公司理财精要版原书第12版习题库答案Ross12e_Chapter11_TB

公司理财精要版原书第12版习题库答案Ross12e_Chapter01_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 1 Introduction to Corporate Finance1) Which one of the following functions should be the responsibility of the controller rather than the treasurer?A) Depositing cash receiptsB) Processing cost reportsC) Analyzing equipment purchasesD) Approving credit for a customerE) Paying a vendor2) The treasurer of a corporation generally reports directly to the:A) board of directors.B) chairman of the board.C) chief executive officer.D) president.E) vice president of finance.3) Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A) The vice president of finance reports to the chairman of the board.B) The chief executive officer reports to the president.C) The controller reports to the chief financial officer.D) The treasurer reports to the president.E) The chief operations officer reports to the vice president of production.4) An example of a capital budgeting decision is deciding:A) how many shares of stock to issue.B) whether or not to purchase a new machine for the production line.C) how to refinance a debt issue that is maturing.D) how much inventory to keep on hand.E) how much money should be kept in the checking account.5) When evaluating the timing of a project's projected cash flows, a financial manager is analyzing:A) the amount of each expected cash flow.B) only the start-up costs that are expected to require cash resources.C) only the date of the final cash flow related to the project.D) the amount by which cash receipts are expected to exceed cash outflows.E) when each cash flow is expected to occur.6) Capital structure decisions include determining:A) which one of two projects to accept.B) how to allocate investment funds to multiple projects.C) the amount of funds needed to finance customer purchases of a new product.D) how much debt should be assumed to fund a project.E) how much inventory will be needed to support a project.7) The decision to issue additional shares of stock is an example of:A) working capital management.B) a net working capital decision.C) capital budgeting.D) a controller's duties.E) a capital structure decision.8) Which one of the following questions is a working capital management decision?A) Should the company issue new shares of stock or borrow money?B) Should the company update or replace its older equipment?C) How much inventory should be on hand for immediate sale?D) Should the company close one of its current stores?E) How much should the company borrow to buy a new building?9) Which one of the following is a working capital management decision?A) What type(s) of equipment is (are) needed to complete a current project?B) Should the firm pay cash for a purchase or use the credit offered by the supplier?C) What amount of long-term debt is required to complete a project?D) How many shares of stock should the firm issue to fund an acquisition?E) Should a project should be accepted?10) Working capital management decisions include determining:A) the minimum level of cash to be kept in a checking account.B) the best method of producing a product.C) the number of employees needed to work during a particular shift.D) when to replace obsolete equipment.E) if a competitor should be acquired.11) Which one of the following terms is defined as the management of a firm's long-term investments?A) Working capital managementB) Financial allocationC) Agency cost analysisD) Capital budgetingE) Capital structure12) Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A) Working capital managementB) Cash managementC) Cost analysisD) Capital budgetingE) Capital structure13) A firm's short-term assets and its short-term liabilities are referred to as the firm's:A) working capital.B) debt.C) investment capital.D) net capital.E) capital structure.14) Which one of the following questions is least likely to be addressed by financial managers?A) How should a product be marketed?B) Should customers be given 30 or 45 days to pay for their credit purchases?C) Should the firm borrow more money?D) Should the firm acquire new equipment?E) How much cash should the firm keep on hand?15) A business owned by a solitary individual who has unlimited liability for the firm's debt is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.16) A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.17) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A) general partner.B) sole proprietor.C) limited partner.D) corporate shareholder.E) zero partner.18) A business created as a distinct legal entity and treated as a legal "person" is called a(n):A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) unlimited liability company.19) Which one of the following statements concerning a sole proprietorship is correct?A) A sole proprietorship is designed to protect the personal assets of the owner.B) The profits of a sole proprietorship are subject to double taxation.C) The owner of a sole proprietorship is personally responsible for all of the company's debts.D) There are very few sole proprietorships remaining in the U.S. today.E) A sole proprietorship is structured the same as a limited liability company.20) Which one of the following statements concerning a sole proprietorship is correct?A) The life of a sole proprietorship is limited.B) A sole proprietor can generally raise large sums of capital quite easily.C) Transferring ownership of a sole proprietorship is easier than transferring ownership of a corporation.D) A sole proprietorship is taxed the same as a C corporation.E) A sole proprietorship is the most regulated form of organization.21) Which of the following individuals have unlimited liability for a firm's debts based on their ownership interest?A) Only general partnersB) Only sole proprietorsC) All stockholdersD) Both limited and general partnersE) Both general partners and sole proprietors22) The primary advantage of being a limited partner is:A) the receipt of tax-free income.B) the partner's active participation in the firm's activities.C) the lack of any potential financial loss.D) the daily control over the business affairs of the partnership.E) the partner's maximum loss is limited to their capital investment.23) A general partner:A) is personally responsible for all partnership debts.B) has no say over a firm's daily operations.C) faces double taxation whereas a limited partner does not.D) has a maximum loss equal to his or her equity investment.E) receives a salary in lieu of a portion of the profits.24) A limited partnership:A) has an unlimited life.B) can opt to be taxed as a corporation.C) terminates at the death of any one limited partner.D) has at least one partner who has unlimited liability for all of the partnership's debts.E) consists solely of limited partners.25) A partnership with four general partners:A) distributes profits based on percentage of ownership.B) has an unlimited partnership life.C) limits the active involvement in the firm to a single partner.D) limits each partner's personal liability to 25 percent of the partnership's total debt.E) must distribute 25 percent of the profits to each partner.26) One disadvantage of the corporate form of business ownership is the:A) limited liability of its shareholders for the firm's debts.B) double taxation of distributed profits.C) firm's greater ability to raise capital than other forms of ownership.D) firm's potential for an unlimited life.E) firm's ability to issue additional shares of stock.27) Which one of the following statements is correct?A) The majority of firms in the U.S. are structured as corporations.B) Corporate profits are taxable income to the shareholders when earned.C) Corporations can have an unlimited life.D) Shareholders are protected from all potential losses.E) Shareholders directly elect the corporate president.28) Which one of the following statements is correct?A) A general partnership is legally the same as a corporation.B) Income from both sole proprietorships and partnerships that is taxable is treated