高级财务会计:第二章综合练习答案

高级财务会计课后习题答案(仅供参考)(1)

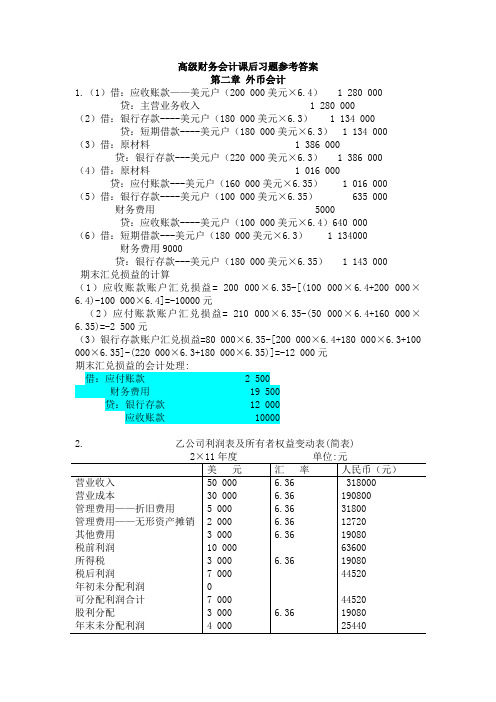

高级财务会计课后习题参考答案第二章外币会计1.(1)借:应收账款——美元户(200 000美元×6.4) 1 280 000贷:主营业务收入 1 280 000(2)借:银行存款----美元户(180 000美元×6.3) 1 134 000贷:短期借款----美元户(180 000美元×6.3) 1 134 000(3)借:原材料 1 386 000贷:银行存款---美元户(220 000美元×6.3) 1 386 000(4)借:原材料 1 016 000贷:应付账款---美元户(160 000美元×6.35) 1 016 000(5)借:银行存款----美元户(100 000美元×6.35) 635 000 财务费用 5000贷:应收账款----美元户(100 000美元×6.4)640 000(6)借:短期借款---美元户(180 000美元×6.3) 1 134000财务费用9000贷:银行存款---美元户(180 000美元×6.35) 1 143 000期末汇兑损益的计算(1)应收账款账户汇兑损益= 200 000×6.35-[(100 000×6.4+200 000×6.4)-100 000×6.4]=-10000元(2)应付账款账户汇兑损益= 210 000×6.35-(50 000×6.4+160 000×6.35)=-2 500元(3)银行存款账户汇兑损益=80 000×6.35-[200 000×6.4+180 000×6.3+100 000×6.35]-(220 000×6.3+180 000×6.35)]=-12 000元期末汇兑损益的会计处理:借:应付账款 2 500财务费用 19 500贷:银行存款 12 000应收账款 100002. 乙公司利润表及所有者权益变动表(简表)乙公司资产负债表1.(1)①机床的2011年12月31日的账面价值为110万元;该项机床的计税基础应当是90万元(原值120万元减去计税累计折旧30万元)。

高级财务会计(00159)02

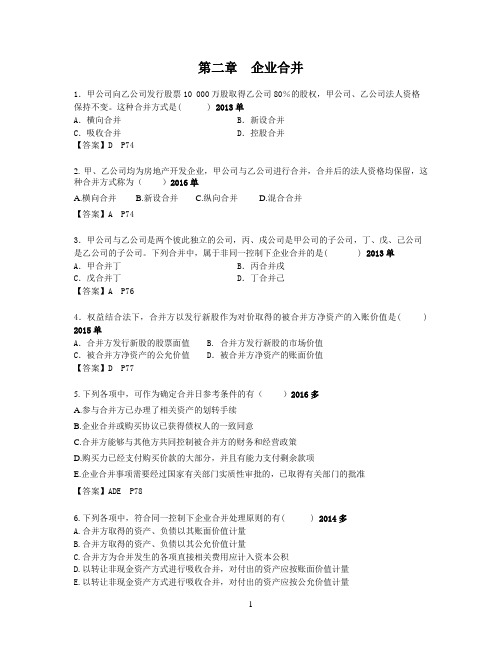

第二章企业合并1.甲公司向乙公司发行股票10 000万股取得乙公司80%的股权,甲公司、乙公司法人资格保持不变。

这种合并方式是( ) 2013单A.横向合并B.新设合并C.吸收合并D.控股合并【答案】D P742. 甲、乙公司均为房地产开发企业,甲公司与乙公司进行合并,合并后的法人资格均保留,这种合并方式称为()2016单A.横向合并B.新设合并C.纵向合并D.混合合并【答案】A P743.甲公司与乙公司是两个彼此独立的公司,丙、戌公司是甲公司的子公司,丁、戊、己公司是乙公司的子公司。

下列合并中,属于非同一控制下企业合并的是( ) 2013单A.甲合并丁B.丙合并戌C.戊合并丁D.丁合并己【答案】A P764.权益结合法下,合并方以发行新股作为对价取得的被合并方净资产的入账价值是( ) 2015单A.合并方发行新股的股票面值 B. 合并方发行新股的市场价值C.被合并方净资产的公允价值 D.被合并方净资产的账面价值【答案】D P775. 下列各项中,可作为确定合并日参考条件的有()2016多A.参与合并方已办理了相关资产的划转手续B.企业合并或购买协议已获得债权人的一致同意C.合并方能够与其他方共同控制被合并方的财务和经营政策D.购买力已经支付购买价款的大部分,并且有能力支付剩余款项E.企业合并事项需要经过国家有关部门实质性审批的,已取得有关部门的批准【答案】ADE P786.下列各项中,符合同一控制下企业合并处理原则的有( ) 2014多A.合并方取得的资产、负债以其账面价值计量B.合并方取得的资产、负债以其公允价值计量C.合并方为合并发生的各项直接相关费用应计入资本公积D.以转让非现金资产方式进行吸收合并,对付出的资产应按账面价值计量E.以转让非现金资产方式进行吸收合并,对付出的资产应按公允价值计量【答案】AD P807. 企业集团内部甲子公司以发行股票方式对乙子公司进行吸收合并,在合并过程中为发行股票而发生的佣金等相关费用,应于发生时计入()2016单A.财务费用B.管理费用C.资本公积D.投资收益【答案】C P808.2010年6月1日,甲公司以账面价值7 500万元、公允价值8 500万元的土地使用权吸收合并乙公司,合并日甲公司资本公积金额为2 000万元,合并日乙公司净资产的账面价值为7 800万元,公允价值为8 600万元,该合并为同一控制下企业合并,则甲公司合并后的资本公积是()2012单A.1 300万元B.1 700万元C.2 300万元D.2 700万元【答案】C P812000+(7800-7500)=2300万9.(2010核算题改编)2009年1月1日,甲公司发行每股面值1元的股票l,200,000股吸收合并乙公司,股票发行手续费及佣金50,000元以银行存款支付,支付与合并相关的费用40,000元。

高级财务会计--第二章企业合并习题答案

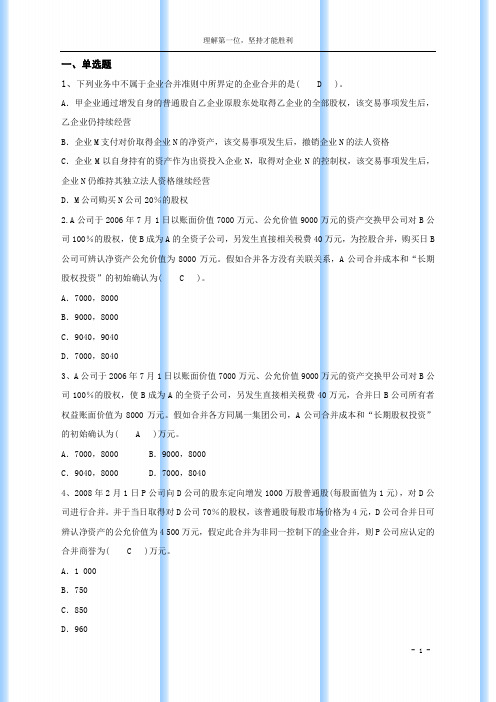

一、单选题1、下列业务中不属于企业合并准则中所界定的企业合并的是( D )。

A.甲企业通过增发自身的普通股自乙企业原股东处取得乙企业的全部股权,该交易事项发生后,乙企业仍持续经营B.企业M支付对价取得企业N的净资产,该交易事项发生后,撤销企业N的法人资格C.企业M以自身持有的资产作为出资投入企业N,取得对企业N的控制权,该交易事项发生后,企业N仍维持其独立法人资格继续经营D.M公司购买N公司20%的股权2.A公司于2006年7月1日以账面价值7000万元、公允价值9000万元的资产交换甲公司对B公司100%的股权,使B成为A的全资子公司,另发生直接相关税费40万元,为控股合并,购买日B 公司可辨认净资产公允价值为8000万元。

假如合并各方没有关联关系,A公司合并成本和“长期股权投资”的初始确认为( C )。

A.7000,8000B.9000,8000C.9040,9040D.7000,80403、A公司于2006年7月1日以账面价值7000万元、公允价值9000万元的资产交换甲公司对B公司100%的股权,使B成为A的全资子公司,另发生直接相关税费40万元,合并日B公司所有者权益账面价值为8000万元。

假如合并各方同属一集团公司,A公司合并成本和“长期股权投资”的初始确认为( A )万元。

A.7000,8000 B.9000,8000C.9040,8000 D.7000,80404、2008年2月1日P公司向D公司的股东定向增发1000万股普通股(每股面值为1元),对D公司进行合并。

并于当日取得对D公司70%的股权,该普通股每股市场价格为4元,D公司合并日可辨认净资产的公允价值为4 500万元,假定此合并为非同一控制下的企业合并,则P公司应认定的合并商誉为( C )万元。

A.1 000B.750C.850D.9605、T公司以一项原价1 000万元、累计折旧400万元的设备和一项原价为600万元、累计摊销为150万元的专利权作为对价取得同一集团内另一家全资企业H公司100%的股权,合并日 H公司所有者权益总量为 1 300万元,T公司在确认对H公司的长期股权投资时,对资本公积的处理是( A )。

