会计专业英语重点1

会计专业英语

会计专业英语-CAL-FENGHAI.-(YICAI)-Company One1一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance with established procedures.3.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits.C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’ equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs.petence’ judgment’ and ethical behavior of individual accountants’D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receiving in exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A.Dr. Bad Debt Accts. $1,500B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retained earnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900(B)A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $300pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )A.Dr. Office Equipment $2,000B.Dr.Office Equipment $2,000Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,100pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B )A.Dr. Accts Rec $2000B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )A.Dr.Office equipment $2500B.Dr. Office equipment $2500Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly highcontinuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

会计的基本英语知识点汇总

会计的基本英语知识点汇总1. Introduction to Accounting会计简介Accounting is the systematic process of identifying, recording, measuring, classifying, summarizing, interpreting, and communicating financial information. It plays a crucial role in the management and decision-making processes of businesses and organizations.会计是一种系统性的流程,用于识别、记录、度量、分类、总结、解释和传达财务信息。

它在企业和组织的管理和决策过程中发挥着至关重要的作用。

2. Basic Accounting Principles基本会计原则There are several fundamental principles that underpin the field of accounting:有几个基本原则支撑着会计领域:a) Accrual Principle: This principle states that financial transactions should be recorded when they occur and not when the cash is received or paid out.应计原则:该原则规定财务交易应在其发生时记录,而不是在现金收到或支付时记录。

b) Matching Principle: This principle states that expenses should be recognized in the same accounting period as the revenues they help generate.配比原则:该原则规定支出应在与其相关的收入产生的同一会计期间内确认。

会计专业英语重点词汇大全[1]

![会计专业英语重点词汇大全[1]](https://img.taocdn.com/s3/m/62bbf31e26284b73f242336c1eb91a37f11132a4.png)

•accounting 会计、会计学•account 账户•account for / as 核算•certified public accountant / CPA 注册会计师•chief financial officer 财务总监•budgeting 预算•auditing 审计•agency 机构•fair value 公允价值•historical cost 历史成本•replacement cost 重置成本•reimbursement 偿还、补偿•executive 行政部门、行政人员•measure 计量•tax returns 纳税申报表•tax exempt 免税•director 懂事长•board of director 董事会•ethics of accounting 会计职业道德•integrity 诚信•competence 能力•business transaction 经济交易•account payee 转账支票•accounting data 会计数据、信息•accounting equation 会计等式•account title 会计科目•assets 资产•liabilities 负债•owners’ equity 所有者权益•revenue 收入•income 收益•gains 利得•abnormal loss 非常损失•bookkeeping 账簿、簿记•double-entry system 复式记账法•tax bearer 纳税人•custom duties 关税•consumption tax 消费税•service fees earned 服务性收入•value added tax / VAT 增值税•enterprise income tax 企业所得税•individual income tax 个人所得税•withdrawal / withdrew 提款、撤资•balance 余额•mortgage 抵押•incur 产生、招致•apportion 分配、分摊•accounting cycle会计循环、会计周期•entry分录、记录•trial balance试算平衡•worksheet 工作草表、工作底稿•post reference / post .ref过账依据、过账参考•debit 借、借方•credit 贷、贷方、信用•summary/ explanation 摘要•insurance 保险•premium policy 保险单•current assets 流动资产•long-term assets 长期资产•property 财产、物资•cash / currency 货币资金、现金•accounts receivable 应收账款•provision for bad debts /allowance for uncollectible account / doubtdebts 坏帐准备•recoveries 追回款•direct write-off method 直接冲销法•allowance method 备抵法•contra account 备抵账户•prepaid expense 预付、待摊费用•prepayment / advance to supplies 预付账款•inventory 存货•merchandise inventory库存商品•finished goods 产成品•semi-finished goods 半成品•good in process 在产品•construction in process 在建工程•warehousing 仓库•FIFO /LIFO/ weight average / specific identification存货发出成本计价的四种方法•overhead 企业经费•long-term equity investment 长期投资•fixed assets / plant assets 固定资产•useful life 使用寿命•residual value / salvage value 残值•unit –production method 单位产量法•depreciation per unit单位折旧额•accumulated depreciation 累计折旧•accelerate method 加速折旧法•DDB method 法双倍余额递减•SYD method 年数总和法•disposal of fixed assets 固定资产清理•intangible assets 无形资产•patents 专利权•trademarks 商标权•goodwill 商誉•deferred assets 递延资产•operating lease 经营租赁•capital lease 融资租赁•capital expenditure 资本性支出•revenue expenditure 收益性支出•amortize 分期偿还(债务)•other cash equivalent 其他货币资金•order / draft 汇票•deposit 存款、订金•IOUS 借据•postdated check延付支票(不属于流动资产)•outstanding check 未付支票•not sufficient funds check 资金不足支票•electronic funds transfer 电子资金转账•service charges / handling charge 手续费•petty cash 备用金•bank statement 银行对账单•bank reconciliation 银行余额调节表•receipt 收入、收据•reimburse 偿还、报销 vt •disbursement 支付、支出•creditor 债权人•promissory note 本票•dishonor 拒绝承兑、拒付• trade discount 商业折扣•cash discount / sales discount 现金折扣•sales returns and allowance 销售折让•perpetual inventory system 永续盘存制•periodic inventory system 定期盘存制•expiration / maturity 到期、截止•obligation ; liability义务•liabilities 负债•book value账面价值•face value ; par value票面价值•discount 折价、贴现、折扣•account payable应付账款•not payable应付票据•taxes payable 应交税费•vat-input 增值税进项税•vat-output 增值税销项税•commercial accepted draft 商业承兑汇票•bank accepted draft 银行承兑汇票•short-term loan 短期借款•advance from customer / unearned revenues 预收账款•interests 利息•dividends 股利•pay off 偿付清、还清•salaries payable 应付职工薪酬•wages 基本工资•bonus 奖金、红利•pension payment 养老保险•medical insurance premiums 医疗保险金•housing reserves 住房公积金•non-monetary welfare 非货币性福利•employee 雇员、员工•bond 债券•premium 溢价、保险金、佣金•due date / maturity date 到期应付日、到期日•paid-in capital 实收资本•capital stock 股本•capital reserve 资本公积•surplus reserve 盈余公积•undistributed profit 未分配利润•retained earnings 留存收益•common stock 普通股•preferred stock 优先股•Corporatio.limite..Co.LT.股份有限公司•Single proprietorship / sole proprietorship 独有企业•Partnership 合伙企业•Fees earned 酬金、酬劳•Real estate 房地产、不动产•Commision 回扣、佣金•General journal 日记总账•Special journal 特种日记账•general ledger 总分类账•subsidiary ledger 明细分类账•original document / source document 原始凭证•chart of account title 会计科目表•primary operating revenue 主营业务收入•operating expense 经营费用、期间费用•revenues realization principle 收入实现制•accrual basis 权责发生制•matching principle 配比性原则•prudence principle 谨慎性原则•time period 时间分期•balance sheet 资产负债表•income statement 利润表•statement of cash flow 现金流量表• revenue / sales 营业收入•cost of goods sold / cost of sales 营业成本•sales taxes and extra charges / operating taxes 营业税金与附加•selling expense 销售费用•advertising expense 广告费用•general and administrative expense 管理与总务费用、管理费用•utility expense 公共事业费用•financing expense 财务费用•loss of assets impairment 资产减值损失•changes of fair value assets 公允减值变动•income from investment 投资收益•gross profit 毛利、利润总额•net profit 净利润•current ratio 流动比率•quick ratio 速度比率•debts to total assets ratio 资产负债比•capitalization ratio 资本化比率•times interests earned ratio 已获利息倍数•EBIT 息税前利润•inventory turnover 存货周转率•rate of return on assets 资产报酬率•profit margin 边际利润•earning per share 每股收益•liquidity ratio 流动性比率•financing leverage ratio财务杠杆比率•efficiency ratio效用比率•profitability ratio盈利能力比率•trend analysis 趋势分析法•common-size analysis 结构分析法•ration analysis比率分析法。

