国际经济学作业答案-第六章完整版.doc

《 国际经济学》冯德连 第三版 每章案例参考答案(人大版)

国际经济学(第三版)案例参考答案冯德连主编绪论案例参考答案 (2)第一章案例参考答案 (2)第二章案例参考答案 (3)第三章案例参考答案 (4)第四章案例参考答案 (4)第五章案例参考答案 (4)第六章案例参考答案 (4)第七章案例参考答案 (5)第八章案例参考答案 (5)第九章案例参考答案 (5)第十章案例参考答案 (7)第十一章案例参考答案 (8)第十二章案例参考答案 (8)第十三章案例参考答案 (9)第十四章案例参考答案 (11)第十五章案例参考答案 (11)第十六章案例参考答案 (14)第十七章案例参考答案 (15)第十八章案例参考答案 (15)绪论案例参考答案1.答案:主要包括七大主题:贸易所得、贸易模式、贸易保护、国际收支平衡、汇率决定、国际间政策协调,以及国际资本市场。

该教材提出了其他作者没能系统论述的新观点:汇率决定的资产市场分析方法;规模报酬递增与市场结构;政治学与贸易政策理论;国际宏观经济政策协调;世界资本市场与发展中国家;国际要素流动。

2.答案:答案是肯定的,但是历史表明政治力量可以超越技术进步的作用。

(参阅[美]克鲁格曼、奥伯斯法尔德著的《国际经济学:理论与政策》(第八版),中国人民大学2010年版,第18-19页)。

引力模型:在其他条件不变的情况下,两国间的贸易规模与两国的GDP 成正比,与两国间的距离成反比。

公式为:ij j i ij D Y Y a T ⨯⨯= ij T 是i 国与j 国间的国际贸易额,i Y 是i 国的GDP ,j Y 是j 国的GDP ,ij D 是两国间的距离。

第一章案例参考答案1.答案:(1)发展中国家的经济地位决定贸易的规模经济收益主要流向发达国家。

(2)市场经济体制和多边贸易体制在全球的发展,对谋求贸易利益的政策实施空间造成约束。

(3)技术上的差异使得欠发达国家处于国际分工体系的下端。

2.答案:上世纪50年代初,普雷维什(Prebisch )和辛格(Singe )的研究形成了著名的普雷维什-辛格假说,即初级产品相对于工业制成品的贸易条件存在持续下降的趋势,国际贸易产生的贸易所得的分配因此是向主要出口工业制成品的发达国家倾斜的,而出口初级产品为主的发展中国家则处于不利的地位。

【精品】国际经济学作业答案第六章(可编辑)

国际经济学作业答案-第六章------------------------------------------作者------------------------------------------日期Chapter 6 Economies of Scale, Imperfect Competition, and International TradeMultiple Choice Questions1. External economies of scale arise when the cost per unit(a) rises as the industry grows larger.(b) falls as the industry grows larger rises as the average firm grows larger.(c) falls as the average firm grows larger.(d) remains constant.(e) None of the above.Answer: B2. Internal economies of scale arise when the cost per unit(a) rises as the industry grows larger.(b) falls as the industry grows larger.(c) rises as the average firm grows larger.(d) falls as the average firm grows larger.(e) None of the above.Answer: D3. External economies of scale(a) may be associated with a perfectly competitive industry.(b) cannot be associated with a perfectly competitive industry.(c) tends to result in one huge monopoly.(d) tends to result in large profits for each firm.(e) None of the above.Answer: A4. Internal economies of scale(a) may be associated with a perfectly competitive industry.(b) cannot be associated with a perfectly competitive industry.(c) are associated only with sophisticated products such as aircraft.(d) cannot form the basis for international trade.(e) None of the above.Answer: B5. A monopolistic firm(a) can sell as much as it wants for any price it determines in the market.(b) cannot determine the price, which is determined by consumer demand.(c) will never sell a product whose demand is inelastic at the quantity sold.(d) cannot sell additional quantity unless it raises the price on each unit.(e) None of the above.Answer: C6. Monopolistic competition is associated with(a) cut-throat price competition.(b) product differentiation.(c) explicit consideration at firm level of the feedback effec ts of other firms’ pricing decisions.(d) high profit margins.(e) None of the above.Answer: B7. The most common market structure is(a) perfect competition.(b) monopolistic competition.(c) small-group oligopoly.(d) perfectly vertical integration.(e) None of the above.Answer: C8. Modeling trade in monopolistic industries is problematic because(a) there is no one generally accepted model of oligopoly behavior.(b) there are no models of oligopoly behavior.(c) it is difficult to find an oligopoly in the real world.(d) collusion among oligopolists makes usable data rare.(e) None of the above.Answer: A9. Where there are economies of scale, the scale of production possible in a country is constrained by(a) the size of the country.(b) the size of t he trading partner’s country.(c) the size of the domestic market.(d) the size of the domestic plus the foreign market.(e) None of the above.Answer: D10. Where there are economies of scale, an increase in the size of the market will(a) increase the number of firms and raise the price per unit.(b) decrease the number of firms and raise the price per unit.(c) increase the number of firms and lower the price per unit.(d) decrease the number of firms and lower the price per unit.(e) None of the above.Answer: C11. The simultaneous export and import of widgets by the United States is an example of(a) increasing returns to scale.(b) imperfect competition.(c) intra-industry trade.(d) inter-industry trade.(e) None of the above.Answer: C12. If output more than doubles when all inputs are doubled, production is said to occur underconditions of(a) increasing returns to scale.(b) imperfect competition.(c) intra-industry trade.(d) inter-industry trade.(e) None of the above.Answer: A13. Intra-industry trade can be explained in part by(a) transportation costs within and between countries.(b) problems of data aggregation and categorization.(c) increasing returns to scale.(d) All of the above.(e) None of the above.Answer: D14. If some industries exhibit internal (firm specific) increasing returns to scale in each country, weshould not expect to see(a) intra-industry trade between countries.(b) perfect competition in these industries.(c) inter-industry trade between countries.(d) high levels of specialization in both countries.(e) None of the above.Answer: B15. Intra-industry trade is most common in the trade patterns of(a) developing countries of Asia and Africa.(b) industrial countries of Western Europe.(c) all countries.(d) North-South trade.(e) None of the above.Answer: B16. International trade based on scale economies is likely to be associated with(a) Ricardian comparative advantage.(b) comparative advantage associated with Heckscher-Ohlin factor-proportions.(c) comparative advantage based on quality and service.(d) comparative advantage based on diminishing returns.(e) None of the above.Answer: E17. International trade based on external scale economies in both countries is likely to be carried out by a(a) relatively large number of price competing firms.(b) relatively small number of price competing firms.(c) relatively small number of competing oligopolists.(d) monopoly firms in each country/industry.(e) None of the above.Answer: A18. International trade based solely on internal scale economies in both countries is likely to be carriedout by a(a) relatively large number of price competing firms.(b) relatively small number of price competing firms.(c) relatively small number of competing oligopolists.(d) monopoly firms in each country/industry.(e) None of the above.Answer: D19. A monopoly firm engaged in international trade will(a) equate average to local costs.(b) equate marginal costs with foreign marginal revenues.(c) equate marginal costs with the highest price the market will bear.(d) equate marginal costs with marginal revenues in both domestic and in foreign markets.(e) None of the above.Answer: D20. A monopoly firm will maximize profits by(a) charging the same price in domestic and in foreign markets.(b) producing where the marginal revenue is higher in foreign markets.(c) producing where the marginal revenue is higher in the domestic market.(d) equating the marginal revenues in domestic and foreign markets.(e) None of the above.Answer: D21. A firm in monopolistic competition(a) earns positive monopoly profits because each sells a differentiated product.(b) earns positive oligopoly profits because each firm sells a differentiated product.(c) earns zero economic profits because it is in perfectly or pure competition.(d) earns zero economic profits because of free entry.(e) None of the above.Answer: D22. The larger the number of firms in a monopolistic competition situation,(a) the larger are that country’s exports.(b) the higher is the price charged.(c) the fewer varieties are sold.(d) the lower is the price charged.(e) None of the above.Answer: D23. The monopolistic competition model is one in which there is/are(a) a monopoly.(b) perfect competition.(c) economies of scale.(d) government intervention in the market.(e) None of the above.Answer: C24. In industries in which there are scale economies, the variety of goods that a country can produce isconstrained by(a) the size of the labor force.(b) anti-trust legislation.(c) the size of the market.(d) the fixed cost.(e) None of the above.Answer: C25. An industry is characterized by scale economies, and exists in two countries. Should these twocountries engage in trade such that the combined market is supplied by one country’s industry, then(a) consumers in both countries would suffer higher prices and fewer varieties.(b) consumers in the importing country would suffer higher prices and fewer varieties.(c) consumers in the exporting country would suffer higher prices and fewer varieties.(d) consumers in both countries would enjoy fewer varieties available but lower prices.(e) None of the above.Answer: E26. An industry is characterized by scale economies and exists in two countries. In order for consumersof its products to enjoy both lower prices and more variety of choice,(a) each country’s marginal cost must equal that of the other country.(b) the marginal cost of this industry must equal marginal revenue in the other.(c) the monopoly must lower prices in order to sell more.(d) the two countries must engage in international trade one with the other.(e) None of the above.Answer: D27. A product is produced in a monopolistically competitive industry with scale economies. If thisindustry exists in two countries, and these two countries engage in trade one with the other, then we would expect(a) the country in which the price of the product is lower will export the product.(b) the country with a relative abundance of the factor of production in which production of theproduct is intensive will export this product.(c) each of the countries will export different varieties of the product to the other.(d) neither country will export this product since there is no comparative advantage.(e) None of the above.Answer: C28. The reason why one country may export a product which is produced with positive scale economies is(a) its labor productivity will tend to be higher.(b) it enjoys a relative abundance of the factor intensely used in the product’s production.(c) its demand is biased in favor of the product.(d) its demand is biased against the product.(e) None of the above.Answer: E29. Two countries engaged in trade in products with no scale economies, produced under conditions ofperfect competition, are likely to be engaged in(a) monopolistic competition.(b) inter-industry trade.(c) intra-industry trade.(d) Heckscher-Ohlin trade.(e) None of the above.Answer: B30. Two countries engaged in trade in products with scale economies, produced under conditions ofmonopolistic competition, are likely to be engaged in(a) price competition.(b) inter-industry trade.(c) intra-industry trade.(d) Heckscher-Ohlinean trade.(e) None of the above.Answer: C31. History and accident determine the details of trade involving(a) Ricardian and Classical comparative advantage.(b) Heckscher-Ohlin model consideration.(c) taste reversals.(d) scale economies.(e) None of the above.Answer: D32. We often observe intra-industry North-South trade in “computers and related devices.” This is due to(a) classification and aggregation ambiguities.(b) monopolistic competition.(c) specific factors issues.(d) scale economies.(e) None of the above.Answer: A33. We often observe “pseudo-intra-industry trade” between the Unite d States and Mexico. Actually,such trade is consistent with(a) oligopolistic markets.(b) comparative advantage associated with Heckscher-Ohlin model.(c) optimal tariff issues.(d) huge sucking sound.(e) None of the above.Answer: B34. Intra-industry trade will tend to dominate trade flows when which of the following exists?(a) Large differences between relative country factor availabilities(b) Small differences between relative country factor availabilities(c) Homogeneous products that cannot be differentiated(d) Constant cost industries(e) None of the above.Answer: B35. The most common form of price discrimination in international trade is(a) non-tariff barriers.(b) Voluntary Export Restraints.(c) dumping.(d) preferential trade arrangements.(e) None of the above.Answer: CEssay Questions1. Why is it that if an industry were operating under conditions of domestic internal scale economies(applies to firm in the country)—then the resultant equilibrium cannot be consistent with the pure competition model?Answer: Because once one firm became bigger than another, or if one firm began the industry, then no other firm would be able to match its per unit cost, so that they would be driven out ofthe industry.2. Is it possible that if positive scale economies characterize an industry, that its equilibrium may beconsistent with purely competitive conditions? Explain how this could happen.Answer: Yes. If the scale economies were external to the firm, then there is no reason why the firms may not be in perfect competition.3. If a scale economy is the dominant technological factor defining or establishing comparativeadvantage, then the underlying facts explaining why a particular country dominates world markets in some product may be pure chance, or historical accident. Explain, and compare this with the answer you would give for the Heckscher-Ohlin model of comparative advantage.Answer: This statement is true, since the reason the seller is a monopolist may be that it happened to have been the first to produce this product in this country. It may have no connection toany supply or demand related factors; nor to any natural or man-made availability. This isall exactly the opposite of the Heckscher-Ohlin Neo-Classical model’s explanation of thedeterminants of comparative advantage.4. It is possible that trade based on external scale economies may leave a country worse off than itwould have been without trade. Explain how this could happen.Answer: One answer is that the terms of trade effects may dominate any other factors.5. If scale economies were not only external to firms, but were also external to individual countries.That is, the larger the worldwide industry (regardless of where firms or plants are located), thecheaper would be the per-unit cost of production. Describe what world trade would look like in this case.Answer: Presumably each country would specialize in some component of the final product. This would result in much observed intra-industry trade.6. Why are increasing returns to scale and fixed costs important in models of international trade andmonopolistic competition?Answer: There are many answers. Three of these are(a) Increasing returns to scale, and high fixed costs may be inconsistent with perfectcompetition. In such a case, the initial autarkic state may be a suboptimal equilibrium.For example, relative prices may not equal marginal rates of transformation. It followsfrom this that a change in output compositions associated with trade may result in anational welfare for one or both trading countries that is inferior to that associatedwith the initial autarkic conditions. Hence no “gains from trade.”(b) In a case of increasing scale economies at the firm or plant level, the determination ofwhich product will be exported by which country is ex-ante indeterminate. Therefore,deriving clear implications concerning the effects of trade on income distributionssuch as may be derived from the Samuelson-Stolper Theorem is no longer generallypossible.(c) Market structures containing positive scale economies and imperfect competition mayallow for “two-way trade,” or intra-industry trade. As in b. above, the varioustheorems derivable from the Heckscher-Ohlin model concerning directions of tradeand income distributions are no longer generally applicable.7. Explain why it may be argued that the relative importance of the intra-industry component of worldtrade is likely to lessen economic strife or confrontation (a la Stolper-Samuelson) associated with commercial policy within countries in which overall trade is expanding?Answer: In the case of the Neo-Classical H-O model, the expansion of trade will tend to increase the incomes of those factors in which the exports are relatively intense. This may createsituations i n which unskilled labor’s already relatively low relative incomes would worsenin a country such as the U.S., hence heating up “class warfare.” In the case of intra-industry trade, the expanding exports will tend to be in relatively fragmented subsets ofp roducts (“brands”). Such export expansion will have no determinant or systematictendency to affect relative factor returns in any deterministic manner.8. Explain why positive economies of scale in one (of two) sectors may establish a comparativeadvantage for the large (as compared to the small) country in the production of the commoditywhich exhibits positive scale economies.Answer: In the case of the H-O model, the actual size of the country is irrelevant in thedetermination of the direction of trade (though it may affect the equilibrium terms oftrade). When positive scale economies apply to the production of one product, the countrythat can devote more resources (in absolute terms) will be able to sell that product cheaper,and therefore will be mo re likely to gain a “revealed” comparative advantage in thatproduct. This will be the country with more factors (both labor and capital)—the largercountry.Quantitative/Graphing Problems1. The figure above represents the demand and cost functions facing a Brazilian Steel producingmonopolist. If it were unable to export, and was constrained by its domestic market, what quantity would it sell at what price?Answer: It would sell 5 (million tons) at a price of $8/ton.2. Now the monopolist discovers that it can export as much as it likes of its steel at the world price of$5/ton. It will therefore expand for-export production up to the point where its marginal cost equals $5. How much steel will the monopolist sell, and at what price?Answer: It would sell 10 million tons at $5/ton.3. Given the opportunity to sell at world prices, the marginal (opportunity) cost of selling a tondomestically is what?Answer: $5/ton.4. While selling exports it would also maximize its domestic sales by equating its marginal(opportunity) cost to its marginal revenue of $5. How much steel would the firm sell domestically, and at what price?Answer: 4 million tons at $10/ton.5. The Brazilian firm is charging its foreign (U.S.) customers one half the price it is charging itsdomestic customers. Is this good or bad for the real income or economic welfare of theUnited States? Is the Brazilian firm engaged in dumping? Is this predatory behavior on the partof the Brazilian steel company?Answer: Good. Yes, if you define dumping as selling abroad at a price lower than domestically. No, if by dumping you mean selling below marginal cost. No—this is not being done in orderto capture market shares, but rather is “mere” static profit maximization behavior, as isexpected of any self-respecting monopolist.6. The following Table describes the labor-input coefficients needed to produce one Widget in Englandand Portugal. Both countries are identical in size, tastes, technology. This technology is described in the table below:To ProduceThis Many Widgets, Or This Many Apples Labor-Hour Requirements1 32 53 64 75 86 97 10Let us assume that each country has 10 labor-hours available. Further, consumers always consume an equal amount of apples and widgets.(a) How of each product will be produced in England under autarky? 2 widgets and 2 apples.(b) Judging from autarky conditions, which country has a comparative advantage in widgets?(c) If England (completely) specialized in widgets, how many widgets would be produced, and howmany apples?(d) If the world terms of trade were established at 3.5 widgets 3.5 Apples, which country wouldenjoy gains from trade (as compared to The autarky solution?)(e) If Portugal were to completely specialize in widgets, how would the answers to c and d change?(f) What would the production possibility curve look like in each country?Answers: (a) 2 widgets and 2 apples(b) None(c) 7 widgets in England and 7 apples in Portugal(d) both would gain from trade. Instead of consuming 2 widgets and 2 apples, they wouldeach consume 3.5 widgets and 3.5 apples.(e) Same numbers as c, except that the countries will each be assigned a different product.Exactly the same answer for d.(f) convex to the origin.。

