会计英语课后习题参考答案(终审稿)

(完整版)会计英语课后习题参考答案解析

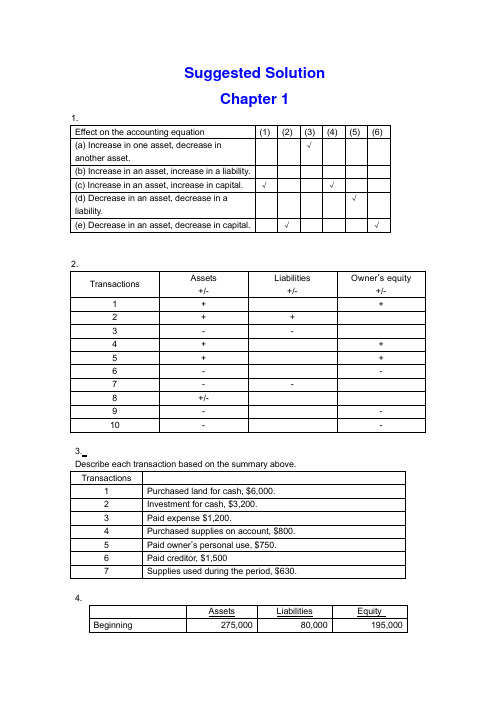

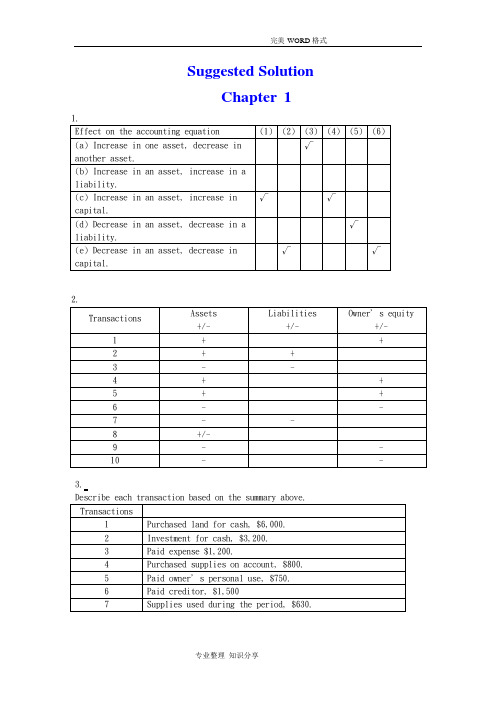

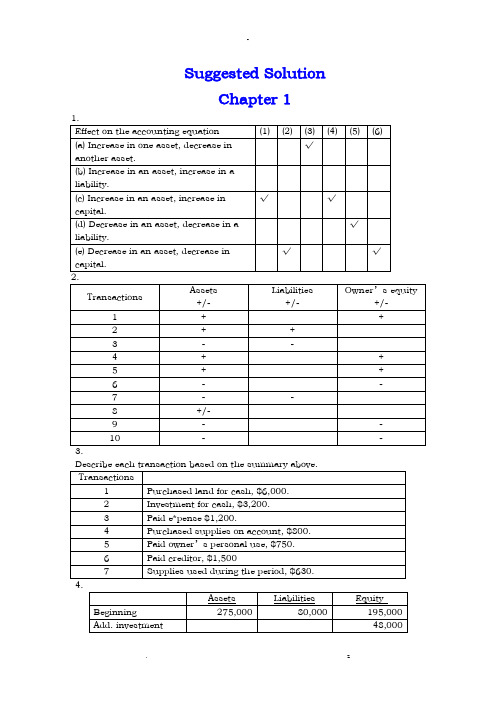

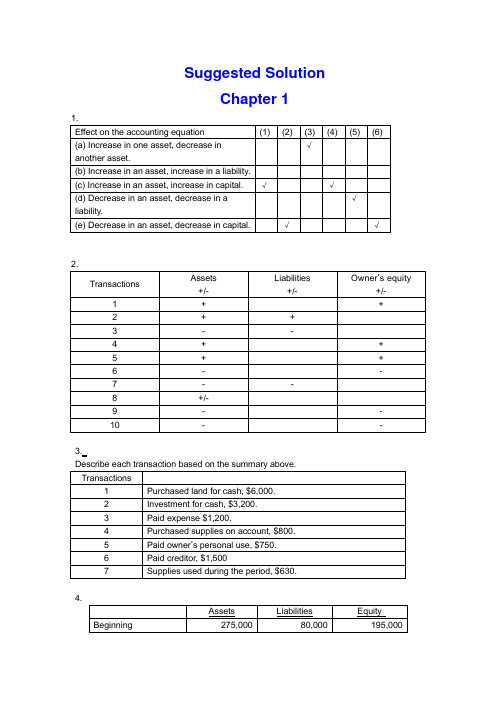

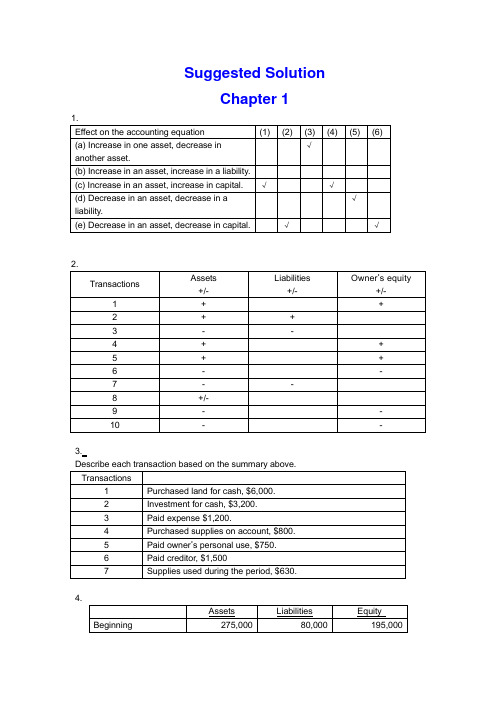

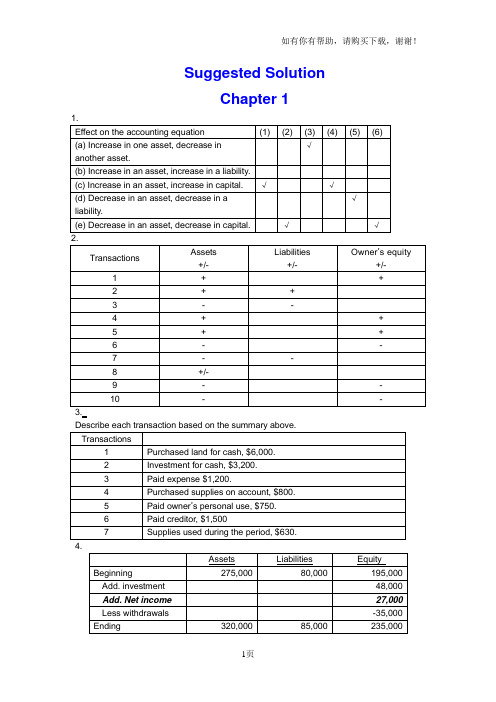

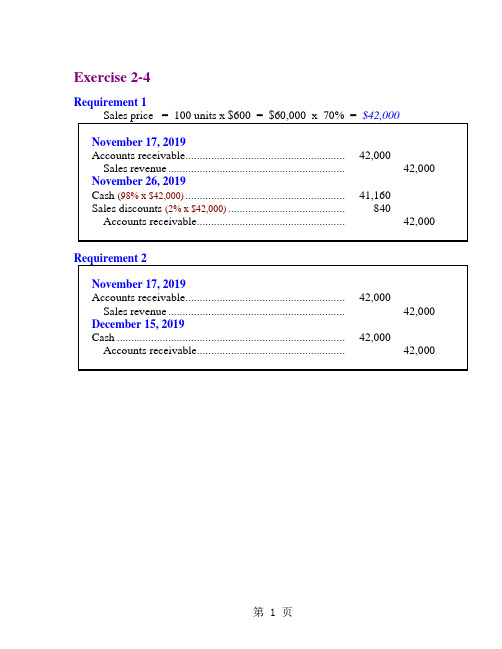

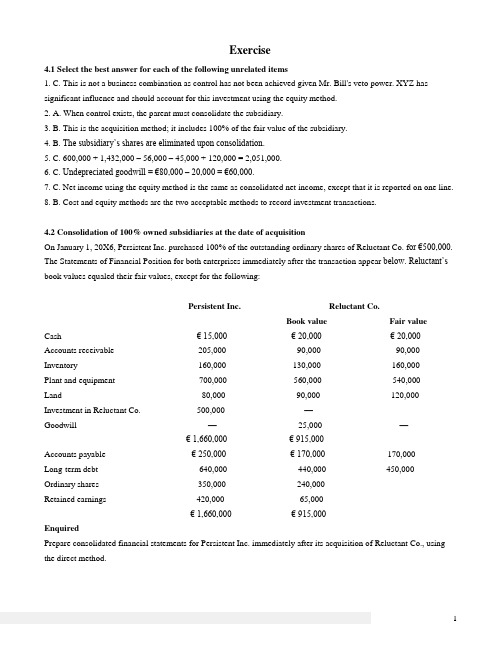

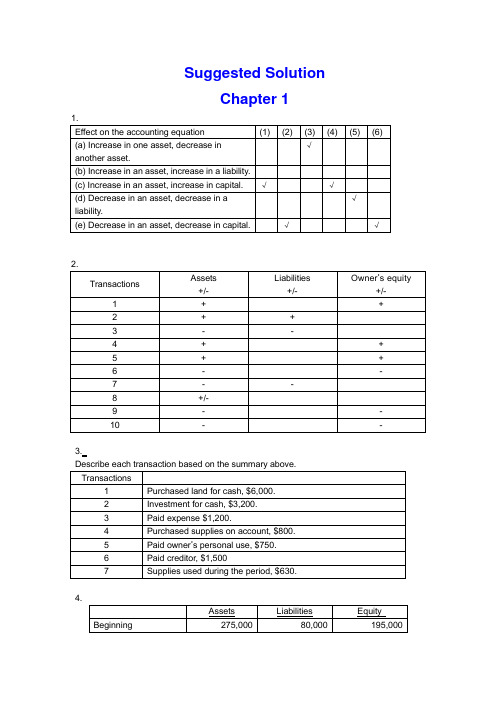

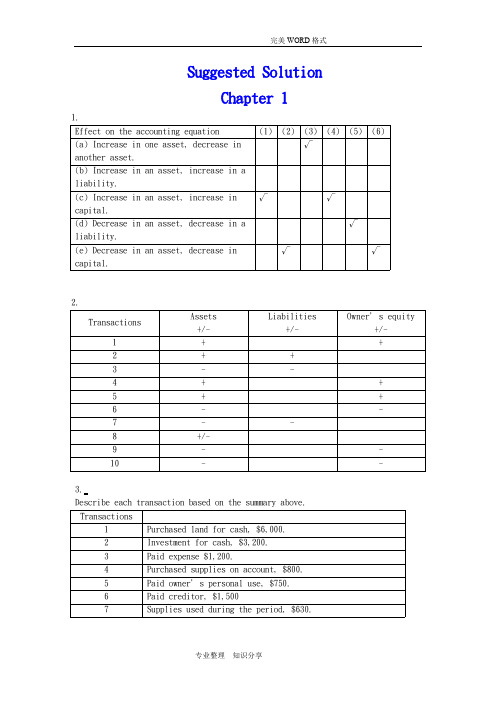

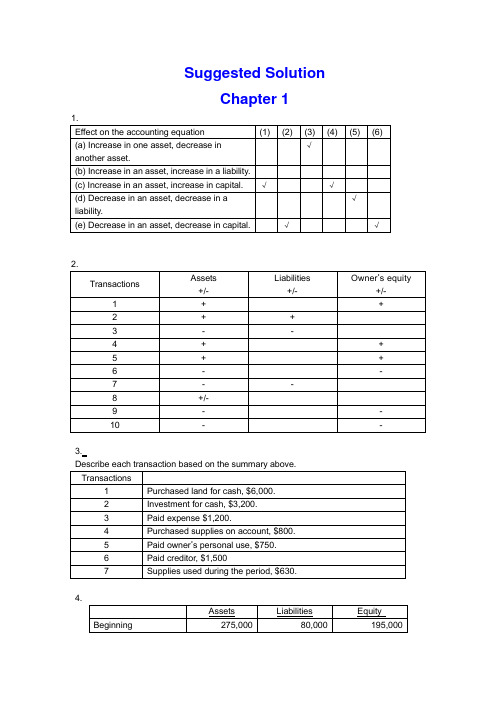

Suggested SolutionChapter 11.3.4.5.(a)(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ........................... 1,800 b.Revenue ..................................... 4,500Accounts receivable ................... 4,500 c.Owner’s withdrawals ........................ 1,500Salaries Expense ....................... 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 – 60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500 b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000December 31, 2009 Cash 42,500Investment in K 42,500 Investment in K 146,000 Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100 Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400 Income tax payable 21,60020⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)4.5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000+Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25). g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Sales revenue ....................................... 310,000 To record sale of goods on accountCost of goods sold ...................................... 220,000 Inventory ........................................... 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ..................................... 15,500* Allowance for sales returns (B/S) ................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ........................................ 31,000* Provision for warranties (B/S) ...................... 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns ............................. 12,400 Accounts receivable ................................. 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) .......................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures in year 1 for warranty workCash ................................................... 297,600*Accounts receivable ................................. 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) .......................... 8,400 Cash/Accounts payable ............................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory............................................... 480,000 Cash/Accounts payable ............................... 480,000 To record purchase of inventoryInventory............................................... 124,000 Cash/Accounts payable ............................... 