会计专业英语复习题(1)(1)

【题型】:一、词汇默写10个,共10分已销商品成本cost of goods sold期初存货beginning inventory期末存货ending inventory在途物资goods in transit个别计价法specific identification method 加权平均法weighted average method先进先出法first-in,first-out method后进后出法last-in,first-out method货物流goods flow实地盘存制periodic inventory system永续盘存制perpetual inventory system实物资产,有形资产tangible assets固定百分比法fixed percentage method直线法straight line method余额递减法declining balance methods股本capital stock可折旧资产depreciable asset残值salvage value历史成本法historical cost systems公允价值fair value累计折旧accumulated depreciation账面值book value资本利得capital gain加速折旧法accelerated depreciation methods双倍余额递减法double-declining-balance method 工作量折旧法activity depreciation methods 多项资产multiple-asset长期投资long term investment短期投资current investment公允价值fair value市场价值market value股利,红利dividends账面价值carrying amount预付税款advance taxes paid应收票据note receivable应付票据note payable利息收入interest receivable拒绝承兑dishonor应收利息interest receivable利息费用interest expense应付利息interest payable预付账款prepayment应付工资salaries payable应交税金taxes payable不带息票据moninterest-bearing note匹配原则matching principle票据贴现discount on notes payable预收款项unearned revenues或有负债contingent liabilities现值present value商业票据commercial paper年金annuity面值face value市场利率market rate二、中译英5句,共25分1.会计师在记录经济业务时必须遵守经济主体原则。

