公司理财考试复习题

公司理财原版题库Chap010

Chapter 10Return and Risk: The Capital-Assets-Pricing Model Multiple Choice Questions1. When a security is added to a portfolio the appropriate return and risk contributions areA) the expected return of the asset and its standard deviation.B) the expected return and the variance.C) the expected return and the beta.D) the historical return and the beta.E) these both can not be measured.Answer: C Difficulty: Medium Page: 2552. When stocks with the same expected return are combined into a portfolioA) the expected return of the portfolio is less than the weighted average expected return of thestocks.B) the expected return of the portfolio is greater than the weighted average expected return of thestocks.C) the expected return of the portfolio is equal to the weighted average expected return of thestocks.D) there is no relationship between the expected return of the portfolio and the expected return ofthe stocks.E) None of the above.Answer: C Difficulty: Easy Page: 2613. Covariance measures the interrelationship between two securities in terms ofA) both expected return and direction of return movement.B) both size and direction of return movement.C) the standard deviation of returns.D) both expected return and size of return movements.E) the correlations of returns.Answer: B Difficulty: Medium Page: 258-259Use the following to answer questions 4-5:GenLabs has been a hot stock the last few years, but is risky. The expected returns for GenLabs are highly dependent on the state of the economy as follows:State of Economy Probability GenLabs ReturnsDepression .05 -50%Recession .10 -15Mild Slowdown .20 5Normal .30 15%Broad Expansion .20 25Strong Expansion .15 404. The expected return on GenLabs is:A) 3.3%B) 8.5%C) 12.5%D) 20.5%E) None of the above.Answer: C Difficulty: Medium Page: 256Rationale:E(r) = .05(-.5) + .10(-.15) + .2(.05) + .3(.15) + .2(.25) + .15(.40) = .125 = 12.5%5. The variance of GenLabs returns isA) .0207B) .0428C) .0643D) .0733E) None of the above.Answer: B Difficulty: Medium Page: 256-257Rationale:.05(-.50 - .125)2 + .1(-.15 - .125)2 + .2(.05 - .125)2 + .3(.15 - .125)2 + .2(.25 - .125)2 + .15(.40 - .125)2 = .04286. The standard deviation of GenLabs returns isA) .0845B) .2069C) .3065D) .3358E) None of the above.Answer: B Difficulty: Medium Page: 256-257Rationale:.05(-.50 - .125)2 + .1(-.15 - .125)2 + .2(.05 - .125)2 + .3(.15 - .125)2 + .2(.25 - .125)2 + .15(.40 - .125)2 = .0428(.0428) = .20697. The correlation between two stocksA) can take in positive values.B) can take on negative values.C) cannot be greater than 1.D) cannot be less than -1.E) All of the above.Answer: E Difficulty: Medium Page: 260-2618. If the correlation between two stocks is –1, the returnsA) generally move in the same direction.B) move perfectly opposite one another.C) are unrelated to one another as it is < 0.D) have standard deviations of equal size but opposite signs.E) None of the above.Answer: B Difficulty: Medium Page: 2609. Stock A has an expected return of 20%, and stock B has an expected return of 4%. However, therisk of stock A as measured by its variance is 3 times that of stock B. If the two stocks arecombined equally in a portfolio, what would be the portfolio's expected return?A) 4%B) 12%C) 20%D) Greater than 20%E) Need more information to answer.Answer: B Difficulty: Medium Page: 262Rationale:Rp = 20(.5) + 4(.5) = 12%Use the following to answer questions 10-14:Idaho Slopes (IS) and Dakota Steppes (DS) are both seasonal businesses. IS is a downhill skiing facility, while DS is a tour company that specializes in walking tours and camping. The equally likely returns on each company over the next year is expected to be:Economy Idaho Slopes Dakota SteppesStrong Downturn -10% 2%Mild Downturn - 4% 7%Slow Growth 4% 6%Moderate Growth 12% 4%Strong Growth 20% 4%10. The mean expected returns of Idaho Slopes and Dakota Steppes areA) 4.0%; 6.0%B) 4.4%; 4.6%C) 5.5%; 5.8%D) 10.0%; 6.0%E) None of the aboveAnswer: B Difficulty: Medium Page: 256Rationale:IS = (-10%-4%+4%+12%+20%)/5 = 4.4%DS = (2%+7%+6%+4%+4%)/5 = 4.6%11. The variances of Idaho Slopes and Dakota Steppes areA) .0145; .00038B) .011584; .000304C) .006454; .000154D) .0008068; .000193E) None of the aboveAnswer: B Difficulty: Hard Page: 256-257Rationale:2IS = .2 = 0.0115842DS = .2 = .00030412. The covariance between the Idaho Slopes and Dakota Steppes returns isA) .00187B) .00240C) .00028D) .000056E) None of the aboveAnswer: C Difficulty: Hard Page: 258-259Rationale:ISDS = = .0002813. If Idaho Slopes and Dakota Steppes are combined in a portfolio with 50% invested in each, theexpected return and risk would be?A) 4.5%; 0%B) 4.5%; 5.48%C) 5.0%; 0%D) 5.625%; 37.2%E) 8.0%; 8.2%Answer: B Difficulty: Hard Page: 261-262Rationale:Rp = .5(.044) + .5(.046) = .045 = 4.5%p = .5 = .05477 = 5.48%14. The correlation between stocks A and B is theA) covariance between A and B divided by the standard deviation of A times the standarddeviation of B.B) standard deviation A divided by the standard deviation of B.C) standard deviation of B divided by the covariance between A and B.D) variance of A plus the variance of B dividend by the covariance.E) None of the above.Answer: A Difficulty: Medium Page: 26015. A portfolio is entirely invested into Buzz's Bauxite Boring Equity, which is expected to return 16%,and Zum's Inc. bonds, which are expected to return 8%. Sixty percent of the funds are invested in Buzz's and the rest in Zum's. What is the expected return on the portfolio?A) 6.4%B) 9.6%C) 12.8%D) 24.2%E) Need additional information.Answer: C Difficulty: Medium Page: 262Rationale:R p = .60(R Buzz)+.40(R Zum) = .60(16%) + .40(8%) = 12.8%16. You have plotted the data for two securities over time on the same graph, ie., the month return ofeach security for the last 5 years. If the pattern of the movements of the two securities rose and fell as the other did, these two securities would haveA) no correlation at all.B) a weak negative correlation.C) a strong negative correlation.D) a strong positive correlation.E) one can not get any idea of the correlation from a graph.Answer: D Difficulty: Easy Page: 26017. If the covariance of stock 1 with stock 2 is -.0065, then what is the covariance of stock 2 with stock1?A) -.0065B) +.0065C) greater than +.0065D) less than -.0065E) Need additional information.Answer: A Difficulty: Medium Page: 258-25918. If you have a portfolio of two risky stocks which turns out to have no diversification benefit. Thereason you have no diversification is the returnsA) are too small.B) move perfectly opposite of one another.C) are too large to offset.D) move perfectly with one another.E) are completely unrelated to one another.Answer: D Difficulty: Easy Page: 26419. A portfolio will usually containA) one riskless asset.B) one risky asset.C) two or more assets.D) no assets.E) None of the above.Answer: C Difficulty: Easy Page: 26120. The variance of Stock A is .004, the variance of the market is .007 and the covariance between thetwo is .0026. What is the correlation coefficient?A) .9285B) .8542C) .5010D) .4913E) .3510Answer: D Difficulty: Medium Page: 260Rationale:Standard deviation of B = .06325, Standard deviation of the market = .08366CORR = COV/(SDA)(SDM) = .0026/(.06325)(.08366) = .491321. If the correlation between two stocks is +1, then a portfolio combining these two stocks will have avariance that isA) less than the weighted average of the two individual variances.B) greater than the weighted average of the two individual variances.C) equal to the weighted average of the two individual variances.D) less than or equal to average variance of the two weighted variances, depending on otherinformation.E) None of the above.Answer: C Difficulty: Medium Page: 26422. The opportunity set of portfolios isA) all possible return combinations of those securities.B) all possible risk combinations of those securities.C) all possible risk-return combinations of those securities.D) the best or highest risk-return combination.E) the lowest risk-return combination.Answer: C Difficulty: Medium Page: 26723. A portfolio has 50% of its funds invested in Security One and 50% of its funds invested in SecurityTwo. Security One has a standard deviation of 6. Security Two has a standard deviation of 12. The securities have a coefficient of correlation of .5. Which of the following values is closest toportfolio variance?A) .0027B) .0063C) .0095D) .0104E) One must have covariance to calculate expected value.Answer: B Difficulty: Medium Page: 262Rationale: Var. = .52(.06)2 + .52(.12)2 + 2(.5)(.5)(.5)(6)(12) = .0009 + .0036 + .0018 = .006324. A portfolio has 25% of its funds invested in Security C and 75% of its funds invested in Security D.Security C has an expected return of 8% and a standard deviation of 6. Security D has an expected return of 10% and a standard deviation of 10. The securities have a coefficient of correlation of .6.Which of the following values is closest to portfolio return and variance?A) .090; .0081B) .095; .001675C) .095; .0072D) .100; .00849E) Cannot calculate without the number of covariance terms.Answer: C Difficulty: Medium Page: 261-262Rationale:E(R) = .25(.08) + .75(.10) = .095 = 9.5%Variance = .252(.06)2 + .752(.10)2 + 2(.25)(.75)(.06)(.60)(.10) = .007225. When many assets are included in a portfolio or index the risk of the portfolio or index will beA) greater than the risk of the securities because the correlations are greater than 1.B) equal to the risk of the securities because the correlations are equal to 1.C) less than the risk of the securities because the correlations are usually less than 1.D) unaffected by the risk of securities because their correlations are less than 1.E) None of the above.Answer: C Difficulty: Medium Page: 26426. The efficient set of portfoliosA) contains the portfolio combinations with the highest return for a given level of risk.B) contains the portfolio combinations with the lowest risk for a given level of return.C) is the lowest overall risk portfolio.D) Both A and BE) Both A and C.Answer: D Difficulty: Medium Page: 26727. Diversification can effectively reduce risk. Once a portfolio is diversified the type of riskremaining isA) individual security risk.B) riskless security risk.C) risk related to the market portfolio.D) total standard deviations.E) None of the above.Answer: C Difficulty: Easy Page: 27428. For a highly diversified equally weighted portfolio with a large number of securities, the portfoliovariance isA) the average covariance.B) the average expected value.C) the average variance.D) the weighted average expected value.E) the weighted average variance.Answer: A Difficulty: Medium Page: 273-27429. A well-diversified portfolio has negligibleA) expected return.B) systematic risk.C) unsystematic risk.D) variance.E) Both C and D.Answer: C Difficulty: Easy Page: 27430. The CML is the pricing relationship betweenA) efficient portfolios and beta.B) the risk-free asset and standard deviation of the portfolio return.C) the optimal portfolio and the standard deviation of portfolio return.D) beta and the standard deviation of portfolio return.E) None of the above.Answer: C Difficulty: Medium Page: 27931. The SML is the equilibrium pricing relationship forA) efficient portfolios.B) single securities.C) inefficient