国际结算单选题大合集资料

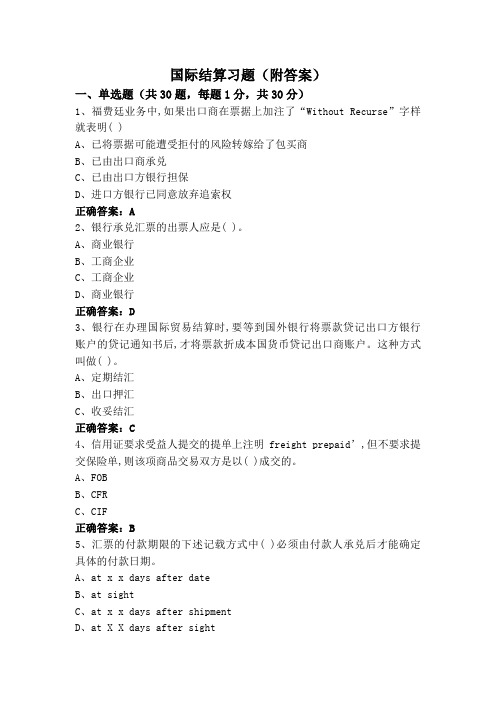

国际结算习题(附答案)

国际结算习题(附答案)一、单选题(共30题,每题1分,共30分)1、福费廷业务中,如果出口商在票据上加注了“Without Recurse”字样就表明( )A、已将票据可能遭受拒付的风险转嫁给了包买商B、已由出口商承兑C、已由出口方银行担保D、进口方银行已同意放弃追索权正确答案:A2、银行承兑汇票的出票人应是( )。

A、商业银行B、工商企业C、工商企业D、商业银行正确答案:D3、银行在办理国际贸易结算时,要等到国外银行将票款贷记出口方银行账户的贷记通知书后,才将票款折成本国货币贷记出口商账户。

这种方式叫做( )。

A、定期结汇B、出口押汇C、收妥结汇正确答案:C4、信用证要求受益人提交的提单上注明freight prepaid’,但不要求提交保险单,则该项商品交易双方是以( )成交的。

A、FOBB、CFRC、CIF正确答案:B5、汇票的付款期限的下述记载方式中( )必须由付款人承兑后才能确定具体的付款日期。

A、at x x days after dateB、at sightC、at x x days after shipmentD、at X X days after sight正确答案:D6、一张金额为30万美元的可撤销信用证,未规定可否分批装运受益人装运了价值为5万美元的货物后,即向出口地银行办理了议付。

第二天收到开证行撤销该信用证的通知此时,开证行( )A、对已办理议付的5万美元仍应偿付其余25万美元则失效B、对已办理议付的5万美元可以拒绝偿付,并指示议付行向受益人追索所议付的5万美元C、因撤销通知到达前,该证已被凭以办理部分议付故该信用证不能被撤销正确答案:A7、某笔信用证业务中,信用证要求受益人按发票金额的110%投保。

这增加的10%,是( )。

A、进口商自愿多向保险公司交纳保险费B、进口商的预期毛利润率C、保险公司向进口商提出的要求D、进口商想从保险公司多得到补偿正确答案:B8、根据我国的票据法,当票据上金额的大小写不一致时( )。

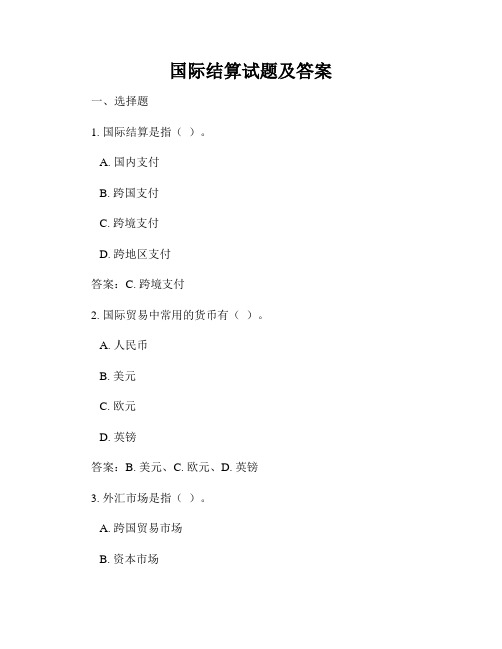

国际结算试题及答案

国际结算试题及答案一、选择题1. 国际结算是指()。

A. 国内支付B. 跨国支付C. 跨境支付D. 跨地区支付答案:C. 跨境支付2. 国际贸易中常用的货币有()。

A. 人民币B. 美元C. 欧元D. 英镑答案:B. 美元、C. 欧元、D. 英镑3. 外汇市场是指()。

A. 跨国贸易市场B. 资本市场C. 货币兑换市场D. 国内金融市场答案:C. 货币兑换市场4. 发票是国际结算中的重要凭证,以下关于发票的说法正确的是()。

A. 发票是买方向卖方索取的B. 发票是卖方主动提供给买方的C. 发票是国际结算的唯一凭证D. 发票不需要保存备查答案:A. 发票是买方向卖方索取的5. 信用证是国际贸易中常用的支付方式,下列说法正确的是()。

A. 信用证由买方开立并通知给卖方B. 信用证由卖方开立并通知给买方C. 信用证是买卖双方共同开立的D. 信用证不需要经过银行承兑答案:A. 信用证由买方开立并通知给卖方二、填空题1. 国际结算中,常用的结算方式有()和()。

答案:电汇、信用证2. 外汇市场的重要参与者包括()、()和()。

答案:商业银行、中央银行、投资者3. 在信用证中,开证行是指(),通知行是指()。

答案:买方银行、卖方银行4. 国际结算中,应收账款指的是卖方向买方销售货物或提供劳务而产生的()。

答案:应收款项5. 外汇交易的买入价和卖出价之间的差额称为()。

答案:汇率点差三、简答题1. 请简述电汇的工作原理。

电汇是一种常用的国际结算方式,其工作原理如下:首先,买方将支付款项交给本国的银行,填写有关电汇信息,并提供卖方的银行账号和国际银行账号。

然后,买方的银行根据这些信息,向卖方的银行发送支付指令,并扣除相应款项。

卖方的银行收到支付指令后,将款项划转至卖方账户,并通知卖方款项到账的消息。

最后,卖方确认收到款项后,交付货物或提供服务,完成交易。

2. 请简述信用证的优缺点。

信用证是一种常用的国际贸易支付方式,其优点和缺点如下:优点:- 买卖双方都能获得支付保障,减少交易风险。

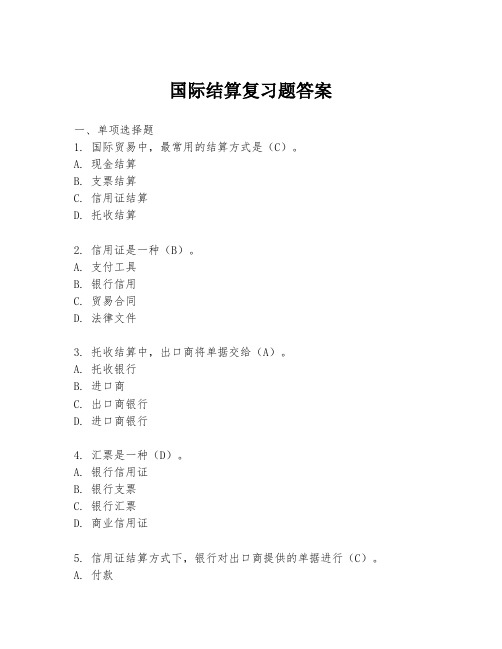

国际结算复习题答案

国际结算复习题答案一、单项选择题1. 国际贸易中,最常用的结算方式是(C)。

A. 现金结算B. 支票结算C. 信用证结算D. 托收结算2. 信用证是一种(B)。

A. 支付工具B. 银行信用C. 贸易合同D. 法律文件3. 托收结算中,出口商将单据交给(A)。

A. 托收银行B. 进口商C. 出口商银行D. 进口商银行4. 汇票是一种(D)。

A. 银行信用证B. 银行支票C. 银行汇票D. 商业信用证5. 信用证结算方式下,银行对出口商提供的单据进行(C)。

A. 付款B. 承兑C. 审核D. 贴现二、多项选择题1. 信用证结算的优点包括(ABCD)。

A. 降低风险B. 提高安全性C. 促进贸易D. 增加贸易便利性2. 托收结算方式中,可能涉及的银行包括(ABC)。

A. 托收银行B. 代收银行C. 议付银行D. 清算银行3. 汇票结算中,汇票的当事人包括(ABD)。

A. 出票人B. 付款人C. 收款人D. 持票人三、判断题1. 信用证结算方式下,银行对单据的审核是无条件的。

(×)2. 托收结算方式下,出口商的风险高于信用证结算方式。

(√)3. 汇票结算中,汇票到期后,付款人有权拒绝付款。

(×)四、简答题1. 简述信用证结算方式的特点。

答:信用证结算方式是一种由银行出具的,对出口商提供的单据进行审核并承诺付款的结算方式。

其特点包括:安全性高,因为银行作为第三方介入,降低了贸易双方的风险;灵活性强,可以根据贸易双方的需求定制信用证条款;促进贸易,因为银行的介入提高了贸易双方的信任度。

