西南财经大学金融学研究生考试真题2

西南财经大学金融学研究生考试真题3

西南财经大学金融学研究生考试真题3西南财经大学2001年金融学研究生考试真题金融学(货币方向)课程名称:货币金融学适用专业:金融学一、判断题(每小题8分,计40分)1、货币流通手段职能是在货币的价值尺度职能的基础上发展起来的。

2、就同类信用而言,短期利率必然低于长期利率。

3、到期收益率(yield to maturity)就是零息票债券的收益率。

4、通货膨胀使各个集团的收入调整速度产生差异。

5、《巴塞尔协议》关于资本的规定是为了消除各国银行之间的竞争。

二、简答题(每小题10分,计30分)1、信用卡是不是一种新的货币形式?为什么?2、信用创造的实质何在?为什么?3、分析单元银行制和分支行制的优劣。

三、论述题(每小题15分,计30分)1、试论中国金融业实行分业管理与参与国际金融业竞争的关系。

2、论对通货紧缩的治理。

课程名称:综合考试适用专业:金融学(金融方向)银行经营管理一、判断分析题(首先判断下面的表述是否正确,如果错误请说明理由。

每小题2分,共10分)1、商业银行与工商企业一样,经营目的是为获取利润。

2、商业银行的信用中介职能直接影响社会货币供应量。

3、商业银行的收益都来自存贷利差。

4、资本是商业银行的经营者自己投入的本钱。

5、票据贴现实际上是商业银行发放贷款的一种方式。

二、简答题(每小题5分,共10分)1、怎样计算商业银行的风险资产?2、商业银行贷款经营应遵循的基本原则是什么?三、论述题(10分)试论我国国有商业银行的资本充足率。

金融市场一简答题(每小题5分,共10分)1、开放型基金和封闭型基金有什么区别?2、投资者的无差异曲线有何特点?二论述题(20分)试比较分析证券发行的注册制与核准制。

凯程教育:凯程考研成立于2005年,国内首家全日制集训机构考研,一直从事高端全日制辅导,由李海洋教授、张鑫教授、卢营教授、王洋教授、杨武金教授、张释然教授、索玉柱教授、方浩教授等一批高级考研教研队伍组成,为学员全程高质量授课、答疑、测试、督导、报考指导、方法指导、联系导师、复试等全方位的考研服务。

【西南财经大学】经济学二考研真题

西南财经大学802经济学二考研真题综合分析西南财经大学是教育部直属的国家“211工程”和“985工程”优势学科创新平台建设的全国重点大学,也是国家教育体制改革试点高校。

作为一所区域性财经院校,西南财经大学在南方特别是华南地区很有名气(很多毕业生毕业后去了深圳等华南地区工作),就业情况非常不错。

西南财经大学绝大部分经济学相关专业初试考试科目为“802经济学二”(部分专业初试考试科目为“801经济学一”)。

为了便于考生更好地了解本考试科目,跨考教育经济学名师郑炳对本考试科目进行如下解读。

一、802经济学二适用专业经济学院:国民经济学、区域经济学财政税务学院:财政学、税收学金融学院:金融学、金融工程、信用管理工商管理学院:产业经济学、消费经济学、流通经济学国际商学院:国际贸易学统计学院:统计学、数量经济学中国金融研究中心:金融学证券与期货学院:金融学公共管理学院:劳动经济学、公共经济制度与政策经济信息工程学院:金融学、金融贸易电子商务保险学院:保险学经济数学学院:数理金融学经济与管理研究院:金融学中国西部经济研究中心:农业经济学跨考经济学考研辅导名师郑炳老师点评:·西南财经大学经济学相关专业招生人数多,且推免人数少,因此相对于其他财经院校来说,相对容易考。

·考虑到很多专业初试考试科目一样,建议考生前期没必要太过于纠结到底报哪个专业,前期认真复习是王道,后期到底选择报哪个专业结合自身复习情况以及专业爱好而定。

二、802经济学二参考书目西南财经大学“802经济学二”仅给出考试大纲,没有指定参考书。

根据考试大纲,推荐考生参照以下教材复习备考:平狄克《微观经济学》,中国人民大学出版社高鸿业《西方经济学(宏观部分)》,中国人民大学出版社刘诗白《政治经济学》,西南财经大学出版社跨考经济学考研辅导名师郑炳老师点评:·上述三本教材只是重要的三本教材。

为了专业课取得高分,考生除了看上述三本教材,还可以看以下教材:范里安《微观经济学:现代观点》、曼昆《宏观经济学》和逄锦聚《政治经济学》。

2002-2009年西财经经济学二初试真题NEW

2002-2009年西财经经济学二初试真题NEW西财经经济学二初试真题2002-2009年西南财经大学2009年硕士研究生入学考试经济学(二)政治经济学部分一、辨析题(10分)一般情况下,获利水平低于平均利润率的资本是银行资本。

二、简答题1、劳动力商品与一般商品相比,它的价值和使用价值有什么特点?(13分)2、简析近年来我国居民消费需求不足的原因。

(12分)三、论述题(每题20分)1、论述马克思的级差地租理论及其现实意义。

2、用总量平衡理论分析当前中国宏观经济总量运行中存在的问题及解决的政策选择。

西方经济学部分简述题四、假设一个只有家人和企业的两部门经济中,消费C=100+0.8y,投资i=150—6r,货币供给m=150,货币需求L=0.2y+4r。

不考虑税收和价格因素,假设单位为亿美元。

(1)分别计算该经济的IS曲线和LM曲线;(2)当产品市场和货币市场同时均衡时的利率和国民收入(15分) 五、假设经济的总量生产函数为Y=KαL1-α,根据新古典增长理论,(1)分别求出稳态水平的人均资本存量K*和人均收入水平y*;(2)据此说明储蓄率的外生变化对人均收入水平的影响。

(10分)六、假设经济中的菲利普斯曲线πt=πt-1-0.5(u-0.06)。

(1)该经济的自然失业率是多少?(2)为使通货膨胀减少5个百分点,必须有多少周期性失业?(10分)七、运用供求均衡分析法说明销售税在市场双方之间的分配,并分析销售税对社会的经济福利的影响。

