企业所得税申报表-英文版(中华人民共和国企业所得税年度纳税申报表(A类,2014年版)》)

中华人民共和国企业所得税年度纳税申报表(A类)(A

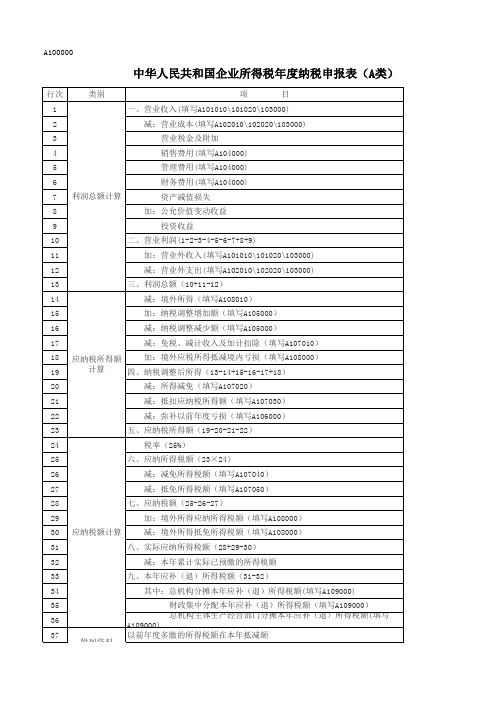

中华人民共和国企业所得税年度纳税申报表(A类)(A100000)【表单说明】本表为年度纳税申报表主表,企业应该根据《中华人民共和国企业所得税法》及其实施条例(以下简称税法)、相关税收政策,以及国家统一会计制度(企业会计准则、小企业会计准则、企业会计制度、事业单位会计准则和民间非营利组织会计制度等)的规定,计算填报纳税人利润总额、应纳税所得额、应纳税额和附列资料等有关项目。

企业在计算应纳税所得额及应纳所得税时,企业财务、会计处理办法与税法规定不一致的,应当按照税法规定计算。

税法规定不明确的,在没有明确规定之前,暂按企业财务、会计规定计算。

一、有关项目填报说明(一)表体项目本表是在纳税人会计利润总额的基础上,加减纳税调整等金额后计算出“纳税调整后所得”(应纳税所得额)。

会计与税法的差异(包括收入类、扣除类、资产类等差异)通过《纳税调整项目明细表》(A105000)集中填报。

本表包括利润总额计算、应纳税所得额计算、应纳税额计算、附列资料四个部分。

1.“利润总额计算”中的项目,按照国家统一会计制度口径计算填报。

实行企业会计准则、小企业会计准则、企业会计制度、分行业会计制度纳税人其数据直接取自利润表;实行事业单位会计准则的纳税人其数据取自收入支出表;实行民间非营利组织会计制度纳税人其数据取自业务活动表;实行其他国家统一会计制度的纳税人,根据本表项目进行分析填报。

2.“应纳税所得额计算”和“应纳税额计算”中的项目,除根据主表逻辑关系计算的外,通过附表相应栏次填报。

(二)行次说明第1-13行参照企业会计准则利润表的说明编写。

1.第1行“营业收入”:填报纳税人主要经营业务和其他经营业务取得的收入总额。

本行根据“主营业务收入”和“其他业务收入”的数额填报。

一般企业纳税人通过《一般企业收入明细表》(A101010)填报;金融企业纳税人通过《金融企业收入明细表》(A101020)填报;事业单位、社会团体、民办非企业单位、非营利组织等纳税人通过《事业单位、民间非营利组织收入、支出明细表》(A103000)填报。

《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》部分表单及填报说明(2020年修订)

-1-

《企业所得税年度纳税申报表填报表单》填报说明

本表列示申报表全部表单名称及编号。纳税人在填报申报表之前,请仔细阅读这 些表单的填报信息,并根据企业的涉税业务,选择“是否填报”。选择“填报”的, 在“□”内打“√”,并完成该表单内容的填报。未选择“填报”的表单,无需向税务 机关报送。各表单有关情况如下:

A109000

跨地区经营汇总纳税企业年度分摊企业所得税明细表

A109010

企业所得税汇总纳税分支机构所得税分配表

说明:企业应当根据实际情况选择需要填报的表单。

是否填报

√ √ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □

职工薪酬支出及纳税调整明细表

A105060

广告费和业务宣传费等跨年度纳税调整明细表

A105070

捐赠支出及纳税调整明细表

A105080

资产折旧、摊销及纳税调整明细表

A105090

资产损失税前扣除及纳税调整明细表

A105100

企业重组及递延纳税事项纳税调整明细表

A105110

政策性搬迁纳税调整明细表

A105120

附件

《中华人民共和国企业所得税年度纳税申报表 (A 类,2017 年版)》部分表单及填报说明

(2020 年修订)

国家税务总局 2020 年 12 月

目录

企业所得税年度纳税申报表填报表单...........................................................................- 1 《企业所得税年度纳税申报表填报表单》填报说明...................................................- 2 A000000 企业所得税年度纳税申报基础信息表......................................................... - 7 A000000 《企业所得税年度纳税申报基础信息表》填报说明................................. - 8 A100000 《中华人民共和国企业所得税年度纳税申报表(A 类)》填报说明.... - 19 A105000 纳税调整项目明细表................................................................................... - 26 A105000 《纳税调整项目明细表》填报说明........................................................... - 28 A105070 捐赠支出及纳税调整明细表....................................................................... - 39 A105070 《捐赠支出及纳税调整明细表》填报说明............................................... - 40 A105080 资产折旧、摊销及纳税调整明细表........................................................... - 45 A105080 《资产折旧、摊销及纳税调整明细表》填报说明................................... - 48 A105090 资产损失税前扣除及纳税调整明细表....................................................... - 53 A105090 《资产损失税前扣除及纳税调整明细表》填报说明............................... - 55 A105120 贷款损失准备金及纳税调整明细表...........................................................- 61 A105120 《贷款损失准备金及纳税调整明细表》填报说明.....................................- 62 A106000 企业所得税弥补亏损明细表....................................................................... - 65 A106000 《企业所得税弥补亏损明细表》填报说明............................................... - 66 A107020 所得减免优惠明细表................................................................................... - 70 A107020 《所得减免优惠明细表》填报说明........................................................... - 72 A107040 减免所得税优惠明细表............................................................................... - 80 A107040 《减免所得税优惠明细表》填报说明....................................................... - 80 A107042 软件、集成电路企业优惠情况及明细表................................................... - 99 A107042 《软件、集成电路企业优惠情况及明细表》填报说明......................... - 100 A108000 《境外所得税收抵免明细表》填报说明................................................. - 106 A108010 境外所得纳税调整后所得明细表............................................................. - 111 A108010 《境外所得纳税调整后所得明细表》填报说明..................................... - 112 -