2. 托收结算方式和信用证结算方式的主要区别是什么?答:托收结算方式和信用证结算方式的主要区别在于银行的角色和责任不同。

在托收结算中,银行仅作为中介,负责传递单据和款项,不承担付款责任。

而在信用证结算中,银行对出口商提供的单据进行审核,并在符合信用证条款的情况下承诺付款,承担了一定的付款责任。

五、案例分析题某出口商与进口商签订了一份贸易合同,合同规定采用信用证结算方式。

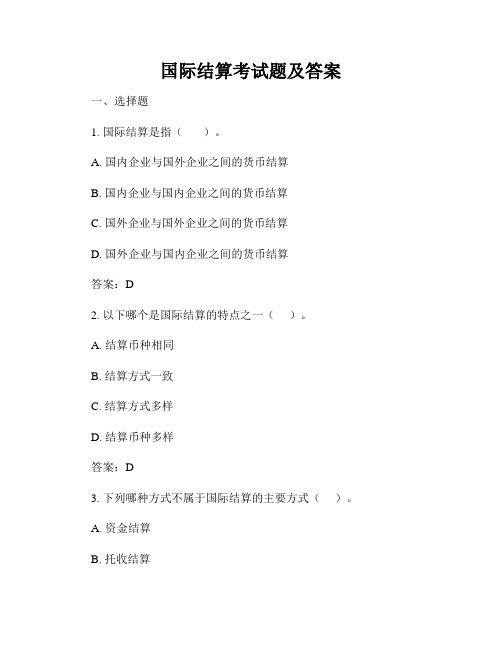

国际结算考试题及答案

国际结算考试题及答案一、选择题1. 国际结算是指()。

A. 国内企业与国外企业之间的货币结算B. 国内企业与国内企业之间的货币结算C. 国外企业与国外企业之间的货币结算D. 国外企业与国内企业之间的货币结算答案:D2. 以下哪个是国际结算的特点之一()。

A. 结算币种相同B. 结算方式一致C. 结算方式多样D. 结算币种多样答案:D3. 下列哪种方式不属于国际结算的主要方式()。

A. 资金结算B. 托收结算C. 信用证结算D. 缴纳税款答案:D4. 以下哪个不是外汇市场的主要参与者()。

A. 商业银行B. 中央银行C. 政府机构D. 零售客户答案:D5. 外汇市场的主要参与者通过()进行交易。

A. 交割行B. 交易平台C. 清算行D. 结算行答案:B二、简答题1. 请简要介绍国际结算的分类方式。

答:国际结算可以按照结算币种、结算方式和结算地点等进行分类。

按照结算币种可以分为单币结算和多币结算;按照结算方式可以分为付款结算、托收结算、信用证结算等;按照结算地点可以分为跨境结算和同城结算。

2. 请简要说明托收结算的流程。

答:托收结算是指出口商通过银行将出口商品的单据托收给进口商的银行,进口商的银行负责收款并通知进口商。

托收结算流程一般包括出口商将单据交给本地银行,本地银行经过审核后将单据发送到进口商的银行,进口商的银行收到单据后通知进口商进行付款,最后进口商付款给进口商的银行,进口商的银行再将款项转给出口商的银行。

三、应用题某公司与境外供应商A签订了一份货物销售合同,合同金额为50,000美元,合同约定采用信用证结算方式。

合同条款如下:1. 信用证金额:50,000美元2. 信用证有效期:2019年1月1日至2019年12月31日3. 装运期限:2019年3月1日至2019年3月31日4. 单据要求:商业发票、装箱单、产地证明等请回答以下问题:1. 请列出双方在信用证结算方式下的权利和义务。

答:供应商A的权利:在合同有效期内向信用证银行提交符合信用证要求的单据,并获得款项支付。

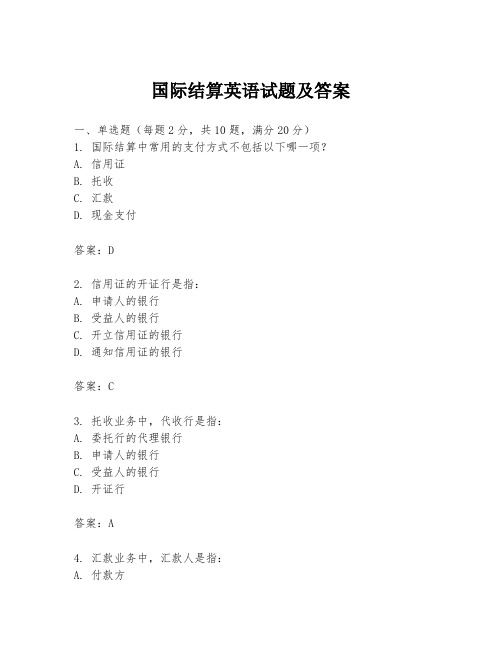

国际结算英语试题及答案

国际结算英语试题及答案一、单选题(每题2分,共10题,满分20分)1. 国际结算中常用的支付方式不包括以下哪一项?A. 信用证B. 托收C. 汇款D. 现金支付答案:D2. 信用证的开证行是指:A. 申请人的银行B. 受益人的银行C. 开立信用证的银行D. 通知信用证的银行答案:C3. 托收业务中,代收行是指:A. 委托行的代理银行B. 申请人的银行C. 受益人的银行D. 开证行答案:A4. 汇款业务中,汇款人是指:A. 付款方B. 收款方C. 银行D. 任何第三方答案:A5. 在信用证结算方式中,受益人提交的单据不符合信用证条款时,开证行将:A. 无条件付款B. 拒绝付款C. 保留付款D. 延迟付款答案:B6. 国际结算中,汇票的付款期限通常分为即期和:A. 远期B. 定期C. 延期D. 长期答案:A7. 国际结算中,银行保函通常用于:A. 贸易融资B. 项目投标C. 信用担保D. 以上都是答案:D8. 信用证结算方式中,如果信用证过期,受益人将:A. 无法使用信用证B. 可以延期使用C. 可以部分使用D. 可以全额使用答案:A9. 在国际结算中,D/P(付款交单)和D/A(承兑交单)的主要区别在于:A. 交单时间B. 付款时间C. 交单地点D. 付款方式答案:D10. 国际结算中,SWIFT是指:A. 环球银行金融电信协会B. 国际货币基金组织C. 世界贸易组织D. 国际商会答案:A二、多选题(每题3分,共5题,满分15分)1. 国际结算中,以下哪些属于贸易术语?A. FOBB. CIFC. DDPD. T/T答案:A, B, C2. 信用证结算方式中,以下哪些属于信用证的特点?A. 银行信用B. 独立性C. 可转让性D. 无条件性答案:A, B3. 国际结算中,以下哪些属于支付方式?A. 信用证B. 托收C. 汇款D. 现金支付答案:A, B, C4. 国际结算中,以下哪些属于汇票的类型?A. 商业汇票B. 银行汇票C. 即期汇票D. 远期汇票答案:A, B, C, D5. 在国际结算中,以下哪些属于银行保函的类型?A. 投标保函B. 履约保函C. 预付款保函D. 质量保函答案:A, B, C, D三、判断题(每题1分,共5题,满分5分)1. 信用证是一种无条件的支付承诺。

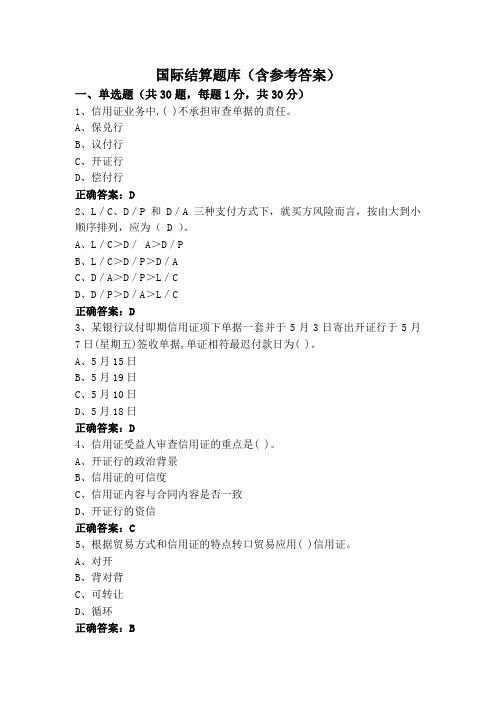

国际结算题库(含参考答案)

国际结算题库(含参考答案)一、单选题(共30题,每题1分,共30分)1、信用证业务中,( )不承担审查单据的责任。

A、保兑行B、议付行C、开证行D、偿付行正确答案:D2、L/C、D/P和D/A三种支付方式下,就买方风险而言,按由大到小顺序排列,应为( D )。

A、L/C>D/ A>D/PB、L/C>D/P>D/AC、D/A>D/P>L/CD、D/P>D/A>L/C正确答案:D3、某银行议付即期信用证项下单据一套并于5月3日寄出开证行于5月7日(星期五)签收单据,单证相符最迟付款日为( )。

A、5月15日B、5月19日C、5月10日D、5月18日正确答案:D4、信用证受益人审查信用证的重点是( )。

A、开证行的政治背景B、信用证的可信度C、信用证内容与合同内容是否一致D、开证行的资信正确答案:C5、根据贸易方式和信用证的特点转口贸易应用( )信用证。

A、对开B、背对背C、可转让D、循环正确答案:B6、因付款人拒付,代收行按托收行指示将单据退回.单据存根旧途中遗失的风险由( )承担。

A、托收行B、代收行C、委托人D、付款人正确答案:C7、对于出口商来说,( )最符合安全及时收汇的原队A、付款文单托收B、远期付款信用证C、即期付款信用证D、附有电资条款的信用证正确答案:C8、跟单托收中,银行办理了出口押汇,风险在于( )。

A、托收行B、委托人C、付款人D、代收行正确答案:B9、承兑是( ) 对远期汇票表示承担到期付款责任的行为。

A、持票人B、收款人C、受益人D、受票人正确答案:A10、对于受益人来说.下列种类信用证中( )最为有利。

A、不可撤销承兑B、不可撤销远期付款C、不可撤销议付D、不可撤销即期付款正确答案:D11、当中央银行要紧缩银根时,将( )票据的再贴现率。

A、提高B、降低正确答案:A12、即期付款信用证项下,可以用来取代汇票的是( )。

A、海运提单B、商业发票C、保险单D、商品检验单正确答案:B13、在下列“可撤销信用证的描述中错误的是( )。

国际结算业务习题库及参考答案

国际结算业务习题库及参考答案一、单选题(共30题,每题1分,共30分)1、报送小额批量跨境收入信息时,单笔()万元(含)以下的企业可按企业主体和境外付款人国别地区合并报送,也可逐笔报送。

A、20B、10C、100D、50正确答案:D2、下列不属于“展业三原则”的是A、了解客户B、尽职审查C、了解规定D、了解业务正确答案:C3、境内企业可根据实际需要就一笔境外人民币借款开立( )人民币专用存款账户A、1个B、多个C、2个正确答案:B4、根据我行即期结售汇操作规定,总分行系统的即期询价操作界面的价差指()A、客户成交汇率与市价的点差B、市价与分行成本汇率的点差C、基准价与客户成交汇率的点差D、客户成交汇率与分行成本汇率的点差正确答案:D5、办理国内信用证业务时,所提交的发票其日期原则上不得早于信用证开立前()。