高级财务会计习题参考答案1-4章

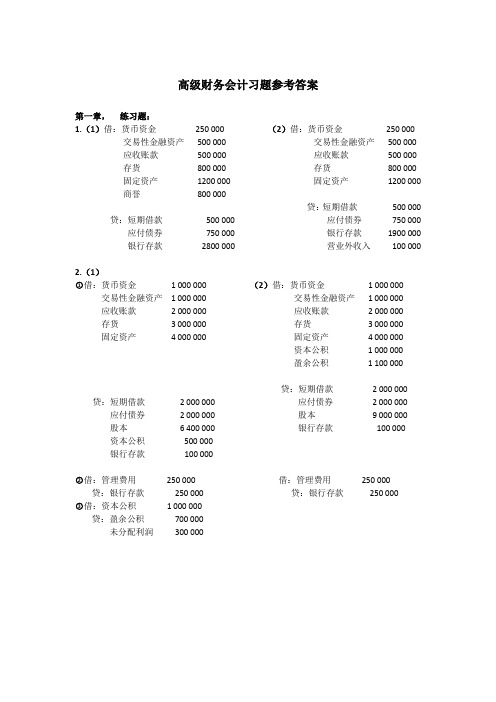

高级财务会计习题参考答案第一章,练习题:1.(1)借:货币资金250 000 (2)借:货币资金250 000交易性金融资产500 000 交易性金融资产500 000应收账款500 000 应收账款500 000存货800 000 存货800 000固定资产1200 000 固定资产1200 000商誉800 000贷:短期借款500 000 贷:短期借款500 000 应付债券750 000 应付债券750 000 银行存款1900 000银行存款2800 000 营业外收入100 0002.(1)○1借:货币资金 1 000 000 (2)借:货币资金 1 000 000 交易性金融资产 1 000 000 交易性金融资产 1 000 000应收账款 2 000 000 应收账款 2 000 000存货 3 000 000 存货 3 000 000固定资产 4 000 000 固定资产 4 000 000资本公积 1 000 000盈余公积 1 100 000贷:短期借款 2 000 000 贷:短期借款 2 000 000 应付债券 2 000 000 应付债券 2 000 000 股本9 000 000股本 6 400 000 银行存款100 000资本公积500 000银行存款100 000○2借:管理费用250 000 借:管理费用250 000 贷:银行存款250 000 贷:银行存款250 000○3借:资本公积 1 000 000贷:盈余公积700 000未分配利润300 000第二章,练习题:1.(1)借:长期股权投资—乙公司8 000 000贷:银行存款8 000 000(2)商誉= 8 000 000—(12 000 000 — 4 500 000)x 80% = 2 000 000少数股东权益= (12 000 000 — 4 500 000)x 20% = 1 500 000借:股本 4 000 000 贷:应付债券500 000 资本公积 2 000 000 长期股权投资—乙公司8 000 000未分配利润 1 000 000 少数股东权益 1 500 000存货200 000固定资产800 000商誉 2 000 0002.(1)合并时C公司净资产账面价值= 12 000 000—5 000 000 = 7 000 000A公司长期股权投资的入账金额= 7 000 000 x 80% =5 600 000借:长期股权投资—C公司 5 600 000 借:管理费用200 000贷:股本 4 000 000 贷:银行存款200 000 资本公积 1 600 000(2)少数股东权益= 7 000 000 x 20% = 1 400 000○1借:股本 4 000 000 ○2借:资本公积800 000 资本公积 2 000 000 贷:未分配利润800 000未分配利润 1 000 000贷:长期股权投资—C公司 5 600 000少数股东权益 1 400 000(此步为恢复C公司在合并前属于A公司那部分留存收益C公司:留存收益有未分配利润100万,则属于A公司的为100 x80% = 80万,且此时A公司资本公积贷方共有:100+160=260万,>80万,足够冲减)第三章,练习题1.本期存货应摊销额:450 —260 = 190万元本期固定资产应摊销额= (9 300—5 150)/10 = 415万元本期无形资产应摊销额= (1 500—500)/10 =100万元乙公司调整后净利润= 1 600—190—415—100 = 895万元购买日,乙公司可辨认净资产公允价= 13 700—2 850 = 10 850万元商誉= 投资成本—乙公司净资产公允价x 70% = 1 155万元少数股东权益= 10 850 x 30% = 3255万元(1)2009年度,甲对乙公司长期股权投资在成本法下核算:○12009年1月1日,购买乙公司70%股权借:长期股权投资—乙公司8 750贷:银行存款8 750○22009年3月15日,乙公司宣布发放股利,甲公司所占份额= 300 x 70% = 210 借:应收股利—乙公司210贷:投资收益210○33月21日,以公司正式发放股利借:银行存款210贷:应收股利210(2)2009年1月1日,合并当日的调整及抵消分录:借:股本 2 500 贷:长期股权投资8 750 资本公积 1 500 少数股东权益 3 255盈余公积500未分配利润 1 010存货190固定资产 4 150无形资产 1 000商誉 1 155(3)调整的净利润中,母公司所占份额= 895 x 70% = 626.5万元少数股东所占份额= 895 x 30% = 268.5万元发放股利中,母公司所占份额= 300 x 70% = 210万元少数股东所占份额= 300 x 30% = 90万元○1母子公司单独财务报表调整:a.调整资产低估数对乙公司2009年净利润的影响:借:营业成本190管理费用515贷:累计折旧415累计摊销100存货190b.将甲对乙的长期股权投资由成本法调整为权益法:借:长期股权投资626.5贷:投资收益626.5借:投资收益210贷:长期股权投资210○2合并式的调整与抵消分录:a.抵消母公司的长期股权投资与子公司的所有者权益,将乙公司资产的账面价值调为公允价值,并确认商誉。