企业所得税汇算清缴申报表A类 英文版

Calculation on total profit

Calculation on taxable income

Calculation on the tax payable

Attchment

Tax Return Form for the Yearly Prepayment of Enterprise Income Tax of the People's Republic of China (Type A) Items I. Operating income(attached formA101010\101020\103000) Less:Operating cost (attached formA102010\102020\103000) Business tax and surcharges Sales expenses (attached formA104000) Adminisstrative expenses (attached formA104000) Financial expenses (attached formA104000) Loss from asset devaluation Plus:Gains on the changes in the fair value Income from investment II.Operating profit(1-2-3-4-5-6-7+8+9) Plus:Non-operating income (attached formA101010\101020\103000) Less:Non-operating expenses (attached formA102010\102020\103000) III. Total profit(10+11-12) Less:Oversea income(attached formA108010) Plus:Tax Adjustment Increasing(attached formA105000) Less:Tax Adjusment Decreasing(attached formA105000) Less:Adjustment for tax exemption/reduction of income/collectively deductions(attached formA107010) Plus:Foreign Taxable Income to Cover the Territory of Loss(attached formA108000) IV. Income after tax adjustment(13-14+15-16-17+18) Less:Tax-exempt income(attached formA107020) Less:Deduction of taxable income(attached formA107030) Less:Prior year deficiency(attached formA106000) V. Taxable income(19-20-21-22) Tax rate(25%) VI. Tax payable(23×24) Less:Tax-free Tax Payable(attached formA107040) Less:Deductable Tax Payable(attached formA107050) VII. Tax Payable after adjustment(25-26-27) Plus:Oversea Tax Payable(attached formA108000) Less:Deductable Oversea Tax Payable(attached formA108000) VIII. Actual Tax Payable(28+29-30) Less:Prepaid income tax in current year IX. Final Tax Payable(31-32) Including:Income tax allocation by head institution(attached formA109000) Collective allocation of income tax by financial department (attached formA109000) Independent operation department of head institution should share income tax(attached formA109000) Prior Year Overpaid Tax Deducted in Current Year Prior Year Tax Payable Paid in Current Year

中华人民共和国企业所得税年度纳税申报表A类版

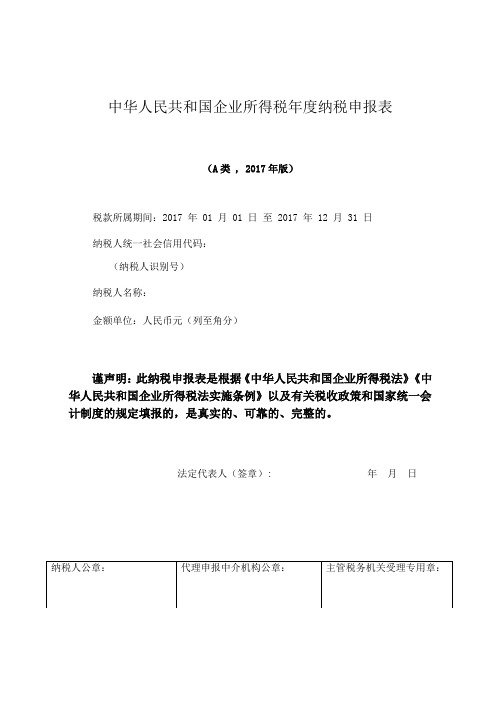

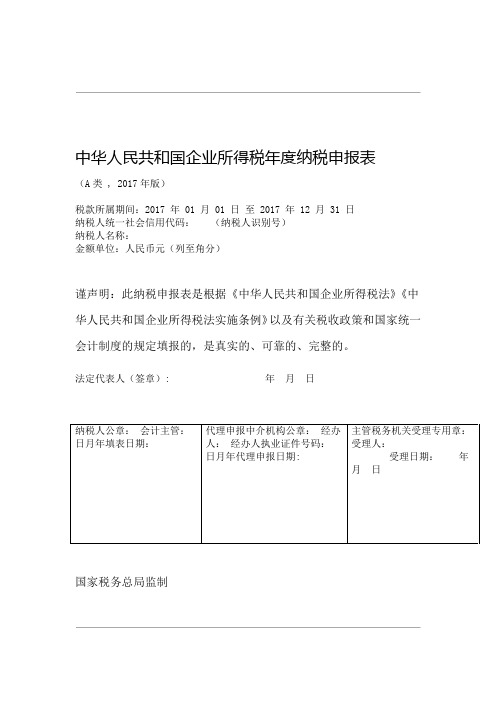

中华人民共和国企业所得税年度纳税申报表

(A类 , 2017年版)

税款所属期间:2017 年 01 月 01 日至 2017 年 12 月 31 日

纳税人统一社会信用代码:

(纳税人识别号)

纳税人名称:

金额单位:人民币元(列至角分)

谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》《中华人民共和国企业所得税法实施条例》以及有关税收政策和国家统一会计制度的规定填报的,是真实的、可靠的、完整的。

法定代表人(签章): 年月日

国家税务总局监制

A000000 企业基础信息表

A100000 中华人民共和国企业所得税年度纳税申报表(A类)

A101010 一般企业收入明细表

A102010 一般企业成本支出明细表

A104000 期间费用明细表

A105000 纳税调整项目明细表

A105050 职工薪酬支出及纳税调整明细表

A105080 资产折旧、摊销及纳税调整明细表

A106000 企业所得税弥补亏损明细表。

《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》部分表单及填报说明(2020年修订)

企业所得税年度纳税申报表填报表单

表单编号

表单名称

A000000 企业所得税年度纳税申报基础信息表

A100000 中华人民共和国企业所得税年度纳税申报表(A 类)

A101010

一般企业收入明细表

A101020

金融企业收入明细表

A102010

一般企业成本支出明细表

A102020

金融企业支出明细表

A103000

减免所得税优惠明细表

A107041

高新技术企业优惠情况及明细表

A107042

软件、集成电路企业优惠情况及明细表

A107050

税额抵免优惠明细表

A108000

境外所得税收抵免明细表

A108010

境外所得纳税调整后所得明细表

A108020

境外分支机构弥补亏损明细表

A108030

跨年度结转抵免境外所得税明细表

附件

《中华人民共和国企业所得税年度纳税申报表 (A 类,2017 年版)》部分表单及填报说明

(2020 年修订)

