功:7-7 1kg 、112,0.95p aMPa x ==的蒸汽,定温膨胀到21p MPa =,求终点状态参数2222,,,t v h s ,并求该过程中对蒸汽所加入的热量q 和过程中蒸汽对外界所作的膨胀功w. 解:由 h-s 图查得7-8 一台功率为20 000 KW 的汽轮机,其耗汽率61.3210/d kg J -=⨯。

计量经济学第七章第5,6,7题答案

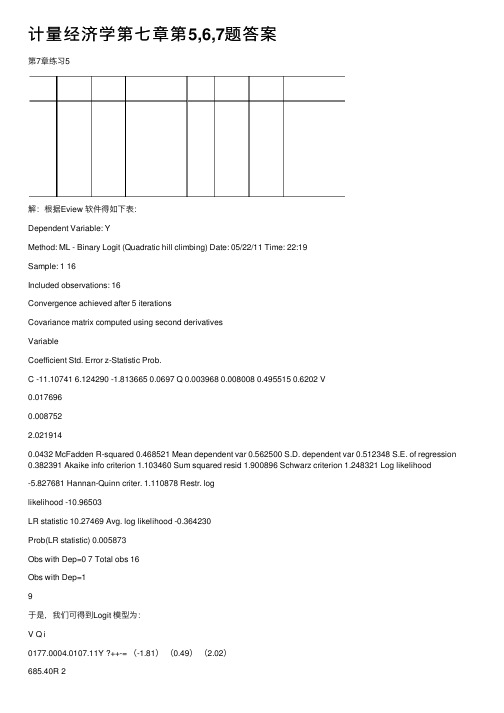

计量经济学第七章第5,6,7题答案第7章练习5解:根据Eview 软件得如下表:Dependent Variable: YMethod: ML - Binary Logit (Quadratic hill climbing) Date: 05/22/11 Time: 22:19Sample: 1 16Included observations: 16Convergence achieved after 5 iterationsCovariance matrix computed using second derivativesVariableCoefficient Std. Error z-Statistic Prob.C -11.10741 6.124290 -1.813665 0.0697 Q 0.003968 0.008008 0.495515 0.6202 V0.0176960.0087522.0219140.0432 McFadden R-squared 0.468521 Mean dependent var 0.562500 S.D. dependent var 0.512348 S.E. of regression 0.382391 Akaike info criterion 1.103460 Sum squared resid 1.900896 Schwarz criterion 1.248321 Log likelihood-5.827681 Hannan-Quinn criter. 1.110878 Restr. loglikelihood -10.96503LR statistic 10.27469 Avg. log likelihood -0.364230Prob(LR statistic) 0.005873Obs with Dep=0 7 Total obs 16Obs with Dep=19于是,我们可得到Logit 模型为:V Q i0177.0004.0107.11Y ?++-= (-1.81)(0.49)(2.02)685.40R 2MCF = , LR(2)=10.27如果在Binary estination 这⼀栏中选择Probit 估计⽅法,可得到如下表:Dependent Variable: YMethod: ML - Binary Probit (Quadratic hill climbing) Date: 05/22/11 Time: 22:25 Sample: 1 16Included observations: 16Convergence achieved after 5 iterationsCovariance matrix computed using second derivativesVariableCoefficient Std. Error z-Statistic Prob.C -6.634542 3.396882 -1.953127 0.0508 Q 0.002403 0.004585 0.524121 0.6002 V0.0105320.0046932.2442990.0248 McFadden R-squared 0.476272 Mean dependent var 0.562500 S.D. dependent var 0.512348 S.E. of regression 0.381655 Akaike info criterion 1.092836 Sum squared resid 1.893588 Schwarz criterion 1.237696 Log likelihood-5.742687 Hannan-Quinn criter. 1.100254 Restr. loglikelihood -10.96503LR statistic 10.44468 Avg. log likelihood -0.358918Prob(LR statistic) 0.005395Obs with Dep=0 7 Total obs 16Obs with Dep=19于是,我们可得到Probit 模型为:V Q i0105.00024.035.66Y ?++-= (-1.95)(0.52)(2.24)763.40R 2MCF = , LR(2)=10.44第7章练习6 下表列出了美国、加拿⼤、英国在1980~1999年的失业率Y 以及对制造业的补偿X 的相关数解:(1)根据Eview 软件操作得如下表:美国(US ):Dependent Variable: Y Method: Least Squares Date: 05/22/11 Time: 22:38 Sample: 1980 1999 Included observations: 20VariableCoefficientStd. Error t-Statistic Prob.C 10.56858 1.138982 9.278972 0.0000 X-0.0454030.012538-3.6211890.0020R-squared 0.421464 Mean dependent var 6.545000 Adjusted R-squared 0.389323 S.D. dependent var 1.432875 S.E. of regression 1.119732 Akaike infocriterion3.158696 Sum squared resid 22.56840 Schwarz criterion3.258269 Log likelihood -29.58696 Hannan-Quinncriter.3.178133 F-statistic 13.11301 Durbin-Watson stat 0.797022 Prob(F-statistic)0.001953根据上表可得对美国的OLS 估计结果为:tt X 0454.05686.10Y ?-= (9.28)(-3.62) 4215.02=R , 3893.02=R , D.W.=0.797, RSS=22.57加拿⼤(CA):Dependent Variable: Y Method: Least Squares Date: 05/22/11 Time: 22:43Sample: 1980 1999 Included observations: 20。

第七章练习题及参考解答(第四版)计量经济学

第七章练习题及参考解答7.1 表7.4中给出了1981-2015年中国城镇居民人均年消费支出(PCE)和城镇居民人均可支配收入(PDI)数据。

表7.4 1981-2015年中国城镇居民消费支出(PCE)和可支配收入(PDI)数据 (单位:元)估计下列模型:tt t t tt t PCE B PDI B B PCE PDI A A PCE υμ+++=++=-132121(1) 解释这两个回归模型的结果。

(2) 短期和长期边际消费倾向(MPC )是多少?分析该地区消费同收入的关系。

(3) 建立适当的分布滞后模型,用库伊克变换转换为库伊克模型后进行估计,并对估计结果进行分析判断。

【练习题7.1参考解答】(1) 解释这两个回归模型的结果。

Dependent Variable: PCE Method: Least Squares Date: 03/10/18 Time: 09:12 Sample: 1981 2005Variable Coefficient Std. Error t-Statistic Prob.C 149.0975 24.56734 6.068933 0.0000R-squared 0.998965 Mean dependent var 2983.768Adjusted R-squared 0.998920 S.D. dependent var 2364.412S.E. of regression 77.70773 Akaike info criterion 11.62040Sum squared resid 138885.3 Schwarz criterion 11.71791Log likelihood -143.2551 F-statistic 22196.24Durbin-Watson stat 0.531721 Prob(F-statistic) 0.000000收入跟消费间有显著关系。

