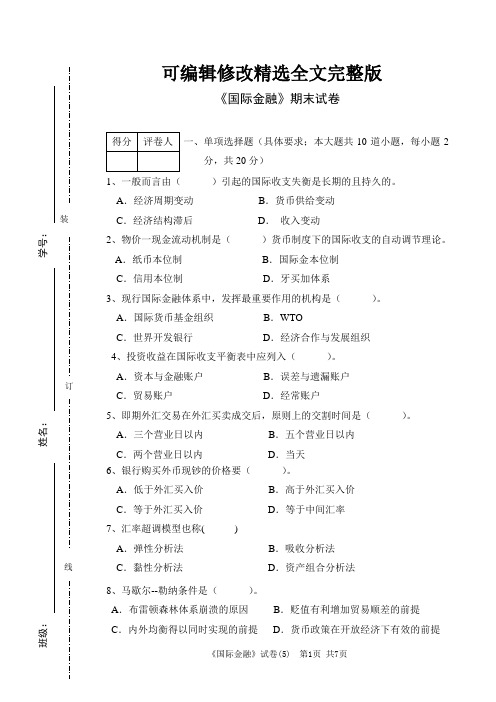

国际金融双语期末A卷

国际金融试题(A)卷

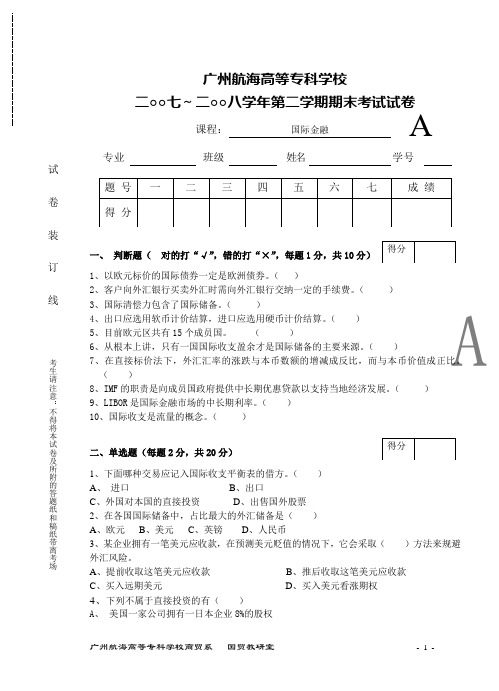

广州航海高等专科学校商贸系 国贸教研室 - 1 -广州航海高等专科学校二○○七~二○○八学年第二学期期末考试试卷一、 判断题( 对的打“√”,错的打“×”,每题1分,共10分)1、以欧元标价的国际债券一定是欧洲债券。

( )2、客户向外汇银行买卖外汇时需向外汇银行交纳一定的手续费。

( )3、国际清偿力包含了国际储备。

( )4、出口应选用软币计价结算,进口应选用硬币计价结算。

( ) 5、目前欧元区共有15个成员国。

( )6、从根本上讲,只有一国国际收支盈余才是国际储备的主要来源。

( )7、在直接标价法下,外汇汇率的涨跌与本币数额的增减成反比,而与本币价值成正比。

( )8、IMF 的职责是向成员国政府提供中长期优惠贷款以支持当地经济发展。

( ) 9、LIBOR 是国际金融市场的中长期利率。

( ) 10、国际收支是流量的概念。

( )二、单选题(每题2分,共20分) 1、下面哪种交易应记入国际收支平衡表的借方。

( ) A 、 进口 B 、出口C 、外国对本国的直接投资D 、出售国外股票 2、在各国国际储备中,占比最大的外汇储备是( ) A 、欧元 B 、美元 C 、英镑 D 、人民币3、某企业拥有一笔美元应收款,在预测美元贬值的情况下,它会采取( )方法来规避外汇风险。

A 、提前收取这笔美元应收款B 、推后收取这笔美元应收款C 、买入远期美元D 、买入美元看涨期权4、下列不属于直接投资的有( )A 、 美国一家公司拥有一日本企业8%的股权课程:国际金融专业班级姓名学号A试 卷 装 订 线考生请注意:不得将本试卷及所附的答题纸和稿纸带离考场B、青岛海尔在海外设立子公司C、天津摩托罗拉将在中国的投资利润进行再投资D、麦当劳在中国开连锁店5、牙买加体系的特点不包括()A、汇率相当稳定B、储备货币多元化C、国际收支调节的政策选择余地加大D、汇率安排多样化6、我国外汇管理的主要负责机构是()A、中国人民银行B、中国银行C、国家外汇管理局D、财政部7、欧元启动的时间是()A、1999年1月B、2002年1月C、1999年7月D、2002年7月8、《巴塞尔协议》规定,银行资本充足率不得低于()A、4%B、8%C、10%D、15%9、“用若干数量的本币来表示外币的价格”,这种汇率标价法叫()A、直接标价法B、间接标价法C、美元标价法D、复汇率10、国际借贷所产生的利息,应列入国际收支平衡表的()账户。

国际金融考试A卷试卷和答案

A.以安全性为主B.保持多元化的货币储备C.以盈利性为主、适当考虑安全性和流动性

D、根据国际市场的形势,随时调整各种储备货币的比例

12一国的国际收支出现逆差,一般会导致()

A.本币汇率下浮B.本币汇率上浮C.利率水平上升D.外汇储备增加

13.投资收益在国际收支平衡表中应列入()。

A.经常账.B.资本账.C.金融账.. D.储备与相关项目

4、欧式期权:欧式期权(European Options)即是指买入期权的一方必须在期权到期日当天才能行使的期权。在亚洲区的金融市场,规定行使期权的时间是期权到期日的北京时间下午14∶00。过了这一时间,再有价值的期权都会自动失效作废。

5、米德冲突:即在汇率固定不变时,政府只能主要运用影响社会总需求的政策来调节内外均衡,在开放经济运行的特定区间便会出现内外均衡难以兼顾的情形。在米德的分析中,内外均衡的冲突一般是指在固定汇率下,失业增加、经常账户逆差或通货膨胀、经常账户盈余这两种特定的内外经济状况组合。

该公司可选择履行期权合约。(1分)

2.(每小点1分)