高级财务会计第二章练习

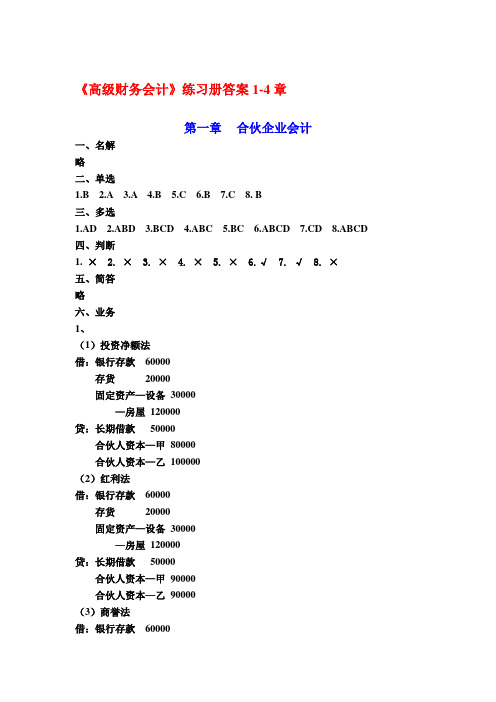

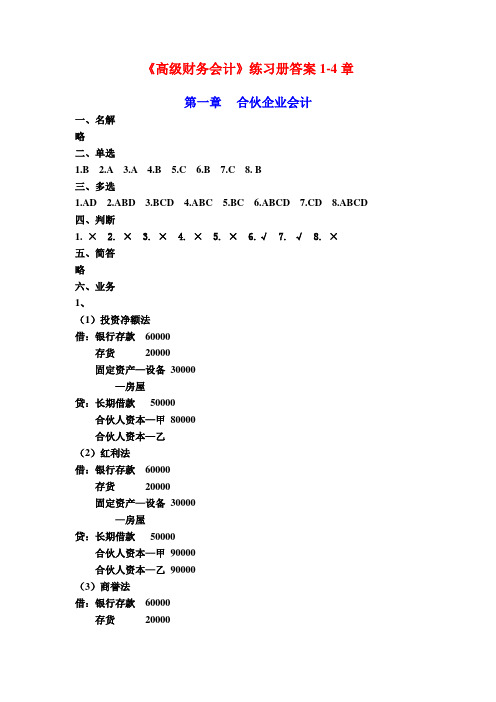

《高级财务会计》练习册答案1-4章

《高级财务会计》练习册答案1-4章第一章合伙企业会计一、名解略二、单选1.B2.A3.A4.B5.C6.B7.C8. B三、多选1.AD2.ABD3.BCD4.ABC5.BC6.ABCD7.CD8.ABCD四、判断1.×2. ×3. ×4. ×5. ×6.√7. √8. ×五、简答略六、业务1、(1)投资净额法借:银行存款60000存货20000固定资产—设备30000—房屋120000贷:长期借款50000合伙人资本—甲80000合伙人资本—乙100000(2)红利法借:银行存款60000存货20000固定资产—设备30000—房屋120000贷:长期借款50000合伙人资本—甲90000合伙人资本—乙90000(3)商誉法借:银行存款60000存货20000固定资产—设备30000—房屋120000商誉20000贷:长期借款50000合伙人资本—甲100000合伙人资本—乙1000002、(1)按加权平均资本余额分配张三= 20000×3/12+22000×5/12+25000×4/12=22500(元)李四=20000×6/12+15000×3/12+11000×3/12=16500(元)张三=100000×(22500/39000)=57692.31(元)李四=100000 ×(16500/39000)=42307.69(元)(2)借:本年利润100 000贷:合伙人资本—张三57692.31—李四42307.63、(1)红利法新合伙企业的资本总额=8000+4000=12000甲转让给丙的资本额=8000-(8000+4000)×30%=4400元乙转让给丙的资本额=4000-(8000+4000)×20%=1600元借:合伙人资本—甲4400—乙1600贷:合伙人资本—丙6000(2)商誉法新合伙企业的资本总额=4000×2÷50%=16000元商誉=16000-12000=4000元借:商誉4000贷:合伙人资本—甲2400—乙1600甲转让给丙的资本额=(8000+2400)-(8000+4000+4000)×30%=5600元乙转让给丙的资本额=(4000+1600)-(8000+4000+4000)×20%=2400元借:合伙人资本—甲5600—乙2400贷:合伙人资本—丙80004、(1)借:合伙人资本—甲45600—乙30400贷:合伙人资本—丙76000(2)借:现金72000贷:合伙人资本—丙72000借:商誉60000贷:合伙人资本—甲36000—乙24000(3)借:现金52000合伙人资本—甲2400—乙1600贷:合伙人资本—丙560005、(1)红利法借:合伙人资本—甲12000—乙100000—丙8000贷: 现金120000(2)商誉部分确认法商誉=退付现金—退伙人资本余额=12-10=2(万元) 借:商誉20000贷:合伙人资本—B 20000借: 合伙人资本—B 120000贷:现金120000(3)商誉全部确认法商誉=2÷1/3=2×3=6(万元),甲、乙、丙各自得到3万元.2万元.1万元.借:商誉60000贷:合伙人资本—甲30000—乙20000—丙10000借: 合伙人资本—乙120000贷:现金1200006、(1)借:现金50000合伙人资本—甲7000—乙3000贷:存货60000(2)借:现金60000合伙人资本—甲14000—乙6000贷:固定资产(净值)80000(3)借:现金44000合伙人资本—甲11200—乙4800贷:应收账款(净额)60000(4)借:应付账款80000贷:现金80000(5)借:应付合伙人借款—甲20000贷:现金20000(6)借:合伙人资本—甲17800—乙56200贷:现金74000第二章分支机构会计一、名解略二、单选1.D2.C3.B4.D5.D6.A7.D8.B9.D 10.B三、多选1.BCDE2.ABDE3.AB4.BCDE5.AB6.ABC7.CDE8.ADE9.ACDE 10.ABCDE四、判断1.×2. ×3. ×4. ×5. √6. ×7. √8. √9. √ 10. ×五、简答略六、业务1、总公司分支机构借:分支机构往来40 借:库存商品30贷:库存商品30 银行存款10 银行存款10 贷:总公司往来40 借:分支机构往来20 借:固定资产20 贷:银行存款20 贷:总公司往来20借:营业费用 4贷:累计折旧 4借:银行存款35贷:主营业务收入35借:主营业务成本20贷:库存商品20借:营业费用 2贷:银行存款 2 借:营业费用18贷:银行存款18借:分支机构往来 1 借:营业费用 1贷:营业费用 1 贷:总公司往来 1 借:银行存款27 借:总公司往来27贷:分支机构往来27 贷:银行存款27 联合报表的抵销分录:借:总公司往来34贷:分支机构往来34结账分录:借:分支机构往来22 借:主营业务收入35贷:本年利润——分支机构转入22 贷:营业费用 3主营业务成本20总公司往来22 2、总公司分支机构借;分支机构往来120 借:库存商品120贷:库存商品100 贷:总公司往来120存货加价20与内部交易相关的抵销分录:借:存货加价20贷:主营业务成本16存货 43、总公司:分支机构:借:分支机构往来60 借:库存商品60贷:库存商品50 贷:总公司往来60 存货加价10联合报表抵消分录:借:存货加价18贷:存货 4主营业务成本14总公司结账时确认存货已实现利润:借:存货加价14贷:本年利润144、总公司分支机构:借:分支机构往来8 借:银行存款8贷:银行存款8 贷:总公司往来8借:分支机构往来22 借:库存商品22贷:库存商品20 贷:总公司往来22存货加价2借:固定资产 5 借:总公司往来 5贷:分支机构往来 5 贷:银行存款 5借:分支机构往来 1 借:营业费用 1贷:累计折旧 1 贷:总公司往来 1借:库存商品 2贷:银行存款 2借:营业费用 1贷:银行存款 1借:银行存款32贷:主营业务收入32借:主营业务成本21.8贷:库存商品21.8 借:银行存款18 借:总公司往来18借:分支机构往来8.2 借:主营业务收入32 贷:本年利润8.2 贷:主营业务成本21.8营业费用 2总公司往来8.2 借:存货加价1.8贷:本年利润 1.8第三章企业合并一、名解略二、单选勘误:第31页单选第1题,题目改为:企业合并中不属于法律形式的合并为1.D2.A3.A4.B5.B6.C7.A8.D9.A 10.C三、多选1.AD2.AD3.BD4.AB5.ABD四、判断1.×2. ×3. ×4. ×5. ×6. ×7. ×8. √9. √ 10. √五、简答略六、业务1. 同一控制下的企业合并①借:银行存款10应收账款30存货40土地10固定资产110资本公积40贷:应付账款20应付票据30银行存款190②借:银行存款10应收账款30存货40土地10固定资产110贷:应付账款20应付票据30银行存款30股本100资本公积20③借:银行存款10应收账款30存货40土地10固定资产110贷:应付账款20应付票据30应付债券130资本公积20非同一控制下的企业合并①借:银行存款10应收账款28存货50土地20固定资产130贷:应付账款20应付票据28银行存款190②商誉=(30+100×2)-190=40万借:银行存款10应收账款28存货50土地20固定资产130商誉40贷:应付账款20应付票据28银行存款30股本100资本公积100③借:银行存款10应收账款28存货50土地20固定资产130贷:应付账款20应付票据28应付债券130营业外收入60 2.(1)借:长期股权投资10000贷:股本1000资本公积9000(2)借:存货1000长期股权投资500固定资产1500无形资产1000实收资本6000资本公积2000盈余公积300未分配利润2700商誉1000贷:长期股权投资10000少数股权投资6000(4)借:银行存款200应收账款800库存商品5000长期股权投资1500固定资产9500无形资产2000商誉1000贷:短期借款2000应付账款1000其他应付款1000股本1600资本公积14400第四章合并财务报表(上)一、名解略二、单选1.D2.C3.B4.B5.D6.A7.A8.B9.C 10.D三、多选1.ABD2.ABC3.AC4.ABCD5.ABC6.ABC7.ACD8.ACD9.ACD 10.AD四、判断1.√2. ×3. ×4. √5. √6. ×7. √8. ×9. √ 10. ×五、简答略六、业务1.①借:固定资产——办公楼200贷:资本公积——其他资本公积200②借:管理费用20贷:固定资产——累计折旧20③借:长期股权投资——S公司228应收股利720贷:投资收益——S公司948④借:股本2000资本公积900盈余公积800未分配利润480商誉520贷:长期股权投资3028少数股东权益l672⑤借:投资收益948少数股东损益632未分配利润一年初400贷:本年利润分配一提取盈余公积300本年利润分配一应付股利1200未分配利润—年末4802.(学生必须写得很小,否则空白不够)(1)借:长期股权投资8000资本公积200贷:银行存款8200借:应收股利400贷:长期股权投资400借:银行存款400贷:应收股利400借:应收股利320长期股权投资400贷:投资收益720借:银行存款320贷:应收股利320(2)×7年12月31日按权益法调整后的长期股权投资账面余额=8000+1000×80%-500×80%=8400万元×8年12月31日按权益法调整后的长期股权投资账面余额=8000+1000×80%-500×80%+1200×80%-400×80%=9040万元(3)×7年×8年借:股本 6000 6000资本公积—年初 1000 1000盈余公积—年初 300 400—本年 100 120未分配利润—年末 3100 3780 贷:长期股权投资 8400 9040少数股权投资 2100 2260借:投资收益 800 960少数股东损益 200 240未分配利润—年初 2700 3100贷:提取盈余公积 100 120对所有者的分配 500 400未分配利润—年末 3100 37803.(学生必须写得很小,否则空白不够)(1)借:长期股权投资33000贷:银行存款33000借:应收股利800贷:长期股权投资800借:银行存款800贷:应收股利800借:应收股利880贷:长期股权投资880借:银行存款880贷:应收股利880(2)×7年12月31日按权益法调整后的长期股权投资账面余额=33000+4000×80%-1000×80%=35400万元×8年12月31日按权益法调整后的长期股权投资账面余额=33000+4000×80%-1000×80%+5000×80%-1100×80%=38520万元(3)×7年×8年借:股本 30000 30000资本公积—年初 2000 2000盈余公积—年初 800 1200—本年 400 500未分配利润—年末 9800 13200商誉 1000 1000 贷:长期股权投资 35400 38520 少数股权投资 8600 9380借:投资收益 3200 4000少数股东损益 800 1000未分配利润—年初 7200 9800贷:提取盈余公积 400 500对所有者的分配 1000 1100未分配利润—年末9800 13200。