计量经济学第七章第5,6,7题答案

第7章练习5在申请出国读学位的16名学生中有如下GRE数量与词汇分数。

解:根据Eview软件得如下表:Dependent Variable: YMethod: ML - Binary Logit (Quadratic hill climbing)Date: 05/22/11 Time: 22:19Sample: 1 16Included observations: 16Convergence achieved after 5 iterationsCovariance matrix computed using second derivativesVariable Coefficient Std. Error z-Statistic Prob.CQVMcFadden R-squared Mean dependent var. dependent var . of regression Akaike info criterion Sum squared resid Schwarz criterionLog likelihoodHannan-Quinn criter. Restr. loglikelihoodLR statistic Avg. log likelihoodProb(LR statistic)Obs with Dep=0 7 Total obs 16Obs with Dep=19于是,我们可得到Logit 模型为:V Q i0177.0004.0107.11Y ˆ++-= () () ()685.40R 2MCF = , LR(2)=如果在Binary estination 这一栏中选择Probit 估计方法,可得到如下表:Dependent Variable: YMethod: ML - Binary Probit (Quadratic hill climbing) Date: 05/22/11 Time: 22:25 Sample: 1 16Included observations: 16Convergence achieved after 5 iterationsCovariance matrix computed using second derivativesVariable Coefficient Std. Error z-Statistic Prob.C QVMcFadden R-squared Mean dependent var . dependent var . of regression Akaike info criterion Sum squared resid Schwarz criterionLog likelihoodHannan-Quinn criter. Restr. loglikelihoodLR statistic Avg. log likelihoodProb(LR statistic)Obs with Dep=0 7 Total obs 16Obs with Dep=19于是,我们可得到Probit 模型为:V Q i0105.00024.035.66Y ˆ++-= () () ()763.40R 2MCF = , LR(2)=第7章练习6下表列出了美国、加拿大、英国在1980~1999年的失业率Y 以及对制造业的补偿X 的相关数据资料。