英文会计知识点总结归纳

英文会计知识点总结归纳IntroductionAccounting is a fundamental aspect of any business, as it involves the recording, analyzing, and reporting of financial transactions. It provides businesses with essential information to make informed decisions, assess their financial health, and comply with regulatory requirements. In this article, we will summarize and consolidate key accounting knowledge points that are crucial for understanding the principles and practices of accounting.1. Basics of Accounting1.1. Definition of AccountingAccounting is the process of recording, analyzing, and interpreting financial transactions of an organization. It provides a systematic and comprehensive record of all financial activities and enables the preparation of financial statements.1.2. Accounting EquationThe accounting equation, also known as the balance sheet equation, is a fundamental principle of accounting that states:Assets = Liabilities + EquityThis equation represents the relationship between a company's assets, liabilities, and equity, and must always remain in balance.1.3. Types of AccountingThere are several types of accounting, including financial accounting, management accounting, cost accounting, and tax accounting. Each type serves a specific purpose and audience, such as external stakeholders, internal management, and regulatory authorities.2. Financial Statements2.1. Balance SheetThe balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess its solvency and liquidity.2.2. Income StatementThe income statement, also known as the profit and loss statement, summarizes a company's revenues and expenses over a specific period. It provides insights into the company's profitability and performance.2.3. Cash Flow StatementThe cash flow statement tracks the inflow and outflow of cash within an organization. It categorizes cash flows into operating, investing, and financing activities, and helps assess the company's ability to generate cash and meet its obligations.3. Principles of Accounting3.1. Accrual Basis vs. Cash Basis AccountingAccrual basis accounting recognizes revenues and expenses when they are incurred, regardless of when cash is exchanged. Cash basis accounting, on the other hand, records transactions only when cash is received or paid. Accrual basis accounting provides a more accurate representation of a company's financial performance.3.2. Matching PrincipleThe matching principle requires that expenses be recognized in the same period as the revenues to which they relate. This principle ensures that a company's financial statements accurately reflect its profitability.3.3. Revenue RecognitionRevenue recognition dictates when and how revenue should be recorded in a company's financial statements. It is crucial for determining a company's financial performance and must adhere to generally accepted accounting principles (GAAP).4. Assets and Liabilities4.1. Types of AssetsAssets are resources owned by a company and can be categorized into current assets (e.g., cash, inventory) and non-current assets (e.g., property, plant, and equipment). Understanding the nature and value of an organization's assets is vital for assessing its financial health.4.2. Types of LiabilitiesLiabilities represent an organization's obligations to outside parties and can include accounts payable, long-term debt, and accrued expenses. Managing and tracking liabilities is crucial for maintaining financial stability.5. Internal Controls5.1. Importance of Internal ControlsInternal controls are processes and procedures that a company implements to safeguard its assets, ensure accuracy in financial reporting, and comply with regulations. They help prevent fraud, errors, and mismanagement of funds.5.2. Segregation of DutiesSegregation of duties involves dividing responsibilities among different individuals to prevent the occurrence of fraud and errors. It ensures that no single individual has control over critical financial processes.6. Auditing6.1. Purpose of AuditingAuditing is the process of examining a company's financial statements and accounting records to ensure accuracy, integrity, and compliance with laws and regulations. It provides independent assurance to stakeholders regarding the company's financial performance.6.2. Types of AuditsThere are different types of audits, such as external audits conducted by independent accounting firms, internal audits performed by a company's internal audit department, and government audits carried out by regulatory agencies.7. Taxation7.1. Tax PlanningTax planning involves the structuring of financial activities to minimize tax liabilities within the boundaries of the law. It requires an in-depth understanding of tax laws, regulations, and incentives.7.2. Tax Deductions and CreditsUnderstanding tax deductions and credits is essential for businesses to optimize their tax positions and reduce their tax burden. Deductions lower taxable income, while credits directly reduce the amount of tax owed.8. Financial Analysis8.1. Ratio AnalysisRatio analysis involves the use of financial ratios to evaluate a company's performance, liquidity, solvency, and efficiency. Common ratios include profitability ratios, liquidity ratios, and leverage ratios.8.2. Trend AnalysisTrend analysis involves comparing financial data over different periods to identify patterns, changes, and potential areas for improvement. It helps in assessing a company's financial health and predicting future performance.ConclusionAccounting is a critical aspect of business that provides insights into an organization's financial performance, health, and compliance. Understanding the basics of accounting, financial statements, principles, assets and liabilities, internal controls, auditing, taxation, and financial analysis is essential for business owners, managers, and financial professionals to make informed decisions and ensure the financial success of their organizations. By consolidating and summarizing these key accounting knowledge points, individuals can gain a comprehensive understanding of the principles and practices of accounting.。

会计英语知识点归纳总结

会计英语知识点归纳总结English: In accounting, there are several key concepts and principles that serve as the foundation for financial reporting. The accrual principle dictates that revenue and expenses should be recognized when they are incurred, regardless of when cash is actually received or paid. The matching principle requires that expenses should be matched to the revenue they help to generate, ensuring that the true cost of earning that revenue is accurately reflected. The going concern concept assumes that a business will continue to operate indefinitely, allowing for the long-term allocation of costs and recognition of assets. The consistency principle mandates that once an accounting method is chosen, it should be consistently applied from one period to the next. And the materiality principle states that financial information should only be disclosed if omitting or misstating it could influence the economic decisions of users.中文翻译: 在会计中,有几个关键概念和原则为财务报告奠定了基础。

《会计专业英语》Chapter 1 Introduction to Accounting

▪ 1.1 What is accounting ▪ 1.2 Forms of business entities ▪ 1.3 Business activities ▪ 1.4 Users of accounting information ▪ 1.5 Types of accounting ▪ 1.6 Careers in accounting

12

Internal users

➢ Internal users are employees of an enterprise and are directly involved in managing and operating the business.

➢ From basic labor categories to chief executive officers, all employees are paid, and their paychecks are generated by the accounting information system.

➢ Resources owned by a business are called capital assets. ➢ Assets have different types and names. Various, non-current,

and tangible assets are called property, plant, and equipment (PPE).

9

Investing activity

➢ Investing activities involve the purchase of the resources a company needs in order to operate.

