《国际支付与结算》(英文)教学大纲.doc

国际支付与结算chapter 1

Chapter 1 Brief Introduction

International payments and settlements are originated from both international trade transactions such as the sales of tangible goods and intangible service transactions and international non-trade transactions such as international lendings and investments. International non-commercial settlement is of equal importance.

Ⅲ.International Reserve Ⅳ .Net Error & Omission

Chapter 1 Brief Introduction

1.1 International Trade

•the exchange of goods and services in

one country for those in another country.

Chapter 1 Brief Introduction

• 1). EXW

Ex Works (…Named Place) 工厂交货(指定目的地) The seller fulfills his obligation to deliver when he has made the goods available to the buyer at his premises or another named place not cleared for export and not loaded on any collecting vehicle. 当卖方在其所在地或其他指定的地点(如工场、工厂或仓 库)将货物交给买方处置时,即完成交货,卖方不办理出 口清关手续或将货物装上任何运输工具。

国际支付与结算教学设计

国际支付与结算教学设计一、前言随着国际经济全球化的深入,国际支付与结算成为国际金融领域不可或缺的重要组成部分。

如何在教学中让学生充分了解国际支付与结算的相关知识,掌握其实践技能,是本文所探讨的问题。

二、课程目标本课程旨在让学生:1.了解国际支付与结算的基本概念、原理和方法;2.掌握跨境支付的流程与注意事项;3.掌握跨境结算的流程、方式和税务规则;4.能够运用所学知识,处理国际支付与结算业务实务问题。

三、课程大纲本课程主要包括以下三个模块:模块一:国际支付基础知识1.国际支付的定义、特点和分类;2.国际支付的主要形式和工具;3.跨境支付流程与注意事项;4.台湾地区银行联名卡使用规定。

模块二:国际结算实务1.国际商务货款结算的方式和流程;2.国际贸易信用证的种类和结算流程;3.离岸人民币帐户、外汇帐户及相关税务规定;4.企业国际融资工具的使用。

模块三:国际支付与结算案例分析1.国际支付与结算的典型案例;2.案例分析与解决方案讨论。

四、教学方法本课程采用“案例教学+项目实践”的教学方式,使学生在老师的指导下通过模拟实践、沟通交流等多种方式,掌握国际支付与结算的实际操作技能,并提高其实战能力。

五、教学评估本课程采用分段考核的方式进行集中评估。

其中,期中考核占50%,期末考核占50%。

具体考核方式包括:1.课堂答问:20%2.期中论文:30%3.期末任务:50%六、学生选用教材1.《国际贸易支付与结算》陈乃强主编;2.《跨境支付与结算实务》向玉红主编;3.网络平台资料。

七、结论本文从学生的视角出发,探讨了如何设计一门关于国际支付与结算的课程,以帮助他们全面了解国际支付与结算的相关知识及实践技能。

通过本课程的学习,学生能够灵活运用所学知识,在实践中解决复杂的国际支付与结算问题,提高其实战能力和实际价值。

国际结算英文版讲义

Comparison

among the three kinds of

remittances:

T/T It is in a form of dispatching cable or telex or SWIFT Authentication is made by test key. It is a safe method of remittance. The cost of remittance is higher. It is the fastest and most prevalent method of remittance. M/T D/D It is in a form of mail It is in a form of banker’s advice or payment order demand draft By signature (on payment order Not as safe as T/T lower Owing to its slower speed, banks reduce the use of M/T in the remittance the By signature (on draft) Not as safe as T/T lower It may be purchased by a bank other than drawee bank. It is a useful method of remittance. the

Banker’s Demand Draft, D/D

Remitter

① 票 汇 申 请 书 交 款 付 费 ④ 汇款通知书(票根) ② 银 行 即 期 汇 票

资金

③ 银行即期汇票 ⑤ 银 行 即 期 汇 票

《国际结算(双语)》-课程实验教学大纲

《国际结算(双语)》课程实验教学大纲一、课程基本信息课程代码:16081803课程名称:国际结算(双语)英文名称:International Settlements实验总学时:12学时适用专业:金融学、保险学、金融工程学、保险学课程类别:专业课先修课程:大学英语、金融学、商业银行经营管理二、实验教学的总体目的和要求(黑体/小四)1、对学生的要求:(1)专业教学要求:学生应掌握汇票的编制、汇票的贴现与背书相关业务、汇款电文编写与汇款申请书填写、托收项下汇票的编制、托收申请书填写、信用证申请书填写等国际结算实操业务。

所有内容的填写都用英文完成。

(2)思政教学要求:在实际国际结算业务操作中,学生应理解诚信重诺、坚守契约精神的信念,树立高度的职业责任心,认真完成实务操作中的每一步骤。

同时,培养学生分析问题与解决问题的能力,形成以发展眼光来看待问题的辩证思维。

2、对教师的要求:(1)专业教学要求:教师应在学生进行实操前,进行课程内容复习与方法指导,确保实验内容顺利进行;同时在实验过程中,学生遇到任何技术性问题,教师应予以及时解答;应对实验成果及时给分与评价,成绩计入实验课成绩。

(2)思政教学要求:教师首先应以身作则,提前准备好实验所需材料,并流畅解决实验当中遇到的问题。

同时,应在实验内容讲解过程中,通过潜移默化的方式向学生传递思政思想,并在实验考核中着重强调针对思政内容的评分。

3、对实验条件的要求:要求实验室应有电脑、投影以及网络,能够方便教师展示实验内容以及学生在电脑上完成实验操作。

三、实验教学内容实验项目一实验名称:汇票的缮制1(Negotiable Instruments)实验内容:各类汇票的制作、汇票的贴现、承兑通知书的填写实验性质:综合性实验学时:2学时实验目的与要求:(1)专业要求:要求学生掌握汇票中需要填写的项目类型,以及各项目填写的具体要求;掌握在不同类型远期汇票下,汇票到期日的计算方法;掌握汇票承兑通知书的填写方法;掌握汇票贴现期限、利息的计算方法。

