CPA10分英语完全解析(中华会计英语讲义)

CPA注册会计师会计讲义会计英语第十四章第十五章合并讲解

CPA注册会计师会计讲义会计英语第十四章第十五章合并讲解第十四章/第十五章合并讲解第14章资产负债表日后事项本部分内容在近几年专业阶段考试中也是主观题的热门考点,其经常通过与或有事项、资产减值、销售退回、前期差错等内容结合考查。

复习时应当重点注意日后调整事项与非调整事项的判断,日后调整事项的会计处理以及报表调整。

I. 资产负债表日后事项的分类Classification of Events after Balance Sheet Date资产负债表日后事项包括资产负债表日后调整事项和资产负债表日后非调整事项。

The events after the balance sheet date include the adjusting events and non-adjusting events after the balance sheet date.II. 资产负债表日后调整事项Adjusting Events after the Balance Sheet Date企业发生资产负债表日后调整事项,应当调整资产负债表日的财务报表。

An enterprise shall adjust its financial statements on the balance sheet date for any adjusting event occurring after the balance sheet date.III. 资产负债表日后非调整事项资产负债表日后发生的非调整事项,不应当调整资产负债表日的财务报表,应当在报表附注中披露每项重要的资产负债表日后非调整事项的性质、内容,及其对财务状况和经营成果的影响。

无法作出估计的,应当说明原因。

An enterprise may not adjust the financial statement on the balance sheet date for any non-adjusting event occurring after the balance sheet date while the nature, content and influence on financial position and operational result relating to materialnon-adjusting events which occur after balance sheet date should be disclosed in the notes to accounts, if the estimates could not be made, the reasons should be explained.第15章长期股权投资和企业合并本部分既是重点内容又是难点内容,从考试情况看,其经常在专业阶段的主观题中进行考查,所占分值较大,考生应全面熟练掌握。

CPA10分英语完全解析(中华会计英语讲义)

-liabilities: The IASB’s Framework defines liabilities as ‘a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits’. Many aspects of this definition are complementary (as a mirror image) to the definition of assets, however the IASB stresses that the essential characteristic of a liability is that the entity has a present obligation. Such obligations are usually legally enforceable (by a binding contract or by statute), but obligations also arise where there is an expectation (by a third party) of an entity assuming responsibility for costs where there is no legal requirement to do so. Such obligations are referred to as constructive (by IAS 37 Provisions, contingent liabilities and contingent assets). An example of this would be repairing or replacing faulty goods (beyond any warranty period) or incurring environmental costs (e.g. landscaping the site of a previous quarry) where there is no legal obligation to do so. Where entities do incur constructive obligations it is usually to maintain the goodwill and reputation of the entity. One area of difficulty is where entities cannot be sure whether an obligation exists or not, it may depend upon a future uncertain event. These are more generally known as contingent liabilities. --负债 国际会计准则委员会编报财务报表的框架将负债定义为:企业由于过去事项而承担的现 时义务,该义务的履行预期会导致含有经济利益的资源流出企业。该定义许多方面与资产定 义遥相呼应。但国际会计准则强调负债的本质特征是指企业要有现时的义务。这样的义务通 常在法律上是强制执行的(具有约束力的合同或法定要求)义务。有时该项义务来来自第三方 的期望,即企业会承担某些非法定要求的成本。这样的义务称之为推定义务。例如企业在产 品保证期期满后才显现缺陷也要予以修理或承担环保成本,这些都不是法定要求去做的。如 果企业产生了推定义务,则是为了保持商誉或信誉而做。但比较困难的一点是企业有时很难 确定是否存在一项义务,它将取决于某件将来要发生的不确定事件。这些通常称为或有负债。

英文语法书推荐汇总

英文语法书推荐汇总英语语法是个忧伤的话题,英文语法学起来真的很难,很多学英语的人都被英文语法吓到。

下面是店铺为你整理的英文语法书推荐,希望大家喜欢!英文语法书推荐1.《英语语法新思维》初级、中级、高级作者张满胜【推荐所有学生和老师阅读】记得我当年读的时候,还是32开本,新版内容扩充,版式变为16开。