会计英语课件1

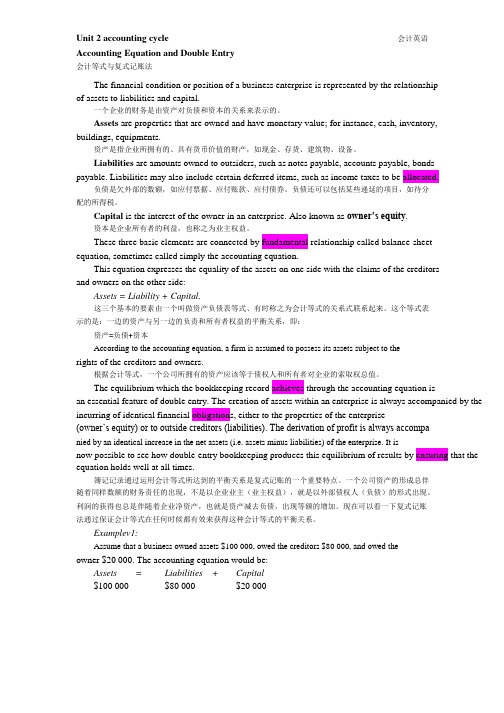

Unit 2 accounting cycle会计英语Accounting Equation and Double Entry会计等式与复式记账法The financial condition or position of a business enterprise is represented by the relationshipof assets to liabilities and capital.一个企业的财务是由资产对负债和资本的关系来表示的。

Assets are properties that are owned and have monetary value; for instance, cash, inventory, buildings, equipments.资产是指企业所拥有的、具有货币价值的财产,如现金、存货、建筑物、设备。

Liabilities are amounts owned to outsiders, such as notes payable, accounts payable, bonds payable. Liabilities may also include certain deferred items, such as income taxes to be allocated.负债是欠外部的数额,如应付票据、应付账款、应付债券。

负债还可以包括某些递延的项目,如待分配的所得税。

Capital is the interest of the owner in an enterprise. Also known as owner’s equity.资本是企业所有者的利益,也称之为业主权益。

These three basic elements are connected by fundamental relationship called balance-sheet equation, sometimes called simply the accounting equation.This equation expresses the equality of the assets on one side with the claims of the creditorsand owners on the other side:Assets = Liability + Capital.这三个基本的要素由一个叫做资产负债表等式、有时称之为会计等式的关系式联系起来。

(完整版)会计专业英语词汇大全

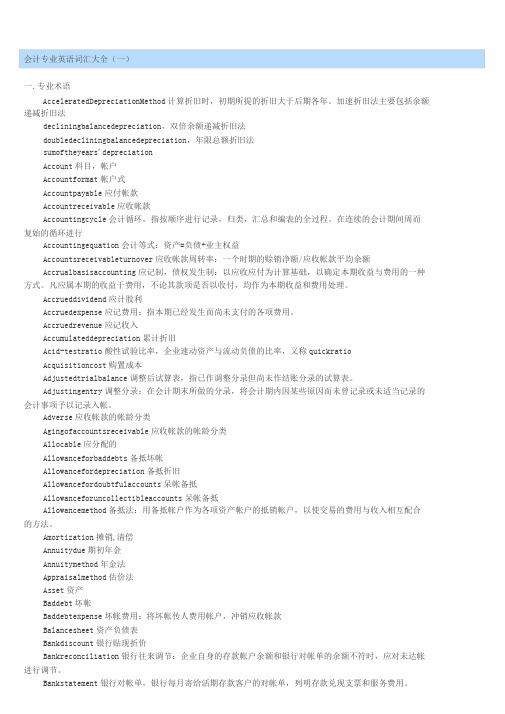

会计专业英语词汇大全(一)一.专业术语Accelerated Depreciation Method 计算折旧时,早期所提的折旧大于后期各年。

加快折旧法主要包含余额递减折旧法declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总数折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 对付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按次序进行记录,归类,汇总和编表的全过程。

在连续的会计期间循环往复的循环进行Accounting equation 会计等式:财产= 欠债 + 业主权益Accounts receivable turnover 应收帐款周转率:一个期间的赊销净额/ 应收帐款均匀余额Accrual basis accounting 应记制,债权发生制:以应收对付为计算基础,以确立本期利润与花费的一种方式。

凡应属本期的利润于花费,无论其款项能否以收付,均作为本期利润和花费办理。

Accrued dividend 应计股利Accrued expense 应记花费:指本期已经发生而还没有支付的各项花费。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,公司速动财产与流动欠债的比率,又称quick ratioAcquisition cost 购买成本Adjusted trial balance 调整后试算表,指已作调整分录但还没有作结账分录的试算表。

Adjusting entry调整分录:在会计期末所做的分录,将会计期内因某些原由此不曾记录或未适合记录的会计事项予以记录入帐。

会计专业英语L11

Nashville, TN 37459 Clothes Mart Nashville, TN

May 31, 2006

Lesson 11

CASH CONTROL 现金控制

11- 1

Learning Objectives

Define internal control and identify requirements for good internal accounting control Apply internal control to cash receipts and disbursements Define cash and explain how to report them

11- 6

NEW WORDS, PHRASES AND SPECIAL TERMS

Internal control 内部控制 The measures an organization employsfor

fraud欺骗(行为) or misfeasance不当行为 ,滥用职权are minimized.

Issuing checks for payment of verified, approved and recorded obligations.

