信用证外贸术语-单证

外贸单证 名词解释

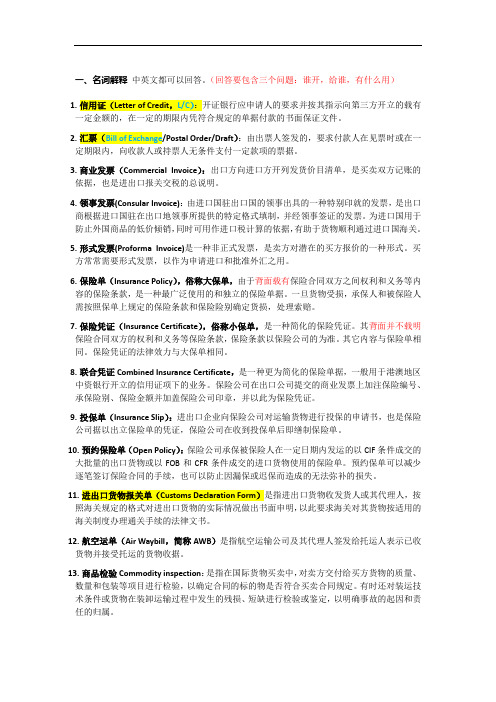

一、名词解释中英文都可以回答。

(回答要包含三个问题:谁开,给谁,有什么用)1.信用证(Letter of Credit,L/C):开证银行应申请人的要求并按其指示向第三方开立的载有一定金额的,在一定的期限内凭符合规定的单据付款的书面保证文件。

2.汇票(Bill of Exchange/Postal Order/Draft):由出票人签发的,要求付款人在见票时或在一定期限内,向收款人或持票人无条件支付一定款项的票据。

3.商业发票(Commercial Invoice):出口方向进口方开列发货价目清单,是买卖双方记账的依据,也是进出口报关交税的总说明。

4.领事发票(Consular Invoice):由进口国驻出口国的领事出具的一种特别印就的发票,是出口商根据进口国驻在出口地领事所提供的特定格式填制,并经领事签证的发票。

为进口国用于防止外国商品的低价倾销,同时可用作进口税计算的依据,有助于货物顺利通过进口国海关。

5.形式发票(Proforma Invoice)是一种非正式发票,是卖方对潜在的买方报价的一种形式。

买方常常需要形式发票,以作为申请进口和批准外汇之用。

6.保险单(Insurance Policy),俗称大保单,由于背面载有保险合同双方之间权利和义务等内容的保险条款,是一种最广泛使用的和独立的保险单据。

一旦货物受损,承保人和被保险人需按照保单上规定的保险条款和保险险别确定货损,处理索赔。

7.保险凭证(Insurance Certificate),俗称小保单,是一种简化的保险凭证。

其背面并不载明保险合同双方的权利和义务等保险条款,保险条款以保险公司的为准。

其它内容与保险单相同。

保险凭证的法律效力与大保单相同。

8.联合凭证Combined Insurance Certificate,是一种更为简化的保险单据,一般用于港澳地区中资银行开立的信用证项下的业务。

保险公司在出口公司提交的商业发票上加注保险编号、承保险别、保险金额并加盖保险公司印章,并以此为保险凭证。

外贸单证知识知识交流

知识梳理一、信用证1.种类不可撤销信用证Irrevocable L/C/可撤销信用证Revocable L/C即期信用证Sight L/C /远期信用证Usance L/C保兑信用证Confirmed L/C /不保兑信用证Unconfirmed L/C可转让信用证Transferable L/C /不可转让信用证Non-transferable L/C有追索权信用证With recourse L/C /无追索权信用证Without recourse L/C跟单信用证Documentary L/C /光票信用证Clean L/C循环信用证Revolving L/C背对背信用证Back to Back L/C 对开信用证Reciprocal L/C信开信用证To open by airmail L/C 电开信用证To open by cable L/C2.译1)drawn on “向……开立”2)Against 凭……3)Applicant 申请人4)Opening /Issuing bank 开证行5)Beneficiary受益人6)Advising bank /Notifying bank通知行7)Negotiating bank 议付行8)The soft clause 软条款9)Discrepancy fee 不符点费10)Sequence of total 报文页次2711)Documentary credit NB 信用证号2012)Reference to pre-advice 预先通知号2313)Date of Issue 开证日期31C14)Date and Place of expiry 信用证有效期和有效地点31D15)Currency code amount 结算货币和金额32B16)Percentage credit amount tolerance 信用证金额上下浮动范围(溢短装)39A 17)Maximum credit amount 信用证最高金额39B18)Additional Amount 附加金额39C19)Form of documentary credit 跟单信用证形式40A20)Applicable rules 信用证法则40E21)Any bank 自由议付41A22)Available with......by...... 指定银行及兑付方式41D23)Drawee 汇票付款人42A 42D24)Drafts at 汇票付款日期42C25)Mixed payment details 混合付款条款42M26)Deferred payment details 迟期付款条款42P27)Partial shipment 分装条款43P28)Transhipment 转运43T29)Loading on board /dispatch/packing in charge at/from 装船发运和接收监管地点44A 30)For transportation to 货物发运最终地点44 B31)Port of loading 装货港44E32)Port of discharge 卸货港44F33)Latest date of shipment最迟装运期44C34)Shipment period 船期44D35)Description of goods and /or services 货物描述46A/B36)Documents required 单据要求46A/B37)Additional conditions 特别条款47A/B38)Period for presentation 交单期限4839)Confirmation instruction 保兑指示4940)Applicant 信用证申请人5041)Applicant bank 信用证开证银行51A/D42)Reimbursement bank 偿付行53A/D43)Advised through bank 通知行57A44)Beneficiary 信用证受益人5945)Charges 费用71B46)Sender to receiver information 附言7247)Instruction to the paying/accepting/negotiating bank 给付款行、承兑行、议付行的指示78 48)Swift code 银行代码49)SWIFT 环球银行财务电讯协会(=Society for Worldwide Interbank Financial Telecommunication )二、合同contractycan date 受载期(= layday and canceling date)2.Notice of arrival 到货通知单3.ETA 预计到达时间(=Estimated Time of Arrival)4.PWWD每晴天工作日(= Per Weather Working Day)5.Dispatch 速遣Demurrage 滞期6.Fixture note 租船确认合同7.NOR 准备就绪通知书(=Notice of Readiness)8.Time Sheet 装卸时间表(计算单)9.Draft survey 水尺计重10.Shipping terms 发运条件11.Gencon 金康合同(General contract)12.C/P Charter Party 租船契约13.Discrepancies 不符点14.Bill of Lading 提单15.Blank endorsed 空白背书made out to order 做成指示抬头to order凭指示16.Insurance policy 保险单Insurance certificate 保险凭证17.Transfer of risks18.Time of delivery 交货期19.In bulk 散装20.Port of loading 装货港Port of discharging 卸货港21.Per Wet Metric Ton 每湿吨22.Be borne by 由……承担23.At seller’s option 由卖方选择24.Fraction prorate 按比例test shipment date 最迟装运期26.Statement of fact 实事记录27.Once on demurrage always on demurrage 一旦滞期永远滞期28.“Freight payable as per charter party”按照租船契约付运费29.F.P.A 平安险IC 中国检验认证集团(=China Commodity Inspection Corporation)31.Account number 账号32.Swift code 银行代码33.Beneficiary Bank 受益行34.Force Majeure 不可抗力35.Act of god 天灾Act of Government 政府行为36.Description of ship 船舶说明description of goods 货名37.UCP 跟单信用证统一惯例(Uniform Customs and Practice)38.D/P 付款交单(document against payment)D/A 承兑交单(=document against acceptance)39.In duplicate 一式两份In triplicate 一式三份In quadruplicate 一式四份In quintuplicate 一式五份In sextuplicate 一式六份In septuplicate 一式七份In octuplicate 一式八份In nonuplicate 一十九份In decuplicate 一式十份40.T/T 电汇(=Telegraph transfer)41.MOEP 矿石出口许可证(=Mineral Ore Export Permit)42.OTP 矿石运输许可证(=Ore Transport Permit)43.Port Charter 港口租约44.WIPON (=Whether in port or not)不管进港与否45.泊位租约berth charter46.WIBON (=Whether in berth or not)不管泊位与否47.Reachable on arrival 到达即可靠泊三、汇票draft/ Bill of Exchange1.当事人1)出票人drawer2) 受票人drawee3)收款人payee2.种类1)按出票人银行汇票Banker’s draft 商业汇票commercial draft2)有无附属单据光票clean bill 跟单汇票documentary bill3)付款时间即期汇票sight draft 远期汇票time bill or usance bill远期汇票付款时间规定:见票后XX天付款at XX days after sight出票后XX 天付款at XX days after date of draft提单签发日后XX天付款at XX days after date of B/L指定日期付款at a fixed date in future3.使用1)出票Issue2)提示presentation3)承兑acceptance4)付款payment5)背书endorsement6)拒付dishonor4翻译1)Pay to the order of “凭……指示”2)若信用证规定:Drawn on applicantDrawn on account eeDrawn on XX co买方(开证申请人)为付款人Drawn on openerDrawn on principalsDrawn on them/themselvesDrawn on you/yourselves指通知行Drawn on us/ourselves开证行、付款行、偿付行等为付款银行Drawn on XX bank3)汇票的抬头国际票据市场上,汇票的抬头通常有三种写法:限制性抬头“pay XX only ”(仅付款给某人)或加上(Not negotiable 不准流通)指示抬头“pay to the order of .......”可背书转让持票人或来人抬头pay bearer (付给来人)在我国对外贸易中,汇票的收款人一般都是以银行为指示抬头。

