再保险的重要性

保险风险的评估与再保险策略

保险风险的评估与再保险策略保险业作为金融行业的重要组成部分,在现代社会中扮演着至关重要的角色。

然而,随着风险不断增长和变化,保险公司需要不断评估风险并采取相应的再保险策略,以确保其可持续发展。

本文将探讨保险风险的评估和再保险策略,以帮助保险公司更好地应对风险挑战。

一、保险风险的评估保险风险的评估是保险公司在制定风险管理策略时的首要任务。

保险风险可以分为自然风险、人为风险和金融风险等多个方面。

评估这些风险的关键是收集和分析大量的数据,包括历史损失数据、风险事件的概率和影响程度以及相关行业和市场的趋势和发展。

评估保险风险的方法有很多,其中一种常用的方法是基于统计模型的风险评估。

通过建立风险模型,根据历史数据和概率理论,可以计算出不同风险事件的发生概率和影响程度。

此外,保险公司还可以借助专业的风险评估工具和技术,如风险管理信息系统和大数据分析,来提高风险评估的准确性和全面性。

二、再保险策略的选择再保险是保险公司为分散风险而购买的保险。

通过再保险,保险公司将一部分风险转移给再保险公司,以减少其承担的风险规模。

再保险策略的选择在保险业务中起着重要作用。

在选择再保险策略时,保险公司需要考虑多个因素,包括风险的类型和规模、再保险市场和再保险公司的实力和可靠性以及再保险条款和费率等。

保险公司可以选择不同类型的再保险协议,如纵向再保险、横向再保险和合作再保险,以满足其风险管理的需求。

此外,保险公司还可以采取多元化的再保险策略,包括购买不同再保险程序和使用不同再保险公司的组合。

这样可以进一步降低风险集中度,提高保险公司的风险承受能力和资本回报率。

三、风险管理的重要性风险管理在保险业中具有重要的意义。

通过科学合理地评估和管理风险,保险公司可以有效降低风险带来的不确定性和潜在损失,提高经营稳定性和盈利能力。

风险管理还可以帮助保险公司更好地满足监管要求。

在当前监管环境下,保险公司需要制定并实施有效的风险管理措施,以确保其合规经营和资本充足性。

了解保险行业中的再保险和风险转移

了解保险行业中的再保险和风险转移保险行业是为了最大化风险转移和保障个人、组织和社会的安全而存在的。

在保险交易中,再保险是一种重要的风险转移工具。

本文将详细介绍再保险和风险转移的概念、作用和在保险行业中的重要性。

1. 再保险的定义再保险指的是保险公司将部分风险转移给其他保险公司的行为。

简而言之,再保险就是保险公司的保险。

保险公司通过向再保险公司购买保险,将自身面临的巨大风险分散到多个机构之间,从而降低其承担的风险。

再保险是保险行业中的一种重要业务方式,旨在将特别大、特别复杂以及超出保险公司能够承担范围的风险进行合理分配。

2. 再保险的作用再保险在保险行业中发挥着至关重要的作用。

首先,再保险可以帮助保险公司管理其风险,确保其不会因为一次巨大赔偿而面临破产的危险。

当保险公司承保了巨大的风险,如自然灾害引发的大规模损失时,通过再保险,保险公司可以将风险转移给再保险公司,分散风险并保持资金流动性。

其次,再保险也可以帮助保险公司拓展业务。

对于一些风险较高或规模较大的保险项目,保险公司可能面临潜在的资金压力。

通过再保险,保险公司可以获得更大的资本支持,从而能够接受更多高风险的项目,扩大其业务范围。

最后,再保险还有助于提高保险公司的声誉和可信度。

通过向再保险公司购买保险,保险公司向投保人展示了其财务实力和能力,从而增强了投保人对其公司的信任和信心。

这对于保险公司来说非常重要,因为保险业是建立在信任和可靠性的基础上的。

3. 风险转移的具体方式再保险代表了保险行业中的风险转移。

风险转移是指将风险从一个实体转移到另一个实体的过程。

在再保险中,风险转移主要通过合同的方式进行。

保险公司向再保险公司支付一定的保险费,再保险公司承担保险公司所转移的风险责任。

这样,保险公司就能够将自身的风险降低到一定程度,避免全额承担损失。

另一种常见的风险转移方式是通过协议进行。

保险公司和再保险公司可以在合同中明确约定再保险的细节,如责任范围、保费支付方式和期限等。

学会正确理解保险中的再保险与分保

学会正确理解保险中的再保险与分保再保险与分保的正确理解保险作为一种金融手段,旨在为个人或企业提供风险保障。

然而,保险公司自身也面临着巨大风险,为了减少风险以保证自身的稳定性,保险公司常常会寻找再保险和分保这两种方式来转移部分风险。

本文将详细介绍再保险与分保的概念、特点和作用,以及它们在保险行业中的重要性。

一、再保险的概念和特点再保险是指保险公司通过向其他保险公司购买保险合约,以将自身承担的风险由原始保险人转移给再保险人的行为。

再保险的特点主要包括以下几个方面:1. 风险转移和风险分散:再保险可以将保险公司所承担的风险从一个或多个再保险人那里进行转移,从而降低自身风险承担的压力,实现风险的分散和分摊。

