基础会计英文翻译

会计中英文对照

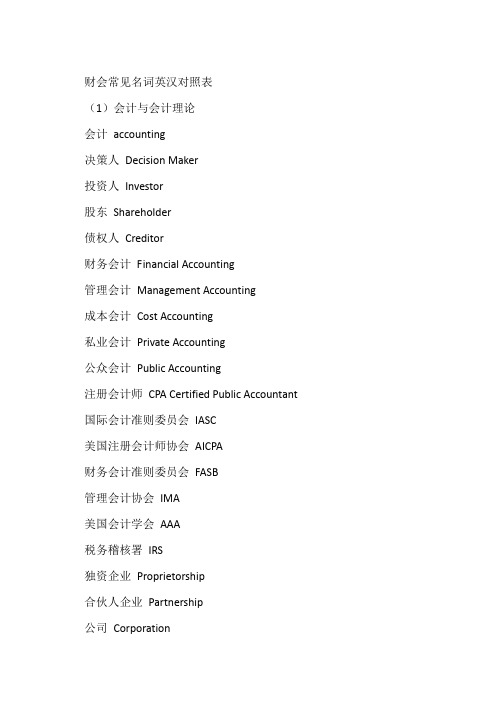

财会常见名词英汉对照表(1)会计与会计理论会计accounting决策人Decision Maker投资人Investor股东Shareholder债权人Creditor财务会计Financial Accounting管理会计Management Accounting成本会计Cost Accounting私业会计Private Accounting公众会计Public Accounting注册会计师CPA Certified Public Accountant 国际会计准则委员会IASC美国注册会计师协会AICPA财务会计准则委员会FASB管理会计协会IMA美国会计学会AAA税务稽核署IRS独资企业Proprietorship合伙人企业Partnership公司Corporation会计目标Accounting Objectives会计假设Accounting Assumptions会计要素Accounting Elements会计原则Accounting Principles会计实务过程Accounting Procedures财务报表Financial Statements财务分析Financial Analysis会计主体假设Separate-entity Assumption货币计量假设Unit-of-measure Assumption持续经营假设Continuity(Going-concern) Assumption 会计分期假设Time-period Assumption资产Asset负债Liability业主权益Owner's Equity收入Revenue费用Expense收益Income亏损Loss历史成本原则Cost Principle收入实现原则Revenue Principle配比原则Matching Principle全面披露原则Full-disclosure (Reporting) Principle明细分类帐Subsidiary Ledger试算平衡Trial Balance现金收款日记帐Cash receipt journal现金付款日记帐Cash disbursements journal 销售日记帐Sales Journal购货日记帐Purchase Journal普通日记帐General Journal工作底稿Worksheet调整分录Adjusting entries结帐Closing entries(3)现金与应收帐款现金Cash银行存款Cash in bank库存现金Cash in hand流动资产Current assets偿债基金Sinking fund定额备用金Imprest petty cash支票Check(cheque)银行对帐单Bank statement银行存款调节表Bank reconciliation statement 在途存款Outstanding deposit在途支票Outstanding check应付凭单Vouchers payable应收帐款Account receivable应收票据Note receivable起运点交货价F.O.B shipping point目的地交货价F.O.B destination point商业折扣Trade discount现金折扣Cash discount销售退回及折让Sales return and allowance 坏帐费用Bad debt expense备抵法Allowance method备抵坏帐Bad debt allowance损益表法Income statement approach资产负债表法Balance sheet approach帐龄分析法Aging analysis method直接冲销法Direct write-off method带息票据Interest bearing note不带息票据Non-interest bearing note出票人Maker受款人Payee本金Principal利息率Interest rate到期日Maturity date本票Promissory note贴现Discount背书Endorse拒付费Protest fee(4)存货存货Inventory商品存货Merchandise inventory产成品存货Finished goods inventory在产品存货Work in process inventory原材料存货Raw materials inventory起运地离岸价格F.O.B shipping point目的地抵岸价格F.O.B destination寄销Consignment寄销人Consignor承销人Consignee定期盘存Periodic inventory永续盘存Perpetual inventory购货Purchase购货折让和折扣Purchase allowance and discounts 存货盈余或短缺Inventory overages and shortages 分批认定法Specific identification加权平均法Weighted average先进先出法First-in, first-out or FIFO后进先出法Lost-in, first-out or LIFO移动平均法Moving average成本或市价孰低法Lower of cost or market or LCM 市价Market value重置成本Replacement cost可变现净值Net realizable value上限Upper limit下限Lower limit毛利法Gross margin method零售价格法Retail method成本率Cost ratio(5)长期投资长期投资Long-term investment长期股票投资Investment on stocks长期债券投资Investment on bonds成本法Cost method权益法Equity method合并法Consolidation method股利宣布日Declaration date股权登记日Date of record除息日Ex-dividend date付息日Payment date债券面值Face value, Par value债券折价Discount on bonds债券溢价Premium on bonds票面利率Contract interest rate, stated rate市场利率Market interest ratio, Effective rate普通股Common Stock优先股Preferred Stock现金股利Cash dividends股票股利Stock dividends清算股利Liquidating dividends到期日Maturity date到期值Maturity value直线摊销法Straight-Line method of amortization实际利息摊销法Effective-interest method of amortization (6)固定资产固定资产Plant assets or Fixed assets原值Original value预计使用年限Expected useful life预计残值Estimated residual value折旧费用Depreciation expense累计折旧Accumulated depreciation帐面价值Carrying value应提折旧成本Depreciation cost净值Net value在建工程Construction-in-process磨损Wear and tear过时Obsolescence直线法Straight-line method (SL)工作量法Units-of-production method (UOP)加速折旧法Accelerated depreciation method双倍余额递减法Double-declining balance method (DDB) 年数总和法Sum-of-the-years-digits method (SYD)以旧换新Trade in经营租赁Operating lease融资租赁Capital lease廉价购买权Bargain purchase option (BPO)资产负债表外筹资Off-balance-sheet financing最低租赁付款额Minimum lease payments(7)无形资产无形资产Intangible assets专利权Patents商标权Trademarks, Trade names著作权Copyrights特许权或专营权Franchises商誉Goodwill开办费Organization cost租赁权Leasehold摊销Amortization(8)流动负债负债Liability流动负债Current liability应付帐款Account payable应付票据Notes payable贴现票据Discount notes长期负债一年内到期部分Current maturities of long-term liabilities应付股利Dividends payable预收收益Prepayments by customers存入保证金Refundable deposits应付费用Accrual expense增值税value added tax营业税Business tax应付所得税Income tax payable应付奖金Bonuses payable产品质量担保负债Estimated liabilities under product warranties赠品和兑换券Premiums, coupons and trading stamps 或有事项Contingency或有负债Contingent或有损失Loss contingencies或有利得Gain contingencies永久性差异Permanent difference时间性差异Timing difference应付税款法Taxes payable method纳税影响会计法Tax effect accounting method递延所得税负债法Deferred income tax liability method (9)长期负债长期负债Long-term Liabilities应付公司债券Bonds payable有担保品的公司债券Secured Bonds抵押公司债券Mortgage Bonds保证公司债券Guaranteed Bonds信用公司债券Debenture Bonds一次还本公司债券Term Bonds分期还本公司债券Serial Bonds可转换公司债券Convertible Bonds可赎回公司债券Callable Bonds可要求公司债券Redeemable Bonds记名公司债券Registered Bonds无记名公司债券Coupon Bonds普通公司债券Ordinary Bonds收益公司债券Income Bonds名义利率,票面利率Nominal rate实际利率Actual rate有效利率Effective rate溢价Premium折价Discount面值Par value直线法Straight-line method实际利率法Effective interest method 到期直接偿付Repayment at maturity 提前偿付Repayment at advance偿债基金Sinking fund长期应付票据Long-term notes payable 抵押借款Mortgage loan(10)业主权益权益Equity业主权益Owner's equity股东权益Stockholder's equity投入资本Contributed capital缴入资本Paid-in capital股本Capital stock资本公积Capital surplus留存收益Retained earnings核定股本Authorized capital stock实收资本Issued capital stock发行在外股本Outstanding capital stock库藏股Treasury stock普通股Common stock优先股Preferred stock累积优先股Cumulative preferred stock非累积优先股Noncumulative preferred stock完全参加优先股Fully participating preferred stock部分参加优先股Partially participating preferred stock非部分参加优先股Nonpartially participating preferred stock 现金发行Issuance for cash非现金发行Issuance for noncash consideration股票的合并发行Lump-sum sales of stock发行成本Issuance cost成本法Cost method面值法Par value method捐赠资本Donated capital盈余分配Distribution of earnings股利Dividend股利政策Dividend policy宣布日Date of declaration股权登记日Date of record除息日Ex-dividend date股利支付日Date of payment现金股利Cash dividend股票股利Stock dividend拨款appropriation(11)财务报表财务报表Financial Statement资产负债表Balance Sheet收益表Income Statement帐户式Account Form报告式Report Form编制(报表)Prepare工作底稿Worksheet多步式Multi-step单步式Single-step(12)财务状况变动表财务状况变动表中的现金基础SCFP.Cash Basis(现金流量表)财务状况变动表中的营运资金基础SCFP.Working Capital Basis (资金来源与运用表)营运资金Working Capital全部资源概念All-resources concept直接交换业务Direct exchanges正常营业活动Normal operating activities财务活动Financing activities投资活动Investing activities(13)财务报表分析财务报表分析Analysis of financial statements比较财务报表Comparative financial statements趋势百分比Trend percentage比率Ratios普通股每股收益Earnings per share of common stock股利收益率Dividend yield ratio价益比Price-earnings ratio普通股每股帐面价值Book value per share of common stock 资本报酬率Return on investment总资产报酬率Return on total asset债券收益率Yield rate on bonds已获利息倍数Number of times interest earned债券比率Debt ratio优先股收益率Yield rate on preferred stock营运资本Working Capital周转Turnover存货周转率Inventory turnover应收帐款周转率Accounts receivable turnover 流动比率Current ratio速动比率Quick ratio酸性试验比率Acid test ratio(14)合并财务报表合并财务报表Consolidated financial statements 吸收合并Merger创立合并Consolidation控股公司Parent company附属公司Subsidiary company少数股权Minority interest权益联营合并Pooling of interest购买合并Combination by purchase权益法Equity method成本法Cost method(15)物价变动中的会计计量物价变动之会计Price-level changes accounting一般物价水平会计General price-level accounting货币购买力会计Purchasing-power accounting统一币值会计Constant dollar accounting历史成本Historical cost现行价值会计Current value accounting现行成本Current cost重置成本Replacement cost物价指数Price-level index国民生产总值物价指数Gross national product implicit price deflator (or GNP deflator)消费物价指数Consumer price index (or CPI)批发物价指数Wholesale price index货币性资产Monetary assets货币性负债Monetary liabilities货币购买力损益Purchasing-power gains or losses资产持有损益Holding gains or losses未实现的资产持有损益Unrealized holding gains or losses 现行价值与统一币值会计Constant dollar and current cost accountingoracle的应用软件版本11提供了45个集成的软件模块。