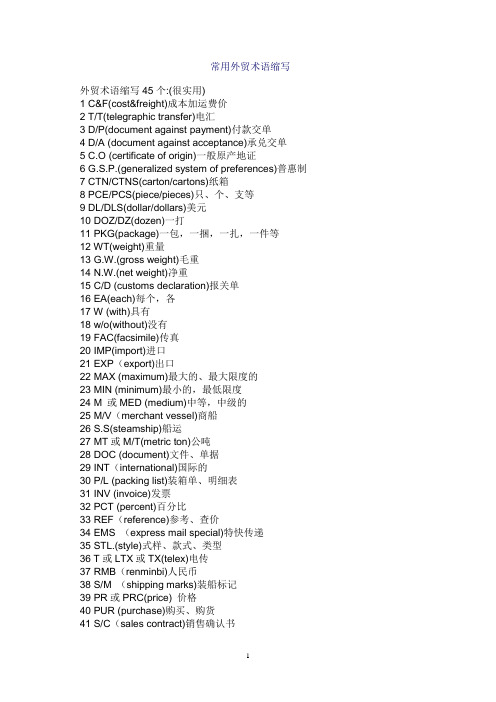

外贸术语缩写

常用外贸术语缩写外贸术语缩写45个:(很实用)1 C&F(cost&freight)成本加运费价2 T/T(telegraphic transfer)电汇3 D/P(document against payment)付款交单4 D/A (document against acceptance)承兑交单5 C.O (certificate of origin)一般原产地证6 G.S.P.(generalized system of preferences)普惠制7 CTN/CTNS(carton/cartons)纸箱8 PCE/PCS(piece/pieces)只、个、支等9 DL/DLS(dollar/dollars)美元10 DOZ/DZ(dozen)一打11 PKG(package)一包,一捆,一扎,一件等12 WT(weight)重量13 G.W.(gross weight)毛重14 N.W.(net weight)净重15 C/D (customs declaration)报关单16 EA(each)每个,各17 W (with)具有18 w/o(without)没有19 FAC(facsimile)传真20 IMP(import)进口21 EXP(export)出口22 MAX (maximum)最大的、最大限度的23 MIN (minimum)最小的,最低限度24 M 或MED (medium)中等,中级的25 M/V(merchant vessel)商船26 S.S(steamship)船运27 MT或M/T(metric ton)公吨28 DOC (document)文件、单据29 INT(international)国际的30 P/L (packing list)装箱单、明细表31 INV (invoice)发票32 PCT (percent)百分比33 REF(reference)参考、查价34 EMS (express mail special)特快传递35 STL.(style)式样、款式、类型36 T或LTX或TX(telex)电传37 RMB(renminbi)人民币38 S/M (shipping marks)装船标记39 PR或PRC(price) 价格40 PUR (purchase)购买、购货41 S/C(sales contract)销售确认书42 L/C (letter of credit)信用证43 B/L (bill of lading)提单44 FOB (free on board)离岸价45 CIF (cost,insurance&freight)成本、保险加运费价comprehensive package of services全面的一揽子服务a designated manned ship 一艘特定的配备船员的船air freight空运货物Airline cooperation 航空公司协作arrival notice到货通知as per按照bale or grain capacity包装或散装容积BALTIME form波尔的姆格式bank draft银行汇票bareboat chartering光船租船BARECON form贝尔康格式bargaining strenght 讨价还价的能力bill of entry 报关单bills of lading提单BIMCO波罗的海国际航运运协会blank bill of lading不记名提单break bulk cargo杂货,普通货物breakage of packing risks包装破裂险bunker adjustment factor (BAF)燃油价格调整因素;燃油附加费business correspondence商务通信call at a port挂靠,停靠cargo transportation货物运输carriage of goods by sea海上货物运输carriage of goods by road公路货物运输carrier承运人carrying capacity运载能力certificate of registry登记证书CFR (Cost and Freight) CFR (成本加运费)chargeable weight 计费重量charter party 租船合同check list核查单CIF (Cost,Insurance and Freight)CIF (成本、保险费加运费) CIP (Carriage and Insurance Paid To)CIP (运费、保险费付至) clash and breakage risks碰损、破碎险class rates等级运价clean bill of lading清洁提单clear the goods for export办理货物出口清关手续combined transport合并运输commission agent委托代理人common carrier公共承运人conference lines班轮公会运输consignee收货人consolidated shipment集运货物Constructive total loss推定全损container cargo集装箱货物containerization集装箱化contract of affreightment (COA)包运合同contract of carriage货物运输合同CPT (Carriage Paid To)CPT (运费付至)lashing 捆扎加固special cargo 特殊货物报关单、核销单、提单等的英文翻译出口报关单bill of customs clearance核销单verification sheet倒签提单antedated B/L直销direct selling传销multi-level selling,pyramid selling唛头mark正唛shipping mark,main mark, front mark侧唛side markTHC 码头操作费FAF 燃料附加费YAS 码头附加费或者日元升值附加费EPS是设备位置附加费EXW工厂交货AIR WAYBILL NUMBER 包裹空运运单号B/L NO 海运的提单M B/L (Ocean Bill of Lading)海上提单H B/L (House Bill of Lading)仓库提单报关单英文单词和缩写一.单证(Documents)进出口业务涉及的单证总的包括三大类:1、金融单证(信用证、汇票、支票和本票)2、商业单证(发票、装箱单、运输单据、保险单等3、用于政府管制的单证(许可证、原产地证明、商检证等)declaration form报关单nThree steps—declaration, examination of goods andn release of goods, are taken by the Customs to exercise control over general import and export goods.海关对进出境货物的监管一般经过申报、查验和放行三个环节。

国际贸易术语1

常用国际贸易术语SCO:SCO=SOFT CORPORATE OFFER 软发盘或责任供货函的意思,外贸单证是指进出口业务中使用的各种单据和证书,买卖双方凭借这些单证来处理货物的交付、运输、保险、商检和结汇等,单证工作主要有审证、制单、审单、交单和归档五个方面,它贯穿于进出口合同履行的全过程,具有工作量大、涉及面广、时间性强和要求高等特点。

ICPO:不可撤销意向书LOI:购货意向书POP: Proof of Product 产品证明产品证明也就是货物证明PB: Performance Bond(履约保证金)POF: Proof of Funds(资金证明)FCO: Formal Change Order(合同正式更改确认书)Q88:BG:银行保函BCL:银行资信证明。

DLC:跟单信用证SBLC:备用信用证MT103:是电汇MT103-23:这个MT103有个形式为MT103-23,也就是有条件支付形式.MT760: BG/MT760/SKR是根据ICC458见索即付和ICC500有条件付款等条款制定的。

