D1 03 Regulatory Trends & Business Implications Apr 2008

股权投资一级市场英语

股权投资一级市场英语The primary market is a crucial component of the financial ecosystem, serving as the gateway for companies to raise capital and for investors to gain exposure to new investment opportunities. Within this market, equity investment plays a vital role, allowing investors to participate in the growth and success of emerging businesses. As the global economy continues to evolve, understanding the dynamics of the primary market and the nuances of equity investment has become increasingly important for both individual and institutional investors.One of the primary advantages of the primary market is the ability to access investment opportunities that are not readily available in the secondary market. These opportunities often come in the form of initial public offerings (IPOs) or private placements, where investors can participate in the early stages of a company's development. By investing in the primary market, investors can potentially benefit from the upside potential of a company's growth, as well as the opportunity to shape the trajectory of the business through active involvement.However, navigating the primary market can be a complex endeavor, requiring a deep understanding of the regulatory landscape, market dynamics, and the due diligence process. Investors must carefully evaluate the fundamentals of the companies they are considering, assessing factors such as the management team, financial performance, industry trends, and competitive positioning. This level of scrutiny is crucial, as the primary market can be more volatile and riskier than the secondary market, with a higher potential for both substantial gains and losses.One of the key aspects of equity investment in the primary market is the concept of valuation. Determining the appropriate valuation of a company is a critical component of the investment decision-making process. Investors must carefully analyze the company's financial statements, growth projections, and market positioning to arrive at a reasonable valuation range. This analysis can be particularly challenging in the case of early-stage or high-growth companies, where traditional valuation methods may not fully capture the potential of the business.In addition to valuation, investors must also consider the regulatory environment and the specific requirements for participation in the primary market. In many jurisdictions, there are strict guidelines and regulations governing the issuance of securities, the disclosure ofinformation, and the eligibility of investors. Compliance with these regulations is essential, as non-compliance can result in significant legal and financial consequences.Another important aspect of equity investment in the primary market is the role of underwriters. Underwriters are financial institutions that facilitate the issuance of securities, providing guidance and support to the issuing company throughout the process. These intermediaries play a crucial role in pricing the offering, marketing the securities to potential investors, and ensuring the successful completion of the transaction. Investors must carefully evaluate the reputation and track record of the underwriters involved in a particular offering, as their expertise and integrity can significantly impact the success of the investment.Beyond the technical aspects of equity investment in the primary market, investors must also consider the broader economic and market conditions that can influence the performance of their investments. Factors such as interest rates, economic growth, industry trends, and global events can all have a significant impact on the valuation and performance of primary market investments. Successful investors must be able to navigate these complexities, adapting their strategies and risk management approaches to capitalize on opportunities while mitigating potential downside risks.In conclusion, equity investment in the primary market presents both opportunities and challenges for investors. By understanding the regulatory environment, valuation methodologies, and the role of underwriters, investors can position themselves to identify and capitalize on promising investment opportunities in the primary market. However, this endeavor requires a significant level of research, analysis, and risk management, as the primary market can be more volatile and uncertain than the secondary market. As the global financial landscape continues to evolve, the importance of primary market equity investment will only continue to grow, making it a critical area of focus for both individual and institutional investors.。

2023年中国医疗器械行业发展状况分析报告模板

医疗器械行业未来发展趋势预测

标题一: 医疗行业的发展状况医疗行业的发展状况1.医疗器械行业的发展状 况 近年来,中国医疗器械行业一直保持高速增长的态势,特别是在政策支持和科技进步的双重推动下,行业发 展速度更是显著提升。据统计,2022年中国医疗器械市场规模已经达到了惊人的X亿元,较前一年增长了百 分之Y。其中,医疗设备、耗材和医疗服务等领域的增长尤其显著。2.医疗器械 行业未来发展趋势预测 3. 智能化和数字化将成为主流随着人工智能和物联网技术的发展,医疗器械的智能化和数字化趋势越来越明 显。预计未来几年,智能医疗设备将在医疗器械市场占据越来越重要的地位。据统计,到2025年,智能化 医疗设备将占据医疗器械市场的一半以上份额。4. 高端医疗设备市场将持续扩大

PART 01

医疗器械行业市场规模及增长趋 势

Market size and growth trend of the medical device industry

市场规模分析: 当前市场规模-预计未来市场规模- 影响因素 分析

1 .医疗行业市场规模及发展状况简析

标题一: 医疗行业的发展状况市场规模分析: 2. 当前市场规模: 当前,中国的医疗器械行业已进入了快速增长期,市场 规模呈现出逐年增长的趋势。据统计,截至2022年底,中国的医疗器械市场规模已达到 了约XX亿元人民币,比去年同期增长了约XX%。这一增长主要得益于国家对医疗行业的重视和投入,以及公众对 健康需求的不断提高。3. 预计未来市场规模: 预计未来几年,中国的医疗器械市场规模将继续保持快速增长。一方面 ,随着国家对医疗行业的投入不断加大,医疗设施和服务的覆盖面将进一步扩大,医 疗器械的需求量也将随之增加。另一方面,随着公众健康意识的提高,医疗器械的使用率也将不断提高,这也将 推动 市场规模的扩大。据预测,到2025年,中国的医疗器械市场规模将达到约XX亿元人民币。影响因素分析: 技术创新 是医疗器械行业发展的关键因素之一。随着科技的不断进步,越来越多的新技术、新材料和新工艺被应用 于医疗器械 研发和生产中,这不仅提高了医疗器械的性能和安全性,也降低了生产成本,从而提高了市场竞争力。

英文财务季度分析报告(3篇)