portfolios.D) All of the above.E) None of the above.Answer: D Difficulty: Easy Page: 285-28632. A typical investor is assumed to beA) a fair gambler.B) a gambler.C) a single security holder.D) risk averse.E) risk neutral.Answer: D Difficulty: Medium Page: 27533. You've owned a share of stock for 6 years. It returned 5% in 3 of those years and -5% in the other3. What was the variance?A) 0B) .0015C) .0030D) .0150E) .0400Answer: C Difficulty: Medium Page: 256-257Rationale:VAR= {(5-0)2 + (5-0)2 +(5-0)2 + (5-0)2 +(5-0)2 + (5-0)2/5 - 3034. The total number of variance and covariance terms in portfolio is N2. How many of these would be(including non-unique) covariance's?A) NB) N2C) N2 - ND) N2 - N/2E) None of the above.Answer: C Difficulty: Medium Page: 27235. Total risk can be divided intoA) standard deviation and variance.B) standard deviation and covariance.C) portfolio risk and beta.D) systematic risk and unsystematic risk.E) portfolio risk and covariance.Answer: D Difficulty: Easy Page: 27436. Beta measuresA) the ability to diversify risk.B) how an asset covaries with the market.C) the actual return on an asset.D) the standard of the assets' returns.E) All of the above.Answer: B Difficulty: Medium Page: 28337. The dominant portfolio with the lowest possible risk measures isA) the efficient frontier.B) the minimum variance portfolio.C) the upper tail of the efficient set.D) the tangency portfolio.E) None of the above.Answer: B Difficulty: Medium Page: 26638. The measure of beta associates most closely withA) idiosyncratic risk.B) risk-free return.C) systematic risk.D) unexpected risk.E) unsystematic risk.Answer: C Difficulty: Easy Page: 26939. An efficient set of portfolios isA) the complete opportunity set.B) the portion of the opportunity set below the minimum variance portfolio.C) only the minimum variance portfolio.D) the dominant portion of the opportunity set.E) only the maximum return portfolio.Answer: D Difficulty: Medium Page: 27040. A stock with a beta of zero would be expected to have a rate of return equal toA) the risk-free rate.B) the market rate.C) the prime rate.D) the average AAA bond.E) None of the above.Answer: A Difficulty: Medium Page: 28541. The combination of the efficient set of portfolios with a riskless lending and borrowing rate resultsinA) the capital market line which shows that all investors will only invest in the riskless asset.B) the capital market line which shows that all investors will invest in a combination of theriskless asset and the tangency portfolio.C) the security market line which shows that all investors will invest in the riskless asset only.D) the security market line which shows that all investors will invest in a combination of theriskless asset and the tangency portfolio.E) None of the above.Answer: B Difficulty: Medium Page: 27842. According to the CAPMA) the expected return on a security is negatively and non-linearly related to the security's beta.B) the expected return on a security is negatively and linearly related to the security's beta.C) the expected return on a security is positively and linearly related to the security's variance.D) the expected return on a security is positively and non-linearly related to the security's beta.E) the expected return on a security is positively and linearly related to the security's beta.Answer: E Difficulty: Easy Page: 28243. The diversification effect of a portfolio of two stocksA) increases as the correlation between the stocks declines.B) increases as the correlation between the stocks rises.C) decreases as the correlation between the stocks rises.D) Both A and C.E) None of the above.Answer: A Difficulty: Medium Page: 26644. The elements along the diagonal of the Variance / Covariance matrix areA) covariances.B) security weights.C) security selections.D) variances.E) None of the above.Answer: D Difficulty: Medium Page: 27245. The elements in the off-diagonal positions of the Variance / Covariance matrix areA) covariances.B) security selections.C) variances.D) security weights.E) None of the above.Answer: A Difficulty: Medium Page: 27246. The separation principle states that an investor willA) choose any efficient portfolio and invest some amount in the riskless asset to generate theexpected return.B) choose an efficient portfolio based on individual risk tolerance or utility.C) never choose to invest in the riskless asset because the expected return on the riskless asset islower over time.D) invest only in the riskless asset and tangency portfolio choosing the weights based onindividual risk tolerance.E) All of the above.Answer: D Difficulty: Medium47. The beta of a security is calculated byA) dividing the covariance of the security with the market by the variance of the market.B) dividing the correlation of the security with the market by the variance of the market.C) dividing the variance of the market by the covariance of the security with the market.D) dividing the variance of the market by the correlation of the security with the market.E) None of the above.Answer: A Difficulty: Medium Page: 28348. If investors possess homogeneous expectations over all assets in the market portfolio, when risklesslending and borrowing is allowed, the market portfolio is defined toA) be the same portfolio of risky assets chosen by all investors.B) have the securities weighted by their market value proportions.C) be a diversified portfolio.D) All of the above.E) None of the above.Answer: D Difficulty: Medium Page: 28049. A portfolio contains two assets. The first asset comprises 40% of the portfolio and has a beta of 1.2.The other asset has a beta of 1.5. The portfolio beta isA) 1.35B) 1.38C) 1.42D) 1.50E) 1.55Answer: B Difficulty: Medium Page: 287Rationale:βp = .4(1.2)+.6(1.5)=1.3850. A portfolio contains four assets. Asset 1 has a beta of .8 and comprises 30% of the portfolio. Asset2 has a beta of 1.1 and comprises 30% of the portfolio. Asset3 has a beta of 1.5 and comprises 20%of the portfolio. Asset 4 has a beta of 1.6 and comprises the remaining 20% of the portfolio. If the riskless rate is expected to be 3% and the market risk premium is 6%, what is the beta of theportfolio?A) 0.80B) 1.10C) 1.19D) 1.25E) 1.40Answer: C Difficulty: Hard Page: 287Rationale:βp = .3(.8)+.3(1.1)+.2(1.5)+.2(1.6)=1.1951. The characteristic line is graphically depicted asA) the plot of the relationship between beta and expected return.B) the plot of the returns of the security against the beta.C) the plot of the security returns against the market index returns.D) the plot of the beta against the market index returns.E) None of the above.Answer: C Difficulty: Medium Page: 281-28252. Recent research by Fama and French calls into questions the CAPM because they findA) average security returns are negatively related to the firm P/E and M/B ratios.B) P/E and M/B are only two of several factors explaining average returns.C) a weak relationship between average returns and beta for 1941 to 1990 and no relationshipfrom 1963 to 1990.D) Both A and C.E) Both B and C.Answer: D Difficulty: Hard Page: 29553. Further study to evaluate the Fama-French results and the CAPM are needed becauseA) P/E and M/B may be two of a large set of factors which were found due to hindsight bias.B) A positive relationship is found over the period 1927 to 1990 indicating more than 50 years ofdata are necessary for proper CAPM testing.C) Annual data based estimates of beta show positive relationships to average returns, whilemonthly betas do not.D) All of the above.E) None of the above.Answer: D Difficulty: Hard Page: 295-296Essay Questions54. Given the following data:Year Returns – Ink, Inc. Returns – S & P 500 1 10% 15% 2 0% -2% 3 -5% -2% 4 15 10% 5 5% 0%Calculate the covariance between Ink and the S&P 500.Difficulty: Hard Page: 258-259 Answer:R I IRR I - IR R SP SP R R SP –SP R.10 .05 .05 .15 .042.108 .00 .05 -.05 -.02 .042 -.062 -.05 .05 -.10 -.02 .042 -.062 .15 .05 .10 .10 .042 .058 .05.05.00 .00 .0421-.042(R I - I R ) x (R SP –SP R ).05 x.108 .0054 -.05 x -.062 .0031 -.10 x -.062 .0062 .10 x .058 .00580 x -.402.0205/5=.004155. A portfolio is made up of 75% of stock 1, and 25% of stock 2. Stock 1 has a variance of .08, andstock 2 has a variance of .035. The covariance between the stocks is -.001. Calculate both the variance and the standard deviation of the portfolio. Difficulty: Medium Page: 262 Answer: σ² = (.75)²(.08) + (.25)²(.035) + 2(.25)(.75)(-.001) = .0468 σ = .216356. Illustrate and explain the impact of adding securities to a portfolio assuming the securities are ofaverage correlation with each other. Difficulty: Medium Page: 274Answer:As N increases, portfolio risk decreases. As N gets large, portfolio risk approaches the market risk.For details please refer to the text Figure 10.7 page 274.57. Given the following information on 3 stocks:Stock A Stock B Stock C T-Bills Market PortExp. Return .19 .15 .09 .07 .18Variance .0200 .1196 .0205 .0000 .0064Covariance withMkt Portfolio .007 .0045 .0013 .0000 .0064Using the CAPM, calculate the expected return for Stock's A, B, and C. Which stocks would you recommend purchasing?Difficulty: Hard Page: 285-287Answer:B A = .0070/.0064 = 1.094; ra = .07 + (.18-.07)1.094 = .1903B B = .0045/.0064 = 0.703; rb = .07 + (.18-.07)0.703 = .1473B C = .0013/.0064 = 0.203; rc = .07 + (.18-.07)0.203 = .0.923Indifferent on A as .1903 = .19.Would buy B as .15 > .1473.Would not buy C as .09 < .0923.58. Returns for the IC Company and for the S&P 500 Index over the previous 4-year period are givenbelow:Year IC Co. S & P 5001 30% 17%2 0% 20%3 -8% 7%4 0% 5%What are the average returns on IC and on the S&P 500 index? If you had invested $1.00 in IC, how much would you have had after 4 years? What is the correlation between the returns on IC and the S&P?Difficulty: Medium Page: 259Answer:Average return is 22/4 = 5.5% for IC and 49/4 = 12.25% for the S&P.After 4 years $1.00 in IC grows to $1.00(1.30)(.92) = 1.196 = $1.20.For n=4σIC = 14.52, σSP = 6.38, σIC,SP = 46.125, determining ( r IC,SP ) =0.498For n-1 = 3σIC = 16.76 σSP = 7.37 σIC,SP = 61.50 determining (r IC,SP ) =. 49859. Draw and explain the relationship between the opportunity set for a two asset portfolio when thecorrelation is: [Choose from -1, -.5, 0, +.5, and +1] Difficulty: Hard Page: 267-268 Answer: ∙ Opportunity set is made up of a portfolio of two asset combinations with weights from (0,100) to (100,0). ∙ Upper point--maximum return portfolio, 100% in highest return sec. ∙ Inflection point--minimum variance portfolio ∙ See diagram, pg. 267MRPStd. DeviationRpOpportunity SetBetween the MVP (Minimum Variance Portfolio) andthe MRP (Maximum Return Portfolio) is the efficient set of portfolios.60. The diagram below represents an opportunity set for a two asset combination. Indicate the correctefficient set with labels; explain why it is so. Difficulty: Hard Page: 267-268 Answer: ∙ Efficient set is portion of opportunity set that dominates. ∙ Provides maximum return for given risk or converse.MRPStd. DeviationRpOpportunity SetA is on the efficient frontier with the best return to risk combination. Portfolioson the frontier dominate all other portfolios. A dominates both B and C. B has a higher standard deviation for the same return while C has a lower return for the same standard deviation.ABCXX。

