信用证(不可撤销)中英文范本

信用证中英文对照

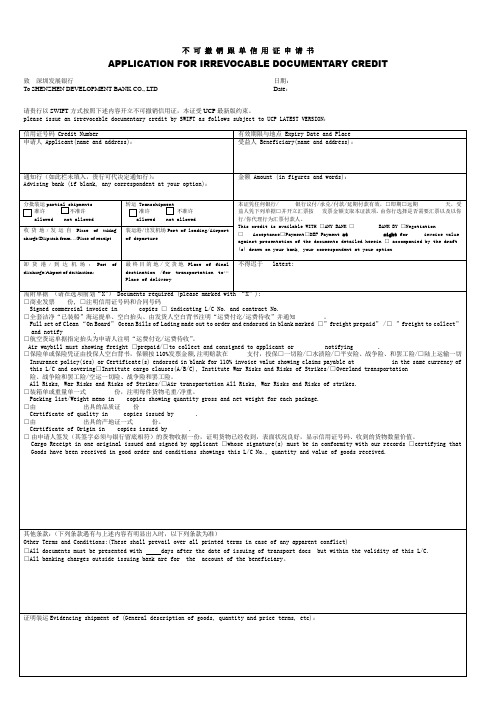

不可撤销跟单信用证申请书APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT 致深圳发展银行日期:To SHENZHEN DEVELOPMENT BANK CO., LTD Date:请贵行以SWIFT方式按照下述内容开立不可撤销信用证,本证受UCP最新版约束。

please issue an irrevocable documentary credit by SWIFT as follows subject to UCP LATEST VERSION:申请书编号:深发开证申字第号因业务需要,请贵行按申请书正面英文格式,依照国际商会出版物《跟单信用证统一惯例》最新版开立一份不可撤销跟单信用证。

为此,我公司不可撤销地承担有关责任如下:一、申请开立的信用证为□非额度内□额度内(额度合同名称:,额度合同编号:)授信。

二、申请开立的信用证为□即期□远期,金额为。

三、如本申请书项下授信属于额度项下的,额度合同项下的担保方式同样适用。

在贵行开立信用证之前,我公司还将向贵行提供如下担保(在选择项内打“√”):□由作为保证人,承担连带保证责任,并与贵行签妥相关担保合同。

□由作为抵押人/出质人,以其所有或依法有权处分的(财产)提供抵押/质押,并与贵行签妥相关担保合同,办妥相应的担保手续。

□由我公司向贵行交付相当于信用证金额%保证金,保证金账号为,保证金按利率计息。

本条款不因总合同及本申请书其他条款的无效而无效。

办理业务过程中我公司追加保证金的,视为对本条款的自动修改,无需另行确认。

□四、本申请书项下信用证垫款的罚息按照计收。

五、我公司保证在相符交单的情况下对外付款/承兑/承诺付款,并在收到贵行来单通知书和单据副本起二个工作日内,书面通知贵行是否同意付款/承兑/承诺付款,逾期不通知视为同意付款/承兑/承诺付款;贵行确定为相符交单且我公司在收到贵行来单通知书和单据副本起二个工作日内未提出异议,即视为相符交单。

单证具体案例中英对照

单证具体案例中英对照(一)信用证(不可撤销跟单信用证)(二)汇票(即期汇票、远期汇票)(三)发票(四)装箱单(五)提单(六)保险单(七)商品检验证书(品质检验证书,品质、重量证书,卫生检验证书、植物检疫证书)(八)普惠制原产地证书(一)信用证(不可撤销信用证)中英文范例不可撤销信用证(Irrevocable Credit)是指开证行一经开出、在有效期内未经受益人或议付行等有关当事人同意,不得随意修改或撤销的信用证;只要受益人按该证规定提供有关单据,开证行(或其指定的银行)保证付清货款。

凡使用这种信用证,必须在该证上注明“不可撤销”(Irrevocable)的字样,并载有开证行保证付款的文句。

按《跟单信用证统一惯例(第400号出版物)》第7条C款的规定,“如无该项表示,信用证应视为可撤销的。

”这种信用证对卖方收取货款较有保障,在国际贸易中被广泛的使用.范例如下:不可撤销跟单信用证Letter of Credit, Irrevocable documentaryBank ALondon, International DivisionAddress:Tel: Telex: Date:Irrevocable Letter of Credit Credit numberOf issuing bank:16358Of issuing bank 8536Advising bank ApplicantBank of china Guangzhou Joseph Smith & Sons 52XX Street, SouthamptonBeneficiary AmountGuang Arts & Crafts Corporation US$2000(US Dollars Two Thousand Only) Guangzhou, ChinaExpiry31 May 1986 at the counter of:Dear Sirs(二)汇票中英文范例-即期汇票与远期汇票汇票(bill of exchange)由一方向另一方签发,要求对方立即或在一定时日内,对某人或其指定人或持票人支付一定金额的、无条件的书面支付命令。

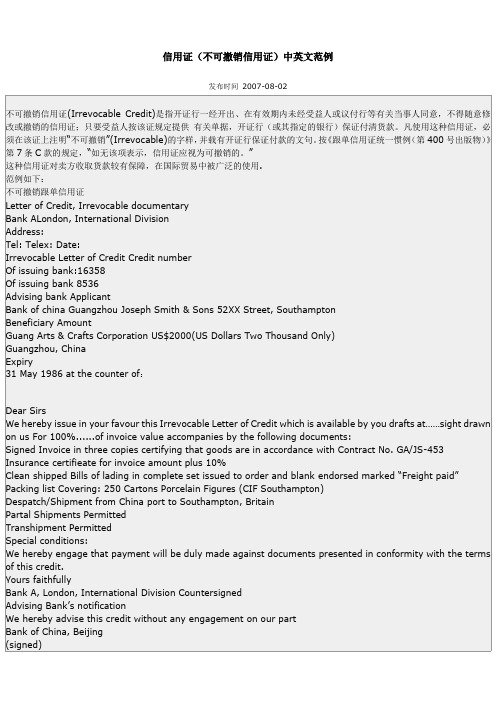

信用证(不可撤销信用证)中英文范例

信用证(不可撤销信用证)中英文范例发布时间2007-08-02不可撤销信用证(Irrevocable Credit)是指开证行一经开出、在有效期内未经受益人或议付行等有关当事人同意,不得随意修改或撤销的信用证;只要受益人按该证规定提供有关单据,开证行(或其指定的银行)保证付清货款。

凡使用这种信用证,必须在该证上注明“不可撤销”(Irrevocable)的字样,并载有开证行保证付款的文句。

按《跟单信用证统一惯例(第400号出版物)》第7条C款的规定,“如无该项表示,信用证应视为可撤销的。

”这种信用证对卖方收取货款较有保障,在国际贸易中被广泛的使用.范例如下:不可撤销跟单信用证Letter of Credit, Irrevocable documentaryBank ALondon, International DivisionAddress:Tel: Telex: Date:Irrevocable Letter of Credit Credit numberOf issuing bank:16358Of issuing bank 8536Advising bank ApplicantBank of china Guangzhou Joseph Smith & Sons 52XX Street, SouthamptonBeneficiary AmountGuang Arts & Crafts Corporation US$2000(US Dollars Two Thousand Only)Guangzhou, ChinaExpiry31 May 1986 at the counter of:Dear SirsWe hereby issue in your favour this Irrevocable Letter of Credit which is available by yo u drafts at……sight drawn on us For 100%......of invoice value accompanies by the following documents:Signed Invoice in three copies certifying that goods are in accordance with Contract No. GA/JS-453 Insurance certifieate for invoice amount plus 10%Clean shipped Bills of lading in complete set issued to order and blank endorsed marked “Freight paid” Packing list Covering: 250 Cartons Porcelain Figures (CIF Southampton)Despatch/Shipment from China port to Southampton, BritainPartal Shipments PermittedTranshipment PermittedSpecial conditions:We hereby engage that payment will be duly made against documents presented in conformity with the terms of this credit.Yours faithfullyBank A, London, International Division CountersignedAdvising Bank’s notificationWe hereby advise this credit without any engagement on our partBank of China, Beijing(signed)20 April 1986以下为中文:伦敦“A”国际部地址:电话:电传号码:电报挂号:日期:1986年4月10日不可撤销信用证开证行证号:16358通知行证号:8536通知行:申请开证人:中国银行广州分行南安普顿XXX约瑟夫.史密斯父子公司受益人:金额:中国、广州2,000美元(贰千美元正)广州工艺品公司有效期:截至1986年5月31日在中国广州中国银行分行办公处敬启者:兹开立以贵公司为受益人的不可撤销信用证,凭贵公司开具以我行为付款人,按发票金额100%开立的即期汇票用款,并须附有下列“X”的单据:X经签署的发票一式三份,证明货物属第GA/JS-453号合同项下。