(10分)八、什么是帕累托最优?联系图形分析说明完全竞争经济的一般均衡状态是帕累托最优。

(15分)九、联系图形说明卡特尔模型的主要内容,并分析卡特尔组织的稳定问题。

(15分)西南财经大学2008年研究生考试经济学(二)政治经济学部分:一、辨析题(15分):剩余价值转化为利润,价值也就转化为了生产价格。

二、简答题(每题10分,共20分)1 简单分析社会总资本扩大再生产的实现条件及其派生公式并说明其经济涵义。

西财考研99-09金融复试真题.doc

西南财经大学1999年研究生考试金融学试题一、判断正误并简述理由(每小题6分,共30分)1、在融资领域中,直接融资所占比率越高,社会资源的利用效率就越好。

2、货币数量越多,说明一国的货币化程度越高。

3、银行储蓄存款的增减变化不能真实地反映家庭个人剩余收入的变化。

4、金融创新的过程就是金融风险增加的过程。

5、银行信用在分配资源的基础上创造资源。

二、简答题(每小题6分,共30分)1、试分析“1:8”经验公式的内容、意义及缺陷2、试分析银行表外业务产生和发展的原因3、简述货币主义的汇率理论4、简述“物价-现金流动机制”5、简述“马歇尔-勒纳条件”三、分析计算(10分)四、论述(每小题20分,共40分)1、分析设置跨省一级分行的目的、意义及存在的问题2、我国政府一再重申人民币不贬值是出于经济方面的考虑,根据你所学的国际金融理论,请谈谈你的看法综合考试:金融理论与实务一、简答(8*5)1、可转换债券及其特点2、简述《巴塞尔协议》的贯彻实施对国际银行业经营管理的影响3、证券流通市场的作用4、简述贷款五类划分及其意义5、对比分析股份制银行利润分配与国家银行的差异二、论述(10分)1、论我国股票市场存在的问题及其应采取的措施2、试论现代商业银行表外业务的特点及其管理西南财大2000年研究生考试金融学试题一、判断分析题(32分)1、商品价格上升可以由非货币因素引起2、呆账准备金是为了应付支付困难而设立的准备金3、金融机构的融资效率高于金融市场的融资效率4、备付金制度是为了保证客户提现的准备金制度二、简答题(40分)1、如何理解“储蓄可能为储蓄者带来实质性的亏损”2、简述金融安全与经济安全的关系3、简述“存款是第一性的”的内涵的意义4、比较“实物储蓄与货币储蓄”的异同三、论述(28)1、试分析“金融由账房先生向经济调解着”的转变过程2、论金融创新与金融监管的关系金融理论与实践---银行经营与管理部分一、名词解释(6分)1、可用头寸2、商业银行集约化二、计算(4分)若某银行1998年6月1日拆出资金1800万元,拆借期限为2个月,资金在途期限6天,该行尚存上级行利率和在途损失利率约为万分之三,请计算保本拆借利率为多少三、简答(12分)1、主银行制度与主办银行制度的内容与区别2、如何理解“银行经营与管理既是一门科学,又是一门艺术”四、论述(8分)试论西方商业银行金融营销的产生、发展与变化金融理论与实践---金融市场学部分一、简答(10分)1、简述风险、不规则风险和规则风险及三者的关系2、中国公司为什么要选择ADR形式在美国间接上市二、论述(20分)我国现阶段为什么要大力发展证券投资基金西南财大2001年研究生考试金融学试题课程名称:货币金融学适用专业:金融学一、判断(40)1、货币流通手段职能是在货币的价值尺度职能的基础上发展起来的2、就同类信用而言,短期利率必然低于长期利率3、到期收益率(yield to maturity)就是零息票债券的收益率4、通货膨胀使各个集团的收入调整速度产生差异5、《巴塞尔协议》关于资本的规定是为了消除各国银行之间的竞争二、简答(30)1、信用卡是不是一种新的货币形式?为什么?2、信用创造的实质何在?为什么?3、分析单元银行制和分支行制的优劣三、论述(30)1、试论中国金融业实行分业管理与国际金融业竞争的关系2、试论对通货紧缩的治理银行经营管理一、判断分析(首先判断下面的表述是否正确,如果错误请说明理由,每小题2分,共10分)1、商业银行与工商企业一样,经营目的是为获取利润2、商业银行的信用中介职能直接影响社会货币供应量3、商业银行的收益都来自存贷利差4、资本是商业银行的经营者自己投入的本钱。

西财经经济学二初试真题2002-2009

西财经经济学二初试真题2002-2009年西南财经大学2003年研究生考试经济学(二)一、辨析题商品经济就是市场经济(15分)错,见书3P201二、简答题(共95分)1.为什么说商品是使用价值和价值的矛盾统一体。

(10分)见书1P20-212.简述对外开放和自力更生的关系。

(10分)见书5P3733.什么是支持价格?举例分析支持价格的利弊。

(15分)见书4P34第二段4.短期个别厂商的供给曲线是如何形成的?它与短期市场供给曲线有何关系?(15分)5.在寡头市场上,粘性价格经常存在。

用相关模型解释其原因。

(15分)见书4P298-299,用价格领导模型来解释见书4P1236.作出短期菲力普斯曲线,分析其政策含义。

(15分)见高鸿业的西方经济学(合订本)P7767.分析影响经济增长的因素。

(15分)见书2P298-302三、论述题(每小题20分,共40分)1.试分析资本循环和资本周转研究的侧重点以及二者的内在联系。

(20分)见书1P105-1062.试论坚持公有制为主体与发展非公有制经济的相互关系。

(20分)见书2P40-41P37西南财经大学2002年研究生考试经济学(二)政治经济学部分一,简答题(每题10分,共30分)1.怎样理解货币转化为资本与劳动力成为商品之间的关系。

见书3P65-662.为什么借贷利息不能相当于全部的平均利润?见书1P177-1783.简要说明企业制度的演进。

见书2P102-103二。

论述题(20分)试论当前扩大内需中宏观经济政策的综合运用。

见书2P287-294 乘数效应西方经济学部分三,什么是无差异曲线,无差异曲线有哪些特点?(10分)见书4p47-48四,为什么说MR=MC是厂商的利润最大化决策条件?(10分)见书4p102五。

什么是公共产品?公共产品有哪些特征?为什么说市场经济不能解决公共产品的供给问题?(12分)见书4P196-198六。

财政政策的局限性表现在哪些方面?(10分)见书4P241七。

西南财经大学2020-2021年金融专硕431金融学综合考研真题

2020年西南财经大学研究生入学考试431金融学综合货币金融学一、简答题(每题12分,共48分)1、二级市场的含义、功能及其组织形式(12分)2、银行持有超额准备金的原因(12分)3、金融行业内的利益冲突的含义及解决办法(12分)4、固定汇率制度的运行机制(12分)二、计算题(15分)假定法定准备金为2000亿元,超额准备金为3000亿元,流通中的现金为5000亿元,活期存款为10000亿元。

问:1、请计算货币总量(M1)和基础货币(6分)2、请计算法定准备金率、超额准备金率和现金比率(6分)3、假设中央银行向商业银行发放了1亿元的贴现贷款,假设其他因素不变,请计算这一行动对货币总量(M1)的影响(3分)三、论述题(15分)中央银行增加货币供给量会对利率产生何种影响?请综合运用流动性偏好理论和债券供求理论加以分析四、材料题(12分)【真材料假材料题】1、请写出货币数量理论的公式并说明其理论观点(4分)2、货币数量理论成立的假设前提(4分)3、结合图分析为什么实际通胀率不等于M2增速(4分)公司理财(该部分试题不携带计算题,提供现值系数表、终值系数表和年金现值系数表,见后续附表,计算题需要给出计算过程)五、简答题(每题5分,共20分)1、请问财务绩效评估中的流动性指标衡量公司哪方面的能力,举出3个常见的流动性指标。

(5分)2、在MM定理中,如果只放宽“完美市场”里关于公司所得税的假设,此时公司最后的债务政策是什么?为什么?(5分)3、ABC公司考虑在一片土地上盖新工厂,该土地已经由公司拥有,但该土地上的现有建筑将需要拆除。

请问ABC公司在进行资本预算时,下列哪些属于该项目的增量现金流(5分)①土地的现在的市值②去年在该片土地上铺新路的成本③清除现有建筑物的费用4、请问下列叙述是否正确:50%的股票股利与一分为二的拆股对持有者的股票数量的影响是相同的。

为什么?如果错误请修正该句子(5分)六、计算题(20分)1、XX公司的总应收账款是3000元,若以平均日销售额来衡量,应收账款的平均收账期是20天(以一年365天计算),该公司的资产总额是75000元,经营利润率5%。

