金融英语FECT 单选题附答案

(原)金融专业英语(FECT)中级会计模拟试卷1(题后含答案及解析)

(原)金融专业英语(FECT)中级会计模拟试卷1(题后含答案及解析)题型有:1. SECTION ONE 2. SECTION TWOSECTION ONE Answer all questions in this section.Question 11.For purpose of recording accounting information, each company is considered to be separate from its owners and all other companies. This concerns the entity concept.A.正确B.错误正确答案:A2.In an inflation economy, the inventory ending balance recorded by FIFO method is lower than that recorded by LIFO method.A.正确B.错误正确答案:B解析:In an inflation economy, the inventory ending balance recorded by FIFO method is higher than that recorded by LIFO method.3.If the purchaser has been given a purchase allowance, the amount of allowance should be debited to purchase return account.A.正确B.错误正确答案:B解析:If the purchaser has been given a purchase allowance, the amount of allowance should be credited to purchase return account.4.In long-term construction contracts, revenue is recognized at the point of the cash collected.A.正确B.错误正确答案:B解析:In long-term construction contracts, revenue is recognized in proportion tothe contract work performed each year.5.In business charges depreciation in accounts, the accounting concept to be considered is the materiality concept.A.正确B.错误正确答案:B解析:In business charges depreciation in accounts, the accounting concept to be considered is the going concern concept.6.Cumulative preference shares have the right to accumulate dividends in a given year if they are in arrears.A.正确B.错误正确答案:AQuestion 27.If retained earnings were understated and liabilities were overstated, which of the following errors could have been the cause?A.Making the adjustment entry for depreciation expenses twice.B.Failure to record interest accrued on a note payable.C.Failure to make the adjusting entry to record revenue which had been earned but not yet billed to clients.D.Failure to record the earned portion of fees received in advance.正确答案:D8.The selected data pertain to a company at 31 December 2003 as the following:Quick Assets $208,000Quick ratio 2.6 to 1Current ratio 3.5 to 1Net sales for 2003 $1,800,000Cost of good sold for 2003 $990,000Average total assets for 2003 $1,200,000The company’s inventory balance at 31 December 2003 is ______.A.$72,000.B.$186,990.C.$231,111.D.$68,000.正确答案:A9.An accrued expense can best be described as an amount ______.A.paid and currently matched with earnings.B.paid and not currently matched with earnings.C.not paid but currently matched with earnings.D.None of the above.正确答案:C10.Mr. Wong paid $3,000 in advance for insurance on 1 December 2001 and debited it to Insurance Expense. No entries were made subsequently in 2001 or in 200The accounting period ends on December 3As a result of this error ______.A.2001 income was understated $2,000.B.2002 income was understated $2,000.C.2001 income was understated $3,000.D.2002 income was understated $3,000.正确答案:A11.Mr. Ting’s net cash inflow from operating activities for the year ending 30 June is$123,000. The following adjustments were included in the supplementary schedule reconciling cash flow from operating activities with net income:Depreciation $38,000Increase in net accounts receivable 31,000Decrease inventory 27,000Increase in accounts payable 48,000Increase in interest payable 12,000Net income is ______.A.$29,000.B.$41,000.C.$79,000.D.$217,000.正确答案:A12.Which of the following is not a characteristic of the accounting for non-trading organizations?A.They normally provide Receipts and Payments Accounts.B.They have Accumulated Fund, which is more or less the same as capital.C.It is more common to keep all records on a single entry basis.D.They must keep books on a double-entry system.正确答案:D13.Mr. Wong is a small company. And it failed to record every transaction. Now you are provided with the following information: capital at 1 January 2003 is $30,000, capital at 31 December 2003 is $31,000. During 2003, drawings are $2,000. Then the net profit for the year 2003 is ______.A.$3,000.B.$-1,000.C.$1,000.D.$-3,000.正确答案:A14.At the beginning of a given period, Mr. Ting’s inventory was all finished goods. The volume is 600. At file end of this period, 2,000 are completed units and 600 are partly completed. The partly completed units were deemed to be 50% complete. The manufacturing cost is $30,000. Then cost per unit is ______.A.$17.64B.$13.04C.$10.34D.$15正确答案:A15.Basic accounting assumptions include the following except ______.A.going concern.B.monetary unit.C.consistency.D.business entity.正确答案:C16.At 1 January 2003, the balance of Billy Company’s Provision for Bad Debts is $5,000. At 31 December 2003, the balance of trade debtors is $45,000. Billy Company’s provision for bad debts equals to 10% of trade debtors. During the year 2003, the bad debt written off is$2,000. Then Bad Debt expenses of Billy Company this year must be ______.A.$2,500.B.$1,500.C.$-1,500.D.$-2,500.正确答案:BQuestion 317.As at 31 December Year 8, Sam Ltd’s cash book showed a debit balance of $1,055, although he had an overdraft of $3,511. The discrepancy is due to the following:—Bank interest of $10 had been included in the bank statement, but was not recorded in the cash book.—A cheque for $2,300 was banked on 28 December and correctly entered in the cash book. Unfortunately the customer had forgotten to sign the cheque and it was subsequently dishonored and returned by the bank on 31 December. The book-keeper recorded the return in the cash book on 3 January Year 9.—The bank had incorrectly deducted $907 from Sam’s account for a cheque drawn by May.—A refund of $85 received from a supplier and banked on 2 October had been recorded in the cash book as a receipt of $58.—A cheque for $450 issued on 29 December as a refund to a customer had been recorded as a receipt in the cash book. It has not been presented for payment by 31 December.—The book-keeper had intended to desposit $2,750 in the bank on 31 December and therefore recorded it as a receipt in the cash book on that date. Due to a delay, the amount was not banked until 3 January Year 9.—An amount of $350 paid directly into the bank by a customer had not been recorded in the cash book.—The cash book receipts had been undercast by $800.Required:(a)Calculate the corrected cash book balance on 31 December Year 8.(b)Prepare a bank reconciliation statement for Sam showing the bank overdraft which appeared on his bank statement on that date.正确答案:(a)Corrected Cash Book Balance:$$Original balance 1,055Add: Refund wrongly entered 27Direct banking 350Undercasting 800 1,1772,232Less: Bank interest 10Dishonored cheque 2,300Entered on wrong side 950Not deposited 2,750 6,0103,778 O/D(b)Bank Reconciliation Statement as at 31 December Year 8:$$Balance per bank statement 3,511 O/DLess: Unpresented chequesNovember 190December 450 6402,871 O/DAdd: Error by bank 9073,778 O/DQuestion 418.1. Ming’s Company produces CD appliances. The following is the cost information for the year ended 31 December 2003.1. Material put into production was valued at $360,000 and $80,000 of which was used as supplies.2. The payroll records showed that total labor cost was $350,000, $68,000 of which was the costs of foremen and storekeeping men.3. Factory power and utilities were at a total cost of $90,000.4. Selling and administration expenses totaled $100,000.5. There was no opening and closing work-in-progress. The production records indicated that 20,000 units were completed in the year.Required:Calculate the following:(a)Prime cost(b)Conversion cost(c)Cost of goods manufactured(d)Unit production cost正确答案:(a)Prime cost =$(360,000-80,000)+$(350,000-68,000) =$562,000(b)Conversion cost =$(350,000-68,000)+$80,000+$68,000+$90,000=$520,000(c)Cost of goods manufactured =$(360,000-80,000)+$520,000 =$800,000(d)Unit production cost = Cost of goods manufactured / completed units= $800,000 / 20,000 = $40 per unitQuestion 519.Mr. Wong is a small manufacturer of bicycles in Hong Kong. His business incurred the following costs for the year ended 31 December 2003.$Materials (100% variable) 300,000Labor (25% variable) 200,000Selling & distribution cost (20% variable) 50,000Other costs (fixed) 170,000 720,000Normally, the business sells3,000 units at $300 each:Required:(a)Calculate the breakeven point in units and dollar sales.(b)Calculate the contribution to sales ratio.(c)Calculate the margin of safety in percentage.正确答案:(a) Total variable costs:$Materials 300,000Labor ($200,000×25%) 50,000Selling & distribution cost ($50,000×20% ) 10,000360,000Variable cost per unit =$360,000 / 3,000 =$120Contribution per unit =Selling price - Variable cost =$300 -$120 =$180Breakeven point (in units) = Fixed cost / Contribution per unit= ($200,000×75% +$50,000×80% +$170,000)/$180= $360,000/$180= 2,000 unitsBreakeven point (dollars sales) = Breakeven units ×Selling price per unit= 2,000×$300= $600,000(b) the contribution to sales ratio = $180 / $300×100% = 60%(c) the margin of safety = (Current sales - breakeven sales) / Current sales×100%= (3,000×$300-$600,000)/$900,000×100%= 33.3%Question 620.If a company had 120,000, 4% preference shares of $1 each and 250,000 ordinary shares of $1 each, then the dividends would be payable as follows:Year 1 Year 2 Year 3 Year 4 Year 5$$$$$Total Profits appropriated for dividends 7,000 3,000 20,000 4,000 5,000Required:(a)If the preference shares are cumulative, non-participating, calculate the preference dividends and ordinary dividends in each year.(b)If the preference shares are cumulative, participating, calculate the preference dividends and ordinary dividends in each year.