as individual income.C) Partnerships are the most complicated type of business to form.D) All business organizations have bylaws.E) Only firms organized as sole proprietorships have limited lives.29) The articles of incorporation:A) describe the purpose of the firm and set forth the number of shares of stock that can be issued.B) are amended periodically especially prior to corporate elections.C) explain how corporate directors are to be elected and the length of their terms.D) sets forth the procedures by which a firm regulates itself.E) include only the corporation's name and intended life.30) Corporate bylaws:A) must be amended should a firm decide to increase the number of shares authorized.B) cannot be amended once adopted.C) define the name by which the firm will operate.D) describe the intended life and purpose of the organization.E) determine how a corporation regulates itself.31) A limited liability company:A) can only have a single owner.B) is comprised of limited partners only.C) is taxed similar to a partnership.D) is taxed similar to a C corporation.E) generates totally tax-free income.32) Which business form is best suited to raising large amounts of capital?A) Sole proprietorshipB) Limited liability companyC) CorporationD) General partnershipE) Limited partnership33) A ________ has all the respective rights and privileges of a legal person.A) sole proprietorshipB) general partnershipC) limited partnershipD) corporationE) limited liability company34) Sam, Alfredo, and Juan want to start a small U.S. business. Juan will fund the venture but wants to limit his liability to his initial investment and has no interest in the daily operations. Sam will contribute his full efforts on a daily basis but has limited funds to invest in the business. Alfredo will be involved as an active consultant and manager and will also contribute funds. Sam and Alfredo are willing to accept liability for the firm's debts as they feel they have nothing to lose by doing so. All three individuals will share in the firm's profits and wish to keep the initial organizational costs of the business to a minimum. Which form of business entity should these individuals adopt?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) General partnershipE) Corporation35) Sally and Alicia are equal general partners in a business. They are content with their current management and tax situation but are uncomfortable with their unlimited liability. Which form of business entity should they consider as a replacement to their current arrangement assuming they wish to remain the only two owners of the business?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) Limited liability companyE) Corporation36) The growth of both sole proprietorships and partnerships is frequently limited by the firm's:A) double taxation.B) bylaws.C) inability to raise cash.D) limited liability.E) agency problems.37) Corporate dividends are:A) tax-free because the income is taxed at the personal level when earned by the firm.B) tax-free because they are distributions of aftertax income.C) tax-free since the corporation pays tax on that income when it is earned.D) taxed at both the corporate and the personal level when the dividends are paid to shareholders.E) taxable income of the recipient even though that income was previously taxed.38) Financial managers should primarily focus on the interests of:A) stakeholders.B) the vice president of finance.C) their immediate supervisor.D) shareholders.E) the board of directors.39) Which one of the following best states the primary goal of financial management?A) Maximize current dividends per shareB) Maximize the current value per shareC) Increase cash flow and avoid financial distressD) Minimize operational costs while maximizing firm efficiencyE) Maintain steady growth while increasing current profits40) Which one of the following best illustrates that the management of a firm is adhering to the goal of financial management?A) An increase in the amount of the quarterly dividendB) A decrease in the per unit production costsC) An increase in the number of shares outstandingD) A decrease in the net working capitalE) An increase in the market value per share41) Financial managers should strive to maximize the current value per share of the existingstock to:A) guarantee the company will grow in size at the maximum possible rate.B) increase employee salaries.C) best represent the interests of the current shareholders.D) increase the current dividends per share.E) provide managers with shares of stock as part of their compensation.42) Decisions made by financial managers should primarily focus on increasing the:A) size of the firm.B) growth rate of the firm.C) gross profit per unit produced.D) market value per share of outstanding stock.E) total sales.43) The Sarbanes-Oxley Act of 2002 is a governmental response to:A) decreasing corporate profits.B) the terrorist attacks on 9/11/2001.C) a weakening economy.D) deregulation of the stock exchanges.E) management greed and abuses.44) Which one of the following is an unintended result of the Sarbanes-Oxley Act?A) More detailed and accurate financial reportingB) Increased management awareness of internal controlsC) Corporations delisting from major exchangesD) Increased responsibility for corporate officersE) Identification of internal control weaknesses45) A firm which opts to "go dark" in response to the Sarbanes-Oxley Act:A) must continue to provide audited financial statements to the public.B) must continue to provide a detailed list of internal control deficiencies on an annual basis.C) can provide less information to its shareholders than it did prior to "going dark".D) can continue publicly trading its stock but only on the exchange on which it was previously listed.E) ceases to exist.46) The Sarbanes-Oxley Act of 2002 holds a public company's ________ responsible for the accuracy of the company's financial statements.A) managersB) internal auditorsC) external legal counselD) internal legal counselE) Securities and Exchange Commission agent47) Which one of the following actions by a financial manager is most apt to create an agency problem?A) Refusing to borrow money when doing so will create losses for the firmB) Refusing to lower selling prices if doing so will reduce the net profitsC) Refusing to expand the company if doing so will lower the value of the equityD) Agreeing to pay bonuses based on the market value of the company's stock rather than on its level of salesE) Increasing current profits when doing so lowers the value of the company's equity48) Which one of the following is least apt to help convince managers to work in the best interest of the stockholders? Assume there are no golden parachutes.A) Compensation based on the value of the stockB) Stock option plansC) Threat of a company takeoverD) Threat of a proxy fightE) Increasing managers' base salaries49) Agency problems are most associated with:A) sole proprietorships.B) general partnerships.C) limited partnerships.D) corporations.E) limited liability companies.50) Which one of the following is an agency cost?A) Accepting an investment opportunity that will add value to the firmB) Increasing the quarterly dividendC) Investing in a new project that creates firm valueD) Hiring outside accountants to audit the company's financial statementsE) Closing a division of the firm that is operating at a loss51) Which one of the following is a means by which shareholders can replace company management?A) Stock optionsB) PromotionC) Sarbanes-Oxley ActD) Agency playE) Proxy fight52) Which one of the following grants an individual the right to vote on behalf of a shareholder?A) ProxyB) By-lawsC) Indenture agreementD) Stock optionE) Stock audit53) Which one of the following parties has ultimate control of a corporation?A) Chairman of the boardB) Board of directorsC) Chief executive officerD) Chief operating officerE) Shareholders54) Which of the following parties are considered stakeholders of a firm?A) Employees and the governmentB) Long-term