而且,这种在国际贸易中新兴的付款方式近年来已被美、欧及香港地区多数国际知名大银行所广泛采用,其发展的态势将全面取代国际贸易中传统的付款方式“跟单信用证”。

开证行:在此程序中,开证行(或买方银行)对于执行的合同扮演两个角色,一是开证行是这笔交易的第一付款责任人,二是买方银行又是这笔交易的“第三方委托人”。

银行付款保函:在这个程序中,保函内容“无条件的、不可撤消的、保兑的、全款的”是完全保护卖方的(见附件一和二),而且开证行为第一付款责任人。

在整个过程中,正本银行保函一直存放在开证行安全帐户直至卖方按照合同规定履约其全部责任。

MT760:是银行保函的通知函,这个通知函是根据合同第九章和附件四内容开立的,是用来保护买方和买方银行的(见附件三、四)。

安全帐户/安全收据在开证行开立的“第三方责任人”/信托帐户存放正本保函,只把安全收据提供给卖方作为收据。

外贸单证中的信用证翻译

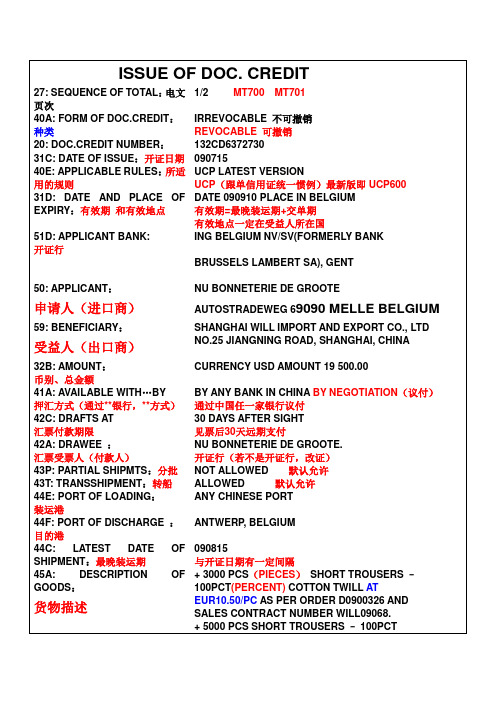

ISSUE OF DOC. CREDIT 27: SEQUENCE OF TOTAL:电文页次1/2 MT700 MT70140A: FORM OF DOC.CREDIT:种类IRREVOCABLE 不可撤销REVOCABLE 可撤销20: DOC.CREDIT NUMBER:132CD6372730 31C: DATE OF ISSUE:开证日期09071540E: APPLICABLE RULES:所适用的规则UCP LATEST VERSIONUCP(跟单信用证统一惯例)最新版即UCP60031D: DATE AND PLACE OF EXPIRY:有效期和有效地点DATE 090910 PLACE IN BELGIUM 有效期=最晚装运期+交单期有效地点一定在受益人所在国51D: APPLICANT BANK:开证行ING BELGIUM NV/SV(FORMERLY BANKBRUSSELS LAMBERT SA), GENT50: APPLICANT:NU BONNETERIE DE GROOTE申请人(进口商)AUTOSTRADEWEG 69090 MELLE BELGIUM 59: BENEFICIARY:SHANGHAI WILL IMPORT AND EXPORT CO., LTD 受益人(出口商)NO.25 JIANGNING ROAD, SHANGHAI, CHINA32B: AMOUNT:币别、总金额CURRENCY USD AMOUNT 19 500.0041A: AVAILABLE WITH…BY 押汇方式(通过**银行,**方式)BY ANY BANK IN CHINA BY NEGOTIATION(议付)通过中国任一家银行议付42C: DRAFTS AT 汇票付款期限30 DAYS AFTER SIGHT 见票后30天远期支付42A: DRAWEE :汇票受票人(付款人)NU BONNETERIE DE GROOTE. 开证行(若不是开证行,改证)43P: PARTIAL SHIPMTS:分批NOT ALLOWED 默认允许43T: TRANSSHIPMENT:转船ALLOWED 默认允许44E: PORT OF LOADING:装运港ANY CHINESE PORT44F: PORT OF DISCHARGE :目的港ANTWERP, BELGIUM44C: LATEST DATE OF SHIPMENT:最晚装运期090815与开证日期有一定间隔45A: DESCRIPTION OF GOODS:+ 3000 PCS(PIECES)SHORT TROUSERS –100PCT(PERCENT) COTTON TWILL ATEUR10.50/PC AS PER ORDER D0900326 AND SALES CONTRACT NUMBER WILL09068.+ 5000 PCS SHORT TROUSERS – 100PCT货物描述COTTON TWILL AT EUR12.00/PC AS PERORDER D0900327 AND SALES CONTRACTNUMBER WILL09069.SALES CONDITIONS: CFR ANTWERPPACKING: 50PCS/CTN(CARTON)46A:DOCUMENTS REQUIRED: 1. SIGNED COMMERCIAL INVOICES IN 4 ORGINAL(正本)AND 4 COPIES(副本)所需单据 2. FULL SET OF CLEAN ON BOARD OCEAN BILLS OFLADING, MADE OUT TO ORDER, BLANK ENDORSED,MARKED FREIGHT COLLECT NOTIFY THE APPLICANT提单3. CERTIFICATE OF ORIGIN.原产地证书4. PACKING LIST(装箱单)IN QUADRUPLICATE (一式四份)STATING CONTENTS OF EACH PACKAGESEPARARTELY.5.INSURANCE POLICY(保险单)/CERTIFICATE ISSUEDIN DUPLICATE IN NEGOTIABLE FORM, COVERING ALLRISKS, FROM WAREHOUSE TO WAREHOUSE FOR 120PCT OF INVOICE VALUE. INSURANCEPOLICY/CERTIFICATE MUST CLEARLY STATE IN THEBODY CLAIMS, IF ANY, ARE PAYABLE IN BELGIUMIRRESPECTIVE OF PERCENTAGE47A:ADDITIONAL CONDITIONS:附加条款1/ ALL DOCUMENTS PRESENTED UNDER THIS LC MUST BE ISSUED IN ENGLISH.7/ IN CASE THE DOCUMENTS CONTAIN DISCREPANCIES(不符点), WE RESERVE THE RIGHT TO CHARGE DISCREPANCY FEES AMOUNTING TO EUR 75 OR EQUIVALENT.71B: CHARGES:费用ALL CHARGES ARE TO BE BORN BY BENEFICIARY48: PERIOD FOR PRESENTATION:交单期WITHIN 5 DAYS AFTER THE DATE OF SHIPMENT, BUT WITHIN THE VALIDITY OF THIS CREDIT49:CONFIRMATION INSTRUCTION:是否保兑WITHOUT 默认是不保兑。

单证贸易术语

常用外贸术语大全ANER 亚洲北美东行运费协定 Asia NorthAmerica EastboundRateB组BAF 燃油附加费 Bunker AdjustmentFactorBAF 燃油附加费,大多数航线都有,但标准不一。

B/L 海运提单 Bill of LadingB/R 买价 Buying RateC组(主要运费已付)CFR 成本加运费(……指定目的港)CFR(cost and freight)成本加运费价C&F(成本加运费):COST AND FREIGHTC&F 成本加海运费 COST AND FREIGHTCIF 成本、保险费加运费付至(……指定目的港)CIF 成本,保险加海运费 COST,INSURANCE,FRIGHTCIF(成本运费加保险,俗称“到岸价”):COST INSURANCE AND FREIGHT FOB (离岸价):FREE ON BOARDCPT 运费付至(……指定目的港)CPT 运费付至目的地 Carriage Paid ToCIP 运费、保险费付至(……指定目的地)CIP 运费、保险费付至目的地 Carriage and Insurance Paid ToCY/CY 整柜交货(起点/终点)C.Y。

货柜场 Container YardCY(码头):CONTAINER YARDCFS(场):CARGO FREIGHT STATIONC/D (customs declaration)报关单C.C.(运费到付):COLLECTC。