国际经济学作业及答案

第一章国际贸易理论的微观基础1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章古典贸易理论1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 X、Y的单位产出所需的劳动投入A BX Y 621512表2 X、Y的单位产出所需的劳动投入 A BX Y 10455答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

国际经济学课后习题答案(精编文档).doc

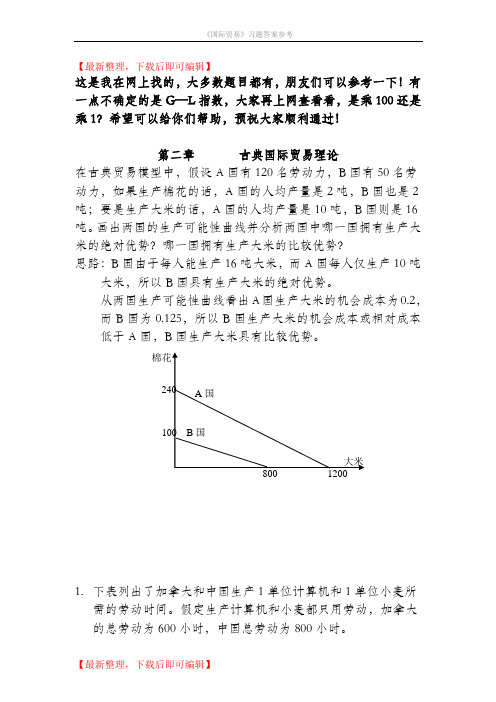

【最新整理,下载后即可编辑】这是我在网上找的,大多数题目都有,朋友们可以参考一下!有一点不确定的是G—L指数,大家再上网查看看,是乘100还是乘1?希望可以给你们帮助,预祝大家顺利通过!第二章古典国际贸易理论在古典贸易模型中,假设A国有120名劳动力,B国有50名劳动力,如果生产棉花的话,A国的人均产量是2吨,B国也是2吨;要是生产大米的话,A国的人均产量是10吨,B国则是16吨。

画出两国的生产可能性曲线并分析两国中哪一国拥有生产大米的绝对优势?哪一国拥有生产大米的比较优势?思路:B国由于每人能生产16吨大米,而A国每人仅生产10吨大米,所以B国具有生产大米的绝对优势。

从两国生产可能性曲线看出A国生产大米的机会成本为0.2,而B国为0.125,所以B国生产大米的机会成本或相对成本低于A国,B国生产大米具有比较优势。

1.下表列出了加拿大和中国生产1单位计算机和1单位小麦所需的劳动时间。

假定生产计算机和小麦都只用劳动,加拿大的总劳动为600小时,中国总劳动为800小时。

(1)计算不发生贸易时各国生产计算机的机会成本。

(2)哪个国家具有生产计算机的比较优势?哪个国家具有生产小麦的比较优势?(3)如果给定世界价格是1单位计算机交换22单位的小麦,加拿大参与贸易可以从每单位的进口中节省多少劳动时间?中国可以从每单位进口中节省多少劳动时间?如果给定世界价格是1单位计算机交换24单位的小麦,加拿大和中国分别可以从进口每单位的货物中节省多少劳动时间?(4)在自由贸易的情况下,各国应生产什么产品,数量是多少?整个世界的福利水平是提高还是降低了?试用图分析。

(以效用水平来衡量福利水平)思路:(1)中国生产计算机的机会成本为100/4=25,加拿大为60/3=20(2)因为加拿大生产计算机的机会成本比中国低,所以加拿大具有生产者计算机的比较优势,中国就具有生产小麦的比较优势。

(3)如果各国按照比较优势生产和出口,加拿大进口小麦出口计算机,中国进口计算机出口小麦。

国际经济学课程学习题集与参考答案

国际经济学习题集及参考答案一、填空、选择、判断题(每题1分):第一章:1、国际贸易理论以微观经济学原理为基础,讨论世界围的资源配置问题。

2、最常用国际贸易模型的结构形式为两个国家、两种产品(或部门)和两种要素。

3、在完竞争的假设前提下,封闭条件下的相对价格是国际贸易产生的基础。

4、国家间的供给、需求方面的差异是造成相对价格的根源。

5、贸易后,国际均衡价格由两国的供需共同决定,国际均衡价格处于两国封闭下的相对价格之间。

6、国际贸易利益包括两个部分:来自交换的利益和来自专业化的利益。

7、贸易理论主要围绕三个问题展开:国际贸易的格局、国际贸易的条件、国际贸易的收益。

第二章:1、斯密的绝对优势论认为国际贸易的基础是各国之间劳动生产率的绝对差别;嘉图的比较优势论认为国际贸易的基础是各国之间劳动生产率的相对差别。

2、哈伯勒首先用机会成本概念来阐明比较优势论。

3、重商主义者提倡的国家经济政策有:限制进口和鼓励出口,采取奖金、退税、协定和殖民地贸易等措施鼓励出口。

4、嘉图认为在国际贸易中起决定作用的不是绝对成本,而是相对成本。

5、斯密的绝对优势论认为国际贸易的基础是各国之间劳动生产率的绝对差别;劳动生产率的比较优势论认为国际贸易的基础是各国之间劳动生产率的相对差别。

6、在嘉图模型中,生产可能性边界线方程是一个线性方程式,表示A、B两国的PPF曲线是一条直线段。

7、重商主义者提倡的国家经济政策有:限制进口和鼓励出口,采取奖金、退税、协定和殖民地贸易等措施鼓励出口。

8、嘉图认为在国际贸易中起决定作用的不是绝对成本,而是相对成本。

9、机会成本概念表明:彼种选择的机会成本就构成此种选择的机会成本。

选择题:1、首先用机会成本理论来解释比较优势原理的学者是: C、A、嘉图B、罗布津斯基C、哈伯勒D、穆勒第三章:1、要素禀赋理论最初是由赫克歇尔和俄林提出的,后经萨缪尔森等人加工不断完善。