11- 16

Voucher System of Control

Cashier Accounting Receiving Supplier (Vendor) Purchasing Requesting

11- 15

Voucher System of Control

A voucher system establishes procedures for:

会计学原理专业英语词汇对照(第一二章)

会计学原理专业英语词汇对照第一章:必知词汇accounting会计recordkeeping or bookkeeping簿记shareholders股东board of directors董事会auditors审计suppliers供应商creditor债权人ethics职业道德GAAP公认会计原则(美国)SEC证券交易委员会(美国)FASB财务会计准则委员会(美国)IASB国际会计准则理事会(国际)IFRS国际财务报告准则(国际)Relevant相关Reliable可靠Comparable可比Principles原则The measurement principle/ the cost principle计量原则/ 成本原则The revenue recognition principle收入确认原则The expense recognition principle/ the matching principle支出确认原则/配比原则Sale on credit/ on account 赊销Purchase on credit/on account赊购The full disclosure principle充分披露原则Assumptions假设The going-concern assumption持续经验假设The monetary unit assumption货币计量假设The time period assumption会计分期假设The business entity assumption会计主体假设Sole proprietorship独资企业Unlimited liability无限责任Partnership合伙企业Corporation公司Double taxation双重课税Expanded accounting equation扩展会计等式Assets资产Liabilities负债Owners, equity 所有者权益Net assets净资产Owners, capital所有者资本Owners, withdrawals所有者提取/所有者抽回投资Expenses费用Revenue收入Net income净利润Net loss净损失Income statement利润表Statement of owners, equity所有者权益表/所有者权益变动表Balance sheet资产负债表Statement of cash flows现金流量表第二章:必知词汇(上文有的不再重复)Accounting books/books会计帐簿Source documents原始凭证Account账户General ledger总分类账Ledger分类账Account receivable应收账款Note receivable应收票据Prepaid accounts/ prepaid expenses预付账款/待摊费用Account payable应付账款Note payable应付票据Unearned revenue预收账款Accrued liabilities应计负债Increase增加Decrease减少Chart of accounts会计科目表T-account T形账户Debit借方(Dr.)Credit贷方(Cr.)Account balance账户余额Normal balance正常余额Double entry accounting 复式记账法Journalizing登记日记账Journal日记账General journal普通日记账Journal entry日记账分录Posting过账Balance column account三栏式账户PR(posting reference)过账索引Trial balance试算平衡表Unadjusted statements调整前的财务报表必记口诀:有借必有贷,借贷必相等。

会计专业基础英语

Accounting- 1 -Unit 4 AccountingPART I Fundamentals to Accounting第一部分 会计基本原理1.accounting [ə'ka ʊnt ɪŋ]n. 会计会计2.double-entry system 复式记账法复式记账法 2-1 Dr.(Debit) 借记借记借记 2-2 Cr.(Credit) 贷记贷记贷记3.accounting basic assumption 会计基本假设会计基本假设4.accounting entity 会计主体会计主体5.going concern 持续经营持续经营6.accounting periods 会计分期会计分期7.monetary measurement 货币计量货币计量8.accounting basis 会计基础会计基础9.accrual [ə'kr ʊəl] b asis basis 权责发生制权责发生制 【讲解】【讲解】accrual n. 自然增长,权责发生制原则,应计项目自然增长,权责发生制原则,应计项目自然增长,权责发生制原则,应计项目 accrual concept 应计概念应计概念应计概念 accrue [ə'kruː] v. 积累,自然增长或利益增加,产生积累,自然增长或利益增加,产生积累,自然增长或利益增加,产生 10.accounting policies 会计政策会计政策 11.substance over form 实质重于形式实质重于形式12.accounting elements 会计要素会计要素 13.recognition [rek əg'n ɪʃ(ə)n] n.确认确认 13-1 initial recognition [rek əg'n ɪʃ(ə)n] 初始确认初始确认 【讲解】【讲解】recognize ['r ɛk əg'na ɪz] v.确认确认确认14.measurement ['me ʒəm(ə)nt] n.计量计量计量 14-1 subsequent ['s ['s ʌbs ɪkw(ə)nt] measurement 后续计量后续计量后续计量 15.asset ['æset] n. 资产资产资产 16.liability [la ɪə'b ɪl ɪt ɪ] n. 