creditorsC) Government and common stockholdersD) Common stockholdersE) Long-term creditors and common stockholders55) Which one of the following represents a cash outflow from a corporation?A) Issuance of new securitiesB) Payment of dividendsC) New loan proceedsD) Receipt of tax refundE) Initial sale of common stock56) Which one of the following is a cash flow from a corporation into the financial markets?A) Borrowing of long-term debtB) Payment of government taxesC) Payment of loan interestD) Issuance of corporate debtE) Sale of common stock57) Which one of the following is a primary market transaction?A) Sale of currently outstanding stock by a dealer to an individual investorB) Sale of a new share of stock to an individual investorC) Stock ownership transfer from one shareholder to another shareholderD) Gift of stock from one shareholder to another shareholderE) Gift of stock by a shareholder to a family member58) Shareholder A sold 500 shares of ABC stock on the New York Stock Exchange. This transaction:A) took place in the primary market.B) occurred in a dealer market.C) was facilitated in the secondary market.D) involved a proxy.E) was a private placement.59) Public offerings of debt and equity must be registered with the:A) New York Board of Governors.B) Federal Reserve.C) NYSE Registration Office.D) Securities and Exchange Commission.E) Market Dealers Exchange.60) Which one of the following statements is generally correct?A) Private placements must be registered with the SEC.B) All secondary markets are auction markets.C) Dealer markets have a physical trading floor.D) Auction markets match buy and sell orders.E) Dealers arrange trades but never own the securities traded.61) Which one of the following statements concerning stock exchanges is correct?A) NASDAQ is a broker market.B) The NYSE is a dealer market.C) The exchange with the strictest listing requirements is NASDAQ.D) Some large companies are listed on NASDAQ.E) Most debt securities are traded on the NYSE.62) Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in which one of the following?A) Primary, dealer marketB) Secondary, dealer marketC) Primary, auction marketD) Secondary, auction marketE) Secondary, OTC market63) Which one of the following statements is correct concerning the NYSE?A) The publicly traded shares of a NYSE-listed firm must be worth at least $250 million.B) The NYSE is the largest dealer market for listed securities in the United States.C) The listing requirements for the NYSE are more stringent than those of NASDAQ.D) Any corporation desiring to be listed on the NYSE can do so for a fee.E) The NYSE is an OTC market functioning as both a primary and a secondary market.11。

公司理财精要版原书第12版习题库答案Ross12e_Chapter22_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 22 Behavioral Finance: Implications for Financial Management1) Nadine made a business decision that turned out badly. In reflecting upon her decision, she decided it was a reasoning error that led to the faulty decision. Which one of the following areas of study best applies to this situation?A) Corporate ethicsB) Financial statement analysisC) Managerial financeD) Debt managementE) Behavioral finance2) Peter has successfully managed the finances of A.D. Leadbetter in a manner that has yielded abnormally high returns. Due to this success, Peter has decided to publish a newsletter for financial executives so that he can share his superior financial wisdom with others. There is a very real probability that Peter has which one of the following characteristics?A) Gambler's fallacyB) Frame dependenceC) OverconfidenceD) Representativeness heuristicE) Sentiment-based risk attitudes3) Jeremy believes he excels at picking stock winners and thus trades frequently. Which characteristic does he most likely represent?A) Confirmation biasB) Frame dependenceC) OverconfidenceD) Representativeness heuristicE) Break-even effect4) Anytime Ted analyzes a proposed project, he always assigns a much higher probability of success to the project than is warranted by the information he has gathered. Ted suffers from which one of the following?A) Frame dependenceB) Mental accountingC) Endowment effectD) Confirmation biasE) Overoptimism5) The tendency for a decision maker to search for reassurance that a recent decision he or she made was a good decision represents which one of the following characteristics?A) OverconfidenceB) OveroptimismC) Affect heuristicD) Confirmation biasE) Representativeness heuristic6) Which one of the following best illustrates an error which you, as a project manager, might make due to confirmation bias?A) Overestimating the best outcome expected from a project while underestimating the possibility of a less favorable outcomeB) Assuming that a new project will be profitable since similar projects in the past were successfulC) Assuming that your expectations of the future outcome from a project are more accurate than the expectations of others within your organizationD) Listening to the advice of subordinates with whom you agree while ignoring the advice of subordinates with whom you tend to disagreeE) Downplaying the cost of future failure of an existing project since the project has already paid for itself7) Assume you are an overconfident manager. You are most apt to do which one of the following more so than you would if you were not overconfident?A) Research a project more thoroughly before committing funds to commence itB) Accept risky projects that turn out to be less profitable than you expectedC) Wait until new technology proves its worth before incorporating it into your firm's operationsD) Avoid mergers and acquisitionsE) Invest excess company cash more conservatively than your peers at other firms8) Marzella Corp. is analyzing a project that involves expanding the firm into a new product line. The project's financial projections will tend to have which one of the following characteristics if the person compiling those projections suffers from overoptimism?A) Overestimated construction costsB) Overestimated expensesC) Overestimated net present valuesD) Underestimated profitsE) Underestimated sales estimates9) Alice believes she can accurately forecast the future and makes business decisions based on this belief. Which characteristics does this belief represent?A) OverconfidenceB) OveroptimismC) Affect heuristicD) Confirmation biasE) Representativeness heuristic10) Kate tends to hold onto assets that have lost value in the hope that their values will increase in the future. Kate illustrates which one of the following?A) Frame dependenceB) Self-attribution biasC) Gambler's fallacyD) Break-even effectE) Regret aversion11) Which one of the following refers to the fact that an individual may reply differently if a question is asked in an equivalent but different manner?A) Loss aversionB) Gambler's fallacyC) Frame dependenceD) OverconfidenceE) Format reference12) Aivree wants to accumulate great wealth but she invests all of her funds in U.S. Treasury bills because she wants to avoid the potential losses she knows can occur in the stock markets. Aivree best illustrates which one of these characteristics?A) Loss aversionB) Gambler's fallacyC) Disposition effectD) Law of small numbersE) Mental accounting13) Consumer Marketing just conducted a two-phase survey. In the first phase, the survey questions were worded such that the answers tended to sound positive. In the second phase, the survey questions were reworded so the answers tended to convey a negative feeling. Both sets of survey questions should have resulted in similar results as the information solicited was essentially identical. However, the survey results varied significantly. This survey best illustrates which one of the following?A) Mental accountingB) OverconfidenceC) Self-attribution biasD) Confirmation biasE) Frame dependence14) Recently, a neighbor you have known for years won a lottery and received a $250,000 prize. This neighbor decided to invest all of his winnings in a new business venture that