国际结算英文版教学大纲

国际结算英文版教学大纲International Settlement English Teaching SyllabusIntroduction:The International Settlement English Teaching Syllabus aims to provide a comprehensive framework for teaching English in the context of international settlement. This syllabus is designed to cater to the needs of learners who are involved in international settlement activities, such as international business negotiations, cross-border transactions, and cultural exchanges. By focusing on language skills and cultural understanding, this syllabus aims to equip learners with the necessary language proficiency and intercultural competence required in an international settlement setting.Section 1: Language Skills DevelopmentIn this section, learners will develop their language skills in four key areas: listening, speaking, reading, and writing. The syllabus will provide a range of activities and tasks that promote the acquisition of these skills. For example, learners will engage in listening exercises that simulate real-life situations in international settlement, such as understanding business negotiations or participating in conference calls. Speaking activities will focus on developing fluency and accuracy in oral communication, with an emphasis on negotiation skills and cross-cultural communication. Reading materials will include authentic texts from various sources, such as business reports, legal documents, and news articles, to enhance learners' reading comprehension and vocabulary. Writingtasks will involve drafting emails, business letters, and reports, enabling learners to effectively communicate in written form within an international settlement context.Section 2: Cultural UnderstandingIn this section, learners will develop their intercultural competence by gaining a deeper understanding of different cultures and their impact on international settlement. Cultural sensitivity and awareness are crucial in establishing successful business relationships and avoiding misunderstandings. The syllabus will include topics such as cultural values, etiquette, and communication styles in different countries. Learners will engage in discussions, role-plays, and case studies to explore the cultural nuances that influence international settlement practices. By developing a better understanding of cultural differences, learners will be better equipped to navigate the complexities of international business and foster successful partnerships.Section 3: Professional SkillsIn this section, learners will acquire the necessary professional skills required in the field of international settlement. This includes skills such as negotiation, presentation, and networking. Negotiation skills are essential in international business transactions, and learners will engage in simulated negotiation exercises to develop their ability to communicate effectively and reach mutually beneficial agreements. Presentation skills are also crucial in international settlement, as learners may need to deliver persuasive presentations to clients orstakeholders. Networking skills will be emphasized, as building and maintaining professional relationships is vital in the international settlement arena. Learners will have opportunities to practice these skills through role-plays, group discussions, and real-life scenarios.Conclusion:The International Settlement English Teaching Syllabus provides a comprehensive and structured approach to teaching English in the context of international settlement. By focusing on language skills development, cultural understanding, and professional skills, learners will be equipped with the necessary tools to navigate the complexities of international business and establish successful partnerships. This syllabus serves as a valuable resource for educators and learners alike, ensuring that English language education aligns with the demands of the international settlement field.。

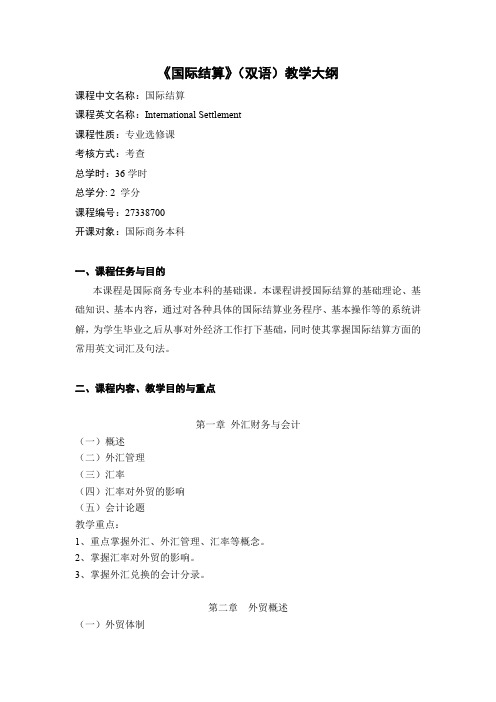

《国际结算》(双语)教学大纲

《国际结算》(双语)教学大纲课程中文名称:国际结算课程英文名称:International Settlement课程性质:专业选修课考核方式:考查总学时:36学时总学分: 2 学分课程编号:27338700开课对象:国际商务本科一、课程任务与目的本课程是国际商务专业本科的基础课。

本课程讲授国际结算的基础理论、基础知识、基本内容,通过对各种具体的国际结算业务程序、基本操作等的系统讲解,为学生毕业之后从事对外经济工作打下基础,同时使其掌握国际结算方面的常用英文词汇及句法。

二、课程内容、教学目的与重点第一章外汇财务与会计(一)概述(二)外汇管理(三)汇率(四)汇率对外贸的影响(五)会计论题教学重点:1、重点掌握外汇、外汇管理、汇率等概念。