这几乎是可以向除了少儿外的所有学生推荐的必备语法学习书籍。

走进语法、通悟语法、驾驭语法。

阶梯层级;环环相扣,层层递进,逻辑性强。

不仅讲解规则规律,更深刻洞悉思维差异。

张满胜是英国剑桥大学硕士(曾是上海新东方老师)。

娓娓道来式的写作,没有很多“大部头”的“粗暴感”和“断裂感”。

循序渐进,语法水平——“曲折式前进,螺旋式上升”!力荐!2.《英语阅读参考手册》老一辈学术大师叶永昌先生的名作。

【推荐所有学生和老师阅读】本书前身《科技英语阅读手册》发行130万册。

130万册!知道什么概念嘛!老一辈大师做学问真是一丝不苟。

语言简明扼要,一针见血,分析问题精辟透彻。

甚至目录都配了两套,按照“语法”和“单词”分别排列。

别的不说,单看叶老此书的整整17页目录,就知道什么叫做治学严谨了。

文字非常流畅,不会掉书袋般晦涩难懂。

300多页,章章节节,有心人两周的零散时间也能通读了。

再用两周复习,靠谱。

2010年4月新版。

仍能回忆起,2010年秋季,我抱着这本书坐在川大校园里细细研读此书的场景。

这20多块钱,花得很值……3.《当代实用英语精华》罗国梁教授主编。

【推荐高水平学员和所有老师阅读】这本书写得很用心。

非常详细。

很多其他语法书有意无意忽略的东西,在此书里都给你详细地罗列出来。

对于深入领会语言中的一些常见的、特殊的、规律的、意外的……种种现象,都是极有帮助的。

4.《大学英语语法——讲座与测试》(我也不知道现在出到第几版了)作者:徐广联【推荐针对某些语法项目需强化训练和所有语法老师(尤其是高考语法老师)阅读】这本书,其实我很想把它归类为“工具书”,但是里面每个章节后都有大量的海量的习题……可以说这是一部集“教材+练习册+工具书”的这么一本书。

2019注会会计英语基础讲义

2019注会会计英语基础讲义xx年注册会计师考试辅导会计前言总体考情分析一般选择综合题第1题要求选用英文作答,若用英文作答完全正确,则在原题满分的基础上多加5分。

对于《会计》科目来讲,综合题的知识点分布可能性很大,知识面比较广,所以对于常见的综合性知识点,均需要关注如何转化为英文作答的形式。

在本次教学中, 将会按照专题的形式,同时结合具体例题,分别使用中文与英文进行讲解,并帮助学员提炼相关专业词汇。

在具体每个专题的讲解时,每个专题会以先列举常用的词汇,最后结合典型例题的形式进行演练。

部分专题在讲解中将会整合在一次授课中完成。

本次授课共涉及以下17个专题:1.固定资产和无形资产2.投资性房地产3.资产减值4.借款费用5.股份支付6.或有事项7.金融工具8.收入.费用和利润9.非货币性资产交换和债务重组10.所得税11.外币折算12.租赁13.会计政策变更.估计变更.差错更正14.资产负债表日后事项15.长期股权投资和企业合并16.合并财务报表17.每股收益课堂教学形式由于自xx年起注册会计师考试采用机考的形式,因此同学们在运用英语进行综合题目作答的过程中能够快速准确的在电脑上输入答案是得分的前提。

为了提高同学们快速输入英语答案的准确性,本门课程需要同学们在上课过程中跟随主讲老师将英文部分内容在Word文档中输出,以达到对单词的准确拼写以及对语法句型熟悉掌握的目的。

专题一固定资产和无形资产目录 01 考情分析 02 词汇归纳总结03 重点.难点讲解 04 同步系统训练考情分析有关固定资产和无形资产的内容在注会考试中属于非常重要的基础知识,可能并不单独以主观题形式进行考查,但是专业阶段主观题所考查的知识点中一般都会穿插其相关内容。

如与借款费用.会计估计变更及差错更正等内容的结合。

因此,要给予一定的重视。

词汇归纳总结固定资产 Fixed asset 无形资产 Intangible asset 预定可使用状态 Expected conditions for use 运费 Freight 装卸费Loading fee 具有融资性质 With financing nature 实际上;生效 In effect 依照 According to/ In accordance with 直线法Straight line method 工作量法 Unit of production method 双倍余额递减法 Double declining balance method 年数总和法Sum of the years digits method 累计折旧 Accumulated depreciation 后续支出 Subsequent expenditure 更新改造Transformation and renovation 修理费用 Repair expenditure 管理费用 General and administrative expense 销售费用Selling expense 研究阶段 Research stage 开发阶段Development stage 摊销 Amortization 确定 Determine 在建工程 Construction in process 预计使用寿命 Estimated useful life 特许权 Franchise right 保险费 Insurance expense 长期应付款 Long-term payable 专利权 Patent 研究开发费用Research and development cost 残值 Residual value 有形资产 Tangible asset 重点.难点讲解考点一:固定资产的初始计量 Initial Measurement of Fixed Assets1.外购固定资产 Purchased fixed assets 外购固定资产的成本,包括购买价款.相关税费.使固定资产达到预定可使用状态前所发生的可归属于该项资产的运输费.装卸费.安装费和专业人员服务费等。

注册会计师考试英语讲义精品文档10页

注会考试英语讲义一、相关背景1、2019年注册会计师考试在英语测试选考的同时,将在会计和审计两门课程中直接增加10分的英语附加题。

这一变化主要是为了满足中国经济和行业发展对国际人才的需要。

财政部CPA考试委员会将根据今年的考试情况进一步研究如何将英文附加题逐步推广到其他考试科目中。

据此看来,在CPA各科考试中加重英语的分量将是一个趋势。

2、增加英语附加题后,会计、审计总分为110分,及格分仍为60分,总体考试时间不变。

英语附加题要求用英语回答,所以考生朋友们一定要根据本人英语水平选择作答。

有一定英语基础(大学英语四、六级水平,掌握一定的财经英语词汇),打算选答英语附加题的考生朋友更应该合理规划和安排时间,在考试时认真阅读试卷首页的特别提示和答题导语,争取尽可能多的在英语附加题上拿分。

