会计专业英语复习题答案

大学会计英语考试题及答案

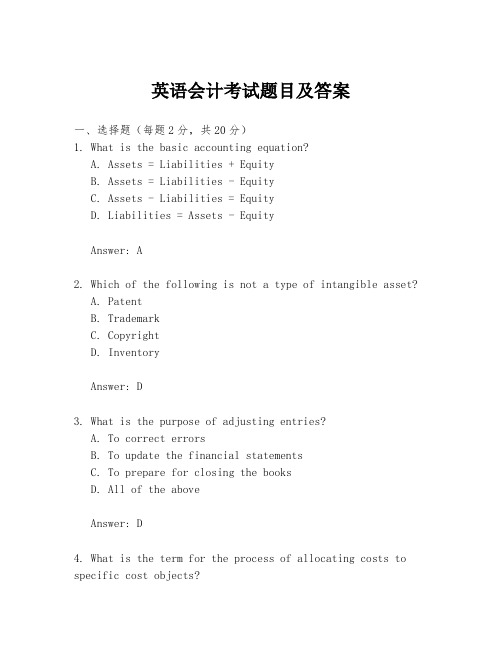

大学会计英语考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting principle?A. Going ConcernB. ConsistencyB. MaterialityD. Cash Basis AccountingAnswer: D2. What is the purpose of the balance sheet?A. To show the profitability of a company.B. To show the financial position of a company at a given point in time.C. To show the cash flow of a company.D. To show the company's budget.Answer: B3. The term "Accrual Basis Accounting" refers to accounting where:A. Revenues and expenses are recognized when cash is received or paid.B. Revenues and expenses are recognized when they are earned or incurred, regardless of the cash flow.C. Only expenses are recognized when they are incurred.D. Only revenues are recognized when they are earned.Answer: B4. What does the term "Double Entry Bookkeeping" mean?A. Every transaction is recorded in two accounts.B. Every transaction is recorded in only one account.C. Transactions are recorded on both sides of the balance sheet.D. Transactions are not recorded in the general ledger.Answer: A5. Which of the following is a non-current asset?A. InventoryB. Accounts PayableC. LandD. Wages ExpenseAnswer: C二、填空题(每空2分,共20分)6. The accounting equation is _______ = _______ + _______. Answer: Assets; Liabilities; Owner's Equity7. The term "Depreciation" refers to the systematic allocation of the cost of a(n) _______ asset over its useful life.Answer: Tangible8. In accounting, the matching principle requires thatrevenues and expenses must be recognized in the same periodin which they are _______.Answer: Earned or Incurred9. The financial statement that shows the results ofoperations over a period of time is known as the _______.Answer: Income Statement10. The process of adjusting the accounts at the end of the accounting period to match revenues and expenses is called_______.Answer: Adjusting Entries三、简答题(每题10分,共20分)11. Explain the difference between "Historical Cost" and"Fair Value" in accounting.Answer: Historical Cost refers to the original amountpaid to acquire an asset or the amount received to issue a liability. It is the amount recorded on the company's booksat the time of the transaction. Fair Value, on the other hand, is the estimated amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm's length transaction. It is the current marketvalue of the asset or liability.12. What are the main components of a Cash Flow Statement and how do they reflect the liquidity of a company?Answer: The main components of a Cash Flow Statement arethe Cash Flows from Operating Activities, Cash Flows from Investing Activities, and Cash Flows from Financing Activities. These components reflect the liquidity of a company by showing how much cash is being generated or used by the company's operations, investments, and financing activities. A positive cash flow from operations indicates that the company is generating enough cash to sustain itself, while negative cash flows may indicate financial stress.四、计算题(每题15分,共40分)13. A company has the following transactions for the year:- Sales on credit: $50,000- Cash sales: $30,000- Purchases on credit: $40,000- Cash purchases: $10,000- Wages paid in cash: $15,000- Depreciation expense: $5,000- Interest paid in cash: $2,000Calculate the net cash provided by operating activities using the indirect method.Answer:Net Income = Sales - (Cost of Goods Sold + Operating Expenses)= ($50,000 + $30,000) - ($40,000 + $10,000 + $15,000 + $5,000)= $80,000 - $70,000= $10,000Adjustments for Non-Cash Items:- Depreciation Expense: +$5,000 (since it's a non-cash expense)Increase/Decrease in Operating Assets and Liabilities: - Accounts Receivable: -$50,000 (decrease in asset, so。

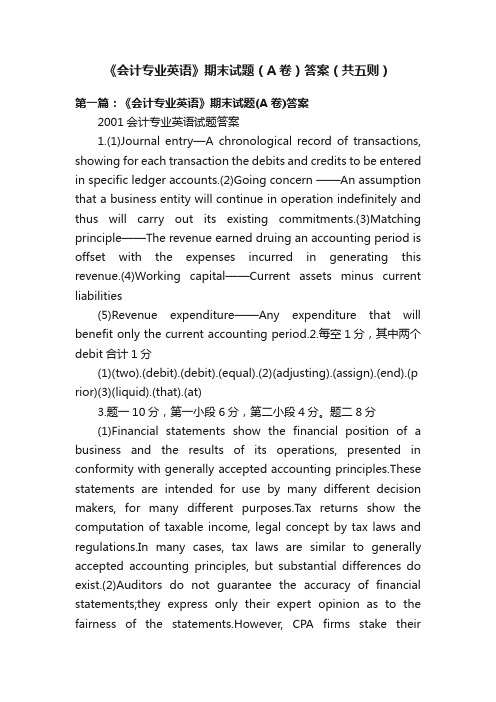

《会计专业英语》期末试题(A卷)答案(共五则)

《会计专业英语》期末试题(A卷)答案(共五则)第一篇:《会计专业英语》期末试题(A卷)答案2001会计专业英语试题答案1.(1)Journal entry—A chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts.(2)Going concern ——An assumption that a business entity will continue in operation indefinitely and thus will carry out its existing commitments.(3)Matching principle——The revenue earned druing an accounting period is offset with the expenses incurred in generating this revenue.(4)Working capital——Current assets minus current liabilities(5)Revenue expenditure——Any expenditure that will benefit only the current accounting period.2.每空1分,其中两个debit合计1分(1)(two).(debit).(debit).(equal).(2)(adjusting).(assign).(end).(p rior)(3)(liquid).(that).(at)3.题一10分,第一小段6分,第二小段4分。

题二8分(1)Financial statements show the financial position of a business and the results of its operations, presented in conformity with generally accepted accounting principles.These statements are intended for use by many different decision makers, for many different purposes.Tax returns show the computation of taxable income, legal concept by tax laws and regulations.In many cases, tax laws are similar to generally accepted accounting principles, but substantial differences do exist.(2)Auditors do not guarantee the accuracy of financial statements;they express only their expert opinion as to the fairness of the statements.However, CPA firms stake theirreputations on the thoroughness of their audits and the dependability of their audit reports.4.每小题6分,每小题包括三小句,每小句2分。

会计专业英语复习题答案

一、中译英accounting equationstatement of cash flowreal estatecredit balanceworking capitaloriginal vouchersFIFOcurrency unitcash basiscapital leaseretained earningscommon stockincome taxpar valueearnings par shareaccounting principleT-accountaccounting information system current depositfixed assetsgross marginlower-of-cost-or-market-rule long-term investment intangible assets operating leaseretained earnings preferred stockpar valuecash equivalentsquick ratioauditinghistoricalcost principlegeneral ledgercurrent liabilities internal control system interest rate merchandise inventory capital expenditure intangible assetssales taxretained earningspar valuesubsequent eventsquick ratiosecurity market二、英译中1、会计是计量企业经济活动,处理、加工信息,将结果与决策者交流的信息系统。