第1篇Executive SummaryThis report provides a comprehensive analysis of the financial performance of [Company Name] for the quarter ending [Date]. The analysis covers key financial metrics, revenue trends, cost analysis, and profitability. The report aims to assess the company’s financial health, identify areas of strength and weakness, and provide insights for future strategic decisions.1. Introduction[Company Name] is a [brief description of the company’s industry and main products/services]. The company operates in a highly competitive market and has been striving to maintain its market share and profitability. This report aims to evaluate the company’s financial performance over the past quarter and provide recommendations for improvement.2. Financial Highlights2.1 RevenueThe total revenue for the quarter ending [Date] was [Amount], representing a [percentage] increase/decrease from the previous quarter and a [percentage] increase/decrease from the same quarter last year. The revenue growth can be attributed to [key factors contributing to revenue growth, such as new product launches, market expansion, or increased sales in existing markets].2.2 ProfitabilityThe net income for the quarter was [Amount], resulting in a net margin of [percentage]. This represents a [percentage] increase/decrease from the previous quarter and a [percentage] increase/decrease from the same quarter last year. The improved profitability can be attributed to [key factors contributing to increased profitability, such as cost reduction measures, improved operational efficiency, or higher sales margins].2.3 Operating ExpensesOperating expenses for the quarter were [Amount], which represents a [percentage] increase/decrease from the previous quarter. The main contributors to the increase/decrease in operating expenses were [mention specific expenses, such as marketing, research and development, or administrative costs].2.4 Cash FlowThe company’s cash flow from operations was [Amount], indicating a [percentage] increase/decrease from the previous quarter. Theincrease/decrease in cash flow can be attributed to [key factors, such as improved collections from customers, reduced accounts payable, or increased sales].3. Revenue Analysis3.1 Product/Service Line AnalysisThe revenue breakdown by product/service line is as follows:- Product/Service Line A: [Percentage of total revenue] with revenue of [Amount]- Product/Service Line B: [Percentage of total revenue] with revenue of [Amount]- Product/Service Line C: [Percentage of total revenue] with revenue of [Amount]The highest-growth product/service line was [Product/Service Line A], which saw a [percentage] increase in revenue. This growth can be attributed to [factors contributing to the growth, such as new market segments, product enhancements, or increased marketing efforts].3.2 Geographic AnalysisThe revenue breakdown by geographic region is as follows:- Region A: [Percentage of total revenue] with revenue of [Amount]- Region B: [Percentage of total revenue] with revenue of [Amount]- Region C: [Percentage of total revenue] with revenue of [Amount]Region A was the highest contributor to revenue, accounting for [percentage] of the total. The growth in this region can be attributedto [factors contributing to the growth, such as successful market entry, increased demand, or local economic growth].4. Cost Analysis4.1 Cost of Goods Sold (COGS)The COGS for the quarter was [Amount], representing [percentage] oftotal revenue. The main drivers of COGS were [mention specific cost components, such as raw materials, labor, or manufacturing overhead]. The cost of goods sold increased by [percentage] from the previous quarter, primarily due to [factors contributing to the increase, such as price increases for raw materials or increased production volumes].4.2 Selling, General, and Administrative (SG&A) ExpensesSG&A expenses for the quarter were [Amount], which represents [percentage] of total revenue. The main components of SG&A expenses were [mention specific expense categories, such as salaries, marketing, or administrative costs]. The increase/decrease in SG&A expenses can be attributed to [factors contributing to the change, such as changes in staffing levels, marketing campaigns, or other administrative activities].5. Profitability Analysis5.1 Gross MarginThe gross margin for the quarter was [percentage], which represents a [percentage] increase/decrease from the previous quarter. Theincrease/decrease in gross margin can be attributed to [factors contributing to the change, such as changes in product mix, cost savings, or improved pricing strategies].5.2 Operating MarginThe operating margin for the quarter was [percentage], reflecting a [percentage] increase/decrease from the previous quarter. Theincrease/decrease in operating margin can be attributed to [factors contributing to the change, such as improved operational efficiency, reduced operating expenses, or increased revenue].6. Key Findings and Recommendations6.1 Key Findings- Revenue growth was driven by [key factors].- Profitability improved due to [key factors].- Cost of goods sold increased primarily due to [factors].- SG&A expenses were [increase/decrease], driven by [factors].6.2 Recommendations- Continue to invest in [key areas, such as product development, marketing, or market expansion].- Evaluate the effectiveness of cost-saving initiatives and implement further measures where necessary.- Monitor the performance of [key product/service lines or geographic regions] and adjust strategies accordingly.- Strengthen cash flow management to ensure adequate liquidity.7. ConclusionThis report provides a detailed analysis of [Company Name]’s financial performance for the quarter ending [Date]. The company has shown strong revenue growth and improved profitability, driven by various factors. However, there are areas that require attention, such as cost management and operational efficiency. By implementing the recommended strategies, [Company Name] can continue to strengthen its financial position and achieve long-term success.Appendix- Detailed financial statements- Breakdown of revenue by product/service line and geographic region- Analysis of key financial ratios- Trend analysis of key financial metricsNote: This report is for internal use only and should not be distributed without the permission of [Company Name].第2篇IntroductionThis report provides a comprehensive analysis of the financial performance of [Company Name] for the quarter ending [Date]. Theanalysis covers key financial metrics, profitability, liquidity, solvency, and efficiency ratios, as well as a discussion of the major factors influencing the company's performance during the quarter. The report aims to offer insights into the financial health of the company and guide stakeholders in making informed decisions.Executive SummaryThe financial performance of [Company Name] for the quarter ending [Date] has been robust, with a significant increase in revenue and profit margins. The company has demonstrated strong operational efficiency and has maintained a healthy liquidity position. However, challenges in the market and competitive pressures require continued vigilance andstrategic adjustments to ensure sustained growth.Revenue AnalysisTotal revenue for the quarter was [Amount], reflecting a [Percentage] increase from the previous quarter and a [Percentage] increase from the same quarter last year. The growth in revenue can be attributed to several factors:1. Increased Sales Volume: Sales volume increased by [Percentage],driven by strong demand in [Product/Service Category].2. Product Mix Improvement: The company has successfully shifted its product mix towards higher margin products, contributing to a [Percentage] increase in revenue.3. Geographical Expansion: The company has expanded its market reach, particularly in [Region/Country], which has led to a [Percentage] increase in revenue.Profitability AnalysisNet profit for the quarter was [Amount], representing a [Percentage] increase from the previous quarter and a [Percentage] increase from the same quarter last year. The increase in profitability can be attributed to the following factors:1. Cost Control: The company has successfully implemented cost control measures, resulting in a [Percentage] decrease in operating expenses.2. Efficiency Improvements: Operational efficiency has improved by [Percentage], leading to lower production costs.3. Price Increases: The company has implemented price increases in certain products, which has contributed to higher profit margins.Liquidity AnalysisThe company's liquidity position remains strong, with a current ratio of [Ratio] and a quick ratio of [Ratio]. The current ratio indicates that the company has sufficient current assets to cover its current liabilities, while the quick ratio demonstrates the company's ability to meet its short-term obligations without relying on inventory.Solvency AnalysisThe company's solvency position is also healthy, with a debt-to-equity ratio of [Ratio]. This ratio indicates that the company's equity is [Percentage] of its total assets, suggesting a low level of financial leverage.Efficiency AnalysisThe company's operational efficiency has improved, as evidenced by the following ratios:1. Inventory Turnover: The inventory turnover ratio has increased to [Ratio], indicating a faster turnover of inventory.2. Accounts Receivable Turnover: The accounts receivable turnover ratio has improved to [Ratio], suggesting improved collection efficiency.3. Fixed Asset Turnover: The fixed asset turnover ratio has increased to [Ratio], indicating more efficient use of fixed assets.Risk FactorsDespite the positive financial performance, several risk factors need to be monitored:1. Competition: Intense competition in the market may erode profit margins.2. Economic Conditions: Economic downturns can impact consumer spending and demand for the company's products/services.3. Regulatory Changes: Changes in regulations may increase costs and impact the company's operations.ConclusionThe financial performance of [Company Name] for the quarter ending [Date] has been commendable, with strong revenue growth and improved profitability. The company's strong liquidity and solvency positions, along with its operational efficiency, indicate a healthy financial outlook. However, continued vigilance and strategic adjustments are required to address potential risks and ensure sustained growth.Recommendations1. Market Expansion: Continue to explore new markets and expand the company's geographical reach.2. Product Development: Invest in research and development to create innovative products that meet customer needs.3. Cost Management: Maintain a focus on cost control and operational efficiency to ensure sustainable profitability.4. Risk Management: Develop strategies to mitigate potential risks, such as economic downturns and regulatory changes.By implementing these recommendations, [Company Name] can continue to build a strong financial foundation and achieve long-term success.AppendixThe following tables provide a detailed breakdown of the financial metrics discussed in this report:1. Revenue Breakdown by Product/Service2. Profit and Loss Statement3. Balance Sheet4. Cash Flow StatementThis report is intended to provide a comprehensive analysis of [Company Name]'s financial performance for the quarter ending [Date]. For further information or clarification, please refer to the appendices or contact the financial team.[Signature][Name][Title][Company Name][Date]第3篇Executive SummaryThis report provides a comprehensive analysis of the financial performance of [Company Name] for the third quarter of [Fiscal Year].The report covers key financial metrics, profitability, liquidity, solvency, and operational efficiency. It also includes an analysis of the external environment and a discussion on the potential risks and opportunities facing the company. The objective is to provide stakeholders with insights into the company's financial health and its prospects for the future.1. Introduction[Company Name] is a leading [industry/sector] company with a strong presence in [key markets/geographical regions]. The company operates through [number of business segments] segments, each contributing to the overall financial performance. This report focuses on the financial performance of the company for the third quarter of [Fiscal Year], comparing it with the same period in the previous year and with the industry benchmarks.2. Financial HighlightsRevenue: Total revenue for the third quarter was [amount], representing a [percentage] increase/decrease compared to the same period last year. This growth was driven by [key factors, e.g., new product launches, increased market share, expansion into new markets].Net Income: Net income for the third quarter was [amount], reflecting a [percentage] increase/decrease compared to the same period last year. The increase/decrease was primarily due to [factors such as improved operating margins, cost reductions, or changes in tax laws].Earnings Per Share (EPS): EPS for the third quarter was [amount], indicating a [percentage] increase/decrease from the same period last year. This increase/decrease was primarily due to [factors such as higher net income and a decrease/increase in the number of outstanding shares].Return on Equity (ROE): ROE for the third quarter was [percentage],up/down from [percentage] in the same period last year. Theimprovement/deterioration was primarily due to [factors such as increased net income and a decrease/increase in equity].Current Ratio: The current ratio for the third quarter was [ratio], indicating [solvency position, e.g., strong liquidity, sufficient to cover short-term obligations].Debt-to-Equity Ratio: The debt-to-equity ratio for the third quarter was [ratio], showing [financial leverage, e.g., moderate leverage, indicating a balanced capital structure].3. Detailed Financial Analysis3.1 Revenue AnalysisSegment-wise Revenue: The breakdown of revenue by segment is as follows:Segment A: [amount], representing [percentage] of total revenue.Segment B: [amount], representing [percentage] of total revenue.Segment C: [amount], representing [percentage] of total revenue.Product-wise Revenue: The breakdown of revenue by product is as follows:Product X: [amount], representing [percentage] of total revenue.Product Y: [amount], representing [percentage] of total revenue.Product Z: [amount], representing [percentage] of total revenue.Market-wise Revenue: The breakdown of revenue by market is as follows:Market A: [amount], representing [percentage] of total revenue.Market B: [amount], representing [percentage] of total revenue.Market C: [amount], representing [percentage] of total revenue.3.2 Profitability AnalysisGross Margin: The gross margin for the third quarter was [percentage], up/down from [percentage] in the same period last year. The change was primarily due to [factors such as increased sales volume, cost reductions, or changes in product mix].Operating Margin: The operating margin for the third quarter was [percentage], up/down from [percentage] in the same period last year. The change was primarily due to [factors such as improved operational efficiency, cost reductions, or changes in revenue mix].Net Margin: The net margin for the third quarter was [percentage],up/down from [percentage] in the same period last year. The change was primarily due to [factors such as increased net income, lower interest expenses, or changes in tax laws].3.3 Liquidity and Solvency AnalysisCurrent Ratio: The current ratio remained stable at [ratio], indicating that the company has sufficient liquidity to meet its short-term obligations.Debt-to-Equity Ratio: The debt-to-equity ratio has increased/decreased to [ratio], reflecting [financial leverage position, e.g., a moderate increase in leverage, which may be a strategic move to fund growth initiatives].Interest Coverage Ratio: The interest coverage ratio for the third quarter was [ratio], indicating that the company has[adequate/inadequate] ability to cover its interest expenses with its operating income.4. External Environment AnalysisThe external environment has been characterized by [key factors, e.g., economic growth, industry trends, regulatory changes, and technological advancements]. These factors have had both positive and negative impacts on the company's financial performance.4.1 Positive FactorsEconomic Growth: The global economy has shown signs of recovery, which has led to increased demand for [company's products/services].Industry Trends: The industry is witnessing [trends, e.g.,technological advancements, increased customer expectations, and consolidation].Technological Advancements: The company has been investing intechnology to improve its operational efficiency and product offerings.4.2 Negative FactorsRegulatory Changes: New regulations in [industry] have increased compliance costs for the company.Competition: The company faces increased competition from [competitors], which has put pressure on pricing and margins.5. Risks and Opportunities5.1 RisksEconomic Downturn: A global economic downturn could lead to reduced demand for the company's products/services.Competition: Intense competition could erode market share and profitability.Regulatory Changes: New regulations could increase costs and hinder growth.5.2 OpportunitiesMarket Expansion: The company has opportunities to expand into new markets and customer segments.Product Innovation: The development of new products and services can drive growth and improve profitability.Partnerships: Strategic partnerships can enhance the company's competitive position and market reach.6. Conclusion[Company Name] has delivered a strong financial performance in the third quarter of [Fiscal Year], driven by [key factors]. The company has a robust financial position and is well-positioned to capitalize on the opportunities in the external environment. However, it also faces significant risks, which need to be managed effectively. The management team is committed to driving sustainable growth and creating value for its stakeholders.7. RecommendationsContinue to invest in research and development to enhance product offerings.Explore strategic partnerships to expand market reach.Monitor regulatory changes and ensure compliance.Implement cost reduction initiatives to improve profitability.8. AppendicesFinancial StatementsKey RatiosIndustry BenchmarksManagement CommentaryNote: This report is a template and should be customized to reflect the specific financial data and circumstances of [Company Name].。