A、两个月B、半年C、三个月D、一个月正确答案:C6、申报主体采取网络申报方式进行申报的,若忘记外汇管理局应用服务平台密码,我行应如何处理A、我行联系外汇管理局应用服务平台系统开发机构为申报主体进行重置B、我行在外汇管理局应用服务平台银行端为申报主体进行重置C、通知申报主体去所属外汇管理局进行重置D、我行直接联系当地外汇管理局为申报主体进行重置正确答案:B7、外商投资企业采用支付结汇制办理资本金结汇后的人民币资金应转入(),企业通过网银或通过柜面(转账支票或电汇单等)进行人民币资金划转。

A、人民币临时存款账户B、人民币专用账户C、人民币一般户或基本户D、结汇待支付账户正确答案:C8、外商投资企业资本金账户经银行办理货币出资入账登记后的外汇资本金可根据企业的实际经营需要在银行办理结汇,这种方式称为()。

A、结汇制B、意愿结汇制C、任一方式D、支付结汇制正确答案:B9、支行在为申请人办理购房结汇时,应当严格按照《关于规范房地产市场外汇管理有关问题的通知》(汇发[2006]47 号)审核境外机构和个人提交的申请材料,对于符合规定的,银行在为申请人办理购房结汇手续后,将结汇资金直接划入()人民币账户。

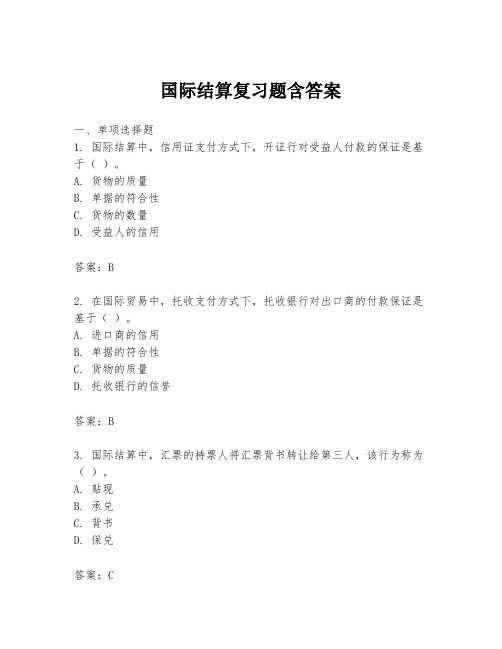

国际结算复习题含答案

国际结算复习题含答案一、单项选择题1. 国际结算中,信用证支付方式下,开证行对受益人付款的保证是基于()。

A. 货物的质量B. 单据的符合性C. 货物的数量D. 受益人的信用答案:B2. 在国际贸易中,托收支付方式下,托收银行对出口商的付款保证是基于()。

A. 进口商的信用B. 单据的符合性C. 货物的质量D. 托收银行的信誉答案:B3. 国际结算中,汇票的持票人将汇票背书转让给第三人,该行为称为()。

A. 贴现B. 承兑C. 背书D. 保兑答案:C4. 信用证结算方式下,受益人提交的单据必须符合()。

A. 开证行的要求B. 出口商的要求C. 进口商的要求D. 国际商会的规定答案:A5. 国际结算中,银行保函是银行对()的一种保证。

A. 货物的质量B. 单据的符合性C. 交易双方的信用D. 交易双方的履约答案:D二、多项选择题1. 国际结算中,以下哪些属于支付方式?()A. 信用证B. 托收C. 汇款D. 保函答案:ABCD2. 国际结算中,以下哪些因素会影响汇票的贴现?()A. 汇票的面额B. 贴现率C. 汇票的到期日D. 贴现银行的信誉答案:ABC3. 国际结算中,以下哪些属于信用证的特点?()A. 银行信用B. 单据交易C. 独立性原则D. 无条件付款承诺答案:ABCD三、判断题1. 信用证结算方式下,只要单据符合信用证条款,开证行必须无条件付款。

()答案:正确2. 托收结算方式下,托收银行对出口商的付款没有保证。

()答案:正确3. 汇票的贴现是指持票人将未到期的汇票转让给银行,银行扣除贴现利息后支付给持票人。

()答案:正确四、简答题1. 简述国际结算中信用证结算方式的主要特点。

答案:信用证结算方式的主要特点包括银行信用、单据交易、独立性原则和无条件付款承诺。

在信用证结算方式下,开证行对受益人付款的保证是基于单据的符合性,而不是货物的质量或数量,也不是受益人的信用。

2. 描述国际结算中托收结算方式的基本流程。

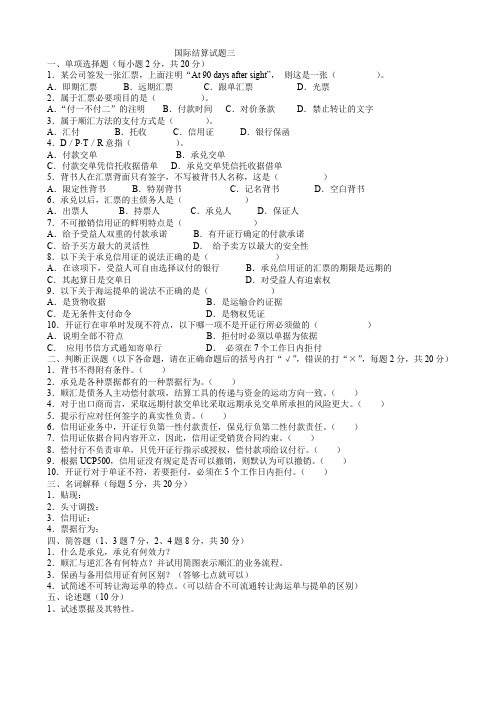

(完整word版)国际结算试题及答案

国际结算试题三一、单项选择题(每小题2分,共20分)1.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()。

A.即期汇票B.远期汇票C.跟单汇票D.光票2.属于汇票必要项目的是()。

A.“付一不付二”的注明B.付款时间C.对价条款D.禁止转让的文字3.属于顺汇方法的支付方式是()。

A.汇付B.托收C.信用证D.银行保函4.D/P·T/R意指()。

A.付款交单B.承兑交单C.付款交单凭信托收据借单D.承兑交单凭信托收据借单5.背书人在汇票背面只有签字,不写被背书人名称,这是()A.限定性背书B.特别背书C.记名背书D.空白背书6.承兑以后,汇票的主债务人是()A.出票人B.持票人C.承兑人D.保证人7.不可撤销信用证的鲜明特点是()A.给予受益人双重的付款承诺B.有开证行确定的付款承诺C.给予买方最大的灵活性D.给予卖方以最大的安全性8.以下关于承兑信用证的说法正确的是()A.在该项下,受益人可自由选择议付的银行B.承兑信用证的汇票的期限是远期的C.其起算日是交单日D.对受益人有追索权9.以下关于海运提单的说法不正确的是()A.是货物收据B.是运输合约证据C.是无条件支付命令D.是物权凭证10.开证行在审单时发现不符点,以下哪一项不是开证行所必须做的()A.说明全部不符点B.拒付时必须以单据为依据C.应用书信方式通知寄单行D.必须在7个工作日内拒付二、判断正误题(以下各命题,请在正确命题后的括号内打“√”,错误的打“×”,每题2分,共20分)1.背书不得附有条件。

()2.承兑是各种票据都有的一种票据行为。

()3.顺汇是债务人主动偿付款项,结算工具的传递与资金的运动方向一致。

()4.对于出口商而言,采取远期付款交单比采取远期承兑交单所承担的风险更大。

()5.提示行应对任何签字的真实性负责。

()6.信用证业务中,开证行负第一性付款责任,保兑行负第二性付款责任。

国际结算单项选择题

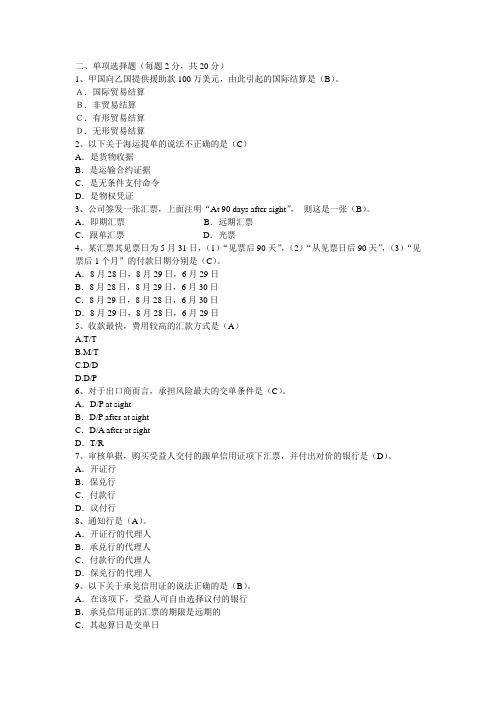

二、单项选择题(每题2分,共20分)1、甲国向乙国提供援助款100万美元,由此引起的国际结算是(B)。

A.国际贸易结算B.非贸易结算C.有形贸易结算D.无形贸易结算2、以下关于海运提单的说法不正确的是(C)A.是货物收据B.是运输合约证据C.是无条件支付命令D.是物权凭证3、公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张(B)。

A.即期汇票B.远期汇票C.跟单汇票D.光票4、某汇票其见票日为5月31日,(1)“见票后90天”,(2)“从见票日后90天”,(3)“见票后1个月”的付款日期分别是(C)。

A.8月28日,8月29日,6月29日B.8月28日,8月29日,6月30日C.8月29日,8月28日,6月30日D.8月29日,8月28日,6月29日5、收款最快,费用较高的汇款方式是(A)A.T/TB.M/TC.D/DD.D/P6、对于出口商而言,承担风险最大的交单条件是(C)。

A.D/P at sightB.D/P after at sightC.D/A after at sightD.T/R7、审核单据,购买受益人交付的跟单信用证项下汇票,并付出对价的银行是(D)。

A.开证行B.保兑行C.付款行D.议付行8、通知行是(A)。

A.开证行的代理人B.承兑行的代理人C.付款行的代理人D.保兑行的代理人9、以下关于承兑信用证的说法正确的是(B)。

A.在该项下,受益人可自由选择议付的银行B.承兑信用证的汇票的期限是远期的C.其起算日是交单日D.对受益人有追索权10、一份信用证如果未注明是否可以撤销,则是(B)的。