124,000 To record refurbishment of inventoryAccounts receivable ..................................... 310,000 Inventory ........................................... 220,000 Deferred gross margin ............................... 90,000 To record sale of goods on accountDeferred gross margin ................................... 12,400 Accounts receivable ................................. 12,400 To record return of goods within the 30-day return period. It is assumed the goods have no value and are disposed of.Deferred warranty costs (B/S) ........................... 18,600 Cash/Accounts payable ............................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash ................................................... 297,600* Accounts receivable ................................. 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................. 8,400 Cash/Accounts payable ............................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin ................................... **77,600Cost of goods sold ...................................... 220,000 Sales revenue ....................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ........................................ 27,000* Deferred warranty costs ............................. 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty period has expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that it will eventually earn on the sales. The performance criteria might also be invoked here. The performancecriterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determinethe percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recordedin revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30%$ 6,0002006 $20,000 × 70%$ 14,0002007 $20,000 × 100%$ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under the percentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress ....... 5,400 7,550 5,850 Cash, payables, etc. 5,400 7,550 5,850 2. Progress billings:Accounts receivable ..... 3,100 4,900 12,000 Progress billings ... 3,100 4,900 12,000 3. Collections on billings:Cash .................... 2,400 4,000 12,400 Accounts receivable . 2,400 4,000 12,400 4. Recognition of profit:Construction in progress 600 450 150Construction expense .... 5,400 7,550 5,850 Revenue from long-termcontract .......... 6,000 8,000 6,000 5. To close construction in progress:Progress billings ....... 