(1)香港外汇市场

币种即期汇率三个月升贴水数三个月实际远期汇率

美元7.8900贴水1007.8800

日元0.1300升水1000.1400

澳元6.2361贴水616.2300

法郎4.2360贴水1604.2200

(2)纽约外汇市场

国际金融双语期末A卷

国际金融双语期末A卷--————————————————————————————————作者:————————————————————————————————日期:Part I: Multiple choice(1*30=30score)( only one choice for each question)1.Which of the following transactions is recorded in the financial account?A)Ford motor company builds a new plant in ChinaB)A Chinese businessman imports Ford automobiles from the United States.C)A U.S. tourist spends money on a trip to China.D)The New York Yankees are paid $10 million by the Chinese to play anexhibition game in Beijing, China.2.In the balance of payments, the statistical discrepancy or error term is used to:A)Ensure that the sum of all debits matches the sum of all credits.B)Ensure that imports equal the value of exports.C)Obtain an accurate account of a balance-of-payments deficit.D)Obtain an accurate account of a balance-of-payments surplus.3. A deficit in the overall balance generally is an indication that:A)The country’s monetary authorities were selling foreign currency.B)The country’s moneta ry authorities were buying foreign currency.C)The country’s monetary authorities were buying domestic currency.D)The country’s monetary authorities were buying imported goods.4. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the United States. These prices suggest that the exchange rate between the won and the dollar is:A)1.5 won per dollarB)0.75 won per dollarC)$1.50 per wonD)$3 per won5. To the US, U.S. capital inflows will create a __________ foreign currency and a __________ U.S. dollars.A)Demand for; supply ofB)Supply of; demand forC)Shortage of; demand forD)Supply of; shortage of6. U.S. imports of goods and services will create a __________ foreign currency anda __________ U.S. dollars.A) Demand for; supply ofB) Supply of; demand forC) Shortage of; demand forD) Supply of; shortage of7.If the spot price of the euro is $1.10 per euro and the 30-day forward rate is $1.00 per euro, and you believe that the spot rate in 30 days will be $1.05 per euro, you canmaximize speculative gains by:A)Buying euros in the spot market and selling the euros in 30 days at thefuture spot rate.B)Signing a forward foreign exchange contract to sell the euros in 30 days.C)Signing a forward foreign exchange contract to sell the dollars in 30 days.D)Buying dollars in the spot market and selling the dollars in 30 days at thefuture spot rate.8.Assume you are a Chinese exporter and expect to receive $250,000 at the end of 60 days. You can remove the risk of loss due to a devaluation of the dollar by:A)Selling dollars in the forward market for 60-day delivery.B)Buying dollars now and selling it at the end of 60 days.C)Selling the yuan equivalent in the forward market for 60-day delivery.D)Keeping the dollars in the United States after they are delivered to you.9. The interest rate in the U.K. is 4% for 90 days, the current spot rate is $2.00/£ and the forward rate is $1.96/£. If the covered interest rate differential is about 1%, then the interest rate in the U.S. for 90 days would have to be:A)7%B)4%C)3%D)2%10. If the covered interest differential is zero:A)International investments will be unprofitable.B)Parity has not been reached.C)The overall covered return on a foreign-currency investment equals thereturn on a comparable domestic-currency investment.D) A currency is at a forward premium by as much as its interest rate is higherthan the interest rate in the other country.11. When uncovered interest parity holds:A) A currency is expected to appreciate by as much as its interest rate is lowerthan the interest rate in the other country.B) A currency is expected to appreciate by as much as its interest rateis higher than the interest rate in the other countryC) A currency is expected to depreciate by as much as itsinterest rate is lower than the interest rate in the other countryD)The forward premium equals the interest rate differential.12. International Fisher Effect refers to the condition when:A)Covered differential equals zero.B)Expected uncovered differential equals zero.C)Uncovered interest parity holds.D)Both (B) and (C).13. __________ purchasing power parity states that the difference between changes over time in product-price levels in two countries will be offset by the change in the exchange rate over this time.A)FullB)PartialC)RelativeD)Absolute14. The __________ approach to exchange rates emphasizes the importance of the supply and demand for money as a key to understanding the determinants of exchange rates.A)Purchasing-power-parityB)Asset marketC)MonetaryD)Balance of payments15. Based on PPP and the quantity theory of money, if Japan’s real income rises relative to real income in the US, there should be a(n):A)Appreciation of the dollar.B)Appreciation of the yen.C)Interest rate parity.D)Depreciation of the yen.16..The __________ effect can sometimes be destabilizing because it moves the exchange rate away from its long-run equilibrium value.A)BandwagonB)BubbleC)Exchange rateD)Arbitrage17. The law of __________ states that a product that is easily and freely traded in a perfectly competitive global market should have the same price everywhere.A) International tradeB) One priceC) Diminishing returnsD) Relative PPP18..According to the relative version of purchasing power parity, when the foreign country inflation rate increases, the home coun try’s:A)Currency tends to depreciate.B)Currency tends to appreciate.C)Inflation rate tends to decrease.D)Inflation rate tends to stay the same.19..Which of the following are in place when government imposes limits on or requires approvals for payments related to some (or all) international financial activities?A)Exchange controls.B)Capital controls.C)Official interventions.D)Adjustable pegs.20. Pressures in the foreign exchange market are such as to cause the British pound to appreciate with respect to the U.S. dollar. If Britain is trying to maintain a fixed exchange rate with respect to the U.S. dollar, which of the following interventions will stem the pressures for appreciation of the pound?A)Britain should sell pounds and buy dollars.B)Britain should do nothing as a fixed rate will not change.C)Britain should buy pounds and sell dollars.D)Britain should decrease their money supply to contract the economy.21. Faced with ever increasing outflows of gold in the late 1960’s, the United States:A)Used contractionary fiscal policies to rid the nation of deficits.B)Devalued the dollar in terms of gold.C) Suspended the convertibility of dollars into gold.D) Imposed foreign exchange controls.22. .If the marginal propensity to save is 0.3 and the marginal propensity to import is 0.1, and the government increases expenditures by $10 billion, ignoring foreign-income repercussions(回流效应), how much will GDP rise?A)$20 billion.B)$10 billion.C)$25 billion.D)$15 billion.23.The IS curve illustrates:A)All combinations of domestic output levels and interest rates for which thedomestic product market is in equilibrium.B)All combinations of domestic output levels and interest rates for which thedomestic money market is in equilibrium.C)All combinations of domestic output levels and interest rates that results ina zero balance for the country’s official settlements balance.D)All combinations of domestic output levels and interest rates for whichthere is full employment.24.The LM curve has a:A)Positive slope because a higher interest rate leads to a decrease in thedemand for money and thus a higher level of domestic production isneeded to cause people to continue to hold the same amount ofmoney.B)Negative slope because a higher interest rate leads to a decrease in thedemand for money and thus a higher level of domestic production isneeded to cause people to continue to hold the same amount ofmoney.C)Negative slope because a higher interest rate leads to a decrease inaggregate demand and thus a lower level of domestic production isneeded for equilibrium.D)Positive slope because a higher interest rate leads to a decrease inaggregate demand and thus a higher money supply is needed forequilibrium.25. Official intervention in the foreign exchange market to defend a fixed exchange rate when the value of domestic currency is under downward pressure:A)Causes international reserve holdings to rise.B)Has no impact on the domestic money supply.C)Causes the domestic money supply to rise.D)Causes the domestic money supply to fall.26. Floating exchange rates ensure:A) Full employment domestically.B) Domestic price stability.C) Equilibrium in the overall balance of payments.D) A surplus in the trade balance.27. There are limits to the ability of monetary authorities to use sterilized intervention in the case of a surplus because:A)The central bank may be unwilling to increase its holdings of foreigncurrency.B)Pressure from foreign countries to allow the domestic currency todepreciate will lead to large losses.C)The central bank is limited in its ability to obtain foreign currency.D)There are no limits on the use of sterilized intervention.28. Under a floating exchange rate regime, following an expansion in the money supply, monetary authorities will:A) Buy foreign currency in the foreign exchange market.B) Buy domestic currency in the foreign exchange market.C) Do nothing in the foreign exchange market.D) Sell domestic currency in the foreign exchange market.29.Given the IS-LM-FE framework and an overall payments balance of zero, if the country implements expansionary monetary policy, the LM curve will shift to the __________ which will lead to the country's currency __________. In response, the FE and IS curves will shift to the __________ and external balance will be reestablished.A) left; appreciating; rightB) left; depreciating; leftC) right; depreciating; rightD) right; appreciating; right30. Under a floating exchange rate regime with a low degree of capital mobility, expansionary fiscal policy will lead to:A) Higher interest rates.B) Lower interest rates.C) Capital outflows.D) A surplus in the official settlements balance.Part II, True or False (10*1.5=15 score)( T for true and F For false, you are not required to give reason for your choice) 1.If a currency is at a forward premium by as much as its interest rate is lower than the interest rate in the other country, covered interest parity holds.2. Contractionary fiscal policy with floating exchange rates and low capital mobility leads to currency depreciation.3. Over the long-run, a country with a relatively high inflation rate tends to have a depreciating currency.4.The quantity theory of money says that in any country the money supply isequated to the demand for money, which is directly proportional to the money value of the gross domestic product.5.With fixed exchange rates, external capital flow shocks have little impact on theinternal economy.6.The Bretton Woods conference created the International Monetary Fund (IMF).7.The official settlements balance is in deficit if the IS-LM intersection is to theright of the FE curve.8.(P f*e / P) is a useful indicator of a country’s international price competitiveness.9.The assignment rule says that, with fixed exchange rates, fiscal policy should beassigned to stabilizing the balance of payments and monetary policy should be assigned to stabilizing the domestic economy.10.The J curve shows a typical response of the current account balance to a drop inthe exchange rate value of a country's currency.Part III: Questions(6*6=36 score)1.You are provided with the following information about a country's internationaltransactions during a given year:Service exports $ 346Service imports $354Merchandise exports $480Merchandise imports $348Income flow, net $153Unilateral transfers, net $142Increase in the country holding of foreign assets, net $352(excluding official reserves assets)Increase in foreign holding of foreign assets, net $252(excluding official reserves assets)Statistical discrepancy, net $154Calculate the official settlements balance and the current account balance. Is the country increasing or decreasing its net holdings of official reserve assets? Why? 2. The following rates exist:Current spot exchange rate: $1.8/£Annualized interest rate on 90-day dollar-denominated bonds: 8% (2% for 90 days) Annualized interest rate on 90-day pound-denominated bonds: 12% (3% for 90 days)Financial investor expect the spot exchange rate to be $1.77/£ in 90 days,A)With the uncovered interest differential to make judgment that if he bases his decisions solely on the difference in the expected rate of return, should a U.S.-based investor make an uncovered investment in pound-denominated bonds rather than investing in dollar-denominated bonds? Why?B) if there is substantial uncovered investment seeking higher expected returns, what pressure is placed on the current spot exchange rate?3.What is the exchange rate overshooting, why does it occur?4.Assume that a government has become committed to maintaining a fixedexchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. This exchange controls result in considerable costs to a country whose government imposes them. Describe these costs and the role that bribery and parallel markets can play in economies with exchange controls.Figure: Welfare Losses from Exchange Controls5. Use the standard IS-LM-FE framework and assume the country begins at a triple intersection under floating exchange rate. What effect will the following have on domestic interest rates, output levels, and the official settlements balance, assuming low capital mobility?