国家税务总局 2020 年 12 月

目录

企业所得税年度纳税申报表填报表单...........................................................................- 1 《企业所得税年度纳税申报表填报表单》填报说明...................................................- 2 A000000 企业所得税年度纳税申报基础信息表......................................................... - 7 A000000 《企业所得税年度纳税申报基础信息表》填报说明................................. - 8 A100000 《中华人民共和国企业所得税年度纳税申报表(A 类)》填报说明.... - 19 A105000 纳税调整项目明细表................................................................................... - 26 A105000 《纳税调整项目明细表》填报说明........................................................... - 28 A105070 捐赠支出及纳税调整明细表....................................................................... - 39 A105070 《捐赠支出及纳税调整明细表》填报说明............................................... - 40 A105080 资产折旧、摊销及纳税调整明细表........................................................... - 45 A105080 《资产折旧、摊销及纳税调整明细表》填报说明................................... - 48 A105090 资产损失税前扣除及纳税调整明细表....................................................... - 53 A105090 《资产损失税前扣除及纳税调整明细表》填报说明............................... - 55 A105120 贷款损失准备金及纳税调整明细表...........................................................- 61 A105120 《贷款损失准备金及纳税调整明细表》填报说明.....................................- 62 A106000 企业所得税弥补亏损明细表....................................................................... - 65 A106000 《企业所得税弥补亏损明细表》填报说明............................................... - 66 A107020 所得减免优惠明细表................................................................................... - 70 A107020 《所得减免优惠明细表》填报说明........................................................... - 72 A107040 减免所得税优惠明细表............................................................................... - 80 A107040 《减免所得税优惠明细表》填报说明....................................................... - 80 A107042 软件、集成电路企业优惠情况及明细表................................................... - 99 A107042 《软件、集成电路企业优惠情况及明细表》填报说明......................... - 100 A108000 《境外所得税收抵免明细表》填报说明................................................. - 106 A108010 境外所得纳税调整后所得明细表............................................................. - 111 A108010 《境外所得纳税调整后所得明细表》填报说明..................................... - 112 -

2020《企业所得税年度纳税申报表(A类)及其附表》及填报说明精品

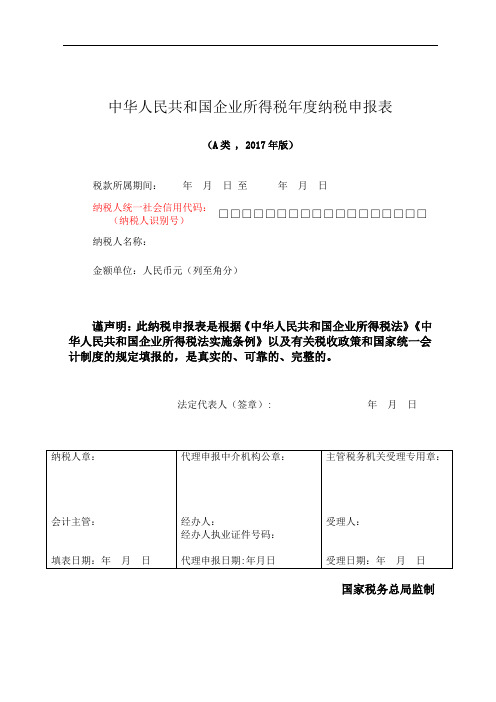

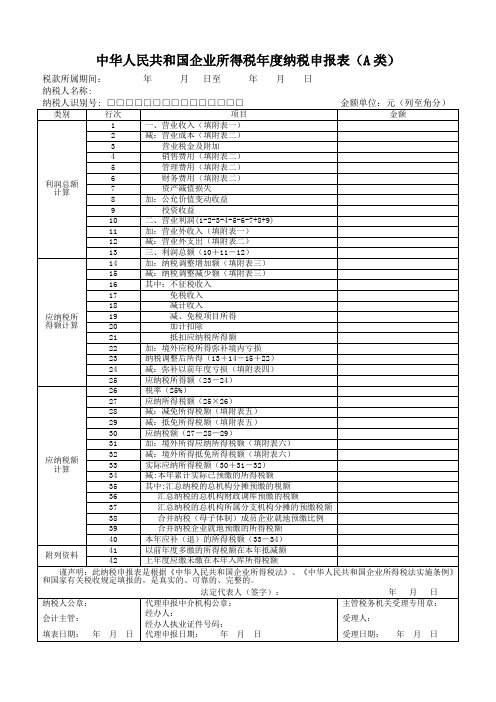

中华人民共和国企业所得税年度纳税申报表(A类)税款所属期间:年月日至年月日纳税人名称:《中华人民共和国企业所得税年度纳税申报表(A类)》填报说明一、适用范围本表适用于实行查账征收企业所得税的居民纳税人(以下简称纳税人)填报。

二、填报依据及内容根据《中华人民共和国企业所得税法》及其实施条例、相关税收政策,以及国家统一会计制度(企业会计制度、企业会计准则、小企业会计制度、分行业会计制度、事业单位会计制度和民间非营利组织会计制度)的规定,填报计算纳税人利润总额、应纳税所得额、应纳税额和附列资料等有关项目。

三、有关项目填报说明(一)表头项目1.“税款所属期间”:正常经营的纳税人,填报公历当年1月1日至12月31日;纳税人年度中间开业的,填报实际生产经营之日的当月1日至同年12月31日;纳税人年度中间发生合并、分立、破产、停业等情况的,填报公历当年1月1日至实际停业或法院裁定并宣告破产之日的当月月末;纳税人年度中间开业且年度中间又发生合并、分立、破产、停业等情况的,填报实际生产经营之日的当月1日至实际停业或法院裁定并宣告破产之日的当月月末。