20,000 Construction in progress 20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products,IAS18 defines performance as the point when the seller of the goods hastransferred the risks and rewards of ownership to the buyer. Normally, this meansthat performance is done at the time of sale. Although the seller may haveperformed much of the work prior to the sale (production, selling efforts, etc.),there is still significant risk to the seller that a buyer may not be found.Therefore, from a reliability point of view, revenue recognition is delayed untilthe point of sale. Also, there may be significant risks remaining with the sellerof the product even after the sale. Warranties given by the seller are a riskthat remains with the seller. However, if this risk can be reliably estimatedat the time of sale, revenue can be recognized at the point of sale. Performanceis quite different under a long-term construction contract. Here, performancereally is considered to be a measure of the work done. Revenue is recognizedover the production period as the work is performed. It is intended to reflectthe amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can berecognized because there is a known and committed buyer. If the contractor is not able to estimate how much of the work has been done (perhaps because he or she can’t reliably estimate how much work must still be done), then profit would not be recognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliably estimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set).However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account. This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment.As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection of amounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenue recognition.b. Because of the performance criterion of revenue recognition, it would seem to be most appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example, that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because, in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowing the selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser to buy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100)$ 20,000 Additional lessons ((200 × 8) × $30)48,000 Examinations ((200 × 80%) × $130)20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3))3,600 Additional lessons ((200 × 8) × $3))4,800 Examinations ((200 × 80%) × $30)4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000)36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division2,100,000$ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ………………………. -48,000Payment of income tax ………………………………-13,000Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ………………………..-34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000 Add: increases in current liabilities 180,000 Net cash flows from operating-200,000Investing activitiesSale of land -50,000 Purchase of PPE -1,500,000Net cash flows from investing-1,550,000Financing activitiesIssuance of common shares 400,000 Payment of cash dividend -50,000 Issuance of non-current liabilities 1,000,000 Net cash flows from financing1,350,000Net changes in cash-400,0005.。