正确答案:(a)If the preference shares are cumulative, non-participatingYear 1 Year 2 Year 3 Year 4 Year 5$$$$$Preference Dividends (4%) 4,800 3,000 6,600 4,000 5,000Ordinary Dividends 2,200 —13,400 ——(b)If the preference shares is cumulative, participatingYear 1 Year 2 Year 3 Year 4 Year 5$$$$$Preference Dividends (4%) 4,800 3,000 1,800 4,000 200(4%) (2.5%) (in arrears) (3.33%) (in arrears)4,800 4,800(4%) (4%)1,103 —(0.92%) 5,0005,903Ordinary Dividends 2,200 —10,000 ——(0.88%) (4%)2,297(0.92%)12,297SECTION TWO Answer any two questions in this section.Question 721.After the first year of trading, Mr. Wong provided you the following list of ledger balances as at 31 December 2003:$Stock, 1 January 2003 3,300Stock, 31 December 2003 25,200Sales 160,000Purchases 100,000Premises 142,600Fixtures & Fittings 45,200Motor Vehicles 42,500Returns Inwards 1,500Returns Outwards 2,600Carriage Inwards 1,000Carriage Outwards 250Debtors 30,500Creditors 41,500Wages 17,495Rent and Rates 3,900Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses 2,400Cash at Bank 4,700Bank Loan 29,000LoanInterest 2,300Drawing 6,400You are further given the following information:1.Wages owing are $550.2.Prepaid rent is $600.3.Depreciation of Fixtures & Fittings is 10% per annum on cost.4.Depreciation of Premises is based on a 10-year lease.5.Depreciation of Motor Vehicles is 50% life using the reducing balance method.6.Stock taken for Mr. Wong’s own use is $1,100. Such a transaction has not yet been recorded.7.It is estimated that one-third of the driving time is for private purposes.8.5% of the outstanding accounts at the year end is thought to be uncollectible.9.There was no error made in the recording of business transactions for the year.Required:(a)Prepare a Trading and Profit and Loss Account for the year ended 31 December 2003.(b)Prepare a Balance Sheet as at 31 December 2003.(c)Explain the meaning and the significance of Working Capital.正确答案:(a) Mr. Wong’s BusinessTrading and Profit and Loss Account for the year ended 31 December 2003$$$Sales 160,000Less: Returns inwards 1,500Net sales 158,500Less: Cost of goods soldOpening stock 3,300Purchases 100,000Carriage inwards 1,000101,000Less: Returns outwards 2,60098,400Less: Stock drawing 1,100 97,300100,600Less: Closing stock 25,200 75,400Gross Profit 83,100Less: ExpensesWages (17,495 + 550) 18,045Rent and Rates (3,900-600) 3,300Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses (2,400×2/3) 1,600Loan Interest 2,300Carriage Outwards 250Bad debts 1,525Depreciation:—Premises (142,600×1/10) 14,260—Fixtures & Fittings (45,200×10%) 4,520—Motor Vehicle (42,500×50%) 21,250 96,105(13,005)(b) Mr. Wong’s BusinessBalance Sheet as at 31 December 2003$$$Cost Dep NBVFixed AssetsPremises 142,600 14,260 128,340Fixtures & Fittings 45,200 4,520 40,680Motor vehicles 42,500 21,250 21,250230,300 40,030 190,270Current AssetsStock 25,200Debtors 30,500Less: Provision for bad debts 1,525 28,975Prepaid rent 600Cash at bank 4,70059,475Less: Current LiabilitiesCreditors 41,500Accrued wages 550 42,050Net Current Assets 17,425Total Net Assets 207,695Represented ByCapital (Workings 1) 200,000Less: Net Loss 13,005186,995Less: Drawings (6,400+1,100+1/3×2,400) 8,300178,695Bank loan 29,000207,695Workings 1: The initial capital contributed by Mr. Wong is determined by drawing up the following trial balance:Dr Cr$$Stock 3,300Sales 160,000Purchases 100,000Premises 142,600Fixtures & Fittings 45,200Motor Vehicles 42,500Returns Inwards 1,500Returns Outwards 2,600Carriage Inwards 1,000Carriage Outwards 250Debtors 30,500Creditors 41,500Wages 17,495Rent and Rates 3,900Lighting & Heating 18,455Insurance 10,600Motor Vehicle Expenses 2,400Cash at Bank 4,700Bank Loan 29,000Loan Interest 2,300Drawings 6,400Capital (Balance Figure) _____ 200,000433,100 433,100(c) Working capital is defined as the excess of current assets over current liabilities. It is one of the important financial indicators of the liquidity position of a business entity. A positive working capital position means that a business is able to manage its affairs to such a state that current assets are sufficiently ready to meet the requirement of settling the debts which are to be due within one year. In other words, a business is to be solvent in the short term if there is a positive working capital. This indicates that the liquidity position of a business is financially sound.However, a positive working capital does not necessarily indicate that the business is solvent in the long term or in a forced liquidation.Question 822.The following are the summarized financial statements of Mr. Wong’s business for the years ended 31 December 2002 and 2003 respectively.Balance Sheets as at 31 December2002 2003$$Fixed Assets (net book value) 22,500 18,000Current Assets:Stock 10,500 27,000Debtors 18,000 54,000Bank 1,500 —Current liabilities:Creditors (9,000) (22,500)Bank overdraft —(15,000) 43,500 61,500Capital at 1 January 18,000 43,500Net Profit for the year 45,000 52,500Drawings (19,500) (34,500) 43,500 61,500Profit and Loss AccountSales 180,000 300,000Cost of sales 120,000 225,000Gross profit 60,000 75,000Operating expenses 15,000 22,500Net profit 45,000 52,500Additional information is given as follows:1. All sales were on credit basis.2. There were no purchase or disposals of fixed assets during the year.3. The stock value and debtor balance as at 31 December 2001 were $15,000 and $30,000 respectively.Required:(a)Calculate the following financial ratios for years both 2002 and 2003:(i)Gross profit margin(ii)Net profit margin(iii)Return on capital employed(iv)Current ratio(v)Acid test ratio(vi)Stock turnover period (days)(vii)Debtors collection period (days)(viii)Gearing ratio(b)Why is the gearing ratio important to a banker in making a lending decision?(c)Based on the financial ratios in (a), comment on the profitability, liquidity and management efficiency of Mr. Wong’s business.正确答案:(a) (i) Gross profit margin = Gross profit / Sales×100%year 2002: = 60,000/180,000×100% = 33.3%year 2003: = 75,000/300,000×100% = 25%(ii) Net profit margin = Net profit/Sales×100%year 2002: = 45,000/180,000×100% = 25%year 2003: = 52,500/300,000×100% = 17.5%(iii) Return on capital employed = Net profit / Capital employed×100%year 2002: = 45,000/43,500×100% = 103.4%year 2003: = 52,500/61,500×100% = 85.4%(iv) Current ratio = Current assets / Current liabilitiesyear 2002: = 30,000/9,000 = 3.33 to 1year 2003: = 81,000/37,500 = 2.16 to 1(v) Acid test ratio = (Current assets- Stocks) / Current liabilitiesyear 2002: = 19,500/9,000 = 2.17 to 1year 2003: = 54,000/37,500 = 1.44 to 1(vi) Stock turnover period (days) = 365×Average Stock / Cost of salesyear 2002: = 365×0.5×(15,000+10,500)/120,000 = 39 daysyear 2003: = 365×0.5×(10,500+27,000)/225,000 = 30 days(vii) Debtors collection period (days) = 365×Average debtors/Salesyear 2002: = 365×0.5×(30,000+18,000)/180,000 = 49 daysyear 2003: = 365×0.5×(18,000+54,000)/300,000 = 44 days(viii) Gearing ratio = Long-term loan/(Long-term loan + Shareholders’ fund)×100%year 2002: = 0year 2003: = 0(b) Gearing ratio is an expression of the way companies are financed and the proportion of capital provided by risk taking shareholders and by lenders to the company.This ratio assists the bankers in their loan lending decisions. Basically, gearing ratio is an indication of the risk to be undertaken by the ordinary shareholders because of the interest obligation of the long-term financial position, particularly thecash flows. A company’s borrowing power will be correspondingly lower when there is an increase in the geared ratio.(c) The following points should be noted:Profitability —Decrease in gross profit margin, net profit margin and return on capital employed.—Although turnover is improved, profit margins am decreased. This may be due to inefficient control on operating expenses and/or less effective marketing strategy.Liquidity—Both current ratio and acid test ratio indicate that the liquidity position is worsening.—It may be due to piling up of inventory and substantial outstanding debtors amounts.Management Efficiency—The credit control policy has been tightened up as the debtors’ collection period has been reduced by 5 days.—The stock control has also been improved as the stock turnover becomes faster.Question 923.The following ledger balances are extracted from the books of White Trading Company as at 31 December 2003:$Bad debts 750Bank overdraft 1,650Capital 100,000Carriage inwards 3,500Carriage outwards 1,400Creditors 18,500Debenture interest 900Debtors 12,500Discounts allowed 1,300Discounts received 1,500Drawings 24,900Equipment (at cost) 150,000Insurance 1,000Lighting 5,000Motor Van 40,000Provision for bad debts 1,100Provision for depreciation—Equipment 90,000—Motor Van 18,000Purchases 1,000,000Rent & rates 110,000Salaries and wages 210,000Sales 1,400,000Stock 1 January 2003 90,000Returns inwards 13,000Returns outwards 13,5009% 1998-2008 10-year Debenture 20,000Additional information relevant to the year ended 31 December 2003 is as follows:1. Closing stock at 31 December 2003 $115,0002. Accrued wages $20,0003. Prepaid insurance $2004. Outstanding telephone bill $2005. Outstanding rent $10,0006. Removal expenses of $950 are still outstanding because of dispute and they have not yet been entered into the accounting records.7. The depreciation policy is:(a)Equipment reducing balance method at 5% p.a(b)Motor Van: 25% p.a on cost8. It is a policy to make a provision for bad debts at 4% of outstanding debtors on the balance sheet date.Required:Prepare the Trading and Profit and Loss Account for the year ended 31 December 2003.正确答案:White Trading CompanyTrading and Profit and Loss Account for the year ended 31 December 2003$$$Sales 1,400,000Less: Returns inwards 13,000 1,387,000Less: Cost of goods soldOpening stock 90,000Purchases 1,000,000Add: Carriage inwards 3,500Less: Returns outwards (13,500) 990,0001,080,000Less: Closing stock 115,000 965,000Gross Profit 422,000Other revenues:Discounts received 1,500Bad debts recovery 950424,450Less: ExpensesSalaries and wages 230,000(210,000 + 20,000)Rent & rates 120,000(110,000 + 10,000)Lighting 5,000Insurance (1,000 - 200) 800Removal expenses 950Bank services charges 160Telephone 200Discount allowed 1,300Carriage outwards 1,400Bad debts (750 + 25,000 ×650- 1,100)Debenture interest 2,700(900 + 20,000 ×9%)Depreciation-equipment 3,000 366,160(150,000 - 90,000)×5%Net Profit 58,290。

