韩国现代公司英文介绍

韩国企业--现代汽车集团

跨国公司供应链管理管理案例分析——韩国现代携手Samyeong电缆本文根据《运营管理》(第11版,理查德B蔡斯、罗伯特·雅各布斯、巴古拉·阿奎拉诺著,任建标等译,机械工业出版社,2007)修订而成。

特此说明!从某种程度上来说,可以将供应链和客户关系看作是一体化的。

例如,A是B的供应商,那么B也就是A的客户。

在B的供应链管理中,B所强调的就是对A的供应商管理;而在A的价值链中,A所强调的就是对B的客户关系管理。

我们以下将从韩国现代汽车(B)携手Samyeong(A)电缆公司的案例中分析这种关系。

1. 现代汽车公司简介现代汽车公司是由在韩国历史上最富传奇色彩的商业巨子郑周永先在1967年一手创办的韩国最大汽车企业。

现代汽车公司年生产能力为145万辆,可以生产从轿车、客车、货车至特种车的各类型车种。

其轿车产品主要有:Accent、Elantra、Sonata、 Grandeur、Dynasty等,排量从1.3升至3.5升。

商用车产品主要有:H100微型客车、Chorus轻型客车、Aero大中型客车系列、各类载货汽车、牵引车、自卸车以及各种专用汽车等。

与全球其它领先的汽车公司相比,现代汽车历史虽短,却浓缩了汽车产业的发展史,它从建立工厂到能够独立自主开发车型仅用了18年(1967-1985),并且在2006年,现代汽车集团在全球汽车公司销售排名榜中已经名列第6位。

韩国现代汽车的发展大致经过三个阶段:第一阶段是1967—1970年的创业期。

它和美国福特汽车公司合作,引进福特技术生产“哥蒂拉”牌小汽车,并在1970年建成年产2.6万辆生产能力的蔚山工厂。

第二阶段是1970—1975年的消化吸收期。

在这期间现代公司花巨资,在公司内进行消化吸收福特技术。

1974年投资1亿美元建设年产5.6万辆的新厂,1975年,该厂建成,小汽车国产化率达到100%。

第三阶段是1975年以后开始走向世界。

1976年,自己设计生产的福尼牌小轿车下线,现代公司走向成熟。

汽车中英文名对照

耶尔奇JELCZ

波罗乃兹POLONEZ

星STAR

茹克ZUK

菲亚特FIAT

尤诺UNO

捷克

阿维亚AVIA

柯罗沙KAROSA

利阿兹LIAZ

斯柯达SKODA

太脱拉TATRA

斯柯达.福尔曼SKODA

FORMAN

斯柯达.福泊瑞特SKODA

FAVORIT

弗雷西亚FELICIA

萨发利SAFARI

阿斯特罗ASTRO

美国福特汽车公司福特部

福特FORD

依克诺莱恩ECONOLINE

格雷那达GRANADA

陶若斯TAURUS

玛斯坦MUSTANG

雷鸟THUNDERBIRD

天霸TEMPO

维多利亚.皇冠CROWN.

VICTORIA

期望ASPIRE

康拓CONTOUR

奥塔娃OCTAVIA

南斯拉夫

法普FAP

桑诺斯SANOS

达姆TAM

红旗ZASTAVA

罗马尼亚

阿罗ARO

达契亚DACIA

罗曼ROMAN

俱乐部CLUB

匈牙利

伊卡露斯IKARUS

拉巴RABA

意大利

阿尔詹塔ARGERTA

代利DAILY

菲亚特FLAT

依维柯IVECO

美国通用汽车公司奥斯莫比尔部

奥斯莫比尔OLDSMOBILE

九十八NINETYEIGHT

卡特莱斯CUTLASS

阿奇娃ACHIEVA

塞拉CIERA

极光AURORA

激情INTRIGUE

韩国现代集团详细介绍

韩国现代集团简介韩国现代集团是韩国最大的多元化综合性财团之一,曾是韩国5大财团之一,世界五百强排名36名,公司总部位于韩国汉城。

创始人郑周永从1946年至1951年期间先后创建了现代汽车、现代土建、现代建设等公司,70年代又建立了现代重工业公司,从而使现代集团成为以建筑、造船、汽车行业为主,兼营钢铁、机械、贸易、运输、水泥生产、冶金、金融、电子工业等几十个行业的综合性企业集团。

其下属造船业位居全球三强,现代汽车公司是韩国最大的汽车企业,也是世界第八大汽车生产厂家。

现代集团历史1940年,郑周永在汉城成立了当时罕见的汽车修配厂,这是现代集团最早的雏形。

1946年,郑周永开办了“现代汽车修理所”,这是郑周永第一次把“现代”作为一个商业性企业的名称,随后郑又创办了“现代土建社”。

1950年,郑周永将“现代汽车修理所”和“现代土建社”合并为现代建设股份有限公司,从此拉开了创建“现代王朝”的序幕。

在家人的协助下,郑周永率领现代集团在韩国创造了一系列让人叹为观止的辉煌:现代集团下面的旗舰企业——现代建设集团是韩国建筑业的第一大企业,在韩国的18座核电站中,有12座是现代建设集团所修建;现代汽车集团,韩国的第一大汽车企业,20世纪70年代,制造出韩国第一辆国产汽车,其蔚山工厂是世界第一大汽车工厂;现代重工集团,是全球最大的造船厂;现代电子是全球第二大芯片制造商…… 1992年,现代集团的销售额占到了韩国整个国民收入的16%,达到惊人的532亿美元,出口额达到87亿美元,占全国出口总量的12%,在韩国的国民经济中举足轻重。

下辖的企业达到46家、涉及的领域包括电子、建筑、汽车、钢铁、造船、石化……成为韩国当之无愧的第一企业。

富可敌国上世纪末的整整10年中,现代集团一直雄踞韩国大企业集团排行榜榜首,鼎盛时期拥有80多个子公司,18万名员工,业务横跨汽车、造船、建筑等数十个行业,总资产高达97万亿韩元(1美元约合1000韩元),年销售额相当于韩国政府全年的预算。

韩国现代集团(自己总结)

Effective self-restructuringThree periods:(一)、1998年,在韩国汽车工业因野心勃勃的扩张和前一年的金融危机而带来的剧变之后,现代汽车收购了起亚汽车。

In 1998,because the ambitious of expansion in Korea’s motor industry and the large changes after last financial crisis last year,Hyundai Motor Corporation acquired Kia Motor Company.(二)、 2000年9月1日现代汽车公司正式与戴姆勒-克莱斯勒建立了战略联盟并断绝了与现代集团的关系,成为一个独立的企业集团,此举使现代集团在韩国企业集团中的排行从第一位跌至第二位,原居第二位的三星集团跃居首位。

现代汽车公司从现代集团分离出来之后,现代集团的资产总额从近89万亿韩元降至54.61万亿韩元。

2002年之前现代集团再次分裂,变成若干个互不附属的企业。

现代重工业公司、现代尾浦造船厂等公司也从现代集团中分离出来。

On September 1. 2000,Hyundai Motor Corporation formally Daimler Chrysler established a strategic alliance and cut off the relationship with Hyundai Motor Group. Hyundai Motor Group become a independent corporation,which makes Hyundai Motor Group fell to the second from the ranking first in Korea enterprise group,Samsung became the ranking first instead of Hyundai Motor Group. After Hyundai Motor Corporation separated from Hyundai Motor Group,the total assets of Hyundai MotorGroup fell to 54.61 trillion won from 89 trillion won. In 2002,Hyundai Motor Group separated again, which divided into a number of each subsidiary corporation.Hyundai Heavy Industry Corporation, Hyundai Shipyard Corporation also separated from Hyundai Motor Group.(三)、2001年,戴姆勒-现代卡车公司成立。

韩国-现代汽车公司等介绍

• 第三阶段是1975年以后开始走向世界。1976年,自己设 计生产的福尼牌小轿车下线,现代公司走向成熟。80年 代,现代公司垄断了韩国市场,和丰田公司分手,与三菱 公司结盟,生产小马牌汽车。 • 1983年小马牌汽车销往加拿大而大为走红,1985年 就卖出7.9万辆。1986年,现代公司的超小马汽车投入美 国市场,当年即售出16万辆,创下汽车业销售奇迹,从而 奠定了现代汽车公司的国际地位。 • 从小弟弟到世界排名第七

•

•

1998年,现代汽车公司度过了艰难的一年。国内市场的销售量严重下 降。然而,随着EF索娜塔sonata和XG车型的推出,现代汽车公司的 新车型获得了成功,并在国际新闻界中获得了最高的推崇。不仅如 此,由于出口情况有利,出口量持续迅速增长,这也部分抵消了国内 市场的销量下降。这期间公司也进行了合并和工业结构重组。收购起 亚(Kia)/Asia汽车厂以及与HPI和HMS的合并令现代汽车达到了全 球市场中竞争所需的经济规模。1999年度对现代汽车来说是一个非常 活跃和富有收获的年度。继1998年EF索娜塔sonata和君爵XG的成功 之后,现代汽车公司又推出了其四款最新车型:世纪 Centennial、雅 绅Accent、酷派双门轿车Coupe改进型和特杰Trajet。特杰Trajet是现 代汽车首次推出的MPV车型。它的成功推出令现代汽车进入了世界轿 车市场的一个新领域,并且进一步拓宽了现代汽车公司庞大的车型系 列。

• 现代汽车公司的标志椭圆内的斜字母H是 现代公司英文名HYUNDAI的首个字母,椭 圆既代表汽车方向盘,又可看作地球,两 者结合寓意了现代汽车遍布世界。

北京现代 • 索纳塔sonata 领翔 御翔 御翔是第六代索纳塔,领翔是第六代索纳塔的改款 • 雅绅特 ACCENT • i30 • 伊兰特 悦动 elantra • 名驭MOINCA • 途胜 TUCSON

现代汽车

现代汽车

韩国最大的汽车企业

01 旗下主要车型

目录

02 发展历程

03 集团理念

04 集团研发

05 机器人

06 全球地位

07 公司排名

09 暂停开发

目录

08 争议事件

现代汽车公司(현대자동차 주식회사,朝鲜汉字转简体:现代自动车株式会社,英文:Hyundai Motor Company)是现代汽车集团(Hyundai Motor Group)的核心企业。

1946年,郑周永在首尔中区(서울 중구)草洞建立了现代汽车工业社,从此现代建设的历史也拉开了帷幕。 1947年在汽修厂角落里挂起了"现代土木建设会社"牌子,1950年现代土木建设与现代汽车工业合并后,诞生了赫 赫有名的现代建设公司。

1967年,郑周永怀着"将汽车产业发展成为韩国经济的出口战略型产业"的远大理想成立了现代汽车。郑周永 名誉会长的汽车产业富国之梦在现代汽车集团成长历史和精神中一直得到了传承。

现代与起亚汽车2014上半年在华总计销售了86.4万辆汽车,较2013年同期上涨了9.7% 。

现代起亚汽车6月在俄罗斯市场共售出33777辆,单月销量首次超越俄罗斯汽车制造商伏尔加。得益于此,6 月其市场份额达到16.9%,首次超越伏尔加(15.1%),登上第一宝座 。

