(仅供参考)会计专业英语名词解释

会计专业术语中英文对照(大全)

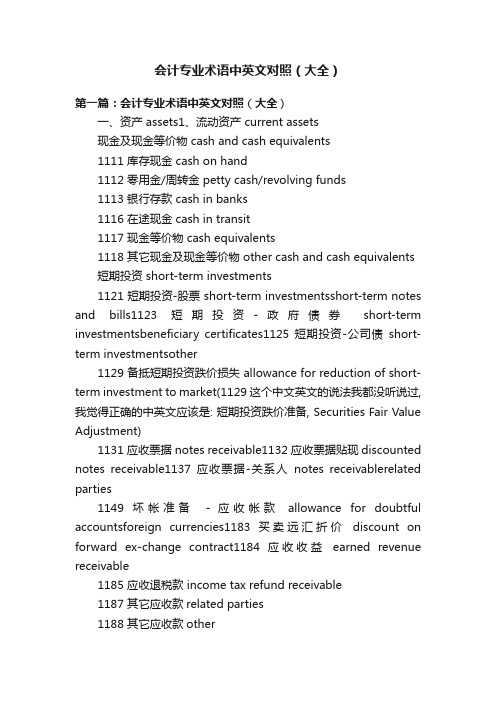

会计专业术语中英文对照(大全)第一篇:会计专业术语中英文对照(大全)一、资产 assets1、流动资产 current assets现金及现金等价物 cash and cash equivalents1111 库存现金 cash on hand1112 零用金/周转金 petty cash/revolving funds1113 银行存款 cash in banks1116 在途现金 cash in transit1117 现金等价物 cash equivalents1118 其它现金及现金等价物 other cash and cash equivalents 短期投资 short-term investments1121 短期投资-股票 short-term investmentsshort-term notes and bills1123 短期投资-政府债券short-term investmentsbeneficiary certificates1125 短期投资-公司债short-term investmentsother1129 备抵短期投资跌价损失 allowance for reduction of short-term investment to market(1129这个中文英文的说法我都没听说过,我觉得正确的中英文应该是: 短期投资跌价准备, Securities Fair Value Adjustment)1131 应收票据 notes receivable1132 应收票据贴现 discounted notes receivable1137 应收票据-关系人notes receivablerelated parties1149 坏帐准备-应收帐款allowance for doubtful accountsforeign currencies1183 买卖远汇折价discount on forward ex-change contract1184 应收收益earned revenue receivable1185 应收退税款 income tax refund receivable1187 其它应收款related parties1188 其它应收款other1189 坏帐准备other receivables121~122 存货 inventories1211 商品存货 merchandise inventory1212 寄销商品 consigned goods1213 在途商品 goods in transit1219 存货跌价准备 allowance to reduce inventory to market 1221 制成品 finished goods1222 寄销制成品 consigned finished goods1223 副产品 by-products1224 在制品 work in process1225 委外加工 work in processother2、基金及长期投资 funds and long-term investments基金 funds1311 偿债基金 redemption fund(or sinking fund)1312 改良及扩充基金 fund for improvement and expansion 1313 意外损失准备基金 contingency fund1314 退休基金 pension fund1318 其它基金 other funds长期投资 long-term investments1321 长期股权投资 long-term equity investments1322 长期债券投资 long-term bond investments1323 长期不动产投资 long-term real estate investments1324 人寿保险现金解约价值cash surrender value of life insurance1328 其它长期投资 other long-term investments 1329 备抵长期投资跌价损失 allowance for excess of cost over market value of long-term investments3、固定资产property , plant, and equipment土地 land1411 土地 land1418 土地-重估增值 landrevaluation increments1429 累积折旧-土地改良物 accumulated depreciationbuildings144~146 机(器)具及设备 machinery and equipment1441 机(器)具 machinery1448 机(器)具-重估增值 machinerymachinery151 租赁资产 leased assets1511 租赁资产 leased assets1519 累积折旧-租赁资产accumulated depreciationleasehold improvements156 未完工程及预付购置设备款construction in progress and prepayments forequipment1561 未完工程 construction in progress1562 预付购置设备款 prepayment for equipment158 杂项固定资产miscellaneous property, plant, and equipment1581 杂项固定资产miscellaneous property, plant, and equipment1588 杂项固定资产-重估增值miscellaneous property, plant, and equipmentmiscellaneous property, plant, and equipment递耗资产 depletable assets161 递耗资产 depletable assets1611 天然资源 natural resources1618 天然资源-重估增值natural resources-revaluation increments1619 累积折耗-天然资源accumulated depletionother 其它资产 other assets181 递延资产 deferred assets1811 债券发行成本 deferred bond issuance costs1812 长期预付租金 long-term prepaid rent1813 长期预付保险费 long-term prepaid insurance1814 递延所得税资产 deferred income tax assets1815 预付退休金 prepaid pension cost1818 其它递延资产 other deferred assets182 闲置资产 idle assets1821 闲置资产 idle assets184 长期应收票据及款项与催收帐款long-term notes , accounts and overdue receivables1841 长期应收票据 long-term notes receivable1842 长期应收帐款 long-term accounts receivable1843 催收帐款 overdue receivables1847 长期应收票据及款项与催收帐款-关系人 long-term notes, accounts and overdue receivables-related parties1848 其它长期应收款项 other long-term receivables1849 备抵呆帐-长期应收票据及款项与催收帐款allowance for uncollectible accountsincremental value from revaluation 1859 累积折旧-出租资产 accumulated depreciationrestricted 1888 杂项资产-其它 miscellaneous assets-other第二篇:会计专业术语中英文对照流动资产: CURRENT ASSETS:货币资金 Cash结算备付金 Provision of settlement fund拆出资金 Funds lent交易性金融资产 Financial assets held for trading应收票据 Notes receivable应收账款 Accounts receivable预付款项 Advances to suppliers应收保费 Insurance premiums receivable应收分保账款 Cession premiums receivable应收分保合同准备金 Provision of cession receivable应收利息 Interests receivable其他应收款 Other receivable买入返售金融资产 Recoursable financial assets acquired存货Inventories其中:原材料 Raw material库存商品 Stock goods一年内到期的非流动资产 Non-current assets maturing within one year其他流动资产 Other current assets流动资产合计 TOTAL CURRENT ASSETS非流动资产:NON-CURRENT ASSETS发放贷款及垫款 Loans and payments on behalf可供出售金融资产 Available-for-sale financial assets持有至到期投资 Held-to-maturity investments长期应收款 Long-term receivables长期股权投资 Long-term equity investments投资性房地产 Investment real estates固定资产原价 Fixed assets original cost减:累计折旧 Less:Accumulated depreciation固定资产净值 Fixed assets--net value减:固定资产减值准备 Less:Fixed assets impairment provision 固定资产净额 Fixed assets--net book value在建工程 Construction in progress工程物资 Construction supplies固定资产清理 Fixed assets pending disposal生产性生物资产 Bearer biological assets油气资产 Oil and natural gas assets无形资产 Intangibel assets开发支出 Research and development costs商誉 Goodwill长期待摊费用 Long-term deferred expenses递延所得税资产 Deferred tax assets其他非流动资产 Other non-current assets其中:特准储备物资Physical assets reserve specificallyauthorized非流动资产合计 TOTAL NON-CURRENT ASSETS流动负债:CURRENT LIABILITIES:短期借款 Short-term borrowings向中央银行借款 Borrowings from central bank吸收存款及同业存放 Deposits from customers and interbank 拆入资金 Deposit funds交易性金融负债 Financial assets held for liabilities应付票据 Notes payable应付账款 Accounts payable预收款项 Advances from customers卖出回购金融资产款 Funds from sales of financial assets with repurchasement agreement应付手续费及佣金Handling charges and commissions payable应付职工薪酬 Employee benefits payable其中:应付工资 Including:Accrued payroll应付福利费 Welfare benefits payable其中:职工奖励及福利基金 Including:Staff and workers' bonus and selfare应交税费 Taxes and surcharges payable其中:应交税金 Including:Taxes payable应付利息 Interests payable其他应付款 Other payables应付分保账款 Cession insurance premiums payable保险合同准备金 Provision for insurance contracts代理买卖证券款 Funds received as agent of stock exchange代理承销证券款 Funds received as stock underwrite一年内到期的非流动负债Non-current liabilities maturing within one year其他流动负债 Other current liablities流动负债合计 TOTAL CURRENT LIABILITIES:非流动负债:NON-CURRENT LIABILITIES:长期借款Long-term loans应付债券 Debentures payable长期应付款 Long-term payables专项应付款 Specific payable预计负债 Accrued liabilities递延所得税负债 Deferred tax liabilities其他非流动负债 Other non-current liablities其中:特准储备基金 Authorized reserve fund非流动负债合计 TOTAL NON-CURRENT LIABILITIES:负债合计 TOTAL LIABILITIES所有者权益(或股东权益):OWNERS'(OWNER'S)/SHAREHOLDERS' EQUITY实收资本(股本)Registered capital国家资本 National capital集体资本 Collective capital法人资本 Legal person's capital其中:国有法人资本Including:State-owned legal person's capital集体法人资本Collective legal person“s capital个人资本Personal capital外商资本 Foreign businessmen's capital减:已归还投资 Less:Returned investment实收资本(或股本)净额 Registered capital--net book value资本公积 Capital surplus减:库存股 Treasury stock专项储备 Special reserve盈余公积 Surplus reserve其中:法定公积金Including:Statutory accumulation reserve任意公积金 Discretionary accumulation储备基金 Reserved funds企业发展基金 Enterprise expension funds利润归还投资 Profits capitalised on retum of investments一般风险准备 Provision for normal risks未分配利润 Undistributed profits外币报表折算差额 Exchange differences on translating foreign operations归属于母公司所有者权益合计 Total owners' equity belongs to parent company少数股东权益 Minority interest所有者权益合计 TOTAL OWNERS' EQUITY负债及所有者权益总计 TOTAL LIABILITIES & OWNERS' EQUITY一、营业总收入 OVERALL SALES其中:营业收入 Including:Sales from operations其中:主营业务收入 Including:sales of main operations其他业务收入 Income from other operations利息收入 Interest income已赚保费 Insurance premiums earned手续费及佣金收入 Handling charges and commissions income二、营业总成本 OVERALL COSTS其中:营业成本 Including: Cost of operations其中:主营业务成本 Including:Cost of main operations其他业务成本 cost of other operations利息支出 Interest expenses手续费及佣金支出Handling charges and commissions expenses退保金 Refund of insurance premiums赔付支出净额 Net payments for insurance claims提取保险合同准备金净额 Net provision for insurance contracts 保单红利支出 Commissions on insurance policies分保费用 Cession charges营业税金及附加 Sales tax and additions销售费用 Selling and distribution expenses管理费用 General and administrative expenses其中:业务招待费 business entertainment研究与开发费research and development财务费用Financial expenses其中:利息支出 Interest expense利息收入 Interest income汇兑净损失(净收益以“-”号填列)Gain or loss on foreign exchange transactions(less exchange gain)资产减值损失 Impairment loss on assets其他other加:公允价值变动收益(损失以“-”号填列)Plus: Gain or loss from changes in fair values(loss expressed with ”-“)投资收益(损失以“-”号填列)Investment income(loss expressed with ”-“)其中:对联营企业和合营企业的投资收益 Including: Investment income from joint ventures and affiliates(loss expressed with ”-“)汇兑收益(损失以“-”号填列)Gain or loss on foreign exchange transactions s(loss expressed with ”-“)三、营业利润(亏损以“-”号填列)PROFIT FROM OPERATIONS加:营业外收入 Plus: Non-operating profit 其中:非流动资产处置利得 Gains from disposal of non-current assets非货币性资产交换利得Gains from exchange of non-monetary assets政府补助 Government grant income债务重组利得 Gains from debt restructuring减:营业外支出 Less:Non-operating expenses其中:非流动资产处置损失Including:Losses from disposal ofnon-current assets非货币性资产交换损失Losses from exchange of non-monetary assets债务重组损失 Losses from debt restructuring四、利润总额(亏损总额以“-”号填列)PROFIT BEFORE TAX(LOSS EXPRESSED WITH ”-“)减:所得税费用 Less: Income tax expenses五、净利润(净亏损以“-”号填列)NET PROFIT(LOSS EXPRESSED WITH ”-")归属于母公司所有者的净利润Net profit belonging to parent company少数股东损益 Minority interest六、每股收益: EARNINGS PER SHARE(EPS)基本每股收益 Basic EPS稀释每股收益 Diluted EPS七、其他综合收益 OTHER CONSOLIDATED INCOME八、综合收益总额 TOTAL CONSOLIDATED INCOME归属于母公司所有者的综合收益总额Consolidated income belonging to parent company归属于少数股东的综合收益总额Consolidated income belonging to Minority shareholders九、补充资料 SUPPLEMENTARY INFORMATION营业总收入中:出口产品销售收入 Including overall sales:sales income of export products营业总成本中:出口产品销售成本 Including overall costs:sales cost of export products第三篇:模具常用专业术语中英文对照塑料模具常用专业术语中英文对照模胚(架): mold base三板模(细水口):3-plate mold二板模(大水口):2-plate 定位圈(法栏)locating ring 浇口套(唧嘴)sprue bushing热流道: hot runner,hot manifold面板:cavity adaptor plate 水口板:runner stripper plate 上模板(A板):cavity plate 下模板(B板):core plate 上内模(型腔\母模\凹模):cavity insert下内模(型芯\公模\凸模):core insert 推板:stripper plate 模脚(方铁)spacer plate 顶针板:ejector retainner plate托板(顶针底板): support plat垃圾钉:stop pin撑头: support pillar底板:coreadaptor plate 推杆:push bar 顶针: ejector pin 司筒:ejector sleeve司筒针:ejector pin 回针:push bake pin 导柱:leader pin/guide pin 导套:bushing/guide bushing中托司(顶针板导套):shoulder guide bushing中托边(顶针板导柱):guide pin滑块(行位): slide 波子弹弓(定位珠):ball catch 耐磨板/油板:wedge wear 压条:plate斜导边(斜导柱):angle pin压座/铲鸡:wedge斜顶:angle from pin 斜顶杆:angle ejector rod 缩呵:movable core,return core core puller尼龙拉勾(扣机):nylonlatch lock栓打螺丝:S.H.S.B 镶针:pin喉塞: pipe plug锁模块:lock plate挡板:stop plate螺丝: screw推板:stripper plate斜顶:lifterplate塑胶管:plastic tube快速接头:jiffy quick connector plug/sockermold内模管位:core/cavity inter-lockflash(塑件)毛边电极(铜公):copper electrode五金模具常用专业术语中英文对照cutting die, blanking die冲裁模progressive die, follow(-on)die 连续模compound die复合模punched hole冲孔panel board镶块to cutedges=side cut=side scrap切边to bending折弯to pull, to stretch拉伸Line streching, line pulling线拉伸engraving, to engrave刻印 top plate上托板(顶板)top block 上垫脚punch set上模座punch pad上垫板punch holder上夹板stripper pad脱料背板up stripper上脱料板die pad下垫板die holder下夹板die set下模座bottom block下垫脚bottom plate 底板(下托板)stripping plate 脱料板(表里打)outer stripper外脱料板inner stripper内脱料板lower stripper 下脱料板上模座upper die set 成型公 form punch脱料板stripper 垫板subplate/backup plate下模座die plate垫脚parallel托板mounting plate 顶料销kick off初始管位first start pin 带肩螺丝shoulder screw两用销lifter pin弹簧护套spring cage 拔牙螺丝jack screw侧冲组件 cam sectionbites导导正装置 guide equipment 尺rail漏废料孔 slug hole限位块stop block送料板rail plate刀口trim line挡块stopper倒角chamfer入子insert 浮块lifter 销钉dowel 护套bushing压块keeper尖角sharp--angle整形公restrike forming 靠块heel 普通弹簧coil springpunch 对正块alignmentblock镶件insert止挡板stop plate闭合高度shuthight 插针pilot pin挂台head 上夹板/固定座顶杆lifter bolt扣位pocket of head导柱guide post导套guide bushing油嘴oil nipple接刀口mismatch/cookieholder/retainer下模座lower die set成刑母公formingdie码模槽mounting slot 球锁紧固定座ball-lock起吊孔handing hole垫片shim/wear-plate键槽key slot沉孔counter hole导正块thrustblock 第四篇:音乐专业术语中英文对照Accordion 手风琴Aftertouch 触后Alto 女低音Amplitude 振幅Amplitude Modulation(AM)调幅Analogue 模拟的Anticipation 先现音Arpeggio 琶音,分解和弦Attack 起音Audio 音频Augmented 增音程,增和弦Ballade 叙事曲Band 波段,大乐队Banjo 班卓琴(美国民间乐器)Bank 音色库Baritone 男中音Barline 小节线Baroque 巴罗克Bass 贝司Bassoon 大管(巴松)Brass 铜管总称Cassette 卡座Cello 大提琴Channel 音色通道Choir 人声合唱Chord 和弦Chorus 合唱效果器Clarinet 单簧管Clef 谱号Combination 组合音色Compressor 压缩效果器Concerto 协奏曲Console 调音台Contrabass 低音提琴Ctrl 控制器Cymbal 镲,钹Decay 衰减Delay 延迟效果器Digital 数码的Diminished 减音程,减和弦Distorted 失真效果器Dolby NR 杜比降噪 Dominant 属音(和弦)Dot 附点Drum 鼓Duration 音符的时值Echo 回声,反射Effector 效果器Encore 返场加演曲目English Horn 英国管Enhance 增益Envelope 包络EQ(Equalizer)均衡器Exciter 激励器External 外置的,外部设备的Fade in 淡入Fade out 淡出Fantasia 幻想曲Filter 滤波器Flange 凸缘效果器Flat 降号Flute 长笛French Horn 圆号(法国号)Frequency 频率Frequency Modulation(FM)调频Fret 吉它指板Fretless Bass 无品贝司Grace Note 装饰音Grand Piano 三角钢琴Graphic 图解式的Guitar 吉它Harmonica 口琴Harmony 和声,和声学Harp 竖琴Harpsichord 古钢琴Instrument 乐器Intermezzo 间奏曲Internal 内置的,内部的Interval 音程Inversion 转位Key 调Keyboard 键盘Leading-note 导音LFO 低频震荡器 Loop 循环反复Lyric 歌词Major 大调的March 进行曲Measure 小节Metronome 节拍器Minor 小调的Modulation 调制Mordent 波音Monitor 监听Mono 单声道Multiple 多重,多轨Mute 静音Nocturne 夜曲Normalize 最大化波形Note 音符Nylon 尼龙弦吉它Oboe 双簧管Octave 八度Opera 歌剧Orchestral 交响乐团Organ 管风琴Overdrive 过载效果器Overture 序曲Pad 铺垫和弦Pan 相位Pattern 模板Pedal 踏板Percussion 打击乐Phase 相位调整Phones 耳机Piccolo 短笛Pitch 音高Pitch Bend 音高的滑动(推弦)Pizz String 弦乐器拨弦Playback 回放Polyphony 复调,复音数Prelude 前奏曲Quantize 量化Quartet 四重奏(唱)Quintet 五重奏(唱)Realtime 实时的 Recorder 竖笛Relative key 关系调Release 释音Renaissance 文艺复兴Reverb 混响Reverse 颠倒位置Rhapsody 狂想曲Sample 采样器Sample rate 采样率Sampler 采样器Sawtooth 锯齿波Sax 萨克斯Scale 音阶Score 谱面Serenade 小夜曲Sequencer 音序器Sharp 升号Sine 正弦波Sitar 西他(印度乐器)SMPTE 音视频同步码Solo 独奏Sonata 奏鸣曲Soprano 女高音Spectrum 频谱Square 方型波Staff 五线谱Steel 钢弦吉它Stereo 立体声Strings 弦乐器Subdominant 下属音(和弦)Suspension 延留音Sustain 延音(踏板)Symphony 交响曲Synth 合成的Synthesizer 合成器Tab 吉它六线谱Tape 磁带Tempo 速度Tenor 男高音Timpani 定音鼓Tonica 主和弦Track 音轨 Transpose 移调Tremolo 颤音Trembone 长号Trio 三重奏(唱)Trumpet 小号Tuba 大号Turn 调音Velocity 触键力度Vibrato 颤音,振动Viola 中提琴Violin 小提琴Voice 声部Volume 音量Wah 哇音效果器Xylophone 木琴第五篇:物探专业术语中英文对照lunar tide太阴潮 solar tide太阳潮 turbulence湍流spectrum of turbulence湍流谱turbulent diffusion湍流扩散turbulent dissipation湍流耗散turbulent exchange湍流交换turbulent mixing湍流混合 twilight曙暮光 wind shear风切变 yield function产额函数zonal circulation纬向环流zonal wind纬向风airglow气辉MST radarMST雷达,对流层、平流层、中层大气探测雷达。