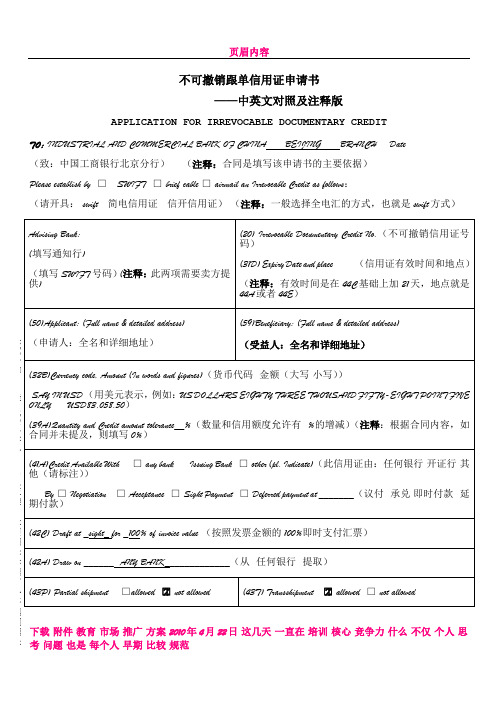

不可撤销跟单信用证申请书(中英文对照及注释版)avicxiao

下载 附件 教育 市场 推广 方案 2010年4月22日 这几天 一直在 培训 核心 竞争力 什么 不仅 个人 思不可撤销跟单信用证申请书——中英文对照及注释版APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITTO: INDUSTRIAL AND COMMERCIAL BANK OF CHINA BEIJING BRANCH Date (致:中国工商银行北京分行) (注释:合同是填写该申请书的主要依据)Please establish by □ SWIFT □ brief cable □ airmail an Irrevocable Credit as follows :(请开具: swift 简电信用证 信开信用证) (注释:一般选择全电汇的方式,也就是swift 方式)照国(46A) Documents required: (marked with X) 票据要求(请用X做记号)(注释:下面的条款最好按照开证行(工商银行)给予的既定格式填写,可以稍微做些改动,如需补充,可以在后面添加其他条款)( X)Signed Commercial Invoice in _3 originals and 2 copies_indicating L/C No.Contract No. JC2010LWMT-100(经签字的商业发票,3份原件,2份复印件,标明信用证号码和合同号码JC2010LWMT-100)( X ) Full set of clean on board ocean Bill of Lading plus 2 non-negotiable copy(ies) made out to order and blank endorsed, marked freight prepaid □to collect, □ showing freight amount.(全套清洁已装船海运提单附上2份不可谈判的/禁止转让的复印件做成空白抬头、空白背书标注运费已付待付表明运费金额)( )Air Waybills showing “freight □ to collect □prepaid” indicating frei ght amount and consigned to□ Applicant □ Issuing Bank(空运单据标明运费待付已付标注运费金额并委托/交付给申请人开证行)( )Forwarding agent’s Cargo Receipt (之前代理商的货物收据)( X ) Full set of Insurance Policy/Certificate □plus 1 copy(ies) for 110 % of CIF or CIP value of the shipped goods, endorsed in blank, showing claims, if any, payable in China in currency of the Credit, covering □Institute Cargo Clauses (A), □ Institute War Clauses (Cargo), □ Institute Strikes Clauses (Cargo); □ Institute Cargo Clauses (Air), □ Institute War Clauses.(Air Cargo) □ Institute Strikes Clauses.(Air Cargo); □Ocean Marine Transportation All Risks, War Risks ;(全套保险单/保险凭证附上1份复印件按照装船货物的CIF或者CIP金额的110%投保空白背书,下载附件教育市场推广方案 2010年4月22日这几天一直在培训核心竞争力什么不仅个人思下载附件教育市场推广方案 2010年4月22日这几天一直在培训核心竞争力什么不仅个人思以上位置如果不够用请用附页说明并加盖骑缝章开证申请人(公章或授权印鉴) :法定代表人或被授权人:联系人:电话:下载附件教育市场推广方案 2010年4月22日这几天一直在培训核心竞争力什么不仅个人思。