(you are suggested explain with figure)a. The central bank increases the money supply.b. The government increases its spending.6.Explain the effects of expanding the money supply on the economy of a country with fixed exchange rates. (Assume the country begins at a triple intersection ,you are suggested explain with figure)Part III, Reading and analysis (9 score for paper1 and 10 score for paper 2)1: China to further reform RMB exchange rate regime (体制)The People's Bank of China (PBOC ), China's central bank, has decided to proceed further with the reform of the Renminbi (RMB ) exchange rate regime to enhance the RMB exchange rate flexibility, a spokesperson of the central bank said on Jun 19, 2010, Saturday Beijing. The decision was made in view of the recent economic situation and financial market developments at home and abroad, and the balance of payments (BOP) situation in China, the spokesperson said in a statement.In further proceeding with the reform, continued emphasis would be placed to reflecting market supply and demand with reference to a basket of currencies. The exchange rate floating bands will remain the same as previously announced in the inter-bank foreign exchange market, the spokesman said.The spokesperson said China's external trade is becoming more balanced. The ratio of current account surplus to GDP, after a notable reduction in 2009, has been declining since the beginning of 2010. 30$/££B S £ B1.5D £ EA C"With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist," the spokesperson said.The PBOC will further enable market to play a fundamental role in resource allocation, promote a more balanced BOP account, maintain the RMB exchange rate basically stable at an adaptive and equilibrium level, and achieve the macroeconomic and financial stability in China, the spokesperson said.China has moved into a managed floating exchange rate regime based on market supply and demand with reference of a basket of currencies since July 1, 2005.The spokesperson said the reform of the RMB exchange rate regime has been making steady progress since 2005, producing the anticipated results and playing a positive role. ( On July 21, 2005, the People's Bank of China, announced that the RMB yuan, will be traded at a rate of 8.11 to the US and the yuan to US dollar pegging system is switched to a basket of foreign currencies.) With the current round of international financial crisis was at its worst, the exchange rate of a number of sovereign currencies to the US dollar depreciated by varying margins."The stability of the RMB exchange rate has played an important role in mitigating(缓解) the crisis' impact, contributing significantly to Asian and global recovery, and demonstrating China's efforts in promoting global rebalancing," the spokesperson said.The gradual recovery of the global economy and upturn of the Chinese economy has become more solid with enhanced economic stability. It is desirable to proceed further with reform of the RMB exchange rate regime and increase the RMB exchange rate flexibility, said the spokesperson.Question1:Why the spokesperson said. "With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist,"Question2: Why the Chinese Central bank would like to proceed the reform of the Renminbi (RMB)exchange rate regime to enhance the RMB exchange rate flexibility. Can you explain the benefit by making the RMB more flexible?2: Hot money flow and its explanationThe generally accepted view is that the inflow of short-term speculative money (so-called hot-money) began in 2007 in China targeting capital gains derived from rising stock and property prices an d the anticipated appreciation of the RMB. “hot money” is defined as the flow of funds counted as capital and financial account other than for direct investment and errors and omissions. In other words, “hot money” is defined as “changes in reserve assets”minus “changes in current account” minus “direct investment flows”. This is the simplest way to express the movement of short-term funds, and the most conservative, as the estimates tend to be smaller.When adjustments are made for the some policy measures, the BoP statistics indicate that “hot money” inflows into China accelerated from 22.5 billion USD in the first half of 2007, to 70.2 billion USD in the second half of 2007, and up to 139.1 billion USD in the first half of 2008. In contrast, a huge 184.8 billion USD of “hot money” flowed out in the second half of 2008 (2008, 2H)(Figure 1).Figure 1: Hot money in China after adjustmentForeignDirectCurrentHotSome people says that the huge inflow of hot money is the reason for the increasing price of stock price and property price. In order to check this point, here we give two figures about the Shanghai Stock index and Property (资产) Price index of different regions including ShangHai, Shengzhen, Beijing.Figure 2: Shanghai Stock IndexFigure 3: Property Price index.We find that Stock prices peaked in October 2008, and thereafter began a downward trend(Figure 2). Growth in property prices began to fall in the first half of 2008 (c) (Figure 3) althoughthe hot money inflow go to its peak at the same time.Figure 4: RMB exchange rate and interest rate parityInterestRMBForwardChange of From the above figure 4, we find that the RMB forward exchange rate shifted after therapid appreciation of the RMB spot exchange rate, and deviated from interest rateparity from late-2007 until the autumn of 2008. The distance from interest rate parity widened most in the first half of 2008. This is because spot exchange rates are underthe control of the authorities while forward exchange rates are not, and their appreciation reflected market pa rticipants’ expectation of spot rate appreciation in the following period. As a consequence, the RMB forward exchange rate movedtoward appreciation, and the difference between the RMB forward rate and spot ratebegan to deviate from interest rate parity in May 2007, peaking in March 2008.Figure 5: Returns from arbitrage transactions using RMB forward exchangerateQuestion 1: From fighre1,2,3, do you agree with the such idea that the huge hot money inflow is the main force that pushes the Chinese stock price and property price increase and raises the bubbles. Why?Question 2: With the figure 1, 4, 5 would you please explain the relationship between RMB appreciation and hot money inflow by the asset market approach, say, the covered interest differential equation and covered interest parity.浙江财经学院2009~2010学年第一学期《国际金融(双语)》课程期末考试试卷( A 卷)答案PART I: Multiple choice(10*1=10)1-5 AAAAB 6-10 ACACC 11-15 ADCCB 16-20 ABBBA21-25 CCAAD 26-30CACCAPART II TRUTH OR FALSE(10*1.5=15)1T 2 F 3 T 4T 5F. 6T 7T 8T 9 F 10 TPART III: Questions(6*6=36)Question 1:POSSIBLE RESPONSE:Current account balance: $346 - 354 + 480 - 348 + 153 - 142 = $135Official settlements balance: $346 - 354 + 480 - 348 +153 -142 + 252 – 352 + 154 = $189Change in official reserve assets (net) = -official settlements balance = -$189.The country is increasing its net holdings of official reserve assets.Question 2:POSSIBLE RESPONSE:a)From the point of view of the U.S.-based investor, the expected uncovered interest differential is [(1+0.03)*1.77/1.8]-(1+0.02)=-0.0072. Because the differential is negative, the U.S –based investor should stay at home, investing in dollar-denominated bonds, if he bases his decision on the difference in expected reurns.b) If there is substantial uncovered investment flowing from Britain to the United States, this increases the supply of pounds in the spot exchange market. There is downward pressure on the spot exchange rate to drop below $1.8/pound. The pound teds to depreciate.Question 3:POSSIBLE RESPONSE:Overshooting occurs because in this sticky price version of the monetary approach, prices are assumed to be fixed in the short run and completely flexible in the long run.A considerable amount of time must pass for the increase in money supply to lead to an increase in domestic prices. Thus, purchasing power parity is more realistically assumed to hold in the long run but not in the short run. Because prices are sticky at first, the increase in money supply drives down domestic interest rates. This shift favors foreign currency assets which results in immediate depreciation of the domestic currency. As prices adjust, the domestic currency reverts back to its new long run equilibrium.Question4、Assume that a government has become committed to maintaining a fixed exchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. This exchange controls result in considerable costs to a country whose government imposes them. Describe these costs and the role that bribery and parallel markets can play in economies with exchange controls. Figure: Welfare Losses from Exchange ControlsPOSSIBLE RESPONSE:The exchange controls require exporters to turn over all their revenues from foreign buyers to the government. The government, in turn, gives them $1.0 in domestic bank deposits for each pound sterling they have earned. In Figure 20.2, the exchange control limits the foreign currency available to 30 billion pounds, which is the amount earned by the country’s exporters at the exchange rate of $1.0 per pound. Even if those who most value the limited foreign currency get it, the country suffers a loss of well being equal to the triangular area depicted by CEA.Actual exchange control regimes are likely to have other effects and costs. One such example is the efforts evade exchange controls. People are frustrated when they are not allowed to buy foreign exchange, even though they are willing to pay more than the recipients of foreign exchange will get from the government when these holders sell their foreign currency. The frustrated demanders will look for other ways to obtain foreign exchange. One way is to bribe the government functionaries in charge of determining the official approvals. Another is to offer more to recipients of foreign exchange than the government is offering. In this way a second foreign exchange market, a parallel market or black market, develops as a way for private demanders and sellers of foreign exchange to evade exchange controls. Parallel markets exist in most countries that have exchange controls.5. Use the standard IS-LM-FE framework and assume the country begins at a triple intersection under floating exchange rate. What effect will the following have on domestic interest rates, output levels, and the official settlements balance, assuming low capital mobility?(you are suggested explain with figure)a.The central bank increases the money supply.b.The government increases its spending.POSSIBLE RESPONSE:a.The LM curve shifts to the right, and the country moves to a new short-runequilibrium at the intersection of the IS curve and the new LM curve.The domestic interest rate decreases, real GDP increases, and the officialsettlements balance goes into deficit. With the increase in the moneysupply, it is temporarily greater than money demand. To bring about anequilibrium in the money market, interest rates must fall. The fall ininterest rates increases interest-sensitive spending, so the GDP outputlevel increases. There is now a payment deficit because the newintersection of the IS and LM curves takes place to the right of the FEcurve.b.The IS curve shifts to the right, and the country moves to a new short-runequilibrium at the intersection of the LM curve and the new IS curve.Real GDP increases, the domestic interest rate increases, and the officialsettlements balance goes into deficit. This new intersection occurs to theright of the relatively steep FE curve, which corresponds to a paymentsdeficit.The figure is neglected.6. Explain the effects of expanding the money supply on the economy of a country with fixed exchange rates. (Assume the country begins at a triple intersection , you are suggested explain with figure)POSSIBLE RESPONSE:Beginning from an external balance, an expansion in the money supply increases bank liquidity. In the short run, as banks compete with each other to lend money, interest rates are bid down. The fall in interest rates causes some holders of financial assets denominated in the domestic currency to seek higher returns abroad. The international capital outflow causes the financial account to deteriorate. the currency of this country will under the pressure of depreciate, thus the central bank should intervene the foreign market by buying the domestic currency. Thus the concretionary monetary policy will be applied.Finally we will find it that the expansionary monetary policy can not make effect on the economy..The figure is neglected.Part III, Reading and analysisReading 1 ,9 scoreQuestion1:Why the spokesperson said. "With the BOP account moving closer to equilibrium, the basis for large-scale appreciation of the RMB exchange rate does not exist,"POSSIBLE RESPONSE:The policy makers usually will pursuer both the external balance and internal balance, the external balance means that the Balance of Payments or the current account balance plus the financial account balance is close to zero. In this situation, it means that the export value (including goods, services and financial products) is equal to the import value in China. Thus in the foreign exchange market the supply of foreign currency is similar to the demand of the foreign currency and the foreign exchange market is close to the equilibrium. The values of Chinese currency RMB will not experience the appreciation pressure more. So the spokesperson said the basis for large-scale appreciation of the RMB exchange rate does not exist. This basis means the BOP account moving closer to equilibrium.Question2: Why the Chinese Central bank would like to proceed the reform of the Renminbi (RMB)exchange rate regime to enhance the RMB exchange rate flexibility. Can。