会计英语词汇英文解释.doc

会计英语词汇英文解释.doc1.Accounting(会计)The process of indentifying, recording, summarizing and reporting economic information to decision makers.2.Financial accounting(财务会计)The field of accounting that serves external decision makers, such as stockholders, suppliers, banks and government agencies.3.Management accounting(管理会计)The field of accounting that serves internal decision makers, such as top executives, department heads and people at other management levels within an organization.4.Annual report(年报)A combination of financial statements, management discussion and analysis and graphs and charts that is provided annually to investors.5.Balance sheet (statement of financial position, statement of financial condition)(资产负债表)A financial statement that shows the financial status of a business entity at a particular instant in time.6.Balance sheet equation(资产负债方程式)Assets = Liabilities + Owners' equity.7.Assets(资产)Economic resources that are expected to help generate future cash inflows or help reduce future cash outflows.8.Liabilities (负债)Economic obligations of the organization to outsiders ,or claims against its assets by outsiders.9.Owners’ equity (所有者权益)The resid ual interest in the organization’s assets afterdeducting liabilities.10.Notes payable (应付票据)Promissory notes that are evidence of a debt and state the terms of payment.11.Entity (实体)An organization or a section of an organization that stands apart from other organization and individuals as a separate economics unit.12.Transaction (交易)Any event that both affects the financial position of an entity and be reliably recorded in money terms.13.Inventory (存货)Goods held by a company for the purpose of sale to customers.14.Account (帐户)A summary record of the changes in a particular assets, liability, or owne r’ equity.15. Account payable (应付帐款)A liability that results from a purchase of goods or services on account.17.Creditor (债权人)A person or entity to whom money is owed.18.Debtor (债务人)A person or entity that owes money to another.19.Sole proprietorship (个体经营、独资经营)A separate organization with a single owner.20.Partnership (合伙)A form of organization that joins two or more individuals together as co-owners(共有人).21.Corporation (公司)A business organization that is created by individual state laws.22.Limited liability (有限责任)A feature of the corporate form of organization whereby corporate creditors ordinarily have claims against the corporate assets only.23.Publicly owned (公有)A corporation in which shares in the ownership are sold to the public.24.Privately owned (私有)A corporation owned by a family, a small group of shareholders, or a single individual, in which shares of ownership are not publicly sold.25.Stockholders’ equity (shareholders’ equi ty) (股东权益)Owners’ equity of a corporation.The excess of assets over liabilities of a corporation.26.Paid-in capital(实际投入资本)The total capital investment in a corporation by its owners both at and subsequent to the inception of business.27.Par value(票面值)The nominal dollar amount printed on stock certificates.。