2、要素禀赋理论由H-O定理、要素价格均等化定理和罗伯津斯基定理、斯托伯-萨缪尔森定理等构成3、要素价格均等化理论指出国际贸易通过商品价格的均等化会导致要素价格的均等化,从而在世界围实现资源的最佳配置。

国际经济学习题及答案

第一章导论1.国际经济学是怎样产生并发展成为一门独立学科的?答案提示:(1)国际经济学产生的客观基础及其最初表现形式:客观基础为跨越国界的经济活动;最初表现形式是国际贸易活动;(2)国际经济学产生的学科前提是国际贸易学和国际金融学;(3)国际经济学的发展:20世纪60年代后成为一门独立的学科,并不断发展。

2.国际经济学的研究对象和研究方法是什么?答案提示:(1)国际经济学的研究对象:跨越国界的经济活动及其运动规律(2)国际经济学的研究方法:与经济学的一般研究方法比较,基本相同,即:宏观与微观相结合、静态与动态相结合、定性与定量分析相结合、局部均衡与一般均衡相结合、理论与政策相结合国际经济学的具体分析框架为2×2×2模型(两个国家、两种产品、两种生产要素),通过不断放松假设,使理论逼近现实。

第二章古典国际贸易理论一、单项选择题1.重商主义贸易理论认为贸易是()。

A.正和博弈B.零和博弈C.国际分工D.财富2.贸易福利的国际间的相互比较是指()。

A.比较优势B.比较利益C.比较成本D.国际分工3.国际间商品生产成本比率的相互比较是()。

A.比较优势B.比较利益C.比较成本D.国际分工4.亚当·斯密认为贸易的基础是()。

A.比较优势B.劳动生产率C.国际分工D.绝对优势5.大卫·李嘉图认为贸易的基础是()A.比较优势B.劳动生产率C.国际分工D.绝对优势二、多项选择题1.古典国际贸易理论讨论的主要问题包括()A.绝对优势B.比较优势C.规模经济D.消费者偏好E.比较利益2、大卫·李嘉图的理论的假设前提有()。

A.生产要素只在一国内部自由流动B.生产要素在一国国内及国际间均自由流动C.政府对贸易进行干预D.贸易国的生产成本不变E.商品的价值由劳动量决定三、判断题1.重商主义贸易理论认为国际贸易利益是通过损害他国利益实现的。

2.贸易差额论代表着晚期重商主义理论的核心思想。

李坤望国际经济学第四版课后习题答案(自整理)

资料范本本资料为word版本,可以直接编辑和打印,感谢您的下载李坤望国际经济学第四版课后习题答案(自整理)地点:__________________时间:__________________说明:本资料适用于约定双方经过谈判,协商而共同承认,共同遵守的责任与义务,仅供参考,文档可直接下载或修改,不需要的部分可直接删除,使用时请详细阅读内容第一章1.封闭条件下,中国和美国的小麦与布的交换比率分别为1:4和2:5,那么在两国之间展开贸易后,小麦与布之间的交换比率可能为.A.1:6B.2:6C.3:6D.4:62.在机会成本递增条件下,只要各国在生产同样产品时存在着价格差异,那么比较利益理论就仍然有效。

这种说法是否正确?A.正确B.不正确3.作为新贸易理论的核心基础之一,规模经济意味着随着产量增加,()A.平均成本与边际成本都下降B. 平均成本变化不确定,边际成本下降C. 平均成本下降D.平均成本与边际成本都上升4.以下说法中,()是错误的。

A.绝对优势理论是以机会成本不变为前提的,而相对优势理论则是以机会成本递增为前提的B.相对优势理论可以部分地解释经济技术发展水平和层次不同的国家之间进行贸易的基础C.生产要素禀赋理论用生产要素禀赋的差异解释国际贸易产生的动因D.无论是生产技术差异还是生产要素禀赋差异导致国际贸易产生,都是以两国之间同一产品的价格存在差异为前提第二章1.下列() 属于李嘉图模型的假定前提条件。

A.生产过程中使用资本和劳动力两种要素B.没有运输成本和其他交易成本C.生产要素可以在两国间自由流动D.生产要素非充分利用因此机会成本不变2.下列()不属于重商主义的观点。

A.货币是财富的唯一表现形式B.通过国际贸易可以提高所有贸易参与国的福利水平C.出口意味着贵金属的流入D.进口意味着贵金属的流出3.下列关于技术差异论的表述哪一项是不正确的()A.分为绝对技术差异论与相对技术差异论B.劳动力在国内两个部门之间自由流动,而且机会成本保持不变C.参与贸易的两个国家福利水平都可以得到提高D.一国比另一国家的技术优势越大,则通过国际贸易获得的福利增加越大4.下列哪一条不是重商主义的理论主张()A.贸易不是“零和”的B.多卖少买,保持贸易顺差,是获得财富的基本原则C.国家应干预经济,鼓励出口,限制进口D.金银货币是财富的唯一形态第三章1.假定每单位x产品的生产需要4单位劳动与6单位土地,每单位Y产品的生产需要2单位劳动与4单位土地,如果本国有100 单位劳动与200单位土地,外国有200单位劳动与300单位土地,则根据H-O理论可推出()A. X是土地密集型产品,本国出口X产B. X 是土地密集型产品,品本国出口YC. Y是土地密集型产品,产品本国出口.D.Y是土地密集型产品,X产品本国出2.根据要素禀赋理论,如果美国与中国相比是资本相对丰裕的国家,汽车是资本密集型产品,而纺织品是劳动密集型产品,则与封闭条件下相比,中美两国进行贸易后()。

《国际经济学》(第四版)教学案例与答案详细版-第6章

《国际经济学》(第四版)教学案例与答案详细版-第6章(p96-97)案例6—1 赫尔普曼和克鲁格曼著《市场结构与对外贸易》【基本案情】【基本案情】《市场结构与对外贸易》是赫尔普曼和克鲁格曼的力作,是赫尔普曼和克鲁格曼的力作,是国际是国际贸易理论方面的“重大突破”(迪克西特、巴格瓦蒂),是“我们每个人的书房里都需要的里程碑式的书”(萨缪尔森)。

该书自1985年出版以来就受到西方经济学界的重视。

版以来就受到西方经济学界的重视。

它建立了一个新的分析框架,它建立了一个新的分析框架,将各种新的贸易理论综合起来,提炼出共同的精髓,发展出自己的理论,使原来处于外围的理论上升到能与传统国际贸易理论并驾齐驱的核心地位。

该书对产业内贸易和贸易的福利效应做了分析。

此外,该书还有对公司的分析,而传统的国际贸易理论是不涉及公司的。

还有对公司的分析,而传统的国际贸易理论是不涉及公司的。

【国际经济问题】【国际经济问题】赫尔普曼和克鲁格曼《市场结构与对外贸易》的主要内容和基本思想。

思想。

【案例分析】【案例分析】《市场结构与对外贸易》有14章,即要素比例理论、技术和市场结构、外部效应、可竞争市场、寡占、相异产品的需求、公司行为、贸易量和贸易构成、福利、运输成本和非贸易商品、中间投入品、单产品公司、垂直一体化、总结和结论。

该书为不完全竞争的市场结构提高供了一个完整的新的国际贸易理论。

作者赫尔普曼和克鲁格曼发展出来的理论解释了贸易模式,展出来的理论解释了贸易模式,特别是工业国家的贸易模式,特别是工业国家的贸易模式,特别是工业国家的贸易模式,并使贸并使贸易和跨国公司的作用结合了起来。

本书为可竞争市场、寡头、福利以及跨国公司提供了全新的材料,及跨国公司提供了全新的材料,为外部经济、为外部经济、中间投入品和贸易构成提供了新的洞见。

提供了新的洞见。

【知识点】【知识点】不完全竞争与国际贸易。

不完全竞争与国际贸易。

(p97)案例6—2 产业内贸易与中美贸易摩擦【基本案情】【基本案情】一项研究表明[柳剑平等(2009)],中美贸易摩擦的2/3以上发生在纺织服装、钢铁制品等产业内贸易指数较低的产业中;钢铁制品等产业内贸易指数较低的产业中;而在以产而在以产业内贸易指数较高的化学化工、塑料制品、纸制品、公路车辆及设备、机械和机电产品等产业中,贸易摩擦发生的次数相对较少。

国际经济学的课后答案及选择

第一章绪论(一) 选择题1.国际经济学在研究资源配置时,是以〔D.政府〕作为根本的经济单位来划分的。

2.国际经济学研究的对象是〔D 各国之间的经济活动和经济关系〕3.从国际间经济资源流动的难易度看,〔C人员〕流动最容易〔二〕问答题1.试述国际经济学和国内经济学的关系。

答案提示:〔1〕联络:国际经济学与国内经济学研究的经济活动是相似的,面临的主要问题也是相似的;〔2〕最主要的区别是国际经济的民族国家性。

第二章古典的国际贸易理论〔一〕选择题本国消费A、B、C、D四种产品的单位劳动投入分别为1、2、4、15,外国消费这四种产品的单位劳动投入分别为12、18、24、30,根据李嘉图模型,本国在哪种产品上拥有最大比拟优势?在哪种产品上拥有最大比拟优势?〔〔c〕A、D〕答案:C〔二〕问答题1.亚当·斯密对国际贸易理论的主要奉献有哪些?答案提示:亚当·斯密的主要奉献是:〔1〕鞭挞了重商主义;〔2〕提出了绝对优势之一概念;〔3〕强调国际分工是使国民财富增加的最重要手段。

2.绝对优势理论和比拟优势理论的区别是什么?答案提示:〔1〕绝对优势理论强调,国与国之间劳动消费率的绝对差异导致的技术程度的差异是产生国际贸易的主要原因;〔2〕比拟优势理论强调,劳动消费率的相对差异导致的技术程度的差异是产生国际贸易的主要原因。

第二章问答题2.假设A、B两国的消费技术条件如下所示,那么两国还有进展贸易的动机吗?解释原因。

答案提示:从绝对优势来看,两国当中A国在两种产品中都有绝对优势;从比拟优势来看,两国不存在相对技术差异。

所以,两国没有进展国际贸易的动机。

3.证明即使一国在某一商品上具有绝对优势,也未必具有比拟优势。

答案提示:假如ax>bx,那么称A国在X消费上具有绝对优势;假如ax/ay>bx/by,那么称A国在X消费上具有比拟优势。

当 ay=by或者ay<by的时候,由ax>bx可以推出ax/ay>bx/by,但是,当ay>by的时候,ax>bx不能保证。

(完整版)国际经济学课后答案

第一章绪论1、列举出体现当前国际经济学问题的一些重要事件,他们为什么重要?他们都是怎么影响中国与欧、美、日的经济和政治关系的?当前的国际金融危机最能体现国际经济学问题,其深刻地影响了世界各国的金融、实体经济、政治等领域,也影响了各国之间的关系因此显得尤为重要;其对中国与欧、美、日的政治和经济关系的影响为:减少中国对上述国家的出口,影响中国外汇储备,贸易摩擦加剧,经济联系加强,因而也会导致中国与上述国家在政治上的对话与合作。

2、我们如何评价一国与他国之间的相互依赖程度?我们可以通过一国的对外贸易依存度来评价该国与他国之间的相互依赖程度,也可以通过其他方式来评价比如一国政府政策的溢出效应和回震效应以及对外贸易对国民生活水平的影响。

3、国际贸易理论及国际贸易政策研究的内容是什么?为什么说他们是国际经济学的微观方面?国际贸易理论分析贸易的基础和所得,国际贸易政策考察贸易限制和新保护主义的原因和效果。

国际贸易理论和政策是国际经济学的微观方面,因为他们把国家看作基本单位,并研究单个商品的(相对)价格。

4、什么是外汇交易市场及国际收支平衡表?调节国际收支平衡意味着什么?为什么说他们是国际经济学的宏观方面?什么是宏观开放经济学及国际金融?外汇交易市场描述一国货币与他国货币交换的框架,国际收支平衡表测度了一国与外部世界交易的总收入与总支出的情况。