日本汽车产业调查公司“FOURIN”2014年9月14日发布的世界汽车调查月报显示,现代起亚汽车的海外销量 比重为84.5%,在全球车企中排名第三 。

现代glovis 介绍

现代glovis 介绍

现代Glovis(Hyundai Glovis)是韩国现代汽车集团(Hyundai Motor Group)旗下的一家全球物流和供应链解决方案提供商。

Glovis成立于2001年,总部位于韩国首尔,并在全球范围内设有多个分支机构和办事处。

作为韩国最大的汽车运输公司,现代Glovis专注于为现代汽车集团及其合作伙伴提供全球物流和供应链服务。

其业务范围包括汽车运输、港口操作、海运、航运、仓储和配送、供应链管理等。

Glovis 通过自有的物流网络和全球合作伙伴网络,为客户提供高效、可靠和安全的物流解决方案。

现代Glovis在全球范围内拥有广泛的物流网络和设施。

它在韩国拥有多个汽车物流中心和港口,能够提供从汽车生产到交付的全程物流服务。

此外,Glovis还在美洲、欧洲、亚洲和澳大利亚等地设有分支机构和办事处,通过与当地的物流合作伙伴合作,为客户提供全球范围的物流服务。

为了提供更加全面的供应链解决方案,现代Glovis还积极开展供应链管理和咨询服务。

它利用先进的技术和系统,通过优化供应链流程和管理,帮助客户提高效率、降低成本,并提供可持续发展的解决方案。

总的来说,现代Glovis作为现代汽车集团的物流合作伙伴,致力于

为客户提供全球范围内的物流和供应链解决方案。

通过其专业的服务和广泛的物流网络,Glovis在汽车运输和供应链领域取得了良好的声誉,并在全球范围内持续发展壮大。

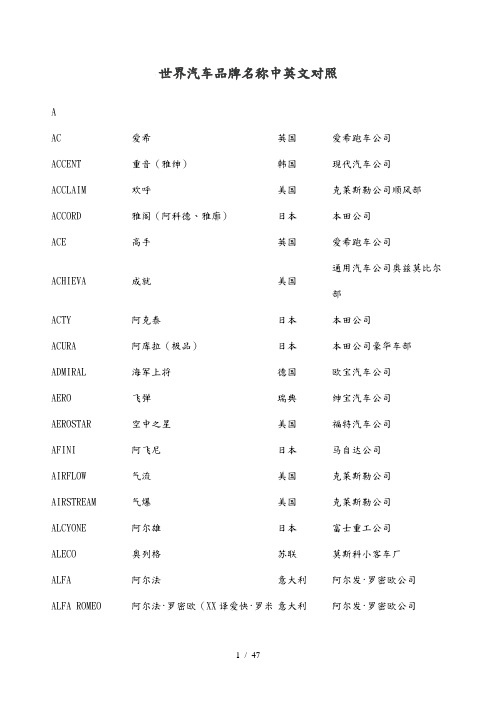

世界汽车品牌名称中英文对照

世界汽车品牌名称中英文对照AAC 爱希英国爱希跑车公司ACCENT 重音(雅绅)韩国现代汽车公司ACCLAIM 欢呼美国克莱斯勒公司顺风部ACCORD 雅阁(阿科德、雅廓)日本本田公司ACE 高手英国爱希跑车公司通用汽车公司奥兹莫比尔ACHIEVA 成就美国部ACTY 阿克泰日本本田公司ACURA 阿库拉(极品)日本本田公司豪华车部ADMIRAL 海军上将德国欧宝汽车公司AERO 飞弹瑞典绅宝汽车公司AEROSTAR 空中之星美国福特汽车公司AFINI 阿飞尼日本马自达公司AIRFLOW 气流美国克莱斯勒公司AIRSTREAM 气爆美国克莱斯勒公司ALCYONE 阿尔雄日本富士重工公司ALECO 奥列格苏联莫斯科小客车厂ALFA 阿尔法意大利阿尔发·罗密欧公司ALFA ROMEO 阿尔法·罗密欧(XX译爱快·罗米意大利阿尔发·罗密欧公司欧)ALFASUD 阿尔法苏意大利阿尔发·罗密欧公司ALFETTA 阿尔菲塔意大利阿尔发·罗密欧公司ALHAMBRA 阿尔汉布拉西班牙西特公司ALLANTE 阿尔兰特(艾杨迪)美国通用汽车公司卡迪莱克部ALLEGRO 阿莱格罗英国罗孚汽车公司ALLIANCE 联盟法国雷诺汽车公司ALMERA 阿尔美拉日本日产汽车公司ALPINA 阿尔宾那德国宝马汽车公司ALPINE 阿尔派法国雷诺汽车公司ALTIME 阿尔蒂马日本日产汽车公司ALTO 奥拓日本铃木汽车公司AMBASSADOR 大使美国美国汽车公司AMBASSADOR 大使印度印度斯坦公司AMC 美国美国汽车公司AM GENERAL 美国美国汽车综合公司AMIGO 阿米格日本五十铃汽车公司ANFINI 安菲妮日本马自达公司APOLLO 阿波罗美国通用汽车公司别克部APPLAUSE 普乐(掌声、雅宝士)日本大发公司APV 多用途车ARCADIA 阿卡迪亚韩国大宇汽车公司ARGENTA 阿金塔意大利菲亚特工业公司ARGENTO VIVO 梦中丽人日本本田汽车公司ARIES 爱丽丝美国克莱斯勒公司道奇部ARMADA 阿玛达印度ARO 阿罗罗马尼亚穆西尔汽车厂ARROW 飞箭美国克莱斯勒公司道奇部ASCONA 阿斯科纳德国欧宝汽车公司ASCOT 阿科特日本本田汽车公司ASIA 亚细亚韩国亚细亚汽车公司ASKA 阿斯卡日本五十铃汽车公司ASPEN 白杨美国克莱斯勒公司道奇部ASPIRE 追求美国福特汽车公司ASTON MARTIN 阿斯顿·马丁英国阿斯顿·马丁·拉贡公司ASTRA 雅特(阿斯特拉,德国精湛)德国欧宝汽车公司ASTRAMAX 大阿斯特拉英国沃克斯豪尔汽车公司ASTRE 阿斯特美国通用汽车公司旁蒂克部通用汽车公司货车及客车ASTRO 天体(宇宙)美国部奥迪纳苏汽车公司(大众AUDI 奥迪德国公司的子公司)通用汽车公司奥兹莫比尔AURORA 曙光(黎明女神)美国部AUSTER 南风日本日产汽车公司AUSTIN 奥斯汀英国罗孚汽车公司AUTOBIANCHI 奥托比安希意大利奥托比安希公司AVALON 亚洲龙(阿瓦龙)日本丰田汽车公司AVANTI 阿凡提美国阿凡提汽车公司AVELLA 阿维拉韩国起亚工业公司AVENGER 复仇者美国克莱斯勒公司道奇部罗尔斯-罗依斯汽车公司AZURE 蓝天英国本特利部BBARINA 巴丽娜澳大利亚霍顿汽车公司BACK PACK 背包美国克莱斯勒公司顺风部BALENO 百乐日本铃木汽车公司BALLADE 叙事曲日本本田公司BARCHETTA 新月意大利玛莎拉蒂公司BARRACUDA 梭鱼美国克莱斯勒汽车公司BEDFORD 贝德福德英国沃尔斯豪尔汽车公司BEETLE 甲克虫德国大众汽车公司BEL AIR 贝埃尔美国通用汽车公司雪佛莱部BELMONT 贝尔蒙特英国沃克斯豪斯汽车公司BELVEDERE 观景楼美国克莱斯勒汽车公司BENTLEY 本特利英国罗尔斯-罗依斯汽车公司BENZ 奔驰(本茨,平治)德国梅赛德斯-奔驰公司BERETTA 贝里塔美国通用汽车公司雪佛莱部BERLIET 贝里埃法国贝利埃汽车公司BERLINA 贝琳娜澳大利亚霍顿汽车公司BERTONE 博通意大利博通汽车设计公司BEAT 比特(节拍)日本本田公司BERETTA 贝雷塔美国通用汽车公司雪佛莱部BETA 贝塔意大利兰旗公司BIARRITZ 拜芮茨美国通用汽车公司卡迪莱克部BIGHORN 大号角日本五十铃汽车公司BL 英国英国利兰汽车公司BLAZER 传播者美国通用汽车公司雪佛莱部BLITZ 闪电意大利博通汽车设计公司BLUEBIRD 蓝鸟日本日产汽车公司BMW 宝马(巴依尔)德国宝马汽车公司BOBCAT 山猫美国福特汽车公司林肯部BONGO 本格日本马自达公司BONNEVILLE 博纳维尔美国通用汽车公司旁蒂克部BOXER 拳击家日本马自达公司BOXSTER 芭色尔德国保时捷公司BRAT 小鬼日本五十铃汽车公司BRAVA 布拉瓦意大利菲亚特工业公司通用汽车公司奥兹莫比尔BRAVDA 布拉瓦达美国部BRAVO 布拉沃意大利菲亚特工业公司BREEZE 轻风美国克莱斯勒公司顺风部BRISA 布里萨韩国起亚工业公司BRISTOL 布利斯托英国布利斯托汽车公司BRONCO 烈马美国福特汽车公司罗尔斯-罗依斯汽车公司BROOKLAND 布罗克兰英国本特利部美国通用汽车公司卡迪莱BROUGHAM 超级沙龙(布劳汉姆)美国克部BUCRANE 布克兰韩国大宇汽车公司BUGATTI 布加迪意大利布加迪公司BUICK 别克美国通用汽车公司的一个分部CCABALL 卡布尔日本日产汽车公司CABRIOLET 敞篷车CABRO 眼镜蛇英国AC 公司CABSTAR 货星日本日产汽车公司CADILLAC 卡迪拉克(凯迪莱克)美国通用汽车公司的一个分部CALA 卡拉意大利兰伯基尼汽车公司CALAIS 加来通用汽车公司卡迪莱克部CALDINA 卡尔迪娜日本丰田汽车公司CALIBRA 佳丽(卡利布拉)德国欧宝公司CAMARGUE 卡马克英国罗尔斯-罗依斯汽车公司CAMARO 卡马洛美国通用汽车公司雪佛莱部CAMPER 野营者美国美国汽车公司CAMRY 佳美日本丰田汽车公司CANTER 奔马日本三菱汽车公司CAPELLA 卡佩拉日本马自达公司CAPITAL 首都韩国起亚工业公司CAPRI 凯丽(快百里)美国福特汽车公司水星部CAPRICE 随想曲(开普瑞斯)美国通用汽车公司雪佛莱部CARAVAN 商队日本日产汽车公司CARAVAN 捷龙美国克莱斯勒公司道奇部CARAVELLE 卡拉维尔德国大众汽车公司CARAVELLE 卡拉维尔美国克莱斯勒公司CARGO 货运意大利伊维柯工业车辆公司CARGOSTAR 货运之星美国万国联合收割机公司CARINA 卡利那日本丰田汽车公司CARSMA 凯斯玛日本三菱汽车公司CARLTON 卡尔通英国沃克斯豪尔汽车公司CAROL 颂歌日本马自达公司CARRERA 卡列拉德国保时捷研究设计发展公司CARRY 运载日本铃木汽车公司CATALINA 卡塔丽娜美国通用汽车公司旁蒂克部CAVALIER 骑士英国沃克斯豪尔汽车公司CAVALIER 骑士美国通用汽车公司雪佛莱部CADRIC 公爵日本日产汽车公司CEFIRO 赛飞龙(风度)日本日产汽车公司CELEBRITY 名人美国通用汽车公司雪佛莱部CELICA 赛利卡日本丰田汽车公司CENTURY 世纪美国通用汽车公司别克部CENTURY 世纪日本丰田汽车公司CERBERA 赛伯乐英国TVR 公司CERVO 牡鹿日本铃木汽车公司CHALLENGER 挑战者美国克莱斯勒公司道奇部CHAMP 冠军美国克莱斯勒公司CHARADE 夏利日本大发公司CHARMANT 魅力日本大发公司CHARGER 战马美国克莱斯勒公司道奇部CHASER 猎手(追击者)日本丰田汽车公司CHECKER 切克美国切克汽车公司CHEROKEE 切诺基美国克莱斯勒汽车公司CHERRY 樱花日本日产汽车公司CHEVELLE 学维尔美国通用汽车公司雪佛莱部CHEVETTE 