OpportunityCosts

国际经济学作业答案第三章

Home has a comparative advantage in both products.

The opportunity cost of cloth in terms of widgets in Foreign is if it is ascertained that Foreign uses

neither country will want to export the good in which it enjoys comparative advantage.

both countries will want to specialize in cloth.

Given the following information:

both countries could benefit from trade with each other.

neither country could benefit from trade with each other.

each country will want to export the good in which it enjoys comparative advantage.

each country enjoys superior terms of trade.

each country has a more elastic demand for the imported goods.

each country has a more elastic supply for the supplied goods.

SAP学习笔记(CO模块学习笔记2)

Cost Flows

接下来看是学习Cost Flows,也就是传说中的成本流了。今天只以制造业来学习。制造业的产品的成本可以分为3类:(1)direct material (2)direct labor (3)manufacturing overhead

制造业都是有放置原材料的仓库,有加工材料的车间、包装成品的车间。仓库的原材料都记在原材料科目下面,在生产过程中,会从仓库提取原材料到车间加工,这时借Work-in-Progress科目,贷原材料,人力费用也是借Work-in-Progress科目,贷应付员工工资。制造费用是借Work-in-Progress科目,贷制造费用。当生产完工,产成品完成以后。借产成品科目,贷Work-in-Progress科目。当完成销售后,借销售成本,贷产成品。价值从原材料、人力、制造费用先转移到Work-in-Progress科目,表示正在生产,然后转移到产成品科目,表示已完工的产品,最后转移到销售成本。这就是成本流的概念了。

(1)当制造费用科目的借方>贷方:

比如实际借制造费用借方总计21000,贷方总计是20000,那么借方多出的1000块钱表示低估了制造费用,这样销售成本会偏低。一般处理是借销售成本1000,贷制造费用1000.

(2)当制造费用科目的借方<贷方:

比如实际制造费用借方总额是19000,贷方总计是20000,那么贷方多出的1000表示高估了制造费用,这样销售成本偏高。一般处理是借制造费用1000,贷销售成本1000.

最后两种成本是Out-of-Pocket costs和Opportunity costs。Out-of-Pocket costs是指在日常运营中各种花费的成本。如果一个快餐馆需要装修窗户,那么装修窗户的花费就是Out-of-pocket costs。一般企业和个人都只考虑这种成本,而没有考虑后者,就是Opportunity costs。比如我花费60块钱去看一场2小时的电影,那么如果我不去看电影,而是用这2个小时可以做临时工,每小时20块收入。2×20=40块钱就是去看电影的Opportunity costs。

机会成本

机会成本opportunity cost定义1:一种资源(如资金或劳力等)用于本项目而放弃用于其他机会时,所可能损失的利益。

定义2:某项资源未能得到充分利用而放弃掉的获利机会所带来的成本。

在生活中,有些机会成本是可以用货币来进行衡量的。

例如,农民在获得更多土地时,如果选择养猪就不能选择养鸡,养猪的机会成本就是放弃养鸡的收益。

但有些机会成本往往无法用货币衡量,例如,在图书馆看书学习还是享受电视剧带来的快乐之间进行选择。

而机会成本泛指一切在作出选择后其中一个最大的损失,机会成本会随付出的代价改变而作出改变,例如被舍弃掉的选项之喜爱程度或价值作出改变时,而得到之价值是不会令机会成本改变的。

概念要点机会必须是决策者可选择的项目机会成本所指的机会必须是决策者可选择的项目,若不是决策者可选择的项目便不属于决策者的机会。

例如某农民只会养猪和养鸡,那么养牛就不会是某农民的机会。

机会成本是指放弃的机会中收益最高的项目放弃的机会中收益最高的项目才是机会成本,即机会成本不是放弃项目的收益总和。

例如某农民只能在养猪、养鸡和养牛中择一从事,若三者的收益关系为养牛>养猪>养鸡,则养猪和养鸡的机会成本皆为养牛,而养牛的机会成本仅为养猪。

机会成本与资源稀缺性的关系在稀缺性的世界中选择一种东西意味着放弃其他东西。

一项选择的机会成本,也就是所放弃的物品或劳务的价值。

机会成本是指在资源有限条件下,当把一定资源用于某种产品生产时所放弃的用于其他可能得到的最大收益。

不理解机会成本就不理解经济学当一个人经历了刻骨铭心的人生变故与人生挫折面临重大选择时----他会产生对哲学和宗教的需求;当一个社会经济经历特别重大的危机和经济衰退----它才会产生对市场经济学的需求,换句话说,在某一个时点,社会需要的是"经济学",更多的时候,需要的是经济政策学。

1、经济学研究选择、权衡取舍;2、选择实在有与无、多与少之间进行;3、仅仅关注“收益、成本、利润”不是经济学----是会计学;4、比较“得失|、关注收益以及放弃的(机会成本)才是经济学;5、绝大多数人关注得到的收益而忽视放弃的收益-----放弃的收益就是机会成本;6、曼昆《经济学原理》:看一场电影的机会成本是什么?---为看电影放弃的收益;7、看场电影的收益100个单位;如果同样时间打工得到的收益50个单位。

国际经济学名词解释

第三章1、时机本钱(opportunity cost):是指企业为从事某项经营活动而放弃另一项经营活动的时机,或利用一定资源获得某种收入时所放弃的另一种收入。

2、比拟优势(comparative advantage):如果一个国家在本国生产一种产品的时机本钱低于在其他国家生产该种产品的时机本钱,那么这个国家在生产该种产品上就具有比拟优势。

3、李嘉图模型(Ricardian model):是指以各国之间相对劳动生产率的不同来解释国际贸易现象的贸易理论模型。

4、单位产品劳动投入(unit labor requirement):是指生产一单位产品所需要投入的劳动小时数。

5、生产可能性边界(production possibility frontier):是指在技术不变和资源充分利用的情况下,社会或单个厂商把全部资源充分地和有效率地用于生产商品所能获得的最大产量的各种组合的曲线。

6、绝对优势(absolute advantage):当一个国家能够以少于其他国家的劳动投入生产出同样单位的商品时,就说该国在生产这种商品上具有绝对优势。

7、局部均衡分析(partial equilibrium analysis):是指假定其他条件不变时,单独分析某一经济当事人或某一市场的价格和供求变化的经济分析方法和理论。