he knew only had a 5 percent chance of success. Previous to this, the neighbor had always been ultra conservative with his money and had refused to invest in this business venture as recently as last week. Which one of the following behaviors most applies to your neighbor's decision to invest in this business venture now?A) Disposition effectB) Affect heuristicC) Gambler's fallacyD) House moneyE) Get-evenitis15) The tendency to sell winners and hold losers is known as the:A) representativeness heuristic.B) disposition effect.C) house money effect.D) self-attribution bias.E) affect heuristic.16) Steve purchased a stock last year for $34 a share. The stock increased in value to $36 a share before declining to its current value of $30. Steve has decided to sell the stock, but only if he can receive $34 a share or better. Steve is primarily suffering from which one of the following behavioral conditions?A) Representativeness heuristicB) House moneyC) Loss aversionD) RandomnessE) Myopic loss aversion17) Over the past six months, you have watched as your parent's retirement savings have declined in value by 25 percent due to a severe financial market downturn. As a result, you have decided that you will never invest in stocks for your own retirement but will instead keep all of your money in an insured bank account. Which behavioral characteristic have you acquired as a result of the market downturn?A) Myopic loss aversionB) Get-evenitisC) Self-attribution biasD) Mental accountingE) Regret aversion18) Ramon opened a combination laundry and dry cleaning establishment three years ago that is quite successful. He has considered expanding this business by opening another location but keeps putting off that decision for fear that the second location will not be a success. Ramon is currently displaying which one of the following behavioral characteristics?A) Self-attribution biasB) OverconfidenceC) Regret aversionD) House money effectE) Frame dependence19) Phyllis is planning for her retirement in 15 years. She currently lives comfortably on $38,000a year given that she is debt-free. Based on her family history she only expects to live ten years after she retires. Thus, she computes her retirement need as $38,000 a year for ten years. Which one of the following behaviors applies to Phyllis?A) Regret aversionB) Money illusionC) Self-attribution biasD) Endowment effectE) Myopic loss aversion20) Kate is attempting to sell her house for $260,000. Fred lives across the street in an identical house. Fred recently stated to his wife that Kate's house is probably worth only $250,000 but that once she sells her house, he would like to put their house on the market at $285,000 and then move into a condominium. Which one of the following behaviors applies to Fred?A) Myopic loss aversionB) House money effectC) Money illusionD) Self-attribution biasE) Endowment effect21) You have a tendency to take credit for the decisions you make that have good outcomes even when those outcomes are out of your control. On the other hand, you blame bad luck for your decisions that turn out badly. Which of these terms applies to you?A) Myopic loss aversionB) House money effectC) Money illusionD) Self-attribution biasE) Endowment effect22) A tendency to be overly conservative when faced with new information is referred to as:A) anchoring and adjustment.B) heuristics.C) self-attribution.D) loss aversion.E) regret aversion.23) Bill feels that he possesses a good dose of "street smarts." Thus, he makes his business decisions based on how a project feels to him rather than taking the time to financially analyze a project. This type of behavior is referred to as:A) overconfidence.B) endowment effect.C) money illusion.D) affect heuristic.E) sentiment-based risk.24) Which term refers to the tendency to shy away from the unknown?A) Aversion to ambiguityB) Clustering illusionC) Anchoring and adjustmentD) Recency biasE) Availability bias25) You recently overheard your boss telling someone that if he'd actually crunched some numbers and done some analysis instead of just going with his instincts, he never would have opened the new store in Centre City. Which one of the following caused your boss to make a bad decision?A) Regret aversionB) Endowment effectC) Money illusionD) Affect heuristicE) Representativeness heuristic26) Roger's Meat Market is a chain of retail stores that limits its sales to fresh-cut meats. The stores have been very profitable in northern cities. However, when two stores were opened in the south, both lost money and had to be closed. Roger, the owner, has now concluded that no southern-based store should be opened as it would not be profitable. Which one of the following applies to Roger?A) Confirmation biasB) Endowment effectC) Money illusionD) Affect heuristicE) Representativeness heuristic27) Up until three years ago, A.C. Dime opened an average of ten new retail stores a year. One of every ten new stores had to be closed within two years due to poor sales. This 90 percent success ratio was fairly steady for over 30 years. Starting three years ago, the firm has opened 40 new stores and every one had significant profits within six months. Management believes their recent success is not just a random event and that all future stores will be profitable. Thus, the managers have decided to open a minimum of 15 new stores each year. The managers are suffering from:A) arbitrage limitations.B) anchoring and adjustment.C) aversion to ambiguity.D) the clustering illusion.E) myopic aversion.28) You are employed as a commission-based sales clerk for a cosmetics retail store. You know that, on average, exactly 50 percent of the customers that enter your store will make at least one purchase. Thus far this morning, you have waited on eight customers without making a single sale. You are convinced that the next customer you wait on will buy something. This belief is known as:A) aversion to ambiguity.B) the law of small numbers.C) anchoring and adjusting.D) gambler's fallacy.E) false consensus.29) The last six times you purchased a stock you earned high returns within one year. Thus, you believe you will have the same result with your next stock purchase. This is an example of which one of the following?A) Recency biasB) Anchoring and adjustmentC) Frame dependenceD) Aversion to ambiguityE) Clustering illusion30) You started an online business two weeks ago. Thus far, you have averaged ten sales a day, which is one sale for every five hits. You are now considering giving up your day job and becoming a full-time online retailer. You have calculated the amount of income you can earn based on ten sales a day and know that level of income would support you in a comfortable fashion. The belief that you will have ten sales per day if this becomes your full-time occupation is based on which one of the following?A) Mental accountingB) Anchoring and adjustmentC) Law of small numbersD) Bubble and crash theoryE) Confirmation bias31) You are a hard-charging manager who doesn't really like to sit at a desk for too long. You prefer to gather information quickly, make a decision, and move on to the next item on your agenda. Which one of the following applies to you?A) Availability biasB) Arbitrage limitsC) Law of small numbersD) Representativeness heuristicE) Regret aversion32) Your friends are all investing in a start-up company. You, on the other hand, refuse to invest in the company because you don't know the odds of it becoming successful. Which behavioral characteristic are you displaying?A) Aversion to ambiguityB) Recency biasC) Sentiment-based risk aversionD) Clustering illusionE) Money illusion33) You are the manager of a retail store. You believe the economy is in a recession and that sales for the month will be unusually slow. Since you have complete discretion over the pricing at your location, you decide to have a storewide sale and offer ten percent off all merchandise for a three-day period. You don't expect your superiors to criticize this decision as you believe