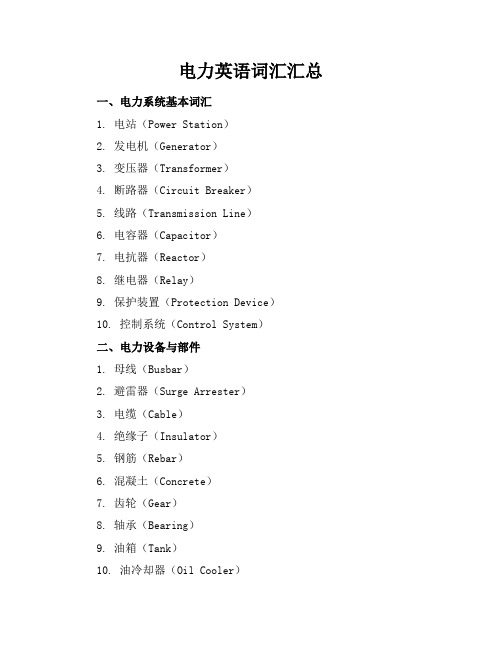

电力英语词汇汇总

电力英语词汇汇总一、电力系统基本词汇1. 电站(Power Station)2. 发电机(Generator)3. 变压器(Transformer)4. 断路器(Circuit Breaker)5. 线路(Transmission Line)6. 电容器(Capacitor)7. 电抗器(Reactor)8. 继电器(Relay)9. 保护装置(Protection Device)10. 控制系统(Control System)二、电力设备与部件1. 母线(Busbar)2. 避雷器(Surge Arrester)3. 电缆(Cable)4. 绝缘子(Insulator)5. 钢筋(Rebar)6. 混凝土(Concrete)7. 齿轮(Gear)8. 轴承(Bearing)9. 油箱(Tank)10. 油冷却器(Oil Cooler)三、电力工程术语1. 电力工程(Electric Power Engineering)2. 设计规范(Design Specification)3. 施工图纸(Construction Drawing)4. 工程预算(Project Budget)5. 施工方案(Construction Scheme)6. 质量验收(Quality Acceptance)7. 安全生产(Safety Production)8. 环境保护(Environmental Protection)9. 节能减排(Energy Saving and Emission Reduction)10. 智能电网(Smart Grid)四、电力行业组织与机构1. 国家能源局(National Energy Administration)2. 电力公司(Electric Power Corporation)3. 电力设计院(Electric Power Design Institute)4. 电力科学研究院(Electric Power Research Institute)5. 电力行业协会(Electric Power Industry Association)6. 电力工会(Electric Power Trade Union)7. 电力市场(Electricity Market)8. 电力监管机构(Electric Power Regulatory Authority)9. 电力消费者协会(Electric Power Consumer Association)10. 国际电力组织(International Electric Power Organization)五、电力技术与发展1. 火力发电(Thermal Power Generation)2. 水力发电(Hydroelectric Power Generation)3. 核能发电(Nuclear Power Generation)4. 风能发电(Wind Power Generation)5. 太阳能发电(Solar Power Generation)6. 新能源(New Energy)7. 分布式发电(Distributed Generation)8. 电动汽车(Electric Vehicle)9. 能源互联网(Energy Internet)10. 电力系统自动化(Electric Power System Automation)六、电力运行与维护1. 电网调度(Power Grid Dispatching)2. 运行监控(Operation Monitoring)3. 设备巡检(Equipment Patrol Inspection)4. 预防性维修(Preventive Maintenance)5. 故障处理(Fault Handling)6. 状态检修(ConditionBased Maintenance)7. 安全操作(Safe Operation)8. 电力可靠性(Electric Power Reliability)9. 负荷预测(Load Forecasting)10. 电力质量(Power Quality)七、电力法律法规与政策1. 电力法(Electricity Law)2. 电力市场监管条例(Electricity Market Regulation)3. 电力设施保护条例(Regulations for the Protection of Electric Power Facilities)4. 电力供应与使用条例(Regulations on Electric Power Supply and Use)5. 电力价格政策(Electricity Pricing Policy)6. 电力体制改革(Electricity System Reform)7. 能源发展战略行动计划(Energy Development Strategy Action Plan)8. 环境保护法律法规(Environmental Protection Laws and Regulations)9. 节能减排政策(Energy Saving and Emission Reduction Policy)10. 电力行业发展规划(Electric Power Industry Development Plan)八、电力市场与交易1. 电力市场交易规则(Electricity Market Trading Rules)2. 电力中长期合同(Longterm Electricity Contract)3. 电力现货市场(Electricity Spot Market)4. 电价形成机制(Electricity Price Formation Mechanism)5. 售电公司(Electricity Sales Company)6. 用户侧响应(Customer Side Response)7. 跨区电力交易(Crossregional Electricity Trade)8. 电力市场分析(Electricity Market Analysis)9. 电力市场竞争(Electricity Market Competition)10. 电力市场风险管理与控制(Electricity Market Risk Management and Control)九、电力行业发展趋势1. 电力行业数字化转型(Digital Transformation of Electric Power Industry)2. 电力系统灵活性(Flexibility of Electric Power System)3. 电力储能技术(Electricity Storage Technology)4. 电力需求侧管理(Electricity Demand Side Management)5. 电力行业智能化(Intelligence of Electric Power Industry)6. 电力行业绿色低碳发展(Green and Lowcarbon Development of Electric Power Industry)7. 电力行业国际合作(International Cooperation inElectric Power Industry)8. 电力行业人才培养(Talent Training in Electric Power Industry)9. 电力行业科技创新(Technological Innovation in Electric Power Industry)10. 电力行业可持续发展(Sustainable Development of Electric Power Industry)十、电力行业热点问题1. 电力供需平衡(Electricity Supply and Demand Balance)2. 电力系统安全稳定(Safety and Stability of Electric Power System)3. 电力扶贫(Electricity Poverty Alleviation)4. 电动汽车充电基础设施建设(Electric Vehicle Charging Infrastructure Construction)5. 电力行业去产能(Capacity Reduction in Electric Power Industry)6. 电力行业环境保护(Environmental Protection in Electric Power Industry)7. 电力行业信用体系建设(Credit System Construction in Electric Power Industry)8. 电力行业反垄断(Antitrust in Electric Power Industry)9. 电力行业对外开放(Openingup of Electric Power Industry)10. 电力行业社会责任(Social Responsibility of Electric Power Industry)十一、电力技术创新与应用1. 智能电网技术(Smart Grid Technology)2. 分布式能源系统(Distributed Energy Systems)3. 微电网技术(Microgrid Technology)4. 能量管理系统(Energy Management System)5. 高压直流输电(High Voltage Direct Current Transmission)6. 超导技术(Superconductivity Technology)7. 电力电子技术(Power Electronics Technology)8. 量子计算在电力领域的应用(Application of Quantum Computing in Electric Power Field)9. 大数据与电力系统分析(Big Data and Electric Power System Analysis)10. 云计算在电力行业的应用(Application of Cloud Computing in Electric Power Industry)十二、电力工程项目管理1. 项目可行性研究(Project Feasibility Study)2. 项目立项(Project Approval)3. 项目招投标(Project Bidding)4. 项目合同管理(Project Contract Management)5. 项目进度控制(Project Schedule Control)6. 项目成本管理(Project Cost Management)7. 项目质量管理(Project Quality Management)8. 项目风险管理(Project Risk Management)9. 项目验收与移交(Project Acceptance and Handover)10. 项目后评价(Project Postevaluation)十三、电力行业职业素养与技能1. 电力工程师职业道德(Professional Ethics for Electrical Engineers)2. 电力行业职业技能培训(Vocational Skills Training in Electric Power Industry)3. 电力行业职称评定(Professional Title Evaluation in Electric Power Industry)4. 电力行业从业资格证书(Qualification Certificates in Electric Power Industry)5. 电力行业创新能力培养(Innovation Ability Training in Electric Power Industry)6. 电力行业团队协作(Team Collaboration in Electric Power Industry)7. 电力行业沟通与协调能力(Communication and Coordination Skills in Electric Power Industry)8. 电力行业应急处理能力(Emergency Handling Ability in Electric Power Industry)9. 电力行业法律法规知识(Legal Knowledge in Electric Power Industry)10. 电力行业国际视野(International Perspective in Electric Power Industry)十四、电力行业国际合作与交流1. 国际电力组织(International Electric Power Organizations)2. 国际电力展览会(International Electric Power Exhibitions)3. 国际电力技术交流(International Electric Power Technology Exchange)4. 国际电力项目合作(International Electric Power Project Cooperation)5. 国际电力市场分析(International Electric Power Market Analysis)6. 国际电力标准制定(International Electric Power Standards Development)7. 国际电力人才培养与合作(International Electric Power Talent Training and Cooperation)8. 国际电力政策研究(International Electric Power Policy Research)9. 国际电力环境保护合作(International Electric Power Environmental Protection Cooperation)10. 国际电力行业发展趋势探讨(Discussion on International Electric Power Industry Development Trends)。