国际金融试卷A及答案

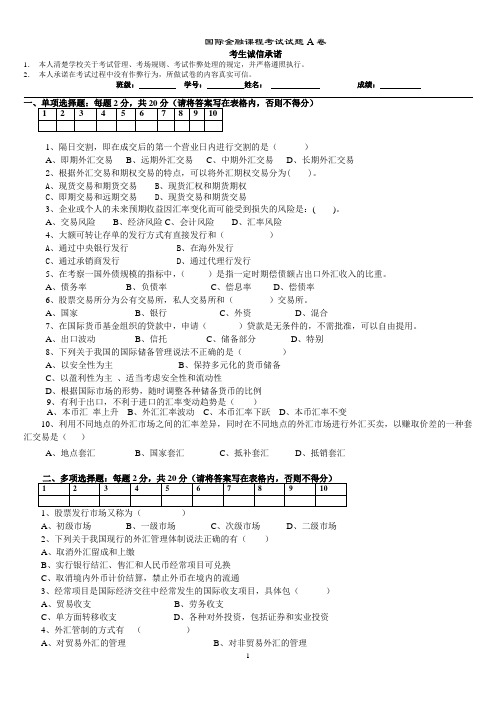

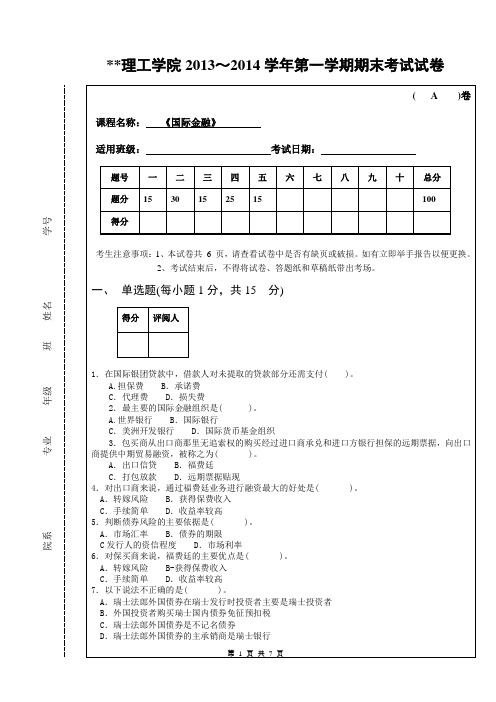

2.本人承诺在考试过程中没有作弊行为,所做试卷的内容真实可信。

班级:学号:姓名:成绩:1、隔日交割,即在成交后的第一个营业日内进行交割的是()A、即期外汇交易B、远期外汇交易C、中期外汇交易D、长期外汇交易2、根据外汇交易和期权交易的特点,可以将外汇期权交易分为( )。

A、现货交易和期货交易B、现货汇权和期货期权C、即期交易和远期交易D、现货交易和期货交易3、企业或个人的未来预期收益因汇率变化而可能受到损失的风险是:( )。

A、交易风险B、经济风险C、会计风险D、汇率风险4、大额可转让存单的发行方式有直接发行和()A、通过中央银行发行B、在海外发行C、通过承销商发行D、通过代理行发行5、在考察一国外债规模的指标中,()是指一定时期偿债额占出口外汇收入的比重。

A、债务率B、负债率C、偿息率D、偿债率6、股票交易所分为公有交易所,私人交易所和()交易所。

A、国家B、银行C、外资D、混合7、在国际货币基金组织的贷款中,申请()贷款是无条件的,不需批准,可以自由提用。

A、出口波动B、信托C、储备部分D、特别8、下列关于我国的国际储备管理说法不正确的是()A、以安全性为主B、保持多元化的货币储备C、以盈利性为主、适当考虑安全性和流动性D、根据国际市场的形势,随时调整各种储备货币的比例9、有利于出口,不利于进口的汇率变动趋势是()A、本币汇率上升B、外汇汇率波动C、本币汇率下跃D、本币汇率不变10、利用不同地点的外汇市场之间的汇率差异,同时在不同地点的外汇市场进行外汇买卖,以赚取价差的一种套汇交易是()A、地点套汇B、国家套汇C、抵补套汇D、抵销套汇A、初级市场B、一级市场C、次级市场D、二级市场2、下列关于我国现行的外汇管理体制说法正确的有()A、取消外汇留成和上缴B、实行银行结汇、售汇和人民币经常项目可兑换C、取消境内外币计价结算,禁止外币在境内的流通3、经常项目是国际经济交往中经常发生的国际收支项目,具体包()A、贸易收支B、劳务收支C、单方面转移收支D、各种对外投资,包括证券和实业投资4、外汇管制的方式有()A、对贸易外汇的管理B、对非贸易外汇的管理2.本人承诺在考试过程中没有作弊行为,所做试卷的内容真实可信。