计量经济学 卡特版课后第七章答案

CHAPTER 7Exercise Solutions141Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 142EXERCISE 7.1(a) When a GPA is increased by one unit, and other variables are held constant, averagestarting salary will increase by the amount $1643 ( 4.66t =, and the coefficient is significant at α = 0.001). Students who take econometrics will have a starting salary which is $5033 higher, on average, than the starting salary of those who did not take econometrics (11.03t =, and the coefficient is significant at α = 0.001). The intercept suggests the starting salary for someone with a zero GPA and who did not take econometrics is $24,200. However, this figure is likely to be unreliable since there would be no one with a zero GPA . The R 2 = 0.74 implies 74% of the variation of starting salary is explained by GPA and METRICS(b) A suitably modified equation is 1234SAL GPA METRICS FEMALE e =β+β+β+β+ Then, the parameter 4β is an intercept dummy variable that captures the effect of genderon starting salary, all else held constant.()()1231423if = 0if = 1GPA METRICSFEMALE E SAL GPA METRICS FEMALE β+β+β⎧⎪=⎨β+β+β+β⎪⎩(c) To see if the value of econometrics is the same for men and women, we change the modelto 12345SAL GPA METRICS FEMALE METRICS FEMALE e =β+β+β+β+β×+ Then, the parameter 4β is an intercept dummy variable that captures the effect of genderon starting salary, all else held constant. The parameter 5β is a slope dummy variable that captures any change in the slope for females, relative to males.()()()12314235if = 0if = 1GPA METRICSFEMALE E SAL GPA METRICS FEMALE β+β+β⎧⎪=⎨β+β+β+β+β⎪⎩Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 143EXERCISE 7.2(a) Considering each of the coefficients in turn, we have the following interpretations.Intercept : At the beginning of the time period over which observations were taken, on a day which is not Friday, Saturday or a holiday, and a day which has neither a full moon nor a half moon, the estimated average number of emergency room cases was 93.69.T : We estimate that the average number of emergency room cases has been increasing by 0.0338 per day, other factors held constant. This time trend has a t -value of 3.058 and a p -value = 0.0025 < 0.01.HOLIDAY : The average number of emergency room cases is estimated to go up by 13.86on holidays. The “holiday effect” is significant at the 0.05 level of significance. FRI and SAT : The average number of emergency room cases is estimated to go up by 6.9and 10.6 on Fridays and Saturdays, respectively. These estimated coefficients are both significant at the 0.01 level. FULLMOON : The average number of emergency room cases is estimated to go up by2.45 on days when there is a full moon. However, a null hypothesis stating that a full moon has no influence on the number of emergency room cases would not be rejected at any reasonable level of significance. NEWMOON : The average number of emergency room cases is estimated to go up by 6.4on days when there is a new moon. However, a null hypothesis stating that a new moon has no influence on the number of emergency room cases would not be rejected at the usual 10% level, or smaller. Therefore, hospitals should expect more calls on holidays, Fridays and Saturdays, and also should expect a steady increase over time.(b)There are very little changes in the remaining coefficients, or their standard errors, when FULLMOON and NEWMOON are omitted. The equation goodness-of-fit statistic decreases slightly, as expected when variables are omitted. Based on these casual observations the consequences of omitting FULLMOON and NEWMOON are negligible. (c) The null and alternative hypotheses are067:0H β=β= 167: or is nonzero.H ββThe test statistic is()2(2297)R U U SSE SSE F SSE −=−whereR SSE = 27424.19 is the sum of squared errors from the estimated equation with FULLMOON and NEWMOON omitted and U SSE = 27108.82 is the sum of squared errors from the estimated equation with these variables included. The calculated value of the F statistic is 1.29. The .05 critical value is (0.95,2,222) 3.307F =, and corresponding p -value is0.277. Thus, we do not reject the null hypothesis that new and full moons have no impact on the number of emergency room cases.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 144EXERCISE 7.3(a) The estimated coefficient of the price of alcohol suggests that, if the price of pure alcohol goes up by $1 per liter, the average number of days (out of 31) that alcohol is consumed will fall by 0.045.(b) The price elasticity at the means is given by24.780.0450.3203.49q pp q∂=−×=−∂(c) To compute this elasticity, we need q for married black males in the 21-30 age range. It is given by4.0990.04524.780.00005712425 1.6370.8070.0350.5803.97713q =−×+×+−+−=Thus, the price elasticity is24.780.0450.2803.97713q p p q ∂=−×=−∂ (d)The coefficient of income suggests that a $1 increase in income will increase the averagenumber of days on which alcohol is consumed by 0.000057. If income was measured in terms of thousand-dollar units, which would be a sensible thing to do, the estimated coefficient would change to 0.057.(e) The effect of GENDER suggests that, on average, males consume alcohol on 1.637 moredays than women. On average, married people consume alcohol on 0.807 less days than single people. Those in the 12-20 age range consume alcohol on 1.531 less days than those who are over 30. Those in the 21-30 age range consume alcohol on 0.035 more days than those who are over 30. This last estimate is not significantly different from zero, however. Thus, two age ranges instead of three (12-20 and an omitted category of more than 20), are likely to be adequate. Black and Hispanic individuals consume alcohol on 0.580 and 0.564 less days, respectively, than individuals from other races. Keeping in mind that the critical t -value is 1.960, all coefficients are significantly different from zero, except that for the dummy variable for the 21-30 age range.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 145EXERCISE 7.4(a) The estimated coefficient for SQFT suggests that an additional square foot of floor spacewill increase the price of the house by $72.79. The positive sign is as expected, and the estimated coefficient is significantly different from zero. The estimated coefficient for AGE implies the house price is $179 less for each year the house is older. The negative sign implies older houses cost less, other things being equal. The coefficient is significantly different from zero.(b) The estimated coefficients for the dummy variables are all negative and they becomeincreasingly negative as we move from D92 to D96. Thus, house prices have been steadily declining in Stockton over the period 1991-96, holding constant both the size and age of the house.(c) Including a dummy variable for 1991 would have introduced exact collinearity unless theintercept was omitted. Exact collinearity would cause least squares estimation to fail. The collinearity arises between the dummy variables and the constant term because the sum of the dummy variables equals 1; the value of the constant term.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 146EXERCISE 7.5(a)The estimated marginal response of yield to nitrogen is()()8.0112 1.9440.5677.444 3.888when 16.877 3.888when 26.310 3.888when 3E YIELD NITRO PHOS NITRO NITRO PHOS NITRO PHOS NITROPHOS ∂=−××−×∂=−==−==−=The effect of additional nitrogen on yield depends on both the level of nitrogen and the level of phosphorus. For a given level of phosphorus, marginal yield is positive for small values of NITRO but becomes negative if too much nitrogen is applied. The level of NITRO that achieves maximum yield for a given level of PHOS is obtained by setting the first derivative equal to zero. For example, when PHOS = 1 the maximum yield occurs when NITRO = 7.444/3.888 = 1.915. The larger the amount of phosphorus used, the smaller the amount of nitrogen required to attain the maximum yield. (b)The estimated marginal response of yield to phosphorous is()()4.80020.7780.5674.233 1.556when 13.666 1.556when 23.099 1.556when 3E YIELD PHOS NITRO PHOS PHOS NITRO PHOS NITRO PHOSNITRO ∂=−××−×∂=−==−==−= Comments similar to those made for part (a) are also relevant here.(c)(i) We want to test 0246:20H β+β+β= against the alternative 1246:20.H β+β+β≠The value of the test statistic is ()24624627.367se 2b b b t b b b ++===++At a 5% significance level, the critical t -value is c t ± where (0.975,21) 2.080c t t ==. Since t > 2.080 we reject the null hypothesis and conclude that the marginal product ofyield to nitrogen is not zero when NITRO = 1 and PHOS = 1.(ii) We want to test 0246:40H β+β+β= against the alternative 1246:40H β+β+β≠.The value of the test statistic is()2462464 1.660se 4b b b t b b b ++===−++Since |t| < 2.080 (0.975,21)t =, we do not reject the null hypothesis. A zero marginal yieldwith respect to nitrogen is compatible with the data when NITRO = 1 and PHOS = 2.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 147Exercise 7.5(c) (continued)(c)(iii) We want to test 0246:60H β+β+β= against the alternative 1246:60H β+β+β≠.The value of the test statistic is()24624668.742se 6b b b t b b b ++===−++Since |t| > 2.080 (0.975,21)t =, we reject the null hypothesis and conclude that themarginal product of yield to nitrogen is not zero when NITRO = 3 and PHOS = 1.(d) The maximizing levels NITRO ∗ and PHOS ∗ are those values for NITRO and PHOS suchthat the first-order partial derivatives are equal to zero.()()35620E YIELD PHOS NITRO PHOS ∗∗∂=β+β+β=∂()()24620E YIELD NITRO PHOS NITRO ∗∗∂=β+β+β=∂The solutions and their estimates are 253622645228.011(0.778) 4.800(0.567)1.7014(0.567)4( 1.944)(0.778)NITRO ∗ββ−ββ××−−×−===β−ββ−−×−−34262264522 4.800( 1.944)8.011(0.567)2.4654(0.567)4( 1.944)(0.778)PHOS ∗ββ−ββ××−−×−===β−ββ−−×−−The yield maximizing levels of fertilizer are not necessarily the optimal levels. Theoptimal levels are those where the marginal cost of the inputs is equal to the marginal value product of those inputs. Thus, the optimal levels are those for which()()PHOS PEANUTS E YIELD PRICE PHOS PRICE ∂=∂ and ()()NITROPEANUTSE YIELD PRICE NITRO PRICE ∂=∂Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 148EXERCISE 7.6(a) The model to estimate is()()112323ln +PRICE UTOWN SQFT SQFT UTOWN AGE POOL FPLACE e=β+δ+β+γ×β+δ+δ+The estimated equation, with standard errors in parentheses, isn ()()()()()()ln 4.46380.33340.035960.003428(se)0.02640.03590.001040.001414PRICE UTOWN SQFT SQFT UTOWN =++−×()()()20.0009040.018990.0065560.86190.0002180.005100.004140AGE POOL FPLACER −++=(b) In the log-linear functional form 12ln(),y x e =β+β+ we have21dy dx y=β or 2dydx y =β Thus, a 1 unit change in x leads to a percentage change in y equal to 2100×β.In this case2311PRICE UTOWNSQFT PRICE PRICE AGE PRICE∂=β+γ∂∂=β∂Using this result for the coefficients of SQFT and AGE , we find that an additional 100 square feet of floor space increases price by 3.6% for a house not in University town; a house which is a year older leads to a reduction in price of 0.0904%. Both estimated coefficients are significantly different from zero. (c) Using the results in Section 7.5.1a,()2ln()ln()100100%poolnopool PRICEPRICE PRICE −×=δ×≈Δan approximation of the percentage change in price due to the presence of a pool is 1.90%. Using the results in Section7.5.1b,()21001100pool nopool nopool PRICE PRICE e PRICE δ⎛⎞−×=−×⎜⎟⎜⎟⎝⎠the exact percentage change in price due to the presence of a pool is 1.92%.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 149Exercise 7.6 (continued)(d) From Section 7.5.1a,()3ln()ln()100100%fireplacenofireplace PRICEPRICE PRICE −×=δ×≈Δan approximation of the percentage change in price due to the presence of a fireplace is 0.66%.From Section 7.5.1b,()31001100fireplace nofireplace nofireplace PRICE PRICE e PRICE δ⎛⎞−×=−×⎜⎟⎜⎟⎝⎠the exact percentage change in price due to the presence of a fireplace is also 0.66%. (e)In this case the difference in log-prices is given by()n ()n ()2525ln ln 0.33340.003428250.33340.003428250.2477utown noutown SQFT SQFT PRICE PRICE UTOWN UTOWN ==−=−××=−×= and the percentage change in price attributable to being near the university, for a 2500square-feet home, is()0.2477110028.11%e−×=Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 150EXERCISE 7.7(a) The estimated equation isn ()()()()()()()2ln 8.9848 3.7463 1.1495 1.2880.4237 (se)0.64640.57650.44860.60530.1052 1.4313 0.84280.1562SAL1APR1APR2APR3DISP DISPAD R =−++++=(b) The estimates of2β, 3β and 4β are all significant and have the expected signs. The sign of 2β is negative, while the signs of the other two coefficients are positive. These signs imply that Brands 2 and 3 are substitutes for Brand 1. If the price of Brand 1 rises, then sales of Brand 1 will fall, but a price rise for Brand 2 or 3 will increase sales of Brand 1. Furthermore, with the log-linear function, the coefficients are interpreted as proportionalchanges in quantity from a 1-unit change in price. For example, a one-unit increase in the price of Brand 1 will lead to a 375% decline in sales; a one-unit increase in the price of Brand 2 will lead to a 115% increase in sales. These percentages are large because prices are measured in dollar units. If we wish toconsider a 1 cent change in price – a change more realistic than a 1-dollar change – then the percentages 375 and 115 become 3.75% and 1.15%, respectively. (c) There are three situations that are of interest. (i) No display and no advertisement{}11234exp SAL1APR1APR2APR3Q =β+β+β+β=(ii) A display but no advertisement{}{}2123455exp exp SAL1APR1APR2APR3Q =β+β+β+β+β=β(iii) A display and an advertisement{}{}3123466exp exp SAL1APR1APR2APR3Q =β+β+β+β+β=βThe estimated percentage increase in sales from a display but no advertisement isn n n 210.423751exp{}100100(1)10052.8%Q b Q SAL1SAL1e Q SAL1−−×=×=−×=Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 151Exercise 7.7(c) (continued)(c) The estimated percentage increase in sales from a display and an advertisement isn n n 311.431361exp{}100100(1)100318%Q b Q SAL1SAL1e Q SAL1−−×=×=−×=The signs and relative magnitudes of 5b and 6b lead to results consistent with economiclogic. A display increases sales; a display and an advertisement increase sales by an even larger amount.