《高级财务会计》练习册答案1-4章

《高级财务会计》练习册答案1-4章第一章合伙企业会计一、名解略二、单选1.B2.A3.A4.B5.C6.B7.C8. B三、多选1.AD2.ABD3.BCD4.ABC5.BC6.ABCD7.CD8.ABCD四、判断1.×2. ×3. ×4. ×5. ×6.√7. √8. ×五、简答略六、业务1、(1)投资净额法借:银行存款60000存货20000固定资产—设备30000—房屋贷:长期借款50000合伙人资本—甲80000合伙人资本—乙(2)红利法借:银行存款60000存货20000固定资产—设备30000—房屋贷:长期借款50000合伙人资本—甲90000合伙人资本—乙90000(3)商誉法借:银行存款60000存货20000固定资产—设备30000—房屋商誉20000贷:长期借款50000合伙人资本—甲合伙人资本—乙2、(1)按加权平均资本余额分配张三= 20000×3/12+22000×5/12+25000×4/12=22500(元)李四=20000×6/12+15000×3/12+11000×3/12=16500(元)张三=×(22500/39000)=57692.31(元)李四=×(16500/39000)=42307.69(元)(2)借:本年利润100 000贷:合伙人资本—张三57692.31—李四42307.63、(1)红利法新合伙企业的资本总额=8000+4000=12000甲转让给丙的资本额=8000-(8000+4000)×30%=4400元乙转让给丙的资本额=4000-(8000+4000)×20%=1600元借:合伙人资本—甲4400—乙1600贷:合伙人资本—丙6000(2)商誉法新合伙企业的资本总额=4000×2÷50%=16000元商誉=16000-12000=4000元借:商誉4000贷:合伙人资本—甲2400—乙1600甲转让给丙的资本额=(8000+2400)-(8000+4000+4000)×30%=5600元乙转让给丙的资本额=(4000+1600)-(8000+4000+4000)×20%=2400元借:合伙人资本—甲5600—乙2400贷:合伙人资本—丙80004、(1)借:合伙人资本—甲45600—乙30400贷:合伙人资本—丙76000(2)借:现金72000贷:合伙人资本—丙72000借:商誉60000贷:合伙人资本—甲36000—乙24000(3)借:现金52000合伙人资本—甲2400—乙1600贷:合伙人资本—丙560005、(1)红利法借:合伙人资本—甲12000—乙—丙8000贷: 现金(2)商誉部分确认法商誉=退付现金—退伙人资本余额=12-10=2(万元) 借:商誉20000贷:合伙人资本—B 20000借: 合伙人资本—B贷:现金(3)商誉全部确认法商誉=2÷1/3=2×3=6(万元),甲、乙、丙各自得到3万元.2万元.1万元.借:商誉60000贷:合伙人资本—甲30000—乙20000—丙10000借: 合伙人资本—乙贷:现金6、(1)借:现金50000合伙人资本—甲7000—乙3000贷:存货60000(2)借:现金60000合伙人资本—甲14000—乙6000贷:固定资产(净值)80000(3)借:现金44000合伙人资本—甲11200—乙4800贷:应收账款(净额)60000(4)借:应付账款80000贷:现金80000(5)借:应付合伙人借款—甲20000贷:现金20000(6)借:合伙人资本—甲17800—乙56200贷:现金74000第二章分支机构会计一、名解略二、单选1.D2.C3.B4.D5.D6.A7.D8.B9.D 10.B三、多选1.BCDE2.ABDE3.AB4.BCDE5.AB6.ABC7.CDE8.ADE9.ACDE 10.ABCDE四、判断1.×2. ×3. ×4. ×5. √6. ×7. √8. √9. √ 10. ×五、简答略六、业务1、总公司分支机构借:分支机构往来40 借:库存商品30贷:库存商品30 银行存款10 银行存款10 贷:总公司往来40 借:分支机构往来20 借:固定资产20 贷:银行存款20 贷:总公司往来20借:营业费用 4贷:累计折旧 4借:银行存款35贷:主营业务收入35借:主营业务成本20贷:库存商品20借:营业费用 2贷:银行存款 2 借:营业费用18贷:银行存款18借:分支机构往来 1 借:营业费用 1贷:营业费用 1 贷:总公司往来 1 借:银行存款27 借:总公司往来27贷:分支机构往来27 贷:银行存款27联合报表的抵销分录:借:总公司往来34贷:分支机构往来34结账分录:借:分支机构往来22 借:主营业务收入35贷:本年利润——分支机构转入22 贷:营业费用 3主营业务成本20总公司往来222、总公司分支机构借;分支机构往来120 借:库存商品120贷:库存商品100 贷:总公司往来120存货加价20与内部交易相关的抵销分录:借:存货加价20贷:主营业务成本16存货 43、总公司:分支机构:借:分支机构往来60 借:库存商品60贷:库存商品50 贷:总公司往来60 存货加价10联合报表抵消分录:借:存货加价18贷:存货 4主营业务成本14总公司结账时确认存货已实现利润:借:存货加价14贷:本年利润144、总公司分支机构:借:分支机构往来8 借:银行存款8贷:银行存款8 贷:总公司往来8借:分支机构往来22 借:库存商品22贷:库存商品20 贷:总公司往来22 存货加价2借:固定资产 5 借:总公司往来 5贷:分支机构往来 5 贷:银行存款 5借:分支机构往来 1 借:营业费用 1贷:累计折旧 1 贷:总公司往来 1借:库存商品 2贷:银行存款 2借:营业费用 1贷:银行存款 1借:银行存款32贷:主营业务收入32借:主营业务成本21.8贷:库存商品21.8 借:银行存款18 借:总公司往来18借:分支机构往来8.2 借:主营业务收入32 贷:本年利润8.2 贷:主营业务成本21.8营业费用 2总公司往来8.2 借:存货加价1.8贷:本年利润 1.8第三章企业合并一、名解略二、单选勘误:第31页单选第1题,题目改为:企业合并中不属于法律形式的合并为1.D2.A3.A4.B5.B6.C7.A8.D9.A 10.C三、多选1.AD2.AD3.BD4.AB5.ABD四、判断1.×2. ×3. ×4. ×5. ×6. ×7. ×8. √9. √ 10. √五、简答略六、业务1. 同一控制下的企业合并①借:银行存款10应收账款30存货40土地10固定资产110资本公积40贷:应付账款20应付票据30银行存款190②借:银行存款10应收账款30存货40土地10固定资产110贷:应付账款20应付票据30银行存款30股本100资本公积20③借:银行存款10应收账款30存货40土地10固定资产110贷:应付账款20应付票据30应付债券130资本公积20非同一控制下的企业合并①借:银行存款10应收账款28存货50土地20固定资产130贷:应付账款20应付票据28银行存款190②商誉=(30+100×2)-190=40万借:银行存款10应收账款28存货50土地20固定资产130商誉40贷:应付账款20应付票据28银行存款30股本100资本公积100③借:银行存款10应收账款28存货50土地20固定资产130贷:应付账款20应付票据28应付债券130营业外收入60 2.(1)借:长期股权投资10000贷:股本1000资本公积9000(2)借:存货1000长期股权投资500固定资产1500无形资产1000实收资本6000资本公积2000盈余公积300未分配利润2700商誉1000贷:长期股权投资10000少数股权投资6000(4)借:银行存款200应收账款800库存商品5000长期股权投资1500固定资产9500无形资产2000商誉1000贷:短期借款2000应付账款1000其他应付款1000股本1600资本公积14400第四章合并财务报表(上)一、名解略二、单选1.D2.C3.B4.B5.D6.A7.A8.B9.C 10.D三、多选1.ABD2.ABC3.AC4.ABCD5.ABC6.ABC7.ACD8.ACD9.ACD 10.AD四、判断1.√2. ×3. ×4. √5. √6. ×7. √8. ×9. √ 10. ×五、简答略六、业务1.①借:固定资产——办公楼200贷:资本公积——其他资本公积200②借:管理费用20贷:固定资产——累计折旧20③借:长期股权投资——S公司228应收股利720贷:投资收益——S公司948④借:股本2000资本公积900盈余公积800未分配利润480商誉520贷:长期股权投资3028少数股东权益l672⑤借:投资收益948少数股东损益632未分配利润一年初400贷:本年利润分配一提取盈余公积300本年利润分配一应付股利1200未分配利润—年末4802.(学生必须写得很小,否则空白不够)(1)借:长期股权投资8000资本公积200贷:银行存款8200借:应收股利400贷:长期股权投资400借:银行存款400贷:应收股利400借:应收股利320长期股权投资400贷:投资收益720借:银行存款320贷:应收股利320(2)×7年12月31日按权益法调整后的长期股权投资账面余额=8000+1000×80%-500×80%=8400万元×8年12月31日按权益法调整后的长期股权投资账面余额=8000+1000×80%-500×80%+1200×80%-400×80%=9040万元(3)×7年×8年借:股本 6000 6000资本公积—年初 1000 1000盈余公积—年初 300 400—本年 100 120未分配利润—年末 3100 3780 贷:长期股权投资 8400 9040少数股权投资 2100 2260借:投资收益 800 960少数股东损益 200 240未分配利润—年初 2700 3100贷:提取盈余公积 100 120对所有者的分配 500 400未分配利润—年末 3100 37803.(学生必须写得很小,否则空白不够)(1)借:长期股权投资33000贷:银行存款33000借:应收股利800贷:长期股权投资800借:银行存款800贷:应收股利800借:应收股利880贷:长期股权投资880借:银行存款880贷:应收股利880(2)×7年12月31日按权益法调整后的长期股权投资账面余额=33000+4000×80%-1000×80%=35400万元×8年12月31日按权益法调整后的长期股权投资账面余额=33000+4000×80%-1000×80%+5000×80%-1100×80%=38520万元(3)×7年×8年借:股本 30000 30000资本公积—年初 2000 2000盈余公积—年初 800 1200—本年 400 500未分配利润—年末 9800 13200商誉 1000 1000 贷:长期股权投资 35400 38520 少数股权投资 8600 9380借:投资收益 3200 4000少数股东损益 800 1000未分配利润—年初 7200 9800贷:提取盈余公积 400 500对所有者的分配 1000 1100未分配利润—年末9800 13200。