they, along with the majority of the other store managers, feel the same way about the economy as you do. Which one of the following applies to you?A) Recency biasB) Law of small numbersC) Gambler's fallacyD) False consensusE) Money illusion34) The last two promotions within a firm involved individuals who completed the same advanced managerial program. As a result, the company president has stipulated that all future management hires must be graduates of that program. This behavior is typical of someone who has which one of the following characteristics?A) Endowment effectB) Framing effectC) Representativeness heuristicD) Narrow framingE) Affect heuristic35) Which term refers to the reliance on stereotypes or limited samples to form opinions about an entire class?A) Clustering illusionB) Law of small numbersC) Representativeness heuristicD) False consensusE) Recency bias36) It is believed by some individuals that, in an efficient market, the actions of traders who constantly buy and sell on any perceived market mispricing will in effect cause market prices to correctly reflect asset values. A person who believes that the actions of these traders will not result in correctly valued prices are most apt to believe in which one of the following?A) Gambler's fallacyB) Limits to arbitrageC) Availability biasD) False consensusE) Clustering illusion37) Which one of the following is an investment risk that investors face in addition to firm-based risk and market-based risk?A) Management-related riskB) Inflation riskC) Supply chain riskD) Interest rate riskE) Sentiment-based risk38) Which word best describes the stock market during the month of October 1987?A) CrashB) CircleC) BubbleD) LimitE) Flat39) All of the following create limits to arbitrage except:A) firm-specific risk.B) noise traders.C) thinly traded securities.D) rational traders.E) implementation costs.40) AB Industries is an all-equity firm that has $10 per share in cash and a book value per share of $12. At which one of the following market prices would you know with absolute certainty that the stock was mispriced?A) $9B) $10C) $11D) $12E) $1341) Approximately what percent of its total value did the stock market lose on "Black Monday"?A) 19B) 10C) 23D) 30E) 3842) Which one of the following statements related to market crashes is correct?A) Financial market crashes are unique to the United States.B) A market crash tends to occur within a week but have effects that last many years.C) Once the market finally crashed in 1929, stock prices began a long period of steady increases.D) The market crash of 1987 occurred on a day when trading volume was light indicating there were a limited number of irrational investors involved.E) Actions in Washington, D.C., may have helped contribute to the market crash in 1929 but not to the 1987 crash.43) Which one of the following statements is true?A) Market crashes tend to be accompanied by low market volume.B) The Asian market crash was followed by a quick recovery.C) The market crashes of 1929 and 1987 are very similar in both the percentage decline in market value and in the ensuing market recovery.D) Market crashes tend to follow market bubbles.E) Market bubbles and crashes prove that financial markets are inefficient.44) Following the Crash of 1929, the stock market:A) began to slowly, but steadily, increase in value.B) was flat for about three years and then began a slow, steady rise to pre-crash values.C) continued to decline slightly before increasing over a 3-year period to its pre-crash values.D) temporarily increased in value and then began a 3-year decline to ten percent of its pre-crash value.E) recouped its 90 percent loss within the following three years.45) Which one of these statements related to the Crash of 1987 is false?A) Program trading is at least partially to blame for the market meltdown.B) Between August and October 1987 the market declined over 40 percent.C) In some cases, it became impossible to contact a market maker.D) Trading volume exceeded the market's capacity to handle the order flows.E) Following the Crash of 1987, the market continued to slowly decline over the following year.46) Which one of the following is given as a key reason why many of the dot-com companies failed following their IPO's?A) Lack of a solid business modelB) Lack of internet accessC) Market crash in AsiaD) Change in government regulationsE) Program trading47) Historical returns support which one of the following statements?A) Financial markets are highly inefficient as suggested by behavioral finance.B) Professional money managers tend to outperform the Vanguard 500 index fund about 60 percent of the time on average.C) The longer the time span, the more likely a professional money manager will outperform an index fund, such as the S&P 500.D) Historical data supports the statement that arbitrage results in a 100 percent totally efficient market.E) The financial markets appear to be highly efficient because, on average, they outperform professional money managers.48) Which one of the following statements is correct?A) In a totally efficient market every investment has a zero net present value.B) Portfolio managers with tenures greater than 10 years, consistently outperform the market.C) The performance of professional money managers improves the longer the investment period.D) Mutual funds that are actively managed outperform index funds over the long term.E) The number of mutual funds outperforming the Vanguard 500 Index Fund over a 10-year period is steadily rising.。

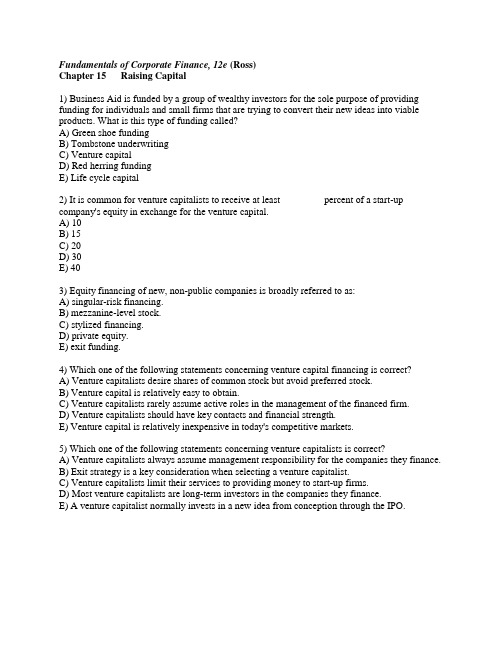

公司理财精要版原书第12版习题库答案Ross12e_Chapter15_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 15 Raising Capital1) Business Aid is funded by a group of wealthy investors for the sole purpose of providing funding for individuals and small firms that are trying to convert their new ideas into viable products. What is this type of funding called?A) Green shoe fundingB) Tombstone underwritingC) Venture capitalD) Red herring fundingE) Life cycle capital2) It is common for venture capitalists to receive at least ________ percent of a start-up company's equity in exchange for the venture capital.A) 10B) 15C) 20D) 30E) 403) Equity financing of new, non-public companies is broadly referred to as:A) singular-risk financing.B) mezzanine-level stock.C) stylized financing.D) private equity.E) exit funding.4) Which one of the following statements concerning venture capital financing is correct?A) Venture capitalists desire shares of common stock but avoid preferred stock.B) Venture capital is relatively easy to obtain.C) Venture capitalists rarely assume active roles in the management of the financed firm.D) Venture capitalists should have key contacts and financial strength.E) Venture capital is relatively inexpensive in today's competitive markets.5) Which one of the following statements concerning venture capitalists is correct?A) Venture capitalists always assume management responsibility for the companies they finance.B) Exit strategy is a key consideration when selecting a venture capitalist.C) Venture capitalists limit their services to providing money to start-up firms.D) Most venture capitalists are long-term investors in the companies they finance.E) A venture capitalist normally invests in a new idea from conception through the IPO.6) When selecting a venture capitalist, which one of the following characteristics is probably the least important?A) Financial strengthB) Level of involvementC) ContactsD) Exit strategyE) Underwriting experience7) Trevor is the CEO of Harvest Foods, which is a privately held corporation. What is the first step he must take if he wishes to take Harvest Foods public?A) Select an underwriterB) Obtain SEC approvalC) Gain board approvalD) Prepare a registration statementE) Distribute a prospectus8) Which one of these describes an exception to the registration filing requirement of the SEC?A) Loans that mature in one year or lessB) Issues that have an approved prospectusC) Loans of $10 million or