英语作文-资产管理行业监管趋严,公司纷纷加强合规建设

英语作文-资产管理行业监管趋严,公司纷纷加强合规建设In recent years, the asset management industry has faced a paradigm shift as regulatory bodies around the globe have tightened their oversight. This change has been driven by a growing need for transparency, accountability, and protection of investors' interests. As a result, companies within this sector are increasingly bolstering their compliance infrastructure to adapt to the stringent regulatory environment.The impetus for this regulatory rigor stems from past financial crises, which highlighted the repercussions of lax oversight and the potential risks posed by complex investment products. Consequently, regulators have introduced a slew of measures aimed at ensuring firms engage in ethical practices and maintain the integrity of the financial markets. These measures include enhanced due diligence requirements, stricter control over investment practices, and increased reporting and disclosure obligations.Firms are responding to these regulatory demands by investing in sophisticated compliance programs. They are employing advanced technologies such as artificial intelligence and machine learning to monitor transactions and detect anomalies that may indicate fraudulent activities or conflicts of interest. Compliance teams are also being expanded, with professionals who possess a deep understanding of regulatory laws and the ability to implement effective compliance strategies.Moreover, asset management companies are fostering a culture of compliance from the top down. Senior management is taking a proactive role in promoting ethical behavior and ensuring that all employees understand the importance of compliance in their daily operations. Training programs are regularly conducted to keep staff updated on the latest regulatory developments and compliance best practices.The benefits of these efforts extend beyond mere regulatory adherence. A strong compliance framework can enhance a firm's reputation, attract more investors, andprovide a competitive edge in the market. It also minimizes the risk of financial penalties and legal repercussions that can arise from non-compliance.In conclusion, as the regulatory landscape of the asset management industry continues to evolve, companies are recognizing the necessity of robust compliance structures. By prioritizing compliance, firms not only safeguard themselves against regulatory risks but also contribute to the stability and reliability of the financial markets. This commitment to compliance is essential for the long-term success and sustainability of the asset management industry.This essay has provided an overview of the current trends in regulatory compliance within the asset management industry, highlighting the proactive steps companies are taking to strengthen their compliance frameworks. The language used aimed to be precise, vivid, and concise, maintaining logical coherence throughout the document to ensure a smooth and consistent tone. 。

风险预警的发布流程

风险预警的发布流程Risk alert is a critical process in any organization to ensure the timely identification and mitigation of potential risks that may impact the business. 风险预警是任何组织中至关重要的流程,确保及时识别和减轻可能影响业务的潜在风险。

It involves the gathering of information, analysis of data, and the communication of findings to relevant stakeholders. 它涉及信息的收集,数据的分析,以及将发现结果传达给相关利益相关者。

The release of risk alerts should follow a structured process to ensure that all necessary steps are taken and the information is communicated effectively. 发布风险预警应该遵循结构化的流程,确保采取了所有必要的步骤,并有效地传达信息。

In this article, we will explore the key components of the risk alert release process and discuss the importance of each step in mitigating potential risks. 在本文中,我们将探讨风险预警发布流程的关键组成部分,并讨论每个步骤在减轻潜在风险方面的重要性。

The first step in the risk alert release process is the identification of potential risks. 风险预警发布流程的第一步是识别潜在风险。

建立管理体系英语作文

建立管理体系英语作文1. Establishing a management system is crucial for the smooth operation of any organization. It helps to set clear goals, allocate resources effectively, and monitor progress towards achieving objectives.2. A well-designed management system can improve communication among team members, enhance decision-making processes, and ensure accountability at all levels of the organization.3. Implementing a management system requires strong leadership, effective delegation of tasks, and regular monitoring and evaluation of performance to identify areas for improvement.4. Training and development programs play a key role in ensuring that employees understand and adhere to the policies and procedures outlined in the management system.5. Continuous feedback and open communication channels are essential for addressing issues, resolving conflicts, and fostering a positive work environment within the organization.6. Regular audits and reviews of the management system are necessary to identify gaps, assess risks, and make necessary adjustments to ensure its effectiveness and efficiency.7. Embracing technology and automation can streamline processes, reduce manual errors, and enhance data accuracy in the management system.8. Adapting to changes in the external environment, such as market trends, regulatory requirements, and technological advancements, is vital for the management system to remain relevant and competitive.9. Collaboration and teamwork are essential for the successful implementation and maintenance of a managementsystem, as it requires the collective effort and commitment of all stakeholders involved.。

Undefined

01

Introduction

Background of the report

The report was commissioned to investigate a specific issue or problem

It provides an overview of the current situation and identifies key trends and

05

Suggested undefined coping strategies

Government level response strategies

03

Exploration of undefined solutions

Plan 1: Improve laws and regulations

Establish comprehensive laws and regulations

Develop comprehensive laws and regulations to define and regulate undefined behaviors, covering various aspects such as data privacy, cybersecurity, and AI ethics

In mathematics, undefined values may vary from division by zero, taking the logarithm of a negative number, or other operations that are not defined for central inputs