对外经贸大学公司理财试卷

对外经济贸易大学《公司理财》期末考试试卷(参考答案完美版)学号:姓名:成绩:案例1:(50分)Ragan Thermal Systems公司9年前由Carrington和Genevieve Ragan两兄妹创建。

公司生产和安装商务用的采暖通风与空调系统(HV AC)。

Ragan公司因拥有能提高系统能源适用效率的私人技术,正处于高速增长阶段。

目前,公司由两兄妹平等地共同拥有。

他们之间的最初协议是每人拥有50,000股公司股票,如果某一方要出股票,那么这些股票必须按某一折扣价提供给对方。

尽管此时两兄妹不打算出售股票,但他们希望对手中股票的注:EPS:每股盈利,DPS:每股股利,Stock Price:每股价格,ROE:权益资本回报率,R:必要报酬率Expert hld的EPS为负,原因在于去年会计冲销,如果不进行冲销,那么该公司的EPS为2.34美元。

去年,Ragan公司的EPS为4.32美元,并且向两兄妹各支付了54000美元。

目前,公司的ROE为25%。

两兄妹相信,公司的必要报酬率为20%。

根据公司增长率计算公式,公司增长率g = ROE × b,其中b为再投资比率。

1.假设公司会保持目前的增长率,那么公司股票的每股价值是多少?2.为了验证他们的计算,两兄妹雇了Josh Schlessman为顾问。

Josh研究发现,Ragan公司的技术优势只能再持续5年,然后,公司的增长率将降为行业平均水平。

另外,Josh认为,公司所使用的必要报酬率太高,他认为使用行业的平均必要报酬率更合适。

在Josh 的假设下,公司的股票价格应该是多少?解题提示:股价P0 = D1 / (R – g)答案1、增长率g =ROE*Retention ratio=0.25*(4.32-54000/50000)/4.32=0.1875 股价P =D1/(R-g)=D0(1+g)/(R-g)=1.08*(1+0.1875)/(0.2-0.1875)=102.6答案3、Industry Payout Ratio=(0.16+0.52+0.54)/(0.82+1.32+2.34)=0.2723 Industry Retention Ratio=1-0.2723=0.7277Industry ROE=0.13行业平均增长率Industry g (gi)=0.7277*0.13=0.0946D1 =D0(1+g) =1.08*(1+0.1875)=1.2825 折现P1= D1/1+0.1167=1.1485 D2 =D0(1+g)^2 =1.08*(1+0.1875)^2 折现P2=D2/(1+0.1167)^2=1.2213D3 =D0(1+g)^3 =1.08*(1+0.1875)^3 折现P3=D3/(1+0.1167)^3=1.2987D4 =D0(1+g)^4 =1.08*(1+0.1875)^4 折现P4=D4/(1+0.1167)^4=1.3811D5 =D0(1+g)^2 =1.08*(1+0.1875)^5 折现P5=D5/(1+0.1167)^5=1.4686D6 =D5(1+gi) = D5(1+0.0946) = 2.7916Value in year 5 = D6/Ri-gi = D6/(0.1167-0.0946) =126.30折现PV5 =126.30/(1+0.1167)^5 = 72.73每股价值PV= P1+P2+P3+P4+P5+PV5 = 79.25案例2:(50分)Cheek产品公司(CPI)在53年前由Joe Cheek创建,其最初销售如薯片和快餐。

公司理财期末考试试题开卷

公司理财期末考试试题开卷### 公司理财期末考试试题一、选择题(每题2分,共10分)1. 公司的财务杠杆效应是指:- A. 公司使用债务融资来增加股东的回报率- B. 公司通过增加资产来提高利润- C. 公司通过减少成本来提高利润- D. 公司通过增加销售来提高利润2. 资本资产定价模型(CAPM)中,β系数代表的是: - A. 资产的期望回报率- B. 资产的无风险回报率- C. 资产的系统性风险- D. 资产的非系统性风险3. 以下哪项不是公司财务报表的一部分?- A. 资产负债表- B. 利润表- C. 现金流量表- D. 产品目录4. 公司进行股票回购的主要目的通常是为了:- A. 增加公司的市场竞争力- B. 增加公司的资产总额- C. 提高每股收益(EPS)- D. 降低公司的负债比率5. 以下哪项不是影响公司资本成本的因素?- A. 公司的财务风险- B. 市场的利率水平- C. 公司的经营风险- D. 公司的行业地位二、简答题(每题10分,共20分)1. 请简述公司进行现金管理时需要考虑的主要因素。

2. 描述一下公司在进行资本预算时,如何评估一个投资项目的净现值(NPV)。

三、计算题(每题15分,共30分)1. 假设一家公司的税前利润为100万元,税率为25%,公司的债务利息为20万元,债务成本为10%。

请计算该公司的税后利润和企业价值增加值(EVA)。

2. 某公司计划进行一项投资,初始投资为500万元,预计该项目的年现金流入为120万元,持续5年。

假设公司的资本成本为10%,计算该项目的净现值(NPV)。

四、案例分析题(每题20分,共20分)某公司目前考虑发行新股来筹集资金,用于偿还现有债务和进行新的投资。

公司现有债务总额为5000万元,年利率为8%,公司希望通过发行新股筹集的资金来偿还这笔债务。

公司计划发行的股票数量为500万股,每股发行价格为10元。

请分析:- 公司发行新股后,财务杠杆的变化。

江苏高等教育自学考试公司理财真题

江苏高等教育自学考试公司理财真题The following text is amended on 12 November 2020.2015年4月江苏省高等教育自学考试 07524公司理财一、单项选择题(每小题1分.共25分)在下列每小题的四个备选答案中选出一个正确答案,并将其字母标号填入题干的括号内。

1.公司财务管理内容不包括( )A.长期投资管理 B.长期融资管理C.营运资本管理 D.业绩考核管理2.股东通常用来协调与经营者之间利益的方法主要是( )A.约束和激励 B.解聘和激励 C.激励和接收 D.解聘和接收3.假设以10%的年利率借的30000元,投资于某个寿命为10年的项目,为使该投资项目成为有利的项目,每年至少应收回的现金数额为( )(提示:(P/A,10%,10) =A.3000元 B.4882元 C.5374元 D.6000元4.甲公司平价发行5年期的公司债券,债券票面利率为10%,每半年付息一次,到期一次偿还本金。