2、掌握汇率对外贸的影响。

3、掌握外汇兑换的会计分录。

第二章外贸概述(一)外贸体制(二)国际商会《国际贸易条款》(2000版)教学重点:1、重点掌握国际商会《国际贸易条款》中对13种“贸易术语”的解释。

2、掌握我国外贸体制的发展变化。

第三章运输和运费(一)运输业务系统(二)单证(三)运费教学重点:1、重点掌握海运提单概念、作用、关系人及其提单的背书转让。

掌握提单正面和提单签字人的要求,掌握提单的清洁问题。

2、重点掌握不可流通转让海运单与海运提单的区别。

3、了解租船合约提单的定义、作用。

4、掌握多式运输的形成。

重点掌握多式运输单据与海运提单的区别。

5、掌握不同运输方式适用的贸易条件。

第四章保险(一)概述(二)风险和保险覆盖范围(三)单证(四)保险费的计算(五)运费和保险费的会计处理教学重点:1、重点掌握保险风险和保险覆盖范围。

2、重点掌握保险单据的定义与分类。

3、掌握保险费的计算。

4、掌握运费和保险费的会计处理。

第五章税务(一)关税(二)流转税——增值税(三)消费税(四)营业税教学重点:1、重点掌握关税的概念、计算。

2、掌握外贸中流转税——增值税的计算、出口退税的原理及其会计处理。

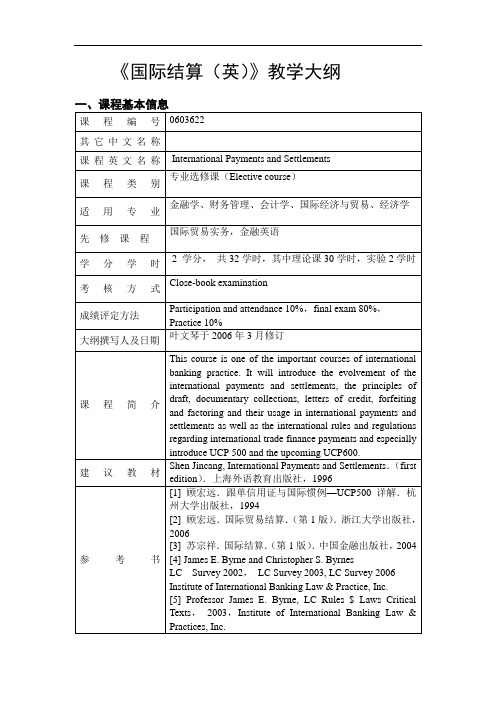

《国际结算(英)》教学大纲

《国际结算(英)》教学大纲二、The feature and students of the courseThe course is open for the students majoring in International Finance, Accounting and International Trade. It will provide the students with a comprehensive overview of bank practices in international payments and settlements and introduce various techniques in international trade finance.三. The aim and requirements of the courseAim of the course:The overall aim of this course is to develop the students’understanding in international payments and settlements and to increase the students’ ability to conduct international banking practices. The students will develop a better understanding of the advantages as well as the risks involved in using these payments methods. By the end of the course, the students will be able to understand the documentation, international rules and regulations regarding international trade finance; to understand the principles of letter of credit, documentary collections, drafts, etc.; to understand the different types of letters of credit and their usages in practice. This course will also keep the students well informed of the latest developments in international finance.Requirements:In the course,the students are required to be able to draw a draft, issue and examine documents under a letter of credit, and apply the terms of UCP 500 and the upcoming UCP600 to analyze cases.四、Method of teachingThis course is mainly delivered by lectures and incorporates the use of exercises, cases and discussions.五、Content of the course and time allocationChapter One IntroductionClass hour :1Requirements:This chapter will make a general introduction of the course , the rough content of the international trade finance and its evolvement. The students are required to be familiar with the characteristics of the course and the main terms of trade such as in intercom 2000.Priority: feature of the international payments and settlementsContent:1.What are international payments and settlements2.Evolution of international payments and settlements3.Basic points for attention in international payments and settlements4.Characteristics of modern international payments and settlementsChapter Two Credit InstrumentsClass hour: 1Requirements:to understand the features, function and the parties of the negotiable instruments and to have a good grasp of the principle of the negotiable instruments.Priority:negotiation of instrumentContent :1.Characteristics of a negotiable instrument2.Functions of a negotiable instrument3.Parties to a negotiable instrumentChapter Three Bill of Exchange---Definition, Acts Class hour: 2Requirements:to learn the definition, principle and acts of the draft.Priority:feature of a bill of exchangeContent:1.What is a bill of exchange: As defined in the Bills of Exchange Act 1882 of the United Kingdom, a bill of exchange is an unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer.2.Acts of a bill of exchangeIssueEndorsementPresentmentAcceptancePaymentDishonourNotice of dishonourProtestRight of recourseAcceptance for honour supra protestPayment for honour supra protestGuaranteeChapter Four Bill of Exchange---Lost Bill, Discounting, Acceptingand Forfaiting a Bill, ClassificationClass hour:1.5Requirements:to grasp the discounting and acceptance of a draft and identify various types of draft.Priority:discounting and acceptance of a bill of exchangeContent:1.Lost bill of exchange2.Discounting, accepting and forfeiting a bill of exchange3.Classification of a bill of exchangeChapter Five Promissory NoteClass hour: 0.5 hourRequirements:have a better understanding of the feature of a promissory note and distinguish the difference of promissory note and draft.Priority: difference from bill of exchangeContent:1.What is a promissory note2.Characteristics of a promissory note3.Essentials to a promissory note4.Difference between a bill of exchange and a promissory noteChapter Six ChequeClass hour: 1Requirements:to understand the feature of a cheque and distinguish it from a draft.Priority:feature of a chequeContent:1.What is a cheque2.Essentials to a cheque3.Features of a cheque4.Countermand of payment5.Wrongful dishonour of a cheque6.Crossed cheques7.Difference between a bill of exchange and a chequeChapter Seven Correspondent Banking Relationships Class hour: 1Requirements:to realize the importance and necessity of establishing correspondent relationship.Priority:control documentsContent:1.Correspondent bank, branch, representative office, agency, banking subsidiary and affiliate2.Why establish correspondent banking relationship3.Which banks should become the correspondents4.How to establish correspondent banking relationship5.Control documents6.Expanding international banking business with the aid of foreign correspondentsChapter Eight RemittanceClass hour: 1Requirements:to understand the principle of remittance and the practices.Priority:advantage and disadvantage of remittanceContent :1.Parties related to a remittance2.Accounts between international banks3.Ways of transfer4.Methods of reimbursement5.Cancellation of the remittance6.Advantages and disadvantages of different ways of transferChapter Nine Terms and Methods of Payment in InternationalTrade---Payment in Advance, Open