会计学 企业决策的基础 课后习题答案 chapter8解析

会计学 企业决策的基础 16版 6-8章 课后习题答案

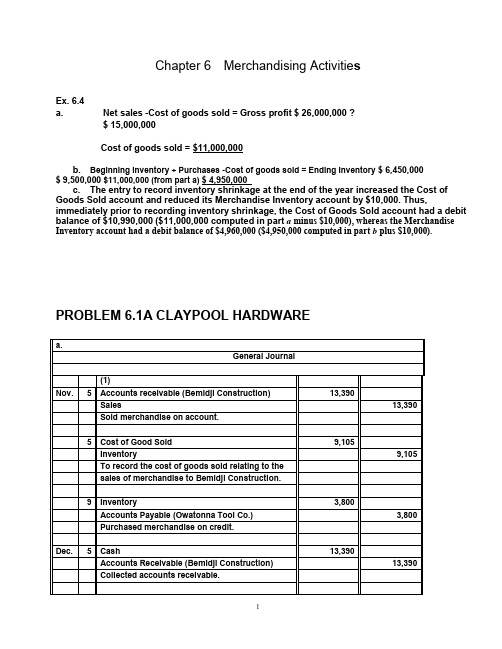

Chapter 6Merchandising Activitie sEx. 6.4a. Net sales -Cost of goods sold = Gross profit $ 26,000,000 ?$ 15,000,000Cost of goods sold = $11,000,000b. Beginning inventory + Purchases -Cost of goods sold = Ending Inventory $ 6,450,000$ 9,500,000 $11,000,000 (from part a) $ 4,950,000c. The entry to record inventory shrinkage at the end of the year increased the Cost of Goods Sold account and reduced its Merchandise Inventory account by $10,000. Thus, immediately prior to recording inventory shrinkage, the Cost of Goods Sold account had a debit balance of $10,990,000 ($11,000,000 computed in part a minus $10,000), whereas the Merchandise Inventory account had a debit balance of $4,960,000 ($4,950,000 computed in part b plus $10,000). PROBLEM 6.1A CLAYPOOL HARDWAREc. Claypool seems quite able to pass its extra transportation costs on to its customers and, in fact, enjoysa significant financial benefit from its remote location. The following data support these conclusions:Claypool Industry Hardware Average DifferenceAnnual sales …………………………….. $1,024,900 $1,000,000 $24,900Gross profit ……………………………… 327,968250,000 (1) 77,968Gross profit rate ………………………… 32% (2) 25% 7%(1) $1,000,000 sales 25% = $250,000(2) $327,968 gross profit $1,024,900 net sales = 32%Claypool earned a gross profit rate of 32%, which is significantly higher than the industry average.Claypool’s sales were above the industry average, and it e arned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-thanaverage amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores.Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5A SIOGO SHOES AND SOLE MATESc. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if it must borrow moneyfor a short period of time at an annual rate of 11%. By taking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only0.6% interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount isgreater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods sold。