国际金融考试试题

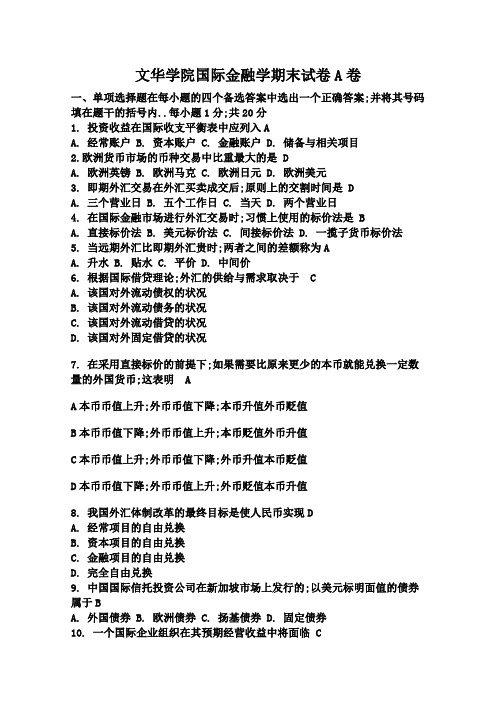

文华学院国际金融学期末试卷A卷一、单项选择题在每小题的四个备选答案中选出一个正确答案;并将其号码填在题干的括号内..每小题1分;共20分1. 投资收益在国际收支平衡表中应列入AA. 经常账户B. 资本账户C. 金融账户D. 储备与相关项目2.欧洲货币市场的币种交易中比重最大的是 DA. 欧洲英镑B. 欧洲马克C. 欧洲日元D. 欧洲美元3. 即期外汇交易在外汇买卖成交后;原则上的交割时间是 DA. 三个营业日B. 五个工作日C. 当天D. 两个营业日4. 在国际金融市场进行外汇交易时;习惯上使用的标价法是 BA. 直接标价法B. 美元标价法C. 间接标价法D. 一揽子货币标价法5. 当远期外汇比即期外汇贵时;两者之间的差额称为AA. 升水B. 贴水C. 平价D. 中间价6. 根据国际借贷理论;外汇的供给与需求取决于 CA. 该国对外流动债权的状况B. 该国对外流动债务的状况C. 该国对外流动借贷的状况D. 该国对外固定借贷的状况7. 在采用直接标价的前提下;如果需要比原来更少的本币就能兑换一定数量的外国货币;这表明 AA本币币值上升;外币币值下降;本币升值外币贬值B本币币值下降;外币币值上升;本币贬值外币升值C本币币值上升;外币币值下降;外币升值本币贬值D本币币值下降;外币币值上升;外币贬值本币升值8. 我国外汇体制改革的最终目标是使人民币实现DA. 经常项目的自由兑换B. 资本项目的自由兑换C. 金融项目的自由兑换D. 完全自由兑换9. 中国国际信托投资公司在新加坡市场上发行的;以美元标明面值的债券属于BA. 外国债券B. 欧洲债券C. 扬基债券D. 固定债券10. 一个国际企业组织在其预期经营收益中将面临 CA. 交易风险B. 收益风险C. 经济风险D. 会计风险11. 衍生金融工具市场上的交易对象是 BA. 外国货币B. 各种金融合约C. 贵金属D. 原形金融资产12. 由国内通货膨胀或通货紧缩而导致的国际收支平衡;称为 DA. 周期性失衡B. 收入性失衡C. 偶发性失衡D. 货币性失衡13. 外汇期权交易的主要目的是为了 AA. 对汇率的变动提供套期保值B. 将价格变动的风险进行转嫁C. 换取权利金D. 退还保证金14. 货币市场利率的变化影响证券价格的变化;如果市场利率上升超过未到期公司债券利率;则BA. 债券价格上涨;股票价格上涨B. 债券价格下跌;股票价格下跌C. 债券价格上涨;股票价格下跌D. 债券价格下跌;股票价格上涨15. 外汇储备资产中的一级储备的特点是BA. 盈利性最高;流动性最低B. 盈利性最低;流动性最高C. 盈利性和流动性都高D. 盈利性和流动性都低16. 在期权交易中AA. 买方的损失有限;收益无限B. 买方的损失无限;收益有限C. 卖方的损失无限;收益无限D. 卖方的损失有限;收益有限17. 根据国际收支的弹性分析理论;货币贬值改善贸易收支的前提条件是AA. 进出口需求弹性之和大于1B. 进出口需求弹性之和等于1C. 进出口需求弹性之和小于1D. 进出口供给弹性之和大于118. 某日纽约外汇市场即期汇率美元/瑞士法郎1.7130—40;3个月远期差价140—135;则远期汇率为CA.1.8530—1.8490B.1.7270—1.7275C.1.6990—1.7005D.1.5730—1.579019.货币贬值改善国际收支的条件是AA.Dx+Di=1B.Dx+Di>1C.Dx+Di<1D.Dx-Di>120. 设某企业90天后有一笔外汇收入;则这笔业务AA. 既存在时间风险又存在价值风险B. 只存在价值风险C. 只存在时间风险D. 既存在时间风险;又存在利率风险四计算题481.我国某外贸公司向英国出口商品;6月2日装船发货;收到价值100万英镑的3个月远期汇票;担心到期结汇时英镑对美元汇价下降;减少美元创汇收入;以外汇期权交易保值.8已知:6月2日即期汇价GBP1=USD1.4500IMM协定价格GBP1=USD1.4800IMM期权费GBP1=USD0.0212期权交易佣金占合同金额的0.5%;采用欧式期权..3个月后在英镑对美元汇价分别为GBP1=USD1.4000与GBP1=USD1.6000的两种情况下;该公司各收入多少美元145.155 157.1552.假定某年3月一美国进口商三个月以后需支付货款DM500;000;目前即期汇率为DM1=USD0.5000..为避免三个月后马克升值的风险;决定买入4份6月到期德国马克期货合同每份合同为DM125;000;成交价为DM1=USD0.5100..6月份德国马克果然升值;即期汇率为DM1=USD0.7000;德国马克期货合同的价格上升到DM1=USD0.7100..如果不考虑佣金、保证金及利息;试计算该进口商的净盈亏.. 51.19DKR/件5.香港某出口商向丹麦出口服装一批;原报价为100港币/件;现丹麦进口商要求港商向其发出克朗的报价..8某日香港外汇市场外汇牌价GBP1=HKD11.2820-11.2840伦敦市场牌价 GBP1=DKr5.7743-5.77576.某日纽约外汇市场上即期汇率报价为1美元=125.59-125.73日元;三个月远期日元报价为贴水0.91-1.12;如果顾客买入三个月远期100万日元需要支付多少美元计算结果精确到小数点后2位87905.141、一国货币升值对其进出口收支产生何种影响A、出口增加;进口减少B、出口减少;进口增加C、出口增加;进口增加D、出口减少;进口减少2、sDr2是A、欧洲经济货币联盟创设的货币B、欧洲货币体系的中心货币C、imf创设的储备资产和记帐单位D、世界银行创设的一种特别使用资金的权利3、一般情况下;即期交易的起息日定为A、成交当天B、成交后第一个营业日C、成交后第二个营业日D、成交后一星期内4、收购国外企业的股权达到10%以上;一般认为属于A、股票投资B、证券投资C、直接投资D、间接投资5、汇率不稳有下浮趋势且在外汇市场上被人们抛售的货币是A、非自由兑换货币B、硬货币C、软货币D、自由外汇6、汇率波动受黄金输送费用的限制;各国国际收支能够自动调节;这种货币制度是A、浮动汇率制B、国际金本位制C、布雷顿森林体系D、混合本位制7、国际收支平衡表中的基本差额计算是根据A、商品的进口和出口B、经常项目C、经常项目和资本项目D、经常项目和资本项目中的长期资本收支8、在采用直接标价的前提下;如果需要比原来更少的本币就能兑换一定数量的外国货币;这表明A、本币币值上升;外币币值下降;通常称为外汇汇率上升B、本币币值下降;外币币值上升;通常称为外汇汇率上升C、本币币值上升;外币币值下降;通常称为外汇汇率下降D、本币币值下降;外币币值上升;通常称为外汇汇率下降9、当一国经济出现膨胀和顺差时;为了内外经济的平衡;根据财政货币政策配合理论;应采取的措施是A、膨胀性的财政政策和膨胀性的货币政策B、紧缩性的财政政策和紧缩性的货币政策C、膨胀性的财政政策和紧缩性的货币政策D、紧缩性的财政政策和膨胀性的货币政策10、欧洲货币市场是A、经营欧洲货币单位的国家金融市场B、经营欧洲国家货币的国际金融市场C、欧洲国家国际金融市场的总称D、经营境外货币的国际金融市场11、国际债券包括A、固定利率债券和浮动利率债券B、外国债券和欧洲债券C、美元债券和日元债券D、欧洲美元债券和欧元债券12、二次世界大战前为了恢复国际货币秩序达成的;对战后国际货币体系的建立有启示作用..A、自由贸易协定B、三国货币协定C、布雷顿森林协定D、君子协定13、世界上国际金融中心有几十个;而最大的三个金融中心是A、伦敦、法兰克福和纽约B、伦敦、巴黎和纽约C、伦敦、纽约和东京D、伦敦、纽约和香港14、金融汇率是为了限制A、资本流入B、资本流出C、套汇D、套利15、汇率定值偏高等于对非贸易生产给予补贴;这样A、对资源配置不利B、对进口不利C、对出口不利D、对本国经济发展不利16、国际储备运营管理有三个基本原则是A、安全、流动、盈利B、安全、固定、保值C、安全、固定、盈利D、流动、保值、增值17、一国国际收支顺差会使A、外国对该国货币需求增加;该国货币汇率上升B、外国对该国货币需求减少;该国货币汇率下跌C、外国对该国货币需求增加;该国货币汇率下跌D、外国对该国货币需求减少;该国货币汇率上升18、金本位的特点是黄金可以A、自由买卖、自由铸造、自由兑换B、自由铸造、自由兑换、自由输出入C、自由买卖、自由铸造、自由输出入D、自由流通、自由兑换、自由输出入19、布雷顿森林体系规定会员国汇率波动幅度为A、±10%B、±2.25%C、±1%D、±10-20%20、国际贷款的风险产生的原因是对银行规定法定准备金或对银行征收税款;此类风险属A、国家风险B、信贷风险C、利率风险D、管制风险21、欧洲货币体系建立的汇率稳定机制规定成员国之间汇率波动允许的幅度为A、±1%B、±1.5%C、±1.75%D、±2.25%22、布雷顿森林协议在对会员国缴纳的资金来源中规定A、会员国份额必须全部以黄金或可兑换的黄金货币缴纳B、会员国份额的50%以黄金或可兑换成黄金的货币缴纳;其余50%的份额以本国货币缴纳C、会员国份额的25%以黄金或可兑换成黄金的货币缴纳;其余75%的份额以本国货币缴纳D、会员国份额必须全部以本国货币缴纳23、根据财政政策配合的理论;当一国实施紧缩性的财政政策和货币政策;其目的在于A、克服该国经济的通货膨胀和国际收支逆差B、克服该国经济的衰退和国际收支逆差C、克服该国通货膨胀和国际收支顺差D、克服该国经济衰退和国际收支顺差24、资本流出是指本国资本流到外国;它表示A、外国对本国的负债减少B、本国对外国的负债增加C、外国在本国的资产增加D、外国在本国的资产减少25、货币市场利率的变化影响证券价格的变化;如果市场利率上升超过未到期公司债券利率;则A、债券价格上涨;股票价格上涨B、债券价格下跌;股票价格下跌C、债券价格上涨;股票价格下跌D、债券价格下跌;股票价格上涨26、目前;我国人民币实施的汇率制度是A、固定汇率制B、弹性汇率制C、有管理浮动汇率制D、钉住汇率制27、若一国货币汇率高估;往往会出现A、外汇供给增加;外汇需求减少;国际收支顺差B、外汇供给减少;外汇需求增加;国际收支逆差C、外汇供给增加;外汇需求减少;国际收支逆差D、外汇供给减少;外汇需求增加;国际收支顺差28、从长期讲;影响一国货币币值的因素是A、国际收支状况B、经济实力C、通货膨胀D、利率高低29、汇率采取直接标价法的国家和地区有A、美国和英国B、美国和香港C、英国和日本D、香港和日本30、;促进了国际金融市场的形成和发展..A、货币的自由兑换B、国际资本的流动C、生产和资本的国际化D、国际贸易的发展31、史密森协定规定市场外汇汇率波动幅度从±1%扩大到A、±2.25%B、±6%C、±10%D、自由浮动32、美国联邦储备q条款规定A、储蓄利率的上限B、商业银行存款准备金的比率C、活期存款不计利息D、储蓄和定期存款利率的上限33、所谓外汇管制就是对外汇交易实行一定的限制;目的是A、防止资金外逃B、限制非法贸易C、奖出限入D、平衡国际收支、限制汇价34、主张采取透支原则;建立国际清算联盟是的主要内容..A、贝克计划B、凯恩斯计划C、怀特计划D、布雷迪计划35、工商业扩张导致A、资金需求增加;证券价格上涨B、资金需求增加;证券价格下跌C、资金需求减少;证券价格上涨D、资金需求减少;证券价格下跌36、持有一国国际储备的首要用途是A、支持本国货币汇率B、维护本国的国际信誉C、保持国际支付能力D、赢得竞争利益37、当国际收支的收入数字大于支出数字时;差额则列入以使国际收支人为地达到平衡..A、“错误和遗漏”项目的支出方B、“错误和遗漏”项目的收入方C、“官方结算项目”的支出方D、“官方结算项目”的收入方38、国际上认为;一国当年应偿还外债的还本付息额占当年商品劳务出口收入的以内才是适度的..A、100%B、50%C、20%D、10%39、外汇远期交易的特点是A、它是一个有组织的市场;在交易所以公开叫价方式进行B、业务范围广泛;银行、公司和一般平民均可参加C、合约规格标准化D、交易只限于交易所会员之间40、短期资本流动与长期资本流动除期限不同之外;另一个重要的区别是A、投资者意图不同B、短期资本流动对货币供应量有直接影响C、短期资本流动使用的是1年以下的借贷资金D、长期资本流动对货币供应量有直接影响简答题1、简述国际收支平衡表的编制原理..1复式簿记原理1分2外汇收入记入贷方;外汇支出记入借方2分3外汇供给记入贷方;外汇需求记入借方1分2、国际金融中心形成必须具备哪些条件1政治经济稳定1分2金融体系发达1分3外汇市场发达1分4外汇管制松;资本流动方便0.5分5现代化通讯交通设施0.5分参考答案1、B2、C3、C4、C5、C6、B7、D8、C9、D 10、D 11、B 12、B 13、C 14、A 15、A 16、A 17、A 18、B 19、C 20、D 21、D 22、C 23、A 24、D 25、B 26、C 27、B 28、B 29、D 30、C 31、A 32、D 33、D 34、B 35、A 36、C 37、A 38、C 39、B 40、B。