会计专业英语知识点

会计专业英语知识点作为一门重要的商科专业,会计在各行各业中都扮演着重要的角色。

对于学习会计的学生来说,掌握好会计专业的英语知识点是非常必要的。

本文将介绍一些与会计专业相关的英语知识点,以帮助学生在学习和实践中更好地应用。

一、会计基础术语1. Assets(资产):在会计中,资产指的是公司拥有的具有现金价值的资源,包括现金、存货、房地产等。

2. Liabilities(负债):负债是指公司对外的债务或应付款项,在会计中包括借款、应付账款等。

3. Equity(所有者权益):也被称为净资产或股东权益,表示公司的所有者对于其资产净值的权益。

4. Revenue(收入):收入是指公司通过销售产品或提供服务而获得的资金流入。

5. Expenses(费用):费用是指公司为经营活动而发生的支出,包括租金、工资、税金等。

6. Balance Sheet(资产负债表):资产负债表是一份会计报表,以资产、负债和所有者权益的形式显示公司的财务状况。

二、会计报表1. Income Statement(利润表):利润表显示了公司在一定期间内的收入、费用和净利润。

2. Cash Flow Statement(现金流量表):现金流量表反映了公司在一定期间内现金收入、现金支出以及现金净增加额。

3. Statement of Retained Earnings(留存收益表):留存收益表展示了公司在一定期间内的净利润和分红情况。

4. Statement of Changes in Equity(权益变动表):权益变动表展示了公司在一段时间内所有者权益的变化情况,包括净利润、股东投资等。

三、审计和税务1. Audit(审计):审计是对公司财务报表和财务记录的全面审核和检查。

2. Taxation(税务):税务是指涉及支付税款和申报纳税义务的活动,包括个人所得税、企业所得税等。

3. Tax Return(纳税申报表):纳税申报表是个人或企业向税务机关报告收入和纳税情况的文件。

会计术语英汉对照

会计名词术语英汉对照(仅供参考,欢迎指正和补充)account title 会计科目,账户名称account 账户accounting circle 会计循环accounting entity assumption 会计主体假设accounting period assumption 会计分期假设accounting process 会计流程accounting report 会计报告accounts payable 应付账款accounts receivable turnover ratio 应收账款周转率accounts receivable 应收账款accrual-basis accounting 应计制会计,权责发生制会计accrued accounting 应计制会计accrued revenues 应计收入accumulated depreciation 累计折旧adjusting entries 调整分录administrative expenses 管理费用advances 预付款aging schedule 账龄分析表allowance for doubtful accounts 坏账准备allowance for returns 备抵销售退回asset 资产average collection period 平均收款期bad debts expense 坏账费用balance sheet 资产负债表bank account 银行存款bank reconciliation 银行存款余额调节bank statement 银行对账单book of original entry 原始分录簿book value 账面价值bookkeeping 簿记business document 业务凭证calendar year 日历年度carrying value 账面价值,现存价值cash (net) realizable value 可变现净值cash advance 预付现金cash count sheet 现金盘点表cash disbursement 现金支出cash discount 现金折扣cash inflows 现金流入cash outflows 现金流出cash over or shot 现金溢缺cash payments journal 现金支出分录簿cash receipt 现金收入cash receipts journal 现金收入分录簿cash refund 现金折扣cash register receipt 收款机收据(收银条)cash 现金cash-basis accounting 现金制会计,收付实现制会计cashier 收银员,出纳chart of accounts 会计科目表check register 支票登记簿check 支票claim 索取权、求偿权claimer 索取者、求偿权人classified balance sheet 分类资产负债表closing entries 结账分录closing the book 结账common stock 普通股comparability 可比性compensating balances 补偿性余额,补偿性最低存款额compound entry 复合分录conceptual framework 概念框架conservatism 稳健性consistency 一致性contra asset account 资产对销账户,资产备抵账户contra-revenue account 收入抵消账户corporation 公司correcting entries 更正分录cost of goods sold 销货成本cost principle 成本计价原则credibility 可靠性credit balance 贷方余额credit(s) 贷,贷方current assets 流动资产current liability 流动负债current ratio 流动比率current replacement cost 现行重置成本dealership 代理商debit balance 借方余额debit(s) 借,借方debt to total a ssets ratio 资产负债率debt(s) 债务decision usefulness 决策有用性deferrals 递延项目deposit slip 存款单deposit ticket 存款单deposits in transit 在途存款depreciation expense 折旧费用dishonor (note) 拒绝承兑(票据)dividend 股利double-entry system 复式记账法due date 到期due from sb. 应收某人due from sb. 应收某人earnings per share 每股盈余economic entity assumption 经济主体假设economic event 经济事项electronic funds transfer 电子资金转账ending balance 期末余额endorsement 背书enter 登记expense 费用expired cost 已耗成本factor 客账经纪商,代理商faithful representation 忠实表述,如实反映feedback value 反馈价值Financial Accounting Standards B oard (FASB) (美国)财务会计准则委员会financial statements 财务报表finished goods 产成品first-in, first-out(FIFO) 先进先出法fiscal year 会计年度,财政年度FOB destination 目的地交货FOB shipping point 寄发地交货FOB 离岸价格For Deposit Only 仅限转账freight cost 运费general journal 普通分录簿Generally Accepted Accounting S tandards (GAAP) 公认会计准则going concern assumption 持续经营假设going-concern assumption 持续经营假设grace period 宽限期gro s s profit 毛利guaranteed debt 担保债券honor (note) 承兑(票据)imprest system 定额备用金制度income from operations 营业利润income sheet 利润表income summary 损益汇总income tax 所得税intangible assets 无形资产interim period 中期International Accounting Standards Board (IASB) 国际会计准则委员会inventory count 存货盘点,盘存inventory summary sheets 库存汇总表inventory turnover 存货周转率investor 投资者journal 分录簿,日记账journalize 登分录簿,记日记账last-in, first-out(LIFO) 后进先出法lease liability 租赁负债ledger 分类账liability 负债liquidity 流动性,变现能力long-term investment 长期投资long-term liability 长期负债lower of cost or market 成本与市价孰低法market value 市场价值matching principle 匹配原则materiality 重要性merchandise inventory 库存商品miscellaneous expense 杂费monetary measurement assumption 货币计量假设monetary unit assumption 货币单位假设money down 现金,现款mortgage 抵押借款net assets 净资产net income 净收益neutral 中立性nominal account 虚账户note payable 应付票据note(s) 附注obligations 承付款项on account 赊账on demand 见票即付operating expenses 营业费用operating income 营业利润other expenses and losses 其他费用和损失other revenues and gains 其他收入和利得outstanding checks 未兑现支票owed to sb. 应付、亏欠某人paid-in capital 投入资本partnership 合伙企业,合伙制past-due 逾期,过期未付periodic inventory system 定期盘存制permanent account 永久性账户perpetual inventory system 永续盘存制petty cash fund 小额现金基金postdated check 未到期支票posting 过账predictive value 预测价值prepaid expenses 预付费用prepaid insurance 预付保险profit margin percentage 销售利润率profitability 盈利能力promissory note 本票proprietorship 独资企业,业主制purchase invoice 购货发票purchases journal 购货分录簿raw meterials 原材料real account 实账户relevance 相关性reliability 可靠性remittance advice 汇款通知restrictive endorsement 限制性背书retailer 零售商retained earnings statement 留存盈余表retained earnings 留存盈余return on assets 总资产收益率return on equity 权益收益率,净资产收益率revenue recognition principle 收入确认原则revenue 收入reversing entries 转会分录ring up 把款项(金额)记入sale on credit 赊销,信用销售sales discount 销售折扣sales journal 销货分录簿sales return and allowance 销售退回和折让sales slip 销售单scrap value 残值Securities and Exchange Commission (SEC) (美国)证券交易委员会selling expenses 销售费用service revenue 服务收入simple entry 简单分录solvency 偿债能力source document 原始凭证special journal 特种分录簿specific identification 个别认定法,个别计价法statement of cash flows 现金流量表stockholders ’equity 股东权益subsidiary ledger 明细分类账supplies (日常)用品taxes payable 应付税费temporary account 暂时性账户three-column form of account 三栏式账户time period assumption 会计分期假设treasurer 财务主管,出纳trial balance 试算平衡uncollectable(s) 坏账uncollected account expense 坏账费用unearned revenue 预收收入,未实现收入unexpired cost 未耗成本unexpired cost 未耗用成本verifiable 可核性,可验证性voucher register 付款凭单登记簿voucher system 付款凭单制度wage payable 应付职工薪酬wholesaler 批发商work in process 在产品work sheet 工作底稿working capital 营运资本working paper 工作底稿write-off 冲销。