2.“纳税人识别号”:填报税务机关统一核发的税务登记证号码。

3.“纳税人名称”:填报税务登记证所载纳税人的全称。

(二)表体项目本表是在纳税人会计利润总额的基础上,加减纳税调整额后计算出“纳税调整后所得”(应纳税所得额)。

会计与税法的差异(包括收入类、扣除类、资产类等差异)通过纳税调整项目明细表(附表三)集中体现。

本表包括利润总额计算、应纳税所得额计算、应纳税额计算和附列资料四个部分。

1.“利润总额计算”中的项目,按照国家统一会计制度口径计算填报。

实行企业会计准则的纳税人,其数据直接取自损益表;实行其他国家统一会计制度的纳税人,与本表不一致的项目,按照其利润表项目进行分析填报。

利润总额部分的收入、成本、费用明细项目,一般工商企业纳税人,通过附表一(1)《收入明细表》和附表二(1)《成本费用明细表》相应栏次填报;金融企业纳税人,通过附表一(2)《金融企业收入明细表》、附表二(2)《金融企业成本费用明细表》相应栏次填报;事业单位、社会团体、民办非企业单位、非营利组织等纳税人,通过附表一(3)《事业单位、社会团体、民办非企业单位收入项目明细表》和附表二(3)《事业单位、社会团体、民办非企业单位支出项目明细表》相应栏次填报。

04:A100000《中华人民共和国企业所得税年度纳税申报表(A类》(税务2020年)

1

一、营业收入(填写A101010\101020\103000)

2

减:营业成本(填写A102010\102020\103000)

3

减:税金及附加

4

中华人民共和国企业所得税年度纳税申报表(A类)A100000

本表包括利润总额计算、应纳税所得额计算、应纳税额计算三个部分。 1.“利润总额计算”中的项目,按照国家统一会计制度规定计算填报。实行企业会计 准则、小企业会计准则、企业会计制度、分行业会计制度的纳税人,其数据直接取自 《利润表》(另有说明的除外);实行事业单位会计准则的纳税人,其数据取自《收 入支出表》;实行民间非营利组织会计制度的纳税人,其数据取自《业务活动表》; 实行其他国家统一会计制度的纳税人,根据本表项目进行分析填报。 2.“应纳税所得额计算”和“应纳税额计算”中的项目,除根据主表逻辑关系计算以外 ,通过附表相应栏次填报。

一、“利润总额计算”项目分析 利润总额计算是按照国家统一会计制度口径计算进行的。由于会计在计 算利润时依据的基本原则与税法计算应纳税所得额确认原则存在一定的差异, 因此,在纳税问题上不能将企业的会计利润直接用来计算税收,需要按照税 法口径进行相应调整。

二、“应纳税所得额计算”项目分析

应纳税所得额计算是企业所得税年度纳税申报表主表中最为核心与重要的内 容。其逻辑结构是在会计利润的基础上,对会计上已经确认的收入按照企业所得 税对收入确认的确定原则、纳税能力原则、便于征管原则,重新梳理会计收入, 使其成为税法认可的计税的收入总额;同样,从企业所得税的税前扣除合理性与 相关性角度,对会计上已经列为支出的成本费用从定量标准、定性分析、时间上 的选择与程序上的要求三个方面进行了梳理,使其成为税法认可的税前可以扣除 的成本费用总额。同时,在技术上充分考虑了税收优惠对应纳税所得额的影响。

中华人民共和国企业所得税年度纳税申报表(A类-2017年版)

中华人民共和国企业所得税年度纳税申报表

(A类 , 2017年版)

税款所属期间:2017 年 01 月 01 日至 2017 年 12 月 31 日

纳税人统一社会信用代码:(纳税人识别号)

纳税人名称:

金额单位:人民币元(列至角分)

谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》《中华人民共和国企业所得税法实施条例》以及有关税收政策和国家统一会计制度的规定填报的,是真实的、可靠的、完整的。

法定代表人(签章): 年月日

国家税务总局监制

企业所得税年度纳税申报表填报表单

A000000 企业基础信息表

A100000

中华人民共和国企业所得税年度纳税申报表(A类)

- 4 -

A101010

一般企业收入明细表

- 5 -

A102010

一般企业成本支出明细表

- 6 -

A104000

期间费用明细表

A105000

纳税调整项目明细表

- 8 -

A105050

职工薪酬支出及纳税调整明细表

- 9 -

A105080 资产折旧、摊销及纳税调整明细表

A106000 企业所得税弥补亏损明细表。

企业所得税年度纳税申报表(全)

中华人民共和国企业所得税年度纳税申报表(A类)

税款所属期间: 年 月 日至 年 月 日 纳税人名称: 纳税人识别号: □□□□□□□□□□□□□□□ 金额单位:元(列至角分) 项目 金额 类别 行次 一、营业收入(填附表一) 1 减:营业成本(填附表二) 2 营业税金及附加 3 销售费用(填附表二) 4 管理费用(填附表二) 5 财务费用(填附表二) 6 利润总 资产减值损失 7 额计算 加:公允价值变动收益 8 投资收益 9 二、营业利润 10 加:营业外收入(填附表一) 11 减:营业外支出(填附表二) 12 三、利润总额(10+11-12) 13 加:纳税调整增加额(填附表三) 14 减:纳税调整减少额(填附表三) 15 其中:不征税收入 16 免税收入 17 减计收入 18 应纳税 减、免税项目所得 19 所得额 加计扣除 20 计算 抵扣应纳税所得额 21 加:境外应税所得弥补境内亏损 22 纳税调整后所得(13+14-15+22) 23 减:弥补以前年度亏损(填附表四) 24 应纳税所得额(23-24) 25 税率(25%) 26 应纳所得税额(25×26) 27 减:减免所得税额(填附表五) 28 减:抵免所得税额(填附表五) 29 应纳税额(27-28-29) 30 加:境外所得应纳所得税额(填附表六) 31 减:境外所得抵免所得税额(填附表六) 32 应纳税 实际应纳所得税额(30+31-32) 33 额计算 减:本年累计实际已预缴的所得税额 34 其中:汇总纳税的总机构分摊预缴的税额 35 汇总纳税的总机构财政调库预缴的税额 36 汇总纳税的总机构所属分支机构分摊的预缴税额 37 合并纳税(母子体制)成员企业就地预缴比例 38 合并纳税企业就地预缴的所得税额 39 本年应补(退)的所得税额(33-34) 40 附列资 以前年度多缴的所得税额在本年抵减额 41 料 以前年度应缴未缴在本年入库所得税额 42 主管税务机关受理专用章: 纳税人公章: 代理申报中介机构公章: 受理人: 经办人: 经办人及执业证件号码: 受理日期:年 月 日 申报日期: 年 月 日 代理申报日期:年 月 日