2. 资本管理和风险控制:再保险帮助保险公司更有效地管理其资本,降低其所需的准备金和资本金的数量,同时也能提供更好的风险控制能力。

3. 提升信用和信誉:通过购买再保险,保险公司可以提高其自身的信用和信誉度,从而吸引更多的客户和投资者。

二、分保的概念和作用分保是指保险公司将自身所承担的一部分风险再次转移给其他保险公司的行为。

它与再保险相似,但区别在于转移的风险范围和方式。

分保主要有以下几个作用:1. 风险管理和控制:分保有助于保险公司更好地管理和控制其承担的风险。

通过分散风险,保险公司可以降低自身的风险承担量,提高资本利用效率。

2. 提高业务能力:通过与其他保险公司进行分保,保险公司可以在业务上相互借鉴、合作和学习,提高自身的业务能力和技术水平。

3. 扩大市场份额:通过与其他保险公司进行分保,保险公司可以扩大其业务范围和市场份额。

分保可以使保险公司提供更广泛的保险产品和服务,满足客户多样化的需求。

三、再保险与分保的关系再保险和分保是相互关联的概念,它们在保险行业中相辅相成,发挥着各自独特的作用。

再保险是指保险公司将其所承担的风险再次转移给再保险人,而分保是指保险公司将自身所承担的风险再次转移给其他保险公司。

加强再保分入业务管理制度

加强再保分入业务管理制度一、企业背景再保险业务是指保险公司将一部分自己承保的风险向再保险公司转移的一种保险形式。

再保险分为分入再保险和分出再保险。

我国再保险市场发展较晚,但在改革开放以来,再保险市场得到了迅速的发展。

我国再保险市场规模不断扩大,竞争日益激烈。

再保险分入业务管理制度的健全与否,直接影响到公司再保险业务的发展和长期稳定。

二、再保险分入业务管理制度的重要性再保险分入业务管理制度是公司对再保险分入业务进行管理的基本制度。

再保险分入业务的管理制度健全与否,直接关系到公司的再保险分入业务的经营风险。

如果再保险分入业务管理制度不健全,就会导致再保险分入风险控制不力,可能会对公司的财务和声誉造成严重的影响。

三、再保险分入业务管理制度的内容1.再保险分入业务的组织管理公司应当根据再保险分入业务的规模和特点,合理布局再保险分入业务的组织结构。

明确再保险分入业务的职责、权限和责任,建立分工明确的再保险分入业务的组织管理制度。

2.再保险分入业务的风险管理公司应当建立健全的再保险分入业务风险管理制度,包括风险识别、风险评估、风险监控、风险应对等环节。

公司应当采取有效措施,合理控制再保险分入业务的风险水平,确保公司再保险分入业务的稳健经营。

3.再保险分入业务的合同管理公司应当建立健全的再保险分入业务合同管理制度,包括合同的签订、履行、监督等环节。

公司应当严格遵守再保险分入业务的合同规定,确保公司再保险分入业务的合同权益得到有效保障。

4.再保险分入业务的信息披露公司应当建立健全的再保险分入业务信息披露制度,包括信息披露的内容、方式、对象等方面的规定。

公司应当及时、准确、全面地披露再保险分入业务的相关信息,维护公司的信用和声誉。

5.再保险分入业务的监督管理公司应当建立健全的再保险分入业务监督管理制度,包括监督管理的对象、内容、方式、程序等方面的规定。

公司应当加强对再保险分入业务的监督管理,确保再保险分入业务的合规经营。

再保险业务集中度管理制度

再保险业务集中度管理制度全文共四篇示例,供读者参考第一篇示例:再保险是保险行业中非常重要的一环,其作用是通过再保险公司转移风险、分散风险,从而帮助保险公司降低风险,提高资本利用效率。

而再保险业务的集中度管理制度,则是指对再保险公司集中度的监管和管理,以确保再保险业务平稳运行、风险可控、保险市场稳定。

再保险业务集中度管理制度包括了从再保险公司的准入,到再保险公司的风险控制以及再保险业务的发展等全过程的监管。

对再保险公司的准入要求非常严格,包括资金实力、管理水平、公司背景等多个方面的考量,确保再保险公司的实力雄厚、风险可控。

对再保险公司的股权结构、关联交易等也要进行严格监管,防止再保险公司因过度集中的风险而导致金融风险。

在再保险业务集中度管理中,监管部门还要对再保险公司的风险控制能力进行评估,确保再保险公司有足够的风险管理能力和控制措施,从而规避再保险公司风险集中带来的系统风险。