会计名词解释大全

会计名词解释大全1. 会计 (Accounting): 记录、分析和报告财务信息的过程,用于决策、评估和监控经济实体的财务状况。

2. 会计师 (Accountant): 专门从事会计工作的人员,负责处理和管理财务数据,并生成财务报表。

3. 会计准则 (Accounting Standards): 规范会计和财务报告的准则和原则,以确保财务信息的准确、可比性和透明度。

4. 资产 (Assets): 具有经济价值的资源或财产,可带给公司未来经济利益。

5. 负债 (Liabilities): 公司所欠他人的债务或义务,需要在未来偿还或履行。

6. 所有者权益 (Owner's Equity): 公司所有者对其资产的权益,是公司净资产和所有欠他人的债务之差。

7. 收入 (Revenue): 公司在日常经营活动中产生的现金流入或收入,源于销售产品或提供服务等。

8. 成本 (Cost): 公司为生产或销售产品或服务所发生的费用,包括直接成本和间接成本。

9. 费用 (Expense): 公司在日常经营活动中发生的费用,包括人力资源、办公设备维护、运输等。

10. 现金流量 (Cash Flow): 公司在一定时间内的现金流入和流出的记录,反映公司的现金状况和运营活动。

11. 财务报表 (Financial Statements): 反映公司财务状况和经营业绩的文件,包括利润表、资产负债表和现金流量表等。

12. 利润表(Income Statement): 反映公司在一定时间内的收入、成本和利润的报表,也称为损益表或结果表。

13. 资产负债表 (Balance Sheet): 反映公司在特定日期的资产、负债和所有者权益的报表,也称为财务状况表。

14. 现金流量表 (Cash Flow Statement): 反映公司在一定时间内现金流入和流出情况的报表,用于评估公司的现金状况和运营活动。

15. 财务比率 (Financial Ratios): 使用财务数据计算的比率,用于评估公司的财务稳定性、赢利能力和运营效率等。

会计专业名词及解释50个

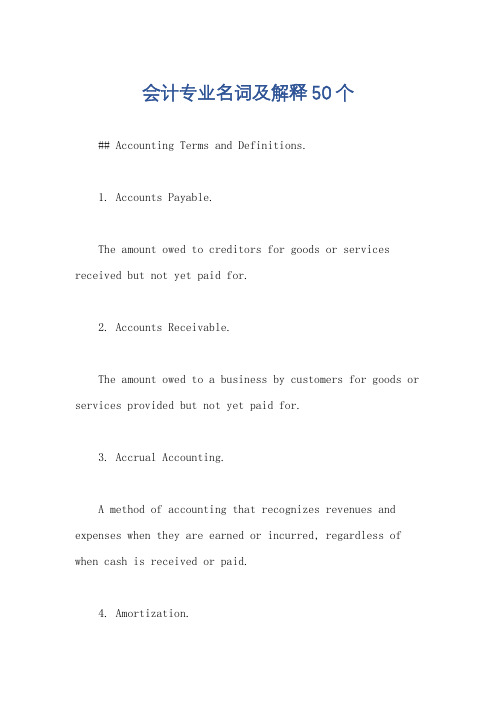

会计专业名词及解释50个## Accounting Terms and Definitions.1. Accounts Payable.The amount owed to creditors for goods or services received but not yet paid for.2. Accounts Receivable.The amount owed to a business by customers for goods or services provided but not yet paid for.3. Accrual Accounting.A method of accounting that recognizes revenues and expenses when they are earned or incurred, regardless of when cash is received or paid.4. Amortization.The process of spreading the cost of an intangible asset over its useful life.5. Assets.Anything of value that a business owns or controls.6. Audit.An independent examination of a business's financial statements to ensure their accuracy and compliance with accounting standards.7. Balance Sheet.A financial statement that shows the financial condition of a business at a specific point in time.8. Bond.A loan made by an investor to a business, typicallywith a fixed interest rate and maturity date.9. Bookkeeping.The process of recording and summarizing financial transactions.10. Capital.The amount of money invested in a business by its owners.11. Cash Flow Statement.A financial statement that shows the sources and uses of cash during a specific period of time.12. Certified Public Accountant (CPA)。

会计英语术语中英文对照

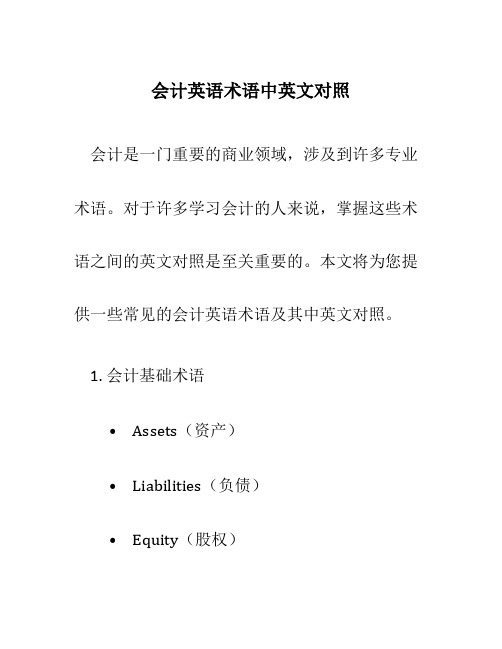

会计英语术语中英文对照会计是一门重要的商业领域,涉及到许多专业术语。

对于许多学习会计的人来说,掌握这些术语之间的英文对照是至关重要的。

本文将为您提供一些常见的会计英语术语及其中英文对照。

1. 会计基础术语•Assets(资产)•Liabilities(负债)•Equity(股权)•Revenue(收入)•Expenses(费用)•Net Income(净收入)•Gross Income(毛收入)•Profit(利润)•Loss(亏损)•Balance Sheet(资产负债表)•Income Statement(利润表)•Cash Flow Statement(现金流量表)•Statement of Retned Earnings(留存收益表)2. 资产类•Current Assets(流动资产)•Fixed Assets(固定资产)•Intangible Assets(无形资产)•Cash(现金)•Accounts Receivable(应收账款)•Inventory(库存)•Prepd Expenses(预付费用)•Property, Plant, and Equipment(房地产、厂房和设备)3. 负债类•Current Liabilities(流动负债)•Long-term Liabilities(长期负债)•Accounts Payable(应付账款)•Notes Payable(应付票据)•Accrued Expenses(应计费用)•Deferred Revenues(预收收入)•Bonds Payable(应付债券)4. 股权类•Common Stock(普通股)•Preferred Stock(优先股)•Retned Earnings(留存收益)•Dividends(股息)•Treasury Stock(库存股)5. 收入类•Sales(销售额)•Revenue(收入)•Sales Revenue(销售收入)•Service Revenue(服务收入)•Interest Revenue(利息收入)•Dividend Revenue(股息收入)6. 费用类•Cost of Goods Sold(销售成本)•Operating Expenses(营业费用)•Selling Expenses(销售费用)•General and Administrative Expenses(管理费用)•Depreciation Expenses(折旧费)•Amortization Expenses(摊销费)•Interest Expenses(利息费用)•Income Tax Expenses(所得税费用)7. 现金流量类•Operating Activities(经营活动)•Investing Activities(投资活动)•Financing Activities(融资活动)•Cash Inflows(现金流入)•Cash Outflows(现金流出)•Net Cash Flow(净现金流量)8. 财务报表•Balance Sheet(资产负债表)•Income Statement(利润表)•Cash Flow Statement(现金流量表)•Statement of Retned Earnings(留存收益表)总结以上是一些常见的会计英语术语及其中英文对照。

会计英语名词解释

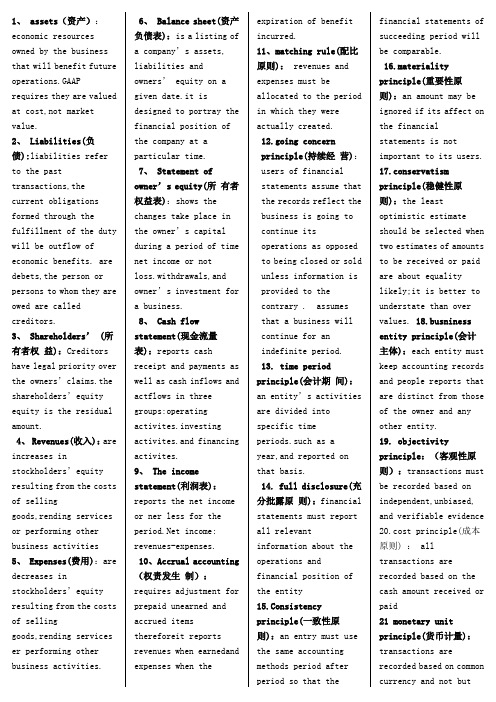

1、 assets(资产):economic resources owned by the business that will benefit future operations.GAAP requires they are valued at cost,not market value.2、 Liabilities(负债):liabilities refer to the past transactions,the current obligations formed through the fulfillment of the duty will be outflow of economic benefits. are debets,the person or persons to whom they are owed are called creditors.3、Shareholders’ (所有者权益):Creditors have legal priority over the owners’claims.the shareholders’equity equity is the residual amount.4、 Revenues(收入):are increases in stockholders’equity resulting from the costs of sellinggoods,rending services or performing other business activities 5、 Expenses(费用):are decreases in stockholders’equity resulting from the costs of sellinggoods,rending services er performing other business activities.6、 Balance sheet(资产负债表):is a listing ofa company’s assets,liabilities andowners’ equity on agiven date.it isdesigned to portray thefinancial position ofthe company at aparticular time.7、 Statement ofowner’s equity(所有者权益表):shows thechanges take place inthe owner’s capitalduring a period of timenet income or notloss.withdrawals,andowner’s investment fora business.8、 Cash flowstatement(现金流量表):reports cashreceipt and payments aswell as cash inflows andactflows in threegroups:operatingactivites.investingactivites.and financingactivites.9、 The incomestatement(利润表):reports the net incomeor ner less for the income:revenues-expenses.10、Accrual accounting(权责发生制):requires adjustment forprepaid unearned andaccrued itemsthereforeit reportsrevenues when earnedandexpenses when theexpiration of benefitincurred.11、matching rule(配比原则): revenues andexpenses must beallocated to the periodin which they wereactually created.12.going concernprinciple(持续经营):users of financialstatements assume thatthe records reflect thebusiness is going tocontinue itsoperations as opposedto being closed or soldunless information isprovided to thecontrary . assumesthat a business willcontinue for anindefinite period.13. time periodprinciple(会计期间):an entity’s activitiesare divided intospecific timeperiods.such as ayear,and reported onthat basis.14. full disclosure(充分批露原则):financialstatements must reportall relevantinformation about theoperations andfinancial position ofthe entity15.Consistencyprinciple(一致性原则):an entry must usethe same accountingmethods period afterperiod so that thefinancial statements ofsucceeding period willbe comparable.16.materialityprinciple(重要性原则):an amount may beignored if its affect onthe financialstatements is notimportant to its users.17.conservatismprinciple(稳健性原则):the leastoptimistic estimateshould be selected whentwo estimates of amountsto be received or paidare about equalitylikely;it is better tounderstate than overvalues. 18.busninessentity principle(会计主体):each entity mustkeep accounting recordsand people reports thatare distinct from thoseof the owner and anyother entity.19. objectivityprinciple:(客观性原则):transactions mustbe recorded based onindependent,unbiased,and verifiable evidence20.cost principle(成本原则) : alltransactions arerecorded based on thecash amount received orpaid21 monetary unitprinciple(货币计量):transactions arerecorded based on commoncurrency and not butadjusted for changesin value22 time periodprinciple (会计分期):an entity’sactivities are divided into specific time periods, such as a year,and reported on that basis23 revenue recognition principle(收入确认):revenue and related expenses are recorded when realizedregardless of when cash is actually paid24 balance sheet (资产负债表):the balance sheet lists all assets, liabilities, and owner’s equity as of a specific date of an business entity . the balance sheet shows that assets equal the sum of liabilities and owner’s equity.25 income statement(利润表):the income statement lists revenues and expenses and shows net income or net loss for a period of time, such as a month, or a year.26statement of owner’s equity(留存收益表):the statement of owner’s equity shows the changes take place in the owners capital during a period of time from net income or net loss, withdrawals, and owner’s investmentfor a business.27 Cash flow statement (现金流量表) the cash flow statement reports cash receipts and payments as well as cash inflows and outflows in three groups: operating activities, investing activities and financing activities.The accounting cycle1journalizetransactions2post to the ledger3 prepare trial balance4 make adjustment5prepare adjustmenttrial balance6prepare financial statements7journalize and post closing entries8 repare post-closingtrial balance。