学维特英国沃克斯豪尔汽车公司CHEVROLET 雪佛兰美国通用汽车公司的一个分部CHICO 齐柯德国大众汽车公司CHIMAERA 驰马拉英国TVR 公司CHRYSLER 克莱斯勒美国克莱斯勒公司CIADIA 加的亚阿根廷加的亚汽车公司CIELO 蓝天韩国大宇汽车公司通用汽车公司奥兹莫比尔CIERA 赛拉美国部CIMA 喜马日本日产汽车公司CIMARRON 西马龙美国通用汽车公司卡迪莱克部CINQUECENTO 新快全多(文艺复兴)意大利菲亚特工业公司CIRRUS 卷云美国克莱斯勒公司CISTALIA 西斯塔利亚德国保时捷研究设计发展公司CITATION 嘉奖美国通用汽车公司雪佛莱部CITROEN 雪铁龙法国雪铁龙汽车公司CITY 城市德国欧宝汽车公司CITY 城市日本本田汽车公司CIVIC 市民(思域)日本本田公司CIVILIAN 平民日本日产汽车公司CLIO 克利鸥法国雷诺汽车集团CLIPPER 快马日本日产汽车公司CLUB 俱乐部美国福特汽车公司CLUBMAN 交际家英国陆虎汽车公司COASTER 考斯利日本丰田汽车公司COBRA 眼镜蛇英国爱希跑车公司COBRA 眼镜蛇美国福特汽车公司COLONY PARK 移民公园美国福特汽车公司COLT 小马美国克莱斯勒公司道奇部ANCHE 科曼契美国克莱斯勒公司MODORE 海军准将德国欧宝汽车公司CONCERTO 雄才日本本田公司CONCORD 协和(君王)美国克莱斯勒公司CONCORD 协和韩国起亚工业公司CONDOR 神鹰日本日产柴油机公司CONQUEST 征服美国通用汽车公司雪佛莱部CONSORTE 伴侣日本大发公司CONSUL 领事美国福特汽车公司CLASSIC 康特萨-经典印度印度斯坦公司CONTINENTAL 大陆美国福特汽车公司林肯部罗尔斯-罗依斯汽车公司CONTINENTAL 大陆英国本特利部CONTOUR 轮廓美国福特汽车公司CORDIA 科迪亚日本三菱汽车公司CORDOBA 科尔多巴美国克莱斯勒公司CORDOBA 科尔多巴西班牙西特公司CORNICHE 险路英国罗尔斯-罗依斯汽车公司COROLLA 花冠(歌乐娜)日本丰田汽车公司CORONA 花冠(可乐娜)日本丰田汽车公司CORONET 王冠美国克莱斯勒公司CORRADO 科拉多德国大众汽车公司CORSA 可赛日本丰田汽车公司CORSA 可赛德国欧宝汽车公司CORSICA 可喜家美国通用汽车公司雪佛莱部CORTINA 柯蒂那美国福特汽车公司CORVETTE 科尔维特(科维、护卫舰)美国通用汽车公司雪佛莱部COSMO 宇宙日本马自达公司COUGAR 美洲狮美国福特汽车公司水星部COUNTACH 康塔什(蛮牛)意大利兰伯基尼汽车公司COUNTRY 家乡美国福特汽车公司COUPE 小型运动轿车COURIER 信使美国福特汽车公司CREDOS 魁多韩国起亚工业公司CRESSIDA 克莱希达日本丰田汽车公司CRESTA 登峰日本丰田汽车公司CRESTWOOD 克莱斯伍美国克莱斯勒公司CREW 乘务员日本日产汽车公司CROMA 克罗玛意大利菲亚特工业公司CROWN 皇冠日本丰田汽车公司CROWN VICTORIA 维多利亚皇冠美国福特汽车公司通用汽车公司奥兹莫比尔CRUISER 巡洋舰美国部CUNNINGHAM 康凡美国通用汽车公司雪佛莱部CUORE 库雷(廓丽)日本大发公司CUPPUCCINO 开普喜乐日本铃木汽车公司CUSTOM 风俗美国福特汽车公司CUSTOM 风俗美国通用汽车公司别克部通用汽车公司奥兹莫比尔CUTLASS 弯刀(短剑)美国部CYNOS 西诺斯日本丰田汽车公司DDACIA 达西亚罗马尼亚彼特什蒂汽车厂DAEWOO 大宇韩国大宇汽车公司DAF 达夫荷兰达夫汽车厂DAIHATSU 大发日本大发工业公司DAILY 得意意大利跨国工业车辆公司DAIMLER 戴姆勒德国德国最早的汽车公司之一DAIMLER 戴姆勒英国美洲虎公司戴姆勒-克莱斯勒德国-美国戴姆勒-克莱斯勒公司DAIMLER-CHRYSLERDAKOTA 达科他美国克莱斯勒汽车公司道奇部DART 标枪美国克莱斯勒公司道奇部DASHER 冲击者德国大众汽车公司DATUSUN 达特桑(得胜)日本日产汽车公司玛吉鲁斯·道依兹公司(现DAUTZ 道依兹德国属依维柯公司)DAYTONA 戴通娜美国克莱斯勒公司DAYTONE 戴托娜意大利法拉利公司D-C 戴姆勒-克莱斯勒德国-美国戴姆勒-克莱斯勒公司DEAUVILLE 迪维尔意大利托马索公司DEBONAIR 快乐(德宝)日本三菱汽车公司DEDRA 德托意大利蓝旗公司DEFENDER 卫士英国罗孚汽车公司DELICA 德利卡日本三菱汽车公司DELPHI 德尔福美国法拉利公司DELTA 德尔塔日本大发公司DELTA 德尔塔意大利蓝旗公司通用汽车公司奥兹莫比尔DELTA 德尔塔美国部DEMON 守护神美国克莱斯勒公司DERBY 赛马(杜比)德国大众汽车公司DE SOTO 德索托美国克莱斯勒公司DETOMASO 德托马索日本大发公司DE VILLE 都市(帝威)美国通用汽车公司卡迪莱克部DIABLO 迪亚布罗(恶魔)意大利兰伯基尼汽车公司DIAMANTE 宝石(戴芒特)日本三菱汽车公司DINO 迪诺意大利法拉利公司DIPLOMAT 外交家美国克莱斯勒公司道奇部DIPLOMAT 外交家德国欧宝汽车公司DISCOVER 发现者英国陆虎汽车公司DIXI 迪西亚德国欧宝汽车公司DODGE 道奇美国克莱斯勒公司的一个分部DOLOMITE XX石英国美洲虎公司DOMANI 明天日本本田汽车公司DOWNTOWN 城市意大利菲亚特工业公司DUSTER 清洁工美国克莱斯勒公司DYANE 黛恩法国雪铁龙汽车公司DYNA 戴娜日本丰田汽车公司DYNASTY 王朝美国克莱斯勒公司EEAGLE 鹰美国美国汽车公司的一个分部ECLAT 光辉英国莲花汽车公司ECLIPSE 日全蚀日本三菱汽车公司ECONOLINE 经济线美国福特汽车公司的轻型客车EDSEL 埃塞尔美国福特汽车公司通用汽车公司奥兹莫比尔EIGHTY EIGHT 八十八美国部ELAN 爱伦(精灵)英国莲花汽车公司ELANTRA 伊兰特拉韩国现代汽车公司EL CAMINO 爱卡米诺美国通用汽车公司ELECTRA 电美国通用汽车公司别克部ELDORADO 爱尔多拉多美国通用汽车公司卡迪莱克部ELF 埃尔夫日本五十铃汽车公司ELITE 精华英国莲花汽车公司EMERAUDE 爱墨绿日本三菱汽车公司ENCORE 重演法国雷诺汽车公司ERF 厄夫英国厄夫公司ESCAPE 爱仕美国福特汽车公司ESCORT 护卫者美国福特汽车公司ESCUDO 埃斯库多日本铃木汽车公司ESPACE 太空(埃斯佩多)法国雷诺汽车公司ESPADA 埃斯巴达意大利兰伯基尼汽车公司ESPERO 希望韩国大宇汽车公司ESPRIT 精灵英国莲花汽车公司ESTEEM 尊重日本铃木汽车公司ETUDE 练习曲日本马自达公司EUNOS 俊朗日本马自达公司的豪华车部EUROPA 欧罗巴英国莲花汽车公司法国、意大PSA 与菲亚特集团EVASION 逃遁利EVOQ 依沃克美国通用汽车公司卡迪莱克部EXCEL 杰出韩国现代汽车公司EXECUTIVE 董事美国克莱斯勒公司顺风部EXPEDITION 远征队美国福特汽车公司EXPLER 探险号美国福特汽车公司EXPO 展览日本三菱汽车公司EXPRESS 快运法国塔尔伯特公司FFACT 法克特德国辰德公司FAIRLADY 贵妇人日本日产汽车公司FAIRLANE 菲尔兰美国福特汽车公司FAIRMONT 菲尔蒙特美国福特汽车公司FALCON 猎鹰美国福特汽车公司FAMILIA 家族日本马自达公司FAP 法普前南斯拉夫法普·费莫斯汽车公司FASTER 快车日本五十铃汽车公司FAUN 福恩德国福恩公司FELICIA 弗雷西亚捷克斯柯达公司FELLOW 伙伴日本大发公司FEROZA 费罗莎日本大发公司FERRARI 法拉利(费拉丽)意大利法拉利公司FESTIVA 节日美国福特汽车公司FIAT 菲亚特意大利菲亚特工业公司FIERO 菲洛美国通用汽车公司旁蒂克部FIESTA 嘉年华(节日)美国福特汽车公司FIFTH AVENUE 第五大街美国克莱斯勒公司FIREBIRD 火鸟美国通用汽车公司旁蒂克部FIREFLY 萤火虫美国通用汽车公司旁蒂克部通用汽车公司奥兹莫比尔FIRENZA 佛罗伦萨美国部FLAIR 天才美国福特汽车公司FLEETSTAR 车队之星美国万国联合收割机公司美国通用汽车公司卡迪莱FLEETWOOD 弗利特伍德(富丽沃)美国克部FLORIAN 御马日本五十铃汽车公司FOCUS 焦点美国福特汽车公司FODEN 福登英国福登公司FORD 福特美国福特汽车公司FORMA 福马俄罗斯伏尔加公司FORTE 强音日本三菱汽车公司FORWARD 前进日本五十铃汽车公司FOX 狐狸巴西巴西德国大众汽车公司FREE LANDER 神星者英国陆虎汽车公司FREIGHTLINER 货运线美国货运线公司FRONTE 先驱者日本铃木汽车公司FRONTE 先驱者意大利蓝旗公司FRONTERA 福龙德国欧宝汽车公司FSO 波兰波罗乃兹汽车厂FSR 波兰福斯尔公司FUEGO 飞优果法国雷诺汽车集团FUN 发烧友美国福特汽车公司FURY 复仇女神美国克莱斯勒公司顺风部FUSO 扶桑日本三菱汽车公司FUTURA 富图拉美国福特汽车公司FWD 美国美国四轮驱动汽车公司GGALANT 华丽(豪侠)日本三菱汽车公司GALAXY 银河美国福特汽车公司GAMMA 伽马意大利蓝旗公司GAZ 嘎斯(又译“格斯”)俄罗斯高尔基汽车厂GAZELLE 羚羊日本日产汽车公司GEMINI 双子星座(吉米尼)日本五十铃汽车公司通用汽车公司货车及客车GENERAL 将军美国部GEO 吉奥美国通用汽车公司的一个分部GEODGEALO 