8、一般均衡分析(general equilibrium analysis):是指在一种价格体系下,整个经济中所有相关市场上的供应和需求同时到达均衡的状态。

9、相对需求曲线(relative demand curve):是表示某种产品的相对价格与市场相对需求量之间的相互关系的曲线。

10、相对供应曲线(relative supply curve):是表示某种产品的相对价格与市场相对供应量之间的相互关系的曲线。

11、贸易所得(gains from trade):是指一个国家从国际贸易活动中获得的利益。

12、相对工资(relative wage):是指一国工人每小时的工资与外国工人每小时工资的比值。

国经资料无选择题

国贸名词解释1.Opportunity cost theory (机会成本理论):The theory that the cost of a commodity is the amount of asecond commodity that must be given up to release just enough resources to produce one more unit of the first commodity.2.Production possibility frontier (生产可能性曲线):A curve showing the various alternative combinationsof two commodities that a nation can produce by fully utilizing all of its resources with the best technology available to it .3.Marginal rate of transformation (边际转换率):The amount of one commodity that a nation must giveup to produce each additional unit of another commodity .The is another name for the opportunity cost of a commodity and is given by the slope of the production frontier at the point of production.munity indifference curve (社会无差异性曲线):The curve that shows the various combinations oftwo commodities yielding equal satisfaction to the community or nation .Community indifference curves are negatively sloped, convex from origin ,and should not cross.5.Terms of trade (贸易条件):The ratio of the index price of a nation’s export to its import commodities.6.Equilibrium-commodity price with trade (贸易均衡的相对商品价格): The common relativecommodity price in two nations at which trade is balanced.7.Offer curves (提供曲线):A curve that shows how much of its import commodity a nation demands to bewilling to supply various amount of its export commodity ,or the willingness of the nation to import and export at various relative commodity prices.8.The Heckscher-Ohlin theorem (赫克歇尔-俄林原理):The part of the Heckscher-Ochlin theory thatpostulates that a nation will export the commodity intensive in its relatively abundant and cheap factor and import the commodity intensive in its relatively scarce and expensive factor.问答题P16 2. What was the basis for and the pattern of trade according to Adam Smith ? How were gains from trade generated ? What policies did Smith advocate in international trade? What did he think was the proper function of government in the economic life of the nation ?根据亚当斯密的理论,其贸易模式的基础和模式是什么?贸易所得是怎样产生的?亚当主张在国际贸易中推行怎样的针车?他认为振幅在国家的经济运行中应当扮演怎样的角色?Proponents of an open trading system maintain that free trade leads to lower prices, the development of more efficient production methods, and a greater range of consumption choices. Free trade permits resources to move from their lowest productivity to their highest productivity. Critics of an open trading system maintain that import competition may displace domestic firms and workers. It is also argued that during periods of national emergency, it is in the best interests of a nation to protect strategic industries.P52 2. The mercantilists maintained that government should stimulate exports and restrict imports soas to increase a nation's holdings of gold. A nation could only gain at the expense of other nations because not all nations could simultaneously have a trade surplus. Smith maintained that with free trade, international specialization of resources in production leads to an increase in world output which can be shared by both trading partners. All nations simultaneously can enjoy gains from trade in terms of production and consumption.3.Assume that by devoting all of its resources to the production of steel, France can produce 40 tons. By devoting all of its resources to televisions, France can produce 60 televisions. Comparable figures for Japan are 20 tons of steel and 10 televisions. In this example, France has an absolute advantage in the production of steel and televisions. France has a comparative advantage in televisions.4.Ignoring the role of demand's impact on market prices, Smith and Ricardo maintained that a country's competitive position is underland by cost conditions. Smith's trade theory is based on absolute costs, while comparative costs underlie Ricardo's trade theory.P104 5.The Leontief paradox questioned the applicability of the factor-endowment theory by concluding that the United States exported labor-intensive goods. This was the opposite conclusion that would be expected when applying the factor endowment theory to the United States.7.In general, the size of the welfare responses to tariffs is determined by the impact of the tariffs on domestic prices and the response of domestic producers and consumers to these price changes.P78 4.The gains a country enjoys from free trade depend on the equilibrium terms of trade, which is determined by world supply and demand conditions. By recognizing only the role of supply, Ricardo was unable to determine the equilibrium terms of trade.P52 7.Where a nation produces along its production possibilities curve in autarky affects the nation's comparative costs under increasing cost conditions. This is because the slope of a bowed-out production possibilities curve, which indicates the marginal rate of transformation, varies at each point along the curve. Under conditions of constant costs, the production possibilities curve is a straight line. The marginal rate of transformation does not change in response to movements along the production possibilities curve.判断题第1章国际经济F 1.The two most important trading partners of the United States are Canada and Mexico.F 2.The United States exports a larger percentage of its gross domestic product than Japan, Germany,and Canada.T 3.Opening the economy to international trade tends to lessen inflationary pressures at home.T 4.The benefits of international trade accrue in the forms of lower domestic prices, development of more efficient methods and new products, and a greater range of consumption choices.F 5.In an open trading system, a country will import those commodities that it produces at relativelylow cost while exporting commodities that can be produced at relatively high cost.T 6.Although free trade provides benefits for consumers, it is often argued that import protection should be provided to domestic producers of strategic goods and materials vital to thenation’s security.T 7.In the long run, competitiveness depends on an industry’s natu ral resources, its stock of machinery and equipment, and the skill of its workers in creating goods that people want to buy.F 8.If a nation has an open economy, it means that the nation allows private ownership of capital.F 9.Increased foreign competition tends to increase profits of domestic import-competing companies.F 10.Restrictive trade policies have resulted in U.S. producers of minerals and metals supplying all ofthe U.S. consumers’ needs.第2章T 1.According to the mercantilists, a nation’s welfare would improve if it maintained a surplus of exports over imports.F 2.The mercantilists maintained that a free-trade policy best enhances a nation’s welfare.T 3.The mercantilists contended that because one nation’s gains from tr ade come the expense of its trading partners, not all nations could simultaneously realize gains from trade.F 4.According to the price-specie-flow doctrine, a trade-surplus nation would experience gold outflows,a decrease in its money supply, and a fall in its price level.F 5. The trade theories of Adam Smith and David Ricardo viewed the determination of competitiveness from the demand side of the market.T 6.According to the principle of absolute advantage, international trade is beneficial to the world if one nation has an absolute cost advantage in the production of one good while the othernation has an absolute cost advantage in the other good.F 7.The principle of absolute advantage asserts that mutually beneficial trade can occur even if onenation is absolutely more efficient in the production of all goods.F 8.The basis for trade is explained by the principle of absolute advantage according to David Ricardoand the principle of comparative advantage according to Adam Smith.F 9.The principle of comparative advantage contends that a nation should specialize in and export thegood in which its absolute advantage is smallest or its absolute disadvantage is greatest.T 10.The Ricardian theory of comparative advantage assumes only two nations and two products, labor can move freely within a nation, and perfect competition exists in all markets.F 11.Assume that the United States is more efficient than the United Kingdom in the production of allgoods. Mutually beneficial trade is possible according to the principle of absoluteadvantage, but is impossible according to the principle of comparative advantage.F 12.It is possible for a nation not to have an absolute advantage in anything; but it is not possible forone nation to have a comparative advantage in everything and the other nation to have acomparative advantage in nothing.F 13.Ricardo’s theory of comparative advantage was of limited relevance to the real world since itassumed that labor was only one of several factors of production.T pared to Ricardian trade theory, modern trade theory provides a more general view of comparative advantage since it is based on all factors of production rather than just labor. T 