监管部门还要定期对再保险公司的业务情况、风险暴露情况进行监控,及时发现风险隐患和问题,引导再保险公司积极采取措施加以解决。

在保险市场日益竞争激烈、风险日益复杂的情况下,再保险业务集中度管理制度显得尤为关键。

保险行业各方要共同努力,加强风险管理,做好再保险业务的监管,维护再保险市场的稳定和健康发展。

再保险业务集中度管理制度,不仅仅是对再保险公司的监管,更是对整个再保险市场的监管。

只有加强监管,规范再保险业务,才能提高再保险市场的透明度、公平性和稳定性,为保险市场的发展创造良好的环境。

再保险业务集中度管理制度的建立和完善,是保险行业的重要课题,也是保险监管机构的重要职责。

再保险业务集中度管理制度的建立和完善,对提升再保险市场的风险管理水平,促进再保险市场的健康发展具有积极意义。

各方要共同努力,加强协作,共同维护再保险市场的稳定和健康发展。

希望通过大家的共同努力,再保险市场能够实现更好的发展,为经济社会的可持续发展作出积极贡献。

【结束】第二篇示例:再保险业务是保险行业中的重要组成部分,其作用是帮助保险公司转移风险,保障其财务稳健。

再保险合同条款

再保险合同条款I. 引言在保险业中,再保险起着非常重要的作用。

由于保险风险巨大,保险公司经常需要将其风险再进行分散和转移。

再保险合同就是保险公司与再保险公司之间达成的一种协议,用于分摊风险和保护市场稳定。

本文将探讨再保险合同的条款,以及它们在保险业中的作用。

II. 再保险合同的定义再保险合同是指保险公司与再保险公司之间就特定风险的分摊和转移而达成的协议。

再保险合同的主要目的是降低保险公司的风险暴露,保护其财务稳定性。

再保险合同通常规定了再保险公司的责任范围、再保险费率、索赔处理方式等重要内容。

III. 再保险合同条款的常见内容1. 风险分担再保险合同首先明确了再保险公司对风险的分担程度。

通常有两种方式:比例再保险和非比例再保险。

比例再保险是再保险公司按照事先约定的比例承担风险,如70%的再保险比例意味着再保险公司将承担70%的索赔金额。

非比例再保险则是再保险公司承担超过设定限额的损失,例如超过1百万的索赔金额。

2. 再保险费率和支付方式再保险合同还规定了再保险费率和支付方式。

通常再保险费率是按照保险公司的风险水平和历史索赔率等因素确定的。

支付方式可以是一次性支付或分期支付,根据合同的具体约定执行。

3. 索赔处理再保险合同中的索赔处理条款非常重要。

它规定了再保险公司对索赔的处理方式,包括索赔通知的时限、索赔文件的提交要求等。

一般情况下,再保险公司要求保险公司在收到索赔通知后立即将相关文件提交给再保险公司,并按照约定程序进行索赔的处理。

4. 解除合同再保险合同还包括了解除合同的条款。

当发生特定情况,如合同终止、违约行为等,任何一方都有权解除合同。

解除合同的条款通常规定了合同解除的程序和后续义务。

IV. 再保险合同的作用再保险合同在保险业中发挥着重要的作用,具体如下:1. 分担风险再保险合同允许保险公司将一部分风险转移给再保险公司,减轻其单独承担风险的压力。

这有助于保险公司提高资本效率,并确保其财务健康。

保险业中的再保险了解再保险对保险市场的重要性

保险业中的再保险了解再保险对保险市场的重要性保险业中的再保险:了解再保险对保险市场的重要性保险业是现代经济中一个不可或缺的组成部分,其为个人和企业提供了风险的保障与转移。

然而,随着风险的不断增加和保险公司规模的扩大,再保险在保险市场中的地位变得尤为重要。

本文将介绍再保险的概念和功能,以及再保险对保险市场的重要性。

一、再保险的概念和功能再保险是指保险公司为了分散风险,将自己承担的部分风险再向其他保险公司转移的保险形式。

再保险起源于19世纪的英国和美国,随着全球保险市场的发展逐渐成为保险业必不可少的一环。

再保险的功能主要有三个方面:1. 分散风险:通过再保险,保险公司可以将自身承担的风险分散到其他保险公司。

例如,一家保险公司在面对一次大型自然灾害赔付时可能承担不起全部赔付额,但通过再保险,该保险公司可以将部分风险转移给其他再保险公司,减轻自身风险承受压力。

2. 提高保险公司资本利用效率:再保险公司通常拥有更多的资本实力和风险管理经验,与保险公司相比,它们更具备承担大额风险的能力。

因此,保险公司通过再保险可以提高自身的资本利用效率,降低资本占用率,从而更好地满足市场需求。

3. 促进保险市场稳定发展:再保险在保险市场中起到了稳定经济风险的重要作用。

通过再保险,保险公司可以有效分散风险,减少可能的财务损失,保持健康的财务状况,从而提高整个保险市场的稳定性和发展潜力。

二、再保险对保险市场的重要性再保险对保险市场的重要性不可忽视,它在以下几个方面发挥着关键作用:1. 保障保险公司的可持续发展:再保险的存在有效地保障了保险公司的可持续发展。