2、基本的财务报表有:资产负债表;损益表;现金流量表。

3、会计假设有:会计主体假设;持续经营假设;期间假设;币值稳定假设。

4、资产是企业拥有的具有货币价值的财产。

会计英语试题及答案

会计英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesB. RevenuesD. Equity答案:C2. The accounting equation can be expressed as:A. Assets = Liabilities + EquityB. Assets + Liabilities = EquityC. Assets - Liabilities = EquityD. Liabilities - Equity = Assets答案:A3. What does the term "Double Entry Bookkeeping" refer to?A. Recording transactions in two accountsB. Recording transactions in two different currenciesC. Recording transactions in two different formatsD. Recording transactions in two different books答案:A4. Which of the following is not a type of adjusting entry?A. AccrualB. PrepaymentC. DepreciationD. Amortization答案:B5. The purpose of closing entries is to:A. Prepare financial statementsB. Adjust for accruals and deferralsC. Record the sale of inventoryD. Record the purchase of fixed assets答案:A6. Which of the following is a measure of a company's liquidity?A. Return on Investment (ROI)B. Debt to Equity RatioC. Current RatioD. Profit Margin答案:C7. The term "Depreciation" refers to:A. The decrease in value of an asset over timeB. The increase in value of an asset over timeC. The amount of an asset that is used upD. The process of selling an asset答案:A8. What is the purpose of a trial balance?A. To calculate net incomeB. To check the accuracy of accounting recordsC. To determine the value of assetsD. To calculate the cost of goods sold答案:B9. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Budget答案:D10. The accounting principle that requires expenses to be recorded in the same period as the revenues they generate is known as:A. Going ConcernB. Matching PrincipleC. Historical Cost PrincipleD. Materiality答案:B二、填空题(每题2分,共20分)1. The __________ is the process of recording financial transactions in a systematic way.答案:Journalizing2. The __________ is a summary of the financial transactionsof a business during a specific period.答案:Ledger3. __________ is the accounting principle that requires all accounting information to be based on historical cost.答案:Historical Cost Principle4. The __________ is a financial statement that shows a company's financial position at a specific point in time.答案:Balance Sheet5. __________ is the process of estimating revenues and expenses for a future period.答案:Budgeting6. __________ is the accounting principle that requires all transactions to be recorded in the period in which they occur.答案:Accrual Basis Accounting7. The __________ is a financial statement that shows the results of a company's operations over a period of time.答案:Income Statement8. __________ is the process of determining the value of a company's assets and liabilities.答案:Valuation9. __________ is the accounting principle that requires alltransactions to be recorded in the order in which they occur.答案:Chronological Order10. The __________ is a financial statement that shows the sources and uses of cash during a period of time.答案:Cash Flow Statement三、简答题(每题15分,共30分)1. 描述会计信息的质量特征有哪些,并简要解释它们的含义。

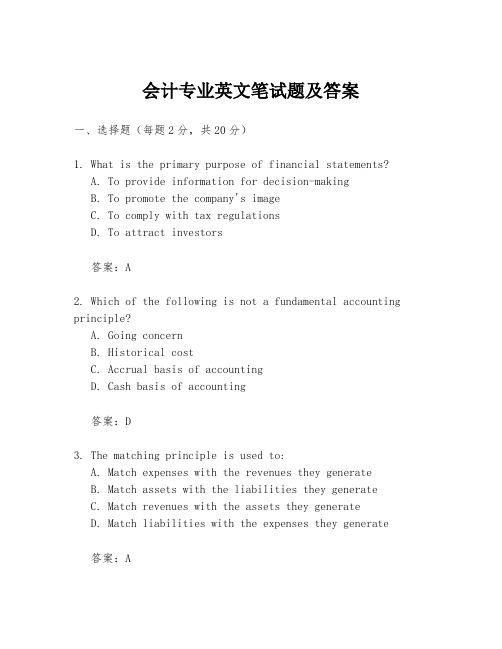

会计专业英文笔试题及答案

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

会计学英语试题及答案

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

会计英语考试题目及答案

会计英语考试题目及答案一、选择题(每题2分,共20分)1. Which of the following is a basic accounting principle?A. The Going Concern PrincipleB. The Historical Cost PrincipleC. Both A and BD. Neither A nor BAnswer: C. Both A and B2. What is the term for the systematic arrangement of accounts in a specific order?A. JournalB. LedgerC. Trial BalanceD. Chart of AccountsAnswer: D. Chart of Accounts3. What does the term "Debit" mean in accounting?A. An increase in assetsB. A decrease in liabilitiesC. An increase in equityD. A decrease in expensesAnswer: A. An increase in assets4. Which of the following is not a type of financialstatement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D. Payroll Report5. What is the purpose of an adjusting entry?A. To update the financial recordsB. To prepare for the next accounting periodC. To correct errors in the accounting recordsD. All of the aboveAnswer: D. All of the above6. Which of the following is an example of a current asset?A. InventoryB. LandC. EquipmentD. Bonds PayableAnswer: A. Inventory7. What is the formula for calculating the return on investment (ROI)?A. (Net Income / Total Assets) * 100B. (Net Income / Total Equity) * 100C. (Net Income / Investment) * 100D. (Total Assets / Net Income) * 100Answer: C. (Net Income / Investment) * 1008. What is the accounting equation?A. Assets = Liabilities + EquityB. Liabilities - Equity = AssetsC. Assets + Liabilities = EquityD. Equity + Assets = LiabilitiesAnswer: A. Assets = Liabilities + Equity9. What is the purpose of depreciation?A. To reduce the value of an asset over timeB. To increase the value of an asset over timeC. To calculate the cost of an assetD. To determine the net income of a companyAnswer: A. To reduce the value of an asset over time10. Which of the following is not a function of a general ledger?A. To record daily transactionsB. To summarize financial informationC. To provide a detailed account of each transactionD. To prepare financial statementsAnswer: A. To record daily transactions二、简答题(每题5分,共30分)1. Explain the difference between an asset and a liability. Answer: An asset is a resource owned by a business that hasfuture economic benefit, such as cash, inventory, or property.A liability is an obligation or debt that a business owes to others, such as loans, accounts payable, or salaries payable.2. What is the purpose of a balance sheet?Answer: The purpose of a balance sheet is to provide a snapshot of a company's financial position at a specificpoint in time, showing the company's assets, liabilities, and equity.3. Define the term "revenue."Answer: Revenue is the income generated from the normal business operations of a company, such as the sale of goodsor services.4. What is the difference between a journal and a ledger?Answer: A journal is a book that records financialtransactions in chronological order, while a ledger is a book that summarizes and organizes the financial transactions by accounts.5. Explain the concept of accrual accounting.Answer: Accrual accounting is a method of accounting where revenues and expenses are recorded when they are earned or incurred, not when cash is received or paid.6. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to ensure that the total debits equal the total credits in the general ledger, indicating that the accounting records are in balance.三、案例分析题(每题25分,共50分)1. A company purchased equipment for $50,000 on January 1, 2023, with a useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: Using the straight-line method, the annual depreciation expense is calculated as follows:Depreciation Expense = (Cost of Equipment - Residual Value) / Useful LifeDepreciation Expense = ($50,000 - $0) / 5 = $10,000 per year2. A company has the following transactions for the month of March 2023:- Sold goods for $20,000 on credit.- Purchased inventory for $15,000 in cash.- Paid $2,000 in salaries.- Received $18,。