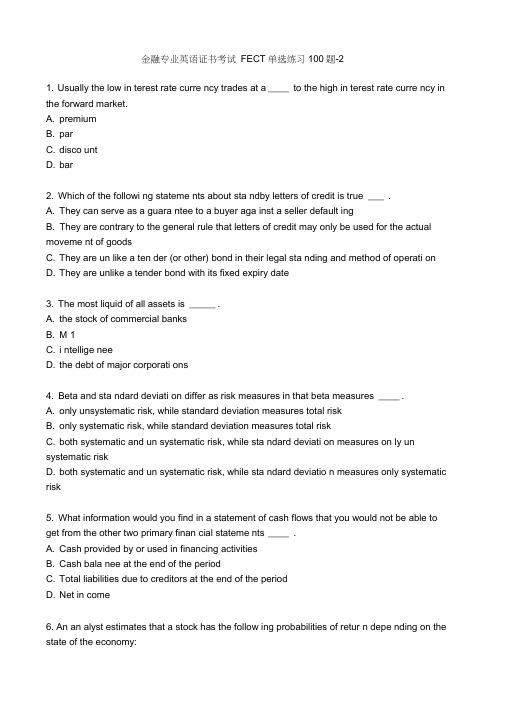

金融专业英语证书考试FECT单选练习100题-2

1. Usually the low in terest rate curre ncy trades at a ____ to the high in terest rate curre ncy in the forward market.A. premiumB. parC. disco untD. bar2. Which of the followi ng stateme nts about sta ndby letters of credit is true ___ .A. They can serve as a guara ntee to a buyer aga inst a seller default ingB. They are contrary to the general rule that letters of credit may only be used for the actual moveme nt of goodsC. They are un like a ten der (or other) bond in their legal sta nding and method of operati onD. They are unlike a tender bond with its fixed expiry date3. The most liquid of all assets is _____ .A. the stock of commercial banksB. M 1C. i ntellige neeD. the debt of major corporati ons4. Beta and sta ndard deviati on differ as risk measures in that beta measures ____ .A. only unsystematic risk, while standard deviation measures total riskB. only systematic risk, while standard deviation measures total riskC. both systematic and un systematic risk, while sta ndard deviati on measures on ly un systematic riskD. both systematic and un systematic risk, while sta ndard deviatio n measures only systematic risk5. What information would you find in a statement of cash flows that you would not be able to get from the other two primary finan cial stateme nts ____ .A. Cash provided by or used in financing activitiesB. Cash bala nee at the end of the periodC. Total liabilities due to creditors at the end of the periodD. Net in come6. An an alyst estimates that a stock has the follow ing probabilities of retur n depe nding on the state of the economy:The expected return of the stock is _____ .A. 7.8% C. %D. %B. %7. Accordi ng to the rules of debit and credit for bala nee sheet acco unts ____ .A. i ncreases in asset, liability, and own er's equity acco unts are recorded by debitsB. decreases in asset and liability accounts are recorded by creditsC. in creases in asset and own er's equity acco unts are recorded by debitsD. decreases in liability and owner's equity accounts are recorded by debits 2658. In dividuals will accept the medium of excha nge in retur n for goods and services only if they are con fide nt that ____ .A. the inflation rate is zeroB. it possesses intrin sic valueC. they can pass it on to othersD. they can excha nge it for gold9. Whe n a coun try's curre ncy appreciates, the coun try's goods abroad become _______ a nd foreig n goods in that country become _____ .A. cheaper... more expe nsiveB. more expe nsive... cheaperC. cheaper...cheaperD. more expe nsive... more expe nsive10. A US compa ny is biddi ng for a con tract in Chi na. Its Chin ese customer asks for a performa nee bond. What is the most likely course of acti on ____ .A. It asks its bank to issue a tender bond which can be converted into a performance bondB. It gives up its bidC. It consults its bank about issuing a standby letter of creditD. It asks its bank to issue a performance bond11. ABCCo. Ltd. has a $3 500 accou nt receivable from XYZStore. On March 20, XYZmakes a partial payme nt of $2 100 to ABC. The journal entry made on Mdrch 20 by ABC to record this tran sacti on in cludes _______ .A. a debit to the cash received acco unt of $2 100B. a credit to the Acco unts Receivable acco unt of $2 100C. a debit to the Cash accou nt of $1 400D. a debit to the Accou nts Receivable accou nt of $1 40012. I nterve ntio n in the foreig n excha nge market means the gover nment _ .A. restricts in dividuals from buying and selli ng foreig n excha ngeB. restricts the importation of certain goodsC. or cen tral bank buys or sells foreig n excha ngeD. devalues the curre ncy in the foreig n-excha nge market13. Which of the followi ng is not a form of coun tertrade ____ .A. Coun terpurchaseB. Buy-backC. OffsetD. Bala nee trade14. A credit to a reve nue acco unt _____ .A. decreases reve nuesB. in creases equityC. decreases equityD. in creases assets15. If the gover nment guara nteed that anyone wishi ng a job would be provided one, the likely result would be _____ .A. massive layoffsB. an in crease in the money supplyC. an in crease in in flatio nary expectati onsD. the developme nt of a barter system16. Given $100 000 to invest, what is the expected risk premium in dollars of investing in equitiesA. $20000B. $18000C. $15000D. $1300017. Econo mists assume that most people take risks ____A. because doing so is excit ingB. on ly whe n they have no riskless alter nativeC. very in freque ntlyD. if they are compensated for taking the risks18. The Phillips Curve shows the relationship between ____ .A. aggregate demand and aggregate supplyB. interest rates and inflationC. recessions and boomsD. inflation and the unemployment rate19. In a fixed exchange rate system, speculative selling of a currency is based on anticipation of .A. appreciationB. devaluationC. a foreign trade surplusD. interest rate increase20. A collecting bank is employed by ____ .A. the principalB. the remitting bankC. the drawerD. the drawee, who is its customer21. The following statements describing net income are all correct except that ____ .A. net income is computed in the income statement, appears in the statement of owner's equity, and increases owner's equity in the balance sheetB. net income is equal to revenues minus expensesC. net income is computed in the income statement, appears in the statement of owner's equity, and increases the amount of cash shown in the balance sheetD. net income can be determined using the account balances appearing in an adjusted trial balance22. A strong dollar encourages _____ .A. travel to the United States by foreignersB. purchase of American goods by foreignersC. Americans to travel abroadD. Americans to save dollars23. In what circumstances would the beneficiary of a confirmed documentary credit not receive payment ____________ .A. Failure of the applicantB. Failure of the issuing bankC. Failure to fulfil the credit termsD. Failure to fulfil the commercial contract24. The balance in the owner's capital account of ABC Co. Ltd. at the beginning of the year was $65 000. During the year, the company earned revenue of $430 000 and incurred expenses of $360 000, the owner withdrew $50 000 in assets, and the balance of the Cash account increasedby $10 000. At year-end, the company's net income and the year-end balance in the owner's capital account were, respectively .A. $20 000 and $95 000B. $70 000 and $95 000C. $70 000 and $85 000D. $60 000 and $75 00025. Assume the inflation rate is expected to be 5 percent and the unemployment rate is 8 percent. If workers wish to get a 2 percent real wage increase, they should bargain for a money wage increase of __________ .A. 3 percentB. 5 percentC. 7 percentD. 13 percent26. Which statement about portfolio diversification is correct .A. Proper diversification can reduce or eliminate systematic riskB. As more securities are added to a portfolio, total risk typically would be expected to fall at a decreasing rateC. The risk-reducing benefits of diversification do not occur meaningfully until at least 30 individual securities are included in the portfolioD. Diversification reduces the portfolio's expected return because it reduces a portfolio's total risk27. Your customer is the applicant for a documentary credit. Which of the following points would appear to be illogical if they appeared on the application form __________ .A. Invoice price shown as FOB, bills of lading to be marked freight paidB. Last date for shipment one week before expiry dateC. Invoice price shown as C&F, but no insurance document requestedD. No mention of the latest date of shipment28. Portfolio theory as described by Markowitz is most concerned with ___ .A. the effect of diversification on portfolio riskB. B. the elimination of systematic riskC. active portfolio management to enhance returnD. the identification of unsystematic risk29. Commercial bank deposits with the central bank are part of the bank'sA. net worthB. demand depositsC. loan portfolioD. reserves30. Foreign trade can be conducted on the following terms except for ____ .A. open accountB. documentary collectionC. documentary creditsD. public bonds31。