金融热点事件英语版作文

金融热点事件英语版作文题目,Financial Hot Topics: An Overview。

With the rapid pace of globalization and the interconnectedness of financial markets worldwide,financial hot topics have become a focal point for discussion and analysis. From stock market fluctuations to cryptocurrency trends, these events shape the economic landscape and influence investor sentiment. In this essay, we will delve into some of the most prominent financial hot topics of recent times, examining their implications and significance.One of the most talked-about phenomena in recent years has been the rise of cryptocurrencies, particularly Bitcoin. Bitcoin, the first and most well-known cryptocurrency, has experienced tremendous growth in value, attracting both fervent supporters and staunch critics. Advocates tout its potential to revolutionize the financial system, offering decentralized transactions and a hedge against inflation.However, skeptics warn of its volatility and lack of regulation, citing concerns about its use in illegal activities and its susceptibility to market manipulation.In addition to Bitcoin, the broader cryptocurrency market has witnessed the emergence of numerous altcoins, each with its own unique features and value propositions. Ethereum, for example, introduced the concept of smart contracts, enabling developers to build decentralized applications (DApps) on its blockchain. Other cryptocurrencies like Ripple (XRP) and Litecoin (LTC) have also garnered attention for their innovative technologies and growing adoption.Another hot topic that has captured the attention of investors and policymakers alike is the phenomenon of meme stocks. These stocks, popularized on social media platforms like Reddit and Twitter, experience sudden surges intrading activity driven by online communities of retail investors. GameStop (GME), AMC Entertainment (AMC), and BlackBerry (BB) are among the most notable examples of meme stocks that have experienced meteoric rises in share prices,often defying traditional market fundamentals.The rise of meme stocks has sparked debate about the democratization of finance and the power of retailinvestors in influencing market dynamics. While someapplaud the empowerment of individual investors tochallenge institutional norms, others warn of the risks associated with speculative trading and market manipulation. Regulatory bodies have been prompted to reassess market regulations and surveillance mechanisms to address these concerns effectively.In addition to cryptocurrencies and meme stocks, environmental, social, and governance (ESG) investing has gained significant traction in recent years. ESG criteria evaluate a company's performance on environmental, social, and governance factors, allowing investors to align their portfolios with their values. With growing awareness of climate change and social inequality, investors are increasingly prioritizing sustainability and ethical business practices in their investment decisions.The proliferation of ESG investing reflects a broader shift towards responsible capitalism, where companies are held accountable not only for their financial performance but also for their impact on society and the environment. This trend has led to greater transparency and disclosure requirements, as companies strive to demonstrate their commitment to sustainability and social responsibility.In conclusion, financial hot topics encompass a wide range of issues that reflect the evolving nature of global markets and investor preferences. From the rise of cryptocurrencies to the emergence of meme stocks and the growing importance of ESG investing, these topics underscore the interconnectedness of finance, technology, and society. As these trends continue to unfold, it is essential for investors, policymakers, and regulators to adapt and respond effectively to the challenges and opportunities they present. Through informed analysis and proactive engagement, we can navigate the complexities of the financial landscape and build a more resilient and sustainable future.。

讨论商业问题英文作文模板

讨论商业问题英文作文模板英文回答:Introduction:In the ever-evolving business landscape, it is essential for organizations to navigate complex problems effectively to achieve sustained success. This essay will provide a comprehensive approach to discussing business problems, considering their characteristics, potential causes, and viable solutions.Characteristics of Business Problems:Complexity: Business problems often involve multiple interconnected factors, making it challenging to identify the root cause and develop appropriate solutions.Uncertainty: Predictions about future outcomes or behavior are often difficult to make with certainty,introducing an element of risk into problem-solving.Stakeholder involvement: Stakeholders with varying interests and perspectives can influence the problem andits potential solutions.Time sensitivity: Some problems require immediate attention, while others may have more extended timelinesfor resolution.Potential Causes of Business Problems:Internal factors: Inefficient processes, lack of resources, communication breakdowns, and employee disengagement.External factors: Economic downturns, changes in market trends, regulatory shifts, and technological disruptions.Human error: Mistakes, negligence, or poor judgment by individuals can lead to business problems.External events: Natural disasters, pandemics, and geopolitical conflicts can disrupt business operations.Viable Solutions for Business Problems:Problem definition and analysis: Clearly identify the problem, gather relevant data, and analyze its root causes.Stakeholder engagement: Consult with stakeholders to gather insights, consider their perspectives, and build consensus.Solution brainstorming and evaluation: Generate multiple potential solutions, assess their feasibility, and evaluate their potential impact.Implementation and monitoring: Implement the chosen solution, communicate it effectively, and monitor its progress to ensure effectiveness.Continuous improvement: Regularly review thesolution's performance, gather feedback, and make necessary adjustments to enhance its effectiveness.Conclusion:Addressing business problems requires a systematic approach that considers their characteristics, potential causes, and viable solutions. By understanding these aspects, organizations can effectively navigate challenges, optimize decision-making, and foster innovation to achieve long-term success.中文回答:导言:在不断发展的商业环境中,企业必须有效地解决复杂的问题,才能实现持续的成功。

岗位适用度的自我评价

岗位适用度的自我评价英文回答:Summary.My qualifications and expertise align strongly with the requirements of this position. I possess a comprehensive understanding of the industry, proven experience in developing and executing successful projects, and a deep commitment to delivering exceptional results. I am confident that I can make a significant contribution to your organization and drive positive outcomes.Technical Skills.I am proficient in a wide range of technical skills relevant to this role, including:Project management methodologies (Agile, Scrum, Waterfall)。

Software development methodologies (SDLC, DevOps)。

Data analysis and visualization tools (SQL, Excel, Tableau)。

Cloud computing platforms (AWS, Azure, GCP)。

Programming languages (Python, Java, SQL)。

Industry Knowledge.I have a deep understanding of the industry your organization operates in. I am familiar with the latest trends, regulatory requirements, and best practices, and I have a proven track record of success in this sector. This knowledge enables me to quickly identify opportunities, develop innovative solutions, and effectively manage projects in this dynamic environment.Project Management.I am an experienced project manager with a provenability to plan, execute, and deliver successful projectson time and within budget. I am skilled in:Defining project scope and objectives.Developing project plans and timelines.Managing stakeholders and resources.Monitoring progress and controlling risks.Delivering high-quality deliverables.Teamwork and Communication.I am a highly effective team player with excellent communication and interpersonal skills. I am comfortable working in both independent and collaborative settings, and I am adept at building strong relationships with colleagues, clients, and stakeholders. I am also proficient in written and verbal communication, and I am able to articulatecomplex technical information clearly and concisely.Customer Focus.I am committed to delivering exceptional customer service and exceeding expectations. I am passionate about understanding customer needs and developing solutions that meet or exceed those needs. I am also skilled in building and maintaining strong customer relationships, and I am always willing to go the extra mile to ensure customer satisfaction.Conclusion.I am confident that my skills, experience, and commitment to excellence make me an ideal candidate for this position. I am eager to contribute my knowledge and expertise to your organization and help it achieve its strategic objectives.中文回答:岗位适用度自我评价。

医疗机构过期药品的处理流程

医疗机构过期药品的处理流程1.医疗机构应建立过期药品处理制度,包括收集、分类和处理程序。

Medical institutions should establish a system for handling expired drugs, including collection, classification, and disposal procedures.2.过期药品应被及时清理并分类存放,以免混淆使用。

Expired drugs should be cleaned up and stored in separate categories in a timely manner to avoid confusion.3.应定期对过期药品进行清点和检查,确保及时发现并处理。

Regular inventory and inspection of expired drugs should be conducted to ensure timely detection and disposal.4.过期药品应按规定的程序进行销毁,防止滥用和污染环境。

Expired drugs should be disposed of according to established procedures to prevent misuse and environmental contamination.5.部分过期药品可能具有危险性,需要特殊处理,不得随意丢弃或倾倒。

Some expired drugs may be hazardous and require special handling; they should not be discarded or dumped at will.6.医疗机构应与专业的药品处理公司合作,确保过期药品得到安全有效地处理。

Medical institutions should partner with professional drug disposal companies to ensure the safe and effective disposal of expired drugs.7.过期的药品应按照国家规定的相关法律法规进行处理,不得私自处理或出售。

