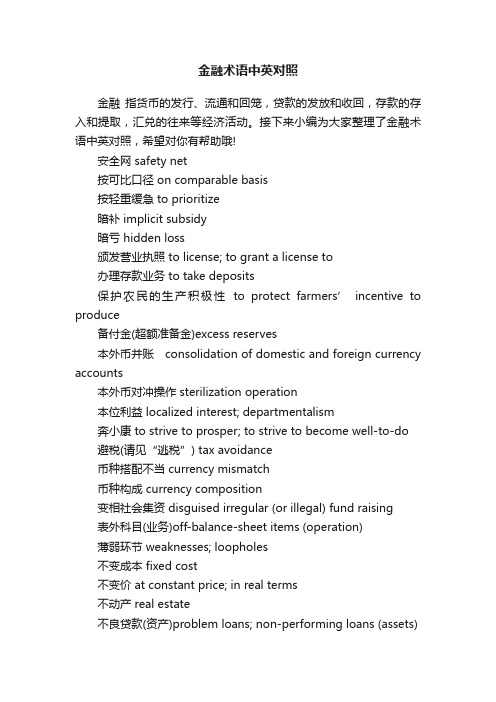

金融术语中英文对照

金融术语中英对照

金融术语中英对照金融指货币的发行、流通和回笼,贷款的发放和收回,存款的存入和提取,汇兑的往来等经济活动。

接下来小编为大家整理了金融术语中英对照,希望对你有帮助哦!安全网 safety net按可比口径 on comparable basis按轻重缓急 to prioritize暗补 implicit subsidy暗亏 hidden loss颁发营业执照 to license; to grant a license to办理存款业务 to take deposits保护农民的生产积极性to protect farmers’ incentive to produce备付金(超额准备金)excess reserves本外币并账consolidation of domestic and foreign currency accounts本外币对冲操作 sterilization operation本位利益 localized interest; departmentalism奔小康 to strive to prosper; to strive to become well-to-do 避税(请见“逃税”) tax avoidance币种搭配不当 currency mismatch币种构成 currency composition变相社会集资 disguised irregular (or illegal) fund raising表外科目(业务)off-balance-sheet items (operation)薄弱环节 weaknesses; loopholes不变成本 fixed cost不变价 at constant price; in real terms不动产 real estate不良贷款(资产)problem loans; non-performing loans (assets)从价税 ad valorem tax从紧控制 tight control存贷款比例 loan/deposit ratio存款保险体系 deposit insurance system存款货币银行 deposit money banks存款准备金 required reserves财务公司 finance companies财政赤字 fiscal deficit财政挤银行 fiscal pressure on the central bank (over monetary policy)财政政策与货币政策的配合coordination of fiscal and monetary policies采取循序渐进的方法 in a phased and sequenced manner操作弹性 operational flexibility操纵汇率 to manipulate exchange rate产品构成 product composition; product mix产品积压 stock pile; excessive inventory产销率current period inventory; (即期库存,不含前期库存)sales/output ratio产销衔接 marketability产业政策 industrial policy长期国债 treasury bonds敞口头寸 open position炒股 to speculate in the stock market承购包销 underwrite(securities)成套机电产品 complete sets of equipment; complete plant(s) 城市信用社 urban credit cooperatives (UCCs)城市合作银行urban cooperative banks; municipal united banks城市商业银行 municipal commercial banks城乡居民收入增长超过物价涨幅real growth in household income持续升温 persistent overheating重复布点 duplicate projects重置成本 replacement cost重组计划 restructuring plan筹资渠道 funding sources; financing channels初见成效 initial success出口统一管理、归口经营 canalization of exports出口退税 export tax rebate储蓄存款household deposits (不完全等同于西方的savings deposits,前者包括活期存款,后者不包括。