该债券的有效年利率是( )C. 10. 25% . 5%5.-般来说,无法通过多样化投资来予以分散的风险是( )A.系统风险 B.非系统风险 C.总风险 D.公司特有风险6.证券j的风险溢价可表示为( )-rf B.j×(r m-r f) +×(r m - r f) ×r f7.可以被称为“表外融资”的是( )A.融资租赁 B.经营租赁 C.长期借款 D.新股发行8.收益性和风险性均较高的营运资本融资政策是( )A.折中型融资政策 B.激进型融资政策C.稳健型融资政策 D.混合型融资政策9.某公司上年销售收入为1000万元,若下一年产品价格会提高5%,公司销售量增长10%,所确定的外部融资占销售收入增长百分比为25%,则相应外部资金需要量为( )A. 25万元 B.25. 75万元 C.万元 D.38. 75万元10.下列各项中,不属于投资项目现金流出量的是( )A.经营付现成本 B.固定资产折旧费用C.固定资产投资支出 D.以前垫支的营运成本11.折旧具有抵税作用,由于计提折旧而减少的所得税额的计算公式为( )A.折旧额×所得税税率B.折旧额×(1-所得税税率)C.(经营付现成本十折旧率)×所得税税率D.(净利润十折旧率)×所得税税率12.存货模式下,与收益持有量成正比例关系的是( )A.现金周转期 B.现金交易成本 C.现金总成本 D.现金机会成本13. MM公司所得税模型认为,在考虑公司所得税的情况下,公司价值会随着负债比率的提高而增加,原因是( )A.财务杠杆的作用 B.总杠杆的作用C.利息可以抵税 D.利息可以税前扣除14.如果将考虑公司所得税的MM模型和CAPM模型结合起来,可以得到负债公司的股本成本等于( )A.无风险利率十经营风险溢价B.货币时间价值十经营风险溢价C.无风险利率十经营风险溢价十财务风险溢价D.无风险利率十经营风险溢价十财务风险溢价十总风险溢价15.如果BBC公司无负债时的公司价值为1000万元,经测算,该公司最佳资本结构为负债比率40%,因此准备采用股转债的方式将公司的资本结构调整为最佳资本结构,该公司所得税税率为25%。

公司理财期末考试题(A卷)

《公司理财》期末考试题(A 卷)一、判断题(共10分,每小题1分)1. 在终值与利率一定的情况下,计息期越多,复利现值就越小。

( )2. 在企业财务关系中最为重要的关系是指企业与作为社会管理者的政府有关部门、社会公众之间的关系。

( )3. 单利与复利是两种不同的计息方法,单利终值与复利终值在任何时候都不可能相等。

( )4. 发行普通股股票可以按票面金额等价发行,也可以偏离票面金额按溢价、折价发行。

( )5. 在个别资本成本一定的情况下,企业综合资本成本的高低取决于资金总额。

( )6. 某一投资方案按10%的贴现率计算的净现值大于零,那么,该方案的内含报酬率大于10%。

( )7. 就风险而言,从大到小的排列顺序为:金融证券、公司证券、政府证券。

( ) 8. 存货ABC 控制法中,C 类物资是指数量少、价值低的物质。

( ) 9. 只要公司拥有足够现金,就可以发放现金股利。

( )10.利润中心必然是成本中心,投资中心必然是利润中心,所以投资中心首先是成本中心,但利润中心并不一定都是投资中心。

( )二、单项选择题(共15分,每小题1分)1. 作为企业财务管理目标,每股利润最大化目标较之利润最大化目标的优点在于( )。

A 考虑了资金的时间价值 B 考虑了投资风险价值C 反映了创造利润与投入资本之间的关系D 能够避免企业的短期行为 2. 随单价的变动而同方向变动的是( )。

A 保本量B 保利量C 变动成本率D 单位边际贡献 3. 在期望值不同时,比较风险的大小,可采用( )。

…………………………………………………………………………………………………………………………………………………………………………………………………密……………………………封………………………………………线………………………………………A 标准差B 标准差系数C 期望值D 概率 4. 普通股每股净资产反映了普通股的( )。

公司理财考试题

《公司理财》复习题(2013年4月)一、单项选择题1、在筹资理财阶段,公司理财的重点内容是( B )。

A有效运用资金 B如何设法筹集到所需资金 C研究投资组合 D国际融资2、现代公司理财的目标是( C )。

A获利能力最大化 B偿债能力最大化 C股东财富最大化 D追求利润最大化3、由于生产经营活动的进行而引起资金不断地循环叫做(C )。

A资金运动 B财务活动 C资金周转 D资金耗费4、资产负债表为( B )。

A动态报表 B静态报表 C动态与静态相结合的报表 D既不是动态报表也不是静态报表5、资产负债表中的所有项目的“期末数”一栏,是根据( A )。

A本期有关账户的期末余额填列的 B本期有关账户的期初余额填列的C有关账户的本期借方发生额填列的 D有关账户的本期贷方发生额填列的6、下列负债中属于长期负债的是( D )。

A应付账款 B应交税金 C预计负债 D应付债券7、公司流动性最强的资产是( A )。

A货币资金 B短期投资 C应收账款 D存货8、资本公积可按法定程序经批准后( A )。

A转增资本 B弥补亏损 C用于集体福利 D用于发放优先股股利9、公司的法定盈余公积在转增资本后,一般不得低于注册资金的( C )。

A 10%B 20%C 25%D 50%10、利润表中的收入是( B )。

A按收付实现制确认的 B按权责发生制确认的 C按永续盘存制确认的 D按实地盘存制确认的11、下列各项费用中属于营业费用的有( C )。

A坏账损失 B业务招待费 C广告费 D金融机构手续费12、下列各项费用中属于财务费用的是( C )。

A广告费 B劳动保险费 C利息支出 D坏账损失13、反映公司所得与所占用的比例关系的财务指标是(B )。

A资产负债率 B资产利润率 C存货周转率 D销售利润率14、通常被用来描述一个公司经济效益高低的代表性指标是( C )。

A销售利润率 B资产负债率 C资产利润率 D成本费用利润率15、反映公司所得与所费的比例关系的财务指标是( D )。

《公司理财》期末试卷A(含答案)

《公司理财》期末试卷A(含答案)第 2 页XXXX 学 院2015 /2016 学年第 2学期考试试卷( A )卷课程名称:公司理财 适用专业/年级:2014级会计电算化本卷共 5 页,考试方式: 闭卷 ,考试时间: 90 分钟一、单项选择题 (本题共12小题,每题2分,共24分)1.以下企业组织形式当中创立最容易维持经营固定成本最低的是( ) 。

A.个人独资企业 B.合伙制企业 C.有限责任公司 D.股份有限公司 2.公司的目标不包括以下( )。

A.生存目标 B.发展目标 C.盈利目标 D.收购目标3.资产负债率主要是反映企业的( )指标。

A.盈利能力 B.长期偿债能力 C.发展能力 D.营运能力4.企业的财务报告不包括( )。

A.现金流量表B.财务状况说明书C.利润分配表D.比较百分比会计报表 5.资产负债表不提供( )等信息。

A.资产结构B.负债水平C.经营成果D.资金来源情况6.某校准备设立永久性奖学金,每年计划颁发36000元资金,若年复利率为12%,该校现在应向银行存入( )元本金。

A .450000 B .300000 C .350000 D .3600007.债券投资中,债券发行人无法按期支付利息或本金的风险称为( )专业班级: 姓 名: 学 号:密 封装 订第3页第4页5.影响资金时间价值大小的因素主要包括()。

A.单利B.复利C.资金额D.利率和期限6.下列选项中,()可以视为年金的形式。

A.直线法计提的折旧 B.租金C.利滚利 D.保险费二、计算分析题(本题共3小题,第1题18分,第二题20分,第三题20分,共58分)1.某公司有一项付款业务,有甲乙两种付款方式可供选择。

甲方案:现在支付15万元,一次性结清。

乙方案:分5年付款,1-5年各年初的付款分别为3、3、4、4、4万元,年利率为10%。

已知:(F/A,10%,1)=(P/A,10%,1)=0.9091 (P/A,10%,3)=2.4869要求:按现值计算,选出较优方案并说明理由。

成人教育 《公司理财》期末考试复习题及参考答案

公司理财练习题A一、名词解释1、β系数1、股利政策3、资本结构4、杜邦分析法二、问答题1、证券市场线的走势受那些因素的影响?2、企业项目投资的现金流量分为几个部分?各部分的构成是什么?3、发行普通股筹资的利弊分别是什么?4、公司制企业的特点有哪些?5、企业的主营业务利润由几个部分构成,各个组成部分又包含什么内容?三、计算题1、在一项合约中,你可以有两种选择:1)从现在起的6年后收到25000元;2)从现在起的12年后收到50000元。

求:在年利率为多少时两种选择对你而言没有区别?(保留到小数点后4位)2、公司目前的资本结构为长期资本总额600万元,其中债务200万元,普通股股本400万元,每股面值100元,4万股全部发行在外,目前市场价每股300元。

债务利息10%,所得税率33%。

公司欲追加筹资200万元,有两筹资方案:甲:全部发行普通股,向现有股东配股,4配1,每股股价200元,配发一万股;乙:向银行贷款200万元,因风险增加银行要求的利息率为15%。

根据会计人员的测算,追加筹资后销售额可望达到800万元,变动成本率为50%,固定成本180万元。

求1)两方案的每股利润无差别点。

2)哪种方案为较优方案。

3同方公司的β为1.55,无风险收益率为10%,市场组合的期望收益率为13%。

目前公司支付的每股股利为2美元,投资者预期未来几年公司的年股利增长率为8%。

求:1)该股票期望收益率为多少?(保留到小数点后4位)2)确定的收益率下,该股票每股市价是多少?(保留整数)4、公司目前的资本结构为长期资本总额600万元,其中债务200万元,普通股股本400万元,每股面值100元,4万股全部发行在外,目前市场价每股300元。