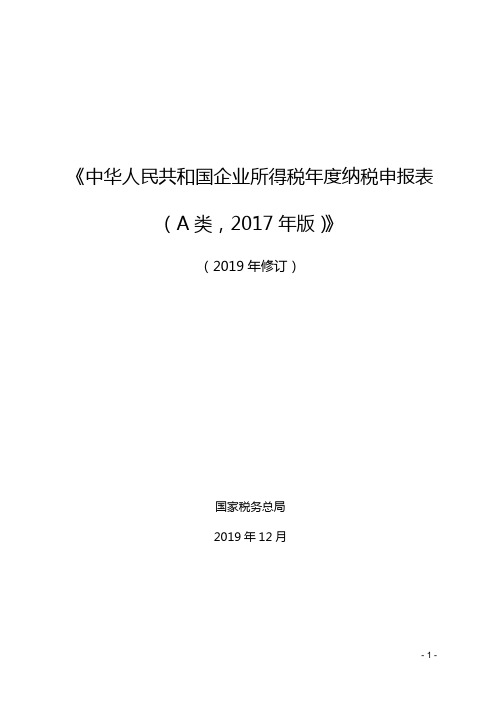

《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》

《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》(2019年修订)国家税务总局2019年12月目录中华人民共和国企业所得税年度纳税申报表封面 (5)《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》封面填报说明 (6)企业所得税年度纳税申报表填报表单 (7)《企业所得税年度纳税申报表填报表单》填报说明 (8)A000000企业所得税年度纳税申报基础信息表 (13)A000000《企业所得税年度纳税申报基础信息表》填报说明 (14)A100000中华人民共和国企业所得税年度纳税申报表(A类) (26)A100000《中华人民共和国企业所得税年度纳税申报表(A类)》填报说明 (27)A101010一般企业收入明细表 (34)A101010《一般企业收入明细表》填报说明 (35)A101020金融企业收入明细表 (38)A101020《金融企业收入明细表》填报说明 (39)A102010一般企业成本支出明细表 (42)A102010《一般企业成本支出明细表》填报说明 (43)A102020金融企业支出明细表 (46)A102020《金融企业支出明细表》填报说明 (47)A103000事业单位、民间非营利组织收入、支出明细表 (50)A103000《事业单位、民间非营利组织收入、支出明细表》填报说明 (51)A104000期间费用明细表 (55)A104000《期间费用明细表》填报说明 (56)A105000纳税调整项目明细表 (58)A105000《纳税调整项目明细表》填报说明 (59)A105010视同销售和房地产开发企业特定业务纳税调整明细表 (69)A105010《视同销售和房地产开发企业特定业务纳税调整明细表》填报说明 (70)A105020未按权责发生制确认收入纳税调整明细表 (75)A105020《未按权责发生制确认收入纳税调整明细表》填报说明 (76)A105030投资收益纳税调整明细表 (78)A105030《投资收益纳税调整明细表》填报说明 (79)A105040专项用途财政性资金纳税调整明细表 (81)A105040《专项用途财政性资金纳税调整明细表》填报说明 (82)A105050职工薪酬支出及纳税调整明细表 (84)A105050《职工薪酬支出及纳税调整明细表》填报说明 (85)A105060广告费和业务宣传费等跨年度纳税调整明细表 (90)A105060《广告费和业务宣传费等跨年度纳税调整明细表》填报说明 (91)A105070捐赠支出及纳税调整明细表 (94)A105070《捐赠支出及纳税调整明细表》填报说明 (95)A105080资产折旧、摊销及纳税调整明细表 (99)A105080《资产折旧、摊销及纳税调整明细表》填报说明 (101)A105090资产损失税前扣除及纳税调整明细表 (105)A105090《资产损失税前扣除及纳税调整明细表》填报说明 (107)A105100企业重组及递延纳税事项纳税调整明细表 (112)A105100《企业重组及递延纳税事项纳税调整明细表》填报说明 (113)A105110政策性搬迁纳税调整明细表 (117)A105110《政策性搬迁纳税调整明细表》填报说明 (118)A105120特殊行业准备金及纳税调整明细表 (121)A105120《特殊行业准备金及纳税调整明细表》填报说明 (122)A106000企业所得税弥补亏损明细表 (126)A106000《企业所得税弥补亏损明细表》填报说明 (127)A107010免税、减计收入及加计扣除优惠明细表 (130)A107010《免税、减计收入及加计扣除优惠明细表》填报说明 (131)A107011符合条件的居民企业之间的股息、红利等权益性投资收益优惠明细表 (136)A107011《符合条件的居民企业之间的股息、红利等权益性投资收益优惠明细表》填报说明 (137)A107012研发费用加计扣除优惠明细表 (141)A107012《研发费用加计扣除优惠明细表》填报说明 (143)A107020所得减免优惠明细表 (149)A107020《所得减免优惠明细表》填报说明 (150)A107030抵扣应纳税所得额明细表 (157)A107030《抵扣应纳税所得额明细表》填报说明 (158)A107040减免所得税优惠明细表 (162)A107040《减免所得税优惠明细表》填报说明 (163)A107041高新技术企业优惠情况及明细表 (175)A107041《高新技术企业优惠情况及明细表》填报说明 (176)A107042软件、集成电路企业优惠情况及明细表 (180)A107042《软件、集成电路企业优惠情况及明细表》填报说明 (182)A107050税额抵免优惠明细表 (189)A107050《税额抵免优惠明细表》填报说明 (190)A108000境外所得税收抵免明细表 (193)A108000《境外所得税收抵免明细表》填报说明 (194)A108010境外所得纳税调整后所得明细表 (198)A108010《境外所得纳税调整后所得明细表》填报说明 (199)A108020境外分支机构弥补亏损明细表 (201)A108020《境外分支机构弥补亏损明细表》填报说明 (202)A108030跨年度结转抵免境外所得税明细表 (204)A108030《跨年度结转抵免境外所得税明细表》填报说明 (205)A109000跨地区经营汇总纳税企业年度分摊企业所得税明细表 (207)A109000《跨地区经营汇总纳税企业年度分摊企业所得税明细表》填报说明 (208)A109010企业所得税汇总纳税分支机构所得税分配表 (211)A109010《企业所得税汇总纳税分支机构所得税分配表》填报说明 (212)中华人民共和国企业所得税年度纳税申报表封面(A类 , 2017年版)税款所属期间:年月日至年月日纳税人识别号□□□□□□□□□□□□□□□□□□(统一社会信用代码):纳税人名称:金额单位:人民币元(列至角分)谨声明:本纳税申报表是根据国家税收法律法规及相关规定填报的,是真实的、可靠的、完整的。

《中华人民共和国企业所得税年度纳税申报表A类,2017年版》(2019修订版)(带填表说明)