会计英语课后习题及参考答案

Suggested SolutionChapter 13.4.5.(b) net income = 9,260-7,470=1,790(c) net income = 1,790+2,500=4,290Chapter 21.a.To increase Notes Payable -CRb.To decrease Accounts Receivable-CRc.To increase Owner, Capital -CRd.To decrease Unearned Fees -DRe.To decrease Prepaid Insurance -CRf.To decrease Cash - CRg.To increase Utilities Expense -DRh.To increase Fees Earned -CRi.To increase Store Equipment -DRj.To increase Owner, Withdrawal -DR2.a.Cash 1,800Accounts payable ................................................... 1,800 b.Revenue ................................................................... 4,500Accounts receivable ...................................... 4,500c.Owner’s withdrawals ................................................ 1,500Salaries Expense ............................................ 1,500 d.Accounts Receivable (750)Revenue (750)3.Prepare adjusting journal entries at December 31, the end of the year.Advertising expense 600Prepaid advertising 600Insurance expense (2160/12*2) 360Prepaid insurance 360Unearned revenue 2,100Service revenue 2,100Consultant expense 900Prepaid consultant 900Unearned revenue 3,000Service revenue 3,000 4.1. $388,4002. $22,5203. $366,6004. $21,8005.1. net loss for the year ended June 30, 2002: $60,0002. DR Jon Nissen, Capital 60,000CR income summary 60,0003. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000Chapter 31. Dundee Realty bank reconciliationOctober 31, 2009Reconciled balance $6,220 Reconciled balance $6,2202. April 7 Dr: Notes receivable—A company 5400Cr: Accounts receivable—A company 540012 Dr: Cash 5394.5Interest expense 5.5Cr: Notes receivable 5400June 6 Dr: Accounts receivable—A company 5533Cr: Cash 553318 Dr: Cash 5560.7Cr: Accounts receivable—A company 5533Interest revenue 27.73. (a) As a whole: the ending inventory=685(b) applied separately to each product: the ending inventory=6254. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,0005.(1) 24,000+60,000-90,000*0.8=12000(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828Chapter 41. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;(c) first-year depreciation = 114,000 * 40% = 45,600second-year depreciation = (114,000 – 45,600) * 40% = 27,360;(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,5003. (1) depreciation expense = 30,000(2) book value = 600,000 – 30,000 * 2=540,000(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,5004. Situation 1:Jan 1st, 2008 Investment in M 260,000Cash 260,000June 30 Cash 6000Dividend revenue 6000Situation 2:January 1, 2008 Investment in S 81,000Cash 81,000June 15 Cash 10,800Investment in S 10,800December 31 Investment in S 25,500Investment Revenue 25,5005. a. December 31, 2008 Investment in K 1,200,000Cash 1,200,000June 30, 2009 Dividend Receivable 42,500Dividend Revenue 42,500December 31, 2009 Cash 42,500Dividend Receivable 42,500b. December 31, 2008 Investment in K 1,200,000Cash 1,200,000 December 31, 2009 Cash 42,500Investment in K 42,500Investment in K 146,000Investment revenue 146,000 c. In a, the investment amount is 1,200,000net income reposed is 42,500In b, the investment amount is 1,303,500Net income reposed is 146,000Chapter 51.a. June 1: Dr: Inventory 198,000Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000Cr: Notes Payable 300,000b. Dr: Interest Expenses (for notes on June 11) 12,100Cr: Interest Payable 12,100Dr: Interest Expenses (for notes on June 12) 8,175Cr: Interest Payable 8,175c. Balance sheet presentation:Notes Payable 498,000 Accrued Interest on Notes Payable 20,275d. For Green:Dr: Notes Payable 198,000 Interest Payable 12,100Interest Expense 7,700Cr: Cash 217,800For Western:Dr: Notes Payable 300,000Interest Payable 8,175Interest Expense 18,825Cr: Cash 327,0002.(1) 20⨯8 Deferred income tax is a liability 2,400Income tax payable 21,600 20⨯9 Deferred income tax is an asset 600Income tax payable 26,100(2) 20⨯8: Dr: Tax expense 24,000Cr: Income tax payable 21,600 Deferred income tax 2,400 20⨯9: Dr: Tax expense 25,500Deferred income tax 600Cr: Income tax payable 26,100 (3) 20⨯8: Income statement: tax expense 24,000Balance sheet: income tax payable 21,600 20⨯9: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,1003.a. 1,560,000 (20000000*12 %* (1-35%))b. 7.8% (20000000*12 %* (1-35%)/20000000)5.Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896Chapter 61. Mar. 1Cash 1,200,000Common Stock 1,000,000Paid-in Capital in Excess of Par Value 200,000Mar. 15Organization Expense 50,000Common Stock 50,000Mar. 23Patent 120,000Common Stock 100,000Paid-in Capital in Excess of Par Value 20,000The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.2. July.1Treasury Stock 180,000Cash 180,000The cost of treasury purchased is 180,000/30,000=60 per share.Nov. 1Cash 70,000Treasury Stock 60,000Paid-in Capital from Treasury Stock 10,000Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.Dec. 20Cash 75,000Paid-in Capital from Treasury Stock 15,000Treasury Stock 90,000The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.3. a. July 1Retained Earnings 24,000Dividends Payable—Preferred Stock 24,000b.Sept.1Dividends Payable—Preferred Stock 24,000Cash 24,000c. Dec.1Retained Earnings 80,000Dividends Payable—Common Stock 80,000d. Dec.31Income Summary 350,000Retained Earnings 350,0004.a. Preferred stock gives its owner certain advantages over common stockholders. These benefits include the right to receive dividends before the common stockholders and the right to receive assets before the common stockholders if the corporation liquidates. Corporation pay a fixed amount of dividends on preferred stock.The 7% cumulative term indicates that the investors earn 7% fixed dividends.b. 7%*120%*20,000=504,000c. If corporation issued debt, it has obligation to repay principald. The date of declaration decrease the stockholders’ equity; the date of record and the date of payment have no effect on stockholders.5.a. Jan. 15Retained Earnings 35,000Accumulated Depreciation 35,000To correct error in prior year’s depreciation.b. Mar. 20Loss from Earthquake 70,000Building 70,000c. Mar. 31Retained Earnings 12,500Dividends Payable 12,500d. Apirl.15Dividends Payable 12,500Cash 12,500e. June 30Retained Earnings 37,500Common Stock 25,000Additional Paid-in Capital 12,500To record issuance of 10% stock dividend: 10%*25,000=2,500 shares;2500*$15=$37,500f. Dec. 31Depreciation Expense 14,000Accumulated Depreciation 14,000Original depreciation: $40,000/40=$10,000 per year. Book value on Jan.1, 2009 is $350,000(=$400,000-5*$10,000). Deprecation for 2009 is $14,000(=$350,000/25).g. The company does not need to make entry in the accounting records. But the amount of Common Stock ($10 par value) decreases 275,000, while the amount of Common Stock ($5 par value) increases 275,000.Chapter 71.Requirement 1If revenue is recognized at the date of delivery, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Sales revenue ......................................................................... 310,000 To record sale of goods on accountCost of goods sold ........................................................................ 220,000 Inventory ................................................................................. 220,000 To record the cost of the goods sold as an expenseSales returns (I/S) ......................................................................... 15,500* Allowance for sales returns (B/S) ........................................... 15,500 To record provision for return of goods sold under 30-day return period* 5% of $310,000Warranty expense ......................................................................... 