财务会计英语 练习及答案ch02

财务英语试题及答案

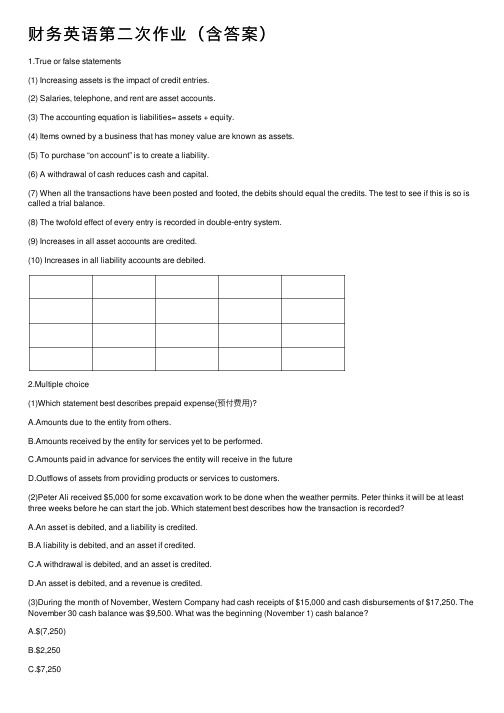

财务英语试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording, summarizing, and reporting financial transactions?A. BudgetingB. AccountingC. AuditingD. Forecasting答案:B2. Which of the following is a financial statement that showsa company's financial position at a specific point in time?A. Income StatementB. Balance SheetC. Cash Flow StatementD. Statement of Retained Earnings答案:B3. The difference between the purchase price and the fair market value of an asset is known as:A. DepreciationB. AmortizationC. GoodwillD. Capital Gains答案:C4. What is the term for the systematic allocation of the cost of a tangible asset over its useful life?A. DepreciationB. AmortizationC. AccrualD. Provision答案:A5. Which of the following is not a type of revenue recognition?A. Cash basisB. Accrual basisC. Installment methodD. All of the above答案:D6. The process of estimating the cost of completing a project is known as:A. BudgetingB. Cost estimationC. Project managementD. Cost accounting答案:B7. Which of the following is a non-current liability?A. Accounts payableB. Wages payableC. Long-term debtD. Income tax payable答案:C8. The term used to describe the process of adjusting the accounts at the end of an accounting period is:A. Closing the booksB. JournalizingC. PostingD. Adjusting entries答案:D9. What is the term for the financial statement that shows the changes in equity of a company over a period of time?A. Balance SheetB. Income StatementC. Statement of Changes in EquityD. Cash Flow Statement答案:C10. The process of verifying the accuracy of financial records is known as:A. BudgetingB. AuditingC. ForecastingD. Valuation答案:B二、填空题(每空1分,共10分)1. The __________ is the process of determining the value of an asset or liability.答案:valuation2. A __________ is a type of financial instrument that represents a creditor's claim on a company's assets.答案:bond3. The __________ is the difference between the cost of an asset and its depreciation.答案:book value4. __________ is the process of converting non-cash items into cash equivalents.答案:Liquidation5. A __________ is a financial statement that provides information about a company's cash inflows and outflows during a specific period.答案:Cash Flow Statement6. The __________ is the process of estimating the useful life of an asset.答案:depreciation schedule7. __________ is the practice of recording revenues and expenses when they are earned or incurred, not when cash is received or paid.答案:Accrual accounting8. __________ is the process of recording transactions in the order they are received.答案:Journalizing9. __________ is the practice of matching expenses with the revenues they helped to generate.答案:Matching principle10. A __________ is a document that provides evidence of a transaction.答案:voucher三、简答题(每题5分,共20分)1. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity.2. Explain the concept of "double-entry bookkeeping."答案:Double-entry bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to another account, ensuring that the total of debits equals the total of credits.3. What is the purpose of an income statement?答案:The purpose of an income statement is to summarize a company's revenues, expenses, and profits or losses over a specific period of time.4. Describe the role of a financial controller in anorganization.答案:A financial controller is responsible for overseeing the financial operations of an organization, including budgeting, financial reporting, and ensuring compliance with financial regulations and policies.四、论述题(每题15分,共30分)1. Discuss the importance of financial planning in business management.答案:Financial planning is crucial in business management as it helps in setting financial goals。

财务会计英语 练习及答案ch03

36.If the adjustment to recognize expired insurance at the end of the period is inadvertently omitted, the assets at the end of the period will be understated.

ANS:TDIF:2OBJ:02

13.An adjusting entry would adjust an expense account so the expense is reported when incurred.

ANS:TDIF:2OBJ:02

14.An adjusting entry to accrue an incurred expense will affect total liabilities.

ANS:TDIF:2OBJ:02

15.The difference between deferred revenue and accrued revenue is that accrued revenue has been recorded and needs adjusting and deferred revenue has never been recorded.

ANS:TDIF:4OBJ:03

34.The balance in the prepaid insurance account before adjustment at the end of the year is $4,000. The amount of the journal entry required to record insurance expense will be $2,500 if the amount of unexpired insurance applicable to future periods is $1,500.

财务会计英文影印版第十版课后练习题含答案 (2)

财务会计英文影印版第十版课后练习题含答案简介本文档为《财务会计英文影印版第十版》的课后练习题及答案。

该书是一本介绍财务会计的教材,涵盖了财务会计理论和实践,适用于财务会计初学者。

练习题Chapter 11.1 Expln the difference between management accounting and financial accounting.1.2 Expln the purpose of financial statements.1.3 Expln the role of the audit committee.1.4 Expln the difference between the balance sheet and the income statement.Chapter 22.1 Expln the difference between revenue and profit.2.2 Expln the difference between cash basis accounting and accrual basis accounting.2.3 Expln the purpose of the statement of cash flows.Chapter 33.1 Expln the difference between current and non-current assets.3.2 Expln the difference between current and non-current liabilities.3.3 Expln the difference between financing activities and investing activities.Chapter 44.1 Expln the purpose of the double-entry accounting system.4.2 Expln the difference between debits and credits.4.3 Expln the purpose of the trial balance.Chapter 55.1 Expln the difference between the cost of goods sold and operating expenses.5.2 Expln the purpose of the income statement.5.3 Expln the difference between gross profit and net profit.答案Chapter 11.1 Management accounting is concerned with providing information for internal decision-making, while financial accounting is concerned with providing information to external users.1.2 The purpose of financial statements is to provide information about an entity’s financial performance, financial position, and cash flows.1.3 The audit committee is responsible for overseeing the financial reporting process and ensuring the integrity of financial statements.1.4 The balance sheet shows an entity’s financial position at a specific point in time, while the income statement shows an entity’s financial performance over a period of time.Chapter 22.1 Revenue represents the amounts earned from the sale of goods or services, while profit represents the difference between revenue and expenses.2.2 Cash basis accounting recognizes revenue and expenses when cash is received or pd, while accrual basis accounting recognizes revenue and expenses when they are earned or incurred, regardless of when cash is received or pd.2.3 The statement of cash flows is used to show the inflows and outflows of cash from operating, investing, and financing activities.Chapter 33.1 Current assets are expected to be converted to cash within one year, while non-current assets are expected to be held for more than one year.3.2 Current liabilities are expected to be pd within one year, while non-current liabilities are expected to be pd after one year.3.3 Financing activities involve obtning funds from external sources and paying dividends to shareholders, while investing activities involve acquiring and disposing of property, plant, and equipment, and other long-term investments.Chapter 44.1 The double-entry accounting system ensures that everytransaction is recorded in two accounts, with equal debits and credits,in order to mntn the equality of debits and credits in the accounting equation.4.2 Debits are used to record increases in assets and expenses and decreases in liabilities and equity, while credits are used to record increases in liabilities and equity and decreases in assets and expenses.4.3 The trial balance is a list of all the accounts in the ledgerwith their balances, used to ensure that the total of the debits equals the total of the credits.Chapter 55.1 The cost of goods sold represents the cost of the goods or services sold by a company, while operating expenses represent the other costs of running a business.5.2 The income statement shows a company’s revenue, expenses, andnet income or loss for a period of time.5.3 Gross profit represents revenue minus the cost of goods sold, while net profit represents gross profit minus operating expenses.结论本文档为《财务会计英文影印版第十版》课后练习题及答案,涵盖了财务会计的基本理论和实践。