开证申请书(中英文) - 不可撤销信用证

ORIGINAL 正本不可撤销跟单信用证申请书IRREVOCABLE DOCUMENTARY CREDIT APPLICATION致 : 恒生银行(中国)有限公司分行 日期 To Hang Seng Bank (China) LimitedBranchDate本信用证以下列方式发出This Credit is to be dispatched by:电讯传递 Full teletransmission 专人快递Courier ( 附简电 with brief teletransmission) 在贵行柜台领取 Collection at your counter :(联系人 Contact person :电话 Tel :)信用证编号 DC No.: 受益人 (名称及地址) Beneficiary (name & address):申请人 (名称及地址) Applicant (name & address):联系人 Contact person : 电话 Tel :传真 Fax :信用证金额 (小写) Credit Amount in figures :信用证金额(大写) Credit Amount in words :信用证金额增减幅度 Tolerance of amount: +/- % 通知行 (名称及地址) Advising Bank (name & address):汇票 Drafts at 见票即付 sight 于见票后 天付款days sight / 以开证行为汇票付款人按货物发票全价 drawn on issuing bank for full invoice value of goods收货地/自……发运/接收地#Place of Taking in Charge/ Dispatch from…/ Place of Receipt #:裝货港/起运机场 Port of Loading/ Airport of Departure :卸货港/目的机场 Port of Discharge/ Airport of Destination:最迟裝运日期 Latest shipment date (DD/MM/YY): 终止日 Expiry date (DD/MM/YY): 交单期 Period of presentation : (在信用证有效期内) 日days but within the validity of the credit.终止地 Place of expiry :受益人所在国家或 In beneficiary’s country or 开证行柜台At issuing bank’s counter分批裝运 Partial shipments : 允许 Allowed 不允许 Not allowed最终目的地/运输至……/交货地 Place of Final Destination/ For Transportation to…/ Place of Delivery #:(#如果信用证要求多式联运单据则必须填写此项)(#must be completed if DC calls for multimodal or combined transport document)转运 Transhipment : 允许 Allowed 不允许 Not allowed 贸易条款 Trade term : FOB FCA CFR CPT CIF CIP其它 Others (请说明 please specify):货物(请简略描述,无须赘述)Goods (brief description without excessive detail):X ) 1-4 06/07 EY X ) 2-4 06/07 E申请开立不可撤销跟单信用证的条款与条件(“条款与条件”)TERMS AND CONDITIONS UNDER IRREVOCABLE DOCUMENTARY CREDIT APPLICATION (“TERMS AND CONDITIONS”)鉴于恒生银行(中国)有限公司(简称”银行”)根据开立不可撤销跟单信用证申请书(以下简称“申请书”)开立跟单信用证,信用证申请人(“申请人”)同意:In consideration of Hang Seng Bank (China) Limited (“the Bank”) establishing documentary credit under an Irrevocable Documentary Credit Application (“this application”), the applicant of the documentary credit (“the Applicant”) agrees: 承兑及在到期日偿付根据本信用证所载条款开立的所有汇票; (a) to accept and pay at maturity all drafts drawn in accordance with the terms of the documentary credit;(b) 在到期日或之前向银行交付资金,以偿付银行支付的所有款项和/或银行所承兑的金额,并偿付银行的全部佣金及费用(包括运费,如有)以及银行或银行的代理行与本信用证相关而发生的任何性质的义务、责任及费用;to provide the Bank at or before maturity with funds to meet all disbursements and/or the Bank’s acceptances and to pay all the Bank’s commission and charges including freight if any and all obligations, liabilities and expenses of any nature incurred by the Bank or the Bank’s agents in connection with the documentary credit;(c)如保险由申请人负责,自不可撤销跟单信用证申请日起15天内,把银行认可的保额为全额发票价值另加至少10%的保险单、保险凭证或临时保单送交银行保存, 如临时保单已送交银行保存,则于其后获得正式签发的保险单或保险凭证时, 立即将有关保险单或保险凭证交付银行,否则银行可以(但无义务)另行购买保险,费用一律由申请人承担;in the event of insurance being covered on this side, to deposit with the Bank within 15 days from the date of this application an insurance policy or certificate or cover note acceptable to the Bank for full invoice values plus at least 10% and in case an insurance cover note is deposited with the Bank, to produce to the Bank the relevant insurance policy or certificate forthwith when the same is subsequently issued, failing which the Bank may (but is not obliged to) effect insurance at the applicant’s expense;(d)银行可全权指定银行的往来行、代理行、分行、办事处或子银行作为信用证的通知行, 不论申请人是否已对此进行指定,银行也有权从任何往来行、代理行、办事处或子银行请求、收取及保留任何形式的款项和收益,无论采取折扣、佣金或其它任何形式,而无需向申请人支付或得到申请人的同意或通知申请人;that the Bank has sole discretion in the selection of any correspondent or agent or branch, office or subsidiary through whom the documentary credit may be advised to the beneficiary thereof whether or not the applicant has nominated the same and that the Bank is also entitled to solicit, receive and retain any payment and benefit in whatever form, whether by way of rebate, commission or otherwise, from any correspondent agent, branch, office or subsidiary without accounting to and without consent from, or notice to, the applicant; (e) 银行及其管理人员、雇员、往来行、代理行、分行、办事处和子银行不得对由于使用邮递、电传或电报机构传送其指示或因其指示有不清晰之处而导致的错误或延误而承担任何责任;that the Bank and its officers and employees and correspondents, agents, branches, offices and subsidiaries shall not be liable for any mistake or delay which may result in or from the transmission of its instructions by the postal, cable and telegraph authorities, or in or from any ambiguity in such instructions;(f) 授权银行可全权决定接受反映信用证受益人所在地或者通知信用证的往来行或代理行所在地的当地市场惯例的保单或保险凭证,若上述所在地在美国境内,该保单或保险凭证应为包含美国协会条款的保单或保险凭证;that the Bank is authorized to accept at the Bank’s sole discretion insurance policies or certificates which reflect any local market practice in the jurisdiction where the beneficiary of the relevant documentary credit or where the correspondent or agent through which it is advised is located including American Institute clauses insurance policies or certificates where such jurisdiction is in the United States of America; (g) 如果单据本身表面状况良好,并且除发票以外的单据在总体上载明符合本信用证要求的相关货物的一般性描述,便可视为与本信用证的条款相符;that it shall be a sufficient compliance with the documentary credit if the documents purported to be in order and the documents other than invoice contain only a general description of the relevant goods provided that the documents tendered taken as a whole contain the description required by the documentary credit;在需要进口许可证时,向银行提供申请书所述货物的有效进口许可证,而进口货物经申请人证明为非禁止或限制种类的货物;(h) where an import license is required, to exhibit to the Bank a valid import license for the goods described in this application, the importation of which is certified by the applicant to be not prohibited or restricted;(i) 为保证偿付申请人于任何时间欠付的本申请书项下的任何及所有款项,银行对所有相关货物、单据及保险单及其收益均有担保权益(包括质押权及留置权(如法律允许)),可全权决定且有权在货物运抵之前或之后出售相关货物而无需另行通知申请人;that to secure the payment of all or any moneys for which the applicant may at any time be liable under this application, the Bank has a security interest (including pledge and lien (if permitted by law)) on all the relevant goods, documents and policies and proceeds thereof with full discretion and power of sale over the relevant goods before or after arrival without notice to the applicant; (j) 无特定指示时,无需固定汇率;that fixing exchange is not required if no specific instruction is given;(k) 授权银行(但银行无义务)对信用证指明的单据作任何银行认为必要的补充,以确保符合法律法规;C N I M 10-R 4(Y X ) 3-4 06/07 Ethat the Bank is authorized (but not obliged) to make any additions to the documents specified under the documentary credit which the Bank may consider necessary to ensure compliance with the applicable laws and regulations;(l) 在没有与本申请书中所述内容相反的指示的情况下,授权银行全权指示任何其往来行、代理行、分行或子银行以一次或多次邮递或其它传递方法传递任何汇票及/或单据;that in the absence of any instructions to the contrary specified in this application, the Bank is authorized to instruct any correspondent, agent, branch, office or subsidiary to dispatch any draft(s) and/or any documents by one or more mails or other method of conveyance as the Bank may at its sole discretion determine;(m)在银行根据本信用证付款之前或之后,如以申请人名义签/盖在货物收据、信托收据或其它文件上的签名、印章或公章被发现为假冒,只要银行已对该等签名、印章和/或公章与银行记录中所存档的核实相似,银行有权为付款之目的全权决定接受此等签名、印章或公章,且对申请人具有最终的约束力,申请人须向银行偿付银行在本信用证项下的付款;that notwithstanding that the signature(s), chop(s) and/or seal(s) purported to be given put or affixed on the applicant’s behalf on the cargo receipt, trust receipt or any other document(s) required under the documentary credit issued pursuant to this application may subsequently be found to be forgery whether on or before or after the Bank’s payment under the documentary credit, such signature(s), chop(s) and/or seal(s) may be accepted by the Bank at its discretion for the purpose of payment and shall be conclusively binding upon the applicant and the applicant shall be bound to reimburse the Bank for its payment under the documentary credit provided that the Bank has verified it/them to be favourably comparable with that/those appearing in the Bank’s record;(n) 本申请书、信用证及其项下票据受在银行存档的由申请人签署的有关贸易融资的交易文件(包括贸易融资业务通用协议)所载的条款与条件(可不时修订)约束;that this application, the documentary credit and drawings thereunder are also subject to the terms and conditions of the documents relating to trade financing transactions (including the Bank’s Trade Financing General Agreement) executed by the applicant and on file with the Bank (as they may be amended from time to time);(o) 除非在将来的修订中另有约定,本申请书、信用证及将来的修订及其项下票据均受在开立信用证时的国际商会《跟单信用证统一惯例》的通行版本所约束;that this application, the documentary credit and subsequent amendment(s) and drawing(s) are subject to the Uniform Customs and Practice for the Documentary Credits of the International Chamber of Commerce as are in effect at the time of establishing the documentary credit, unless otherwise stipulated in subsequent amendment(s) to the documentary credit;(p) 申请人充分理解国际商会第600号出版物《跟单信用证统一惯例》2007年修订版第34条的含义或《跟单信用证统一惯例》将来的版本中任何类似性质的条款的含义,如果一家银行声称已就本信用证作出议付,在无相反证据的情况下确认其善意及议付的事实;that the applicant fully understands the implications of Article 34 of the Uniform Customs and Practice for Documentary Credits, 2007 Revision, International Chamber of Commerce Publication No. 600 or any article(s) of similar nature in subsequent edition(s) of the Uniform Customs and Practice for Documentary Credits of the International Chamber of Commerce and acknowledges that where a bank claims to have negotiated under the documentary credit, its good faith and the fact of negotiation thereof shall be presumed in the absence of evidence to the contrary;(q) 本信用证将来的所有修订(如有)均受上述条款与条件约束;that all subsequent amendment(s) (if any) to the documentary credit is/are subject to the above terms and conditions; and(r)本申请书及其条款与条件均受中国法律(为此条款与条件之目的,不包括香港特别行政区、澳门特别行政区及台湾的法律)管辖并按其解释。