《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》(2019年修订)国家税务总局2019年12月目录目录 (I)中华人民共和国企业所得税年度纳税申报表 (1)《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》封面填报说明 (2)企业所得税年度纳税申报表填报表单 (3)《企业所得税年度纳税申报表填报表单》填报说明 (4)A000000企业所得税年度纳税申报基础信息表 (9)A000000《企业所得税年度纳税申报基础信息表》填报说明 (10)A100000中华人民共和国企业所得税年度纳税申报表(A类) (23)A100000《中华人民共和国企业所得税年度纳税申报表(A类)》填报说明 (24)A101010一般企业收入明细表 (31)A101010《一般企业收入明细表》填报说明 (32)A101020金融企业收入明细表 (35)A101020《金融企业收入明细表》填报说明 (36)A102010一般企业成本支出明细表 (39)A102010《一般企业成本支出明细表》填报说明 (40)A102020金融企业支出明细表 (43)A102020《金融企业支出明细表》填报说明 (44)A103000事业单位、民间非营利组织收入、支出明细表 (47)A103000《事业单位、民间非营利组织收入、支出明细表》填报说明 (48)A104000期间费用明细表 (52)A104000《期间费用明细表》填报说明 (53)A105000纳税调整项目明细表 (55)A105000《纳税调整项目明细表》填报说明 (56)A105010视同销售和房地产开发企业特定业务纳税调整明细表 (66)A105010《视同销售和房地产开发企业特定业务纳税调整明细表》填报说明 (67)A105020未按权责发生制确认收入纳税调整明细表 (72)A105020《未按权责发生制确认收入纳税调整明细表》填报说明 (73)A105030投资收益纳税调整明细表 (75)A105030《投资收益纳税调整明细表》填报说明 (76)A105040专项用途财政性资金纳税调整明细表 (78)A105040《专项用途财政性资金纳税调整明细表》填报说明 (79)A105050职工薪酬支出及纳税调整明细表 (81)A105050《职工薪酬支出及纳税调整明细表》填报说明 (82)A105060广告费和业务宣传费跨年度纳税调整明细表 (87)A105060《广告费和业务宣传费跨年度纳税调整明细表》填报说明 (88)A105070捐赠支出及纳税调整明细表 (91)A105070《捐赠支出及纳税调整明细表》填报说明 (92)A105080资产折旧、摊销及纳税调整明细表 (96)A105080《资产折旧、摊销及纳税调整明细表》填报说明 (98)A105090资产损失税前扣除及纳税调整明细表 (102)A105090《资产损失税前扣除及纳税调整明细表》填报说明 (104)A105100企业重组及递延纳税事项纳税调整明细表 (109)A105100《企业重组及递延纳税事项纳税调整明细表》填报说明 (110)A105110政策性搬迁纳税调整明细表 (114)A105110《政策性搬迁纳税调整明细表》填报说明 (115)A105120特殊行业准备金及纳税调整明细表 (118)A105120《特殊行业准备金及纳税调整明细表》填报说明 (119)A106000企业所得税弥补亏损明细表 (123)A106000《企业所得税弥补亏损明细表》填报说明 (124)A107010免税、减计收入及加计扣除优惠明细表 (127)A107010《免税、减计收入及加计扣除优惠明细表》填报说明 (128)A107011符合条件的居民企业之间的股息、红利等权益性投资收益优惠明细表 (134)A107011《符合条件的居民企业之间的股息、红利等权益性投资收益优惠明细表》填报说明 (135)A107012研发费用加计扣除优惠明细表 (139)A107012《研发费用加计扣除优惠明细表》填报说明 (141)A107020所得减免优惠明细表 (147)A107020《所得减免优惠明细表》填报说明 (148)A107030抵扣应纳税所得额明细表 (155)A107030《抵扣应纳税所得额明细表》填报说明 (156)A107040减免所得税优惠明细表 (160)A107040《减免所得税优惠明细表》填报说明 (161)A107041高新技术企业优惠情况及明细表 (173)A107041《高新技术企业优惠情况及明细表》填报说明 (174)A107042软件、集成电路企业优惠情况及明细表 (178)A107042《软件、集成电路企业优惠情况及明细表》填报说明 (179)A107050税额抵免优惠明细表 (186)A107050《税额抵免优惠明细表》填报说明 (187)A108000境外所得税收抵免明细表 (190)A108000《境外所得税收抵免明细表》填报说明 (191)A108010境外所得纳税调整后所得明细表 (195)A108010《境外所得纳税调整后所得明细表》填报说明 (196)A108020境外分支机构弥补亏损明细表 (198)A108020《境外分支机构弥补亏损明细表》填报说明 (199)A108030跨年度结转抵免境外所得税明细表 (201)A108030《跨年度结转抵免境外所得税明细表》填报说明 (202)A109000跨地区经营汇总纳税企业年度分摊企业所得税明细表 (204)A109000《跨地区经营汇总纳税企业年度分摊企业所得税明细表》填报说明 (205)A109010企业所得税汇总纳税分支机构所得税分配表 (208)A109010《企业所得税汇总纳税分支机构所得税分配表》填报说明 (209)中华人民共和国企业所得税年度纳税申报表(A类 , 2017年版)税款所属期间:年月日至年月日纳税人识别号□□□□□□□□□□□□□□□□□□(统一社会信用代码):纳税人名称:金额单位:人民币元(列至角分)谨声明:本纳税申报表是根据国家税收法律法规及相关规定填报的,是真实的、可靠的、完整的。

中华人民共和国企业所得税年度纳税申报表(A类,2017年版)(蓝城检测删减版)

中华人民共和国企业所得税年度纳税申报表(A类 , 2017年版)税款所属期间:年月日至年月日纳税人统一社会信用代码:□□□□□□□□□□□□□□□□□□(纳税人识别号)纳税人名称:金额单位:人民币元(列至角分)谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》《中华人民共和国企业所得税法实施条例》以及有关税收政策和国家统一会计制度的规定填报的,是真实的、可靠的、完整的。

法定代表人(签章): 年月日国家税务总局监制《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》封面填报说明《中华人民共和国企业所得税年度纳税申报表(A类,2017年版)》(以下简称申报表)适用于实行查账征收企业所得税的居民企业纳税人(以下简称纳税人)填报。

有关项目填报说明如下:1.“税款所属期间”:正常经营的纳税人,填报公历当年1月1日至12月31日;纳税人年度中间开业的,填报实际生产经营之日至当年12月31日;纳税人年度中间发生合并、分立、破产、停业等情况的,填报公历当年1月1日至实际停业或法院裁定并宣告破产之日;纳税人年度中间开业且年度中间又发生合并、分立、破产、停业等情况的,填报实际生产经营之日至实际停业或法院裁定并宣告破产之日。