lessD) Issues of less than $5 millionE) Issues that have received an approved letter of comment9) The Securities and Exchange Commission:A) verifies the accuracy of the information contained in the prospectus.B) publishes red herrings on prospective new security offerings.C) examines the prospectus during the Green Shoe period.D) reviews registration statements to ensure they comply with current laws and regulations.E) determines the final offer price once they have approved the registration statement.10) What is the form called that is filed with the SEC and discloses the material information on a securities issuer when that issuer offers new securities to the general public?A) ProspectusB) Red herringC) IndentureD) Public disclosure statementE) Registration statement11) M&C Merchants is offering $2.5 million of new securities to the general public. Which SEC regulation governs this offering?A) Regulation AB) Regulation CC) Regulation GD) Regulation QE) Regulation R12) What is a prospectus?A) A letter issued by the SEC authorizing a new issue of securitiesB) A report stating that the SEC recommends a new security to investorsC) A letter issued by the SEC that outlines the changes required for a registration statement to be approvedD) A document that describes the details of a proposed security offering along with relevant information about the issuerE) An advertisement in a financial newspaper that describes a security offering13) Which one of the following is a preliminary prospectus?A) TombstoneB) Green shoeC) Registration statementD) Rights offerE) Red herring14) Advertisements in a financial newspaper announcing a public offering of securities, along with a list of the investment banks handling the offering, are called:A) red herrings.B) tombstones.C) Green Shoes.D) registration statements.E) cash offers.15) The raising of small amounts of capital from a large number of people is known as:A) a rights offering.B) over allocating.C) a diversified offer.D) crowdfunding.E) a standby offer.16) During a 12-month period, a company is permitted to issue new securities through crowdfunding up to a limit of:A) $200 thousand.B) $500 thousand.C) $1 million.D) $5 million.E) $50 million.17) What is an issue of securities that is offered for sale to the general public on a direct cash basis called?A) Best efforts underwritingB) Firm commitment underwritingC) General cash offerD) Rights offerE) Herring offer18) Alberto currently owns 2,500 shares of Southern Tools. He has just been notified that the company is issuing additional shares and he is being given a chance to purchase some of these shares prior to the shares being offered to the general public. What is this type of an offer called?A) Best efforts offerB) Firm commitment offerC) General cash offerD) Rights offerE) Priority offer19) JLK is a partnership that was formed two years ago and has been extremely successful thus far. The owners have decided to incorporate and offer shares of stock to the general public. What is this type of an equity offering called?A) Venture capital offeringB) Shelf offeringC) Private placementD) Seasoned equity offeringE) Initial public offering20) What is a seasoned equity offering?A) An offering of shares by shareholders for repurchase by the issuerB) Shares of stock that have been recommended for purchase by the SECC) Equity securities held by a company's founder that are being offered for sale to the general publicD) Sale of newly issued equity shares by a publicly owned companyE) Outstanding shares that are offered for sale by one of a company's original founders21) Executive Tours has decided to go public and has hired an investment firm to handle the offering. The investment firm is serving as a(n):A) aftermarket specialist.B) venture capitalist.C) underwriter.D) seasoned writer.E) primary investor.22) Underwriters generally:A) pay a spread to the issuing firm.B) provide only best efforts underwriting in the U.S.C) accept the risk of selling the new securities in exchange for the gross spread.D) market and distribute an entire issue of new securities within their own firm.E) pass the risk of unsold shares back to the issuing firm via a firm commitment agreement.23) A syndicate can best be defined as a:A) venture capitalist.B) group of attorneys providing services for an IPO.C) block of investors who control a firm.D) bank that loans funds to finance the start-up of a new company.E) group of underwriters sharing the risk of selling a new issue of securities.24) The difference between the underwriters' cost of buying shares in a firm commitment and the offering price of those securities to the public is called the:A) gross spread.B) under price amount.C) filing fee.D) new issue premium.E) offer price.25) Jones & Co. recently went public and received $23.07 a share on their entire offer of 30,000 shares. Keeser & Co. served as the underwriter and sold 28,500 shares to the public at an offer price of $26.50 a share. What type of underwriting was this?A) Best effortsB) ShelfC) OversubscribedD) Private placementE) Firm commitment26) Blue Stone Builders recently offered to sell 45,000 newly issued shares of stock to the public. The underwriters charged a fee of 8.2 percent and paid Blue Stone Builders the uniform auction price for each of those shares. Which one of the following terms best describes this underwriting?A) Dutch auctionB) Best effortsC) Public rightsD) Private placementE) Market commitment27) The 40-day period following an IPO during which the SEC places restrictions on the public communications of the issuer is known as the ________ period.A) auctionB) quietC) lockupD) Green ShoeE) red28) Mobile Units recently offered 75,000 new shares of stock for sale. The underwriters sold a total of 78,500 shares to the public at a price of $16 a share. The additional 3,500 shares were purchased in accordance with which one of the following?A) Green Shoe provisionB) Red herring provisionC) Quiet provisionD) Lockup agreementE) Post-issue agreement29) With firm commitment underwriting, the issuing firm:A) is unsure of the total amount of funds it will receive until after the offering is completed.B) is unsure of the number of shares it will actually issue until after the offering is completed.C) knows exactly how many shares will be purchased by the general public during the offer period.D) retains the financial risk associated with unsold shares.E) knows upfront the amount of money it will receive from the stock offering.30) Which one of the following is a key goal of the aftermarket period?A) Collecting the largest number of Dutch auction bids as possibleB) Determining a fair offer priceC) Supporting the market price for a new securities issueD) Establishing a broad-based underwriting syndicateE) Distributing red herrings to as many potential investors as possible31) Which one of the following statements is correct?A) The quiet period commences when a registration statement is filed with the SEC and ends on the day the IPO shares commence trading.B) Lockup agreements outline how oversubscribed IPO shares will be allocated.C) Additional IPO shares can be issued in accordance with the lockup agreement.D) Quiet period restrictions only apply to the issuer of new securities.E) A public interview with an issuer's CFO could cause a forced delay in the issuer's IPO.32) With Dutch auction underwriting:A) each winning bidder pays the minimum price offered by any bidder.B) all successful bidders pay the same price per share.C) all bidders receive at least a portion of the quantity for which they bid.D) the selling firm receives the maximum possible price for each security sold.E) the bidder for the largest quantity receives the first allocation of securities.33) Individual investors might avoid requesting 100 shares in an upcoming IPO because they:A) do not want to be bothered with submitting their bid to the SEC for approval.B) do not want to abide by the quiet period requirement.C) are prevented from entering orders for less than 1,000 shares.D) are more