C 运费到付 CollectCNTR NO. (柜号):CONTAINER NUMBERC。

O (certificate of origin)一般原产地证CTN/CTNS(carton/cartons)纸箱C.S。

C 货柜服务费 Container Service ChargeC/(CNEE)收货人 ConsigneeC/O 产地证 Certificate of OriginCAF 货币汇率附加费 Currency Adjustment FactorCFS 散货仓库 Container Freight StationCFS/CFS 散装交货(起点/终点)CHB 报关行 Customs House BrokerCOMM 商品 CommodityCTNR 柜子 ContainerD组(到达)DAF 边境交货(……指定地点)DAF 边境交货 Delivered At FrontierDES 目的港船上交货(……指定目的港)DES 目的港船上交货 Delivered Ex ShipDEQ 目的港码头交货(……指定目的港)DEQ 目的港码头交货 Delivered Ex QuayDDU 未完税交货(……指定目的地)DDU 未完税交货 Delivered Duty UnpaidDDP 完税后交货(……指定目的地)DDP 完税后交货 Delivered Duty PaidDDC、IAC 直航附加费,美加航线使用DDC 目的港码头费 Destination Delivery ChargeDL/DLS(dollar/dollars)美元D/P(document against payment)付款交单D/P 付款交单 Document Against PaymentDOC (document)文件、单据DOC(文件费):DOCUMENT CHARGEDoc#文件号码 Document NumberD/A (document against acceptance)承兑交单D/A 承兑交单 Document Against AcceptanceDOZ/DZ(dozen)一打D/O 到港通知 Delivery OrderE组(发货)EXW 工厂交货(……指定地点)Ex 工厂交货 Work/ExFactoryETA(到港日):ESTIMATED TIME OF ARRIVALETD(开船日):ESTIMATED TIME OF DELIVERYETC(截关日):ESTIMATED TIME OF CLOSINGEBS、EBA 部分航线燃油附加费的表示方式,EBS一般是澳洲航线使用, EBA一般是非洲航线、中南美航线使用EXP(export)出口EA(each)每个,各EPS 设备位置附加费 Equipment Position SurchargesF组(主要运费未付)FCA 货交承运人(……指定地点)FCA 货交承运人 Free CarrierFAS 船边交货(……指定装运港)FOB 船上交货(……指定装运港)FOB 船上交货 Free On BoardFOB (离岸价):FREE ON BOARDCIF(成本运费加保险,俗称“到岸价"):COST INSURANCE AND FREIGHTFCL(整箱货):FULL CONTAINER CARGO LOADFCL 整柜 Full Container LoadLCL(拼箱货):LESS THAN ONECONTAINER CARGO LOADFAF 燃油价调整附加费(日本航线专用)FAF 燃料附加费 Fuel AdjustmentFactorFAC(facsimile)传真Form A -—-产地证(贸易公司)F/F 货运代理 Freight ForwarderFAK 各种货品 Freight All KindFAS 装运港船边交货 Free Alongside ShipFeeder Vessel/Lighter 驳船航次FEU 40‘柜型 Forty—Foot Equivalent Unit 40’FMC 联邦海事委员会 Federal Maritime CommissionFIO是FREE IN AND OUT的意思,指船公司不付装船和卸船费用FIOST条款,指船公司不负责装,卸,平舱,理舱FI是FREE IN的意思,指船公司不付装FO是FREE OUT的意思,同理指船公司不付卸G组GRI 综合费率上涨附加费,一般是南美航线、美国航线使用GRI 全面涨价 General RateIncreaseG.W.(gross weight)毛重G.W.(gross weight)毛重N。

外贸常用的单证

原产地证

原产地证包括一般原产地证(CERTIFICATION OF ORIGINA)和普惠制原产地证(GSP FORM A)。原产地证是证明我出口货物生产和制造地的证明文件,是出口产品进入国际贸易领域的“身份证”。货物进口国据此对进口货物给予不同的关税待遇和决定限制与否。中国的原产地证有固定印刷格式,一般由商检局出具。出口企业申请办理此证,首先要在当地办理企业注册登记,然后才有资格申请签证。

受益人声明主要用于不便或无法用官方文件证明的,客户要求做到的事宜,或其他一些类似于保函(保证承担某些责任或某些可能产生的责任的声明)的内容。

书写上无规定格式,只需要列标题为BENEFICIARY CERTIFICATION,行文上有“WE HEREBY CERTIFICATE THAT…”后面加上客户所需声明的内容,再落款盖章即可。

6.装船通知(SHIPPING ADVICE)

船开前或不迟于船开当日,由发货人出具给收货人的装船情况通知。格式不限,但应包括下列内容:收货人(Consignee)、发货人(Consigner)、货物名(Goods)、提单号(B/L Number)、集装箱/铅封号(Container/Seal Number)、船名(Vessel Name)、航次(Voy)、目的港(Destination Port)、起航日(ETD, Estimated)和预计抵达日(ETA, Estimated Time of Arrival)等项目内。

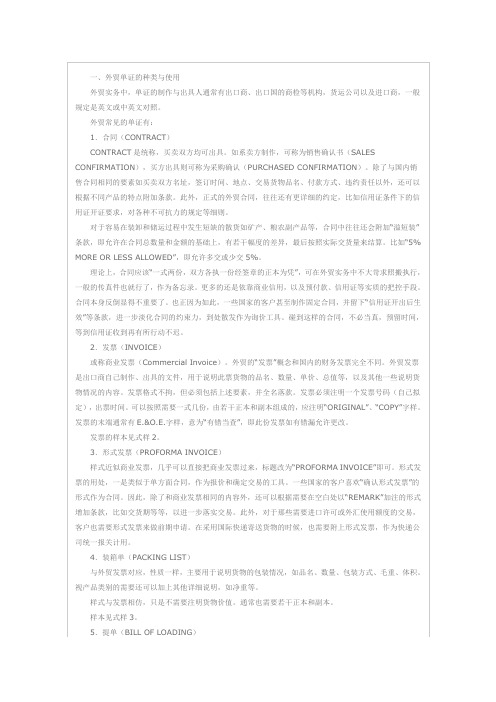

一、外贸单证的种类与使用

外贸实务中,单证的制作与出具人通常有出口商、出口国的商检等机构,货运公司以及进口商,一般规定是英文或中英文对照。

第一章 国际贸易单证概述

第一章国际贸易单证概述一、单证概述(一)单证的含义1、单证:国际结算中应用的单据、文件与证书,凭借这种文件来处理国际货物的交付、运输、保险、商检、结汇等。

2、狭义单证:单据和信用证3、广义单证:各种文件和凭证。

(二)国际商务单证工作的意义1、国际结算的基本工具国际贸易主要表现为单据的买卖。

在信用证业务中,各有关当事人处理的是单据而不是有关的货物、服务或其他行为。

以CIF贸易条件成交的合同,卖方凭单交货,买方凭单付款,实行单据和付款对流的原则。

例:(2006年试题)在信用证支付方式下,卖方凭以向客户收取货款的,不是实际货物,而是与来证要求完全相符的全套单据。

(正确)2、经营管理的重要环节外贸企业经营的好坏与单证工作组织管理的优劣关系很大。

3、政策性很强的涉外工作4、企业业务和素质的体现(三)国际商务单证工作的基本要求1、正确——单证工作的前提,包含两方面的内容(1) 各种单据必须做到“三相符”;单证相符:单据与信用证相符——占首要地位单单相符:单据与单据相符单同相符:单据与贸易合同相符银行只要求前两个相符,而对于外贸企业,则还要加上一个“单货相符”。

(2) 二是单据必须与有关惯例和法令规定相符。

信用证按照(UCP600)的解释。

例:(外销员试题)所谓信用证“严格相符”的原则,是指受益人必须做到:①单证与合同严格相符。

②单据和信用证严格相符。

③信用证和合同严格相符。

应选:②2、完整(1) 成套单证群体的完整性在结汇时,要提供齐全的,成套的单证。

(2) 每一种单据的所填内容必须完备齐全(3) 单据的份数齐全,尤其是提单的份数。

例:(2005年试题)根据制单的“完整”原则,下列表述不正确的是( D ) A.单据种类的完整 B.单据所填写的内容完整C.每种单据份数的完整D.所有单证都必须签署3、及时(1)出单及时:各种单据的出单日期必须合理可行,不能超过信用证有效期或按商业习惯的合理日期。

保险单日期早于或等于提单的签发日期提单日期不得迟于装运期装运通知书必须在货物装运后立即发出。

外贸英语口语外贸信用证用语大全

外贸英语口语:外贸信用证用语大全(二)Certificate of origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A” “格式A”产地证明书7.genetalised system of preference certificate of origin form “A” 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full tet of forwarding agents'cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯食物证书8.combined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大入口声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与目的港(1)despatch/shipment from Chinese port to… 从中国口岸发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按本钱加运费价钱用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5)from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国口岸至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not)permitted (不)允许分运(2)partial shipments (are) allowed (prohibited)准予(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5)partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何口岸转运Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s)must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4.draft(s)must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port)until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s)drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 按照本证项下开具的汇票须在1977年8月30日或该日前在中邦交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非还有规定,(本证)于1977年8月15日受益人国家满期12.draft(s)drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring)date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until… 本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents'cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s)drawn under and in compliance with the terms of the credit that such draft (s)shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit)凡按照本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡按照本证的条款开具并提示汇票,咱们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有依照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必需由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须别离由持续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全数单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding)airmails 单据要由持续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。