15.Constant opportunity costs suggest that the relative cost of producing one product in terms of the other will remain the same no matter where a nation chooses to locate on itsproduction-possibilities schedule.F 16.There are two explanations of constant opportunity costs: (1) factors of production are imperfectsubstitutes for each other; (2) all units of a given factor have different qualities.F 17.With increasing opportunity costs, a nation totally specializes in the production of the commodityof its comparative advantage; with constant opportunity costs, a nation partially specializesin the production of the commodity of its comparative advantage.T 18.A nation’s trade triangle denotes its exports, imports, and terms of trade.F 19.International trade leads to increased welfare if a nation can achieve a post-trade consumptionpoint lying inside of its production-possibilities schedule.F 20.If the U.S. post-trade consumption point lies along its production possibilities schedule, theUnited States achieves a higher level of welfare with trade than without trade.T 21.If productivity in the German computer industry grows faster than it does in the Japanese computer industry, the opportunity cost of each computer produced in Japan increasesrelative to the opportunity cost of a computer produced in Germany.T 22.If Japan loses competitiveness in computers, Japanese computer workers lose jobs to foreign computer workers and the wages of Japanese computer workers tend to fall relative to thewages of foreign computer workers.F 23.With constant opportunity costs, a nation will achieve the greatest possible gains from trade if itpartially specializes in the production of the commodity of its comparative disadvantage. T 24.By reducing the overall volume of trade, import restrictions tend to reduce a nation’s gains from trade.F 25.With increasing opportunity costs, comparative advantage depends on a nation’s supplyconditions and demand conditions; with constant opportunity costs, comparative advantagedepends only on demand conditions.T 26.According to the principle of comparative advantage, an open trading system results in resources being channeled from uses of low productivity to those of high productivity.T 27.The existence of exit barriers tends to delay the closing of inefficient firms that face international competitive disadvantages.T 28.MacDougall’s empirical study of comparative advantage was based on the notion that a product’s labor cost is underlaid by labor productivity and the wage rate.F 29.The MacDougall study of comparative advantage hypothesized that in those industries in whichU.S. labor productivity was relatively high, U.S. exports to the world should be lower thanU.K. exports to the world, after adjusting for wage differentials.F 30.The basic idea of mercantilism was that wealth consisted of the goods and services produced by anation.T 31.According to Adam Smith, international trade was a “win-win” situation since all nations could enjoy gains from trade.F 32.The price-specie-flow mechanism illustrated why one nation’s gains from trade wereaccompanied by another country’s losses.F plete specialization usually occurs under the assumption of increasing opportunity costs.F 34.Adam Smith contended that gold, silver, and other precious metals constituted the wealth of anation.T 35.The price-specie-flow mechanism illustrated why nations could not maintain trade surpluses or trade deficits over the long run.T 36.The marginal rate of transformation equals the absolute slope of a country’s production possibilities schedule.T 37.Assume that Germany has higher labor productivity and higher wage levels than France.Germany can produce a commodity more cheaply than France if its productivitydifferential more than offsets its wage differential.T 38.Ricardo’s theory of comparative advantage does not take into account demand conditions when determining relative commodity prices.F 39.If Canada has a higher wage level and higher labor productivity than Mexico, Canada willnecessarily produce a good at a higher labor cost than Mexico.T 40.If Argentina has a comparative advantage over Brazil in beef relative to coffee, Argentina will specialize in beef production.第3章国际平衡T 1.Modern trade theory recognizes that the pattern of world trade is governed by both demand conditions and supply conditions.T 2.A nation achieves autarky equilibrium at the point where its community indifference curve is tangent to its production possibilities schedule.F 3.In autarky equilibrium, a nation realizes the lowest possible level of satisfaction given theconstraint of its production possibilities schedule.F 4.In autarky equilibrium, a nation’s marginal rate of transformat ion (measured by the slope of itsproduction possibilities schedule) exceeds the marginal rate of substitution (measured bythe slope of its community indifference curve) by the largest possible amount.T 5.A nation benefits from international trade if it can achieve a higher indifference curve than it can in autarky.T 6.A nation realizes maximum gains from trade at the point where the international terms-of-trade line is tangent to its community indifference curve.F 7.The Ricardian theory of comparative advantage could fully explain the distribution of the gainsfrom trade among trading partners.F 8.Because the Ricardian theory of comparative advantage was based only on a nation’s demandconditions, it could not fully explain the distribution of the gains from trade among tradingpartners.T 9.Because the Ricardian theory of comparative advantage was based only on a nation’s supply conditions, it could only determine the outer limits within which the equilibrium terms oftrade would lie.T 10.The domestic cost ratios of nations set the outer limits to the equilibrium terms of trade.T 11.Mutually beneficial trade for two countries occurs if the equilibrium terms of trade lies between the two countries’ domestic cost ratios.F 12.Assume that the United States and Canada engage in trade. If the international terms of tradecoincides with the U.S. cost ratio, the United States realizes all of the gains from trade withCanada.T 13.Assume that the United States and Canada engage in trade. If the international terms of trade coincides with the Canadian cost ratio, the United States realizes all of the gains from tradewith Canada.T 14.If the international terms of trade lies beneath (inside) the Mexican cost ratio, Mexico is worse off with trade than without trade.F 15.Although J. S. Mill recognized that the region of mutually beneficial trade is bounded by the costratios of two countries, it was not until David Ricardo developed the theory of reciprocaldemand that the equilibrium terms of trade could be determined.T 16.According to J. S. Mill, if we know the domestic demand expressed by both trading partners for both products, the equilibrium terms of trade can be defined.F 17.The theory of reciprocal demand asserts that as the U.S. demand for Canadian wheat rises, theequilibrium terms of trade improve for the United States.F 18.Assume that Canada has a comparative advantage in wheat and a comparative disadvantage inautos. As the Canadian demand for w heat increases, Canada’s equilibrium terms of tradeimproves.T 19.The theory of reciprocal demand best applies when two countries are of equal economic size, so that the demand conditions of each nation have a noticeable impact on market prices.F 20.The theory of reciprocal demand best applies when one country has a “large” economy and theother country has a “small” economy.T 21.If two nations of approximately the same size and with similar taste patterns participate in international trade, the gains from trade tend to be shared about equally between them.F 22.The expression “importance of being unimportant” suggests that if one nation is much larger thanthe other, the larger nation realizes most of the gains from trade while the smaller nationrealizes fewer gains from trade.T 23.Export-biased growth is based on an expansion of a resource, or an improvement in technology, used intensively in the production of an export commodity.F 24.A country experiencing export-biased growth gains because it can produce more and because theinternational price rises for its export good.F 25.Immiserizing growth occurs when export-biased growth generates an improving terms-of-tradeeffect that adds to the gains of increased output.T 26.An improvement in a nation’s terms of trade occurs if the prices of its exports rise relative to the prices of its imports over a given time period.F 27.If a country’s terms of trade worsen, it must exchange fewer exports for a given amount ofimports.F 28.If a country’s terms of trade improve, it must exchange more exports for a given amount ofimports.T 29.The terms of trade represents the rate of exchange between a country’s exports and imports.T 30.Assume 1990 to be the base year. If by the end of 1997 a country’s export price index rose from 100 to 130 while its import price index rose from 100 to 115, its terms of trade wouldequal 113.F 31.Assume 1990 to be the base year. If by the end of 1997 a country’s export price index rose from100 to 140 while its import price index rose from 100 to 160, its terms