会计专业名词英语

名词术语表Absorption costing(完全成本法):制造产品的成本报告方法,内容通常包括直接材料、直接人工和制造费用。

Accelerated depreciation method(加速折旧法):一种在资产使用的第1年产生较高的折旧费用,之后年度折旧费用逐渐下降的折旧方法。

Account(账户):用来记录财务报表项目增减变化的会计表格。

Account form(账户式):类似会计恒等式的一种资产负债表格式,它将资产项目列示在表的左边,负债和所有者权益项目列示在表的右边。

Account payable(应付账款):一项因赊购而产生的负债。

Account receivable(应收账款):采取信用方式销售产品或提供服务而应向顾客收取的款项。

Accounting(会计):一个向企业利益相关者提供有关企业经营活动和状况信息的信息系统。

Accounting cycle(会计循环):以分析经济业务并编制分录为起点,以结账后试算平衡表为终点的过程。

Accounting equation(会计恒等式):资产=负债+所有者权益。

Accounting period concept(会计期间概念):一种会计概念,它假定企业的经济寿命可以被划分为若干期间。

Accounting system(会计系统):企业为满足内部管理和外部信息使用者需要而对财务数据进行收集、分类、汇总和报告所采用的方法和程序。

Accounts payable subsidiary ledger(应付账款明细分类账):由各个供应商(债权人)的单个账户组成的分类账。

Accounts receivable subsidiary ledger(应收账款明细分类账):由各个顾客(债务人)的单个账户组成的分类账。

Accounts receivable turnover(应收账款周转率):销售净额与应收账款之间的关系。

这一比率通过销售净额除以平均应收账款净额计算而得,用以衡量年度内应收账款收回的快慢。

会计英语的名词解释

会计英语的名词解释在全球化的经济环境中,会计英语作为一种专业词汇系统成为了国际上财务人员必备的技能之一。

掌握会计英语不仅可以提高专业素养,还有助于加强与国际同行的交流。

本文将对一些常见的会计英语名词进行解释,帮助读者更好地理解与运用这些术语。

1. Assets(资产)资产是指任何有经济价值的资源,可以是现金、股票、债券、房产等,用来支持企业运营。

资产一般被分为长期资产和流动资产,前者指那些用于长期经营的资产,如土地、建筑等,后者指较流动的资产,如存货、应收账款等。

2. Liabilities(负债)负债是指企业所欠的债务或义务,包括应付账款、贷款、未付工资等。

负债按照偿还期限可以分为长期负债和流动负债,前者指一年以上需要偿还的债务,后者指一年内需要偿还的债务。

3. Equity(所有者权益)所有者权益是指企业拥有者对其资产净值的权利。

它包括股东权益和留存收益。

股东权益可以通过发行股票来获得,而留存收益是企业利润未分配的部分。

4. Revenue(收入)收入是企业在正常经营活动中产生的经济利益,如销售商品、提供服务等所获得的钱款。

收入可以分为主营业务收入和其他业务收入。

5. Expenses(费用)费用是企业为了开展正常经营活动而发生的支出,如工资、租金、采购成本等。

费用可以分为直接费用和间接费用,前者指与产品生产直接相关的费用,后者指与产品生产间接相关的费用。

6. Depreciation(折旧)折旧是指某种固定资产按照一定的标准逐年减少其价值的过程。

折旧费用会计上被逐年分摊在企业的成本中,以反映固定资产的使用寿命与价值的变化。

7. Amortization(摊销)摊销是指对某类资产进行逐年分配的过程,以反映其价值随时间的减少。

摊销一般适用于有限生命周期的资产,如专利权、版权等。

8. Audit(审计)审计是一项独立的、客观的评估,用于确定企业的财务报表是否符合会计准则和法律法规的规定。

审计旨在验证企业的财务信息的真实性与准确性。

(仅供参考)会计专业英语名词解释

会计专业英语名词解释Chapter 11. Accounting: Accounting is the process of identifying, measuring, recording, andcommunicating economic information to permit informed judgments and decisions by users of the information.2. Accrual basis accounting: Accrual basis accounting refers to an accounting methodthat records financial events based on economic activity rather than financial activity.Under accrual accounting, revenue is recorded when it is earned and realized, regardless of when actual payment is received. Similarly, expenses are matched with revenue regardless of when they are actually paid.3. Balance sheet: Balance sheet is the financial statement showing the financial positionof an entity by summarizing its assets, liabilities, and owner’s equity at one sp ecific date.4. Business entity: Business entity refers to an economic unit that controls resources,incurs obligations, and engages in business activities.5. CAS: Chinese Accounting Standards refer to the accounting concepts, measurementtechniques, and standards of presentation used in financial statements made by the PRC Financial Apartment.6. Cash basis accounting: Cash basis accounting is a method of bookkeeping thatrecords financial events based on cash flows and cash position. Revenue is recognized when cash is received and expense is recognized when cash is paid out.7. Conservatism: Conservatism states that when alternative accounting valuations areequally possible, the accountant should select the one that is least likely to overstate assets and income in the current period.8. Consistency: Consistency means that a company uses the same accountingprinciples and methods from year to year.9. Continuity: Continuity refers to an accounting assumption, also known as thegoing-concern assumption, that the company will continue to operate in the near future, unless substantial evidence to the contrary exists.10. Corporation: Corporation is a business organized as a separate legal entity understate corporation law and having ownership divided into transferable shares of stock.11. Cost principle: Cost principle is a widely used principle of accounting for assets at theiroriginal cost to the current owner.12. Financial accounting: Financial accounting refers to the development and use ofaccounting information describing the financial position of an entity and the results of its operations.13. Financial position: Financial position refers to the financial resources and obligationsof an organization, as described in a balance sheet.14. Financial reporting: Financial reporting refers to the process of periodically providing“general-purpose”financial information (such as financial statements) to persons outside the business organization.15. Financial statements: Financial statements refer to the four related accounting reportsthe summarize the current financial position of an entity and the results of its operations for the preceding year ( or other time period).16. Full disclosure principle: Full disclosure principle requires that circumstances andevents that make a difference to financial statement users be disclosed.17. Going-concern assumption: Go-concern assumption is an assumption by accountantsthat a business will operate indefinitely unless specific evidence to the contrary, such as impending bankruptcy, exists.18. Historical cost: The historical cost of an asset is the exchange price in the transactionin which the asset was acquired.19. Matching principle: Matching principle is an accounting principle that dictates thatexpenses be matched with revenue in the period in which efforts are made to generate revenue.20. Materiality: Materiality refers to the magnitude of an omission or misstatement ofaccounting information that, considering the circumstances, makes it likely that the judgment of a reasonable person relying on the information would have been influenced by the omission or misstatement.21. Market value: Market value is the estimated amount for which a property shouldexchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently, and without compulsion,22. Net realizable value: The net realizable value of an asset is the amount of cash (or theequivalent) that could be obtained on the date of the balance sheet by selling the asset in its present condition, in an orderly liquidation.23. Income statement: Income statement is a financial statement indicating theprofitability of a business over a preceding time period.24. Partnership: Partnership is a business owned by two or more persons associated aspartners.25. Present value: The present value of an asset is the net amount of discounted futurecash inflows less the discounted future cash outflows relating to the asset.26. Proprietorship: Partnership is a business owned by one person.27. Relevance: Accounting information is relevant if it can make a difference in a decisionby helping users predict the outcomes of past, present, and future events or confirm or correct prior expectations. To be relevant, accounting information should have either predictive or feedback value, or both. In addition, it should be timely,28. Reliability: Reliable information is reasonably free from error and bias, and faithfullyrepresents what it is intended to represent. That is, to be reliable, information should be verifiable, neutral, and possess representational faithfulness,29. Revenue recognition principle: An accounting principle that dictates that revenue berecognized in the accounting period in which it is earned.30. Statement of cash flow: A financial statement summarizing the cash receipts and cashpayments of the business over the same time period covered by the income statement.31. Statement of owner’s equity: A financial statement explaining certain changes in theamount of the owner’s equity (investment) in the business.1. Asset: Assets mean the entire property of a person, association, corporation, or estateapplicable or subject to the payment of debts.2. Operating cycle: The operating cycle is the time span from when cash is used toacquire goods and service and until cash is received from the sale of goods and service.3. Cash: cash refers to an exchange medium launched into circulation which is availablefor any ordinary use and can be used to purchase goods or services or repay debts.4. Cash equivalents: Cash equivalents are short-term, highly liquid investments or otherassets that readily convertible to cash and sufficiently close to their due date.5. Internal control: Internal control means all policies and procedures used to protectassets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies.Chapter 31. Receivables: Receivables refer to the monetary claims against business, individualsand other debtors.2. Accounts receivable: Accounts receivables are amounts due from customers for creditsales. This section begins by describing how accounts receivables occur. It includes receivables that occur when customers use credit cards issued by third parties and when a company gives credit directly to customers.3. Installment accounts receivables: Installment accounts receivables are amounts overan extended time period.4. Commercial discounts: Commercial discounts refer to a certain sum of moneydeducted from listed prices.5. Cash discounts: Cash discounts refer to a deduction from gross invoice price, whichare an inducement offered to the buyer to encourage the payments of goods within a specific period of time.6. The percentage-of-sale method: The percentage-of-sale method estimates somepercentage of credit sales would turn out to be uncollectible, in which the percentage of bad debts to credit sales should be properly estimated with the past experience. 7. The percentage-of-receivable method: The percentage-of-receivable methodestimates the uncollectible with a percentage of the ending balance of accounts receivables rather than credit sales.8. The aging method: The aging method analyzes the age structure of the accountbalance. In this method, an aging schedule is prepared, classifying the length of time that has passes since the sale that gave rise to them.9. The allowance method: The allowance method is the most usual way that companiesuse to record uncollectible accounts. In calculating uncollectible accounts, an account allowances for uncollectible receivable is set up.10. Promissory note: A promissory note is a written promise to pay a certain sum ofmoney on demand or at a fixed and determinable future time, generally over 30 or 60 days.1. Inventory: Inventory is the total amount if goods and/or materials contained in a storeor factory at any given.2. Product costs: Product costs are those costs that “attach”to the inventory. Suchcharges include freight charges on goods purchased, other direct costs of acquisition, and labor and other production costs incurred in processing the goods up to the time of sale.3. The perpetual inventory system: The perpetual inventory system requires thatseparate inventory ledger be maintained for each goods.4. The periodic inventory system: The periodic inventory system requires a companydetermines the quantity of inventory on hand only periodically, under which the cost of ending inventory is subtracted from the cost of goods available for sale, then the cost of goods sold are determined.5. The specific identification method: The specific identification method can be usedwhen units in the ending inventory can be identified as coming from specific purchases.6. The weighted average cost method: The weighted average cost method assumes thatthe goods available for sale have the same cost per unit. Under this method, the cost of goods available for sale is allocated on the basis of the weighted-average unit c0st.7. The first-in, first-out (FIFO) method: The first-in, first-out (FIFO) method is base on theassumption that the costs of the first items acquired should be assigned to the first item sold.Chapter 51. Accelerated depreciation: Accelerated depreciation is a method of depreciation thatcall for recognition of relatively large amounts if depreciation in the early years of an asset’s useful life and relatively small amounts in the later years.2. Depreciable value: Depreciable value is the amount of the acquisition cost to beallocated as depreciation over the total useful life of an asset. It is the difference between the total acquisition cost and the estimated residual value.3. Depreciation: Depreciation is the systematic allocation of the cost of an asset toexpress over the years of its estimated useful life.4. Fair market value: Fair market value is the value of an asset based on the price forwhich a company could sell the asset to an independent third party.5. Impairment: Impairment is a change in economic conditions which reduces theeconomic usefulness of an asset.6. Residual value: Residual value is the amount a company expects to receive fromdisposal of an asset at the end of its useful life.7. Useful life: Useful life refers to the shorter of the physical life or the economic life of anasset.1. Amortization: The systematic write-off to expense of the cost of an intangible assetover the period of its economic usefulness.2. Copyright: A grant by the state government covering the right to publish, sell, orotherwise control literary or artistic products for the life of the author plus 50 years. 