Advanced Accounting 第二章答案

Chapter 2STOCK INVESTMENTS — INVESTOR ACCOUNTING AND REPORTING Answers to Questions1Only the investor’s accounts are affected when outstanding stock is acquired from existing stockholders.The investor records the investment at its cost. Since the investee company is not a party to the transaction, its accounts are not affected.Both investor and investee accounts are affected when unissued stock is acquired directly from the investee. The investor records the investment at its cost and the investee adjusts its asset and owners’ equity accounts to reflect the issuance of previously unissued stock.2Goodwill arising from an equity investment of 20 percent or more is not recorded separately from the investment account. Under the equity method, the investment is presented on one line of the balance sheet in accordance with the one-line consolidation concept.3Dividends received from earnings accumulated before an investment is acquired are treated as decreases in the investment account balance under the fair value/cost method. Such dividends are considered a return ofa part of the original investment.4The equity method of accounting for investments increases the investment account for the investor’s share of the investee’s income and decreases it for the investor’s share of the investee’s losses and for dividends received from the investee. In addition, the investment and investment income accounts are adjusted for amortization of any investment cost-book value differentials related to the interest acquired. Adjustments to the investment and investment income accounts are also needed for unrealized profits and losses from transactions between the investor and investee companies.5The equity method is referred to as a one-line consolidation because the investment account is reported on one line of the investor’s balance sheet and investment income is reported on one line of the investor’s income statement (except when the investee has extraordinary or cumulative-effect type adjustments). In addition, the investment income is computed such that the parent company’s income and stockholders’ equity are equal to the consolidated net income and consolidated stockholders’ equity that would result if the statements of the investor and investee were consolidated.6If the equity method of accounting is applied correctly, the income of the parent company will generally equal consolidated net income.7The difference in the equity method and consolidation lies in the detail reported, but not in the amount of income reported. The equity method reports investment income on one line of the income statement whereas the details of revenues and expenses are reported in the consolidated income statement.8The investment account balance of the investor will equal underlying book value of the investee if (a) the equity method is correctly applied, (b) the investment was acquired at book value which was equal to fair value, the pooling method was used, or the cost-book value differentials have all been amortized, and (c) there have been no intercompany transactions between the affiliated companies that have created investment account-book value differences.9The investment account balance must be converted from the cost to the equity method when acquisitions increase the interest held to 20 percent or more. The amount of the adjustment is the difference between the investment income reported under the cost method in prior years and the income that would have been reported if the equity method of accounting had been used. Changes from the cost to the equity method of accounting for equity investments are changes in the reporting entity that require restatement of prior years’ financial statements when the effect is material.10The one-line consolidation is adjusted whe n the investee’s income includes extraordinary items, gains or losses from discontinued operations, or cumulative-effect type adjustments. In this case, the investor’s share of the investee’s ordinary income is reported as investment income under a one-line consolidation, but the investor’s share of extraordinary items, cumulative-effect type adjustments, and gains and losses from discontinued operations is combined with similar items of the investor.11The remaining 15 percent interest in the investee is accounted for under the fair value/cost method, and the investment account balance immediately after the sale becomes the new cost basis.12Yes. When an investee has preferred stock in its capital structure, the investor has to allocate the investee’s inco me to preferred and common stockholders. Then, the investor takes up its share of theinvestee’s income allocated to common stockholders in applying the equity method. The allocation isnot necessary when the investee has only common stock outstanding.13Goodwill impairment losses are calculated by business reporting units. For each reporting unit, the company must first determine the fair values of net assets. The fair value of the reporting unit is theamount at which it could be purchased in a current market transaction. This may be based on marketprices, discounted cash flow analyses, or similar current transactions. This is done in the same manneras is done to originally record a combination. Any excess measured fair value is the fair value ofgoodwill. The company then compares the goodwill fair value estimate to the carrying value ofgoodwill to determine if there has been an impairment during the period.14Yes. Impairment losses for subsidiaries are computed as outlined in the solution to question 13.Companies compare fair values to book valuers for equity method investments as a whole. Firms mayrecognize impairments for equity method investments as a whole, but perform no separate goodwillimpairment.15Initial impairment losses recorded upon adoption of SFAS 142 are treated as the cumulative effect of an accounting change. Impairment losses resulting from subsequent annual reviews are included in thecalculation of income from operations.SOLUTIONS TO EXERCISESSolution E2-11 d2 c3 c4 d5 bSolution E2-2 [AICPA adapted]1 d2 b3 d4 bGrade’s investment is reported at its $300,000 cost because the equity method is not appropriate and because Grade’s share of Medium’s income exceeds dividends received since acquisition [($260,000 ⨯ 15%) >$20,000].5 cDividends received from Zafacon for the two years were $10,500 ($70,000 ⨯15%), but only $9,000 (15% of Zafacon’s income of $60,000 for the two years) is shown on Torquel’s income statement as d ividend income fromthe Zafacon investment. The remaining $1,500 reduces the investmentaccount balance.6 c[$50,000 + $150,000 + ($300,000 ⨯ 10%)]7 a8 dInvestment balance January 2 $250,000Add: Income from Pod ($100,000 ⨯ 30%) 30,000Investment in Pod December 31 $280,000 Solution E2-31Bowman’s percentage ownership in TrevorBowman’s 20,000 shares/(60,000 + 20,000) shares = 25%2GoodwillInvestment cost $500,000Book value acquired ($1,000,000 + $500,000) ⨯ 25% 375,000Goodwill $125,000 Solution E2-4Income from Medley for 2007Share of Medley’s income ($200,000 ⨯ 1/2 year ⨯ 30%) $ 30,000Solution E2-51Income from OakeyShare of Oakey’s reported income ($800,000 30%) $ 240,000 Less: Excess allocated to inventory (100,000)(50,000) Less: Depreciation of excess allocated to building($200,000/4 years)Income from Oakey $ 90,0002Investment account balance at December 31Cost of investment in Oakey $2,000,000 Add: Income from Oakey 90,000 Less: Dividends (60,000)Investment in Oakey December 31 $2,030,000Alternative solution:Underlying equity in Oakey at January 1 ($1,500,000/.3) $5,000,000 Income less dividends 600,000 Underlying equity December 31 5,600,000 Interest owned 30% Book value of interest owned December 31 1,680,000 Add: Unamortized excess 350,000 Investment in Oakey December 31 $2,030,000Solution E2-6Journal entry on Martin’s books:Investment in Neighbors $ 120,000Loss from discontinued operations 20,000Income from Kelly $ 140,000 To recognize income from 40% investment in Neighbors.Solution E2-71 aDividends received from Bennett ($120,000 ⨯ 15%) $ 18,000 Share of income since acquisition of interest2006 ($20,000 ⨯ 15%) (3,000)2007 ($80,000 ⨯ 15%) (12,000) Excess dividends received over share of income $ 3,000Investment in Bennett January 3, 2006 $ 50,000 Less: Excess dividends received over share of income (3,000) Investment in Bennett December 31, 2007 $ 47,0002 bCost of 10,000 of 40,000 shares outstanding $1,400,000 Book value of 25% interest acquired ($4,000,000stockholders’ equity at December 31, 2006 +$1,400,000 from additional stock issuance) ⨯ 25% 1,350,000 Excess cost over book value acquired (goodwill) $ 50,000 3 dThe investment in Monroe balance remains at the originalcost.4 cIncome before extraordinary item $ 200,000 Percent owned 40% Income from Krazy Products $ 80,000 Solution E2-8Preliminary computationsCost of 40% interest January 1, 2006 $2,400,000 Book value acquired ($4,000,000 ⨯ 40%) (1,600,000) Excess cost over book value acquired $ 800,000 Excess allocated to:Inventories $100,000 ⨯ 40% $ 40,000 Equipment $200,000 ⨯ 40% 80,000 Goodwill for the remainder 680,000 Excess cost over book value acquired $ 800,000 Raython’s underlying e quity in Treaton ($5,500,000 ⨯ 40%) $2,200,000 Add: Goodwill 680,000 Investment balance December 31, 2010 $2,880,000Alternative computation:Raython’s share of the change in Treaton’s stockholders’equity ($1,500,000 ⨯ 40%) $ 600,000 Less: Excess allocated to inventories ($40,000 ⨯ 100%) (40,000) Less: Excess allocated to equipment ($80,000/4 years ⨯ 4 years) (80,000) Increase in investment account 480,000 Original investment 2,400,000 Investment balance December 31, 2010 $2,880,000Solution E2-91Income from RunnerShare of income to common ($400,000 - $30,000 preferreddividends) ⨯ 30% $ 111,000 2Investment in Runner December 31, 2007Investment cost $1,250,000 Add: Income from Runner 111,000 Less: Dividends from Runner ($200,000 dividends - $30,000dividends to preferred) ⨯ 30% (51,000) Investment in Runner December 31, 2007 $1,310,000 Solution E2-101Income from Tree ($300,000 – 100,000) ⨯ 25%Investment income October 1 to December 31 $ 25,000 2Investment balance December 31Investment cost October 1 $ 600,000 Add: Income from Tree 25,000 Less: Dividends --- Investment in Tree December 31 $ 625,000Solution E2-11Preliminary computationsGoodwill from first 10% interest:Cost of investment $ 50,000 Book value acquired ($420,000 ⨯ 10%) (42,000) Excess cost over book value acquired $ 8,000 Goodwill from second 10% interest:Cost of investment $ 100,000 Book value acquired ($500,000 ⨯ 10%) (50,000) Excess cost over book value acquired $ 50,000 1Correcting entry as of January 2, 2007 toconvert investment to the equity basisAccumulated gain/loss on stock available forSale 50,00050,000 Valuation allowance to record SAS at fairValueTo remove the valuation allowance entered onDecember 31, 2007 under the fair value methodfor an available for sale security.Investment in Twizzle 8,000Retained earnings 8,000 To adjust investment account to an equity basiscomputed as follows:Share of Twizzle’s income for 2007 $ 20,000Less: Share of dividends for 2007 (12,000)$ 8,000 2Income from Twizzle for 2007Income from Twizzle on original 10% investment $ 10,000Income from Twizzle on second 10% investment 10,000 Income from Twizzle $ 20,000Solution E2-12Preliminary computationsStockholders’ equity of Tall on December 31, 2006 $380,000 Sale of 12,000 previously unissued shares on January 1, 2007 250,000 Stock holders’ equity after issuance on January 1, 2007 $630,000 Cost of 12,000 shares to River $250,000 Book value of 12,000 shares acquired$630,000 ⨯ 12,000/36,000 shares 210,000 Excess cost over book value acquired $ 40,000Excess is allocated as follows:Buildings $60,000 ⨯ 12,000/36,000 shares $ 20,000 Goodwill 20,000 Excess cost over book value acquired $ 40,000 Journal entries on River’s books during 2007January 1Investment in Tall 250,000Cash 250,000 To record acquisition of a 1/3 interest in Tall.During 2007Cash 30,000Investment in Tall 30,000 To record dividends received from Tall ($90,000 ⨯ 1/3).December 31Investment in Tall 38,000Income from Tall 38,000 To record investment income from Tall computed asfollows:Share of Tall’s income ($120,000 ⨯ 1/3) $ 40,000Depreciation on building ($20,000/10 years) (2,000)Income from Tall$ 38,000Solution E2-131Journal entries on BIP’s books for 2007Cash 30,000Investment in Crown (30%) 30,000 To record dividends received from Crown($100,000 ⨯ 30%).Investment in Crown (30%) 60,000Extraordinary loss (from Crown) 6,000Income from Crown 66,000 To record investment income from Crown computedas follows:Share of income before extraordinary item$170,000 ⨯ 30% $ 51,000 Add: Excess fair value over cost realizedin 2007$50,000 ⨯ 30% 15,000 Income from Crown before extraordinary$ 66,000 loss2Investment in Crown balance December 31, 2007Investment cost $ 195,000 Add: Income from Crown after extraordinary loss 60,000 Less: Dividends received from Crown (30,000) Investment in Crown December 31 $225,000 Check: Investment balance is equal to underlying book value($700,000 + $150,000 - $100,000) ⨯ 30% = $225,0003 BIP CorporationIncome Statementfor the year ended December 31, 2007Sales $1,000,000 Expenses 700,000 Operating income 300,000 Income from Crown (before extraordinary item) 66,000 Income before extraordinary