Account Business, Factoring,CollectionClass hour:2Requirements:have a better understanding of various methods of payment.Priority:factoring and collectionContent :1.Payment in advance2.Open account business3.Factoring4.CollectionWhat is a collectionParties to a collectionTypes of collections: Documents against payment (D/P)Documents against acceptance (D/A)Collection procedureRisks and advantages of collection methodLiability and responsibility of the banks doing collection businessChapter Ten Terms and Methods of Payment in International Trade-----Letters of Credit(L/C)Class hour: 6Requirements:to understand the principle of the letters of credit, to be acquainted with the rights and obligations of various parties of the L/C. to understand the features of different types of letters of credit and the procedure of issuing and usage of a credit and the practice of amendment of a credit.Priority:Characteristics of a letter of creditContent:1.What is L/C2.Characteristics of a letter of credit3.Functions, advantages and disadvantages of a letter of credit4.Parties to a letter of credit5.Contents of a letter of credit6.Classification of letters of creditDocumentary credit:Irrevocable creditConfirmed creditUnconfirmed creditSight creditUsance or time creditPayment creditDeferred payment letter of creditAcceptance letter of creditNegotiation creditRevolving creditTransferable creditBack to back letter of credit7.Procedures of letter of credit operations8.Amendment under a letter of creditChapter Eleven Terms and Methods of Payment in InternationalTrade---Letters of GuaranteeClass hour: 1Requirements:to understand the feature of a letter of guarantee, and its difference from a letter of credit. To be familiar with various types of letters of guarantee.Priority:nature of a letter of guaranteeContent:1.Nature of demand guarantee2.Parties to a letter of guarantee3.Contents and clauses under a guarantee4.Types of guarantees5.Points for attention in establishing a letter of guarantee6.Forms of a letter of guarantee7.Difference between a letter of guarantee and a letter of credit8.Cancellation of a guarantee9.Standby letter of creditChapter Twelve Documents-Draft, Invoice, Insurance PolicyClass hour: 1Requirements:to understand the feature of various documents, content and their functions and learn to make and examine various documents.Priority:to draw a draftContent:1.Draft2.Invoice3.Insurance policy or certificateChapter Thirteen Documents---Air Waybill, Road Waybill, Cargo Receipt, Parcel Post Receipt, Bill of LadingClass hour: 3Requirements: to understand the three functions of ocean B/L and distinguish it from other transport documents.Priority: Characteristics of the ocean B/LContent:1.Air waybill2.Road waybill, consignment note3.Cargo receipt, railway bill4.Courier receipt and post receipt5.Bill of ladingWhat is a bill of ladingThe functions of a bill of ladingParties to a bill of ladingTypes of bill of lading(1)Shipped on board bill of lading(2)Received for shipment bill of lading(3)Direct bill of lading(4)Transshipment bill of lading(5)Straight bill of lading or named consignee bill of lading(6)Order bill of lading, or negotiable bill of lading(7)Clean bill of lading and unclean bill of lading(8)Stale bill of ladingChapter Fourteen Documents—Combined Transport Documents,Miscellaneous DocumentsClass hour: 2Requirements:to understand multi-mode transportation documents and various export documents.Priority:combined transport documents and the difference between CTD and ocean B/LContent:bined transport documents2.Miscellaneous documentsConsular invoiceCertificate of origin and A GSP Certificate of origin Form ACustoms invoiceInspection certificatePacking listBeneficiary’s statementChapter Fifteen Documents examination and ReimbursementClass hour: 2Requirements:learn to examine documents against L/C and learn how to handle discrepant documents so as to better understand and apply UCP500 or upcoming UCP600.Priority:to grasp the skill of examining documentsContent:1.General principle2.Examining a draft3.Examining a commercial invoice4.Examining a certificate of origin5.Examining Marine Insurance Documents6.Examining a bill of lading7.Examining other documents8.Most common discrepancies9.Bank’s common practice if the documents presented do not meet the credit requirement10.Payment refused by the issuing bank11.Payment and reimbursement under a letter of creditChapter Sixteen Supplementary material: Uniform Customs and Practice for Documentary Credits-----1993 Revision (Publication No.500)Class hour: 4Requirements:In order to be familiar with the international regulations and uniform practices, we require the students to understand the mains articles of UCP 500 and learn application of the terms in banking practice.Content:all the articles of UCP 500 and introduction of upcoming UCP 600六. Practice and case discussionRequirements: In order to let students have an real experience in bank’s documentary credit operation, we’ll organize the students to issue a set of shipping documents according to an L/C and examine the documents. Finally the students will have a seminar dealing with cases of L/Cs subject to UCP 500.Class hour: 2 hours。

国际结算双语课程标准--英文版

Practice 2. TT process operation

4

Collection

To understand the definition of collection,be familiar with the international practice,parties and application of collection

International settlement(bilinguacoluisrsme) standard

First, summary of course

It is the core course of international economic and trade major, based on the operating skills’ cultivation about methods of international settlement, combining theory with reality, emphasising on positional operation, paying attention to the cultivation of comprehensive ability about finding, analyzing and solving problems, etc.