债务利息10%,所得税率33%。

公司欲追加筹资200万元,有两筹资方案:甲:全部发行普通股,向现有股东配股,4配1,每股股价200元,配发一万股;乙:向银行贷款200万元,因风险增加银行要求的利息率为15%。

罗斯公司理财题库全集

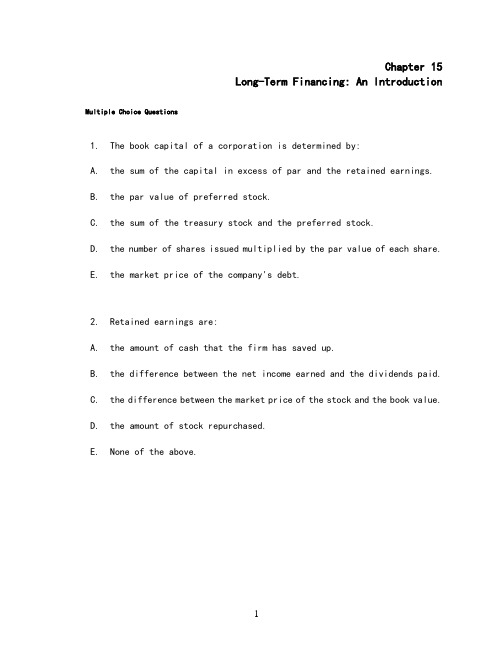

Chapter 15Long-Term Financing: An Introduction Multiple Choice Questions1. The book capital of a corporation is determined by:A. the sum of the capital in excess of par and the retained earnings.B. the par value of preferred stock.C. the sum of the treasury stock and the preferred stock.D. the number of shares issued multiplied by the par value of each share.E. the market price of the company's debt.2. Retained earnings are:A. the amount of cash that the firm has saved up.B. the difference between the net income earned and the dividends paid.C. the difference between the market price of the stock and the book value.D. the amount of stock repurchased.E. None of the above.3. The book value of the shareholders' ownership is represented by:A. the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.B. the total assets minus the net worth.C. the sum of the preferred stock, debt and the capital surplus.D. the sum of the total assets minus the current liabilities.E. None of the above.4. Shares of stock that have been repurchased by the corporation are called:A. treasury stock.B. undistributed capital stock.C. retained equity.D. capital surplus shares.E. None of the above.5. The market value of the ownership of the firm equals:A. the market price of the stock times the number of shares outstanding.B. the sum of the market price of the bonds and the stock.C. the par value of the stock times the number of shares outstanding.D. the market price of the stock minus the retained earnings.E. None of the above.6. A grant of authority allowing someone else to vote shares of stock that you own is called:A. a power-of-share authorization.B. a proxy.C. a share authority grant (SAG).D. a restricted conveyance.E. None of the above.7. Unsecured corporate debt is called a(n):A. indenture.B. debenture.C. bond.D. mortgage.E. None of the above.8. A standard arrangement for the orderly retirement of long-term debt calls for the corporation to make regular payments into a(n):A. custodial account.B. sinking fund.C. retirement fund.D. irrevocable trustee fund.E. None of the above9. Debt that may be extinguished before maturity is referred to as:A. sinking-fund debt.B. debentures.C. callable debt.D. indenture debt.E. None of the above.10. If a long-term debt instrument is perpetual, it is called a(n):A. secured debt issue.B. subordinated debt issue.C. consol.D. capital debt issue.E. indenture.11. The amount of loan a person or firm borrows from a lender is the:A. creditor.B. indenture.C. debenture.D. principal.E. amortization.12. The written agreement between a corporation and its bondholders is called:A. the collateral agreement.B. the deed.C. the indenture.D. the deed of conveyance.E. None of the above.13. If cumulative voting is permitted:A. the total number of votes a shareholder has is equal to the number of shares owned.B. the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.C. the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.D. the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.E. None of the above.14. The market-to-book value ratio is implies growth and success when it is:A. greater than 0.B. less than 10.C. less than 0.D. less than 1.E. greater than 1.15. There are 3 directors' seats up for election. If you own 1,000 shares of stock and you can cast 3,000 votes for a particular director, this is illustrative of:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.16. If you own 1,000 shares of stock and you can cast only 1,000 votes fora particular director, then the stock features:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.17. If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.A. proxy fightB. stockholder derivative actionC. tender offerD. vote of confidenceE. None of the above.18. Shareholders usually have which of the following right(s)A. To elect board members, the authorizing of new shares and other matters of great importance to shareholders such as being acquired.B. To share proportionally in regular and liquidating dividends.C. To share proportionally in any new stock sold.D. All of the above.E. None of the above.19. Different classes of stock usually are issued to:A. maintain ownership control by holding the class of stock with greater voting rights.B. pay less in dividends between the classes of stock.C. fool investors into thinking that equity is equity and there is no difference in control or value features.D. extract perquisites without the other class of stockholders knowing.E. None of the above.20. Which of the following statements is falseA. Creditors do not have voting power.B. Payment on interest on debt in considered an expense, while payment of dividends is a return on capital.C. Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid common stock dividends cannot force liquidation.D. One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.E. None of the above.21. Corporations try to create hybrid securities that look like equity but are called debt because:A. debt interest expense is tax deductible.B. bankruptcy costs are eliminated or reduced.C. these securities have lower risk than debt.D. Both A and C.E. Both A and B.22. Technically speaking, a long-term corporate debt offering that features a specific attachment to corporate property is generally called:A. a debenture.B. a bond.C. a long-term liability.D. a preferred liability.E. None of the above.23. If a firm retires or extinguishes a debt issue before maturity, the specific amount they pay is:A. the amortization amount.B. the call price.C. the sinking fund amount.D. the spread premium.E. None of the above.24. If a debenture is subordinated, it:A. has a higher priority status than specified creditors.B. is secondary to equity.C. must give preference to the specified creditor in the event of default.D. has been issued because the company is in default.E. None of the above.25. Not paying the dividends on a cumulative preferred issue may result in:A. preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.B. voting rights are granted to preferred stockholders if preferred dividends are in arrears.C. no payment of dividends to common shareholders.D. Both A and B.E. Both B and C.26. Preferred stock has both a tax advantage and a tax disadvantage. These two are:A. in default there are no taxes and dividends are taxed in corporate hands at 70%.B. corporate dividends are taxed on 30% of the dividends received and expenses are deductible.C. dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.D. dividends are fully tax deductible but are not equity capital.E. None of the above.27. Preferred stock may be desirable to issue for which of the following reason(s)A. If there is no taxable income, preferred stock does not impose a tax penalty.B. The failure to pay preferred dividends, cumulative or noncumulative, will not cause bankruptcy.C. Preferred dividends are not tax deductible and therefore will not provide a tax shield but will reduce net income.D. Both B and C.E. Both A and B.28. Preferred stock may exist because:A. losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B. an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C. corporations get a 70% tax exemption on preferred dividends received.D. All of the above.E. None of the above.29. The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings. This prohibition is an example of a(n):A. maintenance of security provision.B. collateral restriction.C. affirmative indenture.D. restrictive covenant.E. None of the above.30. What percentage of the dividends received by one corporation from another is taxableA. 15%B. 30%C. 34%D. 70%E. 100%31. Which of the following statements about preferred stock is trueA. Unlike dividends paid on common stock, dividends paid on preferred stock are a tax-deductible expense.B. Unpaid dividends on preferred stock are a debt of the corporation.C. If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.D. There is no difference in the voting rights of preferred and common stockholders.E. None of the above.32. If a debt issue is callable, the call price is generally ____ par.A. greater thanB. less thanC. equal toD. unrelated toE. It varies widely based on the risk of the firm.33. There was an upward trend in the ratio of the book value of debt to the book value of debt and equity throughout the 1990s. Some of this was due to the repurchasing of stock. The market value ratio of debt to debt and equity exhibited no upward trend. This can be explained by:A. the change in the accounting rules of the period.B. the difference between tax accounting and accounting for financial accounting purposes.C. a large increase in the market value of equity that was greater than the increase in debt.D. All of the above.E. None of the above.34. Based on historical experience, which of the following best describes the "pecking order" of long-term financing strategy in the .A. Long-term debt first, new common equity, internal financing last.B. Long-term debt first, internal financing, new common equity last.C. Internal financing first, new common equity, long-term borrowing last.D. Internal financing first, long-term borrowing, new common equity last.E. None of the above.35. Financial deficits are created when:A. profits and retained earnings are greater than the capital-spending requirement.B. profits and retained earnings are less than the capital-spending requirement.C. profits and retained earnings are equal to the capital-spending requirement.D. All of the above.E. None of the above.36. Financial economists prefer to use market values when measuring debt ratios because:A. market values are more stable than book values.B. market values are a better reflection of current value than historical value.C. market values are readily available and do not have to be calculated like book values.D. market values are more difficult to calculate which makes financial economists more valuable.E. None of the above.37. Corporate financial officers prefer to use book values when measuring debt ratios because:A. book values are more stable than market values.B. debt covenant restriction are usually expressed in book value terms.C. rating agencies measure debt ratios in book values terms.D. All of the above.E. None of the above.38. Rockwell Corporation had net income of $150,000 for the year ending 2008. The company decided to payout 40% of earnings per share as a dividend. Rockwell has 120,000 shares issued and outstanding. What are the retained earnings for 2008A. $40,000B. $60,000C. $90,000D. $150,000E. None of the above39. Nelson Company had equity accounts in 2008 as follows:Projected income is $150,000 and 40% of this amount will be paid out immediately as dividends. What will the ending retained earnings account beA. $90,000B. $92,000C. $122,000D. $210,000E. $242,00040. Holden Bicycles has 1,000 shares outstanding each with a par value of $. If they are sold to shareholders at $10 each, what would the capital surplus beA. $100B. $900C. $9,900D. $10,000E. $11,00041. The Lory Bookstore used internal financing as a source of long-term financing for 80% of its total needs in 2008. The company borrowed an additional 27% of its total needs in the long-term debt markets in 2008. What were Lory's net new stock issues in that yearA. -20%B. -7%C. 7%D. 20%E. 27%42. David's Building Equipment (DBE) had net income of $200,000 for the year ending 2008. The company decided to payout 30% of earnings per share as a dividend. DBE has 50,000 shares issued and outstanding. What are the retained earnings for 2008A. $60,000B. $140,000C. $150,000D. $200,000E. None of the above.43. Alexandra Investments had equity accounts in 2008 as follows:Projected income is $200,000 and 20% of this amount will be paid out immediately as dividends. What will the ending retained earnings account beA. $160,000B. $250,000C. $270,000D. $410,000E. $470,00044. Michael's