乔治亚罗意大利乔治亚罗汽车设计公司GERMANY 日耳曼美国福特汽车公司林肯部GHIA 吉亚美国福特汽车公司GHIBLI 吉百利意大利玛莎拉蒂公司GIULIETTA 吉里耶塔意大利阿尔法·罗密欧公司GLORIA 光荣日本日产汽车公司GM 通用美国通用汽车公司GMC 通用美国通用汽车公司吉普公司GOLF 高尔夫德国大众汽车公司GOLDEN EAGLE 金鹰美国美国汽车公司吉普公司GORDINI 哥地尼法国雷诺汽车集团GRANADA 格雷那达美国福特汽车公司GRAND AM 大艾姆美国通用汽车公司旁蒂克部GRANDEOR 现代王韩国现代汽车公司GRAND FAMILIA 大家族日本马自达公司GRAND MARQUIS 老侯爵美国福特汽车公司水星部GRAND PRIX 大奖赛美国通用汽车公司旁蒂克部GRAND VOYAGER 老航海家美国克莱斯勒汽车公司GRAN FURY 风暴美国克莱斯勒汽车公司GRAN SPORT 运动美国通用汽车公司别克部GRAN VILLE 大都市美国通用汽车公司旁蒂克部GREMLIN 格雷姆林美国美国汽车公司GRIFFITH 格力菲斯英国TVR 公司GTO GTO 跑车美国通用汽车公司旁蒂克部GYPSY 吉卜赛印度HHIACE 海狮日本丰田汽车公司HINDUSTAN 印度斯坦印度印度斯坦汽车公司HIJET 海捷特日本大发公司HILUX 海拉克斯日本丰田汽车公司HINO 日野日本日野汽车公司HOBBY 霍比巴西福特汽车公司HOLDEN 霍尔顿澳大利亚霍尔顿汽车公司HOMER 通信鸽日本日产汽车公司HONCHO 老板美国美国汽车公司吉普公司HONDA 本田日本本田技研工业公司HORIZON 水平线法国塔尔伯特公司HORIZON 水平线美国克莱斯勒汽车公司HUMMER 悍马美国美国汽车综合公司HUNTER 猎人法国塔尔伯特公司HYUNDAI 现代韩国现代汽车公司IIAD 英国英国国际汽车设计公司IBIZA DESIGNER 依比扎西班牙图雷斯莫汽车公司IDEA 依地亚意大利意大利汽车设计公司IFA 依发德国原XX德国依发汽车厂IKARUS 依卡露斯匈牙利伊卡露斯车身和车辆厂IKON 爱卡美国福特汽车公司ILTIS 白鼬德国大众汽车公司IMPACT 冲击美国通用汽车公司IMPALASS 英普拉美国通用汽车公司雪佛莱部IMPERIAL 帝国美国克莱斯勒公司IMPREZA 银泊(翼豹,英普里扎)日本富士重工业公司IMPULSE 脉冲日本五十铃汽车公司INFINTI 无限日本日产汽车公司豪华车部INNOCENTI 英诺仙蒂意大利英诺仙蒂公司INSPIRE 励志日本本田汽车公司INTEGRA 英特格(形格)日本本田汽车公司豪华车部INTERNATIONAL 万国美国万国联合收割机公司INTREPID 无畏(勇士)美国克莱斯勒公司道奇部通用汽车公司奥兹莫比尔INTRIGUE 神奇美国部IPANEMA 依帕内马巴西通用汽车公司IRMSHER 依姆舍尔德国依姆舍尔公司ISETTA 依赛塔德国宝马公司ISUZU 五十铃日本五十铃汽车公司IVECO 依维柯意大利(跨国)工业车辆公司IXION 爱客新美国福特汽车公司JJAGUAR 美洲虎(杰戈娃,捷豹)英国美洲虎公司JALPA 亚尔帕意大利兰伯基尼汽车公司JAVA 佳娃英国罗尔斯-罗依斯汽车公司克莱斯勒汽车公司吉JEEP 吉普美国普·鹰部JELCZ 野尔奇波兰耶尔奇汽车厂JETTA 捷达德国大众汽车公司通用汽车公司货车及客车JIMMY 吉米美国部JIMNY 吉姆尼日本铃木汽车公司JOURNEY 旅行日本五十铃汽车公司JUNIOR 少年日本日产汽车公司JUSTY 约斯蒂日本富士重工业公司KKA 美国福特汽车公司KADETT 士官生德国欧宝汽车公司KALLISTA 卡丽丝塔韩国双龙汽车公司KAMAZ 卡马兹俄罗斯卡马河汽车厂KANGGOO 甘果法国雷诺汽车集团KAPITAIN 船长德国欧宝汽车公司KAPPA 卡帕意大利蓝旗公司KARISMA 卡里斯玛意大利博通汽车设计公司KARMAN GHIA 卡曼吉亚德国大众汽车公司KAYAK 卡亚克意大利博通汽车设计公司KIA 起亚韩国起亚工业公司KOMBI 康比德国大众汽车公司KORRANDO 科兰多韩国双龙汽车公司LLADA 拉达俄罗斯伏尔加汽车厂LAGO 拉果法国塔尔伯特公司LAGONDA 拉贡达英国阿斯顿·马丁·拉贡达公司LAGUNA 拉古娜法国雷诺汽车集团LAMBDA 兰伯达意大利兰旗公司LAMBORGHINI 兰伯基尼(XX译林宝坚尼)意大利兰伯基尼汽车公司LAMPO 兰博意大利菲亚特工业公司LANCER 轻骑兵日本三菱汽车公司LANCIA 兰旗(蓝旗)意大利兰旗公司LAND CRUISER 陆地巡洋舰(沙漠王)日本丰田汽车公司LAND ROVER 览胜陆虎(兰治罗孚)英国陆虎汽车公司LANTRA 兰特拉韩国现代汽车公司LASER 镭射美国克莱斯勒公司顺风部LAUREL 桂冠日本日产汽车公司LEAN MACHINE 斜车美国通用汽车公司LE BARON 男爵美国克莱斯勒公司LE CAR 雷卡法国雷诺汽车集团LEEZA 丽萨日本大发公司LEGACY 力狮(传世,遗产)日本富士重工业公司LEGEND 传奇(里程)日本本田汽车公司阿库拉部LE MANS 勒芒美国通用汽车公司旁蒂克部LEONE 雄狮日本富士重工业公司LE SABRA 马刀美国通用汽车公司别克部LEXUS 凌志(列克萨斯)日本丰田汽车公司豪华车部LEYLAND 利兰英国利兰汽车公司LIAZ 利阿兹斯洛伐克利阿兹汽车厂LIBERO 自由人日本富士重工业公司LIGIER 里吉尔法国里吉尔汽车公司LIFE 生活日本本田公司LINCOLN 林肯美国福特汽车公司林肯部LITEACE 莱特艾斯日本丰田汽车公司LOADSTAR 北极星美国万国联合收割机公司LOTUS 莲花(又译洛托斯)英国莲花汽车公司LOYALE 罗耶尔日本富士重工业公司LUAZ 洛兹乌克兰越野车公司LUCE 光日本日本马自达公司LUCINO 卢齐诺日本日产汽车公司LUMINA 鲁米娜美国通用汽车公司雪佛莱部LUPO 路波德国大众汽车公司LYNX 天猫座美国福特汽车公司MMACK 麦克美国麦克卡车公司MAESTRO 艺术大师英国陆虎汽车公司MAGIRUS 玛吉鲁斯德国玛吉鲁斯·道依兹公司MAGNUM 马格纳姆美国克莱斯勒公司道奇部MAHINDRA 马辛德拉印度马辛德拉汽车公司MALAGA 马拉加西班牙西特公司MALIBU 马利布美国通用汽车公司雪佛莱部奥格斯堡·纽伦堡机械公M.A.N 曼德国司MANTA 曼塔德国欧宝汽车公司MARATHON 马拉松美国切克汽车公司的出租汽车MARBELLA 玛贝拉西班牙西特公司MARCH 前进日本日产汽车公司MAREA 马力昂意大利菲亚特工业公司MARINA 玛丽娜英国陆虎汽车公司MARK II 马克 II 日本丰田汽车公司MARK V 马克 V 英国美洲虎公司MARK 7 马克 7 美国福特汽车公司MARQUIS 侯爵美国福特汽车公司林肯部MARUTI 马鲁蒂印度马鲁蒂公司MASERATI 玛莎拉蒂意大利玛沙拉蒂公司MASHALATTI 玛莎拉蒂意大利菲亚特工业公司MASTER 大师法国雷诺汽车集团MATADOR 斗牛士美国美国汽车公司MATIZ 马提兹韩国大宇汽车公司MATRA 马特拉法国塔尔伯特公司MAVERICK 独立美国福特汽车公司MAUS 茅斯日本三菱汽车公司MAXI 马克西英国陆虎汽车公司MAXIMA 马克西玛(千里马)日本日产汽车公司MAXX 马可斯德国欧宝汽车公司德国老牌汽车,以著名汽MAYBACH 梅巴赫德国车发明家命名MAZDA 马自达(XX译“万事得”)日本马自达公司MCLAREN 麦拿仑麦拿仑赛车公司MEDALLION 梅达莲美国克莱斯勒公司MEDALLION 梅达莲法国雷诺汽车集团MEGANE 梅甘娜法国雷诺汽车集团MEHARI 梅哈利法国雪铁龙汽车公司梅塞德斯-奔驰汽车公MERCEDES-BENZ 梅赛德斯-奔驰德国司,即奔驰公司的全称MERCURY 默寇利(水星)美国福特汽车公司林肯部MERKUR SCORPIO 默克·天蝎座美国福特汽车公司METEOR 流星南非南非汽车公司METRO 地下铁道美国通用汽车公司 CEO 部METRO MAYFAIR 城市贵族英国陆虎汽车公司METROPOLITAN 大都市人美国那什公司老牌小型运动轿车,已并MG 美琦英国入罗孚汽车公司MICRA 米克拉日本日产汽车公司MIDGET 侏儒英国美洲虎公司MIDI 米地英国贝德福公司MILANO VERDE 米拉诺·沃德意大利阿尔法·罗密欧公司MINI 米尼(迷你)英国陆虎汽车公司MINICA 米尼卡日本三菱汽车公司MINI CAB WIDE 小宽头日本三菱汽车公司MIRA 米拉日本大发公司MIRADA 米拉达美国克莱斯勒公司道奇部MIRAGE 海市蜃楼日本三菱汽车公司MISITQUE 密斯迪美国福特汽车公司水星部MITSUBISHI 三菱日本三菱汽车公司MIURA 米拉意大利兰伯基尼公司MOKE 毛驴英国利兰公司MONACO 摩纳哥美国克莱斯勒公司道奇部MONARCH 君主美国福特汽车公司林肯部MONDEO 蒙迪欧欧洲福特汽车公司MONDIAL 世界(芒德尔)意大利法拉利公司MONTE CARLO 蒙特卡洛美国通用汽车公司雪佛莱部MONTE CARLO 蒙特卡洛意大利兰旗公司MONTEGO 蒙特哥英国陆虎汽车公司MONTEREY 蒙泰雷德国欧宝汽车公司MONTERO 蒙特洛日本三菱汽车公司MONTEZ 蒙泰兹巴西JPX 公司MONZA 蒙扎意大利法拉利公司MONZA 蒙扎德国欧宝汽车公司MORGAN 摩根英国摩根汽车公司MORNING CAR 晨车韩国起亚工业公司MOSKOVICH 莫斯科人俄罗斯莫斯科小客车厂。