英语基础较差的考生朋友不要慌乱,心态要放平和,力争前面的100分,如果时间允许可尝试做英语附加题。

二、可能的题型因为只有10分的英语题,所以估计出客观题的可能性不大,很有可能是主观题,并且是专业题。

题型可能包括:名词解释,英汉互译,问答(理论性的或业务性的)。

三、会计英语讲解会计报表中英文对照Accounting1. Financial reporting(财务报告)includes not only financial statements but also other means of communicating information that relates, directly or indirectly, to the information provided by a business enterprise’s accounting system----that is, information abo ut an enterprise’s resources, obligations, earnings, etc.2. Objectives of financial reporting: 财务报告的目标Financial reporting should:(1) Provide information that helps in making investment and credit decisions.(2) Provide information that enables assessing future cash flows.(3) Provide information that enables users to learn about economic resources, claims against those resources, and changes in them.3. Basic accounting assumptions 基本会计假设(1) Economic entity assumption 会计主体假设This assumption simply says that the business and the owner of the business are two separate legal and economic entities. Each entity should account and report its own financial activities.(2) Going concern assumption 持续经营假设This assumption states that the enterprise will continue in operation long enough to carry out its existing objectives.This assumption enables accountants to make estimates about asset lives and how transactions might be amortized over time.This assumption enables an accountant to use accrual accounting which records accrual and deferral entries as of each balance sheet date.(3) Time period assumption 会计分期假设This assumption assumes that the economic life of a business can be divided into artificial time periods.The most typical time segment = Calendar YearNext most typical time segment = Fiscal Year(4) Monetary unit assumption 货币计量假设This assumption states that only transaction data that can be expressed in terms of money be included in the accounting records, and the unit of measure remains relatively constant over time in terms of purchasing power.In essence, this assumption disregards the effects of inflation or deflation in the economy in which the entity operates.This assumption provides support for the "Historical Cost" principle.4. Accrual-basis accounting 权责发生制会计5. Qualitative characteristics 会计信息质量特征(1) Reliability 可靠性For accounting information to be reliable, it must be dependable and trustworthy.Accounting information is reliable to the extend that it is:Verifiable: means that information has been objectively determined, arrived at, or created. More than one person could consider the facts of a situation and reach a similar conclusion. Representationally faithful: that something is what it is represented to be. For example, if a machine is listed as a fixed asset on the balance sheet, then the company can prove that the machine exists, is owned by the company, is in working condition, and is currently being used to support the revenue generating activities of the company.Neutral: means that information is presented in accordance with generally accepted accounting principles and practices, and without bias.(2) Relevance 相关性Relevant information is capable of making a difference in the decisions of users by helping them to evaluate the potential effects of past, present, or future transactions or other events on future cash flows (predictive value) or to confirm or correct their previous evaluations (confirmatory value).(3) Understandability 可理解性Understandability is the quality of information that enables users who have a reasonable knowledge of business and economic activities and financial reporting, and who study the information with reasonable diligence, to comprehend its meaning.(4) Comparability 可比性Comparability: suggests that accounting information that has been measured and reported in a similar manner by different enterprises should be capable of being compared because each of the enterprises is applying the same generally accepted accounting principles and practices. Consistency: suggests that an entity has used the same accounting principle or practice from one period to another, therefore, if the dollar amount reported for a category is different from one period to the next, then chances are that the difference is due to a change like an increase or decrease in sales volume rather than being due to a change in the method of calculating the dollar amount.(5) Substance over form 实质重于形式Substance over form emphasizes the economic substance of an event even though its legal form may provide a different result.It requires that business enterprise should perform accounting recognition, measurement and reporting in accordance with the economic substance rather than the legal form of an event ortransaction.(6) Materiality 重要性Information is material if its omission or misstatement could influence the resource allocation decisions that users make on the basis of an entity’s financial report. Materiality depends on the nature and amount of the item judged in the particular circumstances of its omission or misstatement. Deciding when an amount is material in relation to other amounts is a matter of judgment and professional expertise.(7) Conservatism 谨慎性Conservatism dictates that when in doubt, choose the method that will be least likely to overstate assets and income, and understate liabilities and expenses.(8) Timeliness 及时性Timeliness means having information available to decision makers before it loses its capacity to influence decisions. If information becomes available only after the time that a decision must be made, it has no capacity to influence that decision and thus lacks relevance.6. Basic accounting elements 基本会计要素(1) Asset 资产An asset is a resource that is owned or controlled by an enterprise as a result of past transactions or events and is expected to generate economic benefits to the enterprise.(2) Liability 负债A liability is a present obligation arising from past transactions or events which are expected to give rise to an outflow of economic benefits from the enterprise.A present obligation is a duty committed by the enterprise under current circumstances. Obligations that will result from the occurrence of future transactions or events are not present obligations and shall not be recognized as liabilities.(3) owners’equity 所有者权益Owners’ equity is the residual interest in the assets of an enterprise after deducting all its liabilities.Owners’ equity of a company is also known as shareholders’ equity.(4) Revenue 收入Revenue is the gross inflow of economic benefits derived from the course of ordinary activities that result in increases in equity, other than those relating to contributions from owners.(5) Expense 费用Expenses are the gross outflow of economic benefits resulted from the course of ordinary activities that resul t in decreases in owners’ equity, other than those relating to appropriations of profits to owners.(6) Profit 利润Profit is the operating result of an enterprise over a specific accounting period. Profit includes the net amount of revenue after deducting expenses, gains and losses directly recognized in profit of the current period, etc.7. Five measurement attributes 会计计量属性(1) Historical cost 历史成本Assets are recorded at the amount of cash or cash equivalents paid or the fair value of the consideration given to acquire them at the time of their acquisition. Liabilities are recorded at the amount of proceeds or assets received in exchange for the present obligation, or the amountpayable under contract for assuming the present obligation, or at the amount of cash or cash equivalents expected to be paid to satisfy the liability in the normal course of business.