会计学-企业决策的基础 问题详解

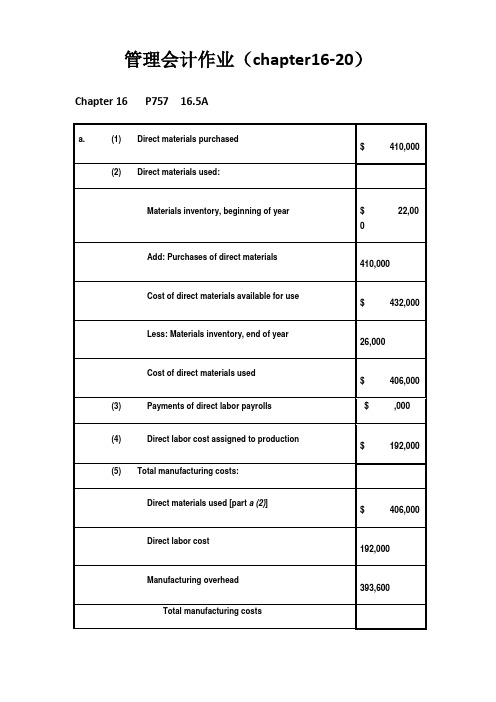

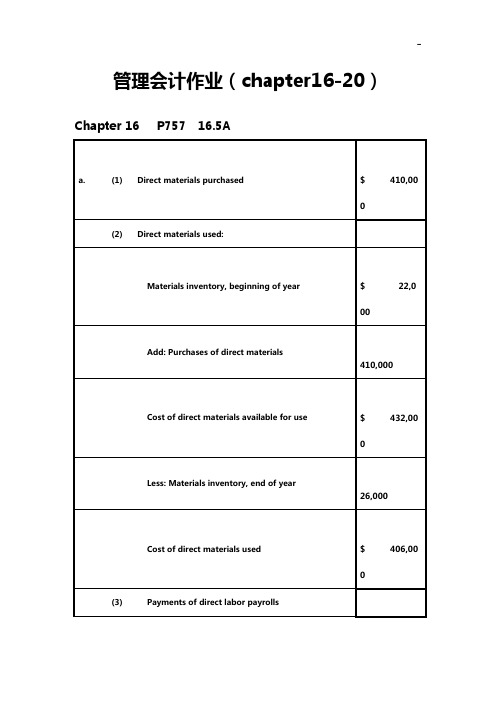

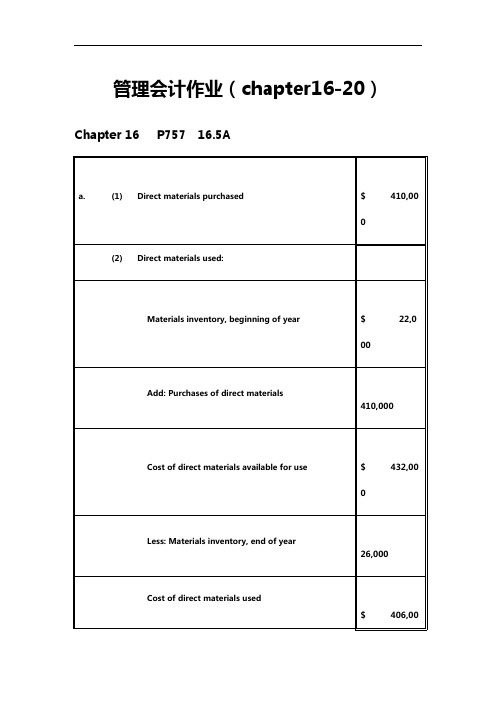

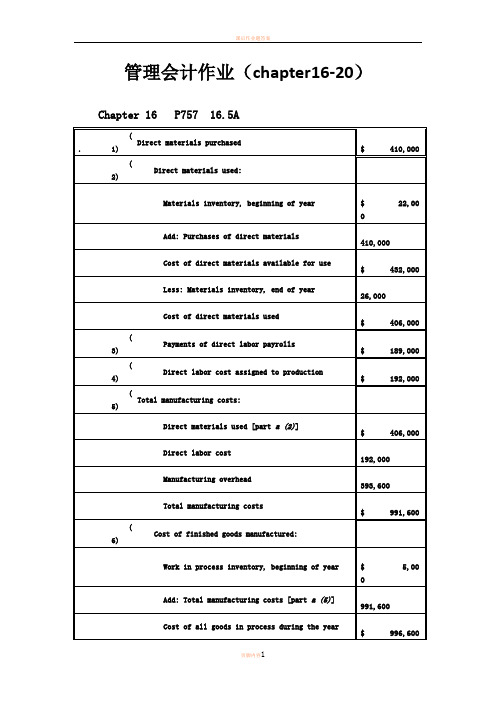

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct laborhourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3Aa4,000 EU $61.50 = $246,000 b4,000 EU $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target OperatingIncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37。

会计学-企业决策的基础 答案

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line. Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1a. job costing (each project of a construction company is unique)b . both job and process costing (institutional clients may represent unique jobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3A4,000 EU @ $61.50 = $246,000 b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume ?Fixed Costs + Target OperatingIncomeUnit Contribution Margin?$390,000 + $350,000= $20,000 units$37。

会计学 企业决策的基础 课后习题答案 chapter

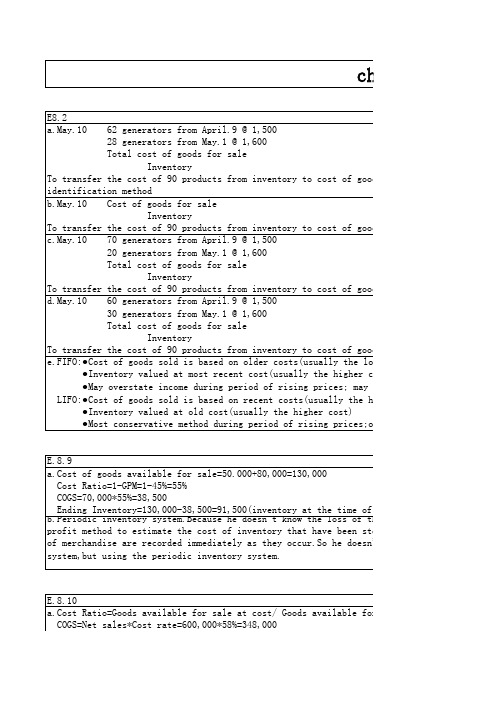

20 generators from May.1 @ 1,600 Total cost of goods for sale

chapter8

st of goods sold account by the specific

st of goods sold account by the average-cost

st of goods sold account by the FIFO method

500 generators from January 9 @ 32

Total cost of goods for sale

Inventory

To transfer the cost of 1000 products from inventory to cost of goods sold account by the

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the LI e.FIFO:●Cost of goods sold is based on older costs(usually the lower costs)

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the FI d.May.10 60 generators from April.9 @ 1,500

(完整版)课后习题答案(决策)

第八章思考与练习:1. 什么是决策?决策有那些特点?答:广义的说,把决策看作一个管理过程,是人们为了实现特定的目标,运用科学的理论与方法,系统地分析主客观条件,提出各种预选方案,从中选出最佳方案,并对最佳方案进行实施、监控的过程。

包括从设定目标,理解问题,确定备选方案,评估备选方案,选择、实施的全过程。

狭义的说,决策就是为解决某种问题,从多种替代方案中选择一种行动方案的过程。

决策的特点可按照划分的类别来说明:1.按决策的作用分类(1)战略决策。

是指有关企业的发展方向的重大全局决策,由高层管理人员作出。

(2)管理决策。

为保证企业总体战略目标的实现而解决局部问题的重要决策,由中层管理人员作出。

(3)业务决策。

是指基层管理人员为解决日常工作和作业任务中的问题所作的决策。

2.按决策的性质分类(1)程序化决策。

即有关常规的、反复发生的问题的决策。

(2)非程序化决策。

是指偶然发生的或首次出现而又较为重要的非重要复性决策。

3.按决策的问题的条件分类(1)确定性决策。

是指可供选择的方案中只有一种自然状态时的决策。

即决策的条件是确定的。

(2)风险型决策。

是指可供选择的方案中,存在两种或两种以上的自然状态,但每种自然状态所发生概率的大小是可以估计的。

(3)不确定型决策。

指在可供选择的方案中存在两种或两种以上的自然状态,而且,这些自然状态所发生的概率是无法估计的。

4,按决策的风格来分,可分为:行为决策;概念决策;命令决策;分析决策。

5、按决策的方法来分,可分为:有限理性决策和直觉决策。

2. 科学决策应该遵从哪些原则?答:最优化的原则、系统原则、信息准全原则、可行性原则和集团决策原则。

3. 决策在管理中的作用如何?你能否通过实例来说明决策的重要性?答:决策是管理的基础,决策是计划工作的核心,计划工作是组织,人员配备,指导与领导,控制工作的基础。