(d) The results of these tests appear in the table below.Part 0H Test Value Degrees of Freedom 5% Critical ValueDecision(i) β5 = 0 t = 4.03 46 2.01 Reject H 0 (ii) β6 = 0 t = 9.17 46 2.01 Reject H 0 (iii) β5 = β6 = 0 F = 42.0 (2,46) 3.20 Reject H 0 (iv)β6 ≤ β5t = 6.8646 1.68 Reject H 0(e) The test results suggest that both a store display and a newspaper advertisement will increase sales, and that both forms of advertising will increase sales by more than a store display by itself.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 152EXERCISE 7.8(a) The estimated equation, with standard errors in parentheses, isn 215.45970.2698 2.35820.4391(se) (0.2537)(0.0868)(0.2629)PRICEAGE NET R =+−=All estimated coefficients are significantly different from zero. The intercept suggests thatthe average price of CDs that have a 1999 copyright and are not sold on the internet is $15.46. For every year the copyright date is earlier than 1999, the price increases by 27 cents. For CDs sold through the internet, the price is $2.36 cheaper. The positive coefficient of AGE supports Mixon and Ressler’s hypothesis. (b) The estimated equation, with standard errors in parentheses, isn 215.52880.7885 2.35690.4380(se) (0.2424)(0.2567) (0.2632)PRICEOLD NET R =+−=Again, all estimated coefficients are significantly different from zero. They suggest thatthe average price of new releases, not sold on the internet, is $15.53. If the CD is not a new release, the price is 79 cents higher. If it is purchased over the internet, the price is $2.36 less. The positive coefficient of OLD supports Mixon and Ressler’s hypothesis.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 153EXERCISE 7.9The estimated coefficients and their standard errors (in parenthesis) for the various parts ofthis question are given in the following table.Variable (a) (b) (c) (f) (g) Constant (β1) 128.98* 342.88* 161.47 109.72 98.48(34.59) (72.34) (120.7) (135.6) (179.1)2()AGE β −7.5756* −2.9774 −2.0383 −1.7200 (2.317) (3.352) (3.542) (4.842) 3()INC β 1.4577* 2.3822* 9.0739* 18.325 22.104(0.5974) (0.6036) (3.670) (11.49) (40.26)4()AGE INC ×β −0.1602 −0.6115 −0.9087 (0.0867) (0.5381) (3.079)25()AGE INC ×β 0.0055 0.0131 (0.0064) (0.0784)36()AGE INC ×β −0.000065 (0.000663) SSE 819286 635637 580609 568869 568708 N K − 38 37 36 35 34* indicates a t -value greater than 2.(a) See table.(b) The signs of the estimated coefficients suggest that pizza consumption responds positivelyto income and negatively to age, as we would expect. All estimated coefficients are greater than twice their standard errors, indicating they are significantly different from zero using one or two-tailed tests. We note that scaling the income variable (dividing by 1000) has increased the coefficient 1000 times. (c) To comment on the signs we need to consider the marginal effects()()24E PIZZA INC AGE ∂=β+β∂()34E PIZZA AGE INC∂=β+β∂We expect β3 > 0 and β4 < 0 implying that the response of pizza consumption to incomewill be positive, but that it will decline with age. The estimates agree with these expectations. Negative signs for b 2 and b 4 imply that, as someone ages, his or her pizza consumption will decline, and the decline will be greater the higher the level of income.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 154Exercise 7.9(c) (continued)(c) The t value for the age-income interaction variable is t = −0.1602/0.0867 = −1.847.Critical values for a 5% significance level and one and two-tailed tests are, respectively, (0.05,36) 1.688t =− and (0.025,36) 2.028t =−. Thus, if we use the prior information β4 < 0, thenwe find the interaction coefficient is significant. However, if a two-tailed test is employed, the estimated coefficient is not significant. The coefficients of INC and (INC × AGE ) have increased 1000 times due to the effects of scaling.(d) The hypotheses areH 0: β2 = β4 = 0andH 1: β2 ≠ 0 and/or β4 ≠ 0The value of the F statistic under the assumption that H 0 is true is()()()81928658060927.4058060936R U U SSE SSE J F SSE T -K −−===The 5% critical value for (2, 36) degrees of freedom is F c = 3.26 and the p -value of the testis 0.002. Thus, we reject H 0 and conclude that age does affect pizza expenditure. (e) The marginal propensity to spend on pizza is given by()34E PIZZA AGE INC∂=β+β∂Point estimates, standard errors and 95% interval estimates for this quantity, for different ages, are given in the following table.Point Standard Confidence Interval AgeEstimate Error Lower Upper20 5.870 1.977 1.861 9.878 30 4.268 1.176 1.882 6.653 40 2.665 0.605 1.439 3.892 50 1.063 0.923 −0.8092.935The interval estimates were calculated using (0.975,36) 2.0281c t t ==. As an example of how the standard errors were calculated, consider age 30. We have()n ()n ()n ()n ()23434344var 30var 30var 230cov ,13.4669000.0075228600.31421 1.38392se 30 1.1763b b b b b b b b +=++×=+×−×=+==The corresponding interval estimate is4.268 ± 2.028 × 1.176 = (1.882, 6.653)Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 155Exercise 7.9(e) (continued)(e)The point estimates for the marginal propensity to spend on pizza decline as age increases, as we would expect. However, the confidence intervals are relatively wide indicating that our information on the marginal propensities is not very reliable. Indeed, all the confidence intervals do overlap. (f) This model is given by212345+PIZZA INC AGE AGE INC AGE INC e =ββ+β+β×+β×+The marginal effect of income is now given by()2245+E PIZZA AGE AGE INC∂=β+ββ∂If this marginal effect is to increase with age, up to a point, and then decline, then β5 < 0. The sign of the estimated coefficient b 5 = 0.0055 did not agree with this anticipation. However, with a t value of t = 0.0055/0.0064 = 0.86, it is not significantly different from zero.(g)Two ways to check for collinearity are (i) to examine the simple correlations between each pair of variables in the regression, and (ii) to examine the R 2 values from auxiliary regressions where each explanatory variable is regressed on all other explanatory variables in the equation. In the tables below there are 3 simple correlations greater than 0.94 in part (f) and 5 in part (g). The number of auxiliary regressions with R 2s greater than 0.99 is 3 for part (f) and 4 for part (g). Thus, collinearity is potentially a problem. Examining the estimates and their standard errors confirms this fact. In both cases there are no t -values which are greater than 2 and hence no coefficients are significantly different from zero. None of the coefficients are reliably estimated. In general, including squared and cubed variables can lead to collinearity if there is inadequate variation in a variable.Simple CorrelationsAGE AGE INC ×2AGE INC × 3AGE INC ×INC 0.4685 0.9812 0.9436 0.8975 AGE0.5862 0.6504 0.6887 AGE INC × 0.9893 0.9636 2AGE INC ×0.9921R 2 Values from Auxiliary RegressionsLHS variableR 2 in part (f) R 2 in part (g)INC0.99796 0.99983 AGE0.68400 0.82598 AGE INC × 0.99956 0.99999 2AGE INC × 0.99859 0.999993AGE INC × 0.99994Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 156EXERCISE 7.10(a) The estimated equation with gender (FEMALE ) included, and with standard errors written in parentheses, isn ()()()()461.86408.18280.0024190.2581 (se)51.3441 1.55010.000427.7681PIZZA AGE INCOME FEMALE =−+−The t -value for gender is 190.258127.7681 6.8517t =−=− indicating that it is a relevantexplanatory variable. Including it in the model has led to substantial changes in the coefficients of the remaining variables.(b) When level of educational attainment is included the estimated model, with the standarderrors in parentheses, becomesn ()()()()317.38988.30140.002990.7944 (se)83.3909 2.32630.000757.8402PIZZAAGE INCOME HS =−++()()1.680273.204762.662192.0859COLLEGE GRAD−−None of the dummy variable coefficients are significant, casting doubt on the relevance of education as an explanatory variable. Also, including the education dummies has had little impact on the remaining coefficient estimates. To confirm the lack of evidence supporting the inclusion of education, we need to use an F test to jointly test whether the coefficients of HS, COLLEGE and GRAD are all zero. The value of this statistic is()()()63563753944632.020*********R U U SSE SSE J F SSE N K −−===−The 5% critical value for (3, 34) degrees of freedom is F c = 3.05; the p -value is 0.13. Wecannot conclude that level of educational attainment influences pizza consumption. (c) To test this hypothesis we estimate a model where the dummy variable gender (FEMALE ) interacts with every other variable in the equation. The estimated equation, with standard errors in parentheses, isn ()()()()451.36059.36320.0036208.3393 (se)63.9450 1.91550.000796.5078PIZZA AGE INCOME FEMALE =−+−()()2.83370.00183.08710.0008AGE×FEMALE INCOME×FEMALE−Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 157Exercise 7.10(c) (continued)(c)To test the hypothesis that the regression equations for males and females are identical, we test jointly whether the coefficients of FEMALE , AGE ×FEMALE , INCOME ×FEMALE are all zero. Note that individual t tests on each of these coefficients do not suggest gender is relevant. However, when we take all variables together, the F value for jointly testing their coefficients is()()()635636.7244466.5318.1344244466.534R U U SSE SSE J F SSE N K −−===−This value is greater than F c = 2.866 which is the 5% critical value for (3, 36) degrees offreedom. The p -value is 0.0000. Thus, we reject the null hypothesis that males and females have identical pizza expenditure equations. This result implies different equations should be used to model pizza expenditure for males, and that for females. It does not say how the equations differ. For example, all their coefficients could be different, or simply modelling different intercepts might be adequate.Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 158EXERCISE 7.11(a) The estimated result, with standard errors in parentheses, isn ()()()()161.4654 2.97740.009070.00016(se)120.6634 3.35210.003670.0000867PIZZA AGE INCOME INCOME×AGE =−+−This is identical to the result reported in 7.4.(b) From the sample we obtain average age = 33.475 and average income = 42,925. Thus, the required marginal effect of income isn ()0.009070.0001633.4750.00371E PIZZA INCOME∂=−×=∂Using computer software, we find the standard error of this estimate to be 0.000927, and the t value for testing whether the marginal effect is significantly different from zero is t =0.003710.000927 4.00=. The corresponding p -value is 0.0003 leading us to conclude that the marginal income effect is statistically significant at a 1% level of significance.(c) A 95% interval estimate for the marginal income effect is given by0.00371 ± 2.0281 × 0.000927 = (0.00183, 0.00559)(d) The marginal effect of age for an individual of average income is given byn ()()E PIZZA AGE ∂∂= −2.9774 − 0.00016INCOME = −2.9774 − 0.00016 × 42,925 = −9.854 Using computer software, we find the standard error of this estimate to be 2.5616, and thet value for testing whether the marginal effect is significantly different from zero is 9.8542.5616 3.85t =−=−The p -value of the test is 0.0005, implying that the marginal age effect is significantlydifferent from zero at a 1% level of significance. (e) A 95% interval estimate for the marginal age effect is given by −9.854 ± 2.0281 × 2.5616 = (−15.05, −4.66)Chapter 7, Exercise Solutions, Principles of Econometrics, 3e 159Exercise 7.11 (continued)(f)Important pieces of information for Gutbusters are the responses of pizza consumption to age and income. It is helpful to know the demand for pizzas in young and old communities and in high and low income areas. A good starting point in an investigation of this kind is to evaluate the responses at average age and average income. Such an evaluation will indicate whether there are noticeable responses, and, if so, give some idea of their magnitudes. The two responses are estimated asn ()E PIZZA INCOME ∂∂ = 0.0037n ()()E PIZZA AGE ∂∂ = −9.85Both these estimates are significantly different from zero at a 1% level of significance. They suggest that increasing income will increase pizza consumption, but, as a community ages, its demand for pizza declines. Interval estimates give an indication of the reliability of the estimated responses. In this context, we estimate that the income response lies between 0.0018 and 0.0056, while the age response lies between −15.05 and −4.66.。