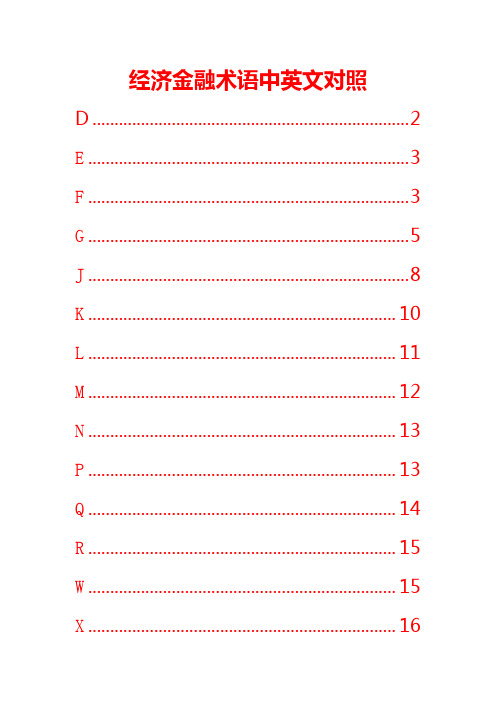

经济金融术语中英文对照

经济金融术语中英文对照D (2)E (3)F (3)G (5)J (8)K (10)L (11)M (12)N (13)P (13)Q (14)R (15)W (15)X (16)Y (18)Z (19)D打白条 issue IOU大额存单 certificate of deposit(CD)大额提现 withdraw deposits in large amounts大面积滑坡 wide-spread decline大一统的银行体制(all-in-one)mono-bank system呆账(请见“坏账”) bad loans呆账准备金 loan loss reserves(provisions)呆滞贷款 idle loans贷款沉淀 non-performing loans贷款分类 loan classification贷款限额管理 credit control;to impose credit ceiling贷款约束机制 credit disciplinary(constraint)mechanism代理国库 to act as fiscal agent代理金融机构贷款 make loans on behalf of other institutions 戴帽贷款 ear-marked loans倒逼机制 reversed transmission of the pressure for easing monetary condition道德风险 moral hazard地区差别 regional disparity第一产业 the primary industry第二产业 the secondary industry第三产业 the service industry;the tertiary industry 递延资产 deferrable assets订货不足 insufficient orders定期存款 time deposits定向募集 raising funds from targeted sources东道国(请见“母国”) host country独立核算 independent accounting短期国债 treasury bills对冲操作 sterilization operation;hedging对非金融部门债权 claims on non-financial sector多种所有制形式 diversified ownershipE恶性通货膨胀 hyperinflation二级市场 secondary marketF发行货币 to issue currency发行总股本 total stock issue法定准备金 required reserves;reserve requirement法人股 institutional shares法人股东 institutional shareholders法治 rule of law房地产投资 real estate investment放松银根 to ease monetary policy非现场稽核 off-site surveillance(or monitoring)非银行金融机构 non-bank financial institutions非赢利性机构 non-profit organizations分税制 assignment of central and local taxes;tax assignment system分业经营segregation of financial business (services);division of business scope based on the type of financial institutions风险暴露(风险敞口) risk exposure风险管理 risk management风险意识 risk awareness风险资本比例 risk-weighted capital ratios风险资本标准 risk-based capital standard服务事业收入 public service charges;user's charges扶贫 poverty alleviation负增长 negative growth复式预算制double-entry budgeting;capital and current budgetary accountG改革试点 reform experimentation杠杆率 leverage ratio杠杆收购 leveraged buyout高息集资 to raise funds by offering high interest个人股 non-institutional shares根本扭转 fundamental turnaround(or reversal)公开市场操作 open market operations公款私存 deposit public funds in personal accounts公用事业 public utilities公有经济 the state-owned sector;the public sector公有制 public ownership工业成本利润率 profit-to-cost ratio工业增加值 industrial value added供大于求 supply exceeding demand;excessive supply鼓励措施 incentives股份合作企业 joint-equity cooperative enterprises股份制企业 joint-equity enterprises股份制银行 joint-equity banks固定资产贷款 fixed asset loans关税减免 tariff reduction and exemption关税减让 tariff concessions关税优惠 tariff incentives;preferential tariff treatment规范行为 to regularize(or standardize)…behavior规模效益 economies of scale国计民生 national interest and people's livelihood国家对个人其他支出 other government outlays to individuals 国家风险 country risk国际分工 international division of labor国际收支 balance of payments国有独资商业银行 wholly state-owned commercial banks国有经济(部门) the state-owned(or public)sector国有企业 state-owned enterprises(SOEs)国有制 state-ownership国有资产流失 erosion of state assets国债回购 government securities repurchase国债一级自营商 primary underwriters of government securities 过度竞争 excessive competition过度膨胀 excessive expansionH合理预期 rational expectation核心资本 core capital合资企业 joint-venture enterprises红利 dividend宏观经济运营良好 sound macroeconomic performance宏观经济基本状况 macroeconomic fundamentals宏观调控 macroeconomic management(or adjustment)宏观调控目标 macroeconomic objectives(or targets)坏账 bad debt还本付息 debt service换汇成本unit export cost;local currency cost of export earnings汇兑在途 funds in float汇兑支出 advance payment of remittance by the beneficiary's bank汇率并轨 unification of exchange rates活期存款 demand deposits汇率失调 exchange rate misalignment混合所有制 diversified(mixed)ownership货币政策态势 monetary policy stance货款拖欠 overdue obligations to suppliers过热J基本建设投资 investment in infrastructure基本经济要素 economic fundamentals基本适度 broadly appropriate基准利率 benchmark interest rate机关团体存款 deposits of non-profit institutions机会成本 opportunity cost激励机制 incentive mechanism积压严重 heavy stockpile;excessive inventory挤提存款 run on banks挤占挪用 unwarranted diversion of(financial)resources(from designated uses)技改投资 investment in technological upgrading技术密集型产品 technology-intensive product计划单列市 municipalities with independent planning status 计划经济 planned economy集体经济 the collective sector加大结构调整力度 to intensify structural adjustment加工贸易 processing trade加快态势 accelerating trend加强税收征管稽查 to enhance tax administration加权价 weighted average price价格放开 price liberalization价格形成机制 pricing mechanism减亏 to reduce losses简化手续 to cut red tape;to simplify(streamline)procedures 交投活跃 brisk trading缴存准备金 to deposit required reserves结构扭曲 structural distortion结构失调 structural imbalance结构性矛盾突出 acute structural imbalance结构优化 structural improvement(optimization)结汇、售汇 sale and purchase of foreign exchange金融脆弱 financial fragility金融动荡 financial turbulence金融风波 financial disturbance金融恐慌 financial panic金融危机 financial crisis金融压抑 financial repression金融衍生物 financial derivatives金融诈骗 financial fraud紧缩银根 to tighten monetary policy紧缩政策 austerity policies;tight financial policies经常账户可兑换 current account convertibility经济特区 special economic zones(SEZs)经济体制改革 economic reform经济增长方式的转变 change in the main source of economic growth(from investment expansion to efficiency gains)经济增长减速 economic slowdown;moderation in economic growth 经济制裁 economic sanction经营自主权 autonomy in management景气回升 recovery in business activity境外投资 overseas investment竞争加剧 intensifying competition局部性金融风波 localized(isolated)financial disturbance 迹象 signs of overheatingK开办人民币业务 to engage in RMB business可维持(可持续)经济增长 sustainable economic growth可变成本 variable cost可自由兑换货币 freely convertible currency控制现金投放 control currency issuance扣除物价因素 in real terms;on inflation-adjusted basis库存产品 inventory跨国银行业务 cross-border banking跨年度采购 cross-year procurement会计准则 accounting standardL来料加工 processing of imported materials for export离岸银行业务 off-shore banking(business)理顺外贸体制 to rationalize foreign trade regime利率杠杆的调节作用 the role of interest rates in resource allocation利润驱动 profit-driven利息回收率 interest collection ratio联行清算 inter-bank settlement连锁企业 franchise(businesses);chain businesses良性循环 virtuous cycle两极分化growing income disparity;polarization in income distribution零售物价指数 retail price index(RPI)流动性比例 liquidity ratio流动资产周转率/流通速度 velocity of liquid assets流动资金贷款 working capital loans流通体制 distribution system流通网络 distribution network留购(租赁期满时承租人可购买租赁物) hire purchase垄断行业 monopolized industry(sector)乱集资 irregular(illegal)fund raising乱收费 irregular(illegal)charges乱摊派 unjustified(arbitrary)leviesM买方市场 buyer's market卖方市场 seller's market卖出回购证券 matched sale