31,000* Provision for warranties (B/S) ................................................. 31,000 To record provision, at time of sale, for warranty expenditures* 10% of $310,000Allowance for sales returns .......................................................... 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within 30-day return period.It is assumed the returned goods have no value and are disposed of.Provision for warranties (B/S) ....................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures in year 1 for warranty workCash .............................................................................................. 297,600*Accounts receivable ............................................................... 297,600 To record collection of Accounts Receivable* $310,000 – $12,400Year 2Provision for warranties (B/S) ....................................................... 8,400 Cash/Accounts payable .......................................................... 8,400 To record expenditures in year 2 for warranty workRequirement 2If revenue is recognized only when the warranty period has expired, the following journal entries would be used to record the transactions for the two years:Year 1Inventory ....................................................................................... 480,000 Cash/Accounts payable .......................................................... 480,000 To record purchase of inventoryInventory ....................................................................................... 124,000 Cash/Accounts payable .......................................................... 124,000 To record refurbishment of inventoryAccounts receivable ...................................................................... 310,000 Inventory ................................................................................. 220,000 Deferred gross margin ............................................................ 90,000 To record sale of goods on accountDeferred gross margin .................................................................. 12,400 Accounts receivable ............................................................... 12,400 To record return of goods within the 30-day return period. It is assumed the goods haveno value and are disposed of.Deferred warranty costs (B/S) ...................................................... 18,600 Cash/Accounts payable .......................................................... 18,600 To record expenditures for warranty work in year 1. The warranty costs incurred are deferred because the related revenue has not yet been recognizedCash .............................................................................................. 297,600* Accounts receivable ............................................................... 297,600 To record collection of Accounts receivable* $310,000 – $12,400Year 2Deferred warranty costs ................................................................ 8,400 Cash/Accounts payable .......................................................... 8,400 To record warranty costs incurred in year 2 related to year 1 sales. The warranty costs incurred are deferred because the related revenue has not yet been recognized.Deferred gross margin .................................................................. **77,600Cost of goods sold ........................................................................ 220,000 Sales revenue ......................................................................... 297,600* To record recognition of sales revenue from year 1 sales and related cost of goods sold at expiry of warranty period* $310,000 – $12,400** ($90,000 – $12,400)Warranty expense ......................................................................... 27,000* Deferred warranty costs ......................................................... 27,000 To record recognition of warranty expense at same time as related sales revenue recognition* $18,600 + $8,400Requirement 3Allied Auto Parts Inc. might choose to recognize revenue only after the warranty periodhas expired if they are not able to make a good estimate, at the time of sale, of the amount of warranty work that will be required under the terms of the one-year warranty. If Allied is not able, at the time of sale, to make a good estimate of the warranty work that will be required, then the measurability criterion of revenue recognition is not met at the time of sale. The measurability criterion means that the amount of revenue can be reliably measured. If the seller is not able to estimate the amount of work that will have to be done under the warranty agreement, then it is not able to reasonably measure the profit that itwill eventually earn on the sales. The performance criteria might also be invoked here.The performance criterion means that the seller has transferred the significant risks and rewards of ownership to the buyer. As long as there is warranty work to be performed after the sale that is the responsibility of the seller, you might argue that performance is not substantially complete. However, if the seller was able to reliably estimate the amount of warranty work, then performance would be satisfied on the assumption that we could measure the risk that remains with the seller, and make a provision for it.2.Percentage-of-completion method:The first step in applying revenue recognition using the percentage-of-completion method (using costs incurred to date compared to estimated total costs to determine the percentage of completion) is to estimate the percentage of completion of the project at the end of each year. This is done in the following table (in $000s):End of 2005 End of 2006 End of 2007Total costs incurred $ 5,400 $ 12,950 $ 18,800 Total estimated costs 18,000 18,500 18,800 % completed 30% 70% 100%Once the percentage of completion at the end of each year has been calculated as above, the next step is to allocate the appropriate amount of revenue to each year, based on the percentage completed to date, less what has previously been recorded in revenue. This is done in the following table (in $000s):2005 2006 20072005 $20,000 × 30% $ 6,0002006 $20,000 × 70% $ 14,0002007 $20,000 × 100% $ 20,000 Less: Revenue recognized in prior years (0) (6,000) (14,000) Revenue for year $ 6,000 $ 8,000 $ 6,000Therefore, the profit to be recognized each year on the construction project would be:2005 2006 2007 TotalRevenue recognized $ 6,000 $ 8,000 $ 6,000 $ 20,000 Construction costs incurred (expenses) (5,400) (7,550) (5,850) (18,800) Gross profit for the year $ 600 $ 450 $ 150 $ 1,200The following journal entries are used to record the transactions under thepercentage-of-completion method of revenue recognition:2005 2006 20071. Costs of construction:Construction in progress .................. 5,400 7,550 5,850 Cash, payables, etc. ..... 5,400 7,550 5,850 2. Progress billings:Accounts receivable ............ 3,100 4,900 12,000 Progress billings ............ 3,100 4,900 12,000 3. Collections on billings:Cash .................................... 2,400 4,000 12,400 Accounts receivable ...... 2,400 4,000 12,400 4. Recognition of profit:Construction in progress ..... 600 450 150Construction expense.......... 5,400 7,550 5,850 Revenue from long-termcontract ...................... 6,000 8,000 6,000 5. To close construction in progress:Progress billings .................. 