保险公司通过再保险可以将大额风险转移给再保险公司,降低自身的风险承受能力,从而更好地应对潜在的保险风险。

2. 推动保险业创新与发展:再保险为保险公司提供了更大的安全边际,使得保险公司可以更加大胆地承担更大额度的风险。

这不仅推动保险业务的创新,也为保险公司之间的竞争带来更多可能性。

再保险的作用

再保险的作用再保险,即保险人之保险,是保险人将自己所承保的风险责任事项转移给其他保险人或投保人的一种保险行为。

再保险能够使被保险人将风险转移至其他被保险人,同时保险人也可将所承保的责任转移至再保险人。

在再保险交易中,再保险人并非对原保险人的承保风险实施再次风险定价,而是在评估原保险人的风险分散程度后,相应调减自己的保费收入,实现对其承保风险的责任分散。

一、再保险的定义再保险是一种商业行为,其主要作用在于风险的分散和成本节约。

在再保险中,原保险人同意将其承担的特定风险责任,按照合同约定条件,转让给其他保险人或投保人承担。

再保险是国际保险市场通行的一种基本组织形式,是国际保险业赖以生存和发展的重要机制之一。

二、再保险的作用1.分散风险:再保险能够将单个被保险人的风险分散给其他被保险人,使得单个被保险人的风险相对较小,降低其损失的概率和程度。

这一作用在大型项目或巨灾风险的分担中尤为明显。

2.成本节约:通过再保险,保险公司可以将部分风险责任转让给其他保险公司或投保人,从而减轻自身的风险压力。

这样,保险公司可以将节省下来的资金用于扩大业务规模或提高服务质量,从而实现成本节约。

3.增强信誉:对于保险公司来说,承担大量的风险责任可能会影响其信誉。

通过再保险,保险公司可以将部分风险责任转移给其他保险公司或投保人,从而减轻自身的压力,增强其在市场上的信誉。

4.优化资源配置:再保险市场是一个全球性的市场,不同国家和地区之间的保险公司可以相互合作,共同分担风险责任。

这有助于优化资源配置,促进国际间的经济交流与合作。

5.促进国际合作:再保险是国际保险市场的重要组成部分,它有助于促进国际间的经济合作和交流。

通过再保险交易,不同国家的保险公司可以相互了解彼此的风险状况和风险管理能力,从而为未来的合作打下基础。

三、结论综上所述,再保险在风险分散、成本节约、增强信誉、优化资源配置和促进国际合作等方面发挥着重要作用。

随着全球经济的不断发展,再保险市场的重要性将越来越突出。

保险业风险管理的重要工具

保险业风险管理的重要工具保险业是一个必不可少的金融行业,为个人和企业提供风险保障。

然而,保险公司本身也面临着各种潜在的风险,如道德风险、操作风险和市场风险等。

为了确保保险公司的稳健经营和可持续发展,风险管理成为其重要的工具。

本文将分析保险业风险管理的重要性,以及一些常用的风险管理技术。

一、保险业风险管理的重要性1. 保障公司盈利能力:保险公司经营的核心是根据风险评估来确定保费,并提供保险赔付。

然而,风险是不可预测的,保险公司可能面临大量索赔。

通过风险管理,保险公司能够更好地预测和控制风险,确保公司的盈利能力。

2. 减少公司损失:风险管理帮助保险公司识别和评估潜在的风险,以制定相应的控制和防范措施。

通过减少风险事件的发生和损失的大小,保险公司能够降低公司的损失。

3. 提高公司的声誉和信誉度:通过有效的风险管理,保险公司能够更好地控制和应对风险,提供高质量的服务。

这有助于提高客户满意度,树立良好的公司形象,增强市场竞争力。

二、常用的保险业风险管理技术1. 风险评估和定价技术:风险评估是风险管理的基础,通过对客户和资产的风险进行评估,保险公司可以确定适当的保费和保险条款。

同时,定价技术也需要对相关风险因素进行评估和建模,以确保保险公司不会承担超过其承受能力的风险。

2. 再保险:再保险是保险公司将一部分风险转移给其他保险公司的方法。

通过再保险,保险公司可以分散风险,减轻单一风险对公司造成的损失。

再保险公司通常拥有更强大的资金实力和更丰富的经验,能够更好地应对大规模的风险事件。

3. 风险控制措施:保险公司可以采取一系列措施来减少风险的发生和损失的大小。

例如,建立完善的内部控制体系和业务流程,加强员工培训和监管,以及购买适当的保险产品来应对特定的风险。

4. 现代科技的应用:现代科技为风险管理提供了更多的工具和方法。

例如,大数据分析可以帮助保险公司更准确地评估风险、预测风险事件的发生概率,并制定相应的应对策略。

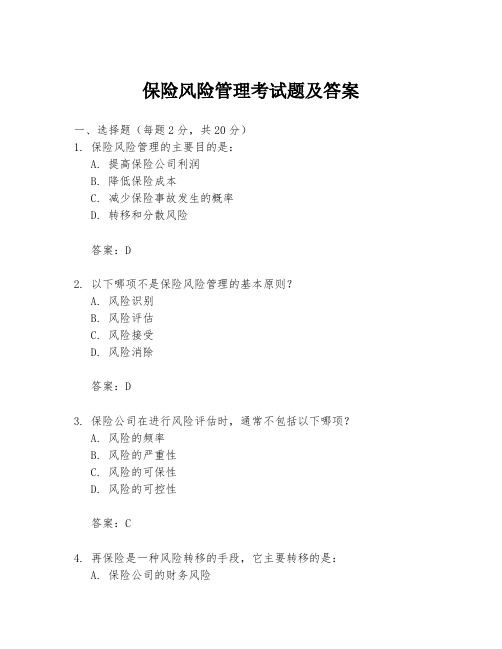

保险风险管理考试题及答案

保险风险管理考试题及答案一、选择题(每题2分,共20分)1. 保险风险管理的主要目的是:A. 提高保险公司利润B. 降低保险成本C. 减少保险事故发生的概率D. 转移和分散风险答案:D2. 以下哪项不是保险风险管理的基本原则?A. 风险识别B. 风险评估C. 风险接受D. 风险消除答案:D3. 保险公司在进行风险评估时,通常不包括以下哪项?A. 风险的频率B. 风险的严重性C. 风险的可保性D. 风险的可控性答案:C4. 再保险是一种风险转移的手段,它主要转移的是:A. 保险公司的财务风险B. 投保人的风险C. 保险公司的运营风险D. 保险公司的法律风险答案:A5. 保险合同中,免赔额的作用是:A. 增加保险公司的赔付B. 减少保险公司的赔付C. 提高保险费率D. 降低保险费率答案:B6. 保险风险管理中,风险分散的策略不包括:A. 投资组合多样化B. 再保险C. 风险自留D. 风险转移答案:C7. 以下哪项不是保险风险管理中的风险识别方法?A. 历史数据分析B. 专家咨询C. 风险调查问卷D. 风险预测答案:D8. 保险风险管理中的风险评估方法不包括:A. 概率分布法B. 蒙特卡洛模拟C. 风险矩阵D. 风险规避答案:D9. 保险公司在风险管理中采用的预防措施不包括:A. 风险教育B. 风险控制C. 风险规避D. 风险转移答案:C10. 保险风险管理的目标不包括:A. 保护保险公司的资产B. 确保保险公司的财务稳定C. 提高保险公司的市场竞争力D. 增加保险公司的市场份额答案:D二、简答题(每题10分,共30分)1. 简述保险风险管理的流程。

答案:保险风险管理的流程通常包括风险识别、风险评估、风险控制和风险监控四个步骤。

首先,通过各种方法识别可能影响保险公司的风险因素;其次,对这些风险进行评估,确定其可能带来的影响和损失;然后,根据评估结果,采取相应的措施进行风险控制,如风险转移、风险自留等;最后,对风险管理的效果进行监控,确保风险管理措施的有效性。