(2) Current replacement cost 现时重置成本Assets are carried at the amount of cash or cash equivalents that would have to be paid if a same or similar asset was acquired currently. Liabilities are carried at the amount of cash or cash equivalents that would be currently required to settle the obligation.(3) Net realizable value 可实现净值Assets are carried at the amount of cash or cash equivalents that could be obtained by selling the asset in the ordinary course of business, less the estimated costs of completion, the estimated selling costs and related tax payments.(4) Present value 现值Assets are carried at the present discounted value of the future net cash inflows that the item is expected to generate from its continuing use and ultimate disposal. Liabilities are carried at the present discounted value of the future net cash outflows that are expected to be required to settle the liabilities within the expected settlement period.(5) Fair value 公允价值Assets and liabilities are carried at the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.8. Financial statements 财务报表(1) Balance sheet 资产负债表A balance sheet is an accounting statement that reflects the financial position of an enterprise at a specific date.(2) Income statement 损益表An income statement is an accounting statement that reflects the operating results of an enterprise for a certain accounting period.(3) Statement of cash flows 现金流量表A cash flow statement is an accounting statement that reflects the inflows and outflows of cash and cash equivalents of an enterprise for a certain accounting period.(4) Statement of changes in owners’equity 所有者权益变动表A statement of changes in owners’ equity reports the changes in owners’ equity for a specific period of time.(5) Notes to financial statements 财务报表附注Notes to the accounting statements are further explanations of items presented in the accounting statements, and explanations of items not presented in the accounting statements, etc.9. Accounting entry 会计分录Debit: CashCredit: Common Stock10. Basic accounting equation 基本会计等式Assets = Liabilities + owners’ equi ty11. List of present and potential users of financial information 财务信息的使用者investors, creditors, employees, suppliers, customers, and governmental agencies.四、审计英语讲解Auditing1. Assurance engagements and external audit◇Materiality, true and fair presentation, reasonable assuranceMateriality is the magnitude of an omission or misstatement of accounting information that, in the light of surrounding circumstances, makes it probable that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement. An auditor must consider materiality both in (1) planning the audit and designing audit procedures and (2) evaluating audit results.◇Appointment, removal and resignation of auditors◇Types of opinion: standard unqualified opinion, Unqualified with additional explanatory language, qualified opinion, adverse opinion, disclaimer of opinion◇Professional ethics: independence, objectivity, integrity, professional competence, due care, confidentiality, professional behavior◇Engagement letter2. Planning and risk assessment◇General principles○Plan and perform audits with an attitude of professional skepticism○Audit risks = inherent risk ×control risk ×detection risk(1) Inherent risk refers to the likelihood of material misstatement of an assertion, assuming no related internal control. This risk differs by account and assertion.(2) Control risk is the likelihood that a material misstatement will not be prevented or detected ona timely basis by internal control. This risk is assessed using the results of tests of control.(3) Detection risk is the likelihood that an auditor’s procedures lead to an improper conclusion that no material misstatement exists in an assertion when in fact such a misstatement does exist. The auditor’s substantive tests are primarily relied upon to restrict detection risk.○Risk-based approach◇Understanding the entity and knowledge of the businessThe CPA should obtain a level of knowledge of the client’s business that will enable effective planning and performance of the audit in accordance with generally accepted auditing standards. This knowledge helps the auditor in(1) Identifying areas that may need special consideration(2) Assessing conditions under which accounting data are produced, processed, reviewed and accumulated(3) Evaluating accounting estimates for reasonableness (e.g., valuation of inventories, depreciation, allowance for doubtful accounts, percentage of completion of long-term contracts)(4) Evaluating the reasonableness of management representations(5) Making judgments about the appropriateness of the accounting principles applied and the adequacy of disclosures◇Assessing the risks of material misstatement and fraud○Materiality (level), tolerable error◇Analytical proceduresAnalytical procedures are normally used at three stages of the audit: (1) planning, (2) substantive testing, and (3) overall review at the conclusion of an audit. They are required during the planning and overall review stages.Analytical procedures used for 3 purposes:(1) Planning nature, timing, and extent of other auditing procedures(2) Substantive tests about particular assertions(3) Overall review in the final stage of audit◇Planning an audit◇Audit documentation: working papers◇The work of others○Rely on the work of experts○Rely on the work of internal audit3. Internal controlInternal control is a process effected by an entity’s board of directors, management, and other personnel—designed to provide reasonable assurance regarding the achievement of objectives in the following categories: (1) reliability of financial reporting, (2) effectiveness and efficiency of operations, and (3) compliance with applicable laws and regulations.Five components of internal control(1) control environment(2) risk assessment(3) control activities(4) information and communication(5) monitoring◇The evaluation of internal control systems○Tests of control○Substantive procedures (time, nature, extent)◇Transaction cycles: revenue, purchases, inventory, etc.4. Audit evidence◇Obtain sufficient, appropriate audit evidence◇Assertions contained in the financial statements: completeness, occurrence, existence, measurement, presentation and disclosure, rights and obligations, valuation◇The audit of specific items○Receivables: confirmation○Inventory: counting, cut-off, confirmation of inventory held by third parties○Payables: supplier statement reconciliation, confirmation○Bank and cash: bank confirmation◇Auditing sampling5. Review◇Subsequent events◇Going concern◇Management representations◇Audit finalization and the final review: unadjusted differences6. Reporting审计1.鉴证业务和外部审计◇重要性,真实、公允反映,合理保证◇注册会计师的聘用,解聘和辞职◇审计意见类型:标准无保留意见,带解释段的无保留意见,保留意见,否定意见,无法表示意见◇职业道德:独立、客观和公正,专业胜任能力,应有的关注,保密性,职业行为◇审计业务约定书2.审计计划和风险评估◇一般原则○计划和执行审计业务应保持应有的职业怀疑态度○审计风险=固有风险×控制风险×检查风险○风险导向型审计◇了解被审单位◇估计重大错报或舞弊的风险○重要性水平,可容忍误差◇分析性复核程序◇制定审计计划◇审计记录:工作底稿◇利用其他人的工作○利用专家工作○利用内部审计人员的工作3.内部控制◇内部控制系统评价○控制测试○实质性程序(时间,性质,范围)◇交易循环:收入循环、采购循环、存货循环,等等。