金融市场试卷(2)金融考试题西南财经大学天府学院

1) The price paid for the rental of borrowed funds (usually expressed as a percentage ofthe rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: C2) Financial markets and institutionsA) involve the movement of huge quantities of money.B) affect the profits of businesses.C) affect the types of goods and services produced in an economy.D) do all of the above.E) do only (A) and (B) of the above.Answer: D3) Which of the following can be described as involving direct finance?A) A corporationʹs stock is traded in an over-the-counter market.B) People buy shares in a mutual fund.C) A pension fund manager buys commercial paper in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets.E) None of the above.Answer: E4) The purpose of diversification is toA) reduce the volatility of a portfolioʹs return.B) raise the volatility of a portfolioʹs return.C) reduce the average return on a portfolio.D) raise the average return on a portfolio.Answer: A5) When the interest rate on a bond is _________ the equilibrium interest rate, there is excess_________ in the bond market and the interest rate will _________.A) below; demand; riseB) below; demand; fallC) below; supply; riseD) above; supply; fallAnswer: C6) In a recession when income and wealth are falling, the demand for bonds _________ and thedemand curve shifts to the _________.A) falls; rightB) falls; leftC) rises; rightD) rises; leftAnswer: B7) When people begin to expect a large stock market decline, the demand curve for bonds shifts to the _________ and the interest rate _________.A) right; fallsB) right; risesC) left; fallsD) left; risesAnswer: A8) The spread between interest rates on low quality corporate bonds and U.S. government bonds_________ during the Great Depression.A) was reversedB) narrowed significantlyC) widened significantlyD) did not changeAnswer: C9) If income tax rates were lowered, thenA) the interest rate on municipal bonds would fall.B) the interest rate on Treasury bonds would rise.C) the interest rate on municipal bonds would rise.D) the price of Treasury bonds would fall.Answer: C10) According to the expectations theory of the term structure,A) yield curves should be equally likely to slope downward as to slope upward.B) when the yield curve is steeply upward-sloping, short-term interest rates are expected torise in the future.C) when the yield curve is downward-sloping, short-term interest rates are expected to remain relatively stable in the future.D) all of the above.E) only A and B of the above.Answer:E11) According to the efficient market hypothesisA) one cannot expect to earn an abnormally high return by purchasing a security.B) information in newspapers and in the published reports of financial analysts is alreadyreflected in market prices.C) unexploited profit opportunities abound, thereby explaining why so many people getrich by trading securities.D) all of the above are true.E) only A and B of the above are true.Answer: E12) To say that stock prices follow a ʺrandom walkʺ is to argue thatA) stock prices rise, then fall.B) stock prices rise, then fall in a predictable fashion.C) stock prices tend to follow trends.D) stock prices are, for all practical purposes, unpredictable.Answer:D13) The efficient market hypothesis suggests thatA) investors should purchase no-load mutual funds which have low management fees.B) investors can use the advice of technical analysts to outperform the market.C) investors let too many unexploited profit opportunities go by if they adopt a ʺbuy andholdʺ strategy.D) only A and B of the above are sensible strategies.Answer: A14) Which of the following is empirical evidence indicating that the efficient market hypothesismay not always be generally applicable?A) Small-firm effectB) January effectC) Market OverreactionD) All of the aboveAnswer: D15) An open market purchase of securities by the Fed willA) increase assets of the nonbank public and increase assets of the banking system.B) decrease assets of the nonbank public and increase assets of the Fed.C) decrease assets of the banking system and increase assets of the Fed.D) have no effect on assets of the nonbank public but increase assets of the Fed.E) increase assets of the banking system and decrease assets of the Fed.Answer: D16) Under usual circumstances, an increase in the discount rate causesA) the federal funds rate to fall.B) the federal funds rate to rise.C) no change in the federal funds rate.D) the supply of reserves to increase.E) the supply of reserves to decrease.Answer: C17) Which of the following is not an operating target?A) Nonborrowed reservesB) Monetary baseC) Federal funds interest rateD) Discount rateE) All are operating targets.Answer: D18) Money market instrumentsA) are usually sold in large denominations.B) have low default risk.C) mature in one year or less.D) are characterized by all of the above.E) are characterized by only A and B of the above.Answer: D19) If the Fed wants to lower the federal funds interest rate, it will _________ the banking system by _________ securities.A) add reserves to; sellingB) add reserves to; buyingC) remove reserves from; sellingD) remove reserves from; buyingAnswer: B20) Money market transactionsA) do not take place in any one particular location or building.B) are usually arranged purchases and sales between participants over the phone by tradersand completed electronically.C) both (a) and (b).D) none the the above.Answer: C21) The primary reason that individuals and firms choose to borrow long-term is to reduce the risk that interest rates will fall before they pay off their debt.Answer:False22) Typically, the interest rate on corporate bonds will be higher the more restrictions areplaced on management through restrictive covenants, because the bonds will beconsidered safer by bondholdersAnswer: False23) A change in the current yield always signals a change in the same direction of the yield tomaturity.Answer: True24) A bankʹs balance sheet indicates whether or not the bank is profitable. Answer: False25) Deposits that banks keep in accounts at the Federal Reserve less vault cash is called reserves.Answer: False26) Since a bankʹs assets exceed its equity capital, the return on assets always exceeds the return on equity.Answer: False27) Adverse selection refers to those most at risk being most aggressive in their search for funds.Answer: True28) Financial innovation has provided more options to both investors and borrowers. Answer: True28) When the federal governmentʹs budget deficit decreases, the demand curve for bonds shifts tothe right.Answer: False29) An increase in the inflation rate will cause the demand curve for bonds to shift to the right.Answer: False30) A positive liquidity premium indicates that investors prefer long-term bonds over short-termbonds.Answer: False31) When yield curves are downward sloping, long-term interest rates are above short-terminterest rates.Answer: False32) In an efficient market, abnormal returns are not possible even using inside information.Answer: False33) Technical analysis is a popular technique used to predict stock prices by studying past stock price data and search for patterns such as trends and regular cycles. Answer: True34) An open market sale leads to an expansion of reserves and deposits in the banking system and hence to a decline in the monetary base and the money supply.Answer: False35) Open market purchases by the Fed increase the supply of nonborrowed reserves. Answer: True36) In general, money market instruments are low risk, high yield securities. Answer: False37) Money markets are referred to as retail markets because small individual investors are theprimary buyers of money market securities.Answer: False38) Capital market securities are less liquid and have longer maturities than money marketsecurities.Answer: True39) The current yield on a bond is a good approximation of the bondʹs yield to maturity when the bond matures in five years or less and its price differs from its par value by a large amount.Answer: False40) A bankʹs largest source of funds is its borrowing from the Fed. Answer: False1.Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Discount Rate Current Price3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?(10分)Solution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its face value. The opposite holds true when yield to maturity is below the coupon rate. For a given maturity, the bond’s current price falls as yield to maturity rises.For a given yield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals the coupon rate, a bond’s current price equal s its facevalue regardless of years to maturity.2. At your favorite bond store, Bonds-R-Us, you see the following prices:1-year $100 zero selling for $90.193-year 10% coupon $1000 par bond selling for $10002-year 10% coupon $1000 par bond selling for $1000Assume that the pure expectations theory for the term structure of interest rates holds, no liquidity or maturity premium exists, and the bonds are equally risky. What is the implied 1-year rate two years from now? (10分)Solution:From (a), you know that the 1-year rate today is 10.877%.Using this information, (c) tells you that:2-year rate)^2+ 1100/(1 + 100/1.10877 =1000So, the 2-year rate today is 9.95%.Using these two rates, (b) tells you that:3-year rate)3+ 1100/(1 + 100/1.09952 + 100/1.10877 =1000So, the 3-year rate today is 9.97%⨯ 9.97% – 2 ⨯ (3 =year rate 2 years from now 10.01%=9.95%)3. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years. (15分)What is the duration of the bank’s commercial loan portfolio?What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60PV of Payments 3.33 3.09 34.61 41.03Time Weighted PV of Payments 3.33 6.18 103.83Time Weighted PV of PaymentsDivided by Price 0.08 0.15 2.53 2.76The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio’s 2.86= (2.76) ⨯ 4/7 + (3) ⨯ 3/ 7 =durationIf rates increased,4. According to the loanable funds frameworks, draw two figures to explain the changes of interest rates during expansion and recession. (5分)Problems1. The following table lists foreign exchange rates between US dollars and British pounds during April.Date US Dollars perGBP Date US Dollars perGBP4/1 1.9564 4/18 1.75044/4 1.9293 4/19 1.72554/5 1.914 4/20 1.69144/6 1.9374 4/21 1.6724/7 1.961 4/22 1.66844/8 1.8925 4/25 1.66744/11 1.8822 4/26 1.68574/12 1.8558 4/27 1.69254/13 1.796 4/28 1.72014/14 1.7902 4/29 1.75124/15 1.7785Which day would have been the best day to convert $200 into British pounds?Which day would have been the worst day? What would be the difference in pounds?2. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the following table:Years to Maturity Discount Rate CurrentPrice3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?3. You are willing to pay $15,625 now to purchase a perpetuity which will pay you and your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity?4. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years.a. What is th e duration of the bank’s commercial loan portfolio?b. What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?5. Consider a bond that promises the following cash flows. The required discount rate is 12%.Year 0 1 2 3 4Promised Payments 160 170 180 230You plan to buy this bond, hold it for 2½ years, and then sell the bond.a. What total cash will you receive from the bond after the 2½ years? Assume that periodic cash flows are reinvested at 12%.b. If immediately after buying this bond, all market interest rates drop to 11% (including your reinvestment rate), what will be the impact on your total cash flow after 2½ years? How doesthis compare to part (a)?c. Assuming all market interest rates are 12%, what is the duration of this bond?Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.5 1.5180230160(1.12)170(1.12)$733.69.1.12 1.12⨯+⨯++= b. This is the same as part (a), but the rate is now 11%.1.50.50.5 1.5180230160(1.11)170(1.11)$733.74.1.11 1.11⨯+⨯++= Notice that this is only $0.05 different from part (a).6. You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year, and believe that the required yield next year will have the following probability distribution:Probability Required Yield0.1 6.60% 0.2 6.75% 0.4 7.00% 0.2 7.20% 0.17.45%a. What is your expected price when you sell the bond?b. What is the standard deviation?Multiple Choice1.When the inflation rate is expected to increase, the real cost of borrowing declines at any given interest rate; as a result, the _________ bonds increases and the _________ curve shifts to the right. A) demand for; demand B) demand for; supply C) supply of; demand D) supply of; supplyIn Figure 4.1, the most likely cause of the increasein the equilibrium interest rate from i1 to i2 isA)an increase in the price of bonds. B) a business cycle boom.C) an increase in the expected inflation rate. D) a decrease in the expected inflation rate.In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is a(n) _________ in _________. A) increase; the expected inflation rateB) decrease; the expected inflation rateC) increase; economic growthD) decrease; economic growthSolution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its facevalue. The opposite holds true when yield to maturity is below the coupon rate. For a givenmaturity, the bond’s current price falls as yield to maturity rises. For a given y ield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals thecoupon rate, a bond’s current price equals its face value regardless of years to maturity.Solution: To find your yield to maturity, Perpetuity value = PMT/I.So, 15625 = 1250/I. I = 0.08The answer to the final part, using a financial calculator:N = 20; I = 8; PMT = 1250; FV = 0Compute PV : PV = 12,272.69Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.5 1.5180230160(1.12)170(1.12)$733.69.1.12 1.12⨯+⨯++= b. This is the same as part (a), but the rate is now 11%.1.50.50.5 1.5180230160(1.11)170(1.11)$733.74.1.11 1.11⨯+⨯++= Notice that this is only $0.05 different from part (a). c. The duration is calculated as follows:Year1 2 3 4 Sum Payments160.00 170.00 180.00 230.00 PV of Payments142.86 135.52 128.12 146.17 552.67Time Weighted PV of Payments142.86 271.05 384.36 584.68 Time Weighted PV of PaymentsDivided by Price0.260.490.701.062.50Since the duration and the holding period are the same, you are insulated from immediate changes in interest rates! It doesn’t always work out this perfectly, but the idea is important.Solution: The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year1 2 3 Sum Payment3.60 3.60 43.60PV of Payments3.33 3.09 34.61 41.03Time Weighted PV of Payments3.33 6.18 103.83 Time Weighted PV of PaymentsDivided by Price0.080.152.532.76The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio’s duration = 3/7 ⨯ (3) + 4/7 ⨯ (2.76) = 2.86If rates increased, 0.005DUR 2.8670,000,000926,852.1 1.08i P P i ∆∆=-⨯⨯=-⨯⨯=-+ ASMT 02_1112A1. Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Yield to MaturityCurrent Price3 5 3 7 6 7 9 7 9 9What relationship do you observe between yield to maturity and the current market value?2. You are willing to pay $15,625 now to purchase a perpetuity which will pay youand your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity? 3. Assume you just deposited $1,000 into a bank account. The current real interestrate is 2% and inflation is expected to be 6% over the next year. What nominal interest rate would you require from the bank over the next year? How much money will you have at the end of one year? If you are saving to buy a stereo that currently sells for $1,050, will you have enough to buy it? 4. A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for$871.65. Compute your rate of return if you sell the bond next year for $880.10.。