外贸单证实务--信用证

本章复习要点

• • • •

信用证的定义、特点、作用 信用证方式的当事人 信用证的种类 信用证的国际惯例

信用证的开立形式

• •

1、信开本 2、电开本 电开本是指开证行使用电报、电传、传真、SWIFT等各 种电讯方法将信用证条款传达给通知行。电开本又可 分为以下几种: (1)简电本 (2)全电本 (3)SWIFT信用证。SWIFT是“全球银行金融电讯协 会”(SOCIETY FOR WORLDWIDE INTERBANK FINANCIAL TELECOMMUNICATION)的简称。于 1973年在比利时布鲁塞尔成立,该组织设有自动化的 国际金融电讯网,该协定的成员银行可以通过该电讯 网办理信用证业务以及外汇买卖、证券交易、托收等。

信用证风险防范

•

4.谨慎地确立合同条款 出口企业或工贸公司在与外商签约时, 应平等、合理、谨慎地确立合同 条款。 以发国家和集体利益为重,彻底杜绝 一切有损国家和集体利益的不平等、 不 合理条款,如"预付履约金、质保金, 拥金和中介费条款"等

信用证案例(一):软条款陷阱

•

•

•

辽宁某贸易公司与美国金华企业签订了销往香港的5万 立方米花岗岩合同,总金额高达1,950万美元,买方通 过香港某银行开出了上述合同下的第一笔信用证,金额 为195万美元。 信用规定:“货物只能待收到申请人指定船名的装运通 知后装运,而该装运通知将由开证行随后经信用证修改 书方式发出”。 该贸易公司收到来证后,即将质保金260万元 人民币付 给了买方指定代表。装船前,买方代表来产地验货,以 货物质量不合格为由,拒绝签发"装运通知",致使货物 滞留产地,中方公司根本无法发货收汇,损失十分惨重。

信用证案例

国际贸易术语

常用国际贸易术语SCO SCO=SOFT CORPORATE OFFER 软发盘或责任供货函的意思,外贸单证是指进岀口业务中使用的各种单据和证书,买卖双方凭借这些单证来处理货物的交付、运输、保险、商检和结汇等,单证工作主要有审证、制单、审单、交单和归档五个方面,它贯穿于进出口合同履行的全过程,具有工作量大、涉及面广、时间性强和要求高等特点。

ICPO:不可撤销意向书LOI:购货意向书POP:Proof of Product 产品证明产品证明也就是货物证明PB Performanee Bond(履约保证金)POF Proof of Funds(资金证明)FCO Formal Change Order(合同正式更改确认书)Q88BG :银行保函BCL银行资信证明。

DLC跟单信用证SBLC备用信用证MT103是电汇MT103-23:这个MT103有个形式为MT103-23,也就是有条件支付形式.MT760:BG/MT760/SKR1根据ICC458见索即付和ICC500有条件付款等条款制定的。

而且,这种在国际贸易中新兴的付款方式近年来已被美、欧及香港地区多数国际知名大银行所广泛采用,其发展的态势将全面取代国际贸易中传统的付款方式“跟单信用证”。

开证行:在此程序中,开证行(或买方银行)对于执行的合同扮演两个角色,一是开证行是这笔交易的第一付款责任人,二是买方银行又是这笔交易的“第三方委托人”。

银行付款保函:在这个程序中,保函内容“无条件的、不可撤消的、保兑的、全款的”是完全保护卖方的(见附件一和二),而且开证行为第一付款责任人。

在整个过程中,正本银行保函一直存放在开证行安全帐户直至卖方按照合同规定履约其全部责任。

?MT760是银行保函的通知函,这个通知函是根据合同第九章和附件四内容开立的,是用来保护买方和买方银行的(见附件三、四)。

安全帐户 /安全收据在开证行开立的“第三方责任人”/信托帐户存放正本保函,只把安全收据提供给卖方作为收据。

外贸付款方式及国际贸易术语大全

外贸付款方式及国际贸易术语大全外贸最常用的外贸付款方式:1.信用证L/C(Letter of Credit),2.电汇 T/T (TelegraphicTransfer),3.付款交单D/P(Document against Payment).其中L/C用的最多T/T其次,.D/P 较少。

1.信用证L/C(Letter of Credit)。

信用证是目前国际贸易付款方式最常用的一种付款方式,每个做外贸的人早晚都将会接触到它。

对不少人来说,一提起信用证,就会联想到密密麻麻充满术语的令人望而生畏的天书。

其实信用证可以说是一份由银行担保付款的 S/C。

只要你照着这份合同的事项一一遵照着去做,提供相应的单据给银行就必须把钱付给你。

所以应该说信用证从理论上来说是非常保险的付款方式。

信用证一旦开具,他就是真金白银。

也正因为如此,一份可靠的信用证甚至可以作为担保物,拿到银行去贷款,为卖方资金周转提供便利,也就是“信用证打包贷款”。

但是在实际操作中,信用证有的时候也不是那么保险。

原因是信用证中可能会存在很难然你做到的软条款,造成人为的不符点。

2.第二种常见交货方式为电汇 T/T(Telegraphic Transfer)。

这种方式操作非常简单,可以分为前T/T,和后T/T,前T/T就是,合同签订后,先付一部分订金,一般都是30%,生产完毕,通知付款,付清余款,然后发货,交付全套单证。

不过前T/T比较少见一点,在欧美国家出现的比较多。

因为欧美国家的客户处在信誉很好的环境,他自己也就非常信任别人。

最为多见的是后T/T, 收到订金,安排生产,出货,客户收到单证拷贝件后,付余款;卖家收到余款后,寄送全套单证。

T/T订金的比率,是谈判和签订合同的重要内容。

订金的比率最低应该是够你把货发出去,和拖回来。

万一客户拒付,也就没有什么多大损失。

T/T 与L/C比较,就是操作非常简单,灵活性比较大,比如交期吃紧,更改包装,等等,只要客户同意,没有什么关系。

外贸单证英语+单证英语词汇

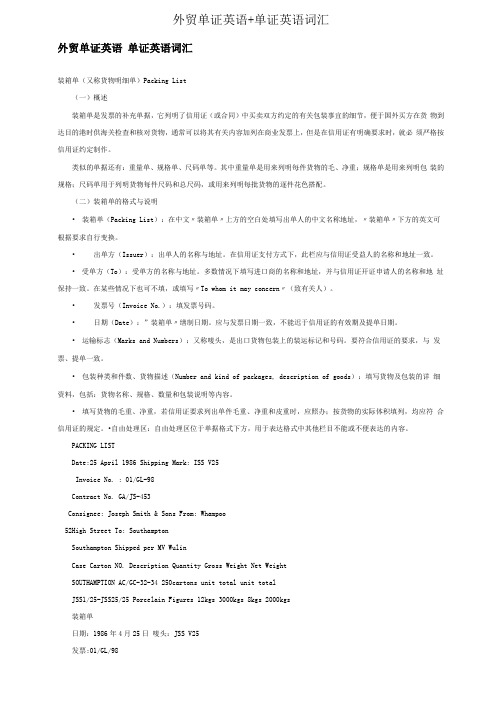

外贸单证英语+单证英语词汇外贸单证英语单证英语词汇装箱单(又称货物明细单)Packing List(一)概述装箱单是发票的补充单据,它列明了信用证(或合同)中买卖双方约定的有关包装事宜的细节,便于国外买方在货物到达目的港时供海关检查和核对货物,通常可以将其有关内容加列在商业发票上,但是在信用证有明确要求时,就必须严格按信用证约定制作。

类似的单据还有:重量单、规格单、尺码单等。

其中重量单是用来列明每件货物的毛、净重;规格单是用来列明包装的规格;尺码单用于列明货物每件尺码和总尺码,或用来列明每批货物的逐件花色搭配。

(二)装箱单的格式与说明•装箱单(Packing List):在中文〃装箱单〃上方的空白处填写出单人的中文名称地址,〃装箱单〃下方的英文可根据要求自行变换。

•出单方(Issuer):出单人的名称与地址。

在信用证支付方式下,此栏应与信用证受益人的名称和地址一致。

•受单方(To):受单方的名称与地址。

多数情况下填写进口商的名称和地址,并与信用证开证申请人的名称和地址保持一致。

在某些情况下也可不填,或填写〃To whom it may concern〃(致有关人)。

•发票号(Invoice No.):填发票号码。

•日期(Date):”装箱单〃缮制日期。

应与发票日期一致,不能迟于信用证的有效期及提单日期。

•运输标志(Marks and Numbers):又称唛头,是出口货物包装上的装运标记和号码。

要符合信用证的要求,与发票、提单一致。

•包装种类和件数、货物描述(Number and kind of packages, description of goods):填写货物及包装的详细资料,包括:货物名称、规格、数量和包装说明等内容。