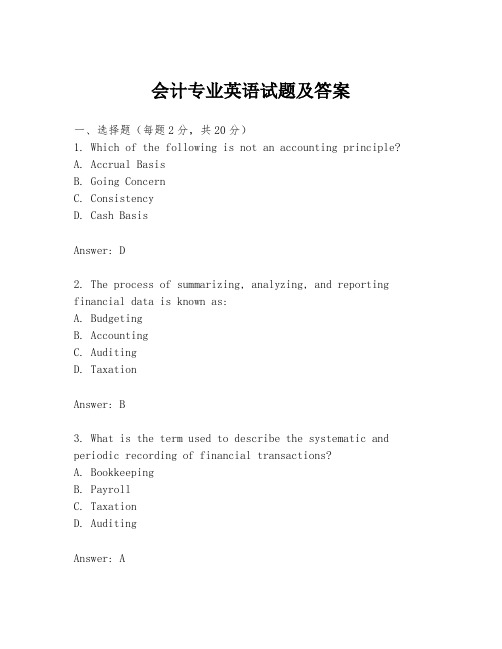

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

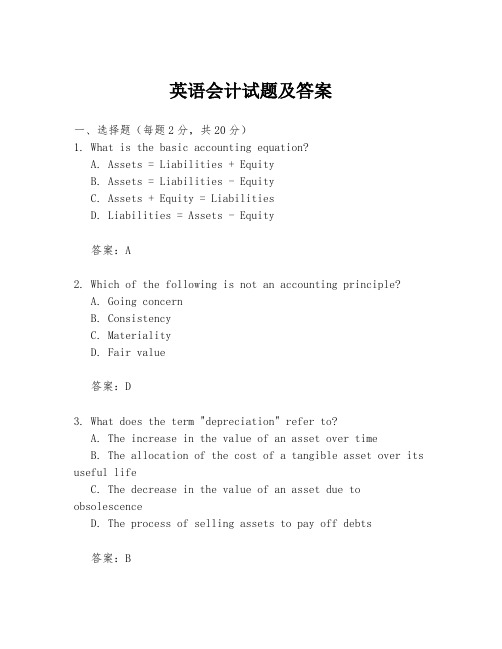

英语会计试题及答案

英语会计试题及答案一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets + Equity = LiabilitiesD. Liabilities = Assets - Equity答案:A2. Which of the following is not an accounting principle?A. Going concernB. ConsistencyC. MaterialityD. Fair value答案:D3. What does the term "depreciation" refer to?A. The increase in the value of an asset over timeB. The allocation of the cost of a tangible asset over its useful lifeC. The decrease in the value of an asset due to obsolescenceD. The process of selling assets to pay off debts答案:B4. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Accounts payable答案:C5. What is the purpose of adjusting entries?A. To correct errors in the booksB. To update the financial statements to reflect the current financial positionC. To prepare for the next accounting periodD. To comply with tax regulations答案:B6. What is the accounting treatment for revenue recognition?A. Recognize revenue when cash is receivedB. Recognize revenue when the service is providedC. Recognize revenue when the service is earned and the amount is measurableD. Recognize revenue when the product is delivered答案:C7. Which of the following is a liability?A. Common stockB. Retained earningsC. Accounts payableD. Dividends答案:C8. What is the accounting term for the process of estimating the cost of completing a project?A. Job costingB. Activity-based costingC. Standard costingD. Variable costing答案:A9. What does the term "accrual basis accounting" mean?A. Revenues and expenses are recognized when cash is received or paidB. Revenues are recognized when earned, and expenses are recognized when incurredC. All transactions are recorded in the period in which they occurD. Only cash transactions are recorded答案:B10. Which of the following is an example of a contingent liability?A. Accounts payableB. Unearned revenueC. A lawsuit that may result in a lossD. A long-term loan答案:C二、简答题(每题5分,共30分)1. Explain the difference between a debit and a credit in accounting.答案:In accounting, a debit is an entry that increases an asset or an expense and decreases a liability or equity. Conversely, a credit is an entry that increases a liabilityor equity and decreases an asset or an expense.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns, liabilities represent what a company owes, and equity represents the ownership interest in the company.3. Describe the accounting cycle.答案:The accounting cycle is a series of stepsaccountants follow to prepare financial statements. Itincludes journalizing transactions, posting to the ledger, adjusting entries, preparing an adjusted trial balance,closing entries, and preparing financial statements.4. What is the purpose of closing entries?答案:The purpose of closing entries is to transfer the balances of temporary accounts to the appropriate permanent accounts, such as retained earnings, at the end of an accounting period. This process helps to reset the temporaryaccounts for the next accounting period.5. Explain the concept of matching principle in accounting.答案:The matching principle in accounting states that revenues should be recognized in the same period as the expenses incurred to generate those revenues. This ensures that the financial statements accurately reflect the company's performance over the period.6. What are the two main types of financial statements?答案:The two main types of financial statements are the balance sheet, which presents a company's financial position at a specific point in time, and the income statement, which shows the company's financial performance over a period of time.三、计算题(每题15分,共30分)1. A company has the following trial balance figures: Cash $10,000, Accounts Receivable $5,000, Supplies $2,000, Equipment $15,000, Accounts Payable $4,000, Common Stock $10,000, Retained Earnings $6,000, Dividends $2,000, Sales Revenue $20,000, Cost。

英语会计考试题目及答案

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic accounting equation?A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Liabilities = Assets - EquityAnswer: A2. Which of the following is not a type of intangible asset?A. PatentB. TrademarkC. CopyrightD. InventoryAnswer: D3. What is the purpose of adjusting entries?A. To correct errorsB. To update the financial statementsC. To prepare for closing the booksD. All of the aboveAnswer: D4. What is the term for the process of allocating costs to specific cost objects?A. Cost allocationB. Cost centeringC. Cost accountingD. Cost trackingAnswer: A5. Which of the following is an example of a non-current liability?A. Accounts payableB. Long-term debtC. Wages payableD. Sales tax payableAnswer: B二、简答题(每题10分,共20分)6. Explain the concept of depreciation and its impact on financial statements.Answer: Depreciation is the systematic allocation of the cost of a tangible asset over its useful life. It reflects the consumption of the asset's economic benefits and is used to match the expense with the revenue generated by the asset. The impact on financial statements includes a reduction in the asset's book value on the balance sheet and an increase in the accumulated depreciation account, as well as a decrease in net income on the income statement due to the depreciation expense.7. What are the main differences between cash and accrualaccounting?Answer: Cash accounting records transactions when cash is received or paid, focusing on the actual movement of cash. Accrual accounting, on the other hand, records transactions when they occur, regardless of when cash is received or paid. Accrual accounting provides a more comprehensive picture of a company's financial performance by matching revenues with the expenses incurred to generate those revenues.三、计算题(每题15分,共30分)8. If a company purchased a machine for $120,000 with an estimated useful life of 10 years and no residual value, calculate the annual depreciation expense using the straight-line method.Answer: Annual depreciation expense = (Cost of the machine - Residual value) / Useful life = ($120,000 - $0) / 10 years = $12,000 per year.9. A company has the following accounts at the end of the year: Accounts Receivable $50,000, Inventory $30,000, and Prepaid Expenses $10,000. Calculate the current assets.Answer: Current assets = Accounts Receivable + Inventory + Prepaid Expenses = $50,000 + $30,000 + $10,000 = $90,000.四、案例分析题(每题15分,共15分)10. A company reported net income of $200,000 for the year. However, they made an error in recording a $10,000 expense that was not included in the income statement. What is thecorrected net income?Answer: The corrected net income should be reduced by the omitted expense. Therefore, the corrected net income = Original net income - Omitted expense = $200,000 - $10,000 = $190,000.五、论述题(每题15分,共15分)11. Discuss the importance of internal controls in preventing fraud and ensuring accurate financial reporting.Answer: Internal controls are critical in preventing fraud and ensuring accurate financial reporting as they provide a system of checks and balances within an organization. They help to safeguard assets, promote operational efficiency, and ensure compliance with laws and regulations. Effective internal controls can deter and detect errors or fraud, thereby enhancing the reliability and integrity of financial statements.考试结束,请考生停止作答。