A.可以撤销的B.不可撤销的C.由开证行说了算D.由申请人说了算1.T/T、M/T和D/D的中文含义分别为()。

A.信汇、票汇、电汇 B.电汇、票汇、信汇C.电汇、信汇、票汇 D.票汇、信汇、电汇2.以下哪种信用证对受益人有追索权()A.延期信用证 B.议付信用证C.承兑信用证 D.即期信用证3.与信用证方式相比,国际保理业务的独有的特点是()。

国际结算试题及答案

国际结算试题及答案一、单项选择题(每题2分,共20分)1. 国际结算中,信用证是一种______。

A. 付款承诺B. 付款保证C. 收款承诺D. 收款保证答案:B2. 汇票的付款人是______。

A. 出票人B. 收款人C. 承兑人D. 付款人答案:C3. 托收结算方式中,D/P是指______。

A. 付款交单B. 承兑交单C. 付款承兑D. 承兑付款答案:A4. 在国际贸易中,L/C是指______。

A. 信用证B. 托收C. 汇款D. 保函答案:A5. 出口商在收到信用证后,应进行的第一步操作是______。

A. 准备货物B. 审核信用证C. 装运货物D. 申请出口许可证答案:B6. 信用证结算方式下,受益人提交的单据不符合信用证条款,银行将______。

A. 直接付款B. 拒绝付款C. 延迟付款D. 部分付款答案:B7. 汇款结算方式中,T/T是指______。

A. 电汇B. 信汇C. 票汇D. 托收答案:A8. 保函是一种______。

A. 付款承诺B. 收款承诺C. 付款保证D. 收款保证答案:C9. 在国际贸易中,出口商通常使用______来降低信用风险。

A. 信用证B. 汇款C. 托收D. 保函答案:A10. 信用证结算方式下,如果信用证过期,受益人将______。

A. 无法使用信用证B. 可以延期使用C. 可以修改条款D. 可以继续使用答案:A二、多项选择题(每题3分,共15分)1. 以下哪些属于国际结算方式?A. 信用证B. 汇款C. 托收D. 保函答案:ABCD2. 信用证结算方式下,受益人提交的单据符合信用证条款,银行将______。

A. 直接付款B. 拒绝付款C. 延迟付款D. 部分付款答案:A3. 汇款结算方式中,以下哪些属于汇款方式?A. T/TB. M/TC. D/DD. D/A答案:AB4. 以下哪些因素会影响国际结算方式的选择?A. 交易双方的信用状况B. 交易金额的大小C. 交易双方的关系D. 交易的货物类型答案:ABCD5. 托收结算方式中,以下哪些属于托收方式?A. D/PB. D/AC. C.O.DD. D/O答案:AB三、判断题(每题1分,共10分)1. 信用证是一种无条件的付款承诺。

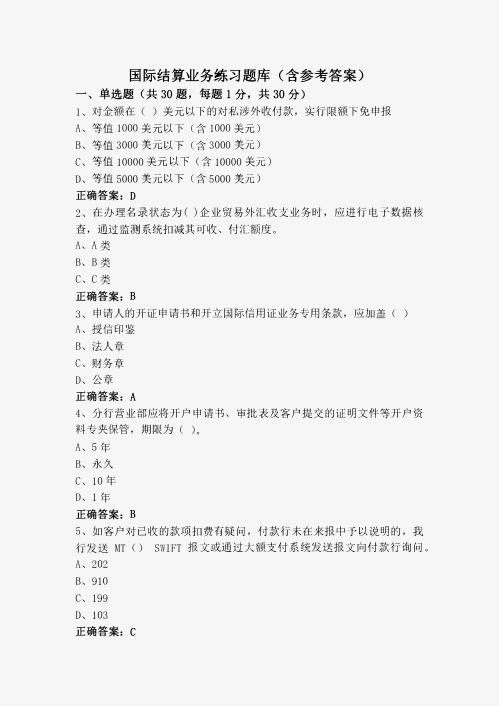

国际结算业务练习题库(含参考答案)

国际结算业务练习题库(含参考答案)一、单选题(共30题,每题1分,共30分)l、对金额在()美元以下的对私涉外收付款,实行限额下免申报A、等值1000美元以下(含1000美元)B、等值3000美元以下(含3000美元)C、等值10000美元以下(含10000美元)D、等值5000美元以下(含5000美元)正确答案: D2、在办理名录状态为()企业贸易外汇收支业务时,应进行电子数据核查,通过监测系统扣减其可收、付汇额度。

A、A类B、B类C、C类正确答案: B3、申请人的开证申请书和开立国际信用证业务专用条款,应加盖()A、授信印鉴B、法人章C、财务章D、公章正确答案: A4、分行营业部应将开户申请书、审批表及客户提交的证明文件等开户资料专夹保管,期限为()。

A、5年B、永久C、10年D、1年正确答案: B5、如客户对已收的款项扣费有疑问,付款行未在来报中予以说明的,我行发送MT()SWIFT报文或通过大额支付系统发送报文向付款行询问。

A、202B、910C、199D、103正确答案: C6、美元非存款质押贷业务,同一客户及其关联集团在我行开立的账户中有美元存款,则美元贷款利率()我行给予同一客户及其关联集团的美元存款利率。

A、不得低千B、等于C、不得高千正确答案: A7、外商投资企业需提供结汇后人民币资金用途证明文件方可办理资本金结汇,称为()。

A、意愿结汇制B、结汇制C、任一方式D、支付结汇制正确答案: D8、根据我行代客即期结售汇业务管理办法,我行对分支行开办结售汇业务实行()A、备案制B、核准制C、审批制正确答案: C9、人民币汇出汇款报文如为SW I F T报文,主管在国业系统授权报文至SWIFT系统,并在SWIFT系统进行报文授权发送后,相关经办人员应及时确认报文状态为"()"。