注册会计师考试CPA税法英语班课件讲义

增值税常用计算公式的英文表达及应用纳税人销售货物或者应税劳务的价格明显偏低并无正当理由的,或者有视同销售行为无销售额的,按下列顺序确定销售额:(1)按纳税人当月同类货物的平均销售价格确定;(2)按纳税人最近时期同类货物的平均销售价格确定;(3)按组成计税价格确定。

组成计税价格的公式为组成计税价格=成本×(1+成本利润率)属于应征消费税的货物,其组成计税价格中应加计消费税额。

公式中的成本是指:销售自产货物的为实际生产成本,销售外购货物的为实际采购成本。

公式中的成本利润率由国家税务总局确定。

For taxpayers whose prices are obviously low and without proper justification, or have activities of selling goods but without invoiced sales amounts, the sales amount shall be determined according to the following sequence: (1)Determined according to the average selling price of the taxpayer on the same goods in the same month;(2)Determined according to the average selling price of the taxpayer on the same goods in the recent period;(3)Determined according to the composite assessable value. The formula of the composite assessable value shall be:Composite assessable Value = Cost ×(1 + cost plus margin)For goods subject to Consumption Tax, the composite assessable value shall include Consumption Tax payable.Composite assessable value=cost ×(1+cost plus margin)+ Consumption Tax "Cost" in the formula refers to the actual costs of products sold for sales of self-produced goods; and the actual costs of purchases for sales of purchased goods. The rate of cost-plus margin in the formula shall be determined by the State Administration of Taxation.【例题·计算题】某企业(增值税一般纳税人),2014年1月份生产加工500件新产品,每件成本价200元(无同类产品市场售价),全部售给本企业职工,取得收入10万元。

综合阶段英语学习讲义-注册会计师(CPA-)第06讲

综合阶段英语学习讲义-注册会计师(CPA-)第06讲Unit three Auditing审计1.风险评估2.风险应对3.销售与收款循环审计4.采购与付款循环审计5.特殊项⽬的考虑6.完成审计⼯作与出具审计报告⼀、Risk assessment、Risk response and Transaction cycle(⼀)Key words1. 财务报表审计总体⽬标:The objective of an external audit engagement is to enable the auditor to express an opinion on whether the financial statementsgive a true and fair view (or present fairly in all material respects)are prepared, in all material respects, in accordance with an applicablefinancial reporting framework.外部审计业务的⽬标就是使审计⼈员能够就财务报表是否在所有重⼤⽅⾯做出真实公允的反映,财务报表是否在所有重⼤⽅⾯按照适⽤的财务报告框架编制发表审计意见。

Misstatement, including omissions, are considered to be material if they, individually or in aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.如果错报(包括漏报)单独或汇总起来可能合理预期会影响财务报表使⽤者依据财务报表作出的经济决策,则认为错报是重⼤的。

会英第一讲

accounting element accounting entity accounting entry accounting equation accounting error accounting estimate accounting firm accounting for assets acquisition

5. Multiple choice questions (choose the best for your answer) ) 6. Prepare journal entries 7. Statement of Cash Flows

• Dictionary of Accounting Terms /accoun ting-terms/accounting-dictionary/ • CPA英语考试资料汇总(CPA必备) 英语考试资料汇总( 必备) 英语考试资料汇总 必备 /bbs/dispbbs.asp? boardid=20&Id=34526 /learn/2007-1121/367.html danchen82@

2. Please read the following passage carefully and fill in each of the blanks with a word most appropriate to the content Eg. The double-entry system of accounting takes its name from the fact that every business transaction is recorded by (____) ) types of entries: 1:( :(_____) entries to : :( ) one or more accounts and 2: credit entries : to one or more accounts. In recording any transaction, the total dollar amount of the , (______) entries must (_____) the total ) ) dollar amount of credit entries.