《基础会计学》教学大纲-中译英翻译样本

《基础会计学》教学⼤纲-中译英翻译样本《基础会计学》教学⼤纲学时:54 学分:3⼀、课程性质本课程是⾯向南京农业⼤学经济、管理类专业本科⽣开设的⼀门专业必修课。

课程编号:1622课程名称:基础会计学英⽂名称:Fundamental Accounting⾯向专业:会计、农经、电⼦、⾦融、营销、⼈⼒、国贸主要内容:本课程主要介绍会计的⽬标、职能、对象、基本假设、⼀般原则、会计确认与计量等会计学基本理论;会计科⽬、会计账户、会计凭证、会计账簿、会计报告等会计基本知识;设置会计科⽬和账户、填制和审核会计凭证、登记会计账簿、编制会计报告等会计基本⽅法。

⼆、教学⽬的和要求通过本课程教学,使学⽣掌握会计学的基本理论、基本知识和基本⽅法,为进⼀步学习财务会计课程及相关学科打下坚实的基础。

具体要求是:(⼀)了解会计的产⽣和发展的历史、会计学的主要内容,了解会计的⽬标、职能和对象;(⼆)理解会计基本假设、掌握会计⼀般原则,掌握会计确认和计量的基本知识;(三)掌握会计核算的基本⽅法,对企业发⽣的基本经济业务能够进⾏正确的会计处理;(四)了解会计⼯作组织与管理的基础知识。