计量经济学第七章答案

练习题7.1参考解答(1)先用第一个模型回归,结果如下:22216.4269 1.008106 t=(-6.619723) (67.0592)R 0.996455 R 0.996233 DW=1.366654 F=4496.936PCE PDI =-+==利用第二个模型进行回归,结果如下:122233.27360.9823820.037158 t=(-5.120436) (6.970817) (0.257997)R 0.996542 R 0.996048 DW=1.570195 F=2017.064t t t PCE PDI PCE -=-++==(2)从模型一得到MPC=1.008106;从模型二得到,短期MPC=0.982382,长期MPC=0.982382+(0.037158)=1.01954练习题7.2参考答案(1)在局部调整假定下,先估计如下形式的一阶自回归模型:*1*1*0*t t t t u Y X Y +++=-ββα估计结果如下:122ˆ15.104030.6292730.271676 se=(4.72945) (0.097819) (0.114858)t= (-3.193613) (6.433031) (2.365315)R =0.987125 R =0.985695 F=690.0561 DW=1.518595t t t Y X Y -=-++根据局部调整模型的参数关系,有****1 1 t tu u αδαβδββδδ===-=将上述估计结果代入得到:*1110.2716760.728324δβ=-=-=*20.738064ααδ==-*0.864001ββδ==故局部调整模型估计结果为:*ˆ20.7380640.864001t tY X =-+经济意义解释:该地区销售额每增加1亿元,未来预期最佳新增固定资产投资为0.864001亿元。

运用德宾h检验一阶自相关:(121(1 1.34022d h =-=-⨯=在显著性水平05.0=α上,查标准正态分布表得临界值,由于,则接收21.96h α=21.3402 1.96h h α=<=原假设0=ρ,说明自回归模型不存在一阶自相关。