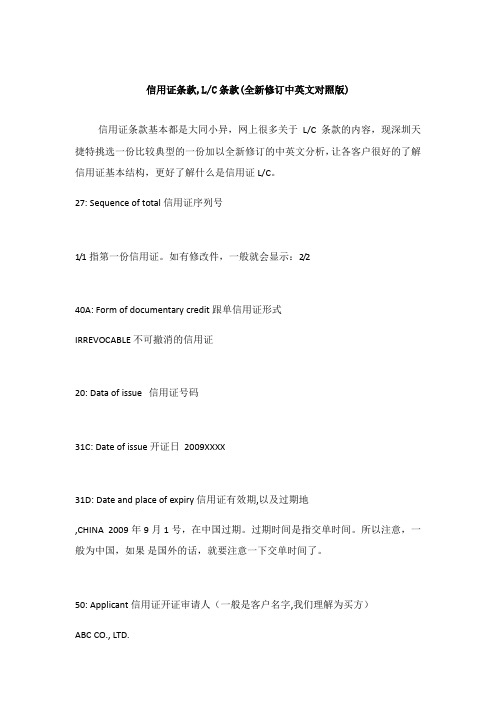

信用证条款中英文对照版及数字代码含义

信用证条款,L/C条款(全新修订中英文对照版)信用证条款基本都是大同小异,网上很多关于L/C条款的内容,现深圳天捷特挑选一份比较典型的一份加以全新修订的中英文分析,让各客户很好的了解信用证基本结构,更好了解什么是信用证L/C。

27: Sequence of total 信用证序列号1/1 指第一份信用证。

如有修改件,一般就会显示:2/240A: Form of documentary credit 跟单信用证形式IRREVOCABLE 不可撤消的信用证20: Data of issue 信用证号码31C: Date of issue 开证日 2009XXXX31D: Date and place of expiry 信用证有效期,以及过期地,CHINA 2009年9月1号,在中国过期。

过期时间是指交单时间。

所以注意,一般为中国,如果是国外的话,就要注意一下交单时间了。

50: Applicant 信用证开证审请人(一般是客户名字,我们理解为买方)ABC CO., LTD.JAPAN59: Beneficiary 受益人(你们公司名,我们理解为:卖方)EFG CO., LTD.ADDRESS32B: Currency code amount 信用证项下的金额USD XXXXXXX,41D: Available with 议付适用银行ANY BANK IN CHINABY NEGOTIATION 任何中国的银行可议付(注意这里,如果是BY PAYMENT的话,就没有下面的42C了)42C: Draft at 开汇票XXX DAYS AFTER SIGHTFOR FULL INVOICE VALUE 见票XXX天付款(发票全额)这里是远期信用证的表示了,如果是即期信用证的话,那就会显示 DRAFT AT SIGHT。

42A: Drawee 付款人ABOCCNBJXXXAGRICULTURAL BANK OF CHINA, XXX BRANCH 某农业银行某支行43P: Partial shipment 是否允许分批装运ALLOWED 允许43T: Transshipment 是否允许转运ALLOWED 允许转运44A:PORT Of Taking charge 装货地 CHINA ANY PORT44B: For transportation to 目的港CHINESE PORT信用证提单如何打:(这里参考一下百度知道)具体代码与提单栏目的对应关系:44A对应place of receipt44E对应port of loading44F对应port of discharge44B对应place of delivery深圳天捷发现一般很少看到44A,44F出现在信用证,所以,如果提单,正确处理是, 44E对应PORT OF LOADING 44B 对应PLACE OF DELIVERY, 如果没有转运,44B 也对应PLACE OF DELIVERY,至于PLACE OF RECEIPT,很多船公司都不打,所以不出现也无所谓。

(完整版)信用证样本中英文对照1

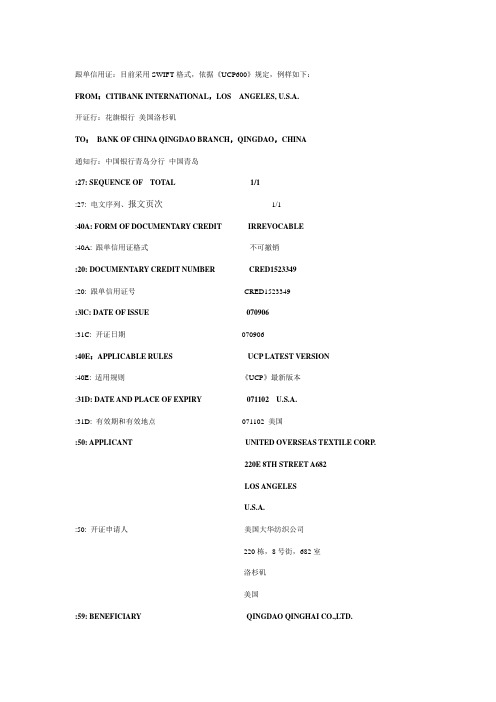

跟单信用证:目前采用SWIFT格式,依据《UCP600》规定,例样如下:FROM:CITIBANK INTERNATIONAL,LOS ANGELES, U.S.A.开证行:花旗银行美国洛杉矶TO:BANK OF CHINA QINGDAO BRANCH,QINGDAO,CHINA通知行:中国银行青岛分行中国青岛:27: SEQUENCE OF TOTAL 1/1:27: 电文序列、报文页次1/1:40A: FORM OF DOCUMENTARY CREDIT IRREVOCABLE:40A: 跟单信用证格式不可撤销:20: DOCUMENTARY CREDIT NUMBER CRED1523349:20: 跟单信用证号CRED1523349:3lC: DATE OF ISSUE 070906:31C: 开证日期070906:40E:APPLICABLE RULES UCP LATEST VERSION:40E: 适用规则《UCP》最新版本:31D: DATE AND PLACE OF EXPIRY 071102 U.S.A.:31D: 有效期和有效地点071102 美国:50: APPLICANT UNITED OVERSEAS TEXTILE CORP.220E 8TH STREET A682LOS ANGELESU.S.A.:50: 开证申请人美国大华纺织公司220栋,8号街,682室洛杉矶美国:59: BENEFICIARY QINGDAO QINGHAI CO.,LTD.186 CHONGQIN ROADQINGDAO 266002 CHINA:59: 受益人青岛青海有限公司重庆路186号中国青岛266002(邮编):32B: CURRENCY CODE, AMOUNT: USD58575,00:32B: 货币代码和金额58575.00美元:39A:PRECENTAGE CREDIT AMOUNT TOLERANCE 10/10:39A: 信用证金额上下浮动百分比10/10(10%):41A: A V AILABLE WITH.. BY.. CITIUS33LAX BY DEFERRED PAYMENT :41A: 兑付方式花旗银行洛杉矶分行以延期付款方式兑付:42P: DEFERRED PAYMENT DETAILS AT 90 DAYS AFTER B/L DATE:42P: 延期付款细节提单签发日后90天:43P: PARTIAL SHIPMENTS NOT ALLOWED:43P: 分批装运不允许:43T: TRANSSHIPMENT NOT ALLOWED:43T: 转运不允许:44E: PORT OF LOADING/AIRPORT OF DEPARTURE QINGDAO PORT,CHINA:44E: 装运港/始发航空站中国青岛港:44F: PORT OF DISCHARGE/AIRPORT OF DESTINATION LOS ANGELES PORT,U.S.A. :44F: 卸货港/目的航空站美国洛杉矶港:44C: LATEST DATE OF SHIPMENT 071017:44C: 最晚装运期071017:45A: DESCRIPTION OF GOODS AND/OR SERVICES+TRADE TERMS: CIF LOS ANGELES PORT,U.S.A. ORIGIN:CHINA+ 71000M OF 100% POLYESTER WOVEN DYED FABRICAT USD0.75 PER MWIDTH:150CM,>180G/M2:45A: 货物/服务描述+贸易术语:CIF洛杉矶港,美国原产地:中国+71000米100%涤纶染色机织布料单价为0.75美元/米幅宽:150厘米,克重:不小于180克/平方米:46A: DOCUMENTS REQUIRED+SIGNED COMMERCIAL INVOICE IN THREEFOLD+FULL SET OF CLEAN ON BOARD OCEAN BILL OF LADING MADE OUT TO THE ORDER AND BLANK ENDORSED,NOTIFY:APPLICANT(FULL ADDRESS)MARKED FREIGHT PREPAID +SIGNED DETAILED PACKING LIST+CERTIFICATE OF ORIGIN+HANDSIGNED INSURANCE POLICY/CERTIFICATE COVERING MARINE INSTITUTE CARGO CLAUSES A (1.1.1982),INSTITUTE STRIKE CLAUSES CARGO(1.1.1982),INSTITUTE WAR CLAUSES CARGO (1.1.1982) FOR 110PCT OF THE INVOICE AMOUNT:46A: 单据要求+签署的商业发票,一式三份+全套清洁的已装船提单,空白抬头(TO ORDER),空白背书,通知开证申请人(完整地址),注明运费预付+签署的装箱单+原产地证书+手签的保险单或保险凭证,遵照英国伦敦保险协会货物条款,按照发票总金额的110%投保ICCA,ICC 罢工险、ICC战争险:47A: ADDITIONAL CONDITION 10PCT MORE OR LESS IN AMOUNT AND QUANTITY ALLOWED:47A: 附加条款金额和数量允许有上下10%的变动幅度:71B: CHARGES ALL CHARGES AND COMMISSIONS OUTSIDE U.S.A. ARE FORBENEFICIARY'S ACCOUNT:71B: 费用发生在美国以外的全部费用和佣金由受益人承担:48: PERIOD FOR PRESENTATION WITHIN 15 DAYS AFTER SHIPMENT BUT WITHIN THEV ALIDITY OF THIS CREDIT:48: 交单期限装运期后15天,但必须在信用证有效期内:49: CONFIRMATION INSTRUCTIONS WITHOUT:49: 保兑指示没有:78: INSTRUCTIONS TO THE PAYING/ACCEPTING/NEGOTIATING BANKAT MATURITY DATE,UPON RECEIPT OF COMPLYING DOCUMENTS C/O OURSELVES,WE WILL COVER THE REMITTING BANK AS PER THEIR INSTRUCTIONS:78: 对付款行/承兑行/议付行的指示在到期日,我行在收到相符单据后,根据偿付行的指示偿付货物。