金融市场试卷(2)金融考试题西南财经大学天府学院解析

1) The price paid for the rental of borrowed funds (usually expressed as a percentage ofthe rental of $100 per year) is commonly referred to as theA) inflation rate.B) exchange rate.C) interest rate.D) aggregate price level.Answer: C2) Financial markets and institutionsA) involve the movement of huge quantities of money.B) affect the profits of businesses.C) affect the types of goods and services produced in an economy.D) do all of the above.E) do only (A) and (B) of the above.Answer: D3) Which of the following can be described as involving direct finance?A) A corporation?s stock is traded in an over-the-counter market.B) People buy shares in a mutual fund.C) A pension fund manager buys commercial paper in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets.E) None of the above.Answer: E4) The purpose of diversification is toA) reduce the volatility of a portfolio?s return.B) raise the volatility of a portfolio?s return.C) reduce the average return on a portfolio.D) raise the average return on a portfolio.Answer: A5) When the interest rate on a bond is _________ the equilibrium interest rate, there is excess_________ in the bond market and the interest rate will _________.A) below; demand; riseB) below; demand; fallC) below; supply; riseD) above; supply; fallAnswer: C6) In a recession when income and wealth are falling, the demand for bonds _________ and thedemand curve shifts to the _________.A) falls; rightB) falls; leftC) rises; rightD) rises; leftAnswer: B7) When people begin to expect a large stock market decline, the demand curve for bonds shifts to the _________ and the interest rate _________.A) right; fallsB) right; risesC) left; fallsD) left; risesAnswer: A8) The spread between interest rates on low quality corporate bonds and U.S. government bonds_________ during the Great Depression.A) was reversedB) narrowed significantlyC) widened significantlyD) did not changeAnswer: C9) If income tax rates were lowered, thenA) the interest rate on municipal bonds would fall.B) the interest rate on Treasury bonds would rise.C) the interest rate on municipal bonds would rise.D) the price of Treasury bonds would fall.Answer: C10) According to the expectations theory of the term structure,A) yield curves should be equally likely to slope downward as to slope upward.B) when the yield curve is steeply upward-sloping, short-term interest rates are expected torise in the future.C) when the yield curve is downward-sloping, short-term interest rates are expected to remain relatively stable in the future.D) all of the above.E) only A and B of the above.Answer:E11) According to the efficient market hypothesisA) one cannot expect to earn an abnormally high return by purchasing a security.B) information in newspapers a nd in the published reports of financial analysts is alreadyreflected in market prices.C) unexploited profit opportunities abound, thereby explaining why so many people getrich by trading securities.D) all of the above are true.E) only A and B of the above are true.Answer: E12) To say that stock prices follow a ?r andom walk? is to argue thatA) stock prices rise, then fall.B) stock prices rise, then fall in a predictable fashion.C) stock prices tend to follow trends.D) stock prices are, for all practical purposes, unpredictable.Answer:D13) The efficient market hypothesis suggests thatA) investors should purchase no-load mutual funds which have low management fees.B) investors can use the advice of technical analysts to outperform the market.C) investors let too many unexploited profit opportunities go by if they adopt a ?buy andhold? strategy.D) only A and B of the above are sensible strategies.Answer: A14) Which of the following is empirical evidence indicating that the efficient market hypothesismay not always be generally applicable?A) Small-firm effectB) January effectC) Market OverreactionD) All of the aboveAnswer: D15) An open market purchase of securities by the Fed willA) increase assets of the nonbank public and increase assets of the banking system.B) decrease assets of the nonbank public and increase assets of the Fed.C) decrease assets of the banking system and increase assets of the Fed.D) have no effect on assets of the nonbank public but increase assets of the Fed.E) increase assets of the banking system and decrease assets of the Fed.Answer: D16) Under usual circumstances, an increase in the discount rate causesA) the federal funds rate to fall.B) the federal funds rate to rise.C) no change in the federal funds rate.D) the supply of reserves to increase.E) the supply of reserves to decrease.Answer: C17) Which of the following is not an operating target?A) Nonborrowed reservesB) Monetary baseC) Federal funds interest rateD) Discount rateE) All are operating targets.Answer: D18) Money market instrumentsA) are usually sold in large denominations.B) have low default risk.C) mature in one year or less.D) are characterized by all of the above.E) are characterized by only A and B of the above.Answer: D19) If the Fed wants to lower the federal funds interest rate, it will _________ the banking system by _________ securities.A) add reserves to; sellingB) add reserves to; buyingC) remove reserves from; sellingD) remove reserves from; buyingAnswer: B20) Money market transactionsA) do not take place in any one particular location or building.B) are usually arranged purchases and sales between participants over the phone by tradersand completed electronically.C) both (a) and (b).D) none the the above.Answer: C21) The primary reason that individuals and firms choose to borrow long-term is to reduce the risk that interest rates will fall before they pay off their debt.Answer:False22) Typically, the interest rate on corporate bonds will be higher the more restrictions areplaced on management through restrictive covenants, because the bonds will beconsidered safer by bondholdersAnswer: False23) A change in the current yield always signals a change in the same direction of the yield tomaturity.Answer: True24) A bank?s balance sheet indicates whether or not the bank is profitable. Answer: False25) Deposits that banks keep in accounts at the Federal Reserve less vault cash is called reserves.Answer: False26) Since a bank?s assets exceed its equity capital, the return on assets always exceeds the return on equity.Answer: False27) Adverse selection refers to those most at risk being most aggressive in their search for funds.Answer: True28) Financial innovation has provided more options to both investors and borrowers. Answer: True28) When the federal government?s budget deficit decreases, the demand curve for bonds shifts tothe right.Answer: False29) An increase in the inflation rate will cause the demand curve for bonds to shift to the right.Answer: False30) A positive liquidity premium indicates that investors prefer long-term bonds over short-termbonds.Answer: False31) When yield curves are downward sloping, long-term interest rates are above short-terminterest rates.Answer: False32) In an efficient market, abnormal returns are not possible even using inside information.Answer: False33) Technical analysis is a popular technique used to predict stock prices by studying past stock price data and search for patterns such as trends and regular cycles. Answer: True34) An open market sale leads to an expansion of reserves and deposits in the banking system and hence to a decline in the monetary base and the money supply.Answer: False35) Open market purchases by the Fed increase the supply of nonborrowed reserves.Answer: True36) In general, money market instruments are low risk, high yield securities.Answer: False37) Money markets are referred to as retail markets because small individual investorsare theprimary buyers of money market securities.Answer: False38) Capital market securities are less liquid and have longer maturities than moneymarketsecurities.Answer: True39) The current yield on a bond is a good approximation of the bond?s yield tomaturity when the bond matures in five years or less and its price differs from itspar value by a large amount.Answer: False40) A bank?s largest source of funds is its borrowing from the Fed.Answer: False1.Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Discount Rate Current Price3 53 76 79 79 9What relationship do you observe between yield to maturity and the currentmarket value?