负债负债负债 17.owners’ equity 所有者权益所有者权益 18.shareholder’s equity 股东权益股东权益股东权益 19.expense [ɪk'spens; ek-] n. 费用费用费用 20.profit ['pr ɒf ɪt] n.利润利润利润 21.residual [r ɪ'z ɪdj ʊəl] equity 剩余权益剩余权益 22.residual claim 剩余索取权剩余索取权 23.capital ['kæpɪt(ə)l] n.资本资本资本 24.gains [ɡeinz] n. 利得利得利得 25.loss [l ɒs] n.损失损失损失 26.Retained earnings 留存收益留存收益 27.Share premium 股本溢价股本溢价股本溢价28.historical cost 历史成本历史成本 【讲解】【讲解】historical [h ɪ'st ɒr ɪk(ə)l] adj. 历史的历史的历史的,,历史上的历史上的 historic [h ɪ'st ɒr ɪk] adj.有历史意义的有历史意义的有历史意义的,,历史上著名的历史上著名的28-1 replacement [r [r ɪ'ple ɪsm(ə)nt] cost重置成本重置成本 29.Balance Sheet/Statement of Financial Position 资产负债表资产负债表 29-1 Income Statement 利润表利润表 29-2 Cash Flow Statement 现金流量表现金流量表29-3 Statement of changes in owners’equity (or shareholders’shareholders’equity) equity) 所有者权益(股东权益)变动表东权益)变动表29-4 notes [n [n əʊts] n.附注附注附注PART II Financial Assets*第二部分 金融资产*30.financial assets 金融资产金融资产e.g. A financial instrument is any contract that gives rise to a financial asset ofone enterprise and a financial liability or equity instrument of another enter 【讲解】【讲解】give rise to 引起,导致引起,导致31.cash on hand 库存现金库存现金 32.bank deposits [d ɪ'p ɒz ɪt] 银行存款银行存款 33.A/R, account receivable 应收账款应收账款 34.notes receivable 应收票据应收票据 35.others receivable 其他应收款项其他应收款项 36.equity investment 股权投资股权投资 37.bond investment 债券投资债券投资38.derivative financial instrument 衍生金融工具衍生金融工具 39.active market 活跃市场活跃市场40.quotation [kw ə(ʊ)'te ɪʃ(ə)n]n.报价报价 41.financial assets at fair value through profit or loss 以公允价值计量且其变动计入当期损益的金融资产入当期损益的金融资产41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产且其变动计入当期损益的金融资产41-2 financial assets held for trading 交易性金融资产交易性金融资产 42.financial liability 金融负债金融负债 43.transaction costs 交易费用交易费用43-1 incremental external cost 新增的外部费用新增的外部费用 【讲解】【讲解】incremental [ɪnkr ə'm əntl] adj.增量的增量的增量的,,增值的增值的44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利已宣告但尚未发放的现金股利 投资收益投资收益45.profit and loss arising from fair value changes 公允价值变动损益公允价值变动损益 46.Held-to-maturity investments 持有至到期投资持有至到期投资 47.amortized cost 摊余成本摊余成本 【讲解】【讲解】amortized [ə'm ɔ:taizd]adj. 分期偿还的分期偿还的,,已摊销的已摊销的48.effective interest rate 实际利率实际利率 49.loan [l əʊn] n.贷款贷款贷款 50.receivables [ri'si:v əblz] n.应收账款应收账款应收账款 51.available-for-sale financial assets 可供出售金融资产可供出售金融资产 52.impairment of financial assets 金融资产减值金融资产减值52-1 impairment loss of financial assets 金融资产减值损失金融资产减值损失 53.transfer of financial assets 金融资产转移金融资产转移53-1 transfer of the financial asset in its entirety 金融资产整体转移金融资产整体转移 53-2 transfer of a part of the financial asset 金融资产部分转移金融资产部分转移 54.derecognition [diː'rekəg'n ɪʃən] n.终止确认,撤销承认终止确认,撤销承认54-1 derecognize [diː'rekə[diː'rekəgna ɪz] v.撤销承认撤销承认撤销承认 e.g. An enterprise shall derecognize a financial liability (or part of it) only w the underlying present obligation (or part of it) is discharged /cancelled . 【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

英文财务会计知识点

英文财务会计知识点前言:财务会计是一项重要的管理工具,它能为企业提供财务信息,帮助管理者做出正确的决策,以实现企业的长期稳定发展。

掌握财务会计的基本知识,对于任何从事商业活动的人来说都是必需的。

本文将介绍一些常见的,帮助读者更好地理解和应用这些知识。

1. 会计基本概念会计是一门记录、处理和报告财务信息的学科。

在财务会计中,有一些基本概念需要熟悉。

1.1 会计等式会计等式是财务会计的基本原理,表示资产等于负债加所有者权益。

Assets = Liabilities + Owners' Equity。

1.2 会计周期会计周期是指将企业的财务信息分为若干期间进行记录和报告的时间间隔。

常用的会计周期包括年度、季度和月度。

2. 资产负债表资产负债表是反映企业在特定日期上的财务状况的报表。

它列出了企业的资产、负债和所有者权益。

2.1 资产资产是企业拥有的具有经济价值的资源,包括现金、应收账款、存货、固定资产等。

Assets是资产的英文。

2.2 负债负债是企业的债务或付款义务,包括应付账款、短期负债、长期债务等。

Liabilities是负债的英文。

2.3 所有者权益所有者权益是企业的净资产,包括股东的投资和累积利润。

Owners' Equity是所有者权益的英文。

3. 利润表利润表是反映企业在一定期间内盈利情况的报表。

它列出了企业的收入、成本和利润。

3.1 收入收入是企业在销售商品或提供服务过程中所取得的经济利益。

Revenues是收入的英文。

3.2 成本成本是企业为生产和销售商品或提供服务所支出的费用。

Expenses是成本的英文。

3.3 利润利润是企业在一定期间内的净收入,即收入减去成本。

Profit是利润的英文。

4. 现金流量表现金流量表是反映企业现金流入和流出情况的报表。

它分为经营活动、投资活动和筹资活动三个部分。

4.1 经营活动现金流量经营活动现金流量是企业在日常运营中产生的现金流量,包括销售商品、收取应收款项等。

会计知识点总结小学英语

会计知识点总结小学英语1. What is Accounting?Accounting is the process of recording and analyzing financial transactions, as well as preparing financial statements such as the balance sheet, income statement, and cash flow statement. It provides vital information to stakeholders such as investors, creditors, and management to assess the financial performance and position of a business or organization.2. The Accounting EquationThe accounting equation, also known as the balance sheet equation, is the foundation of double-entry accounting. It states that assets equal liabilities plus equity. This means that the resources owned by a business (assets) are financed by either borrowing money (liabilities) or investing money from the owner (equity).3. Types of AccountsIn accounting, there are five main types of accounts:- Assets: These are resources owned by the business, such as cash, inventory, and equipment.- Liabilities: These are obligations or debts owed by the business, such as loans, accounts payable, and bonds.- Equity: This represents the owner's investment in the business and the retained earnings. - Revenue: This is the income generated from the primary activities of the business, such as sales and services.- Expenses: These are the costs incurred in running the business, such as rent, utilities, and wages.4. Debits and CreditsIn double-entry accounting, every transaction affects at least two accounts, with one account being debited and the other being credited. Debits and credits must always balance, meaning that the total debits must equal the total credits. Debits increase assets and expenses, while they decrease liabilities and equity. On the other hand, credits decrease assets and expenses, while they increase liabilities and equity.5. Financial StatementsThe financial statements are the end result of the accounting process, and they provide a snapshot of the financial performance and position of a business. The three main financial statements are:- Balance Sheet: This shows the assets, liabilities, and equity of a business at a specific point in time.- Income Statement: This shows the revenue and expenses of a business over a period, resulting in the net income or net loss.- Cash Flow Statement: This shows the cash inflows and outflows from operating, investing, and financing activities, and it helps to assess the cash position of a business.6. Accounting PrinciplesThere are several accounting principles that guide the preparation of financial statements and ensure consistency and accuracy in financial reporting. Some of the key accounting principles include:- Going Concern: This principle assumes that a business will continue to operate indefinitely, which allows assets to be valued at their historical cost rather than their liquidation value.- Revenue Recognition: This principle dictates when and how to record revenue, such as when it is earned and realizable.- Matching Principle: This principle requires that expenses should be recognized in the same period as the revenue they help generate, ensuring that the income statement accurately reflects the profitability of the business.7. Importance of AccountingAccounting is important for several reasons:- It provides crucial information for decision-making, such as whether to invest in a business or grant a loan.- It helps to monitor the financial performance and position of a business, enabling management to make informed decisions for growth and profitability.- It ensures compliance with legal and regulatory requirements, such as tax laws and financial reporting standards.In conclusion, accounting is an essential part of the business world, and it is important for students to understand its basic concepts and principles. By learning about accounting, students can gain a better understanding of financial literacy and develop the skills needed to manage their own finances in the future.。

会计专业英语lesson 1 Accounting an information system

《会计专业英语》课堂教案本次课标题:Lesson 1 Accounting:An Information system授课班级10会计上课时间2学时上课地点教学目标能力(技能)目标知识目标①Understand capital markets and decision making.②Identify the users of accounting information.Master the news words and terms①Understand the history and development ofaccounting②Explain the difference between Financialaccounting and managerial accounting能力训练任务及案例本章要求学生对会计的内涵、会计执业的内涵、会计信息使用者有大致的了解。

可从近期出现的新闻热点事件出发,从分析重大经济案例着手。

教学重点/难点教学重点:The definition of Accounting. The purpose of Accounting system.The principle of Accounting.教学难点:The requirement of Accounting information.The users of Accounting information.The Accounting profession.教材/教参教材:常勋肖华,《会计专业英语》,上海:立信会计出版社,2005年11月。

参考资料:1.李海红,实用会计英语.大连:大连理工出版社,2010年2月二、教学(过程)设计步骤教学活动教学方法教学手段学生活动时间分配(分钟)一会计英语课程介绍:详细的介绍本课程的定位,教学目标,教学内容,考核方式,参考资料等。

(详细内容见说课PPT)讲授法谈话法讨论法多媒体谈谈对本课程的期望与看法。

会计专业英语重点1

会计专业英语重点1Unit 1Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results.许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。

Unit 2Each proprietorship, partnership, and corporation is a separate entity.每一独资企业、合伙企业和股份公司都是一个单独的主体。

In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred – not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements.在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。

会计专业英语词汇大全

会计专业英语词汇大全(一)一.专业术语AcceleratedDepreciationMethod计算折旧时,初期所提的折旧大于后期各年。

加速折旧法主要包括余额递减折旧法decliningbalancedepreciation,双倍余额递减折旧法doubledecliningbalancedepreciation,年限总额折旧法sumoftheyears'depreciationAccount科目,帐户Accountformat帐户式Accountpayable应付帐款Accountreceivable应收帐款Accountingcycle会计循环,指按顺序进行记录,归类,汇总和编表的全过程。

在连续的会计期间周而复始的循环进行Accountingequation会计等式:资产=负债+业主权益Accountsreceivableturnover应收帐款周转率:一个时期的赊销净额/应收帐款平均余额Accrualbasisaccounting应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。

凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。

Accrueddividend应计股利Accruedexpense应记费用:指本期已经发生而尚未支付的各项费用。

Accruedrevenue应记收入Accumulateddepreciation累计折旧Acid-testratio酸性试验比率,企业速动资产与流动负债的比率,又称quickratioAcquisitioncost购置成本Adjustedtrialbalance调整后试算表,指已作调整分录但尚未作结账分录的试算表。

Adjustingentry调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。

Adverse应收帐款的帐龄分类Agingofaccountsreceivable应收帐款的帐龄分类Allocable应分配的Allowanceforbaddebts备抵坏帐Allowancefordepreciation备抵折旧Allowancefordoubtfulaccounts呆帐备抵Allowanceforuncollectibleaccounts呆帐备抵Allowancemethod备抵法:用备抵帐户作为各项资产帐户的抵销帐户,以使交易的费用与收入相互配合的方法。