of repo贸易差额 trade balance民间信用 non-institutionalized credit免二减三 exemption of income tax for the first two years ofmaking profit and 50% tax reduction for thefollowing three years明补 explicit subsidy明亏 explicit loss名牌产品 brand products母国(请见“东道国”) home countryN内部控制 internal control内部审计 internal audit内地与香港 the mainland and Hong Kong内债 domestic debt扭亏为盈 to turn a loss-making enterprise into a profitable one扭曲金融分配 distorted allocation of financial resources 农副产品采购支出 outlays for agricultural procurement农村信用社 rural credit cooperatives(RCCs)P泡沫效应 bubble effect泡沫经济 bubble economy培育新的经济增长点 to tap new sources of economic growth 片面追求发展速度 excessive pursuit of growth平衡发展 balanced development瓶颈制约 bottleneck(constraints)平稳回升 steady recovery铺底流动资金 initial(start-up)working capital普遍回升 broad-based recovery配套改革 concomitant(supporting)reforms配套人民币资金 lQ企业办社会 enterprises burdened with social responsibilities 企业集团战略 corporate group strategy企业兼并重组 company merger and restructuring企业领导班子 enterprise management企业所得税 enterprise(corporate)income tax企业效益 corporate profitability企业资金违规流入股市 irregular flow of enterprise funds into the stock market欠税 tax arrears欠息 overdue interest强化税收征管 to strengthen tax administration强制措施 enforcement action翘尾因素 carryover effect切一刀 partial application清理收回贷款 clean up and recover loans(破产)清算 liquidation倾斜政策 preferential policy区别对待 differential treatment趋势加强 intensifying trend全球化 globalization权益回报率 returns on equity(ROE)缺乏后劲 unsustainable momentumR绕规模贷款 to circumvent credit ceiling人均国内生产总值 per capita GDP人均收入 per capita income人民币升值压力 upward pressure on the Renminbi(exchange rate)认缴资本 subscribed capital软贷款 soft loans软预算约束 soft budget constraint软着陆 soft landingocal currency funding of…W外部审计 external audit外国直接投资 foreign direct investment (FDI)外汇储备 foreign exchange reserves外汇调剂 foreign exchange swap外汇占款 the RMB counterpart of foreign exchange reserves;the RMB equivalent of offcial foreign exchange holdings外向型经济 export-oriented economy外债 external debt外资企业 foreign-funded enterprises完善现代企业制度 to improve the modern enterprise system 完税凭证 tax payment documentation违法经营 illegal business委托存款 entrusted deposits稳步增长 steady growth稳健的银行系统 a sound banking system稳中求进 to make progress while ensuring stability无纸交易 book-entry(or paperless/scriptless)transaction 物价监测 price monitoringX吸纳流动性 to absorb liquidity稀缺经济 scarcity economy洗钱 money laundering系统内调度 fund allocation within a bank系统性金融危机 systemic financial crisis下岗工人 laid-off employees下游企业 down-stream enterprises现场稽核 on-site examination现金滞留(居民手中) cash held outside the banking system 乡镇企业 township and village enterprises(TVEs)消费物价指数 consumer price index(CPI)消费税 excise(consumption)tax消灭财政赤字to balance the budget;to eliminate fiscal deficit销货款回笼 reflow of corporate sales income to the banking system销售平淡 lackluster sales协议外资金额 committed amount of foreign investment新经济增长点 new sources of economic growth新开工项目 new projects;newly started projects新增贷款 incremental credit; loan increment; credit growth; credit expansion新增就业位置 new jobs;new job opportunities信贷规模考核 review the compliance with credit ceilings信号失真 distorted signals信托投资公司 trust and investment companies信息不对称 information asymmetry信息反馈 feedback(information)信息共享系统 information sharing system信息披露 information disclosure信用扩张 credir expansion信用评级 credit rating姓“资”还是姓“社”pertaining to socialism or capitalism;socialist orcaptialist行政措施 administrative measures需求膨胀 demand expansion; excessive demand虚伪存款 window-dressing deposits削减冗员 to shed excess labor force寻租 rent seeking迅速反弹 quick reboundY养老基金 pension fund一刀切universal application;non-discretionary implementation一级市场 primary market应收未收利息 overdue interest银行网点 banking outlets赢利能力 profitability营业税 business tax硬贷款(商业贷款) commercial loans用地审批 to grant land use right有管理的浮动汇率 managed floating exchange rate证券投资 portfolio investment游资(热钱) hot money有市场的产品 marketable products有效供给 effective supply诱发新一轮经济扩张 trigger a new round of economic expansion 逾期贷款 overdue loans;past-due loans与国际惯例接轨to become compatible with internationally accepted与国际市场接轨 to integrate with the world market预算外支出(收入) off-budget (extra-budgetary) expenditure (revenue)预调 pre-emptive adjustment月环比 on a month-on-month basis; on a monthly basisZ再贷款 central bank lending在国际金融机构储备头寸 reserve position in international financial institutions在人行存款 deposits at (with) the central bank在途资金 fund in float增加农业投入 to increase investment in agriculture增势减缓 deceleration of growth;moderation of growthmomentum增收节支措施revenue-enhancing and expenditure control measures增长平稳 steady growth增值税 value-added tax(VAT)涨幅偏高 higher-than-desirable growth rate;excessive growth 账外账 concealed accounts折旧 depreciation整顿 retrenchment;consolidation政策工具 policy instrument政策性业务 policy-related operations政策性银行 policy banks政策组合 policy mix政府干预 government intervention证券交易清算 settlement of securities transactions证券业务占款 funding of securities purchase支付困难 payment difficulty支付能力 payment capacity直接调控方式向 to increase the reliance on indirect policy instruments间接调控方式转变职能转换 transformation of functions职业道德 professional ethics指令性措施 mandatory measures指令性计划 mandatory plan;administered plan制定和实施货币政策 to conduct monetary policy;to formulate and implement monetary policy滞后影响 lagged effect中介机构 intermediaries中央与地方财政 delineation of fiscal responsibilities分灶吃饭重点建设 key construction projects;key investment project周期谷底 bottom(trough)of business cycle周转速度 velocity主办银行 main bank主权风险 sovereign risk注册资本 registered capital逐步到位 to phase in;phased implementation逐步取消 to phase out抓大放小 to seize the big and free the small(to maintain close oversight on the large state-ownedenterprises and subject smaller ones to market competition)专款专用 use of funds as ear-marked转贷 on-lending转轨经济 transition economy转机 turnaround转折关头 turning point准财政赤字 quasi-fiscal deficit准货币 quasi-money资本不足 under-capitalized资本充足率 capital adequacy ratio资本利润率 return on capital资本账户可兑换 capital account convertibility资不抵债 insolvent;insolvency资产负债表 balance sheet资产负债率liability/asset ratio;ratio of liabilities to assets资产集中 asset concentration资产贡献率 asset contribution factor资产利润率 return on assets (ROA)资产质量 asset quality资产组合 asset portfolio资金成本 cost of funding;cost of capital;financing cost资金到位 fully funded (project)资金宽裕 to have sufficient funds资金利用率 fund utilization rate资金缺口 financing gap资金体外循环 financial disintermediation资金占压 funds tied up自筹投资项目 self-financed projects自有资金 equity fund综合国力 overall national strength(often measured by GDP)综合效益指标 overall efficiency indicator综合治理 comprehensive adjustment(retrenchment);over-haul 总成交额 total contract value总交易量 total amount of transactions总成本 total cost最后贷款人 lender of last resort。