会计专业英语模拟试题及复习资料

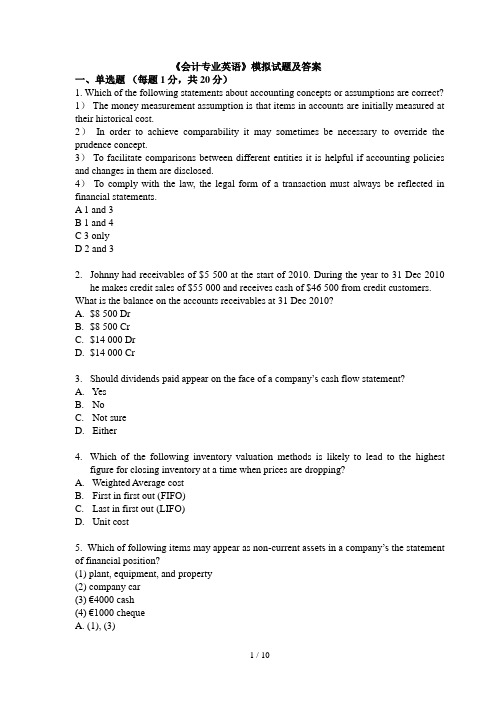

《会计专业英语》模拟试题及答案一、单选题(每题1分,共 20分)1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2)In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4)To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32.Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010?A.$8 500 DrB.$8 500 CrC.$14 000 DrD.$14 000 Cr3.Should dividends paid appear on the face of a company’s cash flow statement?A. YesB. NoC. Not sureD. Either4.Which of the following inventory valuation methods is likely to lead to the highestfigure for closing inventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-current assets in a company’s the statement of financial position?(1) plant, equipment, and property(2) company car(3) €4000 cash(4) €1000 chequeA. (1), (3)B. (1), (2)C. (2), (3)D. (2), (4)6. Whi ch of the following items may appear as current liabilities in a company’s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree?1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expenses account $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until 30 June 2010. It was increased from that date to $96,000 per year. What rent expense and end of year prepayment should be included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Plant and equipment: $860,000Depreciation for plant and equipment: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 was sold for $49,000. The plant had originally cost $80,000. Plant purchased during the year cost $180,000. It is the company.s policy to charge a full year depreciation in the year of acquisition of an asset and none in the year of sale, using a rate of 10% on the straight line basis. What net amount should appear in Lambda.s balance sheet at 30 September 2010 for plant and equipment?A $563,000B $467,000C $510,000D $606,00010. A company’s plant and machinery ledger account for the year ended 30 September 2010 was as follows:The company’s policy is to charge depreciation at 20% per year on the straight line basis, with proportionate depreciation in years of purchase and disposal. What is the depreciation charge for the year ended 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of financial information.(1) True(2) Prudence(3) Completeness(4) CorrectWhich of these characteristics contribute to reliability?A (1), (3) and (4) onlyB (1), (2) and (4) onlyC (1), (2) and (3) onlyD (2), (3) and (4) only12. The plant and machinery cost account of a company is shown below. The company’s policy is to charge depreciation at 20% on the straight line basis, with proportionate depreciation in years of acquisition and disposal.A. $67,000B. $64,200C. $70,000D. $68,60013. In preparing its financial statements for the current year, a company’s closi ng inventory was understated by $300,000. What will be the effect of this error if it remains uncorrected?A The current year’s profit will be overstated and next year’s profit will be understatedB The current year’s profit will be understated but there will be no effect on next year’s profitC The curr ent year’s profit will be understated and next year’s profit will be overstatedD The current year’s profit will be overstated but there will be no effect on next year’s profit.14. In preparing a company’s cash flow statement, which, if any, of the following items could form part of the calculation of cash flow from financing activities?(1) Proceeds of sale of premises(2) Dividends received(3) Issue of sharesA 1 onlyB 2 onlyC 3 onlyD None of them.15. At 31 March 2009 a company had oil in hand to be used for heating costing $8,200 and an unpaid heating oil bill for $3,600. At 31 March 2010 the heating oil in hand was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil during the year ended 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the company’s income statement for heating oil for the year?A $23,900B $36,100C $45,300D $33,10016. In times of inflation In times of rising prices, what effect does the use of the historical cost concept have on a company’s asset values and profit?A. Asset values and profit both undervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimated residual value of the plant in 10 years time is estimated to be $6,000. Beta’s policy is to charge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta’s accou nting period of 18 months to 30/09/2010 ?A. $5400B. $900C. $1350D. $67518. A company’s income statement for the year ended 31 December 2005 showed a n et profit of $83,600. It was later found that $18,000 paid for the purchase of a motor van had been debited to the motor expenses account. It is the company’s policy to depreciate motor vans at 25 per cent per year on the straight line basis, with a full y ear’s cha rge in the year of acquisition. What would the net profit be after adjusting for this error?A.$97,100B.$70,100C.$106,100D.$101,60019. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect of a transaction must always be shown in the financial statements even if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only20. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it’s paid or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only二、翻译题(共30分)1、将下列分录翻译成英文(每个2分,共10分)1.借:固定资产清理 30 000累计折旧 10 000贷:固定资产 40 0002.借:银行存款 10 500贷:交易性金融资产 10 000投资收益 5003.借:应付职工薪酬 1 000贷:库存现金 1 0004.借:银行存款 4 095贷:其他业务收入 3 500应交税费–应交增值税(销项税额) 5955.借:应付票据 40 000贷:银行存款 40 0002、将下列报表翻译成中文(每空1分,共20分)1.ABC group the statement of financial position as at 31/Dec/2010€2.Non-current assets3.Intangible assets4.Property, plant and equipment5.Investment in associates6.Held-for-maturity investment7.Deferred income tax assets8.Current Assets9.Trade and other receivables10.Derivative financial instruments11.Cash and cash equivalents12.Assets of discontinued operation13.Assets in total14.Current Liabilities15.Accrued payroll16.Accrued dividend17.Accrued accounts18.Non-current Liabilities19.Liabilities in total Assets三、阅读题(共30分)Research and development (R&D)Accounting treatment of R&DUnder International Accounting Standards the accounting for R&D is dealt with under IAS 38, Intangible Assets. IAS 38 states that an intangible asset is to be recognised if, and onlyif, the following criteria are met: it is probable that future economic benefits from the asset will flow to the entity, the cost of the asset can be reliably measured.The above recognition criteria look straightforward enough, but in reality it can prove to be very difficult to assess whether or not these have been met. In order to make this recognition of intangibles more clear, IAS 38 separates an R&D project into a research phase and a development phase.Research phaseIt is impossible to demonstrate whether or not a product or service at the research stage will generate any probable future economic benefit. As a result, IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.Development phaseUnder IAS 38, an intangible asset arising from development must be capitalised if an entity can demonstrate all of the following criteria: the technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset; existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably. If any of the recognition criteria are not met then the expenditure must be charged to the income statement as incurred. Note that if the recognition criteria have been met, capitalisation must take place. Once development costs have been capitalised, the asset should be amortised in accordance with the accruals concept over its finite life. Amortisation must only begin when commercial production has commenced.Questions:1)Outline the criterias of recognition of intangible assets (5分)2)Criterias to recognised as development (5分)3)Identify the accounting treatment of research phase (10分)4)Identify the accounting treatment of development phase (10分)四、业务题(按要求用英文编制分录,每题2分,共20分)Johnny set up a business and in the first a few days of trading the following transactions occurred (ignore all the tax):1)He invests $80 000 of his money in his business bank account2)He then buys goods from Isabel, a supplier for $4 000 and pays by cheque, the goods isdelivered right after the payment3) A sale is made for $3 000 –the customer pays by cheque4)Johnny makes another sale for $2 000 and the customer promises to pay in the future5)He then buys goods from another supplier, Kamen, for $2 000 on credit, goods isdelivered on time6)He pays a telephone bill of $800 by cheque7)The credit customer pays the balance on his account8)He returened some faulty goods to his supplier Kamen, which worth $400.9)Bank interest of $70 is received10)A cheque customer returned $400 goods to him for a refund参考答案1、单选题1-5 CCACB 6-10 DCDCD 11-15 ABCDD 16-20 CBABA2、翻译题1)中翻英1.Dr disposal of fixed assetDepreciationCr fixed asset2. Dr BankCr Tradable financial assetInvestment income3.Dr accrued payrollCr cash4.Dr bankCr other operating revenueAccrued tax-V AT (output)5.Dr accrued notesCr bank2) 英翻中1.编制单位:ABC 资产负债表时间:2010年12月31日单位:欧元2.非流动资产3.无形资产4.固定资产5.长期股权投资6.持有至到期投资7.递延所得税资产8.流动资产9.应收账款及其他应收款10.货币资金11.非持续性经营资产12.资产总计13.负债14.流动负债15.应付职工薪酬16.应付股利17.应付账款18.非流动负债19.负债总计20.净资产3、阅读题1)Outline the criterias of recognition of intangible assets (5分)IAS 38 states that an intangible asset is to be recognised if, and only if, the following criteria are met: it is probable that future economic benefits from the asset will flow to the entity, the cost of the asset can be reliably measured.2)Criterias to recognised as developmentthe technical feasibility of completing the intangible asset (so that it will be available for use or sale); intention to complete and use or sell the asset; ability to use or sell the asset;existence of a market or, if to be used internally, the usefulness of the asset; availability of adequate technical, financial, and other resources to complete the asset; the cost of the asset can be measured reliably.3)Identify the accounting treatment of research phase (10分)IAS 38 states that all expenditure incurred at the research stage should be written off to the statement of comprehensive income as an expense when incurred, and will never be capitalised as an intangible asset.4)Identify the accounting treatment of development phase (10分)intangible asset arising from development must be capitalised Once development costs have been capitalised, the asset should be amortised in accordance with the accruals concept over its finite life. Amortisation must only begin when commercial production has commenced.4、业务题1)Dr bankCr capital2)Dr finished goodsCr bank3)Dr bankCr sales revenue4)Dr accounts receivableCr sales revenue5)Dr finished goodsCr accrued accounts6)Dr administrativeCr bank7)Dr bankCr accounts receivable8)Dr bankCr finished goods9)Dr bankCr financial expense10)Dr sales revenueCr bank。