第七章课后习题答案

第七章课后习题答案问题1:请简述第七章中讨论的主要概念。

答案:第七章主要讨论了[具体概念],它涉及到[概念的详细解释]。

此概念在[相关领域或情境]中具有重要意义,因为它[解释了什么或如何应用]。

问题2:如何计算[特定数学公式或计算过程]?答案:要计算[特定数学公式或计算过程],首先需要确定所有必要的变量。

然后,按照以下步骤进行计算:1. [第一步计算过程]2. [第二步计算过程]3. [以此类推,直至最终结果]问题3:分析[案例研究或实际情境],并讨论其对[相关概念]的影响。

答案:在[案例研究或实际情境]中,我们可以看到[相关概念]的应用。

具体来说,[案例或情境描述]展示了[概念如何影响结果]。

通过这个案例,我们可以更好地理解[概念]在实际生活中的应用和重要性。

问题4:解释[特定术语或理论],并给出一个例子。

答案: [特定术语或理论]是指[术语或理论的定义]。

例如,在[相关领域]中,[术语或理论]可以用来[具体应用或解释]。

一个具体的例子是[例子描述],它清楚地展示了[术语或理论]的实际应用。

问题5: [选择题或判断题]。

答案: [正确答案]。

这个问题的答案是[正确答案],因为[解释为什么这是正确答案]。

总结:第七章的习题涵盖了对[章节主题]的深入理解,包括理论概念、实际应用和计算技能。

通过解答这些问题,学生可以更好地掌握章节内容,并将其应用于解决实际问题。

请注意,以上内容仅为模板,具体答案需要根据实际的章节内容和习题进行定制。

如果需要针对特定章节的具体习题答案,请提供相关章节的详细内容和习题,以便我能够提供更准确的答案。

第七章单方程计量经济学应用模型

第七章单方程计量经济学应用模型一、内容题要本章要紧介绍了假设干种单方程计量经济学模型的应用模型。

包括生产函数模型、需求函数模型、消费函数模型以及投资函数模型、货币需求函数模型等经济学领域常见的函数模型。

本章所列举的内容更多得关注了相关函数模型自身的开展状况,而不是计量模型估量本身。

其目的,是使学习者了解各函数模型是如何开展而来的,即掌握建立与开展计量经济学应用模型的方法论。

生产函数模型,首先介绍生产函数的几个全然咨询题,包括它的定义、特征、开展历程等,并对要素的替代弹性、技术进步的相概念进行了回纳。

然后分不以要素之间替代性质的描述为线索与以技术要素的描述这线索介绍了生产函数模型的开展,前者包括从线性生产函数、C-D生产函数、不变替代弹性〔CES〕生产函数、变替代弹性〔VES〕生产函数、多要素生产函数到超越对数生产函数的介绍;后者包括对技术要素作为一个不变参数的生产函数模型、革新的C-D、CES生产函数模型、含表达型技术进步的生产函数模型、边界生产函数模型的介绍。

最后对各种类型的生产函数的估量以及在技术进步分析中的应用进行了了讨论。

与生产函数模型相仿,需求函数模型仍是从全然概念、全然特性、各种需求函数的类型及其估量方法等方面进行讨论,尤其是对线性支出系统需求函数模型的开展及其估量咨询题进行了较具体的讨论。

消费函数模型局部,要紧介绍了几个重要的消费函数模型及其参数估量咨询题,包括尽对收进假设消费函数模型、相对收进假设消费函数模型、生命周期假设消费函数模型、持久收进假设消费函数模型、合理预期的消费函数模型习惯预期的消费函数模型。

并对消费函数的一般形式进行了讨论。

在其他常用的单方程应用模型中要紧介绍了投资函数模型与货币需求函数模型,前者要紧讨论了加速模型、利润决定的投资函数模型、新古典投资函数模型;后者要紧讨论了古典货币学讲需求函数模型、Keynes货币学讲需求函数模型、现代货币主义的货币需求函数模型、后Keynes货币学讲需求函数模型等。

本科计量第七版习题参考答案

第六章动态经济模型:自回归模型和分布滞后模型6.1 (1)错。

(2)对。

(3)错。

估计量既不是无偏的,又不是一致的。

(4)对。

(5)错。

将产生一致估计量,但是在小样本情况下,得到的估计量是有偏的。

(6)对。

6.2对于科克模型和适应预期模型,应用OLS法不仅得不到无偏估计量,而且也得不到一致估计量。

但是,部分调整模型不同,用OLS法直接估计部分调整模型,将产生一致估计值,虽然估计值通常是有偏的(在小样本情况下)。

6.3科克方法简单地假定解释变量的各滞后值的系数(有时称为权数)按几何级数递减,即:Yt=α+βXt÷β λ Xt-ι ÷β λ2χt.2 +...+ ut其中O<λ<l0这实际上是假设无限滞后分布,由于0<入<1, X的逐次滞后值对Y的影响是逐渐递减的。

而阿尔蒙方法的基本假设是,如果Y依赖于X的现期值和若干期滞后值, 则权数由一个多项式分布给出。

由于这个原因,阿尔蒙滞后也称为多项式分布滞后。

即在分布滞后模型工=α + β0X t + B1X—+∙∙∙ ++ %中,假定:βi =tz0 +tz1z + a2i2 H ------ F a p i p其中P为多项式的阶数。

也就是用一个P阶多项式来拟合分布滞后,该多项式曲线通过滞后分布的所有点。

6.4(1)估计的Y值是非随机变量X1和X2的线性函数,与扰动项v无关。

(2)与利维顿方法相比,本方法造成多重共线性的风险要小一些。

6.5(1)M∣= aγxγ2+ βλγλY t-∕3lχl(l-χ2)Y l.l+ β2γ2R t-β2r2(1 -∕1)R t.l ÷(2 - ∕l—χ2)μt-∖-(1-∕ι )(1-Yι)M t_2÷[u t—(2 —∕1-χ2)〃1 ÷(I -∕ι )(1-Yz )u t-21 其中&)是a、为和72的函数。

(2)第(1)问中得到的模型高度参数非线性,它的参数需采用非线性回归技术来估计。

计量经济学(山东财经大学)智慧树知到课后章节答案2023年下山东财经大学

计量经济学(山东财经大学)智慧树知到课后章节答案2023年下山东财经大学山东财经大学第一章测试1.计量经济学是以下哪些学科相结合的综合性学科答案:任意角度;统计学;经济学2.一个计量经济模型由以下哪些部分构成答案:方程式;随机误差项;参数;变量3.与其他经济模型相比,计量经济模型有如下特点答案:动态性;经验性;随机性4.一个计量经济模型中,可作为解释变量的有答案:控制变量;内生变量;滞后变量;联合收获型;外生变量5.计量经济模型的应用在于答案:经济预测;检验和发展经济理论;结构分析;政策评价第二章测试1.一般地,仅改变自变量自身的度量单位,不会影响截距估计值。