金融英语的单选题

金融英语:FECT-1单选题(一)1. Which of the following is not a function of money? ______.A. To act as a medium of exchangeB. To act as a unit of accountC. To act as a store of valueD. To provide a double coincidence of wantsE. To act as a means of payment2. The price in the foreign exchange market is called ______.A. the trade surplusB. the exchange rateC. the money priceD. the currency rate3. Market risk refers to the risk of______.A. financial prices fluctuationsB. defaultC. fraudD. deferred payments4. Which of the following is not among the generally accepted accounting principles? ______.A. Cash basisB. PrudenceC. ConsistencyD. Going concernE. Money measurement.5. What is a documentary letter of credit? ______.A. A conditional bank undertaking to pay an exporter on production of stipulated documentationB. A method of lending against documentary securityC. An international trade settlement system biased in favour of importersD. All of the above6. Holding a group of assets reduces risk as long as the assets ______.A. are perfectly correlatedB. are completely independentC. do not have precisely the same pattern of returnsD. have a correlation coefficient greater than one7. An amount, payable in money goods, or service, owed by a business to a creditor, is known as a/an .A. liabilityB. debtC. equityD. asset8. What function is money serving when you buy a ticket to a movie? ______.A. store of valueB. a medium of exchangeC. transaction demandD. a unit of account9. If foreigners expect that the future price of sterling will be lower, the ______.A. supply of sterling will increase, demand for sterling will fall, and the exchange rate will fallB. supply of sterling will increase, demand for sterling will rise, and the exchange rate may or may not increaseC. supply of sterling will fall, demand for sterling will increase, and the exchange rate will riseD. supply of sterling will fall, demand for sterling will fall, and the exchange rate may or may not fall10. The documentary collection provides the seller with a greater degree of protection than shipping on ______.A. open accountB. bank's letter of guaranteeC. banker's draftD. documentary credit11. Which of the following statements is not true of central banks? ______.A. They pay the government's salariesB. They always undertake the regulation of the banking systemC. They are always the lender of last resortD. None of the above12. When GBP/USD rate goes from 1.6150 to 1.8500, we say the dollar ______.A. appreciates by 12.70%B. depreciates by 14.55%C. depreciates by 12.70%D. appreciates by 14.55%13. According to diversification principle in investment, suppose you invest Stock X and Stock Y with equal funds, which of the following is not true? ______.A. If X and Y are totally independent with each other, the risk of the portfolio is reducedB. If X and Y are perfectly negatively correlated, the risk of the portfolio is perfectly offsetC. If X and Y are perfectly positively correlated, the risk of the portfolio is neither reduced nor increasedD. If X and Y are perfectly negatively correlated, the risk of the portfolio is neither reduced nor increased14. These are four main methods of securing payment in international trade:(1) payment under documentary credit(2) open account(3) collection, that is document against payment or acceptance of a bill of exchange(4) payment in advanceFrom an exporter's point of view, the order of preference is ______.A. (4) , (2) , (3) , (1)B. (4) , (1) , (3) , (2)C. (4) , (3) , (1) , (2)D. (2) , (4) , (1) , (3)15. The main liability on a bank balance sheet is ______.A. depositsB. capital and reservesC. loans and overdraftsD. cash16. ______ shows that net income for a specified period of time and how it was calculated.A. The income statementB. The capital statementC. The accounting statementD. The statement of financial condition17. Why must the liabilities and assets of a bank be actively managed? ______.A. Because assets and liabilities are not evenly matched on the same time scaleB. Because assets and liabilities are evenly matchedC. Because the interbank market uses LIBORD. Because assets and liabilities can be underwritten18. If the expected returns of two risky assets have a perfect negative correlation, then risk .A. is increasedB. falls to zeroC. is unaffectedD. is reduced by one-half19. A possible disadvantage of freely fluctuating exchange rates with no official intervention is that .A. some nations would experience continual deficitsB. the exchange rates may experience wide and frequent fluctuationsC. nations would no longer be able to undertake domestic policies designed to achieve and maintain full employmentD. nations would need a larger supply of international reserves than otherwise20. What are your GBP/USD position and the average rate if you sell £4m at 1.6350 buy £5m at 1.6340 and sell $5m at 1.6348?A. Short £2 058 478.10 long $3 370 000 at 1.6371B. Long £5 941 521.90 short $9710 000 at 1.6342C. Short £5 941 521.90 long $9 710 000 at 1.6342D. Long £4 058 478.10 short $6 630 000 at 1.6336答案:1.D2.B3.A4.A5.A6.C7.A8.B9.A 10.A11.B 12.B 13.D 14.B 15.A 16.A 17.A 18.B 19.B 20.D(二)1. Under which one of the following circumstances would it be wise for your customer to arrange a forward foreign exchange contract? ______.A. Import of goods priced in a foreign currencyB. Import of goods priced in RMBC. Export of goods priced in RMBD. Export of goods priced in a foreign currency where the rate of exchange has been agreed in the sales contract2. Incoterms address ______.A. the risks of loss between the partiesB. breaches of contractC. ownership rightsD. type of ship used3. Which of the following is or was an example of representative full-bodied money? ______.A. Debt moneyB. ATS accountC. Gold certificateD. Demand deposit4. Risks associated with investing in foreign countries are the following except ______.A. voting riskB. exchange rate riskC. country riskD. political risk5. An exporter sells goods to a customer abroad on FOB and on CIF term. Who is responsible for the freight charges in each? ______.A. Exporter; ExporterB. Exporter; ImporterC. Importer; ImporterD. Importer; Exporter6. Default risk refers to the possibility that a borrower may ______.A. be unable to repay the principal on his loanB. be unable to make the interest payments on his loanC. go bankruptD. all of the above7. What is the reserve requirement? ______.A. The requirement of a bank to deposit a percentage of moneyB. The requirement for deposits in cashC. The percentage of a bank's deposits in the form of cash reservesD. The requirement for cash reserves8. A draft is like a check that can be endorsed but it isn't a title to goods, like ______.A. a bill of ladingB. an inspection certificateC. a certificate of originD. an insurance certificate9. Arbitrage ______.A. is a general economic term for buying something where it is cheap and selling it where it is dearB. keeps exchange rates consistent across marketsC. has been outlawed by the International Monetary FundD. cannot occur where there is a forward exchange marketE. both A and B10. What is the purpose of comparing the ledger entries with the documents? ______.A. To prove that all the transactions have made for the right amountsB. To prove that all the accounts have been posted correctlyC. To check the number of all the debits and creditsD. To post the right accounts11. What is Dollar Cost Averaging? ______.A. A brokerage account that gives investors cheap tradesB. The idea that prices tend to rise over the long termC. Buying stocks that are below average in valueD. A flat quarterly mutual fund fee averaged throughout the yearE. A strategy of investing money on a regular basis to take advantage of market fluctuations12. From a Chinese bank's point of view, the currency account which it maintains abroad is known as______, while a RMB account operated in China for a foreign bank is termed ______.A. a vostro account... a nostro accountB. a vostro account…a mirror accountC. a mirror account…a nostro accountD. a nostro account... a vostro account13. Under FOB terms the bill of lading would state goods ______.A. loaded on board, freight payable at destinationB. loaded on board, freight paidC. received for shipment, freight paidD. received for shipment, freight payable at destination14. The liabilities of the bank as shown in its balance sheet represent the ______ which it uses in its business.A. sources of the fundsB. share capitalC. investmentsD. advances to customers15. International payments and other messages are often sent through an international computer network called ______.A. CHAPSB. BACSC. SWIFTD. EIMT16. Low levels of uncertainty (risk) are associated with .A. stocksB. stock optionsC. higher potential returnsD. lower potential returns17. Government securities would appear on a commercial bank's balance sheet as ______.A. an assetB. reservesC. part of net worthD. a liability18. A major problem with a fixed exchange rate system is that when countries run foreign trade deficits, ______.A. there is no self-correcting mechanismB. currency values become unstableC. the value of the reserve currency declinesD. world inflation increases19. In a particular economy banks are required to keep 25 percent of all deposits in the form of reserves; this gives a credit-creation multiplier of ______.A. fourB. threeC. twoD. five20. Regulation of the money supply and financial markets is referred to as ______.A. fiscal policyB. income policyC. monetary policyD. budgetary policy答案:1.A2.A3.C4.A5.D6.D7.A8.A9.E 10.B11.E 12.D 13.A 14.A 15.C 16.D 17.A 18.A 19.A 20.C(三)1. When a country runs a foreign trade deficit under a flexible foreign exchange rate system, its .A. imports automatically increaseB. currency automatically depreciatesC. exports automatically declineD. currency automatically appreciates2. Which of the following statements is not true of accounting? ______.A. Accounting is language of businessB. The user of accounting includes business, government, nonprofit organizations and individuals.C. Accounting is useful for decision makingD. Accounting is an end rather than a means to an end3. The term foreign exchange is best defined by the following statement: it is ______.A. the rate of exchange between