(省)4. 简述决策的基本过程。

你在实际工作中是如何作决策的?答:决策过程主要分为四个阶段:情报活动、设计活动、抉择活动和实施活动。

会计学-企业单位决策的基本答案解析

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application ratebased on machine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on directlabor hours:ManufacturingOverhead= $337,500=$22.50 per direct laborhourDirect LaborHours 15,000Chapter 17 P805 17.8Ad . The Custom Cuts product line is very labor intensive in comparison to the Basic Chunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturingcosts assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e . The benefits the company would achieve by implementing an activity-based costing system include: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex. a job costing (each project of a construction company is18.1 . unique)b . both job and process costing (institutional clients may represent unique jobs)c . job costing (each set of equipment is uniquely designed and manufactured)d . process costing (the dog houses are uniformly manufactured in high volumes)e . process costing (the vitamins and supplements are uniformly manufactured in high volumes)Chapter 18 P841 18.3A•Beginning WIP•Started•Units completed•Ending WIP•Beginning WIP •Units started•Units completed •Ending WIP•Cost of beginning WIP•Cost added during the period•Cost of goods transferred•Add ending WIPa4,000 EU @ $61.50 = $246,000b4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba . (1)$49 [($192,000 + $48,000 + $54,000) ÷6,000 units](2)$109 [($480,000 + $108,000 + $66,000) ÷6,000 units](3)$158 ($49 + $109)(4)$32 ($192,000 ÷6,000 units)(5)$18 ($108,000 ÷6,000 units)b . In evaluating the overall efficiency of the Engine Department, management would look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad . No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) =$540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume Fixed Costs + Target OperatingIncomeUnit Contribution Margin$390,000 + $350,000= $20,000 units $37。

会计学-企业决策地基础 问题详解

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application ratebased on machine-hours:ManufacturingOverhead =$420,000= $35 per machine-hourMachine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead= $337,500=$22.50 per direct laborhourDirect LaborHours 15,000Chapter 17 P805 17.8Ad . The Custom Cuts product line is very labor intensive in comparison to the Basic Chunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e . The benefits the company would achieve by implementing an activity-based costing system include: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex.18.1 a.job costing (each project of a construction company is unique)b.both job and process costing (institutional clients may represent unique jobs)c.job costing (each set of equipment is uniquely designed and manufactured)d.process costing (the dog houses are uniformlymanufactured in high volumes)e.process costing (the vitamins and supplements areuniformly manufactured in high volumes)Chapter 18 P841 18.3A•Beginning WIP•Started•Units completed•Ending WIP•Beginning WIP•Units started•Units completed •Ending WIP•Cost of beginning WIP•Cost added during the period•Cost of goods transferred•Add ending WIPa4,000 EU $61.50 =$246,000b4,000 EU $13.50 = $54,000Chapter 18 P845 18.2Ba(1$49 [($192,000 + $48,000 + $54,000) ÷6,000 units]. )(2)$109 [($480,000 + $108,000 + $66,000) ÷6,000 units](3)$158 ($49 + $109)(4)$32 ($192,000 ÷6,000 units)(5)$18 ($108,000 ÷6,000 units)b . In evaluating the overall efficiency of the Engine Department, management would look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad . No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) =$540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will notenable Thermal Tent to break even. Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:SalesVolume Fixed Costs + Target OperatingIncomeUnit Contribution Margin$390,000 + $350,000= $20,000 units$37。

《初级会计学》教材习题答案第八章

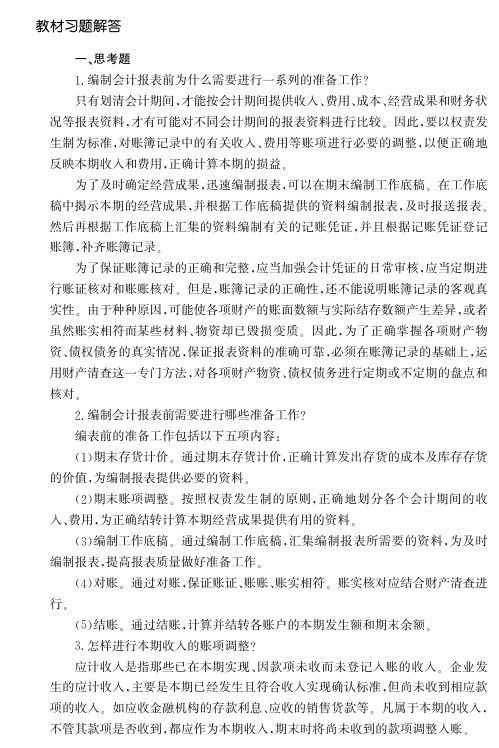

教材习题解答一!思考题!"编制会计报表前为什么需要进行一系列的准备工作!只有划清会计期间"才能按会计期间提供收入#费用#成本#经营成果和财务状况等报表资料"才有可能对不同会计期间的报表资料进行比较$因此"要以权责发生制为标准"对账簿记录中的有关收入#费用等账项进行必要的调整"以便正确地反映本期收入和费用"正确计算本期的损益$为了及时确定经营成果"迅速编制报表"可以在期末编制工作底稿$在工作底稿中揭示本期的经营成果"并根据工作底稿提供的资料编制报表"及时报送报表$然后再根据工作底稿上汇集的资料编制有关的记账凭证"并且根据记账凭证登记账簿"补齐账簿记录$为了保证账簿记录的正确和完整"应当加强会计凭证的日常审核"应当定期进行账证核对和账账核对$但是"账簿记录的正确性"还不能说明账簿记录的客观真实性$由于种种原因"可能使各项财产的账面数额与实际结存数额产生差异"或者虽然账实相符而某些材料#物资却已毁损变质$因此"为了正确掌握各项财产物资#债权债务的真实情况"保证报表资料的准确可靠"必须在账簿记录的基础上"运用财产清查这一专门方法"对各项财产物资#债权债务进行定期或不定期的盘点和核对$#"编制会计报表前需要进行哪些准备工作!编表前的准备工作包括以下五项内容%&!’期末存货计价$通过期末存货计价"正确计算发出存货的成本及库存存货的价值"为编制报表提供必要的资料$&#’期末账项调整$按照权责发生制的原则"正确地划分各个会计期间的收入#费用"为正确结转计算本期经营成果提供有用的资料$&$’编制工作底稿$通过编制工作底稿"汇集编制报表所需要的资料"为及时编制报表"提高报表质量做好准备工作$&%’对账$通过对账"保证账证#账账#账实相符$账实核对应结合财产清查进行$&&’结账$通过结账"计算并结转各账户的本期发生额和期末余额$$"怎样进行本期收入的账项调整!应计收入是指那些已在本期实现#因款项未收而未登记入账的收入$企业发生的应计收入"主要是本期已经发生且符合收入实现确认标准"但尚未收到相应款项的收入$如应收金融机构的存款利息#应收的销售货款等$凡属于本期的收入"不管其款项是否收到"都应作为本期收入"期末时将尚未收到的款项调整入账$收入分摊是指企业已经收取有关款项"但未完成销售商品或提供劳务"需在期末按本期已完成的比例"分摊确认本期已实现收入的金额"并调整以前预收款项时形成的负债$已收款入账"因尚未向付款单位提供商品#劳务或财产物资使用权"不属于收款期的收入"是一种负债性质的预收收入"通常在向付款单位提供商品#劳务或财产使用权的期间确认收入$在计算本期收入时"应该将这部分预收收入进行账项调整$%"怎样进行本期费用与支出的调整!应计费用是指那些已在本期发生"因款项未付而未登记入账的费用$企业发生的费用"本期已经受益"由于这些费用尚未支付"故在日常的账簿记录中尚未登记入账"如应付银行借款利息支出#保险费支出#大修理费用支出等$凡属于本期的费用"不管其款项是否支付"都应作为本期费用处理$期末应将那些属于本期而尚未支付的费用调整入账$费用分摊是指企业的支出已经发生"能使若干各会计期间受益"为正确计算各个会计期间的盈亏"将这些支出在其受益的会计期间进行分摊"在计算本期费用时"应该将这部分费用进行调整$属于本期负担的费用"采用一定的方法分摊计入本期的费用$&"对账包括哪些内容!为什么要进行对账!对账就是在有关经济业务入账以后"进行账簿记录的核对$在会计工作中"由于种种原因"难免发生记账#计算等差错"也难免出现账实不符的现象$为了确保账簿记录的正确#完整#真实"在有关经济业务入账之后"必须进行账簿记录的核对$对账工作是为保证账证相符#账账相符和账实相符的一项检查性工作$’"结账时应该注意哪些问题!对结账时间有什么要求!结账就是在会计期末计算并结转各账户的本期发生额和期末余额$结账程序主要包括以下两个步骤%&!’结账前"必须将属于本期内发生的各项经济业务和应由本期受益的收入#负担的费用全部登记入账$不得把将要发生的经济业务提前入账"也不得把已经在本期发生的经济业务延至下期&甚至以后期’入账$为了确保结账的正确"在本期发生的各项经济业务全部入账的基础上"须按照会计核算原则的要求"将有关的转账事项编制记账原始凭证"并据以编制记账凭证"记入有关账簿$ &#’结账时"应结出每个账户的期末余额$需要结出当月&季’发生额的&如各项收入#费用账户等’"应单列一行进行发生额的登记"在摘要栏内注明(本月&季’合计)字样"并在下面划一单红线至余额栏*需要结出本年累计发生额的"为了反映自年初开始直至本月末为止的累计发生额"还应在月&季’结下面再单列一行进行累计发生额的登记"并在下面再划一单红线至余额栏$结账包括月结#季结和年结$("为什么要进行财产清查!保证财务信息资料的真实性"是对会计信息最重要的质量要求$但是"由于种种主客观原因"往往会出现某些财产物资实存数与账存数不符的现象$因此"必须进行财产清查"对各项财产物资和债权债务进行定期或不定期的盘点和核对$在账实相符的基础上编制财务报表$财产清查是通过对各项财产物资进行盘点和核对"确定其实存数"查明实存数与其账存数是否相符的一种专门方法$其作用可归纳为%&!’确保核算资料的真实可靠*&#’健全财产物资的管理制度*&$’促进财产物资的安全完整及有效使用*&%’保证结算制度的贯彻执行$)"财产清查有哪些种类!财产清查按照清查的范围大小"可分为全面清查和局部清查$全面清查就是对属于本单位或存放在本单位的所有财产物资#货币资金和各项债权债务进行全面盘点和核对$对资产负债表内所列的项目"要一一盘点#核对$局部清查就是根据管理的需要或依据有关规定"对部分财产物资#债权债务进行盘点和核对$财产清查按照清查时间是否事先有计划"可分为定期清查和不定期&临时’清查$定期清查就是按事先计划安排的时间对财产物资#债权债务进行的清查$一般是在年度#季度#月份#每日结账时进行$不定期清查是事先并无计划安排"根据实际需要所进行的临时性清查$*"财产清查有哪些方法!财产物资的清查方法可分为两类%&!’清查财产物资实存数的方法$这类方法主要是从数量方面对财产物资进行清查"有实地盘点法和技术推算法两种$实地盘点法是通过实地清点或用计量器具确定各项财产物资的方法$这种方法适用于各项实物财产物资的清查$技术推算法是通过技术推算法确定有关财产物资的方法$这种方法是通过量方#计尺等方法确定有关财产物资实有数量"一般适用于那些大量成堆或难以逐一清点其数量的财产"如堆存的煤或油罐中的油等$&#’清查财产物资金额的方法$这类方法主要是从金额方面对财产物资进行清查"包括账面价值法#评估确认法#协商议价法#查询核实法等$账面价值法是根据账面价值确定财产物资价值量的方法$这种方法根据各项财产物资的实有数量和账面价值&单位价值’确定财产物资的价值"适用于结账前所进行的财产清查$评估确认法是根据资产评估的价值确定财产物资价值量的方法$这种方法根据资产的特点"由专门的评估机构依据资产评估方法"对有关的财产物资进行评估"以评估确认的价值作为财产物资的价值"适用于企业改组#隶属关系改变#联营#单位撤销#清产核资等情况$协商议价法是根据涉及资产利益的有关各方"按照互惠互利#公平市价的原则"以达成的协议价确定财产物资价值量的方法$这种方法以协商议价作为财产物资的价值"适用于企业联营投资等情况$查询核实法是依据账簿记录"以一定的查询方式"核查财产物资#货币资金#债权债务数量及其价值量的方法$这种方法根据查询结果进行分析"以确定有关财产物资#货币资金#债权债务的实物数量和价值量"适用于债权债务#委托代销#委托加工#出租出借的财产物资以及外埠临时存款等$!+"财产清查中出现差异为什么必须通过(待处理财产损溢)账户调整!为了核算和监督财产清查结果的账务处理情况"需设置(待处理财产损溢)账户$这个账户是一个过渡型账户"主要用于从发现账存#实存不一致到有关部门批准进行处理的过程$该账户的借方先用来登记发生的待处理盘亏#毁损的金额"待盘亏#毁损的原因查明"并经审批后"再从该账户的贷方转入有关账户的借方*该账户的贷方先用来登记发生的待处理盘盈的金额"待盘盈的原因查明"并经审批后再从该账户的借方转入有关账户的贷方$!!"银行存款对账单与银行存款日记账核对时如何编制余额调节表!银行存款余额调节表的编制方法主要有两种%一种是余额调节法*一种是差额调节法$&!’余额调节法$余额调节法是指编制调节表时"在双方&开户行和企业各为一方’现有银行存款余额基础上"各自加减未达账项进行调节的方法$调节的方式也有两种%一种是补记式"即双方在原有余额基础上"各自补记对方已入账而本单位尚未入账的账项&包括增加和减少款项’"然后检查经过调节后的账面余额是否相等*另一种是还原式"又称冲销式"即双方在原有余额基础上"各自将本单位已入账而对方尚未入账的款项&包括增加和减少款项’"从本单位原有账面余额中冲销"然后检查经过调节后的账面余额是否相等$&#’差额调节法$银行存款余额调节表的编制"除了上述余额调节法外"还有一种差额调节法$差额调节法是根据未达账项对双方银行存款余额的差额的影响数额进行调节$!#"为什么需要编制工作底稿!一般情况下"期末是会计部门会计工作繁忙的高峰"调账#对账#结账#编制报表"一环扣一环"大量的业务工作要在短短的几天内完成$为了避免差错"防止忙中出错"并能尽快了解本期的经营状况和经营成果"及时报送报表"可以先通过编制工作底稿的办法"把基本资料算出来"再根据工作底稿的资料编制调账#结账的会计分录"把账簿记录补齐$编制工作底稿"是检查账簿记录是否正确的一种方法$因此"可以把编制工作底稿视为对账#结账的一项内容$编制工作底稿又可以为编制利润表和资产负债表提供必要的资料"也可以把编制工作底稿视为编制报表前的一项重要准备工作$所以"编制工作底稿是会计资料由账簿向报表过渡的一项重要会计核算工作$!$"怎样进行工作底稿中试算表的填制!将(调整前余&发生’额)与(账项调整)两栏相同科目的借#贷金额加减"同方向金额相加"反方向金额相减$合并所得的金额就是(调整后余&发生’额)相应会计科目的金额"将其填入(调整后余额)栏内$二!案例题"案例!#!王伟先生是华光公司的总经理"公司成立于#++’年#月"!#月#&日公司财务部经理提出需要进行财产清查"为编制会计报表做准备$经过总经理办公会同意"财务部会同物资保管部门#生产部门一起组织了#)+#*日的财产清查$通过清查发现"甲种材料盘盈’+++元"乙种材料盘亏%)++元"丁种材料有价值)++元的毁损$请问财务部应该怎样进行账务处理!答%财务部应先将盘盈#盘亏及毁损材料的情况通过(待处理财产损溢)科目反映"即%!借%原材料+++甲’+++ !!贷%待处理财产损溢’+++ !借%待处理财产损溢&’++ !!贷%原材料+++乙%)++ +++丙)++然后"调查发生盘亏#盘盈以及毁损的原因"明确责任后"分别作如下处理%定额内的盘亏"应增加费用*责任事故造成的损失"应由过失人负责赔偿*非常事故"如自然灾害"在扣除保险公司赔款和残料价值后"经批准列作营业外支出等$ "案例"#!华光公司在#++)年!!月#*日将银行存款日记账与银行对账单进行核对"发现有一笔&+万元的账项对不上"经过多方查找发现了一张银行到账的通知单被重复记账"马上进行了更正$!#月$+日公司收到了银行对账单"经过编制银行存款余额调节表后发现了)笔未达账项"财务部根据银行对账单进行记账更正$请问财务部的处理是否正确!为什么!答%对于!!月#*日发现的重复记账进行更正是正确的"因为该差额属于会计差错"所以必须更正$但是!#月$+日的未达账项"是开户银行和本单位之间"对于同一款项的收付业务"由于凭证传递时间和记账时间的不同"发生一方已经入账而另一方尚未入账的会计事项"并非会计差错"所以不应更正$编制银行存款余额调节表的目的"只是为了检查账簿记录的正确性"并不是要更改账簿记录"对于银行已经入账而本单位尚未入账的业务和本单位已经入账而银行尚未入账的业务"均不进行账务处理"待业务凭证到达后"再做账务处理$对于长期悬置的未达账项"应及时查阅凭证#账簿及有关资料"查明原因"及时和银行联系"查明情况"予以解决$。

会计学-企业决策的基础 答案教学资料

会计学-企业决策的基础答案管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based on machine-hours:Manufacturing Overhead= $420,000= $35 per machine-hourMachine-Hours 12,000Department Two overhead application rate based on direct labor hours:Manufacturing Overhead= $337,500= $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company’s current practice of using direct laborhours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probablyexplains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costingsystem include: (1) a better identification of its operating inefficiencies, (2) a betterunderstanding of its overhead cost structure, (3) a better understanding of theresource requirements of each product line, (4) the potential to increase the sellingprice of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability todecrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1a. job costing (each project of a construction company is unique)B. Ex.18.1b. both job and process costing (institutional clients may represent uniquejobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d. process costing (the dog houses are uniformly manufactured in highvolumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3Ab4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target Operating IncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37。

会计学——企业决策的基础(英文版)课后习题答案_comprehensive_problem_1(完整版)

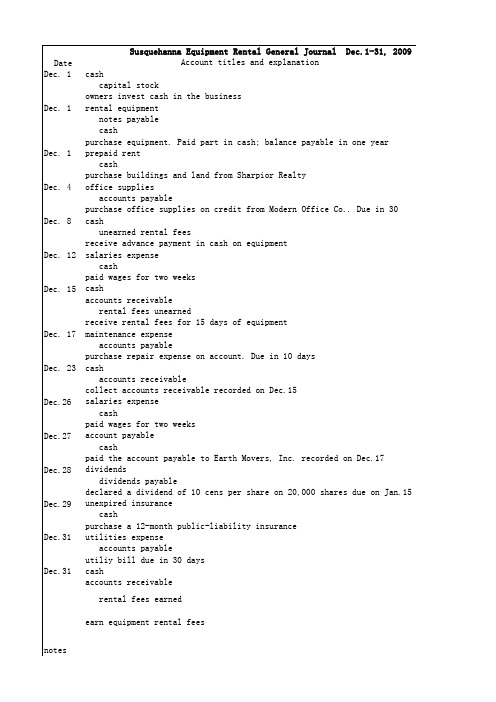

notes

unadjusted trail balance

Susquehanna Equipment Rental adjustments Dr Cr Dr Cr

work sheet for

balance sheet accounts cash accounts receivable prepaid rent unexpired insurance office supplies rental equipment accumulated depreciation: rental equipment notes payable accounts payable interest payable salaries payable dividends payable unearned rental fees income taxes payable capital stock retained earnings dividends income statement accounts rental fees earned salaries expense maintenance expense utilities expense rent expense office supplies expense depreciation expense interest expense income taxes expense income summary subtotal net income total

Dec.26

Dec.27

Dec.28

Dec.29

Dec.31

Dec.31

cash capital stock owners invest cash in the business rental equipment notes payable cash purchase equipment. Paid part in cash; balance payable in one year prepaid rent cash purchase buildings and land from Sharpior Realty office supplies accounts payable purchase office supplies on credit from Modern Office Co.. Due in 30 days cash unearned rental fees receive advance payment in cash on equipment salaries expense cash paid wages for two weeks cash accounts receivable rental fees unearned receive rental fees for 15 days of equipment maintenance expense accounts payable purchase repair expense on account. Due in 10 days cash accounts receivable collect accounts receivable recorded on Dec.15 salaries expense cash paid wages for two weeks account payable cash paid the account payable to Earth Movers, Inc. recorded on Dec.17 dividends dividends payable declared a dividend of 10 cens per share on 20,000 shares due on Jan.15 unexpired insurance cash purchase a 12-month public-liability insurance utilities expense accounts payable utiliy bill due in 30 days cash accounts receivable rental fees earned earn equipment rental fees

《会计基础》第八章习题及答案

第八章财务会计报告一、单项选择题1、在资产负债表中,资产是按照(D)排列的。

A.清偿时间的先后顺序B.会计人员的填写习惯C.金额大小D.流动性大小2、下列报表中,不属于企业对外提供的动态报表的是(D)。

A.利润表B.所有者权益变动表C.现金流量表D.资产负债表3、多步式利润表中的利润总额是以(D)为基础来计算的。

A.营业收入B.营业成本C.投资收益D.营业利润4、按照我国的会计准则,资产负债表采用的格式为(C)。

A.单步报告式B.多步报告式C.账户式D.混合式5、企业财务会计报告所提供的信息资料应具有时效性,这是指编制财务会计报告应符合(D)的要求。

A.真实可靠B.相关可比C.全面完整D.编报及时6、关于企业利润构成,下列表述不正确的是(A)。

A.企业的利润总额由营业利润、投资收益和营业外收入三部分组成B.营业成本=主营业务成本+其他业务成本C.利润总额=营业利润+营业外收入-营业外支出D.净利润=利润总额-所得税费用7、以下说法不正确的是(D)。

A.通过资产负债表项目金额及其相关比率的分析,可以帮助报表使用者全面了解企业的资产状况,盈利能力,分析企业的债务偿还能力,从而为未来的经济决策提供参考信息B.负债一般分为流动负债和长期负债C.账户式资产负债表分为左右两方,左方为资产项目D.账户式资产负债表分为左右两方,右方为资产项目8、资产负债表是根据(D)这一会计等式编制的。

A.收入-费用=利润B.现金流入-现金流出=现金净流量C.资产=负债+所有者权益+收入-费用D.资产=负债+所有者权益9、某企业本月主营业务收入为1 000 000元,其他业务收入为80 000元,营业外收入为90 000元,主营业务成本为760 000元,其他业务成本为50 000元,营业税金及附加为30 000元,营业外支出为75 000元,管理费用为40 000元,销售费用为30 000元,财务费用为15 000元,所得税费用为75 000元。

会计学-企业决策的基础 答案

管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa.Department One overhead application ratebased on machine-hours:Manufacturing Overhead$420,000=$35 per machine-hourMachine-Hours 12,00 0Department Two overhead application rate based on direct labor hours:Manufacturing Overhead$337,500=$22.50 per direct laborhourDirect Labor Hours 15,00 0Chapter 17 P805 17.8Ad .The Custom Cuts product line is very labor intensive in comparison to theBasic Chunks product line. Thus, the company’s current practice of using direct labor hours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e .The benefits the company would achieve by implementing an activity-basedcosting system include: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1B. Ex. 18.1a.job costing (each project of a construction company is unique)b.both job and process costing (institutional clients may represent unique jobs)c.job costing (each set of equipment is uniquely designed and manufactured)d.process costing (the dog houses are uniformly manufactured in high volumes)e.process costing (the vitamins and supplements are uniformly manufactured in high volumes)Chapter 18 P841 18.3AInputs:•Beginning WIP•StartedOutputs:•Units completed•Ending WIP•Beginning WIP•Units started•Units completed•Ending WIP•Cost of beginning WIP•Cost added during the period•Cost of goods transferredtransferred•Add ending WIP$246,000b4,000 EU @ $13.50 =$54,000Chapter 18 P845 18.2Ba .(1)$49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2)$109 [($480,000 + $108,000 + $66,000) ÷6,000 units] (3)$158 ($49 + $109)(4)$32 ($192,000 ÷ 6,000 units)(5)$18 ($108,000 ÷ 6,000 units)b .In evaluating the overall efficiency of the Engine Department, managementwould look at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad .No. With a unit sales price of $94, the break-even sales volume in unitsis 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units)$540,000$1054,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales VolumeFixed Costs + TargetOperating IncomeUnit Contribution Margin$390,000 + $350,000= $20,000 units $37。

会计学企业决策的基础《会计学企业决策的基础》

PPT文档演模板

会计学企业决策的基础《会计学企业 决策的基础》

国家设计的会计监督:

▪ 会计监督的三个层次: ▪ 企业内部、社会监督、国家

监督 ▪ 国家监督的六个方面: ▪ 财政、审计、税务、银行、

证券监管、保险监管。

PPT文档演模板

会计学企业决策的基础《会计学企业 决策的基础》

PPT文档演模板

会计学企业决策的基础《会计学企业 决策的基础》

会计要素:

§ 一、资产 § 资产(Assets)是指过去的交易、事项形成并由

企业拥有或者控制的资源,该资源预期会给 企业带来经济利益。 § 企业的资产按流动性分为流动资产、长期投 资、固定资产、无形资产和其他资产。

PPT文档演模板

会计学企业决策的础《会计学企业 决策的基础》

会计方法

§ 每门学科都有其特有的研究对象和方法。

§ 会计所特有的方法可概括为:

§ 1.严格的法律要求——会计记录绝大部分会 涉及与业主、客户、职工等方面的权利义务, 例如分红、收账、发工资等。一旦有民事纠 纷,甚至刑事犯罪案件,很多要向会计记录 取证。因此任何一笔会计记录都必须严格符 合解决法律问题的要求。

企业生产经营过程

•投资 者

•补偿生产消耗(C+V)

•货

•材

币

料

•在产品

•

•支付工资和费用旧 折

•固定资产

•W=C+V+M

•国家

•产成品 •货币’ •分配 •两金

•投资者

•沉淀

•企业

PPT文档演模板

会计学企业决策的基础《会计学企业 决策的基础》

财务会计信息系统:

•信息系统

会计学8章习题及答案

第八章财务成果的核算一、单项选择题1.下列各项中属于营业外收入的是()。

A.销售原材料取得的收入B.出租无形资产取得的收入C.处置无形资产净收益D.出租固定资产的租金收入2.在下列项中属于营业外支出的是()。

A.销售原材料的成本B.租出固定资产折旧C.处置固定资产净损失D.无法收回的应收账款3.自然灾害造成的非常损失应()。

A.计入管理费用B.计入营业外支出C.冲减税后利润D.计入其他业务成本4.企业支付的公益性、救济性捐赠应在()账户中列支。

A.“主营业务成本”B.“其他业务成本”C.“投资收益”D.“营业外支出”5.计算应交所得税的基数称为纳税所得,它与利润总额的关系是()。

A.等于利润总额B.与利润总额无关系C.在利润总额的基础上按税法规定进行调整计算求得D.本年实现的利润总额+上年未分配利润6. “利润分配”账户在年终结账后出现借方余额,表示()。

A.未分配的利润额B.未弥补的亏损额C.已分配的利润额D.已实现的利润总额7.计算出应交所得税的账务处理是()。

A.借:所得税费用B.借:所得税费用贷:利润分配贷:本年利润C.借:所得税费用D.借:应交税费贷:应交税费贷:所得税费用8.公司按实现净利润的10%计提法定盈余公积的账务处理是()。

A.借:利润分配B.借:本年利润贷:盈余公积贷:盈余公积C.借:盈余公积D.借:盈余公积贷:利润分配贷:本年利润二、多项选择题1.下列各项中能够用于计算营业利润的是()。

A.营业收入B.营业成本C.投资收益D.资产减值损失E.三项期间费用2.下述总账科目,采用账结法在月末转账后无余额的是()。

A.主营业务收入B.营业外收入C.投资收益D.管理费用E.本年利润3.下列总账年终结转后无余额的是()。

A.管理费用B.销售费用C.投资收益D.本年利润E.利润分配4. 利润总额主要由()构成。

A.主营业务收入B.营业利润C.投资收益D.营业外收入E.营业外支出5.下列账户中能与“利润分配”账户产生对应关系的是( )。

会计学原理教材第八章答案

第八章对账、结账与利润确定习题一习题二1.编制会计分录3.略4.编制结帐后试算表四平公司试算表习题三1.编制银行存款余额调节表银行存款余额调节表2.作必要的会计分录分录簿习题四银行存款余额调节表20×8年11月30日* 47 056=49608+1300+2448-6300习题五1.编制银行存款余额调节表银行存款余额调节表2. 公司不需编制会计分录1.赵宏挪用公款的数额为:27 020+36 740=63 760(元)2.公司银行存款日记账的正确余额为:1 410 000-(27 020+36 740+15 310+24 700+19230) -50 000=1 237 000(元)3.改进意见:(1)库存现金和银行存款的收付、记账工作必须由专人办理,不能职责不清、一人兼管。

(2)开支票时,应注明用途等,并有专人审核盖章。

(3)企业内部审计人员或稽查人员应定期对库存库存现金进行清查,以保证库存现金的正确使用和安全完整等。

习题七分录簿分录簿习题九1,2.开设总分类帐,并进行结帐总分类帐帐户名称:库存现金帐户名称:材料采购帐户名称:原材料帐户名称:生产成本帐户名称:制造费用帐户名称:固定资产帐户名称:累计折旧帐户名称:应付职工薪酬帐户名称:应交税费帐户名称:主营业务收入帐户名称:主营业务成本帐户名称:营业税金及附加帐户名称:销售费用帐户名称:管理费用帐户名称:所得税费用3.编制总分类帐户本期发生额及余额表总分类帐户本期发生额及余额表 2008年4月习题十A公司:①=292500 ②=18200 ③=274300B公司:④=263200 ⑤=21700 ⑥=273700C公司:⑦=258750 ⑧=270250 ⑨=213900D公司:⑩=161200 ⑾44640 ⑿32240习题十一嘉兴公司每年的工程损益如下:20×5年:工程利润=2000000×(240000÷1500000)-240000=80000(元)20×6年:工程利润=2000000×(1040000÷1500000)-320000-800000=267000(元)20×7年:工程利润=2000000-320000-1067000-580000=33000(元)嘉兴公司每年的利润总额如下:20×5年:利润总额=80000+20000-45000=55000(元)20×6年:利润总额=267000+20000-500000-100000=137000(元)20×7年:利润总额=33000+20000=53000(元)习题十二1.编制结帐分录分录簿2.计算本年营业利润,利润总额及净利润本年营业利润=223000元本年利润总额=183000元本年净利润=128100元习题十三1,3.开设总分类帐户和明细分类帐户,并结计各帐户的本期发生额和期末余额总分类帐帐户名称:银行存款帐户名称:应收帐款帐户名称:材料采购帐户名称:原材料帐户名称:生产成本帐户名称:制造费用帐户名称:长期待摊费用帐户名称:固定资产帐户名称:累计折旧帐户名称:短期借款帐户名称:主营业务收入帐户名称:主营业务成本帐户名称:销售费用帐户名称:财务费用帐户名称:本年利润材料明细帐材料名称:A材料计量单位:千克,元材料名称:B材料计量单位:千克,元生产成本明细帐产品名称:甲产品单位:元库存商品明细帐产品名称:甲产品计量单位:件,元产品名称:乙产品计量单位:件,元2.编制会计分录分录簿。