()答案:对2.在线性模型中,被解释变量和解释变量必须为线性形式。

()答案:错3.女性受教育程度(educ)对生育率(kids)影响的回归方程为,其中为误差项。

年龄、收入、家庭背景都可能包含在误差项中,但它们必须与受教育程度无关。

()答案:错4.属于线性回归。

()答案:对5.自变量可以为相同的常数。

()答案:错第三章测试1.过原点回归OLS残差的样本平均值为0。

答案:错2.在多元回归中,没有一个自变量是常数,自变量间也不存在严格的线性关系。

答案:对3.在多元回归中,即使模型存在完全共线性问题,依旧可以运用OLS进行估计。

答案:错4.如果多元回归分析中包含了一个或多个无关变量,并不会影响到OLS估计的无偏性。

答案:对5.误差方差越大意味着方程中的“噪音”越多,对于给定的因变量y,可以通过在方程中增加更多的解释变量,来减少误差方差。

答案:对第四章测试1.Which of the following is a statistic that can be used to test hypotheses abouta single population parameter?答案:t statistic2.Which of the following statements is true of confdence intervals?答案:Confidence intervals in a CLM provide a range of likely values for thepopulation parameter3.Which of the following statements is true of hypothesis testing?答案:A restricted model will always have fewer parameters than itsunrestricted model4.Which of the following correctly identifies a reason why some authors preferto report the standard errors rather than the t statistic?答案:Having standard errors makes it easier to compute confdence intervals.5.Which of the following statements is true?答案:The F statistic is always nonnegative as SSRr is never smaller thanSSRur.6.If the calculated value of the t statistic is greater than the critical value, thenull hypothesis, H0 is rejected in favor of the alternative hypothesis, H1.答案:对第五章测试1.In the following equation, gdp refers to gross domestic product, and FDI refers to foreign direct investment.( )log(gdp) = 2.65 + 0.527log(bankcredit ) + 0.222FDI(0.13) (0.022) (0.017)Which of the following statements is then true?答案:If bank credit increases by 1%, gdp increases by 0.527%, the level of FDI remaining constant.2.In the following equation, gdp refers to gross domestic product, and FDI refers to foreign direct investment ( )log(gdp) = 2.65 + 0.527log(bankcredit ) + 0.222FDI(0.13) (0.022) (0.017)Which of the following statements is then true?答案:If FDI increases by 1%, gdp increases by approximately 24.8%, the amount of bank credit remaining constant.3.Which of the following correctly represents the equation for adjusted R2? ( )答案:.4.在多元回归中,调整后的决定系数与决定系数的关系为()答案:5.If a new independent variable is added to a regression equation, the adjustedR2 increases only if the absolute value of the t statistic of the new variable isgreater than one. ( )答案:对第六章测试1.在本身是离散的情况下,把虚拟变量加入回归方程,对于在平均意义下解释回归变量没有影响。

油品计量课后习题答案

《油品计量基础》习题集第一章概述一、填空题1.计量是“实现单位统一,量值准确可靠的活动。

”2.我国的计量,远在秦始皇称霸的时代,称之为“度量衡”,其量的单位仅为长度、容量和重量,所用的主要器具是尺、斗、秤。

3.《中华人民共和国计量法》规定:“国家采用国际单位制。

国际单位制计量单位和国家选定的其他计量单位,为国家法定计量单位”。

4.确定被测量的量值是计量的目的,最终是为了社会需求。

5.计量的特性为:准确性、一致性、溯源性、法制性。

6.测量是“以确定量值为目的的一组操作”。

二、判断题(在括号内答案正确的打√,答案错误的打×)1.计量是可数的量。

(×)2.长度、温度、时间都是一般的量。

测得某汽油30℃的密度是0.7300g/cm3则是具体的量。

(√)3.在线测量一般均属于静态测量。

(×)三、选择题(将正确答案的符号填在括号内)1.计量是“实现单位统一,量值准确可靠的活动。

”其活动指:(A C D)A.科学技术上的B.上层建筑上的C.行政管理上的D.法律法规上的2.计量:(A B F)A.计量是一门科学B.计量属于测量C.计量不通过计量器具可以统计出物体及现象的数据D.计量就是计量学F.在菜市场买菜过秤过程就是计量过程四、问答题1.什么是量、计量和测量?答:“量是现象、物体或物质可定性区别和定量确定的一种属性”。

计量是“实现单位统一、量值准确可靠的活动”。

测量是“以确定量值为目的的一组操作”。

2.计量包括哪些方面的内容?在科学技术上它属于什么范畴?它有那些特点?答:计量的内容在不断地扩展和充实,通常可概括为6个方面:计量单位和单位制;计量器具(或测量仪器),包括实现或复现计量单位和计量基准、标准与工作计量器具;量值传递与量值溯源,包括检定、校准、测试、检验与检测;物理常量、材料与物质特性的测定;不确定度、数据处理与测量理论及其方法;计量管理,包括计量保证与计量监督等。

在科学技术上计量属于测量的范畴。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

习题解释概念(1)分类变量 (2)定量变量 (3)虚拟变量 ( 4)虚拟变量陷阱 (5)交互项(6)结构不稳定 (7)经季节调整后的时间序列答:(1)分类变量:在回归模型中,我们对具有某种特征或条件的情形赋值1,不具有某种特征或条件的情形赋值0,这样便定义了一个变量D :1,0,D ⎧=⎨⎩具有某种特征不具有某种特征我们称这样的变量为分类变量。

(2)具有数值特征的变量,如工资、工作年数、受教育年数等,这些变量就称为定量变量。

(3)在回归模型中,我们对具有某种特征或条件的情形赋值1,不具有某种特征或条件的情形赋值0,这样便定义了一个变量D :1,0,D ⎧=⎨⎩具有某种特征不具有某种特征我们称这样的变量为虚拟变量(dummy variable )。

(4)虚拟变量陷阱是指回归方程包含了所有类别(特征)对应的虚拟变量以及截距项,从而导致了完全共线性问题。

(5)交互项是指虚拟变量与定量变量相乘,或者两个定量变量相乘或是两个虚拟变量相乘,甚至更复杂的形式。

比如模型:12345i i i i i i i household lwage female married female married u βββββ=++++⋅+female married ⋅就是交互项。

(6)如果利用不同的样本数据估计同一形式的计量模型,可能会得到1β、2β不同的估计结果。

如果估计的参数之间存在着显著性差异,就称为模型结构不稳定。

(7)一些重要的经济时间序列,如果是受到季节性因素影响的数据,利用季节虚拟变量或者其他方法将其中的季节成分去除,这一过程被称为经季节调整的时间序列。

如果你有连续几年的月度数据,为检验以下假设,需要引入多少个虚拟变量如何设定这些虚拟变量(1)一年中的每一个月份都表现出受季节因素影响;(2)只有2、7、8月表现出受季节因素影响。

答:(1)对于一年中的每个月份都受季节因素影响这一假设,需要引入三个虚拟变量。

分别定义2D 、3D 、4D 如下:21,0,D ⎧=⎨⎩如果为夏季如果不为夏季 31,0,D ⎧=⎨⎩如果为秋季如果不为秋季 41,0,D ⎧=⎨⎩如果为冬季如果不为冬季(2)如果只有2、7、8月表现出受季节因素影响,则只需要引入一个虚拟变量。