of trade wouldequal 120.T 32.Assume 1990 to be the base year. If by the end of 1997 a country’s export price index rose from 100 to 125 while its import price index rose from 100 to 125, its terms of trade wouldequal 100.T 33.The commodity terms of trade are found by dividing a country’s import price index by its export price index.T 34.For the commodity terms of trade to improve, a country’s export price inde x must rise relative to its import price index over a given time period.F 35.For the commodity terms of trade to improve, a country’s import price index must rise relative toits export price index over a given time period.4章贸易模型的扩展及应用T 1.According to Ricardian theory, comparative advantage depends on relative differences in labor productivity.F 2.The Heckscher-Ohlin theory asserts that relative differences in labor productivity underliecomparative advantage.T 3.The factor-endowment theory highlights the relative abundance of a nation’s resources as the key factor underlying comparative advantage.F 4.According to the factor-endowment theory, a nation will export that good for which a large amountof the relatively scarce resource is used.F 5.According to the factor-endowment theory, a nation will import that good for which a largeamount of the relatively abundant resource is used.T 6.The Heckscher-Ohlin theory suggests that land-abundant nations will export land-intensive goods while labor-abundant nations will export labor-intensive goods.F 7.The Heckscher-Ohlin theory contends that over a period of years a country that initially is anexporter of a product will become an importer of that product.F 8.The Heckscher-Ohlin theory emphasizes the role that demand plays in the creation of comparativeadvantage.T 9.The factor-endowment theory asserts that with specialization and trade there tends to occur an equalization in the relative resource prices of trading partners.F 10.According to the factor-endowment theory, international specialization and trade cause a nation’scheap resource to become cheaper and a nation’s expensive resource to become moreexpensive.T 11.Fears about the downward pressure that cheap foreign workers place on U.S. wages have led U.S.labor unions to lobby for import restrictions such as tariffs and quotas.T 12.According to the factor-price-equalization theory, international trade results in the relative differences in resource prices between nations being eliminated.F 13.Empirical testing by Wassily Leontief gave support to the Heckscher-Ohlin theory of trade.F 14.The Leontief Paradox was the first major challenge to the product-life-cycle theory of trade.T 15.The Leontief Paradox suggested that, in contrast to the predictions of the factor-endowment theory, U.S. exports were less capital-intensive than U.S. import-competing goods.T 16.The specific-factors theory analyzes the income distribution effects of trade in the short run when resources are immobile among industries.F 17.Owners of resources specific to export industries tend to lose from international trade, whileowners of factors specific to import-competing industries tend to gain.F 18.The factor-price-equalization theory is a short-run version of the specific-factors theory.T 19.With economies of scale, specialization in a few products allows a manufacturer to benefit from longer production runs which lead to decreasing average cost.F 20.With decreasing costs, a country has an incentive to partially specialize in the product of itscomparative advantage.T 21.By widening the size of the domestic market, international trade permits companies to take advantage of longer production runs and increasing efficiencies such as mass production. T 22.The theory of overlapping demands applies best to trade in manufactured goods.T 23.Decreasing cost conditions lead to complete specialization in the production of the commodity of comparative advantage.F 24.According to Staffan Linder, the factor endowment theory is useful in explaining trade patterns inmanufactured goods, but not primary products.F 25.The theory of overlapping demands asserts that trade in manufactured goods is stronger the lesssimilar the demand structures of two countries.T 26.The theory of overlapping demands contends that international trade in manufactured products is strongest among nations with similar income levels.T 27.According to the theory of overlapping demands, trade in manufactured goods would be greater among two wealthy countries than among a wealthy country and a poor country.F 28.Recent studies of U.S. resource endowments indicate that the United States is most abundant inunskilled labor, followed by semi-skilled labor and skilled labor.T 29.Intraindustry trade would occur if computers manufactured in the United States by IBM are exported to Japan while the United States imports computers manufactured by Hitachi ofJapan.T 30.Because seasons in the Southern Hemisphere are opposite those in the Northern Hemisphere, one would expect intraindustry trade to occur in agricultural products.T 31.Intraindustry trade can be explained by product differentiation, economies of scale, seasons of the year, and transportation costs.F 32.According to the theory of intraindustry trade, many manufactured goods undergo a trade cycle inwhich the home country initially is an exporter and eventually becomes an importer of aproduct.F 33.The product-life-cycle theory applies best to trade in primary products in the short run.T 34.According to the product-life-cycle theory, the first stage of a product’s trade cycle is when it is introduced to the home market.T 35.According to the product life cycle theory, the last stage of a product’s trade cycle is when it becomes an import-competing good.T 36.Ricardo’s theory of comparative advantage is a static theory that does not consider changes in international competitiveness over the long run.T 37.Dynamic comparative advantage refers to the creation of comparative advantage through the mobilization of skilled labor, technology, and capital.F 38.Industrial policy seeks to direct resources to declining industries in which productivity is low,linkages to the rest of the economy are weak, and future competitiveness is remote.T 39.Europe’s jumbo-jet manufacturer, Airbus, has justified receiving governmental subsidies on the grounds that the subsidies prevent the United States from becoming a monopoly in thejumbo-jet market.F 40.The imposition of pollution-control regulations on domestic steel manufacturers leads todecreases in production costs and an improvement in the steel manufacturers’competitiveness.F 41.Empirical studies conclude that U.S. environmental policies are a more important determinant oftrade performance than capital, raw materials, labor skills, and wages.F 42.Most developing countries have pollution-control laws and enforcement policies that are morestringent than those of the major industrial countries.F 43.Although the theory of comparative advantage explains trade in manufactured goods, it has noexplanatory value for trade in business services.T 44.When transportation costs are added to our trade model, the low-cost exporting country produces less, consumes more, and exports less than that which occurs in the absence oftransportation costs.F 45.When transportation costs are added to our trade model, the degree of specialization in productionbetween two countries increases as do the gains from trade.T 46.In the absence of transportation costs, free trade results in the equalization of the prices of traded goods, as well as resource prices, in the trading nations.T 47.In industries where the final product is much less weighty or bulky than the materials from which it is made, firms tend to locate production near resource supplies.F 48.Industrial processes that add weight or bulk to a commodity are likely to be located near theresource market to minimize transportation costs.T 49.A product will be traded only if the cost of transporting it between nations is less than the pretrade difference between their relative product prices.F 50.Generally speaking, transportation costs are more important than production costs as a source ofcomparative advantage.F 51.The product-life-cycle model contends that when a new product is introduced to the home market,it generally requires low-skilled labor to produce it.F 52.According to the product life cycle model, comparative advantage shifts from cheap-laborcountries to high-technology countries after a manufactured good becomes standardized.5章F 1.To protect domestic producers from foreign competition, the U.S. government levies both importtariffs and export tariffs.T 2.With a compound tariff, a domestic importer of an automobile might be required to pay a duty of $200 plus 4 percent of the value of the automobile.F 3.With a specific tariff, the degree of protection afforded domestic producers varies directly withchanges in import prices.T 4.During a business recession, when cheaper products are purchased, a specific tariff provides domestic producers a greater amount of protection against import-competing goods.F 5.A ad valorem tariff provides domestic producers a declining degree of protection againstimport-competing goods during periods of changing prices.。