常见金融术语英汉对照与详解

�

)本成有持( yrraC-fo-tsoC )数因换转( rotcaF noisrevnoC )算清额净同合( gnitteN lautcartnoC )士瑞所交期洲欧( serutuF FNOC )易交续连( gnidarT suounitnoC )小大约合( eziS tcartnoC

)问顾易交品商( rosivdA gnidarT ytidommoC

�

)扣折( gnitnuocsiD

)�行央国德�行银邦联志意德( knabsednuB ehcstueD

)格价算结日( ecirP tnemeltteS yliaD )算结日每( tnemeltteS yliaD

)金证保通流的前目( nigraM gnitadiuqiL tnerruC )求请叉交( tseuqeR ssorC )型模坦斯宾鲁-斯罗-斯克考( ledoM nietsnibuR-ssoR-xoC )权期购认兑备( llaC derevoC )方手对( ytrapretnuoC )度曲凸( ytixevnoC )换转( noisrevnoC )票息( nopuoC )险避叉交( egdeH ssorC )易交叉交( edarT ssorC

)约合月即( tcartnoC tnorF

)场市部内围范大( tekraM edisnI dednetxE )位仓行执( noitisoP desicrexE )权期行执( noitpO desicrexE )行执( esicrexE )除排( noisulcxE )认确行执( noitamrifnoC noitucexE )格价行执( ecirP desicrexE )期到( noitaripxE

)权期内价( noitpO yenom-eht-nI )码编别识券证际国( rebmuN noitacifitnedI seitiruceS lanoitanretnI )差价品产跨( daerpS tcudorp-retnI )品产间区( tcudorP lavretnI

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

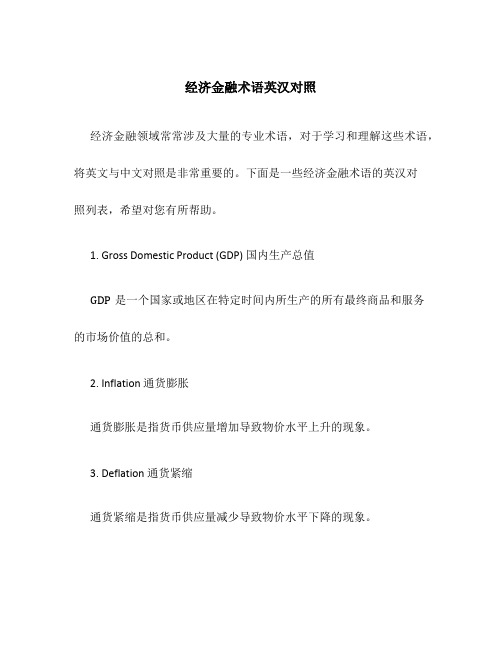

经济金融术语英汉对照

经济金融术语英汉对照经济金融领域常常涉及大量的专业术语,对于学习和理解这些术语,将英文与中文对照是非常重要的。

下面是一些经济金融术语的英汉对照列表,希望对您有所帮助。

1. Gross Domestic Product (GDP) 国内生产总值GDP是一个国家或地区在特定时间内所生产的所有最终商品和服务的市场价值的总和。

2. Inflation 通货膨胀通货膨胀是指货币供应量增加导致物价水平上升的现象。

3. Deflation 通货紧缩通货紧缩是指货币供应量减少导致物价水平下降的现象。

4. Interest Rate 利率利率是指借贷资金所产生的利息与本金之间的比率。

5. Exchange Rate 汇率汇率是指一种货币与另一种货币之间的兑换比率。

6. Stock Market 股票市场股票市场是指买卖股票的场所,也是企业融资的重要途径。

7. Bond 债券债券是一种证券,表示借款人向债权人承诺在一定期限内支付利息和本金。

8. Foreign Direct Investment (FDI) 外商直接投资外商直接投资是指一个国家的企业在另一个国家的企业中进行的长期投资。

9. Taxation 税收税收是政府从个人和企业获得财政收入的一种方式。

10. Budget Deficit 预算赤字预算赤字是指政府支出超过收入的情况,需要通过借贷或印钞等方式来弥补。

11. Trade Surplus/Trade Deficit 贸易顺差/贸易逆差贸易顺差指一个国家的出口额大于进口额,贸易逆差则相反。

12. Monetary Policy 货币政策货币政策是由中央银行制定和执行的调控货币供应量和利率水平的政策。

13. Fiscal Policy 财政政策财政政策是由政府制定和执行的调控财政支出和税收的政策。

14. Central Bank 央行央行是一个国家的货币发行和货币政策的实施机构。

15. Market Economy 市场经济市场经济是一种以市场配置资源和决定价格的经济体制。

常用金融术语中英对照

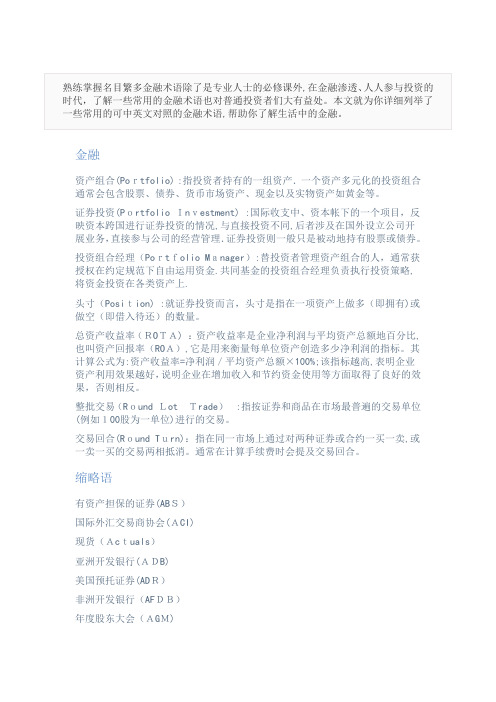

熟练掌握名目繁多金融术语除了是专业人士的必修课外,在金融渗透、人人参与投资的时代,了解一些常用的金融术语也对普通投资者们大有益处。

本文就为你详细列举了一些常用的可中英文对照的金融术语,帮助你了解生活中的金融。

金融资产组合(Portfolio) :指投资者持有的一组资产。

一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等。

证券投资(Portfolio Investment) :国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理。

证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金。

共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上。

头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标。

其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round Lot Trade) :指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(Repo Rate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