two currenciesB. synonymous with currency exchangeC. the place in which foreign currencies are exchangedD. an instrument such as paper currency, note, and check used to make payments between countries4. What is Asset Allocation? ______.A. Buying assets of different types, risks, and potential returnsB. Buying assets with more than one brokerage accountC. The ability to buy mutual fundsD. Buying stocks for the long term5. External users of financial accounting information include all of the following except .A. suppliersB. line managersC. general publicD. creditors6. CAPM is short for .A. Capital Asset Pricing ModelB. Cash Added Price MatrixC. Capital Asset Pricing MatrixD. Cost and Price Model7. Liquidity measures the ______.A. value of an assetB. ease with which an asset can be exchangedC. usefulness of an assetD. economic and monetary reliability of an asset compared with other assets8. In a letter of credit transaction, the bank pays the seller against ______ which agree(s) with______.A. documents... the creditB. merchandise... the contractC. documents... the contractD. merchandise...the buyer ordered9. A barter economy is one that does not possess _______.A. any wealthB. printed currencyC. a medium of exchangeD. gold10. Which of the following is not true of airway bill? ______.A. When goods are delivered to the airline, the airway bill is signed by them or their agents as a receipt of the goodsB. Airway bill is a document of title to the goodsC. Airway bill may also provide evidence of despatch of the goods where it has been stamped indicating details of the relevant flightD. None of the above11. The value of money varies _____.A. directly with the unemployment rateB. directly with the price levelC. inversely with the unemploymentD. inversely with the price level12. The economics news on the television reports that the dollar has strengthened relative to the Japanese yen. This means that ______.A. the dollar has depreciated relative to the yenB. the dollar can now purchase more yenC. the yen can now purchase more dollarsD. the US trade balance with the Japanese economy has improved13. The theory of international exchange that holds that exchange rates are set so that the price of similar goods in different countries is the same is the ______.A. price feedback theoryB. trade feedback theoryC. purchasing power parity theoryD. J-curve theory14. According to the optimal portfolio theory, where should portfolios lie? ______.A. On the efficient frontierB. Above the efficient frontierC. Under the efficient frontierD. Anywhere, as long as the portfolio is diversified15. Which of the following is not a user of management accounting information? ______.A. Store managerB. CreditorC. CEOD. CFO16. Based on the scenarios below, what is the expected return for a portfolio with the following return profile? ______.Market Conditionbear Normal BullProbability 02 0.3 05Rate of return —25% 10% 24%A. 4%B. 10%C. 20%D. 25%Use the following expectations on Stocks X and Y to answer questions 17 through 19 (round to the nearest percent).Bear Market Normal Market Bull MarketProbability 0.2 0.5 0.3Stock X_ -20% 18% 50%Stock Y -15% 20% 10%17. Financial markets serve to channel funds from ______.A. the government to contractorsB. investors to consumersC. consumers to producersD. savers to investors18. The agreements that were reached at the Bretton Woods conference in 1944 established a system .A. of essentially fixed exchange rates under which each country agreed to intervene in the foreign exchange market when necessary to maintain the agreed-upon value of its currencyB. of floating exchange rates determined by the supply and demand of one nation's currency relative to the currency of other nationsC. that prohibited governments from intervening in the foreign exchange marketsD. in which the values of currencies were fixed in terms of a specific number of ounces of gold, which in turn determined their values in international trading 19. Which of the following statements is not consistent with generally accepted accounting principles relating to asset valuation? .A. Assets are originally recorded in accounting records at their cost to the business entityB. Accountants prefer to base the valuation of assets upon objective, verifiable evidence rather than upon appraisals or personal opinionC. Accountants assume that assets such as office supplies, land and buildings will be used in business operations rather than sold at current market pricesD. Subtracting total liabilities from total assets indicates what the owner's equity in the business is worth under current market conditions20. A fiscal expansion in the UK ______ the pound sterling.A. tends to appreciateB. tends to depreciateC. does not affect the price ofD. has no predictable effect on the price of答案:1.B2.D3.D4.A5.B6.A7.B8.A9.C 10.B11.D 12.B 13.C 14.A 15.B 16.B 17.A 18.A 19.D 20.A(四)1. What are the expected returns for Stocks X and Y respectively? ______.A. 20% and 10%B. 18% and 12%C. 20% and 11%D. 18% and 5%2. Which of the following payment terms eliminates the exchange risk, assuming the exporter invoices in foreign currency? ______.A. Confirmed irrevocable documentary creditB. Open accountC. Documentary collection D/AD. None of the above3. ABC Co. Ltd. purchased a car for $ 12 000, making a down payment of $5 000 cash and signing a $7 000 note payable due in 60 days. Which of the following is not correct? ______.A. From the viewpoint of a short-term creditor, this transaction makes the business less solventB. Total liabilities increased by $7 000C. Total assets increased by $12 000D. This transaction had no immediate effect on the owner's equity in the business4. Which of the following terms of payment will entirely eliminate country risk? ______.A. Revocable documentary creditsB. Confirmed Irrevocable documentary creditsC. Documentary collection D/PD. Documentary collection D/A5. The expiry date of a documentary credit is Sunday, 24 February, and documents have to be A presented to you. Which of the following is an acceptable presentation? (Assume there is no latest stated date for shipment stipulated.) ______.A. Presentation to you on Monday 25 February with the bill of lading dated 25 FebruaryB. Presentation on Monday 25 February with the bill of lading dated Sunday 24 FebruaryC. Presentation on Tuesday 26 February with the bill of lading dated Sunday 24 FebruaryD. Presentation on Friday 22 February with the bill of lading dated Sunday 29 January6. What are the standard deviations of returns on Stocks X and Y respectively? ______.A. 15% and 26%B. 24% and 13%C. 20% and 4%D. 28% and 8%7. Who makes the first presentation of documents under a transferable credit? ______.A. ApplicantB. First beneficiaryC. Second beneficiaryD. None of the above8. A transaction caused a $10 000 decrease in both total assets and total liabilities. This transaction could have been ______.A. repayment of a $ 10 000 bank loanB. an asset with a cost of $10000 was destroyed by fireC. purchase of a delivery truck for $10 000 cashD. collection of a $10 000 account receivable9. Money ceases to serve as an effective store of value when ______.A. the government runs large deficitsB. the unemployment rate is very highC. productivity in the economy declinesD. rapid inflation occurs10. An indication that the money supply is greater than the desirable amount would be .A. insufficient spending and excessive savingB. deflationC. inadequate spending and rising unemploymentD. rising wages and prices11. If a nation's interest rates are relatively low compared to those of other countries, then the exchange value of its currency will tend to ______ under a system of exchange rates.A. appreciate... floatingB. depreciate...floatingC. appreciate... fixedD. depreciate... fixed12. Which of the following is true of a company's balance sheet? ______.A. It displays sources and uses of cash for the periodB. It is unnecessary if both an income statement and a statement of cash flows are availableC. It is a separate representation of the company's revenue and expense transactions for the yearD. It is an expansion of the basic accounting equation of Assets=Liabilities+Owner's Equity13. When Americans or foreigners expect the return on dollar deposits to be high relative to the return on foreign deposits, there is a ______ demand for dollar deposits and a correspondingly ______ demand for foreign deposits.A. higher... higherB. lower... higherC. higher... lowerD. lower...lower14. Velocity is the ______.A. inverse of GNPB. speed at which checking accounts are converted into cashC. relationship between the price level and the money supplyD. rate at which money turns over15. Assume that of your $10 000 portfolio, you invest $9 000 in Stock X and $1 000 in Stock Y. What is the expected return on your portfolio? ______.A. 18%B. 20%C. 19%D. 3%16. Which of the following would you expect to find in a correctly prepared income statement? .A. Cash balance at the end of the periodB. Expenses incurred during the period to earn revenuesC. Contributions by the owner during the periodD. The reported company's financial position at a specific date17. The concept of beta is most closely associated with ______.A. correlation coefficientB. the capital asset pricing modelC. nonsystematic riskD. mean-variance analysis18. The velocity of money for a given year can be calculated by ______.A. dividing GNP by the money supplyB. dividing aggregate supply by aggregate demandC. dividing the price level by the money supplyD. multiplying the price level by total output19. The theory of purchasing power parity states that exchange rates between any two currencies will adjust to reflect changes in ______.A. the price levels of the two countriesB. the current account balances of the two countriesC. the fiscal policies of the two countriesD. the trade balances of the two countries20. Before issuing a credit, it is important for the issuing bank ______.A. to make certain of the importer's creditworthinessB. to go through the contract termsC. to have a thorough understanding of the exporterD. all of the above答案:1.A2.D3.C4.B5.B6.B7.C8.A9.D 10.D11.B 12.D 13.C 14.D 15.C 16.B 17.B 18.A 19.A 20.A一、单选1、我省规定,各种机动车、拖挂车载重量超过十吨的,其超过部分(B)征收车船使用税。