(10分)Solution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its face value. The opposite holds true when yield to maturity is below the couponrate. For a given maturity, the bond’s current price falls as yield to maturity rises.For a given yield to maturity, a bond’s value rises as its maturity increases. When yield to maturity equals the coupon rate, a bond’s current price equals its facevalue regardless of years to maturity.2. At your favorite bond store, Bonds-R-Us, you see the following prices:1-year $100 zero selling for $90.193-year 10% coupon $1000 par bond selling for $10002-year 10% coupon $1000 par bond selling for $1000Assume that the pure expectations theory for the term structure of interest rates holds, no liquidity or maturity premium exists, and the bonds are equally risky. What is the implied 1-year rate two years from now? (10分)Solution:From (a), you know that the 1-year rate today is 10.877%.Using this information, (c) tells you that:2-year rate)^2 1100/(1 100/1.10877 1000So, the 2-year rate today is 9.95%.Using these two rates, (b) tells you that:3-year rate)3 1100/(1 100/1.09952 100/1.10877 1000So, the 3-year rate today is 9.97%9.97% – 2 (3 year rate 2 years from now 10.01%9.95%)3. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years. (15分)What is the duration of the bank’s commercial loan portfolio?What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60PV of Payments 3.33 3.09 34.61 41.03Time Weighted PV of Payments 3.33 6.18 103.83Time Weighted PV of PaymentsDivided by Price 0.08 0.15 2.53 2.76The duration of a portfolio is the weighted average duration of its individual securities.2.86 (2.76) 4/7 (3) 3/ 7 durationSo, the portfolio’sIf rates increased,4. According to the loanable funds frameworks, draw two figures to explain the changes of interest rates during expansion and recession. (5分)Problems1. The following table lists foreign exchange rates between US dollars and British pounds during April.Date US Dollars perGBP Date US Dollars perGBP4/1 1.9564 4/18 1.75044/4 1.9293 4/19 1.72554/5 1.914 4/20 1.69144/6 1.9374 4/21 1.6724/7 1.961 4/22 1.66844/8 1.8925 4/25 1.66744/11 1.8822 4/26 1.68574/12 1.8558 4/27 1.69254/13 1.796 4/28 1.72014/14 1.7902 4/29 1.75124/15 1.7785Which day would have been the best day to convert $200 into British pounds?Which day would have been the worst day? What would be the difference in pounds?2. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the following table:Years to Maturity Discount Rate CurrentPrice3 53 76 79 79 9What relationship do you observe between yield to maturity and the current market value?3. You are willing to pay $15,625 now to purchase a perpetuity which will pay you and your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity?4. A bank has two, 3-year commercial loans with a present value of $70 million. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second is for $40 million. It requires an annual interest payment of $3.6 million. The principal of$40 million is due in 3 years.a. What is the duration of the bank’s commercial loan portfolio?b. What will happen to the value of its portfolio if the general level of interest rates increased from 8% to 8.5%?5. Consider a bond that promises the following cash flows. The required discount rate is 12%.Year 0 1 2 3 4Promised Payments 160 170 180 230You plan to buy this bond, hold it for 2? years, and then sell the bond.a. What total cash will you receive from the bond after the 2? years? Assume that periodic cash flows are reinvested at 12%.b. If immediately after buying this bond, all market interest rates drop to 11% (including your reinvestment rate), what will be the impact on your total cash flow after 2? years? How doesthis compare to part (a)?c. Assuming all market interest rates are 12%, what is the duration of this bond?Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.51.5180230160(1.12)170(1.12)$733.69.1.121.12b. This is the same as part (a), but the rate is now 11%.1.50.50.51.5180230160(1.11)170(1.11)$733.74.1.111.11Notice that this is only $0.05 different from part (a).6. You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year, and believe that the required yield next year will have the following probability distribution:Probability Required Yield0.1 6.60% 0.2 6.75% 0.4 7.00% 0.2 7.20% 0.17.45%a. What is your expected price when you sell the bond?b. What is the standard deviation? Multiple Choice1.When the inflation rate is expected to increase, the real cost of borrowing declines at any given interest rate; as a result, the _________ bonds increases and the _________ curve shifts to the right. A) demand for; demand B) demand for; supply C) supply of; demand D) supply of; supplyIn Figure 4.1, the most likely cause of the increase in the equilibrium interest rate from i1 to i2 isA)an increase in the price of bonds. B) a business cycle boom.C) an increase in the expected inflation rate. D) a decrease in the expected inflation rate.In Figure 4.2, one possible explanation for the increase in the interest rate from i1 to i2 is a(n) _________ in _________. A) increase; the expected inflation rateB) decrease; the expected inflation rateC) increase; economic growthD) decrease; economic growthSolution:Years to Maturity Yield to Maturity Current Price3 5 $1,054.463 7 $1,000.006 7 $1,000.009 5 $1,142.169 9 $ 880.10When yield to maturity is above the coupon rate, the band’s current price is below its facevalue. The opposite holds true when yield to maturity is below the coupon rate. For agivenield tomaturity, the bond’s current price falls as yield to maturity rises. For a given ymaturity, a bond’s value rises as its maturity increases. When yield to maturity equalsthecoupon rate, a bond’s current price equals its face value regardless of years tomaturity.Solution: To find your yield to maturity, Perpetuity value PMT/I.So, 15625 1250/I. I 0.08The answer to the final part, using a financial calculator:N 20; I 8; PMT 1250; FV 0Compute PV : PV 12,272.69Solution:a. You will receive 160, reinvested that for 1.5 years, and 170 reinvested for 0.5 years. Then you will sell the remaining cash flows, discounted at 12%. This gives you:1.50.50.51.5180230160(1.12)170(1.12)$733.69.1.121.12b. This is the same as part (a), but the rate is now 11%.1.50.50.51.5180230160(1.11)170(1.11)$733.74.1.111.11Notice that this is only $0.05 different from part (a). c. The duration is calculated as follows:Year 1 2 3 4 SumPayments160.00 170.00 180.00 230.00 PV of Payments142.86 135.52 128.12 146.17 552.67 Time Weighted PV of Payments142.86 271.05 384.36 584.68 Time Weighted PV of PaymentsDivided by Price0.260.490.701.062.50Since the duration and the holding period are the same, you are insulated from immediate changes in interest rates! It doesn ’t always work out this perfectly, but the idea is important.Solution:The duration of the first loan is 3 years since it is a zero-coupon loan. The duration of the second loan is as follows:Year 1 2 3 SumPayment 3.60 3.60 43.60 PV of Payments 3.33 3.09 34.61 41.03 Time Weighted PV of Payments3.33 6.18 103.83 Time Weighted PV of PaymentsDivided by Price0.080.152.532.76 The duration of a portfolio is the weighted average duration of its individual securities.So, the portfolio ’s duration 3/7 (3) 4/7 (2.76) 2.86If rates increased, 0.005DUR2.8670,000,000926,852.1 1.08i P P iASMT 02_1112A1. Consider a bond with a 7% annual coupon and a face value of $1,000. Completethe following table:Years to Maturity Yield to MaturityCurrent Price3 5 3 7 6 7 9 7 99What relationship do you observe between yield to maturity and the current market value?2. You are willing to pay $15,625 now to purchase a perpetuity which will pay youand your heirs $1,250 each year, forever, starting at the end of this year. If your required rate of return does not change, how much would you be willing to pay if this were a 20-year, annual payment, ordinary annuity instead of a perpetuity? 3. Assume you just deposited $1,000 into a bank account. The current real interestrate is 2% and inflation is expected to be 6% over the next year. What nominal interest rate would you require from the bank over the next year? How muchmoney will you have at the end of one year? If you are saving to buy a stereo that currently sells for $1,050, will you have enough to buy it? 4. A 10-year, 7% coupon bond with a face value of $1,000 is currently selling for$871.65. Compute your rate of return if you sell the bond next year for $880.10.。