英语作文-农业科学研究和试验发展行业的竞争态势分析

英语作文-农业科学研究和试验发展行业的竞争态势分析The agricultural science research and experimental development sector is witnessing a dynamic landscape of competition driven by various factors. This analysis delves into the current competitive state within this industry, examining key players, emerging trends, and challenges.One of the primary drivers of competition in agricultural science research and experimental development is the pursuit of innovation. Companies and research institutions constantly strive to develop new technologies, methodologies, and products to enhance agricultural productivity, sustainability, and efficiency. This relentless pursuit of innovation fosters a competitive environment where organizations vie to be at the forefront of scientific breakthroughs.Moreover, the increasing global demand for food security and sustainable agriculture further intensifies competition within the industry. As populations grow and environmental concerns mount, there is a pressing need for innovative solutions to address challenges such as climate change, soil degradation, and water scarcity. This demand creates opportunities for organizations that can offer effective solutions while also posing challenges for those unable to keep pace with the evolving needs of the agricultural sector.The competitive landscape of agricultural science research and experimental development is also shaped by regulatory frameworks and government policies. Government funding, subsidies, and regulations play a significant role in determining the resources available to organizations engaged in agricultural research and development. Moreover, policies related to intellectual property rights, biosecurity, and environmental protection can impact the strategies and competitiveness of industry players.Furthermore, partnerships and collaborations are increasingly important in driving innovation and competitiveness in the agricultural science sector. Collaborations betweenresearch institutions, private companies, and government agencies facilitate knowledge exchange, resource sharing, and access to complementary expertise. Strategic alliances can also enable organizations to pool resources and mitigate risks associated with research and development endeavors.In addition to traditional players such as agricultural biotechnology companies and research universities, new entrants and disruptors are reshaping the competitive landscape. Start-ups, incubators, and accelerators are bringing fresh perspectives and innovative technologies to the industry, challenging established norms and driving rapid change. Moreover, advancements in fields such as artificial intelligence, big data analytics, and precision agriculture are opening up new avenues for competition and collaboration.However, alongside opportunities, the agricultural science research and experimental development sector also faces significant challenges. These include resource constraints, regulatory hurdles, market volatility, and public skepticism towards genetically modified organisms (GMOs) and other novel technologies. Moreover, the COVID-19 pandemic has highlighted vulnerabilities in global supply chains and underscored the importance of resilience and adaptability in the face of unforeseen disruptions.In conclusion, the competitive landscape of the agricultural science research and experimental development industry is characterized by innovation, global demand, regulatory dynamics, partnerships, and emerging trends. Organizations operating in this sector must navigate these complexities while striving to leverage opportunities and overcome challenges to drive sustainable growth and impact in the agricultural sector.。

英语作文 制造业的发展趋势

英语作文制造业的发展趋势The Development Trends of the Manufacturing IndustryThe manufacturing industry has long been a crucial driver of economic growth and technological advancement. As the world continues to evolve, the manufacturing sector has also undergone significant transformations, adapting to new challenges and opportunities. In this essay, we will explore the emerging development trends in the manufacturing industry and their implications for the future.One of the most prominent trends in the manufacturing industry is the increasing automation and integration of advanced technologies. The rise of Industry 4.0, which encompasses the integration of cyber-physical systems, the Internet of Things (IoT), and artificial intelligence (AI), has revolutionized the way manufacturing processes are designed and executed. Automation, robotics, and intelligent systems are becoming increasingly prevalent in production lines, reducing the reliance on manual labor and enhancing efficiency, precision, and consistency. This technological transformation has not only improved productivity but also enabled manufacturers to respond more quickly to changing market demands and customerpreferences.Another key trend in the manufacturing industry is the growing emphasis on sustainability and environmental consciousness. Driven by global concerns about climate change and resource depletion, manufacturers are now actively seeking ways to reduce their carbon footprint and adopt more eco-friendly practices. This includes the use of renewable energy sources, the implementation of circular economy principles, and the development of sustainable product design and manufacturing processes. Manufacturers are also exploring innovative materials and technologies that can reduce waste, minimize energy consumption, and promote the reuse and recycling of materials.The shift towards personalization and customization is another significant trend in the manufacturing industry. Consumers today are increasingly demanding products that are tailored to their individual preferences and needs. In response, manufacturers are leveraging advanced technologies such as 3D printing, mass customization, and on-demand production to offer more personalized products. This trend not only enhances customer satisfaction but also allows manufacturers to differentiate themselves in a highly competitive market.The globalization of the manufacturing industry is another notabletrend that has shaped the industry's landscape. With the rise of international trade agreements and the expansion of global supply chains, manufacturers are now operating in a more interconnected and complex environment. This has led to the emergence of multinational manufacturing hubs, where companies can leverage regional advantages, such as access to skilled labor, raw materials, and favorable regulations, to optimize their production and distribution processes. At the same time, the globalization of the industry has also exposed manufacturers to increased competition and the need to adapt to diverse cultural and regulatory environments.In addition to these overarching trends, the manufacturing industry is also witnessing the rise of new business models and innovative approaches to value creation. For instance, the servitization of manufacturing, where manufacturers offer integrated solutions that combine products and services, is gaining traction. This shift towards a more service-oriented business model allows manufacturers to create additional revenue streams, enhance customer loyalty, and differentiate themselves in the market.Furthermore, the increasing emphasis on data-driven decision-making and the integration of advanced analytics is transforming the way manufacturers approach their operations. The collection and analysis of real-time data from production lines, supply chains, andcustomer interactions enable manufacturers to make more informed decisions, optimize processes, and anticipate market trends more effectively.As the manufacturing industry continues to evolve, it is clear that the future of the sector will be shaped by a combination of technological advancements, sustainability concerns, and shifting consumer preferences. Manufacturers who are able to adapt to these trends and embrace innovative strategies will be well-positioned to thrive in the years to come. By leveraging the power of emerging technologies, adopting sustainable practices, and responding to the changing needs of their customers, manufacturers can drive the continued growth and development of this vital industry.。

《世界一流财务管理体系的指导意见》五大功能作用

《世界一流财务管理体系的指导意见》五大功能作用The guidance on a world-class financial management system provides five key functions or roles. These functions are crucial for the effective management of financial resources and ensuring the overall financial health of an organization.1. Strategic Planning and Decision-Making:A world-class financial management system plays a vitalrole in strategic planning and decision-making processes. It provides accurate and timely financial information to the management team, enabling them to make informed decisions about resource allocation, investment opportunities, and business expansions. This function helps organizations align their financial goals with theiroverall strategic objectives.(战略规划和决策:一流的财务管理体系在战略规划和决策过程中起着重要作用。

它向管理团队提供准确和及时的财务信息,使他们能够就资源配置、投资机会和业务扩展等方面做出明智决策。

这一功能有助于组织将其财务目标与整体战略目标相协调。

机构组成翻译英语作文

机构组成翻译英语作文Title: The Structure and Composition of Organizations。

Organizations are intricate structures, each comprising various components that work in harmony to achieve common goals. Understanding these components is essential for comprehending how organizations function effectively. Let's delve into the key elements that constitute an organization.1. Mission and Vision Statement: At the core of every organization lies its mission and vision. The mission defines the organization's purpose, while the visionoutlines its aspirations for the future. These statements serve as guiding principles, aligning the efforts of all members towards a shared objective.2. Leadership: Effective leadership is crucial for steering the organization towards success. Leaders set the direction, inspire teams, and make critical decisions. They establish the organizational culture and values, shapingthe behavior and mindset of its members.3. Departments and Divisions: Organizations typically consist of various departments or divisions, each responsible for specific functions or tasks. Common departments include finance, human resources, marketing, operations, and research and development. Dividing tasks among departments enhances efficiency and specialization.4. Employees: The workforce forms the backbone of any organization. Employees bring diverse skills, knowledge, and perspectives to the table, driving innovation and productivity. Hiring the right talent, nurturing their growth, and fostering a positive work environment are essential for organizational success.5. Communication Channels: Clear and effective communication is vital for seamless operations within an organization. Communication channels can range from formal (such as memos and meetings) to informal (such as water-cooler conversations). Ensuring open lines of communication facilitates collaboration and problem-solving.6. Organizational Culture: Culture encompasses the shared values, beliefs, and norms that define an organization. It influences how employees interact, make decisions, and perceive their work environment. A strong organizational culture fosters cohesion, loyalty, and employee satisfaction.7. Policies and Procedures: Organizations establish policies and procedures to govern various aspects of operations, from employee conduct to financial management. These guidelines ensure consistency, compliance with regulations, and mitigate risks.8. Resources: Organizations require various resources to function effectively, including financial, human, technological, and physical resources. Allocating resources efficiently and strategically is essential for optimizing performance and achieving objectives.9. Stakeholders: Stakeholders are individuals or entities with an interest or influence in theorganization's activities and outcomes. They can include employees, customers, suppliers, shareholders, government agencies, and the community at large. Engaging with stakeholders and addressing their needs builds trust and fosters long-term relationships.10. External Environment: Organizations operate withina broader external environment shaped by factors such as economic conditions, technological advancements, market trends, regulatory changes, and competitive pressures. Adapting to external forces and anticipating future trends is crucial for sustainability and growth.In conclusion, organizations are complex entities comprised of various interdependent components. By understanding and effectively managing these components, organizations can navigate challenges, capitalize on opportunities, and achieve their objectives in a dynamic and ever-changing world.。