Motor Scooters has 1,000 shares outstanding each with a par value of $. If they are sold to shareholders at $5 each, what would the capital surplus beA. $4,400B. $4,500C. $4,750D. $4,950E. $5,00045. Calhoun Computech used internal financing as a source of long-term financing for 80% of its total needs in 2008. The company borrowed an additional 15% of its total needs in the long-term debt markets in 2008. What were Calhoun's net new stock issues, in percentage terms, for 2008A. -10%B. -5%C. 5%D. 10%E. 15%Essay QuestionsInformation on shareholder's equity as currently shown on the books of the Eaton Corporation is given as:46. From this information, calculate Eaton's book value per share.47. Rework the shareholder's equity as it appears on the books if the company issues 40,000 new shares of common at $70 per share.48. Preferred Stock, as a hybrid security, presents somewhat of a puzzle as to why they are issued. What elements give rise to the puzzle and how is it explained49. Different countries have different sources of funds. For example, in the United States, internally generated funds count for over 4/5 of all funds while in Japan, it is about ½ with externally generated funds making up the remainder. The disparities are less in the United Kingdom and Germany, with about 2/3 of funds coming from internal sources. Discuss this disparity and why it might exist.Chapter 15 Long-Term Financing: An Introduction Answer KeyMultiple Choice Questions1. The book capital of a corporation is determined by:A.the sum of the capital in excess of par and the retained earnings.B.the par value of preferred stock.C.the sum of the treasury stock and the preferred stock.D.the number of shares issued multiplied by the par value of each share.E.the market price of the company's debt.Difficulty level: EasyTopic: BOOK CAPITALType: DEFINITIONS2. Retained earnings are:A.the amount of cash that the firm has saved up.B.the difference between the net income earned and the dividends paid.C.the difference between the market price of the stock and the book value.D.the amount of stock repurchased.E.None of the above.Difficulty level: EasyTopic: RETAINED EARNINGSType: DEFINITIONS3. The book value of the shareholders' ownership is represented by:A.the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.B.the total assets minus the net worth.C.the sum of the preferred stock, debt and the capital surplus.D.the sum of the total assets minus the current liabilities.E.None of the above.Difficulty level: MediumTopic: BOOK VALUEType: DEFINITIONS4. Shares of stock that have been repurchased by the corporation are called:A.treasury stock.B.undistributed capital stock.C.retained equity.D.capital surplus shares.E.None of the above.Difficulty level: EasyTopic: TREASURY STOCKType: DEFINITIONS5. The market value of the ownership of the firm equals:A.the market price of the stock times the number of shares outstanding.B.the sum of the market price of the bonds and the stock.C.the par value of the stock times the number of shares outstanding.D.the market price of the stock minus the retained earnings.E.None of the above.Difficulty level: EasyTopic: MARKET VALUE OF EQUITYType: DEFINITIONS6. A grant of authority allowing someone else to vote shares of stock that you own is called:A. a power-of-share authorization.B. a proxy.C. a share authority grant (SAG).D. a restricted conveyance.E.None of the above.Difficulty level: EasyTopic: PROXYType: DEFINITIONS7. Unsecured corporate debt is called a(n):A.indenture.B.debenture.C.bond.D.mortgage.E.None of the above.Difficulty level: EasyTopic: DEBENTUREType: DEFINITIONS8. A standard arrangement for the orderly retirement of long-term debt calls for the corporation to make regular payments into a(n):A.custodial account.B.sinking fund.C.retirement fund.D.irrevocable trustee fund.E.None of the aboveDifficulty level: EasyTopic: SINKING FUNDType: DEFINITIONS9. Debt that may be extinguished before maturity is referred to as:A.sinking-fund debt.B.debentures.C.callable debt.D.indenture debt.E.None of the above.Difficulty level: EasyTopic: CALLABLE DEBTType: DEFINITIONS10. If a long-term debt instrument is perpetual, it is called a(n):A.secured debt issue.B.subordinated debt issue.C.consol.D.capital debt issue.E.indenture.Difficulty level: EasyTopic: CONSOL OR PERPETUAL DEBTType: DEFINITIONS11. The amount of loan a person or firm borrows from a lender is the:A.creditor.B.indenture.C.debenture.D.principal.E.amortization.Difficulty level: EasyTopic: LOAN PRINCIPALType: DEFINITIONS12. The written agreement between a corporation and its bondholders is called:A.the collateral agreement.B.the deed.C.the indenture.D.the deed of conveyance.E.None of the above.Difficulty level: EasyTopic: INDENTUREType: DEFINITIONS13. If cumulative voting is permitted:A.the total number of votes a shareholder has is equal to the number of shares owned.B.the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.C.the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.D.the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.E.None of the above.Difficulty level: EasyTopic: CUMULATIVE VOTINGType: CONCEPTS14. The market-to-book value ratio is implies growth and success when it is:A.greater than 0.B.less than 10.C.less than 0.D.less than 1.E.greater than 1.Difficulty level: MediumTopic: MARKET-TO-BOOK RATIOType: CONCEPTS15. There are 3 directors' seats up for election. If you own 1,000 shares of stock and you can cast 3,000 votes for a particular director, this is illustrative of:A.cumulative voting.B.absolute priority voting.C.sequential voting.D.straight voting.E.None of the above.Difficulty level: EasyTopic: CUMULATIVE VOTINGType: CONCEPTS16. If you own 1,000 shares of stock and you can cast only 1,000 votes fora particular director, then the stock features:A.cumulative voting.B.absolute priority voting.C.sequential voting.D.straight voting.E.None of the above.Difficulty level: EasyTopic: STRAIGHT VOTINGType: CONCEPTS17. If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.A.proxy fightB.stockholder derivative actionC.tender offerD.vote of confidenceE.None of the above.Difficulty level: EasyTopic: PROXY FIGHTType: CONCEPTS18. Shareholders usually have which of the following right(s)A.To elect board members, the authorizing of new shares and other matters of great importance to shareholders such as being acquired.B.To share proportionally in regular and liquidating dividends.C.To share proportionally in any new stock sold.D.All of the above.E.None of the above.Difficulty level: EasyTopic: SHAREHOLDER RIGHTSType: CONCEPTS19. Different classes of stock usually are issued to:A.maintain ownership control by holding the class of stock with greater voting rights.B.pay less in dividends between the classes of stock.C.fool investors into thinking that equity is equity and there is no difference in control or value features.D.extract perquisites without the other class of stockholders knowing.E.None of the above.Difficulty level: MediumTopic: CLASSES OF STOCKType: CONCEPTS20. Which of the following statements is falseA.Creditors do not have voting power.B.Payment on interest on debt in considered an expense, while payment of dividends is a return on capital.C.Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid common stock dividends cannot force liquidation.D.One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.E.None of the above.Difficulty level: MediumTopic: COSTS OF LONG TERM FINANCINGType: CONCEPTS21. Corporations try to create hybrid securities that look like equity but are called debt because:A.debt interest expense is tax deductible.B.bankruptcy costs are eliminated or reduced.C.these securities have lower risk than debt.D.Both A and C.E.Both A and B.Difficulty level: MediumTopic: HYBRID SECURITIESType: CONCEPTS22. Technically speaking, a long-term corporate debt offering that features a specific attachment to corporate property is generally called:A. a debenture.B. a bond.C. a long-term liability.D. a preferred liability.E.None of the above.Difficulty level: EasyTopic: BONDType: CONCEPTS23. If a firm retires or extinguishes a debt issue before maturity, the specific amount they pay is:A.the amortization amount.B.the call price.C.the sinking fund amount.D.the spread premium.E.None of the above.Difficulty level: EasyTopic: CALLABLE DEBTType: CONCEPTS24. If a debenture is subordinated, it:A.has a higher priority status than specified creditors.B.is secondary to equity.C.must give preference to the specified creditor in the event of default.D.has been issued because the company is in default.E.None of the above.Difficulty level: MediumTopic: SUBORDINATED DEBENTUREType: CONCEPTS25. Not paying the dividends on a cumulative preferred issue may result in:A.preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.B.voting rights are granted to preferred stockholders if preferred dividends are in arrears.C.no payment of dividends to common shareholders.D.Both A and B.E.Both B and C.Difficulty level: MediumTopic: PREFERRED STOCK AND DIVIDENDSType: CONCEPTS26. Preferred stock has both a tax advantage and a tax disadvantage. These two are:A.in default there are no taxes and dividends are taxed in corporate hands at 70%.B.corporate dividends are taxed on 30% of the dividends received and expenses are deductible.C.dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.D.dividends are fully tax deductible but are not equity capital.E.None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS27. Preferred stock may be desirable to issue for which of the following reason(s)A.If there is no taxable income, preferred stock does not impose a tax penalty.B.The failure to pay preferred dividends, cumulative or noncumulative, will not cause bankruptcy.C.Preferred dividends are not tax deductible and therefore will not provide a tax shield but will reduce net income.D.Both B and C.E.Both A and B.Difficulty level: ChallengeTopic: PREFERRED STOCKType: CONCEPTS28. Preferred stock may exist because:A.losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B.an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C.corporations get a 70% tax exemption on preferred dividends received.D.All of the above.E.None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS29. The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings. This prohibition is an example of a(n):A.maintenance of security provision.B.collateral restriction.C.affirmative indenture.D.restrictive covenant.E.None of the above.Difficulty level: EasyTopic: RESTRICTIVE COVENANTType: CONCEPTS30. What percentage of the dividends received by one corporation from another is taxableA.15%B.30%C.34%D.70%E.100%Difficulty level: EasyTopic: TAXABLE CORPORATE DIVIDENDSType: CONCEPTS31. Which of the following statements about preferred stock is trueA.Unlike dividends paid on common stock, dividends paid on preferred stock are a tax-deductible expense.B.Unpaid dividends on preferred stock are a debt of the corporation.C.If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.D.There is no difference in the voting rights of preferred and common stockholders.E.None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS32. If a debt issue is callable, the call price is generally ____ par.A.greater thanB.less thanC.equal toD.unrelated toE.It varies widely based on the risk of the firm.Difficulty level: EasyTopic: CALLABLE DEBTType: CONCEPTS33. There was an upward trend in the ratio of the book value of debt to the book value of debt and equity throughout the 1990s. Some of this was due to the repurchasing of stock. The market value ratio of debt to debt and equity exhibited no upward trend. This can be explained by:A.the change in the accounting rules of the period.B.the difference between tax accounting and accounting for financial accounting purposes.C. a large increase in the market value of equity that was greater than the increase in debt.D.All of the above.E.None of the above.Difficulty level: EasyTopic: DEBT FINANCING TRENDSType: CONCEPTS。