信用证样本中英文对照

信用证样本中英文对照Issue of a Documentary CreditBKCHCNBJA08E SESSION: 000 ISN: 000000BANK OF CHINALIAONINGNO. 5 ZHONGSHAN SQUAREZHONGSHAN DISTRICTDALIANCHINA-------开证行Destination Bank:KOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO--------通知行Type of Documentary Credit40AIRREVOCABLE-------- 信用证性质为不可撤消Letter of Credit Number20LC84E0081/99------ 信用证号码,一般做单时都要求注此号Date of Issue31G990916------开证日期Date and Place of Expiry31D991015 KOREA-------失效时间地点Applicant Bank51DBANK OF CHINA LIAONING BRANCH----开证行Applicant50DALIAN WEIDA TRADING CO., LTD.------开证申请人Beneficiary59SANGYONG CORPORATIONCPO BOX 110SEOULKOREA-------受益人Currency Code, Amount32BUSD 1,146,725.04------- 信用证总额Available with...by...41DANY BANK BY NEGOTIATION-------呈兑方式任何银行议付有的信用证为ANY BANK BY PAYMENT, 些两句有区别, 第一个为银行付款后无追索权, 第二个则有追索权就是有权限要回已付给你的钱Drafts at42C45 DAYS AFTER SIGHT-------见证45天内付款Drawee42DBANK OF CHINA LIAONING BRANCH-------付款行Partial Shipments43PNOT ALLOWED---分装不允许Transhipment43TNOT ALLOWED---转船不允许Shipping on Board/Dispatch/Packing in Charge at/ from44A RUSSIAN SEA----- 起运港Transportation to44BDALIAN PORT, P.R.CHINA -----目的港Latest Date of Shipment44C990913--------最迟装运期Description of Goods or Services: 45A--------货物描述FROZEN YELLOWFIN SOLE WHOLE ROUND (WITH WHITE BELL Y) USD770/MT CFR DALIAN QUANTITY: 200MTALASKA PLAICE (WITH YELLOW BELL Y) USD600/MT CFR DALIAN QUANTITY: 300MTDocuments Required: 46A------------议付单据1. SIGNED COMMERCIAL INVOICE IN 5 COPIES.--------------签字的商业发票五份2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED "FREIGHT PREPAID" NOTIFYING LIAONING OCEAN FISHING CO., LTD. TEL:(86)411-3680288-------------一整套清洁已装船提单, 抬头为TO ORDER 的空白背书,且注明运费已付,通知人为LIAONING OCEAN FISHING CO., LTD. TEL:(86)411-36802883. PACKING LIST/WEIGHT MEMO IN 4 COPIES INDICATING QUANTITY/GROSS AND NET WEIGHTS OF EACH PACKAGE AND PACKING CONDITIONSAS CALLED FOR BY THE L/C.-------------装箱单/重量单四份, 显示每个包装产品的数量/毛净重和信用证要求的包装情况.4. CERTIFICATE OF QUALITY IN 3 COPIES ISSUED BY PUBLIC RECOGNIZED SURVEYOR.--------由PUBLIC RECOGNIZED SURVEYOR签发的质量证明三份..5. BENEFICIARY'S CERTIFIED COPY OF FAX DISPATCHED TO THE ACCOUNTEE WITH 3 DAYS AFTER SHIPMENT ADVISING NAME OF VESSEL, DATE, QUANTITY, WEIGHT, V ALUE OF SHIPMENT, L/C NUMBER AND CONTRACT NUMBER.--------受益人证明的传真件, 在船开后三天内已将船名航次,日期,货物的数量, 重量价值,信用证号和合同号通知付款人.6. CERTIFICATE OF ORIGIN IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的原产地证明三份.7. CERTIFICATE OF HEALTH IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的健康/检疫证明三份.ADDITIONAL INSTRUCTIONS: 47A-----------附加指示1. CHARTER PARTY B/L AND THIRD PARTY DOCUMENTS ARE ACCEPTABLE.----------租船提单和第三方单据可以接受2. SHIPMENT PRIOR TO L/C ISSUING DATE IS ACCEPTABLE.----------装船期在信用证有效期内可接受这句是不是有点问题? 应该这样理解: 先于L/C签发日的船期是可接受的. 对否?3. BOTH QUANTITY AND AMOUNT 10 PERCENT MORE OR LESS ARE ALLOWED.---------允许数量和金额公差在10%左右Charges71BALL BANKING CHARGES OUTSIDE THE OPENNING BANK ARE FOR BENEFICIARY'S ACCOUNT.Period for Presentation48DOCUMENTSMUST BE PRESENTED WITHIN 15 DAYS AFTER THE DA TE OF ISSUANCE OF THE TRANSPORT DOCUMENTS BUT WITHIN THE V ALIDITY OF THE CREDIT.Confimation Instructions49WITHOUTInstructions to the Paying/Accepting/Negotiating Bank: 781. ALL DOCUMENTS TO BE FORWARDED IN ONE COVER, UNLESS OTHERWISE STA TED ABOVE.2. DISCREPANT DOCUMENT FEE OF USD 50.00 OR EQUAL CURRENCY WILL BE DEDUCTED FROM DRAWING IF DOCUMENTS WITH DISCREPANCIES ARE ACCEPTED."Advising Through" Bank57AKOEXKRSEXXX MESSAGE TYPE: 700KOREA EXCHANGE BANKSEOUL178.2 KA, ULCHI RO, CHUNG-KO信用证(不可撤销信用证)中英文范例不可撤销信用证(Irrevocablecredit)是指开证行一经开出、在有效期内未经受益人或议付行等有关当事人同意,不得随意修改或撤销的信用证;只要受益人按该证规定提供有关单据,开证行(或其指定的银行)保证付清货款。

不可撤销跟单信用证申请书(中英文对照及注释版)avicxiao

(43T) Transshipment □X allowed □ not allowed

(分批装运 允许 不允许)

(转运 允许 不允许)

(44A) Loading on board from(装运从) (注释:44A 和 44B 用于空运填)

(44B) for transportation to (运至)

(44E) Port of Loading (装运港) (注释:44E 和 44F 用于海运填)

(44F) Port of Discharge (卸货港)

(44C) Time of Shipment: NOT LATER THAN (装运最迟日期)

(45A) Description of goods or services

成功是失败之母,一切都是努力的结果

依照国际商会《跟单信用证统一惯例》(2007 年修订版)第 600 号出版物

不可撤销跟单信用证申请书 ——中英文对照及注释版

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT

TO: INDUSTRIAL AND COMMERCIAL BANK OF CHINA

( X ) Full set of clean on board ocean Bill of Lading plus 2 non-negotiable copy(ies) made out to order and blank endorsed,

marked freight prepaid □to collect, □ showing freight amount.

in blank, showing claims, if any, payable in China in currency of the Credit, covering □Institute Cargo Clauses (A), □

信用证样本及翻译

信用证样本及翻译Sample of Credit Letter of Credit[Issuer’s Letterhead][Date][Beneficiary Name][Address][City, State, ZIP Code]Dear Sir/Madam,We are pleased to inform you that we have established an irrevocable credit in your favor, as per your request and instructions. The details of the credit are as follows:1. Credit Number: [XXX]2. Date of Issue: [Date]3. Expiry Date: [Date]4. Amount: [Amount]5. Beneficiary: [Beneficiary Name]6. Applicant: [Applicant Name]7. Advise Through: [Advising Bank]8. Available With: [Negotiating Bank]9. Partial Shipments: [Allowed/Not Allowed]10. Transshipment: [Allowed/Not Allowed]11. Description of Goods: [Detailed Description]12. Documents Required: [List of Required Documents]We kindly request you to review the credit and acknowledge your acceptance by signing and returning two copies of this letter to our bank. Please note that failure to do so may result in delay or refusal of payment.We trust that this credit will facilitate a smooth transaction between you and our customer. Should you have any questions, please feel free to contact us at the contact details mentioned below.Thank you for your cooperation. We look forward to a successful and mutually beneficial business relationship.Yours sincerely,[Issuing B ank’s Representative][Designation][Contact Details]【发证行抬头】【日期】【受益人姓名】【地址】【城市,州,邮编】尊敬的先生/女士我们很高兴地通知您,根据您的请求和指示,我们已为您建立了一种不可撤销的信用证。

不可撤销信用证格式

□by payment at sight

□by deferred payment at:

□by acceptance of drafts at:

□by negotiation

Against the documents detailed herein:

□and beneficiary’s draft drawn on:

Transshipment:□allowed□not allowed

□Insபைடு நூலகம்rance covered by buyers

信用证中英文对照

信用证样本(中英文对照)信用证样本:以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTDLETTERS OF CREDIT DEPARTMENTNTCOSIA COMMERCIAL OPERATIONS CENTERINTERNATIONAL DIVISION************TEL:******FAX:******TELEX:2451 & 4933 KYPRIA CYSWIFT:BCYPCY2NDATE:23 MARCH 2005APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDITSWIFT MT700 SENT TO:MT700转送至STANDARD CHARTERD BANKUNIT 1-8 52/F SHUN NIND SQUAREO1 WANG COMMERCIAL CENTRE,SHEN NANROAD EAST,SHENZHEN 518008 - CHINA渣打银行深圳分行深南东路5002号信兴广场地王商业大厦52楼1-8单元电话:82461688:27: SEQUENCE OF TOTAL序列号1/1 指只有一张电文:40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式IRREVOCABLE 不可撤消的信用证:20OCUMENTARY CREDIT NUMBER信用证号码00143-01-0053557:31C: DATE OF ISSUE开证日如果这项没有填,则开证日期为电文的发送日期。

:31DATE AND PLACE OF EXPIRY信用证有效期050622 IN CHINA 050622在中国到期:50: APPLICANT 信用证开证审请人******* NICOSIA 较对应同发票上是一致的:59: BENEFICIARY 受益人CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂:32B: CURRENCY CODE,AMOUNT 信用证项下的金额USD***7841,89:41D:AVAILABLE WITH....BY.... 议付适用银行STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行:42CRAFTS AT 开汇票SIGHT 即期:42A:DRAWEE 付款人BCYPCY2NO10BANK OF CYPRUS LTD 塞浦路斯的银行名:43 PARTIAL SHIPMENTS 是否允许分批装运NOT ALLOWED 不可以:43T:TRANSHIPMENT转运ALLOWED允许:44AOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM...装船港口SHENZHEN PORT深圳:44B:FOR TRANSPORTATION TO 目的港LIMASSOL PORT发票中无提及:44C: LATEST DATE OF SHIPMENT最后装船期050601:045A:DESCRIPTION OF GOODS AND/OR SERVICES 货物/服务描述SANITARY WARE 陶瓷洁具F O B SHENZHEN PORT,INCOTERMS 2000 fob深圳港,INCOMTERMS 2000:046A:DOCUMENTS REQUIRED 须提供的单据文件*FULL SET (AT LEAST THREE) ORIGINAL CLEAN SHIPPED ON BOARD BILLSOF LADING ISSUED TO THE ORDER OF BANK OF CYPRUS PUBLIC COMPANYLTD,CYPRUS,NOTIFY PARTIES APPLICANT AND OURSELVES,SHOWING全套清洁已装船提单原件(至少三份),作成以“塞浦路斯股份有限公司”为抬头,通知开证人和我们自己,注明*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIRAGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYINGTHAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETYMANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001BY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO.HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:A)原产地为中国B)同号码为HL050307 开立日为07/03/05的商业发票内容一致:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND THE NAME OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(如果有要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSEL IS NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI, CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta, Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICANTS.保险由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANGUAGE.所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARANTEE STRICTLY 保结押汇或是银行保函PROHIBITED. 禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTS PRESENTED UNDER THIS CREDIT,WHETHER ACCEPTED OR NOT,PLUS OUR CHARGES FOR EACH MESSAGE CONCERNING REJECTION AND/OR ACCEPTANCE MUST BE BORNE BY BENEFICIARIES THEMSELVES AND DEDUCTED FROM THE AMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US AND REJECTED,WE MAY RELEASE THE DOCUMENTS AND EFFECT SETTLEMENT UPON APPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANY COMMUNICATION WITH THE PRESENTER THAT WE ARE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS TO THE CONTRARY ARE RECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利。

不可撤销信用证原文--英文

Specimen of Irrevocable Letter of CreditOption A (in case 100% payment is made at one time)Date:To: (The Supplier)This Letter of Credit is forward through (name of bank)We open an irrevocable Letter of Credit No. in your favor by Order of (name of the Purchaser) for account of, to the extent of available against your draft(s) drawn at sight on (name of the Purchaser) for 100% of the invoice value, accompanied by the following documents:1.Four (4) copies of commercial invoice (indicating Contract No.).2.Clean on board Ocean Bills of Lading marked “freight prepaid” and made out to order,blank endorsed and notifying at the port of Destination.3.Four (4) copies of Packing List and/or weight Memo showing quantity and gross and netweight of each package.4.Four (4) copies of Certificate of quality issued by the manufacturer.5.Your letter stating that extra bills have been dispatched according to contract terms.6.Your certified copy of fax dispatched to the account within forty eight (48) hours aftershipment advising name of vessel, quantity, weight, value and date of shipment.7.Your letter stating prior approval of the nationality of the vessel by the Purchaser.8.Insurance policy or certificate covering one hundred and ten percent (110%) of invoicevalue against all risks and war risks.9.Five (5) copies of certificate of country of origin.10.Sight drafts to be drawn on the Purchaser to (name of bank).EVIDENCING SHIPMENT OF: Goods under the Contract No.Price Terms:An extra certificate should be issued by you confirming that all the contents in the bills under this letter of credit comply with the above-mentioned contract terms.Shipment from ... to ...Not later than (Date)Partial shipment allowed. Transshipment allowed.This Credit remains valid in until (inclusive) and all draft (s) must be marked that they are drawn under this Letter of Credit.We hereby undertake that against presentation of the drafts and shipping documents drawn under and in compliance with the terms of this Credit, the same shall be negotiated subject to special instructions item 1 and 2 stated hereunder.SPECIAL INSTRUCTIONS:1.Negotiations of drafts under this Credit are restricted to the above-mentioned advising bank. On negotiation, the negotiating bank should claim reimbursement from by cable provided all terms and conditions stipulated herein have been complied with and simultaneously the negotiation bank should dispatch all documents to us in One Lot by first available airmail.2.All banking charges outside of the PRC and interest charges for negotiation are to be borneby the beneficiary.。

不可撤销跟单信用证申请书中英文对照

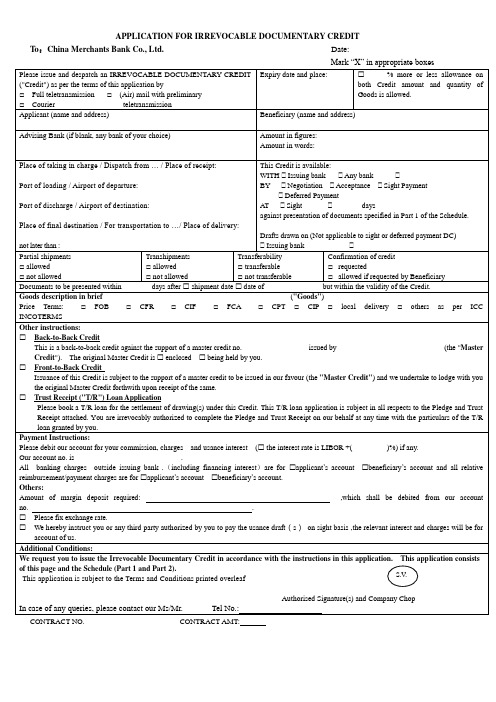

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDITTo:China Merchants Bank Co., Ltd. Date:___________________CONTRACT NO.CONTRACT AMT:SCHEDULE不可撤销跟单信用证申请书致:中国招商银行股份有限公司日期:在相应的框中标记“X”请发行及寄发的不可撤销跟单信用证(“信贷”)按本申请的条款到期日期和到期地点大概 %的信贷金额和数量的商品津贴信用证发送形式如下:是被允许的完全远程传送原始的航空邮件传送快递申请人(姓名和地址)收益人(姓名和地址)通知行小写金额大写金额收货地点/调度…/收货地点: 议付适用银行装货港/机场出发: 开户行任何银行卸货港/目的地机场: 通过□谈判接受□即期付款□延期付款最终目的地的地方/运输…/交货地点: 即期__天__凭单第1部分中指定的时间表。

不迟于: 汇票上(不适用于即期或延期付款直流)开户银行:分批装运转运转移信用证确认□允许□允许□可转移□要求□不允许□不允许□不可转移□受益人要求则允许文件必须在装船后天之内发出,但必须在信用证有效期内提交货物简要描述:价格条款:□离岸价格□成本加运费□到岸价格□货交承运人□运费付至□运费和保险费付至□本地交付□其他按照ICC国际贸易术语通则解释其他说明:□背对背信用证这个背对背信用证与雇主的支持是相反的,信贷号码:开户于:(主信贷)原来的信贷是□关闭的□在你手上□从前端到后端的信贷这张信用证的发行是从属于以我方收益发行的原始信用状的,我方保证一旦我方收到相同的信用证就马上向你方提供原来的原始信用证。

□信托收据(T / R)贷款申请请订一个T / R贷款解决本证项下开具的图纸。

此T / R贷款申请从属于承诺和信托收据附呈。

你不可撤销地授权完成承诺,代表我们的信托收据在任何时候与T / R颁发的贷款的细节。

付款说明:请从我方账户扣除你方佣金、手续费以及远期利率该利率是伦敦银行同业拆进利率+()%,如果有的话。

最新不可撤销信用证 英文|信用证申请英文邮件格式范文.doc

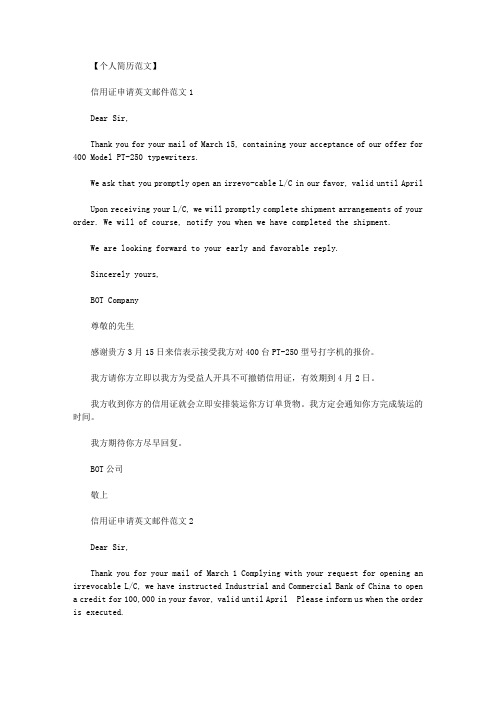

【个人简历范文】信用证申请英文邮件范文1Dear Sir,Thank you for your mail of March 15, containing your acceptance of our offer for 400 Model PT-250 typewriters.We ask that you promptly open an irrevo-cable L/C in our favor, valid until AprilUpon receiving your L/C, we will promptly complete shipment arrangements of your order. We will of course, notify you when we have completed the shipment.We are looking forward to your early and favorable reply.Sincerely yours,BOT Company尊敬的先生感谢贵方3月15日来信表示接受我方对400台PT-250型号打字机的报价。

我方请你方立即以我方为受益人开具不可撤销信用证,有效期到4月2日。

我方收到你方的信用证就会立即安排装运你方订单货物。

我方定会通知你方完成装运的时间。

我方期待你方尽早回复。

BOT公司敬上信用证申请英文邮件范文2Dear Sir,Thank you for your mail of March 1 Complying with your request for opening an irrevocable L/C, we have instructed Industrial and Commercial Bank of China to open a credit for 100,000 in your favor, valid until April Please inform us when the order is executed.Thank you for your cooperation.Sincerely yours,ABC Company尊敬的先生非常感谢贵方3月16日的来信。

不可撤销信用证译文--中文

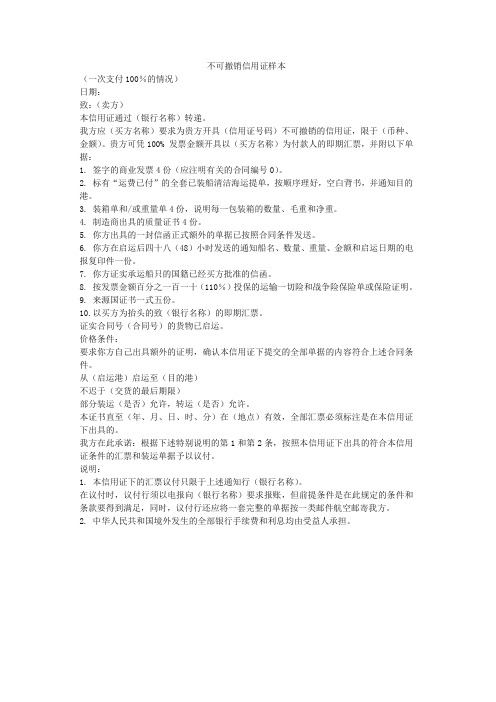

不可撤销信用证样本(一次支付100%的情况)日期:致:(卖方)本信用证通过(银行名称)转递。

我方应(买方名称)要求为贵方开具(信用证号码)不可撤销的信用证,限于(币种、金额)。

贵方可凭100% 发票金额开具以(买方名称)为付款人的即期汇票,并附以下单据:1. 签字的商业发票4份(应注明有关的合同编号0)。

2. 标有“运费已付”的全套已装船清洁海运提单,按顺序理好,空白背书,并通知目的港。

3. 装箱单和/或重量单4份,说明每一包装箱的数量、毛重和净重。

4. 制造商出具的质量证书4份。

5. 你方出具的一封信函正式额外的单据已按照合同条件发送。

6. 你方在启运后四十八(48)小时发送的通知船名、数量、重量、金额和启运日期的电报复印件一份。

7. 你方证实承运船只的国籍已经买方批准的信函。

8. 按发票金额百分之一百一十(110%)投保的运输一切险和战争险保险单或保险证明。

9. 来源国证书一式五份。

10.以买方为抬头的致(银行名称)的即期汇票。

证实合同号(合同号)的货物已启运。

价格条件:要求你方自己出具额外的证明,确认本信用证下提交的全部单据的内容符合上述合同条件。

从(启运港)启运至(目的港)不迟于(交货的最后期限)部分装运(是否)允许,转运(是否)允许。

本证书直至(年、月、日、时、分)在(地点)有效,全部汇票必须标注是在本信用证下出具的。

我方在此承诺:根据下述特别说明的第1和第2条,按照本信用证下出具的符合本信用证条件的汇票和装运单据予以议付。

说明:1. 本信用证下的汇票议付只限于上述通知行(银行名称)。

在议付时,议付行须以电报向(银行名称)要求报账,但前提条件是在此规定的条件和条款要得到满足,同时,议付行还应将一套完整的单据按一类邮件航空邮寄我方。

2. 中华人民共和国境外发生的全部银行手续费和利息均由受益人承担。

信用证条款中英文对照

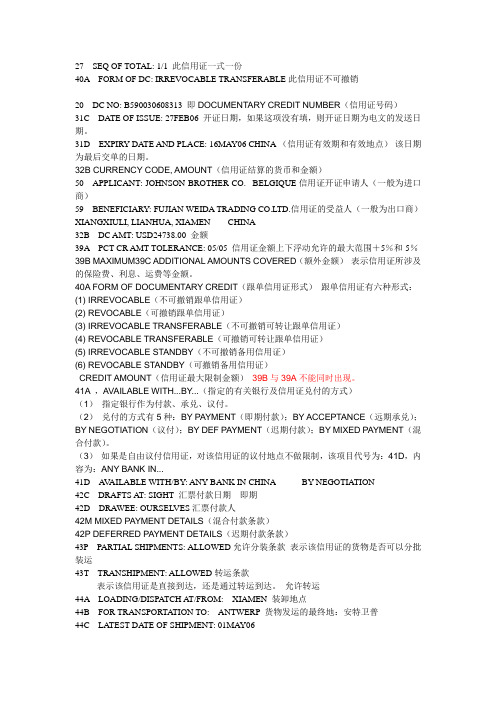

27 SEQ OF TOTAL: 1/1 此信用证一式一份40A FORM OF DC: IRREVOCABLE TRANSFERABLE此信用证不可撤销20 DC NO: B590030608313 即DOCUMENTARY CREDIT NUMBER(信用证号码)31C DATE OF ISSUE: 27FEB06 开证日期,如果这项没有填,则开证日期为电文的发送日期。

31D EXPIRY DA TE AND PLACE: 16MAY06 CHINA (信用证有效期和有效地点)该日期为最后交单的日期。

32B CURRENCY CODE, AMOUNT(信用证结算的货币和金额)50 APPLICANT: JOHNSON BROTHER CO. BELGIQUE信用证开证申请人(一般为进口商)59 BENEFICIARY: FUJIAN WEIDA TRADING CO.LTD.信用证的受益人(一般为出口商)XIANGXIULI, LIANHUA, XIAMEN CHINA32B DC AMT: USD24738.00 金额39A PCT CR AMT TOLERANCE: 05/05 信用证金额上下浮动允许的最大范围+5%和-5%39B MAXIMUM39C ADDITIONAL AMOUNTS COVERED(额外金额)表示信用证所涉及的保险费、利息、运费等金额。

40A FORM OF DOCUMENTARY CREDIT(跟单信用证形式)跟单信用证有六种形式:(1) IRREVOCABLE(不可撤销跟单信用证)(2) REVOCABLE(可撤销跟单信用证)(3) IRREVOCABLE TRANSFERABLE(不可撤销可转让跟单信用证)(4) REVOCABLE TRANSFERABLE(可撤销可转让跟单信用证)(5) IRREVOCABLE STANDBY(不可撤销备用信用证)(6) REVOCABLE STANDBY(可撤销备用信用证)CREDIT AMOUNT(信用证最大限制金额)39B与39A不能同时出现。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Letter of Credit, Irrevocable documentary

Bank ALondon, International Division

Address:

Tel: Telex: Date:

Irrevocable Letter of Credit

Credit number

Of issuing bank:16358

Of issuing bank 8536

Advising bank Applicant

Bank of china Guangzhou Joseph Smith & Sons 52XX Street, Southampton

Beneficiary Amount

Guang Arts & Crafts Corporation US$2000(US Dollars Two Thousand Only)

Guangzhou, China

Expiry

31 May 1986 at the counter of:

Dear Sirs

We hereby issue in your favour this Irrevocable Letter of Credit which is available by you drafts at……sight drawn on us

For 100%......of invoice value accompanies by the following documents:

Signed Invoice in three copies certifying that goods are in accordance with Contract No. GA/JS-453

Insurance certifieate for invoice amount plus 10%

Clean shipped Bills of lading in complete set issued to order and blank endorsed marked “Freight paid”

Packing list

Covering: 250 Cartons Porcelain Figures (CIF Southampton)

Despatch/Shipment from China port to Southampton, Britain

Partal Shipments Permitted

Transhipment Permitted

Special conditions:

We hereby engage that payment will be duly made against documents presented in conformity with the terms of this credit.

Yours faithfully

Bank A, London, International Division Countersigned

Advising Bank’s notification

We hereby advise this credit without any engagement on our part

Bank of China, Beijing

(signed)

20 April 1986

以下为中文:

伦敦“A”国际部

地址:

电话:电传号码:电报挂号:

日期:1986年4月10日

不可撤销信用证开证行证号:16358

通知行证号:8536 通知行:申请开证人:

中国银行广州分行南安普顿XXX

约瑟夫.史密斯父子公司

受益人:金额:

中国、广州 2,000美元(贰千美元正)

广州工艺品公司有效期:

截至1986年5月31日在中国广州中国银行分行办公处

敬启者:

兹开立以贵公司为受益人的不可撤销信用证,凭贵公司开具以我行为付款恩,按发票金额100%开立的即期汇票用款,并须附有下列“X”的单据:

X经签署的发票一式三份,证明货物属第GA/JS-453号合同项下。

X保险凭证。

保险金额为发票金额加百分之十,投保险别为水渍险和战争险。

X全套清洁“货已装船”、“运费已付”、空白抬头、空白背书的提单。

X装箱单

证明装运:250箱瓷人(CIF南安普顿)

每次提交单据,均须注明开证行和通知行证号

装运:分批装运:转船:

自:中国港口

至:英国南安普顿允许允许

特别条件:

单据须于提单签发之日起二十一天内提交,但在任何情况下,不得超过本信用证的有效期。

本行保证,在符合本证条款的单据提交本行时,即与付款。

伦敦“A”银行国际部

(地址:XXX)

(签名)

1986年4月20日

通知行声明:

本行仅通知本信用证,不受任何约束。

中国银行广州分行(签名)

1986年4月20日。