中国人保考试题库 第三部分 综合卷 英文

中国人保考试题库第三部分综合卷英文全文共3篇示例,供读者参考篇1Chinese People's Insurance Company Exam Question Bank Part Three Comprehensive PaperIntroduction:The Chinese People's Insurance Company (PICC) is one of the largest insurance companies in China, providing a wide range of insurance products and services to individuals and businesses. As part of their recruitment process, they have developed an extensive exam question bank to assess the knowledge and skills of candidates. This document focuses on the third part of the exam question bank, which covers a comprehensive range of topics in English.Section 1: Reading ComprehensionThis section tests candidates' ability to understand and analyze written texts in English. Candidates will be required to read a series of passages and answer questions based on the main ideas, supporting details, and implications of the text.Topics may include insurance policies, industry trends, and regulatory frameworks.Section 2: Vocabulary and GrammarThis section evaluates candidates' mastery of English vocabulary and grammar. Questions may cover synonyms, antonyms, idiomatic expressions, sentence structure, verb tense, and word usage. Candidates will need to demonstrate a strong command of the English language to succeed in this section.Section 3: Writing SkillsCandidates will be asked to write a short essay in English on a given topic related to the insurance industry. They will be assessed on their ability to present ideas clearly, organize information logically, and use correct grammar and vocabulary. Topics may include the importance of insurance, risk management strategies, and emerging trends in the industry.Conclusion:The Chinese People's Insurance Company Exam Question Bank Part Three Comprehensive Paper is designed to assess candidates' proficiency in English and their knowledge of the insurance industry. By studying and practicing the questions inthis document, candidates can improve their chances of success in the PICC recruitment process. Good luck!篇2The Chinese Insurance Professional Qualification Examination, also known as the China People's Insurance Examination, is a comprehensive test that individuals must pass in order to work in the insurance industry in China. The examination is divided into several parts, with the third part being the Integrated Exam.The Integrated Exam covers a wide range of topics related to insurance, including insurance laws and regulations, insurance products and services, insurance operations, risk management, and ethics in the insurance industry. It is designed to test the candidate's knowledge and understanding of the insurance industry as a whole.The exam consists of multiple-choice questions, short answer questions, and case studies. Candidates are required to demonstrate their knowledge of insurance concepts and principles, as well as their ability to apply these concepts to real-world situations.Preparing for the Integrated Exam requires candidates to study a variety of materials, including textbooks, study guides, and practice exams. It is important to review the key concepts and principles covered in the exam, as well as to practice answering different types of questions.Passing the Integrated Exam is essential for individuals who wish to pursue a career in the insurance industry in China. It demonstrates that the candidate has the knowledge and skills necessary to work in this field and can be trusted to provide quality service to clients.In conclusion, the Integrated Exam is a challenging but essential part of the China People's Insurance Examination. By preparing thoroughly and demonstrating their knowledge and understanding of the insurance industry, candidates can increase their chances of passing the exam and pursuing a successful career in insurance.篇3The Chinese People's Insurance Company (CPIC) is one of the largest insurance companies in China, offering a wide range of insurance products including life insurance, property insurance, and casualty insurance. As part of their recruitmentprocess, CPIC conducts an entrance exam to assess the knowledge and skills of potential candidates. The exam consists of three parts: comprehensive, professional, and English.In this document, we will focus on the third part of the CPIC exam: the English test. The English test is designed to assess candidates' proficiency in the English language, as well as their ability to understand and communicate in English effectively. The test covers various topics such as reading comprehension, grammar, vocabulary, and writing skills.The reading comprehension section of the English test consists of passages on a variety of topics, including business, economics, and current affairs. Candidates are required to read the passages and answer questions based on the information presented in the text. This section not only tests candidates' reading skills but also their ability to comprehend and analyze written information.The grammar and vocabulary section assesses candidates' knowledge of English grammar rules, as well as their ability to use a wide range of vocabulary accurately. This section may include multiple-choice questions, fill-in-the-blanks exercises, and sentence correction tasks. Candidates are expected todemonstrate a strong command of English grammar and vocabulary in this section.The writing skills section of the English test requires candidates to compose written responses to prompts or questions. This section tests candidates' ability to organize their thoughts coherently, express ideas clearly, and use correct grammar and punctuation. Candidates may be asked to write essays, reports, or formal letters in this section.In conclusion, the English test in the CPIC entrance exam is an important component of the assessment process for potential candidates. It evaluates candidates' language skills and their ability to communicate effectively in English, which is essential for roles that require interaction with English-speaking clients or colleagues. Candidates who perform well in the English test demonstrate their readiness to work in a global environment and contribute to the success of CPIC.。

信息差英语作文

信息差英语作文Information AsymmetryIn today's rapidly evolving global marketplace, the concept of information asymmetry has become increasingly relevant and significant. Information asymmetry refers to the unequal distribution of information between two or more parties involved in a transaction or decision-making process. This imbalance of information can have far-reaching consequences, affecting various aspects of our personal, professional, and economic lives.One of the primary areas where information asymmetry is prevalent is in the financial sector. Investors, both individual and institutional, often face a disadvantage when compared to the financial institutions and experts who possess more in-depth knowledge and insider information about the markets, investment opportunities, and potential risks. This disparity in information can lead to suboptimal investment decisions, making it challenging for average investors to make informed choices and protect their financial interests.Moreover, information asymmetry can also be observed in the realm of consumer purchases, where sellers often have a morecomprehensive understanding of the products or services they are offering than the buyers. This discrepancy can enable sellers to exploit the lack of knowledge on the part of the consumers, leading to unfair pricing, hidden costs, or the sale of substandard goods. This scenario is particularly prevalent in the insurance industry, where policyholders may not fully comprehend the complexities of their coverage or the potential exclusions and limitations within their policies.In the healthcare sector, information asymmetry can have even more profound implications. Patients often rely heavily on the expertise and recommendations of healthcare professionals, such as doctors and specialists, who possess a deeper understanding of medical conditions, treatment options, and potential outcomes. This power imbalance can make it difficult for patients to actively participate in their own healthcare decisions, potentially leading to suboptimal treatment choices or even medical errors.Furthermore, information asymmetry can have significant consequences in the labor market. Employers often have a more comprehensive understanding of the industry, job requirements, and potential career trajectories, while job applicants may lack the necessary information to effectively negotiate their compensation or understand the long-term prospects of the position. This discrepancy can lead to unfair hiring practices, wage disparities, and limitations inthe career advancement opportunities available to employees.Beyond the economic realm, information asymmetry can also manifest in social and political spheres. Governments and policymakers may possess privileged information regarding national security, public policies, or societal trends, which can be withheld from the general public. This lack of transparency can undermine the ability of citizens to make informed decisions, participate in the democratic process, and hold their elected officials accountable.To address the challenges posed by information asymmetry, various strategies and initiatives have been developed. Regulatory bodies, such as financial regulators and consumer protection agencies, have introduced measures to enhance transparency, disclosure requirements, and access to information for all stakeholders. Additionally, technological advancements, such as the internet and digital platforms, have enabled the democratization of information, empowering individuals and small businesses to access a wider range of data and make more informed decisions.Moreover, the importance of education and financial literacy cannot be overstated. By equipping individuals with the knowledge and tools to navigate complex financial, healthcare, and employment-related decisions, we can empower them to make informed choices and mitigate the negative impacts of information asymmetry.In conclusion, information asymmetry is a complex and multifaceted issue that permeates various aspects of our lives. Addressing this challenge requires a multifaceted approach, including strengthening regulatory frameworks, leveraging technological advancements, and promoting education and financial literacy. By working towards a more equitable and transparent distribution of information, we can foster a more just and inclusive society, where all individuals have the opportunity to make informed decisions and achieve their full potential.。

医疗器械专业英语

Definition

Medical devices refer to instruments, accessories, implements, materials, or other articles that are used alone or in combination with other devices, for human beings for one or more of the specific objectives of diagnosis, prevention, monitoring, treatment, or allocation of disease, injury, or disability

Current situation and trends of domestic and

international markets

Domestic market

International

market

Trends

The domestic market for medical devices is growing rapidly, driven by factors such as increasing healthcare expenditure, aging population, and rising incidence of chronic diseases

Policies and Regulations in English • International trade and exchange of medical

devices

01

Overview of Medical Devices

Definition and classification of medical devices

英语作文-金融资产管理公司积极发展跨境业务,拓展海外市场

英语作文-金融资产管理公司积极发展跨境业务,拓展海外市场In recent years, financial asset management companies have been actively developing cross-border business and expanding into overseas markets. This trend is driven by the increasing globalization of the financial industry and the growing demand for diversified investment opportunities. In this article, we will explore the reasons behind this phenomenon and discuss the benefits and challenges of expanding cross-border business for financial asset management companies.One of the main reasons why financial asset management companies are actively developing cross-border business is the pursuit of higher returns. By expanding into overseas markets, these companies can tap into new investment opportunities and diversify their portfolios. This is particularly important in today's globalized economy, where market conditions and investment landscapes can vary significantly across different countries and regions. By investing in a diverse range of assets, financial asset management companies can mitigate risks and potentially achieve higher returns for their clients.Another driving force behind the expansion of cross-border business is the increasing demand from clients for international investment options. As individuals and institutions become more globally connected, they seek investment opportunities beyond their domestic markets. By offering cross-border investment products and services, financial asset management companies can cater to this demand and provide their clients with access to a wider range of investment opportunities. This not only enhances the company's competitiveness but also strengthens its relationship with clients by meeting their evolving needs.Furthermore, expanding into overseas markets can also help financial asset management companies enhance their brand reputation and global presence. By establishing a presence in key international financial centers, these companies can gaincredibility and visibility on a global scale. This can attract new clients and business partners, as well as foster collaborations with local financial institutions and regulatory bodies. Additionally, a strong global presence can also provide companies with valuable insights into international market trends and regulatory developments, enabling them to better navigate the complexities of cross-border business.However, expanding cross-border business is not without its challenges. One of the main challenges is the need to navigate complex regulatory frameworks and comply with local laws and regulations. Each country has its own set of rules and requirements for financial services, and companies must ensure that they are in full compliance to avoid legal and reputational risks. This often requires significant investment in legal and compliance resources, as well as a deep understanding of local market dynamics and regulatory practices.Another challenge is the cultural and language barriers that companies may encounter when operating in foreign markets. Building relationships and effectively communicating with clients, business partners, and regulators in different cultural contexts can be a daunting task. It requires cultural sensitivity, language proficiency, and the ability to adapt to local business customs and practices. Companies that can successfully overcome these challenges can gain a competitive edge and establish strong relationships with clients and partners in overseas markets.In conclusion, the active development of cross-border business by financial asset management companies is driven by the pursuit of higher returns, the increasing demand for international investment options, and the desire to enhance brand reputation and global presence. While there are challenges associated with expanding into overseas markets, the potential benefits are significant. By carefully navigating regulatory frameworks, overcoming cultural barriers, and seizing new investment opportunities, financial asset management companies can position themselves for success in the global marketplace.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

3

影响HSE政策的国家部门

公安部 环保部 地方 环保局

地 方 和 规定 实 、 施 标 监 准 督

地方局、委

安监局

质监局

法 起草 律 、 、颁 法 规 布 和 标 准

化学品 (环保局)

产 品与 册 注 生 产信 息

卫生部

建设项目 国务院

、 政策 核 准 宏观 投 资 、 法规

应急中心

应急响

应

消防局 发改委

水污染法 2008 修订 固废法 2004 修订 环境影响评价法 02 修订大气法 00 国家环保总局 98

噪声法 96 水污染法 修订 96 固废法 1995 环境保护法 89 大气法 87 水污染防治法 84 建立环保局 1982 暂行环境法 79 一般性方针 73 文化大革命 大跃进 1949 1973 1983 1995

法规动态及对业务的影响

5

职业健康和安全的标准

• 工作场所有害因素职业接触限值 化学有害因素 GBZ2.1-2007

( 2007年11月1生效,原GBZ2-2002 废止)

• 工作场所有害因素职业接触限值 物理因素 GBZ2.2-2007

( 2007年11月1生效,原GBZ2-2002 废止)

• • • • •

Delivering sustainable solutions in a more competitive world

17

环境保护标准

• • • • • • • • •

涂料工业水污染物排放标准 (征求意见稿) 2008-3-14 酚醛树脂工业水污染物排放标准 2008-3-10 环氧树脂工业水污染物排放标准 2008-3-10 储油库、加油站大气污染治理项目验收技术规范 (征求意见稿) 2008-3-10 清洁生产标准 印制电路板制造业 (征求意见稿) 2008-3-4 农业工业水污染物排放标准 菊酯类和磺酰脲类 (征求意见稿) 2008-2-2 酵母工业水污染物排放标准 2008-2 制革及皮毛加工工业水污染物排放标准 2008-2 电池工业水污染物排放标准 2008-2

Delivering sustainable solutions in a more competitive world

公安局

3 4

法规动态及对业务的影响

2

中国健康和安全立法 --现状和发展趋势

Delivering sustainable solutions in a more competitive world

• 环境保护综合法

• 《中华人民共和国环境保护法》 • 《中华人民共和国环境影响评价法》 • 《中华人民共和国清洁生产法》

污染防治法 (6)

• 环境保护单行法

• 针对特定的保护对象而专门调整 • 可归纳为以下二类:

资源保护法 (9)

Delivering sustainable solutions in a more competitive world

11

中国环境立法 --现状和发展趋势

Delivering sustainable solutions in a more competitive world

12

法规动态及对业务的影响

6

中国环境保护的发展史

>两千年以前 >五十年以前 >二十年以前 >十年前 >五年前 >去年 >明年? >十年后?

土壤地下水污染防治。?

Delivering sustainable solutions in a more competitive world

9

职业健康和安全的法规和条例

• • • • •

建设项目劳动安全卫生预评价管理办法 1998-02-05 工业企业建设项目卫生预评价规范 建设项目劳动安全卫生监察规定 建设项目职业病危害分类管理办法 建设项目职业卫生审查规定 2000-12-05 1997-01-01 2006-07- 27 2006-09-18 2006-07-07

第4级

政府部门 地方政府

Delivering sustainable solutions in a more competitive world

2

法规动态及对业务的影响

1

中国健康、安全和环境法规体系构成

第一级 法律

第二级

行政法规/条例

第三级

地方性法规

第四级

行政规章

Delivering sustainable solutions in a more competitive world

• 职业健康监护监督管理办法 (修订版)

• 职业健康监护技术规范 GBZ188-2007 2007-10-01 • 职业病诊断与鉴定管理办法 (修订稿) (征求意见稿) 2008-1-11 • 建筑起重机械安全监督管理规定 2008-1-28

10

Delivering sustainable solutions in a more competitive world

机械加工设备一般安全要求 漏电保护器安全监察规定 漏电保护器安装和运行 建筑设计防火规范

GB 12266-90 1990-06-01 GB 13955-92 GB50016-2006 (原GBJ 16-87废止)

医疗废物专用包装袋、容器和警示标志标准(HJ 421-2008) 2008-4-1

Delivering sustainable solutions in a more competitive world

中国健康、安全和环境立法 --现状和发展趋势

环境资源管理 ERM中国 2008年5月12日

1

Delivering sustainable solutions in a more competitive world

中国立法主体

第1级

全国人民代表大会

国务院

第2级

省级人民代表大会

第3级

国家级HSE管理机构

Delivering sustainable solutions in a more competitive world

8

法规动态及对业务的影响

4

职业健康和安全的法规和条例

• 工伤保险条例 2004-01-01 • 危险化学品安全管理条例 2002-03-15 • 危险化学品安全管理条例 (征求意见稿) 2008-2-29 • 危险化学品建设项目安全评价细则(试行)2007-12-12 • 安全生产许可证条例 2004-01-13 • 电力设施保护条例 1997-9-15

15

环境保护法律的发展过程

• • • • • • • •

环境保护法 (1989年颁布, 正在修订) 固体废物防治法 (1995年颁布, 2004年12月29日修订) 水污染防治法 (2008-06-01) 噪声污染防治法 (1996颁布,正在修订) 刑法 (2006年6月29日修正案) 宪法(2004年3月修正案) 大气污染防治法 (2000年修订, 正在再次修订) 海洋环境保护法 (1999年颁布)

法规动态及对业务的影响

12

统计数据

• 2007年无锡太湖蓝藻爆发 • 2006年北京沙尘暴 • 2005年松花江环境事件 • 超过50%的降雨为酸雨, 最低的pH为3.9 • 据报道,每年约有130,000人死亡,约700,000人受伤. 直接经济损 失超过 2500亿人民币, 相当于2.5% 的国民生产总值 • 每年大约100,000 的人死于交通事故 • 每年约有700,000 例职业病发生

Delivering sustainable solutions in a more competitive world

16

法规动态及对业务的影响

8

环境保护法规、条例

• 电子废物污染环境防治管理办法 2008-2-1 • 防治海洋工程建设项目污染损害海洋环境管理条例 2006-11-1 • 环境标志产品技术要求 2008-4-1 • 排污许可证管理条例 (征求意见稿) 2008-1-9 • 地质勘查资质管理条例 2008-7-1 • 污染源限期治理管理办法(征求意见稿)2008-3-3

10

变化中的中国

外滩今貌

1925年的外滩

Delivering sustainable solutions in a more competitive world

21

1920前的苏州河

• Fishing nets along the

creek

Delivering sustainable solutions in a more competitive world

中国是全球经济增长的一个原动力 还是引起全球原材料/能源危 机的主要原因?

• 社会稳定 VS 可持续发展