公司理财期末考试复习

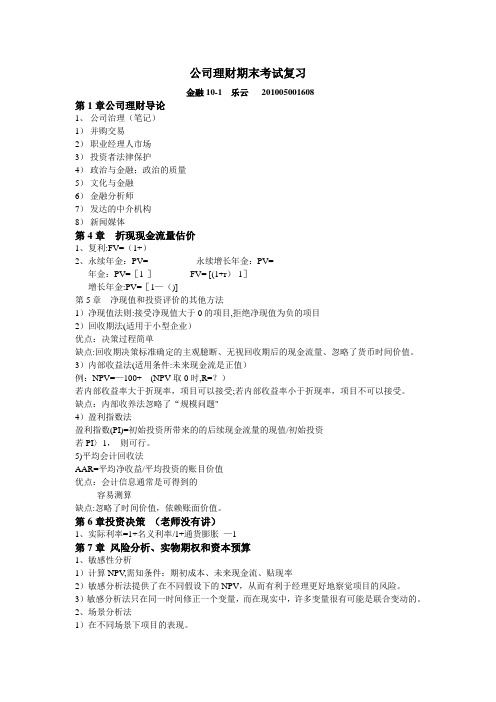

公司理财期末考试复习金融10-1 乐云201005001608第1章公司理财导论1、公司治理(笔记)1)并购交易2)职业经理人市场3)投资者法律保护4)政治与金融;政治的质量5)文化与金融6)金融分析师7)发达的中介机构8)新闻媒体第4章折现现金流量估价1、复利:FV=(1+)2、永续年金:PV= 永续增长年金:PV=年金:PV=[1-]FV= [(1+r)-1]增长年金:PV=[1—()]第5章净现值和投资评价的其他方法1)净现值法则:接受净现值大于0的项目,拒绝净现值为负的项目2)回收期法(适用于小型企业)优点:决策过程简单缺点:回收期决策标准确定的主观臆断、无视回收期后的现金流量、忽略了货币时间价值。

3)内部收益法(适用条件:未来现金流是正值)例:NPV=—100+ (NPV取0时,R=?)若内部收益率大于折现率,项目可以接受;若内部收益率小于折现率,项目不可以接受。

缺点:内部收养法忽略了“规模问题"4)盈利指数法盈利指数(PI)=初始投资所带来的的后续现金流量的现值/初始投资若PI〉1,则可行。

5)平均会计回收法AAR=平均净收益/平均投资的账目价值优点:会计信息通常是可得到的容易测算缺点:忽略了时间价值,依赖账面价值。

第6章投资决策(老师没有讲)1、实际利率=1+名义利率/1+通货膨胀—1第7章风险分析、实物期权和资本预算1、敏感性分析1)计算NPV,需知条件:期初成本、未来现金流、贴现率2)敏感分析法提供了在不同假设下的NPV,从而有利于经理更好地察觉项目的风险。

3)敏感分析法只在同一时间修正一个变量,而在现实中,许多变量很有可能是联合变动的。

2、场景分析法1)在不同场景下项目的表现。

2)操作性不强3、盈亏平衡法1)计算出项目盈亏平衡时所应实现的销售量2)帮助经理了解项目在亏损前做出错误的预测的危害性3)适用于工业4、实物期权1)拓展期权2)放弃期权3)择机期权5、决策树是对项目中的隐含期权和实物期权进行评估的方法。

公司理财(附答案)

对外经济贸易大学远程教育学院2009-2010学年第二学期《公司理财》期末考试题型与复习题要求掌握的主要内容一、掌握课件每讲后面的重要概念二、会做课件后的习题三、掌握各公式是如何运用的,记住公式会计算,特别是经营杠杆和财务杠杆要求对计算出的结果给予正确的解释。

四、掌握风险的概念,会计算期望值、标准差和变异系数,掌握使用这三者对风险判断的标准。

会运用CAPM计算预期收益率,掌握风险溢酬概念。

五、了解财务报表分析的重要性,掌握常用的比率分析法,会计算各种财务比率。

六、会编制现金流量表,并会用资本预算的决策标准判断项目是否可行。

七、最佳资本预算是融资与投资的结合,要求掌握计算边际资本成本表,根据内含报酬率排序,决定哪些项目可行。

八、从资本结构开始后主要掌握基本概念,没有计算题,考基本概念,类似期中作业。

模拟试题注:1、本试题仅作模拟试题用,可能没有涵盖全部内容,主要是让同学们了解大致题的范围,希望同学们还是要脚踏实地复习,根据复习要求全面复习。

最后考试题型或许有变化,但对于计算题,要回答选择题,仍然需要一步一步计算才能选择正确。

2、在正式考试时,仍然需要认真审题,看似相似的题也可能有不同,认真审题非常重要,根据题目要求做才能保证考试顺利。

预祝同学们考试顺利!模拟试题,每小题2分,正式考试时只有50题,均采用这种题型(请和本学期大纲对照,答案供参考)一、单项选择题(每小题2分)1. 上市公司在考虑股东利益时追求的主要目标应该是:A. 预期的总利润最大化B. 预期的每股收益(EPS)最大化C. 预期的净收益最大化D. 每股股价最大化2. 以下哪项工作可以减少股东与债权人的代理冲突:A. 在公司债券合同中包含限制性的条款B. 向经理提供大量的股票期权C. 通过法律使得公司更容易抵制敌意收购D. 以上所有都是正确的3. 以下哪项措施很可能减少股东和经理之间的代理冲突:A. 付给经理很多固定薪金B. 增加公司替换经理的威胁C. 在债务合同中设置限制性条款D. 以上所有都是正确的4. 以下哪项措施很可能减少股东和经理之间的代理冲突:A. 通过法律严格限制敌意收购B. 经理得到较低的薪水但可以得到额外的公司股票C. 董事会对其公司管理不善加强监控D. B和C是正确的5. 以下哪项机制可以用来激励经理为股东利益而工作?A. 债券契约B. 被收购的威胁C. 来自于董事会的压力D. B和C是正确的6. 以下哪个说法最正确?A. 财务经理的主要目的是为了公司预期现金流量最大化,因为这些预期现金流量最能增加公司股东(所有者)的财富。

公司理财考试复习题及答案

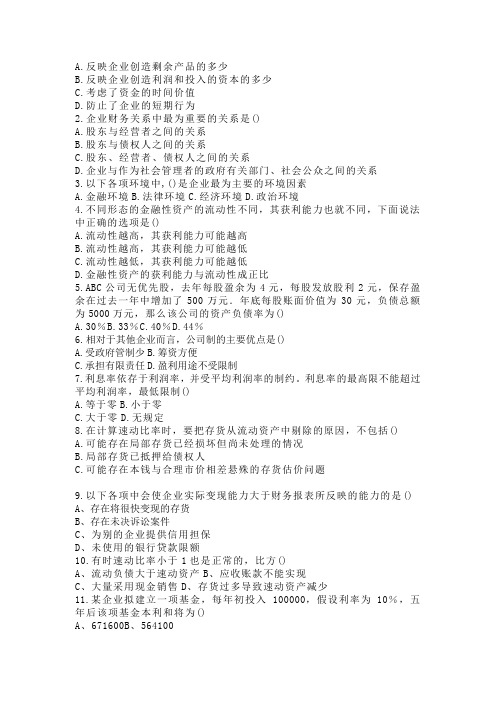

A.反映企业创造剩余产品的多少B.反映企业创造利润和投入的资本的多少C.考虑了资金的时间价值D.防止了企业的短期行为2.企业财务关系中最为重要的关系是()A.股东与经营者之间的关系B.股东与债权人之间的关系C.股东、经营者、债权人之间的关系D.企业与作为社会管理者的政府有关部门、社会公众之间的关系3.以下各项环境中,()是企业最为主要的环境因素A.金融环境B.法律环境C.经济环境D.政治环境4.不同形态的金融性资产的流动性不同,其获利能力也就不同,下面说法中正确的选项是()A.流动性越高,其获利能力可能越高B.流动性越高,其获利能力可能越低C.流动性越低,其获利能力可能越低D.金融性资产的获利能力与流动性成正比5.ABC公司无优先股,去年每股盈余为4元,每股发放股利2元,保存盈余在过去一年中增加了500万元.年底每股账面价值为30元,负债总额为5000万元,那么该公司的资产负债率为()A.30%B.33%C.40%D.44%6.相对于其他企业而言,公司制的主要优点是()A.受政府管制少B.筹资方便C.承担有限责任D.盈利用途不受限制7.利息率依存于利润率,并受平均利润率的制约。

利息率的最高限不能超过平均利润率,最低限制()A.等于零B.小于零C.大于零D.无规定8.在计算速动比率时,要把存货从流动资产中剔除的原因,不包括()A.可能存在局部存货已经损坏但尚未处理的情况B.局部存货已抵押给债权人C.可能存在本钱与合理市价相差悬殊的存货估价问题9.以下各项中会使企业实际变现能力大于财务报表所反映的能力的是()A、存在将很快变现的存货B、存在未决诉讼案件C、为别的企业提供信用担保D、未使用的银行贷款限额10.有时速动比率小于1也是正常的,比方()A、流动负债大于速动资产B、应收账款不能实现C、大量采用现金销售D、存货过多导致速动资产减少11.某企业拟建立一项基金,每年初投入100000,假设利率为10%,五年后该项基金本利和将为()A、671600B、564100C、871600D、61050012.风险报酬斜率的大小取决于()A、标准差B、投资者对风险的心态C、期望报酬率D、投资工程13.如果A、B两种证券的相关系数等于1,A的标准差为18%,B的标准差为10%,在等比例投资的情况下,该证券组合的标准差等于()A、28%B、14%C、8%D、18%14.以下各项中,代表即付年金现值系数的是()A.[〔P/A,i,n+1〕+1]B.[(P/A,i,n+1)-1]C.[(P/A,i,n-1)-1]D.[(P/A,i,n-1)+1]15.方洪拟存入一笔资金以备三年后使用。

公司理财考试计算重点

公司股票的β系数为,无风险利率为6%,市场上所有股票的平均收益率为10%。

要求:(1)计算该股票的预期收益率;(2)若该股票为固定增长股,增长率为6%,预计一年后的股利为元,计算该股票的价值;(3)若该股票未来三年股利呈零增长,每期股利为元,预计从第四年起转为正常增长,增长率为6%,计算该股票的价值。

(P/A ,16%,3)=; (P/F ,16%,3)=; 计算结果保留两位小数点。

已知:β=,rm=6%,rf=10%(1)rs=rm+β(rm-rf )=6%+(10%-6%)=16%(2)g=6%,P0= D1÷(rs-g )(2分)=÷(16%-6%)=15元(1分)(3)P0=×(P/A,16%,3)+%6%16%615.1-+⨯)(×(P/F,16%,3) =×+×=(元)2.ABC 公司的有关资料见下表所示:ABC 公司资料表 单位:万元ABC 公司正在考虑将资本结构中的债务比率增加到60%(假设通过发行债券回购股票改变资本结构,资本总额保持不变)。

目前股票以账面价值每股25元交易,发行债券前后的利率均为9%,所得税税率为25%。

要求:(1)如果负债比率提高到60%,公司需要发行多少新债回购股票?(2)计算发行新债回购股票前后普通股股数。

(3)计算资本结构改变前后的每股收益。

(4)计算资本结构改变前后的财务杠杆系数。

(5)如果息税前利润下降5%,你认为资本结构改变前后的每股收益会发生什么变化?(1)公司需发行新债=10000×60%-1200=4800(万元)(2)回购股票数=4800/25=192(万股)发行新债前股数=8800/25=352(万股)发行新债后股数=352-192=160(万股)(3)每股收益:发行新债前=(1500-1200×9%)×(1-25%)/352=(元)发行新债后=(1500-6000×9%)×(1-25%)/160=(元)(4)财务杠杆系数:发行新债前=1500/(1500-1200×9%)=发行新债后=1500/(1500-6000×9%)=(5)如果息税前利润下降5%,发行新债后的每股收益率下降幅度会大于发行新债前每股收益下降幅度,因为前者的财务杠杆系数小于后者。

考试题目1 公司理财

一、单选题1、不属于金融客户的评估依据的是(B )A、职业B、民族C、家庭情况D、社会阶层2、不太适合给客户打电话的时间是(C )A、9点到10点B、12点到13点C、13点半14点半D、17到18点3、以下不属于挖掘客户常用的方法的有( B)A、缘故法B、建立影响中心C、问卷调查法D、转介绍4、潜在客户具备的特征是(A)A、存在对金融服务的需求B、对金融服务没有需求C、不具备经济基础D、对金融服务比较抗拒5、电话访问式问卷不需要考虑的因素有(D )A、通话时间限制B、记录的需要C、对方的性别D、记忆的规律6、不属于客户在购买金融服务的过程中面临的主要风险的是(B )A、功能风险B、心理C、社会D、政治7、以下哪一项不是在电话预约客户之前应做的准备工作( D)A、准备客户基本资料B、打电话的具体内容C、合适的通话时间D、打电话时的天气情况8、以下哪一项不属于金融服务营销中经常使用的营销策略(D )A、产品策略B、价格C、渠道D、人员9、常用的金融服务营销不包括( A)A、政府部门B、兼职代理C、群体组织D、合作机构10、在转介绍过程中使用礼品应注意的问题有(C )A、礼品一定要贵重B、应经常赠送礼品C、礼品一定要控制成本D、尽量送不要钱的礼品11、金融产品居于中心地位的是(B )A、形式产品B、核心C、扩展D、重点12、市场营销组合的4P是指(D )A、价格、权利、地点、促销B、价格、广告、地点、产品C、价格、公关、地点、产品D、价格、产品、地点、促销13、金融产品晟敏周期的第二阶段是(B )A、引入期B、成长期C、成熟期D、衰退期14、金融机构采取报刊评论、研讨会,赞助等促销行为,属于(C )类型的组合促销活动A、广告、宣传B、销售促销C、公共关系D、人员促销15、在金融产品生命周期的最初阶段,把金融产品价格定得很高,以获取最大利润的定价策略是(A )A、撇脂定价B、渗透定价C、产品线定价D、单一价格定价16、身边没有孩子的老年夫妻是家庭生命周期的(A )A、空巢期B、满巢期C、孤独期D、离巢期17、把个人客户分为理性型、保守型、平稳型、冲动型、冒险型是按(C)进行划分A、心理标准B、人口标准C、行为标准D、利益标准18、对年龄在28—35岁的客户,应该重点推广(B )类金融产品A、无形性B、异质性C、同步性D、易逝性19、金融服务的(C )特征表明,顾客只有而且必须加入到服务的生产过程中享受到服务A无形性 B异质性 C同步性 D易逝性20、香港汇丰银行能够面对花旗银行的激烈竞争,对亚洲市场进行细分,争取了大量优质客户,占领了高端市场,它采取的是(C )定位策略。

公司理财试题A

江苏管理干部学院《公司理财》期末考试A卷姓名 学号 成绩一、单项选择题(下列每小题的备选答案中,只有一个符合题意的正确答案。

请将你选定的答案字母填入题后的括号中。

本类题共20个小题,每小题1分,共20分。

多选、错选、不选均不得分)1.现代公司理财的目标是( )。

A.企业价值最大化 B.利润最大化C.每股收益最大化 D.销售收入最大化2.影响速动比率可信性的最主要因素是( )。

A.存货的变现能力 B.短期证券的变现能力C.产品的变现能力 D.应收账款的变现能力3.下列财务比率反映企业短期偿债能力的有( )。

A 现金流量比率B 资产负债率C 偿债保障比率D 利息保障倍数4.比较不同方案的风险程度应用的指标是( )。

A.期望值 B.标准差 C.方差 D.标准离差率5.某上市公司股票的β系数为1.5,此时无风险利率为6%,市场上所有股票的平均收益率为12%,则该公司股票的预期收益率为( )。

A.9% B.15% C.18% D.21%6.现金作为一种资产,它的( )。

A.流动性强,盈利性也强 B.流动性强,盈利性差C.流动性差,盈利性强 D.流动性差,盈利性差7.某公司以10%的年利率借得款项20000元,银行要求公司在一年内逐月均衡偿还,则该项借款的实际利率为( )。

A.10% B.20% C.16% D.22%8.某投资项目,折现率为10%时,净现值为500元,折现率为15%时,净现值为-480元,则该项目的内含报酬率为( )。

A.13.15% B.12.75% C.12.55% D.12.25%9.在进行投资项目风险分析时,易夸大远期现金流量风险的方法是( )。

A.调整现金流量法 B.风险调整折现率法C.净现值法 D.内含报酬率法10.不属于应收账款信用条件的是( )。

A.信用期限 B.折扣期限 C.现金折扣率 D.收账政策 11.某企业规定的信用条件是“5/10,2/20,n/30”,一客户从该企业购入原价为10000元的原材料,并于第15天付款,该客户实际支付的货款应为( )元。

公司理财习题库chap018