1.Definition of standby letter of credit

2.Characteristics of standby letter of credit

3.Differences between standby letter of credit and documentary letter of credit

国际支付与结算大纲整理版

国际支付与结算大纲整理版国际支付与结算大纲一、简称写全称1.T/T Telegraphic Transfer2.CIF Cost Insurance and Freight3.D/A documents against acceptance4.L/C Letter of Credit5.B/L Bill of Lading6.T/R Trust Receipt7.D/D (Remittance by Banker’s) Demand Draft8.D/P documents against payment9.M/T Mail Transfer二、填空1.Settlement on commercial credit includes payment in advance, open account,remittance and collection.2.Before the sixth century B.C., goods were exchanged between traders in differentcountries on a barter basis3.The maker of promissory note has prime liability while the other parties havesecondary liability.4.There are four parties concerned in the international remittance; they are theremitter, the remitting bank, the paying bank, and the payee.5.According to whether the credit can be transferred or not, there are transferablecredit and non-transferable credit.6.The Uniform Rules for Collection (URC) and the UniformCustoms and Practicefor documentary (UCP) were all developed by the International Chamber for Commerce in Paris.1.Settlement on commercial credit includes payment in advance, open account,remittance and collection.2.From the point of view of a Chinese bank, a nostro account is our bank’s accountin books of an overseas bank, denominated in foreign currency.3.Before a draft is accepted, the drawer has prime liability while the other partieshave secondary liability.4.There are four parties concerned in the collection; they are the principal, theremitting bank, the collecting or presenting bank, and the drawee.5.According to whether the credit can be revoked or not, there are revocable creditand irrevocable credit.6.The Uniform Rules for Collection (URC) and the Uniform Customs and Practicefor documentary (UCP) were all developed by the International Chamber for Commerce in Paris.三、计算题1. Suppose an accepted bill for USD80, 000 falls due on July 12 and the exporter takes it to a discount bank on March 9. If the discount rate is 5% (year), what would be the discount interest and how much can the payee get?贴现日:3.9 到期日:7.12 天数:125天到期价值=(80000×5%×125)/ 360=1388.89元The Payee Can Get=80000﹣1388.89=78611.11元2. A draft was issued on July 30th, 2008. The par value was ten thousand RMB. The rate of interest per annum was 8%. The tenor was 3 month after sight and the drawee accepted it on August 27th, 2008. The holder discounted and draft at the rate of 10% per annum on September 19th, 2008.(1) When the draft fall due?November 27th, 2008(2) How much is the discount interest? How much can the holder receive?Face value of the bill=(10000×8%×120)/360+10000=10266.67Discount interest=(10266.67×10%×69)/360=196.78So the discount interest is 196.78 RMB.贴现净值=10266.67-196.78=10069.89So the holder can receive 10069.89 RMB.四、名词解释1. Bill of Exchange: A bill of exchange is defined officially as an unconditional order in writing, addressed by one person to another, signed by the first person, requiring the second person to whom it is addressed to pay on demand, or at a fixed or determinable future time, a certain amount of money, to, or to the order of, a specified person or to the bearer.2. Collection: Collection is an arrangement whereby the goods are shipped and a relevant bill of exchange is drawn by the seller on the buyer, and/or shipping documents are forwarded to the seller’s bank with clear instructions for collection through one of its correspondent bank located in the domicile of the buyer.3. Letter of Credit: A letter of credit is a written undertaking by a bank (issuing bank) given to the seller (beneficiary) at the request, and on the instruction, of the buyer (applicant) to pay at sight or at a determinable future date up to a stated sum of money, within a prescribed time limit and against stipulated documents which complied with the terms and conditions of the credit.4. Remittance: the forward direction of payment instruments and the flow direction of funds are the same.5. D/P: The collecting bank may release the documents only against full and immediate payment, insofar as national, federal or local laws or regulations do not prevent it.6. D/A: The presenting bank may release the documents to the buyer against the buyer’s acceptance of a draft, drawn payable 30-180 days after sight or due on a definite date.7. Check: A check is an unconditional order in writing addressed by the customer to a bank signed by that customer authorizing the bank to pay on demand a specified sum of money to or to the order of a named person or to bearer.8. Documentary Collection: Documentary collection my be described as collectionson financial instruments being accompanied by commercial documents or collections on commercial documents without being accompanied by financial instruments, that is, commercial documents without a bill of exchange.五、简单题或案例分析1.Advantage and disadvantage of M/T.Advantage: In involves bank-to-bank instructions with bank responsible for making payments, so it is rather reliable.Disadvantage:(1)It is possible for the mail transfer order to be delayed or lost in the post, thuscausing difficulty for its payment.(2)As the mail transfer exclusively depends on international airmail service, itstransmission is slower than that of T/T and cannot serve the purpose of quick payment.(3)Unlike the remittance by demand draft, the beneficiary must awaitnotification from the bank concerned.2.Function of bill of lading.(1) It is a receipt for goods signed by the shipping company and given to theshippers.(2) It is a document of title. It can be freely bought and sold just like commodity.In case the buyer dishonors payment, the seller may sell it to other alternative buyers.(3) It is also evidence of contract of carriage between the shipping company andshippers.(4) It can be used for the buyer to take delivery at the port of destination.3.Procedure for amendment of the letter of credit.(1)The seller requests that the buyer make an amendment to the credit. This canbe made by a telephone call, a fax, or by face-to-face negotiation.(2)If the buyer agrees he orders the issuing bank to issue the amendment.(3)The issuing bank amends the credit and notifies the advising bank of theamendment.(4)The advising bank notifies the seller of the amendment.4.Function of negotiable instrument.(1)As a means of payment.(2)As a credit instrument.(3)As a transferable instrument.(4)As a mean of financial5.According to the tenor, list the classification of bill of exchange.(1)Sight bill. It is a bill payable on demand or sight or on presentation.(2)Time bill or usance bill. It is a bill payable at a fixed or determinable futuretime.6.Parties to documentary credit.(1)Applicant/importer/the buyer; (2) Issuing/opening bank/the buyer’s bank;(2)Advising bank; (4) Beneficiary/exporter/the seller; (5) Confirming bank;(6) Negotiation bank; (7) Paying bank/drawee bank; (9) Reimbursing bank.7. Characteristics of letter of credit.(1) It is a kind of banker’s credit. The issuing bank undertakes primary liabilitiesfor payment;(2) The obligation of payment born by the bank is limited and conditional.(3) A letter of credit is self-sufficient documents and isindependent of the salescontract;(4) Letter of credit is a pure documentary business, that is, banks deal withdocuments and not with goods, services or other performances to which the documents relate.。