机会成本~Opportunity Cost

机会成本机会成本(Opportunity Cost):是指为了得到某种东西而所要放弃另一些东西的最大价值。

基本简介机会成本小的具有比较优势。

简单的讲,可以理解为把一定资源投入某一用途后所放弃的在其他用途中所能获得的最大利益。

例如:你购买一套房屋全部用于居住,则不能再出租获利,也就是居住的同时也失去了用于出租等获利的机会;反过来说,你若出租,你则不能再居住。

机会成本主要应用在投资过程中。

在投资决策中,放弃而损失的“潜在利益”,是选取最优方案的机会成本。

商务印书馆《英汉证券投资词典》解释:机会成本英语为:opportunity cost。

名。

不可数。

进行一项投资时不得不放弃另一些投资,这些投资的最大获利就是该项投资的机会成本。

选择投资和放弃投资之间的收益差是可能获取收益的成本。

如投资者仅有一份资金,投资股票时必须放弃国债与基金。

假如国债投资收益为1万元,基金投资收益为2万元,而股票投资收益为3万元,则股票投资的机会成本是2万元,国债投资的机会成本为3万元,基金投资的机会成本也是3万元。

更加简单的讲,就是指你为了从事某件事情而放弃其他事情的价值。

我们常拿融资租赁和贷款比较谁的融资成本高?如果不把机会成本加进去的话,可能会得出一个不正确的结论。

比如人们通常感觉融资租赁的融资成本比银行贷款高。

出现这种认识错误的主要在于没有把机会成本考虑进去。

首先从利率上说租赁公司的资金是从银行来的,因此融资成本一定比银行高。

但从机会成本考虑就不一定了。

银行贷款是以资金占用作为标的的。

融多少资金,就可以算出有多大的成本。

融资租赁是以租赁物件的标的为基础计算成本的,有些厂商租赁打出“零”利率的口号,实际上是一种促销手段。

天下没有免费的宴席,从物件的采购上早已把利息提前纳入销售价格中去了。

因为上述原因,和租赁公司谈利率,实际上没有什么太大的意义。

融资租赁的会计处理上可能会遇到利率问题,但不是租赁公司给出的利率,而是租赁公司的收益率。

成本管理会计习题及答案

1. Cost allocation is the tracing and reassigning of costs to one or more cost objectives suchas departments, customers, or products. True2.Cost assignment is the tracing or allocating of costs to one or more cost objectives, such asactivities and departments. True3. A cost pool is a group of individual costs that is allocated to cost objectives using multiplecost drivers. False4.The contribution approach is a method of internal reporting that emphasizes the distinctionbetween variable and fixed costs for the purpose of better decision making.True5. Relevant information is the historical costs and revenues that differ because of alternative courses of actions. False6. Relevant information might have an element of difference among alternatives.False7. The absorption approach emphasizes the distribution between fixed and variable costs.False8. The contribution margin is computed using variable manufacturing costs, and variable selling and administrative costs.True9. Opportunity costs need to be considered when deciding on the use of limited resources.True10. Opportunity cost depends on alternatives available.True11. Opportunity costs and outlay costs are widely used synonyms.False12. Sunk cost is another term for historical cost or past cost.True1._____ is a method of approximating cost functions.a. Cost driver analysisb. Account analysisc.Product analysisd. Account analysis2.______ is the application of cost measures to expected future activity levels to forecast future costs.a.Activity analysisb. Cost predictionc.Measurement of cost behaviord. A cost function3. The process of identifying appropriate cost drivers and their effects on the costs of making a product or providing a service is called _____.a. cost predictionb. cost measurementc.activity analysisd. budgeting4. _____ is the process of reassigning cost to a cost object.a. Cost accumulationb. Cost accountingc. Cost allocationd. Cost application5. Where a specific product is the cost object, the hourly wages of assembly workers who work on only that product would be classified as a(n) _____.a.direct, variable costb. direct, fixed costc. indirect, variable costd. indirect, fixed cost6. Where a specific product is the cost object, the wages of a security guard w ould probably be classified as a(n) _____.a.direct, variable costb.direct, fixed costc. indirect, variable costd. indirect, fixed cost7.Where a specific product is the cost object, the materials used to manufacture the product would probably be classified as a(n) _____.a.direct, variable costb. direct, fixed costc. indirect, variable costd. indirect, fixed cost8. _____ is the predicted future costs and revenues that will differ among alternative courses of action.a.Relevant informationb.Sunk costs and revenuesc.Historical informationd. Predictable information9. In a special order decision, fixed costs that do not differ between two alternatives are _____.a. of major importance to the decisionb.considered opportunity costsc. important only if they are a material dollar amountd. irrelevant10._____ is the additional cost resulting from producing and selling one additional unit.a.Marginal costmon costc. Opportunity costd. Markup11. Price elasticity measures the _____.a. amount customers are willing to pay for a product or serviceb. effect of price changes on sales volumec. number of units a company is willing to selld.amount of competition in a given industry12. In perfect competition, the profit-maximizing volume is the quantity at which _____.a. marginal cost equals marginal revenueb.contribution margin equals fixed costc. marginal revenue equals priced.price exceeds marginal cost13. Sue is considering leav ing her current position to open a coffee shop. Sue’s current salary is $83,000. Annual coffee shop revenue and costs are estimated at $260,000 and $210,000, respectively. _____ is the opportunity cost of opening the coffee shop.a. $83,000b.$210,000c. $343,000d. $40,00014.Mary is considering leaving her current position to open an ice cream shop. Mary’s current salary is $77,000. Annual ice cream shop revenue and costs are estimated at $260,000 and $210,000, respectively. _____ is the opportunity cost of remaining employed.a. $77,000b.$210,000c.$287,000d.$50,000($260,000 - $210,000 = $50,000)15_____ costs will not continue if an ongoing operation is changed or deleted.a. Avoidableb. Commonc. Sunkd. Differential16. _____ costs are costs that continue even if an operation is halted.a. Commonb. Sunkc. Unavoidabled. Variable17.Manufacturing costs incurred after the split-off are known as _____costs.a. jointb.productc.split-offd. separable18. The _____ is the juncture in manufacturing where the joint products become individually identifiable.a.joint processing junctureb. split-off pointmon pointd.significant juncture19._____ costs are costs of manufacturing two or more products that are not separately identifiable as individual products until their split-off point.a. Separableb.Jointc. Incrementald.Sunk20. In absorption costing, costs are separated into the major categories of_____.a. manufacturing and nonmanufacturingb. manufacturing and fixedc. fixed and variabled. variable and nonmanufacturing21. _____ is (are) used for external