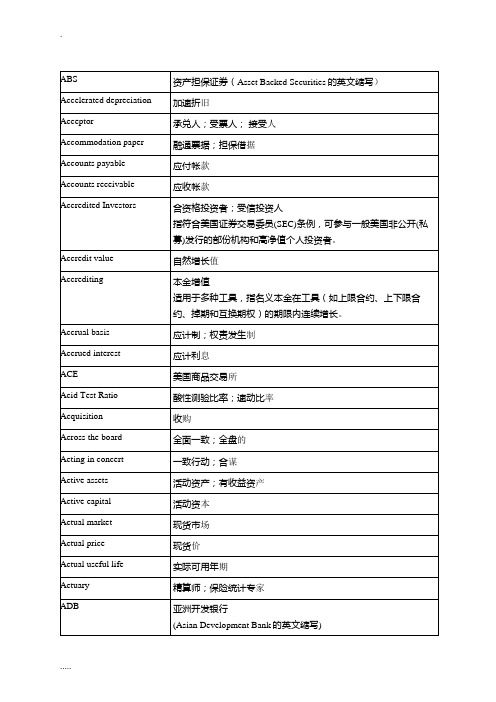

金融术语中英文对照

Back-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balance sheet date 年结日Balloon maturity 到期大额偿还Balloon payment 期末大额偿还Bank, Banker, Banking 银行;银行家;银行业Bank for国际结算银行International Settlements(BIS)Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis Point (BP) 基点;点子一个基点等如一个百分点(%)的百分之一。

举例:25个基点=0.25%Basis swap 基准掉期Basket of currencies 一揽子货币Basket warrant 一揽子备兑证Bear market 熊市;股市行情看淡Bear position 空仓;空头Bear raid 疯狂抛售Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Benchmark mortgage pool 按揭贷款基准组合Beneficiary 受益人Bermudan option 百慕大期权百慕大期权介乎美式与欧式之间,持有人有权在到期日前的一个或多个日期执行期权。

Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买入的一个价格。

常用金融术语(中英对照)

金融资产组合(Portfolio) :指投资者持有的一组资产.一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等。

证券投资(Portfolio Investment) :国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理.证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金.共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上.头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标。

其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round LotTrade):指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(RepoRate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

常见金融术语英汉对照与详解

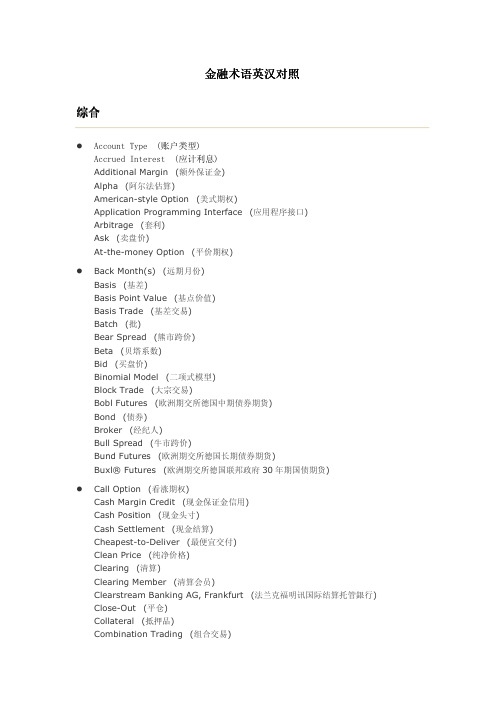

综合

� Account Type (账户类型) Accrued Interest (应计利息) Additional Margin (额外保证金) Alpha (阿尔法估算) American-style Option (美式期权) Application Programming Interface (应用程序接口) Arbitrage (套利) Ask (卖盘价) At-the-money Option (平价期权)

� Raw Data (原始数据) Reference Price (参考价格) Release (版本) Release Method (释放方法) Relevant Trades (相关交易) Remaining Lifetime (距离到期时间) Repurchase Transaction ("Repo") (回购交易)

� Omega (欧米加值) Opening (开盘) Opening Interest (未平仓量) Opening of a Position (开仓) Optimization (最优化) Option (期权) Option Premium (期权金) Option Price (期权价格) Option Pricing Model (OPM) (期权定价模式) Option Seller (期权卖出者) Order (指令) Order Book (指令簿) Order Type (指令类型) OTC Trades (Over-the-Counter Trades) (场外交易) Out-of-the-money Option (价外期权) Overdue Trade-Fail (延期交易未能履约)

� Back Month(s) (远期月份) Basis (基差) Basis Point Value (基点价值) Basis Trade (基差交易) Batch (批) Bear Spread (熊市跨价) Beta (贝塔系数) Bid (买盘价) Binomial Model (二项式模型) Block Trade (大宗交易) Bobl Futures (欧洲期交所德国中期债券期货) Bond (债券) Broker (经纪人) Bull Spread (牛市跨价) Bund Futures (欧洲期交所德国长期债券期货) Buxl® Futures (欧洲期交所德国联邦政府 30 年期国债期货)

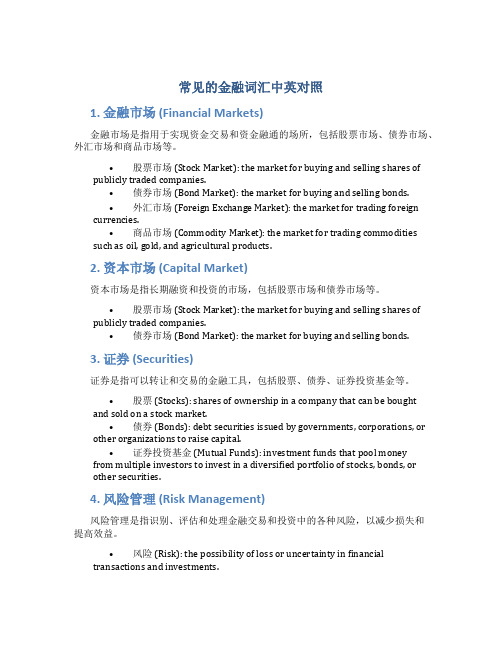

常见的金融词汇中英对照

常见的金融词汇中英对照1. 金融市场 (Financial Markets)金融市场是指用于实现资金交易和资金融通的场所,包括股票市场、债券市场、外汇市场和商品市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.•外汇市场 (Foreign Exchange Market): the market for trading foreign currencies.•商品市场 (Commodity Market): the market for trading commodities such as oil, gold, and agricultural products.2. 资本市场 (Capital Market)资本市场是指长期融资和投资的市场,包括股票市场和债券市场等。

•股票市场 (Stock Market): the market for buying and selling shares of publicly traded companies.•债券市场 (Bond Market): the market for buying and selling bonds.3. 证券 (Securities)证券是指可以转让和交易的金融工具,包括股票、债券、证券投资基金等。

•股票 (Stocks): shares of ownership in a company that can be bought and sold on a stock market.•债券 (Bonds): debt securities issued by governments, corporations, or other organizations to raise capital.•证券投资基金 (Mutual Funds): investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, orother securities.4. 风险管理 (Risk Management)风险管理是指识别、评估和处理金融交易和投资中的各种风险,以减少损失和提高效益。