2.“纳税人统一社会信用代码(纳税人识别号)”:填报工商等部门核发的统一社会信用代码。

未取得统一社会信用代码的,填报税务机关核发的纳税人识别号。

3.“纳税人名称”:填报营业执照、税务登记证等证件载明的纳税人名称。

4.“填报日期”:填报纳税人申报当日日期。

5.纳税人聘请中介机构代理申报的,加盖代理申报中介机构公章,并填报经办人及其执业证件号码等,没有聘请的,填报“无”。

《企业所得税年度纳税申报表填报表单》填报说明些表单,并根据企业的涉税业务,选择“填报”或“不填报”。

选择“填报”的,需完成该表格相关内容的填报;选择“不填报”的,可以不填报该表格。

对选择“不填报”的表格,可以不向税务机关报送。

A100000中华人民共和国企业所得税年度纳税申报表(A类)

38

附列资料

以前年度应缴未缴在本年入库所得税额

(A类)

金 额 2,512,760.00 632,225.93 84,428.72 1,763,436.94 0.00 0.00 0.00 0.00 0.00 32,668.41 0.00 0.00 32,668.41 0.00 0.00 0.00 0.00 0.00 32,668.41 0.00 0.00 32,668.41 0.00 25.00% 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

A100000

中华人民共和国企业所得税年度纳税申报表(A类)

行次 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 附列资料 应纳税额计算 利润总额计算 类别 项 目 一、营业收入(填写A101010\101020\103000) 减:营业成本(填写A102010\102020\103000) 营业税金及附加 销售费用(填写A104000) 管理费用(填写A104000) 财务费用(填写A104000) 资产减值损失 加:公允价值变动收益 投资收益 二、营业利润(1-2-3-4-5-6-7+8+9) 加:营业外收入(填写A101010\101020\103000) 减:营业外支出(填写A102010\102020\103000) 三、利润总额(10+11-12) 减:境外所得(填写A108010) 加:纳税调整增加额(填写A105000) 减:纳税调整减少额(填写A105000) 减:免税、减计收入及加计扣除(填写A107010) 加:境外应税所得抵减境内亏损(填写A108000) 应纳税所得额 计算 四、纳税调整后所得(13-14+15-16-17+18) 减:所得减免(填写A107020) 减:抵扣应纳税所得额(填写A107030) 减:弥补以前年度亏损(填写A106000) 五、应纳税所得额(19-20-21-22) 税率(25%) 六、应纳所得税额(23×24) 减:减免所得税额(填写A107040) 减:抵免所得税额(填写A107050) 七、应纳税额(25-26-27) 加:境外所得应纳所得税额(填写A108000) 减:境外所得抵免所得税额(填写A108000) 八、实际应纳所得税额(28+29-30) 减:本年累计实际已预缴的所得税额 九、本年应补(退)所得税额(31-32) 其中:总机构分摊本年应补(退)所得税额(填写A109000) 财政集中分配本年应补(退)所得税额(填写A109000) 总机构主体生产经营部门分摊本年应补(退)所得税额(填写A109000) 以前年度多缴的所得税额在本年抵减额

中华人民共和国企业所得税年度纳税申报表(A类-2017年版)

中华人民共和国企业所得税年度纳税申报表

(A类 , 2017年版)

税款所属期间:2017 年 01 月 01 日至 2017 年 12 月 31 日

纳税人统一社会信用代码:

(纳税人识别号)

纳税人名称:

金额单位:人民币元(列至角分)

谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》《中华人民共和国企业所得税法实施条例》以及有关税收政策和国家统一会计制度的规定填报的,是真实的、可靠的、完整的。

法定代表人(签章): 年月日

国家税务总局监制

企业所得税年度纳税申报表填报表单

A100000 中华人民共和国企业所得税年度纳税申报表(A类)

A101010 一般企业收入明细表

A102010 一般企业成本支出明细表

A104000 期间费用明细表

A105000 纳税调整项目明细表

A105050 职工薪酬支出及纳税调整明细表

- 10 -

A105080 资产折旧、摊销及纳税调整明细表

A106000 企业所得税弥补亏损明细表。

企业所得税年度纳税申报表(A类)

企业所得税年度纳税申报表(A 类)企业所得税年度纳税申报表填报表单表单编号表单名称选择填报情况填报不填报A000000 企业基础信息表√×A100000 中华人民共和国企业所得税年度纳税申报表(A类)√×A101010 一般企业收入明细表□□A101020 金融企业收入明细表□□A102010 一般企业成本支出明细表□□A102020 金融企业支出明细表□□A103000 事业单位、民间非营利组织收入、支出明细表□□A104000 期间费用明细表□□A105000 纳税调整项目明细表□□A105010 视同销售和房地产开发企业特定业务纳税调整明细表□□A105020 未按权责发生制确认收入纳税调整明细表□□A105030 投资收益纳税调整明细表□□A105040 专项用途财政性资金纳税调整明细表□□A105050 职工薪酬纳税调整明细表□□A105060 广告费和业务宣传费跨年度纳税调整明细表□□A105070 捐赠支出纳税调整明细表□□A105080 资产折旧、摊销情况及纳税调整明细表□□A105081 固定资产加速折旧、扣除明细表□□A105090 资产损失税前扣除及纳税调整明细表□□A105091 资产损失(专项申报)税前扣除及纳税调整明细表□□A105100 企业重组纳税调整明细表□□A105110 政策性搬迁纳税调整明细表□□A105120 特殊行业准备金纳税调整明细表□□A106000 企业所得税弥补亏损明细表□□A107010 免税、减计收入及加计扣除优惠明细表□□A107011 符合条件的居民企业之间的股息、红利等权益性投资收益优惠明细表□□A107012 综合利用资源生产产品取得的收入优惠明细表□□A107013 金融、保险等机构取得的涉农利息、保费收入优惠明细表□□A107014 研发费用加计扣除优惠明细表□□A107020 所得减免优惠明细表□□A107030 抵扣应纳税所得额明细表□□A107040 减免所得税优惠明细表□□A107041 高新技术企业优惠情况及明细表□□A107042 软件、集成电路企业优惠情况及明细表□□A107050 税额抵免优惠明细表□□A108000 境外所得税收抵免明细表□□A108010 境外所得纳税调整后所得明细表□□A108020 境外分支机构弥补亏损明细表□□A108030 跨年度结转抵免境外所得税明细表□□A109000 跨地区经营汇总纳税企业年度分摊企业所得税明细表□□A109010 企业所得税汇总纳税分支机构所得税分配表□□说明:企业应当根据实际情况选择需要填表的表单。