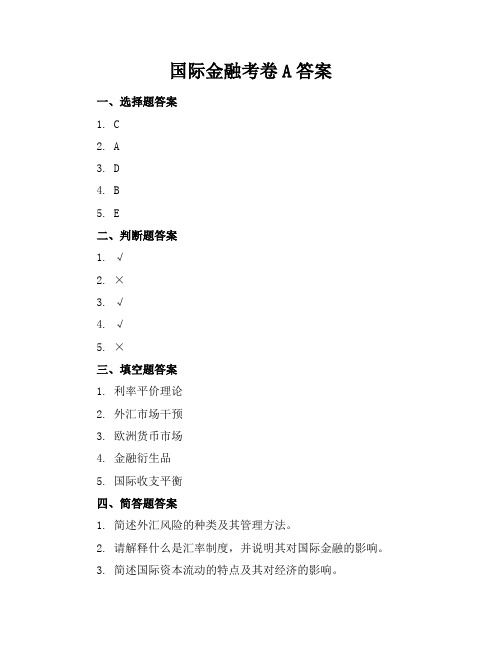

国际金融考卷A答案

国际金融考卷A答案一、选择题答案1. C2. A3. D4. B5. E二、判断题答案1. √2. ×3. √4. √5. ×三、填空题答案1. 利率平价理论2. 外汇市场干预3. 欧洲货币市场4. 金融衍生品5. 国际收支平衡四、简答题答案1. 简述外汇风险的种类及其管理方法。