国际支付与结算课程设计

国际支付与结算课程设计一、教学目标本课程的教学目标旨在帮助学生掌握国际支付与结算的基本理论、方法和实践。

通过本课程的学习,学生应能理解国际支付与结算的基本概念、流程及各类支付工具的使用,掌握汇票、信用证、托收等支付方式的特点和操作要点,并能够分析解决实际操作中的问题。

1.掌握国际支付与结算的基本概念和分类;2.理解国际支付与结算的流程及其中的关键环节;3.熟悉各类支付工具(如汇票、信用证、托收等)的性质、功能和操作流程;4.掌握国际结算中的汇率、利息和风险管理等基本知识。

5.能够运用所学知识分析和解决实际操作中的国际支付与结算问题;6.具备编制和审核国际支付文件(如汇票、信用证等)的能力;7.能够运用现代信息技术手段进行国际支付与结算的操作和管理。

情感态度价值观目标:1.培养学生的国际视野,使其认识到国际支付与结算在全球经济中的重要性;2.树立正确的金钱观和风险意识,遵循国际规则和商业道德进行交易;3.激发学生对国际支付与结算领域的兴趣,培养其持续学习的动力。

二、教学内容本课程的教学内容主要包括国际支付与结算的基本理论、方法和实践。

教学大纲将按照以下顺序展开:1.国际支付与结算概述:国际支付与结算的定义、分类和流程;2.支付工具及其操作:汇票、信用证、托收等支付工具的性质、功能和操作流程;3.国际结算实务:汇款、信用证结算、托收结算等国际结算方式的应用;4.风险管理与监管政策:国际支付与结算中的风险管理、监管政策和合规要求。

三、教学方法为了提高学生的学习兴趣和主动性,本课程将采用多种教学方法相结合的方式进行教学:1.讲授法:通过教师的讲解,使学生掌握国际支付与结算的基本理论和知识点;2.案例分析法:通过分析实际案例,使学生理解和掌握支付工具的操作流程和风险管理;3.讨论法:学生就热点问题进行讨论,培养学生的思辨能力和团队协作精神;4.实验法:利用实验设备进行模拟操作,提高学生的实际操作能力和技能水平。

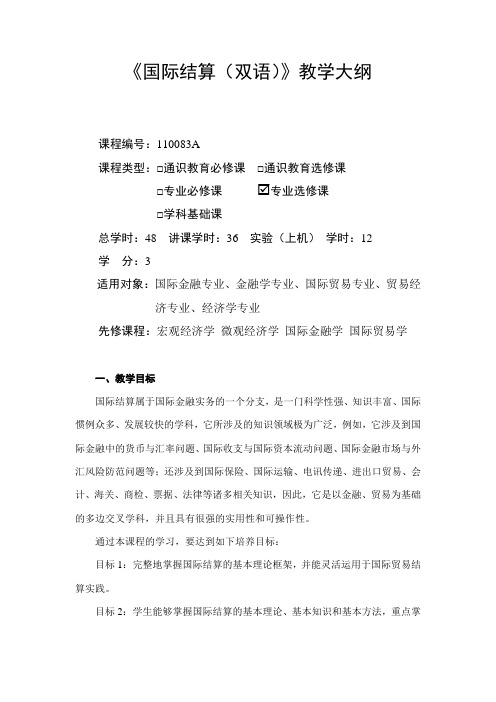

国际结算(双语)-教学大纲

《国际结算(双语)》教学大纲课程编号:110083A课程类型:□通识教育必修课□通识教育选修课□专业必修课 专业选修课□学科基础课总学时:48 讲课学时:36 实验(上机)学时:12学分:3适用对象:国际金融专业、金融学专业、国际贸易专业、贸易经济专业、经济学专业先修课程:宏观经济学微观经济学国际金融学国际贸易学一、教学目标国际结算属于国际金融实务的一个分支,是一门科学性强、知识丰富、国际惯例众多、发展较快的学科,它所涉及的知识领域极为广泛,例如,它涉及到国际金融中的货币与汇率问题、国际收支与国际资本流动问题、国际金融市场与外汇风险防范问题等;还涉及到国际保险、国际运输、电讯传递、进出口贸易、会计、海关、商检、票据、法律等诸多相关知识,因此,它是以金融、贸易为基础的多边交叉学科,并且具有很强的实用性和可操作性。

通过本课程的学习,要达到如下培养目标:目标1:完整地掌握国际结算的基本理论框架,并能灵活运用于国际贸易结算实践。

目标2:学生能够掌握国际结算的基本理论、基本知识和基本方法,重点掌握票据和信用证的使用、单据制作、贸易融资等内容,并了解国际结算方式的最新发展。

目标3:学生可以加深对国际经贸往来程序的理解和掌握,更加符合“专业型、复合型”人才的培养标准。

二、教学内容及其与毕业要求的对应关系教学内容讲授上的要求:重点讲解国际结算的四个维度——国际结算工具、国际结算方式、国际结算单据、国际结算融资。

其中国际结算工具和方式应该精讲、细讲,国际结算单据可以粗讲,国际结算融资可以选讲。

国际结算课程的重点是:使学生深刻领悟国际结算工具的使用,国际结算方式的选择,做到学以致用。

在讲解这部分内容时,重点通过学生操作与教师指点相结合的方法进行。

对拟实现的教学目标所采取的教学方法、教学手段;本课程采用课堂讲授与实验操作相结合的方法进行,综合使用多媒体、板书、慕课等教学手段,使学生能切实有所收获。

对实践教学环节的要求;实践教学中,培养学生制作国际结算工具(本票、支票、汇票)的能力,阅读SWIFT报文内容的能力,掌握国际结算方式(汇款、托收、信用证)的基本业务流程,为学生入职银行业提供专业切入口。

国际支付与结算chapter 2

Chapter 2 Introduction

(3)From payments under simple price terms to payments under more complex price terms

• In the past, international trade payments

System.(跨国美元支付系统)

1970年4月成立,国际美元支付系统。它是一个 著名的私营跨国大额美元支付系统,是跨国美元 交易的主要结算渠道。 通过CHIPS处理的美元交易额约占全球美元总交 易额的95%。 CHIPS成员有纽约清算所协会会员、纽约市商业 银行、外国银行在纽约的分支机构等。

chaining(SWIFT study):

/zjueman/archive/2006/06/28/847335.aspx

Characteristics

1.SWIFT needs member qualification. 2.SWIFT’s charge is low.