调节国际收支平衡意味着调节一国与外部世界交易出现的不均衡(赤字或盈余);由于国际收支平衡表涉及总收入和总支出,调节政策影响国家收入水平和价格总指数,因而他们是国际经济学的宏观方面;外汇交易及国际收支平衡调节涉及总收入和总支出,调整政策影响国家收入水平和价格总指数,这些内容被称为宏观开放经济学或国际金融。

5、浏览报刊并做下列题目:(1)找出5条有关国际经济学的新闻(2)每条新闻对中国经济的重要性或影响(3)每条新闻对你个人有何影响A (1) 国际金融危机: 影响中国整体经济,降低出口、增加失业、经济减速等(2) 美国大选:影响中美未来经济政治关系(3) 石油价格持续下跌:影响中国的能源价格及相关产业(4) 可口可乐收购汇源被商务部否决:《反垄断法》的第一次实施,加强经济法治(5) 各国政府经济刺激方案:对中国经济产生外部性效应B 以上5条新闻对个人影响为:影响个人消费水平和就业前景第二章比较优势理论1、重商主义者的贸易观点如何?他们的国家财富概念与现在有何不同?重商主义者主张政府应当竭尽所能孤立出口,不主张甚至限制商品(尤其是奢侈类消费品)。

国际经济学习题与答案

第一章国际贸易理论的微观基础习题(一)选择题1.微观经济学研究的是单个社会的资源配置问题,而国际贸易理论研究的是()A 一国的资源配置问题B两国范围内的资源配置问题C地区范围内的资源配置问题D世界范围内的资源配置问题2. 一个人在作出选择时,()A如果边际收益非常大,他或她就不用考虑机会成本B进行最小机会成本的选择C比较该选择活动的边际成本和边际收益D只有当总利益非常大时,他或她才会选择使用其稀缺的资源3.机会成本()A由自己支付,而与他人无关B对劳务而言是零,因为劳务不会持续太久;对物品而言是正的,因为物品具有长久性C是为了进行某一选择而放弃的评价最高的选择D是为了进行某一选择放弃的所有选择4.如果两个人在商品的生产中具有不同的机会成本,那么他们能够从专业化与交换中()A都受损B一人受益,一人受损C既不受益,也不受损D都能够受益5. 沿着外凸的生产可能性边界线向下移动时,随着一种物品产量的增加,生产该物品的机会成本将()A保持不变B增加C减少D无法确定6 .一个国家(),能够在其生产可能性边界线之外的点上进行消费。

A没有任何时候B在充分就业的情况下C同其他国家进行贸易时D所有生产要素全部投入生产的时候7.供给曲线除了表示不同的价格水平所提供的商品数量外,还可以被认为是()A愿意并有能力支付的曲线B边际收益曲线C供给的最高价格曲线D供给的最低价格曲线8. 在封闭条件下,一国生产技术的改进降低了棉花的生产成本,那么棉花的价格(),棉花的生产数量()A上升;增加B上升;减少C下降;增加D下降;减少9 .对于两国贸易模型来说,国际均衡价格一定处于两国贸易前的()A最低相对价格水平之下B最高相对价格水平之上C相对价格水平之间D根据具体情况而定10 .经济学家作出这样的假设:作为一种目标,消费者总是在追求()A其效用最大化B其收入的最大化C其边际效用的最大化D以上选项均不对(二)简答题1如何理解狭义和广义的国际贸易,国际贸易理论的主要研究对象是什么?2既然国际贸易理论与微观经济学的基本原理存在着一致性,为什么还要区分国际贸易与国内贸易,将国际贸易作为一个独立的问题来研究呢?3用相对价格概念解释经济行为主体是如何摆脱“货币幻觉”的影响的。

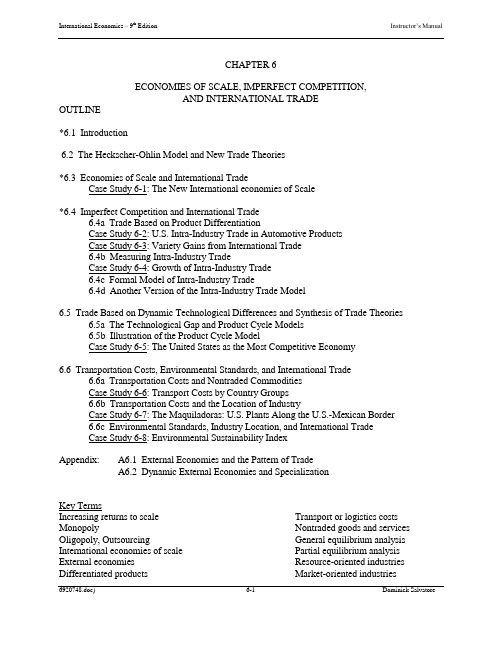

国际经济学第九版英文课后答案 第6单元

CHAPTER 6ECONOMIES OF SCALE, IMPERFECT COMPETITION,AND INTERNATIONAL TRADEOUTLINE*6.1 Introduction6.2 The Heckscher-Ohlin Model and New Trade Theories*6.3 Economies of Scale and International TradeCase Study 6-1: The New International economies of Scale*6.4 Imperfect Competition and International Trade6.4a Trade Based on Product DifferentiationCase Study 6-2: U.S. Intra-Industry Trade in Automotive ProductsCase Study 6-3: Variety Gains from International Trade6.4b Measuring Intra-Industry TradeCase Study 6-4: Growth of Intra-Industry Trade6.4c Formal Model of Intra-Industry Trade6.4d Another Version of the Intra-Industry Trade Model6.5 Trade Based on Dynamic Technological Differences and Synthesis of Trade Theories6.5a The Technological Gap and Product Cycle Models6.5b Illustration of the Product Cycle ModelCase Study 6-5: The United States as the Most Competitive Economy6.6 Transportation Costs, Environmental Standards, and International Trade6.6a Transportation Costs and Nontraded CommoditiesCase Study 6-6: Transport Costs by Country Groups6.6b Transportation Costs and the Location of IndustryCase Study 6-7: The Maquiladoras: U.S. Plants Along the U.S.-Mexican Border6.6c Environmental Standards, Industry Location, and International TradeCase Study 6-8: Environmental Sustainability IndexAppendix: A6.1 External Economies and the Pattern of TradeA6.2 Dynamic External Economies and SpecializationKey TermsIncreasing returns to scale Transport or logistics costs Monopoly Nontraded goods and services Oligopoly, Outsourcing General equilibrium analysis International economies of scale Partial equilibrium analysis External economies Resource-oriented industries Differentiated products Market-oriented industriesIntra-industry trade Footloose industriesIntra-industry trade index Environmental standards Monopolistic competition Dynamic external economies Technological gap model Learning curveProduct cycle model Infant industryLecture Guide:1.Although this is not a core chapter, Sections 6.1, 6.3 and 6.4 are important ones becausethey present some of the most recent developments in international trade theory.2.I would cover sections 1, 2, and 3 in lecture 1. The material is not difficult but veryimportant. I would also assign problems 1-3.3.I would cover section 4 in lecture 2. This is the most important section in the chapter. Iwould pay very close attention to Figures 6-2 and 6-3. These require reviewing from principles of economics, the meaning of differentiated products, monopolistic competition, economies of scale, and the determination of profit maximization by the firm. I would also assign problems 4-9 problems 4-9 and go over in class problems 6-9.4. In lecture 3, I would cover sections 5 and 6 and assign problems 10-14.Answer to Problems:1. See Figure 1.2. See Figure 2.3. See Figure 3.4. a) T = 1 - /1000-1000/ = 1 - 0 = 1.1000+1000 2000b) T = 1 - /1000-750/ = 1 - 250 = 0.86.1000+750 1750c) T = 1 - /1000-500/ = 1 - 500 = 0.67.1000+500 1500d) T = 1 - /1000-250/ = 1 - 750 = 0.4.1000+250 1250e) T = 1 - /1000-0/ = 1 - 1000 = 0.1000+0 10006920748.doc) 6-3 Dominick Salvatore5. a) T = 1 - /1000-1000/ = 1 - 0 = 1.1000+1000 2000b) T = 1 - /750-1000/ = 1 - 250 = 0.86.750+1000 1750c) T = 1 - /500-1000/ = 1 - 500 = 0.67.500+1000 1500d) T = 1 - /250-1000/ = 1 - 750 = 0.4.250+1000 1250e) T = 1 - /0-1000/ = 1 - 1000 = 0.0+1000 1000Note that the results are identical to those in Problem 4 because we take the absolutevalue of exports minus imports or imports minus exports.6. See Figure 4.The AC and the MC curves in Figure 4 are the same as in Figure 6-2. However, D and the corresponding MR curve are higher on the assumption that other firms have not yet imitated this firm's product, reduced its market share, or competed this firm's profits away. In Figure 4, MR=MC at point E, so that the best level of output of the firm is 5 units and price is$4.50. Since at Q=5, AC=$3.00, the firm earns a profit of AB=$2.00 per unit and $10.00in total.7.a) Monopolistic competition resembles monopoly because under both forms of marketorganization the firm produces a product that is unique (i.e., no other firm produces an identical product).b) Monopolistic competition is different from monopoly because under monopolisticcompetition there are many other firms that produce a similar product. On the other hand, there is no close substitute for the product sold by a monopolist.Furthermore, under monopolistic competition, entry into the industry is easy. As a result,attracted by this firm's profits, more firms enter the industry to produce similarproducts. This reduces the monopolistically competitive firm's market share (i.e., itsdemand and corresponding MR curves shift down) until we get to the situationdepicted by Figure 6-2 in the text, where P=AC and our firm breaks even. On the otherhand, under monopoly, entry into the industry is blocked, so that the monopolist cancontinue to earn profits in the long run.6920748.doc) 6-4 Dominick Salvatore6920748.doc) 6-5 Dominick Salvatorec) The difference between monopoly and monopolistic competition is important forconsumer welfare because consumers get a greater variety of the commodity at a lowerprice with monopolistic competition than with monopoly.8. A perfectly competitive firm faces an infinitely elastic or horizontal demand curve. Thismeans that the firm is a price taker and can sell any quantity of the homogenous product at the price determined at the intersection of the market demand and supply curves for thecommodity.Both the demand curves faced by the monopolistic competitive firm and the monopolist are downward sloping, indicating that each can sell more units of the commodity bylowering its price. However, the demand curve facing the monopolistically competitive firm generally has a smaller inclination (i.e., it is more elastic) than the demand curve facingthe monopolist because the former sells a commodity for which many good substitute areavailable.9.If the C curve had shifted down only half as much as curve C' in Figure 6-3, the newequilibrium point would be at P=AC=$2.50 and N=350.10.See Figure 5 on the previous page.11. The increased pirating or production and sale of counterfeit American goods without payingroyalties by foreign producers shorten the U.S. product cycle or the time during which theU.S. firm can reap the benefits from the new product or technology it introduced and thusreduces the ability of U.S. firms to engage in research and development (R & D) newproduct cycles.12. See Figure 6 on the previous page.With transpo rtation costs specialization would proceed to point C in Nation 1 and point C’in Nation 2. Pc in nation 1 (the nation exporting commodity X) is smaller than Pc' in Nation2 (the country importing commodity X) by the relative cost of transporting each unit ofcommodity X from Nation 1 to Nation 2. Trade does not seem to be inequilibrium because transportation costs are expressed in terms of commodity X.13. See Figure 7 on the next page.P2 exceeds P1 by the relative cost of transporting one unit of commodity X from Nation 1 to Nation 2.14. See Figure 8.6920748.doc) 6-6 Dominick Salvatore6920748.doc) 6-7 Dominick SalvatoreApp. 1. See Figure 9.The firm's AC=AF without and BC with external economies. Thus, at agiven level of output of the firm, the firm's AC are lower (i.e., the firm's ACcurve shifts down) as cumulative industry output expands.App. 2. Parameter "a" refers to the starting AC (i.e., the AC when output or Q iszero). Parameter "b" refers to the rate of decline in AC as cumulative industry outputincreases. Thus, "b" should be negative. Furthermore, the larger the absolute valueof b, the more rapid is the decline in AC as cumulative industry expands over time. Multiple-Choice Questions:1. Relaxing the assumptions on which the Heckscher-Ohlin theory rests:a. leads to rejection of the theoryb. leaves the theory unaffected*c. requires complementary trade theoriesd. any of the above.2.Which of the following assumptions of the Heckscher-Ohlin theory, when relaxed, leavethe theory unaffected?a. Two nations, two commodities, and two factorsb. both nations use the same technologyc. the same commodity is L-intensive in both nations*d. all of the above3.Which of the following assumptions of the Heckscher-Ohlin theory, when relaxed,require new trade theories?*a. Economies of scaleb. incomplete specializationc. similar tastes in both nationsd. the existence of transportation costs4.International trade can be based on economies of scale even if both nations have identical:a. factor endowmentsb. tastesc. technology*d. all of the above6920748.doc) 6-8 Dominick Salvatore5. A great deal of international trade:a. is intra-industry tradeb. involves differentiated productsc. is based on monopolistic competition*d. all of the above6. The Heckscher-Ohlin and new trade theories explains most of the trade:a. among industrial countriesb. between developed and developing countriesc. in industrial goods*d. all of the above7.The theory that a nation exports those products for which a large domestic market exists was advanced by:*a. Linderb. Vernonc. Leontiefd. Ohlin8. Intra-industry trade takes place:a. because products are homogeneous*b. in order to take advantage of economies of scalec. because perfect competition is the prevalent form of market organizationd. all of the above9.If a nation exports twice as much of a differentiated product that it imports, its intra-industry (T) index is equal to:a. 1.00b. 0.75*c. 0.50d. 0.2510. Trade based on technological gaps is closely related to:a. the H-O theory*b. the product-cycle theoryc. Linder's theoryd. all of the above11. Which of the following statements is true with regard to the product-cycle theory?a. It depends on differences in technological changes over time among countriesb. it depends on the opening and the closing of technological gaps among countriesc. it postulates that industrial countries export more advanced products to less advanced countries *d. all of the above12. Transport costs:a. increase the price in the importing countryb. reduces the price in the exporting country*c. both of the aboved. neither a nor b.13. Transport costs can be analyzed:a. with demand and supply curvesb. production frontiersc. offer curves*d. all of the above14. The share of transport costs will fall less heavily on the nation:*a. with the more elastic demand and supply of the traded commodityb. with the less elastic demand and supply of the traded commodityc. exporting agricultural productsd. with the largest domestic market15. A footloose industry is one in which the product:a. gains weight in processingb. loses weight in processingc. both of the above*d. neither a nor b.。