保险行业中的再保险业务管理

保险行业中的再保险业务管理保险行业中,再保险业务管理起着至关重要的作用。

再保险是指保险公司将自己承担的一部分风险再向其他保险公司进行转移的过程,能够帮助保险公司管理风险、确保资本充足,同时也能够促进保险市场的稳定发展。

本文将从再保险业务的概念、再保险业务的分类以及再保险业务管理的重要性等方面进行探讨。

一、再保险业务的概念再保险是保险公司为了分散风险、保证自身的稳健经营而采取的一种经营方式。

具体而言,再保险是指保险公司通过与其他保险公司签订合同,将自身承担的风险部分再次转移给再保险公司或再再保险公司的过程。

再保险业务的特点在于风险的再分散,能够使保险公司更好地控制风险,确保风险的可承受性。

二、再保险业务的分类根据再保险公司与原保险公司之间的关系,再保险业务可分为合同再保险和比例再保险两种形式。

1. 合同再保险合同再保险是指再保险公司与原保险公司签订协议,约定再保险公司承担一定比例的风险。

在合同再保险中,再保险公司根据约定的比例分担风险与收取相应的再保险费用。

合同再保险的优点在于明确风险责任和权益分配,有利于双方之间的风险管理。

2. 比例再保险比例再保险是指再保险公司按照原保险公司业务规模,按比例承担风险。

比例再保险的特点在于根据原保险公司的业务规模灵活调整再保险比例,能够更好地满足保险公司的需求。

三、再保险业务管理的重要性再保险业务管理对保险行业的发展起着至关重要的作用。

首先,再保险业务管理能够帮助保险公司有效管理风险。

再保险作为风险的二次分散,能够让保险公司的风险分布更加合理,避免极端风险对保险公司的影响。

其次,再保险业务管理有利于提高保险公司的资本充足率。

再保险能够将一部分风险转移给再保险公司,减轻保险公司的风险负担,提高了保险公司的资本充足率,确保了保险机构的健康运营。

此外,再保险业务管理还能够推动保险市场的稳定发展。

通过再保险,保险公司可以自由承担更多风险,提供更多的保险产品,促进了保险市场的竞争,提高了市场的稳定性和可持续性。

保险行业的再保险和风险分散

保险行业的再保险和风险分散保险行业作为金融行业的重要组成部分,承担了风险的转移和分散的角色。

为了控制和平衡风险,再保险成为了保险行业中的重要环节。

随着市场竞争的加剧和风险的不断增加,再保险在保险行业中的地位变得愈发重要。

本文将探讨保险行业中再保险的作用以及它在风险分散中的重要性。

一、保险行业中的再保险再保险是指原保险公司将其风险通过与其他再保险公司进行交易来转嫁一部分风险。

保险公司作为再保险合同的买方,通过支付再保险费用,将自身承担的风险分散给再保险公司。

再保险公司承担了保险公司的风险,并获得相应的再保险费用。

再保险对于保险公司来说具有多重作用。

首先,再保险可以帮助保险公司控制风险,避免因为某一事件而导致的重大损失。

通过与再保险公司的合作,保险公司可以将风险转嫁给再保险公司,降低自身的风险承受能力。

其次,再保险有助于保险公司扩大业务范围。

由于再保险公司承担了部分风险,保险公司在风险控制上具备了更大的灵活性,可以承保规模更大、风险更高的业务。

这样一来,保险公司可以拓展市场份额,提升盈利能力。

同时,再保险还能够提供专业的风险评估与管理服务。

再保险公司在接受再保险合同之前会对保险公司的风险进行评估,并提供相应的管理建议。

这使得保险公司能够在保险产品设计、风险监控等方面得到专业的指导和支持。

二、再保险在风险分散中的重要性再保险的存在使得保险行业中的风险得以分散。

一方面,再保险可以帮助保险公司将单一风险转嫁给多个再保险公司,从而降低单个保险公司的风险。

多个再保险公司承担同一风险,大大降低了单个保险公司承受风险的程度,保障了保险公司的稳定运营。

另一方面,再保险可以促使不同地区和不同类型的风险得到分散。

由于保险公司的经营范围和专业领域的限制,其风险可能集中在某一特定地区或某一特定行业。

通过与不同地区和不同类型的再保险公司合作,保险公司可以将风险分散到更广泛的范围内,提高整体风险管理水平。

此外,再保险还能够帮助保险公司应对因突发事件或自然灾害引发的大规模赔付。

保险中的自保和再保险

保险中的自保和再保险保险是一种风险管理工具,用于帮助个人和企业在面临潜在风险时进行经济上的保护。

在保险业中,有两个关键概念,即自保和再保险。

自保是指保险公司承担风险的能力和行为,再保险是指保险公司将一部分风险转移给其他保险公司的保险方式。

本文将探讨保险中的自保和再保险的定义、作用以及重要性。

自保自保是指保险公司自行承担风险并对其进行管理的能力和行为。

当一个保险公司接受保险业务时,它会根据其风险承受能力和资金实力,通过计算风险概率和损失的预测,决定承担何种程度的风险。

自保的目的是保证保险公司在承保风险时具备足够的资金来支付赔款,并保持公司的经济稳定。

自保是保险公司的基本职能之一,它有助于保险公司在发生损失时能够履行赔偿的责任,并维持其声誉和财务稳定。

保险公司通过自保,可以通过收取保费,并将其投资以获取回报。

自保还有助于保险公司评估风险和损失,根据历史数据和概率模型进行风险管理。

再保险再保险是保险公司将承担的风险转移给其他保险公司的保险方式。

当一个保险公司面临超出其自保能力的风险时,它可以寻求其他保险公司的支持来分担风险。

再保险的主要目的是提供给保险公司一个额外的保险层,以减轻其承担的风险。

再保险不仅提供了保险公司对大额风险的保护,而且通过分享风险,给予保险公司更多的承保能力。

再保险公司通常会对保险公司提供限额和约定的赔偿金额,从而帮助保险公司在超出自保能力的情况下承担风险。

此外,再保险扮演了一个分散风险的角色,因为它可以把风险分散到多个再保险公司之间。