西南财经大学金融学专业1999-2010真题

西南财经大学20**年金融学专业复试资料第一部分:1999—20**年复试笔试西南财经大学1999年研究生考试金融学(金融方向)课程名称:金融学适用专业:金融学考试时间:1月31日下午一、判断正误并简述理由(每小题6分,计30分)1、在融资领域中,直接融资所占比率越高,社会资源的利用效率就越好。

2、货币数量越多,说明一国的货币化程度越高。

23、银行储蓄存款的增减变化不能真实地反映家庭个人剩余收入的变化。

4、金融创新的过程就是金融风险增加的过程5、银行信用在分配资源的基础上创造资源。

二、简答题(每小题6分,计30分)1、试分析“1:8”经验公式的内容、意义及缺陷。

2、试分析银行表外业务产生和发展的原因。

3、简述货币主义的汇率理论。

4、简述“物价—现金流动机制”。

5、简述“马歇尔—勒纳条件”。

三、分析计算题(10分)在国际金融统计中,中国和美国的消费物价指数(环比)为:1994年初人民币汇率为1美元等于8.7人民币,1996年末人民币汇率为1美元等于8.31人民币。

试计算:1996年末的人民币购买力汇率,并解释购买力汇率与实际汇率的差异。

四、论述题(每小题20分,计40分)1、试分析设置跨省一级分行的目的、意义及存在的问题。

2、我国政府一再重申人民币不贬值是出于经济方面的考虑,根据你所学的国际金融理论,请谈谈你的看法。

课程名称:综合考试适用专业:金融学(金融方向)考试时间:2月1日上午金融理论与实务一简答题(每小题8分,计40分)1、可转换债券及其特点。

2、简述《巴塞尔协议》的贯彻实施对国际银行业经营管理的影响。

3、对比分析股份制银行利润分配与国家银行的差异。

4、证券流通市场的作用。

5、简述贷款五类划分及其意义。

二、论述题(10分)1、论我国股票市场存在的问题及其应采取的措施。

2、试论现代商业银行表外业务的特点及其管理。

西南财经大学20**年研究生考试金融学(货币方向)课程名称:金融学适用专业:金融学(含保险学)考试时间:20**年1月23日下午一、判断分析题(每小题8分,计32分)1、商品价格上升可以由非货币因素引起。

【真题】西南财经大学431金融学综合真题

更多最新考研咨询关注微信公众号 renrenkaoyan

【真题】西南财经大学431金融学综合真题

金融学部分:

简答:

1.金融机构作用。

2,货币职能;3.流动性偏好理论分析增加货币供给对利率的影响;4.比较公开市场操作、贴现贷款、法定存款准备金率对基础货币的作用;5.增加货币供给,对长短期汇率的影响;6,根据信息不对称,分析银行信用管理的原则;

计算:关于债券到期收益率

论述:2014年两次定向下调法定存款准备金率的原因及作用

材料分析:关于金融结构的

公司理财部分

简答:

1.优序融资理论;

2.情景分析和敏感性分析的联系与区别;

计算:

1.权益成本;2,股价

材料分析:关于如何分配股利的

论述:

1.静态资本结构的推论;

2.怎样解决股东与管理层之间的委托代理问题

更多最新考研资讯请扫描上方二维码

爱考机构 中国保过保录高端考研第一品牌! 每年每校每专业限招1‐3人 报名电话010‐51283340 QQ:744569778。

西南财经大学考研真题官方答案-02经济学二

答案部分西南财经大学2002年硕士学位研究生入学考试试题考试科目名称:经济学(二)适用专业:应用经济学各专业考试科目代码:402政治经济学部分一、简答题(每小题10分,共30分)1.怎样理解货币转化为资本与劳动力成为商品之间的关系。