财务会计英文影印版第十版课后练习题含答案

Financial and Managerial Accounting English Version Photocopy Tenth Edition Exercise Questions withAnswersIntroductionThe Financial and Managerial Accounting English Version Photocopy Tenth Edition Exercise Questions with Answers is a comprehensive guide for accounting students to practice and sharpen their skills infinancial and managerial accounting. This guide includes a wide range of exercise questions with detled answers to help students better understand complex accounting concepts. The guide is designed to be an essential study tool for accounting students and professionals who are preparing for certification exams or looking to improve their accounting skills.FeaturesThe guide contns the following features:prehensive coverage of financial and managerialaccounting topics.2.A wide range of exercise questions with detled answers.3.Clear and concise explanations of complex accountingconcepts.4.Easy-to-use format.5.All questions are organized by chapter and topic for easyreference.ContentsThe guide includes the following chapters:1.Accounting in Action2.The Recording Process3.Adjusting the Accountspleting the Accounting Cycle5.Accounting for Merchandising Operations6.Inventories7.Fraud, Internal Control, and Cash8.Accounting for Receivables9.Plant Assets, Natural Resources, and Intangible Assets10.Liabilities11.Corporations: Organization, Stock Transactions, andDividends12.Long-Term Liabilities: Bonds and Notes13.Investments and Fr Value Accounting14.Statement of Cash Flows15.Financial Statement Analysis16.Managerial Accounting Concepts and Principles17.Job Order Costing18.Process Costing19.Cost Behavior and Cost-Volume-Profit Analysis20.Budgeting21.Performance Evaluation Using Variances from StandardCosts22.Performance Evaluation for Decentralized Operations23.Differential Analysis and Product PricingEach chapter includes a series of exercise questions with answers.How to Use the GuideThe guide is designed to be an essential study tool for accounting students and professionals who are preparing for certification exams or looking to improve their accounting skills. Students can use the guide to practice and sharpen their accounting skills. The guide can be used in conjunction with textbooks, lectures, and other study materials. Students are encouraged to work through e ach chapter’s exercises in order, starting with the easier exercises and progressing to the more difficult exercises.ConclusionThe Financial and Managerial Accounting English Version Photocopy Tenth Edition Exercise Questions with Answers is a comprehensive guide for accounting students to practice and sharpen their skills infinancial and managerial accounting. This guide includes a wide range of exercise questions with detled answers to help students better understand complex accounting concepts. The guide is an essential study tool for accounting students and professionals who are preparing for certification exams or looking to improve their accounting skills.。

财务会计英语-练习及答案-ch01

2.An example of a business stakeholder is the federal government.

ANS:TDIF:2OBJ:01

3.A corporation is a business that is legally separate and distinct from its owners.

ANS:FDIF:3OBJ:07

38.The owner is only allowed to withdraw cash from the business.

ANS:FDIF:2OBJ:07

39.Receiving a bill or otherwise being notified that an amount is owed isnotrecorded until the amount is paid.

ANS:FDIF:3OBJ:05

21.The accounting equation can be expressed as Assets - Liabilities = Owner's Equity.

ANS:TDIF:2OBJ:06

22.The rights or claims to the assets of a business may be subdivided into rights of creditors and rights of owners.

ANS:FDIF:3OBJ:07

28.If total assets decreased by $40,000 during a specific period and owner's equity decreased by $45,000 during the same period, the period's change in total liabilities was an $85,000 increase.

财务英语 练习题(含答案)

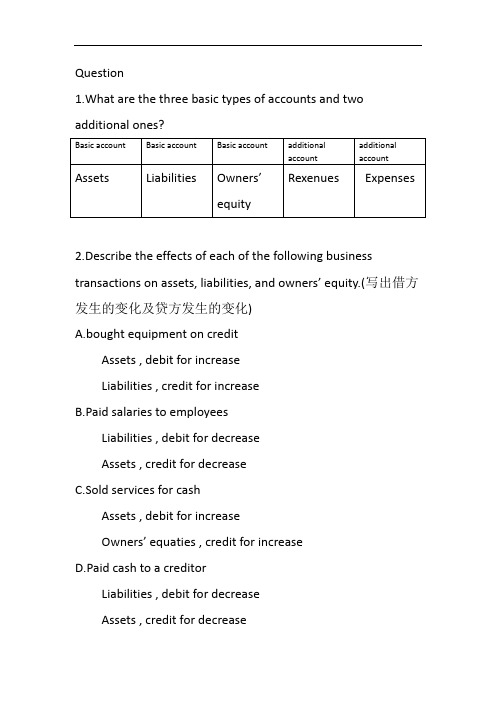

Question1.What are the three basic types of accounts and two additional ones?2.Describe the effects of each of the following business transactions on assets, liabilities, and owners’ equity.(写出借方发生的变化及贷方发生的变化)A.bought equipment on creditAssets , debit for increaseLiabilities , credit for increaseB.Paid salaries to employeesLiabilities , debit for decreaseAssets , credit for decreaseC.Sold services for cashAssets , debit for increaseOwners’ equaties , credit for increaseD.Paid cash to a creditorLiabilities , debit for decreaseAssets , credit for decreaseE.Paid cash for furnitureAssets , debit for increaseAssets , credit for decreaseF.Sold services on creditAssets , debit for increaseOwners’ equaties , credit for increase3.Describe the rules of debit and credit(只需填入debit/credit)Requirement: Complete each of the following statement by using the word debit and credit wherever appropriate.1.Assets accounts normally have debit balances. These accounts increase on the debit side and decrease on the credit side.2.Liabilities accounts normally have credit balances. These accounts increase on the credit side and decrease on the debit side.3.The owners’ capital account normally has credit balance. This account increase on the credit side and decrease on the debit side.。

财务会计英文版原书第5版ch02bwzg

Steps in the Recording

Process

Journal Ledger

The Recording Process Illustrated

Summary illustration of journalizing and posting

The Trial Balance

Limitations of a trial balance Locating errors Use of dollar signs

Expense

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter 3-25

Revenue

Debit / Dr.

Credit / Cr.

Chapter 2-8

Normal Balance

Chapter 3-27

Normal Balance

Chapter 3-26

SO 2

See notes page for discussion

Chapter 2-11

SO 2 Define debits and credits and explain their use in recording business transactions.

Assets and Liabilities

Common Stock

Debit / Dr.

Credit / Cr.

Retained Earnings

Debit / Dr.

Credit / Cr.

Dividends

Debit / Dr.

Credit / Cr.