介绍公司的开头英文作文

介绍公司的开头英文作文英文:Hi there, let me introduce my company to you. We are a startup that specializes in developing mobile applications for both iOS and Android platforms. Our team consists of experienced developers, designers, and project managers who are passionate about creating innovative and user-friendly apps.Our company was founded in 2018 with the aim of providing high-quality mobile solutions to businesses and individuals. Since then, we have worked with variousclients from different industries, including healthcare, education, and entertainment. We have also receivedpositive feedback from our clients, which motivates us to continue improving our services.One of our successful projects is a fitness app that we developed for a fitness center. The app allows users totrack their workouts, set goals, and receive personalized recommendations based on their fitness level and preferences. The app has been well-received by the fitness center's members and has helped them to achieve theirfitness goals.We are committed to delivering excellent results and providing exceptional customer service. We believe that communication is key to a successful project, and we always keep our clients informed throughout the development process. Our goal is to create apps that not only meet our clients' needs but also exceed their expectations.中文:大家好,让我来介绍一下我们的公司。

介绍企业的英文作文

介绍企业的英文作文英文:Hello everyone, I am the founder of our company and I am excited to introduce our enterprise to you. Our companyis a technology-based startup that specializes indeveloping innovative software solutions for businesses.We pride ourselves on our ability to provide customized solutions that meet the unique needs of each of our clients. Our team of experienced developers and designers workclosely with our clients to understand their business requirements and develop solutions that are tailored totheir specific needs.One of our recent projects was developing a mobile app for a local restaurant. We worked closely with therestaurant owner to understand their needs and developed a user-friendly app that allowed customers to order onlineand earn loyalty points. The app was a huge success andhelped the restaurant increase their revenue and customer base.In addition to software development, we also offer consulting services to help businesses optimize their operations and improve their bottom line. Our team of consultants have years of experience in various industries and can provide valuable insights and recommendations to help businesses achieve their goals.We are committed to delivering high-quality solutions and providing excellent customer service. Our goal is to help businesses succeed and grow by leveraging the power of technology.中文:大家好,我是我们公司的创始人,很高兴向大家介绍我们的企业。

介绍公司的英语作文

介绍公司的英语作文Introduction to Our Company。

Our company, XYZ Corporation, is a leading provider of innovative solutions in the field of technology. With a strong focus on research and development, we strive to deliver cutting-edge products and services to meet theever-evolving needs of our customers.Founded in 2005, XYZ Corporation has grown rapidly to become a global player in the technology industry. Our headquarters are located in the bustling city of [City], with additional offices and research facilities spread across several countries. This global presence allows us to tap into diverse talent pools and collaborate with experts from around the world.At XYZ Corporation, we pride ourselves on our commitment to excellence. Our team of highly skilled professionals is dedicated to pushing the boundaries oftechnological innovation. Through continuous investment in research and development, we have been able to develop groundbreaking solutions that have revolutionized various sectors, including telecommunications, healthcare, and finance.One of our flagship products is the XYZ SmartPhone, a state-of-the-art mobile device that combines sleek design with advanced features. Equipped with the latest technology, our smartphones offer seamless connectivity, enhanced security, and an immersive user experience. We have consistently received rave reviews from both consumers and industry experts, solidifying our position as a market leader.In addition to our hardware offerings, XYZ Corporation also provides a range of software solutions. Our team of software engineers works tirelessly to develop user-friendly applications that streamline business processesand enhance productivity. From enterprise resource planning systems to customer relationship management software, our solutions cater to the diverse needs of businesses acrossvarious industries.Furthermore, XYZ Corporation is committed to sustainability and corporate social responsibility. We actively seek ways to minimize our environmental footprint and contribute to the communities in which we operate. Through initiatives such as recycling programs and community outreach projects, we strive to make a positive impact on society.As part of our growth strategy, we also place great emphasis on strategic partnerships and collaborations. By forging alliances with other industry leaders, we are able to leverage complementary strengths and expand our reach. These collaborations enable us to stay at the forefront of technological advancements and offer comprehensive solutions to our customers.In conclusion, XYZ Corporation is a dynamic and innovative company that is dedicated to pushing the boundaries of technology. With a strong focus on research and development, we consistently deliver cutting-edgeproducts and services to meet the evolving needs of our customers. Our commitment to excellence, sustainability, and strategic collaborations sets us apart in the industry. We look forward to continuing our journey of innovation and making a positive impact on the world.。