3. Franchises: Agreements entered into by two parties in which, for a fee, one party (thefranchisor) gives the other party (the franchisee) rights to perform certain functions or sell certain products or services.4. Goodwill: The present value of expected future earnings of a business in excess of theearnings normally realized in the industry.5. Identifiable intangible asset: Intangibles that can be purchased or sold separately fromthe other assets of the company.6. Intangible assets: Those assets which are used in the operation of a business butwhich have no physical substance and are not current.7. Leases (or leaseholds): Intangible assets because a right to use the property is heldby the lessee.8. Patent: An exclusive right granted by the state government giving the owner control ofthe manufacturing, sale, or other use of an invention for a period of years from the date of filling.9. Research and development costs: Expenditures that may lead to patent, copy rights,new processes and new products.10. Trademarks: Distinctive identifications of a manufactured product or of a service,taking the form of a name, a sign, a slogan, a logo, or an emblem.Chapter 71. Available-for-sale securities: Securities that may be sold in the future.2. Consolidated financial statements: Financial statements that present the assets andliabilities controlled by the parent company and the aggregate profitability of the affiliated companies.3. Cost method: An accounting method in which the investment in common stock isrecorded at cost and revenue is recognized only when cash dividends are received.4. Debt investments: Investments in government and corporation bonds.5. Equity method: An accounting method in which the investment in common stock isinitially recorded at cost and the investment account is then adjusted annually to show the investor’s equity in the investee.6. Fair value: Amount for which a security could be sold in a normal market.7. Held-to-maturity securities: Debt securities that investor has the intent and ability tohold to maturity.8. Investment portfolio: A group of stocks in different corporations held for investmentpurposes.9. Long-term investments: Investments that are not readily marketable and thatmanagement does not intend to convert into cash within the next year or operating cycle, whichever is longer.10. Parent company: A company that owns more than 50% of the common stock ofanother entity.11. Short-term investments: Investments that are readily marketable and intend to convertinto cash within the next year or operating cycle, whichever is longer.12. Stock investments: Investments in the capital stock of corporations.13. Subsidiary (affiliated) company: A company in which more than 50% of its stock isowned by another company.14. Trading securities: Securities bought and held primarily for sale in the near term togenerate income on short-term price differences.Chapter 81. Amortization table: A schedule that indicates how installment payments are allocatedbetween interest expense and repayments of principal.2. Capital lease: A lease contract which, in essence, finances the eventual purchase bythe lessee of leased property. The lessor accounts for a capital lease as a sale of property; the lessee records an asset and a liability equal to the present value of the future lease payments. A capital lease is also called a financing lease.3. Commercial paper: Very short-term notes payable issued by financially strongcorporations. They are highly liquid from the investor’s point of view.4. Commitments: Contracts for the future transactions.5. Contra-liability account: A ledger account which is deducted from or offset against arelated liability account in the balance sheet; for example, Discount on Notes Payable.6. Convertible bond: One which may be changed at the option of the bondholder for aspecific number of shares of common stock.7. Deferred income taxes: Income taxes upon income which already has been reportedfor financial reporting purposes, but which will not be reported in income tax returns until future periods.8. Discount on notes payable: A contra-liability account representing any interestcharges applicable to future periods included in the face amount of a note payable.Over the life of the note, the balance of the Discount on Notes Payable account is amortized into Interest Expense.9. Deducted bond: Debenture bonds refer to an unsecured bond.10. Estimated liabilities: Liabilities which appear in financial statements at estimatedamounts.11. Long-term liabilities: Obligations that are not due for at least a year.12. Loss contingency: A possible loss, or expense, stemming from past events, that willbe resolved as to existence and amount by some future event.13. Mortgage bonds: Bonds secured by the pledge of specific assets.14. Operating lease: A lease contract which is in essence a rental agreement. The lesseehas the use of the leased property, but the lessor retains the usual risks and rewards of ownership. The periodic lease payments are accounted for as rent expense by the lessee and as rental revenue by the lessor.Chapter 91. Income: Income is defined as increases in economic benefits during the reportingperiod in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Income encompasses both revenue and gains.2. Revenue: Revenue is income that arises in the course of ordinary activities of anentity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.3. Gains: Gains represent other items that meet the definition of income and may, or maynot arise in the course of the ordinary activities of an entity.4. Accrued revenue: Accrued revenue is the revenue that has been earned but not yetcollected.5. Trade discounts: Trade discounts depend on the volume of the business or size oforder from the customer.6. Cash discounts: Cash discounts are offered to customers by some companies toencourage prompt payment of bills.7. Expenses: Expenses are outflows or using up of assets as part of operations of abusiness to generate sales.8. Employee expenses: Employee expenses are the entitlements which employeesaccumulate as a result of rendering their services to an employer.9. Depreciation (amortization): Depreciation is a periodic expense of operations and isassociated with the consumption or loss of service potential of non-current assets. 10. Bad (doubtful) debts expense: Bad debts expense is, in effect, a reduction of the“receivables” asset.11. Income taxes expense: Income taxes expense is the expense recognized in theaccounting records on an accrual basis that applies to income from continuing operations.12. Profit: Profit is the ultimate result of various operating activities of the enterprise in areporting period.13. Accounting policies: Accounting policies are the specific principles, bases,conventions, rules and practices adopted by an entity in preparing and presenting financial statements.14. Applicable profit: Applicable profit is assets that can be distributed to all kinds ofbeneficiaries.Chapter 101. Owner’s equity: Owner’s equity refers to the sources invested by owners or formed inthe course of the production and operation or other sourced shared by owners.2. Par value: The par value is an arbitrary dollar amount assigned to each share.3. Treasury stock: Treasury stock may be defined as shares of a corporation’s owncapital stock that have been issued and later reacquired by the issuing company but that have not been canceled or permanently retired.4. Capital reserve: Capital reserve refers to the capital which isn’t viewed as the paid-incapital or capital stock.5. Undistributed profit: Undistributed profit is the profit that is not distributed toshareholders but retained to the later years.Journal entries1. A company had the following transactions during January: Using the net method ofrecording purchases, prepare the journal entries to record these January transactions.Jan.2 Purchased merchandise, invoice price of $20 000, with terms 2/10, n/30.4 Received a credit memorandum for $4 000, the invoice price on merchandisereturned from the purchase of January 2.12 Purchased merchandise, invoice price of $15 000, with terms 3/15, n/30.26 Paid for the merchandise purchased on January 12.30 paid for the merchandise purchased on January 2.Answer:Jan.2 Merchandise …………………………………………………….19 600Accounts payable………………………………………………………19 6004 Accounts payable…………………………………………………3 920Merchandise………………………………………………………………3 92012 Merchandise……………………………………………………..14 550Accounts payable………………………………………………………14 55026 Accounts payable………………………………………………..14 550Cash……………………………………………………………………..14 55030 Accounts payable………………………………………………..15 680Expense (400)Cash………………………………………………………………………16 0802. The following series of transactions occurred during 2010 and 2011, when LinwoodCo. sold merchandise to John Moore. Linwood’s annual accounting period ends on December 31.10/01/2010 Sold $12 000 of merchandise to John Moore, terms 2/10, n/3011/15/2010 Moore reports that he cannot pay the account until the early next year. He agrees to exchange the account for a 120-day, 12% note receivable.12/31/2010 Prepared the adjusting journal entry to record accrued interest on the note.03/15/2011 Linwood receives a check from Moore for the maturity value (with interest) of the note.03/22/2011 Linwood receives notification that Moore’s check is being returned for nonsufficient funds (NSF).12/31/2011 Linwood writes off Moore’s account as uncollectible.Prepared Linwood Co.‘s journal entries to record the above transactions.The company uses the allowance method to account for its bad debt expenses.Answer:Oct.1, 2010 Accounts receivable—Moore……………………………..12 000Sales……………………………………………………………..12 000 Nov.15, 2010 Notes receivable……………………………………………12 000Accounts receivable—Moore........................................12 000 Dec.31,2010 Interest receivable (184)Interest revenue (184)($12 000 x 0.12 x 46/360 = $184)Mar.15, 2011 Cash…………………………………………………………..12 480Notes receivable………………………………………………...12 000Interest receivable (184)Interest earned (296)($12 000 x 0.12 x 74/360 = $296)Mar.22, 2011 Accounts receivable—Moore……………………………….12 480Cash…………………………………………………………….12 480 Dec.31, 2011 Allowance for doubtful accounts……………………………12 480Accounts receivable—Moore…………………………………12 4803. (a) A company purchased a patent on January 1, 2006, for $2 500 000. The patent’slegal life is 20 years but the company estimates that the patent’s useful life will only be5 years from the date of acquisition. On June 30, 2006, the company paid legal costsof $162 000 in successfully defending the patent in an infringement suit. Prepare the journal entry to amortize the patent at year end on December 31, 2006.(b) Suxia Company purchased a franchise from Yanyan Food Company for $400 000on January 1, 2006. The franchise is for an indefinite time period and gives Suxia Company the exclusive rights to sell Yanyan Wings in a particular territory. Prepare the journal entry to record the acquisition of the franchise and any necessary adjusting entry at year end on December 31, 2006.(c) Chenghe Company incurred research and development costs of $500 000 in 2006in developing a new product. Prepare the necessary journal entries during 2006 to record these events and any adjustments at year end on December 31, 2006.Answer:JOURNAL ENTRIES(a) December 31, 20×6Amortization Expense …………………………………………..518 000Patent………………………………………………………………… 518 000 (To record patent amortization.)$2 500 000 ÷ 5 years ……………………..$500 000$162 000 ÷ 54 months = …………………….$3 000$3 000×6……………………………………. $18 000$518 000(b) January 1, 20×6Franchise ………………………………………………………..400 000Cash………………………………………………………………. 400 000(To record acquisition of T astee Food franchise.)December 31, 20×6No amortization of the franchise is required since its life is indefinite.(c) 20×6Research and Development Expense……………………….. 500 000Cash………………………………………………………………. 500 000 (To record research and development expense for the Current year.)December 31—no entry.4. Suxia Company had the following transactions pertaining to short-term investments inequity securities.Jan.1 Purchased 900 shares of Chenghe Company stock for $9 450 cash plus brokerage fees of $ 270June.1 Received cash dividends of $0.50 per share on Chenghe Company stock.Sept.15 Sold 400 shares of Chenghe Company stock for $ 4 300 less brokerage fees of $100Dec.1 Received cash dividends of $0.50 per share on Chenghe Company stock.(a) Journalize the transactions.(b) Indicate the income statement effects of the transactions.Answer:(a) Jan. 1 Stock Investments……………………………………….. 9 720Cash..................................................................... 9 720 June 1 Cash (900 × $0.50) .. (450)Dividend Revenue (450)Sept. 15 Cash ($4 300 – $100)…………………………………. 4 200Loss on Sale of Stock Investments (120)Stock Investments (400 × ($9 720 ÷ 900)) ......................4 320 Dec. 1 Cash (500 × $0.50). (250)Dividend Revenue (250)(b) Dividend Revenue is reported under Other Revenues and Gains on theincome statement. Loss on Sale of Stock Investments is reported under Other Expenses and Losses on the income statement.5. Presented below are the three independent situations:(a) Henry Corporation purchased $ 400 000 of its bonds on June 30, 2005 at 102 andimmediately retired them. The carrying value of the bonds on the retirement date was $ 367 200. The bonds pay semiannual interest and the interest payment due on June 30, 2005 has been made and recorded.(b) Rose, Inc., purchased $600 000 of its bonds at 96 on June 30, 2005 andimmediately retired them. The carrying value of the bonds on the retirement date was $ 590 000. The bonds pay semiannual interest and the interest payment due on June 30, 2005 has been made and recorded.(c) Sealy Company has $200 000, 10%, 12-year convertible bonds outstanding.These bonds were sold at face value and pay semiannual interest on June 30 and December 31 of each year. The bonds are convertible into 80 shares of Sealy $ 5 par value common stock for each $ 1 000 par value bond. On December 31, 2005 after the bond interest has been paid, $ 50 000 par value of bonds were converted.The market value of Sealy’s common stock was $ 48 per share on December 31, 2005.Instruction: For each of the independent situations, prepare the journal entry to record the retirement or conversion of the bonds.Answer:(a) June 30 Bonds Payable……………………………………………. 400 000Loss on Bond Redemption……………………………….. 40 800Discount on Bonds Payable ………………………………………...32 800Cash …………………………………………………………………408 000($400 000 – $367 200 = $32 800)($400 000 × 102% = $408 000)(b) June 30 Bonds Payable……………………………………………. 600 000Discount on Bonds Payable………………………………………... 10 000Gain on Bond Redemption ………………………………………….14 000Cash………………………………………………………………… 576 000($600 000 – $590 000 =$10 000)($600 000 × 96% =$576 000)(c) Dec. 31 Bonds Payable………………………………………………. 50 000Common Stock…………………………………………………….. 20 000Paid-in Capital in Excess of Par …………………………………..30 000($5 × 80 × 50 =$20 000)6. Maia’s Bike Shop uses the perpetual inventory system and had the followingtransactions during the month of May:May 3 Sold merchandise to a customer on credit for $ 600, terms 2/10, n/30. The cost of the merchandise sold was $ 350.May 4 Sold merchandise to a customer for cash of $ 425. The cost of themerchandise was $ 250.May 6 Sold merchandise to a customer on credit for $ 1 300, terms 2/10, n/30. The cost of the merchandise sold was $ 750.May 8 The customer from May 3 returned merchandise with a selling price of $ 100.The cost of the merchandise returned was $ 55.May 15 The customer from May 6 paid the full amount due, less any appropriate discounts earned.May 31 The customer from May 3 paid the full amount due, less any appropriate discounts earned.Prepare the required journal entries that Maia’s Bike Shop must make to record these transactions.。