Chapter 3-25

Chapter 2-13

财务会计练习(英语)

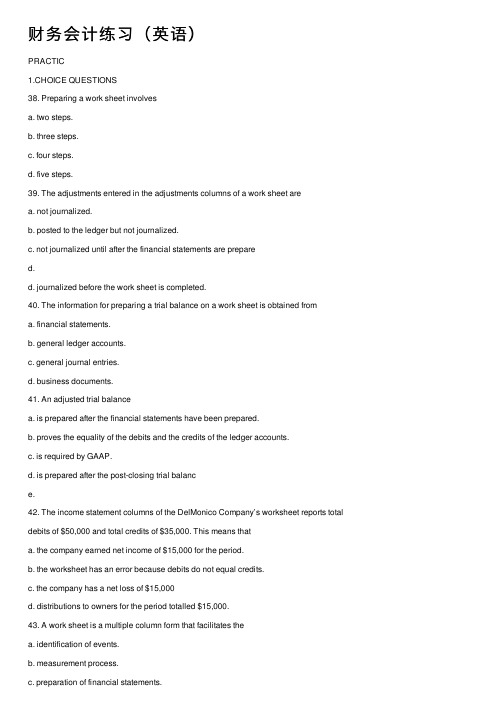

财务会计练习(英语)PRACTIC1.CHOICE QUESTIONS38. Preparing a work sheet involvesa. two steps.b. three steps.c. four steps.d. five steps.39. The adjustments entered in the adjustments columns of a work sheet area. not journalized.b. posted to the ledger but not journalized.c. not journalized until after the financial statements are prepared.d. journalized before the work sheet is completed.40. The information for preparing a trial balance on a work sheet is obtained froma. financial statements.b. general ledger accounts.c. general journal entries.d. business documents.41. An adjusted trial balancea. is prepared after the financial statements have been prepared.b. proves the equality of the debits and the credits of the ledger accounts.c. is required by GAAP.d. is prepared after the post-closing trial balance.42. The income statement columns of the DelMonico Company’s worksheet reports total debits of $50,000 and total credits of $35,000. This means thata. the company earned net income of $15,000 for the period.b. the worksheet has an error because debits do not equal credits.c. the company has a net loss of $15,000d. distributions to owners for the period totalled $15,000.43. A work sheet is a multiple column form that facilitates thea. identification of events.b. measurement process.c. preparation of financial statements.d. analysis process.44. Which of the following companies would be least likely to use a work sheet to facilitatethe adjustment process?a. Large company with numerous accountsb. Small company with numerous accountsc. All companies, since work sheets are required under generally acceptedaccounting principlesd. Small company with few accounts45. A work sheet can be thought of as a(n)a. permanent accounting record.b. optional device used by accountants.c. part of the general ledger.d. part of the journal.46. The account, Supplies, will appear in the following debit columns of the work sheet.a. Trial balanceb. Adjusted trial balancec. Balance sheetd. All of these47. When constructing a work sheet, accounts are often needed that are not listed in thetrial balance already entered on the work sheet from the ledger. Where should these additional accounts be shown on the work sheet?a. They should be inserted in alphabetical order into the trial balance accountsalready given.b. They should be inserted in chart of account order into the trial balance alreadygiven.c. They should be inserted on the lines immediately below the trial balance totals.d. They should not be inserted on the trial balance until the next accounting period.48. When using a work sheet, adjusting entries are journalizeda. after the work sheet is completed and before financial statements are prepared.b. before the adjustments are entered on to the work sheet.c. after the work sheet is completed and after financial statements have beenprepared.d. before the adjusted trial balance is extended to the proper financial statementcolumns.49. Closing entries are made for all accounts excepta. Revenuesb. Expensesc. Dividendsd. Common Stock50. Adjusting journal entries are prepared froma. source documents.b. the adjustment columns of the work sheet.c. the general ledger.d. last year's work sheet.51. The net income (or loss) for the perioda. is found by computing the difference between the income statement credit columnand the balance sheet credit column on the work sheet.b. cannot be found on the work sheet.c. is found by computing the difference between the income statement columns ofthe work sheet.d. is found by computing the difference between the trial balance totals and theadjusted trial balance totals.52. The work sheet does not showa. net income or loss for the period.b. revenue and expense account balances.c. the ending balance in the retained earnings account.d. the trial balance before adjustments.53. If the total debits exceed total credits in the balance sheet columns of the worksheet,retained earningsa. will increase because net income has occurred.b. will decrease because a net loss has occurred.c. is in error because a mistake has occurred.d. will not be affected.Use the following information for questions 54–55.The income statement and balance sheet columns of Pine Company's work sheet reflects the following totals: Income Statement Balance SheetDr. Cr. Dr.Cr.Totals $58,000 $45,000 $34,000 $47,00054. The net income (or loss) for the period isa. $45,000 income.b. $13,000 income.c. $13,000 loss.d. not determinable.55. To enter the net income (or loss) for the period into the above work sheet requires anentry to thea. income statement debit column and the balance sheet credit column.b. income statement credit column and to the balance sheet debit column.c. income statement debit column and the income statement credit column.d. balance sheet debit column and to the balance sheet credit column.56. Closing entries are necessary fora. permanent accounts only.b. temporary accounts only.c. both permanent and temporary accounts.d. permanent or real accounts only.57. Each of the following accounts is closed to Income Summary excepta. Expenses.b. Dividends.c. Revenues.d. All of these are closed to Income Summary.58. Closing entries are madea. in order to terminate the business as an operating entity.b. so that all assets, liabilities, and stockholders’ equity accounts will have zerobalances when the next accounting period starts.c. in order to transfer net income (or loss) and dividend to retained earnings.d. so that financial statements can be prepared.Use the following information from the Income Statement for the month of June, 2006 of Delgado Enterprises to answer questions 59 – 63.Revenues $7,000Expenses:Wages Expense $2,000Advertising Expense 200Rent Expense 1,000Supplies Expense 300Insurance Expense 100Total expenses 3,600Net income $3,40059. The entry to close the revenue account includesa. a debit to Income Summary for $3,400.b. a credit to Income Summary for $3,400.c. a debit to Income Summary for $7,000.d. a credit to Income Summary for $7,000.60. The entry to close the expense accounts includesa. a debit to Income Summary for $3,400.b. a credit to Rent Expense for $1,000,c. a credit to Income Summary for $3,600.d. a debit to Wages Expense for $2,000.61. After the revenue and expense accounts have been closed, the balance in IncomeSummary will bea. $0.b. a debit balance of $3,400.c. a credit balance of $3,400.d. a credit balance of $7,000.62. The entry to close Income Summary to Retained Earnings includesa. a debit to Revenue for $7,000.b. credits to Expenses totalling $3,600.c. a credit to Income Summary for $3,400d. a credit to Retained Earnings for $3,400.63. At June 1, 2006, Delgado reported Retained Earnings of $35,000. The companypaid no dividends during June. At June 30, 2006, the company will report a Retained Earnings balance ofa. $35,000 credit.b. $42,000 credit.c. $38,400 credit.d. $31,600 credit.64. Which of the following is a true statement about closing the books of a corporation?a. Expenses are closed to the Expense Summary account.b. Only revenues are closed to the Income Summary account.c. Revenues and expenses are closed to the Income Summary account.d. Revenues, expenses, and the Dividend account are closed to the IncomeSummary account.Use the following information from the Income Statement for the year 2006 of NOLA Inc. to answer questions 65 – 71. Revenues $70,000Expenses:Wages Expense $45,000Advertising Expense 6,000Rent Expense 12,000Supplies Expense 6,000Utilities Expense 2,500Insurance Expense 2,000Total expenses 73,500Net income (loss) $(3,500)65. The entry to close the revenue account includesa. a debit to Income Summary for $3,500.b. a credit to Income Summary for $3,500.c. a debit to Revenues for $70,000.d. a credit to Revenues for $70,000.66. The entry to close the expense accounts includesa. a debit to Income Summary for $3,500.b. a credit to Income Summary $3,500,c. a debit to Income Summary for $73,500.d. a debit to Wages Expense for $2,500.67. After the revenue and expense accounts have been closed, the balance in IncomeSummary will bea. $0.b. a debit balance of $3,500.c. a credit balance of $3,500.d. a credit balance of $70,000.68. The entry to close Income Summary to Retained Earnings includesa. a debit to Revenue for $70,000.b. credits to Expenses totalling $73,500.c. a credit to Income Summary for $3,500d. a credit to Retained Earnings for $3,500.69. At January 1, 2006, NOLA reported Retained Earnings of $50,000. Dividends for theyear totalled $10,000. At December 31, 2006, the company will report a Retained Earnings balance ofa. $13,500 debit.b. $36,500 credit.c. $40,000 credit.d. $43,500 credit.70. After all closing entries have been posted, the Income Summary account will have a balance ofa. $0.b. $3,500 debit.c. $3,500 credit.d. $36,500 credit.71. After all closing entries have been posted the Revenue account will have a balance ofa. $0.b. $70,000 credit.c. $70,000 debit.d. $3,500 credit.72. The Income Summary account is an important account that is useda. during interim periods.b. in preparing adjusting entries.c. annually in preparing closing entries.d. annually in preparing correcting entries.73. The balance in the income summary account before it is closed will be equal toa. the net income or loss on the income statement.b. the beginning balance in the retained earnings account.c. the ending balance in the retained earnings account.d. zero.74. After closing entries are posted, the balance in the Retained Earnings account in the ledger will be equal toa. the beginning Retained Earnings reported on the owner's equity statement.b. the amount of the Retained Earnings reported on the balance sheet.c. zero.d. the net income for the period.75. A post-closing trial balance is prepareda. after closing entries have been journalized and posted.b. before closing entries have been journalized and posted.c. after closing entries have been journalized but before the entries are posted.d. before closing entries have been journalized but after the entries are posted.76. All of the following statements about the post-closing trial balance are correct except ita. shows that the accounting equation is in balance.b. provides evidence that the journalizing and posting of closing entries have been properly completed.c. contains only permanent accounts.d. proves that all transactions have been recorded.77. A post-closing trial balance will showa. only permanent account balances.b. only temporary account balances.c. zero balances for all accounts.d. the amount of net income (or loss) for the period.78. A post-closing trial balance should be prepareda. before closing entries are posted to the ledger accounts.b. after closing entries are posted to the ledger accounts.c. before adjusting entries are posted to the ledger accounts.d. only if an error in the accounts is detected.79. A post-closing trial balance will showa. zero balances for all accounts.b. zero balances for balance sheet accounts.c. only balance sheet accounts.d. only income statement accounts.80. The purpose of the post-closing trial balance is toa. prove that no mistakes were made.b. prove the equality of the balance sheet account balances that are carried forwardinto the next accounting period.c. prove the equality of the income statement account balances that are carriedforward into the next accounting period.d. list all the balance sheet accounts in alphabetical order for easy reference.81. The balances that appear on the post-closing trial balance will match thea. income statement account balances after adjustments.b. balance sheet account balances after closing entries.c. income statement account balances after closing entries.d. balance sheet account balances after adjustments.82. Which account listed below would be double ruled in the ledger as part of the closing process?a. Cashb. Common Stockc. Dividendsd. Accumulated Depreciation83. A double rule applied to accounts in the ledger during the closing process implies thata. the account is a temporary account.b. the account is a balance sheet account.c. the account balance is not zero.d. a mistake has been made, since double ruling is prescribed.84. The heading for a post-closing trial balance has a date line that is similar to the one found ona. a balance sheet.b. an income statement.c. an owner's equity statement.d. the work sheet.85. Which one of the following is usually prepared only at the end of a company's annual accounting period?a. Preparing financial statementsb. Journalizing and posting adjusting entriesc. Journalizing and posting closing entriesd. Preparing an adjusted trial balance86. The step in the accounting cycle that is performed on a periodic basis (i.e., monthly, quarterly) isa. analyzing transactions.b. journalizing and posting adjusting entries.c. preparing a post-closing trial balance.d. posting to ledger accounts.87. Which one of the following is an optional step in the accounting cycle of a business enterprise?a. Analyze business transactionsb. Prepare a work sheetc. Prepare a trial balanced. Post to the ledger accounts88. The final step in the accounting cycle is to preparea. closing entries.b. financial statements.c. a post-closing trial balance.d. adjusting entries.89. Which of the following steps in the accounting cycle would not generally be performed daily?a. Journalize transactionsb. Post to ledger accountsc. Prepare adjusting entriesd. Analyze business transactions90. Which of the following steps in the accounting cycle may be performed more frequently than annually?a. Prepare a post-closing trial balanceb. Journalize closing entriesc. Post closing entriesd. Prepare a trial balance91. Which of the following depicts the proper sequence of steps in the accounting cycle?a. Journalize the transactions, analyze business transactions, prepare a trial balanceb. Prepare a trial balance, prepare financial statements, prepare adjusting entriesc. Prepare a trial balance, prepare adjusting entries, prepare financial statementsd. Prepare a trial balance, post to ledger accounts, post adjusting entries92. The two optional steps in the accounting cycle are preparinga. a post-closing trial balance and reversing entries.b. a work sheet and post-closing trial balances.c. reversing entries and a work sheet.d. an adjusted trial balance and a post-closing trial balance.93. The first required step in the accounting cycle isa. reversing entries.b. journalizing transactions in the book of original entry.c. analyzing transactions.d. posting transactions.94. Correcting entriesa. always affect at least one balance sheet account and one income statementaccount.b. affect income statement accounts only.c. affect balance sheet accounts only.d. may involve any combination of accounts in need of correction.95. Speedy Bike Company received a $740 check from a customer for the balance due.The transaction was erroneously recorded as a debit to Cash $470 and a credit to Service Revenue $470. The correcting entry isa. Debit Cash, $740; Credit Accounts Receivable, $740.b. Debit Cash, $270 and Accounts Receivable, $470; Credit Service Revenue, $740.c. Debit Cash, $270 and Service Revenue, $470; Credit Accounts Receivable, $740.d. Debit Accounts Receivable, $740; Credit Cash, $270 and Service Revenue, $470.96. If errors occur in the recording process, theya. should be corrected as adjustments at the end of the period.b. should be corrected as soon as they are discovered.c. should be corrected when preparing closing entries.d. cannot be corrected until the next accounting period.97. A correcting entrya. must involve one balance sheet account and one income statement account.b. is another name for a closing entry.c. may involve any combination of accounts.d. is a required step in the accounting cycle.98. An unacceptable way to make a correcting entry is toa. reverse the incorrect entry.b. erase the incorrect entry.c. compare the incorrect entry with the correct entry and make a correcting entry tocorrect the accounts.d. correct it immediately upon discovery.99. Cole Company paid the weekly payroll on January 2 by debiting Wages Expense for$40,000. The accountant preparing the payroll entry overlooked the fact that WagesExpense of $24,000 had been accrued at year end on December 31. The correctingentry isa. Wages Payable ............................................................................ 24,000Cash ................................................................................ 24,000b. Cash .......................................................................................... 16,000Wages Expense .............................................................. 16,000c. Wages Payable ............................................................................ 24,000Wages Expense .............................................................. 24,000d. Cash .......................................................................................... 24,000Wages Expense .............................................................. 24,000100. Tyler Company paid $630 on account to a creditor. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Receivable, $360. Thecorrecting entry isa. Accounts Payable (630)Cash (630)b. Accounts Receivable (360)Cash (360)c. Accounts Receivable (360)Accounts Payable (360)d. Accounts Receivable (360)Accounts Payable (630)Cash (990)101. A lawyer collected $860 of legal fees in advance. He erroneously debited Cash for $680 and credited Accounts Receivable for $680. The correcting entry isa. Cash (680)Accounts Receivable (180)Unearned Revenue (860)b. Cash (860)Service Revenue (860)c. Cash .............................................................................................180Accounts Receivable (680)Unearned Revenue (860)d. Cash (180)Accounts Receivable (180)102. All of the following are property, plant, and equipment excepta. supplies.b. machinery.c. land.d. buildings.Use the following information to answer questions 103-111.The following items are taken from the financial statements of Waters Company for the year ending 12/31/2006: Accounts payable $ 18,000Accounts receivable 11,000Accumulated depreciation – equipment 28,000Advertising expense 21,000Cash 15,000Common stock 90,000Depreciation expense 12,000Dividends 14,000Insurance expense 3,000Note payable, due 6/31/2007 70,000Prepaid insurance (12-month policy) 6,000Rent expense 17,000Retained earnings, 1/1/2006 12,000Salaries expense 32,000Service revenue 133,000Supplies 4,000Supplies expense 6,000Equipment 210,000103. What is the company’s net income for the year ending 12/31/2006?a. $133,000b. $42,000c. $28,000d. $12,000104. What is the balance that would be reported for Retained earnings at 12/31/2006?a. $12,000b. $40,000c. $42,000d. $56,000105. What are total current assets at 12/31/2006?a. $26,000b. $32,000c. $36,000d. $218,000106. What is the book value of the equipment at 12/31/2006?a. $238,000.b. $210,000c. $182,000d. $170,000107. What are total current liabililites at 12/31/2006?a. $18,000b. $70,000c. $88,000d. $0.108. What are total long-term liabilities at 12/31/2006?a. $0b. $70,000.c. $88,000d. $90,000109. What is total stockholders’ equity at 12/31/2006?a. $90,000.b. $102,000.c. $126,000.d. $130,000.110. The sub-classificatio ns for assets on the company’s classified balance sheet would include all of the following except:a. Current Assetsb. Property, Plant and Equipmentc. Intangible Assetsd. All of the above would be included as sub-classifications.111. The current assets should be listed on the balance sheet in the following order:a. cash, accounts receivable, prepaid insurance, equipmentb. cash, prepaid insurance, supplies, accounts receivablec. cash, accounts receivable, prepaid insurance, suppliesd. equipment, supplies, prepaid insurance, accounts receivable, cash112. The operating cycle of a company is the average time that is required to go from cash toa. sales in producing revenues.b. cash in producing revenues.c. inventory in producing revenues.d. accounts receivable in producing revenues.113. On a classified balance sheet, current assets are customarily listeda. in alphabetical order.b. with the largest dollar amounts first.c. in the order of liquidity.d. in the order of acquisition.114. Intangible assets include all of the following except:a. Marketable securities.b. Patents.c. Copyrights.d. Goodwill.115. The relationship between current assets and current liabilities is important in evaluating a company'sa. profitability.b. liquidity.c. market value.d. accounting cycle.116. The most important information needed to determine if companies can pay their current obligations is thea. net income for this year.b. projected net income for next year.c. relationship between current assets and current liabilities.d. relationship between short-term and long-term liabilities.a117. A reversing entrya. reverses entries that were made in error.b. is the exact opposite of an adjusting entry made in a previous period.c. is made when a business disposes of an asset it previously purchased.d. is made when a company sustains a loss in one period and reverses the effectwith a profit in the next period.a118. If a company utilizes reversing entries, they willa. be made at the beginning of the next accounting period.b. not actually be posted to the general ledger accounts.c. be made before the post-closing trial balance.d. be part of the adjusting entry process.119. The steps in the preparation of a work sheet do not includea. analyzing documentary evidence.b. preparing a trial balance on the work sheet.c. entering the adjustments in the adjustment columns.d. entering adjusted balances in the adjusted trial balance columns.120. Balance sheet accounts are considered to bea. temporary owner's equity accounts.b. permanent accounts.c. capital accounts.d. nominal accounts.121. Income Summary has a credit balance of $12,000 in J. Tayler Co. after closing revenues and expenses. The entry to close Income Summary isa. credit Income Summary $12,000, debit Retained Earnings $12,000.b. credit Income Summary $12,000, debit Dividends $12,000.c. debit Income Summary $12,000, credit Dividends $12,000.d. debit Income Summary $12,000, credit Retained Earnings $12,000.122. The post-closing trial balance contains onlya. income statement accounts.b. balance sheet accounts.c. balance sheet and income statement accounts.d. income statement, balance sheet, and owner's equity statement accounts.123. Which of the following is an optional step in the accounting cycle?a. Adjusting entriesb. Closing entriesc. Correcting entriesd. Reversing entries124. Which one of the following statements concerning the accounting cycle is incorrect?a. The accounting cycle includes journalizing transactions and posting to ledgeraccounts.b. The accounting cycle includes only one optional step.c. The steps in the accounting cycle are performed in sequence.d. The steps in the accounting cycle are repeated in each accounting period.125. Correcting entries are madea. at the beginning of an accounting period.b. at the end of an accounting period.c. whenever an error is discovered.d. after closing entries.126. On September 23, Reese Company received a $350 check from Mike Moluf for services to be performed in the future.The bookkeeper for Reese Company incorrectly debited Cash for $350 and credited Accounts Receivable for $350. The amounts have been posted to the ledger. To correct this entry, the bookkeeper shoulda. debit Cash $350 and credit Unearned Service Revenue $350.b. debit Accounts Receivable $350 and credit Unearned Service Revenue $350.c. debit Accounts Receivable $350 and credit Cash $350.d. debit Accounts Receivable $350 and credit Service Revenue $350.127. Fifth Dimension Inc. reported a balance in Retained Earnings of $45,000 on its post-closing trial balance at 12/31/2006. The company earned net income of $30,000 and paid dividends of $5,000 during the year. The 12/31/2006 balance sheet will report Retained Earnings ofa. $40,000b. $45,000c. $70,000d. $75,000128. Current liabilitiesa. must reasonably be expected to be paid from existing current assets or throughthe creation of other current liabilities.b. are listed in the balance sheet in order of their expected maturity.c. must reasonably be expected to be paid within one year or the operating cycle,whichever is shorter.d. should not include long-term debt that is expected to be paid within the next year.a129. The use of reversing entriesa. is a required step in the accounting cycle.b. changes the amounts reported in the financial statements.c. simplifies the recording of subsequent transactions.d. is required for all adjusting entries.2.MATCHING1 Match the items below by entering the appropriate code letter in the space provided.A. Intangible assets F. Book valueB. Permanent accounts G. Current assetsC. Closing entries H. Operating cycleD. Income Summary I. Current liabilitiesE. Reversing entry J. Correcting entries____ 1. Obligations expected to be paid within one year or one operating cycle out of current assets.____ 2. The difference between the cost and the accumulated depreciaion of a depreciable asset.____ 3. Noncurrent assets that do not have physical substance____ 4. A temporary account used in the closing process.____ 5. Balance sheet accounts whose balances are carried forward to the next period.____ 6. The average length of time to go from cash to cash in producing revenue.____ 7. Entries to correct errors made in recording transactions.____ 8. The exact opposite of an adjusting entry made in a previous period.____ 9. Entries at the end of an accounting period to transfer the balances of temporary accounts to a stockholders’ account. ____ 10. Resources which are expected to be realized in cash, sold, or consumed within one year of the balance sheet or the company's operating cycle,whichever is longer.2.MATCHING150. Match the items below by entering the appropriate code letter in the space provided.A. Cost of goods available for sale F. First-in, first-out (FIFO) methodB. Raw materials G. Last-in, first-out (LIFO) methodC. FOB shipping point H. Average cost methodD. FOB destination I. Inventory turnoverE. Net purchases J. Current replacement cost____ 1. Measures the number of times the inventory sold during the period.____ 2. Purchases less purchases returns and allowances and purchases discounts.____ 3. Goods that will be used in the production process but which have not yet been placed into production.____ 4. Cost of goods sold consists of the most recent inventory purchases.____ 5. Sum of beginning merchandise inventory and cost of goods purchased.____ 6. Title to the goods transfers when the public carrier accepts the goods from the seller.____ 7. Ending inventory valuation consists of the most recent inventory purchases.____ 8. The same unit cost is used to value ending inventory and cost of goods sold.____ 9. Title to goods transfers when the goods are delivered to the buyer.____ 10. The amount that would be paid at the present time to acquire an identical item.。

财务会计英语练习及答案ch

财务会计英语练习及答案ch个人收集整理勿做商业用途CHAPTER 16 STATEMENT OF CASH FLOWS个人收集整理勿做商业用途Chapter 16—Statement of Cash FlowsTRUE/FALSE1. The statement of cash flows is not one of the basic financial statements.ANS: F DIF: 1 OBJ: 012. Cash, as the term is used for the statement of cash flows, could indicate either cash or cashequivalents.ANS: T DIF: 1 OBJ: 013. The statement of cash flows is an optional financial statement.ANS: F DIF: 1 OBJ: 014. The statement of cash flows shows the effects on cash ofa company's operating, investing,and financing activities.ANS: T DIF: 1 OBJ: 015. The statement of cash flows reports a firm's major sources of cash receipts and major uses ofcash payments for a period.ANS: T DIF: 1 OBJ: 016. Cash flows from operating activities, as part of the statement of cash flows, include cashtransactions that enter into the determination of net income.ANS: T DIF: 1 OBJ: 017. To arrive at cash flows from operations, it is necessary toconvert the income statement froman accrual basis to the cash basis of accounting.ANS: T DIF: 2 OBJ: 018. Cash flows from investing activities, as part of the statement of cash flows, include receiptsfrom the sale of land.ANS: T DIF: 2 OBJ: 019. Cash flows from financing activities, as part of the statement of cash flows, include paymentsfor dividends.ANS: T DIF: 2 OBJ: 0110. Cash flows from investing activities, as part of the statement of cash flows, include paymentsfor the purchase of treasury stock.ANS: F DIF: 2 OBJ: 0111. Cash flows from investing activities, as part of the statement of cash flows, include receiptsfrom the issuance of bonds payable.ANS: F DIF: 2 OBJ: 0112. There are two alternatives to reporting cash flows from operating activities in the statement ofcash flows: (1) the direct method and (2) the indirect method.ANS: T DIF: 1 OBJ: 0113. The direct method of preparing the operating activities section of the statement of cash flowsreports major classes of gross cash receipts and gross cash payments.ANS: T DIF: 1 OBJ: 0114. Under the direct method of reporting cash flows from operations, the major source of cash iscash received from customers.ANS: T DIF: 1 OBJ: 0115. The main disadvantage of the direct method of reporting cash flows from operating activitiesis that the necessary data are often costly to accumulate.ANS: T DIF: 2 OBJ: 0116. A major disadvantage of the indirect method of reporting cash flows from operating activitiesis that the difference between the net amount of cash flows from operating activities and net income is not emphasized.ANS: F DIF: 2 OBJ: 01个人收集整理勿做商业用途17. Cash outflows from financing activities include the payment of cash dividends, theacquisition of treasury stock, and the repayment of amounts borrowed.ANS: T DIF: 2 OBJ: 0118. Cash flows from investing activities, as part of the statement of cash flows, include paymentsfor the acquisition of fixed assets.ANS: T DIF: 2 OBJ: 0119. The acquisition of land in exchange for common stock is an example of noncash investing andfinancing activity.ANS: T DIF: 2 OBJ: 0120. If a business issued bonds payable in exchange for land, the transaction would be reported in aseparate schedule on the statement of cash flows.ANS: T DIF: 2 OBJ: 0121. A cash flow per share amount should be reported on thestatement of cash flows.ANS: F DIF: 1 OBJ: 0122. Although there is no order in which the noncash balance sheet accounts must be analyzed indetermining data for preparing the statement of cash flows by the indirect method, time can be saved and greater accuracy can be achieved by selecting the accounts in the reverse order in which they appear on the balance sheet.ANS: T DIF: 1 OBJ: 0223. The 2002 edition of Accounting Trends and Techniques reported that 90% of the companiessurveyed used the indirect method to report changes in cash flows from operations.ANS: F DIF: 2 OBJ: 0224. Rarely would the cash flows from operating activities, as reported on the statement of cashflows, be the same as the net income reported on the income statement.ANS: T DIF: 2 OBJ: 0225. If land costing $75,000 was sold for $135,000, the amount reported in the investing activitiessection of the statement of cash flows would be $75,000.ANS: F DIF: 2 OBJ: 0226. If land costing $150,000 was sold for $205,000, the $55,000 gain on the sale would be addedto net income in converting the net income reported on the income statement to cash flows from operating activities for the statement of cash flows prepared by the indirect method.ANS: F DIF: 2 OBJ: 0227. In preparing the cash flows from operating activitiessection of the statement of cash flows bythe indirect method, the net decrease in inventories from the beginning to the end of the period is added to net income for the period.ANS: T DIF: 2 OBJ: 0228. In determining the cash flows from operating activities for the statement of cash flows by theindirect method, the depreciation expense for the period is added to the net income for the period.ANS: T DIF: 2 OBJ: 0229. In preparing the cash flows from operating activities section of the statement of cash flows bythe indirect method, the amortization of bond discount for the period is deducted from the net income for the period.ANS: F DIF: 2 OBJ: 02个人收集整理勿做商业用途30. If cash dividends of $145,000 were declared during the year and the decrease in dividendspayable from the beginning to the end of the year was $7,000, the statement of cash flows would report $152,000 in the financing activities section.ANS: T DIF: 2 OBJ: 0231. The declaration and issuance of a stock dividend would be reported on the statement of cashflows.ANS: F DIF: 2 OBJ: 0232. If 900 shares of $40 par common stock are sold for $48,000, the $48,000 would be reported inthe cash flows from financing activities section of the statement of cash flows.ANS: T DIF: 2 OBJ: 0233. If $500,000 of bonds payable are sold at 101, $500,000 would be reported in the cash flowsfrom financing activities section of the statement of cash flows.ANS: F DIF: 2 OBJ: 0234. Net income was $ 52,000 for the year. The accumulated depreciation balance increased by$17,000 over the year. There were no sales of fixed assets or changes in noncash current assets or liabilities. The cash flow from operations is $35,000ANS: F DIF: 2 OBJ: 0235. Net income for the year was $29,000. Accounts receivable increased $2,500, and accountspayable increased $5,100. The cash flow from operations is $31,600.ANS: T DIF: 2 OBJ: 0236. A building with a cost of $153,000 and accumulated depreciation of $42,000 was sold for an$11,000 gain. The cash generated from this investing activity was $121,000.ANS: F DIF: 2 OBJ: 0237. The indirect method reports cash received from customers in the cash flows from operatingactivities section of the statement of cash flows.ANS: F DIF: 2 OBJ: 0238. Cash paid to acquire treasury stock should be shown on the statement of cash flows frominvesting activities.ANS: F DIF: 2 OBJ: 0239. Repayments of bonds would be shown as a cash outflow in the investing section of thestatement of cash flows.ANS: F DIF: 2 OBJ: 0240. Acquiring equipment by issuing a six-month note should be shown on the statement of cashflows under the investing activities section.ANS: F DIF: 2 OBJ: 0241. In reporting cash flows from investing activities on the statement of cash flows, the cashinflows are usually reported first, followed by the cash outflows.ANS: T DIF: 1 OBJ: 0242.Cash inflows and outflows are not netted in any activity section of the statement of cash flows but are separately disclosed to give the reader full information.ANS: T DIF: 1 OBJ: 0243. The manner of reporting cash flows from investing and financing activities will be differentunder the direct method as compared to the indirect method.ANS: F DIF: 1 OBJ: 0344. Sales reported on the income statement were $375,000. The accounts receivable balancedeclined $6,500 over the year. The amount of cash received from customers was $368,500.个人收集整理勿做商业用途ANS: F DIF: 2 OBJ: 0345. To determine cash payments for merchandise for the cash flow statement using the directmethod, a decrease in accounts payable is added to the cost of merchandise sold.ANS: T DIF: 2 OBJ: 0346. To determine cash payments for operating expenses for the cash flow statement using thedirect method, a decrease in prepaid expenses is added to operating expenses other thandepreciation.ANS: F DIF: 2 OBJ: 0347. To determine cash payments for operating expenses for the cash flow statement using thedirect method, a decrease in accrued expenses is added to operating expenses other thandepreciation.ANS: T DIF: 2 OBJ: 0348. To determine cash payments for income tax for the cash flow statement using the directmethod, an increase in income taxes payable is added to the income tax expense.ANS: F DIF: 2 OBJ: 0349. Free cash flow is cash flow from operations, less cash used to purchase fixed assets tomaintain productive capacity and cash used for dividends.ANS: T DIF: 1 OBJ: 0450. Free cash flow is the measure of operating cash flow available for corporate purposes afterproviding sufficient fixed asset additions to maintain current productive capacity anddividends.ANS: T DIF: 1 OBJ: 04MULTIPLE CHOICE1. Which of the following is not one of the four basic financial statements?a. balance sheetb. statement of cash flowsc. statement of changes in financial positiond. income statementANS: C DIF: 1 OBJ: 012. Which of the following concepts of cash is not appropriate to use in preparing the statementof cash flows?a. cashb. cash and money market fundsc. cash and cash equivalentsd. cash and U.S. treasury bondsANS: D DIF: 2 OBJ: 013. The statement of cash flows reportsa. cash flows from operating activitiesb. total assetsc. total changes in stockholders' equityd. changes in retained earningsANS: A DIF: 1 OBJ: 014. On the statement of cash flows, the cash flows from operating activities section would includea. receipts from the issuance of capital stockb. receipts from the sale of investmentsc. payments for the acquisition of investments个人收集整理勿做商业用途d. cash receipts from sales activitiesANS: D DIF: 2 OBJ: 015. Preferred stock issued in exchange for land would be reported in the statement of cash flowsina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: C DIF: 2 OBJ: 016. Cash paid to purchase long-term investments would be reported in the statement of cash flowsina. the cash flows from operating activities sectionb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. a separate scheduleANS: C DIF: 2 OBJ: 017. A statement of cash flows would not disclose the effects of which of the followingtransactions?a. stock dividends declaredb. bonds payable exchanged for capital stockc. purchase of treasury stockd. capital stock issued to acquire fixed assetsANS: A DIF: 2 OBJ: 018. Which of the following does not represent an outflow of cash and therefore would not bereported on the statement of cash flows as a use of cash?a. purchase of noncurrent assetsb. purchase of treasury stockc. discarding an asset that had been fully depreciatedd. payment of cash dividendsANS: C DIF: 2 OBJ: 019. Which of the following represents an inflow of cash and therefore would be reported on thestatement of cash flows?a. appropriation of retained earningsb. acquisition of treasury stockc. declaration of stock dividendsd. issuance of long-term debtANS: D DIF: 2 OBJ: 0110. A ten-year bond was issued at par for $150,000 cash. This transaction should be shown on astatement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activitiesd. operating activitiesANS: B DIF: 1 OBJ: 0111. Cash paid for preferred stock dividends should be shown on the statement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activities个人收集整理勿做商业用途d. operating activitiesANS: B DIF: 2 OBJ: 0112. The last item on the statement of cash flows prior to the schedule of noncash investing andfinancing activities reportsa. the increase or decrease in cashb. cash at the end of the yearc. net cash flow from investing activitiesd. net cash flow from financing activitiesANS: B DIF: 2 OBJ: 0113. Which of the following is a noncash investing and financing activity?a. payment of a cash dividendb. payment of a six-month note payablec. purchase of merchandise inventory on accountd. issuance of common stock to acquire landANS: D DIF: 2 OBJ: 0114. Which of the following should be shown on a statement of cash flows under the financingactivity section?a. the purchase of a long-term investment in the common stock of another companyb. the payment of cash to retire a long-term notec. the proceeds from the sale of a buildingd. the issuance of a long-term note to acquire landANS: B DIF: 2 OBJ: 0115. A company purchases equipment for $29,000 cash. This transaction should be shown on thestatement of cash flows undera. investing activitiesb. financing activitiesc. noncash investing and financing activitiesd. operating activitiesANS: A DIF: 2 OBJ: 0116. Cash flow per share isa. required to be reported on the balance sheetb. required to be reported on the income statementc. required to be reported on the statement of cash flowsd. not required to be reported on any statementANS: D DIF: 1 OBJ: 0117. On the statement of cash flows prepared by the indirect method, the cash flows from operatingactivities section would includea. receipts from the sale of investmentsb. amortization of premium on bonds payablec. payments for cash dividendsd. receipts from the issuance of capital stockANS: B DIF: 2 OBJ: 0118. The statement of cash flows may be used by management toa. assess the liquidity of the businessb. assess the major policy decisions involving investments and financingc. determine dividend policyd. do all of the aboveANS: D DIF: 1 OBJ: 01个人收集整理勿做商业用途19. Depreciation on factory equipment would be reported in the statement of cash flows preparedby the indirect method ina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: D DIF: 2 OBJ: 0220. Which of the following should be added to net income incalculating net cash flow fromoperating activities using the indirect method?a. an increase in inventoryb. a decrease in accounts payablec. preferred dividends declared and paidd. a decrease in accounts receivableANS: D DIF: 2 OBJ: 0221. Which of the following should be deducted from net income in calculating net cash flow fromoperating activities using the indirect method?a. depreciation expenseb. amortization of premium on bonds payablec. a loss on the sale of equipmentd. dividends declared and paidANS: B DIF: 2 OBJ: 0222. Which of the following below increases cash?a. depreciation expenseb. acquisition of treasury stockc. borrowing money by issuing a six-month noted. the declaration of a cash dividendANS: C DIF: 2 OBJ: 0223. Which one of the following below would not be classified as an operating activity?a. interest expenseb. income taxesc. payment of dividendsd. selling expensesANS: C DIF: 2 OBJ: 0224. Which one of the following below should be added to net income in calculating net cash flowfrom operating activities using the indirect method?a. a gain on the sale of landb. a decrease in accounts payablec. an increase in accrued liabilitiesd. dividends paid on common stockANS: C DIF: 2 OBJ: 0225. On the statement of cash flows prepared by the indirect method, a $50,000 gain on the sale ofinvestments would bea. deducted from net income in converting the net income reported on the incomestatement to cash flows from operating activitiesb. added to net income in converting the net income reported on the income statementto cash flows from operating activitiesc. added to dividends declared in converting the dividends declared to the cash flowsfrom financing activities related to dividends个人收集整理勿做商业用途d. deducted from dividends declared in converting the dividends declared to the cashflows from financing activities related to dividendsANS: A DIF: 2 OBJ: 0226. Accounts receivable arising from trade transactions amounted to $45,000 and $52,000 at thebeginning and end of the year, respectively. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method isb. $112,000c. $98,000d. $140,000ANS: C DIF: 2 OBJ: 0227. The net income reported on the income statement for the current year was $275,000.Depreciation recorded on fixed assets and amortization of patents for the year were $40,000 and $9,000, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:End Beginning Cash $ 50,000 $ 60,000 Accounts receivable 112,000 108,000 Inventories 105,000 93,000 Prepaid expenses 4,500 6,500 Accounts payable (merchandise creditors) 75,000 89,000 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?a. $198,000b. $324,000c. $352,000d. $296,000ANS: D DIF: 3 OBJ: 0228. The following information is available from the current period financial statements:Net income .................................... $140,000Depreciation expense ..................... 28,000Increase in accounts receivable ....... 16,000Decrease in accounts payable ......... 21,000The net cash flow from operating activities using the indirect method isb. $163,000c. $107,000d. $205,000ANS: A DIF: 3 OBJ: 0229. On the statement of cash flows, the cash flows from investing activities section would includea. receipts from the issuance of capital stockb. payments for dividendsc. payments for retirement of bonds payabled. receipts from the sale of investmentsANS: D DIF: 2 OBJ: 02个人收集整理勿做商业用途30. A building with a book value of $ 45,000 is sold for $50,000 cash. Using the indirect method,this transaction should be shown on the statement of cash flows as follows:a. an increase of $45,000 from investing activitiesb. an increase of $50,000 from investing activities and a deduction from net income of$5,000c. an increase of $50,000 from investing activitiesd. an increase of $45,000 from investing activities and an addition to net income of$5,000ANS: B DIF: 2 OBJ: 0231. Cash paid for equipment would be reported in the statement of cash flows ina. the cash flows from operating activities sectionb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. a separate scheduleANS: C DIF: 2 OBJ: 0232. If a gain of $9,000 is incurred in selling (for cash) office equipment having a book value of$55,000, the total amount reported in the cash flows from investing activities section of the statement of cash flows isa. $46,000b. $9,000c. $55,000d. $64,000ANS: D DIF: 2 OBJ: 0233. Which of the following types of transactions would be reported as a cash flow from investingactivity on the statement of cash flows?a. issuance of bonds payableb. issuance of capital stockc. purchase of treasury stockd. purchase of noncurrent assetsANS: D DIF: 2 OBJ: 0234. Land costing $47,000 was sold for $78,000 cash. The gain on the sale was reported on theincome statement as other income. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?a. $78,000b. $47,000c. $109,000d. $31,000ANS: A DIF: 2 OBJ: 0235. Equipment with an original cost of $50,000 and accumulated depreciation of $20,000 wassold at a loss of $7,000. As a result of this transaction, cash woulda. increase by $23,000b. decrease by $7,000c. increase by $43,000d. decrease by $30,000ANS: A DIF: 2 OBJ: 0236. On the statement of cash flows, the cash flows from financing activities section would includea. receipts from the sale of investmentsb. payments for the acquisition of investmentsc. receipts from a note receivabled. receipts from the issuance of capital stockANS: D DIF: 2 OBJ: 0237. On the statement of cash flows, the cash flows from financing activities section would includeall of the following excepta. receipts from the sale of bonds payableb. payments for dividendsc. payments for purchase of treasury stockd. payments of interest on bonds payableANS: D DIF: 2 OBJ: 0238. Cash dividends paid on capital stock would be reported in the statement of cash flows ina. the cash flows from financing activities sectionb. the cash flows from investing activities sectionc. a separate scheduled. the cash flows from operating activities sectionANS: A DIF: 2 OBJ: 0239. Cash dividends of $80,000 were declared during the year. Cash dividends payable were$10,000 and $15,000 at the beginning and end of the year, respectively. The amount of cash for the payment of dividends during the year isa. $85,000b. $80,000c. $95,000d. $75,000ANS: D DIF: 2 OBJ: 0240. On the statement of cash flows, a $20,000 gain on the sale of fixed assets would bea. added to net income in converting the net income reported on the income statementto cash flows from operating activitiesb. deducted from net income in converting the net income reported on the incomestatement to cash flows from operating activitiesc. added to dividends declared in converting the dividends declared to the cash flowsfrom financing activities related to dividendsd. deducted from dividends declared in converting the dividends declared to the cashflows from financing activities related to dividendsANS: B DIF: 2 OBJ: 0241. A business issues 20-year bonds payable in exchange for preferred stock. This transactionwould be reported on the statement of cash flows ina. a separate scheduleb. the cash flows from financing activities sectionc. the cash flows from investing activities sectiond. the cash flows from operating activities sectionANS: A DIF: 2 OBJ: 0242. Land costing $68,000 was sold for $50,000 cash. The loss on the sale was reported on theincome statement as other expense. On the statement of cash flows, what amount should be reported as an investing activity from the sale of land?a. $50,000b. $78,000c. $118,000d. $68,000ANS: A DIF: 2 OBJ: 0243. The current period statement of cash flows includes the flowing:Cash balance at the beginning of the period................... $410,000Cash provided by operating activities ............................ 185,000 Cash used in investing activities .................................... 43,000Cash used in financing activities .................................... 97,000 The cash balance at the end of the period isa. $45,000b. $735,000c. $455,000d. $85,000ANS: C DIF: 2 OBJ: 0244. On the statement of cash flows, the cash flows from operating activities section would includea. receipts from the issuance of capital stockb. payment for interest on short-term notes payablec. payments for the acquisition of investmentsd. payments for cash dividendsANS: B DIF: 2 OBJ: 0345. The cost of merchandise sold during the year was $50,000. Merchandise inventories were$12,500 and $10,500 at the beginning and end of the year, respectively. Accounts payable were $6,000 and $5,000 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments for merchandise totala. $49,000b. $47,000c. $51,000d. $53,000ANS: A DIF: 2 OBJ: 0346. Sales for the year were $600,000. Accounts receivable were $100,000 and $80,000 at thebeginning and end of the year. Cash received from customers to be reported on the cash flow statement using the direct method isa. $700,000b. $600,000c. $580,000d. $620,000ANS: D DIF: 2 OBJ: 0347. Operating expenses other than depreciation for the year were $400,000. Prepaid expensesincreased by $17,000 and accrued expenses decreased by $30,000 during the year. Cash payments for operating expensesto be reported on the cash flow statement using the direct method would bea. $353,000b. $413,000c. $447,000d. $383,000ANS: C DIF: 2 OBJ: 0348. The following selected account balances appeared on the financial statements of the FranklinCompany:Accounts Receivable, Jan. 1 ........... $13,000Accounts Receivable, Dec. 31 ........ 9,000Accounts Payable, Jan 1 ................ 4,000Accounts payable Dec. 31 .............. 7,000Merchandise Inventory, Jan 1 ......... 10,000Merchandise Inventory, Dec 31 ...... 15,000Sales ............................................. 56,000Cost of Goods Sold ........................ 31,000The Franklin Company uses the direct method to calculate net cash flow from operatingactivities. Cash collections from customers area. $56,000b. $52,000c. $60,000d. $45,000ANS: C DIF: 3 OBJ: 0349. The following selected account balances appeared on the financial statements of the FranklinCompany:Accounts Receivable, Jan. 1 ......... $13,000Accounts Receivable, Dec. 31 ...... 9,000Accounts Payable, Jan 1 .............. 4,000Accounts payable Dec. 31 ............ 7,000Merchandise Inventory, Jan 1 ....... 10,000Merchandise Inventory, Dec 31 .... 15,000Sales ........................................... 56,000Cost of Goods Sold ....................... 31,000The Franklin Company uses the direct method to calculate net cash flow from operatingactivities. Cash paid to suppliers isa. $39,000b. $33,000c. $29,000d. $23,000ANS: B DIF: 3 OBJ: 0350. Income tax was $400,000 for the year. Income tax payable was $30,000 and $40,000 at thebeginning and end of the year. Cash payments for income tax reported on the cash flow statement using the direct method isa. $400,000b. $390,000c. $430,000d. $440,000ANS: B DIF: 2 OBJ: 0351. Free cash flow isa. all cash in the bankb. cash from operationsc. cash from financing, less cash used to purchase fixed assets to maintain productive。

财务会计英语版课后答案