20,000 Construction in progress .20,0002005 2006 2007Balance sheetCurrent assets:Accounts receivable $ 700 $ 1,600 $ 1,200 Inventory:Construction in process 6,000 14,000 Less: Progress billings (3,100) (8,000)Costs in excess of billings 2,900 6,000Income statementRevenue from long-term contracts $ 6,000 $ 8,000 $ 6,000 Construction expense (5,400) (7,550) (5,850) Gross profit $ 600 $ 450 $ 1503.a. The three criteria of revenue recognition are performance, measurability, andcollectibility.Performance means that the seller or service provider has performed the work.Depending on the nature of the product or service, performance may mean quitedifferent points of revenue recognition. For example, for the sale of products, IAS18 defines performance as the point when the seller of the goods has transferred therisks and rewards of ownership to the buyer. Normally, this means that performance is done at the time of sale. Although the seller may have performed much of the work prior to the sale (production, selling efforts, etc.), there is still significant risk to theseller that a buyer may not be found. Therefore, from a reliability point of view,revenue recognition is delayed until the point of sale. Also, there may be significant risks remaining with the seller of the product even after the sale. Warranties given by the seller are a risk that remains with the seller. However, if this risk can be reliably estimated at the time of sale, revenue can be recognized at the point of sale.Performance is quite different under a long-term construction contract. Here,performance really is considered to be a measure of the work done. Revenue isrecognized over the production period as the work is performed. It is intended toreflect the amount of effort expended by the seller (contractor). Although legal titlewon’t transfer to the buyer until the project is completed, revenue can be recognized because there is a known and committed buyer. If the contractor is not able toestimate how much of the work has been done (perhaps because he or she can’treliably estimate how much work must still be done), then profit would not berecognized until the extent of performance is known.Measurability means that the seller or service provider must be able to reliablyestimate the amount of the revenue from the sale or service. For the sale of products this is generally known at the time of sale (the sales price is set). However, if the seller provides a return period, it may be necessary to estimate the volume of returns at the time of sale in order to measure the revenue that will be recognized.Collectibility means that the seller or the service provider has reasonable assurance that the sales price will actually be collected. In most cases for the sales of products, the seller is able to recognize revenue at the time of sale even if the sale is on account.This is because the seller has experience with its customers and is able to estimate reliably the risk of non payment. As long as the seller is able to make this estimate, it is appropriate to recognize the revenue but to offset it with a provision for possible non collection. If the seller is unable to make reliable estimates of future collection ofamounts owing, the recognition of revenue would be delayed until the cash is actually received. This is what is done using the instalment sales method of revenuerecognition.b. Because of the performance criterion of revenue recognition, it would seem to bemost appropriate to recognize most revenue as the seller or service provider performs the work. This would be the best measure of performance. This would mean, for example,that sellers of products would recognize their revenue over the whole production, selling, and post sales servicing periods. As we saw above, this is not commonly done because,in many cases, there are still significant risks that are retained by the seller (risk of not being able to sell the product, for example). There are also measurement risks (knowingthe selling price) that exist prior to the sale. The percentage-of-completion method of revenue used for some long-term construction contracts would seem to most closely recognize revenue as the work is performed. As mentioned in Part 1, we are able to recognize revenue on this basis since a contract exists which commits the purchaser tobuy the project (assuming certain conditions are met) and the sales price is known because of the existence of the contract.4.If all revenue is recognized when a student registers for the course, profit for 2007 would be:Sales Revenue1:Manuals and initial lessons (200 × $100) $ 20,000 Additional lessons ((200 × 8) × $30) 48,000 Examinations ((200 × 80%) × $130) 20,800 Total sales revenue 88,800Cost of sales:Manuals and initial lessons (200 × ($15 + $3)) 3,600 Additional lessons ((200 × 8) × $3)) 4,800Examinations ((200 × 80%) × $30) 4,800 Total cost of sales 13,200Depreciation of development costs:$180,000 × (200/1,000) 36,000Profit $ 39,6005.FINISH ENTERPRISESIncome Statementfor the year ending December 31, 2005Continuing operations (excluding the chemical division)Sales ($35,000,000 – $5,500,000) $ 29,500,000Cost of sales ($15,000,000 – $2,800,000) (12,200,000)Gross profit 17,300,000Selling & administration expenses($18,000,000 – $3,200,000) (14,800,000)Profit from operations 2,500,000Income tax expense (40%) 1,000,000Profit after tax $ 1,500,000Discontinuing operations (Chemical division)Sales 5,500,000Cost of sales (2,800,000)Gross profit 2,700,000Selling & administration expenses (3,200,000)Loss from operations (500,000)Income tax expense(40%) 200,000Loss after tax (300,000) Gain on discontinuance of the Chemical division 3,500,000Tax thereon (1,400,000)After-tax gain on discontinuance of the Chemical division 2,100,000 Enterprise net profit $ 3,300,000Chapter 81.Payment of account payable. operatingIssuance of preferred stock for cash. financingPayment of cash dividend. financingSale of long-term investment. investingAmortization of bond discount. no effectCollection of account receivable. operatingIssuance of long-term note payable to borrow cash. financing Depreciation of equipment. no effectPurchase of treasury stock. financingIssuance of common stock for cash. financingPurchase of long-term investment. investingPayment of wages to employees. operatingCollection of cash interest. investingCash sale of land. InvestingDistribution of stock dividend. no effectAcquisition of equipment by issuance of note payable. no effect Payment of long-term debt. financingAcquisition of building by issuance of common stock. no effect Accrual of salary expense. no effect2.(a) Cash received from customers = 816,000(b) Cash payments for purchases of merchandise. =468,000(c) Cash payments for operating expenses. = 268,200(d) Income taxes paid. =36,9003.Cash sales …………………………………………... $9,000 Payment of accounts payable ……………………….-48,000 Payment of income tax ………………………………-13,000 Payment of interest ……………………………..…..-16,000 Collection of accounts receivable ……………………93,000 Payment of salaries and wages ……………………….. -34,000 Cash flows from operating activitiesby the direct method -9,0004.Operating activities:Net loss -200,000 Add: loss on sale of land 250,000 Add: depreciation 300,000Add: amortization of patents 20,000Less: increases in current assets other than cash -750,000Add: increases in current liabilities 180,000Net cash flows from operating -200,000Investing activitiesSale of land -50,000Purchase of PPE -1,500,000Net cash flows from investing -1,550,000Financing activitiesIssuance of common shares 400,000Payment of cash dividend -50,000Issuance of non-current liabilities 1,000,000Net cash flows from financing 1,350,000 Net changes in cash -400,000 5.。