A、ACKB、NACKC、已清算D、未清算正确答案: A10、2015年6月1日起,企业直接投资项下外汇登记应由()为其办理。

国际结算选择题(附答案)140题.doc

Introduction1.To the exporter, the fastest and safest method of settlement is ( B )A.letter of creditB. cash in advanceC. open accountD. banker's draft2.To the importer, the most favorable method of settlement is ( C )A.letter of creditB. cash in advanceC. open accountD. collection3.Which of the following payment method is based on commercial credit?( C )A.letter of creditB.banker's letter of guaranteeC. collectionD. standby credit4.An exporter sells goods to a customer abroad on FOB and on CIF terms, who is responsible for the freight charges in each? (A )A.importer; exporterB. exporter; importerC. importer; importerD. exporter; exporter5.International cash settlement has the following disadvantages except ( B )A.expensiveB. safeC. riskyD. time-consuming6.CHIPS is the electronic clearing system for ( B )A.GBPB. USDYD. EUR7.CHAPS is the electronic clearing system for (A )A.GBPB. USDYD. EUR8.From a Chinese bank's point of view , the current account it maintains abroad is known as ( A )A.a nostro accountB. a vostro accountC. a current accountD.a home currency account9.From a Chinese bank's point of view , the current account maintained by a foreign bank with him is known as (B )A. a nostro accountB.a vostro accountC.a current accountD.a foreign currency account10.International trade settlement methods are used to complete the money transfer aroused by (A)A.goods transactionsB. services supplyC. current transfersD. investment incomes11.Documentary credit business is subject to ( A )A.UCP600B.URC522C. URDG758D. ISP9812.Collection business is subject to ( B )A. UCP600B.URC522C. URDG758D. ISP9813.Standby credit business is subject to ( D )A. UCP600B.URC522C. URDG758D. ISP9814.Letter of guarantee business is subject to ( C )A. UCP600B.URC522C. URDG758D. ISP9815.London is the clearing centre for ( B )A. USDB. GBPC.EURD.HKD16.New York is the clearing centre for (A )A. USDB. GBPC.EURD.HKD17.Tokyo is the clearing centre for ( D )A. USDB. GBPC.EURD.JPY18.Frankfurt is the clearing centre for ( C )A. USDB. GBPC.EURD.HKD19.There are totally ten categories of message types in SWIFT system, among which ( A) are used only to deal with remittance business.A.category 1B. category 2C. category 4D. category 720- There are totally ten categories of message types in SWIFT system, among which ( C ) are used only to deal with collection business.A.category 1B. category 2C. category 4D. category 721.There are totally ten categories of message types in SWIFT system, among which ( D ) are used to deal with letter of credit business.A.category 1B. category 3C. category 4D. category 722.BOJ-NET is the electronic clearing system for ( D )DB. GBPC.EURD.JPY23.TARGET is the electronic clearing system for ( C )DB. GBPC.EURD.JPY24.CHATS is the electronic clearing system for ( D )DB. GBPC.EURD.HKD25.Among the following documents, the one which is not regarded as control documents is ( D )A. authorized signaturesB. test keysC. schedule of terms and conditionsD. correspondent arrangement26.The seller should arrange for the insurance of the goods transportation under ( C )A.FOBB.CFRC.CIFD.EXWNegotiable instruments27.A cheque must be signed by ( A )A.the drawer B the drawee C. the payer D. the payee28.If a cheque dated l s, Feb. 2007 was presented on ( D ) , it would be post-dated.A. 1st Mar. 2007B. 2nd May 2007C. l sl Feb. 2008D. 5lh Jan.200729.( A ) cheque can be cashed over the counter of paying bank.A. An openB. A crossedC. A general crossingD. A special crossing30.The effect of a blank endorsement is to make the cheque payable to the ( C )A. specified person B, order of a specified person C. bearer D. named person31.The role of the ( A ) bank is to debit the cheque to the customer's account.A. paying B, collecting C. advising D. confirming32.If the bill is pay able "60 days after date”,the date of payment is decided according to ( C )A. the date of acceptanceB. the date of presentationC. the date of issuanceD. the date of maturity33.A ( B ) carries comparatively little risks and can be discounted at the finest rate of interest.A. sight billB. bank billC. time billD. commercial bill34.A term bill may be accepted by the ( B )A. drawerB. draweeC. holderD. payee35.The party to whom the bill is addressed is called the ( B )A. drawerB. draweeC. holderD. payee36.When financing is without recourse, this means that the bank has no recourse to the ( D ) if such drafts are dishonored.A.payerB. draweeC. acceptorD. drawer37.The ( C ) of a promissory note assumes the prime liability to make payment of the note.A.holderB. draweeC. makerD. acceptor38.The bill which must be presented for acceptance is ( B )A.the bill payable at xx days after dateB. the bill payable xx days after sightC. the bill payable on a fixed dateD. the bill payable at sight39.In order to retain the liabilities of the other parties, a bill that has been dishonored must be (A )A. protestedB. given to the acceptorC. retained in the filesD. presented to a bank40.( C ) is not a holder of a billA. PayeeB. EndorseeC. DrawerD. Bearer41.Which of the following is a relative essential item of a bill ? ( B )A. amountB. tenorC. payeeD. drawee42.An endorsement,which prohibits the further negotiation of the instrument ,is called ( D ) endorsement.A. qualifiedB. generalC. specificD. restrictive43.A check is a ( D ) draft drawn on a bankA. timeanceC. directD. demand44.An acceptance with " payable on delivery of bill of lading” on the draft is ( D )A.general acceptanceB.partial acceptanceC.non-acceptanceD.qualified acceptance45.The ( B ) of the draft is the person who is instructed to make the payment.A. drawerB. draweeC. payerD. payee46.The act which is never involved in promissory note business is ( C )A.endorsementB.dishonorC.acceptanceD.presentation47.The act which is never involved in check business is ( C )A.endorsementB.dishonorC.acceptanceD.presentation48.The draft with the tenor written as ( B ) must be presented for acceptance.A.payable at sightB. payable at 30days after sightC. payable at 30 days after dateD. payable at 30 days after shipment date49.The endorsement which has no intention to transfer the ownership of the instrument is ( D )A. blank endorsementB. special endorsementC. conditional endorsementD. endorsement for collection50.Among the following persons, the one who has the right to endorse negotiable instruments is(D)A. drawerB. draweeC. endorserD. holder51.The person who has the right of recourse is the ( C )of the negotiable instruments.A. drawerB. draweeC. holderD. acceptor52.The acceptor of a bill is the person who originally named as ( B ) of the bill.A. drawerB. draweeC.payeeD.endorser53.The first endorser of a bill is the ( C ) of the billA. drawerB. draweeC.payeeD.acceptor54.The first holder of a bill is the ( C ) of the billA. drawerB. draweeC.payeeD.acceptor55.Among the following crossed cheques, the one which contains the words ( D ) is a special crossed cheque.A. bankerB. not negotiableC. A/C payeeD. Bank of ChinaRemittance56.The means of authenticating payment order in mail transfer is the ( D )A. SWIFT authentic keyB. schedule of terms and conditionsC. test keyD. authorized signatures57.The means of authenticating payment order in telegraphic transfer is the ( C )A. correspondent arrangementB. schedule of terms and conditionsC. test keyD. authorized signatures58.Which of the following is not a method of remittance? ( C )A. M/TB.T/TC. T/RD. D/D59.Open account as a payment method is usually used when ( D )A.goods are sold under the seller's market conditionB.goods are badly needed by the buyerC.goods are of special standards or special specificationsD.goods are sold under the buyer's market condition60.In remittance business ,the remitting bank may send the payment order to the paying bank through SWIFT by (A )A. MT 103B.MT202C. MT400D.MT70061.If the reimbursement instruction written on the payment order is expressed as 'in cover , we have credited your A/C with us', the A/C relationship between the remitting bank and the paying bank must be( A )A.the paying bank maintains an A/C with remitting bankB.the remitting bank maintains an A/C with paying bankC.both remitting bank and paying bank maintain their A/Cs with a third bankD.remitting bank and paying bank have their A/Cs with two different banks62.If the reimbursement instruction written on the payment order is expressed as 'in cover, please debit our A/C with you', the A/C relationship between the remitting bank and the paying bank must be( B )A.the paying bank maintains an A/C with remitting bankB.the remitting bank maintains an A/C with paying bankC.both remitting bank and paying bank maintain their A/Cs with a third bankD.remitting bank and paying bank have their A/Cs with two different banks63.If the reimbursement instruction written on the payment order is expressed as "in cover, we have authorized Bank A to debit our A/C and credit your A/C with them\ the A/C relationship between the remitting bank and the paying bank must be( C )A.the paying bank maintains an A/C with remitting bankB.the remitting bank maintains an A/C with paying bankC.both remitting bank and paying bank maintain their A/Cs with a third bankD.remitting bank and paying bank have their A/Cs with two different banks64.If the reimbursement instruction written on the payment order is expressed as 'in cover, we have instructed Bank X to transfer the proceeds to your A/C with bank Y', the A/C relationship between the remitting bank and the paying bank must be ( D )A.the paying bank maintains an A/C with remitting bankB.the remitting bank maintains an A/C with paying bankC.both remitting bank and paying bank maintain their A/Cs with a third bankD.remitting bank and paying bank have their A/Cs with two different banks65.In remittance business, if the paying bank maintains an A/C with remitting bank, the reimbursement instruction should be given as ( A )A.in cover, we have credited your A/C with usB.in cover, please debit our A/C with youC.in cover , we have authorized xxx bank to debit our A/C and credit your A/C with themD.in cover , we have instructed A bank to pay the proceeds to your A/C with B bank66.In remittance business, if the remitting bank maintains an A/C with paying bank, the reimbursement instruction should be given as ( B )A.in cover, we have credited your A/C with usB.in cover , please debit our A/C with youC.in cover , we have authorized xxx bank to debit our A/C and credit your A/C with themD.in cover, we have instructed A bank to pay the proceeds to your A/C with B bank67.In remittance business, if both remitting bank and paying bank maintain their A/Cs with a third bank, the reimbursement instruction should be given as ( C )A.in cover , we have credited your A/C with usB.in cover , please debit our A/C with youC.in cover , we have authorized xxx bank to debit our A/C and credit your A/C with themD.in cover, we have instructed A bank to pay the proceeds to your A/C with B bank68.In remittance business, if remitting bank and paying bank have their A/Cs with two different banks, the reimbursement instruction should be given as ( D )A.in cover , we have credited your A/C with usB.in cover , please debit our A/C with youC.in cover , we have authorized xxx bank to debit our A/C and credit your A/C with themD.in cover, we have instructed A bank to pay the proceeds to your A/C with B bankCollection69.It will be more convenient if the collecting bank appointed by the seller ( B )A.is a large bankB.is the remitting bank's correspondent in the place of the importerC.is in the exporter's countryD.acts on the importer's instructions70.Under D/R the documents will not be delivered to the buyer until ( D )A.the goods have arrivedB.the documents have arrivedC.the documents are presented to the buyerD.the bill is paid by the buyer71.Under D/A, the documents will not be delivered to the buyer until ( D )A.the goods have arrivedB.the documents have arrivedC.the documents are presented to the buyerD.the bill is accepted by the buyer72.In collection business, dedailed instructions must be sent to the collecting bank ( B )A. in the application formB in the collection orderC.in the documentsD.in the sales contract73.In collection business, dedailed instructions must be given to the remitting bank ( A )A. in the application formB in the collection orderC.in the documentsD.in the sales contract74.In collection business, banks are obligated to verify the documents received to see that ( C )A.they are authenticB.they are regularC.they are the same as those listed in the collection instructionD.they are in the right form75.The collecting bank will make a protest only when ( C )A.the documents are rejectedB.the case of need is nominatedC.instruction to protest is given by the collection orderD.protective measures in respect of the goods are taken.76.AH the parties to a collection are bound by ( C ) if the collection is subject to it.A. UCP500B.UCP600C. URC522D.URDG75877.A bill of exchange which is accompanied by shipping documents is known as ( B )A.a clean billB.a documentary billC.a clean collectionD.a documentary collection78.In documentary collection, after the goods have been shipped, the exporter presents the documents to ( B ) for collectionA.the collecting bankB.the reimbursing bankC.the remitting bankD.the opening bank79.The instructions for collection are mainly ( D )A.given in the S/CB.written on the bill of exchangeC.given by the importerD.given by the exporter80.Which type of collection offers the greatest security to the exporter? ( B )A.documents against acceptance collectionB.documents against payment collectionC.clean collectionD.documentaiy collection81.Which of the following is not the obligation of the remitting bank? ( D )A.to complete a collection order strictly according to the principaPs instructions.B.to perform following all the instructions given by the principal.C.to keep the documents wellD.to examine the contents of documents in detail82.Which of the following is not the obligation of the collecting bank? ( B )A.to verify the authenticity of the collection orderB.to take care of goodsC.to release documents strictly on the delivery terms of documents.D.to perform following all the instructions given by the remitting bank.83.Case of need in collection business is the representative of ( A )A.the principalB.the remitting bankC.the collecting bankD.the drawee84.In collection business, the drawer of the draft for collection is ( A )A. sellerB. buyerC. remitting bankD. collecting bank85.In collection business, the drawee of the draft for collection is ( B )A. sellerB. buyerC. remitting bankD. collecting bank86.If the collection instruction given by the principal specifies that collection charges are to be borne by the drawee but with no express statement that they may be waived , charges will be for the account of ( A ) providing the drawee refuses to pay them.A. principalB. remitting bankC. collecting bankD. presenting bank87.The advice of payment sent by the collecting bank to remitting bank through SWIFT takes the form as ( A )A. MT400B.MT410C.MT412D.MT41688.The advice of acceptance sent by the collecting bank to remitting bank through SWIFT takes the form as ( C )A. MT400B. MT410C.MT412D.MT41689.The advice of dishonor sent by the collecting bank to remitting bank through SWIFT takes the form as ( D )A. MT400B.MT410C.MT412D.MT41690.The price term which is more favorable to the seller under collection is ( D )A. EXWB.FOBC. CFRD. CIFLetter of credit91.In L/C business , the exporter can receive the payment only when CA.he has shipped the goodsB.he has presented the documentsC.the documents presented constitute a complying presentationD.the importer has taken delivery of the goods.92.The issuing bank can refuse to pay the credit amount when CA.the applicant prevents him from making paymentB.the goods are not the same as those stipulated in the sales contractC.one kind of document required by L/C isn't presented.D.balance of the applicant/s account is not enough for payment.93.Of the following kinds of L/C , —B is the L/C which require no drafts at all.A.sight payment creditB.deferred payment creditC.acceptance credit□.negotiation credit94.Of the following kinds of L/C , ( C ) is the L/C in which drafts are always required.A.sight payment creditB.deferred payment creditC.acceptance creditD.negotiation credit95.Of the following kinds of L/C,D is the L/C which is especially suitablefor use to settle the payment of trade conducted through a middleman.A.non-transferable creditB.reciprocal creditC.revolving creditD.back to back credit96.Of the following kinds of L/C,A is the L/C which is especially suitable foruse to settle the payment of trade conducted through a middleman.A.transferable creditB.reciprocal creditC.revolving creditD.confirmed credit97 Of the following kinds of L/C,C is the L/C which is especially suitable foruse to settle the payment under a long tern contract covering goods to be transported by regular partial shipments.A.non-transferable creditB.reciprocal creditC.revolving creditD.back to back credit98.Of the following kinds of L/C,B is the L/C which is especially suitable foruse to settle the payment under barter transaction.A.non-transferable creditB.reciprocal creditC.revolving creditD.back to back credit99.Confirmation of a credit may be given by BA.the beneficiary at the request of the importerB.the advising bank at the request of the issuing bankC.the advising bank after the receipt of correct documentationD.the issuing bank after the receipt of coiTect documentation100.The credit may only be confirmed if it is so authorized or requested by (A )A.the issuing bankB.the supplierC.the advising bankD.the beneficiary101.The beneficiary of a transferred credit is ( C )A.the negotiating bankB.the middlemanC.the actual supplierD.the beneficiary of the transferable credit102.The second beneficiary of a transferable letter of credit is the ( D )A.middlemanB.transferring bankC.the applicant of the transferred creditD.real supplier of the goods103.The first beneficiary of a transferable letter of credit is the ( A )A.middlemanB.transferring bankC.the applicant of the transferred creditD.real supplier of the goods104.The sum of the transferred credit will normally be ( B )A.the same as in the credit before transferB.less than in the credit before transferC.more than in the credit before transferD.equal to the original credit105.The terms and conditions of the transferred credit can be different from the original credit in the following aspects, with the exception of( C ).A.the amount of the creditB.any unit price stated in the creditC.any quantity stated in the creditD.the expiry date, the period for presentation, or the latest shipment date106.Under the anticipatory credit,on which party does the final responsibility lie for reimbursement if the terms and conditions are not fulfilled by the beneficiary? ( D )A.the issuing bankB.the advising bankC.the beneficiaryD.the applicant107.The red clause credit is often used as a method of ( B )A.providing the buyer with funds prior to shipmentB.providing the seller with funds prior to shipmentC.providing the buyer with funds after shipmentD.providing the seller with funds after shipment108.An applicant must reimburse an issuing bank unless he finds that ( D )A.goods are defectiveB.goods are not as ordered in the sales contractC.documents received do not allow him to clear the goods through customsD.documents do not conform on the face to the terms and conditions of the credit109.Application for any amendment to a letter of credit should be given to the issuing bank by (A)A.the applicantB.the beneficiaryC.the advising bankD.the nominated bank110.In L/C business, documents are presented to ( D ) by the beneficiaryA.the advising bankB.the issuing bankC.the reimbursing bankD.the nominated bank111.If discrepancies found are serious, the following ways can be used by the negotiating bank to deal with them except ( A )A.To honor the docs as usualB.To return the docs to beneficiary for amendmentC.To honor the docs against indemnity guarantee of the beneficiaryD.To cable the discrepancies to issuing bank for authorization of honor112.According to the mode of availability L/C can be classified as ( C )A.clean L/C and documentary L/CB.confirmed L/C and unconfirmed L/CC.sight payment L/C, acceptance L/C .deferred payment L/C and negotiation L/CD.transferable L/C and non-transferable L/C113.Among all the financial methods mentioned bellow , which method provides funds without recourse ? CA.packing loansB.bill discountingC.forfeitingD.borrowing docs against T/R114.Under letter of credit, the primary debtor is the( C )A.applicantB. importerC. issuing bankD. nominated bank115.The applicant of letter of credit is ( B )A.the exporterB. the importerC. the exporter's bankD. the importer's bank 116.The beneficiary of letter of credit is ( A )A.the exporterB. the importerC. the exporter's bankD. the importer's bank 117.A letter of credit which is expired on Oct. 1, 2008 specifies that u documents must be presented within 15da ys after the on board date of bill of lading”. If the on board date of bill of lading is Sep. 10,2008, the latest date of presentation must be (B )A.Sep. 24 ,2008B. Sep. 25 ,2008C. Sep. 26 ,2008D. Oct. 1, 2008118.A letter of credit which is expired on Oct. 1, 2008 specifies that u documents must be presented within 15days after the on board date of bill of lading”. If the on board date of bill of lading is Sep. 25,2008, the latest date of presentation must be (D )A.Sep. 24 ,2008B. Sep. 25 ,2008C. Sep. 26 ,2008D. Oct. 1, 2008119.The message type which is used to issue letter of credit through SWIFT is numbered ( A)A.700B.705C. 707D.710120.The message type which is used to send a amendment to a documentary credit through SWIFT is numbered ( C )A.700B.705C. 707D.710121.Which of the following actions performed by the nominated bank is not regard as the action of honor( D )A.to pay at sight under sight payment creditB.to incur a deferred payment undertaking and pay at maturity under deferred payment creditC.to accept the draft and pay at maturity under acceptance creditD.to negotiate under negotiation creditplying presentation under letter of credit means a presentation that is in accordance with the terms and conditions of credit, the applicable rules of UCP and provisions of ( B )A. ISP98B. ISBP681C. ICC Publication No.522D.ICC Publication No. 758123.Among the following items, the one which is not required to be included in a drawn clause of a draft under letter of credit is ( A )A. the S/C NoB. the L/C NoC. the name of issuing bankD. the issuing date of the credit124.Among the following banks , the one who has no obligation to examine documents under letter of credit is ( C )A. the issuing bankB. the confirming bankC. the reimbursing bankD. the nominated bank125.The expression H on or about11 or similar will be interpreted as a stipulation that an event is to occur during a period of ( B ) the specified date, both start and end dates included.A.three calendar days before until three calendar days afterB.five calendar days before until five calendar days afterC.seven calendar days before until seven calendar days afterD.eleven calendar days before until eleven calendar days after126.If letter of credit specifies the latest date of shipment is on or about May 10, then the actual shipping date should be within ( D ), both start and end dates included, A. May 6-15 B. May5-14 C. May6-14 D. May5—15127.If a bill which is drawn on Dec. 1,2008 specifies the tenor as payable at 30 days after date, the due date of the bill should be ( C )A. Dec. 29. 2008B. Dec.. 30,2008C. Dec. 31, 2008D. Jan. 1, 2008128.If a bill which is accepted on Nov. 1,2008 specifies the tenor as payable at 30 days after sight, the due date of the bill should be ( C )A. Nov. 29. 2008B. Nov. 30,2008C. Dec. 1, 2008D. Dec. 2, 2008Documents129.Short form B/L is considered to be ( A).A.document of titleB.additional documentC.non-negotiablemercial invoice130.Unless otherwise stipulated , banks will not accept ( D )A.direct B/LB.order B/LC.liner B/LD.received for shipment B/L131.Unless otherwise stipulated , banks will not accept ( D )A.direct B/LB.order B/LC.clean B/LD.charter party B/L132.Unless otherwise stipulated , banks will not accept ( D )A.direct B/LB.order B/LC.clean B/LD.on deck B/L133.Unless otherwise stipulated , banks will not accept ( C )A.direct B/LB.order B/LC.unclean B/LD.liner B/L134.If a credit calls for an insurance policy, banks will accept (A)A. an insurance policyB. an insurance certificateC. a or bD. both a and bmercial invoice must be made out in the name of ( B )A.the beneficiaryB.the applicantC.advising bankD.issuing bank136.A bill of lading doesn f t function as ( D )A. a contract of transportationB. a receipt of goodsC a certificate of title to the goods D・ an accounting document137.Freight to collect B/L is suitable for use under ( D )A. CFRB.CIFC.DDUD. FOB138.Freight prepaid B/L is suitable for use under ( A )A. CFRB.EXWC.FCAD. FOB139.The drawee of a draft drawn under letter of credit may be ( C )A. the beneficiaryB. the applicantC. the issuing bankD. the negotiating bank140.The drawer of a draft drawn under letter of credit may be ( A )A. the beneficiaryB. the applicantC. the issuing bankD. the negotiating bank。