汽车名称中英文对照

BERLIET 贝里埃 法国 贝利埃汽车公司

BERLINA 贝琳娜 澳大利亚 霍顿汽车公司

BERTONE 博通 意大利 博通汽车设计公司

BEAT 比特(节拍) 日本 本田公司

汽车名称中英文对照

A

AC 爱希 英国 爱希跑车公司

ACCENT 重音(雅绅) 韩国 现代汽车公司

ACCLAIM 欢呼 美国 克莱斯勒公司顺风部

ACCORD 雅阁(阿科德、雅廓) 日本 本田公司

ACE 高手 英国 爱希跑车公司

CHARGER 战马 美国 克莱斯勒公司道奇部

CHASER 猎手(追击者) 日本 丰田汽车公司

CHECKER 切克 美国 切克汽车公司

CHEROKEE 切诺基 美国 克莱斯勒汽车公司

CHERRY 樱花 日本 日产汽车公司

CARRY 运载 日本 铃木汽车公司

CATALINA 卡塔丽娜 美国 通用汽车公司旁蒂克部

CAVALIER 骑士 英国 沃克斯豪尔汽车公司

CAVALIER 骑士 美国 通用汽车公司雪佛莱部

CADRIC 公爵 日本 日产汽车公司

AM GENERAL 美国 美国汽车综合公司

AMIGO 阿米格 日本 五十铃汽车公司

ANFINI 安菲妮 日本 马自达公司

APOLLO 阿波罗 美国 通用汽车公司别克部

APPLAUSE 普乐(掌声、雅宝士) 日本 大发公司

BROUGHAM 超级沙龙(布劳汉姆) 美国 美国通用汽车公司卡迪莱克部

BUCRANE 布克兰 韩国 大宇汽车公司

BUGATTI 布加迪 意大利 布加迪公司

世界汽车品牌名称中英文对照讲解

世界汽车品牌名称中英文对照LLADA拉达俄罗斯伏尔加汽车厂LAGO拉果法国塔尔伯特公司LAGONDA拉贡达英国阿斯顿·马丁·拉贡达公司LAGUNA拉古娜法国雷诺汽车集团LAMBDA兰伯达意大利兰旗公司兰伯基尼(香港译林宝坚意大利兰伯基尼汽车公司LAMBORGHINI尼)LAMPO兰博意大利菲亚特工业公司LANCER轻骑兵日本三菱汽车公司LANCIA兰旗(蓝旗)意大利兰旗公司LAND CRUISER陆地巡洋舰(沙漠王)日本丰田汽车公司LAND ROVER览胜陆虎(兰治罗孚)英国陆虎汽车公司LANTRA兰特拉韩国现代汽车公司LASER镭射美国克莱斯勒公司顺风部LAUREL桂冠日本日产汽车公司LEAN MACHINE斜车美国通用汽车公司LE BARON男爵美国克莱斯勒公司LE CAR雷卡法国雷诺汽车集团LEEZA丽萨日本大发公司LEGACY力狮(传世,遗产)日本富士重工业公司LEGEND传奇(里程)日本本田汽车公司阿库拉部LE MANS勒芒美国通用汽车公司旁蒂克部LEONE雄狮日本富士重工业公司LE SABRA马刀美国通用汽车公司别克部LEXUS凌志(列克萨斯)日本丰田汽车公司豪华车部LEYLAND利兰英国利兰汽车公司LIAZ利阿兹斯洛伐克利阿兹汽车厂LIBERO自由人日本富士重工业公司LIGIER里吉尔法国里吉尔汽车公司LIFE生活日本本田公司LINCOLN林肯美国福特汽车公司林肯部LITEACE莱特艾斯日本丰田汽车公司LOADSTAR北极星美国万国联合收割机公司LOTUS莲花(又译洛托斯)英国莲花汽车公司LOYALE罗耶尔日本富士重工业公司LUAZ洛兹乌克兰越野车公司LUCE光日本日本马自达公司LUCINO卢齐诺日本日产汽车公司LUMINA鲁米娜美国通用汽车公司雪佛莱部LUPO路波德国大众汽车公司LYNX天猫座美国福特汽车公司MMACK麦克美国麦克卡车公司MAESTRO艺术大师英国陆虎汽车公司MAGIRUS玛吉鲁斯德国玛吉鲁斯·道依兹公司MAGNUM马格纳姆美国克莱斯勒公司道奇部MAHINDRA马辛德拉印度马辛德拉汽车公司MALAGA马拉加西班牙西特公司MALIBU马利布美国通用汽车公司雪佛莱部M.A.N曼德国奥格斯堡·纽伦堡机械公司MANTA曼塔德国欧宝汽车公司MARATHON马拉松美国切克汽车公司的出租汽车MARBELLA玛贝拉西班牙西特公司MARCH前进日本日产汽车公司MAREA马力昂意大利菲亚特工业公司MARINA玛丽娜英国陆虎汽车公司MARK II马克II日本丰田汽车公司MARK V马克V英国美洲虎公司MARK7马克7美国福特汽车公司MARQUIS侯爵美国福特汽车公司林肯部MARUTI马鲁蒂印度马鲁蒂公司MASERATI玛莎拉蒂意大利玛沙拉蒂公司MASHALATTI玛莎拉蒂意大利菲亚特工业公司MASTER大师法国雷诺汽车集团MATADOR斗牛士美国美国汽车公司MATIZ马提兹韩国大宇汽车公司MATRA马特拉法国塔尔伯特公司MAVERICK独立美国福特汽车公司MAUS茅斯日本三菱汽车公司MAXI马克西英国陆虎汽车公司MAXIMA马克西玛(千里马)日本日产汽车公司MAXX马可斯德国欧宝汽车公司MAYBACH梅巴赫德国德国老牌汽车,以著名汽车发明家命名马自达(香港译“万事得”日本马自达公司MAZDA)MCLAREN麦拿仑麦拿仑赛车公司MEDALLION梅达莲美国克莱斯勒公司MEDALLION梅达莲法国雷诺汽车集团MEGANE梅甘娜法国雷诺汽车集团MEHARI梅哈利法国雪铁龙汽车公司梅塞德斯-奔驰汽车公司,即奔驰公司的全MERCEDES-BENZ梅赛德斯-奔驰德国称MERCURY默寇利(水星)美国福特汽车公司林肯部MERKUR SCORPIO默克·天蝎座美国福特汽车公司METEOR流星南非南非汽车公司METRO地下铁道美国通用汽车公司CEO部METRO MAYFAIR城市贵族英国陆虎汽车公司METROPOLITAN大都市人美国那什公司MG美琦英国老牌小型运动轿车,已并入罗孚汽车公司MICRA米克拉日本日产汽车公司MIDGET侏儒英国美洲虎公司MIDI米地英国贝德福公司MILANO VERDE米拉诺·沃德意大利阿尔法·罗密欧公司MINI米尼(迷你)英国陆虎汽车公司MINICA米尼卡日本三菱汽车公司MINI CAB WIDE小宽头日本三菱汽车公司MIRA米拉日本大发公司MIRADA米拉达美国克莱斯勒公司道奇部MIRAGE海市蜃楼日本三菱汽车公司MISITQUE密斯迪美国福特汽车公司水星部MITSUBISHI三菱日本三菱汽车公司MIURA米拉意大利兰伯基尼公司MOKE毛驴英国利兰公司MONACO摩纳哥美国克莱斯勒公司道奇部MONARCH君主美国福特汽车公司林肯部MONDEO蒙迪欧欧洲福特汽车公司MONDIAL世界(芒德尔)意大利法拉利公司MONTE CARLO蒙特卡洛美国通用汽车公司雪佛莱部MONTE CARLO蒙特卡洛意大利兰旗公司MONTEGO蒙特哥英国陆虎汽车公司MONTEREY蒙泰雷德国欧宝汽车公司MONTERO蒙特洛日本三菱汽车公司MONTEZ蒙泰兹巴西JPX公司MONZA蒙扎意大利法拉利公司MONZA蒙扎德国欧宝汽车公司MORGAN摩根英国摩根汽车公司MORNING CAR晨车韩国起亚工业公司MOSKOVICH莫斯科人俄罗斯莫斯科小客车厂MOVE移动日本大发公司MPV多用途汽车MULSANNE马尔森英国罗尔斯-罗依斯汽车公司MUSSO犀牛韩国双龙汽车公司MUSTANG野马美国福特汽车公司MYSTIQUE神秘美国福特汽车公司林肯部NNASH那什美国那什汽车公司,原美国汽车公司的前身NAVAJO纳维约日本马自达公司NAVISTAR航星美国万国联合收割机公司MAZCA纳兹卡德国宝马汽车公司NEON霓虹美国克莱斯勒汽车公司NEWPORT新港美国克莱斯勒公司NEW POWER新动力日本五十铃汽车公司NEW YORKER纽约客美国克莱斯勒公司NEXIA蓝天韩国大宇汽车公司NINBUS祥云日本三菱汽车公司NINETY-EIGHT九十八美国通用汽车公司奥兹莫比尔部NISSAN日产(又译“尼桑”)日本日产汽车公司NISSAN DIESEL日产柴油机日本日产柴油机公司NIVA尼瓦俄罗斯伏尔加汽车厂NOAH娜亚德国大众汽车公司NOVA新星美国通用汽车公司雪佛莱部NSU纳苏德国纳苏汽车公司(已与奥迪公司合并)OODYSSEY奥德赛日本日产汽车公司OKA欧卡俄罗斯卡马河汽车厂OLDSMOBILE奥兹莫比卡美国通用汽车公司的一个分部OMEGA欧米加美国通用汽车公司OMEGA欧米加德国欧宝汽车公司OMNI欧姆尼美国克莱斯勒公司道奇部OPEL欧宝(又译奥贝尔)德国欧宝汽车公司OPTI阿特日本大发公司ORION猎户座美国福特汽车公司OYAK奥亚克土耳其奥亚克公司PPACER标兵美国美国汽车公司PACKARD派卡德派卡德PAJERO帕杰罗日本三菱汽车公司PAMPA大草原美国福特汽车公司PANDA熊猫意大利菲亚特工业公司PANTHER黑豹英国黑豹汽车公司PANTERA豹意大利托马索公司PARISIENNE巴黎仙美国通用汽车公司旁蒂克部PARKWAY小路日本马自达公司PARK AVENUE林荫大道美国通用汽车公司别克部PASEO帕西欧日本丰田汽车公司PASSAT帕萨特德国大众汽车公司PASSPORT护照日本本田公司PATHFINDER开拓者日本日产汽车公司PATROL途乐(侦察兵)日本日产汽车公司PAYSTAR经济之星美国万国联合收割机公司PEGASO毕加索西班牙西班牙王国载货汽车公司PENIN皮宁意大利法拉利公司PEUGEOT标志法国标致汽车公司PHANYON鬼怪英国罗尔斯-罗依斯汽车公司PHOENIX凤凰美国通用汽车公司旁蒂克部PIAZZA广场日本五十铃汽车公司PININFARINA平宁法利那意大利平宁法利那设计公司PINTO斑马美国福特汽车公司PINZGAUER平次高尔奥地利斯泰勒·戴姆勒·普赫公司PLYMOUTH顺风(普利茅斯)美国克莱斯勒公司的一个分部POLARA北极星美国克莱斯勒公司POLO马球德国大众汽车公司POLONEZ波罗乃兹波兰华沙轿车厂PONTIAC旁蒂克美国通用汽车公司的一个分部PONY矮马韩国现代汽车公司PORSCHE保时捷(又译波尔舍)德国保时捷研究设计发展公司PORTER投递员日本马自达公司POTENTIA潜力(波登蒂亚)韩国起亚工业公司POWER RAM壮公羊美国克莱斯勒公司道奇部PRECIS精确日本三菱汽车公司PRELUDE序曲日本本田公司PREMERA霹雳马日本日产汽车公司PREMIER首相美国克莱斯勒公司PRESEA普雷雪日本日产汽车公司PRESIDENT总统日本日产汽车公司PREVIA大霸王日本丰田汽车公司PRIDE自豪韩国起亚工业公司PRIMERA普丽美拉日本日产汽车公司PRINCE王子韩国大宇汽车公司PRINCESS公主英国陆虎汽车公司PRISMA棱镜意大利兰旗公司PRIZM棱镜美国通用汽车公司CEO部PROBE探索美国福特汽车公司PROCEED行进日本马自达公司PRONTO助手美国福特汽车公司PROTéGé门徒日本马自达公司PROTON普路通马来西亚普路通汽车集团PSA法国标致-雪铁龙集团PUBLICA国民日本丰田汽车公司PULLMAN普尔曼德国梅塞德斯-奔驰汽车公司PULSTAR脉冲星日本日产汽车公司PUNTO彭托意大利菲亚特工业公司QQUANTUM量子德国大众汽车公司QUATTRO卡特罗德国奥迪纳苏汽车公司QUATTRO PORTE卡特罗-波特意大利玛沙拉蒂公司QUEST寻觅者日本日产汽车公司QUINT昆特日本本田公司RRABBIT兔牌德国大众汽车公司RACER赛手韩国大宇汽车公司RAFAGA拉法佳日本本田公司RAIDER袭击者美国克莱斯勒汽车公司道奇部RAINBOW彩虹日本日野汽车公司RALLY拉力(越野赛)美国通用汽车公司RAMCHARGER运羊者美国克莱斯勒公司道奇部RAMPAGE冲撞美国克莱斯勒公司RANCHERO牧场主美国福特汽车公司RANGE ROVER览胜陆虎英国陆虎汽车公司RANGER漫游者美国福特汽车公司RAUM劳姆日本丰田汽车公司REATTA丽塔美国通用汽车公司别克部REDEO热调日本五十铃汽车公司REGAL皇朝(豪华)美国通用汽车公司别克部REGATA利加塔意大利菲亚特工业公司REGENT总督美国克莱斯勒公司REKORD创纪录德国欧宝汽车公司RELIANT里莱恩特美国里来恩特汽车公司RENAULT雷诺法国雷诺汽车集团RENDZVOUS朗迪美国通用汽车公司别克部RENEGADE叛逆者美国美国汽车公司吉普公司RETNA雷特那日本富士重工业公司REX雷克斯日本富士重工业公司RITMO赛跑意大利菲亚特工业公司RIVA里瓦俄罗斯伏尔加汽车厂RIVIERA里维埃拉美国通用汽车公司别克部ROADMASTER路霸美国通用汽车公司别克部ROADPACER带路人日本马自达公司ROAD RUNNER路行者美国克莱斯勒公司ROCKY落矶日本大发公司ROCSTA罗科斯塔韩国亚细亚汽车公司RODAE罗得罗马尼亚罗得汽车厂RODEO牛仔功日本五十铃汽车公司罗尔斯-罗依斯(又译劳英国罗尔斯-罗依斯汽车公司ROLLS-ROYCE斯莱斯)ROMAN罗曼罗马尼亚布拉索夫汽车厂ROSA玫瑰日本三菱汽车公司ROVER陆虎(罗孚、路华)英国陆虎汽车公司ROYALE皇家意大利布加迪公司RUGGER橄榄球日本大发公司RUNABOOT快艇法国标致公司RUNNER行者日本丰田汽车公司SSAAB绅宝(又译萨伯)瑞典绅宝公司SABER飒风日本丰田汽车公司SABLE黑貂美国福特汽车公司水星部SAFARI远征美国通用汽车公司旁蒂克部SAFRANE莎法娜(藏红花)法国雷诺汽车集团SAIL赛欧美国通用汽车公司SAMARA萨马拉俄罗斯伏尔加汽车厂SAMCOR萨姆柯南非南非汽车公司SAMURAI武士日本铃木汽车公司SANTANA桑塔纳德国大众汽车公司SAPPARO札幌美国克莱斯勒公司道奇部SATELLITE卫星美国克莱斯勒公司SATURN土星美国通用汽车公司土星部SAVANNA草原日本马自达公司SAVIEM萨维姆法国雷诺汽车集团SAXO萨克索法国雪铁龙汽车公司SCAMP小淘气美国克莱斯勒公司SCANIA斯堪尼亚瑞典斯堪尼亚公司SCIMITAR短弯刀英国里来恩特汽车公司SCIROCCO海风德国大众汽车公司SCORPIO天蝎座欧洲福特汽车公司SCOUPE斯可普韩国现代汽车公司SCOUT海鸟美国万国联合收割机公司SCRAMBLER攀登美国克莱斯勒汽车公司SEAT西特西班牙图雷斯莫汽车公司SEBRING赛布林美国克莱斯勒汽车公司SENATOR议员德国欧宝汽车公司SENTIA森佳日本马自达公司SENTRA哨兵日本日产汽车公司SEPHIA赛菲亚韩国起亚工业公司SERA西娜日本丰田汽车公司SERENA夜曲日本日产汽车公司SEVEL赛维尔阿根廷塞维尔集团SEVILLE赛威美国通用汽车公司卡迪莱克部SHADOW幽灵美国克莱斯勒汽车公司道奇部SHAMAL夏美意大利玛沙拉蒂公司SHARAN沙龙(莎兰)德国大众汽车公司SHELBY谢尔比美国克莱斯勒汽车公司道奇部SHERPA谢帕英国陆虎汽车公司SHOGAN将军日本三菱汽车公司SHO STAR SHO星美国福特汽车公司SHUTTLE航班(穿梭)日本本田汽车公司SIDEKICK赛击日本铃木汽车公司SIENA赛娜意大利菲亚特工业公司SIERRA赛拉美国福特汽车公司SIERRA SAPPHIRE蓝宝石美国福特汽车公司SIGMA西玛(西格玛)日本三菱汽车公司SIGNET图章美国克莱斯勒汽车公司SILBOUETTE西尔包特美国通用汽车公司奥兹莫比尔部SILHOUETTE侧影美国通用汽车公司奥兹莫比尔部SILVER ARROW银箭德国汽车联盟(奥迪公司)SILVER CLOUD银云英国罗尔斯-罗依斯汽车公司SILVER GHOST银灵英国罗尔斯-罗依斯汽车公司SILVER SHADOW银影英国罗尔斯-罗依斯汽车公司SILVER SPIRIT银魂英国罗尔斯-罗依斯汽车公司SILVER SPUR银刺英国罗尔斯-罗依斯汽车公司SILVIA西尔维亚(丝华)日本日产汽车公司SIMCA西姆卡法国塔尔伯特公司SKODA斯柯达捷克斯柯达汽车公司(现属德国大众公司)SKYHAWK天鹰美国通用汽车公司别克部SKYLARK云雀美国通用汽车公司别克部SKYLINE摩天(地平线)日本日产汽车公司SKYLINER地平线美国福特汽车公司SOARER滑翔机日本丰田汽车公司SONATA奏鸣曲(索那塔)韩国现代汽车公司SOVEREIGN元首英国美洲虎公司SPACE GEAR太空工具车日本三菱汽车公司SPACE RUNNER太空运动家日本三菱汽车公司SPACE WAGON太空旅行车日本三菱汽车公司SPAZIO斯帕乔阿根廷塞维尔集团SPECTRON彩虹美国福特汽车公司SPECTRUM光谱美国通用汽车公司雪佛莱部SPECTRUM光谱美国通用汽车公司CEO部SPIDER蜘蛛意大利阿尔法·罗密欧公司SPIDER蜘蛛法国雷诺汽车集团SPIRIT幽灵美国美国汽车公司SPITFIRE烈性人英国美洲虎公司SPORTAGE斯波达韩国起亚工业公司SPORTSMAN体育家美国克莱斯勒公司道奇部SPORTWAGEN运动车法国雷诺汽车集团SPRINT迅跑意大利阿尔法·罗密欧公司SPRINTER短跑家日本丰田汽车公司SPYDER蜘蛛意大利玛沙拉蒂公司SQUAREBACK方背德国大众汽车公司SSANG YONG双龙韩国双龙汽车公司STANZA斯坦扎日本日产汽车公司STAR星波兰FSC公司STARFIRE星火美国通用汽车公司STARION斯塔里昂日本三菱汽车公司STARLET小星日本丰田汽车公司STATESMAN政治家澳大利亚霍尔顿汽车公司STEALTH秘密美国克莱斯勒公司道奇部STELLAR恒星韩国现代汽车公司STERLING斯特林英国陆虎汽车公司STEYR斯泰尔奥地利斯泰勒·戴姆勒·普赫公司STORM风暴美国通用汽车公司旁蒂克部STOUT斯托特日本丰田汽车公司ST.REGIS圣里吉斯美国克莱斯勒公司道奇部STRADA斯特拉达意大利菲亚特工业公司STRATUS层云美国克莱斯勒公司道奇部STYLUS指针日本五十铃汽车公司SUBARU速波(斯巴鲁)日本富士重工业公司SUBURBAN郊区美国通用汽车公司货车及客车部SUMBEAM阳光法国塔尔伯特公司SUMMIT高峰美国美国汽车公司鹰部SUNBIRD太阳鸟美国通用汽车公司旁蒂克部SUNBURST阳光突现美国通用汽车公司旁蒂克部SUNDANCE太阳舞美国克莱斯勒汽车公司顺风部SUNFIRE太阳火美国通用汽车公司旁蒂克部SUNNY阳光(小太阳)日本日产汽车公司SUPER BEE超级蜜蜂美国克莱斯勒公司SUPER CARRY超运日本铃木汽车公司SUPER SALOON超级沙龙韩国大宇汽车公司SUPRA超人(萨普拉)日本丰田汽车公司SUPREMA苏帕雷玛美国通用汽车公司SUZUKI铃木日本铃木汽车公司SWIFT雨燕(斯威夫特)日本五十铃汽车公司SWINGER时髦美国克莱斯勒公司SYNCRO同步德国大众汽车公司TTAFT塔夫特日本大发公司TAHOE太和美国通用汽车公司雪佛莱部TALON大傻(塔隆)美国美国汽车公司鹰部TASMIN塔斯明TVR工程公司TARGA塔加德国保时捷研究设计发展公司TARPAN HONKER塔班亨克波兰福斯尔公司TATRA太脱拉捷克太脱拉汽车厂TALBOT塔尔伯特(得宝)法国塔尔伯特公司TALBOT-MATRA塔尔伯特-马特拉法国塔尔伯特公司TALON大傻美国克莱斯勒公司鹰部TARGA塔加德国保时捷研究设计发展公司TAURUS特使(金牛座)美国福特汽车公司TEMPO天霸(又译天普、速度)美国福特汽车公司TEMPRA特布拉意大利菲亚特工业公司TERCEL雄鹰日本丰田汽车公司TERRA大地美国万国联合收割机公司TESTAROSSA特斯塔罗莎意大利法拉利公司THEMA主旋律(瑟马)意大利兰旗公司THINK欣客美国福特汽车公司THUNDERBIRD雷鸟美国福特汽车公司TICO巧龙(蒂柯)韩国大宇汽车公司TIGRA帝佳德国欧宝汽车公司TIPO蒂波(伙伴)意大利菲亚特工业公司TITAN大力神日本马子达公司TODAY今日日本本田汽车公司TOFAS托发斯土耳其托发斯公司TOLEDO图雷多西班牙西特公司TOMASO托马索意大利托马索公司TOPAZ蜂鸟美国福特汽车公司林肯部TORINO都灵美国福特汽车公司TORONADO托罗纳多美国通用汽车公司TOURING旅游美国通用汽车公司卡迪莱克部TOWNACE城市之花日本福特汽车公司林肯部TOWN COUNTRY城乡美国克莱斯勒公司TOWN CAR城市轿车美国福特汽车公司林肯部TOYOACE丰田之花日本丰田汽车公司TOYOTA丰田日本丰田汽车公司TRACER猎手美国福特汽车公司水星部TRACKER追踪者美国通用汽车公司GEO部TRADER贸易美国福特汽车公司TRADESMAN商业家美国克莱斯勒公司道奇部TRAFFIC塔菲克法国雷诺汽车公司TRANS AM特兰斯艾姆美国通用汽车公司旁蒂克部TRANSIT全顺美国福特汽车公司TRANSPORT泛运美国通用汽车公司旁蒂克部TRANSPORTER运输者德国大众汽车公司TRAVELER旅行家美国万国联合收割机公司TREDIA特利蒂亚日本三菱汽车公司TRIAX三雅美国通用汽车公司雪佛莱部TRITON特利通美国福特汽车公司TRIUMPH凯旋英国美洲虎公司TROOPER骑士日本五十铃汽车公司TURBOSTAR涡轮增压之星意大利依维柯工业车辆公司TVR特威尔英国特维尔公司TWINGO丽人行(屯果)法国雷诺汽车公司UULYSSE优力赛意大利菲亚特工业公司UNIMOG乌尼莫格德国奔驰汽车公司UNO乌诺意大利菲亚特工业公司URRACO于拉科意大利兰伯基尼汽车公司URVAN郊外日本日产汽车公司VVALIANT英勇美国克莱斯勒公司VANAGON瓦纳贡德国大众汽车公司VANETTE瓦内特(巴宁)日本日产汽车公司VANTAGE优势英国阿斯顿·马丁·拉贡公司VARIANT变幻德国大众汽车公司VAUXHALL沃克斯豪尔英国沃克斯豪尔公司VECTRA威达德国欧宝汽车公司VEGA织女星美国克莱斯勒公司VENTO稳妥(文托)德国大众汽车公司“捷达”VENTURA冒险美国通用汽车公司旁蒂克部VENTURI文图力法国文图力汽车公司VERONA维罗娜巴西福特汽车公司VERSAILLES凡尔赛美国福特汽车公司林肯部VIGNALE维纳乃尔英国阿斯顿·马丁·拉贡公司VIGOR伟高(奋发)日本本田公司阿库拉部VILLAGER乡村居民美国福特汽车公司水星部VIOLET紫罗兰日本日产汽车公司VIPER蝰蛇美国克莱斯勒公司道奇部VIRAGE维纳奇英国阿斯顿·马丁·拉贡公司VISA签证法国雪铁龙汽车公司VISION威神(又译美景)美国克莱斯勒公司鹰部VISION美景德国奔驰汽车公司VISTA远景美国克莱斯勒公司VISTEON伟世通美国福特汽车公司的零部件公司VITARA吉星日本铃木汽车公司VITESSE维蒂斯英国罗孚汽车公司VIVA万岁英国沃克斯豪尔公司VIVACE维瓦赛阿根廷赛维尔集团VIVIO维维奥日本富士重工公司VOLARE飞驰美国克莱斯勒公司顺风部VOLANTE飞鼠英国阿斯顿·马丁·拉贡公司VOLGA伏尔加俄罗斯高尔基汽车厂VOLGA伏尔加俄罗斯伏尔加汽车厂VOLKSWAGEN大众(伏克斯瓦根)德国德国大众汽车公司VOLVO富豪(沃尔沃)瑞典沃尔沃公司VOYGER航海家美国克莱斯勒公司顺风部WWAGONEER瓦格尼尔美国克莱斯勒汽车公司吉普·鹰部WARTBURG华特堡德国艾森纳赫汽车厂WAZ瓦兹俄罗斯乌里扬诺夫汽车厂WEEKEND周末阿根廷赛维尔集团WHITH怀特(白牌)美国怀特汽车公司WILDCAT野猫美国通用汽车公司别克部WINDSOR温泽美国克莱斯勒汽车公司WINDSTAR稳达(风之星)美国福特汽车公司WRANGLER牧游者克莱斯勒汽车公司吉普·鹰部XXANAE桑娜法国雪铁龙汽车公司XANTIA ACTIVE桑蒂亚·阿克提凡法国雪铁龙汽车公司XCAR X轿车日本三菱汽车公司XEDOS伊赛多日本马自达公司XSARA萨拉法国雪铁龙汽车公司YYUGO尤格南斯拉夫红旗汽车厂ZZASTAVA红旗南斯拉夫红旗汽车厂ZAZ扎斯乌克兰扎波罗什汽车公司ZEN泽恩印度马鲁蒂公司ZENDER辰德德国辰德公司ZEPHYR和风美国福特汽车公司林肯部ZETA泽达意大利依维柯工业车辆公司ZIL吉尔俄罗斯莫斯科李哈乔夫汽车厂ZIM吉姆前苏联高尔基汽车厂ZOOM变焦法国雷诺汽车公司。

韩国现代重工lcd机器人详细介绍资料

■ Hyundai LCD Robot – Sales Record by Glass Generation

As of May 06, 2015

ITEM

Mother Glass Robot Panel Glass Robot TOTAL :

G2 & 3

G4 & G4.5 233

G5 & G5.5 64 327 391

• System Consulting, Simulation • Design & Engineering • production • Project Management • Installation / Tryout • A/S & Maintenance

• Robot & System Development - Manipulator - Hardware - Software • Machinery • System Control

No.

Order Date

Customer Name

Shop & Process

Goods Delivered

Glass Size

Quantity Ordered

Quantity Shipped

Rated Capacity

Date of M. P

Remark

A. ORIGINAL GLASS HANDLING ROBOT

Marine Engine

Marine Turbines

Robot & System

Industrial Pump

Sale & Marketing

Design & Engineering

韩国的著名汽车公司

大宇汽车公司

• 1967年,金宇中创建了大宇(DAEWOO)汽车公司,位 于韩国仁川市,是韩国第二大汽车公司,现为美国通用旗 下的一个品牌。 • 大宇与美国通用汽车公司关系密切,在创业之初便与通用 Evaluation only. 公司合作生产轿车和八吨以上货车及大客车。大宇以出口 ted with Aspose.Slides for .NET 3.5 Client Profile 为目标,在韩国是最早出口汽车的企业,早在 1984 年就出 口汽车到美国。 Copyright 2004-2011 Aspose Pty Ltd. • 随着同美国通用汽车公司合资的结束,大宇开始建立自己 在全球的生产网络,以达到2000年生产200万辆汽车的年 生产能力,其中一半在韩国。1986年大宇一年产16.7万辆 的汽车厂投产,该厂拥有由机器人操作的自动焊接等世界 一流设备。大宇汽车公司总部设在韩国汉城,主要产品以 轿车和货车为主 。

• 1967年,韩国历史上最富传奇色彩的商业巨子郑 周永先生一手创办现代汽车。与全球其它领先的 汽车公司相比,现代汽车历史虽短,却浓缩了汽 车产业的发展史,它从建立工厂到能够独立自主 开发车型仅用了18年(1967-1985),并成为韩国 最大的汽车集团,跻身全球汽车公司20强。 • 现代拥有世界最大规模之一的汽车生产基地蔚山 Evaluation only. 工厂,全州车厂,牙山工厂, 8个研究中心,拥有 韩国唯一的具有国际水平的汽车综合试验场等。 lient Profile 5.2 主要产品有阿克森特( ACCENT )、索纳塔 Copyright 2004-2011 Aspose Pty Ltd. (SONATA)、伊兰特(Elantra)等轿车以及各类 大中小型客车、载货汽车、牵引车、自卸车和各 种专用汽车等,各类型汽车年产能力145万辆。在 全世界190多个国家和地区拥有近四千家销售商, 今天现代汽车公司每年可出口50万辆以上轿车。 同时在北美、亚洲、非洲和欧洲等地区建立了汽 车生产基地。

有关介绍公司英文作文

有关介绍公司英文作文英文:Hi there, I am excited to introduce our company to you today. Our company is a leading provider of innovative technology solutions in the field of artificialintelligence. We specialize in developing cutting-edge software that helps businesses automate their processes and improve their efficiency.One of our flagship products is a chatbot that can interact with customers and provide them with personalized assistance. This chatbot is powered by advanced machine learning algorithms that allow it to understand natural language and provide accurate responses to customer queries.In addition to our software products, we also offer consulting services to help businesses optimize their operations and adopt the latest technologies. Our team of experts has years of experience in the field of AI and canprovide valuable insights and guidance to our clients.We are committed to providing our customers with the best possible service and support. Our customer service team is available 24/7 to answer any questions or concerns that our clients may have. We also offer regular training and updates to ensure that our clients are always up-to-date with the latest developments in the field of AI.Overall, our company is dedicated to helping businesses harness the power of artificial intelligence to achieve their goals and stay ahead of the competition. We are passionate about what we do and are always looking for new ways to innovate and improve our products and services.中文:大家好,今天我很高兴向大家介绍我们的公司。

汽车标志,英文名称对照及其含义

1.奥迪AUDI:奥迪轿车的标志为四个圆环,代表着合并前的四家公司。

这些公司曾经是自行车、摩托车及小客车的生产厂家。

由于该公司原是由4家公司合并而成,因此每一环都是其中一个公司的象征。

2.奔驰BENZ:1909年6月申请戴姆勒公司登记了三叉星做为轿车的标志,象征着陆上、水上和空中的机械化.1916年在它的四周加上了一个圆圈,在圆的上方镶嵌了4个小星,下面有梅赛德斯“Mercedes”字样。

“梅赛德斯”是幸福的意思,意为戴姆勒生产的汽车将为车主们带来幸福。

3.大众VOLKSWAGEN:大众汽车公司的德文VolksWagenwerk,意为大众使用的汽车,标志中的VW为全称中头一个字母。

标志象是由三个用中指和食指作出的“V”组成,表示大众公司及其产品必胜-必胜-必胜。

4.丰田TOYOTA:丰田公司的三个椭圆的标志是从1990年初开始使用的。

标志中的大椭圆代表地球,中间由两个椭圆垂直组合成一个T字,代表丰田公司。

它象征丰田公司立足于未来,对未来的信心和雄心,还象征着丰田公司立足于顾客,对顾客的保证,象征着用户的心和汽车厂家的心是连在一起的,具有相互信赖感,同时喻示着丰田的高超技术和革新潜力。

5.福特FORD:福特汽车的标志是采用福特英文Ford字样,蓝底白字。

由于创建人亨利·福特喜欢小动物,所以标志设计者把福特的英文画成一只小白兔样子的图案。

6.宝马BMW:宝马标志中间的蓝白相间图案,代表蓝天,白云和旋转不停的螺旋浆,喻示宝马公司渊源悠久的历史,象征该公司过去在航空发动机技术方面的领先地位,又象征公司一贯宗旨和目标:在广阔的时空中,以先进的精湛技术、最新的观念,满足顾客的最大愿望,反映了公司蓬勃向上的气势和日新月异的新面貌。

7.劳斯莱斯ROLLS-ROYCE:劳尔斯·罗劳易斯汽车的标志图案采用两个“R”重叠在一起,象征着你中有我,我中有你,体现了两人融洽及和谐的关系。

劳尔斯·劳易斯的标志除了双R之外,还有著名的飞人标志。

现代重工(中国)投资有限公司

4

건설장비사업본부 건장개발부

主要设计产品介绍

5

건설장비사업본부 건장개발부

研发部 Mission

- 最快速度开发适合于中国市场的设备和 产品

- 强化R & D Center的技术开发能力

- 在中国内地提供良好的技术支持,提高 本公司声誉

6

건설장비사업본부 건장개발부

主要工作职责

1. 根据设计项目要求,具体组织团队完成设计任 务;

现代重工业株式会社是韩国现代集团的主要公司,是一个世界级的综合型重 工业公司,是韩国沽重工业的摇篮,有8个事业部,其中“造船事业部”与“发动机 事业部”具有世界最大的生产规模。

现代重工业

- 造船事业本部 - 海洋事业本部 - 产业机械事业本部 - 引擎机械事业本部 - 电器电子系统事业本部 - 工程设备事业本部 - 研究开发( R & D )

3

건설장비사업본부 건장개발부

现代重工业在中国的历程

• 1995年 • 2002年 • 2003年 • 2004年 • 2004年

• 2006年

• 2007年 • 2007年

常州现代正式注册,登记成立! 北京现代京城合资合同书正式签约! 现代(江苏)正式注册,登记成立! 烟台现代冰轮重工有限公司 江苏现代南自电气有限公司成立,2007年更名为现代重工 (中国)电气有限公司 在上海成立了现代重工(中国)投资有限公司,统一管理 中国所有子公司,并提供技术支持。 在江苏常州设立研发中心 在上海成立了现代融资租赁有限公司

过装载机、挖掘机、叉车研发设计经验者优先考虑。 3)熟悉焊接结构设计、加工制造工艺,至少持有中级工程师资格证

书; 4)熟悉常用钢铁材料的性能、力学分析,熟悉有限元分析更佳; 5)工作踏实,认真细致,责任心强,诚信公平,良好的语言表达、

韩国现代集团发展史

韩国现代集团发展史——外国语学院朝鲜语系13091102 王兴伦摘要:1.自己专业与韩国现代企业的关系2.韩国现代企业简介3.韩国现代企业的发展历史4.结语关键字:韩国语现代企业发展历史经验一.我的专业与韩国现代企业本人是吉林大学外国语学院朝鲜语系的本科生,学习标准韩国语,因为自己的专业是韩国语,所以自然要关心韩国的一切政治,经济,文化等等。

为了能够更好的学习韩国语,为了很好的就业,就不得不关心韩国的企业,比如现代,三星,大宇等等。

但是真正和机械工业有关系的还是现代集体,所以我选择要介绍韩国现代集团。

韩国现代集团是韩国最大的多元化综合性财团之一,创立于1967年,创始人郑周荣先生。

公司总部位于韩国汉城,在汽车、造船、数码电子、重工、机械、基建等领域都占重要地位。

其下属造船业位居全球三强,韩国现代汽车是韩国最大的汽车企业,也是世界第七大汽车生产厂家。

韩国的企业在中国有很多,尤其是在山东,江苏,浙江沿海等地,但是在中国真正能够很有实力的就是韩国现代企业了,北京现代公司在中国实力非常强大。

为了能够就业好,所以便不得不注意韩国现代集团。

二.现代企业的简介①韩国现代集团是韩国最大的多元化综合性财团之一,创立于1967年,创始人郑周永先生。

公司总部位于韩国汉城,在汽车、造船、数码电子、重工、机械、基建等领域都占重要地位。

其下属造船业位居全球三强,现代汽车公司是韩国最大的汽车企业,也是世界第七大汽车生产厂家。

现代数码电子成立于八十年代初,在韩国是一家非常大且非常有影响的IT着名企业,其产品线非常丰富,涵盖了硬件(台式机、笔记本、服务器、网络产品、数据存储、显示设备和数码娱乐产品)、软件、在线游戏等系列产品。

现代数码电子在韩国一直致力于产品的研发和OEM代工业务,是世界众多国际品牌中高端数码产品的重要代工伙伴。

现代内存目前在全球的销售量排名在世界第二。

主要向全球OEM供应的厂商有IBM、HP、DELL,国内主要客户是联想。

部分船公司介绍及优势

PIL是什么船公司?太平船务介绍PIL是英文Pacific International Lines的缩写。

中文名称是新加坡太平船务有限公司(PIL)。

太平船务(PIL)由张允中先生于1967年在新加坡成立。

太平船务(PIL)成立初期,以经营区域性的散杂货运输为主,从1983年起,首次推出了集装箱运输服务。

太平船务(PIL)目前投入运营的船舶共98艘,其中,自有船舶68艘,租船30艘;世界排名第19位。

太平船务(PIL)是第一个拿到中国国内经营资质的班轮公司。

早在1967年新加坡太平船务公司成立时,太平船务(PIL)就开始在中国发展业务,是最早进入中国市场的外国船运公司之一。

太平船务(PIL)在与中国保持了近30年的商贸往来之后,1995年,太平船务在北京正式注册成立了第一家独资公司——太平船务(中国)有限公司。

在随后的近10年里,太平船务(中国)陆续设立了上海、天津、青岛、大连、厦门、宁波、广州、深圳和南京9家分公司,以及杭州、福州、石家庄、郑州、温州、西安、烟台、顺德、武汉、汕头、义乌、重庆和南沙13个代表处。

太平船务(中国)的分公司及代表处共拥有中国、港澳台及外籍雇员超过400名。

2001年,太平船务在上海注册成立了第二家独资公司——太平集运服务(中国)有限公司,从事仓储、分拨等物流相关业务。

太平集团的业务分为三个部分,也就是三个子公司,一是航运公司,二是造箱厂(造集装箱),三是物流公司。

马鲁巴航运有限公司马鲁巴航运船公司英文全称:MARUBA S.C.A.马鲁巴航运船公司英文缩写:MARUBA马鲁巴航运船公司官方网址:.ar马鲁巴航运MARUBA船公司详细介绍:马鲁巴(MARUBA)船公司专业做南美,西非航线集装箱,总部设在布宜诺斯艾利斯,南美东,南美西,两条航线为主营线。

西非直航:TEMA,LOME,LAGOS(TIN CAN),COTONOU 西非中转(VIA DURBAN):WALVIS BAY,LUANDA,POINTE NORIE,LIBREVILLE,DOUALA马士基(海陆)航运有限公司马士基航运船公司英文全称:MAERSK(SEALAND)SHIPPING CO.,LTD.马士基航运船公司英文缩写:MAERSK 或MSK马士基航运船公司官方网址:马士基航运MAERSK船公司详细介绍:马士基(MAERSK)航运公司是 A.P. 穆勒——马士基集团的核心班轮运输机构,也是世界领先的集装箱运输公司。