《会计专业英语》期末复习资料

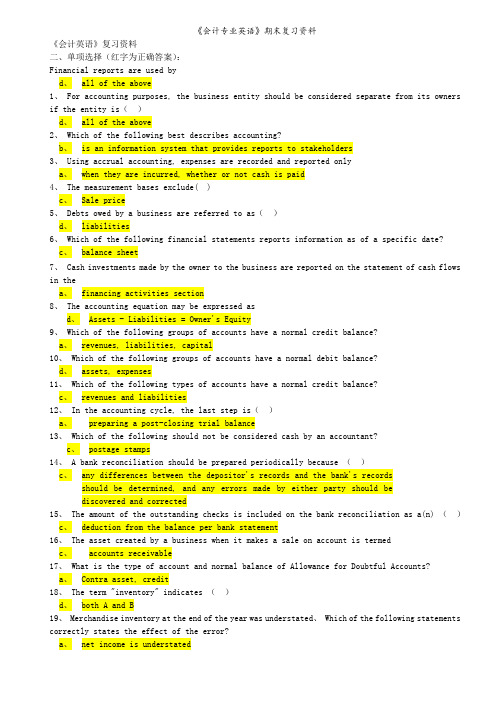

《会计英语》复习资料二、单项选择(红字为正确答案):Financial reports are used byd、all of the above1、 For accounting purposes, the business entity should be considered separate from its owners if the entity is()d、all of the above2、 Which of the following best describes accounting?b、is an information system that provides reports to stakeholders3、 Using accrual accounting, expenses are recorded and reported onlya、when they are incurred, whether or not cash is paid4、 The measurement bases exclude( )c、Sale price5、 Debts owed by a business are referred to as()d、liabilities6、 Which of the following financial statements reports information as of a specific date?c、balance sheet7、 Cash investments made by the owner to the business are reported on the statement of cash flows in thea、financing activities section8、 The accounting equation may be expressed asd、Assets - Liabilities = Owner's Equity9、 Which of the following groups of accounts have a normal credit balance?a、revenues, liabilities, capital10、 Which of the following groups of accounts have a normal debit balance?d、assets, expenses11、 Which of the following types of accounts have a normal credit balance?c、revenues and liabilities12、 In the accounting cycle, the last step is()a、preparing a post-closing trial balance13、 Which of the following should not be considered cash by an accountant?c、postage stamps14、 A bank reconciliation should be prepared periodically because ()c、any differences between the depositor's records and the bank's recordsshould be determined, and any errors made by either party should bediscovered and corrected15、 The amount of the outstanding checks is included on the bank reconciliation as a(n) ()c、deduction from the balance per bank statement16、 The asset created by a business when it makes a sale on account is termedc、accounts receivable17、 What is the type of account and normal balance of Allowance for Doubtful Accounts?a、Contra asset, credit18、 The term "inventory" indicates ()d、both A and B19、 Merchandise inventory at the end of the year was understated、 Which of the following statements correctly states the effect of the error?a、net income is understated20、Merchandise inventory at the end of the year is overstated、 Which of the following statements correctly states the effect of the error?b、owner's equity is overstated21、The inventory method that assigns the most recent costs to cost of good sold isb、LIFO22、Under which method of cost flows is the inventory assumed to be composed of the most recent costs?b、first-in, first-out23、 When the perpetual inventory system is used, the inventory sold is debited to ( )b、cost of merchandise sold24.All of the following below are needed for the calculation of depreciation exceptd、book value25、 A characteristic of a fixed asset is that it isb、used in the operations of a business26、 Accumulated Depreciation ( )c、is a contra asset account27、 The two methods of accounting for investments in stock are the cost method and the ()b、equity method28、 A capital expenditure results in a debit to ()d、an asset account29、 Current liabilities are()d、due and payable within one year30、 The debt created by a business when it makes a purchase on account is referred to as anb、account payable31、 Notes may be issued ()d、all of the above32、The cost of a product warranty should be included as an expense in thec、period of the sale of the product33、 If the market rate of interest is 8%, the price of 6% bonds paying interest semiannually witha face value of $100,000 will bec、Less than $100,00034、 The interest rate specified in the bond indenture is called the ()b、contract rate35、 When the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds ared、callable bonds36、 When the market rate of interest on bonds is higher than the contract rate, the bonds will sell atd、 a discount37、 One potential advantage of financing corporations through the use of bonds rather than common stock isc、the interest expense is deductible for tax purposes by the corporation38、 Characteristics of a corporation include ()d、shareholders who have limited liability39、 Stockholders' equity ()c、includes retained earnings and paid-in capital40、 The excess of issue price over par of common stock is termed a(n) ()d、premium41、 Cash dividends are usually not paid on which of the following?c、treasury stock42、 Which of the following accounts below is reported in the paid-in capital/stockholders' equity section of the corporate balance sheet?d、Preferred Stock43、 If preferred stock has dividends in arrears, the preferred stock must bed、convertible44、 The primary purpose of a stock split is tob、reduce the market price of the stock per share45、 Which statement below is not a reason for a corporation to buy back its own stock、d、to increase the shares outstanding46、 The liability for a dividend is recorded on which of the following dates?d、the date of declaration47、 In credit terms of 2/10, n/30, the "2" represents thed、 percent of the cash discount48、 Revenue should be recognized when()b、the service is performed49、 The ability of a business to pay its debts as they come due and to earn a reasonable amount of income is referred to as ()b、solvency and profitability50、 Which of the following is not included in the computation of the quick ratio?a、inventory四、问答题:3.Differentiate between financial accounting and managerial accounting、财务会计与管理会计得区别。

会计英语的考试题目及答案

会计英语的考试题目及答案会计英语考试题目及答案一、选择题(每题2分,共20分)1. What is the term used to describe the process of recording financial transactions in a company's books?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report答案:D3. The process of ensuring that the financial records are accurate and complete is known as:A. BookkeepingB. AccountingC. AuditingD. Reporting答案:C4. What is the primary purpose of an income statement?A. To show the financial position of a company at a specific point in time.B. To show the changes in equity of a company over a period of time.C. To show the profitability of a company over a period of time.D. To show the cash inflows and outflows of a company over a period of time.答案:C5. Which of the following is not a principle of accounting?A. Accrual BasisB. ConsistencyC. MaterialityD. Fair Value答案:D6. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twice in different accounts.B. Recording transactions in two different ways.C. Recording debits and credits for every transaction.D. Recording transactions in two different books.答案:C7. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Liabilities - Equity = AssetsD. Equity - Assets = Liabilities答案:A8. What is the purpose of depreciation in accounting?A. To increase the value of an asset.B. To allocate the cost of a tangible asset over its useful life.C. To sell an asset.D. To calculate the profit of a company.答案:B9. Which of the following is a non-current liability?A. Accounts PayableB. Wages PayableC. Long-term DebtD. Taxes Payable答案:C10. The term "revenue recognition" refers to the process of:A. Recognizing expenses when they are paid.B. Recognizing revenues when they are earned.C. Recognizing assets when they are acquired.D. Recognizing liabilities when they are incurred.答案:B二、简答题(每题5分,共20分)1. Explain the difference between "cash basis" and "accrual basis" accounting.答案:Cash basis accounting records transactions when cash is received or paid, whereas accrual basis accounting records transactions when they are earned or incurred, regardless of the cash flow.2. What is the purpose of a balance sheet?答案:The purpose of a balance sheet is to present thefinancial position of a company at a specific point in time, showing what the company owns (assets), what it owes (liabilities), and the net worth of the company's owners (equity).3. Define "depreciation" in the context of accounting.答案:Depreciation is the systematic allocation of the costof a tangible asset over its useful life, reflecting the consumption of the asset's economic benefits over time.4. What is the importance of an audit in the financial reporting process?答案:An audit provides an independent assessment of the accuracy and completeness of a company's financial statements, enhancing their credibility and reliability for stakeholders.三、案例分析题(每题15分,共30分)1. Assume you are an accountant for a company that has just sold a product for $10,000 on credit. Prepare the journalentry for this transaction under both cash basis and accrual basis accounting.答案:Under cash basis, no journal entry is made until cashis received. Under accrual basis, the journal entry would be: Dr. Accounts Receivable $10,000Cr. Revenue $10,0002. A company has the following transactions in January: purchased office supplies for $500 in cash, received $2,000for services provided in December, and accrued $1,500 in wages for January. Prepare the adjusting entries for these transactions at the end of January.答案:The adjusting entries would be:Dr. Office Supplies Expense $500Cr. Office Supplies $500 (for cash purchase)Dr. Accounts Receivable $2,000Cr. Revenue $2,000 (for services provided in December)Dr. Wages Payable $1,500Cr. Wages Expense $1,500 (for accrued wages)四、论述题(每题15分,共30分)1. Discuss the role of ethics in accounting and provide examples of ethical dilemmas that an accountant might face. 答案。