2. 请解释什么是汇率制度,并说明其对国际金融的影响。

3. 简述国际资本流动的特点及其对经济的影响。

4. 请简要介绍外汇储备的作用及其管理策略。

5. 简述国际金融市场的主要参与者及其职能。

五、应用题答案1. 请计算某公司外汇敞口的现值。

2. 请分析外汇储备对汇率的影响。

3. 请解释国际收支平衡表的基本构成。

4. 请计算某国国际收支顺差或逆差的情况。

5. 请分析国际金融市场利率水平的影响因素。

六、分析题答案1. 分析国际金融市场利率水平的影响因素。

2. 分析国际资本流动对经济的影响。

七、实践操作题答案1. 请设计一个外汇风险管理策略。

2. 请设计一个国际资本流动监测和预警系统。

八、专业设计题(每题2分,共10分)1. 设计一个针对外汇市场的风险管理策略。

2. 设计一个跨国公司国际融资方案。

3. 设计一个外汇储备管理模型。

4. 设计一个国际金融市场趋势预测模型。

5. 设计一个国际金融监管体系。

九、概念解释题(每题2分,共10分)1. 解释什么是国际收支平衡表。

2. 解释外汇风险管理的概念。

3. 解释国际金融市场利率的决定因素。

4. 解释什么是金融衍生品。

5. 解释什么是国际资本流动。

十、思考题(每题2分,共10分)1. 思考国际金融市场利率水平对经济的影响。

2. 思考国际资本流动对经济的影响。

3. 思考外汇风险管理的重要性。

4. 思考国际金融监管的必要性。

5. 思考外汇储备管理策略。

十一、社会扩展题(每题3分,共15分)1. 讨论国际金融市场利率水平对社会和经济的影响。

2. 分析国际资本流动对全球经济的影响。

英文版国际金融试题和答案

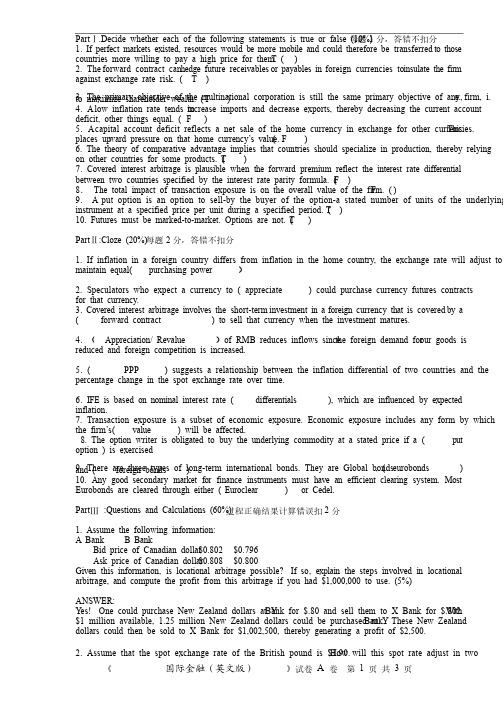

Part Ⅰ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分分,答错不扣分1. 1. If If If perfect perfect perfect markets markets markets existed, existed, existed, resources resources resources would would would be be be more more more mobile mobile mobile and and and could could could therefore therefore therefore be transferred be transferred to to those those countries more willing to pay a high price for them. ( T ) 2. The forward contract can h edge hedge hedge future receivables future receivables or or payables payables payables in in in foreign currencies to foreign currencies to i nsulate insulate insulate the the the firm firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. 7. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage is is is plausible plausible plausible when when when the the the forward forward forward premium premium premium reflect reflect reflect the the the interest interest interest rate rate rate differential differential between two countries specified by the interest rate parity formula. ( F ) 8. The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) Part Ⅱ:Cloze (20%)每题2分,答错不扣分分,答错不扣分1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power )2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. 3. Covered Covered Covered interest interest interest arbitrage arbitrage arbitrage involves involves involves the short-term the short-term investment investment in in in a a a foreign foreign foreign currency currency currency that that that is covered is covered by by a a ( forward contract ) to sell that currency when the investment matures. 4. ( Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. 6. IFE IFE IFE is is is based based based on on on nominal nominal nominal interest interest interest rate rate rate ( ( differentials ), ), which which which are are are influenced influenced influenced by by by expected expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( ( value ) will be affected. 8. 8. The The The option option option writer writer writer is is is obligated obligated obligated to to to buy buy buy the the the underlying underlying underlying commodity commodity commodity at at at a a a stated stated stated price price price if if if a a a ( ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. 10. Any Any Any good good good secondary secondary secondary market market market for for for finance finance finance instruments instruments instruments must must must have have have an an an efficient efficient efficient clearing clearing clearing system. system. system. Most Most Eurobonds are cleared through either ( Euroclear ) or Cedel. Part Ⅲ :Questions and Calculations (60%)过程正确结果计算错误扣2分1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given Given this this this information, information, information, is is is locational locational locational arbitrage arbitrage arbitrage possible? possible? If If so, so, so, explain explain explain the the the steps steps steps involved involved involved in in in locational locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two years if if the the the United United United Kingdom Kingdom Kingdom experiences experiences experiences an an an inflation inflation inflation rate rate rate of of of 7 7 7 percent percent percent per per per year year year while while while the the the United United United States States experiences an inflation rate of 2 percent per year?(10%) ANSWER: According to PPP , forward rate/spot=indexdom/indexfor the exchange rate of the pound will depreciate by 4.7 percent. Therefore, the spot rate would adjust to $1.90 × [1 + (–.047)] = $1.8107 3. 3. Assume Assume Assume that that that the spot the spot exchange exchange rate rate rate of the of the Singapore Singapore dollar dollar dollar is is is $0.70. $0.70. The The one-year one-year one-year interest interest interest rate rate rate is is is 11 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (5%) (5%) ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf) $.70 × (1 + .04) = $0.728 4. Assume that XYZ Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interest rate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise . (10%) ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be be received received received could could could be be be used used used to to to pay pay pay off off off the the the loan. loan. This This amounts amounts amounts to to to (100,000/1.02) (100,000/1.02) (100,000/1.02) = = = about about about S$98,039, which S$98,039, which could could be be be converted converted converted to to to about about about $49,020 $49,020 $49,020 and and and invested. invested. The The borrowing borrowing borrowing of of of Singapore Singapore Singapore dollars dollars dollars has has has offset offset offset the the transaction exposure due to the future receivables in Singapore dollars. 5. 5. A A U.S. company ordered ordered a a a Jaguar Jaguar Jaguar sedan. In sedan. In 6 6 months , months , it will pay pay ££30,000 30,000 for for for the the the car. car. car. It It worried worried that that pound ster1ing might rise sharply from the current rate($1.90). So, the company bought a 6 month pound call (supposed contract size = £35,000) with a strike price of $1.90 for a premium of 2.3 cents/£. (1)Is hedging in the options market better if the £ rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even?(15%)Solution: (1)If the £ rose to $1.92 in 6 months, the U.S. company would rose to $1.92 in 6 months, the U.S. company would exercise the pound call option. The sum of the strike price and premium is $1.90 + $0.023 = $1.9230/£This is bigger than $1.92. So hedging in the options market is not better. (2) when we say the company can break even, we mean that hedging or not hedging doesn’t matter. And only when (strike price + premium )= the exchange rate , hedging or not doesn’t matter. So, the exchange rate =$1.923/£. 6. Discuss the advantages and disadvantages of fixed exchange rate system.(15%) textbook page50 答案以教材第50 页为准页为准P AR T Ⅳ: Diagram(10%) The strike price for a call is $1.67/£. The premium quoted at the Exchange is $0.0222 per British pound. Diagram the profit and loss potential, and the break-even price for this call option Solution: Following diagram shows the profit and loss potential, and the break-even price of this put option: P AR T Ⅴ:Additional Question Suppose Suppose that that that you you you are are are expecting expecting expecting revenues revenues revenues of of of Y Y 100,000 100,000 from from from Japan Japan Japan in in in one one one month. month. Currently, Currently, 1 1 1 month month forward contracts are trading at $1 = $105 Y en. Y ou have the following estimate of the Y en/$ exchange rate in one month. Price Probability 90 Y en/$ 4% 95 Y en/$ 25% 100 Y/$ 45% 105 Y en/$ 20% 110 Y en/$ 6% a) What position in forward contracts would you take to hedge your exchange risk? b) Calculate the expected value of the hedge. c) How could you replicate this hedge in the money market? Y ou are expecting revenues of Y100,000 in one month that you will need to covert to dollars. Y ou could hedge this in forward markets by taking long positions in US dollars (short positions in Japanese Y en). By locking in your price at $1 = Y105, your dollar revenues are guaranteed to be Y100,000/ 105 = $952 On the other hand, you can wait and use the spot markets. Exchange Rate Probability Revenue w/Hedge Revenue w/out Hedge V alue of Hedge 90 Y/$ 4% $1,111 $952 -$159 95 Y/$ 25% $1,052 $952 -$100 100 Y/$ 45% $1,000 $952 -$48 105 Y/$ 20% $952 $952 $0 110 Y/$ 6% $909 $952 $43 Expected V alue = (.02)(-159) + (.25)(-100) + (.45)(-48) + (.20)(0) + (.08)(43) = -$24 Y ou could replicate this hedge by using the following: a) Borrow in Japan b) Convert the Y en to dollars c) Invest the dollars in the US d) Pay back the loan when you receive the Y100,000 。

国际金融与结算期末试卷(英文)

国际⾦融与结算期末试卷(英⽂)湖南涉外经济学院2015—2016学年度第⼀学期《国际⾦融与结算》课程考核试题册学院:外国语学院专业年级:2012级商英本科考核⽅式:闭卷考试时量:100分钟试卷类型: AI. Multiple choices: Choose the best answer to each question, and write your answers on your answer sheet.(本⼤题共20⼩题,每⼩题1分,共20分)1. A credit item in the balance of payments is .A.an item for which the country must be paidB.an item for which the country must payC.any imported itemD.an item that creates a monetary claim owned to a foreigner.2. In a exchange rate system there is no intervention by the government or central bankers.A.fixedB. peggedC. floatingD. managed float3. The price in the foreign exchange market is called .A.the trade surplusB. the money priceC. the exchange rateD. the currency rate4. If Canadian speculators believed the Swiss franc was going to appreciate against the U.S. dollar, theywould .A. puchase Canadian dollarsB. purchase U.S. dollarsC. purchase Swiss francsD. sell Swiss francs5. Under a system of floating exchange rates, the Swiss franc would depreciate in value if which of thefollowing occurs?A. price inflation in FranceB. an increase in U.S. real incomeC. a decrease in the Swiss money supplyD. falling interest rates in Switzerland6. is an example of foreign direct investment.A. Exporting to a countryB. Establishing licensing arrangement in a countryC. Purchasing existing companies in a countryD. Investing directly (without brokers)in foreign stocks7. The payment of a dividend by an American company to a foreign stockholder represents .A. a debit in the US capital accountB. a credit in the US capital accountC. a credit in the US current accountD. a debit in the US current account8. If American exports to Japan increase and American imports from Japan decreases, then, under afloating exchange rate system, we would expect the dollar to .A. weaken against the Japanese yenB. depreciate against the Japanese yenC. devalue against the Japanese yenD. appreciate against the Japanese yen 9. The term foreign exchange is best defined by the following statement; it is .A. the rate of exchange between two currenciesB. an instrument such as paper currency, note, and check used to make payments between countriesC. the place in which foreign currencies are exchangedD. synonymous with currency exchange10. Which of the following is likely to exist when people are willing to pay more for dollars than theofficial rate?A. gray marketB. black marketC. gold marketD. crawling peg market11. Which of the following is NOT a way for a country to defend its fixed exchange rate?A. Engage in one-way speculative bubbleB.Intervene in the foreign exchange market by buying or selling foreign currency.C.Alter domestic interest rates to influence short-term capital flows.D.Impose some form of exchange control to influence short-term capital flows.12. If the price of British pounds in terms of US dollar is $1.80 per pound, then the price of US dollar in terms of British pounds is .A. 1.8£ per dollarB. 0.555£ per dollarC. 0.90£ per dollarD. 3.6£ per dollar13. When a country’s currency appreciates, the country’s goods abroad become , and foreign goods in that country become .A. cheaper…more expensiveB. more expensive…cheaperC. cheaper…cheaperD. more expensive…more expensive14. Intervention in the foreign exchange market means the government .A. restricts individuals from buying and selling foreign exchangeB. restricts the importation of certain goodsC. or central bank buys or sells foreign exchangeD. devalues the currency in the foreign-exchange market15. A strong dollar encourages .A. travel to the United States by foreignersB. purchase of American goods by foreignersC. Americans to travel abroadD. Americans to save dollars.16. In an exchange rate, the first currency is referred to as and the second as .A. the base currency…the quote currencyB. the quote currency…the base currencyC. the base currency…the exchange currencyD. the trade currency…the base currency17. When the Japanese yen appreciates, then we might expect (everything else equal) that imports in Japan will and exports will .A. rise…fallB. rise…riseC. fall…fallD. fall…rise18. While trading in foreign exchange takes place worldwide, the major currency trading centers are located in .A. London, New York, and TokyoB. New York, Zurich, and BahrainC. Paris, Frankfurt, and LondonD. Los Angeles, New York and London19. For an investor who starts with dollars and wants to end up with dollars in the future, which of the following choices is an example of hedging?A. Sell dollars at the spot rate, invest the proceeds in foreign currency-denominated financialinstruments, and sign a forward exchange contract to buy the foreign currency.B. Sell dollars at the spot rate, invest the proceeds in foreign currency-denominated financialinstruments, and sign a forward exchange contract to buy dollars.C. Sell dollars at the spot rate, invest the proceeds in foreign currency-denominated financialinstruments, and then buy dollars at the future spot rate.D. Buy a dollar-denominated financial asset.20. is the rate a bank buys foreign currency from foreign banks or its clients.A. spot rateB. forward rateC. offer rateD. bid rateII. Decide whether each of the following statements is true or false, and write T or F on your answer sheet. (本⼤题共15⼩题,每⼩题1分,共15分)1.Arbitrage is buying a currency low and selling it high.2.As the dollar depreciates against the peso, US residents tend to import more Mexican goods and thusdemand more pesos.3.Forward exchange contracts are used for hedging but not for speculating.4.Today, no country fixed its currency to gold.5.Fixed exchange rates are likely to be changed at some point over time.6. A debit transaction leads to a payment from foreigners.7.The 3-month forward exchange rate between two currencies is the spot rate given by the bank 3months later.8.Similar to stock and commodity exchanges, the foreign exchange market is an organized structure witha central meeting palce and formal licensing requirements.9.Countries with lower inflation rates tend to see an appreication in the value of their currency.10.Every international exchange of value is entered into the balance-of-payments accounts 2 times.11.Captial and financial inflows are analogous to exports of goods and services because they result in thereceipt of funds from other nations.12.A current account deficit occurs when the sum of the credit entries exceeds the sum of the debitentries.13.Imports of goods and services create a demand for foreign currency.14.An exchange rate represents the price of a currency, which is determined by the demand for thatcurrency relative to the supply for that currency.15.Unilateral transfers include items such as government grants abroad, private remittance, and privategrants broad. III. Find the correct term for each definition.(本⼤题共10⼩题,每⼩题3分,共30分)and supply of that currency in foreign exchange market, without the intervention by governments or central bankers.2.It is the account includes all debit and credit items that are exports and imports of goods and services,income receipts and income payments, and gifts.3.This is the price agreed now for a currency exchange that will occur sometime in the future.4.It is an international reserve asset, created by the IMF in 1969 to supplement its member countries’official reserves.5.This is a systematic account of all the exchanges of value between residents of that country and the restof the world during a given time period.6.It is the act of reducing or eliminating a net asset or net liability position in the foreign currency.7.It is a system in which a country tries to keep its exchange rate fixed for long periods of time and onlychanges the pegged rate when there is a substantial disequilibrium at that rate.8.It is a party that mediates between a buyer and seller, who is paid a commission for executing customerorders.9.It is the price for immediate exchange of two currencies.10.It shows a nation’s stocks of international assets and liabilities at a moment in time.IV. Calculate the following problems according to the information.(本⼤题共4⼩题,每⼩题5分,共20分)1.Suppose the exchange rate between the Japanese yen and the US dollar is 100 yen per dollar. Howmany dollars will a Japanese stereo with a price of 60,000 yen cost?2.In the New York foreign market, the spot rate of EUR/USD is 1,8252/62, the points of 1-month EURare 30/20. What is the forward rate of EUR/USD?3.In the Hong Kong foreign market, the spot rate of USD/HKD is 7.7800~7.8000, the points of1-month USD are 30/50. What is the forward rate of USD/HKD?4.If USD1 = JPY 119.7400, USD1 = EUR 0.8943so what is the rate between JPY and EUR?V. Explain how each of the following transactions will be classified and recorded in the US balance of payments.(本⼤题共5⼩题,每⼩题3分,共15分)1. A US importer purchases a shipload of French wine.2. A Japanese automobile firm builds an assembly plant in Kentucky.3. A British manufacturer exports machinery to Japan on a US vessel.4. A US college student spends a year studying in Switzerland.5. American charities donate food to people in drought-plagued Africa.。