重要性自保和再保险在保险业中起着非常重要的作用。

保险公司通过自保和再保险来管理和分散风险,保证在发生损失时能够承担赔款责任。

这两者结合在一起提供了强大的风险管理工具,给予保险公司更大的承保能力,同时保护公司的财务健康。

对于个人和企业来说,自保和再保险也非常重要。

当个人或企业购买保险时,他们希望能够得到充分的保护,以防止潜在的经济损失。

自保和再保险确保保险公司有足够的能力和资源来履行赔偿义务,保护被保险人利益。

保险行业的风险分散与再保险策略

保险行业的风险分散与再保险策略保险行业是为了分散和转移风险而存在的,通过购买保险,被保险人将自己的风险转嫁给保险公司。

然而,保险公司自身也面临着承担大量风险的问题。

为了降低单一风险对保险公司的影响,保险行业采用了风险分散和再保险策略。

一、风险分散的重要性风险分散是保险行业确保稳定运营的关键。

一家保险公司所承担的风险越多,其利润和财务状况受到的影响也就越大。

如果一家保险公司投保的风险高度集中在某一地区或某一行业,当该地区或行业遭受重创时,保险公司将付出巨大的赔偿,从而导致巨大的经济损失。

因此,保险公司需要将风险分散到更广泛的范围内,避免集中承担太多风险。

通过在不同地理区域、行业和客户之间进行风险分散,保险公司可以降低自身所面临的风险,并提高业务的稳定性和持续性。

二、再保险策略的作用再保险是保险公司将部分承担的风险再次转移给其他保险公司的策略。

通过购买再保险,保险公司可以将自身所承担的风险进一步分散,减少遭受重大赔偿的风险。

再保险公司承担被保险人支付的一部分赔款,以换取保险公司支付给再保险公司的保费。

再保险具有以下几个重要作用:1. 风险分散:再保险使保险公司将风险分散到其他保险公司,从而降低自身的风险承担程度。

2. 资金保障:再保险为保险公司提供了资金保障,确保其能够承担巨额赔偿责任,避免因无力支付赔款而导致的倒闭风险。

3. 专业支持:再保险公司通常具备更丰富的经验和专业知识,可以为保险公司提供风险评估、风险管理和赔款处理方面的支持。

4. 扩大业务规模:通过再保险,保险公司可以扩大业务规模,接受更多的投保,从而提高市场份额。

三、再保险策略的分类再保险策略可以根据不同的风险分散方式进行分类。

常见的再保险策略包括:1. 比例再保险:保险公司按照约定的比例与再保险公司分享风险和保费。

根据约定的比例,当保险公司发生赔偿时,再保险公司按照约定的比例分担赔偿责任。

2. 超额再保险:保险公司在超过约定限额的损失范围内,将风险转移给再保险公司。

保险行业的风险评估与管理工具

保险行业的风险评估与管理工具保险行业一直承担着对各种风险进行评估和管理的重要责任,以保护人们、企业和财产免受潜在损失的影响。

为了有效应对风险,保险公司和专业机构开发了各种工具,以帮助他们在风险评估和管理方面提供准确、可靠的信息和解决方案。

本文将介绍一些在保险行业中被广泛应用的风险评估与管理工具。

一、风险评估工具1.保险合同:保险合同是最基本的风险评估工具之一。

它详细描述了保险公司和被保险人之间的权利和义务。

合同中包含了被保险人的个人或财产信息,以及被保险风险的评估和管理细则。

2.风险评估调查报告:保险公司通常会派遣专业人员进行调查和评估被保险人的风险。

他们会考察被保险人的环境、历史记录和风险防控措施,然后撰写详细的报告,对风险进行评估和建议管理措施。

3.风险测量和建模工具:这些工具利用统计学和数学模型分析和预测保险风险。

例如,风险测量模型可以根据历史数据和相关统计指标,预测未来的风险概率和损失大小。

而风险建模工具则可以模拟不同风险场景并对其潜在影响进行评估。

二、风险管理工具1.再保险:再保险是保险公司将部分风险转移给其他保险公司或专业机构的手段。

通过再保险,保险公司可以减轻自身承担的风险压力,降低潜在损失。

2.风险分散和投资组合:保险公司通过将保险风险分散在不同的区域、行业和产品上来降低风险。

此外,他们还可以通过投资组合策略来平衡风险和回报,以实现风险的最优管理。

3.风险管理信息系统(RMIS):风险管理信息系统是一个电子化的工具,用于整合和管理与风险相关的数据和信息。

它可以帮助保险公司实时了解风险情况、跟踪风险变化并做出相应的管理决策。

4.风险管理培训和指导:保险公司为员工提供风险管理培训和指导,以提升他们的风险辨识和管理能力。

这些培训可以包括风险评估技术、风险控制方法和应急管理措施等方面的知识,以确保员工对风险管理工具和流程的正确应用。

三、风险评估与管理工具的重要性风险评估与管理工具在保险行业中起着至关重要的作用。

农业再保险知识

农业再保险知识一、什么是农业再保险1. 农业再保险啊,就像是给农业保险上了一道“保险”。

你想啊,农民伯伯给农作物或者养殖的牲畜买了保险,保险公司承担着风险呢。

但是有时候风险太大啦,保险公司自己可能也会吃不消,这时候就需要农业再保险来帮忙啦。

比如说,有一年某个地区发生了大洪水,好多农田被淹了,农作物损失惨重。

如果只有农业保险公司自己赔,可能会赔到破产呢。

有了农业再保险,就可以分担一部分风险,让保险公司不至于因为一次大灾害就垮掉。

2. 简单来说,农业再保险就是保险公司之间的一种风险转移机制。

就好比你和小伙伴一起玩游戏,遇到了一个超级大的难关,一个人肯定过不了,大家就一起分担这个困难,这样就有可能闯过去啦。

农业再保险也是这样,把农业保险面临的巨大风险分散开来,让整个保险行业都能更加稳定地发展。

3. 从更宏观的角度看,农业再保险对整个农业产业的稳定发展有着超级重要的意义。

它就像一个坚强的后盾,让农民伯伯们不用担心自己的心血因为自然灾害或者其他意外情况一下子就化为泡影。