reporting.a.Absorption costingb. Variable costingc. Direct costingd. Absorption costing and variable costing22. Absorption costing assigns _____ to the product.a. variable manufacturing costsb. all variable costsc. variable and fixed manufacturing costsd. all fixed and variable costs23. The production-volume variance is the difference between_____.a. applied fixed overhead and budgeted fixed overheadb. expected fixed overhead and actual fixed overheadc. expected fixed overhead and budgeted fixed overheadd. budgeted fixed overhead and actual fixed overhead1.Indicate whether each of the following costs is an Inventoriable cost (I) or a Period cost (P):______ 1. depreciation on factory equipment______ 2. depreciation on treasurer's desk______ 3. direct materials______ 4. factory supplies______ 5. indirect labor______ 6. factory equipment repairs and maintenance______ 7. office supplies______ 8. advertising expense______ 9. depreciation on office equipment______10. direct labor______11. factory supervisor's salary______12. factory utilities______13. indirect materials______14. office salaries______15. sales commissionsAnswer:__I__ 1. __I__ 6. __I__11.__P__ 2. __P__ 7. __I__12.__I__ 3. __P__ 8. __I__13.__I__ 4. __P__ 9. __P__14.__I__ 5. __I__10. __P__15.2.Timmerman Company has budgeted sales of $30,000 with the following budgeted costs:Direct materials $6,300Direct labor 4,100Factory overhead:Variable 3,700Fixed 5,600Selling and administrative expenses:Variable 2,400Fixed 3,200Compute the average target markup for setting prices as a percentage of:a. Total costsb. Total variable costsc. Variable manufacturing costsd. Total manufacturing costsAnswer:a. $6,300 + $4,100 + $3,700 + $5,600 + $2,400 + $3,200 = $25,300($30,000 - $25,300) / $25,300 = 19%b. $6,300 + $4,100 + $3,700 + $2,400 = $16,500($30,000 - $16,500) / $16,500 = 82%c. $6,300 + $4,100 + $3,700 = $14,100($30,000 - $14,100) / $14,100 = 113%d. $6,300 + $4,100 + $3,700 + $5,600 = $19,700($30,000 - $19,700) / $19,700 = 52%3. Orange Industries has budgeted sales of $49,500 with the following budgeted costs:Direct materials $15,000Direct labor 5,000Factory overhead:Variable 6,000Fixed 7,000Selling and administrative expenses:Variable 4,500Fixed 6,000Compute the average target markup for setting prices as a percentage of:a. Total manufacturing costsb. Total variable costsc. Total costsd. Variable manufacturing costsAnswer:a. $15,000 + $5,000 + $6,000 + $7,000 = $33,000($49,500 - $33,000) / $33,000 = 50%b. $15,000 + $5,000 + $6,000 + $4,500 = $30,500($49,500 - $30,500) / $30,500 = 62%c. $15,000 + $5,000 + $6,000 + $7,000 + $4,500 + $6,000 = $43,500($49,500 - $43,500) / $43,500 = 14%d. $15,000 + $5,000 + $6,000 = $26,000($49,500 - $26,000) / $26,000 = 90%4. Gwynn Company is considering the replacement of a machine that is presently used to produce its single product.The following data are available:Old ReplacementEquipment EquipmentOriginal cost $210,000 $40,000Useful life in years 12 7Current age in years 5 0Book value $65,000 -Disposal value now $30,000 -Disposal value in 7 years 0 0Annual cash operating costs $10,000 $9,000Required:Ignoring income taxes, prepare a cost comparison of all relevant items for the next seven years together. Indicate the best alternative for Gwynn Company.Answer:Keep Replace DifferenceCash operating costs $70,000 $63,000 $7,000Disposal value of old machine - (30,000) 30,000New machine, acquisition cost - 40,000 (40,000)Total relevant costs $70,000 $73,000 $(3,000)The cumulative effect over the seven years is $3,000 in favor of keeping the old machine.5. The Hawkeye Corporation is contemplating the replacement of some old equipment. The pertinent information is asfollows:Old ReplacementEquipment EquipmentOriginal cost $93,000 $60,000Useful life in years 13 6Current age in years 7 0Book value $57,000 -Disposal value now $45,000 -Disposal value in 6 years 0 0Annual cash operating costs $15,000 $11,000Required:Prepare a cost comparison of all relevant items for the next six years together. Ignore income taxes.Comment on the best alternative for Hawkeye Corporation.Answer:Keep Replace DifferenceCash operating costs $90,000 $66,000 $24,000Disposal value of oldequipment - (45,000) 45,000New equipment,acquisition cost -__ 60,000 (60,000)Total relevant costs $90,000 $81,000 $9,000The $9,000 cumulative effect over the six years favors replacing the old equipment.。

国际经济学理论与政策第三章答案

♦ The opportunity cost of producing roses is the amount of computers not produced.

3-8

2

Comparative Advantage and Opportunity Cost (cont.)

• The US has a lower opportunity cost in producing computers.

♦ Ecuador can produce 30,000 computers, compared to 10 million roses that it could otherwise produce.

Copyright © 2006 Pearson Addison-Wesley. All rights reserved.

3-3

Introduction (cont.)

• The Ricardian model (chapter 3) says differences in productivity of labor between countries cause productive differences, leading to gains from trade.

♦ The US can produce 10 million roses, compared to 100,000 computers that it could otherwise produce.

Copyright © 2006 Pearson Addison-Wesley. All rights reserved.

Opportunity Cost and Production Possibilities

4. Woman who is considering whether to stay home and take care of her children or work at a job paying $9.50 per hour and hire a baby sitter

Examples of Opportunity Cost

5. Seamstress who chooses to make blue shirts instead of striped shirts

6. A landowner decides to farm his own land instead of renting it to a neighbor

1/3 c powdered milk 1c flour 1whip 1small griddle 1/4 h semi skilled labor 1 plate 10 pancakes 15/16c water 2t baking powder 1 measuring set 1camp stove 3 T butter 1knife 1egg 1/4 t salt 1 cup 1/4c white gas 1/2c maple syrup 1fork 2Toil 1 bowl 1 spatula 2 matches

shovel

semi skilled labor

Output for the Digging Technology Some number of postholes or trenches

Elements of the Digging Technology Set

1 shovel 4 postholes 1 shovel 0 postholes 1 hour semi skilled labor 0 trenches 1 hour semi skilled labor 2 trenches

Opportunity cost

Opportunity cost

Is there any free meal in the world ? Will you always accept free meal ? Why ?