常用会计英语名词解释

1.应收账款Accounts receivable:is the revenue that has been earned but not yet collected.2.复式记账double entry accounting:double-entry accounting is a system for recording transactions based on recording increases and decreases in accounts so that debits always equal credits.3.重要性materiality:materiality refers to the magnitude of an omission or misstatement of accounting information that , considering the circumstances,makes it likely that the judgment of a reasonable person relying on the information would have influenced by the omission or misstatement.4.永续盘存制perpetual inventory system:is a system of accounting for merchandise that provides a continuous record showing the quantity and cost of all goods on hand.5.预收账款unearned revenue:some businesses collect cash from customers before earning the revenue,this creates a liability called unearned revenue.6.财务报表financial statement:Four related accounting reports that summarize the current financial position of an entity and the results of its operations for the preceding year(or other time period )7.历史成本historical cost:the historical cost of an asset is the exchange price in the transaction in which the asset was acquired.8.折旧depreciation:depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.9.应付债务accrued liabilities:the liabilities to pay an expense which has accrued during the period. also called accrued expenses.10.收入income:income is defined as increases in economic benefits during the reporting period,in the form of inflows or enhancements of assets,or decreases of liabilities that result in increases in equity,other that those relating to contributions from equity participants. Income encompasses both revenue and gains.11.资产asset:an asset is a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterpriae.12.应付账款account payable:is an unwritten promise to pay a supplier for merchandise or property purchased on credit or for service rendered.13.先进先出法FIFO :a method of computing the cost of inventory and the cost of goods sold based on the assumption that the first merchandise sold,and that the ending inventory consists of the most recently acquired goods.14.商誉goodwill:the present value of expected future earnings of a business in excess of the earnings normally realized in the industry15.历史成本原则cost principle:the widely used principle of accounting for assets at their original cost to the current owner.。

会计的英语名词解释

会计的英语名词解释在商业和财务领域中,会计是一个至关重要的职业。

会计负责记录和报告一个组织的财务信息,为决策者提供有关财务状况和业绩的准确数据。

在这个领域,有很多专业术语和名词。

本文将解释一些常见的会计英语名词。

1. Assets(资产)资产是指一个组织拥有的任何有经济价值的物品或资源。

资产可以是现金、股票、债券、不动产、机器设备等。

在会计报表中,资产被分为流动资产(比如现金和应收账款)和固定资产(比如房地产和设备)。

2. Liabilities(负债)负债是指一个组织所欠的债务或义务。

负债可以是贷款、应付账款、未结工资等。

负债分为流动负债(比如短期贷款和应付账款)和长期负债(长期贷款和债券)两种。

3. Equity(所有者权益)所有者权益是指一个组织的净资产,即资产减去负债后的余额。

所有者权益代表了组织所有者对其资本的权益。

它包括股东的股本和利润留存。

4. Revenue(收入)收入是指一个组织在特定会计期间内从经营活动中获得的货币流入。

收入可以包括销售收入、服务收入、利息收入等。

收入是一个组织盈利能力的一个重要指标。

5. Expenses(费用)费用是指一个组织在特定会计期间内为了生产和销售商品或提供服务而发生的成本。

费用包括人员薪酬、租金、采购成本、广告费用等。

费用是一个组织盈利能力的一个重要指标。

6. Depreciation(折旧)折旧是指资产在使用过程中由于年限或使用量的变化而产生的值减少。

折旧是费用,用于表示长期资产的价值损耗。

例如,一辆车的价值随着时间的推移会逐渐减少,折旧费用就被用来表示这种价值损耗。

7. Balance Sheet(资产负债表)资产负债表是一份会计报表,展示了一个组织在特定时间点的资产、负债和所有者权益的状况。

资产负债表可以帮助决策者了解组织的财务状况和偿债能力。

8. Income Statement(损益表)损益表是一份会计报表,展示了一个组织在特定会计期间内的收入、费用和净收益。

会计的30个专业术语

会计的30个专业术语会计是一个涉及复杂的领域,其中有许多专业术语需要了解和运用。

以下是30个常见的会计专业术语及其解释。

1. 资产(Assets):指企业拥有并能够支配的经济利益。

资产包括现金、应收账款、存货、固定资产等。

2. 负债(Liabilities):指企业所欠的债务或应付的款项。

负债包括应付账款、借款、未付工资等。

3. 所有者权益(Owner's Equity):指企业所有者对企业资产的权益。

所有者权益等于资产减去负债。

4. 利润(Profit):指企业在一定时期内收入超过支出的金额。

利润是企业经营活动的核心指标之一。

5. 成本(Cost):指企业购买或生产商品或服务所发生的费用。

成本包括直接成本、间接成本、固定成本和变动成本等。

6. 收入(Revenue):指企业销售商品或提供服务所获得的现金或应收账款。

收入是企业经营活动的主要来源之一。

7. 费用(Expense):指企业在生产或销售商品或提供服务过程中发生的费用。

费用包括人工费用、运输费用、管理费用等。

8. 折旧(Depreciation):指企业固定资产因使用年限和技术进步而产生的价值减少。

折旧是企业在会计上确认的费用。

9. 摊销(Amortization):指企业无形资产(如专利权、版权等)价值的减少。

摊销是企业在会计上确认的费用。

10. 应收账款(Accounts Receivable):指企业向其他单位或个人销售商品或提供服务而尚未收到的款项。

11. 应付账款(Accounts Payable):指企业购买商品或接受服务而尚未支付的款项。

12. 现金流量表(Cash Flow Statement):指企业在一定时期内现金流入和流出的情况。

现金流量表反映了企业的现金状况和经营活动的现金流量。

13. 资产负债表(Balance Sheet):指企业在一定时期结束时的资产、负债和所有者权益的情况。

资产负债表反映了企业的财务状况。

会计英语1-14章术语翻译(仅供参考,不足之处望批评指正。)