注会财管英语讲义

第1-3章讲义第一章财务管理总论Overview of Financial Management一、主要专业术语或概念中英文对照财务管理financial management财务管理的目标the goal of financial management关于企业财务目标的三种综合表述:利润最大化profit maximization (maximize profit)每股盈余最大化earnings per share maximization股东财富最大化stockholder (shareholder) wealth maximization利益相关者stakeholder股东stockholder/shareholder债权人creditor/bondholder顾客customer职工employee政府government股东价值的影响因素the factors that affect the stockholder value (2008注会财管教材P4图1-1)经营现金流量operating cash flows资本成本cost of capital销售及其增长/成本费用revenues and its growth/cost and expense资本投资/营运资本capital investment/working capital资本结构/破产风险/税率/股利政策capital structure/bankruptcy risk/tax rate/dividend policy经营活动operating activity投资活动investing activity筹资活动financing activity股东、经营者和债权人利益的冲突与协调Conflicts of interest between shareholders,managers and creditors and their reconciliationAn agency relationship(代理关系) exists whenever a principal (委托人) hires an agent(代理人)to act on their behalf。

(第十部分 财会英语)专题二(审计)

(第十部分财会英语)专题二(审计)一、案例分析题1、ABC会计师事务所承接甲公司2012年度财务报表审计业务,其业务的性质和经营规模与其常年审计客户乙公司相类似,ABC会计师事务所在制定总体审计策略和具体审计计划时,作出下列判断:(1)由于甲公司与常年审计客户乙公司业务性质和规模相似,因此确定的重要性水平与乙公司相同。

(2)初步了解2012年度甲公司及其环境未发生重大变化,拟信赖以往审计中对管理层、治理层诚信形成的判断。

(3)制定完成审计计划后,应按照计划执行审计程序,不能够改变计划。

(4)因对甲公司内部审计人员的客观性和专业胜任能力存有疑虑,拟不利用内部审计的工作。

(5)因甲公司存货存放于外省市,监盘成本较高,拟不进行监盘,直接实施替代审计程序。

(6)如对计划的重要性水平作出修正,拟通过修改计划实施的实质性程序的性质、时间安排和范围降低重大错报风险。

<1> 、Requirements:If you are the engagement partner of ABC Accounting Firm, briefly analyze whether above events have any inappropriateness or not as to the information provided above, if any, briefly states reasons.2、ABC会计师事务所接受委托审计甲公司2012年度财务报表,在对甲公司及其环境进行了解时,注意到如下事项:(1)对于用于公共基础建设的液晶显示屏和无线通信设备,甲公司负责将该设备运送到目的地并安装调试,待验收合格后签署验收单,甲公司根据该验收单确认销售收入。

由于竞争激烈,甲公司对其生产的上述设备新增了其他功能,并规定自2012年起对向公共设施建设项目提供的产品给予3个月的免费试用期,在试用期结束后签署设备验收单,因为该项规定,甲公司2012年年末发出商品科目余额比上年同期增长20万元。

cpa会计第一章考点

cpa会计第一章考点英文回答:Chapter 1: Introduction to the CPA Profession.The CPA (Certified Public Accountant) designation is a globally recognized professional certification that signifies a high level of knowledge, skills, and ethical standards in the accounting field.CPAs provide a wide range of services, including:Financial statement auditing.Tax planning and compliance.Consulting.Forensic accounting.To become a CPA, candidates must meet the following requirements:Earn a bachelor's degree in accounting or a related field.Pass the Uniform CPA Examination.Complete a period of relevant work experience.Meet the ethics and character requirements set by the AICPA (American Institute of Certified Public Accountants)。

Chapter 1 考点。

CPA 职业的定义和地位。

CPA 的主要执业领域。

成为一名 CPA 的资格要求。

CPA 职业发展路径。

中文回答:第一章,注册会计师职业概论。

CPA职业的定义和地位。

CPA(Certified Public Accountant,注册会计师)是一种全球认可的专业认证,代表着会计领域较高的知识水平、技能和道德标准。

注会应试指南会计第十章综合题第二题

注会应试指南会计第十章综合题第二题下载提示:该文档是本店铺精心编制而成的,希望大家下载后,能够帮助大家解决实际问题。

文档下载后可定制修改,请根据实际需要进行调整和使用,谢谢!本店铺为大家提供各种类型的实用资料,如教育随笔、日记赏析、句子摘抄、古诗大全、经典美文、话题作文、工作总结、词语解析、文案摘录、其他资料等等,想了解不同资料格式和写法,敬请关注!Download tips: This document is carefully compiled by this editor. I hope that after you download it, it can help you solve practical problems. The document can be customized and modified after downloading, please adjust and use it according to actual needs, thank you! In addition, this shop provides you with various types of practical materials, such as educational essays, diary appreciation, sentence excerpts, ancient poems, classic articles, topic composition, work summary, word parsing, copy excerpts, other materials and so on, want to know different data formats and writing methods, please pay attention!注会应试指南会计第十章第二题:综合题。