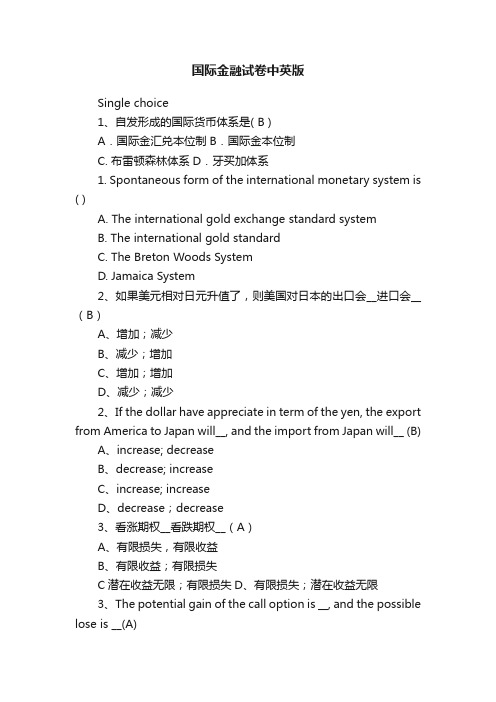

国际金融试卷中英版

国际金融试卷中英版Single choice1、自发形成的国际货币体系是( B )A.国际金汇兑本位制B.国际金本位制C. 布雷顿森林体系D.牙买加体系1. Spontaneous form of the international monetary system is ( )A. The international gold exchange standard systemB. The international gold standardC. The Breton Woods SystemD. Jamaica System2、如果美元相对日元升值了,则美国对日本的出口会__进口会__(B)A、增加;减少B、减少;增加C、增加;增加D、减少;减少2、If the dollar have appreciate in term of the yen, the export from America to Japan will__, and the import from Japan will__ (B)A、increase; decreaseB、decrease; increaseC、increase; increaseD、decrease;decrease3、看涨期权__看跌期权__(A)A、有限损失,有限收益B、有限收益;有限损失C潜在收益无限;有限损失D、有限损失;潜在收益无限3、The potential gain of the call option is __, and the possible lose is __(A)A. unlimited; limitedB. unlimited; unlimitedC. limited; unlimitedD. limited; limited4、外国投资者收购某企业股权10%以上,属于(B)A、资产组合投资B、直接投资C、间接投资D、直接投资4、Economists consider foreign acquisition of 10 percent or more of the entity’s outstanding stock as( B )A、portfolio investmentB、foreign direct investmentC、foreign indirect investmentD、International payment5、如果一国出现通货紧缩和逆差,应该采取()的财政政策和()的货币政策:CA、膨胀性;膨胀性B紧缩性;紧缩性C、膨胀性;紧缩性D;紧缩性;膨胀性5.If Deflation and adverse balance happen in one country ,what you can do is to make Fiscal Policy ( ) and Monetary Policy ( )A. Inflated; InflatedB. Deflationary; DeflationaryC. Inflated; DeflationaryD. Deflationary; Inflated6、巴塞尔协议规定银行必须符合,核心资本对风险调整资产的比率必须超过(B)A、2%B、4%C、6%D、8%6、Under the Basel capital standards, the ratio of core capital to risk-adjusted assets must exceed () percent.A、2%B、4%C、6%D、8%7.假设美国外汇市场上的即期汇率为1英镑=1.4608美元,3个月的远期外汇升水为0.51美分,则远期外汇汇率为( B )A.0.9508B.1.4557C.1.4659D.1.97087、If the spot rate in US foreign exchange market is 1£=1.4608$, and the forward premium in 3 months is 0.15 cent, the forward foreign exchange rate will be (B)A.0.9508B.1.4557C.1.4659D.1.97088、在国际资金完全不流动的浮动汇率制下,经济的自发调整过程中,(A )不发生移动A.LM曲线B.IS曲线C.CA曲线D.MM 线8.In the international capital not flow floating exchange rate system ,The process of adjusting economic spontaneously ,()don't move.A.LM CurveB.IS CurveC.CA CurveD.MM Curve9、决定投资支出变化的因素是:(C)A、名义收入B、实际收入C、利率D财政政策9、The decisive factor of investment spending is(C)A、nominal income B real income C、interest rate D、fiscal policy10.期权交易( C )A.代表金融资产的合约B.买方向卖方交付保险费的费率固定C.买方向卖方交付的保险费不能收回D.买方与卖方的损益具有对称性10、About Options Trading ,which the following is right ?( )A、The contract stand for financial assetsB. the rate of premium which buyer giving to seller is fixed.C. the premium which buyer giving to seller is unredeemable.D. the profit and loss between buyer and seller is symmetrical.PartⅡmultiple choices1、根据外汇风险的表现形式将外汇风险分为(BDE)A、汇率风险B、交易风险C、利率风险D、经济风险E、会计风险2、已过确定合理的经常账户余额的标准为(AD)A、经济理性B、顺差C、逆差 D 可持续性E国际收支平衡3、最大的三个世界金融中心是(ACD)A、伦敦B、巴黎C、纽约D、东京E香港4、估计金本位制的基本特点有(ABDE)A、各国货币以黄金为基础,保持固定比价关系B、实行自由多变的国际结算制度C、特备提款权为主要的国际储备资金D、国际收支依靠市场机制自发调节E、纸币与黄金自由兑换F、在市场机制自发作用下的国际货币制度需要国际金融组织的监管1、According to the foreign exchange risk forms of expressiondivides ,the foreign exchange risk divides into (BDE )A、exchange rate risk B. transaction risk C. interest rate riskD. economic riskE. Accounting Risks2.The standard to be sure that the Current account balance is reasonable (AD )A.economic rationalityB. favourable balanceC.adverse balanceD.SustainabilityE.balance of international payments3.The three biggest The World Financial Centers are (ACD )A.LondonB.ParisC.New YorkD.TokyoE.HongKong4、The characteristics of the Gold Standard (ABDE )A. National currency is a foundation with gold, keep fixed rate of exchangeB. carry out A free and volatile international settlement systemC. Repearing drawn right for International reservesD.The international balance of payments depending on market mechanism spontaneous regulationE.Notes and gold freely convertiblePartⅢtrue/false1、A low inflation rate tends to increase import and decrease export, thereby decreasing the current account deficit, other things equal. (F)2、在纸币制度下,黄金平价是决定汇率的基础(错)2、Under the paper money system, gold parity is the foundation of exchange rate determination (F)3、远期合约与期货合约相比涉及的面值比较小(T)3、Compared with forward contracts, futures contracts typically involve smaller currency denominations. ( T )4、如果经常账户与私人资本账户的借方与贷方的总额为正,则私人部门对外国的支付超过外国对本国的支付(F)4、If the sum of the credits and debits in the current account and the private payment capital account is positive, private payment made to foreigners exceed private payments received from foreigners. ( F )5、Future must be market-to-market. Options are not. ( T )PART ⅤInterpretation1、有效汇率1、Effective Exchange Rate有效汇率是一种以某个变量为权重计算的加权平均汇率指数,它指报告期一国货币对各个样本国货币的汇率以选定的变量为权数计算出的与基期汇率之比的加权平均汇率之和。

国际金融双语期末A卷