apt to receive shares if the IPO is under allocated.E) would have to pay a premium based on their small order size.34) If a firm commitment IPO is overpriced then the:A) investors in the IPO may consider suing the underwriters.B) Green Shoe provision will probably be utilized.C) stock price will generally increase on the first day of trading.D) issuing firm is guaranteed to be successful in the long term.E) issuing firm receives less money than it probably should have.35) All of the following are supporting arguments in favor of IPO underpricing except which one?A) Helps prevent the "winner's curse"B) Rewards institutional investors who share their market value opinionsC) Reduces potential lawsuits against underwritersD) Diminishes underwriting riskE) Provides better returns to issuing firms36) When a firm announces an upcoming seasoned stock offering, the market price of the firm's existing shares tends to:A) increase.B) decrease.C) remain constant.D) respond, but the direction of the response is not predictable as shown by past studies.E) decrease momentarily and then immediately increase substantially within an hour following the announcement.37) The total direct costs of underwriting an equity IPO:A) tend to increase on a percentage basis as the total proceeds of the IPO increase.B) are generally between 7 and 9 percent, regardless of the issue size.C) tend to be less than the direct costs of issuing bonds on a percentage of proceeds basis.D) exclude the gross spread.E) can be as low as 5.5 percent and as high as 25 percent of gross proceeds.38) Which one of the following statements is correct concerning the direct costs of issuing securities?A) Domestic bonds are generally more expensive to issue than equity IPOs.B) The gross spread as a percentage of proceeds is the same for similar-sized IPOs and SEOs.C) A seasoned offering is always more expensive on a percentage basis than an IPO.D) There tends to be substantial economies of scale when issuing any type of security.E) The costs of issuing convertible bonds tend to be less on a percentage basis than the costs of issuing straight debt.39) Shares of PLS United have been selling with rights attached. Tomorrow, the stock will sell independent of these rights. Which one of the following terms applies to tomorrow in relation to this stock?A) Pre-issue dateB) Aftermarket dateC) Declaration dateD) Holder-of-record dateE) Ex-rights date40) The date on which a shareholder is officially listed as the recipient of stock rights is called the:A) issue date.B) offer date.C) declaration date.D) holder-of-record date.E) ex-rights date.41) A rights offering in which an underwriting syndicate agrees to purchase the unsubscribed portion of an issue is called a(n) ________ underwriting.A) standbyB) best effortsC) firm commitmentD) direct feeE) oversubscription42) BK & Co. offered 15,000 shares in a rights offer. T.L. Moore & Co. was the underwriter that by prior agreement purchased the 639 unsold shares. For its participation in this rights offer, T.L. Moore & Co. is most likely entitled to:A) the gross margin.B) the optional spread.C) a standby fee.D) the subscription price.E) an oversubscription fee.43) Franklin Minerals recently had a rights offering of 12,000 shares at an offer price of $17 a share. Isabelle is a shareholder who exercised her rights option by buying all of the rights to which she was entitled based on the number of shares she owns. Currently, there are six shareholders who have opted not to participate in the rights offering. Isabelle would like to purchase these unsubscribed shares. Which one of the following will allow her to do so?A) Standby provisionB) Oversubscription privilegeC) Open offer privilegeD) New issues provisionE) Overallotment provision44) Existing shareholders:A) may or may not have a pre-emptive right to newly issued shares.B) must purchase new shares whenever rights are issued.C) are prohibited from selling their rights.D) are generally well advised to let the rights they receive expire.E) can maintain their proportional ownership positions without exercising their rights.45) To purchase a share in a rights offering, an existing shareholder generally just needs to:A) pay the subscription amount in cash.B) submit the required form along with the required number of rights.C) pay the difference between the market price of the stock and the subscription price.D) submit the required number of rights along with a payment for the underwriting fee.E) submit the required number of rights along with the subscription price.46) The value of a right depends upon the number of rights required for each new share as well as the:A) subscription price and book value per share.B) market and book values per share.C) market price, book value, and subscription price.D) market and subscription prices.E) difference between the market and book values per share.47) Before a seasoned stock offering, you owned 500 shares of a firm that had 20,000 shares outstanding. After the seasoned offering, you still owned 500 shares but the number of shares outstanding rose to 25,000. Which one of the following terms best describes this situation?A) OverallotmentB) Percentage ownership dilutionC) Green Shoe allocationD) Red herring allotmentE) Abnormal event48) Which one of the following statements concerning dilution is correct?A) Dilution of percentage ownership occurs whenever an investor fully participates in a rights offer.B) Market value dilution increases as the net present value of a project increases.C) Market value dilution occurs when the net present value of a project is negative.D) Neither book value dilution nor market value dilution has any direct bearing on individual shareholders.E) Book value dilution is the cause of market value dilution.49) Roy owns 200 shares of RTF Inc. He has opted not to participate in the current rights offering by this company. As a result, Roy will most likely be subject to:A) an oversubscription cost.B) underpricing.C) dilution.D) the Green Shoe provision.E) a locked-in period.50) Direct business loans typically ranging from one to five years are called:A) private placements.B) debt SEOs.C) notes payable.D) debt IPOs.E) term loans.51) The High-End mutual fund recently loaned $13.6 million to Henderson Hardware for 15 years at 6.8 percent interest. This loan is best described as a:A) private placement.B) debt SEO.C) note payable.D) debt IPO.E) term loan.52) Which one of the following statements is correct concerning the issuance of long-term debt?A) A direct private long-term loan has to be registered with the SEC.B) Direct placement debt tends to have more restrictive covenants than publicly issued debt.C) Distribution costs are lower for public debt than for private debt.D) It is easier to renegotiate public debt than private debt.E) Wealthy individuals tend to dominate the private debt market.53) Shelf registration allows a firm to register multiple issues at one time with the SEC and then sell those registered shares anytime during the subsequent:A) 3 months.B) 6 months.C) 180 days.D) 2 years.E) 5 years.54) Pearson Electric recently registered 180,000 shares of stock under SEC Rule 415. The company plans to sell 100,000 shares this year and the remaining 80,000 shares next year. What type of registration was this?A) Standby registrationB) Shelf registrationC) Regulation A registrationD) Regulation Q registrationE) Private placement registration55) The Boat Works decided to go public by offering a total of 135,000 shares of common stockto the public. The company hired an underwriter who arranged a firm commitment underwriting and an initial selling price of $24 a share with a spread of 8.3 percent. As it turned out, the underwriters only sold 122,400 shares to the public. What is the amount paid to the issuer?A) $2,227,280B) $3,074,420C) $2,971,080D) $2,692,820E) $2,477,38056) Nelson Paints recently went public by offering 50,000 shares of common stock to the public. The underwriters provided their services in a best efforts