金融专业英语证书考试FECT单选练习20题-附答案

金融专业英语证书考试FECT单选练习20题-附答案1. What are the expected returns for Stocks X and Y respectively? ______.A. 20% and 10%B. 18% and 12%C. 20% and 11%D. 18% and 5%2. Which of the following payment terms eliminates the exchange risk, assuming the exporter invoices in foreign currency? ______.A. Confirmed irrevocable documentary creditB. Open accountC. Documentary collection D/AD. None of the above3. ABC Co. Ltd. purchased a car for $ 12 000, making a down payment of $5 000 cash and signing a $7 000 note payable due in 60 days. Which of the following is not correct? ______.A. From the viewpoint of a short-term creditor, this transaction makes the business less solventB. Total liabilities increased by $7 000C. Total assets increased by $12 000D. This transaction had no immediate effect on the owner’s equity in the business4. Which of the following terms of payment will entirely eliminate country risk? ______.A. Revocable documentary creditsB. Confirmed Irrevocable documentary creditsC. Documentary collection D/PD. Documentary collection D/A5. The expiry date of a documentary credit is Sunday, 24 February, and documents have to be a presented to you. Which of the following is an acceptable presentation? (Assume there is no latest stated date for shipment stipulated.) ______.A. Presentation to you on Monday 25 February with the bill of lading dated 25 FebruaryB. Presentation on Monday 25 February with the bill of lading dated Sunday 24 FebruaryC. Presentation on Tuesday 26 February with the bill of lading dated Sunday 24 FebruaryD. Presentation on Friday 22 February with the bill of lading dated Sunday 29 January6. What are the standard deviations of returns on Stocks X and Y respectively? ______.A. 15% and 26%B. 24% and 13%C. 20% and 4%D. 28% and 8%7. Who makes the first presentation of documents under a transferable credit? ______.A. ApplicantB. First beneficiaryC. Second beneficiaryD. None of the above8. A transaction caused a $10 000 decrease in both total assets and total liabilities. This transaction could have been ______.A. repayment of a $ 10 000 bank loanB. an asset with a cost of $10000 was destroyed by fireC. purchase of a delivery truck for $10 000 cashD. collection of a $10 000 account receivable9. Money ceases to serve as an effective store of value when ______.A. the government runs large deficitsB. the unemployment rate is very highC. productivity in the economy declinesD. rapid inflation occurs10. An indication that the money supply is greater than the desirable amount would be .A. insufficient spending and excessive savingB. deflationC. inadequate spending and rising unemploymentD. rising wages and prices11. If a nation’s interest rates are relatively low compared to those of other countries, then the exchange value of its currency will tend to ______ under a system of exchange rates.A. appreciate... floatingB. depreciate...floatingC. appreciate... fixedD. depreciate... fixed12. Which of the following is true of a company’s balance sheet? ______.A. It displays sources and uses of cash for the periodB. It is unnecessary if both an income statement and a statement of cash flows are availableC. It is a separate representation of the company’s revenue and expense transactions for the yearD. It is an expansion of the basic accounting equation of Assets=Liabilities Owner’s Equity13. When Americans or foreigners expect the return on dollar deposits to be high relative to the return on foreign deposits, there is a ______ demand for dollar deposits and a correspondingly ______ demand for foreign deposits.A. higher... higherB. lower... higherC. higher... lowerD. lower...lower14. Velocity is the ______.A. inverse of GNPB. speed at which checking accounts are converted into cashC. relationship between the price level and the money supplyD. rate at which money turns over15. Assume that of your $10 000 portfolio, you invest $9 000 in Stock X and $1 000 in Stock Y. What is the expected return on your portfolio? ______.A. 18%B. 20%C. 19%D. 3%16. Which of the following would you expect to find in a correctly prepared income statement? .A. Cash balance at the end of the periodB. Expenses incurred during the period to earn revenuesC. Contributions by the owner during the periodD. The reported company’s financial position at a specific date17. The concept of beta is most closely associated with ______.A. correlation coefficientB. the capital asset pricing modelC. nonsystematic riskD. mean-variance analysis18. The velocity of money for a given year can be calculated by ______.A. dividing GNP by the money supplyB. dividing aggregate supply by aggregate demandC. dividing the price level by the money supplyD. multiplying the price level by total output19. The theory of purchasing power parity states that exchange rates between any two currencies will adjust to reflect changes in ______.A. the price levels of the two countriesB. the current account balances of the two countriesC. the fiscal policies of the two countriesD. the trade balances of the two countries20. Before issuing a credit, it is important for the issuing bank ______.A. to make certain of the importer’s creditworthinessB. to go through the contract termsC. to have a thorough understanding of the exporterD. all of the above答案:1.A2.D3.C4.B5.B6.B7.C8.A9.D 10.D11.B 12.D 13.C 14.D 15.C 16.B 17.B 18.A 19.A 20.A。