自考国际结算试题集及答案

自考国际结算试题集及答案一、选择题1. 国际结算中的汇款方式主要包括哪几种?A. 电汇、信汇、票汇B. 电汇、信汇、托收C. 信汇、票汇、托收D. 电汇、票汇、托收答案:A2. 在国际结算中,信用证支付方式的主要优点是什么?A. 降低交易成本B. 提高交易安全性C. 简化交易流程D. 加快交易速度答案:B3. 托收结算方式中,出口商将货物运单据发送给进口商的方式是什么?A. 直接邮寄B. 通过托收银行C. 通过出口商银行D. 通过国际快递公司答案:B4. 根据《跟单信用证统一惯例》(UCP600),开证行在哪些情况下对单据的不符点免责?A. 单据与信用证条款不符B. 单据与货物描述不符C. 单据晚于货物到达D. 单据在运输途中丢失答案:A5. 在国际结算中,银行保函的主要作用是什么?A. 保证货物质量B. 保证交易双方履约C. 保证货物按时到达D. 保证交易价格合理答案:B二、简答题1. 简述国际结算中汇款、托收和信用证三种支付方式的主要区别。

答案:汇款是一种比较简便的国际结算方式,主要包括电汇、信汇和票汇三种形式。

托收则是出口商通过自己的银行将货物单据发送给进口商的银行,由进口商的银行代为收款。

信用证是一种由银行出具的支付承诺,保证在满足一定条件下支付货款,它为国际贸易提供了较高的安全性。

2. 信用证中“不可撤销信用证”和“可撤销信用证”有何不同?答案:不可撤销信用证是指一旦开出,除非得到所有相关方的同意,否则不能被修改或撤销的信用证。

而可撤销信用证则可以在开证行或信用证受益人的请求下被修改或撤销。

三、案例分析题某出口商A公司与进口商B公司签订了一份国际贸易合同,约定采用信用证方式支付。

合同规定,B公司应在合同签订后5个工作日内通过其银行开出以A公司为受益人的不可撤销信用证。

然而,B公司在合同规定的时间内未能开出信用证,导致A公司无法按时发货。

请问A公司应如何处理此事?答案:A公司首先应与B公司沟通,了解未能开出信用证的具体原因。

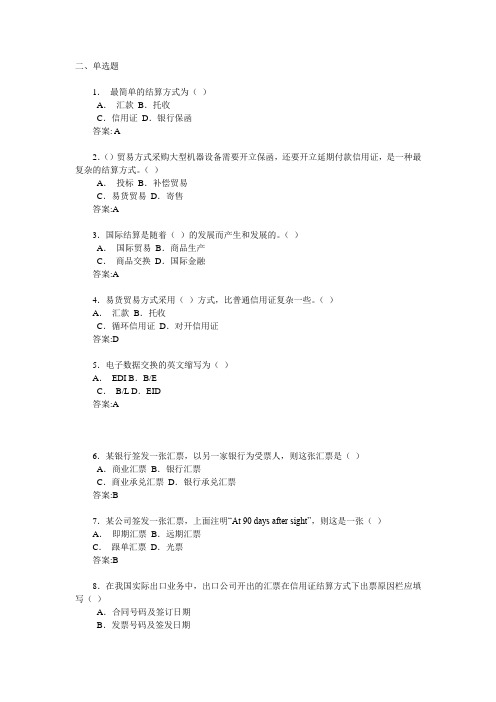

国际结算单选题大合集

二、单选题1.最简单的结算方式为()A.汇款B.托收C.信用证D.银行保函答案: A2.()贸易方式采购大型机器设备需要开立保函,还要开立延期付款信用证,是一种最复杂的结算方式。

()A.投标B.补偿贸易C.易货贸易D.寄售答案:A3.国际结算是随着()的发展而产生和发展的。

()A.国际贸易B.商品生产C.商品交换D.国际金融答案:A4.易货贸易方式采用()方式,比普通信用证复杂一些。

()A.汇款B.托收C.循环信用证D.对开信用证答案:D5.电子数据交换的英文缩写为()A.EDI B.B/EC.B/L D.EID答案:A6.某银行签发一张汇票,以另一家银行为受票人,则这张汇票是()A.商业汇票B.银行汇票C.商业承兑汇票D.银行承兑汇票答案:B7.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()A.即期汇票B.远期汇票C.跟单汇票D.光票答案:B8.在我国实际出口业务中,出口公司开出的汇票在信用证结算方式下出票原因栏应填写()A.合同号码及签订日期B.发票号码及签发日期C.提单号码及签发日期D.信用证号码及出证日答案:D9.在信用证结算方式下,汇票的受款人通常的抬头方式是()。

A.限制性抬头B.指示式抬头C.持票人抬头D.来人抬头答案:B10.在汇票的使用过程中,使汇票一切债务终止的环节是()A.提示B.承兑C.背书D.付款答案:D11.如果出票人想避免承担被追索的责任,也可以在汇票上加注()A.付一不付二B.见索即偿C.不受追索D.单到付款答案:C12.某支票签发人在银行的存款总额低于他所签发的支票票面金额,他签发的这种支票称()A.现金支票B.转帐支票C.旅行支票D.空头支票。

答案:D13.计算汇票付款具体时间时,必须包括()A.见票日B.出票日C.提单日D.付款日答案:D14.属于汇票必要项目的是()A.“付一不付二”的注明B.付款时间C.对价条款D.禁止转让的文字答案:B15.背书人在汇票背面只有签名,不写被背书人,这是()A.限定性背书B.特别背书C.记名背书D.空白背书答案:D16.承兑人对出票人的指示不加限制地同意确认,这是()A.一般承兑B.特别承兑C.普通承兑D.限制承兑答案:A17.持票人将汇票提交付款人的行为是()A.提示B.承兑C.背书D.退票答案:A18.What bills are negotiable? 什么票据是可以背书流通的?(C )A. Pay to John David onlyB. Pay to John David not transferableC. Pay to the order of ABC Co.D. Pay to bearer.答案:C19.按照英国《票据法》的规定,()持票人的权力优于前手,不受前手缺陷的影响。

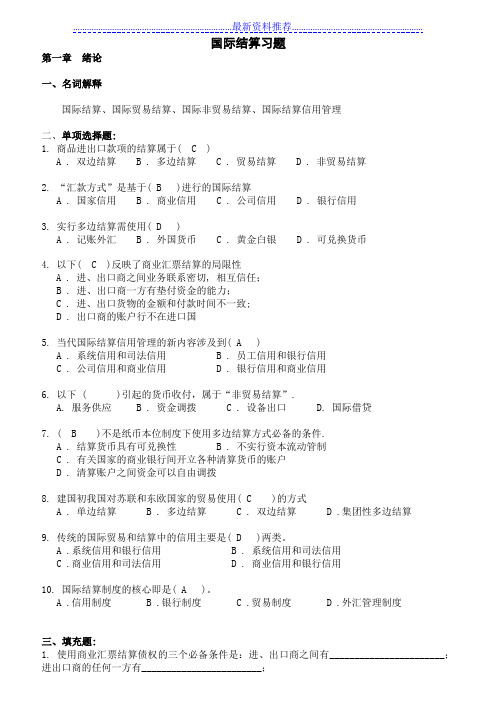

国际结算习题集及答案

……………………………………………………………最新资料推荐…………………………………………………国际结算习题第一章绪论一、名词解释国际结算、国际贸易结算、国际非贸易结算、国际结算信用管理二、单项选择题:1. 商品进出口款项的结算属于( C )A . 双边结算B . 多边结算C . 贸易结算D . 非贸易结算2. “汇款方式”是基于( B )进行的国际结算A . 国家信用B . 商业信用C . 公司信用D . 银行信用3. 实行多边结算需使用( D )A . 记账外汇B . 外国货币C . 黄金白银D . 可兑换货币4. 以下( C )反映了商业汇票结算的局限性A . 进、出口商之间业务联系密切, 相互信任;B . 进、出口商一方有垫付资金的能力;C . 进、出口货物的金额和付款时间不一致;D . 出口商的账户行不在进口国5. 当代国际结算信用管理的新内容涉及到( A )A . 系统信用和司法信用B . 员工信用和银行信用C . 公司信用和商业信用D . 银行信用和商业信用6. 以下 ( )引起的货币收付,属于“非贸易结算”.A. 服务供应 B . 资金调拨 C . 设备出口 D. 国际借贷7. ( B )不是纸币本位制度下使用多边结算方式必备的条件.A . 结算货币具有可兑换性B . 不实行资本流动管制C . 有关国家的商业银行间开立各种清算货币的账户D . 清算账户之间资金可以自由调拨8. 建国初我国对苏联和东欧国家的贸易使用( C )的方式A . 单边结算B . 多边结算C . 双边结算D .集团性多边结算9. 传统的国际贸易和结算中的信用主要是( D )两类。

A .系统信用和银行信用B . 系统信用和司法信用C .商业信用和司法信用D . 商业信用和银行信用10. 国际结算制度的核心即是( A )。

A .信用制度B .银行制度C .贸易制度D .外汇管理制度三、填充题:1. 使用商业汇票结算债权的三个必备条件是:进、出口商之间有_______________________;进出口商的任何一方有________________________;进出口货物的______________________________。

国际结算练习题库与答案

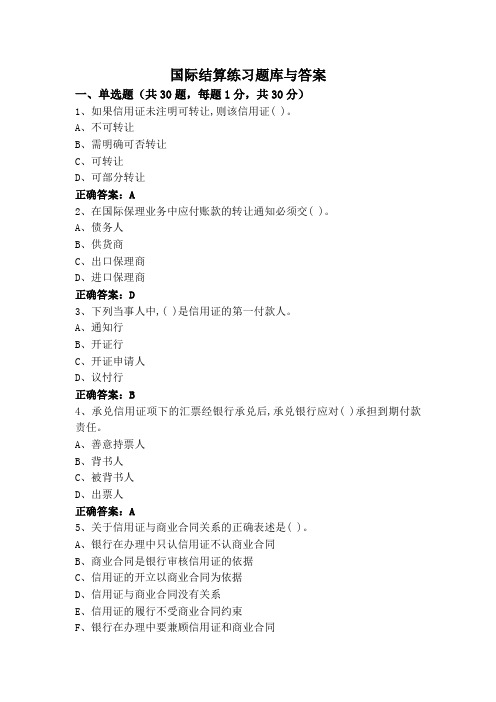

国际结算练习题库与答案一、单选题(共30题,每题1分,共30分)1、如果信用证未注明可转让,则该信用证( )。

A、不可转让B、需明确可否转让C、可转让D、可部分转让正确答案:A2、在国际保理业务中应付账款的转让通知必须交( )。

A、债务人B、供货商C、出口保理商D、进口保理商正确答案:D3、下列当事人中,( )是信用证的第一付款人。

A、通知行B、开证行C、开证申请人D、议忖行正确答案:B4、承兑信用证项下的汇票经银行承兑后,承兑银行应对( )承担到期付款责任。

A、善意持票人B、背书人C、被背书人D、出票人正确答案:A5、关于信用证与商业合同关系的正确表述是( )。

A、银行在办理中只认信用证不认商业合同B、商业合同是银行审核信用证的依据C、信用证的开立以商业合同为依据D、信用证与商业合同没有关系E、信用证的履行不受商业合同约束F、银行在办理中要兼顾信用证和商业合同正确答案:E6、凭信托收据所提取的货物.其所有权属干( )。

A、船公司B、进口商C、地委托人D、托收行正确答案:C7、出口商将信用证项下出口单据交其往来银行或信用证指定银行时可申请办理( )。

A、出口押汇B、进口押汇C、打包放款D、贴现正确答案:A8、若信用证本身未具体规定可否分批装运和可否转运,则受益人( )。

A、不得分批装运,也不能转运B、可以分批装运,也可以转运C、不得分批装运但可以转运D、可以分批装运,但不能转运正确答案:B9、在FOB贸易条件下运费应由( )承担。

A、开证行B、买方C、卖方D、船公司正确答案:B10、( )方式下,汇入行不负通知收款入到银行取款之式A、采汇B、电汇C、外信汇正确答案:A11、托收业务中,汇票的付款人应是( )。

A、进口方银行B、出口方银行C、进口商D、出口商正确答案:C12、( )未经受益人同意可以撤销。

A、可撤销信用证B、未保花的不可撤销信用证C、保兑的不可撤销信用证D、循环信用证正确答案:A13、某平年1月31日出具的汇票上写明“A t one month after date pay to…”,该汇票的到期日为当年( )。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