国际经济学习题课后答案

第一章国际贸易理论的微观基础一、名词解释1、国际贸易的交换利益:是指如果个人或国家之间拥有不同的商品禀赋或不同的偏好,那么通过互相之间的商品交易,他们均可改善各自的福利;2、国际贸易的专业化利益:是指个体或国家之间可以通过专门从事其效率相对最高的生产来获得额外的利益;3、国际均衡价格:是指一国的过剩需求等于一国的过剩供给时,对应的相对价格;4、生产可能性边界:是指在一定的技术条件下,一国的全部资源所能生产的各种物品或劳务的最大产量;5、开放经济:是指一国经济与世界经济存在着广泛的联系;6、封闭经济:是指一国经济与世界经济没有任何的经济往来关系7、贸易条件:是出口商品价格指数与进口商品价格指数之比;二、是非判断题1、国际经济学是研究稀缺资源在世界范围内的有效分配,以及在此过程中发生的经济活动和经济关系的科学; 正确2、国际经济学是经济学的分支学科,是建立在微观经济学和宏观经济学基础上的;正确3、国际经济学经历了重商主义、自由贸易和现代国际经济学理论多层面发展的三个阶段;它是伴随着国际经济活动的不断增加而逐渐完善起来的; 正确4、与一般经济学的研究方法相同,国际贸易理论在分析上也分为实证分析和规范分析两种; 正确5、国际贸易理论分析不涉及货币因素,考虑各国货币制度的差异与关系的影响;错误6、大多数国际贸易理论都是一种静态或比较静态分析,时间因素在国际贸易理论中较多体现;错误7、没有贸易价格差的存在,就不会发生国际贸易; 正确三、单项选择题1、国际经济学在研究资源配置时,作为划分界限的基本经济单位是 DA、企业B、个人C、政府D、国家2、从国际经济资源流动的难度看,最容易流动的要素是 BA、商品B、资本C、人员D、技术3、若贸易的开展导致社会无差异曲线向远离坐标原点的方向移动,则判定贸易对该国是 AA、有益B、有害C、不变D、不能判断4、消费点在同一条社会无差异曲线上移动,表示整个国家的福利水平 CA、增加B、减少C、不变D、不能判断5、在封闭经济条件下,下列不属于一国经济一般均衡的条件的是 DA、生产达到均衡B、消费达到均衡C、市场出清D、货币市场达到均衡6、国际贸易建立的基础是 BA、绝对价格B、相对价格C、不变价格D、以上三种都不是7、在封闭经济条件下,A国X商品的相对价格低于B国X商品的相对价格,我们称A国在X商品上具有 BA、绝对优势B、比较优势C、没有优势D、以上三种都不是8、一国从国际贸易中所获利益的多寡取决于 DA、市场占有率B、技术优势C、竞争优势D、贸易条件四、简述题:1、试用图形分析国际贸易的交换利益和专业化利益;2、试画出贸易提供曲线图形并予以简要分析;3、如果国际贸易发生在一个大国和一个小国之间,那么贸易后国际相对价格更接近于哪个国家在封闭条件下的相对价格水平贸易发生在大国和小国,对大国的该产品价格影响不大,而对小国的该产品价格影响相对较大,而大国在国际市场上的影响力是明显高于小国在国际商场上的影响力,因此大国该产品的价格在国际市场上的影响力是处于引导地位的,小国的产品价格属于从属地位;五、论述题:1、为什么说在决定生产和消费时,相对价格比绝对价格重要当生产处于生产边界线上,资源得到了充分地利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,就是说,增加某一产品的生产是有机会成本的;生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,还要看两个商品的相对价格,即他们在市场上的交换比率;相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了;2、试推导贸易提供曲线;第二章古典国际贸易理论一、名词解释1、比较优势:由英国经济学家大卫·李嘉图提出,是指一个国家生产每种产品都处于绝对优势,而另外一个国家生产每种产品都处于绝对劣势,但只要遵循“两优取重,两弊取轻”的原则进行国际分工和贸易,则双方都能获得利益;2、绝对优势:由英国经济学家亚当·斯密提出,是指一个国家在某种产品的生产上处于绝对优势,而在另外一种产品上处于绝对劣势,另外一个国家相反;如果两个国家都从事自己占优势的商品的生产和国际交换,都可以获得贸易利益;3、机会成本:是指在生产两种产品的条件下,因增加其中一种产品的产量所不得不放弃另外一种产品的量或价值;二、是非判断题1、根据比较优势进行贸易可以使所有贸易国的消费超出其生产可能性边界; 正确2、在机会成本递增条件下,比较优势理论仍然有效,参加贸易的国家仍然可以从国际贸易中获益,国际分工也能达到完全专业化的程度; 错误3、技术的绝对差异会导致各国之间的相互贸易; 正确4、技术的相对差异是各国形成比较成本的基础;绝对技术差异是相对技术差异的特例或特殊形式; 正确5、在古典国际贸易中,生产要素指的是劳动和资本; 错误三、单项选择题1、甲国生产手表需6个劳动日,生产自行车需9个劳动日,乙国生产手表需12个劳动日,生产自行车需10个劳动日,根据比较成本说 CA、甲国生产和出口自行车,乙国生产和出口手表B、乙国进口手表,进口自行车C、甲国生产出口手表,乙国生产出口自行车D、甲国生产出口自行车,乙国生产出口手表2、在比较利益模型中,两种参与贸易商品的国际比价 CA、在两国贸易前的两种商品的国内比价之上B、在两国贸易前的两种商品的国内比价之下C、在两国贸易前的两种商品的国内比价之间D、与贸易前的任何一个国家的国内比价相同3、比较利益理论认为国际贸易的驱动力是 DA、劳动生产率的差异B、技术水平的差异C、产品品质的差异D、价格的差异4、在绝对利益理论与比较利益理论中,机会成本假定是 DA、递增B、递减C、先递增后递减D、不变5、当两国之间存在国际贸易时 AA、生产仍在生产可能性边界上,但消费超出了生产可能性边界B、生产仍在生产可能性边界上,但消费在生产可能性边界之内C、生产与消费都在生产可能性边界之外D、生产在生产可能性边界之外,但消费仍在生产可能性边界上6、假定有两个国家A与B,生产两种产品X与Y;A国生产X产品有比较优势的条件是AA、生产1单位X物品所放弃的Y物品比B国少B、生产1单位X物品所需要的劳动投入比B国少C、生产1单位X物品所需要的资本投入比B国少D、生产1单位X物品所需要的一切投入都比B国少7、古典国际贸易理论的政策主张是 AA、自由贸易政策B、保护贸易政策C、战略性贸易政策D、保护幼稚产业政策8、绝对技术差异论的提出者是 AA、斯密B、李嘉图C、俄林D、魁奈9、亚当·斯密关于国际分工与国际贸易学说的观点是 AA、绝对优势论B、比较优势论C、要素禀赋论D、人力资本论10、在绝对利益理论与比较利益理论中,经济资源能够AA、可以从一个部门自由转移到另外一个部门B、可以从一个国家自由转移到另外一个国家C、不能从一个国家自由转移到另外一个国家D、不能从一个部门自由转移到另外一个部门四、简述题1、试用图形或数学模型分析大卫·李嘉图的比较优势学说;1、该理论的数学分析表1表2结论1分工能提高劳动的熟练程度,提高劳动生产率;2分工使每个人专门从事某项作业,可以节约劳动时间;3分工可以实现人力、物力、财力的最佳组合,发挥最大效益;4分工可以增加社会的整体福利水平;;2、1该理论未能说明国际贸易的根本原因2该理论所说的贸易利益是短期利益3按该理论观念,当今的贸易应在发达国家与发展中国家之间,但事实恰好相反;3、1比较优势的定义:一国在所有商品上的劳动生产率都低于另一国,即所有商品的生产均处于绝对劣势,但是相对劣势较小的商品较之那些相对劣势较大的商品而言,即具有比较优势;2主要内容:A.较大的绝对优势或较小的绝对劣势成为比较优势,各国按照比较优势进行专业化分工与协作,贸易双方均获利;B.国际分工改善了两国福利,贸易利益来源于分工产生的劳动生产率改进;C.贸易模式是专门生产并出口其绝对劣势较小的商品即比较优势商品,同时进口其绝对劣势相对较大的商品,即“两害相权取其轻,两利相权取其重”;2、试说明绝对优势理论的主要缺陷;仅解决了具有不同优势的国家之间的分工和交换的合理性3、简述比较优势理论的主要观点;五、论述题1、比较亚当·斯密和大卫·李嘉图的国际贸易理论;并结合我国实际说明李嘉图的“比较优势论”对我国的借鉴意义;1李嘉图的“比较优势论”是在斯密的“绝对优势论”基础上发展起来的;斯密认为,各国之间分工应按地区、自然条件及绝对成本差异进行,即一国生产并出口的商品,一定是生产上具有绝对优势,成本绝对低的商品;李嘉图发展了这种观点,认为国家参与分工应遵循“两优取重,两弊取轻”的原则,集中力量生产利益较大或不利较小的商品,然后通过对外贸易进行交换,如此形成的国际分工对贸易各国都有利;2数学模型或图形的分析比较;3意义2、在战后的几十年间,日本、韩国等东亚的一些国家或地区的国际贸易商品结构发生了明显的变化,主要出口产品由初级产品变为劳动密集型产品,再到资本密集型产品,试对此变化进行解释;第三章要素禀赋理论一、名词解释1、斯脱尔波——萨谬尔森定理:斯脱尔波——萨谬尔森定理认为,某一种商品相对价格的上升,将导致该商品密集使用的生产要素的实际价格或报酬提高,而另一种生产要素的实际价格或报酬则下降;2、要素密集度是指生产某种产品所投入的两种生产要素的比例;3、里昂剔夫之谜:美国经济学家里昂惕夫运用“投入产出”法考察美国对外贸易的商品结构时,发现美国出口的商品是“劳动密集型产品”,进口的则是“资本密集型产品”;这与赫-俄模型刚好相反;由于赫-俄模型已经被西方经济学界广泛接受,因此里昂惕夫的结论被称为“里昂惕夫迷”或“里昂惕夫反论”;二、是非判断题1、要素禀赋是指一国所拥有的两种生产要素的相对比例,它与其所拥有的生产要素绝对数量无关; 正确2、要素价格均等化会使两国生产同一种产品的要素密集度均等化; 正确3、要素价格的均等化是以商品价格的均等为先决条件的,但在现实中一般很难实现; 正确4、生产要素禀赋理论用各国劳动生产率的差异解释国际贸易的原因; 错误5、无论是技术差异,还是生产要素禀赋差异,它们都是以两国之间同一产品的价格存在差异为前提的;因此,只要存在价格差,各国间就有开展贸易的动力; 正确三、单项选择题1、率先针对生产要素禀赋进行实证分析的经济学家是 CA、斯托尔泊B、萨谬尔森C、里昂剔夫D、俄林2、从国际贸易对生产要素分配的影响来看,国际贸易有利于 