常用金融术语中英对照

熟练掌握名目繁多金融术语除了是专业人士的必修课外,在金融渗透、人人参与投资的时代,了解一些常用的金融术语也对普通投资者们大有益处。

本文就为你详细列举了一些常用的可中英文对照的金融术语,帮助你了解生活中的金融。

金融资产组合(Portfolio) :指投资者持有的一组资产。

一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等。

证券投资(Portfolio Investment) :国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理。

证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金。

共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上。

头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标。

其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round Lot Trade) :指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(Repo Rate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

实用文档之金融术语中英文对照

Back-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balance sheet date 年结日Balloon maturity 到期大额偿还Balloon payment 期末大额偿还Bank, Banker, Banking 银行;银行家;银行业Bank for国际结算银行International Settlements(BIS)Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis Point (BP) 基点;点子一个基点等如一个百分点(%)的百分之一。

举例:25个基点=0.25%Basis swap 基准掉期Basket of currencies 一揽子货币Basket warrant 一揽子备兑证Bear market 熊市;股市行情看淡Bear position 空仓;空头Bear raid 疯狂抛售Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Benchmark mortgage pool 按揭贷款基准组合Beneficiary 受益人Bermudan option 百慕大期权百慕大期权介乎美式与欧式之间,持有人有权在到期日前的一个或多个日期执行期权。

Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买入的一个价格。

金融行业中英文词汇对照汇总

金融行业中英文词汇对照汇总在金融行业中,掌握和了解中英文词汇的对照非常重要。

本文将汇总一些常见的金融行业词汇,以便读者可以更好地理解和运用这些术语。

1. 金融市场•Financial Market(金融市场)•Stock Market(股票市场)•Bond Market(债券市场)•Foreign Exchange Market(外汇市场)•Commodity Market(商品市场)•Derivatives Market(衍生品市场)2. 金融产品•Stocks(股票)•Bonds(债券)•Mutual Funds(共同基金)•ETFs (Exchange-Traded Funds)(交易所交易基金)•Options(期权)•Futures(期货)•Swaps(掉期协议)•Currencies(货币)•Commodities(商品)3. 金融机构•Bank(银行)•Commercial Bank(商业银行)•Investment Bank(投资银行)•Central Bank(中央银行)•Insurance Company(保险公司)•Brokerage Firm(经纪公司)•Asset Management Company(资产管理公司)4. 财务指标•Net Income(净利润)•Revenue(营业收入)•Expenses(费用)•Assets(资产)•Liabilities(负债)•Equity(股东权益)•Return on Investment(投资回报率)•Profit Margin(利润率)•Cash Flow(现金流)•Earnings per Share(每股收益)5. 金融服务•Banking Services(银行服务)•Investment Services(投资服务)•Insurance Services(保险服务)•Financial Planning(财务规划)•Wealth Management(财富管理)•Risk Management(风险管理)•Retirement Planning(退休规划)•Tax Services(税务服务)6. 金融专业名词•Economics(经济学)•Finance(金融学)•Accounting(会计学)•Portfolio Management(投资组合管理)•Asset Allocation(资产配置)•Risk Assessment(风险评估)•Hedge Fund(对冲基金)•Interest Rate(利率)•Inflation(通胀)•Capital(资本)7. 国际金融相关词汇•International Monetary Fund(国际货币基金组织)•World Bank(世界银行)•Export(出口)•Import(进口)•Balance of Trade(贸易差额)•Foreign Direct Investment(外国直接投资)•Exchange Rate(汇率)•Trade Surplus(贸易顺差)•Trade Deficit(贸易逆差)•Sovereign Debt(主权债务)以上仅为一些常见的金融行业中英文词汇对照,读者可以根据需要进一步扩充和学习。

金融术语中英对照(附中文释义)

金融术语中英对照(附中文释义)American Style Option:美式选择权自选择权契约成立之日起,至到期日之前,买方可以在此期间以事先约定的价格,随时要求选择权的卖方履行契约。

亦即,要求选择权的卖方依契约条件买入或卖出交易标的物。

Appreciation: 升值在外汇市场中,升值使指一个货币相对于另一个货币的价值增加。

Arbitrage: 套利在金融市场从事交易时,利用市场的失衡状况来进行交易,以获取利润的操作方式。

其主要操作方法有两种:一为利用同一产品,在不同市场的价格差异;一为利用在同一市场中各种产品的价格差异来操作。

不论是采用何种方法来进行套利交易,其产品或市场的风险程度必须是相等的。

Asset Allocation: 资产分配原则基于风险分散原则,资金经理在评估其资金需求,经营绩效与风险程度之后,将所持有的资产分散投资于各类型的金融产品中。

如股票、外汇、债券、贵金属、房地产、放款、定存等项,以求得收益与风险均衡的最适当资产组合(Optimum Assets Components).Asset/Liability Management(ALM): 资产负债管理由于金融机构的资产为各种放款及投资,而负债主要为各种存款,费用收入、或投资人委托之资金。

因此资产负债管理的目的,即在于使银行以有限的资金,在兼顾安全性(Safty)、流动性(Liquidity)、获利性(Profitability)及分散性(Diversification)的情况下,进行最适当的资产与负债的分配(Asset Allocation)。

At The Money: 评价选择权交易中,履行价格等于远期价格时称之为评价。

Bear Market: 空头市场(熊市)在金融市场中,若投资人认为交易标的物价格会下降,便会进行卖出该交易标的物的操作策略。

因交易者在卖出补回前,其手中并未持有任何交易标的物,故称为:“空头”。

所谓空头市场就是代表大部分的市场参与者皆不看好后市的一种市场状态。

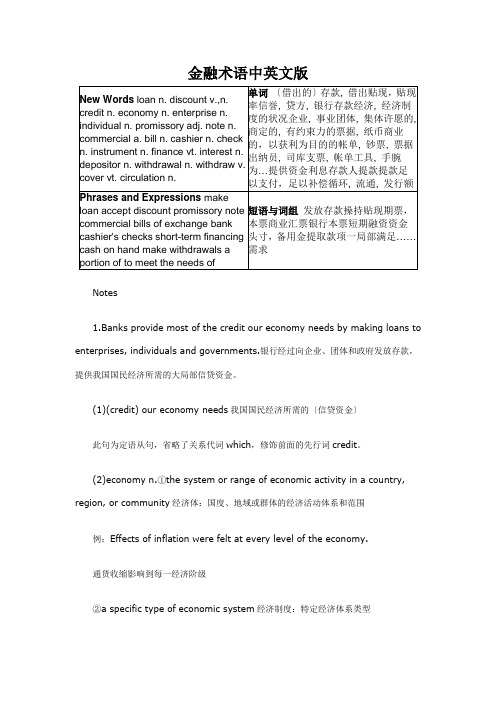

金融术语中英文版

金融术语中英文版Notes1.Banks provide most of the credit our economy needs by making loans to enterprises, individuals and governments.银行经过向企业、团体和政府发放存款,提供我国国民经济所需的大局部信贷资金。