会计英语试题及答案

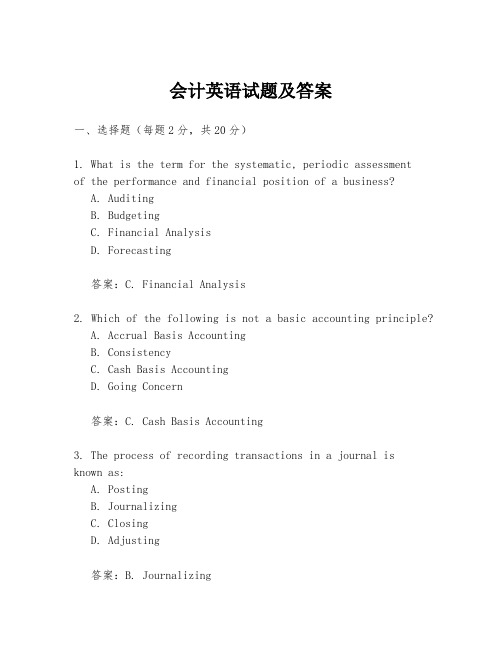

会计英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the systematic, periodic assessmentof the performance and financial position of a business?A. AuditingB. BudgetingC. Financial AnalysisD. Forecasting答案:C. Financial Analysis2. Which of the following is not a basic accounting principle?A. Accrual Basis AccountingB. ConsistencyC. Cash Basis AccountingD. Going Concern答案:C. Cash Basis Accounting3. The process of recording transactions in a journal isknown as:A. PostingB. JournalizingC. ClosingD. Adjusting答案:B. Journalizing4. What does the term "Double Entry" refer to in accounting?A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different periods答案:B. Recording transactions in two different accounts5. The financial statement that provides a snapshot of a company's financial condition at a specific point in time is:A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Changes in Equity答案:B. Balance Sheet二、填空题(每题2分,共20分)6. The __________ is the accounting equation that shows the relationship between assets, liabilities, and equity.答案:Accounting Equation7. In accounting, the term __________ refers to theallocation of the cost of a tangible asset over its useful life.答案:Depreciation8. The __________ is the process of summarizing the transactions recorded in the ledger accounts and presentingthem in a more condensed form.答案:Trial Balance9. __________ is the method of accounting where revenues and expenses are recognized when they are earned or incurred, not necessarily when cash is received or paid.答案:Accrual Accounting10. The __________ is the financial statement that shows the changes in a company's cash and cash equivalents during a period.答案:Cash Flow Statement三、简答题(每题10分,共30分)11. Explain the purpose of a balance sheet in a business context.答案:The purpose of a balance sheet is to provide stakeholders with a snapshot of a company's financialposition at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess the company's liquidity, solvency, and overall financial health.12. What are the main differences between an income statement and a statement of cash flows?答案:The income statement reports a company's financial performance over a period, focusing on revenues and expenses to determine net income. The statement of cash flows, on the other hand, shows the inflows and outflows of cash during thesame period, highlighting how the company generates and uses cash.13. Describe the concept of "matching principle" in accounting.答案:The matching principle in accounting requires that expenses be recognized in the same accounting period as the revenues they helped generate. This principle ensures that the financial statements reflect the actual economic activity of the period, providing a more accurate picture of the company's financial performance.四、计算题(每题15分,共30分)14. Given the following trial balance figures, calculate the total current assets and total current liabilities.| Account | Debit ($) | Credit ($) ||||-|| Cash | 12,000 | || Accounts Receivable | | 8,000 || Inventory | | 15,000 || Prepaid Expenses | 2,000 | || Accounts Payable | | 5,000 || Wages Payable | 1,000 | || Total Current Liabilities | | 6,000 |答案:Total current assets = Cash + Accounts Receivable + Inventory + Prepaid Expenses = 12,000 + 8,000 + 15,000 +2,000 = 37,000Total current liabilities = Accounts Payable + Wages Payable + Total Current Liabilities = 5,000 + 1,000 + 6,000 = 12,00015. If a company has a net income of $50,000 and an increase in retained earnings of $75,000, calculate the dividends paid by the company.答案:Dividends paid = Increase in retained earnings - Net income = 75,000 -。