underwriting. The offering price was set at $17.50 a share and the gross spread was $2.30. After completing their sales efforts, the underwriters determined that they sold a total of 47,500 shares. How much cash did the company receive from its IPO?A) $722,000B) $717,000C) $735,000D) $705,000E) $748,00057) LC Delivery has decided to sell 1,800 shares of stock through a Dutch auction. The bids received are as follows: 600 shares at $37 a share, 800 shares at $36, 900 shares at $35, 200 shares at $34, and 100 shares at $32 a share. How much will the company receive in total from selling the 1,800 shares? Ignore all transaction and flotation costs.A) $63,100B) $52,500C) $63,000D) $58,800E) $52,10058) Bakers' Town Bread is selling 1,500 shares of stock through a Dutch auction. The bids received are as follows: 200 shares at $17 a share, 400 shares at $15, 700 shares at $14, 400 shares at $13, and 200 shares at $11 a share. How much cash will the company receive from selling these shares of stock? Ignore all transaction and flotation costs.A) $22,000B) $22,500C) $23,000D) $24,500E) $20,20059) Eastern Electric is offering 2,100 shares of stock in a Dutch auction. The bids include: 1,400 shares at $32 a share, 1,500 shares at $31, 1,400 shares at $30, and 900 shares at $29 a share. How much cash will Eastern Electric receive from selling these shares? Ignore all transaction and flotation costs.A) $62,100B) $64,200C) $60,000D) $63,000E) $63,30060) You have been instructed to place an order for a client to purchase 500 shares of every IPO that comes to market. The next two IPOs are each priced at $26 a share and will begin trading on the same day. The client is allocated 500 shares of IPO A and 240 shares of IPO B. At the end of the first day of trading, IPO A was selling for $23.90 a share and IPO B was selling for $29.40 a share. What is the client's total profit or loss on these two IPOs as of the end of the first day of trading?A) − $286B) − $234C) − $148D) $275E) $32961) Richard placed an order for 1,000 shares in each of three IPOs at $28 a share. He was allocated 1,000 shares of IPO A, 200 shares of IPO B, and 600 shares of IPO C. On the first day of trading, IPO A opened at $28 a share and ended the day at $24.25 a share. IPO B opened at $30 a share and finished the day at $37 a share. IPO C opened at $28 a share and ended the day at $27.65 a share. What is the total profit or loss on these three IPO purchases as of the end of the first day of trading?A) − $2,160B) − $1,850C) − $1,950D) $2,240E) $2,17562) Two IPOs will commence trading next week. Scott places an order to buy 600 shares of IPOA. Steve places an order to purchase 600 shares of IPO A and 600 shares of IPOB. Both IPOs are priced at $21 a share. Scott is allocated 300 shares of IPO A. Steve is allocated 300 shares of IPO A and 600 shares of IPO B. At the end of the first day of trading, IPO A is selling for $23.30 a share and IPO B is selling for $17.75 a share. How much additional profit did Steve have at the end of the first day of trading as compared to Scott?A) $1,950B) $1,260C) $1,870D) −$1,950E) −$1,26063) Davis Bros. and The Storage Shed have both announced IPOs at $32 per share. One of these is undervalued by $9, and the other is overvalued by $4, but you have no way of knowing whichis which. You plan on buying 1,000 shares of each issue. If an issue is underpriced, it will be rationed, and only half your order will be filled. What is the amount of the difference between your expected profit and the amount of profit you could earn if you could get 1,000 shares of both IPO offerings?A) $4,500B) $5,000C) $4,000D) $5,500E) $6,00064) Wear Ever is expanding and needs $6.8 million to help fund this growth. The company estimates it can sell new shares of stock for $43 a share. It also estimates it will cost an additional $352,000 for filing and legal fees related to the stock issue. The underwriters have agreed to a spread of 7.5 percent. How many shares of stock must be sold for the company to fund its expansion?A) 170,376B) 185,127C) 179,811D) 154,209E) 61,80665) Mountain Teas wants to raise $13.6 million to open a new production facility. The company estimates the issue costs for legal and accounting fees will be $386,000. The underwriters have set the stock price at $27.50 a share and the underwriting spread at 8.15 percent. How many shares of stock must be sold to meet this cash need?A) 528,414B) 553,709C) 569,315D) 492,144E) 501,90966) Outdoor Goods needs $3.8 million to modernize its production equipment. The underwriters set the stock price at $29.50 a share with an underwriting spread of 7.35 percent. This would be a firm commitment underwriting. The estimated issue costs are $272,000. How many shares of stock must be sold to finance this project?A) 148,984B) 188,917C) 152,311D) 186,299E) 162,40067) Flagler Inc. needs to raise $11.6 million, including all accounting and legal fees, to finance its expansion so has decided to sell new shares of equity via a general cash offering. The offer price is $22.50 per share and the underwriting spread is 7.85 percent. How many shares need to be sold?A) 559,474B) 604,011C) 566,667D) 571,008E) 538,40968) New Education needs to raise $8.79 million to finance its expansion and has decided to sell new shares of equity via a general cash offering. The offer price is $31.40 per share, the underwriting spread is 7.32 percent, and the associated administrative expenses and fees are $517,600. How many shares need to be sold?A) 348,907B) 361,222C) 311,111D) 329,937E) 319,83269) The Huff Co. has just gone public. Under a firm commitment agreement, the company received $17.64 for each of the 3.2 million shares sold. The initial offering price was $22.50 per share, and the stock rose to $24.15 per share in the first day of trading. The company paid $984,900 in direct legal and other costs and incurred $340,000 in indirect costs. What was the flotation cost as a percentage of the net amount raised?A) 38.56 percentB) 40.32 percentC) 41.68 percentD) 40.20 percentE) 39.09 percent70) Mountain Mining requires $3.3 million to expand its current operations and has decided to raise these funds through a rights offering at a subscription price of $18 a share. The current market price of the company's stock is $24.70 a share. How many shares of stock must be sold to fund the expansion plans?A) 140,015B) 133,603C) 148,909D) 183,333E) 195,60771) Northwest Rail wants to raise $27.8 million through a rights offering to upgrade its rail lines. How many shares of stock need to be sold if the current market price is $30.34 a share and the subscription price is $26.50 a share?A) 916,282B) 937,856C) 985,065D) 1,058,604E) 1,049,05772) S&S wants to raise $11.3 million through a rights offering with a subscription price of $15 a share. The company has 1.24 million shares outstanding and a market price of $17.50 a share. Each shareholder will receive one right for each share of stock owned. How many rights will be needed to purchase one new share of stock in this offering?A) 1.42B) 1.75C) 1.65D) 1.82E) 1.5573) P&T wants to raise $2.8 million through a rights offering with a subscription price of $20 a share. Currently, the company has 750,000 shares of stock outstanding at a market price of $24.50 a share. One right will be granted for each share of stock outstanding. How many rights are required to purchase one new share of stock in this offering?A) 5.36B) 6.02C) 5.55D) 6.56E) 6.6774) Miller Fruit wants to expand and needs $1.6 million to do so. Currently, the firm has 465,000 shares of stock outstanding at a market price per share of $32.50. The firm decided on a rights offering with one right granted for each share of outstanding stock. The subscription price is $28 a share. How many rights are needed to purchase one new share of stock in this offering?A) 8.14B) 7.17C) 8.22D) 8.63E) 9.45。

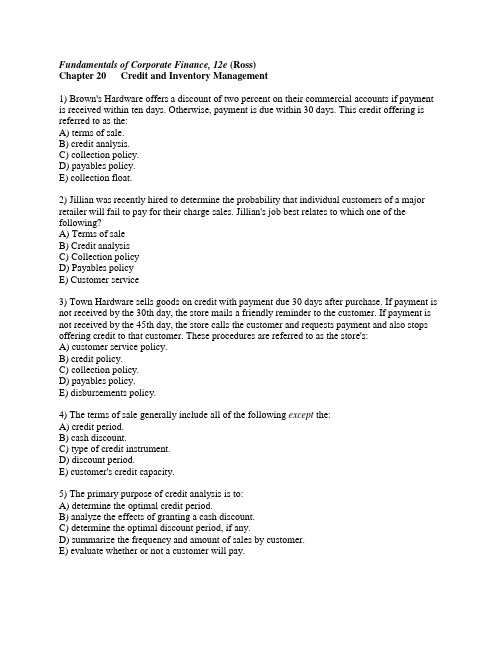

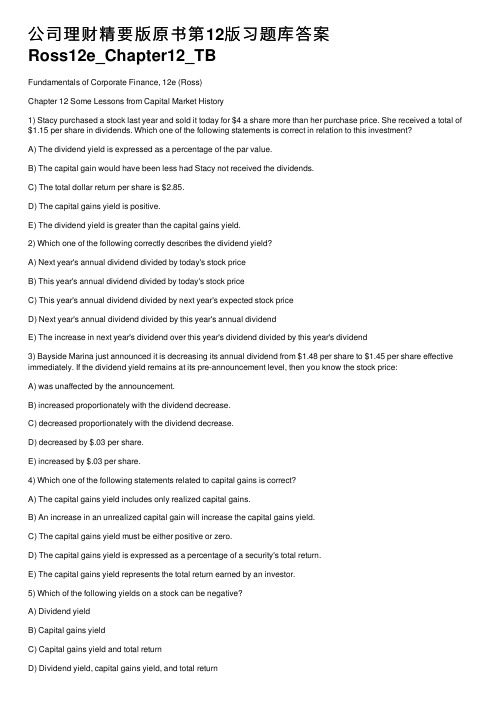

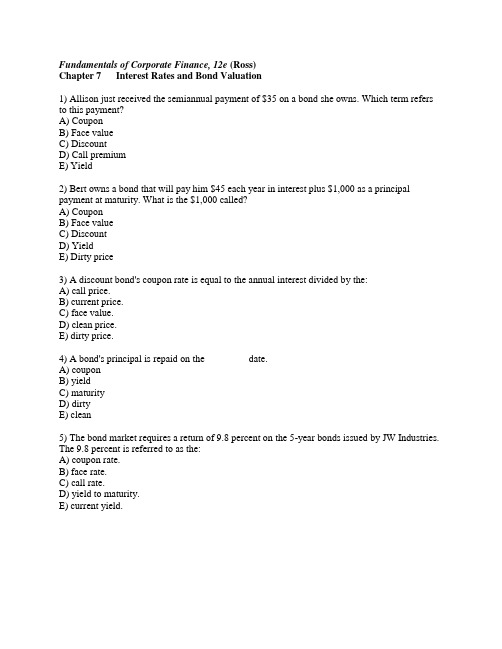

公司理财精要版原书第12版习题库答案Ross12e_Chapter01_TB