2022年金融英语证书考试FECT模拟试题及答案-1

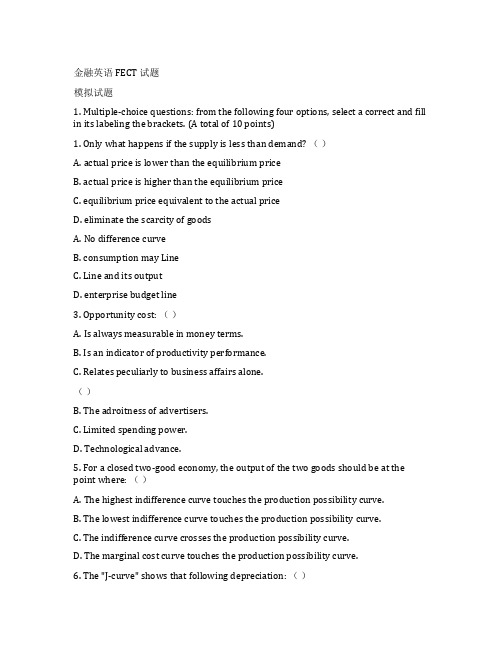

金融英语 FECT 试题模拟试题1. Multiple-choice questions: from the following four options, select a correct and fill in its labeling the brackets. (A total of 10 points)1. Only what happens if the supply is less than demand? ()A. actual price is lower than the equilibrium priceB. actual price is higher than the equilibrium priceC. equilibrium price equivalent to the actual priceD. eliminate the scarcity of goodsA. No difference curveB. consumption may LineC. Line and its outputD. enterprise budget line3. Opportunity cost: ()A. Is always measurable in money terms.B. Is an indicator of productivity performance.C. Relates peculiarly to business affairs alone.()B. The adroitness of advertisers.C. Limited spending power.D. Technological advance.5. For a closed two-good economy, the output of the two goods should be at the point where: ()A. The highest indifference curve touches the production possibility curve.B. The lowest indifference curve touches the production possibility curve.C. The indifference curve crosses the production possibility curve.D. The marginal cost curve touches the production possibility curve.6. The "J-curve" shows that following depreciation: ()A. The quantity of exports falls, making the current account balance worse.B. Here is an initial drop in imports but this is later reversed.C. The cost of imports rises immediately from the price effect, worsening the current account balance, but later quantities of imports and exports respond and the current account balance improves.D. There is an improvement in the balance of payments so long as the Marshall-Lerner conditions are met.7. Which of the following statements about standby letters of credit is true? :()A. They can serve as a guarantee to a buyer against a seller defaultingB. They are contrary to the general rule that letters of credit may only be used for the actual movement of goods金融英语 FECT 试题C. They are unlike a tender (or other) bond in their legal standing and method of operationD. They are unlike a tender bond with its fixed expiry date8. What information would you find in a statement of cash flows that you would not be able to get from the other two primary financial statements? ()A. Cash provided by or used in financing activitiesB. Cash balance at the end of the periodC. Total liabilities due to creditors at the end of the period9. Which of these best describes the U.S. Federal Reserve? ()A. Responsible for monetary policy/money supplyB. Prints money.C. Keeps the country out of debt.D. Helps people in need.10. What is the basic purpose of profits in our market economy? ()A. Pay for wages and salaries of workers.B. Lead businesses to produce what consumers want.D. All of the above.Part 1)金融英语 FECT 试题all of the following EXCEPT: ()B. Profits increase as firms enter the industry.C. Profits are low and firms flee the industry.D. Prices could increase or decrease depending on the level of profits.Part 2)In a recessionary environment, an automaker such as Ford would be expected to: ()A. Produce higher end vehicles.B. Maintain the same product mix as 5 years ago.C. Gain market share if it produces high end vehicles.D. Produce lower end vehicles.Part 3)Assume domestic automakers are growing at a rate of –2%. Ford expects to increase its market share by 0.5%. What is Ford’s growth rate? ()A. 1.5%.B. -3.0%.C. -1.5%.D. 3.0%.Part 4)Suppose instead that Ford’s growth of firm sales is expected to be –3% and the growth of industry sales is 1%. What is Ford’s expected change i n market share? ()A. 3%.Part 5)Which of the following scenarios would be most likely to have a positive impact on Ford’s market share? ()A. New carmakers enter the market.B. An increase in its marketing budget.C. War with an oil producing country.D. The overall number of cars sold increases.Explanations of terms:(10 points)1. Official interest rate2. Fiat money3. GDP4. Mean5. Primary marketsQuestion3: What are the basic objectives of economic policies?Question4: What is the Money Market Mutual Funds?Question5: Why Should I Lease Equipment Instead of Buy?Quetion6:Tell us The Practice of China’s Monetary Policy since Economic Reform and Opening up briefly?金融英语 FECT 试题参考答案1. B A D C A, C A C A BPart 1)Your answer: B was correct!Part 2)Your answer: D was correct!During economic downturns, producers of low-cost products increase their market share at the expense of high-cost producers. This also is true within firms that produce various priced products.Part 3)Your answer: B was incorrect. The correct answer was C!(1 + growth of firm sales) = (1 + growth of industry sales) x (1 + fractional change of market share)= 0.98 x 1.005= 0.9849Growth of firm sales = –1.51%Part 4)Your answer: B was incorrect. The correct answer was C!–Part 5)Your answer: The correct answer was B!An increase in its marketing budget.Explanations of terms:(10 points)1. Official interest rate :Official interest rate is the rate set by the central bank or monetary authorities. The interest rate is one of levers used by governments to regulate economy.金融英语 FECT 试题and by governments to finance budget deficits.Question3:Answer:Since the Great Depression of the 1930s, governments have actively pursued the goal of economic stability at full employment. Known as internal balance, this objective has two dimensions; (D a fully employed economy, and ©no inflation—or, more realistically, a reasonable amount of inflation. Nations traditionally have considered internal balance to be of primary importance and have formulated economic policies to attain this goal.Question 4Answer:The money markets are wholesale markets where most securities trade in large denominations. This characteristic effectively blocks most individuals from investing directly in these securities. However, the markets usually find a way to correct for such deficiencies, especially when potential customers are available. Money market mutual funds represent one sucha of inception in the early 1970s because they provide a means for small investors to take advantage of the returns offered on money market securities. These securities would be out of reach to most small investors because of their large minimum denominations.Question5:Answer:(2) Leasing is practical. By leasing, you transfer the uncertainties and risks of equipment ownership to the lessor, which allows you to concentrate on using that equipment as a productive part of your business.(3) Leasing is cost effective. Equipment is costly and some of the costs are unexpected. When you lease, your risk of getting caught with obsolete equipment is lower because you can upgrade or add equipment to best meet your needs.金融英语 FECT 试题(4) Leasing has tax advantages. Rather than dealing with depreciation schedules and Alternative Minimum Tax (AMT) problems, you, the lessee, simply make the lease payment and deduct it as a business expense.(5) Leasing helps conserve your operating capital. Leasing keeps your lines of credit open. You don’t tie up your cash in equity. Also, you avoid costly down payments. With other advantages such as offbalance sheet financing, leasing helps you better manage your balance sheet.Question6:Answer:China’s monetary policy, in general sense, is the same as the concept of monetary policy in western economics, including such factors as operating instruments, operating targets, intermediate targets and final targets. The impact of monetary policy on China’s macro-economy is produced through the transmission of those factors one by one.(1) The final targets of Chi na’s monetary policy(2) The operating and intermediate targets of China’s monetary policy(3) The monetary policy instruments金融英语 FECT 试题instruments that conform to the socialist market economy has been lawfully set up. With the establishment of socialist market economy the gradual shift from direct to indirect monetary policy instruments has greatly improved transmission mechanism of monetary policy and effectiveness of macroeconomic management in China. But in a transition period the potency of monetary policy is still subject to various factors as follows:●Government’s intervention. In economic activities, intervention by governments at each level is still strong. It is not rarely seen that local governments often force banks to make loans for the sake of development of local economy, which interferes the independence of the central bank’s monetary policy and blurs monetary policy targets, so monetary policy instruments are partly ineffective.●Less developed markets. In the transition period market mechanism is not perfect while the planned mechanism has lost much of its share. So the vacuum in management of national economy appears. As a result distribution of resources is in disorder and the contradiction in economic structure is obvious. The central government has to increase investment in order to better economic structure, so it’s hard to contract investment size, wipe out investment expansion of fixed assets and control the money supply. So implementation of monetary policy of the central bank is interfered with.●Imperfect self-constraint mechanism of financial institutions. As China’s financial institutions are still under reform, their behavior is not standardized because of imperfect self-constraint mechanism. So the impact of the central bank’s monetary policy on reserves of financial institutions is not sure and the operating targets cannot respond sensitively.●Lack of self-constraint mechanism of enterprises. In order to maintain certain increasing rate of funds they banks and the central bank and is harmful to the central bank’s control on the money supply.。

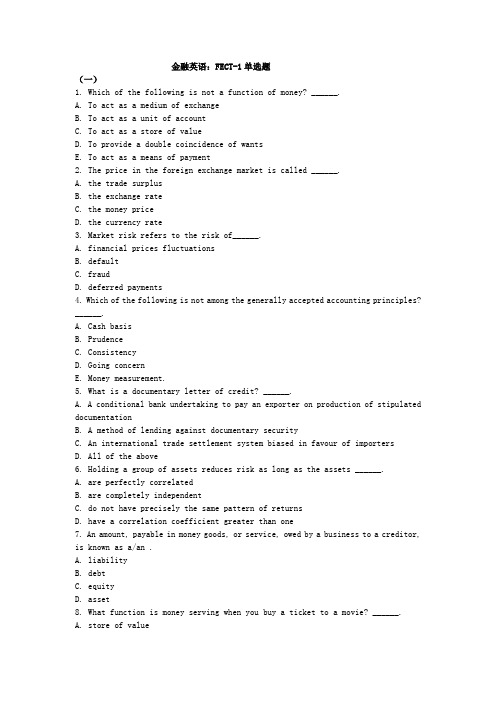

金融英语FECT单选题附答案

金融英语FECT单选题附答案1. Which of the following is not a function of money? ______.A. To act as a medium of exchangeB. To act as a unit of accountC. To act as a store of valueD. To provide a double coincidence of wantsE. To act as a means of payment2. The price in the foreign exchange market is called ______.A. the trade surplusB. the exchange rateC. the money priceD. the currency rate3. Market risk refers to the risk of______.A. financial prices fluctuationsB. defaultC. fraudD. deferred payments4. Which of the following is not among the generally accepted accounting principles? ______.A. Cash basisB. PrudenceC. ConsistencyD. Going concernE. Money measurement.5. What is a documentary letter of credit? ______.A. A conditional bank undertaking to pay an exporter on production of stipulated documentationB. A method of lending against documentary securityC. An international trade settlement system biased in favourof importersD. All of the above6. Holding a group of assets reduces risk as long as the assets ______.A. are perfectly correlatedB. are completely independentC. do not have precisely the same pattern of returnsD. have a correlation coefficient greater than one7. An amount, payable in money goods, or service, owed bya business to a creditor, is known as a/an .A. liabilityB. debtC. equityD. asset8. What function is money serving when you buy a ticket toa movie? ______.A. store of valueB. a medium of exchangeC. transaction demandD. a unit of account9. If foreigners expect that the future price of sterling will be lower, the ______.A. supply of sterling will increase, demand for sterling will fall, and the exchange rate will fallB. supply of sterling will increase, demand for sterling will rise, and the exchange rate may or may not increaseC. supply of sterling will fall, demand for sterling will increase, and the exchange rate will riseD. supply of sterling will fall, demand for sterling will fall, and the exchange rate may or may not fall10. The documentary collection provides the seller with a greater degree of protection than shipping on ______.A. open accountB. bank's letter of guaranteeC. banker's draftD. documentary credit11. Which of the following statements is not true of central banks? ______.A. They pay the government's salariesB. They always undertake the regulation of the banking systemC. They are always the lender of last resortD. None of the above12. When GBP/USD rate goes from 1.6150 to 1.8500, we say the dollar ______.A. appreciates by 12.70%B. depreciates by 14.55%C. depreciates by 12.70%D. appreciates by 14.55%13. According to diversification principle in investment, suppose you invest Stock X and Stock Y with equal funds, which of the following is not true? ______.A. If X and Y are totally independent with each other, the risk of the portfolio is reducedB. If X and Y are perfectly negatively correlated, the risk of the portfolio is perfectly offsetC. If X and Y are perfectly positively correlated, the risk of the portfolio is neither reduced nor increasedD. If X and Y are perfectly negatively correlated, the risk of the portfolio is neither reduced nor increased14. These are four main methods of securing payment in international trade:(1) payment under documentary credit(2) open account(3) collection, that is document against payment or acceptance of a bill of exchange(4) payment in advanceFrom an exporter's point of view, the order of preference is ______.A. (4) , (2) , (3) , (1)B. (4) , (1) , (3) , (2)C. (4) , (3) , (1) , (2)D. (2) , (4) , (1) , (3)15. The main liability on a bank balance sheet is ______.A. depositsB. capital and reservesC. loans and overdraftsD. cash16. ______ shows that net income for a specified period of time and how it was calculated.A. The income statementB. The capital statementC. The accounting statementD. The statement of financial condition17. Why must the liabilities and assets of a bank be actively managed? ______.A. Because assets and liabilities are not evenly matched on the same time scaleB. Because assets and liabilities are evenly matchedC. Because the interbank market uses LIBORD. Because assets and liabilities can be underwritten18. If the expected returns of two risky assets have a perfect negative correlation, then risk .A. is increasedB. falls to zeroC. is unaffectedD. is reduced by one-half19. A possible disadvantage of freely fluctuating exchange rates with no official intervention is that .A. some nations would experience continual deficitsB. the exchange rates may experience wide and frequent fluctuationsC. nations would no longer be able to undertake domestic policies designed to achieve and maintain full employmentD. nations would need a larger supply of international reserves than otherwise20. What are your GBP/USD position and the average rate if you sell £4m at 1.6350 buy £5m at 1.6340 and sell $5m at1.6348?A. Short £2 058 478.10 long $3 370 000 at 1.6371B. Long £5 941 521.90 short $9710 000 at 1.6342C. Short £5 941 521.90 long $9 710 000 at 1.6342D. Long £4 058 478.10 short $6 630 000 at 1.6336答案:1.D2.B3.A4.A5.A6.C7.A8.B9.A 10.A11.B 12.B 13.D 14.B 15.A 16.A 17.A 18.B 19.B 20.D。