Chapter 2 Introduction

2.3 Characteristics of Modern International Payments and Settlements

Various instruments are widely used Banks become the center of international settlements Vehicle currencies are more diversified than before Electronic devices are widely used International lending is often combined with international payments

国际支付和结算精品文档

1.1 Introduction to International Trade

1.1.1 Definition of international trade International trade is the exchange of

goods and services produced in one country for those produced in another country.

2

C9, International factoring and Forfeiting

Chapter 1 Brief Introduction

to International Trade

国际贸易简介

本章目录

1.1 Introduction to International Trade 国际贸易概述

《国际备用证惯例》(International Standby Practices,国际商会第590号出 版物,简称“ISP98”)

《见索即付保函统一规则》

UNIFORM RULES FOR DEMAND GUARANTEES (ICC PUBLICATION NO.758,简称URDG)

教学进度

国际惯例的阅读要求

《关于审核跟单信用证项下单据国际标准银行 实务》(International Standard Banking Practice for the Examination of Documents under Documentary Credits,国际商会第681 号出版物,简称“ISBP”)

北美东岸航线:

– 蒙特利尔(Montreal), – 多伦多(Toronto), – 波士顿(Boston), – 纽约(New York), – 费城(Philadelphia), – 迈阿密(Miami), – 新奥尔良(New Orleans), – 休斯敦(Houston)等。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