会计英语复习资料答案

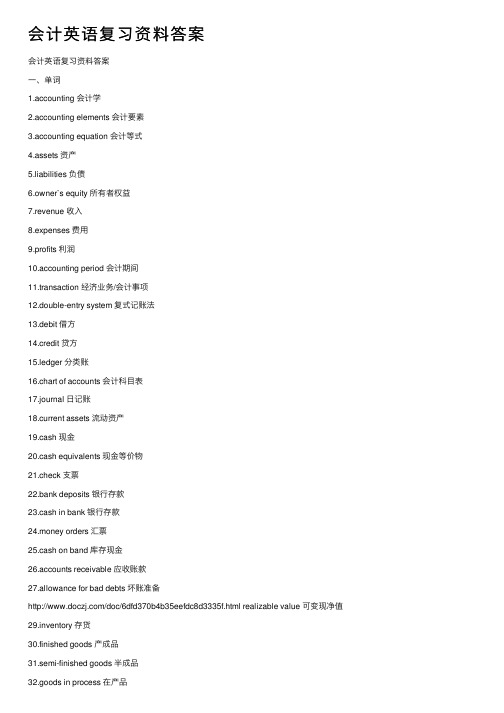

会计英语复习资料答案会计英语复习资料答案⼀、单词1.accounting 会计学2.accounting elements 会计要素3.accounting equation 会计等式4.assets 资产5.liabilities 负债6.owner`s equity 所有者权益7.revenue 收⼊8.expenses 费⽤9.profits 利润10.accounting period 会计期间11.transaction 经济业务/会计事项12.double-entry system 复式记账法13.debit 借⽅14.credit 贷⽅15.ledger 分类账16.chart of accounts 会计科⽬表17.journal ⽇记账18.current assets 流动资产19.cash 现⾦20.cash equivalents 现⾦等价物21.check ⽀票22.bank deposits 银⾏存款23.cash in bank 银⾏存款24.money orders 汇票25.cash on band 库存现⾦26.accounts receivable 应收账款27.allowance for bad debts 坏账准备/doc/6dfd370b4b35eefdc8d3335f.html realizable value 可变现净值29.inventory 存货30.finished goods 产成品31.semi-finished goods 半成品32.goods in process 在产品33.historical cost 历史成本34.specific identification 个别计价法35.first-in, first-out 先进先出法/doc/6dfd370b4b35eefdc8d3335f.html st-in, first-out 后进先出法37.weighted average 加权平均法38.raw materials 原材料39.short-term investment 短期投资40.marketable securities 有价证券41.shareholder 股东42.bonds 债券43.debentures 债券44.long-term assets 长期资产45.fixed assets 固定资产46.intangible assets ⽆形资产47.deferred assets 递延资产/doc/6dfd370b4b35eefdc8d3335f.html eful life 使⽤寿命49.depreciation 折旧50.depreciable amount 应计折旧额51.depreciation method 折旧⽅法52.estimated net residual value 预计净残值53.straight-line method 直线法54.units of production method ⼯作量法55.double declining balance method 双倍余额递减法56.sum-of-the-years-digits method 年数总和法57.amortization 摊销58.impairment 减值59.current liabilities 流动负债60.accounts payable 应付账款61.notes payable 应付票据62.unearned revenue 预收账款63.income taxes payable 应交所得税64.contingent liabilities 或有负债65.long-term liabilities 长期负债66.bonds payable 应付债券67.ownership 所有权68.sole proprietorship 独资企业69.partnership 合伙企业70.corporation 公司/doc/6dfd370b4b35eefdc8d3335f.html mon shareholders 普通股股东72.preferred shareholders 优先股股东/doc/6dfd370b4b35eefdc8d3335f.html mon stock 普通股74.preferred stock 优先股75.dividends 股利76.retained earnings 留存收益77.paid-in capital 实收资本78.capital stock 股本79.addtional paid-in capital 附加投⼊资本80.capital surplus 资本公积81.undistributed profit 未分配利润82.par value ⾯值83.fair value 公允价值84.reserve fund 盈余公积85.legal reserve 法定盈余86.stock split 股利分割87.cash dividends 现⾦股利88.stock dividends 股票股利89.sales revenue 销售收⼊90.service revenue 劳务收⼊91.product costs 产品成本92.direct material costs 直接材料成本93.direct labor costs 直接⼈⼯成本94.indirect costs 间接成本95.manufacturing overhead 制造费⽤96.period expenses 期间费⽤97.operating expense 营业费⽤98.administrative expense 管理费⽤99.finance expense 财务费⽤100.balance sheet 资产负债表101.income statement 利润表/损益表102.cash flow statement 现⾦流量表⼆、填空1. The accounting elements include assets, liabilities, owner`s equity, revenue, expenses, and profits.2. Liabilities are debts of a business.3. Borrowing cash from a bank does not belong to assets; it simply belongs to liability.4. Profit is the excess of revenue over expenses for the accounting period.5. The accounting equation is :assets = liabilities + owner`s equity.6.“Dr.” stands for debits ,while “Cr.” is the abbreviation for credit.7. Liability, owner`s equity, revenue and profit decreases are recorded as debits.8. Short-term investments refer to various of marketable securities.9. Marketable securities include stock and debentures to be realized within one year from the balance sheet date and shall be accounted for at cost.10. Depreciation refers to the systematic allocation of the depreciable amount of a fixed asset over its useful life.11. The four common depreciation methods are the straight-line method, the units of production method.12. The straight –line method shall be employed when it is assumed that an asset`s economic revenue is the same each year, and the repair and maintenance cost is also the same for each period.13. When depreciation is mainly due to wear and tear, the units of production method are usually used.14. The two types of intangible assets are finite and indenfinite intangibles.15. Please name five most commonly seen intangibles , i.e., patents, trademarks, copyrights, franchises and licenses, internet domain names and construction permit.16. Intangible assets do not include internally generated goodwill, brands and publishing titles.17. Intangible assets should be measured initially at cost.18. For intangible assets with finite useful lives enterprises shall consider their amortization while intangible assets with indefinite useful lives shall not be amortized.19. The account of unearned revenue should be decreased when the service paid for in advance has been provided.20. The account of accounts payable should be recorded when the business purchased supplies on credit.21. The account of notes payable used to show what the business owes the bank.22. A corporation`s balance sheet contains assets, liabilities, and shareholders` equity.23. Preferred stock and common stock are the two common capital stocks issued by a corporation.24. Cash dividends and stock dividend are the usual forms of distribution to share holders.25. A stock dividend is a proportional distribution to shareholders of additional shares of the corporation`s common or preferred stocks.26. Retained Earnings represents the corporation`s accumulated net income, less accumulated dividends and other amounts transferred to paid-in capital accounts.三、单选1. Matching each of the following statements with its poper term.(1) accounts receivable ( B )(2) dishonored notes receivable ( C )(3) allowance method ( A )(4) direct write-off method ( D )A. The method of accounting for un-collectible accounts that provides an expense for un-collectible receivables in advance of their write-off.B. A receivable created by selling merchandise or service on credit.C. A note that maker fails to pay on the due date.D. The method of accounting for un-collectible accounts that recognizes the expense only when accounts are judged to be worthless.2. At the end of the fiscal year, accounts receivable has a balance of $100000 and allowance for doubtful accounts has a balance of $7000, The expected net realizable value of the accounts receivable is ( B )A. $7000B. $93000C. $100000D. $1070003. If merchandise inventory is being valued at cost and the price level is steadily rising, the method of costing that will yield the higher net income is ( B )A.LIFOB.FIFOC.AverageD.Periodic4. Given the following information, which of the following accounting transactions is true?( B )Gross payroll $20000Federal income tax withheld $4000Social security tax withheld $1600A. $1600 is recorded as salary expense.B. $14400 is recorded as salary payableC. The $1600 deducted for employee social security tax belongs to the companyD. Payroll is an example of an estimated liability5.If a corporation has outstanding 1000 shares of $9 cumulative preferred stock of $100 par and dividends have been passed for the preceding three years, what is the amount of preferred dividends that must be declared in the current year before a dividend can be declared on common stock?( C ) A. $9000 B. $27000 C. $36000 D. $450006. All of the following are reasons for purchasing treasury stock except to ( B )A. make a market for the stockB. increase the number of shareholdersC. increase the earnings per share and return on equityD. give employee as compensation7. Paid-in capital for a corporation may arise from which of the following sources?( D )A. Issuing cumulative preferred stockB. Receiving donations of real estateC. Selling the corporation`s treasury stockD. All of the above8. Under the equity method, the investment account is decreased by all of the following except the investor`s proportionate share of ( B )A. dividends paid by the investeeB. declines in the fair value of the investmentC. the losses of the investeeD. all of the options9. Cash dividends are paid on the basis of the number of shares ( C )A. authorizedB. issuedC. OutstandingD. outstanding less the number of treasury shares10. The stockholders` equity section of the balance sheet may include ( D )A. common stockB. preferred stockC. donated capitalD. all of the above11. Declaration and issuance of a dividend in stock ( D )A. increases the current ratioB. decreases the amount of working capitalC. decreases total stockholders` equityD. has no effect on total assets, liabilities, or stockholders` equity12. If a corporation reacquires its own stock, the stock is listed on the balance sheet in the ( C )A. current assets sectionB. long term liability sectionC. stockholders` equity sectionD. investments section13. A corporation has issued 25000 shares of $100 par common stock and holds 3000 of these shares as treasury stock. If the corporation declares a $2 per share cash dividend, what amount will be recorded as cash dividend?( C )A. $22000B. $25000C. $44000D. $5000014. A company declared a cash dividend on its common stock on December 15, 2004, payable on January 12, 2005. How would this dividend affect shareholders` equity on the following dates? ( B ) December 15, January 122004 2005A. Decrease. Decrease.B. No effect. No effect.C. No effect. No effect.D. Decrease. Decrease.15. An example of a cash flow from an operating activity is ( D )A. the receipt of cash from issuing stockB. the receipt of cash from issuing bondsC. the payment of cash for dividendsD. the receipt of cash from customers on account16. An example of a cash flow from an investing activity is ( A )A. the receipt of cash from the sale of equipmentB. the receipt of cash from issuing bondsC. the payment of cash for dividendsD. the payment of cash to acquire treasury stock17. An example of a cash flow from a financing activity is ( C )A. the receipt of cash from customers on accountB. the receipt of cash from the sale of equipmentC. the payment of cash for dividendsD. the payment of cash to acquire marketable securities18. A receivable created by selling merchandise or services on credit. ( A )A. accounts receivableB. dishonored notes payableC. allowance methodD. direct write-off method19. At the end of the fiscal year, accounts receivable has a balance of $100000 and allowance for doubtful accounts has a balance of $7000. The expected net realizable value of the accounts receivable is ( B )A. $7000B. $93000C. $100000D. $10700020.( B ) are valuable resources owned by the entity.A. LiabilityB. AssetsC. EquityD. None of them21. Which is intangible asset ( C )A. internally generated goodwillB. internally generated publishing titlesC. franchises and licenseD. internally generated brands22.( A ) shall be employed when it is assumed that an asset`s economic revenue is the same each year, and the repair and maintenance cost is also the same for each period.A. straight-line methodB. units of production methodC. double declining balance methodD. sum-of-the-years-digits(SYD) method四、判断1. Fixed assets are intangible assets. ( F )2. Internally generated goodwill can be viewed as intangible assets. ( F )3. Land doesn`t need depreciation and is considered to have an infinite life. ( T )4. Fixed assets are usually subjected to depreciation. ( T )5. Bonds and stocks are classified as intangible assets.( F )6. Once the expected useful life and estimated net residual value are determined, they shall notbe changed under any circumstances.( F )7. When a corporation issues one type of capital stocks, common stocks are always issued. ( T )8. Par value is strictly a legal matter, and it establishes the legal capital of a corporation. ( T )9. The balance of the additional paid-in capital account represents a gain on the sale of stocks and increases net income. ( F )10. A corporation must, by law, pay a dividend once a year. ( T )11. Dividends are an expense of a corporation and should be charged to the periodic income. ( T )12. Revenue increase owner`s equity. ( T )13. Revenue is recognized when we receive cash from the buyers. ( F )14. Advertising expense is usually collected as period expense. ( T )15. Interest revenue should be measured based on the length of time. ( T )16. If revenue exceed expenses for the same accounting period, the entity is deemed to suffera loss. ( F )17. Asset = liabilities + Expense. ( F )18. Liabilities are debts of a business. ( T )19. Borrowing cash from a bank belongs to revenue. ( F )20. Increase in asset is recorded in credit side. ( F )21. When depreciation is mainly due to wear and tear, straight-line method shall be employed. ( F )22. Bonds payable belong to current liabilities.( F )23. All fixed assets are depreciable over their limited useful life.( F )24. Fixed assets are intangible assets. ( F )25. Internally generated goodwill can be viewed as intangible assets. ( F )26. Land doesn`t need depreciation and is considered to have an infinite life. ( T )五、翻译1. Accounting contains elements both of science and art. The important thing is that it is not merely a collection of arithmetical techniques but a set of complex processes depending on and prepared for people.会计既是科学,也是艺术。