会计专业英语习题答案

会计专业英语习题答案Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000) 1-5a. owner's equityb.liabilityc.assetd.assete.owner'sequity f. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4. decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ...... $297,200 Net income for the month ................ $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000 Leo Perkins, capital, April 30, 2006 .... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120 Operating expenses:Wages expense .......................... $100,100Rent expense ............................. 35,000Supplies expense ........................ 4,550Miscellaneous expense.................. 3,150Total operating expenses ............. 142,800 Net income .................................. $89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. The ratio of liabilities to stockholders’ equity increased from2002 to 2003, indicating an increase in risk for creditors.However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction T ype Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash...................................... 40,000Ira Janke, Capital ................... 40,000 (2) Supplies ................................. 1,800Cash................................... 1,800 (3) Equipment ............................... 24,000Accounts Payable ................... 15,000Cash................................... 9,000 (4) Operating Expenses ................... 3,050Cash................................... 3,050 (5) Accounts Receivable .................. 12,000Service Revenue ..................... 12,000 (6) Accounts Payable ...................... 7,500Cash................................... 7,500 (7) Cash...................................... 9,500Accounts Receivable ............... 9,500 (8) Ira Janke, Drawing ..................... 5,000Cash................................... 5,000 (9) Operating Expenses ................... 1,050Supplies .............................. 1,0502-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 – $4,000– $8,000). Such a negative balance means that the liabilities of Seth’s business exceed the assets.b. Y es. The balance sheet prepared at December 31will balance, with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. T he increase of $28,750 in the cash accountdoes not indicate earnings of that amount.Earnings will represent the net change in allassets and liabilities from operatingtransactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug.1 Rent Expense ........................... 1,500Cash................................... 1,5002 Advertising Expense (700)Cash (700)4 Supplies ................................. 1,050Cash................................... 1,0506 Office Equipment ....................... 7,500Accounts Payable ................... 7,5008 Cash...................................... 3,600Accounts Receivable ............... 3,60012 Accounts Payable ...................... 1,150Cash................................... 1,15020 Gayle McCall, Drawing ................ 1,000Cash................................... 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................. 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct.27 Supplies .......................... 15 1,320Accounts Payable ............ 21 1,320Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ✓...... ...... 585 ......27 .......................... 43 1,320 ...... 1,905 ...... Accounts Payable 21 2006Oct. 1 Balance ................ ✓...... ...... ..... 6,15027 .......................... 43 ...... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ........................................... 13,375 Accounts Receivable .......................... 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000 Accounts Payable .............................. 11,180 Unearned Rent ................................. 4,250 Erin Capelli, Capital ........................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense ................................ 42,000 Advertising Expense ........................... 7,200 Miscellaneous Expense ....................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................ 15,000Wages Expense ..................... 15,000b. Prepaid Rent ............................ 4,500Cash................................... 4,5002-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales .......................... $37,028 $35,925 .......................... $ 1,1033.1%2. Cost of sales ................ (29,658)(28,111) ......................... 1,5475.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes ................. $ (45) $1,300$(1,345)(103.5%)b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000.While sales increased by $1,103 million, a 3.1%increase, cost of sales increased by $1,547 million, a5.5% increase. Selling, general, and administrativeexpenses also increased by $901 million, a 13.8%increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease,and created a $45 million loss in 2000. Little over ayear later, Kmart filed for bankruptcy protection. It hasnow emerged from bankruptcy, hoping to return toprofitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated.Net income will be overstated.b. Prepaid insurance (or assets) will be overstated.Owner’s equity will be overstated.3-5a.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................ 1,215Prepaid Insurance ...................... 1,2153-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,5703-7a.Salary Expense ................................ 9,360Salaries Payable ........................ 9,360 b.Salary Expense ................................ 12,480Salaries Payable ........................ 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over-Under-stated stated stated stated1. Revenue for the year would be $ 0 $6,900 $ 0 $ 02. Expenses for the year would be 0 0 0 3,7403. Net income for the year would be 0 6,900 3,740 04. Assets at December 31 would be 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Own er’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable .......................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenuesare recognized only when the cash is received.Therefore, earned but unbilled revenues would not berecognized in the accounts, and no adjusting entrywould be necessary.3-13a. Fees earned (or revenues) will be understated. Netincome will be understated.b. Accounts (fees) receivable (or assets) will beunderstated. Owner’s equity will be understated.3-14Depreciation Expense ........................... 5,200Accumulated Depreciation ............ 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of theequipment to the periods benefiting from its use. Itdoes not necessarily relate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not avaluation method. That is, depreciation allocates thecost of a fixed asset over its useful life. Depreciationdoes not attempt to measure market values, whichmay vary significantly from year to year.3-17a.Depreciation Expense ......................... 7,500Accumulated Depreciation ............ 7,500 b. (1) D epreciation expense would be understated. Netincome would be overstated.(2) A ccumulated depreciation would be understated,and total assets would be overstated. Owner’sequity would be overstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment 5 5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $2,844,000 8.0b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0Cost of goods sold (3,605,120) 86.4Operating expenses (1,077,447) 25.8Operating income (loss) $(511,242)(12.2)c. Dell is more profitable than Gateway. Specifically,Dell’s cost of goods sold of 82.1% is significantly less(4.3%) than Gateway’s cost of goods sold of 86.4%.In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments TrialBalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 120 Totals 200 200 24 24213 213 20ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 120 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 18 2122 67 67 164 164 224-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense ............................ $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ...........................49Net income ...................................... $18ITHACA SERVICES CO.Statement of Owner’s EquityFor the Year Ended January 31, 2006 Terry Dagley, capital, February 1, 2005 .... $112 Net income for the year ....................... $18 Less withdrawals . (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ... $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities:Cash ............... $ 8 Accounts payable $26 Accounts receivable 57 .. Wages payable 1 Supplies ........... 3 Total liabilities . $ 27 Prepaid insurance 6Total current assets $ 74Property, plant, and Owner’s Equityequipment: Terry Dagley, capital (12)Land ............... $50Equipment ........ $32Less accum. depr. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $1494-72006Jan.31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment 531 Wages Expense (1)Wages Payable (1)4-82006Jan.31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense ............................ $56,800Rent expense ............................... 21,270Utilities expense ............................ 11,500Depreciation expense ..................... 8,000Insurance expense ......................... 4,100Supplies expense .......................... 3,100Miscellaneous expense .................... 2,250Total operating expenses ....... 107,020Net loss ..........................................$ (3,170)4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006 Suzanne Jacob, capital, November 1, 2005$173,750Net income for year ........................... $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000 ($13,750 × 12 months) would be reported as a current liability on the balance sheet. The remainder of $335,000 ($500,000 – $165,000) would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006AssetsLiabilitiesCurrent assetsCurrent liabilities:Cash $31,500Accounts payable ........... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies ............ 1,800 Unearned fees ............... Prepaid insurance 7,200 Total liabilitiesPrepaid rent ....... 4,800Total current assets $67,150 Owner’s E Property, plant, and equipment: Vernon Posey,capital 114,200Equipment ....... $80,600Less accumulated depreciation 21,100 59,500Total liabilities andTotal assets $126,650 owner’s equity ...............4-14Accounts Receivable ............................ 4,100Fees Earned ......................... 4,100 Supplies Expense ...................... 1,300Supplies .............................. 1,300 Insurance Expense ..................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................. 2,800Accumulated Depreciation—Equipment 2,800 Wages Expense ........................ 1,000Wages Payable ...................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detectingand correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ............................. 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................. 25,000b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034)($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December31, 2002 and 2001. In addition, the current ratio is below one at the end of both years. While the working capital and current ratios have improved from 2001 to 2002, creditors would likely be concerned about the ability of 7 Eleven to meet its short-term credit obligations. This concern would warrant further investigation to determine whether this is a temporaryissue (for example, an end-of-the-periodphenomenon) and the company’s plans to address itsworking capital shortcomings.4-20a. (1) Sales Salaries Expense ................ 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ................... 10,250Fees Earned ............................. 10,250b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense ................ 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ................... 10,2504-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) W ages Expense ........................ 45,000Cash ...................................... 45,000(2) Wages Expense ......................... 18,000Wages Payable .......................... 18,000(3) Income Summary .......................1,120,800Wages Expense ......................... 1,120,800(4) Wages Payable .......................... 18,000Wages Expense ......................... 18,000(5) Wages Expense ......................... 43,000Cash ...................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number ofcredit sales supported by promissory notes, a notesreceivable ledger should be maintained. Failure tomaintain a subsidiary ledger when there are asignificant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation ofduties is violated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining theaccounts receivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsiblefor approving credit.e. Appropriate. A promissory note is a formal creditinstrument that is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of DaysPast DueJanzen Industries August 29 93 days (2 + 30+ 31 + 30)Kuehn Company September 3 88 days (27 + 31+ 30)Mauer Inc. October 21 40 days (10 +30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov.30 Uncollectible Accounts Expense ..... 53,315*Allowances for Doubtful Accounts 53, *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible AccountsAge Interval Balance Percent AmountNot past due .............. $450,000 2% $9,0001–30 days past due...... 110,000 4 4,40031–60 days past due .... 51,000 6 3,06061–90 days past due .... 12,500 20 2,50091–180 days past due .. 7,500 60 4,500Over 180 days past due 5,500 80 4,400 Total .................... $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ..... 29,435*.A llowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ........... 7,130Accounts Receivable .................. 7,130b.Uncollectible Accounts Expense ............ 7,130Accounts Receivable .................. 7,130Ex. 8–8Feb.20 Accounts Receivable—Darlene Brogan 12,100 Sales .................................. 12,10020 Cost of Merchandise Sold ............ 7,260Merchandise Inventory .............. 7,260May30 Cash...................................... 6,000Accounts Receivable—Darlene Brogan 6,030 Allowance for Doubtful Accounts .... 6,100Accounts Receivable—Darlene Brogan 6,1Aug. 3Accounts Receivable—Darlene Brogan 6,100 Allowance for Doubtful Accounts . 6,1003 Cash...................................... 6,100Accounts Receivable—Darlene Brogan 6,1$223,900 [$212,800 + $112,350 –($4,050,000 × 21/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100Ex. 8–11a. August 8b. $24,480c. (1) N otes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,(2) C ash......................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)1. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account receivable.7. Payment received from customer for dishonored noteplus interest earned after due date.Ex. 8–132005Dec.13 Notes Receivable ....................... 25,000Accounts Receivable—Visage Co. 25,31 Interest Receivable ..................... 75*Interest Revenue (75)31 Interest Revenue (75)Income Summary (75)2006。