二、单选题1.最简单的结算方式为()A.汇款B.托收C.信用证D.银行保函答案: A2.()贸易方式采购大型机器设备需要开立保函,还要开立延期付款信用证,是一种最复杂的结算方式。

()A.投标B.补偿贸易C.易货贸易D.寄售答案:A3.国际结算是随着()的发展而产生和发展的。

()A.国际贸易B.商品生产C.商品交换D.国际金融答案:A4.易货贸易方式采用()方式,比普通信用证复杂一些。

()A.汇款B.托收C.循环信用证D.对开信用证答案:D5.电子数据交换的英文缩写为()A.EDI B.B/EC.B/L D.EID答案:A6.某银行签发一张汇票,以另一家银行为受票人,则这张汇票是()A.商业汇票B.银行汇票C.商业承兑汇票D.银行承兑汇票答案:B7.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()A.即期汇票B.远期汇票C.跟单汇票D.光票答案:B8.在我国实际出口业务中,出口公司开出的汇票在信用证结算方式下出票原因栏应填写()A.合同号码及签订日期B.发票号码及签发日期C.提单号码及签发日期D.信用证号码及出证日答案:D9.在信用证结算方式下,汇票的受款人通常的抬头方式是()。

A.限制性抬头B.指示式抬头C.持票人抬头D.来人抬头答案:B10.在汇票的使用过程中,使汇票一切债务终止的环节是()A.提示B.承兑C.背书D.付款答案:D11.如果出票人想避免承担被追索的责任,也可以在汇票上加注()A.付一不付二B.见索即偿C.不受追索D.单到付款答案:C12.某支票签发人在银行的存款总额低于他所签发的支票票面金额,他签发的这种支票称()A.现金支票B.转帐支票C.旅行支票D.空头支票。

答案:D13.计算汇票付款具体时间时,必须包括()A.见票日B.出票日C.提单日D.付款日答案:D14.属于汇票必要项目的是()A.“付一不付二”的注明B.付款时间C.对价条款D.禁止转让的文字答案:B15.背书人在汇票背面只有签名,不写被背书人,这是()A.限定性背书B.特别背书C.记名背书D.空白背书答案:D16.承兑人对出票人的指示不加限制地同意确认,这是()A.一般承兑B.特别承兑C.普通承兑D.限制承兑答案:A17.持票人将汇票提交付款人的行为是()A.提示B.承兑C.背书D.退票答案:A18.What bills are negotiable? 什么票据是可以背书流通的?(C )A. Pay to John David onlyB. Pay to John David not transferableC. Pay to the order of ABC Co.D. Pay to bearer.答案:C19.按照英国《票据法》的规定,()持票人的权力优于前手,不受前手缺陷的影响。

A.合法B.正当C.对价D.企业答案:C20.指出下列承兑类型(B )。

ACCEPTED1 June, 1999Payable on delivery of Bill of LadingFor ABC Bank Ltd..,LondonSignatureA.普通承兑B.有条件承兑C.部分承兑D.托收承兑21.如果一张汇票背书为:Pay to the order of B Co.,On delivery Of B/L No.125For A Co.,LondonSignature它属于(D )背书A.特别B.空白C.限制D.带有条件22.属于顺汇方法的支付方式是()A.汇款B.托收C.信用证D.银行保函答案:A23.接受汇出行的委托将款项解付给收款人的银行是()A.托收银行B.汇入行C.代收行D.转递行答案:B24.在汇款方式中,能为收款人提供融资便利的方式是()A.信汇B.票汇C.电汇D.远期汇款答案:B25.属于汇款活动当事人的是()A.委托人B.汇出行C.代收行D.索偿付答案:B26.T/T是指()A.提单B.电汇C.信用证D.银行保函答案:B27.通过汇出行开立的银行汇票的转移实现货款支付的汇付方式是()A.电汇B.信汇C.票汇D.银行转帐答案:C28.从汇款速度来看()一种最快捷的方式,也是目前广泛使用的方式。

A.信汇B.票汇C.电汇D.远期汇款答案:C29. 票汇采用的支付工具是: (D )A.电报B.信汇委托书C.支付委托书D.银行即期汇票30. 结算方式按资金的流向和结算工具传送的方向分类,可分为: (D )A.电汇、信汇、票汇B.汇款、托收、信用证C.本票、汇票、支票D. 顺汇和逆汇31.在托收结算方式下,一旦货款被买方拒付,在进口地承担货物的提货、报关、存仓、转售等责任的当事人是()A.委托人B.托收行C.代收银行D.付款人答案:A32.D/P?T/R意指()A.付款交单B.承兑交单C.付款交单凭信托收据借单D.承兑交单凭信托收据借单答案:C33.承兑交单方式下开立的汇票是()A.即期汇票B.远期汇票C.银行汇票D.银行承兑汇票答案:B34.使用托收方式时,托收行和代收行在货款收进方面()A.没有责任B.承担部分责任C.有责D?视情况分析答案:A35.合同中规定采用D/A 30天的托收方式付款,托收日为9月l日,如寄单邮程为10天,则此业务的提示日承兑日、付款日、交单日为()A.9月11日/9月11日/10月11日B.9月11日/10月11日/9月11日C.9月1日/9月11日/10月11日D.9月1日/10月11日/9月11日答案:B36.承兑交单的起算日应为()A.出票日B.付款人见票承兑日C.付款日D.托收日答案:B37.出口商一般可获得出口保理商提供不超过发票金额()的融资A.40%-90% B.40%-80%C.30%-80% D.30%-90%答案:A38.单保理业务当事人中没有()A.出口商B.进口商C.出口保理商D.进口保理商答案:C39.中国()加入国际保理商联合会。

A.1992年B.1993年C.1994年D.1995年答案:B40.国际保理商联合会的英文缩写为()A.FCI B.FICC.EDI D.IFT答案:A41.保理业务支付的手续费一般是发票金额()A.0.1% B.1%C.0.5% D.1.5%答案:B42 .信用证支付方式实际上把进口人履行的付款责任,转移给()A.出口人B.银行C.供货商D.最终用户答案:B43.在信用证方式下,银行保证向信用证受益人履行付款责任的条件是(〕A.受益人按期履行合同B.受益人按信用证规定交货C.受益人提交严格符合信用要求的单据D.开证申请人付款赎单答案:C44.保兑行对保兑信用证承担的付款责任是()A.第一性的B.第二性的C.第三性的D.第四性的答案:B45.在国际贸易中,用以统一解释、调和信用证各有关当事人矛盾的国际惯例是()A.《托收统一规则》B.《国际商会500号出版物》C.《合约保证书统一规则》D.以上答案均不对答案:B46.一张有效的信用证,必须规定一个()A.装运期B.有效期C.交单期D.议付期答案:B47.按照《跟单信用证统一惯例》的规定,受益人最后向银行交单议付的期限是不迟于提单签发日()A.11天B.15天C.21天D.25天答案:C48.属于银行信用证的国际贸易支付方式是()A.汇付B.托收C.信用证D.票汇答案:C49.在信用证支付方式下,将信用证通知受益人的是()A.开证银行B.通知银行C.转递银行D.议付银行答案:A50.出口商要保证信用证下安全收汇,必须做到()A.单据与合同相符且单单相符B.提交单据与信用证相符且单单相符C.当L/C与合同不符时,提交单据以合同为准合D.提交单据与合同、信用证均相符。

答案:B51.在L/C、D/P和D/A三种支付方式下,就买方风险而言,按由大到小顺序排列,哪个正确()A.L/C> D/A> D/P B.L/C> D/P> D/AC.D/A> D/P> L/C D.D/P> D/A> L/C答案:D52.银行审单议付的依据是()A.合同信用证B.合同单据C.单据信用证D.信用证委托书答案:C53 .L/C上如未明确付款人,则制作汇票时,受票人应为()A.开证申请人B.开证行C.议付行D.通知行答案:B54.当受益人审证时发现信用证与合同不符时,可要求()。

A.开征行改证B.开证人改证C.通知行改证D.付款行改证答案:B55.保兑行对保兑信用证承担的付款责任是()A.第一性的B.第二性的C.第三性的D.第四性的56、受益人开立远期汇票但可通过贴现即期足额收款的信用证是()A.即期信用证B.远期信用证C .假远期信用证D.预支信用证答案:C57.可转让信用证可以转让( )A.一次B.二次C.多次D.无数次答案:A58.某信用证每期用完一定金额后即可自动恢复到原金额使用,无需等待开证行的通知,这份信用证是()A.自动循环信用证B.非自动循环信用证C.半自动循环信用证D.按时间循环信用证答案:A59.一份信用证若经另一银行保证对符合信用证要求的单据履行付款义务,这份信用证就成为()A.不可撤销信用证B.不可转让信用证C.保兑信用证D.议付信用证答案:C60.假远期信用证的远期汇票利息由()A.受益人负担B.议付行负担。

C.付款行负担D.开证人负担答案:D61.在来料加工和补偿贸易中常使用()A.循环信用证B.对开信用证C.对背信用证D.预支信用证答案:B62.由开证银行保证在开证申请人未履行其义务时向受益人偿付的信用证是()A.对开信用证B.对背信用证C.预支信用证D.备用信用证答案:D63.下列有关可转让信用证的说明中有一项是错误的,它是()A.凡属可转让信用证,必须注明“可转让”字样。

B.可转让信用证的受益人可以再次转让。

C.该证的受益人可把信用证转给一个以上的人使用,D.信用证转让后,第一受益人仍需对合同的履行负责。

64.使用假远期信用证,实际上是套用()A.卖方资金B.买方资金C.付款银行资金D.B+C答案:C65.指出装船提单的日期()A.货于5月24日送交船公司B.货于6月4日开始装船C.货于6月4日全部装完D.货于6月24日抵达日本答案:C66.海运提单和航空运单()A.均为物权凭证B.均为“可以转让”的物权凭证C.前者作为物权凭证;后者不可转让,不作物权凭证D.前者不作为物权凭证;后者作物权凭证答案:C67.提单收货人一栏写明:“Pay to the order A Co.,”这是一张()A.指示性提单B.备运提单C.记名提单D.来人提单答案:A68.()提单适用于包括第一程海运在内的两种或两种以上的运输方式,承运人的责任只限于本身经营船舶所完成的运输。