item 366,000 Extraordinary loss (net of tax effect) 6,000 Net income $ 360,000Solution E2-141Income from Water for 2006Equity in income ($108,000 - $8,000 preferred) ⨯ 40% $ 40,000 2Investment in Water December 31, 2006Cost of investment in Water common $ 290,000 Add: Income from Water 40,000 Less: Dividends (16,000) Investment in Water December 31 $ 314,000Solution E2-15Since the total value of Steele has declined by $60,000 while the fair valueof the net identifiable assets is unchanged, the $60,000 decline is the impairment in goodwill for the period. Assuming this is not the initial adoption of SFAS 142, the $60,000 impairment loss is deducted in calculating Park’s income from continuing operations.Solution E2-16Goodwill impairments are calculated at the business reporting unit level. Increases and decreases in fair values across business units are notoffsetting. Flash must report an impairment loss of $5,000 in calculating 2006 income from continuing operations.SOLUTIONS TO PROBLEMSSolution P2-11GoodwillCost of investment in Telly on April 1 $ 343,000Book value acquired:Net assets at December 31 $1,000,000Add: Income for 1/4 year ($120,000 ⨯ 25%) 30,000Less: Dividends paid March 15 (20,000)Book value at April 1 1,010,000Interest acquired 30% 303,000 Goodwill from investment in Telly $ 40,0002Income from Telly for 2007Equity in income before extraordinary item($120,000 ⨯ 3/4 year ⨯ 30%) $ 27,000 Extraordinary gain from Telly ($40,000 ⨯ 30%) 12,000Income from Telly $ 39,0003Investment in Telly at December 31, 2007Investment cost April 1 $ 343,000Add: Income from Telly plus extraordinary gain 39,000Less: Dividends ($20,000 ⨯ 3 quarters) ⨯ 30% (18,000) Investment in Shelly December 31 $ 364,0004Equity in Telly’s net assets at December 31, 2007Telly’s stockholders’ equity January 1$1,000,000Add: Net income 160,000Less: Dividends (80,000) Telly’s stockholders’ equity December 31 1,080,000Investment interest 30% Equity in Telly’s net assets$ 324,0005Extraordinary gain for 2007 to be reported by RitterTelly’s extraordinary gain ⨯ 30% $ 12,0001Cost methodInvestment in Siegel July 1, 2006 (at cost) $110,000 Dividends charged to investment (2,400)$107,600 Investment in Siegel balance at December 31,2006July 1, 2006Investment in Siegel 110,000Cash 110,000 To record initial investment for 80% interest.November 1, 2006Cash 6,400Dividend income 6,400 To record receipt of dividends ($8,000 ⨯ 80%).December 31, 2006Dividend income 2,400Investment in Siegel 2,400 To reduce investment for dividends in excess ofearnings ($8,000 dividends - $5,000 earnings) ⨯80%.2Equity methodInvestment in Siegel July 1, 2006 $110,000 Add: Share of reported income 4,000 Deduct: Dividends charged to investment (6,400) Deduct: Excess Depreciation (1,100) Investment in Siegel balance at December 31,2006 $106,500July 1, 2006Investment in Siegel 110,000Cash 110,000 To record initial investment for 80% interestof Siegel.November 1, 2006Cash 6,400Investment in Siegel 6,400 To record receipt of dividends ($8,000 ⨯ 80%).December 31, 2006Investment in Siegel 2,900Income from Siegel 2,900 To record income from Siegel computed as follows:Share of Siegel’s income ($10,000 ⨯ 1/2 year ⨯ 80%)less excess depreciation ($22,000/10 years ⨯ 1/2 year).Preliminary computationsCost of investment in Zelda $331,000 Book value acquired ($1,000,000 ⨯ 30%) 300,000 Excess cost over book value acquired $ 31,000 Excess allocated:Undervalued inventories ($30,000 ⨯ 30%) $ 9,000 Overvalued building (-$60,000 ⨯ 30%) (18,000) Goodwill for the remainder 40,000 Excess cost over book value acquired $ 31,000 1Income from ZeldaShare of Zelda’s reported income ($100,000 ⨯ 30%) $ 30,000 Less: Excess allocated to inventories sold in 2006 (9,000) Add: Amortization of excess allocated to overvaluedbuilding $18,000/10 years 1,800Income from Zelda—2006 $ 22,800 2Investment balance December 31, 2006Cost of investment $331,000 Add: Income from Zelda 22,800 Less: Share of Zelda’s dividends ($50,000 ⨯ 30%) (15,000) Investment in Zelda balance December 31 $338,8003Vatter’s share of Zelda’s net assetsShare of stockholders’ equity($1,000,000 + $100,000 income - $50,000 dividends) ⨯ 30% $315,000Preliminary computationsInvestment cost of 40% interest $380,000 Book value acquired [$500,000 + ($100,000 ⨯ 1/2 year)] ⨯ 40% 220,000 Excess cost over book value acquired $160,000 Excess allocated:Land $30,000 ⨯ 40% $ 12,000 Equipment $50,000 ⨯ 40% 20,000 Remainder to goodwill 128,000 Excess cost over book value acquired $160,000 July 1, 2006Investment in Dormer 380,000 Cash 380,000 To record initial investment for 40% interest in Dormer.November 2006Cash (other receivables) 20,000 Investment in Dormer 20,000 To record receipt of dividends ($50,000 ⨯ 40%).December 31, 2006Investment in Dormer 20,000 Income from Dormer 20,000 To record share of Dormer’s income ($100,000 ⨯ 1/2 year ⨯ 40%).December 31, 2006Income from Dormer 2,000 Investment in Dormer 2,000 To record depreciation on excess allocated toUndervalued equipment ($20,000/5 years ⨯ 1/2 year).1Schedule to allocate cost—book value differentialsInvestment cost January 1 $1,680,000 Book value acquired ($3,900,000 net assets ⨯ 30%) 1,170,000 Excess cost over book value acquired $ 510,000 Allocation of excess:Fair Value—PercentBook Value Acquired Allocation Inventories $200,000 30% $ 60,000 Land 800,000 30% 240,000 Buildings—net 500,000 30% 150,000 Equipment—net (700,000) 30% (210,000) Bonds payable (100,000) 30% (30,000) Assigned to identifiable net assets 210,000 Remainder to goodwill 300,000 Excess cost over book value acquired $ 510,000 2Income from Tremor for 2006Equity in income ($1,200,000 ⨯ 30%) $ 360,000 Less: Amortization of differentialsInventories (sold in 2006) (60,000)Buildings—net ($150,000/10 years) (15,000)Equipment—net ($210,000/7 years) 30,000Bonds payable ($30,000/5 years) 6,000 Income from Tremor $ 321,000 3Investment in Tremor balance December 31, 2006Investment cost $1,680,000 Add: Income from Tremor 321,000 Less: Dividends ($600,000 ⨯ 30%) (180,000) Investment in Tremor December 31 $1,821,000 Check:Underlying equity ($4,500,000 ⨯ 30%) $1,350,000Unamortized excess:Land 240,000Buildings—net ($150,000 - $15,000) 135,000Equipment—net ($210,000 - $30,000) (180,000)Bonds payable ($30,000 - $6,000) (24,000)Goodwill 300,000 Investment in Tremor account $1,821,0001Income from StapletonInvestment in Stapleton July 1, 2006 at cost $96,000 Book value acquired ($130,000 ⨯ 60%) 78,000 Excess cost over book value acquired $18,000Pauly’s share of Stapleton’s income for 2006($20,000 ⨯ 1/2 year ⨯ 60%) $ 6,000 Less: Excess Depreciation ($18,000/10 years ⨯ 1/2 year) 900 Income from Stapleton for 2006 $ 5,1002Investment balance December 31, 2006Investment cost July 1 $96,000 Add: Income from Stapleton 5,100 Less: Dividends ($12,000 ⨯ 60%) (7,200) Investment in Stapleton December 31 $93,900 Solution P2-7Dill CorporationPartial Income Statementfor the year ended December 31, 2008Investment incomeIncome from Larkspur (equity basis) $45,000 Income before extraordinary item 45,000 Extraordinary gainShare of Larkspur’s operating loss carryforward 30,000 Net income $75,0001Investment income—2008Income from 10% investment:Share of income ($70,000 ⨯ 10%) ⨯ 1 year $7,000Less: Excess depreciation ($20,000 -$15,000) ⨯ 10% ⨯ 1 year (500) $ 6,500 Income from 20% investment:Share of income ($70,000 ⨯ 20%) ⨯ 1/2 year $7,000Less: Excess depreciation ($50,000 -$47,000) ⨯ 10% ⨯ 1/2 year (150) 6,850 Investment income $13,3502Prior period adjustment and other journal entries to record additional purchase of Brady stockThe 10% interest is converted to the equity method as of January 1, 2008 with the following entry:Investment in Brady 4,000Retained earnings 4,000 The adjustment is equal to $50,000 retained earnings increase for 2006and 2007 times 10% interest, less excess depreciation of $1,000 for 2006 and 2007.Unrealized gains on available for salesecurities 5,000Valuation allowance for available forsale securities 5,000 This entry reverses the cumulative fair value adjustment made inprior periods. Since the security was available for sale ratherthan a trading security, the adjustment has had no impact on priorincome statements.Investment in Brady 50,000Cash 50,000 Record the purchase of the additional 20% interest in Brady.3Investment in Brady at December 31, 2009Share of Brady’s underlying equity at Decembe r 31, 2009($290,000 stockholders’ equity ⨯ 30%) $87,000 Add: Unamortized equipment excess on 10% interest 3,000Add: Unamortized equipment excess on 20% interest 2,550Investment account balance December 31 $92,5504Adjustment for Hazel’s purchase of additional stock from Brady Hazel increases its investment in Brady account by $70,000, the amountof the additional investment. The new balance of the investment in Brady account will be $162,550.Preliminary computationsInvestment cost of 90% interest in Sigma $1,980,000 Book value acquired ($2,525,000 + $125,000) ⨯ 90% (2,385,000) Excess book value over cost $ (405,000) Excess allocated:Overvalued plant assets ($500,000 ⨯ 90%) $ (450,000) Undervalued inventories ($50,000 ⨯ 90%) 45,000 Excess book value over cost $ (405,000) 1Investment income for 2006Share of reported income ($250,000 ⨯ 1/2 year ⨯ 90%) $ 112,500Add: Depreciation on overvalued plant assets($450,000/9 years) ⨯ 1/2 year 25,000 Less: Undervaluation allocated to inventories (45,000) Income from Sigma—2006 $ 92,5002Investment balance at December 31, 2007Underlying book value of 90% interest in Sigma(Sigma’s December 31, 2007 equity of $2,700,000 ⨯ 90%) $2,430,000Less: Unamortized overvaluation of plant assets($50,000 per year ⨯ 7 1/2 years) (375,000) Investment balance December 31, 2007 $2,055,0003Journal entries to account for investment in2008Cash (or Dividends receivable) 135,000Investment in Sigma 135,000 To record receipt of dividends ($150,000 ⨯ 90%).Investment in Sigma 230,000Income from Sigma 230,000To record income from Sigma computed as follows: Provo’s share ofSigma’s reported net income ($200,000 ⨯ 90%) plus $50,000amortization of overvalued plant assets.Check: Investment balance December 31, 2007 of $2,055,000 + $230,000income from Sigma - $135,000 dividends = $2,150,000 balance December 31, 2008Alternatively, Sigma’s u nderlying equity ($2,000,000 paid-in capital +$750,000 retained earnings) ⨯ 90% interest - $325,000 unamortized excess allocated to plant assets = $2,150,000 balance December 31, 2008.1Market price of $12 for Crea pe’s sharesCost of investment in Tantani(40,000 shares ⨯ $12) + $40,000 direct costs $ 520,000 Book value acquired ($1,000,000 net assets ⨯ 40%) 400,000 Excess cost over book value acquired $ 120,000 Allocation of excess:Fair Value—P ercentBook Value A cquired Allocation Inventories $ 100,000 40% $ 40,000 Land 200,000 40% 80,000 Buildings—net (200,000) 40% (80,000) Equipment—net 100,000 40% 40,000 Assigned to identifiable net assets 80,000 Remainder assigned to goodwill 40,000 Total allocated $ 120,000 2Market price of $7 for Creape’s sharesCost of investment in Tantani(40,000 shares ⨯ $7) + $40,000 direct costs $ 320,000 Book value acquired ($1,000,000 net assets ⨯ 40%) 400,000 Excess book value over cost $(80,000) Excess allocated to:Fair Value—Percent Initial Reallo- FinalBook Value Acquired Allocation cation Allocation Inventories $100,000 40% $40,000 --- $ 40,000Land 200,000 40% 80,000 $(40,000) 40,000Buildings—net (200,000) 40% (80,000) (53,333) (133,333) Equipment—net 100,000 40% 40,000 (66,667) (26,667) Negative goodwill (160,000) 160,000 0$(80,000) $(80,000)Land $300,000/$1,200,000 ⨯ $160,000 = $40,000Buildings $400,000/$1,200,000 ⨯ $160,000 = $53,333Equipment $500,000/$1,200,000 ⨯ $160,000 = $66,6671Income from Spandix—2006Prudy’s share of Spandix’s income for 2006$40,000 ⨯ 1/2 year ⨯ 15% $ 3,0002Investment in Spandix balance December 31, 2006Investment in Spandix at cost $ 48,750Add: Income from Spandix 3,000Less: Dividends from Spandix November 1 ($15,000 ⨯ 15%) (2,250)Investment in Spandix balance December 31 $ 49,5003Income from Spandix—2007Prudy’s shares of Spandix’s income for 2007:$60,000 income ⨯ 15% interest ⨯ 1 year $ 9,000$60,000 income ⨯ 30% interest ⨯ 1 year 18,000$60,000 income ⨯ 45% interest ⨯ 1/4 year 6,750Prudy’s share of Spandix’s income for 2007 $ 33,7504Investment in Spandix December 31, 2007Investment balance December 31, 2006 (from 2) $ 49,500Add: Additional investments ($99,000 + $162,000) 261,000Add: Income for 2007 (from 3) 33,750Less: Dividends for 2007 ($15,000 ⨯ 45%) + ($15,000 ⨯ 90%) (20,250)Investment in Spandix balance at December 31 $324,000Alternative solutionInvestment cost ($48,750 + $99,000 + $162,000) $309,750Add: Share of reported income2006—$40,000 ⨯ 1/2 year ⨯ 15% $ 3,0002007—$60,000 ⨯ 1 year ⨯ 45% 27,0002007—$60,000 ⨯ 1/4 year ⨯ 45% 6,750 36,750 Less: Dividends2006—$15,000 ⨯ 15% $ 2,2502007—$15,000 ⨯ 45% 6,7502007—$15,000 ⨯ 90% 13,500 (22,500) Investment in Spandix $324,000Note: Since Prudy’s investment in Spandix consisted of 9,000 shares (a45% interest) on January 1, 2007, Prudy correctly used the equity method of accounting for the 15% investment interest held during 2006. Thealternative of reporting income for 2006 on a fair value/cost basis and recording a prior period adjustment for 2007 is not appropriate in view of the overwhelming evidence of an ability to exercise significantinfluence by the time 2006 income is recorded.。