而且也让那些愿意给农业提供保险服务的保险公司更有信心,这样就能有更多的农业保险产品出现,对农民来说也是一件大好事。

二、农业再保险的重要性1. 对于农民来说,农业再保险就像是一颗“定心丸”。

农民靠天吃饭,天气变幻莫测,病虫害也随时可能来袭。

要是没有农业再保险的保障,一旦遭遇大灾,可能一年甚至几年的辛苦就白费了。

有了农业再保险,即使遇到灾害,也能得到相应的赔偿,这样他们就可以更快地恢复生产,不至于因为一次打击就一蹶不振。

2. 对于保险公司而言,这可是一个降低风险的好办法。

就像我们前面说的,农业保险的风险有时候是不可预测的,而且可能非常巨大。

有了农业再保险,保险公司可以把自己承担不了的风险转移出去,这样就可以在保证自己盈利的同时,还能继续为农业提供保险服务。

如果没有农业再保险,可能很多保险公司都不敢涉足农业保险这个领域,那农民就少了很多保障的途径。

再保后综合赔付率例题

再保后综合赔付率例题摘要:1.保险基础知识概述2.再保后综合赔付率的概念及计算方法3.再保后综合赔付率的影响因素4.再保后综合赔付率的实际应用案例5.再保后综合赔付率的重要性正文:【保险基础知识概述】在现代社会,保险已成为人们生活中不可或缺的一部分。

保险作为一种风险管理工具,能够帮助人们在面临突发事件时,将经济损失降到最低。

在保险行业中,有一个重要的概念叫再保险,也称为分保。

再保险是指保险公司将其所承担的保险责任的一部分或全部转移给其他保险公司,以分散风险。

再保险市场的发展和完善,有助于提高保险公司的抵御风险能力,保障被保险人的利益。

【再保后综合赔付率的概念及计算方法】再保后综合赔付率是指再保险公司在承担再保险责任后,实际支付的赔款金额与再保险费收入之比。

再保后综合赔付率的计算公式为:再保后综合赔付率= 再保险公司实际支付的赔款金额/ 再保险费收入再保后综合赔付率可以从一个侧面反映再保险公司的风险承受能力和经营状况。

【再保后综合赔付率的影响因素】再保后综合赔付率的大小受多种因素影响,主要包括以下几个方面:1.保险合同约定的赔付比例:再保险公司根据保险合同约定的赔付比例进行赔付,影响再保后综合赔付率。

2.保险事故的发生频率和损失程度:保险事故的发生频率和损失程度直接影响再保险公司的赔款支出,从而影响再保后综合赔付率。

3.再保险公司的风险管理水平:再保险公司通过风险管理手段,如风险分散、风险评估等,可以降低赔付率,从而影响再保后综合赔付率。

【再保后综合赔付率的实际应用案例】假设某再保险公司在承担再保险责任后,实际支付的赔款金额为1000 万元,再保险费收入为2000 万元,则再保后综合赔付率为:再保后综合赔付率= 1000 万元/ 2000 万元= 50%这意味着该再保险公司在承担再保险责任后,赔付率为50%,即每收取1 元的再保险费,需要支付0.5 元的赔款。

【再保后综合赔付率的重要性】再保后综合赔付率是衡量再保险公司风险承受能力和经营状况的重要指标。

再保险轧差结算

再保险轧差结算摘要:1.再保险轧差结算的定义和重要性2.再保险轧差结算的基本原则3.再保险轧差结算的具体操作流程4.再保险轧差结算的风险控制和挑战5.再保险轧差结算的未来发展趋势正文:再保险轧差结算是再保险业务中的一种重要结算方式,对于再保险市场的稳定和发展具有重要意义。

再保险轧差结算是指再保险人根据约定,对分入的再保险业务进行资金结算的过程。

本文将从再保险轧差结算的定义和重要性、基本原则、具体操作流程、风险控制和挑战以及未来发展趋势等方面进行详细阐述。

首先,再保险轧差结算的定义和重要性。

再保险轧差结算作为再保险业务中的一种重要结算方式,能够有效地实现再保险资金的流转,保障再保险市场的稳定运行。

通过轧差结算,再保险人可以根据业务风险和资金需求进行灵活的资产负债管理,从而降低再保险市场的整体风险。

其次,再保险轧差结算的基本原则。

再保险轧差结算应遵循以下基本原则:1.轧差结算应基于双方约定的再保险合同进行;2.轧差结算应遵循公平、公正、公开的原则;3.轧差结算应以实际发生的再保险业务为依据;4.轧差结算的结果应能够真实反映再保险业务的风险状况。

接着,再保险轧差结算的具体操作流程。

再保险轧差结算的具体操作流程主要包括以下几个步骤:1.再保险人根据分入的再保险业务,计算应支付的再保险资金;2.再保险人向再保险分出人发出轧差通知,告知其轧差金额;3.再保险分出人收到轧差通知后,进行核对并确认;4.双方按照约定的方式进行资金划转,完成轧差结算。

然后,再保险轧差结算的风险控制和挑战。

再保险轧差结算过程中,存在一定的风险和挑战,主要包括:1.信用风险:再保险分出人可能无法按照约定履行支付义务;2.流动性风险:再保险轧差结算过程中,可能存在资金流动性不足的问题;3.信息传递风险:再保险轧差结算过程中,信息传递可能出现失误或延迟,影响结算效率。

最后,再保险轧差结算的未来发展趋势。

随着再保险市场的不断发展,再保险轧差结算将呈现出以下发展趋势:1.结算方式将更加多元化,满足不同再保险业务的需求;2.结算效率将不断提高,降低再保险市场的交易成本;3.结算风险将得到更好的控制,保障再保险市场的稳定运行。

再保险合同的保险标的

再保险合同的保险标的

摘要:

1.再保险合同的定义和作用

2.再保险合同的保险标的类型

3.再保险合同保险标的的重要性

4.我国再保险市场的现状及发展

正文:

再保险合同的保险标的,是指在再保险合同中约定的再保险人所承担的保险责任范围。

再保险合同是一种特殊的保险合同,主要目的是将原保险人承担的保险责任,通过向再保险人支付一定的保费,将其转移一部分或全部给再保险人。

再保险合同的保险标的对于保障原保险人、再保险人和被保险人的权益具有重要意义。

再保险合同的保险标的类型主要包括:

1.人身保险标的:指以人的生命、健康、身体为保险对象的保险合同。

如寿险、健康险、意外险等。

2.财产保险标的:指以财产及其有关利益为保险对象的保险合同。

如财产险、责任险、信用险等。

3.责任保险标的:指以被保险人因其法律责任而应承担的赔偿责任为保险对象的保险合同。

如雇主责任险、环境污染责任险等。

再保险合同保险标的的重要性体现在以下几个方面:

1.分散风险:通过再保险合同,原保险人可以将部分保险责任转移给再保

险人,从而分散自身承担的风险。

2.提高偿付能力:再保险合同可以提高原保险人的偿付能力,确保其在承担保险责任时具备充足的资金实力。

3.稳定保险市场:再保险合同有助于稳定保险市场,降低保险公司的经营风险,从而保障保险市场的健康发展。

我国再保险市场经过多年的发展,已经取得了一定的成绩。

目前,我国再保险市场规模已位居世界前列,市场体系逐步完善,竞争格局逐渐多元化。

然而,与国际再保险市场相比,我国再保险市场在保险密度、保险深度、产品创新等方面仍存在一定差距。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Making better reinsurance decisions…

再保险的重要意义

Making better reinsurance decisions…

Risk and the Insurer

Currency Risk Interest rate risk

的承保限制。例如由于美国市场的经验,将职业病类的风险除外。

*培训 *分享其他市场的经验 *市场信息

14

Micro and Macro Dimensions of Reinsurance

Reinsurance makes insurance more stable and attractive

Source: Swiss Re

Facilitate the smooth exit from specific lines of business or territories • Run-off portfolios

11

再保险的功能

• 稳定财务成果:

*使纯留存收益免受反常的巨大损失的冲击

• 资金管理: *将破产的可能性降低到最小化—确保偿付能力 *提高偿付准备金—减少过剩资本、新业务压力 *减少未满期的保险准备金 *减少和/或延迟纳税义务,例如它是持有巨灾准备金的一种可供选择的方法 *有效地利用资金:包括VaR在内的成本效益分析 • 有利于资金顺利地从特定的商业领域和地区流出: *径流组合

9

再保险的功能

• 提高承保能力: *大线能力,也就是对单一风险提供高限额保险的能力 *保险费能力,也就是一个主要的保险人所能承保的保险费的总量 • 稳定承保结果: *有些自然灾害发生的频率不高,一旦发生却会产生巨大的风险,再保险可以平衡这些

巨灾所造成的多少不一的损失。

*通过进一步的分散风险稳定索赔率 *改变风险(科技进步、立法活动等) *平衡计算的错误和不确定性:风险评估的错误 *未知风险的累积 *通货膨胀

Operational risk

Insurance risk

Modern Enterprise Risk Management concept identifies different types of risks an organization faces. Insurance risk impact on the underwriting results of an insurance company Reinsurance reduces the insurance risk but introduces additional credit risk

15

再保险的大小尺度

再保险可以使得保险活动更加稳定、更具吸引力。

Source: Swiss Re

16

Parties influencing capital management/reinsurance decisions

Regulatory interests Need for a clear and transparent indication of financial strength and development of trigger points for regulatory action Shareholders Need for an understanding of company’s assessment of risk and calculation of capital adequacy in order to make informed investment decisions Capital Markets The growing possibility of cross-sectoral arbitrage demands more transparent measurements of risk management performance Rating Agencies Interest in the way insurers identify, aggregate and manage their risks – increasingly important to have a comprehensive risks assessment model to meet rating agencies stringent evaluation process Management Efficient allocation of funds and resources by identifying businesses that return most for the capital employed and the risks taken

17

影响资金管理/再保险决议的各方:

1)管制利益:

应当公开财力及发展、施行管制措施的动机和出发点,并进行清晰的说明Fra bibliotek2)股东:

需要了解公司的风险评估和资本充足率的计算制度以便做出审慎的投资决定

5

内容概要

• 再保险的功能 • 再保险影响下的密匙管理和配置的问题 • 规划和购买再保险的原则

6

Function of Reinsurance

The role of reinsurance in an insurance organization is growing in importance. From providing capacity and stabilizing underwriting results, it has now become a critical and integral part of the overall management process. It not only impacts on the potential underwriting result but has a direct impact on capital allocation decisions of the organization as well.

•

Stabilization of Underwriting results

• • • • Balancing variations in loss experience due to Infrequent but large risks (natural catastrophe) Stabilization of claims ratio through further spread of risk risk of change (technical progress, legislation,...) Balancing calculations errors / uncertainties – errors of risk evaluation – unknown accumulations – Inflation .

12

Function of Reinsurance

• Provision of services by reinsurers/brokers • Support in insurance or reinsurance technical matters – helping to develop and improve results in areas like sales techniques, risk assessment, risk pricing, product development, claims settlement, administration, etc Risk consulting and management Suggestion for technical restrictions – reinsurers can point out important cover limitations to impose on primary risks e.g. exclusions on occupational hazards as a result of experience in the USA Training Sharing of experience from other markets

Equity risk Reinsurers’ risk Credit risk Insurance risk

3

风险和保险人

Currency Risk Interest rate risk

Operational risk

现代企业风险管理的概念将 识别一个机构所面临的各种不同 类型的风险。 保险风险会对保险公司的承 保结果产生影响。 再保险降低了保险风险,但 是又引入了额外的信贷风险。

Insurance risk

Equity risk Reinsurers’ risk Credit risk Insurance risk

4

Presentation Outline

• Function of reinsurance • Key management and allocation issues influenced by reinsurance • Principles of reinsurance planning and purchase

• •

• •

•

Market information

13

再保险的功能

• 再保险人/经纪人所提供的服务: *对保险/再保险的技术性事项提供支持----帮助其发展和提高销售技术、风险评估

、风险定价、发展产品,理赔和管理的效果等等

*风险咨询与管理 *对技术性的限制提出建议----再保险人可以指明,针对主要的风险应该加入重要

•

• • • •

Improve solvency margin – surplus capital relief, new business strain