CPA英语解读

1.机会成本 机会成本=平均现金持有量×机会成本率= C/2×K 2.交易成本 交易成本=交易次数×每次交易成本=T/C×F 3.最佳持有量及其相关公式 机会成本、交易成本与现金持有量之间的关系, 可以图示如下:

从上图可以看出,当机会成本与交易成本 相等时,相关总成本最低,此时的持有量 即为最佳持有量。由此可以得出:

80 90 0.20 100 0.50 110 0.20 120 0.04 130 0.01

需要量 70 (10×d)

概率(P) 0.01 0.04

(1)不设置保险储备。 不设置保险储备,再订货点为:10×3600/360 =100件。当需求量为100或100以下时,不会发生缺 货。当需求量为110件时,缺货10件,概率为0.20; 当需要量为120件时,缺货量为20件,概率为0.04; 当需求量为130件时,缺货30件,概率0.01。 一次订货的期望缺货量=10×0.20+20×0.04 +30×0.01=3.1件 全年缺货成本=3.1×12×4=148.8(元) 全年储存成本=0 全年相关总成本=148.8(元)

【自制与外购存货的决策】

『正确答案』 (1)外购零件

TC=DU+TC(Q*)=3600×4+240=14640( 元) (2)自制零件

TC=DU+TC(Q*)=3600×3+1440=12240(元) 由于自制的总成本低于外购的总成本,因此以自制为宜。

保险储备

【例】假定某存货的年需要量D=3600件,单位 储存变动成本Kc=2元,单位缺货成本Ku=4元, 交货时间L=10天,已经计算出经济订货量Q= 300件,每年订货次数N=12次。交货期内的存货 需要量及其概率分布见表。要求计算保险储备和 再订货点。

最新注会CPA英语班讲义下载

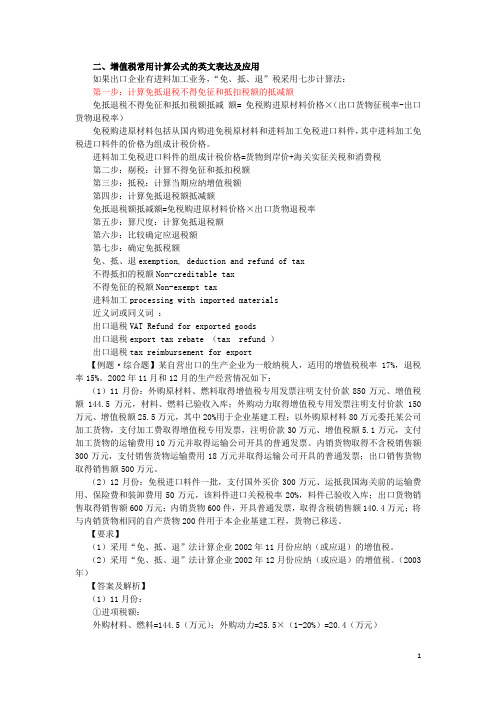

二、增值税常用计算公式的英文表达及应用如果出口企业有进料加工业务,“免、抵、退”税采用七步计算法:第一步:计算免抵退税不得免征和抵扣税额的抵减额免抵退税不得免征和抵扣税额抵减额= 免税购进原材料价格×(出口货物征税率-出口货物退税率)免税购进原材料包括从国内购进免税原材料和进料加工免税进口料件,其中进料加工免税进口料件的价格为组成计税价格。

进料加工免税进口料件的组成计税价格=货物到岸价+海关实征关税和消费税第二步:剔税:计算不得免征和抵扣税额第三步:抵税:计算当期应纳增值税额第四步:计算免抵退税额抵减额免抵退税额抵减额=免税购进原材料价格×出口货物退税率第五步:算尺度:计算免抵退税额第六步:比较确定应退税额第七步:确定免抵税额免、抵、退exemption, deduction and refund of tax不得抵扣的税额Non-creditable tax不得免征的税额Non-exempt tax进料加工processing with imported materials近义词或同义词:出口退税VAT Refund for exported goods出口退税export tax rebate (tax refund )出口退税tax reimbursement for export【例题·综合题】某自营出口的生产企业为一般纳税人,适用的增值税税率17%,退税率15%。

2002年11月和12月的生产经营情况如下:(1)11月份:外购原材料、燃料取得增值税专用发票注明支付价款850万元、增值税额144.5万元,材料、燃料已验收入库;外购动力取得增值税专用发票注明支付价款150万元、增值税额25.5万元,其中20%用于企业基建工程;以外购原材料80万元委托某公司加工货物,支付加工费取得增值税专用发票,注明价款30万元、增值税额5.1万元,支付加工货物的运输费用10万元并取得运输公司开具的普通发票。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

/index_111.html

大家网会计英语论坛

对于会计科英语考试,主要从以下方面来准备: 1.ACCOUNTING TERMS 2.ACCOUNTING THEORIES 3.ACCOUNITNG APPLICATIONS 4.IAS/IFRS/CAS

题型分析

一、名词解释 EXAMPLE Fair Value [答疑编号 31r value is the amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm's length transaction。 所谓公允价值计量模式,就是资产和负债按照在公平交易中,熟悉情况的交易双方自愿进 行资产交换或者债务清偿的金额计量。 Notes: 1.for which…in an arm's length transaction:“介词+关系词”引导的定语从句,修饰the amount 2.arm's length transaction 公平交易 答题规律:开门见山,言简意赅