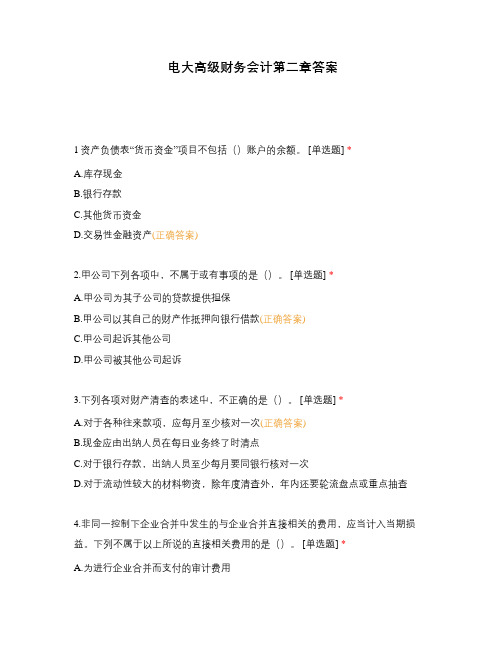

电大高级财务会计第二章答案

电大高级财务会计第二章答案1资产负债表“货币资金”项目不包括()账户的余额。

[单选题] *A.库存现金B.银行存款C.其他货币资金D.交易性金融资产(正确答案)2.甲公司下列各项中,不属于或有事项的是()。

[单选题] *A.甲公司为其子公司的贷款提供担保B.甲公司以其自己的财产作抵押向银行借款(正确答案)C.甲公司起诉其他公司D.甲公司被其他公司起诉3.下列各项对财产清查的表述中,不正确的是()。

[单选题] *A.对于各种往来款项,应每月至少核对一次(正确答案)B.现金应由出纳人员在每日业务终了时清点C.对于银行存款,出纳人员至少每月要同银行核对一次D.对于流动性较大的材料物资,除年度清查外,年内还要轮流盘点或重点抽查4.非同一控制下企业合并中发生的与企业合并直接相关的费用,应当计入当期损益。

下列不属于以上所说的直接相关费用的是()。

[单选题] *A.为进行企业合并而支付的审计费用B.为进行企业合并而支付的法律服务费用C.为进行企业合并而发生的咨询费用D.以权益性证券进行企业合并发生的手续费、佣金(正确答案)5.非同一控制下的企业合并中,以下关于母公司投资收益和子公司利润分配抵消分录的表述中,不正确的是()。

[单选题] *A.抵消母公司投资收益和少数股东损益均按照调整后的净利润份额计算B.抵消子公司利润分配有关项目按照子公司实际提取和分配数计算C.抵消期末未分配利润按照期初和调整后的净利润减去实际分配后的余额计算D.抵消母公司投资收益按照调整后的净利润份额计算,计算少数股东损益的净利润不需调整(正确答案)6.关于财务报表编制的基本要求,下列说法错误的是()。

[单选题] *A.各项目之间的金额不得相互抵销B.至少应当提供所有列报项目上一个可比会计期间的比较数据C.应当在财务报表显著位置披露编报企业的名称等重要信息D.至少按月编制财务报表(正确答案)7.股东(投资者)作为财务会计报告的使用者之一,其主要关注()。

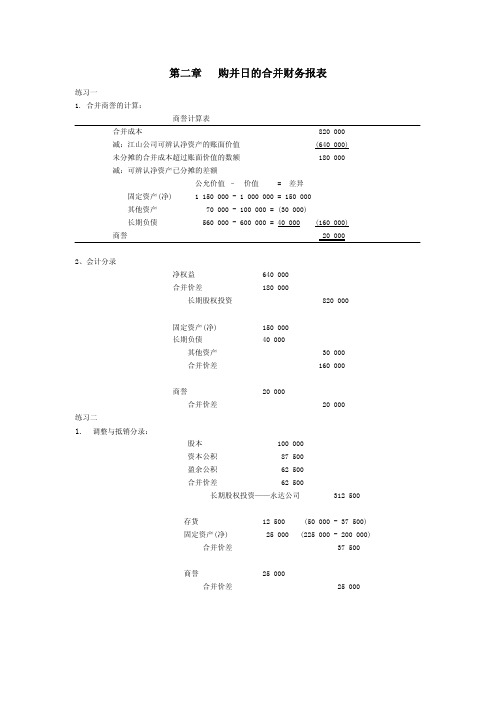

高级财务会计 陈信元 课后答案 第二章购并日的合并财务报表

权益合计

476 000

527 100

1. 编制调整分录,计算当时银河公司的流动资产总额。

应付账款-银桥公司

2 000

应收帐款-中安公司

2 000

可知银桥公司当时流动资产总额为 146 000 - 106 000 + 2 000 = 42 000 元

2. 编制调整分录,计算当时银桥公司的所有者权益合计数(母公司理论)。

个别资产负债表

合并资产负债表

流动资产

106 000

146 000

对银桥公司投资

100 000

—

固定资产(净)

270 000

380 000

商誉

—

1 100

资产合计

476 000

527 100

流动负债

15 000

28 000

少数股东权益

38 100

股本

300 000

300 000

盈余公积

161 000

161 000

存货

384 000

固定资产—房屋

—设备

—土地使用权

资本公积

94 154 198 462 31 384 60 000

存货

384 000

固定资产—设备

120 000

资本公积

264 00

资本公积

204 000

盈余公积(营业外收入,未分配利润) 204 000

2. 编制分录调整 100%的账面价值:

经济实体理论:

600,000 30,000 91,120

7,684,870

股本 资本公积

100 000 261 880

资本公积 管理费用

银行存款

人大第六版高级财务会计课后答案第二章和第三章习题答案

第二章1. 支付的货币性资产占换入资产公允价值(或占换出资产公允价值与支付的货币性资产之和)的比例= 49 000/400 000=12.25%<25%因此,该交换属于非货币性资产交换。

而且该交换具有商业实质,且换入、换出资产的公允价值能够可靠计量。

因而,应当基于公允价值对换入资产进行计价。

(1)A公司的会计处理:第一步,计算确定换入资产的入账价值换入资产的入账价值=换出资产的公允价值-收到的补价-可抵扣的增值税进项税额=400 000-49 000-51 000=300 000(元)第二步,计算确定非货币性资产交换产生的损益A公司换出资产的公允价值为400 000元,账面价值为320 000元,同时收到补价49 000元,因此,该项交换应确认损益=换出资产的公允价值-换出资产的账面价值=400 000-320 000=80 000(元)第三步,会计分录借:固定资产——办公设备 300 000应交税费——应交增值税(进项税额) 51 000银行存款 49 000贷:其他业务收入 400 000借:投资性房地产累计折旧 180 000其他业务成本 320 000贷:投资性房地产 500 000(2)B公司的会计处理:换入资产的入账价值=换出资产的公允价值+支付的补价+应支付的相关税费=300 000+49 000+300 000 ×17%=400 000(元)资产交换应确认损益=换出资产的公允价值-换出资产的账面价值=300 000-280 000=20 000(元)。

借:投资性房地产——房屋 400 000贷:主营业务收入 300 000银行存款 49 000应交税费——应交增值税(销项税额) 51 000300 000 ×17%=51 000借:主营业务成本 280 000贷:库存商品 280 0002.(1)X公司:换入资产的总成本=900 000+600 000-300 000=1200000(元)换入专利技术的入账金额=1200000×400000÷(400000+600000)=480 000(元)换入长期股权投资的入账金额=1200000×600000÷(400000+600000) =720 000(元)借:固定资产清理 1500000贷:在建工程 900000固定资产 600000借:无形资产——专利技术 480000长期股权投资 720000银行存款 300000贷:固定资产清理 1500000(2)Y公司:换入资产的总成本=400 000+600 000+300 000=1300000(元)换入办公楼的入账金额=1300000×900000÷(900000+600000)=780 000(元)换入办公设备的入账金额=1300000×600000÷(900000+600000)=520 000(元)借:在建工程——办公楼 780000固定资产——办公设备 520000贷:无形资产——专利技术 400000长期股投资 600000银行存款 300000第二章1.(1)甲公司的会计分录。

高级财务会计(第二版)习题答案

《高级财务会计》章后习题答案第1章练习题答案一、单项选择题1.【参考答案】C2.【参考答案】C二、多项选择题1.【参考答案】AB2.(1)【参考答案】ACE【解题思路】选项A,商誉的初始确认不确认递延所得税资产,但是因为减值造成的可抵扣暂时性差异需要确认递延所得税资产;选项B,无形资产加计扣除产生的暂时性差异不确认递延所得税资产;选项D,企业准备长期持有,应纳税暂时性差异转回的时间不定,因此不确认递延所得税负债。

(2)【参考答案】ABC【解题思路】确认应交所得税=(15000+300-200×50%+1000-840)×25%=3840(万元)确认递延所得税收益=(300+1000-840)×25%=115(万元)确认所得税费用=3840-115=3725(万元)确认递延所得税资产=(300+1000)×25%=325(万元)确认递延所得税负债=840×25%=210(万元)3.【参考答案】ABC三、判断题【参考答案】×四、计算分析题1.【参考答案】(1)应纳税所得额=会计利润总额+当期发生的可抵扣暂时性差异-当期发生的应纳税暂时性差异-当期转回的可抵扣暂时性差异+当期转回的应纳税暂时性差异-非暂时性差异=1610+10-20-(20+50)+0-(100×50%+420)=1060(万元)其中,当期发生的可抵扣暂时性差异10万元指的是本期增加的产品保修费用计提的预计负债10万元产生的可抵扣暂时性差异;当期发生的应纳税暂时性差异20万元指的是年末根据交易性金融资产公允价值变动确认公允价值变动收益20万元导致交易性金融资产新产生的应纳税暂时性差异;当期转回的可抵扣暂时性差异(20+50)万元指的是本期转回的坏账准备而转回的可抵扣暂时性差异20万元以及实际发生的产品保修费用转回的可抵扣暂时性差异50万元;非暂时性差异(100×50%+420)万元指的是加计扣除的研发支出(100×50%)万元以及税前弥补亏损金额(420万元)。