答:资本家为了进行生产经营,需要掌握一定量的货币,以便购买生产资料和劳动力。

但是,货币本身并不就是资本。

作为资本的货币与作为商品流通媒介的货币是有区别的。

资本流通公式是:G(货币)——W(商品)——Gˊ(更多货币)。

从形式上看,资本总公式是同价值规律相矛盾的。

价值规律要求商品交换按照等价原则进行,因而交换的结果只会使价值的表现形式发生变化,而价值量不会发生变化。

但资本总公式表明,货币资本在流通过程中发生了增殖。

这就是资本总公式的矛盾。

要解决资本总公式的矛盾,关键在于说明剩余价值是在什么条件下产生的,它的来源是什么,也就是要阐明货币在资本主义条件下是怎样转化为特殊资本的。

在资本的总公式中,剩余价值表现为流通的结果。

但是,剩余价值是不可能从流通领域中产生的。

在商品流通中,无论是等价交换还是不等价交换,都不能产生剩余价值。

如果是等价交换,显然只是价值形式的变换,一定量的价值体现在不同的商品上,但价值量是既定的,没有发生变化。

如果是不等价交换,即低于价值购买或高于价值出卖,似乎可以得到更多的价值。

但是,由于商品生产者不断变换买者和卖者的身份,他作为买者多得的,当他作为卖者或买者时又会失掉。

即使某些商品生产者在交换中始终能贱买贵卖,从流通中取得了更多的价值,但这也不能说明剩余价值的真正来源。

因为他多得到的,正是别人失去的,流通中的价值总量没有增加。

那么,剩余价值离开流通过程能不能产生呢?也不能。

如果离开流通过程,即货币所有者把货币贮藏起来,不同其他商品所有者发生联系,价值和剩余价值既无从产生,也无法实现。

由此可见,剩余价值不能产生于流通过程,但又离不开流通过程,它必须以流通过程为媒介。

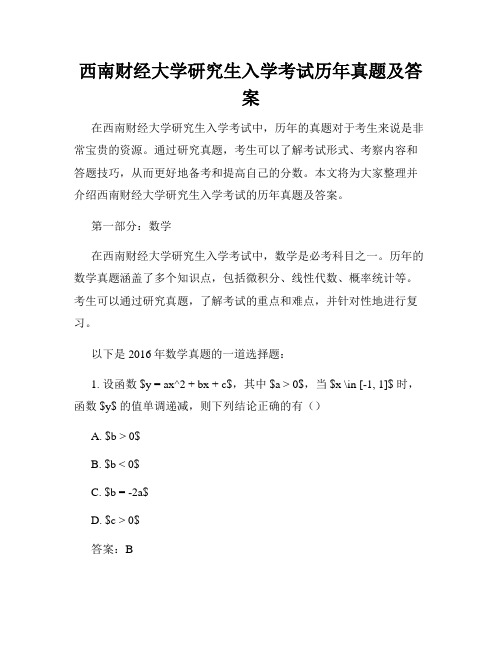

西南财经大学研究生入学考试历年真题及答案

西南财经大学研究生入学考试历年真题及答案在西南财经大学研究生入学考试中,历年的真题对于考生来说是非常宝贵的资源。

通过研究真题,考生可以了解考试形式、考察内容和答题技巧,从而更好地备考和提高自己的分数。

本文将为大家整理并介绍西南财经大学研究生入学考试的历年真题及答案。

第一部分:数学在西南财经大学研究生入学考试中,数学是必考科目之一。

历年的数学真题涵盖了多个知识点,包括微积分、线性代数、概率统计等。

考生可以通过研究真题,了解考试的重点和难点,并针对性地进行复习。

以下是2016年数学真题的一道选择题:1. 设函数 $y = ax^2 + bx + c$,其中 $a > 0$,当 $x \in [-1, 1]$ 时,函数 $y$ 的值单调递减,则下列结论正确的有()A. $b > 0$B. $b < 0$C. $b = -2a$D. $c > 0$答案:B解析:根据函数 $y = ax^2 + bx + c$ 单调递减的特点,可知二次项的系数 $a > 0$,且一次项的系数 $b < 0$,故答案为 B。

通过研究上述题目及其答案,考生可以了解到在判断函数单调性时,需要对函数的二次项系数和一次项系数进行分析。

第二部分:英语英语是西南财经大学研究生入学考试的另一门必考科目。

历年的英语真题主要考察考生的阅读理解、词汇运用和语法等方面的能力。

阅读真题能够帮助考生提高阅读速度和理解能力,积累词汇,并熟悉英语语法。

以下是2018年英语真题的一道阅读理解题:2. According to the passage, the foundation of Chinese age is based on ()A. mythology and legendsB. astronomical phenomenaC. historical eventsD. documentation答案:B解析:根据文章内容可知,中国的年龄计算是基于天文现象的,故答案为 B。

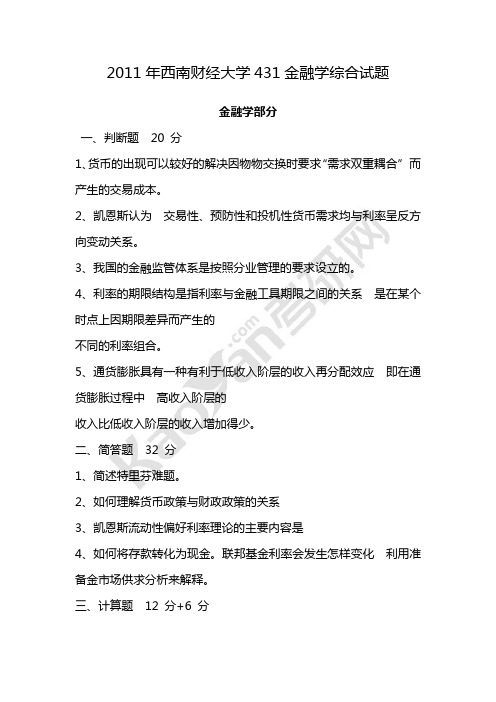

2011-2014年四年西南财经大学金融专业考研历年真题

2011年西南财经大学431金融学综合试题金融学部分一、判断题20分1、货币的出现可以较好的解决因物物交换时要求“需求双重耦合”而产生的交易成本。

2、凯恩斯认为交易性、预防性和投机性货币需求均与利率呈反方向变动关系。

3、我国的金融监管体系是按照分业管理的要求设立的。

4、利率的期限结构是指利率与金融工具期限之间的关系是在某个时点上因期限差异而产生的不同的利率组合。

5、通货膨胀具有一种有利于低收入阶层的收入再分配效应即在通货膨胀过程中高收入阶层的收入比低收入阶层的收入增加得少。

二、简答题32分1、简述特里芬难题。

2、如何理解货币政策与财政政策的关系3、凯恩斯流动性偏好利率理论的主要内容是4、如何将存款转化为现金。

联邦基金利率会发生怎样变化利用准备金市场供求分析来解释。

三、计算题12分+6分已知法定准备金比率为0.1流通中的现金2800亿存款8000亿超额准备金400亿。

1、求现金漏损率、超额准备金率、货币乘数、法定准备金、实有准备金、基础货币。

2、若准备金率变为0.08基础货币、存款比率不变求货币乘数和货币供应量。

四、论述题为什么说商业银行的管理艺术就在于安全性、流动性和盈利性之间保持恰当的平衡如何在其资产管理中贯彻安全性、流动性和盈利性的原则。

20分公司金融部分一、问答题30分1、解释ROE和可持续增长率SGR。

以此说明一家公司可持续增长能力的决定因素。

2、解释NPV和IRR说明两种方法在评价资本预算项目时的决策规则并分析两种方法在评价独立项目和互斥项目上的差异。

3、简述在公司所得税和财务危机成本的约束下资本结构的权衡理论的内容并用图解方式说明公司的价值与负债权益比的关系。

二、计算分析题16分1、一项总投资为TI,可供选的筹资方案有两个A、全部采用权益融资发行100%的普通股融资总股份为n股B、按面值发行50%的永久性债券债券面值为m,利率为i发行%的普通股融资。