大家网会计英语论坛

中华会计英语 Ⅰ.背景介绍

中国注册会计师协会决定在今年的中国注册会计师资格考试会计科、审计科加试 10 分 英语试题,并将该成绩纳入最后考试的总成绩,也即 110 分的试卷 60 分及格。该安排看似突然, 实际上代表了一个趋势,就是要全面提升中国注册会计师的语言水平,进而达到中西合璧,融 会贯通,取长补短,为我所用的目的。

-liabilities: The IASB’s Framework defines liabilities as ‘a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow from the entity of resources embodying economic benefits’. Many aspects of this definition are complementary (as a mirror image) to the definition of assets, however the IASB stresses that the essential characteristic of a liability is that the entity has a present obligation. Such obligations are usually legally enforceable (by a binding contract or by statute), but obligations also arise where there is an expectation (by a third party) of an entity assuming responsibility for costs where there is no legal requirement to do so. Such obligations are referred to as constructive (by IAS 37 Provisions, contingent liabilities and contingent assets). An example of this would be repairing or replacing faulty goods (beyond any warranty period) or incurring environmental costs (e.g. landscaping the site of a previous quarry) where there is no legal obligation to do so. Where entities do incur constructive obligations it is usually to maintain the goodwill and reputation of the entity. One area of difficulty is where entities cannot be sure whether an obligation exists or not, it may depend upon a future uncertain event. These are more generally known as contingent liabilities. --负债 国际会计准则委员会编报财务报表的框架将负债定义为:企业由于过去事项而承担的现 时义务,该义务的履行预期会导致含有经济利益的资源流出企业。该定义许多方面与资产定 义遥相呼应。但国际会计准则强调负债的本质特征是指企业要有现时的义务。这样的义务通 常在法律上是强制执行的(具有约束力的合同或法定要求)义务。有时该项义务来来自第三方 的期望,即企业会承担某些非法定要求的成本。这样的义务称之为推定义务。例如企业在产 品保证期期满后才显现缺陷也要予以修理或承担环保成本,这些都不是法定要求去做的。如 果企业产生了推定义务,则是为了保持商誉或信誉而做。但比较困难的一点是企业有时很难 确定是否存在一项义务,它将取决于某件将来要发生的不确定事件。这些通常称为或有负债。

针对此变化,广大考生应该做到: 稳定情绪 调整心态 振奋精神 悉心备考 该考试变化对广大考生的参考并未产生实质性的不利影响。 所以应该充满自信,不要出现急躁、不安情绪! 积极应对!从积极方面来看待这个趋势和变化!

Ⅱ.考试题型预测 目前获得的关于这 10 分英语考试最新的信息为: 1.一道题 2.主观题 3.专业题 分析: 正是针对此次考试“三题”的特点,我们预测此次考试极有可能的题型如下: 1.名词解释 2.简答题 3.翻译(英汉互译) 4.案例分析 这四类题型都会很好地体现“三题”精神。 会计科考试体系是在中国会计准则(CAS)与国际会计准则(IAS/IFRS)趋同的背景下 考察英文水平的;趋同不是等同,所以考察具体某些业务的分录的可能性虽然存在,但是不大; 更重要考察的是一些“务虚”的内容,即理论或文字表述的内容。

/index_111.html

大家网会计英语论坛

国际会计准则委员会的框架文件将资产定义为:由过去事项而由企业控制的、预期会导 致未来经济利益流入企业的资源。该定义的前半部分强调的是对控制而不是所有权。之所以 这样是因为资产负债表反映的是交易的实质而不是交易的法律形式。这意味着即使在法律上 所有权不归企业,但企业享有与拥有该所有权同样的权利,此时也应在资产负债表上将其确 认为资产。通常的实例为融资租赁资产和其他类似航空着陆权的其他和约义务。资产的控制 权另一重要体现是限制他人对该资产的染指。对过去事件的提及是阻止对未来可能拥有的资 产过早得在资产负债表予以确认。

辅导大体安排

TIME SCHEDULE MEMO 1-1.5hrs 题型分析 对每类题型结合具体实例进行说明,并讲解答题技巧 2.5-3hrs 考点预测 结合题型对可能考查的内容进行预测讲解 该项英语考试对书面表达的要求在英语四级水平。 该项考前紧急冲刺辅导时间紧,任务重,不是零起点辅导,需要有一定的英语基础。

二、简答题 Of particular importance within the Framework are the definitions and recognition criteria for assets and liabilities. Required: Define assets and liabilities and explain the important aspects of their definitions. Explain why these definitions are of particular importance to the preparation of an entity’s balance sheet and income statement. [答疑编号 31010201:针对该题提问] Solution: Definitions–assets: The IASB’s Framework defines assets as‘a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity’. The first part of the definition puts the emphasis on control rather than ownership. This is done so that the balance sheet reflects the substance of transactions rather than their legal form. This means that assets that are not legally owned by an entity, but over which the entity has the rights that are normally conveyed by ownership, are recognised as assets of the entity. Common examples of this would be finance leased assets and other contractual rights such as aircraft landing rights. An important aspect of control of assets is that it allows the entity to restrict the access of others to them. The reference to past events prevents assets that may arise in future from being recognised early.