教学大纲课程名称:《国际结算》(双语)课程号:0 0 4 0 2 5 1-2 (2)《国际支付与结算》(双语)教学大纲(课程英文名称Course name:International Payments and Settlements课程号Serial number:0040251-2(2))(编写时间:2006年6月)一、开设院(部):经济与金融学院二、教学对象:金融专业、金融工程专业等三、课时及其分配:36学时——多媒体授课:30学时;案例分析、作业:6学时四、考核:考核形式——期末考查、平时考核五、教材:Hinkelman Edward G , International Payments and Settlements, The Syndicate of World Trade Press , 2000六、主要参考资料:1.王益平主编:国际支付与结算(英语版),清华大学出版社、北京交通大学出版社,2004(国家教育部新世纪网络课程建设工程项目商务英语系列课程教材)2.邓俊编:国际结算(英语版),武汉大学出版社,2004年3.何康民主编:国际贸易结算(英语版),武汉大学出版社,20044.贺瑛编著:金融专业英语证书考试指南——国际结算(英语版),上海财经大学出版社,19965.(德国)查尔斯•韦勒、乌特•鲍姆佳特著(中国农业银行翻译):国际结算与国际贸易融资实务(双语版),经济管理出版社,19966.朱意秋编著:国际贸易结算新编(双语版),青岛海洋大学出版社,20017.沈锦昶等编著:国际支付与结算.修订本(双语版),上海外贸教育出版社,20028.应诚敏、刁德霖编著:国际结算,高等教育出版社、上海社会科学院出版社,20009.周宇治著:银行国际结算函电交涉案例选评,中国金融出版社,200210.11.12.13.14.15.http:// 七、教学目的、要求与讲授内容提纲:附后PART ONE: THE PURPOSE OF LEARNING THIS COURSEThe objectives of learning this course are that: Firstly, it tries to provide some information on fundamental principles and theories which are closely associated with the international payments and settlements. Secondly, it tries to offer the experiences and skills about how to deal with the safe exchange between the proceeds and goods in international trade. Finally, it tries to make the learners familiarize with the customs and practice in international payments and settlements.This course is a practical course concerning international economics. It deals with financial activities and regularities conducted among different countries in which payments are effected or funds are transferred from one country to another with the aim to payments and settlements more scientifically and effectively. Specifically, major points concerning international payments and settlements are:(1)International payment and settlement methods;(2)The financial instruments that facilitate international payments and settlements;(3)Documents used in international payments and settlements;(4)Rules and regulations on international payments and settlements.PART TWO: DISTRI BUTION OF CLASSHOURSPART THREE: CONTENTS OF INTERNATIONALPAYMENTS AND SETTLEMENTSChapter 1 Introduction(Class hours: 2)I. The Objective/ Requirements of This ChapterThe purpose of this chapter is to induce the general contents of international payments and settlements. In this chapter, we mainly learn the concept and evolution of international payments and settlements, and the structure of the course and the teaching schedule.II. Major Contents of This Chapter1.1. Definition of International Payments and Settlements1.1.1. The general implication1.1.2. The special implication1.2 Evolution of International Payments and settlements1.2.1. From cash settlement to non-cash settlement1.2.2. From direct payment made between international traders to payment effected through a financial intermediary1.2.3. From payments under simple price terms to payments under more complex price terms1.2.4. Internet era1.3 Correspondent Banking Relationship1.3.1. Definition of Correspondent Bank1.3.2. Control Documents1.3.3. Inter-bank Accounts1.3.4. Services provided by correspondentsChapter 2 Credit Instruments(Class hours: 10)I. The Objective/ Require of This ChapterIn this chapter, we will learn the three important negotiable instruments (i.e. bill of exchange, promissory note and check): (1) The functions of a negotiable instrument; (2) The characteristics of each instrument; (3) The essentials of each instrument. It is essential for us to recognize and use them correctly and properly in order that we can facilitate the transfer of credits and do more business with foreigners.II. Major Contents of This Chapter2.1. Negotiable Instruments2.1.1. What is a negotiable instrument?2.1.2. Functions of a negotiable instrument2.1.3. Parties to a negotiable instrument(1) Drawer(2) Drawee (3) Payee (4) Acceptor (5) Endorser (6) Endorsee (7) Guarantor(8) Holder (9) Holder for value (10) Holder in due course2.1.4. Essentials of a negotiable instrument2.2. Bill of Exchange (Draft)2.2.1. What is a bill of exchange?2.2.2. Essentials of a bill of exchange2.2.3 Acts of a bill of exchange(1) Issuance (2) Endorsement (3) Presentment (4) Acceptance (5) Payment (6) Dishonor(7) Notice of dishonor (8) Protest (9) Right of recourse (10) Guarantee2.2.4. Discounting of a bill of exchange2.2.5. Classification of a bill of exchange(1)Banker’s draft or bank draft and trade b ill(2)Banker’s acceptance bill and trader’s acceptance bill(3)Sight bill and time bill or usance bill(4)Clean bill and documentary bill(5)Local currency bill and Foreign currency bill(6)Direct bill and Indirect bill(7)Inland bill or domestic bill and foreign bill2.3. Promissory Note and Check2.3.1. Promissory note2.3.2. Check2.3.3. Difference between a promissory note, a check and a bill of exchange2.4. Case Study and SummaryChapter 3 International Bank Remittance(Class hours: 4)I. The Objective/ Require of This ChapterThis chapter mainly introduces the different methods of fund transfer in international trade. It is important for traders to familiarize with the parties, procedures, advantages and disadvantages of remittance, as well as the function of remittance in international trade.II. Major Contents of This Chapter3.1. The Concept of International Bank Remittance3.2. Parties to a Remittance(1)Remitter (2)Remitting bank (3)Payee (4)Paying bank3.3. Ways of Transfer3.3.1. T/T and M/T(1)Implication (2)Procedure for T/T (3)Procedure for M/T3.3.2. D/D(1)Procedure for D/D (2)Characteristics3.3.3. Advantages and disadvantages3.4. The Function of Remittance in International Trade3.4.1. Payment in advance3.4.2. O/A business3.5. Case StudyChapter 4 Collection(Class hours: 6)I. The Objective/ Require of This ChapterIn this chapter, we will learn: (1)Definition, parties and types of collection; (2)Procedure of various kinds of documentary collection used in international trade; (3)Risk protection and financing under collection methods. This chapter tries to make learners be familiar with the major contents mentioned above.II. Major Contents of This Chapter4.1 Introduction4.1.1 What is a collection?4.1.2 Parties to the operation of collections(1)Principal (Drawer) (2)Remitting bank (3)Collecting/Presenting bank (4)Drawee(5)Case of need4.1.3 Types of collection(1)Documentary collections (2)Clean collections (3)Direct collection4.2 Documentary Collection Procedure4.2.1 D/P(1)D/P at sight (2)Acceptance D/P4.2.2 D/A4.3 Risk Protection and Financing Under Collection Methods4.3.1 Risks for exporter4.3.2 Risks for importer4.3.3 Risk protection4.3.4 Financing under the collection4.4 Case StudyChapter 5 Letter of Credit(Class hours: 10)I. The Objective/ Require of This ChapterThis chapter really illustrates the essence of documentary credit operation in international trade. To familiarize with the characteristics, benefits, procedure, classifications and risk protection of documentary credits would be helpful for us to do business with foreigners. It is not difficult to find that to use L/C settlement properly will be the key to success of business between the buyer and the seller.II. Major Contents of This Chapter5.1 Introduction5.1.1 What is a L/C?(implication)5.1.2 Characteristics of a L/C5.1.3 Benefits of the documentary credit(1)Facilitates financing the documentary credit(2)Provides legal protection(3)Assures expert examination of documents5.1.4 Parties to documentary credit(1)Applicant (2)Issuing bank (3)Advising bank (4)Beneficiary (5)Confirming bank(6)Negotiating bank (7)Paying bank (8)Accepting bank (9)Reimbursing bank5.1.5 Basic procedure of documentary credit(1)Issuance (2)Amendment (3)Utilization (4)Settlement5.2 Types and Uses of Credit5.2.1 Revocable and irrevocable credit5.2.2 Confirmed and unconfirmed credit5.2.3 Sight, usance credit and usance credit payable at sight5.2.4 Transferable and non-transferable credit5.2.5 Payment, acceptance, deferred payment and negotiation credit5.2.6 Clean and documentary credit5.2.7 Special function credits5.2.8 Combined function credits5.3 Credit Financing and Risk Protection5.3.1 Credit as a means of finance5.3.2 Risk protection5.4 Case StudyChapter 6 Documents Under the Credit(Class hours: 2)I. The Objective/ Require of This ChapterThis chapter illustrates the importance and key elements of various documents used in international trade. In this chapter, we will learn:(1) The importance of documents in international settlements; (2) Some major documents used in documentary credits; (3) Sample documents.II. Major Contents of This Chapter7.1 Introduction7.1.1 Importance of documents in international settlements7.1.2 Document list7.2 Invoice7.2.1 Types of invoice7.2.2 Functions7.2.3 Contents and sample7.3 Transport Documents7.3.1 Types of transport documents7.3.2 Bill of lading7.4 Insurance Documents (or Certificate) 7.4.1 Insurance policy7.4.2 Insurance certificate7.5 Document Examination7.5.1 Principle of documentary verification 7.5.2 Procedure of examining documents7.5.3 Essentials of examination。