会计英语复习资料答案

会计英语复习资料答案一、选择题1. D2. B3. C4. A5. B6. C7. A8. D9. B10. C二、填空题1. balance sheet2. income statement3. cash flow statement4. trial balance5. depreciation6. accounts payable7. accounts receivable9. current assets10. long-term liabilities三、解答题1. 会计的定义:会计是一门研究经济活动并以货币为主要计量单位,记录、分析和报告企业财务信息的学科。

2. 会计的目的:会计的目的是为了提供有关企业财务状况和经营成果的信息,以便匡助利益相关者做出决策。

3. 资产、负债和所有者权益:资产是企业拥有的具有经济价值的资源,包括现金、存货、固定资产等。

负债是企业所欠的债务和对付的款项,包括对付账款、长期负债等。

所有者权益是企业的净资产,包括股东投资和留存收益。

4. 会计方程式:会计方程式是会计中最基本的概念,它表达了资产、负债和所有者权益之间的关系。

会计方程式为:资产 = 负债 + 所有者权益。

5. 会计凭证:会计凭证是记录和证明企业经济交易的书面文件,包括收据、发票、支票等。

会计凭证的目的是确保交易的准确性和完整性,为后续的账务处理提供依据。

会计周期是指将企业的经营活动划分为一定的时间段进行记录和报告。

常见的会计周期包括月度、季度和年度,不同的周期可以满足不同利益相关者的需求。

7. 财务报表:财务报表是企业根据会计准则编制的反映财务状况和经营成果的文件。

常见的财务报表包括资产负债表、利润表和现金流量表,它们提供了企业的财务信息给利益相关者。

8. 会计原则:会计原则是会计准则的基础,它规定了会计记录和报告的基本原则和规范。

常见的会计原则包括货币计量原则、实体概念、会计周期原则等,它们确保了会计信息的可靠性和可比性。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

《会计专业英语》复习题参考答案Keys to ExercisesLesson 1Word and Term Study1. e2.d3.a4.c5.bReview Exercises &ProblemsA. 1. F 2. F 3.T 4.F 5.FB. (略)C. 参考译文:由一人拥有和控制的企业被称为个人独资企业。

这种企业形式比较简单,而且通常投资额较小。

个人独资企业的所有者对企业所有的事务制定决策并拥有企业的全部利润。

合伙企业是由两个或以上的人(合伙人)共同拥有和控制的企业组织形式。

一般在合伙企业中,每个合伙人对企业债务都承担无限责任。

同时,合伙企业的寿命也是有限的,企业可能因为某个合伙人死亡或退休而终止。

公司是依照法律规定成立的独立法人组织。

公司由股东拥有,股东通过购买公司的股份为公司提供资本。

股东个人对公司的债务不承担无限责任。

大多数公司的经营业务由股东选出的董事会实施控制。

Lesson 2Word and Term Study1. d2.c3.e4.b5.f6.aReview Exercises& ProblemsA. 1. F 2. T 3.F 4.F 5.FC. 参考译文:在会计恒等式中,资产必须等于负债和所有者权益之和。

因为债权人的财产要求权在企业清算时是优先于所有者支付的,所以在会计基本等式中,负债是排列在所有者权益前面的。

会计恒等式适用于所有的经济实体,无论其大小、业务性质或组织形式。

该等式适用于小型私人经济实体,如街边的杂货店,同样也适用于大公司。

这一等式为记录和总结企业的经济活动提供了基本框架。

Lesson 3Word and Term Study1. c2. e3.d4. b5. aReview Exercises &ProblemsA. 1. d 2.b 3.c 4. c 5. cB. 2. Each transaction must be entered in two or more accounts with equal debit and credit amounts. The normal balances of the three account groups are as follows: Account group Normal BalanceAssets DebitLiabilities CreditOwner’s equity CreditC. Case Problem1.(1)June 2 Asset account debited and Owner’s equity account credited.5 An asset account debited, another asset account credited.7 An asset account debited, a liability account credited.15 An asset account debited, an owner’s equity account credited.20 An expenses account debited, an asset account credited.26 An asset account debited, another asset account credited.28 A liability account debited, an asset account credited.31 An owner’s equity account debited, an asset account credited. (2) June 2 Debit Cash, increased; Credit O.Wilson Capital, increased5 Debit Vehicle, increased; Credit Cash, decreased7 Debit Supplies, increased; Credit Accounts Payable, decreased15 Debit Accounts Receivable, increased; Credit Service Revenue, decreased 20 Debit Advertising Expenses, increased; Credit Cash, decreased26 Debit Cash, increased; Credit Accounts Receivable, decreased28 Debit Accounts Payable, decreased; Credit Cash, decreased31 Debit O. Wilson, Drawings, increased(owner’s equity decreased); Credit Cash,decreasedD.参考译文:试算平衡表并不能证明所有的经济业务都已经入账,也不表明分类账的记录是正确的。

即使试算平衡表的借贷栏合计相等,也还可能存在很多错误。

例如,即使在以下情况下,试算平衡表仍可能是平衡的:(1)一笔业务没有登记到日记账;(2)一笔正确的日记账分录没有过账;(3)一笔日记账分录被两次过账;(4)在登记日记账或过账时使用了错误的账户;(5)在登记业务金额时两处或以上的错误互相抵销。

换句话说,只要过账时借方和贷方的金额相等,即使过入的账户或金额是错误的,试算平衡表的借贷栏合计数仍然会相等。

Lesson 4Word and Term Study1. b. c. d. g. h.2.(1) account number(2) sales returns and allowances(3) credit purchases(4) source document (or business document)(5) journal; ledger accountsReview Exercises &ProblemsA. 1. c 2. a 3.c 4.bB. 1.CR 2. S 3. SR 4.CR 5. CP 6. G 7. CP 8. P 9.PR 10.PC. (1)GENERAL JOURNAL J1(2)(3) Wheeler’s Repair ShopTrial BalanceJanuary 20,2009Debit Credit Cash $4130.5 Prepaid Rent 675 Repair Equipment 1150Accounts Payable 200 P. Wheeler, Capital 5,000 P. Wheeler, Drawings 350Service Revenue 1,180.5 Advertising Expense 75Totals $6,380.5 $6,380.5Lesson 5Word and Term Study1.c2. a3. b4.e5. d Review Exercises &ProblemsA. 1. d 2. b 3.d 4.c 5.cB. 4.(1). June 30 Depreciation Expense 1 362 Accumulated Depreciation —Equipment 1 362(2). June 30 Unearned Revenue 4 200Service Revenue 4 200Accounts PayableService Revenue(3). June 30 Interest Expense 650Interest Payable 650(4). $2 500- $1075 = $1 425June 30 Supplies Expense 1 425Supplies 1 425(5). June 30 Insurance Expense 1 170Prepaid Insurance 1 170C.参考译文:收入实现原则要求收入必须在其赚得的会计期间确认。

在服务企业中,收入被认为是在服务履行的时候赚得的。

另一方面,会计人员还遵循“费用跟着收入走”的原则。

也就是说,费用的确认取决于收入在什么时候确认。

例如,服务企业为履行服务所发生的工薪费用应当在服务收入确认的同一会计期间登记入账,并在同期的损益表中列报,而不论这项费用在此期间是否支付。