Opportunity cost

Opportunity cost ( p.20 ) --definition the value of the next best alternative that must be sacrificed to obtain something else --it is caused by the Choice among alternatives --the basic reason is Scarcity, and we have to choose the best alternative

Opportunity cost

Free good ( p. 21 ) Nhomakorabea--a free good is infinitely abundant and thus does not incur any opportunity costs in its production, i.e. the resources involved can be used without foregoing the production of alternative goods Economic good ( p.21) --a good which uses scarce resources in being provided and thus there is an opportunity cost of the alternative goods forgone

opportunity cost

1.机会成本分析(1,383字节)Opportunity_Cost_Analysis, Opportunity_cost_analysis'''机会成本分析(Opportunity Cost Analysis)''' ==什么是机会成本分析== 机会成本分析是指当做出某一个选择后,而导致的不得不放弃其他可能选择的分析过程。

当被迫做出两者取其一的决定时,就要付出[[机会成本]],一项[[决策]]的机会成本是另一项可得到的最好决策的[[价值]]。

机会成本分析方法着重于分析选择的[[成本]]。

例:饭店有50万元[[资金]],拟投资快餐业,预计年收益为3万元。

而如果用于改善客房条件,预计可以提高2%的客房出租率。

如果客房出租率提高后的收益比3万元高,那么机会成本就是3万元。

==机会成本分析页面分类:管理会计术语2.机会成本率(1,314字节)Opportunity_Cost_Rate, Opportunity_cost_rate'''机会成本率(Opportunity Cost Rate)''' ==什么是机会成本率== '''机会成本率'''是指用于该[[项目投资]]占用的[[资金]]而丧失的用于其它投资机会的潜在[[收益率]]。

[[萨缪尔森]]在其[[《经济学》]]中曾用热狗公司的事例来说明。

热狗公司所有者每周投入60小时,但不领取[[工资]]。

到年末[[结算]]时公司获得了22万[[美元]]的可观[[利润]]。

但是,如果这些所有者能够找到另外工作,其中[[收入]]最高的可以使他们所获年收达45万[[美元]]。

那么这些人所从事的热狗工作产生的[[机会成本]]即为45000美元。

对于此事,[[经济页面分类:财务比率3.机会成本法(8,843字节)Opportunity_Cost_Approach, Opportunity_cost_approach'''机会成本法(Opportunity Cost Approach)''' == 什么是机会成本法?== 是指在无市场价格的情况下,资源使用的成本可以用所牺牲的替代用途的收入来估算。

举例说明生活中的机会成本

举例说明生活中的机会成本【篇一:举例说明生活中的机会成本】机会成本(opportunity cost):是指为了得到某种东西而所要放弃另一些东西的最大价值。

例子:农民在获得更多土地时,如果选择养猪就不能选择养其他家禽,养猪的机会成本就是放弃养鸡或养鸭等的收益。

假设养猪可以获得9万元,养鸡可以获得7万元,养鸭可以获得8万元,那么养猪的机会成本是8万元,养鸡的机会成本为9万元,养鸭的机会成本也为9万元。

【篇三:举例说明生活中的机会成本】机会成本是指为了得到某种东西而所要放弃另一些东西的最大价值在生活中,有些机会成本是可以用货币来进行衡量的。

例如,农民在获得更多徒弟时,如果选择养猪就不能选择养鸡,养猪的机会成本就是放弃养鸡的收益。

但有些机会成本往往无法用货币衡量,例如,在图书馆看书学习还是享受电视剧带来的快乐之间进行选择。

而机会成本泛指一切在作出选择后其中一个最大的损失,机会成本会随付出的代价改变而作出改变,例如被舍弃掉的选项之喜爱程度或价值作出改变时,而得到之价值是不会令机会成本改变的。

