国际经济学(克鲁格曼)教材答案

国际经济学克鲁格曼教材答案

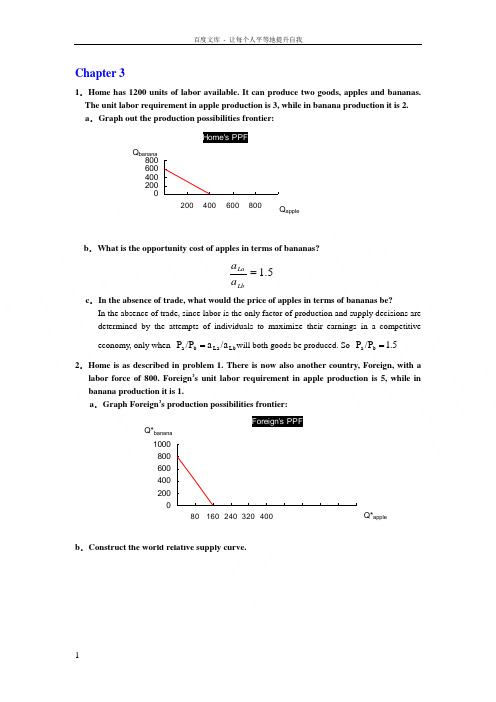

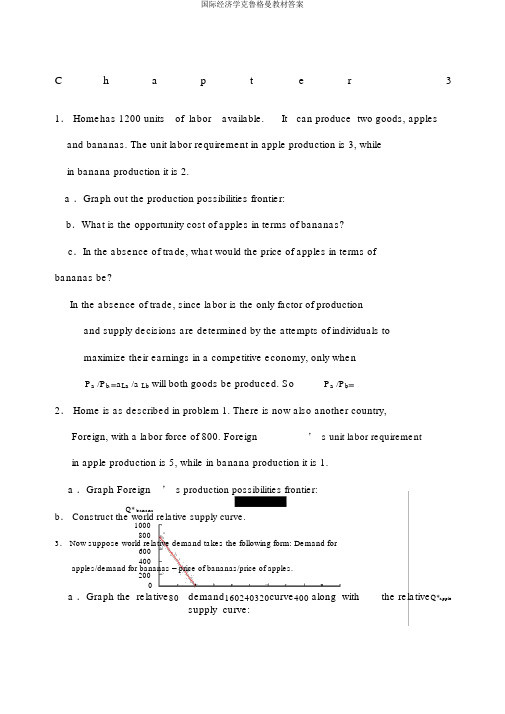

C h a p t e r 31.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2.a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananasc .In the absence of trade, what would the price of apples in terms of bananas beIn the absence of trade, since labor is the only factor of production and supply decisions are determined bythe attempts of individuals to maximize their earnings in a competitive economy, only whenLb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with a labor force of 800. Foreign ’s unit labor requirement in apple production is 5, while in banana production it is 1. a .Graph Foreign ’s production possibilities frontier:b .3. a . ∵∴ b . RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e e c .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the colored lines, which lieoutside the countries ’ production possibility frontiers. And the indirect method, specializing in producingonly one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could thengain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only twobananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case RD: y x 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x ∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Homewill produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor "remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $ an hour; if we allow Korea to export as much as it likes to the UnitedStates, our workers will be forced down to the same level. You can ’t import a $5 shirt without importing the $ wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea ’s low wage reflects the fact that Korea is less productive than the United States in most industries.Actually, trade with a less productive, low wage country can raise the welfare and standard of living ofcountries with high productivity, such as United States. So this pauper labor argument is wrong. 7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problemfor the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argumentThe competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reachconclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic.8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their . counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.)The relative higher purchasing power of U.S. is sustained and maintained by its considerably higherproductivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor.What could we say about the pattern of production and in this case (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If theintersection occurs in a horizontal portion then the country with that price ratio produces both goods. Chapter 41.In the United States where land is cheap, the ratio of land to labor used in cattle rising is higher than that of land used in wheat growing. But in more crowded countries, where land is expensive and labor is cheap, it is common to raise cows by using less land and more labor than Americans use to grow wheat.Can we still say that raising cattle is land intensive compared with farming wheat Why or why not The definition of cattle growing as land intensive depends on the ratio of land to labor used in production, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. The comparison between another country and the United States is less relevant for answering the question. 2.Suppose that at current factor prices cloth is produced using 20 hours of labor for each acre of land, and food is produced using only 5 hours of labor per acre of land.a.Suppose that the economy’s total resources are 600 hours of labor and 60 acres of land. Using adiagram determine the allocation of resources.We can solve this algebraically since L=LC+LF=600 and T=TC+TF=60.The solution is LC=400, TC=20, LF=200 and TF=40.b. Now suppose that the labor supply increase first to 800, then 1000, then 1200 hours. Using a diagram like Figure4-6, trace out the changing allocation of resources.c. What would happen if the labor supply were to increase even furtherAt constant factor prices, some labor would be unused, so factor prices would have to change, or there would be unemployment.3. “The world ’s poorest countries cannot find anything to export. There is no resource that is abundant — certainly not capital or land, and in small poor nations not even labor is abundant.” Discuss. The gains from trade depend on comparative rather than absolute advantage. As to poor countries, what matters is not the absolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. The U.S. labor movement — which mostly represents blue-collar workers rather than professionals and highly educated workers — has traditionally favored limits on imports form less-affluent countries. Is this a shortsighted policy of a rational one in view of the interests of union members How does the answer depend on the model of trade Labor Land ClothFood 0l 800 0l 1000 0l 1200 Labor Land ClothFoodLC LF TCTFIn the Ricardo’s model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries.In the Immobile Factors model labor may gain or lose from trade. Purchasing power in terms of one good will rise, but in terms of the other good it will decline.The Heckscher-Ohlin model directly discusses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits.5.There is substantial inequality of wage levels between regions within the United States. For example,wages of manufacturing workers in equivalent jobs are about 20 percent lower in the Southeast than they are in the Far West. Which of the explanations of failure of factor price equalization mightaccount for this How is this case different from the divergence of wages between the United States and Mexico (which is geographically closer to both the . Southeast and the Far West than the Southeast and Far West are to each other)When we employ factor price equalization, we should pay attention to its conditions: both countries/regions produce both goods; both countries have the same technology of production, and the absence of barriers to trade. Inequality of wage levels between regions within the United States may caused by some or all of these reasons.Actually, the barriers to trade always exist in the real world due to transportation costs. And the trade between U.S. and Mexico, by contrast, is subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.6.Explain why the Leontief paradox and the more recent Bowen, Leamer, and Sveikauskas resultsreported in the text contradict the factor-proportions theory.The factor proportions theory states that countries export those goods whose production is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds.Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found that the correlation between factor endowment and trade patterns is weak for the world as a whole. The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.7.In the discussion of empirical results on the Heckscher-Ohlin model, we noted that recent worksuggests that the efficiency of factors of production seems to differ internationally. Explain how this would affect the concept of factor price equalization.If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.chapter 81. The import demand equation, MD, is found by subtracting the home supply equation from the home demand equation. This results in MD = 80 - 40 x P. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is2.2. a. Foreign's export supply curve, XS, is XS = -40 + 40 x P. In the absence of trade, the price is 1.b. When trade occurs export supply is equal to import demand, XS = MD. Thus, using the equations fromproblems 1 and 2a, P = , and the volume of trade is 20.3. a. The new MD curve is 80 - 40 x (P+t) where t is the specific tariff rate, equal to . (Note: in solving these problems you should be careful about whether a specific tariff or ad valorem tariff is imposed. With an ad valorem tariff, the MD equation would be expressed as MD=80-40 x(1+t)P). The equation for the export supply curve by the foreign country is unchanged. Solving, we find that the world price is $, and thus the internal price at home is $. The volume of trade has been reduced to 10, and the total demand for wheat at home has fallen to 65 (from the free trade level of 70). The total demand for wheat in Foreign has gone up from 50 to 55.b. andc. The welfare of the home country is best studied using the combined numerical and graphicalsolutions presented below in Figure 8-1.where the areas in the figure are:a: 55 (55-50) .5(55-50) (65-55) .5(70-65) (65-55) surplus change: -(a+b+c+d)=. Producer surplus change: a=. Government revenue change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. [Note: in the calculations for the a, b, and d areas a figure of .5 shows up. This is because we are measuring the area of a triangle, which is one-half of the area of the rectangle defined by the product of the horizontal and vertical sides.]4. Using the same solution methodology as in problem 3, when the home country is very small relative to the foreign country, its effects on the terms of trade are expected to be much less. The small country is much more likely to be hurt by its imposition of a tariff. Indeed, this intuition is shown in this problem. The free trade equilibrium is now at the price $ and the trade volume is now $.With the imposition of a tariff of by Home, the new world price is $, the internal home price is $, home demand is units, home supply is and the volume of trade is . When Home is relatively small, the effect of a tariff on world price is smaller than when Home is relatively large. When Foreign and Home were closer in size, a tariffof .5 by home lowered world price by 25 percent, whereas in this case the same tariff lowers world price by about 5 percent. The internal Home price is now closer to the free trade price plus t than when Home was relatively large. In this case, the government revenues from the tariff equal , the consumer surplus loss is , and the producer surplus gain is . The distortionary losses associated with the tariff (areas b+d) sum to and the terms of trade gain (e) is . Clearly, in this small country example the distortionary losses from the tariff swamp the terms of trade gains. The general lesson is the smaller the economy, the larger the losses from a tariff since the terms of trade gains are smaller.5. The effective rate of protection takes into consideration the costs of imported intermediate goods. In this example, half of the cost of an aircraft represents components purchased from other countries. Without the subsidy the aircraft would cost $60 million. The European value added to the aircraft is $30 million. The subsidy cuts the cost of the value added to purchasers of the airplane to $20 million. Thus, the effective rate of protection is (30 - 20)/20 = 50%.6. We first use the foreign export supply and domestic import demand curves to determine the new world price. The foreign supply of exports curve, with a foreign subsidy of 50 percent per unit, becomes XS = -40 +40(1+ x P. The equilibrium world price is and the internal foreign price is . The volume of trade is 32. The foreign demand and supply curves are used to determine the costs and benefits of the subsidy. Construct a diagram similar to that in the text and calculate the area of the various polygons. The government must provide- x 32 = units of output to support the subsidy. Foreign producers surplus rises due to the subsidy by the amount of units of output. Foreign consumers surplus falls due to the higher price by units of the good. Thus, the net loss to Foreign due to the subsidy is + - = units of output. Home consumers and producers face an internal price of as a result of the subsidy. Home consumers surplus rises by 70 x .3 + .5 (6= while Home producers surplus falls by 44 x .3 + .5(6 x .3) = , for a net gain of units of output.7. At a price of $10 per bag of peanuts, Acirema imports 200 bags of peanuts. A quota limiting the import of peanuts to 50 bags has the following effects:a. The price of peanuts rises to $20 per bag.b. The quota rents are ($20 - $10) x 50 = $500.c. The consumption distortion loss is .5 x 100 bags x $10 per bag = $500.d. The production distortion loss is .5 x50 bags x$10 per bag = $250.。

国际经济学第六版中文版克鲁格曼课后习题答案

指导手册伴随克鲁格曼& Obstfeld国际经济学:理论和政策第六版第一章介绍组织章国际经济是什么呢?贸易收益的贸易的模式保护主义国际收支汇率的决心国际政策协调国际资本市场国际经济学:贸易和资金章概述本章的目的是提供概述,国际经济的主题,并提供一种指导组织的文本。

它是相对容易的讲师激励研究国际贸易和金融。

报纸的头版,杂志的封面,导致电视新闻广播的报道预示着美国经济的相互依存与世界其他国家的。

这种相互依存关系可能也会被学生通过他们购买进口的各种各样的商品,他们的个人观测的影响由于国际竞争的混乱,和他们的经验通过出国旅行。

理论的学习国际经济学生成一个理解许多关键事件,塑造我们的国内和国际环境。

在最近的历史,这些事件包括成因及后果的巨额经常账户赤字的美国;显著升值的美元在1980年代的前半期后跟其快速折旧在第二个一半的1980年代,拉丁美洲债务危机的1980年代和墨西哥危机在1994年末;和不断上升的压力,保护不受外国竞争的行业广泛表达了在1980年代后期和更为强烈拥护在1990年代的前半期。

最近,金融危机始于东亚在1997年和年蔓延到世界各地的许多国家,经济和货币联盟在欧洲已经强调了w第二章劳动生产率和比较优势:李嘉图模型组织章比较优势的概念一个单因素经济生产可能性相对价格和供应贸易在单因素的世界箱:比较优势在实践:贝比鲁斯的情况确定相对价格在贸易贸易收益的一个数值例子箱:非贸易的损失相对工资误解的比较优势生产力和竞争力穷人劳动力参数剥削箱:工资反映生产力?比较优势与许多商品设置模型相对工资和专业化确定相对工资与Multigood模型增加运输成本和非贸易商品经验证据在李嘉图模型摘要章概述李嘉图模型的介绍了国际贸易理论。

这个最基本的模型的贸易涉及两个国家,两种商品,和一个生产要素、劳动。

在相对劳动生产率差异各国引起国际贸易。

这李嘉图模型,简单,产生重要的见解关于比较优势和从交易中获利。

这些观点有必要的基础提出了更复杂的模型在后面的章节。

国际经济学克鲁格曼课后习题答案章完整版

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

克鲁格曼国际经济学第八版上册课后答案

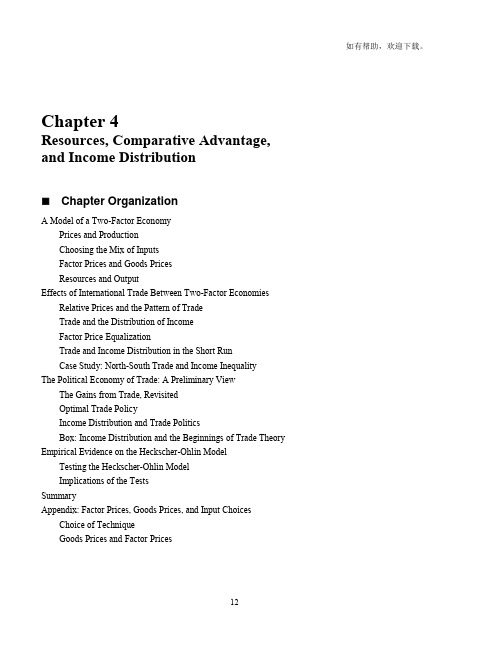

Chapter 4Resources, Comparative Advantage, and Income DistributionChapter OrganizationA Model of a Two-Factor EconomyPrices and ProductionChoosing the Mix of InputsFactor Prices and Goods PricesResources and OutputEffects of International Trade Between Two-Factor Economies Relative Prices and the Pattern of TradeTrade and the Distribution of IncomeFactor Price EqualizationTrade and Income Distribution in the Short RunCase Study: North-South Trade and Income InequalityThe Political Economy of Trade: A Preliminary ViewThe Gains from Trade, RevisitedOptimal Trade PolicyIncome Distribution and Trade PoliticsBox: Income Distribution and the Beginnings of Trade Theory Empirical Evidence on the Heckscher-Ohlin ModelTesting the Heckscher-Ohlin ModelImplications of the TestsSummaryAppendix: Factor Prices, Goods Prices, and Input Choices Choice of TechniqueGoods Prices and Factor PricesChapter OverviewIn Chapter 3, trade between nations was motivated by differences internationally in the relative productivity of workers when producing a range of products. In Chapter 4, this analysis goes a step further by introducing the Heckscher-Ohlin theory.The Heckscher-Ohlin theory considers the pattern of production and trade which will arise when countries have different endowments of factors of production, such as labor, capital, and land. The basic point is that countries tend to export goods that are intensive in the factors with which they are abundantly supplied. Trade has strong effects on the relative earnings of resources, and tends to lead to equalization across countries of prices of the factors of production. These theoretical results and related empirical findings are presented in this chapter.The chapter begins by developing a general equilibrium model of an economy with two goods which are each produced using two factors according to fixed coefficient production functions. The assumption of fixed coefficient production functions provides an unambiguous ranking of goods in terms of factor intensities. (The appendix develops the model when the production functions have variable coefficients.) Two important results are derived using this model. The first is known as the Rybczynski effect. Increasing the relative supply of one factor, holding relative goods prices constant, leads to a biased expansion of production possibilities favoring the relative supply of the good which uses that factor intensively.The second key result is known as the Stolper-Samuelson effect. Increasing the relative price of a good, holding factor supplies constant, increases the return to the factor used intensively in the production of that good by more than the price increase, while lowering the return to the other factor. This result has important income distribution implications.It can be quite instructive to think of the effects of demographic/labor force changes on the supply of different products. For example, how might the pattern of production during the productive years of the “Baby Boom” generation differ from the pattern of production for post Baby Boom generations? What does this imply for returns to factors and relative price behavior?The central message concerning trade patterns of the Heckscher-Ohlin theory is that countries tend to export goods whose production is intensive in factors with which they are relatively abundantly endowed. This is demonstrated by showing that, using the relative supply and relative demand analysis, the country relatively abundantly endowed with a certain factor will produce that factor more cheaply than the other country. International trade leads to a convergence of goods prices. Thus, the results from the Stolper-Samuelson effect demonstrate that owners of a country’s abundant factors gain from trade, but ownersof a country’s scarce factors lose. The extension of this result is the important Factor Price Equalization Theorem, which states that trade in (and thus price equalization of) goods leads to an equalization in the rewards to factors across countries. The political implications of factor price equalization should be interesting to students.The chapter also introduces some political economy considerations. First, it briefly notes that many of the results regarding trade and income distribution assume full and swift adjustment in the economy. In the short run, though, labor and capital that are currently in a particular industry may have sector-specific skills or knowledge and are being forced to move to another sector, and this involves costs. Thus, even if a shift in relative prices were to improve the lot of labor, for those laborers who must change jobs, there is a short run cost.The core of the political economy discussion focuses on the fact that when opening to trade, some may benefit and some may lose, but the expansion of economic opportunity should allow society to redistribute some of the gains towards those who lose, making sure everyone benefits on net. In practice, though, those who lose are often more concentrated and hence have more incentive to try to affect policy. Thus, trade policy is not always welfare maximizing, but may simply reflect the preferences of the loudest and best organized in society.Empirical results concerning the Heckscher-Ohlin theory, beginning with the Leontief paradox and extending to current research, do not support its predictions concerning resource endowments explaining overall patterns of trade, though some patterns do match the broad outlines of its theory (e.g., theUnited States imports more low-skill products from Bangladesh and more high-skill products from Germany). This observation has motivated many economists to consider motives for trade between nations that are not exclusively based on differences across countries. These concepts will be exploredin later chapters. Despite these shortcomings, important and relevant results concerning income distribution are obtained from the Heckscher-Ohlin theory.Answers to Textbook Problems1. The definition of cattle growing as land intensive depends on the ratio of land to labor used inproduction, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries as well if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. Comparisons between another country and the United States is less relevant for this purpose.2. a. The box diagram has 600 as the length of two sides (representing labor) and 60 as the lengthof the other two sides (representing land). There will be a ray from each of the two cornersrepresenting the origins. To find the slopes of these rays we use the information from the questionconcerning the ratios of the production coefficients. The question states that a LC/a TC= 20 anda LF/a TF= 5.Since a LC/a TC= (L C/Q C)/(T C/Q C) =L C/T C we have L C= 20T C. Using the same reasoning,a LF/a TF= (L F/Q F)/(T F/Q F) =L F/T F and since this ratio equals 5, we have L F= 5T F. We cansolve this algebraically since L=L C+ L F= 600 and T=T C+ T F= 60.The solution is L C= 400, T C= 20, L F= 200 and T F= 40.b. The dimensions of the box change with each increase in available labor, but the slopes of the raysfrom the origins remain the same. The solutions in the different cases are as follows.L= 800: T C= 33.33, L C= 666.67, T F= 26.67, L F= 133.33L= 1000: T C= 46.67, L C= 933.33, T F= 13.33, L F= 66.67L= 1200: T C= 60, L C= 1200, T F= 0, L F= 0. (complete specialization).c. At constant factor prices, some labor would be unused, so factor prices would have to change, orthere would be unemployment.3. This question is similar to an issue discussed in Chapter 3. What matters is not the absolute abundanceof factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. In the Ricardian model, labor gains from trade through an increase in its purchasing power. Thisresult does not support labor union demands for limits on imports from less affluent countries. The Heckscher-Ohlin model directly addresses distribution by considering the effects of trade on theowners of factors of production. In the context of this model, unskilled U.S. labor loses fromtrade since this group represents the relatively scarce factors in this country. The results from theHeckscher-Ohlin model support labor union demands for import limits. In the short run, certainunskilled unions may gain or lose from trade depending on in which sector they work, but in theory, in the longer run, the conclusions of the Heckscher-Ohlin model will dominate.5. Specific programmers may face wage cuts due to the competition from India, but this is not inconsistentwith skilled labor wages rising. By making programming more efficient in general, this development may have increased wages for others in the software industry or lowered the prices of the goodsoverall. In the short run, though, it has clearly hurt those with sector specific skills who will facetransition costs. There are many reasons to not block the imports of computer programming services (or outsourcing of these jobs). First, by allowing programming to be done more cheaply, it expands the production possibilities frontier of the U.S., making the entire country better off on average.Necessary redistribution can be done, but we should not stop trade which is making the nation as a whole better off. In addition, no one trade policy action exists in a vacuum, and if the U.S. blocked the programming imports, it could lead to broader trade restrictions in other countries.6. The factor proportions theory states that countries export those goods whose production is intensivein factors with which they are abundantly endowed. One would expect the United States, whichhas a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods.Bowen, Leamer and Sveikauskas found for the world as a whole the correlation between factorendowment and trade patterns to be tenuous. The data do not support the predictions of the theory that countries’ e xports and imports reflect the relative endowments of factors.7. If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be moresuccessful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled workercould earn twice what lower-skilled workers do, and the price of one effective unit of labor would still be equalized.。

国际经济学(克鲁格曼)教材答案

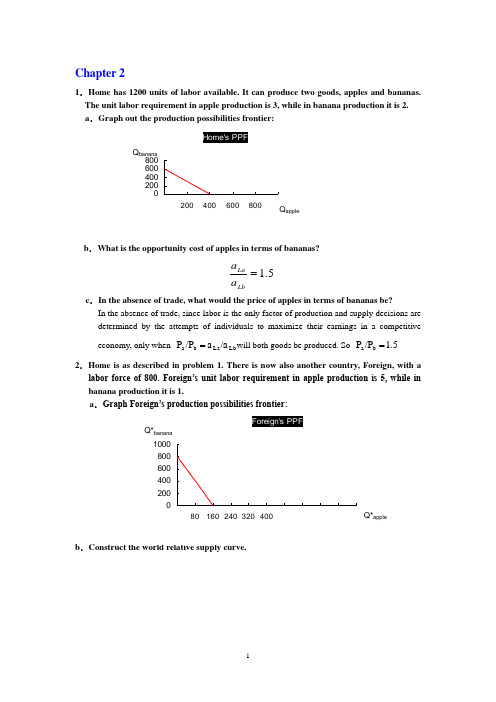

Chapter 31.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign ’s unit labor requirement in apple production is 5, while in banana production it is 1.a .Graph Foreign ’s production possibilities frontier:b .Construct the world relative supply curve.Home's PPF 0200400600800200400600800Q apple Q banana Foreign's PPF0200400600800100080160240320400Q*apple Q*banana3.Now suppose world relative demand takes the following form: Demand for apples/demandfor bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D -**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries ’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case?RD: yx 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x ∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $ an hour; if we allow Korea to export as much as it likes to the United States, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $ wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. Sothis pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their . counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.Chapter 41. In the United States where land is cheap, the ratio of land to labor used in cattle rising ishigher than that of land used in wheat growing. But in more crowded countries, where land is expensive and labor is cheap, it is common to raise cows by using less land and more labor than Americans use to grow wheat. Can we still say that raising cattle is land intensive compared with farming wheat? Why or why not?The definition of cattle growing as land intensive depends on the ratio of land to labor used inproduction, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. The comparison between another country and the United States is less relevant for answering the question.2. Suppose that at current factor prices cloth is produced using 20 hours of labor for eachacre of land, and food is produced using only 5 hours of labor per acre of land.a. Suppose that the economy ’s total resources are 600 hours of labor and 60 acres ofland. Using a diagram determine the allocation of resources.5TF LF /TF LF /QF)(TF / /QF)(LF aTF / aLF 20TC LC /TC LC /QC)(TC / /QC)(LC aTC / aLC =⇒===⇒==We can solve this algebraically since L=LC+LF=600 and T=TC+TF=60. The solution is LC=400, TC=20, LF=200 and TF=40.b. Now suppose that the labor supply increase first to 800, then 1000, then 1200 hours. Using a diagram like Figure4-6, trace out the changing allocation of resources. Labor Land ClothFoodLCLF TCTFtion).specializa (complete 0.LF 0,TF 1200,LC 60,TC :1200L 66.67LF 13.33,TF 933.33,LC 46.67,TC :1000L 133.33LF 26.67,TF 666.67,LC 33.33,TC :800L ===============c. What would happen if the labor supply were to increase even further?At constant factor prices, some labor would be unused, so factor prices would have tochange, or there would be unemployment.3. “The world ’s poorest countries cannot find anything to export. There is no resource thatis abundant — certainly not capital or land, and in small poor nations not even labor is abundant.” Discuss.The gains from trade depend on comparative rather than absolute advantage. As to poor countries, what matters is not the absolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. The U.S. labor movement — which mostly represents blue-collar workers rather thanprofessionals and highly educated workers — has traditionally favored limits on imports form less-affluent countries. Is this a shortsighted policy of a rational one in view of the interests of union members? How does the answer depend on the model of trade?In the Ricardo ’s model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries.In the Immobile Factors model labor may gain or lose from trade. Purchasing power in terms of one good will rise, but in terms of the other good it will decline.The Heckscher-Ohlin model directly discusses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits. 5. There is substantial inequality of wage levels between regions within the United States. Labor Land Cloth Food0l 800 0l 1000 0l 1200For example, wages of manufacturing workers in equivalent jobs are about 20 percent lower in the Southeast than they are in the Far West. Which of the explanations of failure of factor price equalization might account for this? How is this case different from the divergence of wages between the United States and Mexico (which is geographically closer to both the . Southeast and the Far West than the Southeast and Far West are to each other)?When we employ factor price equalization, we should pay attention to its conditions: both countries/regions produce both goods; both countries have the same technology of production, and the absence of barriers to trade. Inequality of wage levels between regions within the United States may caused by some or all of these reasons.Actually, the barriers to trade always exist in the real world due to transportation costs. And the trade between U.S. and Mexico, by contrast, is subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.6.Explain why the Leontief paradox and the more recent Bowen, Leamer, andSveikauskas results reported in the text contradict the factor-proportions theory.The factor proportions theory states that countries export those goods whose production is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found that the correlation between factor endowment and trade patterns is weak for the world as a whole.The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.7.In the discussion of empirical results on the Heckscher-Ohlin model, we noted thatrecent work suggests that the efficiency of factors of production seems to differ internationally. Explain how this would affect the concept of factor price equalization.If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.chapter 81. The import demand equation, MD, is found by subtracting the home supply equation from the home demand equation. This results in MD = 80 - 40 x P. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is2.2. a. Foreign's export supply curve, XS, is XS = -40 + 40 x P. In the absence of trade, the price is 1.b. When trade occurs export supply is equal to import demand, XS = MD. Thus, using theequations from problems 1 and 2a, P = , and the volume of trade is 20.3. a. The new MD curve is 80 - 40 x (P+t) where t is the specific tariff rate, equal to . (Note: in solving these problems you should be careful about whether a specific tariff or ad valorem tariff is imposed. With an ad valorem tariff, the MD equation would be expressed as MD =80-40 x (1+t)P). The equation for the export supply curve by the foreign country is unchanged. Solving, we find that the world price is $, and thus the internal price at home is $. The volume of trade has been reduced to 10, and the total demand for wheat at home has fallen to 65 (from the free trade level of70). The total demand for wheat in Foreign has gone up from 50 to 55.b. andc. The welfare of the home country is best studied using the combined numerical andgraphical solutions presented below in Figure 8-1. Home SupplyHome Demanda b c d e P T =1.7550556070QuantityPrice P W =1.50P T*=1.25where the areas in the figure are:a: 55 (55-50) .5(55-50) (65-55) .5(70-65) (65-55) surplus change: -(a+b+c+d)=. Producer surplus change: a=. Government revenue change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. [Note: in the calculations for the a, b, and d areas a figure of .5 shows up. This is because we are measuring the area of a triangle, which is one-half of the area of the rectangle defined by the product of the horizontal and vertical sides.]4. Using the same solution methodology as in problem 3, when the home country is very small relative to the foreign country, its effects on the terms of trade are expected to be much less. The small country is much more likely to be hurt by its imposition of a tariff. Indeed, this intuition is shown in this problem. The free trade equilibrium is now at the price $ and the trade volume is now $.With the imposition of a tariff of by Home, the new world price is $, the internal home price is $, home demand is units, home supply is and the volume of trade is . When Home is relatively small, the effect of a tariff on world price is smaller than when Home is relatively large. When Foreign and Home were closer in size, a tariff of .5 by home lowered world price by 25 percent, whereas in this case the same tariff lowers world price by about 5 percent. The internal Home price is now closer to the free trade price plus t than when Home was relatively large. In this case, the government revenues from the tariff equal , the consumer surplus loss is , and the producer surplus gain is . The distortionary losses associated with the tariff (areas b+d) sum to and the terms of trade gain (e) is . Clearly, in this small country example the distortionary losses from the tariff swamp the terms of trade gains. The general lesson is the smaller the economy,the larger the losses from a tariff since the terms of trade gains are smaller.5. The effective rate of protection takes into consideration the costs of imported intermediate goods. In this example, half of the cost of an aircraft represents components purchased from other countries. Without the subsidy the aircraft would cost $60 million. The European value added to the aircraft is $30 million. The subsidy cuts the cost of the value added to purchasers of the airplane to $20 million. Thus, the effective rate of protection is (30 - 20)/20 = 50%.6. We first use the foreign export supply and domestic import demand curves to determine the new world price. The foreign supply of exports curve, with a foreign subsidy of 50 percent per unit, becomes XS = -40 + 40(1+ x P. The equilibrium world price is and the internal foreign price is . The volume of trade is 32. The foreign demand and supply curves are used to determine the costs and benefits of the subsidy. Construct a diagram similar to that in the text and calculate the area of the various polygons. The government must provide - x 32 = units of output to support the subsidy. Foreign producers surplus rises due to the subsidy by the amount of units of output. Foreign consumers surplus falls due to the higher price by units of the good. Thus, the net loss to Foreign due to the subsidy is + - = units of output. Home consumers and producers face an internal price of as a result of the subsidy. Home consumers surplus rises by 70 x .3 + .5 (6= while Home producers surplus falls by 44 x .3 + .5(6 x .3) = , for a net gain of units of output.7. At a price of $10 per bag of peanuts, Acirema imports 200 bags of peanuts. A quota limiting the import of peanuts to 50 bags has the following effects:a. The price of peanuts rises to $20 per bag.b. The quota rents are ($20 - $10) x 50 = $500.c. The consumption distortion loss is .5 x 100 bags x $10 per bag = $500.d. The production distortion loss is .5 x50 bags x$10 per bag = $250.。

克鲁格曼国际经济学课后答案

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算和国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

国际经济学(下册国际金融)克鲁格曼 中文答案

《国际经济学》(国际金融)习题答案要点第12章 国民收入核算与国际收支1、如问题所述,GNP 仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从GNP 中减去,出口的中间品价值加到GNP 中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的GNP 中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的GNP ,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的GNP 中减去,并加入美国的GNP 。

2、(1)等式12-2可以写成()()p CA S I T G =-+-。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

国际经济学 (克鲁格曼) 教材解答

Chapter 31.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals tomaximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign ’s unit labor requirement in apple production is 5, while in banana production it is 1.a .Graph Foreign ’s production possibilities frontier:b .3.Now suppose world relative demand takes the following form: Demand for apples/demand for bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D -**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries ’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case? RD: yx 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as much as it likes to the United States, our workers will be forced down to the same level. Y ou can’t import a $5 shirt without importing the $2.50 wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. Sothis pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.Chapter 41. In the United States where land is cheap, the ratio of land to labor used in cattle rising ishigher than that of land used in wheat growing. But in more crowded countries, where land is expensive and labor is cheap, it is common to raise cows by using less land and more labor than Americans use to grow wheat. Can we still say that raising cattle is land intensive compared with farming wheat? Why or why not?The definition of cattle growing as land intensive depends on the ratio of land to labor used inproduction, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. The comparison between another country and the United States is less relevant for answering the question.2. Suppose that at current factor prices cloth is produced using 20 hours of labor for eachacre of land, and food is produced using only 5 hours of labor per acre of land.a. Suppose that the economy ’s total resources are 600 hours of labor and 60 acres ofland. Using a diagram determine the allocation of resources.5TF LF /TF LF /QF)(TF / /QF)(LF aTF / aLF 20TC LC /TC LC /QC)(TC / /QC)(LC aTC / aLC =⇒===⇒==We can solve this algebraically since L=LC+LF=600 and T=TC+TF=60. The solution is LC=400, TC=20, LF=200 and TF=40.b. Now suppose that the labor supply increase first to 800, then 1000, then 1200 hours.Using a diagram like Figure4-6, trace out the changing allocation of resources. Labor Land ClothFoodLC LF TCTFtion).specializa (complete 0.LF 0,TF 1200,LC 60,TC :1200L 66.67LF 13.33,TF 933.33,LC 46.67,TC :1000L 133.33LF 26.67,TF 666.67,LC 33.33,TC :800L ===============c. What would happen if the labor supply were to increase even further?At constant factor prices, some labor would be unused, so factor prices would have to change, or there would be unemployment.3. “The world ’s poorest countries cannot find anything to export. There is no resource thatis abundant — certainly not capital or land, and in small poor nations not even labor is abundant.” Discuss.The gains from trade depend on comparative rather than absolute advantage. As to poor countries, what matters is not the absolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. The U.S. labor movement — which mostly represents blue-collar workers rather thanprofessionals and highly educated workers — has traditionally favored limits on imports form less-affluent countries. Is this a shortsighted policy of a rational one in view of the interests of union members? How does the answer depend on the model of trade?In the Ricardo ’s model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries.In the Immobile Factors model labor may gain or lose from trade. Purchasing power in terms of one good will rise, but in terms of the other good it will decline.The Heckscher-Ohlin model directly discusses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits.5. There is substantial inequality of wage levels between regions within the United States. Labor Land ClothFood0l 800 0l 1000 0l 1200For example, wages of manufacturing workers in equivalent jobs are about 20 percent lower in the Southeast than they are in the Far West. Which of the explanations of failure of factor price equalization might account for this? How is this case different from the divergence of wages between the United States and Mexico (which is geographically closer to both the U.S. Southeast and the Far West than the Southeast and Far West are to each other)?When we employ factor price equalization, we should pay attention to its conditions: both countries/regions produce both goods; both countries have the same technology of production, and the absence of barriers to trade. Inequality of wage levels between regions within the United States may caused by some or all of these reasons.Actually, the barriers to trade always exist in the real world due to transportation costs. And the trade between U.S. and Mexico, by contrast, is subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.6.Explain why the Leontief paradox and the more recent Bowen, Leamer, andSveikauskas results reported in the text contradict the factor-proportions theory.The factor proportions theory states that countries export those goods whose production is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found that the correlation between factor endowment and trade patterns is weak for the world as a whole.The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.7.In the discussion of empirical results on the Heckscher-Ohlin model, we noted thatrecent work suggests that the efficiency of factors of production seems to differ internationally. Explain how this would affect the concept of factor price equalization.If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.chapter 81. The import demand equation, MD, is found by subtracting the home supply equation from the home demand equation. This results in MD = 80 - 40 x P. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is2.2. a. Foreign's export supply curve, XS, is XS = -40 + 40 x P. In the absence of trade, the price is 1.b. When trade occurs export supply is equal to import demand, XS = MD. Thus, using theequations from problems 1 and 2a, P = 1.50, and the volume of trade is 20.3. a. The new MD curve is 80 - 40 x (P+t) where t is the specific tariff rate, equal to 0.5. (Note: in solving these problems you should be careful about whether a specific tariff or ad valorem tariff is imposed. With an ad valorem tariff, the MD equation would be expressed as MD =80-40 x (1+t)P). The equation for the export supply curve by the foreign country is unchanged. Solving, we find that the world price is $1.25, and thus the internal price at home is $1.75. The volume of trade has been reduced to 10, and the total demand for wheat at home has fallen to 65 (from the free trade level of 70). The total demand for wheat in Foreign has gone up from 50 to 55.b. andc. The welfare of the home country is best studied using the combined numerical andgraphical solutions presented below in Figure 8-1.P T =1.7550556070QuantityPrice P W =1.50P T*=1.25where the areas in the figure are:a: 55(1.75-1.50) -.5(55-50)(1.75-1.50)=13.125b: .5(55-50)(1.75-1.50)=0.625c: (65-55)(1.75-1.50)=2.50d: .5(70-65)(1.75-1.50)=0.625e: (65-55)(1.50-1.25)=2.50Consumer surplus change: -(a+b+c+d)=-16.875. Producer surplus change: a=13.125. Government revenue change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. [Note: in the calculations for the a, b, and d areas a figure of .5 shows up. This is because we are measuring the area of a triangle, which is one-half of the area of the rectangle defined by the product of the horizontal and vertical sides.]4. Using the same solution methodology as in problem 3, when the home country is very small relative to the foreign country, its effects on the terms of trade are expected to be much less. The small country is much more likely to be hurt by its imposition of a tariff. Indeed, this intuition is shown in this problem. The free trade equilibrium is now at the price $1.09 and the trade volume is now $36.40.With the imposition of a tariff of 0.5 by Home, the new world price is $1.045, the internal home price is $1.545, home demand is 69.10 units, home supply is 50.90 and the volume of trade is 18.20. When Home is relatively small, the effect of a tariff on world price is smaller than when Home is relatively large. When Foreign and Home were closer in size, a tariff of .5 by home lowered world price by 25 percent, whereas in this case the same tariff lowers world price byabout 5 percent. The internal Home price is now closer to the free trade price plus t than when Home was relatively large. In this case, the government revenues from the tariff equal 9.10, the consumer surplus loss is 33.51, and the producer surplus gain is 21.089. The distortionary losses associated with the tariff (areas b+d) sum to 4.14 and the terms of trade gain (e) is 0.819. Clearly, in this small country example the distortionary losses from the tariff swamp the terms of trade gains. The general lesson is the smaller the economy, the larger the losses from a tariff since the terms of trade gains are smaller.5. The effective rate of protection takes into consideration the costs of imported intermediate goods. In this example, half of the cost of an aircraft represents components purchased from other countries. Without the subsidy the aircraft would cost $60 million. The European value added to the aircraft is $30 million. The subsidy cuts the cost of the value added to purchasers of the airplane to $20 million. Thus, the effective rate of protection is (30 - 20)/20 = 50%.6. We first use the foreign export supply and domestic import demand curves to determine the new world price. The foreign supply of exports curve, with a foreign subsidy of 50 percent per unit, becomes XS= -40 + 40(1+0.5) x P. The equilibrium world price is 1.2 and the internal foreign price is 1.8. The volume of trade is 32. The foreign demand and supply curves are used to determine the costs and benefits of the subsidy. Construct a diagram similar to that in the text and calculate the area of the various polygons. The government must provide (1.8 - 1.2) x 32 = 19.2 units of output to support the subsidy. Foreign producers surplus rises due to the subsidy by the amount of 15.3 units of output. Foreign consumers surplus falls due to the higher price by7.5 units of the good. Thus, the net loss to Foreign due to the subsidy is 7.5 + 19.2 - 15.3 = 11.4 units of output. Home consumers and producers face an internal price of 1.2 as a result of the subsidy. Home consumers surplus rises by 70 x .3 + .5 (6x.3) = 21.9 while Home producers surplus falls by 44 x .3 + .5(6 x .3) = 14.1, for a net gain of 7.8 units of output.7. At a price of $10 per bag of peanuts, Acirema imports 200 bags of peanuts. A quota limiting the import of peanuts to 50 bags has the following effects:a. The price of peanuts rises to $20 per bag.b. The quota rents are ($20 - $10) x 50 = $500.c. The consumption distortion loss is .5 x 100 bags x $10 per bag = $500.x50 bags x$10 per bag = $250.。

克鲁格曼《国际经济学》(国际金融)习题标准答案要点

克鲁格曼《国际经济学》(国际金融)习题答案要点————————————————————————————————作者:————————————————————————————————日期:23 《国际经济学》(国际金融)习题答案要点第12章 国民收入核算与国际收支1、如问题所述,GNP 仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从GNP 中减去,出口的中间品价值加到GNP 中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的GNP 中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的GNP ,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的GNP 中减去,并加入美国的GNP 。

2、(1)等式12-2可以写成()()p CA S I T G =-+-。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

克鲁格曼国际经济学答案.pdf

Chapter 21.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign’s unit labor requirement in apple production is 5, while in banana production it is 1.a .Graph Foreign’s production possibilities frontier:b .3.Now suppose world relative demand takes the following form: Demand for apples/demandfor bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D −**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export applesand import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case? RD: yx 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as m uch as it likes to the United States, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $2.50 wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. Sothis pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.。

国际经济学克鲁格曼教材答案