三、理论教学内容和学时安排第⼀章总论(6课时)第⼀节会计与会计学⼀、会计的定义⼆、会计的产⽣和发展三、会计学的主要内容第⼆节会计的⽬标和职能⼀、会计的⽬标⼆、会计的职能第三节会计的对象和⽅法⼀、会计的对象⼆、会计的⽅法第四节会计的基本假设和⼀般原则⼀、会计基本假设⼆、会计⼀般原则第⼆章会计确认和计量(3课时)第⼀节会计确认⼀、初次确认和再次确认⼆、会计确认的标准三、会计要素的确认第⼆节会计计量⼀、会计计量与会计确认⼆、会计计量单位三、会计计量基础第三章会计科⽬和账户(3课时)第⼀节会计科⽬⼀、会计科⽬的概念⼆、会计科⽬的设置原则三、会计科⽬的分类第⼆节会计账户⼀、会计账户的概念和分类⼆、账户的基本结构第四章借贷复式记账(6课时)第⼀节借贷记账法的理论基础⼀、单式记账和复式记账⼆、会计基本等式第⼆节借贷记账法的基本内容⼀、记账符号⼆、账户类别及其结构三、记账规则四、试算平衡第五章会计凭证(3课时)第⼀节会计凭证概述⼀、会计凭证的概念和种类⼆、会计凭证的作⽤第⼆节原始凭证⼀、原始凭证的基本内容⼆、原始凭证的填制要求三、原始凭证的审核内容第三节记账凭证⼀、记账凭证的基本内容⼆、记账凭证的填制要求和⽅法三、记账凭证的审核内容第六章会计账簿(4课时)第⼀节会计账簿概述⼀、会计账簿的概念和意义⼆、会计账簿的种类第⼆节会计账簿的格式和登记⽅法⼀、⽇记账⼆、总分类账三、明细分类账四、总分类账户和明细分类账户的平⾏登记第三节记账的规则⼀、账簿启⽤规则⼆、账簿登记规则三、错账更正⽅法第四节对账与结账⼀、对账⼆、结账第七章企业基本经济业务的核算(15课时)第⼀节资⾦筹措业务的核算⼀、账户设置⼆、核算举例第⼆节采购业务的核算⼀、账户设置⼆、核算举例第三节⽣产业务的核算⼀、账户设置⼆、核算举例第四节销售业务的核算⼀、账户设置⼆、核算举例第五节利润及其分配的核算⼀、账户设置⼆、核算举例第⼋章财产清查(3课时)第⼀节财产清查概述⼀、财产清查的意义和种类⼆、财产物资的盘存制度第⼆节财产清查的⽅法⼀、实物财产的清查⼆、货币资⾦的清查三、往来款项的清查第三节财产清查的会计处理⼀、账户设置⼆、核算举例第九章财务报告(8课时)第⼀节财务报告概述⼀、财务报告的概念和意义⼆、财务报告的种类三、财务报告的编制要求第⼆节资产负债表⼀、资产负债表的作⽤⼆、资产负债表的结构和内容三、资产负债表的编制⽅法第三节第三节利润表⼀、利润表的作⽤⼆、利润表的结构和内容三、利润表的编制⽅法四、利润分配表第四节第四节现⾦流量表⼀、现⾦流量表的作⽤⼆、现⾦流量表的结构和内容三、现⾦流量表的编制⽅法第五节第五节财务报告分析⼀、偿债能⼒分析⼆、营运能⼒分析三、获利能⼒分析第⼗章会计⼯作组织与管理(3课时)第⼀节会计⼯作组织的意义和原则⼀、会计⼯作组织的意义⼆、会计⼯作组织的原则第⼆节会计机构与会计⼈员⼀、会计机构⼆、会计⼈员第⼀节第⼀节会计法规⼀、会计法规体系⼆、会计法三、会计准则四、会计制度第四节会计档案管理⼀、会计档案的意义⼆、会计档案的⽴卷与归档三、会计档案的保管和调阅四、会计档案的销毁第五节会计电算化⼀、会计电算化概述⼆、会计电算化的特点译⽂:TeachingProgram on Fundamental AccountingCredit Hours: 54 Credits: 3I.Nature of the CourseThe course is a major required course for the undergraduatesin economic and management departments of Nanjing Agricultural University.Course No. 1622Course Name: Fundamental AccountingCourse Name in English: Fundamental AccountingOriented Majors: accounting, agriculturaleconomy, electronics, finance, marketing, human resources and internationaltrade Main Contents: the course mainly introduces the accounting objectives,functions, objects, fundamental assumptions, general principles, accountingconfirmation and measurement and other fundamental accounting theories;accounting subjects, accounts, documents, books, reports and other fundamentalaccounting knowledge; establishing accounting subjects and accounts, fillingout and verifying accounting documents, recording accounting books, preparingaccounting reports and other fundamental accounting methods.II.Teaching Goal and RequirementsThe course aims to allow the students to master fundamental accountingtheories, knowledge and methods, laying solid foundation for further learning financialaccounting and relevant courses, with specific requirements as follows:(I) Learn the creating and developing historyof accounting, the main contents of accounting and the objectives, functionsand objects of accounting;(II) Understand the fundamental assumptions ofaccounting, and master the general principles of accounting and the fundamentalknowledge on accounting confirmation and measurement;(III) Master the fundamental methods of accountingverification, capable of making correct accounting treatment for thefundamental economic business in enterprises.(IV) Understand the fundamental knowledge on theorganization and management of accounting works.III.Arrangement of Contents and Credit Hours of Theoretical Teaching Chapter I GeneralInstruction (6 credit hours)Section 1 Accounting and AccountancyI. Definition ofAccountingII. Creation andDevelopment of AccountingIII. Main Contentsof AccountancySection 2 Objectives and Functions of AccountingI. Objectives ofAccountingII. Functions ofAccountingSection 3 Objects and Methods of AccountingI. Objects ofAccountingII. Methods ofAccountingSection 4 Fundamental Assumptions and GeneralPrinciples of AccountingI. FundamentalAssumptions of AccountingII. GeneralPrinciples of AccountingChapter II Accounting Confirmationand Measurement (3 credit hours) Section 1 Accounting ConfirmationI. Initial Confirmationand Secondary ReconfirmationII. Standards forAccounting ConfirmationIII. Confirmationof Accounting ElementsSection 2 Accounting MeasurementI. AccountingMeasurement and Accounting ConfirmationII. Units ofAccounting MeasurementIII. Basis forAccounting MeasurementChapter III AccountingSubjects and Accounts (3 credit hours)Section 1 Accounting SubjectsI. Concept ofAccounting SubjectsII. EstablishingPrinciples of Accounting SubjectsIII. Classificationof Accounting SubjectsSection 2 Accounting AccountsI. Concept andClassification of Accounting AccountsII. FundamentalStructure of AccountsChapter IV Debit-CreditDouble Entry Bookkeeping (6 credit hours)Section 1 Fundamental Theory of Debit-CreditBookkeepingI. Single EntryBookkeeping and Double Entry BookkeepingII. FundamentalAccounting EquationsSection 2 Basic Contents of Debit-Credit BookkeepingI. BookkeepingSymbolsII. Types andStructures of AccountsIII. Bookkeeping RulesIV. Trial BalanceChapter V AccountingDocuments (3 credit hours)Section 1 Overview of Accounting DocumentsI. Concept and Types of Accounting DocumentsII. Functions of Accounting DocumentsSection 2 Original DocumentsI. Basic Contents of Original DocumentsII. Filling-out Requirements of Original DocumentsIII. Verification Contents of Original DocumentsSection III Bookkeeping VouchersI. Basic Contents of Bookkeeping VouchersII. Filling-out Requirements and Methods ofBookkeeping VouchersIII. Verification Contents of Bookkeeping VouchersChapter VI Accounting Books(4 credit hours)Section 1 Overview of Accounting BooksI. Concept and Meaning of Accounting BooksII. Types of Accounting BooksSection 2 Formats and Recording Methods of AccountingBooksI. JournalII. General LedgerIII. Detailed LedgerIV.Parallel Recording of General Ledger Account and Detailed Ledger AccountSection 3Bookkeeping RulesI. Book Opening RulesII. Book Recording RulesIII. Correction Methods of Accounting ErrorsSection 4 Reconciliation and SettlementI. ReconciliationII. SettlementChapter VII Checking ofBasic Economic Business in Enterprises (15 credit hours) Section 1 Checking of Funding BusinessI. Account SetupII. Examples of CheckingSection 2 Checking of Procurement BusinessI. Account SetupII. Examples of CheckingSection 3 Checking of Production BusinessI. Account SetupII. Examples of CheckingSection 4 Checking of Sales BusinessI. Account SetupII. Examples of CheckingSection 5 Checking of Profit and DistributionI. Account SetupII. Examples of CheckingChapter VIII PropertyInspection (3 credit hours)Section 1 Overview of Property InspectionI. Meaning and Types of Property InspectionII. Property Inventory SystemSection 2 Methods of Property InspectionI. Inspection of Physical PropertyII. Inspection of Monetary FundsIII. Inspection of Current AccountsSection 3 Accounting Treatment of Property InspectionI. Account SetupII. Examples of CheckingChapter IX Financial Report(8 credit hours)Section 1 Overview of Financial ReportI. Concept and Meaning of Financial ReportII. Types of Financial ReportIII. Preparation Requirements of Financial ReportSection 2 Balance SheetI. Functions of Balance SheetII. Structure and Content of Balance SheetIII. Preparation Methods of Balance SheetSection 3 Profit StatementI. Functions of Profit StatementII. Structure and Content of Profit StatementIII. Preparation Methods of Profit StatementIV. Statement of Profit DistributionSection 4 Cash Flow StatementI. Functions of Cash Flow StatementII. Structure and Content of Cash Flow StatementIII. Preparation Methods of Cash Flow StatementSection 5 Analysis on Financial ReportI. Analysis on Debt Paying AbilityII. Analysis on Operating AbilityIII. Analysis on ProfitabilityChapter X Organization andManagement of Accounting Works (3 credit hours) Section 1 Meaningand Principles of Accounting OrganizationsI. Meaning of Accounting OrganizationsII. Principles of Accounting OrganizationsSection 2Accounting Organ and PersonnelI. Accounting OrganII. Accounting PersonnelSection 3 Accounting Laws and RegulationsI. System ofAccounting Laws and RegulationsII. Accounting LawIII. Accounting RulesIV. Accounting SystemSection 4 Management of Accounting ArchivesI. Meaning of Accounting ArchivesII. Establishing and Filing of Accounting ArchivesIII. Keeping and Retrieval of Accounting ArchivesIV. Destruction of Accounting ArchivesSection 5Accounting by EDP (Electronic Data Processing) I. Overview of Accounting byEDPII. Characteristics ofAccounting by EDP。

会计基础(Basic Accountancy)

会计基础是在编制财务报表时,特别是为了确定收入和费用所归属的会计期间、确定资产负债表项目的金额,为运用适合于有关交易和项目的重大概念而提供的方法。

学科关系

会计学与数学关系密切。各种会计方法和技术都离不开数学。会计学与统计的关系,都对社会经济活动进行数量化描述。

会计学按其研究内容,主要有基础会计、财务会计、财务管理、成本会计、管理会计和审计学等重要分支。

基础会计阐明会计的基础知识债和所有者权益的基本理论和方法;财务管理研究资金的筹措、管理、有效利用的理论和方法。

会计基础提供财务报告。财务报告对于经理,监管者,股东,员工等利益相关者是有用的。会计的核心是复式记帐,这种复式记帐法要求每一项业务至少要有两个经济实体,在一个帐户计借方,在另一个帐户相应的计贷方,所有的借方发生额应该等于所有贷方的发生额,即有借必有贷,借贷必相等。如果借贷不等,那么一定有错误,这样复式记帐自身就提供了一种简单的检验错误的方法。

1.收付实现制。

收付实现制,又称现金制,是指企业单位对各项收入和费用的认定是以款项(包括现金和银行存款)的实际收付作为标准。凡属本期实际收到款项的收入和支付款项的费用,不管其是否应归属于本期,都应作为本期的收入和费用入账;反之,凡本期未实际收到的款项收入和未付出款项的支出,即使应归属于本期,也不应作为本期的收入和费用入账。采用这种会计处理制度,本期的收入和费用缺乏合理的配比,所计算的财务成果也不够正确,因此企业单位不宜采用收付实现制但经营活动采用权责发生制,主要适用于行政事业单位。

会计专业基础英语

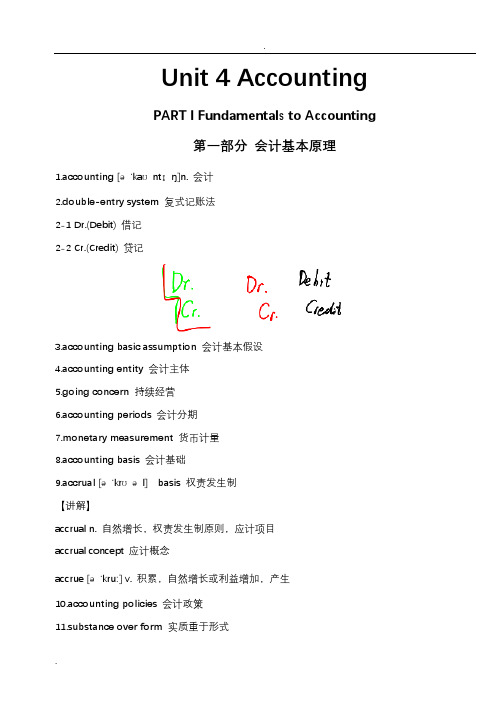

Unit 4 AccountingPART I Fundamentals to Accounting第一部分会计基本原理1.accounting [ə'kaʊntɪŋ]n. 会计2.double-entry system复式记账法2-1 Dr.(Debit) 借记2-2 Cr.(Credit) 贷记3.accounting basic assumption会计基本假设4.accounting entity会计主体5.going concern持续经营6.accounting periods会计分期7.monetary measurement货币计量8.accounting basis会计基础9.accrual [ə'krʊəl] basis权责发生制【讲解】accrual n. 自然增长,权责发生制原则,应计项目accrual concept 应计概念accrue [ə'kruː] v. 积累,自然增长或利益增加,产生10.accounting policies会计政策11.substance over form实质重于形式12.accounting elements会计要素13.recognition [rekəg'nɪʃ(ə)n] n. 确认13-1 initial recognition [rekəg'nɪʃ(ə)n] 初始确认【讲解】recognize ['rɛkəg'naɪz] v. 确认14.measurement ['meʒəm(ə)nt] n. 计量14-1 subsequent ['sʌbsɪkw(ə)nt] measurement 后续计量15.asset ['æset] n. 资产16.liability [laɪə'bɪlɪtɪ] n. 负债17.owners’ equity所有者权益18.shareholder’s equity股东权益19.expense [ɪk'spens; ek-] n. 费用20.profit ['prɒfɪt] n. 利润21.residual [rɪ'zɪdjʊəl] equity剩余权益22.residual claim剩余索取权23.capital ['kæpɪt(ə)l] n. 资本24.gains [ɡeinz] n. 利得25.loss [lɒs] n. 损失26.Retained earnings留存收益27.Share premium股本溢价28.historical cost历史成本【讲解】historical [hɪ'stɒrɪk(ə)l] adj. 历史的,历史上的historic [hɪ'stɒrɪk] adj. 有历史意义的,历史上著名的28-1 replacement [rɪ'pleɪsm(ə)nt] cost 重置成本29.Balance Sheet/Statement of Financial Position资产负债表29-1 Income Statement 利润表29-2 Cash Flow Statement 现金流量表29-3 Statement of changes in owners’equity (or shareholders’equity) 所有者权益(股东权益)变动表29-4 notes [nəʊts] n. 附注PART II Financial Assets*第二部分金融资产*30.financial assets金融资产e.g. A financial instrument is any contract that gives rise to a financial asset of one enterprise and a financial liability or equity instrument of another enterprise. 【讲解】give rise to 引起,导致31.cash on hand 库存现金32.bank deposits [dɪ'pɒzɪt] 银行存款33.A/R, account receivable应收账款34.notes receivable应收票据35.others receivable其他应收款项36.equity investment股权投资37.bond investment债券投资38.derivative financial instrument衍生金融工具39.active market活跃市场40.quotation [kwə(ʊ)'teɪʃ(ə)n]n. 报价41.financial assets at fair value through profit or loss以公允价值计量且其变动计入当期损益的金融资产41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产41-2 financial assets held for trading 交易性金融资产42.financial liability金融负债43.transaction costs交易费用43-1 incremental external cost 新增的外部费用【讲解】incremental [ɪnkrə'məntl] adj. 增量的,增值的44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利投资收益45.profit and loss arising from fair value changes公允价值变动损益46.Held-to-maturity investments持有至到期投资47.amortized cost摊余成本【讲解】amortized [ə'mɔ:taizd]adj. 分期偿还的,已摊销的48.effective interest rate实际利率49.loan [ləʊn] n. 贷款50.receivables [ri'si:vəblz] n. 应收账款51.available-for-sale financial assets可供出售金融资产52.impairment of financial assets金融资产减值52-1 impairment loss of financial assets 金融资产减值损失53.transfer of financial assets金融资产转移53-1 transfer of the financial asset in its entirety 金融资产整体转移53-2 transfer of a part of the financial asset 金融资产部分转移54.derecognition [diː'rekəg'nɪʃən] n. 终止确认,撤销承认54-1 derecognize [diː'rekəgnaɪz] v. 撤销承认e.g. An enterprise shall derecognize a financial liability (or part of it) only when the underlying present obligation (or part of it) is discharged/cancelled.【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

基础会计(英文版)(第二版)Supplement3 Applications of Present Value

Accounting Applications of the Present Value Concept

Estimating the Value of Goodwill

Good will is an intangible asset of a business. It may be defined as the present value of expected future earnings in excess of the normal return on net identifiable assets. One method of estimating goodwill is to estimate the annual amounts by which earnings are expected to exceed a normal return and then to discount these amounts to their present value.

The Concept of Present Value

Set the future value as 1 yuan. The present value of 1 yuan is : p = 1/ (1+ i )n

Table of present values

The Concept of Present Value

66 634

28 599 95 233

Accounting Applications of the Present Value Concept

Capital Lease

A capital lease is regarded as a sale of the leased asset by the lessor to the lessee.

会计英语怎么说

会计英语怎么说会计是以货币为主要计量单位,以凭证为主要依据,借助于专门的技术方法,对一定单位的资金运动进行全面、综合、连续、系统的核算与监督,向有关方面提供会计信息、参与经营管理、旨在提高经济效益的一种经济管理活动。

那么,你知道会计的英语怎么说吗?会计的英文释义:accountingaccountanttreasureraccounting and satisicsbursaraccount会计的英文例句:那个会计向营业部的职员介绍了自己的工作情况。

The accountant described his work to the sales staff.雇会计划得来。

It would pay (you) to use an accountant.他已由仓库调到会计室任职。

He has transferredfrom the warehouse to the accounts office.会计拐走了俱乐部的资金。

The treasurer has run off with the club's funds.会计科已完全计算机化了。

The accounts section has been completely computerized.我们的经理精通会计制度。

Our manager is conversant with account system.通过分析虚假会计报告的成因,提出了治理会计报告中虚假会计信息的对策。

The ctmse of the mendacious financial report is analyzed in this paper.会计信息资源是通过会计核算建造的人造资源;It is manmade resources by the wag of accounting.会计学就是一部会计伦理学。

Accounting science is accounting ethics.会计及时卡住了这笔不必要的开支。

基础会计学英文版参考资料

Cash Basis

Revenues are recognized when earned and expenses are recognized when incurred.

Revenues are recognized when cash is received and expenses are recorded when cash is paid.

4/8/2020

11

3 - 12

P1

Prepaid (Deferred) Expenses

Resources paid for prior to

receiving the actual benefits.

Here is the check for my 24-month insurance policy.

Summary of Expenses

Rent Gasoline Advertising Salaries Utilities and . . . .

$1,000 500

2,000 3,000

450 ....

Now that we have recognized the revenue, let's see what expenses

artificial time periods

Revenue-Recognition Principle

Revenue recognized in the accounting period in

which it is earned

Matching Principle

Expenses matched with revenues in the same period when efforts are

会计英语词汇英文解释

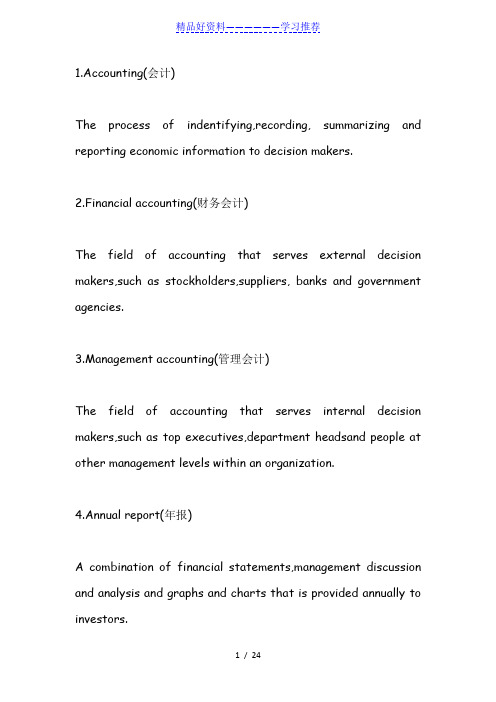

1.Accounting(会计)The process of indentifying,recording, summarizing and reporting economic information to decision makers.2.Financial accounting(财务会计)The field of accounting that serves external decision makers,such as stockholders,suppliers, banks and government agencies.3.Management accounting(管理会计)The field of accounting that serves internal decision makers,such as top executives,department headsand people at other management levels within an organization.4.Annual report(年报)A combination of financial statements,management discussion and analysis and graphs and charts that is provided annually to investors.5.Balance sheet (statement of financial position,statement of financial condition)(资产负债表)A financial statement that shows the financial status of a business entity at a particular instant in time.6.Balance sheet equation(资产负债方程式)Assets = Liabilities + Owners' equity.7.Assets(资产)Economic resources that are expected to help generate future cash inflows or help reduce future cash outflows.8.Liabilities (负债)Economic obligations of the organization to outsiders ,or claims against its assets by outsiders.9.Owners’ equity (所有者权益)The residual interest in the organization’s assets after deducting liabilities.10.Notes payable (应付票据)Promissory notes that are evidence of a debt and state the terms of payment.11.Entity (实体)An organization or a section of an organization that stands apart from other organization and individuals as a separate economics unit.12.Transaction (交易)Any event that both affects the financial position of an entity and be reliably recorded in money terms.13.Inventory (存货)Goods held by a company for the purpose of sale to customers.14.Account (帐户)A summary record of the changes in a particular assets,liability,or owne r’ equity.15.Account payable (应付帐款)A liability that results from a purchase of goods or services on account.17.Creditor (债权人)A person or entity to whom money is owed.18.Debtor (债务人)A person or entity that owes money to another.19.Sole proprietorship (个体经营、独资经营)A separate organization with a single owner.20.Partnership (合伙)A form of organization that joins two or more individuals together as co-owners(共有人).21.Corporation (公司)A business organization that is created by individual state laws.22.Limited liability (有限责任)A feature of the corporate form of organization whereby corporate creditors ordinarily have claims against the corporate assets only.23.Publicly owned (公有)A corporation in which shares in the ownership are sold to thepublic.24.Privately owned (私有)A corporation owned by a family,a small group of shareholders,or a single individual,in which shares of ownership are not publicly sold.25.Stockholders’ equity (shareholders’ equity) (股东权益)Own ers’ equity of a corporation.The excess of assets over liabilities of a corporation.26.Paid-in capital(实际投入资本)The total capital investment in a corporation by its owners both at and subsequent to the inception of business.27.Par value(票面值)The nominal dollar amount printed on stock certificates.29.Auditor (审计师)A person who examines the information used by managers to prepare the financial statements and attests to the credibility of those statements.31.Audit (审计)An examination of transactions and financial statement made in accordance with generally accepted auditing standards.33. Fiscal year (会计、财政年度)The year established for accounting purposes.34.Interim periods (中期)The time spans established for accounting purposes that are less than a year.35.Revenues(sales) (收入OR商品销售收入)Increases in owners’ equity arising from increases in assets received in exchange for the delivery of goods or services to customers.36.Expenses (费用)Decreases in owners’ equity that arise because goods or services are delivered to customers.37.Income (profit ,earnings) (收益、利润)The excess of revenues over expenses.39.Accrual basis (应计制、权责发生制)Accounting method that recognizes the impact of transactions on the financial statements in the time periods when revenues and expenses occur.40.Cash basis (收付实现制)Accounting method that recognizes the impact of transactions on the financial statements only when cash is received or disbursed.43.Cost of goods sold (cost of sales) (销售成本)The original acquisition cost of the inventory that was sold to customers during the reporting period.44.Matching (配比)The recording of expenses in the same time period as the related revenues are recognized.47.Depreciation (折旧)The systematic allocation of the acquisition cost of long-lived of fixed assets to the expenses accounts of particular periods that benefit from the use of the assets. income (净利润)The remainder after all expenses has been deducted from revenues.49.Income statement (statement of earnings, operating statement) (收益表)A report of all revenues and expenses pertaining to a specific time period.50.Statement of cash flows (cash flow statement) (现金流量表)A required statement that reports the cash receipts and cash payments of an entity during a particular period. loss (净损失)The difference between revenues and expenses when expenses exceed revenues.52.Cash dividends (现金股利)Distribution of cash to stockholders that reduce retained income.53.Statement of retained income (利润分配表)A statement that lists the beginning balance in retained income, followed by a description of any changes that occurred during the period, and the ending balance.54.Statement of income and retained income (收入及利润分配表)A statement that included a statement of retained income at the bottom of an income statement.55.Earnings per share (EPS) (每股收益)Net income divided by average number of common shares outstanding.56.Price-earnings ratio (P-E) (市盈率)Market price per share of common stock divided by earnings per share of common stock.57.Dividend-yield ratio (股息率)Common dividends per share dividend by market price per share.58.Dividend-payout ratio (派息率)Common dividends per share dividend by earnings per share.59.Double-entry system (复试记账法)The method usually followed for recording transactions, whereby at least two accounts are always affected by each transaction.60.Ledger (分类账)The records for a group of related accounts kept current in asystematic manner.61.General ledger (总分类账)The collection of accounts that accumulates the amounts reported in the major financial statements.62.T-account (T形账户)Simplified version of ledger accounts that takes the form of the capital letter T.63.Balance (余额)The difference between the total left-side and right-side amounts in an account at any particular time.64.Debit (借方)An entry or balance on the left side of an account.65.Credit (贷方)An entry or balance on the right side of an account.66.Charge (Debit)A word often used instead of debit.67.Source documents (原始凭证)The supporting original records of any transactions.68.Book of original entry (原始分录帐本)A formal chronological record of how the entity’s transactions affect the balances in pertinent accounts.69.General journal (普通日记账)The most common example of a book of original entry; a complete chronological record of transactions.70.Trial balance (试算表)A list of all accounts in the general ledger with their balance.71.Journalizing (记入分类帐)The process of entering transactions into the journal.72.Journal entry (日记帐分录)An analysis of the affects of a transaction on the accounts, usually accompanied by an explanation.81.Accumulated depreciation (allowance for depreciation) (累计折旧)The cumulative sum of all depreciation recognized since the date of acquisition of the particular assets described.82.Data processing 数据处理The totality to the procedures used to record, analyze store, and report on chosen activities.83.Explicit transactions (显性交易)Events such as cash receipts and disbursements, credit purchases, and credit sales that trigger nearly all day-to-day routine entries.84.Implicit transactions (非显性交易)Events (such as the passage of time) that do not generate source documents or visible evidence of the event and are not recognized in the accounting records until the end of an accounting period.85.Adjustments (adjusting entries) (调帐)End-of-period entries that assign the financial effects of implicit transactions to the appropriate time periods.86.Accrue (应计)To accumulate a receivable or payable during a given period eventhough no explicit transactions occurs.87.Unearned revenue (revenue received in advance, deferred revenue, deferred credit) (未实现收入)Revenue received and recorded before it is earned.88.Pretax income (税前利润)Income before income taxes.89.Classified balance sheet (分类资产负债表)A balance sheet that groups the accounts into subcategories to help readers quickly gain a perspective on the company’s financial position.90.Current assets (流动资产)Cash plus assets that are expected to be converted to cash or sold or consumed during the next 12 months or within the normal operating cycle if longer that a year.91.Current liabilities (流动负债)Liabilities that fall due within the coming year or within the normal operating cycle if longer than a year.92.Working capital (营运资金、资本)The excess of current assets over current liabilities.93.Solvency (偿付能力)An entity’s ability to meet its immediate financial obligations as they become due.94.Current ratio (working capital ratio) (流动比率)Current assets divided by current liabilities.Current ratio = Current assets / Current liabilities.95.Report format (报表格式之一)A classified balance sheet with the assets at the top. Example:Balance Sheet, January 31,20X2Assets 1999 1998Current assetsCashAccounts receivable……Total current assetsLong-term assetsStore equipmentAccumulated depreciationTotal assetsLiabilities and Owners’ Equity 1999 1998 Current liabilitiesNote payableAccounts payable…Total current liabilities Stockholder’s equityPaid-in capitalRetained incomeTotal liabilities and owners’ equity96.Account format (报表格式之二)A classified balance sheet with the assets at the left. Example:Balance Sheet, January 31,20X2Assets Liabilities and Owners’ EquityCurrent assets Current liabilitiesCash Note payableAccounts receivable Accounts payable… …Total current assets Total current liabilitiesLong-term assets Stockholder’s equityStore equipment Paid-in capitalAccumulated depreciation Retained incomeTotal Total97.Single-step income statement (单一步骤收入表)An income statement that groups all revenues together and then lists and deducts all expenses together without drawing any intermediate subtotals.98.Multiple-step income statement (复合步骤收入表)An income statement that contains one or more subtotals that highlight significant relationships.99.Gross profit (gross margin) (毛利)The excess of sales revenue over the cost of the inventory that was sold.100.Operating income (operating profit) (营业收入)Gross profit less all operating expenses.101.Profitability (收益能力)The ability of a company to provide investors with a particular rate of return on their investment.102.Gross profit percentage (gross margin percentage) (毛利率)Gross profit divided by sales.Gross profit percentage=Gross profit / Sales103.Return on sales ratio (销售收益率)Net income divided by sales,104.Return on stockholders’ equity ratio (股东权益收益率)Net income divided by invested capital (measured by average stockholder’s equity)。