会计英语第四版参考答案

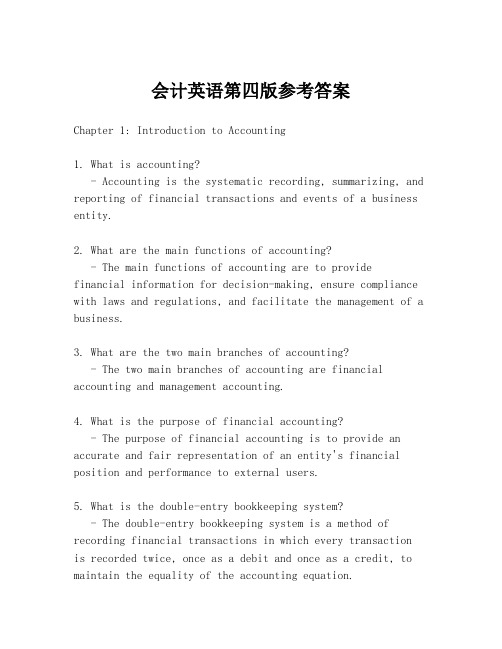

会计英语第四版参考答案Chapter 1: Introduction to Accounting1. What is accounting?- Accounting is the systematic recording, summarizing, and reporting of financial transactions and events of a business entity.2. What are the main functions of accounting?- The main functions of accounting are to providefinancial information for decision-making, ensure compliance with laws and regulations, and facilitate the management of a business.3. What are the two main branches of accounting?- The two main branches of accounting are financial accounting and management accounting.4. What is the purpose of financial accounting?- The purpose of financial accounting is to provide an accurate and fair representation of an entity's financial position and performance to external users.5. What is the double-entry bookkeeping system?- The double-entry bookkeeping system is a method of recording financial transactions in which every transactionis recorded twice, once as a debit and once as a credit, to maintain the equality of the accounting equation.Chapter 2: Accounting Concepts and Principles1. What are the fundamental accounting concepts?- The fundamental accounting concepts include the accrual basis of accounting, going concern, consistency, and materiality.2. What is the accrual basis of accounting?- The accrual basis of accounting records transactions when they occur, regardless of when cash is received or paid.3. What is the going concern assumption?- The going concern assumption is the premise that a business will continue to operate for the foreseeable future.4. What is the principle of consistency?- The principle of consistency requires that an entity should apply accounting policies consistently over time.5. What is the principle of materiality?- The principle of materiality states that only items that could potentially affect the decisions of users of financial statements are included in the financial statements.Chapter 3: The Accounting Equation and Financial Statements1. What is the accounting equation?- The accounting equation is Assets = Liabilities +Owner's Equity.2. What are the four main financial statements?- The four main financial statements are the balance sheet, income statement, statement of changes in equity, and cashflow statement.3. What is the purpose of the balance sheet?- The balance sheet provides a snapshot of an entity's financial position at a specific point in time.4. What is the purpose of the income statement?- The income statement reports the revenues, expenses, and net income of an entity over a period of time.5. What is the purpose of the cash flow statement?- The cash flow statement reports the cash inflows and outflows of an entity over a period of time.Chapter 4: Recording Transactions1. What is a journal entry?- A journal entry is the initial recording of atransaction in the general journal.2. What are the steps in the accounting cycle?- The steps in the accounting cycle are analyzing transactions, journalizing, posting, preparing a trial balance, adjusting entries, preparing financial statements, and closing entries.3. What is the difference between a debit and a credit?- A debit is an increase in assets or a decrease inliabilities or equity, while a credit is an increase in liabilities or equity or a decrease in assets.4. What are adjusting entries?- Adjusting entries are made at the end of an accounting period to ensure that revenues and expenses are recorded in the correct period.5. What is the purpose of closing entries?- Closing entries are made to transfer the balances of temporary accounts to the owner's equity account and to prepare the accounts for the next accounting period.Chapter 5: Accounting for Merchandising Businesses1. What is a merchandise inventory?- A merchandise inventory is the stock of goods held by a business for sale to customers.2. What is the cost of goods sold?- The cost of goods sold is the direct cost of producing the merchandise sold during an accounting period.3. What is the gross profit?- The gross profit is the difference between the sales revenue and the cost of goods sold.4. What is the difference between a perpetual and a periodic inventory system?- A perpetual inventory system updates inventory records in real-time with each sale or purchase, while a periodicinventory system updates inventory records at specific intervals, such as at the end of an accounting period.5. What is the retail method of inventory pricing?- The retail method of inventory pricing is a method of estimating the cost of ending inventory by applying a cost-to-retail ratio to the retail value of the inventory.Chapter 6: Accounting for Service Businesses1. What are the main differences in accounting for service businesses compared to merchandise businesses?- Service businesses do not have inventory and their primary expenses are typically labor and overhead costs.2. What is the main source of revenue for service businesses? - The main source of revenue for service businesses is the fees charged for the services provided.3. What are the typical expenses。

会计英语课后习题参考答案解析(可编辑修改word版)