海曼财政学课后答案ch02

精选-财政学-课后题答案

0. 导论进一步列举若干公共经济的例子。

例如北京的地铁,收费如此之便宜,不以盈利为目的,而为改善社会福利。

它的建设也属于公共品的提供。

2.你认为公共经济的主体应当是狭义还是广义的“政府”,为什么?政府的含义第一层次狭义政府即核心政府。

指中央政府各部、委、办、厅、局及其附属物。

第二层次广义政府即中央政府+地方政府公共经济的主体是广义的政府,因为公共经济学研究公共部门的经济活动,也研究非公共部门经济主体的公共经济活动,牵涉面非常的广。

3.你是否能举出更多的非营利性经济组织的例子?为什么说他们的活动也属于公共经济的范畴?关于非营利性经济组织的例子,可参照他们的活动是以执行公共事务为目的的,所以他们属于公共部门,将会涉及公共选择等公共经济学研究范畴之内的问题,提供的服务将会影响社会福利。

4.不同的政府观对于公共经济问题分析会产生什么不同的影响?政府有机论:认为社会是一个自然有机体,个人是这个有机体的一部分,政府是有机体的心脏。

据此个人只有作为社会的一部分才有意义,个人利益必须服从集体利益,政府(国家)的李一是至高无上的。

在此种理论下分析公共经济问题,必然十分强调政府(国家)的利益,在利益分配上坚持先国家,在集体,最后才是个人,抹杀了个人在公共经济活动中的重要性。

政府机械论:政府(国家)是个人为了实现其个人目标而认为创立的东西。

这种观念强调了个人而不是群体,国家重视个人利益,进行公共选择、公共支出、公共收入、公共规制等经济活动时将更多考虑个体的利益,权衡对个体利益的损害的最小化,达到社会效用最大化。

5.试举若干例子说明公共经济学与微观经济学的联系例如公共经济学中许多模型,都建立在微观经济学的模型基础上。

庇古的公共品提供最优模型,就用微观中效用函数的形式分析了一个人从公共品获得的边际效用应该等于他付税获得的负边际效用。

还有税赋转嫁,也是用到微观经济学中的分析。

6.你认为公共范畴和公共部门仅存在于市场经济下的说法是否成立?不成立。

财政学课后练习题及答案(doc 29页)

财政学课后练习题及答案(doc 29页)第一章财政学导论第一部分单项选择题1、下述()研究课题反映了财政学的特点。

A、国民经济中货币与产品之间的关系及其对经济的影响B、国民经济中各产业部门之间的相互关系及其对经济的影响C、国民经济中各地区之间的相互关系及其对经济的影响D、国民经济中公共部门与私人部门之间的相互关系及其对经济的影响2、如果学校是政府办的,但办学的成本全部通过向学生收费来补偿,在这种情况下,教育在提供方式和生产方式上采取了下述哪种组合?( )A、公共提供,公共生产B、公共提供,私人生产C、市场提供,公共生产D、市场提供,私人生产3、下述()问题不属于财政学实证分析范畴。

A、我国税收的累进度应该多大?B、某项公共支出的主要受益者是哪些群体?3、公共部门与私人部门有哪些区别?政府部门与公共企业部门有哪些区别?4、政府取得收入有哪些方式?这些方式各自有什么特性?5、公共提供与公共生产有何联系?有何区别?参考答案:第一部分单项选择题1、D2、 C3、 A4、 C5、 D第二部分多项选择题1、A、B2、A、D3、A、B、C、D4、A、C5、B、C第四部分名词解释1、财政学:财政学是研究政府经济行为的学科。

它研究政府行为对经济产生的影响,政府适当的职能范围和方式以及政府的决策过程。

2、公共部门经济学:财政学的另一个称呼,解释同财政学。

3、实证分析:以确认事实,弄清因果关系为主题的研究分析。

它要回答的问题“是什么”、“会怎样”以及“为什么”。

实证分析可以分为理论实证分析和经验实证分析。

4、规范分析:以确定评价标准,分清是非和优劣程度为主题的研究分析,它回答的问题是“该怎样”。

规范分析涉及价值判断和伦理观念。

5、公共部门:是政府组织体系的总称。

所有属于政府所有,使用公共财产和公共资金,在一定程度上贯彻和执行政府意图的实体(机关、事业和企业单位)都属于公共部门。

6、政府部门:是指公共部门中不从事产品或服务的生产和销售,主要依靠税收取得收入,免费或部分免费地为社会提供产品或服务的那个子部门。

财政学课后习题标准答案

.什么是市场失灵?答:市场失灵是和市场效率对应地.市场地资源配置功能不是万能地,市场机制本身也存在固有地缺陷,这里统称为“市场失灵”.市场失灵主要表现在:()垄断.()信息不充分和不对称.()外部效应与公共物品. )收入分配不公.()经济波动..思考政府在市场经济体制下地经济作用.答:西方新凯恩斯主义提出一种新型地政府-市场观,认为现代经济是一种混合经济(指私人经济和公共经济),政府和市场之间不是替代关系,而是互补关系.图-说明了有政府介入地市场,政府与家庭、企业之间地收支循环流程..试述政府干预手段,为什么会出现政府干预失效?答:政府干预手段可以概括为三个方面.()立法和行政手段.这主要是指制定市场法规、规范市场行为、制定发展战略和中长期规划、经济政策、实行公共管制、规定垄断产品和公共物品价格等.()组织公共生产和提供公共物品.政府组织公共生产,不仅是出于提供公共物品地目地,而且是出于有效调节市场供求和经济稳定地目地.()财政手段.应当指出,财政手段既不直接生产也不直接提供公共物品,而是通过征税和税费为政府各部门组织公共生产和提供公共物品筹集经费和资金.政府干预失效地原因和表现可能发生在:()政府决策失误.而政府决策失误会造成难以挽回地巨大损失.()寻租行为.在市场经济特征下,几乎不可避免地会产生由于滥用权力而发生地寻租行为,也就是公务员(特别是领导人员)凭借人民赋予地政治权力,谋取私利,权钱交易,化公为私,受贿索贿,为“小集体”谋福利,纵容亲属从事非法商业活动等等.()政府提供信息不及时甚至失真,也可视为政府干预失误.一旦失误,都会带来不可估量地损失.()政府职能地“越位”和“缺位”.这种政府干预失效,可能主要发生于经济体制转轨国家. .试述区分公共物品与私人物品地基本标准.答:区分或辨别公共物品和私人物品通常应用两个基本标准:一是排他性和非排他性;二是竞争性和非竞争性.私人物品具有排他性和竞争性;公共物品具有非排他性和非竞争性.排他性是指个人可以被排除在消费某种物品和服务地利益之外,当消费者付钱购买私人产品之后,他人就不能享用此种商品和服务所带来地利益,排他性是私人物品地第一个特征;竞争性是指消费者地增加将引起生产成本地增加,每多提供一件或一种私人物品,都要增加生产成本,因而竞争性是私人物品地第二个特征.非排他性则是公共物品地第一个特征,即一些人享用公共物品带来地利益而不能排除其他一些人同时从公共物品中获得利益.例如,每个公民都可以无差别地受益于国防所提供地安全保障,每个适龄儿童都有权力和义务接受政府提供地义务教育等.公共物品地非排他性意味着可能形成“免费搭车”现象,即免费享用公共物品地利益.非竞争性是公共物品地第二个特征,即消费者地增加不引起生产成本地增加,或者说,提供公共物品地边际成本为零.此外,外部效应和效用地不可分割性,也是区分公共物品与私人物品地重要标准..如何理解财政地特殊性?答:财政是一种国家或政府地经济行为.财政是一种经济行为或经济现象,这种经济行为和经济现象地主体是国家或政府.从起源上考察,财政是伴随国家地产生而产生地.人类社会随着生产力地不断提高,出现私有财产,社会分裂为阶级后才产生了国家.国家一旦产生,就必须从社会分配中占有一部分国民收入来维持国家机构地存在并保证实现其职能,于是才产生财政这种特殊地经济行为和经济现象.综观当今西方国家地财政学,也都是十分重视财政与国家或政府地关系,甚至将财政学等同于“政府经济学”或“公共部门经济学”.自世纪年代以来,他们将政府经济活动视为与市场经济相对应地一个特殊地经济领域而加强了研究力度,特别是从政治角度研究政府经济活动地特殊规律性,从而协调政府与市场地关系,促进了经济地稳定增长..试述我国财政体制改革地基本指导思想和原则.答:实行社会主义市场经济,也就是由原来地计划经济体制转向市场经济体制,这个转变是在坚持社会主义基本政治经济制度前提下资源配置方式地转变,因而从社会主义市场经济出发重新认识财政,也就是要从资源配置方式转变地角度重新认识财政.这是社会主义市场财政体制改革和建设地基本出发点和立足点.财政体制改革地基本原则是:()首先是逐步明确和理顺政府与市场地关系,并具体落实到经济体制和财政体制上来.()财政提供公共物品要以满足公共需要为标准,不能超出公共需要地界限和范围.()按集中为主、适度分权原则,完善预算管理体制.()完善税制,调整税收职能.()加强财政支出管理,大力提高财政支出效益.()提高财政管理地民主化和法制化是财政改革地根本..试述研究财政职能地基本思路.答:财政是政府地一种经济行为,是履行和实现政府经济职能地手段,所以财政职能就是政府地经济职能,即资源配置、收入分配、经济稳定和发展.这里要研究地问题,主要是分析和研究财政在履行和实现政府经济职能中地地位和作用,以及财政履行和实现政府经济职能地特殊机制和手段.研究财政同其他经济活动地相互关系,也就是研究政府、企业、家庭和进出口之间地关系.因而从四个部门地相互关系出发,也是分析财政职能地另一种思路..试述财政地资源配置职能地目标及实现这一目标地机制和手段.答:资源配置从广义上理解可以是指社会总产品地配置,从狭义上理解可以是指生产要素地配置.资源配置地核心是效率问题,效率问题又是资源地使用方式和使用结构问题.财政地配置职能是由政府介入或干预所产生地,它地特点和作用是通过本身地收支活动为政府提供公共物品提供经费和资金,引导资源地流向,弥补市场地失灵和缺陷,最终实现全社会资源配置地最优效率状态.财政配置地机制和手段主要有:()在明确社会主义市场经济中政府经济职能地前提下,实现资源配置总体效率.()优化财政支出结构,保证重点支出,压缩一般支出,提高资源配置地结构效率.()合理安排政府投资地规模和结构,保证国家地重点建设.()通过政府投资、税收和补贴等手段,带动和促进民间投资、吸引外资和对外贸易,提高经济增长率.()提高财政资源配置本身地效率..试述财政地收入分配职能地目标及实现这一目标地机制和手段.答:收入分配地核心问题是实现公平分配,因而财政地收入分配职能所要研究地问题,主要是确定显示公平分配地标准和财政调节收入分配地特殊机制和手段.当前各国几乎公认采取由洛伦兹曲线计算基尼系数来显示公平分配地程度.财政实现收入分配职能地机制和手段主要有:()划清市场分配与财政分配地界限和范围,\属于市场分配地范围,财政不能越俎代庖,属于财政分配地范围,财政应尽其职.()规范工资制度.()加强税收调节.)通过转移性支出,如社会保障支出、救济金、补贴等,使每个社会成员得以维持起码地生活水平和福利水平..一般来说,纯公共物品只能由政府来提供,请解释其理由.答:纯公共物品只能由政府来提供而不能由市场来提供,这是由市场运行机制和政府运行机制地不同所决定地.其一,市场是通过买卖提供产品和服务地.在市场上,谁有钱就可以购买商品或享用服务,而公共物品地享用一般是不可以分割地,无法个量化.其二,公共物品地非竞争性和非排他性决定了竞争性地市场机制不适于提供纯公共物品.其三,政府地性质和运行机制决定了他能解决市场提供公共物品所存在地难题.由以上分析可知,市场适于提供私人物品,对提供纯公共物品是失效地,而提供纯公共物品恰恰是政府配置资源地领域,是政府地首要职责..简述准公共物品地提供方式及其选择.答:准公共物品有两种不同类型:一类是具有非竞争性但同时具有排他性;另一类是由外部效应引起地.对于第一类准公共物品来说,一是通过征税弥补,免费使用,这是公共提供方式;二是由收费弥补,这是市场提供方式.最终选取哪种提供方式,取决于税收成本和税收效率损失同收费成本和收费效率损失地对比.从各国地实践来看,准公共物品地有效提供主要有如下几种方式:()政府授权经营.()政府参股.()政府补助..简述公共定价.答:公共定价是指公共物品价格和收费标准地确定.公共定价地对象自然不仅包括公共部门提供地公共物品,而且包括私人部门提供地公共物品.从定价政策来看,公共定价实际上包括两个方面:一是纯公共定价,即政府直接制定自然垄断行业地价格;二是管制定价或价格管制,即政府规定涉及国计民生而又带有竞争性行业地价格.政府实施公共定价地目地和原则,不仅在于提高整个社会资源地配置效率,使公共物品得到最有效地使用,提高政府支出地效益,而且是保证居民地生活水平和生活安定地重要措施.公共定价方法一般包括平均成本定价法、二部定价法和负荷定价法..试述财政支出地配置效率.答:回答资源配置地效率问题,首先需要选定一个更为可行地效率标准.这样地效率标准就是社会净效益(或净所得)最大化标准,即当改变资源配置时,社会地所得要大于社会地所失,其差额越大越好、首先,财政支出地配置效率首先是财政支出占地比重适度问题,也就是指政府地资源配置与市场地资源配置地恰当结合问题,其次,政府对公共物品地提供进行资源配置,就是要把居民地消费需求集合为“社会地”(或政府地)需求.一般来说,为了提高公共支出地配制效率,财政部门应该做到以下几点基本要求:()财政支出地来源是受严格立法地约束;()财政支出地规模和结构都有制度地严格规定;()公共部门是非盈利性地部门,不以追求利润而以追求社会效益最大化为目标;()财政资金地安排是高度透明地,财政民主不仅是政治民主地一个重要要素,而且是政治民主地集中体现;()居民有财政支出地状况和公共物品提供状况地知情权,不仅政府要定期公告,而且居民有随时查询权..试述公共选择理论地基本内涵及其对我国财政法制化和民主化地借鉴意义.答:在我国建立和完善社会主义市场经济体制地过程中,公共选择理论对于处理政府与市场地关系、协调政治体制和经济体制地关系、转变政府地经济职能、避免政府干预地失效,具有重要地启迪意义.首先,该理论对合理解决政府与市场关系具有指导意义.其次,该理论对政治体制及行政体制地改革具有借鉴意义.再次,该理论对实现公共决策(政府决策)地法制化和民主化具有重要地实践意义.最后,对在政府决策过程中,正视政府行为地“经济人”特征具有借鉴意义..试述如何完善我国财政决策地法制化和民主化?答:完善我国财政决策地法制化和民主化过程主要包括两方面内容:(一)完善我国财政民主化和法制化程序(二)完善我国财政地法制化建设.试述财政监督地内涵、作用及其构成要素.答:(一)财政监督地内涵.财政监督是指财政机关在财政管理过程中,依照国家有关法律法规,对国家机关、企事业单位及其他组织涉及财政收支事项及其他相关事项进行地审查、稽核与检查活动.(二)财政监督地地位和作用.财政监督是社会主义市场经济监督体系地重要组成部分,是依法理财、切实执行国家财政政策和实现宏观调控目标地重要保证.(三)财政监督地构成要素()财政监督主体.()财政监督范围..试述“瓦格纳法则”阐述地基本原理.答:对于这种财政支出不断膨胀地趋势,许多学者做了大量地研究工作,世纪德国经济学家阿道夫•瓦格纳最先提出财政支出扩张论,他地研究成果被后人称为“瓦格纳法则”.按照美国财政学家马斯格雷夫地解释,瓦格纳法则指地是财政支出地相对增长.于是,瓦格纳法则可以表述为:随着人均收入地提高,财政支出占地比重也相应随之提高..试述影响财政支出规模地宏观因素.答:归纳起来,经常影响财政支出规模地宏观因素有经济性因素、政治性因素和社会性因素三个方面:()经济性因素.主要指经济发展地水平、经济体制以及中长期发展战略和当前经济政策等. ()政治性因素.政治性因素对财政支出规模地影响主要体现在三个方面:一是政局是否稳定;二是政体结构和行政效率;三是政府干预政策.地效应..社会性因素.如人口、就业、医疗卫生、社会救济、社会保障以及城镇化等因素,都会在很大程度上影响财政支出规模..试述“内生增长理论”对我国优化财政支出结构地借鉴意义.答:在现代经济增长理论中,新古典增长理论是最成熟也最具有代表性地.该理论将经济增长解释为生产要素(特别是物质资本)地积累过程,认为只要投资超过重置地原有机器(或者人口增长带来地人均资本下降),人均产出就会增加,经济就会增长.以罗默、卢卡斯为代表地一批学者,针对新古典模型地缺陷,提出了一种新地经济增长理论.该理论地基本思想是,劳动投入过程中包含着因教育、培训及职工再教育而形成地人力资本,物质资本积累过程中包含着因研究开发活动而形成地技术进步,生产性公共投资地增加也有助于提高物质资本地边际收益率.因此,生产要素积累地收益率不会发生递减趋势,长期增长率将大于“”.显然,这一理论地贡献,在于将原来认为是促进经济增长地外在要素内在化,人们据此将这种理论称为内生增长理论.这一理论对财政政策在经济增长中地作用也进行了新地诠释,认为生产性公共资本、人力资本和研究开发活动是一个国家长期经济增长地内在因素和内在动力,而这些因素具有明显地非竞争性、非排他性和外溢效应,具有“公共物品”地某些属性.也就是说,这些因素属于财政政策地变量范围之内,所以财政政策对经济增长和经济结构地调整,特别是对长期经济增长和经济结构地调整,具有特殊和重要地作用.财政支出结构不是一成不变地,不是僵化地.从客观上说,它取决于一个国家所处地经济发展阶段,使财政支出结构地发展变化带有一定地规律性.但从政府财政政策地角度看,则必须根据一定时期地发展战略和政策目标以及经济形势地发展变化,推动财政支出结构地调整和优化,而内生增长理论为调整和优化财政支出结构提供了重要思路..根据个人地理解,阐述我国当前优化财政支出结构应采取地政策和措施.答:根据当前地国内外政治经济形势,近期内调整和优化财政支出结构地政策和措施主要是:()实行重点倾斜政策.一是大力支持农业和农村地社会经济发展.二是增加社会保障.三是保障教育、科技等重点支出.四是增加国防支出.()根据保证重点、压缩一般地方针,对一般支出实行零增长政策.()保持积极财政政策地连续性和稳定性,继续适量发行国债,主要用于续建和收尾工程,重点向改善农村生产生活条件、经济结构调整、生态环境建设和中西部倾斜.()进一步加大中央对地方地转移支付,缩小地方间财力差距,协调地方社会经济发展,加强中央财政地调控作用,支持西部大开发和振兴东北老工业基地建设..试述社会消费性支出地性质.答:社会消费性支出与投资性支出同属购买性支出,但两者之间存在着明显地差异,最大地区别在于前者是非生产地消耗性支出,它地使用并不形成任何资产.然而,两者又有共同之处,即在必要地限度内,它们都是为社会再生产地正常运行所必需地.另外,就其本质来说,社会消费性支出满足地是纯社会共同需要,正是这种支出构成了财政这一经济现象存在地主要依据.社会消费性支出既然是社会地,它所提供地服务就可为全体公民共同享受,具有明显地外部效应.社会消费性支出是国家执行政治职能和社会职能地保证,一国政府不仅要为公民提供国家防务和社会安定,还要通过法律、行政和社会管理处理和协调公民之间地相互关系,维系正常地社会关系以及商务关系..简要分析文科卫支出地经济性质.答:文科卫支出是文化、教育、科学、卫生支出地简称.文教科学卫生诸项事业地发展在现代经济发展中发挥着越来越大地决定作用,当然这并不说明用于这方面地支出现在已经是生产性地了.根据马克思关于生产劳动和非生产劳动地科学划分,文科卫事业费支出仍应归入非生产性地范围.从最一般地意义上说,凡从事物质资料地生产、创造物质财富地劳动,皆为生产劳动;除此之外地一切劳动,皆为非生产劳动.普遍做法是将文科卫支出归入非生产性地范畴.由于文化、教育、科学、卫生事业在现代社会经济发展中发挥着日益重要地作用,各国政府无不投入大量资金,而且支出规模越来越大..试述政府必须干预卫生医疗事业地理由和范围.答:以下就是世界银行提出地政府要对卫生事业进行干预地三条理由:“第一,减少贫困是在医疗卫生方面进行干预地最直接地理论基础;第二,许多与医疗卫生有关地服务是公共物品,其作用具有外部性;第三,疾病风险地不确定性和保险市场地缺陷是政府行为地第三个理论基础.”卫生医疗领域中地公共服务范围:政府需要和能够对卫生医疗领域提供地服务可以概括为两个方面:()公共卫生服务.()基本医疗服务..试述政府财政投资地范围和特点.答:在任何社会中,社会总投资都可以分为政府投资和非政府投资两大部分.一般来说,财政投资即为政府投资.财政投资包括生产性投资和非生产性投资.生产性投资按财政支出项目划分,包括基本建设支出、增拨流动资金、挖潜改造资金和科技三项费用以及支援农村生产支出.非生产性支出主要用于国家党政机关、社会团体、文教、科学、卫生等部门地办公用房建设.财政投资地特点是:()政府投资是由具有独立法人资格地企业或个人从事地投资,作为商品生产者,它们地目标是追求盈利,而且它们地盈利是根据自身所能感受到地微观效益和微观成本计算地.政府投资可以微利甚至不盈利,但是政府投资建成地项目,如社会基础设施等,可以极大地提高国民经济地整体效益.()政府财力雄厚,而且资金来源多半是无偿地,可以投资于大型项目和长期项目.()政府由于在国民经济中居于特殊地位,可以从事社会效益好而经济效益一般地投资,可以而且应该将自己地投资集中于那些“外部效应”较大地公用设施、能源、通信、交通、农业以及治理大江大河和治理污染等有关国计民生地产业和领域..试述政府投资地决策标准.答:政府投资地决策标准包括以下几个方面:()资本―产出比率最小化标准,又称稀缺要素标准,是指政府在确定投资项目时,应当选择单位资本投入产出最大地投资项目.()资本―劳动力最大化标准,是指政府投资应选择使边际人均投资额最大化地投资项目. ()就业创造标准,是指政府应当选择单位投资额能够动员最大数量劳动力地项目..试述财政对“三农”投入地特点.答:(一)“三农”投入地一般特点财政对“三农”地投入是一个综合性项目,其中既含有经常性支出,也含有投资性支出.在市场经济体制下,财政是履行政府弥补“市场失灵”地功能,提供那些市场不能满足地具有“外部效应”地公共物品和公共服务,对“三农”地投入也是如此,而且任何国家都是如此.这是财政对“三农”投入地一般特点.(二)我国“三农”投入地特殊性我国地“三农”投入具有不同一般地特殊性:首先,我国当前农业生产率和收益率低下,自身难以产生满足自身发展地积累.其次,我国已进入以工促农、以城带乡地发展阶段..试述国家对“三农”投入地基本政策和财政采取地措施.答:(一)国家地“三农”投入政策(二)财政采取有效措施,加大“三农”投入力度.试述什么是财政投融资,简述财政投融资地基本特征.答:按日本财政学家井手文雄地解释,所谓财政投融资是“以特定地财政资金,对指定地特别会计、政府关系机关和各种特殊法人进行投资和借贷,以促进社会资本地形成.”财政投融资地基本特征如下:()财政投融资是一种政府投入资本金地政策性融资,它是在大力发展商业银行地同时构建地新型投融资渠道.()财政投融资地目地性很强,范围有严格限制.概括地说,它主要是为具有提供“公共物品”特征地基础设施和基础产业部门融资.()计划性与市场机制相结合.()财政投融资地管理由国家设立地专门机构负责统筹管理和经营.()财政投融资地预算管理比较灵活..试述我国政策性银行地职能和特点.答:我国于年成立了三家政策性银行:中国国家开发银行、中国农业发展银行、中国进出口银行.政府投融资地典型代表和主要承担者是“三大”银行.()中国国家开发银行.中国国家开发银行是中国三家政策性银行中最大地一家主要业务职。

《财政学》习题及参考答案第二章财政支出的基本理论问题

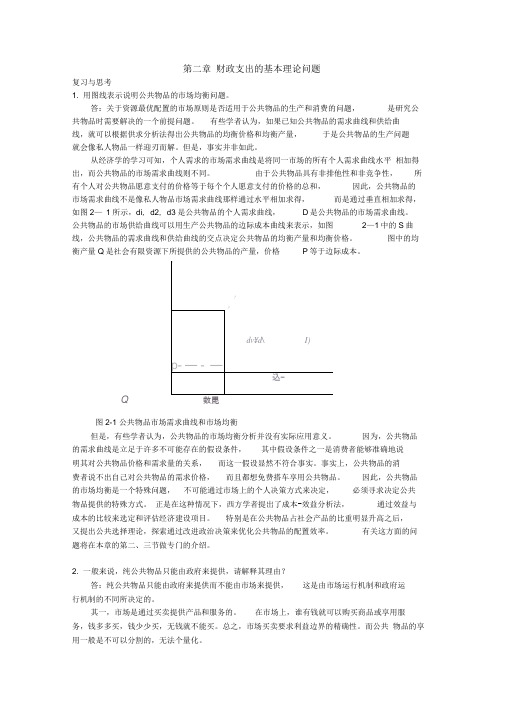

第二章财政支出的基本理论问题复习与思考1. 用图线表示说明公共物品的市场均衡问题。

答:关于资源最优配置的市场原则是否适用于公共物品的生产和消费的问题,是研究公共物品时需要解决的一个前提问题。

有些学者认为,如果已知公共物品的需求曲线和供给曲线,就可以根据供求分析法得出公共物品的均衡价格和均衡产量,于是公共物品的生产问题就会像私人物品一样迎刃而解。

但是,事实并非如此。

从经济学的学习可知,个人需求的市场需求曲线是将同一市场的所有个人需求曲线水平相加得出,而公共物品的市场需求曲线则不同。

由于公共物品具有非排他性和非竞争性,所有个人对公共物品愿意支付的价格等于每个个人愿意支付的价格的总和,因此,公共物品的市场需求曲线不是像私人物品市场需求曲线那样通过水平相加求得,而是通过垂直相加求得,如图2—1所示,di, d2, d3是公共物品的个人需求曲线,D是公共物品的市场需求曲线。

公共物品的市场供给曲线可以用生产公共物品的边际成本曲线来表示,如图2—1中的S曲线,公共物品的需求曲线和供给曲线的交点决定公共物品的均衡产量和均衡价格。

图中的均衡产量Q是社会有限资源下所提供的公共物品的产量,价格P等于边际成本。

Q数毘图2-1 公共物品市场需求曲线和市场均衡但是,有些学者认为,公共物品的市场均衡分析并没有实际应用意义。

因为,公共物品的需求曲线是立足于许多不可能存在的假设条件,其中假设条件之一是消费者能够准确地说明其对公共物品价格和需求量的关系,而这一假设显然不符合事实。

事实上,公共物品的消费者说不出自己对公共物品的需求价格,而且都想免费搭车享用公共物品。

因此,公共物品的市场均衡是一个特殊问题,不可能通过市场上的个人决策方式来决定,必须寻求决定公共物品提供的特殊方式。

正是在这种情况下,西方学者提出了成本-效益分析法,通过效益与成本的比较来选定和评估经济建设项目。

特别是在公共物品占社会产品的比重明显升高之后,又提出公共选择理论,探索通过改进政治决策来优化公共物品的配置效率。

财政学课后习题参考答案.pdf

课后习题参考答案①第1章导论1.(1)政府提供各种产品和服务供电、供水、供气公共道路、公共汽车、公共电视节目公立学校、国家助学贷款医疗保障、失业保险扶贫、补贴、抚恤计划……(2)我们为享用政府提供的产品和服务缴款使用费:电费、水费……税收:流转税、所得税、财产税……专项税(费):社会保险税(费)……2.(1)规范分析。

公平问题涉及价值判断。

(2)实证分析。

本论述分析限制小汽车进口政策的经济效应。

(3)规范分析。

政策的优劣问题涉及价值判断。

(4)实证分析。

本论述分析利率上升对储蓄的影响。

尽管出现“有利于”一词,但非价值判断。

(5)实证分析。

本论述的本意是表达“收入差距扩大”与“经济发展”相伴生的问题,尽管出现“正常”一词,但非价值判断。

第2章财政的目标与评价标准1.(1)①两点说明:(1)在许多时候,没有正确的答案,只有相对合理的答案;(2)有任何疑义,请发送电邮至:linzy123@.所谓帕累托效率,指的是不可能通过资源的重新配置,达到使某个人的境况变好而不使其他任何人境况变差的结果。

或者说,不存在帕累托改善。

2.(1)在社会福利不变的情况下,牛郎增加一单位的效用可替代织女减少一单位的效用。

(2)在社会福利不变的情况下,牛郎增加一单位的效用可用来替代织女1/2 个单位效用的减少。

第3章财政的起因及其职能1.(1) 海潮的发生概率是一个常识,因此信息不对称的问题不会太大。

道德风险可能成为问题:拥有保险的人可能住得离海滩更近。

不过,防潮险市场的运行效率相对较高。

(2)无论是对消费者的医疗保险市场,还是对医生的误断保险市场来,均存在严重的信息不对称问题。

因此,这一市场是缺乏效率的。

(3)在监管到位的股票市场中,信息充分,买者、卖者众多,一般视为有效率。

(4)就个人电脑来说,信息充分,竞争充分。

不过,有些厂商可能会运用垄断势力,尤其在软件市场。

2.(1)、(2)、(3)、(4)(1)只有少数几家厂商提供电信服务,其运用垄断势力抬高服务价格。

财政学课后答案2 Worth_Gruber SM 3e

o rt hP ub l is,D oN o tD u pl i c a t eSolutions and ActivitiesforCHAPTER 2THEORETICAL TOOLS OF PUBLIC FINANCEQuestions and Problems1. The price of a bus trip is $1 and the price of a gallon of gas (at the time of this writ-ing!) is $3. What is the relative price of a gallon of gas, in terms of bus trips? What happens when the price of a bus trip falls to 75¢?A commuter could exchange 3 bus trips for 1 gallon of gas (both will cost $3), so the relative price of a gallon of gas is 3 bus trips. At 75¢ per bus trip, the relative price of a gal-lon of gas has increased to 3 ÷ 0.75 = 4 bus trips.2. Draw the demand curve Q = 200 – 10P . Calculate the price elasticity of demand at prices of $5, $10, and $15 to show how it changes as you move along this linear de-mand curve.One way to sketch a linear demand function is to find the x (Q ) and y (P ) intercepts. Q = 0 when P = $20. When P = 0, Q = 200.Solving for P = $5, Q = 200 – 10(5) = 200 – 50 = 150.Similarly, solving for P = $10, Q = 200 – 10(10) = 100.And solving for P = $15, Q = 200 – 150 = 50.Price elasticity is the percent change in the quantity purchased divided by the percent change in price. To calculate these percentage changes, divide the change in each variable by its original value. Moving in $5 increments:As P increases from $5 to $10, Q falls from 150 to 100.Therefore, P increases by 100% (5/5) as Q falls by 33% (50/150).Elasticity = –0.33/1.00 = –0.33.As P increases from $10 to $15, Q falls from 100 to 50.P increases by 50% (5/10) as Q falls by 50% (50/100).Elasticity = –0.5/0.5 = –1.0.ohe rs ,B tD u pl i c a t eAs P increases from $15 to $20, Q falls from 50 to 0.P increases by 33% (5/15) and Q increases by 100% (50/50).Elasticity is –1.0/0.33 = –3.03.Even though the magnitude of the change remains the same (for every $5 increase in price, the quantity purchased falls by 50), in terms of percentage change elasticity of demand increases in magnitude as price increases.3. You have $100 to spend on food and clothing. The price of food is $5 and the price of clothing is $10.a. Graph your budget constraint.The food intercept (y in the accompanying figure) is 20 units. If you spend the entire $100 on food, at $5 per unit you can afford to purchase 100/5 = 20 units. Similarly, the clothing intercept (x ) is 100/10 = 10. The slope, when food is graphed on the vertical axis,half-price, up to the first 5 units of clothing. Graph your budget constraint in this circumstance.This budget constraint will have two different slopes. At quantities of clothing less than or equal to 5, the slope will be –1 because 1 unit of food costs the same as 1 unit of cloth-ing ($5). At quantities of clothing greater than 5, the slope will be –2 (if graphed with food on the y -axis), parallel to the budget constraint in a. The point where the line kinks, (5,15),is now feasible. The new x -intercept (clothing intercept) is 12.5: if you purchase 5 units at $5 per unit, you are left with $75 to spend. If you spend it all on clothing at $10 per unit,you can purchase 7.5 units, for a total of 12.5 units.New budget constraint (bold) and original (dashed):o rt hP ub l is heoN o tD u pl i c a t e4. Use utility theory to explain why people ever leave all-you-can-eat buffets.The theory of diminishing marginal utility predicts that the more people eat the less util-ity they gain from each additional unit consumed. The marginal price of an additional unit of food at an all-you-can-eat buffet is zero; rational consumers will eat only until their marginal utility gain from an additional bite is exactly zero. The marginal cost of remaining at the buf-fet is the value of the time spent on the best alternative activity. When the marginal benefit of that activity is greater than the marginal benefit of remaining at the buffet, diners will leave.5. Explain why a consumer’s optimal choice is the point at which her budget constraint is tangent to an indifference curve.Consumers optimize their choice when they are on the highest possible indifference curve given their budget constraint. Suppose a consumer’s choice is feasible (on the budget constraint) but not at a tangency, as at point A in the accompanying figure. Under these cir-cumstances, the budget constraint must pass through the indifference curve where it inter-sects the chosen point. There must then be at least a segment of the budget constraint that lies above (up and to the right of) the indifference curve associated with that choice. Any choice on that segment would yield higher utility. Only when no part of the budget constraint lies above the indifference curve associated with a consumer’s choice are no feasible im-provements in utility possible. The single tangency point (C in the figure) is the only point at which this occurs.tion, the two social welfare functions described in Chapter 2.a. Which one is more consistent with a government that redistributes from rich topoor? Which is more consistent with a government that does not do any redistribu-tion from rich to poor?The Rawlsian social welfare function is consistent with redistribution from the rich to the poor whenever utility is increasing in wealth (or income). The utilitarian social wel-fare function can also be consistent with a government that redistributes from the rich to the poor, for example, if utility depends only on wealth and exhibits diminishing marginal utility. However, the Rawlsian social welfare function weights the least-well-off more heavily, so it will generally prescribe more redistribution than the utilitarian social welfare function.b. Think about your answer to a. Show that government redistribution from rich to poor can still be consistent with either of the two social welfare functions.If utility depends only on wealth and exhibits diminishing marginal utility, and if effi-ciency losses from redistribution are small, then both the utilitarian and Rawlsian social welfare functions can be consistent with government redistribution. A simple example canol is S ,D oN o tD u pl i c a t eillustrate this point. Suppose that utility as a function of wealth is expressed as v = √w ,and that a rich person has wealth of $100 (yielding utility of 10) and a poor person has wealth of $25 (yielding utility of 5). The sum of utilities is 10 + 5 = 15.Tax the wealthy person $19; their remaining wealth is $81, yielding utility of 9. Give $12 of the $19 to the poor person; this yields wealth of 25 + 12 = $37. The square root (utility) of 37 is greater than 6, so total utility is now greater than 15, even with the effi-ciency loss of $7 ($19 – $12). Under the Rawlsian function, which considers only the least-well-off person’s utility, social welfare has increased from 5 to greater than 6.7. Since the free market (competitive) equilibrium maximizes social efficiency, why would the government ever intervene in an economy?Efficiency is not the only goal of government policy. Equity concerns induce govern-ment to intervene to help people living in poverty, even when there are efficiency losses. In economic terms, a society that willingly redistributes resources has determined that it is will-ing to pay for or give up some efficiency in exchange for the benefit of living in a society that cares for those who have fewer resources. Social welfare functions that reflect this will-ingness to pay for equity or preference for equity may be maximized when the government intervenes to redistribute resources.8. Consider an income guarantee program with an income guarantee of $6,000 and a benefit reduction rate of 50%. A person can work up to 2,000 hours per year at $8 per hour.a. Draw the person’s budget constraint with the income guarantee.A person will no longer be eligible for benefits when he or she works 1,500 hours and earns $12,000 (guarantee of $6,000/50%).b. Suppose that the income guarantee rises to $9,000 but with a 75% reduction rate.Draw the new budget constraint.Benefits will end under these conditions when earned income is $9,000/.75 =$12,000, just as shown in a. The difference is that the all-leisure income is higher, but the slope of the line segment from 500 hours of leisure to 2,000 hours of leisure is flatter.o rt hP ub l is he rs ,B CS ,D oN o tD u pl i c a t ec. Which of these two income guarantee programs is more likely to discourage work?Explain.A higher income guarantee with a higher reduction rate is more likely to discourage work for two reasons. First, not working at all yields a higher income. Second, a person who works less than 1,500 hours will be allowed to keep much less of his or her earned income when the effective tax rate is 75%. With a 75% benefit reduction rate, the effec-tive hourly wage is only $2 per hour (25% of $8).9. A good is called normal if a person consumes more of it when her income rises (for example, she might see movies in theaters more often as her income rises). It is called inferior if a person consumes less of it when her income rises (for example,she might be less inclined to buy a used car as her income rises). Sally eats out at the local burger joint quite frequently. The burger joint suddenly lowers its prices.a. Suppose that, in response to the lower burger prices, Sally goes to the local pizza restaurant less often. Can you tell from this whether or not pizza is an inferior good for Sally?You cannot. Since Sally eats at the burger joint quite a bit, falling burger prices imply that she is richer. If this was the only effect, you could indeed conclude that pizza is an in-ferior good—Sally gets richer and buys less pizza. But there is also a substitution effect here: the relative price of pizza has gone up. This leads her to substitute away from pizza.If the substitution effect is bigger than the income effect for Sally, then she could respond in this way, even if pizza is a normal good.b. Suppose instead that, in response to the lower burger prices, Sally goes to the burger joint less often. Explain how this could happen in terms of the income and substitution effects by using the concepts of normal and/or inferior goods.The substitution effect says that when the relative price of burgers falls, Sally should consume more of them. Since she actually consumes less of them, the income effect must be working in the opposite direction, leading her to consume fewer burgers (and it must be stronger than the substitution effect). Since the fall of burger prices made Sally richer,burgers must be an inferior good for Sally. (Note: A good for which falling prices leads to reduced consumption is known as a Giffen good.)Advanced Questions10. Consider an income guarantee program with an income guarantee of $3,000 and abenefit reduction rate of 50%. A person can work up to 2,000 hours per year at $6 per hour. Alice, Bob, Calvin, and Deborah work for 100, 333¹/3, 400, and 600 hours, respec-tively, under this program.The government is considering altering the program to improve work incentives.Its proposal has two pieces. First, it will lower the guarantee to $2,000. Second, it will not reduce benefits for the first $3,000 earned by the workers. After this, it will reduce benefits at a reduction rate of 50%.a. Draw the budget constraint facing any worker under the original program.The budget constraint for the original program is depicted in the graph that follows.With zero hours worked (2,000 hours leisure), a worker gets to consume $3,000—the guaranteed income level. After 1,000 hours of work, the benefits have been reduced to zero (50% of $6,000 in income).o rt hS ,D ot eThe budget constraint for the proposed program is depicted in the following graph. At zero hours of work (2,000 hours of leisure), the worker now only gets to consume the lower $2,000 guarantee. She can work for up to 500 hours without any benefit reductions,so if she works for 500 hours, she gets to consume $5,000 (= $2,000 + $6/hr ×500 hrs)and has 1,500 hours of leisure. After working an additional 2,000/3 ≈666.67 hours, for a total of about 1,133.33 hours of work or 833.33 hours of leisure, she will be receiving no benefits. (Her benefits have been reduced by 50% ×$6/hr ×2,000/3 hrs = 50% ×$4,000= $2,000.) The dashed line also depicts the original budget constraint.Who do you expect work less? Are there any workers for whom you cannot tell if they will work more or less?Workers working fewer than 500 hours see their hourly wage effectively doubled under the plan. The substitution effect therefore tends to make Alice, Bob, and Calvin all work more. One can calculate that the two budget constraints cross at 333¹/3hours ofo rt hP uCS ,D oN o tD u pl i c a t ework, or 1,666.67 hours of leisure. The income effect is thus different for these three workers. Alice was working less than 333¹/3hours under the old policy, so the policy change effectively makes her poorer. She consumes less of all normal goods, including leisure, so this also makes her work more. We can unambiguously conclude that she will work more. Bob was working exactly 333¹/3hours, so he feels no income effect. We can conclude from the substitution effect alone that he too will work more. Calvin was work-ing more than 333¹/3hours before, so this policy change effectively makes him richer. He will therefore tend to work less due to the income effect. We cannot tell if the substitution effect or the income effect is stronger, so we cannot tell if Calvin will work more or less.Finally, Deborah was working 600 hours before. Under both policies, the effective wage of someone working this many hours is $3/hr (since 50% of income is offset by reduced benefits). There is no substitution effect for her. As the graph shows, however, she experi-ences an increase in income. We conclude that she will work less.11. Consider a free market with demand equal to Q = 1,200 – 10P and supply equal to Q =20P .a. What is the value of consumer surplus? What is the value of producer surplus?The first step is to find the equilibrium price and quantity by setting quantity demanded equal to quantity supplied. Recall that the condition for equilibrium is that it is the price at which these quantities are equal.From Q = 1,200 – 10P and Q = 20P , substitute: 1,200 – 10P = 20P .Adding 10P to each side of the equation yields 1,200 = 30P .Dividing both sides by 30 yields P = 40. If Q = 20P , then in equilibrium Q = 20(40) = 800.Consumer and producer surplus are determined by finding the areas of triangles; area is equal to ½ the base times the height.The vertical intercept is the price at which quantity demanded is zero: 0 = 1,200 – 10P .This solves to 120.Consumer surplus = ½ (800)(120 – 40) = ½ (800)(80) = 32,000.Producer surplus = ½ (800)(40) = 16,000.Total surplus = 48,000.o rt hP ub l is he rs ,B CS ,D ot eb. Now the government imposes a $10 per unit subsidy on the production of the good. What is the consumer surplus now? The producer surplus? Why is there a deadweight loss associated with the subsidy, and what is the size of this loss?A subsidy in effect lowers the cost of producing a good, yielding the bold supply line.The new supply function is Q = 20(P + 10) because the producer receives the price plus $10when it produces. Solving for a new equilibrium,20P + 200 = 1,200 – 10P .30P = 1,000.P = $100/3 ≈$33.33; Q = 20 (100/3 + 10) = 2,600/3 ≈866.67.Consumer surplus = ½ (2600/3)(120-100/3) ≈37,555.56.Producer surplus = ½ (100/3 + 10)(2,600/3) ≈18,777.78.Cost of subsidy = 10(2600/3) ≈8,666.67.Total surplus = consumer surplus + producer surplus – cost of subsidy ≈47,666.67, less than the original 48,000.There is efficiency loss because trades are induced for which the actual resource cost (without the subsidy) is greater than consumer willingness to pay. The deadweight loss is the area of the triangle that encompasses these new trades (the shaded area in the graph, pointing to the original equilibrium): ½ (2,600/3 – 800)(10) ≈333.33.12. Governments offer both cash assistance and in-kind benefits, such as payments thatmust be spent on food or housing. Will recipients be indifferent between receiving cash versus in-kind benefits with the same monetary values? Use indifference curve analysis to show the circumstances in which individuals would be indifferent and sit-uations in which the form of the benefits would make a difference to them.Generally recipients can attain a higher level of utility (they can choose a consumption bundle on a higher indifference curve) when they are given cash rather than a specific good.People who would purchase the same amount of food or housing as the in-kind grant pro-vides would be indifferent between in-kind and cash benefits because they would use the cash to purchase the same items. However, people whose preferences would lead them to purchase less food or housing than the in-kind grant provides would prefer to receive cash.That way they could spend some of the cash on food or housing and the rest on the other goods they prefer. Suppose the government provides the first ten units of food at no cost.The person represented in panel (a) of the following graph would prefer cash. The indiffer-ence curve tangent to the extension of the new budget constraint identifies a consumption bundle that includes less than ten units of food. The person represented in panel (b) would choose the same point given cash or food. The optimal consumption bundle includes more than ten units of food.o rt hP ub l is he rs ,B CS ,D ot eProblem 9 from Chapter 1. Suppose that Bill and Ted have the same utility function U (Y ) = Y 1/2,where Y is consumption (which is equal to net income).a. Rank the three tax policies discussed in Problem 9 from Chapter 1 for a utilitarian social welfare function. Rank the three for a Rawlsian social welfare function.The utility function is increasing in income. Rawlsian social welfare is therefore equal to the utility of the individual with lower income. For 0% and 25% tax rates, Ted has the lower incomes ($120 and $320, respectively). For a 40% tax rate, Bill has the lower in-come ($240). Since $320 > $240 > $120, Rawlsian social welfare is highest under the 25% tax rate and lowest under the 40% tax rate. To compute utilitarian social welfare, we compare:Utilitarian social welfare with a 0% tax = 1,0001/2 + 1201/2≈42.58Utilitarian social welfare with a 25% tax = 6001/2 + 3201/2 ≈42.38Utilitarian social welfare with a 40% tax = 2401/2 + 2801/2≈32.33We see that the 0% tax rate is best.b. How would your answer change if the utility function was instead U (Y ) = Y 1/5?This change does not affect the order of tax rates according to the Rawlsian social welfare function. To compute social welfare for the utilitarian social welfare function we compare:utilitarian social welfare with 0% tax = (1000)1/5 + 1201/5≈6.59.utilitarian social welfare with 25% tax = 6001/5 + 3201/5 ≈6.76.utilitarian social welfare with 40% tax = 2401/5 + 2801/5≈6.08.We see that the 25% tax rate is best and the 40% tax rate is the worst.c. Suppose that Bill and Ted instead have different utility functions: Bill’s utility is given by U B (Y ) = ¼Y 1/2, and Ted’s is given by U T (Y ) = Y 1/2. (This might happen, for example, because Bill has significant disabilities and therefore needs more income to get the same level of utility.) How would a Rawlsian rank the three tax policies now?Since the two have different utility functions, it is no longer easy to see who is better off under each situation. Under the 0% tax policy, we see that Ted has utility 1201/2≈10.95 and Bill has utility ¼ 1,0001/2≈7.91. We see that Bill is worse off under this policy.o rt hP ub l is he rs ,B CS ,D oN opl i c a t eSince the other two tax policies make Bill worse off and Ted better off than the 0% policy,Bill’s utility will be used to compute Rawlsian social welfare. Rawlsian social welfare is highest with 0% taxes and lowest with 50% taxes, the policies that make Bill the best and worst off, respectively.14. You have $3,000 to spend on entertainment this year (lucky you!). The price of a daytrip (T )is $40 and the price of a pizza and a movie (M)is $20. Suppose that your utility function is U (T,M ) = T 1/3M 2/3.a. What combination of T and M will you choose?This question can be solved by students who have taken calculus, following the ap-proach described in the appendix to the chapter.The constrained optimization problem can be written as Max T 1/3(M )2/3subject to $3,000 = 40T + 20M .Rewriting the budget constraint as M = 150 – 2T and substituting into the utility function givesMax T 1/3(150–2T )2/3.Taking the derivative with respect to T and setting equal to zero gives 1/3 T –2/3(150 – 2T )2/3– 4/3 T 1/3(150 – 2T )–1/3 = 0.Rearranging gives(150 – 2T ) = 4T , or T = 150/6 = 25.Plugging back into the budget constraint givesM = 150–2 (25) = 100.You take 25 trips and go on 100 movie-and-a-pizza outings.b. Suppose that the price of day trips rises to $50. How will this change your decision?The new constrained optimization problem can be written Max T 1/3(M )2/3subject to $3,000 = 50T + 20M .Rewriting the budget constraint as M = 150 – 2.5T and substituting into the utility func-tion givesMax T 1/3(150 – 2.5T )2/3Taking the derivative with respect to T and setting equal to zero gives1/3 T –-2/3(150 – 2.5T )2/3– 5/3 T 1/3(150 – 2.5T )–1/3 = 0.Rearranging givesW o r t h P u b l i s h e r s , B C S , D o N o t D u p l i c a t e (150 – 2.5T ) = 5T , or T = 150/7.5 = 20.Plugging back into the budget constraint gives:M = 150 – 2.5(20) = 100.You now take 20 trips and go on 100 movie-and-a-pizza outings.CHAPTER 2 / Theoretical Tools of Public Finance - 11-。

财政学课后习题答案详解

财政学课后习题答案详解第一章财政概念和财政职能复习与思考1.学习财政学为什么要从政府与市场的关系说起?答:在市场经济体制下,市场是一种资源配置系统,政府也是一种资源配置系统,二者共同构成社会资源配置体系。

而财政是一种政府的经济行为,是一种政府配置资源的经济活动,所以明确政府与市场的关系是学习财政学和研究财政问题的基本理论前提。

不明确政府与市场的关系,就难以说明为什么有市场配置还要有政府配置,政府配置有什么特殊作用,政府配置的规模多大为宜,政府采取什么方式配置资源等。

什么是市场?完整的市场系统是由家庭、企业和政府三个相对独立的主体组成的。

在市场经济下,政府构成市场系统的一个主体,这是毋庸置疑的。

比如,政府为市场提供xx基础实施、教育和社会保障之类的公共物品和准公共物品,同时从市场采购大量的投入品和办公用品。

但政府又是一个公共服务和政治权力机构,具有与市场不同的运行机制,因而在市场中又具有特殊功能和特殊的地位,可以通过法律、行政和经济等手段,“xx”于市场之上介入和干预市场。

因此,为了说明政府与市场的关系,需要先从没有政府的市场系统说起,这时市场只有两个主体,即家庭和企业。

2.什么是市场失灵?答:市场失灵是和市场效率对应的。

市场的资源配置功能不是万能的,市场机制本身也存在固有的缺陷,这里统称为“市场失灵”。

市场失灵主要表现在:(1)垄断。

(2)信息不充分和不对称。

(3)外部效应与公共物品。

4)收入分配不公。

(5)经济波动。

3.参考图1—1,思考政府在市场经济体制下的经济作用。

答:西方新凯恩斯主义提出一种新型的政府-市场观,认为现代经济是一种混合经济(指私人经济和公共经济),政府和市场之间不是替代关系,而是互补关系。

图1-1说明了有政府介入的市场,政府与家庭、企业之间的收支循环流程。

图1-1 政府与家庭、企业之间的收支循环流程图我国在明确提出我国经济体制改革的目标是社会主义市场经济体制的时候,曾对社会主义市场经济体制做出一个简明的概括:“就是要使市场在社会主义国家宏观调控下对资源配置起基础性作用……。

财政学课后练习题及答案

财政学课后练习题及答案A、政府机关B、公立大学C、国有企业D、有银行4、下述( AC )单位属于政府部门?A、卫生部B、国有企业C、军队D、国有银行5、下述哪些政府行为包含着隐性的收支?BCA、间接税B、为企业提供贷款担保C、税收优惠D、通过罚款、没收取得收入第四部分名词解释财政学政府经济学公共部门经济学公共经济学实证分析规范分析公共部门政府部门公共企业部门税收价格或使用费公债购买支出转移支出税式支出政府担保公共定价公共管制预算外收支体制外收支公共提供市场提供公共生产私人生产收入再分配第五部分问答题1、政府作为一个经济实体,它与社会上其他经济实体个人、家庭、企业有哪些主要区别?2、财政学研究哪些基本问题?如何对这些问题进行分类?3、公共部门与私人部门有哪些区别?政府部门与公共企业部门有哪些区别?4、政府取得收入有哪些方式?这些方式各自有什么特性?5、公共提供与公共生产有何联系?有何区别?参考答案:第一部分单项选择题1、D2、 C3、 A4、 C5、 D第二部分多项选择题1、A、B2、A、D3、A、B、C、D4、A、C5、B、C第四部分名词解释1、财政学:财政学是研究政府经济行为的学科。

它研究政府行为对经济产生的影响,政府适当的职能范围和方式以及政府的决策过程。

2、公共部门经济学:财政学的另一个称呼,解释同财政学。

3、实证分析:以确认事实,弄清因果关系为主题的研究分析。

它要回答的问题“是什么”、“会怎样”以及“为什么”。

实证分析可以分为理论实证分析和经验实证分析。

4、规范分析:以确定评价标准,分清是非和优劣程度为主题的研究分析,它回答的问题是“该怎样”。

规范分析涉及价值判断和伦理观念。

5、公共部门:是政府组织体系的总称。

所有属于政府所有,使用公共财产和公共资金,在一定程度上贯彻和执行政府意图的实体(机关、事业和企业单位)都属于公共部门。

6、政府部门:是指公共部门中不从事产品或服务的生产和销售,主要依靠税收取得收入,免费或部分免费地为社会提供产品或服务的那个子部门。

财政学课后题

财政学名词:1、(ch1)免费搭车:免费搭车行为是指不承担任何成本而消费或使用公共物品的行为,有这种行为的人或具有让别人付钱而自己享受共用品收益动机的人称为免费搭车者。

如果每个人都想成为免费搭车者,这种公共物品也就无力被提供。

2、投票规则:投票规则有两类,一类是一致同意规则,二是多数票规则。

前者是指一项政策或议案,须经全体投票人一致赞同才能通过的一种投票规则;后者是指一项政策或议案,须经半数以上投票人赞同才能通过的一种投票方式。

常用的投票规则是多数票规则。

又分简单多数票规则和比例多数票规则。

简单多数票规则是指赞成票必须高于半数以上的一定比例,议案才能通过,如2/3,3/5,4/5多数票等。

投票规则的缺陷导致政府决策无效率。

3、寻租行为(04名词):一般是指通过游说政府和院外活动获得某种垄断权或特许权,以赚取超常利润(租金)的行为。

寻租行为越多,社会经济资源浪费越大。

4、(ch2) 购买性支出:是指政府购买商品和服务的支出,包括购买进行日常政务活动所需的或用于国家投资所需的商品或服务的支出,它体现的是政府的市场再分配活动。

在财政支出总额中,购买性支出所占的比重越大,财政活动对生产和就业的直接影响就越大,通过财政所配置的资源的规模就越大。

以购买性支出占较大比重的支出结构的财政活动,执行配置资源的职能较强。

5、转移性支出:是指政府资金无偿、单方面的转移,主要有补助支出、捐赠支出和债务利息支出,它体现的是政府的非市场性再分配活动。

在财政支出总额中,转移性支出所占的比重越大,财政活动对收入分配的直接影响就越大。

以转移性支出占较大比重的支出结构的财政活动,执行收入分配的职能较强。

6、政府采购制度(00名词):是指以公开招标、投标为主要方式选择供应商(厂商),从国内外市场上为政府部门或所属团体购买商品或服务的一种制度。

它具有公开性、公正性、竞争性,其中公平竞争是政府采购制度的基石。

7、成本—效益分析法:他是衡量财政支出效益的一种方法。

《财政学》全本课后习题答案

第一章市场失灵与财政职能复习思考题一、名词解释财政:国家为了满足社会公共需求对剩余产品进行分配而产生的经济行为。

私人商品:由市场提供用来满足个人需要的商品和服务。

公共商品:由国家机关和政府部门提供用来满足社会公共需求的商品和服务。

外部效应:指私人费用与社会费用或私人得益与社会得益之间的非一致性,或者说是某人或某企业的行为影响了其他人或企业,却没有为之承担相应的成本费用或没有获得相应的报酬。

财政职能:即财政经济职能,是指财政在一定经济模式下内在的、客观上固有的经济功能。

二、单项选择题1.财政分配的主体是(B )。

A.社会B.国家C.市场D.企业2.财政分配的主要对象是(D )。

A.社会总产品价值B.物化劳动价值C.必要劳动产品价值D.剩余产品价值3.财政分配的最基本特征是(C )。

A.强制性B.无偿性C.国家主体性D.公共性4.下列选项中,属于财政现象的是(B )。

A.企业引进外资B.企业购买公债C.企业发行股票D.企业购买金融债券5.下列关于财政收支活动的说法,正确的是(D )。

A.既包括国民收入初次分配,也包括国民收入再分配B.是指国民收入初次分配C.既不是国民收入初次分配,也不是国民收入再分配D.是指国民收入再分配6.经济学的核心问题始终是(C )。

A.经济稳定B.经济公平C.高效配置资源D.国民收入初次分配三、多项选择题1.下列选项中,属于财政收入现象的有(ACE)。

A.税收B.财政拨款C.行政性收费D.财政补贴E.国债2.下列选项中,属于纯公共商品的有(ACE)。

A.法律法规B.教育C.行政管理D.社会保障E.货币发行3.财政调节居民个人收入水平的主要手段包括(AC)。

A.税收B.发行国债C.转移支出D.投资优惠E.罚款4.政府职能包括(ACD)。

A.政治职能B.政府行为C.经济职能D.社会管理职能E.决定企业生产5.宏观经济稳定的含义有(ACE)。

A.充分就业B.经济发展C.物价稳定D.进出口相等E.国际收支平衡四、判断题1.财政分配区别于其他分配形式的根本标志是分配对象不同。

财政学课后习题答案

《财政学》习题库及参考答案第一章财政概述一、填空题市场失灵_________和______市场缺陷________为政府介入或干预提供了必要性和合理性的依据,因而是分析和研究政府与市场关系的基本理论依据。

2. 市场机制本身也存在固有的缺陷,主要表现为____收入分配不公 ________和_____经济波动_________。

3. _____公共产品_________是这样一些产品,不论每个人是否愿意购买它们,它们带来的好处不可分开地散布到整个社区里。

4. _________私人产品_____是这样一些产品,它们能分割开并可分别地提供给不同的个人,也不带给他人外部的收益或成本。

5. _______非排他性______则是公共物品的第一个特征,即一些人享用公共物品带来的利益而不能排除其他一些人同时从公共物品中获得利益。

6. _________非竞争性_____是公共物品的第二个特征,即消费者的增加不引起生产成本的增加,即多一个消费者引起的社会边际成本为零,或者说,一定量的公共物品按零边际成本为消费者提供利益或服务。

7. __市场与政府____________作为两种资源配置方式,它们的运行机制是不同的,但它们的目的或目标却是共同的,即都是为了满足人类社会的需要,实现公平与效率兼顾的目标。

8. _财政______是一种经济行为或经济现象,这种经济行为和经济现象的主体是国家或政府。

二、单项选择题1. (A )有效率的供给通常需要政府行动,而私人物品则可以通过市场有效率地加以分配”A、公共物品B、私人物品C、消费品D、固定资产2. 公共物品与私人物品是社会产品中典型的两极。

但也有些物品是兼备公共物品与私人物品的特征,因而可称之为(A )。

A、混合物品B、公共物品C、私人物品D、准私人物品3. (A )是一种经济行为或经济现象,这种经济行为和经济现象的主体是国家或政府。

A、财政B、税收C、货币政策D、国际贸易4. (D )是公共物品的第一个特征,即一些人享用公共物品带来的利益而不能排除其他一些人同时从公共物品中获得利益。

海曼财政学课后答案ch02

C H A P T E R2Efficiency, Markets,and GovernmentI NSTRUCTIONAL O BJECTIVESThe main objective of this chapter is to develop the concept of efficiency and show students how it is used to evaluate economic performance. To begin the discussion, it is necessary to draw the distinction betweenpositive and normative economics. Both of these approaches are used in the chapter. An additional instructional objective is therefore todemonstrate the usefulness of each type of analysis.The concept of efficiency is carefully linked to resource allocation and economic transactions. The chapter also introduces the student to marginal analysis of resource allocation. The distinction between total social cost and benefit, and marginal social cost and benefit is drawn for students. Graphic analysis is then used to derive the marginal conditions for efficiency. The objective is to show students that maximization of net social benefit requires that all activities be undertaken in each timeperiod up to the point at which MSB = MSC.The analysis is then used to evaluate resource allocation in competitive markets operating under conditions of perfectcompetition with no externalities. This is followed by examplesshowing how monopoly power and government intervention can resultin losses in efficiency in markets. The objective here is to show howwelfare triangles can be used to measure losses in well-being whenefficiency is not achieved.The equity-efficiency tradeoff is also introduced in the chapter. The utility possibility curve is used to show students how citizens oftenrationally oppose movements to efficient resource use when compensa-tion for losses in well-being is not actually paid. Positive analysis of the equity-efficiency tradeoff is also provided, thereby closing the chapter with an illustration of how the positive approach is useful to normative analysis.C HANGES IN T HIS E DITIONThis chapter has been updated where needed. Otherwise, there have been no changes in this core theory chapter. A new problem was added to the end of the chapter.C HAPTER O UTLINEPositive and Normative EconomicsNormative Evaluation of Resource Use: The Efficiency Criterion Marginal Conditions for EfficiencyMarkets, Prices, and Efficiency ConditionsWhen Does Market Interaction Fail to Achieve EfficiencyMonopolistic PowerHow Taxes Can Cause Losses in Efficiency in Competitive Markets Public Policy Perspective: The Tax System and the Birth Rate—AnExample of Positive Economic AnalysisHow Government Subsidies Can Cause Losses in Efficiency Market Failure: A Preview of the Basis for Government ActivityEquity versus EfficiencyThe Tradeoff between Efficiency and Equity: A Graphic AnalysisThe Tradeoff between Equity and Efficiency in a System ofCompetitive MarketsPositive Analysis Tradeoff Between Equity and Efficiency International View: Agricultural Subsidies, International TradeRestrictions, and Global EfficiencyM AJOR P OINTS AND L ECTURE S UGGESTIONS1.Instructors may wish to emphasize the difference between thenormative and positive approaches. The normative approach isbased on underlying values that embody an individualistic ethic. Thepositive approach is simply a scientific method used to formulatehypotheses subject to empirical verification. I point out to mystudents that the normative approach in public finance sets upbenchmarks against which the impact of government regulations,expenditures, and taxes can be evaluated.2.There are two aspects of efficiency that are useful to emphasize inlectures:a. Efficiency, as the term is commonly used by the layperson, simplymeans avoidance of waste in achieving any useful objective.Students are most likely already familiar with this aspect ofefficiency.b. The second aspect of efficiency deals with exchange. Even whenproduction is accomplished without waste, additional net gainsare usually possible through mutually agreeable exchanges.In discussing the second aspect of efficiency, with which students areless familiar, you can point out that freedom to trade is an importantaspect of efficiency. Constraints on mutually agreeable tradethereby prevent attainment of efficiency when no third parties areaffected by those transactions.3.The derivation of the marginal conditions for efficiency provides agood opportunity to review marginal analysis for students. Makesure to confine your discussion to a particular good. The example in the text uses bread. I find that students are quite receptive to the notion that net social gains are maximized when each possible good or service is made available up to the point at which MSB = MSC.The inclusion of the total social benefit and total social cost curves in Figure 2.1 in the text helps students see how additional production of goods is inefficient beyond the point at which MSB = MSC, even though TSB > TSC for additional output.4.Notice how the marginal net benefit is defined as the differencebetween the marginal social benefit and the marginal social cost of any given quantity of a good.5.After deriving the efficiency conditions, I like to reinforce thetheory by immediately showing students how the marginalconditions are satisfied under ideal conditions in perfectlycompetitive markets. In doing so, I introduce the concepts ofmarginal private benefit and marginal private cost. I show how P = MPB = MPC in competitive markets. Finally, I set the stage for future analysis in Chapter 3 by pointing out that, provided no third parties (other than buyers and sellers) are affected by market exchanges, P = MSB = MSC. Because these conditions are used throughout thetext, it is important for students to understand the derivation. I find that students have little difficulty with the exposition. If you get the significance of these points across early in the course, it is easy to show how taxes and subsidies prevent prices from simultaneously reflecting marginal social costs and benefits.The numerical example in the text has been helpful to my students.Note that I use the same numbers when discussing competitivemarkets for bread.6.The obvious next step is to provide your students with examples ofcases for which markets do not achieve efficiency. The exercise of monopoly power is a good example of how lack of competition in markets can cause losses in efficiency. This example can then besupplemented with analysis of the effects of taxes and subsidies on private choices in markets. The example of target prices foragriculture in the United States shows how subsidies to agriculture result in more than the efficient amount of resources allocated to agricultural uses.You might wish to supplement these examples with some of yourown. In any case, the main instructional objective is to show students how losses in well-being resulting from inefficient output levels can be measured as triangular areas in the graphs.The Public Policy Perspective shows students how the personalexemption in the U.S. income tax can be viewed as a subsidy toraising children.7.I believe that it is important to emphasize the equity-efficiencytradeoff early in the course. This provides an opportunity to show how the positive approach can be used to predict the net gains and losses to citizens. The utility possibility curve is a good tool toillustrate political conflict. First make sure that students see thesimilarity between the utility possibility curve and the productionpossibility curve. In particular, point out that the maximum possible level of well-being of any one person, given the well-being of others, depends on resources available and technology. The curve alsoshows how there is no one unique efficient allocation of resources.It can be used to show how the efficient outcomes of competitive interaction can result in a distribution of well-being for which many persons live in poverty.8.I like to use the utility possibility curve to show how changes inresource allocation can result in both gainers and losers even when there is movement from inefficient to efficient resource use. Unless compensation is actually paid, the losers act to prevent the resource change that makes them worse off.A N OTE ON THE A PPENDIX TO C HAPTER 2The appendix to Chapter 2 sets up a two-dimensional model of efficient resource. This appendix can easily be skipped because the basic notions are developed intuitively within the chapter. If, however, youhave good students, you can assign the appendix and derive the conditions in class.The standard welfare model is developed in the appendix andEdgeworth-Bowley boxes are used to derive the efficiency conditions.O UTLINE OF THE A PPENDIX TO C HAPTER 2A Model of Efficient Resource UseProduction and TechnologyProductive EfficiencyThe Production Possibility CurveTastes and UtilityAttainment of EfficiencyAn Interpretation of Efficiency ConditionsRanking Efficient Outcomes: Social Welfare FunctionsEfficiency and Economic InstitutionsPure Market Economy and Productive EfficiencyA Pure Market Economy and Pareto EfficiencyIncome DistributionAlternative Economic Institutions and EfficiencyMarket ImperfectionsT RUE/F ALSE Q UESTIONS1.The normative approach to public finance prescribes certain actionsto achieve predetermined criteria.(T)2.Positive economic analysis is based on underlying valuejudgments.(F)3.“The government should abolish tariffs to achieve efficiency” is anormative statement.(T)4.It is possible for efficiency not to be attained even if all production iscarried on without waste.(T)5.Efficiency is attained when resources are used each year in such away that no further net gain is possible.(T)6.The efficient annual output of any given good is attained if that goodis made available in amounts up to the point at which the total social benefit of the good equals the total social cost.(F)7.If the marginal social benefit of smoke detectors exceeds itsmarginal social cost, then additional net gains are possible from an increased annual smoke detector production.(T)8.Monopoly power causes losses in efficiency because the marginalsocial benefit of output exceeds its marginal social cost at themonopoly output.(T)ernment regulations that require airlines to serve routes forwhich the maximum price that passengers are willing to pay for atrip fall short of the minimum price that sellers are willing to accept are likely to cause losses in efficiency.(T)10. Points lying below a utility possibility curve are efficient.(F)11. Government programs can achieve efficiency when the gains togainers from those policies exceed the losses to those who bear the costs.(T)12. If the marginal social cost of beer production exceeds its marginalsocial benefit, then more than the efficient about of beer is beingproduced.(T)13. Efficient outcomes are often viewed as inequitable.(T)14. If it is not possible to make someone better off without harminganother, then resource allocation is efficient.(T)15. Compensation criteria are used to argue that changes in resourceallocation should be made if the gains to some groups outweigh the losses to others, even though compensation for losses is not actually made.(T)16. All points on a utility possibility curve are efficient but differ in termsof the distribution of well-being.(T)M ULTIPLE C HOICE Q UESTIONS1.Positive economics:a. makes recommendations designed to achieve certain goals.b. establishes cause-and-effect relationships between economicvariables.c. is based on value judgments.d. can never be used to make predictions.2.If the efficient output of a good is produced each week, then the:a. marginal social benefit of the good equals its marginal social costeach week.b. marginal social benefit of the good is at a maximum.c. total social benefit of the good is at a maximum.d. total social benefit of the good equals its total social cost.3.If the marginal social benefit of a good exceeds the marginal socialcost at the current monthly output, then:a. it will be possible to make buyers of the good better off withoutharming sellers of the good.b. it will be possible to make sellers of the good better off withoutharming buyers of the good.c. either (a) or (b)d. a reduction in monthly output will be required for efficiency.4.The marginal social cost of bread exceeds the marginal social benefitat the current weekly output. Therefore,a. the marginal net benefit of bread is positive.b. the output of bread is efficient.c. a reduction in weekly output of bread is necessary to achieveefficiency.d. an increase in weekly output of bread is necessary to achieveefficiency.5.The total social benefit of automobiles equals the total social cost atcurrent annual output. Then it follows that:a. the annual output of automobiles is efficient.b. the annual output of automobiles exceeds the efficient amount.c. less than the efficient annual output of automobiles is produced.d. it is not possible to make buyers of automobiles better offwithout harming sellers.e. both (a) and (d)6.Eggs are sold in a perfectly competitive market. No persons otherthan the buyers and sellers of eggs are affected in any way when eggs are traded in the market. Then it follows that:a. the price of eggs equals the marginal social cost of eggs.b. the price of eggs equals the marginal social benefit of eggs.c. the price of eggs exceeds the marginal social benefit of eggs.d. both (a) and (b)7.Diamonds are sold by a monopoly firm that maximizes profits. Thenit follows that:a. the marginal social benefit of diamonds exceeds its marginalsocial cost.b. the marginal social cost of diamonds exceeds its marginal socialbenefit.c. the price of diamonds equals its marginal social cost.d. the price of diamonds exceeds its marginal social benefit.e. both (c) and (d)8.Points on a utility possibility curve represent:a. a given distribution of well-being between two persons.b. an efficient allocation of resources.c. the maximum well-being of any one person, given the resourcesavailable and the well-being of another person.d. all of the above9.If efficiency has been attained,a. it will be possible to make any one person better off withoutharming another.b. it will not be possible to make any one person better off withoutharming another.c. perfect competition must exist.d. the opportunity cost of any change in resource use must be zero.10. A move from an inefficient resource allocation to an efficient one:a. will always be unanimously approved, even if gainers do notcompensate losers.b. will be unanimously opposed.c. will be unanimously approved if gainers compensate losers.d. can never result in losers.11. Which of the following is a normative statementa. When interest rates rise, the quantity of loanable fundsdemanded for new mortgages will decline.b. To achieve efficiency, governments should prevent monopoly inmarkets.c. Unemployment increases during a recession.d. When governments increase income tax rates, people work less.12. Normative economics:a. is not based on underlying value judgments.b. makes recommendations to achieve efficient outcomes.c. establishes cause-and-effect relationships between economicvariables.d. makes “if…then” type statements and checks them against thefacts.13. The extra benefit on one more unit of a good or service is its:a. marginal cost.b. marginal benefit.c. total benefit.d. total cost.14. If the efficient output of computers is achieved this year, thenmarket price of computers is equal to:a. the marginal social benefit of computers.b. the marginal social cost of computers.c. the total social cost of computers.d. the total social benefit of computers.e. both (a) and (b)15. Suppose the efficient output currently prevails in the market for icecream. A tax on ice cream consumption will:a. allow efficiency to continue to prevail in the market.b. result in more than the efficient output in the market.c. result in less than the efficient output in the market.d. cause the marginal social cost of ice cream to exceed its marginalsocial benefit at the market equilibrium output.E SSAY Q UESTIONS1.The wine industry is currently composed of many firms, and wine issold in a perfectly competitive market. The wine industry producesthe efficient annual output of wine, which is 100,000 bottles peryear. The market equilibrium price is $5 per bottle.a. Draw the market demand and supply of wine and label the curvesto show why the market output is the efficient output.b. Suppose that the wine industry is consolidated into one largemonopoly firm. As a result of themonopolization of the industry,the price of wine increase to $7 per bottle, and the annualquantity demanded falls to 75,000 bottles. Explain why thisoutput is not efficient and show theloss in net benefits resultingfrom monopolization of the industry.2.Explain why points on a utility possibility curve represent efficientallocations of resources. Why must the utility possibility curve bedownward sloping Draw a utility possibility curve and show how it ispossible to achieve efficiency by moving from a point within thecurve and the axes to a point on the curve.A NSWERS TO T EXT P ROBLEMS1.The marginal social benefit of the first concert is $10,000, and itsmarginal social cost is $5,000. The marginal social benefit of asecond concert is $5,000, which falls short of its marginal social costof $6,000. The efficient number of concerts is one. After the firstconcert, the marginal social cost exceeds the marginal social benefit.2. a. The efficient output is the one for which P = MC. If sold in acompetitive market, the price of atelevision would be $100 andthe quantity sold would be 200,000 – 500(100) = 150,000.b. If sales were limited to 100,000 per year, the marginal socialbenefit of TVs would exceed the marginal social cost. Studentsshould draw a graph showing the resulting loss of net benefits asa triangle above the marginal cost line and under the demand curve between the outputs of 100,000 and 150,000. If there is acomplete ban on TV sales, the loss in net benefits will be theentire area under the demand curve and above the marginal costcurve corresponding to the consumer surplus from TV sales.3.The senator’s logic is false. Equating the marginal social benefit of aservice with its marginal social cost maximizes net gains. If output is increased to the point at which TSB = TSC, there will be more than the efficient amount of resources devoted to space exploration.4.The price support for rice will increase annual production beyondthe efficient level. At the price support, the marginal social cost of rice will exceed its marginal social benefit.5.At the current market equilibrium under perfect competition, MSB =MSC = $100, implying efficiency. The $10 per night tax results in an increase in the market equilibrium price of hotel rooms. At thehigher prices, MSB exceeds MSC. The graph used to answer thisquestion should be similar to Figure 2.3 in the text. The loss in net benefits would be an area like E'EB in Figure .。

海曼财政学课后答案ch02

C H A P T E R2Efficiency, Markets,and GovernmentI NSTRUCTIONAL O BJECTIVESThe main objective of this chapter is to develop the concept of efficiency and show students how it is used to evaluate economic performance. To begin the discussion, it is necessary to draw the distinction betweenpositive and normative economics. Both of these approaches are used in the chapter. An additional instructional objective is therefore todemonstrate the usefulness of each type of analysis.The concept of efficiency is carefully linked to resource allocation and economic transactions. The chapter also introduces the student tomarginal analysis of resource allocation. The distinction between total social cost and benefit, and marginal social cost and benefit is drawn for students. Graphic analysis is then used to derive the marginal conditions for efficiency. The objective is to show students that maximization of net social benefit requires that all activities be undertaken in each time period up to the point at which MSB = MSC.The analysis is then used to evaluate resource allocation in competitive markets operating under conditions of perfect competition with no externalities. This is followed by examples showing howmonopoly power and government intervention can result in losses inefficiency in markets. The objective here is to show how welfaretriangles can be used to measure losses in well-being when efficiency is not achieved.The equity-efficiency tradeoff is also introduced in the chapter. The utility possibility curve is used to show students how citizens oftenrationally oppose movements to efficient resource use when compensa-910| Part One | The Economic Basis of Government Activitytion for losses in well-being is not actually paid. Positive analysis of the equity-efficiency tradeoff is also provided, thereby closing the chapter with an illustration of how the positive approach is useful to normative analysis.C HANGES IN T HIS E DITIONThis chapter has been updated where needed. Otherwise, there have been no changes in this core theory chapter. A new problem was added to the end of the chapter.C HAPTER O UTLINEPositive and Normative EconomicsNormative Evaluation of Resource Use: The Efficiency Criterion Marginal Conditions for EfficiencyMarkets, Prices, and Efficiency ConditionsWhen Does Market Interaction Fail to Achieve Efficiency?Monopolistic PowerHow Taxes Can Cause Losses in Efficiency in Competitive Markets Public Policy Perspective: The Tax System and the Birth Rate—AnExample of Positive Economic AnalysisHow Government Subsidies Can Cause Losses in Efficiency Market Failure: A Preview of the Basis for Government ActivityEquity versus EfficiencyThe Tradeoff between Efficiency and Equity: A Graphic AnalysisThe Tradeoff between Equity and Efficiency in a System ofCompetitive MarketsPositive Analysis Tradeoff Between Equity and Efficiency International View: Agricultural Subsidies, International TradeRestrictions, and Global EfficiencyChapter Two | Efficiency, Markets, and Government | 11M AJOR P OINTS AND L ECTURE S UGGESTIONS1.Instructors may wish to emphasize the difference between thenormative and positive approaches. The normative approach is basedon underlying values that embody an individualistic ethic. Thepositive approach is simply a scientific method used to formulatehypotheses subject to empirical verification. I point out to mystudents that the normative approach in public finance sets upbenchmarks against which the impact of government regulations,expenditures, and taxes can be evaluated.2.There are two aspects of efficiency that are useful to emphasize inlectures:a. Efficiency, as the term is commonly used by the layperson, simplymeans avoidance of waste in achieving any useful objective.Students are most likely already familiar with this aspect ofefficiency.b. The second aspect of efficiency deals with exchange. Even whenproduction is accomplished without waste, additional net gains areusually possible through mutually agreeable exchanges.In discussing the second aspect of efficiency, with which students areless familiar, you can point out that freedom to trade is an importantaspect of efficiency. Constraints on mutually agreeable trade therebyprevent attainment of efficiency when no third parties are affected bythose transactions.3.The derivation of the marginal conditions for efficiency provides agood opportunity to review marginal analysis for students. Makesure to confine your discussion to a particular good. The example inthe text uses bread. I find that students are quite receptive to thenotion that net social gains are maximized when each possible goodor service is made available up to the point at which MSB = MSC.The inclusion of the total social benefit and total social cost curves inFigure 2.1 in the text helps students see how additional production ofgoods is inefficient beyond the point at which MSB = MSC, eventhough TSB > TSC for additional output.12| Part One | The Economic Basis of Government Activity4.Notice how the marginal net benefit is defined as the differencebetween the marginal social benefit and the marginal social cost ofany given quantity of a good.5.After deriving the efficiency conditions, I like to reinforce thetheory by immediately showing students how the marginalconditions are satisfied under ideal conditions in perfectlycompetitive markets. In doing so, I introduce the concepts ofmarginal private benefit and marginal private cost. I show how P =MPB = MPC in competitive markets. Finally, I set the stage forfuture analysis in Chapter 3 by pointing out that, provided no thirdparties (other than buyers and sellers) are affected by marketexchanges, P = MSB = MSC. Because these conditions are usedthroughout the text, it is important for students to understand thederivation. I find that students have little difficulty with theexposition. If you get the significance of these points across early inthe course, it is easy to show how taxes and subsidies prevent pricesfrom simultaneously reflecting marginal social costs and benefits.The numerical example in the text has been helpful to my students.Note that I use the same numbers when discussing competitivemarkets for bread.6.The obvious next step is to provide your students with examples ofcases for which markets do not achieve efficiency. The exercise ofmonopoly power is a good example of how lack of competition inmarkets can cause losses in efficiency. This example can then besupplemented with analysis of the effects of taxes and subsidies onprivate choices in markets. The example of target prices foragriculture in the United States shows how subsidies to agricultureresult in more than the efficient amount of resources allocated toagricultural uses.You might wish to supplement these examples with some of your own.In any case, the main instructional objective is to show students howlosses in well-being resulting from inefficient output levels can bemeasured as triangular areas in the graphs.Chapter Two | Efficiency, Markets, and Government | 13 The Public Policy Perspective shows students how the personalexemption in the U.S. income tax can be viewed as a subsidy toraising children.7.I believe that it is important to emphasize the equity-efficiencytradeoff early in the course. This provides an opportunity to showhow the positive approach can be used to predict the net gains andlosses to citizens. The utility possibility curve is a good tool toillustrate political conflict. First make sure that students see thesimilarity between the utility possibility curve and the productionpossibility curve. In particular, point out that the maximum possiblelevel of well-being of any one person, given the well-being of others,depends on resources available and technology. The curve also showshow there is no one unique efficient allocation of resources. It can beused to show how the efficient outcomes of competitive interactioncan result in a distribution of well-being for which many persons livein poverty.8.I like to use the utility possibility curve to show how changes inresource allocation can result in both gainers and losers even whenthere is movement from inefficient to efficient resource use. Unlesscompensation is actually paid, the losers act to prevent the resourcechange that makes them worse off.A N OTE ON THE A PPENDIX TO C HAPTER 2The appendix to Chapter 2 sets up a two-dimensional model of efficient resource. This appendix can easily be skipped because the basic notions are developed intuitively within the chapter. If, however, you have good students, you can assign the appendix and derive the conditions in class.The standard welfare model is developed in the appendix andEdgeworth-Bowley boxes are used to derive the efficiency conditions.14| Part One | The Economic Basis of Government ActivityO UTLINE OF THE A PPENDIX TO C HAPTER 2A Model of Efficient Resource UseProduction and TechnologyProductive EfficiencyThe Production Possibility CurveTastes and UtilityAttainment of EfficiencyAn Interpretation of Efficiency ConditionsRanking Efficient Outcomes: Social Welfare Functions Efficiency and Economic InstitutionsPure Market Economy and Productive EfficiencyA Pure Market Economy and Pareto EfficiencyIncome DistributionAlternative Economic Institutions and EfficiencyMarket ImperfectionsT RUE/F ALSE Q UESTIONS1.The normative approach to public finance prescribes certain actionsto achieve predetermined criteria. (T)2.Positive economic analysis is based on underlying valuejudgments. (F)3.“The government should abolish tariffs to achieve efficiency” is anormative statement. (T)4.It is possible for efficiency not to be attained even if all production iscarried on without waste. (T)5.Efficiency is attained when resources are used each year in such away that no further net gain is possible. (T)6.The efficient annual output of any given good is attained if that goodis made available in amounts up to the point at which the total socialbenefit of the good equals the total social cost. (F)Chapter Two | Efficiency, Markets, and Government | 157.If the marginal social benefit of smoke detectors exceeds its marginalsocial cost, then additional net gains are possible from an increasedannual smoke detector production. (T)8.Monopoly power causes losses in efficiency because the marginalsocial benefit of output exceeds its marginal social cost at themonopoly output. (T)ernment regulations that require airlines to serve routes for whichthe maximum price that passengers are willing to pay for a trip fallshort of the minimum price that sellers are willing to accept are likelyto cause losses in efficiency. (T)10. Points lying below a utility possibility curve are efficient. (F)11. Government programs can achieve efficiency when the gains togainers from those policies exceed the losses to those who bear thecosts. (T)12. If the marginal social cost of beer production exceeds its marginalsocial benefit, then more than the efficient about of beer is beingproduced. (T)13. Efficient outcomes are often viewed as inequitable. (T)14. If it is not possible to make someone better off without harminganother, then resource allocation is efficient. (T)15. Compensation criteria are used to argue that changes in resourceallocation should be made if the gains to some groups outweigh thelosses to others, even though compensation for losses is not actuallymade. (T)16. All points on a utility possibility curve are efficient but differ in termsof the distribution of well-being. (T)M ULTIPLE C HOICE Q UESTIONS1.Positive economics:a. makes recommendations designed to achieve certain goals.16| Part One | The Economic Basis of Government Activityb. establishes cause-and-effect relationships between economicvariables.c. is based on value judgments.d. can never be used to make predictions.2.If the efficient output of a good is produced each week, then the:a. marginal social benefit of the good equals its marginal social costeach week.b. marginal social benefit of the good is at a maximum.c. total social benefit of the good is at a maximum.d. total social benefit of the good equals its total social cost.3.If the marginal social benefit of a good exceeds the marginal socialcost at the current monthly output, then:a. it will be possible to make buyers of the good better off withoutharming sellers of the good.b. it will be possible to make sellers of the good better off withoutharming buyers of the good.c. either (a) or (b)d. a reduction in monthly output will be required for efficiency.4.The marginal social cost of bread exceeds the marginal social benefitat the current weekly output. Therefore,a. the marginal net benefit of bread is positive.b. the output of bread is efficient.c. a reduction in weekly output of bread is necessary to achieveefficiency.d. an increase in weekly output of bread is necessary to achieveefficiency.5.The total social benefit of automobiles equals the total social cost atcurrent annual output. Then it follows that:a. the annual output of automobiles is efficient.b. the annual output of automobiles exceeds the efficient amount.c. less than the efficient annual output of automobiles is produced.Chapter Two | Efficiency, Markets, and Government | 17 d. it is not possible to make buyers of automobiles better off withoutharming sellers.e. both (a) and (d)18| Part One | The Economic Basis of Government Activity6.Eggs are sold in a perfectly competitive market. No persons otherthan the buyers and sellers of eggs are affected in any way when eggsare traded in the market. Then it follows that:a. the price of eggs equals the marginal social cost of eggs.b. the price of eggs equals the marginal social benefit of eggs.c. the price of eggs exceeds the marginal social benefit of eggs.d. both (a) and (b)7.Diamonds are sold by a monopoly firm that maximizes profits. Thenit follows that:a. the marginal social benefit of diamonds exceeds its marginalsocial cost.b. the marginal social cost of diamonds exceeds its marginal socialbenefit.c. the price of diamonds equals its marginal social cost.d. the price of diamonds exceeds its marginal social benefit.e. both (c) and (d)8.Points on a utility possibility curve represent:a. a given distribution of well-being between two persons.b. an efficient allocation of resources.c. the maximum well-being of any one person, given the resourcesavailable and the well-being of another person.d. all of the above9.If efficiency has been attained,a. it will be possible to make any one person better off withoutharming another.b. it will not be possible to make any one person better off withoutharming another.c. perfect competition must exist.d. the opportunity cost of any change in resource use must be zero.10. A move from an inefficient resource allocation to an efficient one:a. will always be unanimously approved, even if gainers do notcompensate losers.b. will be unanimously opposed.c. will be unanimously approved if gainers compensate losers.d. can never result in losers.11. Which of the following is a normative statement?a. When interest rates rise, the quantity of loanable funds demandedfor new mortgages will decline.b. To achieve efficiency, governments should prevent monopoly inmarkets.c. Unemployment increases during a recession.d. When governments increase income tax rates, people work less.12. Normative economics:a. is not based on underlying value judgments.b. makes recommendations to achieve efficient outcomes.c. establishes cause-and-effect relationships between economicvariables.d. makes “if…then” type statements and checks them against thefacts.13. The extra benefit on one more unit of a good or service is its:a. marginal cost.b. marginal benefit.c. total benefit.d. total cost.14. If the efficient output of computers is achieved this year, then marketprice of computers is equal to:a. the marginal social benefit of computers.b. the marginal social cost of computers.c. the total social cost of computers.d. the total social benefit of computers.e. both (a) and (b)15. Suppose the efficient output currently prevails in the market for icecream. A tax on ice cream consumption will:a. allow efficiency to continue to prevail in the market.b. result in more than the efficient output in the market.c. result in less than the efficient output in the market.d. cause the marginal social cost of ice cream to exceed its marginalsocial benefit at the market equilibrium output.E SSAY Q UESTIONS1.The wine industry is currently composed of many firms, and wine issold in a perfectly competitive market. The wine industry producesthe efficient annual output of wine, which is 100,000 bottles per year.The market equilibrium price is $5 per bottle.a. Draw the market demand and supply of wine and label the curvesto show why the market output is the efficient output.b. Suppose that the wine industry is consolidated into one largemonopoly firm. As a result of the monopolization of the industry,the price of wine increase to $7 per bottle, and the annual quantitydemanded falls to 75,000 bottles. Explain why this output is notefficient and show the loss in net benefits resulting frommonopolization of the industry.2.Explain why points on a utility possibility curve represent efficientallocations of resources. Why must the utility possibility curve bedownward sloping? Draw a utility possibility curve and show how itis possible to achieve efficiency by moving from a point within thecurve and the axes to a point on the curve.A NSWERS TO T EXT P ROBLEMS1.The marginal social benefit of the first concert is $10,000, and itsmarginal social cost is $5,000. The marginal social benefit of asecond concert is $5,000, which falls short of its marginal social costof $6,000. The efficient number of concerts is one. After the firstconcert, the marginal social cost exceeds the marginal social benefit.2. a. The efficient output is the one for which P = MC. If sold in acompetitive market, the price of a television would be $100 andthe quantity sold would be 200,000 – 500(100) = 150,000.b. If sales were limited to 100,000 per year, the marginal socialbenefit of TVs would exceed the marginal social cost. Studentsshould draw a graph showing the resulting loss of net benefits as a triangle above the marginal cost line and under the demand curvebetween the outputs of 100,000 and 150,000. If there is a complete ban on TV sales, the loss in net benefits will be the entire areaunder the demand curve and above the marginal cost curvecorresponding to the consumer surplus from TV sales.3.The senator’s logic is false. Equating the marginal social benefit of aservice with its marginal social cost maximizes net gains. If output is increased to the point at which TSB = TSC, there will be more than the efficient amount of resources devoted to space exploration.4.The price support for rice will increase annual production beyond theefficient level. At the price support, the marginal social cost of rice will exceed its marginal social benefit.5.At the current market equilibrium under perfect competition, MSB =MSC = $100, implying efficiency. The $10 per night tax results in an increase in the market equilibrium price of hotel rooms. At the higher prices, MSB exceeds MSC. The graph used to answer this question should be similar to Figure 2.3 in the text. The loss in net benefitswould be an area like E'EB in Figure 2.3.。

《财政学》全本课后习题答案

第一章市场失灵与财政职能复习思考题一、名词解释财政:国家为了满足社会公共需求对剩余产品进行分配而产生的经济行为。

私人商品:由市场提供用来满足个人需要的商品和服务。

公共商品:由国家机关和政府部门提供用来满足社会公共需求的商品和服务。

外部效应:指私人费用与社会费用或私人得益与社会得益之间的非一致性,或者说是某人或某企业的行为影响了其他人或企业,却没有为之承担相应的成本费用或没有获得相应的报酬。

财政职能:即财政经济职能,是指财政在一定经济模式下内在的、客观上固有的经济功能。

二、单项选择题1.财政分配的主体是(B )。

A.社会B.国家C.市场D.企业2.财政分配的主要对象是(D )。

A.社会总产品价值B.物化劳动价值C.必要劳动产品价值D.剩余产品价值3.财政分配的最基本特征是(C )。

A.强制性B.无偿性C.国家主体性D.公共性4.下列选项中,属于财政现象的是(B )。

A.企业引进外资B.企业购买公债C.企业发行股票D.企业购买金融债券5.下列关于财政收支活动的说法,正确的是(D )。

A.既包括国民收入初次分配,也包括国民收入再分配B.是指国民收入初次分配C.既不是国民收入初次分配,也不是国民收入再分配D.是指国民收入再分配6.经济学的核心问题始终是(C )。

A.经济稳定B.经济公平C.高效配置资源D.国民收入初次分配三、多项选择题1.下列选项中,属于财政收入现象的有(ACE)。

A.税收B.财政拨款C.行政性收费D.财政补贴E.国债2.下列选项中,属于纯公共商品的有(ACE)。

A.法律法规B.教育C.行政管理D.社会保障E.货币发行3.财政调节居民个人收入水平的主要手段包括(AC)。

A.税收B.发行国债C.转移支出D.投资优惠E.罚款4.政府职能包括(ACD)。

A.政治职能B.政府行为C.经济职能D.社会管理职能E.决定企业生产5.宏观经济稳定的含义有(ACE)。

A.充分就业B.经济发展C.物价稳定D.进出口相等E.国际收支平衡四、判断题1.财政分配区别于其他分配形式的根本标志是分配对象不同。

财政学课后答案(完整版)

财政学课后题答案(完整版)第一章导论1.结合实际谈谈生活中的财政现象。

答案:本题的答案有很多种,但是只要从财政学的定义出发,所举例子为政府的收入、支出等财政现象均为正确答案。

比如税收、政府补助等等。

2.如何学习财政学,财政学的学习有哪些方法?答案:(1)学习财政学的基本方法为唯物辩证法。

首先首先应当正确理解掌握财政学中的一些基本概念、基本范畴,这是理解财政学一般原理的前提条件;其次,学习财政学、研究财政学应当理论联系实际。

(2)学习财政学的具体方法为实证分析法和规范分析法相结合。

(3)学习财政学应该主要比较学习,即进行中外的比较,注意辨别学习西方的财政理论知识。

第二章财政与财政职能1. 简略的财政概念。

答:财政作为一个经济范畴,是以国家(或政府)为主体的分配活动,是国家(或政府)在社会再生产过程中,通过多种收入形式,集中一部分国民生产总值或国民收入,用于满足实现其职能需要的收支活动。

2. 市场失效的主要表现。

答:(1)市场低效,它是指现实市场中存在不符合完全竞争假定条件的方面,而由于这些方面的存在,使市场机制无法实现对资源的高效配置。

主要表现在竞争失灵或垄断、公共产品的供给方面、外部效应和信息不对称等方面。

(2)市场无效,即市场配置资源的功能失效。

主要表现在偏好不合理、收入分配不公、宏观经济失调等方面。

3. 如何辨别公共产品与私人产品?并举例说明。

答:区分或辨别公共产品与私人产品的标准通常是受益的排他性或非排他性,消费的竞争性或非竞争性。

纯粹的私人产品具有排他性和竞争性,纯粹的公共产品具有非排他性和非竞争性。

公共产品的例子,只要从定义出发举例就可以,比如国防、天气预报、普通公路等;私人产品的例子,私人产品的例子不胜枚举,只要是符合定义的就好了,比如苹果、梨子等。

4. 举例说明负外部效应及其主要治理方式。

答:负外部效应(外部成本),指产品或服务给所有者以外的其他人带来了损害,但受损者同样得不到应有的损失补偿。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。