DA、生产进口竞争品中密集使用的生产要素收入的增加B、生产进口竞争品中密集使用的共同生产要素收入的增加C、生产出口品中密集使用的共同生产要素收入的增加D、生产出口品中密集使用的生产要素收入的增加3、俄林认为 C 是国际贸易的直接原因;A、成本的国际绝对差B、成本比例的国际绝对差C、价格的国际绝对差D、价格比例的国际绝对差4、按照“要素禀赋理论”,俄林认为要实现国际分工的利益,最好是执行 AA、自由贸易政策B、保护幼稚产业政策C、超保护贸易政策D、执行哪种政策,视具体情况而定5、认为土地、劳动、资本的比例关系是决定国际分工和国际贸易发生和发展的最重要的因素,这种观点来源于 CA、绝对优势理论B、比较优势理论C、要素禀赋理论D、以上都不是6、俄林解释国际分工与国际贸易产生的原因,依据的是 CA、绝对成本差异B、比较成本差异C、要素禀赋相对差异D、规模经济效益递增7、要素禀赋理论认为,每种生产要素的价格,是由 CA、它们的国际价格决定B、它们的有效使用价值决定的C、它们的供给和需求决定的D、它们的国内价值决定的8、不改变贸易结构,只改变贸易规模的增长方式有 CA、偏向进口的生产要素增长B、偏向出口的生产要素增长C、生产要素等比例增长D、悲惨的增长9、斯脱尔波——萨谬尔森定理认为,某一种商品相对价格的上升,将导致该商品密集使用的生产要素的实际价格或报酬提高,而另一种生产要素的实际价格或报酬则 BA、上升B、下降C、不变D、不能判断10、罗伯津斯基定理认为,在商品相对价格不变的前提下,某一要素的增加会导致密集使用该要素部门的生产增加,而另一部门的生产则 BA、上升B、下降C、不变D、不能判断四、简述题1、生产要素禀赋论是如何解释国际贸易产生的原因的1商品的价格差2各国生产要素的成本价格差3出口和进口2、简述要素禀赋理论的主要观点;一国应当专业化生产并出口密集使用本国相对丰裕要素的产品,进口密集使用本国相对稀缺要素的产品;1贸易基础:相对要素丰裕度差异→相对要素价格差异→相对商品价格差异→比较优势2贸易模式:“靠山吃山、靠水吃水”3贸易利得:贸易能够增进世界和各国福利4贸易政策:自由贸易五、论述题1、试述H—O模型的主要内容,并分析其对我国的借鉴意义;1每个国家应密集使用丰富的生产要素生产出口商品,应进口密集使用本国稀缺要素的产品; 2产生国际贸易的直接原因是不同国家同种商品价格差异;3生产要素价格均等化趋势;借鉴意义:灵活2、在战后的几十年间,日本、韩国等东亚的一些国家或地区的国际贸易商品结构发生了明显的变化,主要出口产品由初级产品变为劳动密集型产品,再到资本密集型产品,试对此变化进行解释;第四章现代贸易理论一、名词解释1.规模经济:指在产出的某一范围内,平均成本随着产出的增加而递减;规模经济通常有两种表现形式,一种是内在的,即厂商的平均生产成本随着厂商自身生产规模的扩大而下降;另一种对单个厂商来说是外在的,而对整个行业来说是内在的,即平均成本与单个厂商的生产规模无关,但与整个行业的规模有关;2产业内贸易:产业内国际贸易的简称,是指一个国家或地区,在一段时间内,同一产业部门产品既进口又出口的现象;3. 产业间贸易:国家间不同产品的双向贸易;4. 产品生命周期:把产品从诞生到衰落的过程视为一个生命周期,即产品的初始期、成长期和成熟期;不同的阶段,占据支配地位的要素不同,形成的比较优势不同,国际贸易在各国发生;5. 规模收益递增:指生产过程中产出增加的比例大于要素投入增加的比例;二、是非判断题1、二十世纪七十年代以来,以美国经济学家保罗·克鲁格曼为代表的一批经济学家从规模经济的角度说明国际贸易的起因和利益来源,对国际贸易的基础作出了一种新的解释,该理论被称为“新贸易理论”;正确2、如果两国之间不存在比较优势,两国之间绝不会发生贸易;错误;即使两国间不存在比较优势,外部规模经济也可导致国际贸易的产生;3、根据贸易理论,如果两国的国内市场规模存在差异,而其他条件完全相同,那么国内市场规模相对较大的国家将完全专业化生产具有外部规模经济的产品X,而国内市场规模较小的国家将只能完全专业化生产规模收益不变的产品Y;正确4、产业内贸易的发生取决于两国关系要素禀赋的差异;而产业间贸易则完全是由规模经济引起;错误;产业间贸易的发生取决于两国关系要素禀赋的差异;而产业内贸易则完全是由规模经济引起5、在寡头垄断的条件下,会发生两国关系之间同质产品更新换代的双向贸易,即产业内贸易;正确6、在寡头垄断市场下,贸易会使两国的福利恶化;错误;在寡头垄断市场下,贸易后,两国市场结构皆由完全垄断转变为寡头市场结构,减少了两国市场的垄断因素,降低了资源配置的扭曲,市场价格降低,消费者的福利水平提高三、单项选择题1.以下产品中, B 最容易经历一个产品生命周期A.大米B.电视机C.原油D.矿物2.二十世纪七十年代以来,以美国经济学家保罗·克鲁格曼为代表的一批经济学家从规模经济的角度说明国际贸易的起因和利益来源,对国际贸易的基础作出了一种新的解释,该理论被称为 DA.绝对优势理论 B.相对优势理论 C.要素禀赋论 D.新贸易理论3.消费者对差异产品的追求与现代大生产追求规模经济相互矛盾,其解决途径是 DA.国际投资B.国际技术转让C.国际金融D.国际贸易4.产业内贸易更容易发生在 B 之间A.富国与穷国B.类似的高收入国C.发展中国家D.发达国与发展中国5.规模经济更容易发生在 BA.小规模的纺织业B.飞机制造C.制鞋业D.小企业6.产品生命周期理论的提出者是BA. 赫克歇儿B.弗农C.小岛清D.马歇尔7.产品生命周期处于初始期,决定比较优势的因素是 BA.熟练劳动力B. R&DC.资本D.非熟练劳动力8、产品生命周期处于成长期,决定比较优势的因素是 CA.熟练劳动力B. R&DC.资本D.非熟练劳动力9. 产品生命周期处于成熟期,决定比较优势的因素是 AA.熟练劳动力B. R&DC.资本D.非熟练劳动力10.在垄断竞争的贸易模型中,以下描述正确的是 BA..如果两国拥有同样的总体K/L比例,它们之间就不会发生贸易;B.贸易导致了商品品种的增多和规模经济效应的扩大,进而可以带来收益;C.从长期看,厂商可以获利 D.要素禀赋并不能决定产业内贸易的发生;四、简述题任选一题1、比较产品生命周期理论与要素禀赋理论的异同;两者都研究国际贸易发生的原因;产品生命周期理论属于动态分析理论,要素禀赋理论属于静态分析理论;2、试简述规模经济下国际贸易是如何扩大市场和提高社会福利的规模经济下国际贸易使市场扩大:一方面,通过厂商产量的提高实现规模经济利益;另一方面,增加了产品的品种数量;从社会福利的提高来看:一方面,生产成本降低使消费者可以更低的价格购买消费品;另一方面,产品更新换代品种的增加使得消费者可有更多的选择,从而带来更多的满足;3、简述产业间贸易和产业内贸易产生的原因;产业间贸易的发生取决于两国关系要素禀赋的差异;而产业内贸易则完全是由规模经济引起;五、论述题任选一题1、产品生命周期理论对发展中国家有什么启发意义发展中国家生产成熟产品具有劳动力的优势;2、区别“行业内贸易”与“行业间贸易”很有用吗为什么有用;用产业间贸易理论不能解释产业内贸易的现象;3、试论述在不完全竞争条件下,国际贸易仍是互利的;在不完全竞争条件下,贸易可充分实现规模经济利益;贸易可改变市场结构,促进竞争,从而改善资源配置效率并促进技术进步;贸易可增加消费者的消费品种;第六章关税与非关税壁垒一、名词解释1、进口配额:一国政府为保护本国工业,规定在一定时期内对某种商品的进口数量或金额加以限制;2、有效保护率:税或其他贸易政策措施所引起的国内生产附加值的变动率;3、掠夺性倾销:厂商暂时以较低的价格向国外市场销售商品,以获取垄断性的超额利润;4、出口补贴:一国政府为鼓励某种商品出口,所给予的直接补助或间接补助;5、持续性倾销:倾销是无限期的,目的在于追求利润最大化;6、自愿出口限制:商品出口国在进口国的要求下,自愿地限制某些商品在一定时期内的出口数量或金额;二、是非判断题1、关税措施比非关税壁垒更具有直接性、针对性、灵活性、隐蔽性和歧视性;×2、最佳关税或最佳关税率是由关税征收引起的额外损失与额外收益彼此相等的那种关税率,核心问题是通过选择最佳关税使外国的利益转变成本国的利益,实现国与国之间的利益分配;√3、厂商采取倾销的条件是该企业在国内外市场上都具备影响价格的市场势力,而且它所面临的国内外市场的需求曲线的弹性是相同的;×4、最优关税不会减少消费者剩余;×5、进口配额是一种通过对进口数量的限制达到保护本国产品市场的贸易保护措施;√6、最佳关税的征收不能使外国出口商的收益转到进口国; ×7、在现实中,对国内不生产的进口商品征税,一般是为了保护国内生产;×8、对国内可生产的进口商品征税,在大多数情况下是为了获得财政收入;×9、征收关税后,国内进口替代部门的生产厂商能补偿因产出增加而提高的边际成本,于是国内生产减少; ×10、如果关税征收国是一个大国,那么贸易条件的改善对该国有利; √11、与征收关税相比,进口配额不利于限制一国进口商品的数量; ×12、出口补贴是非关税壁垒最常用的一个手段; √13、倾销是在同一国家进行的一种价格歧视行为;×三、单项选择题1、最佳关税水平应等于BA.零进口关税B.零进口关税与禁止性关税之间的水平C.禁止性关税D.禁止性关税以上2、在关税与贸易总协定临时适用的议定书上签字的缔约国共有B个个个个3、商品倾销的目的主要是 C ;A、提高商品的价格竞争力B、提高商品的非价格竞争力C、打击竞争对手占领市场D、进行促销4、能反映关税对本国同类产品的真正有效保护程度的关税是 C ;A、禁止关税B、名义关税C、有效关税D、正常关税5、就国家整体而言,分配进口配额的方法是AA. 竞争性拍卖B. 固定的受惠C. 资源使用申请程序 C. 政府适时分配6、当一国政府对某种产品征收进口关税时,若该产品的需求弹性大于供给弹性生产者与消费者承担关税的程度是AA. 前者大于后者B. 后者大于前者C. 两者相等D. 不确定7、属于非关税壁垒措施的是 DA. 特惠税B. 普遍优惠制C. 差价税D. 海关估价8、按照差别待遇和特定的实施情况,关税可分为 BA. 进口税、出口税、过境税B. 进口附加税、差价税、特惠税普遍优惠制C. 财政关税和保护关税D. 特惠税和普遍优惠制9、从出口补贴中得益的利益集团是 AA、出口国的生产者B、出口国的消费者C、出口国的政府 C、进口国的生产者10、从征收进口关税中受损的利益集团是 A ;。

ch06 国际经济学课后答案与习题(萨尔瓦多)