问公司所得税率为T证明两种筹资方案的每股收益EPS相同时的息税前利润为EBIT=2mi。

西南财经大学2021年 金融专硕431金融学综合考研真题

2021年西南财经大学研究生入学考试431金融学综合货币金融学一、简答题(每题12分,共48分)1.从交易成本的角度出发分析金融中介机构存在的合理性。

(12分)2.哪些因素会影响利率的风险结构?影响的方式。

(12分)3.什么是大而不倒,对金融监管产生了什么影响?(12分)4.什么是信贷配给?信贷配给的作用和具体方式。

(12分)二、计算题(15分)1.根据流动性溢价理论计算三年期债券的利率:预期第一年一年期债券利率为3%,第二年一年期债券利率为4%,第三年一年期债券利率为5%,三年期流动性溢价为0.3%,计算三年期的利率?2.假如A银行收到了1000元的存款,法定准备金率为10%(1)计算超额准备金和法定准备金的变化。

(2)在不保留超额准备金的前提下银行能创造多少贷款?(3)在整个银行体系中,在简单的存款派生机制下,将增加多少货币供给?3.面额1000元的债券,一年后到期,售价800元,计算到期收益率。

三、论述题(15分)简述凯恩斯的流动性偏好理论和弗里德曼现代货币数量论的区别。

四、材料分析题(12分)材料是第二季度货币政策执行报告。

(1)从债券的供给平衡分析解释“长期通货膨胀下降和通货膨胀预期下降,会导致名义利率下降”?(2)从债券的供给平衡分析解释“发达经济体消费、投资意愿下降,经济潜在增速下降,导致均衡利率(实际中性利率)下降”这一现象的原因。

公司理财一、简答题(20分)1.什么是代理人问题?如何解决代理人问题?2.一个融资型的项目,第一期的现金流是100,第二期的现金流是-150,内部收益率法能否适用,如果不能要怎么修改?3.什么是增量现金流,沉没成本对增量现金流产不产生影响?4.用以下比率分析ROE的杜邦恒等式,并说明杜邦分析法的应用?公式是负债权益比,资产周转率,经营利润率和净利润/税后利润。

二、计算题(20分)1.买一个机器20000,分六个月还款,年利率12%。

(1)每个月付多少?(2)第三个月底全付完要付多少?2.一个全权益公司开始价值是1000000元,权益成本是20%,用400000元债务回购股份成本是10%,税是35%。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

西南财经大学金融学研究生考试真题2

课程名称:金融学适用专业:金融学(含保险学)

一、判断分析题(每小题8分,计32分)

1、商品价格上升可以由非货币因素引起。

2、呆帐准备金是为了应付支付困难而设立的准备金。

3、金融机构的融资效率高于金融市场的融资效率。

4、备付金制度是为了保证客户提现的准备金制度。

二、简答题(每小题10分,共40分)

1、如何理解“储蓄可能为储蓄者带来实质性的亏损”?

2、简述金融安全与经济安全的关系。

3、简述“存款是第一性的”的内含的意义。

4、比较“实物储蓄与货币储蓄”的异同。

三、论述题(每小题14分,计28分)

1、试分析“金融由帐房先生向经济调节着”的转变过程。

2、论金融创新与金融监管的关系。

课程名称:综合考试适用专业:金融学(货币方向)

金融理论与实践——银行经营与管理部分:

一、名词解释(每小题3分,共6分)

1、可用头寸

2、商业银行集约化

二、计算题(共4分)

若某银行1998年6月1日拆出资金1800万元,拆借期限为2个月,资金在途期限6天,该行上存上级行利率和在途损失利率均为万分之三。

请计算保本拆借利率为多少。

三、简答题(每小题6分,计12分)

1、主银行制度与主办银行制度的内容及区别。

2、如何理解“银行经营与管理既是一门科学,又是一门艺术”?

四、论述题(8分)

试论西方商业银行金融营销的产生、发展与变化。

金融理论与实践——金融市场学部分:

一、简答题(每小题5分,共10分)

1、简述风险、不规则风险和规则风险及三者的关系。

2、中国公司为什么要选择ADR形式在美国间接上市。

二、论述题(20分)

我国现阶段为什么要大力发展证券投资基金

凯程教育:

凯程考研成立于2005年,国内首家全日制集训机构考研,一直从事高端全日制辅导,由李海洋教授、张鑫教授、卢营教授、王洋教授、杨武金教授、张释然教授、索玉柱教授、方浩教授等一批高级考研教研队伍组成,为学员全程高质量授课、答疑、测试、督导、报考指导、方法指导、联系导师、复试等全方位的考研服务。

凯程考研的宗旨:让学习成为一种习惯;

凯程考研的价值观口号:凯旋归来,前程万里;

信念:让每个学员都有好最好的归宿;

使命:完善全新的教育模式,做中国最专业的考研辅导机构;

激情:永不言弃,乐观向上;

敬业:以专业的态度做非凡的事业;

服务:以学员的前途为已任,为学员提供高效、专业的服务,团队合作,为学员服务,为学员引路。

如何选择考研辅导班:

在考研准备的过程中,会遇到不少困难,尤其对于跨专业考生的专业课来说,通过报辅导班来弥补自己复习的不足,可以大大提高复习效率,节省复习时间,大家可以通过以下几个方面来考察辅导班,或许能帮你找到适合你的辅导班。

师资力量:师资力量是考察辅导班的首要因素,考生可以针对辅导名师的辅导年限、辅导经验、历年辅导效果、学员评价等因素进行综合评价,询问往届学长然后选择。

判断师资力量关键在于综合实力,因为任何一门课程,都不是由一、两个教师包到底的,是一批教师配合的结果。

还要深入了解教师的学术背景、资料著述成就、辅导成就等。

凯程考研名师云集,李海洋、张鑫教授、方浩教授、卢营教授、孙浩教授等一大批名师在凯程授课。

而有的机构只是很普通的老师授课,对知识点把握和命题方向,欠缺火候。

对该专业有辅导历史:必须对该专业深刻理解,才能深入辅导学员考取该校。

在考研辅导班中,从来见过如此辉煌的成绩:凯程教育拿下2015五道口金融学院状元,考取五道口15人,清华经管金融硕士10人,人大金融硕士15个,中财和贸大金融硕士合计20人,北师大教育学7人,会计硕士保录班考取30人,翻译硕士接近20人,中传状元王园璐、郑家威都是来自凯程,法学方面,凯程在人大、北大、贸大、政法、武汉大学、公安大学等院校斩获多个法学和法硕状元,更多专业成绩请查看凯程网站。

在凯程官方网站的光荣榜,成功学员经验谈视频特别多,都是凯程战绩的最好证明。

对于如此高的成绩,凯程集训营班主任邢老师说,凯程如此优异的成绩,是与我们凯程严格的管理,全方位的辅导是分不开的,很多学生本科都不是名校,某些学生来自二本三本甚至不知名的院校,还有很多是工作了多年才回来考的,大多数是跨专业考研,他们的难度大,竞争激烈,没有严格的训练和同学们的刻苦学习,是很难达到优异的成绩。

最好的办法是直接和凯程老师详细沟通一下就清楚了。

建校历史:机构成立的历史也是一个参考因素,历史越久,积累的人脉资源更多。

例如,凯程教育已经成立10年(2005年),一直以来专注于考研,成功率一直遥遥领先,同学们有兴趣可以联系一下他们在线老师或者电话。

有没有实体学校校区:有些机构比较小,就是一个在写字楼里上课,自习,这种环境是不太好的,一个优秀的机构必须是在教学环境,大学校园这样环境。

凯程有自己的学习校区,有吃住学一体化教学环境,独立卫浴、空调、暖气齐全,这也是一个考研机构实力的体现。

此外,最好还要看一下他们的营业执照。