基础会计英文翻译

基础会计学 Fundamental Accounting课程概述:“基础会计学”是财务管理专业和经济学专业的专业课程,学习好该课程可为学生学习后续课程及相关其他专业课程奠定良好基础。

该课程主要对基础会计学的基础知识作了介绍,具体内容包括借贷复式记账法与会计业务循环、企业基本经济业务的核算、制造业企业主要经济业务的核算、账务处理程序、会计核算组织与规范等。

Brief Introduction:The courseFundamental Accounting is a major required course for the undergraduates majoring in financial management and economic,mastering this course can help the students lay the solidfoundation oflearning the latter courses and other relevant major subjects.The course mainly introduces the basic accountingknowledge of the fundamental accounting, which includes debit-credit double entry bookkeeping, accounting cycle,checking of basic economic business inenterprises,checking of main economic business inmanufacturing,账务处理程序、会计核算组织与规范这两个是在不会。

课程目标:1.掌握会计核算的基本理论,基本方法2.掌握会计核算的组织程序,会计核算的载体。

3.掌握借贷复式记账法的原理和方法4.掌握会计凭证1.Master the fundamental methods and theories of accountingverification.2.Master the procedure and the of accounting3.Master the theories and methods of debit-credit double entry bookkeeping.4.Master accounting documents.参考教材:任永平《基础会计学》立信会计出版社,2010年3月出版Reference Book:RenYongping,Ed. Mar. 2010, FundamentalAccounting,Lixin Accounting Publishing Press.。

基础会计(英文版)(第二版)Chapter10 Accounts for Partnership and Distribution of Net Income

Income Summary Guangli, Capital Guanghai, Capital

800 000 440 000 360 000

To close the income summary account by crediting each partner with agreed ratio upon salary allowance and dividing the remaining profits equally

Partnership Accounting

Additional Investments

After three months of operation, the firm was in need of cash for future operation. The two partners of the firm decided to increase their respective investments to 1 000 000 yuan. Cash Gunagli, Captial Guanghai, Capital To record additional investment 330 000 280for Partnership and Distribution of Net Income

Accounts for Partnership

Partnership: a convenient, inexpensive means of combining the capital and the special abilities of two or two partners. Joint venture: the sharing of an operation’s cost, risk, and management with a partner pr partners from overseas.

基础会计(英文版)(第二版)Supplement3 Applications of Present

Year Expected net Present value of = Present value of

cash flow

1 yuan discounted net cash flows

at 10%

1

100 yuan

.909

90.9 yuan

2

100

.826

82.6

3

100

.751

75.1

Total present value of the investment:

Interest revenue (10 621 500 1%)

106 215

Reduction in lease payments receivable

393 785

Accounting Applications of the Present Value Concept

Capital Lease

Accounting Applications of the Present Value Concept

Market Price of Bonds

Present value of future principal payments:

100 000 yuan due after 6 semiannual periods, discounted at 7% per period: 100 000 .66634 (from table of present values)

Capital Lease

Accounting by the lessor (Nanji Co.) :

Leased Payment Receivable (net)

10 621 500

基础会计英

Basic AccountingCode of the course:62103001Name of the course:Basic AccountingCredits:3 The semesters for the course:The second and third semesters The students the course intended for:Undergraduates with the major of Business Administration class, undergraduates with the major of Economics Class.Prevocational curriculum:Political EconomicsThe director of the course: Sun Sumei, Associate Professor, MasterIntroduction of the course:Basic Accounting is an important interdisciplinary basic course for the majors of Business Administration class and Economics Class, and the purpose of the course is to lay the fix foundation for continuing learning other major courses. This course mainly introduces the basic theories of accounting, and explains the setting of accounting titles and accounts, the basic theories and usage of debit and credit accounting, as well as the basic theories of cost calculating and primary method for property inventory in details; introduce the filling of accounting documents, registration of the accounting books and the preparation of the accounting statements and other basic skills Comprehensively. Through this course, students can master the basic knowledge of accounting, and can use of various accounting calculating methods skilled.Course evaluation:The final mark of the course =usual mark *20%+mark of the final exam *80%;The usual mark is decided by the rate of attendance and the situation of assignment.The final exam is closed-book exam.Designated materials:[1]Chen Guohui, Chi Xusheng. “Basic Accounting”. Dalian: Northeast University of Finance and Economics Publishing House, Feb, 2007.Reference materials:[1] Zhu Xiaoping, Xiao Jingyuan, Xu Hong.“Primary Accounting”.Beijing:Chinese People's University Press.2007.[2]Liu Feng,.“Accounting basis”. Beijing:Higher Education Press.2002. practical and manual ability of students. The course includes filling and examining the.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

基础会计学 Fundamental Accounting

课程概述:

“基础会计学”是财务管理专业和经济学专业的专业课程,学习好该课程可为学生学习后续课程及相关其他专业课程奠定良好基础。

该课程主要对基础会计学的基础知识作了介绍,具体内容包括借贷复式记账法与会计业务循环、企业基本经济业务的核算、制造业企业主要经济业务的核算、账务处理程序、会计核算组织与规范等。

Brief Introduction:

The courseFundamental Accounting is a major required course for the undergraduates majoring in financial management and economic,mastering this course can help the students lay the solidfoundation oflearning the latter courses and other relevant major subjects.The course mainly introduces the basic accountingknowledge of the fundamental accounting, which includes debit-credit double entry bookkeeping, accounting cycle,checking of basic economic business in

enterprises,checking of main economic business inmanufacturing,账务处理程序、会计核算组织与规范这两个是在不会。

课程目标:

1.掌握会计核算的基本理论,基本方法

2.掌握会计核算的组织程序,会计核算的载体。

3.掌握借贷复式记账法的原理和方法

4.掌握会计凭证

1.Master the fundamental methods and theories of accountingverification.

2.Master the procedure and the of accounting

3.Master the theories and methods of debit-credit double entry bookkeeping.

4.Master accounting documents.

参考教材:

任永平《基础会计学》立信会计出版社,2010年3月出版Reference Book:

RenYongping,Ed. Mar. 2010, FundamentalAccounting,

Lixin Accounting Publishing Press.。