定义2D 如下:21,0,D ⎧=⎨⎩如果受季节因素影响如果不受季节因素影响一个家庭的消费支出除了受收入水平的影响之外,还与子女的年龄结构密切相关。

如果家庭中有学龄子女,大笔开支会用在教育费用上。

分析家庭的收入水平对消费支出的影响,并引入适当的虚拟变量,检验家庭中有学龄子女对家庭的消费支出是否产生了影响。

分别考虑只影响截距;只影响斜率;二者都有影响的情形。

答:设当不考虑学龄时消费支出和收入水平的模型为:12income age u ββ=+⨯+引入虚拟变量110A ⎧=⎨⎩,有学龄子女,无学龄子女, 当只影响截距时,模型为:1231income age A u βββ=+++当只影响斜率时,模型为:1231income age age A u βββ=++⨯+如果既影响截距又影响斜率时,模型设定为:123141+age+income A age A ββββ=+⨯使用夏季作为参照季节,对例重新进行分析。

答:我们选择夏季为参照季节,分别定义1D 、3D 、4D 如下:11,0,D ⎧=⎨⎩如果为春季如果不为春季31,0,D ⎧=⎨⎩如果为秋季如果不为秋季 41,0,D ⎧=⎨⎩如果为冬季如果不为冬季设定模型为 12314354t t t t t t sale income D D D u βββββ=+++++其中夏季销售量方程的截距项为1β。

回归结果为:13429.490.20 5.640.008 5.28 (9.23) (32.15) (10.84) (0.01) (5.28) 0.973t t t t tsale income D D D t R =++-+=-=从回归结果中可以看出,如果个人可支配收入不变,第一季度的平均销售量比第二季度多,而且具有统计显著性,第三季度的平均销售量比第二季度少,而且不具有统计显著性,第四季度的平均销售量比第一季度的多,而且具有统计显著性。

可以看出气温影响了滑雪器具的销售,一季度、四季度的销售方程没有明显差别,这两个季度都是寒冷的季节,是滑雪器具销售的旺季。

二季度、三季度较为温暖,是滑雪器具销售的淡季,销售量明显少于一、四季度。

我们不再定义三个虚拟变量而是只区别旺季和淡季,重新对例进行估计。

答:如果只区分淡季和旺季,则只需要添加一个虚拟变量,定义虚拟变量:11,0,S ⎧=⎨⎩如果为旺季如果不为淡季设定模型为:1231t t t sale income S u βββ=+++估计回归模型可得:129.540.20 5.46 (9.79) (32.91) (15.19) 0.972t t sale income S t R =++==从显著性可以看出虚拟变量的系数是显著的,说明平均销售量和季节是有关系的。

假设Y 为某年美国汽油的消费量,解释变量为价格(price )和收入(income )。

1970~2000年间有三段时间汽油价格急剧上涨,导致了汽油消费行为模式的改变。

第1阶段开始于1974年,在OPEC (石油输出国组织)决定控制世界石油价格之后;第2阶段开始于1979年,在伊朗发生革命后不久;最一个阶段发生在1990年,正值伊朗入侵科威特。

我们有理由认为石油消费的价格弹性和收入弹性在这些阶段是不同的。

设基本模型为123ln ln ln i i i i Y price income u βββ=+++(1)如果各阶段的截距都相同,描述如何构建模型来检验不同的阶段石油消费行为是否发生了结构变化。

(2)如果收入弹性在三个阶段都不变,描述如何构建模型来检验不同的阶段石油消费行为是否发生了结构变化。

(3)如果三个阶段石油消费函数的截距项、石油消费的价格弹性和收入弹性可能都发生了变化,描述如何对其进行检验。

答:(1)引入虚拟变量:110D ⎧=⎨⎩,第二阶段,其他,21D ⎧=⎨⎩,第三阶段0,其他构建模型:1234152ln ln ln i i i i Y price income D D u βββββ=+++++(2)构建模型:1234152ln ln ln ln ln i i i i i i Y price income D income D income u βββββ=+++⨯+⨯+(3)构建模型:123415261728192ln ln ln ln ln ln ln i i i i i i i iY price income D income D income D D D price D price u βββββββββ=+++⨯+⨯+++⨯+⨯+计算机习题DATA7-5给出了未经季节调整的饰品、玩具和游戏的零售季度数据(1992年第一季度~2008年第二季度):考虑下面的模型:。

1223344t t t t t sales B B D B D B D u =++++其中,D 2=1:第二季度,0:其他;D 3=1:第三季度,0:其他;D 4=1:第四季度,0:其他;(1)估计上述回归。

(2)解释各个系数的含义。

(3)给出回归结果符合逻辑的解释。

(4)如何利用估计的回归结果消除季节模式答:(1)回归模型得:2342930.4158.6757.611338.11 (21.60) (0.96) (0.93) (21.63) 0.913t t t tsales D D D t R =+++==(2)1B 表示的是第一季度的零售额,2B 表示的是第二季度相比较第一季度的零售额增加量,3B 表示的是第三季度相比较于第一季度的零售额增加量,4B 表示的是第四季度相比较于第一季度的零售额增加量。

(3)从回归结果中可以看出,第一季度的零售额是,具有统计显著性,第二季度比第一季度增加,但是显著性水平不高,第三季度比第一季度增加,显著性水平也不高,第四季度比第一季度增加且具有统计显著性。

由此可以看出,在第一、四季度上对销售额的影响是比较大的。

这说明在第一和第四季度是这些商品的旺季,第二、三季度是销售的淡季。

这主要是因为在第一和第四季度上有像圣诞节这样的大型节日,促使了这些商品的消费。

(4)利用回归结果可知,残差项和自变量是不相关的,则利用上述模型即可将季节成分去除。

利用上题数据,估计下面的模型:11223344t t t t t t sales B D B D B D B D u =++++在这个模型中,每个季度都赋予一个虚拟变量。

(1)这个模型与上题的模型有何区别(2)估计这个模型,是否需要加上截距项(3)比较本题与上题的回归结果,你决定选择哪个模型为什么答:(1)从模型中可以看到,这个模型中增加了一项11t B D ,也就是说将第一季度也做为虚拟变量加入到了模型中。

(2)估计该模型时不需要加加上截距项。

(3)估计该模型可得:12342930.41989.08988.022268.5221.6022.9622.2551.080.913t t t t tsales D D D D t R =+++==从回归结果中可以看出,该模型的统计量都是显著的,而且拟合优度和上题中的一致。

可以看出该模型比上题中的模型要好。

DATA7-6给出了46个中产阶级个人收入及其他相关信息的数据,自变量包括:Experience ——工作年限;Management ——1,经理;0,非经理;Education ——1,高中;——2,大学;——3,研究生。

(1)直接利用表中受教育程度的数据进行回归分析合适吗会导致什么样的问题(2)利用Experience 、Management 以及重新设定后的受教育程度变量进行线性回归。

所有变量是统计显著的吗(3)建立一个新的模型,考虑经理人和非经理人因工作经历差异可能导致的收入增量差异。

写出回归结果。

(4)建立一个新的模型,考虑经理人和非经理人由于教育水平的差异可能导致的收入增量差异。

写出回归结果。

答:(1)不合适。

如果这样估计的话会导致回归结果不准确,致使不能正确估计模型。

(2)引入虚拟变量:110D ⎧=⎨⎩,大学,其他,21=0D ⎧⎨⎩,研究生,其他设定模型:1234152salary Experience managerment D D u βββββ=+++++估计方程得:122salary 8305.21540.636785.362817.612601.05 (20.16) (16.17) (19.72) (7.49) (6.02) 0.9Experience managerment D D t R =++++==48由此可以看出,每个系数的估计值都是显著的。