会计专业英语词汇大全

一.专业术语Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。

加速折旧法主要包括余额递减折旧法declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总额折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 应付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。

在连续的会计期间周而复始的循环进行Accounting equation 会计等式:资产 = 负债 + 业主权益Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额 / 应收帐款平均余额Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。

凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。

Accrued dividend 应计股利Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quickratioAcquisition cost 购置成本Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。

Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。

会计英语基础知识点

会计英语基础知识点会计是一门重要的商业领域,为了更好地与国际商务交流,学习会计英语成为很有必要的一项技能。

本文将介绍一些会计英语的基础知识点,以帮助读者更好地掌握会计英语。

一、财务报表财务报表是会计工作中最基本的组成部分之一。

在英语中,财务报表被称为financial statements。

其中包括balance sheet(资产负债表)、income statement(损益表)和cash flow statement(现金流量表)。

学习者应该了解这些报表的基本内容和构成,以便能够正确理解和运用会计英语。

二、会计原则会计原则是指在会计工作中遵循的一些基本准则。

常见的会计原则包括matching principle(配比原则)、revenue recognition principle(收入确认原则)和historical cost principle(历史成本原则)。

了解和掌握这些原则的英文表达可以帮助学习者更好地理解和运用会计英语。

三、会计核算会计核算是会计工作中的重要环节之一。

在英语中,会计核算被称为accounting practices。

学习者需要了解并掌握一些会计核算的基本术语和概念,如debit(借方)、credit(贷方)、trial balance(试算平衡)等。

这些术语在会计工作中经常被使用,掌握它们的英文表达将有助于学习者更好地理解和运用会计英语。

四、会计制度每个国家都有自己的会计制度,在英语中,会计制度被称为accounting system。

了解不同会计制度的特点和差异可以帮助学习者更好地理解和应用会计英语。

例如,中国采用的会计制度是基于事实和凭证的,而国际上一些主力采用的是基于原则和概念的制度。

学习者需要通过学习相关的词汇和表达,来更好地理解各个国家的会计制度。

五、国际会计准则随着全球经济的日益紧密联系,国际会计准则的重要性日益凸显。

在英语中,国际会计准则被称为international accounting standards。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Unit 1Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。

Unit 2Each proprietorship, partnership, and corporation is a separate entity.每一独资企业、合伙企业和股份公司都是一个单独的主体。

In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements.在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。

即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。

如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。

Unit 3During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed.在每一会计年度内,要依次完成被称为会计循环的会计程序。

Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal .根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。

A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits.根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。

A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side.一个T 型账户有左方和右方,分别称做借方和贷方。

After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.当各项交易入账之后,便可计算账户余额(其借项合计数与贷项合计数之间的差额)The process of transferring amounts entered in the journal to the proper ledger amounts is called posting, the objective of which is to classify the effects of transactions on each individual asset , liability , owners’ equity , revenue , and expense account .将日记账记录的金额转入恰当的分类账户的过程叫做过账。

其目的在于把每笔交易对资产、负债、业主权益、收入和费用的个别账户的影响进行归类。

Unit 4The basic principle of double-entry bookkeeping is that every transaction has a twofold effect .复式记账的基本原理是每一项交易活动都有双重的结果。

The financial condition or position of a business enterprise is represented by the relationship of assets to liabilities and capital.一个企业的财务状况是由资产对负债和资本的关系来表示的。

By convention, asset and expense increases are recorded as debits while liability , capital and income increases are recorded as credits.根据惯例,资产和费用的增加被记为借项,而负债,资本和收入增加被记为贷项。

Unit 5The simplest form of the account is known as the T-account because it resembles the letter T. the accountant, as a matter of convenience, refers to the group of company account as the ledger.账户最简单的形式称为丁字账户,因为它类似大写字母T。

会计人员为了方便将公司账户集中作为分类账。

Unit 6The financial statements are the means of conveying to management and to interested outsiders a concise picture of the profitability and financial position of the business. These are three basic financial statements which are reported the financial position of a business: balance sheet, income statement, the statement of cash flows. Balance sheet and income statement are prepared at a particular data, customarily to prepare them at the end of each month .财务报表是向管理人员和有关外界人士传送企业盈利能力和财务状况的简明情况的工具。

报告一个企业财务状况的有三种基本财务报表:资产负债表,损益表和现金流量表。

资产负债表和损益表是在特定日期编制的,习惯上在每个月末编制。

Assets are economic resources which are owned by a business and are expected to benefit future operations.资产是一个企业所拥有的、并期望有益于未来经营的经营资源。

The owners’ equity in a business represents the resources the invested by the owner; it is equal to the total assets minus the liabilities. The equity of the owner is a residual claim because the claims of the creditors legally come first. If you are the owner of a business, you are entitled to whatever remains after the claims of the creditors are fully satisfied.企业中的业主权益代表业主投资的资源;它等于总资产减去负债。

因为债权人的求偿权在法律上优先,所以业主权益是一种剩余求偿权,如果你是企业的业主,在债权人的求偿权全部得到满足之后,剩下的都属于你。

Unit 7Income statement is a statement, sometimes called the profit and loss statement, reporting profitability or the operating result of a business for an accounting period (which can be one month, one quarter, one calendar year or one fiscal year as may be determined by the business concerned).收益表,有时也叫做收益损失表,是用来报告企业一定会计期间(可以是一个月、一季度、一自然年度或一财政年度,由企业自己决定)的盈利情况或经营成果的报表。