•填写货物的毛重、净重,若信用证要求列出单件毛重、净重和皮重时,应照办;按货物的实际体积填列,均应符合信用证的规定。

•自由处理区:自由处理区位于单据格式下方,用于表达格式中其他栏目不能或不便表达的内容。

国际贸易术语

常用国际贸易术语SCO:SCO=SOFTCORPORATEOFFER软发盘或责任供货函的意思,外贸单证是指进出口业务中使用的各种单据和证书,买卖双方凭借这些单证来处理货物的交付、运输、保险、商检和结汇等,单证工作主要有审证、制单、审单、交单和归档五个方面,它贯穿于进出口合同履行的全过程,具有工作量大、涉及面广、时间性强和要求高等特点;ICPO:不可撤销意向书LOI:购货意向书POP:ProofofProduct产品证明产品证明也就是货物证明PB:PerformanceBond履约保证金POF:ProofofFunds资金证明FCO:FormalChangeOrder合同正式更改确认书Q88:BG:银行保函BCL:银行资信证明;DLC:跟单信用证SBLC:备用信用证MT103:是电汇MT103-23:这个MT103有个形式为MT103-23,也就是有条件支付形式.MT760:BG/MT760/SKR是根据ICC458见索即付和ICC500有条件付款等条款制定的;而且,这种在国际贸易中新兴的付款方式近年来已被美、欧及香港地区多数国际知名大银行所广泛采用,其发展的态势将全面取代国际贸易中传统的付款方式“跟单信用证”;开证行:在此程序中,开证行或买方银行对于执行的合同扮演两个角色,一是开证行是这笔交易的第一付款责任人,二是买方银行又是这笔交易的“第三方委托人”;银行付款保函:在这个程序中,保函内容“无条件的、不可撤消的、保兑的、全款的”是完全保护卖方的见附件一和二,而且开证行为第一付款责任人;在整个过程中,正本银行保函一直存放在开证行安全帐户直至卖方按照合同规定履约其全部责任;MT760:是银行保函的通知函,这个通知函是根据合同第九章和附件四内容开立的,是用来保护买方和买方银行的见附件三、四;安全帐户/安全收据在开证行开立的“第三方责任人”/信托帐户存放正本保函,只把安全收据提供给卖方作为收据;BG/MT760/SKR操作程序买方银行1.买方银行向卖方而不是卖方银行发出保函的预通知函,供卖方确认,卖方同意后返回买方或买方银行;2.买方银行/联系行通过MT760密押向卖方银行通知保函生效,通知上没有保函的具体内容,但包括合同第九章付款所需文件和附件四的内容;MT-760通知函包含以下内容:A.本保函只对合同XYZ有效;B.买方银行在银行保函到期时有足额的资金;C.卖方必须按合同XYZ规定完成交货并按合同第九章和附件四规定提供全部付款文件;3.买方银行/联系行将保函正本存放在其银行开立的安全帐户中;4.买方银行/联系行只需要将保函的安全收据和正本保函的复印件提供给卖方或卖方银行;总之,开证行买方银行既是合同的第一付款责任人,也是合同“第三方委托人”,从中起到保护买卖双方的作用;保函注明“无条件的,不可撤消的,保兑的,全款的”是根据ICC458保护卖方在保函到期前能收到全额货款,但是在保函到期前,卖方没有完成合同所规定的相关条款,即MT760通知函中根据ICC500所规定的相关条款,卖方是索取不到任何货款的;SKA/SKR又分别进一步保护了买方和卖方;MT799:是一种信用证的格式,MT799银行资金证明是带密押的自由报文格式,内容主要是对信用证相关的说明.MT799是自由格式,可用于修改信用证的电文.MT799是自由格式电报,是因为前面开证的时候因为银行的错误,所以信用证需要修改,这样的修改,一般银行就发一个799,我们叫更正电报,所以受益人不必支付额外的通知费,开证人也不用支付修改费;但如果因为开证人的原因而修改信用证,则银行发一个700或者701,作为信用证修改件,开证人就要修改费,受益人就要出通知费了;CIF:到岸价格FOB:离岸价格LOI格式:LOI采购意向书格式LETTEROFINTENTLOIWe,______________________,herebythatwearereadywillingandableundertheactofperjurytopurchasethefollowingcommo dityasspecifiedbelowandthatfundingisavailable.我们,______________________,在此,我们准备好了愿意并且能够依据伪证法购买下列商品和资金是可用的1、PRODUCT:产品2、SPECIFICATIONS:规格3、QUANTITY:数量4、DESTINATIONPORT:目的端口5、DELIVERYTERMS:交货条件6、SIZEOFSHIPMENT:装运的大小7、PACKING:包装8、DISCHARGERATEINPORTDESTINATION:在目的港卸货率9、TERMSOFPAYMENT:付款条件:10、PERFORMANCEBOND:履约保证金:11、BANKCOORDINATES:银行坐标:12、TARGETPRICE:目标价格:13、COMPANYDETAILS:公司详情。

国际外贸术语 单词

国际外贸术语单词以下是一些常见的国际外贸术语以及相应的英文单词:1.贸易伙伴:Trading partner2.询盘:Inquiry3.发盘:Offer4.还盘:Counter-offer5.接受:Acceptance6.合同:Contract7.订单:Order8.支付方式:Payment terms9.信用证:Letter of credit (L/C)10.电汇:Telegraphic transfer (T/T)11.托收:Collection12.佣金:Commission13.折扣:Discount14.贸易顺差:Trade surplus15.贸易逆差:Trade deficit16.贸易平衡:Trade balance17.国际贸易:International trade18.世界贸易组织:World Trade Organization (WTO)19.关税:Tariff20.通关手续:Customs clearance21.国际贸易单证:International trade documents22.国际贸易运输:International trade transportation23.国际贸易保险:International trade insurance24.国际贸易支付:International trade payment25.国际贸易争端:International trade disputes26.国际贸易政策:International trade policies27.国际贸易法规:International trade regulations28.国际贸易惯例:International trade practices29.国际贸易合作:International trade cooperation30.国际贸易关系:International trade relations。

外贸各类术语

外贸各类术语L/C (LETTER OF CREDIT) 是信用证,这个是在国际贸易中普遍运用的一种交易方式,它的风险较低,由银行来作为中介,是一种银行信用,但是交易双方向银行缴纳的费用很高,现在在交易中也出现了信用证欺诈的问题,所以使用时也应该谨慎选择。