中华人民共和国企业所得税年度纳税申报表及附表

中华人民共和国企业所得税年度纳税申报表及附表

中华人民共和国企业所得税年度纳税申报表(A类)

税款所属期间:年月日至年月日

纳税人名称:

1

企业所得税年度纳税申报表附表一(1)

收入明细表

2

企业所得税年度纳税申报表附表二(1)

成本费用明细表

3

企业所得税年度纳税申报表附表三

纳税调整项目明细表

2、没有标注的行次,无论执行何种会计核算办法,有差异就填报相应行次,填*号不可填列

3、有二级附表的项目只填调增、调减金额,帐载金额、税收金额不再填写。

经办人(签章): 法定代表人(签章): 4

企业所得税弥补亏损明细表

填报时间:年月日金额单位:元(列至角分)

5

税收优惠明细表

6

企业所得税年度纳税申报表附表八

广告费和业务宣传费跨年度纳税调整表

填报时间:年月日金额单位:元(列至角分)

经办人(签章):法定代表人(签章):经办人:

7

企业所得税年度纳税申报表附表九

资产折旧、摊销纳税调整明细表

填报日期: 年月日金额单位:元(列至角分)

经办人(签章): 法定代表人(签章)8

企业所得税年度纳税申报表附表十

资产减值准备项目调整明细表

填报日期: 年月日金额单位:元(列至角分)

注:表中*项目为执行新会计准则企业专用;表中加﹟项目为执行企业会计制度、小企业会计制度的企业专用。

经办人(签章): 法定代表人(签章):

9。

企业所得税年度申报表A类

中华人民共和国企业所得税年度纳税申报表(A类)税款所属期间:年月日至年月日纳税人名称:收入明细表企业所得税年度纳税申报表附表一(2)金融企业收入明细表经办人(签章):法定代表人(签章):事业单位、社会团体、民办非企业单位收入明细表成本费用明细表企业所得税年度纳税申报表附表二(2)金融企业成本费用明细表企业所得税年度纳税申报表附表二(3)事业单位、社会团体、民办非企业单位支出明细表企业所得税年度纳税申报表附表三纳税调整项目明细表2、没有标注的行次,无论执行何种会计核算办法,有差异就填报相应行次,填*号不可填列3、有二级附表的项目只填调增、调减金额,帐载金额、税收金额不再填写。

经办人(签章): 法定代表人(签章):企业所得税年度纳税申报表附表四企业所得税弥补亏损明细表企业所得税年度纳税申报表附表五税收优惠明细表填报时间:年月日金额单位:元(列至角分)企业所得税年度纳税申报表附表六境外所得税抵免计算明细表经办人(签章): 法定代表人(签章):企业所得税年度纳税申报表附表七以公允价值计量资产纳税调整表经办人(签章): 法定代表人(签章):企业所得税年度纳税申报表附表八广告费和业务宣传费跨年度纳税调整表经办人(签章):法定代表人(签章):企业所得税年度纳税申报表附表九资产折旧、摊销纳税调整明细表填报日期: 年月日金额单位:元(列至角分)经办人(签章): 法定代表人(签章)企业所得税年度纳税申报表附表十资产减值准备项目调整明细表经办人(签章): 法定代表人(签章):企业所得税年度纳税申报表附表十一长期股权投资所得(损失)明细表填报时间:年月日金额单位:元(列至角分)经办人(签章): 法定代表人(签章):。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Special seal of Tax Authority: Person in charge: Accepting for the Monthly (Quarterly) Prepayment of Enterprise Income Tax of the People's Republic of China (Type A, 2014 Version) Taxpayer's registration No.: 210213744396845 Taxation period: from 01/10/2014 to 31/12/2014 line No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 I: Prepay in according to actual profit Business income Business cost Gross profit Plus: Taxable income of special business Less: tax-free income Tax-exempt income Reduction and exempt of taxable income Remedy previous annual loss Actual profit (line 4 +line 5-line 6-line 7-line 8-line 9) Tax rate (25%) Assessed income tax Less: reduction or exempt of income tax Including:reduction or exempt of income tax for qualified small enterprises with low profits Less: actual income tax paid Less: prepayment of income tax for special business Supplement (refund) of income tax (line 12- line 13-line 15-line 16) Less: offset the current income tax with previous annual overpaid income tax 0 Items Taxpayer's Name: Dalian Ming fa Electronic Engineering Co.,Ltd Filling date: 14/01/2015 Monetary Unit: CNY Current amount 0 0 0 0 0 0 0 0 0 0.25 0 0 0 - 0 - Accumulated amount 2,534,314.56 2,100,838.64 6,922.54 0 0 0 0 0 6,922.54 0.25 1,730.64 1,038.38 1,038.38 0 0 692.26 0

Actual supplement (refund) of income tax in current month (quarter) 692.26 - II: Prepay on average according to last annual taxable income Last annual taxable income 0 - Taxable income in current month or quarter (line 21× 1/4 or 1/12) 0 0 Tax rate (25%) 0.25 0.25 Assessed income tax in current month or quarter (line 22× line 23) 0 0 Less:reduction or exempt of income tax for qualified small enterprises with low profits 0 0 Actual assessed income tax in current month or quarter (line 24 -line 25) 0 0 III: Other prepayment method issued by taxation authority Identified prepayment of income tax in current month (quarter) 0 0 Taxpayer in head institution and branch Income tax allocation by head institution (line 17 or line 26 or line28 × 30 0 0 prepay allocation percentage of head institution) 31 Collective allocation of income tax by financial department 0 0 Head Income tax allocation by branch institution 32 0 0 (line 17 or line 26 or line 28 × allocation percentage of branch) Including:independent operation department of head institution should 33 0 0 share income tax 34 Allocation percentage 0 0 branch 35 Allocated income tax amount 0 0 Declaration: This tax return form is finished in accordance with the Law of People's Republic China on Enterprise Income Tax,Regulation on Implementation of Enterprise Income Tax Law of the People's Republic of China and relevant tax regulations of state which has authenticity, reliability and integrity. Signature of legal representative: Taxpayer seal: Agent seal: Accountant: Filling date: Operator: Operator's Practice Certificate No.: Filling date of agent: