英文版罗斯公司理财习题答案Chap005

英文版罗斯公司理财习题答案ChapWord版

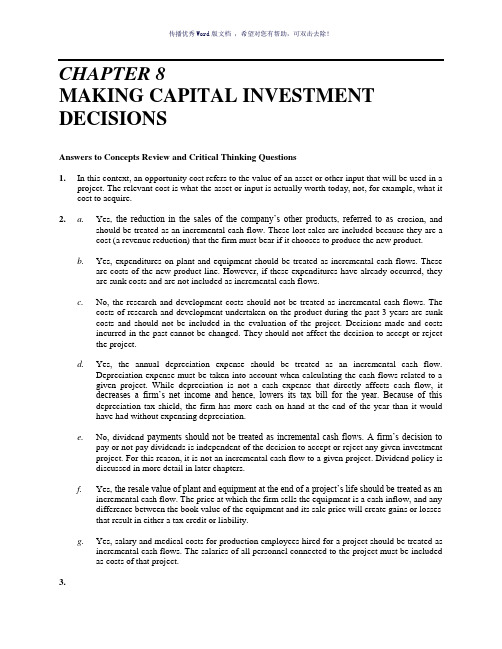

CHAPTER 8MAKING CAPITAL INVESTMENT DECISIONSAnswers to Concepts Review and Critical Thinking Questions1.In this context, an opportunity cost refers to the value of an asset or other input that will be used in aproject. The relevant cost is what the asset or input is actually worth today, not, for example, what it cost to acquire.2. a.Yes, the reduction in the sales of the company’s other products, referred to as erosion, andshould be treated as an incremental cash flow. These lost sales are included because they are a cost (a revenue reduction) that the firm must bear if it chooses to produce the new product.b. Yes, expenditures on plant and equipment should be treated as incremental cash flows. Theseare costs of the new product line. However, if these expenditures have already occurred, they are sunk costs and are not included as incremental cash flows.c. No, the research and development costs should not be treated as incremental cash flows. Thecosts of research and development undertaken on the product during the past 3 years are sunk costs and should not be included in the evaluation of the project. Decisions made and costs incurred in the past cannot be changed. They should not affect the decision to accept or reject the project.d. Yes, the annual depreciation expense should be treated as an incremental cash flow.Depreciation expense must be taken into account when calculating the cash flows related to a given project. While depreciation is not a cash expense that directly affects cash flow, it decreases a firm’s net income and hence, lowers its tax bill for the year. Because of this depreciation tax shield, the firm has more cash on hand at the end of the year than it would have had without expensing depreciation.e.No, dividend payments should not be treated as incremental cash flows. A firm’s decision topay or not pay dividends is independent of the decision to accept or reject any given investment project. For this reason, it is not an incremental cash flow to a given project. Dividend policy is discussed in more detail in later chapters.f.Yes, the resale value of plant and equipment at the end of a project’s life should be treated as anincremental cash flow. The price at which the firm sells the equipment is a cash inflow, and any difference between the book value of the equipment and its sale price will create gains or lossesthat result in either a tax credit or liability.g.Yes, salary and medical costs for production employees hired for a project should be treated asincremental cash flows. The salaries of all personnel connected to the project must be included as costs of that project.3.Item I is a relevant cost because the opportunity to sell the land is lost if the new golf club is produced. Item II is also relevant because the firm must take into account the erosion of sales of existing products when a new product is introduced. If the firm produces the new club, the earnings from the existing clubs will decrease, effectively creating a cost that must be included in the decision.Item III is not relevant because the costs of Research and Development are sunk costs. Decisions made in the past cannot be changed. They are not relevant to the production of the new clubs.4.For tax purposes, a firm would choose MACRS because it provides for larger depreciationdeductions earlier. These larger deductions reduce taxes, but have no other cash consequences.Notice that the choice between MACRS and straight-line is purely a time value issue; the total depreciation is the same; only the timing differs.5.It’s probably only a mild over-simplification. Current liabilities will all be paid, presumably. Thecash portion of current assets will be retrieved. Some receivables won’t be collected, and some inventory will not be sold, of course. Counterbalancing these losses is the fact that inventory sold above cost (and not replaced at the end of the project’s life) acts to increase working capital. These effects tend to offset one another.6.Management’s discretion to set the firm’s capital structure is applicable at the firm level. Since anyone particular project could be financed entirely with equity, another project could be financed with debt, and the firm’s overall capital structure remains unchanged, financing cost s are not relevant in the analysis of a project’s incremental cash flows according to the stand-alone principle.7.The EAC approach is appropriate when comparing mutually exclusive projects with different livesthat will be replaced when they wear out. This type of analysis is necessary so that the projects havea common life span over which they can be compared; in effect, each project is assumed to existover an infinite horizon of N-year repeating projects. Assuming that this type of analysis is valid implies that the project cash flows remain the same forever, thus ignoring the possible effects of, among other things: (1) inflation, (2) changing economic conditions, (3) the increasing unreliability of cash flow estimates that occur far into the future, and (4) the possible effects of future technology improvement that could alter the project cash flows.8.Depreciation is a non-cash expense, but it is tax-deductible on the income statement. Thusdepreciation causes taxes paid, an actual cash outflow, to be reduced by an amount equal to the depreciation tax shield, t c D. A reduction in taxes that would otherwise be paid is the same thing as a cash inflow, so the effects of the depreciation tax shield must be added in to get the total incremental aftertax cash flows.9.There are two particularly important considerations. The first is erosion. Will the “essentialized”book simply displace copies of the existing book that would have otherwise been sold? This is of special concern given the lower price. The second consideration is competition. Will other publishers step in and produce such a product? If so, then any erosion is much less relevant. A particular concern to book publishers (and producers of a variety of other product types) is that the publisher only makes money from the sale of new books. Thus, it is important to examine whether the new book would displace sales of used books (good from the publisher’s perspective) or new books (not good). The concern arises any time there is an active market for used product.10.Definitely. The damage to Porsche’s reputation is definitely a factor the company needed to consider.If the reputation was damaged, the company would have lost sales of its existing car lines.11.One company may be able to produce at lower incremental cost or market better. Also, of course,one of the two may have made a mistake!12.Porsche would recognize that the outsized profits would dwindle as more products come to marketand competition becomes more intense.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = [($5 × 2,000 – ($2 × 2,000)](1 – 0.35) + 0.35($10,000/5)OCF = $4,600So, the NPV of the project is:NPV = –$10,000 + $4,600(PVIFA17%,5)NPV = $4,7172.We will use the bottom-up approach to calculate the operating cash flow for each year. We also mustbe sure to include the net working capital cash flows each year. So, the total cash flow each year will be:Year 1 Year 2 Year 3 Year 4 Sales Rs.7,000 Rs.7,000 Rs.7,000 Rs.7,000Costs 2,000 2,000 2,000 2,000Depreciation 2,500 2,500 2,500 2,500EBT Rs.2,500 Rs.2,500 Rs.2,500 Rs.2,500Tax 850 850 850 850Net income Rs.1,650 Rs.1,650 Rs.1,650 Rs.1,650OCF 0 Rs.4,150 Rs.4,150 Rs.4,150 Rs.4,150Capital spending –Rs.10,000 0 0 0 0NWC –200 –250 –300 –200 950Incremental cashflow –Rs.10,200 Rs.3,900 Rs.3,850 Rs.3,950 Rs.5,100The NPV for the project is:NPV = –Rs.10,200 + Rs.3,900 / 1.10 + Rs.3,850 / 1.102 + Rs.3,950 / 1.103 + Rs.5,100 / 1.104NPV = Rs.2,978.333. Using the tax shield approach to calculating OCF, we get:OCF = (Sales – Costs)(1 – t C) + t C DepreciationOCF = (R2,400,000 – 960,000)(1 – 0.30) + 0.30(R2,700,000/3)OCF = R1,278,000So, the NPV of the project is:NPV = –R2,700,000 + R1,278,000(PVIFA15%,3)NPV = R217,961.704.The cash outflow at the beginning of the project will increase because of the spending on NWC. Atthe end of the project, the company will recover the NWC, so it will be a cash inflow. The sale of the equipment will result in a cash inflow, but we also must account for the taxes which will be paid on this sale. So, the cash flows for each year of the project will be:Year Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,278,0002 1,278,0003 1,725,000 = R1,278,000 + 300,000 + 210,000 + (0 – 210,000)(.30)And the NPV of the project is:NPV = –R3,000,000 + R1,278,000(PVIFA15%,2) + (R1,725,000 / 1.153)NPV = R211,871.465. First we will calculate the annual depreciation for the equipment necessary for the project. Thedepreciation amount each year will be:Year 1 depreciation = R2.7M(0.3330) = R899,100Year 2 depreciation = R2.7M(0.4440) = R1,198,800Year 3 depreciation = R2.7M(0.1480) = R399,600So, the book value of the equipment at the end of three years, which will be the initial investment minus the accumulated depreciation, is:Book value in 3 years = R2.7M – (R899,100 + 1,198,800 + 399,600)Book value in 3 years = R202,500The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = R202,500 + (R202,500 – 210,000)(0.30)Aftertax salvage value = R207,750To calculate the OCF, we will use the tax shield approach, so the cash flow each year is:OCF = (Sales – Costs)(1 – t C) + t C DepreciationYear Cash Flow0 – R3,000,000 = –R2.7M – 300K1 1,277,730.00 = (R1,440,000)(.70) + 0.30(R899,100)2 1,367,640.00 = (R1,440,000)(.70) + 0.30(R1,198,800)3 1,635,630.00 = (R1,440,000)(.70) + 0.30(R399,600) + R207,750 + 300,000Remember to include the NWC cost in Year 0, and the recovery of the NWC at the end of the project.The NPV of the project with these assumptions is:NPV = – R3.0M + (R1,277,730/1.15) + (R1,367,640/1.152) + (R1,635,630/1.153)NPV = R220,655.206. First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation charge = €925,000/5Annual depreciation charge = €185,000The aftertax salvage value of the equipment is:Aftertax salvage value = €90,000(1 – 0.35)Aftertax salvage value = €58,500Using the tax shield approach, the OCF is:OCF = €360,000(1 – 0.35) + 0.35(€185,000)OCF = €298,750Now we can find the project IRR. There is an unusual feature that is a part of this project. Accepting this project means that we will reduce NWC. This reduction in NWC is a cash inflow at Year 0. This reduction in NWC implies that when the project ends, we will have to increase NWC. So, at the end of the project, we will have a cash outflow to restore the NWC to its level before the project. We also must include the aftertax salvage value at the end of the project. The IRR of the project is:NPV = 0 = –€925,000 + 125,000 + €298,750(PVIFA IRR%,5) + [(€58,500 – 125,000) / (1+IRR)5]IRR = 23.85%7.First, we will calculate the annual depreciation of the new equipment. It will be:Annual depreciation = £390,000/5Annual depreciation = £78,000Now, we calculate the aftertax salvage value. The aftertax salvage value is the market price minus (or plus) the taxes on the sale of the equipment, so:Aftertax salvage value = MV + (BV – MV)t cVery often, the book value of the equipment is zero as it is in this case. If the book value is zero, the equation for the aftertax salvage value becomes:Aftertax salvage value = MV + (0 – MV)t cAftertax salvage value = MV(1 – t c)We will use this equation to find the aftertax salvage value since we know the book value is zero. So, the aftertax salvage value is:Aftertax salvage value = £60,000(1 – 0.34)Aftertax salvage value = £39,600Using the tax shield approach, we find the OCF for the project is:OCF = £120,000(1 – 0.34) + 0.34(£78,000)OCF = £105,720Now we can find the project NPV. Notice that we include the NWC in the initial cash outlay. The recovery of the NWC occurs in Year 5, along with the aftertax salvage value.NPV = –£390,000 – 28,000 + £105,720(PVIFA10%,5) + [(£39,600 + 28,000) / 1.15]NPV = £24,736.268.To find the BV at the end of four years, we need to find the accumulated depreciation for the firstfour years. We could calculate a table with the depreciation each year, but an easier way is to add the MACRS depreciation amounts for each of the first four years and multiply this percentage times the cost of the asset. We can then subtract this from the asset cost. Doing so, we get:BV4 = $9,300,000 – 9,300,000(0.2000 + 0.3200 + 0.1920 + 0.1150)BV4 = $1,608,900The asset is sold at a gain to book value, so this gain is taxable.Aftertax salvage value = $2,100,000 + ($1,608,900 – 2,100,000)(.40)Aftertax salvage value = $1,903,5609. We will begin by calculating the initial cash outlay, that is, the cash flow at Time 0. To undertake theproject, we will have to purchase the equipment and increase net working capital. So, the cash outlay today for the project will be:Equipment –€2,000,000NWC –100,000Total –€2,100,000Using the bottom-up approach to calculating the operating cash flow, we find the operating cash flow each year will be:Sales €1,200,000Costs 300,000Depreciation 500,000EBT €400,000Tax 140,000Net income €260,000The operating cash flow is:OCF = Net income + DepreciationOCF = €260,000 + 500,000OCF = €760,000To find the NPV of the project, we add the present value of the project cash flows. We must be sure to add back the net working capital at the end of the project life, since we are assuming the net working capital will be recovered. So, the project NPV is:NPV = –€2,100,000 + €760,000(PVIFA14%,4) + €100,000 / 1.144NPV = €173,629.3810.We will need the aftertax salvage value of the equipment to compute the EAC. Even though theequipment for each product has a different initial cost, both have the same salvage value. The aftertax salvage value for both is:Both cases: aftertax salvage value = $20,000(1 – 0.35) = $13,000To calculate the EAC, we first need the OCF and NPV of each option. The OCF and NPV for Techron I is:OCF = – $34,000(1 – 0.35) + 0.35($210,000/3) = $2,400NPV = –$210,000 + $2,400(PVIFA14%,3) + ($13,000/1.143) = –$195,653.45EAC = –$195,653.45 / (PVIFA14%,3) = –$84,274.10And the OCF and NPV for Techron II is:OCF = – $23,000(1 – 0.35) + 0.35($320,000/5) = $7,450NPV = –$320,000 + $7,450(PVIFA14%,5) + ($13,000/1.145) = –$287,671.75EAC = –$287,671.75 / (PVIFA14%,5) = –$83,794.05The two milling machines have unequal lives, so they can only be compared by expressing both on an equivalent annual basis, which is what the EAC method does. Thus, you prefer the Techron II because it has the lower (less negative) annual cost.。

《公司理财》课后答案(英文版,第六版).doc

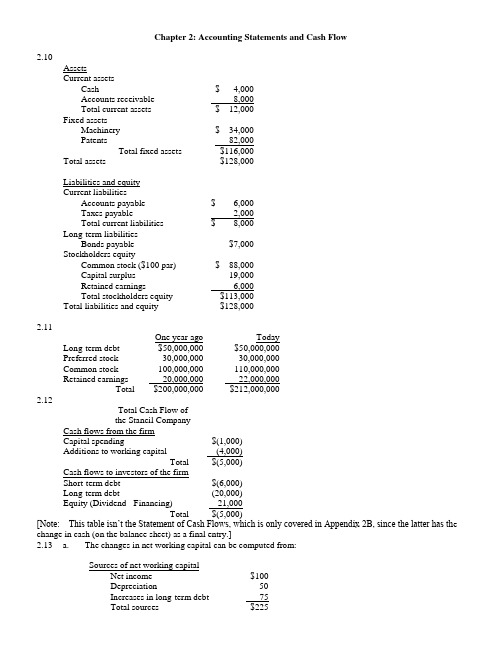

Chapter 2: Accounting Statements and Cash Flow2.10AssetsCurrent assetsCash $ 4,000Accounts receivable 8,000Total current assets $ 12,000Fixed assetsMachinery $ 34,000Patents 82,000Total fixed assets $116,000Total assets $128,000Liabilities and equityCurrent liabilitiesAccounts payable $ 6,000Taxes payable 2,000Total current liabilities $ 8,000Long-term liabilitiesBonds payable $7,000Stockholders equityCommon stock ($100 par) $ 88,000Capital surplus 19,000Retained earnings 6,000Total stockholders equity $113,000Total liabilities and equity $128,0002.11One year ago TodayLong-term debt $50,000,000 $50,000,000Preferred stock 30,000,000 30,000,000Common stock 100,000,000 110,000,000Retained earnings 20,000,000 22,000,000Total $200,000,000 $212,000,0002.12Total Cash Flow ofthe Stancil CompanyCash flows from the firmCapital spending $(1,000)Additions to working capital (4,000)Total $(5,000)Cash flows to investors of the firmShort-term debt $(6,000)Long-term debt (20,000)Equity (Dividend - Financing) 21,000Total $(5,000)[Note: This table isn’t the Statement of Cash Flows, which is only covered in Appendix 2B, since the latter has th e change in cash (on the balance sheet) as a final entry.]2.13 a. The changes in net working capital can be computed from:Sources of net working capitalNet income $100Depreciation 50Increases in long-term debt 75Total sources $225Uses of net working capitalDividends $50Increases in fixed assets* 150Total uses $200Additions to net working capital $25*Includes $50 of depreciation.b.Cash flow from the firmOperating cash flow $150Capital spending (150)Additions to net working capital (25)Total $(25)Cash flow to the investorsDebt $(75)Equity 50Total $(25)Chapter 3: Financial Markets and Net Present Value: First Principles of Finance (Advanced)3.14 $120,000 - ($150,000 - $100,000) (1.1) = $65,0003.15 $40,000 + ($50,000 - $20,000) (1.12) = $73,6003.16 a. ($7 million + $3 million) (1.10) = $11.0 millionb.i. They could spend $10 million by borrowing $5 million today.ii. They will have to spend $5.5 million [= $11 million - ($5 million x 1.1)] at t=1.Chapter 4: Net Present Valuea. $1,000 ⨯ 1.0510 = $1,628.89b. $1,000 ⨯ 1.0710 = $1,967.15c. $1,000 ⨯ 1.0520 = $2,653.30d. Interest compounds on the interest already earned. Therefore, the interest earned inSince this bond has no interim coupon payments, its present value is simply the present value of the $1,000 that will be received in 25 years. Note: As will be discussed in the next chapter, the present value of the payments associated with a bond is the price of that bond.PV = $1,000 /1.125 = $92.30PV = $1,500,000 / 1.0827 = $187,780.23a. At a discount rate of zero, the future value and present value are always the same. Remember, FV =PV (1 + r) t. If r = 0, then the formula reduces to FV = PV. Therefore, the values of the options are $10,000 and $20,000, respectively. You should choose the second option.b. Option one: $10,000 / 1.1 = $9,090.91Option two: $20,000 / 1.15 = $12,418.43Choose the second option.c. Option one: $10,000 / 1.2 = $8,333.33Option two: $20,000 / 1.25 = $8,037.55Choose the first option.d. You are indifferent at the rate that equates the PVs of the two alternatives. You know that rate mustfall between 10% and 20% because the option you would choose differs at these rates. Let r be thediscount rate that makes you indifferent between the options.$10,000 / (1 + r) = $20,000 / (1 + r)5(1 + r)4 = $20,000 / $10,000 = 21 + r = 1.18921r = 0.18921 = 18.921%The $1,000 that you place in the account at the end of the first year will earn interest for six years. The $1,000 that you place in the account at the end of the second year will earn interest for five years, etc. Thus, the account will have a balance of$1,000 (1.12)6 + $1,000 (1.12)5 + $1,000 (1.12)4 + $1,000 (1.12)3= $6,714.61PV = $5,000,000 / 1.1210 = $1,609,866.18a. $1.000 (1.08)3 = $1,259.71b. $1,000 [1 + (0.08 / 2)]2 ⨯ 3 = $1,000 (1.04)6 = $1,265.32c. $1,000 [1 + (0.08 / 12)]12 ⨯ 3 = $1,000 (1.00667)36 = $1,270.24d. $1,000 e0.08 ⨯ 3 = $1,271.25e. The future value increases because of the compounding. The account is earning interest on interest. Essentially, the interest is added to the account balance at the e nd of every compounding period. During the next period, the account earns interest on the new balance. When the compounding period shortens, the balance that earns interest is rising faster.The price of the consol bond is the present value of the coupon payments. Apply the perpetuity formula to find the present value. PV = $120 / 0.15 = $800a. $1,000 / 0.1 = $10,000b. $500 / 0.1 = $5,000 is the value one year from now of the perpetual stream. Thus, the value of theperpetuity is $5,000 / 1.1 = $4,545.45.c. $2,420 / 0.1 = $24,200 is the value two years from now of the perpetual stream. Thus, the value of the perpetuity is $24,200 / 1.12 = $20,000.pply the NPV technique. Since the inflows are an annuity you can use the present value of an annuity factor.ANPV = -$6,200 + $1,200 81.0= -$6,200 + $1,200 (5.3349)= $201.88Yes, you should buy the asset.Use an annuity factor to compute the value two years from today of the twenty payments. Remember, the annuity formula gives you the value of the stream one year before the first payment. Hence, the annuity factor will give you the value at the end of year two of the stream of payments.A= $2,000 (9.8181)Value at the end of year two = $2,000 20.008= $19,636.20The present value is simply that amount discounted back two years.PV = $19,636.20 / 1.082 = $16,834.88The easiest way to do this problem is to use the annuity factor. The annuity factor must be equal to $12,800 / $2,000 = 6.4; remember PV =C A T r. The annuity factors are in the appendix to the text. To use the factor table to solve this problem, scan across the row labeled 10 years until you find 6.4. It is close to the factor for 9%, 6.4177. Thus, the rate you will receive on this note is slightly more than 9%.You can find a more precise answer by interpolating between nine and ten percent.[ 10% ⎤[6.1446 ⎤a ⎡r ⎥bc ⎡6.4 ⎪ d⎣9%⎦⎣6.4177 ⎦By interpolating, you are presuming that the ratio of a to b is equal to the ratio of c to d.(9 - r ) / (9 - 10) = (6.4177 - 6.4 ) / (6.4177 - 6.1446)r = 9.0648%The exact value could be obtained by solving the annuity formula for the interest rate. Sophisticated calculators can compute the rate directly as 9.0626%.[Note: A standard financial calculator’s TVM keys can solve for this rate. With annuity flows, the IRR key on “advanced” financial c alculators is unnecessary.]a. The annuity amount can be computed by first calculating the PV of the $25,000 which youThat amount is $17,824.65 [= $25,000 / 1.075]. Next compute the annuity which has the same present value.A$17,824.65 = C 507.0$17,824.65 = C (4.1002)C = $4,347.26Thus, putting $4,347.26 into the 7% account each year will provide $25,000 five years from today.b. The lump sum payment must be the present value of the $25,000, i.e., $25,000 / 1.075 =$17,824.65The formula for future value of any annuity can be used to solve the problem (see footnote 11 of the text).Option one: This cash flow is an annuity due. To value it, you must use the after-tax amounts. Theafter-tax payment is $160,000 (1 - 0.28) = $115,200. Value all except the first payment using the standard annuity formula, then add back the first payment of $115,200 to obtain the value of this option.AValue = $115,200 + $115,200 30.010= $115,200 + $115,200 (9.4269)= $1,201,178.88Option two: This option is valued similarly. You are able to have $446,000 now; this is already on an after-tax basis. You will receive an annuity of $101,055 for each of the next thirty years. Those payments are taxable when you receive them, so your after-tax payment is $72,759.60 [= $101,055 (1 - 0.28)].AValue = $446,000 + $72,759.60 30.010= $446,000 + $72,759.60 (9.4269)= $1,131,897.47Since option one has a higher PV, you should choose it.et r be the rate of interest you must earn.$10,000(1 + r)12 = $80,000(1 + r)12= 8r = 0.18921 = 18.921%First compute the present value of all the payments you must make for your children’s educati on. The value as of one year before matriculation of one child’s education isA= $21,000 (2.8550) = $59,955.$21,000 415.0This is the value of the elder child’s education fourteen years from now. It is the value of the younger child’s education sixteen years from today. The present value of these isPV = $59,955 / 1.1514 + $59,955 / 1.1516= $14,880.44You want to make fifteen equal payments into an account that yields 15% so that the present value of the equal payments is $14,880.44.A= $14,880.44 / 5.8474 = $2,544.80Payment = $14,880.44 / 15.015This problem applies the growing annuity formula. The first payment is$50,000(1.04)2(0.02) = $1,081.60.PV = $1,081.60 [1 / (0.08 - 0.04) - {1 / (0.08 - 0.04)}{1.04 / 1.08}40]= $21,064.28This is the present value of the payments, so the value forty years from today is$21,064.28 (1.0840) = $457,611.46se the discount factors to discount the individual cash flows. Then compute the NPV of the project. NoticeYou can still use the factor tables to compute their PV. Essentially, they form cash flows that are a six year annuity less a two year annuity. Thus, the appropriate annuity factor to use with them is 2.6198 (= 4.3553 - 1.7355).Year Cash Flow Factor PV0.9091 $636.371$70020.8264 743.769003 1,000 ⎤4 1,000 ⎥ 2.6198 2,619.805 1,000 ⎥6 1,000 ⎦7 1,250 0.5132 641.508 1,375 0.4665 641.44Total $5,282.87NPV = -$5,000 + $5,282.87= $282.87Purchase the machine.Chapter 5: How to Value Bonds and StocksThe amount of the semi-annual interest payment is $40 (=$1,000 ⨯ 0.08 / 2). There are a total of 40 periods;i.e., two half years in each of the twenty years in the term to maturity. The annuity factor tables can be usedto price these bonds. The appropriate discount rate to use is the semi-annual rate. That rate is simply the annual rate divided by two. Thus, for part b the rate to be used is 5% and for part c is it 3%.A+F/(1+r)40PV=C Tra. $40 (19.7928) + $1,000 / 1.0440 = $1,000Notice that whenever the coupon rate and the market rate are the same, the bond is priced at par.b. $40 (17.1591) + $1,000 / 1.0540 = $828.41Notice that whenever the coupon rate is below the market rate, the bond is priced below par.c. $40 (23.1148) + $1,000 / 1.0340 = $1,231.15Notice that whenever the coupon rate is above the market rate, the bond is priced above par.a. The semi-annual interest rate is $60 / $1,000 = 0.06. Thus, the effective annual rate is 1.062 - 1 =0.1236 = 12.36%.A+ $1,000 / 1.0612b. Price = $30 12.006= $748.48A+ $1,000 / 1.0412c. Price = $30 1204.0= $906.15Note: In parts b and c we are implicitly assuming that the yield curve is flat. That is, the yield in year 5applies for year 6 as well.rice = $2 (0.72) / 1.15 + $4 (0.72) / 1.152 + $50 / 1.153= $36.31The number of shares you own = $100,000 / $36.31 = 2,754 sharesPrice = $1.15 (1.18) / 1.12 + $1.15 (1.182) / 1.122 + $1.152 (1.182) / 1.123+ {$1.152 (1.182)(1.06) / (0.12 - 0.06)} / 1.123= $26.95[Insert before last sentence of question: Assume that dividends are a fixed proportion of earnings.] Dividend one year from now = $5 (1 - 0.10) = $4.50Price = $5 + $4.50 / {0.14 - (-0.10)}= $23.75Since the current $5 dividend has not yet been paid, it is still included in the stock price.Chapter 6: Some Alternative Investment Rulesa. Payback period of Project A = 1 + ($7,500 - $4,000) / $3,500 = 2 yearsPayback period of Project B = 2 + ($5,000 - $2,500 -$1,200) / $3,000 = 2.43 yearsProject A should be chosen.b. NPV A = -$7,500 + $4,000 / 1.15 + $3,500 / 1.152 + $1,500 / 1.153 = -$388.96NPV B = -$5,000 + $2,500 / 1.15 + $1,200 / 1.152 + $3,000 / 1.153 = $53.83Project B should be chosen.a. Average Investment:($16,000 + $12,000 + $8,000 + $4,000 + 0) / 5 = $8,000Average accounting return:$4,500 / $8,000 = 0.5625 = 56.25%b. 1. AAR does not consider the timing of the cash flows, hence it does not consider the timevalue of money.2. AAR uses an arbitrary firm standard as the decision rule.3. AAR uses accounting data rather than net cash flows.aAverage Investment = (8000 + 4000 + 1500 + 0)/4 = 3375.00Average Net Income = 2000(1-0.75) = 1500=> AAR = 1500/3375=44.44%a. Solve x by trial and error:-$8,000 + $4,000 / (1 + x) + $3000 / (1 + x)2 + $2,000 / (1 + x)3 = 0x = 6.93%b. No, since the IRR (6.93%) is less than the discount rate of 8%.Alternatively, the NPV @ a discount rate of 0.08 = -$136.62.a. Solve r in the equation:$5,000 - $2,500 / (1 + r) - $2,000 / (1 + r)2 - $1,000 / (1 + r)3- $1,000 / (1 + r)4 = 0By trial and error,IRR = r = 13.99%b. Since this problem is the case of financing, accept the project if the IRR is less than the required rate of return.IRR = 13.99% > 10%Reject the offer.c. IRR = 13.99% < 20%Accept the offer.d. When r = 10%:NPV = $5,000 - $2,500 / 1.1 - $2,000 / 1.12 - $1,000 / 1.13 - $1,000 / 1.14When r = 20%:NPV = $5,000 - $2,500 / 1.2 - $2,000 / 1.22 - $1,000 / 1.23 - $1,000 / 1.24= $466.82Yes, they are consistent with the choices of the IRR rule since the signs of the cash flows change only once.A/ $160,000 = 1.04PI = $40,000 715.0Since the PI exceeds one accept the project.Chapter 7: Net Present Value and Capital BudgetingSince there is uncertainty surrounding the bonus payments, which McRae might receive, you must use the expected value of McRae’s bonuses in the computation of the PV of his contract. McRae’s salary plus the expected value of his bonuses in years one through three is$250,000 + 0.6 ⨯ $75,000 + 0.4 ⨯ $0 = $295,000.Thus the total PV of his three-year contract isPV = $400,000 + $295,000 [(1 - 1 / 1.12363) / 0.1236]+ {$125,000 / 1.12363} [(1 - 1 / 1.123610 / 0.1236]= $1,594,825.68EPS = $800,000 / 200,000 = $4NPVGO = (-$400,000 + $1,000,000) / 200,000 = $3Price = EPS / r + NPVGO= $4 / 0.12 + $3=$36.33Year 0 Year 1 Year 2 Year 3 Year 4 Year 51. Annual Salary$120,000 $120,000 $120,000 $120,000 $120,000 Savings2. Depreciation 100,000 160,000 96,000 57,600 57,6003. Taxable Income 20,000 -40,000 24,000 62,400 62,4004. Taxes 6,800 -13,600 8,160 21,216 21,2165. Operating Cash Flow113,200 133,600 111,840 98,784 98,784 (line 1-4)$100,000 -100,0006. ∆ Net workingcapital7. Investment $500,000 75,792*8. Total Cash Flow -$400,000 $113,200 $133,600 $111,840 $98,784 $74,576*75,792 = $100,000 - 0.34 ($100,000 - $28,800)NPV = -$400,000+ $113,200 / 1.12 + $133,600 / 1.122 + $111,840 / 1.123+ $98,784 / 1.124 + $74,576 / 1.125= -$7,722.52Real interest rate = (1.15 / 1.04) - 1 = 10.58%NPV A = -$40,000+ $20,000 / 1.1058 + $15,000 / 1.10582 + $15,000 / 1.10583= $1,446.76NPV B = -$50,000+ $10,000 / 1.15 + $20,000 / 1.152 + $40,000 / 1.153= $119.17Choose project A.PV = $120,000 / {0.11 - (-0.06)}t = 0 t = 1 t = 2 t = 3 t = 4 t = 5 t = 6 ...$12,000 $6,000 $6,000 $6,000$4,000$12,000 $6,000 $6,000 ...The present value of one cycle is:A+ $4,000 / 1.064PV = $12,000 + $6,000 306.0= $12,000 + $6,000 (2.6730) + $4,000 / 1.064= $31,206.37The cycle is four years long, so use a four year annuity factor to compute the equivalent annual cost (EAC).AEAC = $31,206.37 / 406.0= $31,206.37 / 3.4651= $9,006The present value of such a stream in perpetuity is$9,006 / 0.06 = $150,100o evaluate the word processors, compute their equivalent annual costs (EAC).BangAPV(costs) = (10 ⨯ $8,000) + (10 ⨯ $2,000) 414.0= $80,000 + $20,000 (2.9137)= $138,274EAC = $138,274 / 2.9137= $47,456IOUAPV(costs) = (11 ⨯ $5,000) + (11 ⨯ $2,500) 3.014- (11 ⨯ $500) / 1.143= $55,000 + $27,500 (2.3216) - $5,500 / 1.143= $115,132EAC = $115,132 / 2.3216= $49,592BYO should purchase the Bang word processors.Chapter 8: Strategy and Analysis in Using Net Present ValueThe accounting break-even= (120,000 + 20,000) / (1,500 - 1,100)= 350 units. The accounting break-even= 340,000 / (2.00 - 0.72)= 265,625 abalonesb. [($2.00 ⨯ 300,000) - (340,000 + 0.72 ⨯ 300,000)] (0.65)= $28,600This is the after tax profit.Chapter 9: Capital Market Theory: An Overviewa. Capital gains = $38 - $37 = $1 per shareb. Total dollar returns = Dividends + Capital Gains = $1,000 + ($1*500) = $1,500 On a per share basis, this calculation is $2 + $1 = $3 per sharec. On a per share basis, $3/$37 = 0.0811 = 8.11% On a total dollar basis, $1,500/(500*$37) = 0.0811 = 8.11%d. No, you do not need to sell the shares to include the capital gains in the computation of the returns. The capital gain is included whether or not you realize the gain. Since you could realize the gain if you choose, you should include it.The expected holding period return is:()[]%865.1515865.052$/52$75.54$50.5$==-+There appears to be a lack of clarity about the meaning of holding period returns. The method used in the answer to this question is the one used in Section 9.1. However, the correspondence is not exact, because in this question, unlike Section 9.1, there are cash flows within the holding period. The answer above ignores the dividend paid in the first year. Although the answer above technically conforms to the eqn at the bottom of Fig. 9.2, the presence of intermediate cash flows that aren’t accounted for renders th is measure questionable, at best. There is no similar example in the body of the text, and I have never seen holding period returns calculated in this way before.Although not discussed in this book, there are two generally accepted methods of computing holding period returns in the presence of intermediate cash flows. First, the time weighted return calculates averages (geometric or arithmetic) of returns between cash flows. Unfortunately, that method can’t be used here, because we are not given the va lue of the stock at the end of year one. Second, the dollar weighted measure calculates the internal rate of return over the entire holding period. Theoretically, that method can be applied here, as follows: 0 = -52 + 5.50/(1+r) + 60.25/(1+r)2 => r = 0.1306.This produces a two year holding period return of (1.1306)2 – 1 = 0.2782. Unfortunately, this book does not teach the dollar weighted method.In order to salvage this question in a financially meaningful way, you would need the value of the stock at the end of one year. Then an illustration of the correct use of the time-weighted return would be appropriate. A complicating factor is that, while Section 9.2 illustrates the holding period return using the geometric return for historical data, the arithmetic return is more appropriate for expected future returns.E(R) = T-Bill rate + Average Excess Return = 6.2% + (13.0% -3.8%) = 15.4%. Common Treasury Realized Stocks Bills Risk Premium -7 32.4% 11.2% 21.2%-6 -4.9 14.7 -19.6-5 21.4 10.5 10.9 -4 22.5 8.8 13.7 -3 6.3 9.9 -3.6 -2 32.2 7.7 24.5 Last 18.5 6.2 12.3 b. The average risk premium is 8.49%.49.873.125.246.37.139.106.192.21=++-++- c. Yes, it is possible for the observed risk premium to be negative. This can happen in any single year. The.b.Standard deviation = 03311.0001096.0=.b.Standard deviation = = 0.03137 = 3.137%.b.Chapter 10: Return and Risk: The Capital-Asset-Pricing Model (CAPM)a. = 0.1 (– 4.5%) + 0.2 (4.4%) + 0.5 (12.0%) + 0.2 (20.7%) = 10.57%b.σ2 = 0.1 (–0.045 – 0.1057)2 + 0.2 (0.044 – 0.1057)2 + 0.5 (0.12 – 0.1057)2+ 0.2 (0.207 – 0.1057)2 = 0.0052σ = (0.0052)1/2 = 0.072 = 7.20%Holdings of Atlas stock = 120 ⨯ $50 = $6,000 ⨯ $20 = $3,000Weight of Atlas stock = $6,000 / $9,000 = 2 / 3Weight of Babcock stock = $3,000 / $9,000 = 1 / 3a. = 0.3 (0.12) + 0.7 (0.18) = 0.162 = 16.2%σP 2= 0.32 (0.09)2 + 0.72 (0.25)2 + 2 (0.3) (0.7) (0.09) (0.25) (0.2)= 0.033244σP= (0.033244)1/2 = 0.1823 = 18.23%a.State Return on A Return on B Probability1 15% 35% 0.4 ⨯ 0.5 = 0.22 15% -5% 0.4 ⨯ 0.5 = 0.23 10% 35% 0.6 ⨯ 0.5 = 0.34 10% -5% 0.6 ⨯ 0.5 = 0.3b. = 0.2 [0.5 (0.15) + 0.5 (0.35)] + 0.2[0.5 (0.15) + 0.5 (-0.05)]+ 0.3 [0.5 (0.10) + 0.5 (0.35)] + 0.3 [0.5 (0.10) + 0.5 (-0.05)]= 0.135= 13.5%Note: The solution to this problem requires calculus.Specifically, the solution is found by minimizing a function subject to a constraint. Calculus ability is not necessary to understand the principles behind a minimum variance portfolio.Min { X A2 σA2 + X B2σB2+ 2 X A X B Cov(R A , R B)}subject to X A + X B = 1Let X A = 1 - X B. Then,Min {(1 - X B)2σA2 + X B2σB2+ 2(1 - X B) X B Cov (R A, R B)}Take a derivative with respect to X B.d{∙} / dX B = (2 X B - 2) σA2+ 2 X B σB2 + 2 Cov(R A, R B) - 4 X B Cov(R A, R B)Set the derivative equal to zero, cancel the common 2 and solve for X B.X BσA2- σA2+ X B σB2 + Cov(R A, R B) - 2 X B Cov(R A, R B) = 0X B = {σA2 - Cov(R A, R B)} / {σA2+ σB2 - 2 Cov(R A, R B)}andX A = {σB2 - Cov(R A, R B)} / {σA2+ σB2 - 2 Cov(R A, R B)}Using the data from the problem yields,X A = 0.8125 andX B = 0.1875.a. Using the weights calculated above, the expected return on the minimum variance portfolio isE(R P) = 0.8125 E(R A) + 0.1875 E(R B)= 0.8125 (5%) + 0.1875 (10%)= 5.9375%b. Using the formula derived above, the weights areX A = 2 / 3 andX B = 1 / 3c. The variance of this portfolio is zero.σP 2= X A2 σA2 + X B2σB2+ 2 X A X B Cov(R A , R B)= (4 / 9) (0.01) + (1 / 9) (0.04) + 2 (2 / 3) (1 / 3) (-0.02)= 0This demonstrates that assets can be combined to form a risk-free portfolio.14.2%= 3.7%+β(7.5%) ⇒β = 1.40.25 = R f + 1.4 [R M– R f] (I)0.14 = R f + 0.7 [R M– R f] (II)(I) – (II)=0.11 = 0.7 [R M– R f] (III)[R M– R f ]= 0.1571Put (III) into (I) 0.25 = R f + 1.4[0.1571]R f = 3%[R M– R f ]= 0.1571R M = 0.1571 + 0.03= 18.71%a. = 4.9% + βi (9.4%)βD= Cov(R D, R M) / σM 2 = 0.0635 / 0.04326 = 1.468= 4.9 + 1.468 (9.4) = 18.70%Weights:X A = 5 / 30 = 0.1667X B = 10 / 30 = 0.3333X C = 8 / 30 = 0.2667X D = 1 - X A - X B - X C = 0.2333Beta of portfolio= 0.1667 (0.75) + 0.3333 (1.10) + 0.2667 (1.36) + 0.2333 (1.88)= 1.293= 4 + 1.293 (15 - 4) = 18.22%a. (i) βA= ρA,MσA / σMρA,M= βA σM / σA= (0.9) (0.10) / 0.12= 0.75(ii) σB= βB σM / ρB,M= (1.10) (0.10) / 0.40= 0.275(iii) βC= ρC,MσC / σM= (0.75) (0.24) / 0.10= 1.80(iv) ρM,M= 1(v) βM= 1(vi) σf= 0(vii) ρf,M= 0(viii) βf= 0b. SML:E(R i) = R f + βi {E(R M) - R f}= 0.05 + (0.10) βiSecurity βi E(R i)A 0.13 0.90 0.14B 0.16 1.10 0.16C 0.25 1.80 0.23Security A performed worse than the market, while security C performed better than the market.Security B is fairly priced.c. According to the SML, security A is overpriced while security C is under-priced. Thus, you could invest in security C while sell security A (if you currently hold it).a. The typical risk-averse investor seeks high returns and low risks. To assess thetwo stocks, find theReturns:State of economy ProbabilityReturn on A*Recession 0.1 -0.20 Normal 0.8 0.10 Expansion0.10.20* Since security A pays no dividend, the return on A is simply (P 1 / P 0) - 1. = 0.1 (-0.20) + 0.8 (0.10) + 0.1 (0.20) = 0.08 = 0.09 This was given in the problem.Risk:R A - (R A -)2 P ⨯ (R A -)2 -0.28 0.0784 0.00784 0.02 0.0004 0.00032 0.12 0.0144 0.00144 Variance 0.00960Standard deviation (R A ) = 0.0980βA = {Corr(R A , R M ) σ(R A )} / σ(R M ) = 0.8 (0.0980) / 0.10= 0.784βB = {Corr(R B , R M ) σ(R B )} / σ(R M ) = 0.2 (0.12) / 0.10= 0.24The return on stock B is higher than the return on stock A. The risk of stock B, as measured by itsbeta, is lower than the risk of A. Thus, a typical risk-averse investor will prefer stock B.b. = (0.7) + (0.3) = (0.7) (0.8) + (0.3) (0.09) = 0.083σP 2= 0.72 σA 2 + 0.32 σB 2 + 2 (0.7) (0.3) Corr (R A , R B ) σA σB = (0.49) (0.0096) + (0.09) (0.0144) + (0.42) (0.6) (0.0980) (0.12) = 0.0089635 σP = = 0.0947 c. The beta of a portfolio is the weighted average of the betas of the components of the portfolio. βP = (0.7) βA + (0.3) βB = (0.7) (0.784) + (0.3) (0.240) = 0.621Chapter 11:An Alternative View of Risk and Return: The Arbitrage Pricing Theorya. Stock A:()()R R R R R A A A m m Am A=+-+=+-+βεε105%12142%...Stock B:()()R R R R R B B m m Bm B=+-+=+-+βεε130%098142%...Stock C:()R R R R R C C C m m Cm C=+-+=+-+βεε157%137142%)..(.b.()[]()[]()[]()()()()()()[]()()CB A m cB A m c m B m A m CB A P 25.045.030.0%2.14R 1435.1%925.1225.045.030.0%2.14R 37.125.098.045.02.130.0%7.1525.0%1345.0%5.1030.0%2.14R 37.1%7.1525.0%2.14R 98.0%0.1345.0%2.14R 2.1%5.1030.0R 25.0R 45.0R 30.0R ε+ε+ε+-+=ε+ε+ε+-+++++=ε+-++ε+-++ε+-+=++= c.i.()R R R A B C =+-==+-==+-=105%1215%142%)1113%09815%142%)137%157%13715%142%168%..(..46%.(......ii.R P =+-=12925%1143515%142%)138398%..(..To determine which investment investor would prefer, you must compute the variance of portfolios created bymany stocks from either market. Note, because you know that diversification is good, it is reasonable to assume that once an investor chose the market in which he or she will invest, he or she will buy many stocks in that market.Known:E EF ====001002 and and for all i.i σσεε..Assume: The weight of each stock is 1/N; that is, X N i =1/for all i.If a portfolio is composed of N stocks each forming 1/N proportion of the portfolio, the return on the portfolio is 1/N times the sum of the returns on the N stocks. Recall that the return on each stock is 0.1+βF+ε.()()()()()()[]()()()()()()()[]()[]()[]()()[]()()()()()j i 2j i 22j i i 2222222222P P P P iP ,0.04Corr 0.01,Cov s =isvariance the ,N as limit In the ,Cov 1/N 1s 1/N s )(1/N 1/N F 2F E 1/N F E 0.10.1/N F 0.1E R E R E R Var 0.101/N 00.1E 1/N F E 0.11/N F 0.1E R E 1/N F 0.1F 0.1(1/N)R 1/N R εε+β=εε+β∞⇒εε-+ε+β=ε∑+εβ+β=ε+β=-ε+β+=-==+β+=ε+β+=ε∑+β+=ε+β+=ε+β+==∑∑∑∑∑∑∑∑()()()()()()Thus,F R f E R E R Var R Corr Var R Corr ii ip P p i j PijR 1i =++=++===+=+010*********002250040002500412212111222.........,,εεεεεεa.()()()()Corr Corr Var R Var R i j i j p pεεεε112212000225000225,,..====Since Var ()()R p 1 Var R 2p 〉, a risk averse investor will prefer to invest in the second market.b. Corr ()()εεεε112090i j j ,.,== and Corr 2i()()Var R Var R pp120058500025==..。

(公司理财)英文版罗斯公司理财习题答案C

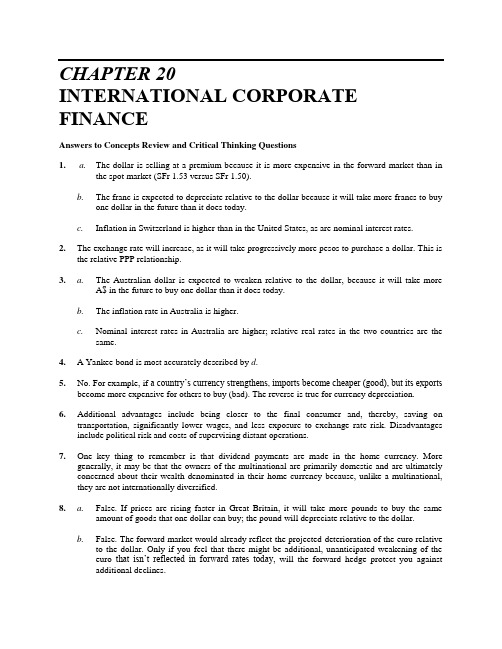

CHAPTER 20INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be better off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doe sn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

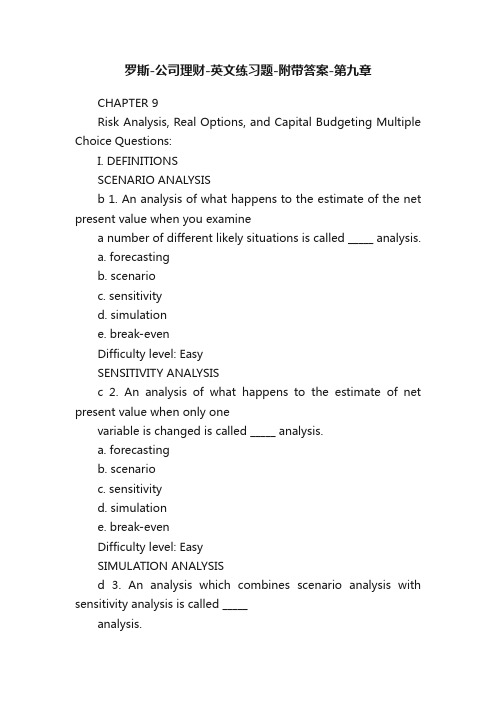

罗斯-公司理财-英文练习题-附带答案-第九章