T/T (TELEGRAFIC TRANSFER) 是电汇,在交易中它较之信用证风险要高一些,但是向银行缴纳的费用要比信用证是缴纳的费用低很多。

D/P和D/A都属于托收,D/P (DOCUMENT AGAINST PAYMENT) 是远期付款交单,就是说买方必须在向卖方付款之后才能够获得提取货物的单据,这种交易方式使卖方能够及时地收到货款,D/A (DOCUMENT AGAINST ACCEPTION) 是承兑交单,就是说只要买方在收到付款通知时向卖方做出一定付款的承诺就可以得到提取货物的有关单据,因此D/A存在一定的风险一、什么叫L/C?L/C即Letter of Credit ,信用状;信用证;信用证书为国际贸易中最常见的付款方式,指银行(开状银行)(*opening bank)询顾客(通常为买方)的请求与指示,向第三人(通常为卖方)所签发的一种文据(instruments)或函件(letter)·其内容包括申请人名称、受益人(beneficiary)、发信日期、交易货物名称、数量、价格、贸易条件、受益人应开汇票的要求(称发票条款),押汇时应付之单据、装运日期、有效期限与开状银行给押汇银行(*negotiating bank)或其他关系人之条款·在该文据或函件中,银行向卖方承诺,如果该第三人能履行该文据或函件所规定的条件,则该第三人得按所载条件签发以该行或其指定的另一银行为付款人的汇票,并由其负兑付的责任·但较特别的是︰(1)信用状中也有以买方为汇票付款人,而由开状银行负责其兑付的;(2)信用状的开发虽是基於贸易而生,但也有非基於贸易而开发的,凭这种信用状签发的汇票通常多不需附上单证,所谓无跟单信用状(*clean credit)即是·其他诸如押标保证(*bid bond)、履约保证(*performance bond)、还款保证(repayment bond)等亦以信用状达成为目的;(3)凭信用状兑款固然多要求受益人签发汇票,但也有不需签发汇票,只须提示收据(receipt)或只需提出规定单证即可兑款的,例如凭收据付款信用状(*payment on receipt credit)及凭单证付款信用状(*payment against documents credit)即是·以信用状作为付款方式,对出口商而言,只要将货物交运,并提示信用状所规定的单证,即可获得开状银行的付款担保,可不必顾虑进口商的失信,押汇银行也多乐于受理押汇,故信用状尚能给予出口商在货物装运\後即可收回货款的资金融通上的便利·就进口商而言,由于出口商必须按照信用状条件押领货款,开状银行审核单证完全符合信用状条件後才予付款,故可预防出口商以假货、劣货充数,或以假单证诈领货款·L/C的分类它的分类很多,下面作了列举,供参考.1.revocable L/C/irrevocable L/C可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight payment L/C/deferred payment L/C/acceptance L/C 即期信用证/延期信用证/承兑信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C /untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C延付信用证/预支信用证11.back to back L/C/reciprocal L/C对背信用证/对开信用证12.traveller's L/C(or:circular L/C)旅行信用证13.negotiation L/C议付信用证14.buyer's usance L/C买方远期信用证外贸信用证结汇,L/C实际业务流程(一)接到国外客户的订单(二)做形式发票传国外客户,国外客户回签,然后国外客户根据合同开立信用证给我们.(三)做生产单传国内客户,国内客户回签,(四)向国外客户要回唛头、彩图、条形码,把唛头、彩图、条形码传给工厂,并且严格按照L/C执行.(五)要求工厂进行生产(六)在离船期大约有10天左右,向国外客户的货代要订舱单标准格式,按要求填好之后反传船公司订舱(七)船公司传出正式的S/O(托单)(八)一般是自己的验货员去供应商厂里验货(如果客户在大陆有验货代表一般是要求供应商把货物拖回本公司,再让客户大陆验货代表进行验货)(九)把S/O传给拖车行(在S/O面前注明拖柜时间、地点、时间,联系电话等前往拖柜)(十)做出报关内容即“FAX MESSAGE”,向拖车行问清报关行地址,以方便外贸公司寄出全套单据(能够归类的尽量归类,目的是减少核销单)(十一)在“FAX MESSAGE”上注明报关行地址,再把“FAX MESSAGE”传给外贸公司(外贸公司会把报关资料传给报关行),同时给厂家下“装柜通知”(十二)装完柜之后,把柜号、封条号等资料填好,(需要熏蒸的货物,把熏蒸格式填好)再传给报关行,进行报关(十三)做出FORM A.(十四)做装船通知传给客户(十五)要回报关单,加上开具增值税专用发票申请表,交给财务会计(十六)做提单补料传给船公司(十七)出示正式FORMA.(十八)准备装船通知、产地证明(FORMA)、提单、发票、装箱单、(有时有消毒熏蒸证书),到银行交单.L/C的标准格式LETTER OF CREDIT编号:Reference:作者:Author:标题:Title:发往:Send to:报文类型:Message Type:优先级:Priority:传送监控:Delivery Monitoring:27 :报文页次sequence of total40A :跟单信用证类型form of documentary credit20 :跟单信用证号码documentary credit31C :开证日期date of issue31D :到期日date of expiry 到期地点place of expiry51A :开证申请人银行——银行代码applicant bank-BIC50 :开证申请人applicant59 :受益人beneficiary32B :货币与金额currency code, amount41D :指定银行与兑付方式available with …by …42C :汇票drafts at…42A :汇票付款人——银行代码drawee-BIC43P :分批装运partial shipments43T :转船transshipment44A :装船/发运/接受监管地点loading on board / dispatch/taking in charge44B :货物运往for transportation to …44C :最迟装运期latest date of shipment45A :货物/或服务名称description of goods and/or services46A :单据要求documents required47A :附加条件additional conditions71B :费用charges48 :交单期限period for presentation49 :保兑指示confirmation instructions78 :给付款行/承兑行/议付行的指示instructions to paying/accepting/negotiating bank72 :附言sender to receiver information二、什么叫T/TT/T(Telegraphic Transfer)电汇,是指汇出行应汇款人申请,拍发加押电报\电传或SWIFT给在另一国家的分行或代理行(即汇入行)指示解付一定金额给收款人的一种汇款方式.T/T付款方式是以外汇现金方式结算,由您的客户将款项汇至贵公司指定的外汇银行账号内,可以要求货到后一定期限内汇款。

信用证外贸术语-单证

国际贸易是一个复杂的流程,各环节都涉及不同单据,相关的英语专业性也很强~~本文档收录了一些外贸用语,列出了外贸操作流程中各单证的具体内容和常用术语如信用证、汇票、收据、提单、装箱单、及其个别保险条款。

这里的英文翻译翻的很好~~很准确,符合术语的法律性内容在此也感谢参与编辑工作的石精凯同学信用证种类——Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/ 远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称——Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate amount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)below 汇票须随附下列注有(×)的单据3.accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s)to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must co ntain the clause “Drafts drawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn under United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s)drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses “Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s)so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s)bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating(showing/evidencing/specifying/declaration of)the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as required for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have be en sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading——提单1. full set shipping(company's)clean on board bill(s)of lading marked "Freight Prepaid" to order of shipper endorsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsedin blank marked "Freight Prepaid" notify: importer(openers, accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean “on board” bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked “Freight prepaid” / “Freight Payable at Destination”全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit andnot later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer, “Freight Prepaid”“Linerterms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A” “格式A”产地证明书7.genetalised system of preference certificate of origin form “A” 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in detail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full set of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件人:通过……转交开证人5.parcel post receipt evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A 海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and destination装运港与目的港(1)despatch/shipment fro m Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/ despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5) from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5) partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4. draft(s) must be negotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the dateof bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive) 本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiatio n within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn andnegotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be sent by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been compliedwith 偿付办法,由你行开出英镑即期汇票向……银行支取。

外贸知识点梳理

知识点1. 外贸专业术语(FOB,CNF,CIF,DDP,D/P,L/C等)2. 重要的概念(信用证,退税,单证等)3. 报价技巧(低高价留尾,完善基本资料,化被动为主动)4. 特别备注的几个points外 贸术 语FOB: Free on Bord.离岸价CNF: Cost and Freight.离岸价+运费CIF: Cost,insurance,freight.到岸价DDP: Delivered Duty Paid.完税后交货AWB: Air Way Bill 空运提单B/L: Bill of Loading 海运提单L/C: Letter of Credit 信用证ETD: Estimated Time of Departure 启航日ETA: Estimated Time of Arrival 抵港日D/P: Documents Against Payment 付款交单Contract: Sales Confirmation+PurchaseConfirmation.销售确认书+采购确认书 Commercial Invoice:商业发票Performance Invoice: 形式发票Packing List: 装箱单Shipping Advice: 装船通知(Shipper/Consigner发货人,Consignee收货人,Container集装箱,Vessel Name船名,Voy航次,DestinationPort目的港,Estimated Time of Departure启航日,Estimated Time of Arrival 抵港日,Place of Delivery交货地点)Insurance Policy: 保险单Inspection Certificates of Quantity: 质检证Certification of Original: 原产地证 GSP Form A: 普惠制原产地证Letter of Credit 信用证(Beneficiary Certification 受益人声明,Forwarder certification船公司/货代声明,Customs Invoice 海关发票,Draft 汇票,Applicant开证申请人,Opening/Issuing Bank 开证行,Advising/Notifying Bank通知行,Paying/Drawee Bank付款银行,Negotiating Bank 议付银行)概 念 难 点信用证,退税,单证信用证申请人——信用证开证行——信用证同知行——信用证受益人具体流程:1. 卖家把开户银行的名称,地址,Swift等资料给买家2. 买家请开证行开信用证并交到我们的国内银行3. 国内银行收到后通知卖家,卖家可去银行领取原件,也可只领取复印件而将原件交由银行保管4. 卖家根据信用证上的规定备货和整理单证,并在信用证规定的时间内把资料交给国内银行5. 国内银行审核无误后快递给国外开证行(通常一周以内收到)6. 国外银行收到后审核单证,无误后通知卖家付款并取走单证(通常2-3周收到货款)注意点 :1. 开证之后不许反悔,所以事先跟买家商量好条款和明细,如发现问题,则一定要即时修改2. 不可轻信客户“接受不符点“的单方承诺,以银行为准3. 如果开证银行不可靠,可以要求“保兑“,要求一家可靠的银行做担保人4. 保证单单一致。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

信用证种类——Kinds of L/C1. revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/ 远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C/untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/undivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/Creciprocal L/C 对背信用证/对开信用证12.traveller's L/C(or:circular L/C) 旅行信用证信用证有关各方名称——Names of Parties Concerned1. opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors 根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one's favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cabl e through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行Amount of the L/C 信用证金额1. amount RMB¥… 金额:人民币2.up to an aggregate am ount of Hongkong Dollars… 累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP… 总金额不得超过英镑……4.to the extent of HKD… 总金额为港币……5.for the amount of USD… 金额为美元……6.for an amount not exceeding total of JPY… 金额的总数不得超过……日元的限度The Stipulations for the shipping Documents1. available against surrender of the following documents bearing our credit number and the full name and ad dress of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款2.drafts to be accompanied by the documents marked(×)bel ow 汇票须随附下列注有(×)的单据3.accompanied against to d ocuments hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents marked(×)in duplicate 随附下列注有(×)的单据一式两份7.drafts are to be accompanied by… 汇票要随附(指单据)……Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s)to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn und er this credit must contain t he clause “Draftsdrawn Under Bank of…credit No.…dated…” 本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing the clause “Drawn und er United Malayan Banking Corp.Bhd.Irrevocable Letter of Credit No.…dated July 12, 1978” 汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s)drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)” 根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses “Drawn under…L/C No.…dated…” 即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s)so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s)bearing the clause:“Drawn und er documentary credit No.…(shown above) of…Bank” 汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”Invoice1. signed commercial invoice 已签署的商业发票(in duplicate 一式两in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份)2.beneficiary's original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating(showing/evidencing/specifying/declaration of)the merchandise, country of origin and any other relevant information. 以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as required for imports into Nigeria. 以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount shoul d be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: und er A/P No.… date of expiry 19th Jan. 1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据bined invoice is not acceptable 不接受联合发票Bill of Loading——提单1. full set shipping(company's)clean on board bill(s)of lading marked "Freight Prepaid" to order of shipper end orsed to … Bank, notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked "Freight Prepaid" notify: importer(openers, accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of cl ean “on board” bills of lading/cargo receipt mad e out to our order/to order and end orsed in blank notify buyers M/S … Co. calling for shipment from China to Hamburg marked “Freight prepaid” / “Freight Payable at Destination”全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of… 提单以……为抬头6.bills of lading must be dated not before the date of this credit andnot later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer, “Freight Prepaid”“Linerterms”“received for shipment” B/L not acceptable 提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本Certificate of Origin1.certificate of origin of China showing 中国产地证明书stating 证明evidencing 列明specifying 说明indicating 表明declaration of 声明2.certificate of Chinese origin 中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited 产地证,不允许装运……的产品4.declaration of origin 产地证明书(产地生明)5.certificate of origin separated 单独出具的产地证6.certificate of origin “form A” “格式A”产地证明书7.genetalised system of preference certificate of origin form “A” 普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing… 详注……的装箱单3.packing list showing in d etail… 注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full set of forwarding agents' cargo receipt 全套运输行所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number 以……为收货人,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels ad dressed to…a/c accountee 邮包收据注明收件人:通过……转交开证人5.parcel post receip t evidencing goods condigned to…and quoting our credit number 以……为收货人并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries 适用于发展中国家的包括价值和产地证明书的格式59A 海关发票证明书7.pure foods certificate 纯食品证书bined certificate of value and Chinese origin 价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice 依照1966年新西兰林木产品进出口法格式5条款的声明或出口人关于货物非用木器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export 用出口国货币标明本国市场售价,并进行笔签的加拿大海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed 完整签署和填写的格式111加拿大进口声明书The Stipulation for Shipping Terms1. loading port and d estination装运港与目的港(1)despatch/shipment from Chinese port to… 从中国港口发送/装运往……(2)evidencing shipment from China to… CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below 列明下面的货物按成本加运费价格用轮船不得迟于1987年7月15日从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987 提单日期不得迟于1987年8月15日(2)shipment must be effected not later than(or on)July 30,1987 货物不得迟于(或于)1987年7月30日装运(3)shipment latest date… 最迟装运日期:……(4)evidencing shipment/ despatch on or before… 列明货物在…年…月…日或在该日以前装运/发送(5) from China port to … not later than 31st August, 1987 不迟于1987年8月31日从中国港口至……3.partial shipments and transhipment 分运与转运(1)partial shipments are (not) permitted (不)允许分运(2)partial shipments (are) allowed (prohibited) 准许(不准)分运(3)without transhipment 不允许转运(4)transhipment at Hongkong allowed 允许在香港转船(5) partial shipments are permissible, transhipment is allowed except at… 允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted 允许分运/按比例装运(7)transhipment are permitted at any port against, through B/lading 凭联运提单允许在任何港口转运Date & Address of Expiry1. valid in…for negotiation until… 在……议付至……止2.draft(s) must be presented to the negotiating(or drawee)bank not later than… 汇票不得迟于……交议付行(受票行)3.expiry date for presention of documents… 交单满期日4. draft(s) must be ne gotiated not later than… 汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977 本证于1977年7月15日止在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977 汇票须在提单日起15天内议付,但不得迟于1977年8月8日7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5月23日为止,包括当日在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation 于1977年8月15日在受益人国家议付期满9.draft(s) drawn und er this credit must be presented for negoatation in China on or before 30th August, 1977 根据本证项下开具的汇票须在1977年8月30日或该日前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August, 1977 本证将在1977年8月15日以后停止议付受益人之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise 除非另有规定,(本证)于1977年8月15日受益人国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires 凭本证项下开具的汇票要在1977年8月12日或该日以前在中国议付,该日以后本证失效13.expiry (expiring) date… 满期日……14.…if negotiation on or before… 在……日或该日以前议付15.negoation must be on or before the 15th day of shipment 自装船日起15天或之前议付16.this credit shall remain in force until 15th August 197 in China 本证到1977年8月15日为止在中国有效17.the credit is available for negotiation or payment abroad until… 本证在国外议付或付款的日期到……为止18.documents to be presented to negotiation bank within 15 days after shipment 单据需在装船后15天内交给议付行19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts 单据需在已装船提单/运输行签发之货物承运收据日期后……天内提示议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn und er and in compliance with the terms of this credit will be duly honored 我行保证及时对所有根据本信用证开具、并与其条款相符的汇票兑付2.we und ertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured 开具并交出的汇票,如与本证的条款相符,我行保证依时付款3.we hereby engage with the drawers, endorsers and bona-fid e holders of draft(s) drawn und er and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and d elivery of d ocuments as specified (if drawn and negotiated with in the validity date of this credit) 凡根据本证开具与本证条款相符的汇票,并能按时提示和交出本证规定的单据,我行保证对出票人、背书人和善意持有人承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation 凡根据本证的条款开具并提示汇票,我们担保对其出票人、背书人和善意持有人在交单时承兑付款5.we hereby und ertake to honour all drafts drawn in accordance with the terms of this credit 所有按照本条款开具的汇票,我行保证兑付In Reimbursement1.instruction to the negotiation bank 议付行注意事项(1)the amount and date of negotiation of each draft must be end orsed on reverse hereof by the negotiation bank 每份汇票的议付金额和日期必须由议付行在本证背面签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries 本证副本供你行存档,请将随附之正本递交给受益人(3)without you confirmation thereon (本证)无需你行保兑(4)documents must be sent by consecutive airmails 单据须分别由连续航次邮寄(注:即不要将两套或数套单据同一航次寄出)(5)all original documents are to be forwarded to us by air mail andduplicate documents by sea-mail 全部单据的正本须用航邮,副本用平邮寄交我行(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail 请将包括3份商业发票在内的第一套单据用挂号航邮经寄我行,第二套单据在下一次航邮寄出(7)original documents must be sent by Registered airmail, and duplicate by subsequent airmail 单据的正本须用挂号航邮寄送,副本在下一班航邮寄送(8)documents must by sent by successive (or succeeding) airmails 单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot 用英文缮制的所有单据须一次寄交我行2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents 偿付办法,我行收到有关单据后,将授权你北京总行借记我总行在该行开立的人民币帐户(2)in reimbu rsement draw your own sight drafts in sterling on…Bank and forward them to our London Office, accompanied by your certificate that all terms of this letter of credit have been complied with 偿付办法,由你行开出英镑即期汇票向……银行支取。