*CHAPTER6Chapter) (Core NONTARIFF TRADE BARRIERS AND THE POLITICAL ECONOMY OF PROTETIONISM OUTLINE6.1 Introduction6.2 Import Quotas6.3 Other Nontariff Trade BarriersCase Study 6-1 Voluntary Export Restraints on Japanese Automobiles to the United States6.4 Dumping and Export SubsidiesCase Study 6-2 Antidumping Measures in Force in 2002Case Study 6-3 Agricultural Subsidies in Developed NationsCase Study 6-4 Pervasiveness of Nontariff Barriers6.5 The Political Economy of Protectionism6.6 Strategic Trade and Industrial PoliciesCase Study 6-5 Economic Effects on the U.S. Economy from Removing all Import Restraints6.7 History of U.S. Commercial Policy6.8 The Uruguay RoundCase Study 6-6 The Multilateral Rounds of Trade Negotiations6.9 Outstanding Trade Problems and the Doha RoundAppendix: Strategic Trade and Industrial Policies with Game TheoryKey Termsprinciple Most-favored-nationQuotaNontariff trade barriers (NTBs) Bilateral tradeprotectionism General Agreement on Tariffs and Trade (GATT) NewVoluntary export restraints (VERs) Multilateral trade negotiationsTechnical, administrative, and other regulations Peril-point provisionsclausecartel EscapeInternationalclauseDumping NationalsecurityPersistent dumping Trade Expansion Act of 1962Trade adjustment assistance (TAP)Predatorydumpingdumping KennedyRoundSporadicTrigger-price mechanism Trade Reform Act of 1974RoundExportsubsidies TokyoExport-Import Bank Trade and Tariff Act of 1984Foreign Sales Corporations Omnibus Trade and Competitiveness Act of 1988UruguayRound(CVDs)dutiesCountervailingOrganization(WTO)TradeWorldScientifictariffpromotion authority or fast trackInfant-industryargument TradepolicyRoundDohatradeStrategicmovement policy AntiglobalizationIndustrialtheoryAct GameSmoot–HawleyTariffTrade Agreements Act of 1934-43-Lecture Guide:1. This is an important core chapter examining some of the most recent developments ininternational trade policy.2. I would cover sections 1-3 in lecture 1. I would pay particular attention to Figure 6-1,which examines the partial equilibrium effects of an import quota. I would also clearlyexplain the difference between a regular import quota and a voluntary export restraint.3. I would cover sections 4 and 5 in lecture 2. I would also clearly explain the meaningand importance of dumping and export subsidies, as well as the political economy ofprotectionism. The four case studies serve to highlight the theory and show the relevance of the theory in today's world.4. The rest of the chapter can be covered in lecture 3. Strategic trade and industrial policies, thehistory of U.S. commercial policy, and the outstaying trade problems and the collapse of the Doha Round of trade negotiations in September 2003 should not be difficult to explain and can lead to a great deal of interesting class discussion.Answer to Problems:1. a. An import quota will increase the price of the product to domestic consumers, reduce the domestic consumption of the good, increase domestic production, and result in a protection or deadweight loss to the economy.b. The effects of an import quota are identical to those of an equivalent import tariff, except that with a quota the government does not collect a tariff revenue (unless it auctions offimport quotas to the highest bidder). The import quota is also more restrictive than anequivalent import tariff because foreign producers cannot increase their exports bylowering their prices.2. By penciling in D”X in Figure 1, we can see that the effects of the import quota are:P x=$2.00 and consumption is 60X, of which 40X are produced domestically and 20X areimported; by auctioning off import licenses, the revenue effect would be $20.3. The effects of an export quota of 20X are identical to those of an import quota of 20X or a100 percent import tariff on commodity X, except that the revenue effect is collected by the exporters, rather than by the domestic importers or their government.4. a. An international cartel is an organization of suppliers of a commodity located in different nations (or it is a group of governments) that agrees to restrict output and the exports of the commodity with the aim of maximizing or increasing the total profits of its members.Although domestic cartels are illegal in the United States and are restricted in Europe, the power of international cartels cannot easily be countered because they do not fall under the jurisdiction of any one nation.b. The most notorious of present-day international cartels is OPEC (Organization ofPetroleum Exporting Countries), which, by restricting production and exports, succeeded in quadrupling the price of crude oil between 1973 and 1974. The economic power ofOPEC declined during the 1980s and 1990s when many other nations (such as Russia,Mexico, Norway, the United Kingdom) encouraged by the sharp increase in prices started to extract and export petroleum.5. a. Dumping refers to the export of a commodity at below cost or at a lower price than thecommodity is sold domestically.b. Dumping is classified as persistent, predatory, and sporadic. Persistent dumping, orinternational price discrimination, refers to the continuous sale of the commodity at ahigher price in the domestic market than internationally . The incentive for persistentdumping is the higher profits it provides to domestic producers.Predatory dumping is the temporary sale of a commodity at below cost or at a lower priceabroad than at home in order to drive foreign producers out of business, after which prices are raised to maximize profits. Sporadic dumping is the occasional sale of a commodity at below cost or at a lower price abroad than domestically in order to unload an unforeseenand temporary surplus of the commodity without having to reduce domestic prices.c. Dumping usually leads to trade restrictions as nations try to protect domestic producersfrom “unfair” foreign competition, even when the dumping is persistent and sporadic.6. a. One fallacious argument is that trade restrictions are needed to protect domestic laboragainst cheap foreign labor. This argument is not valid because even if domestic wagesare higher than wages abroad, domestic labor costs can still be lower if the productivity of labor is sufficiently higher domestically than abroad. If not, expensive-labor nations canstill specialize in the production and export capital- and technology-intensive commodities.b. Another fallacious argument for protection is the scientific tariff. This is the tariff rate that would make the price of imports equal to domestic prices and (so the argument goes) allow domestic producers to meet foreign competition. However, this would eliminate internatio- nal price differences and trade in commodities subject to such “scientific” tariffs.7. a. The infant-industry argument postulates that temporary protection may be justified in order to allow a developing nation to develop an industry in which it has a potential comparative advantage. Temporary trade protection is then justified to establish and protect the domestic industry during its “infancy” until it can grow and meet foreign competition. For thisargument to be valid, however, protection must be temporary and the return in the grown-up industry must be sufficiently high to also offset the higher prices paid by domesticconsumers of the commodity during the period of infancy.b. The infant-industry argument must be qualified in several important ways to be acceptable. First, this argument is more justified for developing nations (where capital markets maynot function properly) than for industrial nations. Second, it is usually difficult to identifywhich industry or potential industry qualifies for this treatment, and experience has shown that protection, once given, is difficult to remove. Third, and most important, what tradeprotection (say in the form of an import tariff) can do, an equivalent production subsidy to the infant industry can do better.8. a. According to strategic industrial trade policy a nation can create a comparative advantage(through temporary trade protection, subsidies, tax benefits, and cooperative government– industry programs) in a high-technology field deemed crucial to future growth in the nation.b. There are also serious difficulties in carrying strategic industrial and trade policies. First, itis extremely difficult to pick winners (i.e., choose the industries that will contribute significantly to growth in the future). Second, if most leading nations undertake strategic trade policies at the same time, their efforts are largely neutralized. Third, when a country does achieve substantial success with a strategic trade policy, this comes at the expense of other countries (i.e., it is a beggar-thy-neighbor policy), which are, therefore, likely to retaliate. Faced with all these practical difficulties, even supporters of strategic trade policy grudgingly acknowledge that free trade is still the best policy, after all.9. a. The main provisions of the Uruguay Round were the reduction of average tariffs onindustrial goods from 4.7 percent to 3 percent, for quotas to be replaced by tariffs, and for antidumping and safeguards to be tightened. The agreement also called for the reduction in agricultural export subsidies and industrial subsidies, and for the protection of intellectual property.b. When fully implemented by 2005, the Uruguay Round is estimated to increase world tradeby about 20 percent (with one quarter of the increase in trade in manufactures and the rest in agriculture) and generate total gains in world income of $349 billion ($164 billion from liberalizing trade in agriculture, $130 billion from manufactures and $55 billion fromservices), with developing countries receiving 42 percent of the total gains (mostly fromliberalization of trade in manufactures), which is roughly double their share of world GDP.10. a. The major trade problems facing the world today are (1) the serious trade disputes amongthe United States, the European Union, and Japan; (2) the high trade protectionism, especially in agriculture and textiles, which are of great importance to developing countries, and the abuse antidumping and safeguards; (3) the breaking up of the world into a few major trading blocks, and a serious anti-globalization movement that has come into existence.b. The Doha Round is needed to take up all of the above problems. However, as of the endof 2003 no negotiating agenda had been decided primarily because of disagreements on agricultural protectionism between developing and developed countries.-46-Multiple-choice Questions:1. An import quota:a. increases the domestic price of the imported commodityb. reduces domestic consumptionc. increases domestic production*d. all of the above2. An increase in the demand of the imported commodity subject to a given import quota:a. reduces the domestic quantity demanded of the commodity*b. increases the domestic production of the commodityc. reduces the domestic price of the commodityd. reduces the producers' surplus3. Adjustment to any shift in the domestic demand or supply of an importable commodityoccurs:a. in domestic price with an import quotab. in the quantity of imports with a tariffc. through the market mechanism with an import tariff but not with an import quota*d. all of the above4. An international cartel refers to:a. dumping*b. an organization of exportersc. an international commodity agreementd. voluntary export restraints5. The temporary sale of a commodity at below cost or at a lower price abroad in order todrive foreign producers out of business is called:*a. predatory dumpingb. sporadic dumpingc. continuous dumpingd. voluntary export restraints6. The type of dumping which would justify antidumping measures by the country subjectto the dumping is:*a. predatory dumpingb. sporadic dumpingc. continuous dumpingd. all of the above7. A fallacious argument for protection is:a. the infant industry argumentb. protection for national defense*c. the scientific tariffd. to correct domestic distortions8. Which of the following is true with respect to the infant-industry argument for protection:a. it refers to temporary protection to establish a domestic industryb. to be valid, the return to the grown-up industry must be sufficiently high also to repayfor the higher prices paid by domestic consumers of the commodity during the infancyperiodc. is inferior to an equivalent production subsidy to the infant industry*d. all of the above9. Which of the following is false with respect to strategic trade policy?a. it postulates that a nation can gain by an activist trade policy*b. it is practiced to some extent by most industrial nationsc. it can easily be carried outd. all of the above10. Industrial policy refers to:a. an activist policy by the government of an industrial country to stimulate thedevelopment of an industryb. the granting of a subsidy to a domestic industry to stimulate the development of anindustryc. the granting of a subsidy to a domestic industry to counter a foreign subsidy*d. all of the above11. Trade protection in the United States is usually provided to:a. low-wage workersb. well-organized industries with large employmentc. industries producing consumer products*d. all of the above12. The most-favored-nation principle refers to:*a. extension to all trade partners of any reciprocal tariff reduction negotiated by theU.S. with any of its trade partnersb. multilateral trade negotiationc. the General Agreement on Tariffs and Traded. the International Trade Organization13. On which of the following principles does GATT rest?a. nondiscriminationb. elimination of nontariff barriersc. consultation among nations in solving trade disputes*d. all of the above14. Which of the following was not negotiated under the Uruguay Round?a. reduction of tariffs on industrial goodsb. replacement of quotas with tariffsc. reduction of subsidies on industrial products and on agricultural exports *d. liberalization in trade in most services15. Game theory refers to:*a. a method of choosing the optimal strategy in conflict situationsb. the granting of a subsidy to correct a domestic distortionc. the theory of tariff protectiond. none of the aboveADDITIONAL ESSAYS AND PROBLEMS FOR PART TWO1. From the following figure, in which Dc and Sc refer, respectively to the domesticdemand and supply curves of cloth, and S F and S F+T refer, respectively, to the worldsupply curve of cloth under free trade and with a 50% import tariff imposed by the nation on the importation of cloth, determine:P CFig 6.1(a) the consumption, production effect, and the trade effect of the tariff.(b) the reduction in consumer surplus, the increase in producer surplus or rent, the tariff revenue, and the protection cost or deadweight loss to the economy as a result of the tariff.Answ. (a) The consumption effect is equal to BR=-20c;the production effect is equal to GN=20C;therefore, the trade effect is equal to -(BR+GN)=-40c.(b) The reduction in consumer surplus is FJHB=$90;the increase in producer surplus is FJMG=$30;the revenue effect is NMHR=$40;the protection cost or deadweight loss to the economy is equal to the sum of the area of triangles GMN and BHR or $20.2. (a) Explain why and under what conditions the infant-industry argument for an importtariff is valid.(b) How must this argument be qualified?Answ. (a) The infant-industry argument for tariffs is generally valid, especially for less developed countries (LDCs). It holds that an LDC may have a potential comparative advantage in a particular commodity, say textiles, but that because its initial production costs are too high (due to lack of know-how and the initial small level of output), this industry cannot be established or grow in the LDC in the face of foreign competition. An import tariff is then justified to help the LDC establish the industry and protect it during its "infancy," until the industry has grown in size and efficiency and is able to meet foreigncompetition. At that time, the tariff is to be removed.(b) In order for the infant-industry argument to be valid, not only must the tariff eventuallybe removed and the "grown up" industry be able to compete with foreign firms without protection, but the extra return in the industry (after the removal of the protection) must be high enough to justify the costs involved during the period of protection. These costs arise because the commodity is produced domestically rather than imported for less. It may also be difficult a priori to determine which industry or potential industry qualifies for this treatment, and to eventually remove the tariff once it is imposed. Economistsalso agree that what a tariff can do here, a direct subsidy to the infant industry can dobetter. This is because a subsidy can be varied so as to provide the infant industry with the same degree of protection as an equivalent import tariff but without distortingrelative prices and domestic consumption. However, a subsidy requires revenue, rather than generating it as the tariff does.-51-3. (a) How can strategic trade policy justify trade protection?(b) What difficulties arise in carrying out a strategic trade policy?Answ. (a) According to strategic trade policy, a nation can create a comparative advantage through temporary trade protection in such fields as semiconductors, computers, telecommunica- tions, and other industries that are deemed crucial to future growth in the nation. These high-technology industries are subject to high risks, require large-scale production toachieve economies of scale and give rise to extensive external economies whensuccessful. Strategic trade policy suggests that by encouraging such industries, thenation can enhance its future growth prospects. This is similar to the infant-industryargument in developing nations, except that it is advanced for industrial nations toacquire a comparative advantage in crucial high-technology industries. Most nationsdo some of this. Indeed, some economists would go so far as to say that a great dealof the postwar industrial and technological success of Japan is due to its strategicindustrial and trade policies.(b) There are three serious difficulties in carrying out strategic trade policy. First,it is extremely difficult to pick winners (i.e., choose the industries that will providelarge external economies in the future) and devise appropriate policies to successfullynurture them. Second, since most leading nations undertake strategic trade policies atthe same time, their efforts are largely neutralized so that the potential benefits to each may be small. Third, when a country does achieve substantial success with strategictrade policy, this comes at the expense of other countries (i.e., it is a beggar-thy-neighbor policy) and so other countries are likely to retaliate. Faced with all thesepractical difficulties, even supporters of strategic trade policy grudgingly acknowledge that free trade is still the best policy, after all.-52-。