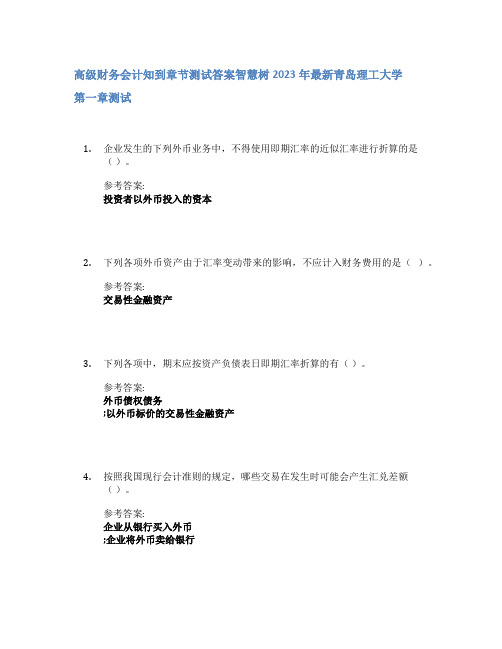

高级财务会计知到章节答案智慧树2023年青岛理工大学

高级财务会计知到章节测试答案智慧树2023年最新青岛理工大学第一章测试1.企业发生的下列外币业务中,不得使用即期汇率的近似汇率进行折算的是()。

参考答案:投资者以外币投入的资本2.下列各项外币资产由于汇率变动带来的影响,不应计入财务费用的是()。

参考答案:交易性金融资产3.下列各项中,期末应按资产负债表日即期汇率折算的有()。

参考答案:外币债权债务;以外币标价的交易性金融资产4.按照我国现行会计准则的规定,哪些交易在发生时可能会产生汇兑差额()。

参考答案:企业从银行买入外币;企业将外币卖给银行5.企业只能选择人民币作为记账本位币。

( )参考答案:错第二章测试1.下列交易或事项中,计税基础不等于账面价值的是()。

参考答案:企业因销售商品提供售后服务于当期确认了100万元的预计负债2.下列项目中,产生可抵扣暂时性差异的有()。

参考答案:期末无形资产账面价值小于其计税基础3.下列项目中,可能会产生暂时性差异的是()。

参考答案:可以在税前补亏的未弥补亏损4.下列项目中,会产生可抵扣暂时性差异的有()。

参考答案:计提存货跌价准备;会计计提的折旧大于税法规定的折旧;预提产品售后保修费用5.在发生的下列交易或事项中,会产生应纳税暂时性差异的有()。

参考答案:企业购入其他权益工具投资,购入当期期末公允价值大于初始确认金额;企业购入无形资产,作为使用寿命不确定的无形资产进行核算,期末没有计提减值准备第三章测试1.资产负债表日后调整事项在进行调整处理时,不能在报表中调整的项目是()。

参考答案:货币资金收支项目2.某零售企业在年度资产负债表日至财务报告批准报出日之间发生的下列事项中,不属于资产负债表日后事项的为()。

参考答案:销售名牌商品3.甲公司在资产负债表日至财务报告批准报出日之间发生的下列事项中,属于资产负债表日后非调整事项的有()。

参考答案:外汇汇率发生重大变动;甲公司的股东A公司将持有甲公司51%的股份转让给B公司;发生重大仲裁4.资产负债表日后事项准则所指资产负债表日是指年度资产负债表日,年度资产负债表日则是指每年的12月31日。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1、正确答案是:A公司购买B公司20%的股权

2、正确答案是:M公司=N公司+P公司

3、正确答案是:购买合并、股权联合合并

4、正确答案是:控股合并

5、正确答案是:参与合并的企业在合并前后均受同一方或相同的多方最终控制且该控制并非暂时性的

6、正确答案是:购买方为进行企业合并发生的各项直接相关费用也应当计入企业购买成本

7、正确答案是:按照合并日被合并方的账面价值计量

8、正确答案是:400

9、正确答案是:账面价值

10、正确答案是:管理费用

11、正确答案是:存货按照现行重置成本确定

12、正确答案是:在控股合并的情况下,应体现在合并当期的个别利润表

13、正确答案是:1000

14、吸收合并, 控股合并,新设合并

15、通过法律或协议,获得决定其他企业财务和经济政策的权利, 获得任命或解除其他企业董事会或类似机构大多数成员的权力, 获得其他企业董事会或对等决策团体会议中多数席位的权利, 一个企业的公允价值大大地超过其他参与合并企业的公允价值,则具有较大公允价值的企业是购买方, 如果企业合并是通过以现金换取有表决权的股份来实现,放弃现金的企业是购买方

16、非同一控制下的吸收合并,购买方在购买日应当按照合并中取得的被购买方各项可辨认资产、负债的公允价值确定其入账价值,确定的企业合并成本与取得被购买方可辨认净资产公允价值的差额,应确认为商誉或计入当期损益, 非同一控制下的控股合并,母公司在购买日编制合并资产负债表时,对于被购买方可辨认资产、负债应当按照合并中确定的公允价值列示, 企业合并成本大于合并中取得的被购买方可辨认净资产公允价值份额的差额,确认为合并资产负债表中的商誉,企业合并成本小于合并中取得的被购买方可辨认净资产公允价值份额的差额,在购买日合并资产负债表中调整盈余公积和未分配利润, 合并方为进行企业合并发生的各项直接相关费用,包括为进行企业合并而支付的审计费用、评估费用、法律服务费用等,于发生时计入管理费用

17、企业合并协议已获股东大会通过, 参与合并各方已办理了必要的财产交接手续, 企业合并事项需要经过国家有关部门审批的,已取得有关主管部门的批准, 合并方或购买方实际上已经控制了被合并方或被购买方的财务和经营政策,并享有相应的利益及承担风险, 合并方或购买方已支付了合并价款的大部分(一般应超过50%),并且有能力支付剩余款项

18、非同一控制下的企业合并,购买方为进行企业合并发生的各项直接相关费用应当计入当期损益,同一控制下的企业合并,合并方为进行企业合并发生的各项直接相关费用,应当于发生时计入当期损益

19、合并方取得的资产和负债应当按照合并日被合并方的账面价值计量, 以支付现金、非现金资产作为合并对价的,发生的各项直接相关费用计入管理费用,合并方取得净资产账面价值与支付的合并对价账面价值的差额调整资本公积

20、为进行合并而发生的法律服务费用, 为进行合并而发生的会计审计费用,为进行合并而发生的咨询费、评估费用等

21、购买方为进行企业合并支付的现金, 购买方为进行企业合并付出的非现金资产的公允价值,购买方为进行企业合并发行的权益性证券在购买日的公允价值, 购买方为进行企业合并发行或承担的债务在购买日的公允价值

22、正确的答案是“错”。

23、正确的答案是“对".

24、正确的答案是“对"。

25、正确的答案是“错”。

26、正确的答案是“错”.

27、正确的答案是“对”。

28、正确的答案是“对”。

29、正确的答案是“对”.

30、正确的答案是“错"。

31、正确的答案是“对”。

32、

1、同一控制下的企业合并

参与合并的企业在合并前后均受同一方或相同的多方最终控制且该控制并非暂时性的,为同一控制下的企业合并。

在上述定义中,同一方是指对参与合并企业在合并前后均实施最终控制的投资者,例如,A、B两公司的最终控制人都是甲,则A、B企业的合并为同一控制下的企业合并;相同的多方通常是指根据投资者之间的协议约定,在对被投资单位的生产经营决策行使表决权时发表一致意见的两个或两个以上的投资者;控制并非暂时性指参与合并各方在合并前后较长的时间内(一般在1年以上,含1年)受同一方或相同的多方最终控制.

同一控制下的企业合并,在合并日取得对其他参与合并企业控制权的一方为合并方,参与合并的其他企业为被合并方。

合并日是指合并方实际取得对被合并方控制权的日期。

同一控制下的企业合并一般发生在企业集团内部,如集团内母子公司之间、子公司与子公司之间等.因此,同一控制下的企业合并通常为股权联合性质的合并.

2、非同一控制下的企业合并

参与合并的各方在合并前后不属于同一方或相同的多方最终控制的,为非同一控制下的企业合并。

例如,甲企业控制人为A、乙企业的控制人为B,则甲、乙两企业的合并为非同一控制下的企业合并。

非同一控制下的企业合并一般为购买性质的合并。

33、1.购买成本大于所取得的可辨认净资产公允价值

购买方在购买日对合并中取得的各项可辨认资产、负债应按其公允价值计量,购买成本大于合并中取得的可辨认净资产公允价值的差额,确认为商誉。

商誉的会计处理视合并方式不同而不同:

(1)在吸收合并方式下,购买方按取得的被购买方的资产、负债的公允价值登记账簿,购买成本大于所取得的可辨认净资产公允价值的差额在购买方账簿及个别资产负债表中确认。

(2)在控股合并方式中,购买方在合并日编制合并资产负债表中,对所取得的被购买方的资产、负债按公允价值列示,购买成本大于合并中取得的各项可辨认资产、负债公允价值份额的差额,在合并资产负债表中确认为商誉。

2.购买成本小于所取得的可辨认净资产公允价值

如果购买成本小于合并中取得的被购买方可辨认净资产公允价值份额,购买方应该对取得的被购买方各项可辨认资产、负债及或有负债的公允价值以及合并成本的计量进行复核;经

复核后合并成本仍小于合并中取得的被购买方可辨认净资产公允价值份额的,其差额应当计入当期损益.

(1)在吸收合并方式下,购买成本小于合并中取得的可辨认净资产公允价值的差额,作为当期损益计入购买方的个别利润表;

(2)在控股合并方式中,购买成本小于合并中取得的可辨认净资产公允价值的差额,理论上应计入购买日的合并利润表,但合并日不编制合并利润表和合并现金流量表,因此,这一差额直接在合并资产负债表中调整盈余公积和未分配利润。

34、借:货币资金300

应收账款 1100

存货 160

长期股权投资1280

固定资产1800

无形资产300

贷:短期借款1200

应付账款 200

其他负债 180

股本1500

资本公积1860

35、

甲公司对该项吸收合并应进行如下的会计处理:

借:货币资金 6 000 000

应收账款16 000 000

存货 2 000 000

长期股权投资25 000 000

固定资产30 000 000

无形资产 5 000 000

贷:短期借款24 000 000

应付账款 6 000 000

固定资产52 000 000

资本公积 2 000 000

36、甲公司应进行如下会计处理:

借:流动资产160 000

固定资产 250 000

无形资产 75 000。