(1)(credit) our economy needs我国国民经济所需的〔信贷资金〕此句为定语从句,省略了关系代词which,修饰前面的先行词credit。

(2)economy n.①the system or range of economic activity in a country, region, or community经济体:国度、地域或群体的经济活动体系和范围例:Effects of inflation were felt at every level of the economy.通货收缩影响到每一经济阶级②a specific type of economic system经济制度:特定经济体系类型例:an industrial economy; a planned economy.工业经济体制;方案经济体制(3)by making loans to enterprises, individuals and governments是介词短语,在句中做状语。

by prep. with the use or help of; through借助于;经过(4)making (loans to…)是动名词,做介词by的宾语。

2.The interest that borrowers pay for their loans or for their notes discounted forms the major source of banks' income.借款人支付存款或贴现票据的利息构成了银行主要支出的来源。

金融常用语中英文对照

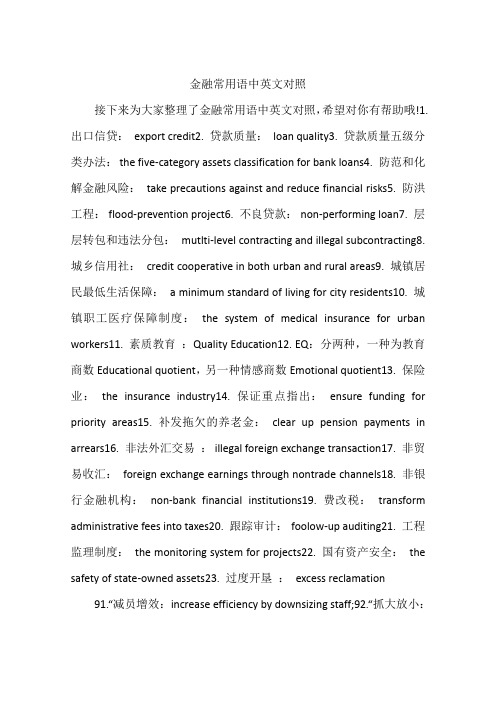

金融常用语中英文对照接下来为大家整理了金融常用语中英文对照,希望对你有帮助哦!1. 出口信贷:export credit2. 贷款质量:loan quality3. 贷款质量五级分类办法:the five-category assets classification for bank loans4. 防范和化解金融风险:take precautions against and reduce financial risks5. 防洪工程:flood-prevention project6. 不良贷款:non-performing loan7. 层层转包和违法分包:mutlti-level contracting and illegal subcontracting8. 城乡信用社:credit cooperative in both urban and rural areas9. 城镇居民最低生活保障:a minimum standard of living for city residents10. 城镇职工医疗保障制度:the system of medical insurance for urban workers11. 素质教育:Quality Education12. EQ:分两种,一种为教育商数Educational quotient,另一种情感商数Emotional quotient13. 保险业:the insurance industry14. 保证重点指出:ensure funding for priority areas15. 补发拖欠的养老金:clear up pension payments in arrears16. 非法外汇交易:illegal foreign exchange transaction17. 非贸易收汇:foreign exchange earnings through nontrade channels18. 非银行金融机构:non-bank financial institutions19. 费改税:transform administrative fees into taxes20. 跟踪审计:foolow-up auditing21. 工程监理制度:the monitoring system for projects22. 国有资产安全:the safety of state-owned assets23. 过度开垦:excess reclamation91.“减员增效:increase efficiency by downsizing staff;92.“抓大放小:manage large enterprises well wh ile ease control over small ones;93.“市政府要办的X件实事:x major projects that should be given top priority as designated on the municipal government's working agenda;94.“两个基本点:two focal points,two of the major points of the line set bythe 13th Congress of the CPC,I.e.upholding the four cardinal principles and the policies reform,opening to the outside world and invigorating domestic economy.95.“投资热点:a region attractive to investors,a muchsought piece of hand,popular investment spot96.“移动电话:本系cellular(有时简作cel)或mobil e(tele)phone97.“三角债:chain debts或debt chains98.“拳头产品:knockout product99.“投诉热线:dial-a-cheat confidential hotline(打电话告诉一件欺诈事件)100.“三通的现译文three links:link of trade,travel and post101.“外资:overseas investments。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Back-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balance sheet date 年结日Balloon maturity 到期大额偿还Balloon payment 期末大额偿还Bank, Banker, Banking 银行;银行家;银行业Bank for国际结算银行International ??Settlements(BIS)Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis Point (BP) 基点;点子一个基点等如一个百分点(%)的百分之一。

举例:25个基点=0.25%Basis swap 基准掉期Basket of currencies 一揽子货币Basket warrant 一揽子备兑证Bear market 熊市;股市行情看淡Bear position 空仓;空头Bear raid 疯狂抛售Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Benchmark mortgage pool 按揭贷款基准组合Beneficiary 受益人Bermudan option 百慕大期权百慕大期权介乎美式与欧式之间,持有人有权在到期日前的一个或多个日期执行期权。

Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买入的一个价格。

Big Band 金融改革Bill of exchange 汇票Bills department 押汇部Binary 二元制;二进法(只有两个可能的结果)Binary option 二元期权又称数字期权或非全有即全无期权。

如果基础工具满足预先确定的启动条件,二元期权将支付一个固定金额,在其他情形下则不支付任何收益。

BIS 国际结算银行(Bank for International Settlements的英文缩写)Blackout period 封锁期Block trade 大额交易;大宗买卖Blue chips 蓝筹股Blue Sky [美国] 蓝天法;股票买卖交易法Board of directors 董事会Bona fide buyer 真诚买家Bond market 债券市场,债市Bonds 债券,债票Bonus issue 派送红股Bonus share 红股;红利股票Book close date 截止过户日期Book closure period 停止过户期间Book value 帐面值Bookbuilding 建立投资者购股意愿档案;建档;询价圈购[股市] 包销商用以定价一笔发行的方法。

包销商在促销活动结束后把所收集的初步购股订单一一记下,然后根据投资者愿意支付的价格水平订定最终发行价。

Bookrunner 投资意愿建档人;帐簿管理人[股市] 指负责为发行建立投资者购股意愿档案的银行,亦即负责为一笔发行组织承销、拟定不同市场的发行规模、执行促销活动、定价、配置和后市稳定工作的银行。

Boom-bust 繁荣-崩溃(形容周期的快起快落)BOOT 建造/拥有/经营/转让(Build, Own, Operate and Transfer的英文缩写)BOT 建造/经营/转让(Build, Operate and Transfer的英文缩写)Bottom line 底线;最低限度Bottom-up 由下而上(方法)Bounced cheque 退票Bourse 股票交易所(法文)BP (Basis Point) 基点;点子(参见Basis Point栏目)Brand management 品牌管理Break-up fees 协议解约金Break-up valuation 破产清理价值评估;解约价值评估Breakeven point 收支平衡点Bretton Woods System 布里敦森林体系它是于1944年7月22日在美国新罕布什尔州布里敦森林召开的联合国家货币金融会议上创立的一个国际货币固定汇率制度。

根据协定,美元与黄金挂钩,而所有其他货币汇价则钉住美元。

体系于上世纪70年代初崩溃。

Bridging loan 临时贷款/过渡贷款Broad money 广义货币(参见M1栏目)Broker, Broking, Brokerage经纪;证券买卖;证券交易;证券行;经纪行HouseBrussels Stock Exchange 布鲁塞尔证券交易所BSSM 建造/设备供应-服务/维修(Build/Supply-Service/Maintain的英文缩写)Bubble economy 泡沫经济Build, Operate and Transfer建造/经营/转让(BOT)Build, Own, Operate and建造/拥有/经营/转让Transfer ??(BOOT)Build/Supply-建造/设备供应-服务/维修Service/Maintain ??(BSSM)Bull market 牛市;股市行情看涨Bullets 不得赎回直至到期(债券结构之一)Bullish 看涨; 看好行情Bundesbank 德国联邦银行;德国央行Business day 营业日Business management 业务管理;商务管理;工商管理Business studies 业务研究;商业研究Butterfly spread 蝶式买卖Buy-back 回购Buy-side analyst 买方分析员[股市]为机构投资者服务的股票研究分析员。

Buyer's credit 买方信贷(进口)Buyout 收购;买入By-law 细则;组织章程C-Corp [美国]指一般股份有限公司CAC 巴黎CAC指数CAGR 复合年增长率Calendar year 月历年度Call-over 公开作价Call-spread warrant 跨价认购权证Call option 认购期权Call protection/provision 赎回保障/条款Call warrant 认购认股权证Callable bond 可赎回债券Candlestick chart 阴阳烛图表日本传统使用的图表方法,最早用于稻米期货市场。

个别表示价格的条状看似一根两端露出烛芯的蜡烛。

蜡烛本身代表从开市到收市的价格差异,烛芯代表最高和最低位,而蜡烛颜色则显示收盘价比开盘价高开还是低开。

一般是白色或绿色代表有较高的收盘价,红色或黑色代表有较低的收盘价。

Cap 上限Capacity 生产能力;产能CAPEX 资本支出Capital Adequacy Ratio 资本充足比率Capital base 资本金;资本基楚Capital expenditure 资本支出Capitalization 资本化;资本总额Capital markets 资本市场;资金市场Capital raising 融资;筹集资金Capped floater 封顶浮动利率债券Carry trade 利率差额交易;套利外汇交易;息差交易例如:当利率偏低,投资者便借入短息(1%)买长债(4%),稳赚可观息差;及/或当美元汇价看低,便借入美元买进看升的亚洲股、汇市。

Carrying cost 利息成本;持有成本;资金成本差额Carrying value 账面价值Cash-settled warrant 现金认股权证Cash earnings per share 每股现金盈利Cash flow 现金流量CBO 债券抵押债券(参见Collateralized Bond Obligation)CBRC 中国银监会(参见China Banking Regulatory Commission栏目)CCASS 中央结算及交收系统(Central Clearing And Settlement System的英文缩写)CD 存款证(Certificate of Deposit的英文缩写)CDO 债务抵押债券(参见Collateralized Debt Obligation)CDS 参见Credit Default Swap栏目CEDEL 世达国际结算系统(即欧洲货币市场结算系统)Ceiling 上限Ceiling-floor agreement 上下限协议Central Clearing &中央结算及交收系统Settlement ??SystemCentral transaction log 中央交易记录Centralized borrowing and中央股份借贷系统lending systemCEO 首席执行官;行政总监;执行总监;首席执行长(Chief Executive Officer的英文缩写)CEPA 即2003年6月29日于香港签署的《内地与香港关于建立更紧密经贸关系的安排》,是英文“The Close r Economic PartnershipArrangement (CEPA) between Hong Kong and the Mainland”的简称。

Certificate of deposit 存款证Certificate of incumbency 公司授权/委任书Certified Public Accountant注册会计师(CPA)CFO 首席财务官;财务总监;首席财务长(Chief Financial Officer的英文缩写)Chaebol 韩国财阀;韩国大企业Chain debts 三角债Change of domicile 迁册(公司更改注册地址)Chapter 11 指美国《破产法》第11章的破产保护申请。

Chartered financial analyst注册金融分析师;特许财务分析师(CFA)Chicago Board of Trade 芝加哥交易所Chicago Board Options芝加哥期权交易所ExchangeChicago Mercantile Exchange 芝加哥商品交易所Chief Executive Officer首席执行官;行政总监;执行总监;首席执行长(CEO)Chief Financial Officer (CFO) 首席财务官;财务总监;首席财务长Chief Information Officer(CIO)首席信息官;首席资讯官;首席资讯长Chief Operations Officer(COO)首席营运官;营运总监;首席营运长China banking 中国银行业China BankingRegulatory ??Commission(CBRC)中国银行业监督管理委员会,简称“银监会”China Capital Markets 中国资本市场;中国资金市场China Development Bank (中国) 国家开发银行China InternationalCapital ??Corporation, CICC中国国际金融有限公司;中金公司China privatization 中国民营化;中国私有化;中国私营化China restructuring 中国重组;中国改组China SecuritiesRegulatory ??Commission(CSRC)中国证券监督管理委员会,简称“证监会”China Stock Markets 中国股票市场;中国股市Chinese Wall 中国墙;职能分隔制度CIO 首席信息官;首席资讯官;首席资讯长(Chief Information Officer的英文缩写)Claim 索偿Clawback notification 回拨/增加本地公开发行份额通知Clean price 洁净价[债市]指债券不包含应计利息的现金流现值CLO 贷款抵押债券(参见Collateralized Loan Obligation)Closed-end fund 封闭式基金Closing price 收盘价Co-lead manager 副主承销;联席主承销Code of conduct 操守准则Collars 利率上下限Collateralized Bond Obligation 债券抵押债券[债市]一种由多个差级组成的债券结构。