国际经济学作业

第二章古典贸易理论1、某国是一个劳动力没有生产效率的国家。

在该国,生产一单位任何商品所需要的劳动量都比别的国家多。

该国的领导人认为,由于劳动力如此缺乏效率,本国不会在国际贸易中获得收益。

他们的想法正确吗?请解释原因。

2、假定在短期内每个国家的劳动力不能在产业间流动,因此每个国家一定是在封闭条件下的生产点生产,在这种情形下允许进行国际贸易仍然有利可图吗?为什么?你的答案与交换所得和专业化生产所得有怎样的联系?3、假定A国和B国的劳动禀赋均为400。

A国生产1个单位的X商品需要5个单位的劳动,而生产1个单位Y商品需要4个单位的劳动。

B国生产1个单位的X商品需要4个单位的劳动,而生产1个单位的Y商品需要8个单位的劳动。

a. 画出两个国家的生产可能性边界。

b. 哪个国家在哪种商品上有绝对优势?为什么?绝对优势理论表明了怎样的贸易方向?为什么?c. 根据绝对优势,如果允许自由贸易,专业化生产在多大程度上发生?为什么?每种商品各自生产多少?d. 不使用绝对优势定理而用相对优势定理回答b和c的问题。

e. b和c的答案和d的答案有何不同?为什么?4、考虑一个由两个国家组成的世界,一个大陆国,一个岛国。

每个国家有1000单位的劳动力,而且劳动力是唯一的投入品。

在大陆国,生产一台电脑需要10单位劳动,生产一单位纺织品需要20单位劳动。

在岛国,生产一台电脑需要20单位劳动,生产一单位纺织品需要10单位劳动。

a.画出每个国家的生产可能性边界。

标出纵轴和横轴的截距以及斜率。

b.大陆国生产一台电脑的机会成本是什么?为什么?大陆国生产一单位纺织品的机会成本是什么?为什么?岛国国生产一台电脑的机会成本是什么?为什么?岛国生产一单位纺织品的机会成本是什么?为什么?c.在自给自足的情况下,电脑的相对价格在大陆国和岛国各是多少?为什么?d.哪个国家在哪种商品上有比较优势?为什么?e.如果大陆国和岛国根据比较优势进行专业化生产,那么大陆国和岛国将各生产多少台电脑,多少单位纺织品?为什么?f.经过几年的贸易,大陆国和岛国通过了新的法律,规定每个国家在每个行业中必须使用一半劳动力。

国际经济学(第六章)

6.2.4规模经济、要素禀赋与国际贸易

分析框架:垄断竞争贸易模型 除了规模经济外,再引入要素禀赋差异这一 因素 分析方法:一般均衡分析(针对两个部门) 假设现有两个部门——X与Y,其中X是资本密集 型部门,属于垄断竞争市场结构,Y是劳动密集 型部门,属于完全竞争市场结构;要素市场仍假 设为完全竞争结构。 假设A、B两国除了要素禀赋存在差异外,其他一 切条件都相同,其中A国为资本丰富的国家,B国 为劳动丰富的国家。

在规模经济报酬递增的条件下:

产出的增长比例比要素投入增加的比例高 随着市场规模的扩张,平均成本(单位成本)降低。

本章结构

6.1外部规模经济与国际贸易

规模经济的含义 外部规模经济与国际贸易

6.2垄断竞争与国际贸易:差异产品产业内贸 易

垄断竞争市场与差异产品下的产业内贸易 寡头垄断与国际贸易:同质产品产业内贸易

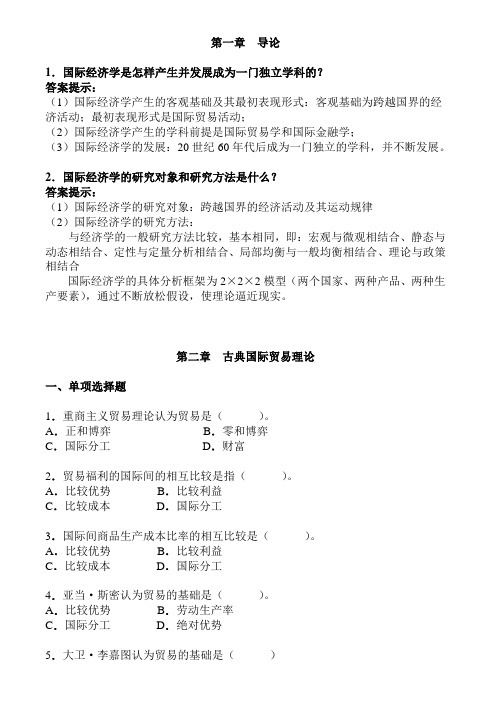

(3)封闭条件下

Y

一般均衡点在图中的A点,在A 点相对价格线(Px/Py)与生 产可能性边界相切。 两国的相对价格完全相同,两 国两种产品都生产,社会福利 也相同。

T

A

C

O

T’

X

图6-1

6.1.2外部规模经济与国际贸易

(4)开放条件下

均衡点E对两国来说都不再是稳定的,两国

通过国际分工与贸易可以改善各自的福利。 如果A国专门生产X,B国专门生产Y,A、B两 国都愿意将各自所生产出的产品一半与对方 进行交换,那么两国的消费点都会超过生产 可能性边界,位于图6-1中直线TT’的中点C, 这时,很明显,两国都会获益。 即使不存在比较优势,外部规模经济也可导 致国际贸易的产生。

国际经济学(第6章)

41

倾销

倾销的经济学分析

价格歧视

针对不同的消费者制定不同的价格的行为 国际贸易中最普遍的价格歧视形式 厂商对其出口的产品制定一个比其在国内市场要低 的价格

倾销

42

倾销

只有当两个条件符合的时候倾销才产生:

不完全竞争行业 被分隔的市场

给定条件下,垄断厂商会发现倾销有利可 图

43

40

垄断竞争与贸易

表 6-3: 1993年美国工业的行业内贸易指数 无 机 化 工 产 品 能 源 设 备 电 气 设 备 有 机 化 工 产 品 药 品 及 医 疗 设 备 办 公 设 备 通 信 器 材 运 钢 服 制 输 铁 装 鞋 机 械

0. 0. 0. 0. 0. 0.8 0. 0. 0. 0. 0. 99 97 96 91 86 1 69 65 43 27 20

38

垄断竞争与贸易

行业间贸易与行业内贸易的主要区别:

行业间贸易反映比较优势,行业内贸易不反映。 行业内贸易的模式是不可预测的,但是行业间的 贸易是由国家间的内在差别决定的。 行业内贸易与行业间贸易的相对重要性取决于国 家之间的相似性。

39

垄断竞争与贸易

行业内贸易的重要性

大概四分之一的世界贸易由行业内贸易组成 在发达国家的制造品贸易中,行业内贸易扮演 了极其重要的角色,而这些贸易占据了世界贸 易的大部分

25

不完全竞争理论

垄断竞争模型的局限性

一般而言,垄断竞争中还存在着另外两种行为, 但却被垄断竞争模型的假设所排除:

勾结行为:

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。