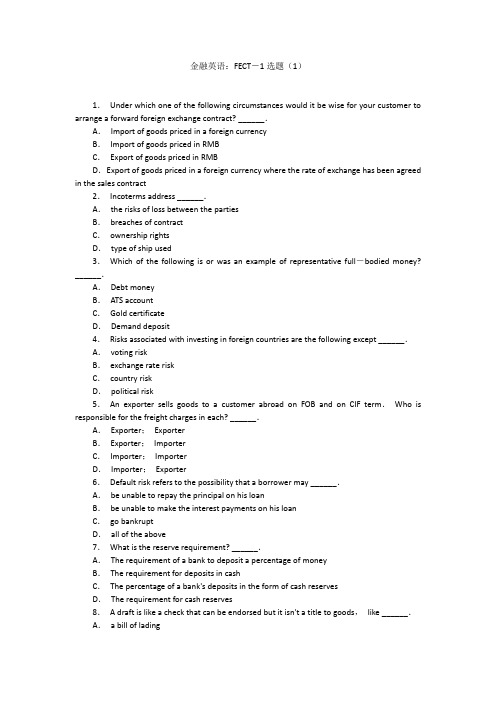

金融英语:FECT-1选题(1)

金融英语:FECT-1选题(1)1.Under which one of the following circumstances would it be wise for your customer to arrange a forward foreign exchange contract? ______.A.Import of goods priced in a foreign currencyB.Import of goods priced in RMBC.Export of goods priced in RMBD.Export of goods priced in a foreign currency where the rate of exchange has been agreed in the sales contract2.Incoterms address ______.A.the risks of loss between the partiesB.breaches of contractC.ownership rightsD.type of ship used3.Which of the following is or was an example of representative full-bodied money? ______.A.Debt moneyB.ATS accountC.Gold certificateD.Demand deposit4.Risks associated with investing in foreign countries are the following except ______.A.voting riskB.exchange rate riskC.country riskD.political risk5.An exporter sells goods to a customer abroad on FOB and on CIF term.Who is responsible for the freight charges in each? ______.A.Exporter;ExporterB.Exporter;ImporterC.Importer;ImporterD.Importer;Exporter6.Default risk refers to the possibility that a borrower may ______.A.be unable to repay the principal on his loanB.be unable to make the interest payments on his loanC.go bankruptD.all of the above7.What is the reserve requirement? ______.A.The requirement of a bank to deposit a percentage of moneyB.The requirement for deposits in cashC.The percentage of a bank's deposits in the form of cash reservesD.The requirement for cash reserves8.A draft is like a check that can be endorsed but it isn't a title to goods,like ______.A. a bill of ladingB.an inspection certificateC.a certificate of originD.an insurance certificate9.Arbitrage ______.A.is a general economic term for buying something where it is cheap and selling it where it is dearB.keeps exchange rates consistent across marketsC.has been outlawed by the International Monetary FundD.cannot occur where there is a forward exchange marketE.both A and B10.What is the purpose of comparing the ledger entries with the documents? ______.A.To prove that all the transactions have made for the right amountsB.To prove that all the accounts have been posted correctlyC.To check the number of all the debits and creditsD.To post the right accounts11.What is Dollar Cost Averaging? ______.A. A brokerage account that gives investors cheap tradesB.The idea that prices tend to rise over the long termC.Buying stocks that are below average in valueD. A flat quarterly mutual fund fee averaged throughout the yearE.A strategy of investing money on a regular basis to take advantage of market fluctuations 12.From a Chinese bank's point of view,the currency account which it maintains abroad is known as______,while a RMB account operated in China for a foreign bank is termed ______.A. a vostro account... a nostro accountB. a vostro account…a mirror accountC. a mirror account…a nostro accountD. a nostro account... a vostro account13.Under FOB terms the bill of lading would state goods ______.A.loaded on board,freight payable at destinationB.loaded on board,freight paidC.received for shipment,freight paidD.received for shipment,freight payable at destination14.The liabilities of the bank as shown in its balance sheet represent the ______ which it uses in its business.A.sources of the fundsB.share capitalC.investmentsD.advances to customers15.International payments and other messages are often sent through an international computer network called ______.A.CHAPSB.BACSC.SWIFTD.EIMT16.Low levels of uncertainty (risk)are associated with .A.stocksB.stock optionsC.higher potential returnsD.lower potential returns17.Government securities would appear on a commercial bank's balance sheet as ______.A.an assetB.reservesC.part of net worthD. a liability18. A major problem with a fixed exchange rate system is that when countries run foreign trade deficits,______.A.there is no self-correcting mechanismB.currency values become unstableC.the value of the reserve currency declinesD.world inflation increases19.In a particular economy banks are required to keep 25 percent of all deposits in the form of reserves;this gives a credit-creation multiplier of ______.A.fourB.threeC.twoD.five20.Regulation of the money supply and financial markets is referred to as ______.A.fiscal policyB.income policyC.monetary policyD.budgetary policy答案:1.A2.A3.C4.A5.D6.D7.A8.A9.E10.B11.E12.D13.A14.A15.C16.D17.A18.A19.A20.C。

2011金融英语(FECT-1)考试综合单选题1(英语学习).doc

2011金融英语(FECT-1)考试综合单选题1(英语学习)1.Under which one of the following circumstances would it be wise for your customer to arrange a forward foreign exchange contract?______.A.Import of goods priced in a foreign currencyB.Import of goods priced in RMBC.Export of goods priced in RMBD.Export of goods priced in a foreign currency where the rate of exchange has been agreed in the sales contract2.Incoterms address ______.A.the risks of loss between the partiesB.breaches of contractC.ownership rightsD.type of ship used3.Which of the following is or was an example of representative full-bodied money?______.A.Debt moneyB.ATS accountC.Gold certificateD.Demand deposit4.Risks associated with investing in foreign countries are the following except ______.A.voting riskB.exchange rate riskC.country riskD.political risk5.An exporter sells goods to a customer abroad on FOB and on CIF term.Who is responsible for the freight charges in each?______.A.Exporter;ExporterB.Exporter;ImporterC.Importer;ImporterD.Importer;Exporter6.Default risk refers to the possibility that a borrower may ______.A.be unable to repay the principal on his loanB.be unable to make the interest payments on his loanC.go bankruptD.all of the above7.What is the reserve requirement?______.A.The requirement of a bank to deposit a percentage of moneyB.The requirement for deposits in cashC.The percentage of a bank‘s deposits in the form of cash reservesD.The requirement for cash reserves8.A draft is like a check that can be endorsed but it isn’t a title to goods,like ______.A.a bill of ladingB.an inspection certificateC.a certificate of originD.an insurance certificate9.Arbitrage ______.A.is a general economic term for buying something where it is cheap and selling it where it is dearB.keeps exchange rates consistent across marketsC.has been outlawed by the International Monetary FundD.cannot occur where there is a forward exchange marketE.both A and B10.What is the purpose of comparing the ledger entries with the documents?______.A.To prove that all the transactions have made for the right amountsB.To prove that all the accounts have been posted correctlyC.To check the number of all the debits and creditsD.To post the right accounts。

(金融保险)金融英语单选题练习