Chapter 1 Accounting会计Accounting equation会计等式Assets资产Auditors审计师Balance sheet资产负债表Bookkeeping记账Business entity assumption会计主体原则Common stock普通股Corporation公司Cost principle成本原则Equity权益Ethics伦理Events事项Expanded accounting equation扩展的会计等式Expenses费用External transactions外部交易External users外部信息使用者Financial accounting财务会计FASB美国财务会计准则委员会Full disclosure principle充分披露原则GAAP公认会计原则Going-concern assumption持续经营原则Income statement损益表Internal transactions内部交易Internal users内部信息使用者IASB国际会计准则理事会Liabilities负债Managerial accounting管理会计Matching principle配比原则Monetary unit assumption货币单位原则Net income净收益Net loss净损失Owner ,Capital所有者名下的资本Owner investment所有者投资Owner withdrawals所有者提取Partnership合伙企业Proprietorship独资企业Recordkeeping记账Revenue recognition principle收入确认原则Revenues收入Sarbanes –Oxley Act《萨班斯—奥克斯利法案》SEC证劵交易委员会Shareholders股东Shares股份Sole proprietorship个人独资企业Statement of cash flows现金流量表Statement of owner’s equity所有者权益表Stock股票Stockholders股东Time period assumption会计分期原则Withdrawals提取Chapter 2 Account账户Account balance账户余额Balance column account三栏式账户Chart of accounts会计科目表Compound journal entry复合日记账分录Credit贷方Creditors债权人Debit借方Debtors债务人Double-entry accounting复式记账法General journal普通日记账General ledger总分类账Journal日记账Journalizing 登记日记账Ledger分类账Posting过账(PR) column过账索引栏Source documents原始凭证T-account T型账户Trial balance试算平衡表Unearned revenue预收收入Chapter 3 Accounting period会计期间Accrual basis accounting权责发生制会计Accrued expenses应计费用Accrued revenues应计收入Adjusted trial balance调整后试算平衡表Adjusting entry调整分录Annual financial statements年度财务报表Book value账面价值Cash basis accounting收付实现制会计Contra account备抵账户Depreciation折旧Fiscal year会计年度Interim financial statements中期财务报表Matching principle配比原则Natural business year自然营业年度Plant assets固定资产Prepaid expenses预付费用Straight-line depreciation method直线折旧法Time period assumption会计分期原则Unadjusted trial balance调整前的试算平衡表Unearned revenues 预收收入Chapter 4 Accounting cycle会计循环Classified balance sheet分类资产负债表Closing entries结账分录Closing process结账过程Current assets流动资产Current liabilities流动负债Income summary损益汇总账户Intangible assets无形资产Long-term investments长期投资Long-term liabilities长期负债Operating cycle营业周期Permanent accounts永久性账户Post-closing trial balance结账后试算平衡表Pro forma financial statements预测财务报表Temporary accounts临时性账户Unclassified balance sheet未分类资产负债表Working papers工作底稿Work sheet工作底表Chapter 5 Cash discount现金折扣Cost of goods sold商品销售成本Credit memorandum贷记通知单Credit period 信用期Credit terms信用条件Debit memorandum借记通知单Discount period折扣期EOM月末FOB交货点General and administrative expenses一般及行政管理费用Gross margin毛利Gross profit毛利Inventory存货List price价目表价格Merchandise 商品Merchandise inventory库存商品Merchandiser商业企业Multiple-step income statement多步式损益表Periodic inventory system定期盘存制Perpetual inventory system永续盘存制Purchase discount购货折扣Retailer零售商Sales discount销售折扣Selling expenses销售费用Shrinkage损耗Single-step income statement单步式损益表Supplementary records辅助记录Trade discount商业折扣Wholesaler批发商Chapter 6 Average cost平均成本Conservatism constraint稳健性原则Consignee 收货人Consignor发货人Consistency concept一致性原则FIFO先进先出法Interim statements中期报告LIFO后进先出法LCM成本与市价孰低法Net realizable value可变现净值Specific identification个别认定法Weighted average加权平均法Chapter 7 Accounts payable ledger应付账款分类账Accounts receivable ledger应收账款分类账Cash disbursements journal现金支出日记账Cash receipts journal现金收入日记账Check register支票登记薄Columnar journal多栏式日记账Compatibility principle适应性原则Controlling account统驭账户Control principle控制原则Cost-benefit principle成本—收益原则Flexibility principle灵活性原则General journal普通日记账Internal controls内部控制Purchases journal购货日记账Relevance principle相关性原则Sales journal销售日记账Schedule of accounts payable应付账款明细表Schedule of accounts receivable应收账款明细表Special journal特种日记账Subsidiary ledger明细分类账Chapter 8 Bank reconciliation银行存款余额调节表Bank statement银行对账单Canceled checks注销支票Cash 现金Cash equivalents现金等价物Cash over and short现金溢缺Check支票Deposit ticket存款单Deposits in transit在途存款EFT电子资金转账Internal control system内部控制制度Liquid assets流动资产Liquidity偿债能力Outstanding checks未兑现支票Petty cash备用金Principles of internal control内部控制原则Sarbanes-Oxley Act《萨班斯—奥克斯利法案》Signature card印鉴卡Voucher 凭单Voucher system凭单制Chapter 9 Accounts receivable应收账款Aging of accounts receivable应收账款账龄分析Allowance for Doubtful Accounts呆帐准备金Allowance method备抵法Bad debts坏账Direct write-off method直接核销法Interest 利息Maker of the note出票人Matching principle配比原则Materiality constraint重要性约束Maturity date of a note票据到期日Payee of the note票据收款人Principal of a note票据的本金Promissory note票据Realizable value可变现价值Chapter 10 Accelerated depreciation method加速折旧法Amortization摊销Asset book value资产账面价值Betterments改良工程投资Capital expenditures资本支出Change in an accounting estimate会计估计变更Copyright版权Cost成本Declining-balance method余额递减法Depletion折耗Depreciation折旧Extraordinary repairs非常修理Franchises特许权Goodwill商誉Impairment减损Inadequacy生产能力不足Indefinite life不确定使用年限Intangible assets无形资产Land improvements土地改良物Lease租约Leasehold租赁权Leasehold improvements租赁资产改良Lessee承租人Lessor 出租人Licenses特许权Limited life有限使用年限MACRS修正后的加速成本回收制度Natural resources自然资源Obsolescence陈旧,过时Ordinary repairs日常维修Patent专利权Plant asset age固定资产寿命Plant assets固定资产Plant asset useful life固定资产使用年限Revenue expenditures收益性支出Salvage value残值Straight-line depreciation直线折旧法Trademark or trade (brand) name商标或品牌Units-of-production depreciation工作量法Useful life使用年限Chapter 11 Contingent liability或有负债Current liabilities流动负债Current portion of long-term debt一年内到期的长期负债Employee benefits员工福利Estimated liability估计负债(FICA)Taxes联邦社会保险税FUTA联邦失业税Gross pay薪资总额Known liabilities已知负债Long-term liabilities长期负债Merit rating考绩Net pay薪资净额Payroll deductions薪资扣款Short-term note payable短期应付票据SUTA州失业救济税Warranty保修Chapter 12Bond 债券Bond certificate债券证书Bond indenture债券契约Carrying (book) value of bonds债券账面价值Discount on bonds payable应付债券折旧Installment note分期付款期票Market rate市场利率Mortgage抵押权Pension plan养老金计划Premium on bonds债券溢价Par value of a bond债券面值Straight-line bond amortization债券利息直线摊销法Chapter 13(AFS) securities可供出售证劵Comprehensive income综合收益Consolidated financial statements合并财务报表Equity method权益法Equity securities with controlling influence具有控制权的权益类证劵Equity securities with significant influence具有重大影响力的权益类证劵(HTM) securities持有至到期证劵Long-term investments长期投资Parent母公司Short-term investments短期投资Subsidiary子公司Trading securities交易性证劵Unrealized gain (loss)未实现收益(损失)Chapter 14Appropriated retained earnings拨定留存收益Authorized stock核定股本Call price赎回价格Callable preferred stock可赎回优先股Capital stock股本Changes in accounting estimates会计估计变更Common stock普通股Convertible preferred stock可转换优先股Corporation股份制公司Cumulative preferred stock累积优先股Date of declaration股利宣告日Date of payment股利发放日Date of record股权登记日Discount on stock股票折旧Dividend in arrears积欠股利Financial leverage财务杠杆Large stock dividend大额股票股利Liquidating cash dividend清算性现金股利Market value per share每股市价Minimum legal capital最低法定资本Noncumulative preferred stock非累积优先股Nonparticipating preferred stock非参与式股票No-par value stock无面值股票Organization expenses组建费Paid-in capital实收资本Paid-in capital in excess of par value资本溢价Participating preferred stock参与式股票Par value面值Par value stock有面值股票Preemptive right优先认股权Preferred stock优先股Premium on stock股票溢价Prior period adjustments前期损益调整Proxy授权委托书Restricted retained earnings限定用途留存收益Retained earnings 留存收益Retained earnings deficit留存收益赤字Reverse stock split并股Small stock dividend小额股票股利Stated value stock设定价值股票Statement of stockholders’ equity股东权益表Stock dividend股票股利Stock options股票期权Stock split股票分割Stockholders’ equity股东权益Treasury stock库藏股。

会计专业英语词汇大全

一.专业术语Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。

加速折旧法主要包括余额递减折旧法declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总额折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 应付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。

在连续的会计期间周而复始的循环进行Accounting equation 会计等式:资产= 负债+ 业主权益Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额/ 应收帐款平均余额Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。

凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。

Accrued dividend 应计股利Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratioAcquisition cost 购置成本Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。

Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。

会计学专业术语英语及解释

会计学专业术语英语及解释Accounting Terminology and Definitions.The field of accounting is rich in specialized terminology, with each term carrying a precise definition and application within the discipline. Below is a compilation of key accounting terms in English, along with their explanations, to aid in understanding the language and concepts of accounting.1. Assets: Tangible or intangible items owned by a company that have economic value and are expected to provide future benefits. These can include cash, equipment, real estate, patents, and goodwill.2. Liabilities: Amounts owed by a company to others, consisting of both short-term debts (such as accounts payable) and long-term debts (like long-term loans).3. Owner's Equity: Represents the net value of acompany, calculated by subtracting liabilities from assets. It reflects the financial position of the owners or shareholders.4. Revenue: Economic inflows generated by a company's normal operating activities. This typically refers to sales or services provided.5. Expenses: Economic outflows incurred by a company during its normal operating activities, used to generate revenue or maintain operations.6. Profit: The net income of a company, calculated by subtracting expenses from revenue. It reflects the company's earning potential and financial performance.7. Accounting Subjects: Specific categories used to classify and record financial transactions. These subjects are the building blocks of financial statements and include assets, liabilities, equity, revenue, expenses, and profit.8. Accounting Books: Books or ledgers thatsystematically record and reflect a company's economic activities based on accounting vouchers. These books are crucial for tracking financial transactions and preparing financial statements.9. Management Accounting: A branch of accounting that focuses on providing financial information and insights to internal management for decision-making purposes. It involves the preparation of internal reports, budgets, and cost analysis.10. Return on Investment (ROI): A metric used to evaluate the profitability of an investment by calculating the ratio of net income to the cost of the investment.11. Statement of Financial Position: A financial statement that presents the assets, liabilities, andowner's equity of a company as of a specific date. It shows the company's financial position and the claims against it.12. Statement of Cash Flows: A financial statement that shows the cash inflows and outflows of a company over aspecific period. It provides information about the sources and uses of cash and helps investors and creditors assess a company's liquidity and solvency.13. Tax Accounting: The area of accounting that deals with the calculation, reporting, and payment of taxes. It involves complying with tax regulations and preparing tax returns.14. Accounting Equation: A fundamental principle in accounting that states that the total of all assets must equal the total of all liabilities and owner's equity. This equation represents the balance sheet of a company.15. Articulation: The process of connecting or linking different financial statements or accounting records to ensure consistency and accuracy.16. Business Entity: A separate legal and financial identity distinct from its owners. It allows for the separate identification and accounting of the assets, liabilities, and activities of the business.17. Capital Stock: The total amount of equity issued bya company to its shareholders. It represents the original investment in the company and is divided into shares.18. Corporation: A type of business organization that has a separate legal existence from its owners.Corporations are owned by shareholders and are managed by a board of directors.19. Cost Principle: An accounting principle thatrequires expenses to be recognized when they are incurred and measured at their actual cost. It ensures that expenses are accurately matched with the revenues they help generate.20. Creditor: A party that has extended credit to another party, usually in the form of a loan. Creditorshave a claim on the assets of the borrower and are entitled to repayment of the loan plus interest.The above terms provide a solid foundation for understanding the language and practices of accounting.Each term plays a crucial role in the financial reporting and decision-making processes of businesses and organizations. Mastering these terms and their definitions is essential for anyone seeking a career in accounting or finance.。

会计英语名词解释