而如果在选择中放弃选择最高价值的选项(首选),那么其机会成本将会是首选。

而作出选择时,应该要选择最高价值的选项(机会成本最低的选项),而放弃选择机会成本最高的选项,即失去越少越明智。

拿融资租赁和贷款比较谁的融资成本高,如果不把机会成本加进去的话,可能会得出一个不正确的结论。

比如人们通常感觉融资租赁的融资成本比银行贷款高。

出现这种认识错误的主要在于没有把机会成本考虑进生产一单位的某种商品的机会成本是指生产者所放弃的使用相同的生产要素在其他生产用途中所能得到的最高收入。

例如,当一个厂商决定利用自己所拥有的经济资源生产一辆汽车时,这就意味着该厂商不可能再利用相同的经济资源来生产200 辆自行车。

于是,可以说,生产一辆汽车的机会成本是所放弃生产的200自行车。

如果用货币数量来代替对实物商品数量的表述,且假定200 辆自行车的价值是 10 元,则可以说,一辆汽车的机会成本是价值为10 万元的其他商品。

INTRODUCTIONARY MICROECONOMICS Opportunity costs

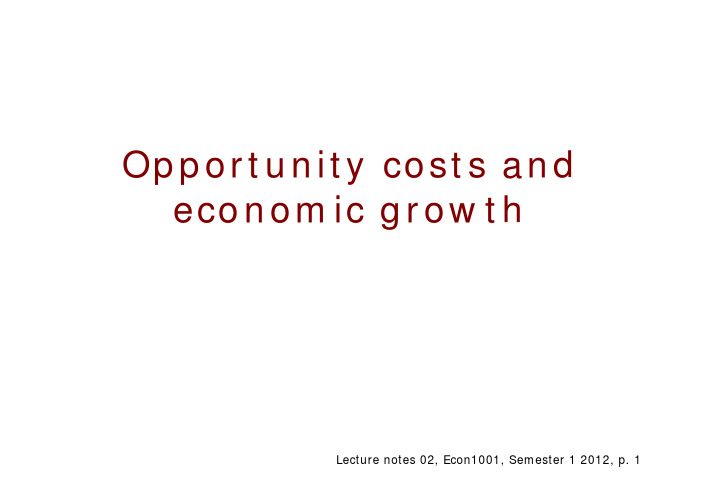

Opportunity costs and economic growthO u t l i n eDefine opportunity costsUse a production possibilities frontier toillustrate:Trade-offs or opportunity costsProduction efficiencyHow current production influenceseconomic growthReading (required) – Ch. 1 & 2 TF(suggested) Borland 1.1C h o i c e a n d o p p o r t u n i t y c o s tScarce resources and unlimited wantsThe need to make choices for individuals,governments, business …Choices involve trade-offs or opportunitycostsThe value of the next best alternativeforegone (see esp. Borland 1.1)Includes explicit AND implicit costs –cost of going to Uni., running a business.R e s o u r c e sLandLabourPhysical and mental effortCapitalGoods we use to produce other good & servicesIncludes physical capital – buildings,machinery, roads & other equipmentHuman capital – knowledge & skill thatindividuals gain from education & workP r o d u c t i o n p o s s i b i l i t i e sThe production possibilities frontier (PPF) Shows which combinations of goods & servicescan be producedDescribes the set of possible output choiceswhen limited resources are used efficientlyProduction efficiency is achieved when it is notpossible to produce more of one good withoutproducing less of some other goodsPoints inside the PPF are inefficient, i.e. someunused resourcesP r o d u c t i o n p o s s i b i l i t i e s (c o n t )Guns ButterA 0 25000B 100 24000C 200 22000D 300 18000E 400 13000F 500 0I n c r e a s i n g o p p o r t u n i t yc o s t o f g u n sP r o d u c t i o n p o s s i b i l i t i e s c u r v eButterGunsP r o d u c t i o n p o s s i b i l i t i e s c u r v eO p p o r t u n i t y C o s t sAn opportunity cost is the highest valuealternative forgoneOC increase as we produce more of onegoodWhy? Because not all resources are equallyproductive in all activities.Hence the shape of the PPF – it is bowedoutwards or is ‘concave to the origin’P r o d u c t i o n p o s s i b i l i t i e s c u r v eE c o n o m i c g r o w t hReflects an economy’s expansion over timeTwo factorsTechnological change, i.e. the development ofnew goods (and services) and better ways ofproducing themCapital accumulation. That is, the growth ofcapital resources such as factories,infrastructure, human capital etc.E c o n o m i c g r o w t h a n d t h e P P F/P P CS c a r c i t y , c h o i c e a n d e c o n o m i c g r o w t hI n v e s t m e n t g o o d sConsumption goodsT h r e e q u e s t i o n sWhat is to be produced?Where on the PPC should the economy be?How should goods be produced?How can resources be used efficiently?For whom are goods produced?A question of allocationS u m m a r yOpportunity costsValue of next best alternative foregone?Production possibilitiesIllustrate feasible productionShow opportunity costs。

机会成本 英语

机会成本英语

机会成本是指在进行某种活动时所放弃的最佳选择的价值。

在经济学中,机会成本是指为获得某种好处而必须放弃的另一种好处的价值,它是指一个人所能获得的最高价值的次优选择。

在英语中,机会成本被称为'Opportunity Cost'。

这个词语的意思是在做某件事时,会失去做其他事情的机会成本。

机会成本在经济学中是一个很重要的概念,因为它能帮助人们做出最明智的决策。

如果人们能够了解机会成本,就能够更好地利用时间和资源,从而取得更大的收益。

例如,在购买一件商品时,人们需要考虑到这笔花费的机会成本,也就是说,人们需要考虑到这笔钱可以用在其他地方所能获得的收益。

总之,机会成本是一个重要的经济学概念,它提醒人们在做决策时需要综合考虑各种因素,从而做出最明智的选择。

- 1 -。

英文2机会成本及贸易

The rent of his storefront: 60,000 per year

Profit calculation

Sales revenue - Stock cost = Gross profit

360,000 - 200,000

= 160,000

Other costs

Wages to employees taxes Water and Electricity

英文2机会成本及贸易

2020/12/17

英文2机会成本及贸易

1.Which one do you choose?

1

2

3

Which opportunity would you choose?

Opportunity cost

Opportunity cost is whatever must be given up to obtain some item.

Making decisions requires trading off one goal against another.

2. People face tradeoffs.

Efficiency v. Equity

Efficiency means society gets the most that it can from its scarce resources. Equity means the benefits of those resources are distributed fairly among the members of society.

3、

• What is your opportunity cost of a 4-year degree at SICHUAN University?

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

The Cost money The of a The you did not Missed Opportunity earn Opportunity Cost

The money you did not earn: $500,000

6

Your Resources

• Your time:

– Run your own business – Work for a salary

13

Economists track both Implicit and Explicit Costs

• Economists explain “economic decisions.” • Economic decisions are explained by profits. • Profits are explained by Costs and revenues • Costs (implicit and explicit) must be taken into consideration to determine profits. 14

12

NO! you still have the $1,000 not in money but in equipment: the hot dog stand is yours.

Accountants only track Explicit Costs…

• An Accountant’s job is to “follow the money”. • Accounting costs include only explicit costs (out-of-pocket expenses)

– Rent for your building – Interest on your money – Salary you are not earning

11

Capital (Money)

You borrow $1,000 to buy equipment (a hot dog stand). The interest on the loan is 5%. You must include this explicit expense as part of your cost:1,000 * 0.05 = 50. Should you ALSO include the $1,000 you paid for the hot dog stand?

A Native American tribe accepted goods worth 60 guilders for the sale of Manhattan in 1626.

If they had invested the money at 6.5% interest, compounded annually, in 2005 their investment would be worth around $1,000 billion dollars!.

At age 65, Nicole has $1,778,831.91 Brent has $ 1,242,758.23: Brent gave up $536,073 to get the car…

CHale Waihona Puke stsExplicitImplicit

Out of pocket expense

The money paid for the car: $30,000

15

Your Resources

16

Resources Working Separately

60,000 + 7,000 + 40,000 = $107,000

17

Tying your resources in a business only makes sense

18

Normal Profit = Zero Economic You earn a “Normal Profit” Profit

– The Rent you are NOT earning because you have the building tied up in your business.

9

Capital (Money)

• If you borrow money and pay interest on it you incur an explicit cost: – The interest you pay the bank on that loan. • If you use your own money, you incur an implicit cost: – The interest you ARE NOT earning on that money.

3

The Power of Compound Interest

Nicole and Brent can save $6,000 a year. Nicole puts her $6000 to earn 7% right away and continues to save $6,000 a year until she retires 45 years later. Brent, decides instead to use his $6,000/ year for car payments the first 5 years and then saves $6,000/year earning 7% for 40 years

7

Labor

• Hired workers represent an explicit cost:

– The wage you pay.

• The time you spend running your business represents an implicit cost:

– The best salary you give up.

8

Opportunity cost of Land

• If you pay rent for the building you use for your business, you incur an explicit cost:

– The Rent you pay.

• If you own the building, you incur an implicit cost:

20

Opportunity Costs Ch. 12

Claudia Garcia-Szekely

2/21/2015

1

“The most powerful force in the universe is compound interest”

Albert Einstein 2

The Power of Compound Interest

when take home the You you earn a “Normal same of money Profit”amount when you take you get with your home only as much resources working as would cover separately Implicit Costs

More than value of the real estate in all five boroughs of New York City.

With a 6.0% interest however, the value of their investment today would have been 7 times less!

When are you really making money?

Profits = Total Revenues – Total Costs. Accounting Profit = Total Revenues – Explicit Costs Economic Profits = Total Revenues – Explicit Costs – Implicit Costs

• Your building:

– Use your building for your business – Rent your building

• Your savings

– Use the money to open your business – Earn a return on your money

Implicit costs= $107,000

19

Above Normal Profit Abnormal Profit

Take home the MORE than what you get with your than resources Take home more what workingto separately is needed cover Implicit Costs

4

What is the cost of that car?

$30,000 The price of the car?

Brent could have earned 7% interest on the $30,000 if he had not used the money to buy the car… is the cost of the car is $30,000 + interest lost?

10

Costs

• Explicit costs are “easy to see” because a payment is made.

– Rent – Interest on loan – Wages

• Implicit costs are "hidden”, they represent a missed opportunity to make money: