国际财政THE NOTES ON INTERNATIONAL FINANCEfinal02

国际金融英文版课后答案

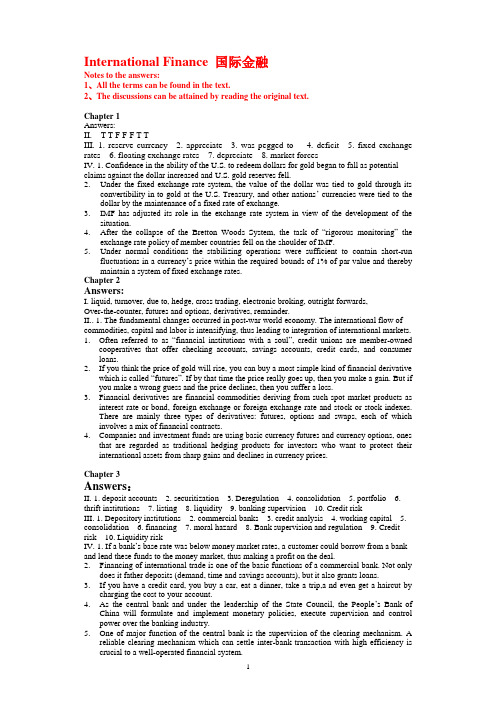

International Finance 国际金融Notes to the ans wers:1、All the terms can be found in the text.2、The discussions can be attained by reading the original text.Chapter 1Answers:II. T T F F F T TIII. 1. reserve currency 2. appreciate 3. was pegged to 4. deficit 5. fixed exchange rates 6. floating exchange rates 7. depreciate 8. market forcesIV. 1. Confidence in the ability of the U.S. to redeem dollars for gold began to fall as potential claims against the dollar increased and U.S. gold reserves fell.2.Under the fixed exchange rate system, the value of the dollar was tied to gold through itsconvertibility in to gold at the U.S. Treasury, and other nations’ currencies were tied to the dollar by the maintenance of a fixed rate of exchange.3.IMF has adjusted its role in the exchange rate system in view of the development of thesituation.4.After the collapse of the Bretton Woods System, the task of ―rigorous monitoring‖theexchange rate policy of member countries fell on the shoulder of IMF.5.Under normal conditions the stabilizing operations were sufficient to contain short-runfluctuations in a currency’s price within the required bounds of 1% of par value and thereby maintain a system of fixed exchange rates.Chapter 2Answers:I. liquid, turnover, due to, hedge, cross trading, electronic broking, outright forwards,Over-the-counter, futures and options, derivatives, remainder.II.. 1. The fundamental changes occurred in post-war world economy. The international flow of commodities, capital and labor is intensifying, thus leading to integration of international markets.1.Often referred to as ―financial institutions with a soul‖, credit unions are member-ownedcooperatives that offer checking accounts, savings accounts, credit cards, and consumer loans.2.If you think the price of gold will rise, you can buy a most simple kind of financial derivativewhich is called ―futures‖. If by that time the price really goes up, then you make a gain. But if you make a wrong guess and the price declines, then you suffer a loss.3.Financial derivatives are financial commodities deriving from such spot market products asinterest rate or bond, foreign exchange or foreign exchange rate and sto ck or stock indexes.There are mainly three types of derivatives: futures, options and swaps, each of which involves a mix of financial contracts.panies and investment funds are using basic currency futures and currency options, onesthat are regarded as traditional hedging products for investors who want to protect their international assets from sharp gains and declines in currency prices.Chapter 3Answers:II. 1. deposit accounts 2. securitization 3. Deregulation 4. consolidation 5. portfolio 6. thrift institutions 7. listing 8. liquidity 9. banking supervision 10. Credit riskIII. 1. Depository institutions 2. commercial banks 3. credit analysis 4. working capital 5. consolidation 6. financing 7. moral hazard 8. Bank supervision and regulation 9. Credit risk 10. Liquidity riskIV. 1. If a bank’s base rate was below money market rates, a customer could borrow from a bank and lend these funds to the money market, thus making a profit on the deal.2.Financing of international trade is one of the basic functions of a commercial bank. Not onlydoes it father deposits (demand, time and savings accounts), but it also grants loans.3.If you have a credit card, you buy a car, eat a dinner, take a trip,a nd even get a haircut bycharging the cost to your account.4.As the central bank and under the leadership of the State Council, the People’s Bank ofChina will formulate and implement monetary policies, execute supervision and control power over the banking industry.5.One of major function of the central bank is the supervision of the clearing mechanis m. Areliable clearing mechanis m which can settle inter-bank transaction with high efficiency is crucial to a well-operated financial system.Chapter 4 Ans wers:II. 1.integrity 2. pretext 3. released 4. produce 5. facilities 6. obliged 7. alleging 8. Claims 9. cleared 10. deliveryIII. 1. in favor of 2. consignment 3. undertaking, terms and conditions 4. cleared 5. regardless of 6. obliged to 7. undervalue arrangement 8. on the pretext of 9. refrain from 10. hinges onIV. 1. The objective of documentary credits is to facilitate international payment by making use of the financial expertise and credit worthiness of one or more banks.2.In compliance with your request, we have effected insurance on your behalf and debited youraccount with the premium in the amount of $1000.3.When an exporter is trading regularly with an importer, he will offer open account terms.4.Exporters usually insist on payment by cash in advance when they are trading with oldcustomers.5.Cash in advance means that the exporter is paid either when the importer places his order orwhen the goods are ready for shipment.Chapter 5.II.1. b 2. c 3. c 4. a 5. b 6. b 7. a 8. cIII. 1. guaranteed 2. without recourse 3. defaults 4. on the buyer’s account 5. is equivalent to 6. in question 7. devaluation 8. validity 9. discrepancy 10. inconsistent withChapter 6Answers:II. 1. open account, creditworthiness 2. demand 3. draw on, creditor 4. protest 5. schedule, discrepancies 6. acceptance 7. drawee 8. guranteedIII. 1. collecting bank 2. tenor 3. the proceeds 4. protest 5. deferred payment 6. presentation 7. the maturity date 8. a document of title 9. the shipping documents 10. transshipmentIV. 1. Documentary collection is a method by which the exporter authorizes the bank to collect money from the importer.2.When a draft is duly presented for acceptance or payment but the acceptance or paymentis refused, the draft is said to be dishonored.3.In the international money market, draft is a circulative and transferable instrument.Endorsement serves to transfer the title of a draft to the transferee.4.A clean bill of lading is favored by the buyer and the banks for financial settlementpurposes.5.Parcel post receipt is issued by the post office for goods sent by parcel post. It is both areceipt and evidence of dispatch and also the basis for claim and adjustment if there is any damage to or loss of parcels.Chapter 7II. financing, discounting, factoring, forfaiting, without recourse, accounts receivable, factor, trade obligations, promissory notes, trade receivables, specialized.III. 1. a cash flow disadvantage 2. without recourse 3. negotiable instruments 4. promissory notes 5. profit margin 6. at a discount, maturity, credit risk 7. A bill of exchange, A promissory noteIV. 1. When a bill is dishonored by non-acceptance or by non-payment, the holder then has an immediate right of recourse against the drawer and the endorsers.2.If a bill of lading is made out to bearer, it can be legally transferred without endorsement.3.The presenting bank should endeavor to ascertain the reasons non-payment ornon-acceptance and advise accordingly to the collecting bank.4.Any charges and expenses incurred by banks in connection with any action for protection o fthe goods will be for the account of the principal.5.Anyone who has a current account at a bank can use a cheque.Chapter EightStructure of the Foreign Exchange Market外汇市场的构成1. Key Terms1)foreign exchange:―Foreign exchange‖ refers t o money denominated in the currency of another nation or group of nations.2)payment“payment”is the transmission of an instruction to transfer value that results from a transaction in the economy.3)settlement―settlement‖ is the final and uncondit ional transfer of the value specified in a payment instruction.2. True or False1) true 2) true 3) true 4) true1)Tell the reasons why the dollar is the market's most widely tradedcurrency?key points: U.S.A economic background; the leadership of USD in the world economy ; the role it plays in investment , trade, etc.2)What kind of market is the foreign exchange market?Make reference to the following parts:(8.7 The Market Is Made Up of An International Network of Dealers)Chapter 9Instruments交易工具1. Key Terms1) spot transactionA spot transaction is a straightforward (or ―outright‖) exchange of one currency for another. The spot rate is the current market price, the benchmark price.Spot transactions do not require immediate settlement, or payment ―on the spot.‖ By convention, the settlement date, or ―value date,‖is the second business day after the ―deal date‖ (or ―trade date‖) on which the transaction is agreed to by the two traders. The two-day period provides ample time for the two parties to confirm the agreement and arrange the clearing and necessary debiting and crediting of bank accounts in various international locations.2) American termsThe phrase ―American terms‖means a direct quote from the point of view of someone located in the United States. For the dollar, that means that the rate is quoted in variable amounts of U.S. dollars and cents per one unit of foreign currency (e.g., $1.2270 per Euro).3) outright forward transactionAn outright forward transaction, like a spot transaction, is a straightforward single purchase/ sale of one currency for another. The only difference is that spot is settled, or delivered, on a value date no later than two business days after the deal date, while outright forward is settled on any pre-agreed date three or more business days after the deal date. Dealers use the term ―outright forward‖ to make clear that it is a single purchase or sale on a future date, and not part of an ―FX swap‖.4) FX swapAn FX swap has two separate legs settling on two different value dates, even though it is arranged as a single transaction and is recorded in the turnover statistics as a single transaction. The two counterparties agree to exchange two currencies at a particular rate on one date (the ―near date‖) and to reverse payments, almost always at a different rate, on a specified sub sequent date (the ―far date‖). Effectively, it is a spot transaction and an outright forward transaction going in opposite directions, or else two outright forwards with different settlement dates, and going in opposite directions. If both dates are less than one month from the deal date, it is a ―short-dated swap‖; if one or both dates are one month or more from the deal date, it is a ―forward swap.‖5) put-call parity―Put-call parity‖says that the price of a European put (or call) option can be deduced from the price of a European call (or put) option on the same currency, with the same strike price and expiration. When the strike price is the same as the forward rate (an ―at-the-money‖forward), the put and the call will be equal in value. When the strike price is not the same as the forward price, the difference between the value of the put and the value of the call will equal the difference in the present values of the two currencies.2. True or False1) true 2) true 3) true3. Cloze1) Traders in the market thus know that for any currency pair, if the basecurrency earns a higher interest rate than the terms currency, the currency will trade at a forward discount, or below the spot rate; and if the base currency earns a lower interest rate than the terms currency, the base currency will trade at a forward premium, or above the spot rate. Whichever side of the transaction the trader is on, the trader won't gain (or lose) from both the interest rate differential and the forward premium/discount. A trader who loses on the interest rate will earn the forward premium, and vice versa.2) A call option is the right, but not the obligation, to buy the underlyingcurrency, and a put option is the right, but not the obligation, to sellthe underlying currency. All currency option trades involve two sides—the purchase of one currency and the sale of another—so that a put to sell pounds sterling for dollars at a certain price is also a call to buy dollars for pounds sterling at that price. The purchased currency is the call side of the trade, and the sold currency is the put side of the trade. The party who purchases the option is the holder or buyer, and the party who creates the option is the seller or writer. The price at which the underlying currency may be bought or sold is the exercise , or strike, price. The option premium is the price of the option that the buyer pays to the writer. In exchange for paying the option premium up front, the buyer gains insurance against adverse movements in the underlying spot exchange rate while retaining the opportunity to benefit from favorable movements. The option writer, on the other hand, is exposed to unbounded risk—although the writer can (and typically does) seek to protect himself through hedging or offsetting transactions.4. Discussions1)What is a derivate financial instrument? Why is traded?2)Discuss the differences between forward and futures markets in foreigncurrency.3)What advantages do foreign currency futures have over foreigncurrency options?4)What is meant if an option is ―in the money‖, ―out of the money‖,or ―atthe money‖?5)What major international contracts are traded on the ChicagoMercantile Exchange ? Philadelphia Stock Exchange?Chapter 10Managing Risk in Foreign Exchange Trading外汇市场交易的风险管理1. Key Terms1) Market riskMarket risk, in simplest terms, is price risk, or ―exposure to (adverse)price change.‖ For a dealer in foreign exchange, two major elements of market risk are exchange rate risk and interest rate risk—that is, risks of adverse change in a currency rate or in an interest rate.2) VARVAR estimates the potential loss from market risk across an entire portfolio, using probability concepts. It seeks to identify the fundamental risks that the portfolio contains, so that the portfolio can be decomposed into underlying risk factors that can be quantified and managed. Employing standard statistical techniques widely used in other fields, and based in part on past experience, VAR can be used to estimate the daily statistical variance, or standard deviation, or volatility, of the entire portfolio. On the basis of that estimate of variance, it is possible to estimate the expected loss from adverse price movements with a specified probability over a particular period of time (usually a day).3) credit riskCredit risk, inherent in all banking activities, arises from the possibility that the counterparty to a contract cannot or will not make the agreed payment at maturity. When an institution provides credit, whatever the form, it expects to be repaid. When a bank or other dealing institution enters a foreign exchange contract, it faces a risk that the counterparty will not perform according to the provisions of the contract. Between the time of the deal and the time of thesettlement, be it a matter of hours, days, or months, there is an extension of credit by both parties and an acceptance of credit risk by the banks or other financial institutions involved. As in the case of market risk, credit risk is one of the fundamental risks to be monitored and controlled in foreign exchange trading.4) legal risksThere are legal risks, or the risk of loss that a contract cannot be enforced, which may occur, for example, because the counterparty is not legally capable of making the binding agreement, or because of insufficient documentation or a contract in conflict with statutes or regulatory policy.2. True or False1)True 2) true3. Translation1) Broadly speaking, the risks in trading foreign exchange are the same asthose in marketing other financial products. These risks can be categorized and subdivided in any number of ways, depending on the particular focus desired and the degree of detail sought. Here, the focus is on two of the basic categories of risk—market risk and credit risk (including settlement risk and sovereign risk)—as they apply to foreign exchange trading. Note is also taken of some other important risks in foreign exchange trading—liquidity risk, legal risk, and operational risk2) It was noted that foreign exchange trading is subject to a particular form ofcredit risk known as settlement risk or Herstatt risk, which stems in part from the fact that the two legs of a foreign exchange transaction are often settled in two different time zones, with different business hours. Also noted was the fact that market participants and central banks have undertaken considerable initiatives in recent years to reduce Herstatt risk.4. Discussions2)Discuss the way how V AR works in measuring and managing marketrisk?3)Why are banks so interested in political or country risk?4)Discuss other forms of risks which you know in foreign exchange. Chapter 11The Determination of Exchange Rates汇率的决定1. Key Terms1) PPPPurchasing Power Parity (PPP) theory holds that in the long run, exchange rates will adjust to equalize the relative purchasing power of currencies. This concept follows from the law of one price, which holds that in competitive markets, identical goods will sell for identical prices when valued in the same currency.2) the law of one priceThe law of one price relates to an individual product. A generalization of that law is the absolute version of PPP, the proposition that exchange rates will equate nations' overall price levels.3) FEER―fundamental equilibrium exchange rate,‖ or FEER,envisaged as the equilibrium exchange rate that would reconcile a nation's internal and external balance. In that system, each country would commit itself to a macroeconomicstrategy designed to lead, in the medium term, to ―internal balance‖—defined as unemployment at the natural rate and minimal inflation—and to ―external balance‖—defined as achieving the targeted current account balance. Each country would be committed to holding its exchange rate within a band or target zone around the FEER, or the level needed to reconcile internal and external balance during the intervening adjustment period.4) monetary approachThe monetary approach to exchange rate determination is based on the proposition that exchange rates are established through the process of balancing the total supply of, and the total demand for, the national money in each nation. The premise is that the supply of money can be controlled by the nation's monetary authorities, and that the demand for money has a stable and predictable linkage to a few key variables, including an inverse relationship to the interest rate—that is, the higher the interest rate, the smaller the demand for money.5) portfolio balance approachThe portfolio balance approach takes a shorter-term view of exchange rates and broadens the focus from the demand and supply conditions for money to take account of the demand and supply conditions for other financial assets as well. Unlike the monetary approach, the portfolio balance approach assumes that domestic and foreign bonds are not perfect substitutes. According to the portfolio balance theory in its simplest form, firms and individuals balance their portfolios among domestic money, domestic bonds, and foreign currency bonds, and they modify their portfolios as conditions change. It is the process of equilibrating the total demand for, and supply of, financial assets in each country that determines the exchange rate.2. True or False1) true 2) true3. Cloze1)PPP is based in part on some unrealistic assumptions: that goods are identical; that all goods are tradable; that there are no transportationcosts, information gaps, taxes, tariffs, or restrictions of trade; and—implicitly and importantly—that exchange rates are influenced only byrelative inflation rates. But contrary to the implicit PPP assumption,exchange rates also can change for reasons other than differences ininflation rates. Real exchange rates can and do change significantly overtime, because of such things as major shifts in productivitygrowth, advances in technology, shifts in factor supplies, changes inmarket structure, commodity shocks, shortage, and booms.2)Each individual and firm chooses a portfolio to suit its needs, based on a variety of considerations—the holder's wealth and tastes, the level ofdomestic and foreign interest rates, expectations of future inflation,interest rates, and so on. Any significant change in the underlying factorswill cause the holder to adjust his portfolio and seek a new equilibrium.These actions to balance portfolios will influence exchange rates.4. Discussions1)How does the purchasing power parity work?2)Describe and discuss one model for forecasting foreign exchange rates.3)Make commends on how good are the various approaches mentioned in the chapter.4)Central banks occasionally intervene in foreign exchange markets. Discuss the purpose of such intervention. How effective is intervention?Chapter 12The Financial Markets金融市场1. Key Terms1)money marketThe money market is really a market for short-term credit, or the option to use someone else's money for a period of time in return for the payment of interest. The money market helps the participants in the economic process cope with routine financial uncertainties. It assists in bridging the differences in the timing of payments and receipts that arise in a market economy.2)capital marketMarkets dealing in instruments with maturities that exceed one year are often referred to as capital markets.3)primary marketThe term ―primary market‖ applies to the original issuance of a credit market instrument. There are a variety of techniques for such sales, including auctions, posting of rates, direct placement, and active customer contacts by a salesperson specializing in the instrument4) secondary marketOnce a debt instrument has been issued, the purchaser may be able to resell it before maturity in a ―secondary market.‖ Again, a number of techniques are available for bringing together potential buyers and sellers of existing debt instruments. They include various types of formal exchanges, informal telephone dealer markets, and electronic trading through bids and offers on computer screens. Often, the same firms that provide primary marketing services help to create or ―make‖ secondary markets.5)RPsIn addition to making outright purchases and sales in the secondary market, entities with money to invest for a brief period can acquire a security temporarily, and holders of debt instruments can borrow short term by selling securities temporarily. These two types of transactions are repurchase agree-ments (RPs) and reverse RPs,respectively. In the wholesale market, banks and government securities dealers offer RPs at competitive rates of return by selling securities under contracts providing for their repurchase from one day to several months later6)BAs 7)CDs (reference to 13.1)8) EurodollarEurodollars are U.S. dollar deposits at banking offices in a country other than the United States.9) EurobankEurobanks—banks dealing in Eurodollar or some other nonlocal currency deposits, including foreign branches of U.S. banks— originally held deposits almost exclusively in Europe, primarily London. While most such deposits are still held in Europe, they are also held in such places as the Bahamas, Bahrain, Canada, the Cayman Islands, Hong Kong, Singapore, and Tokyo, as well as other parts of the world.10)LIBOR (reference to 13.2.2 Certificates of Deposit)London inter-bank offer rate11)mortgage-backed securities12)Eurobond market (details make reference to13.3.3 )The Eurobond market, centered in London, is an offshore market in intermediate- and long-term debt issues. It serves as a source of capital for multinational corporations and for foreign governments. It developed after the United States instituted the interest equalization tax in 1963 to stem capital outflows inspired by relatively low U.S. interest rates.2. True or False1) true 2) true 3) true3. Discussions1) Describe the characteristics of Interest Rate Swap and the role of it in thebank-related financial market.2) What risks are encountered in the swaps markets?3) Discuss one or two specific examples of derivative products and their use.4. Translations1) Markets dealing in instruments with maturities that exceed one year are often referred to as capital markets, since credit to finance investments in new capital would generally be needed for more than one year. The time division is arbitrary. A long-term project can be started with short-term credit, with additional instruments may need to be renewed before a project is completed. Debt instruments that differ in maturity share other characteristics. Hence, the term ―capital market‖ could be –and occasionally is applied to some shorter maturity transactions.2) The secondary market for Treasure securities consists of a network of dealers, brokers, and investors who effect transactions either by telephone or electronically. Telephone trades are generally between dealers and their customers. Electronics trading is arranged through screen-based systems provided by some of the dealers to their customers. It allows selected trades to take place without a conversation. When dealers trade with each other, they generally use brokers. Brokers provide information on screen, but the final trades are made bytelephone.Chapter 13Concepts of Financial Assets Value金融资产价值的概念1. Key Terms1) absolute measure of valueAn absolute measure of value is used when one must compare it to a nominal amount: purchase price, amount to invest, target sum of money to raise2) relative measure of valueA relative measure of rate of return is more convenient to use when one wishes to compare one financial asset to a set of numerous alternative assets. A rate of return is the most commonly used relative measure of value.3) discountingFuture benefits must be discounted (or converted) to their present (or today's) value, before they are summed. Discounting is part of the study of time value of money, or actuarial mathematics, and a complete treatment of it can be found in specialized textbook.4) time value of moneyTime value of money studies how amounts of money are made equivalent over time. Converting amounts today into their future equivalent consists in adding interest to principal, i.e. compounding. Converting amounts in the future into today's equivalent consists of charging an interest, i.e. discounting. Thus, discounting is the exact inverse of compounding.5) FV 6) PV 7) annuity8) short term securitiesShort term securities (i.e. securities with maturity less than one year) are sold at a discount (i.e. nominal value less the interest to be earned over the remaining number of days to maturity). There is no coupon, and no additional benefits such as conversion right, but there may be a penalty for early redemption in the case of some bank certificates of deposit.9) P/E ratio (make reference to 15.5.3 --Earnings Multiple or P/E Ratio)Another approach which is used as a short-cut by a large number of investors, is the earnings multiple. It is sometimes referred to as earningsmultiplier, and it is most commonly known as price-to-earnings or P/E ratio. In many instances, the approach, rather than being an oversimplification, can be an improvement over the previous format. In its most common presentation, the idea is that the price P of a share should be a multiple m of its earnings per share E. The multiple m is an industry average because it is assumed that all companies in an industry face similar marketing, technological and resource challenges, and thus, should have similar organizational and production patterns.10) intrinsic valueintrinsic value, or difference between market price of the underlying stock and strike price (which is also known as exercise price because it is the price at which an option holder can buy from or sell to the option writer the underlying stock through the options exchange)。

国际金融英文版

Higher unemployment rate 6.8% (1879 – 1913), 5.6% (1946 – 1990)

Higher cost to maintain the system, in 1990 the cost would be $137 billion.

Limited supply of the gold can hamper the rapid growth of international trade and investment.

Exchange rate were fluctuated over fairly wide ranges because of the predatory devaluation of the domestic currency.

Gold exchange system were adopted. Other countries held gold, U.S. dollars or British pounds as reserves. U.S. and U.K. held gold. U.S. and U.K. traded gold only with foreign central banks, not private citizens.

The exchange rate would fluctuate between (0.80 + 0.008) = 0.8008 and (0.80 – 0.008) = 0.792

0.8008 and 0.792 are called gold export and import points.

Decline of Bretton Woods system

European and Japanese economy grew fast.

国际经济学 英文

国际经济学英文English:International economics is the study of how countries interact with each other in terms of trade, finance, and international investment. It examines the impact of international organizations, such as the World Trade Organization and the International Monetary Fund, on global economic development, and the role of governments in shaping international economic policies. International economics also explores the effects of globalization, exchange rate fluctuations, and trade agreements on national economies, as well as the implications of economic integration and cooperation among countries. This field of study helps to understand the complexities of cross-border transactions and the interconnectedness of different economies, and provides insights into the potential benefits and challenges of international economic interactions.中文翻译:国际经济学是研究国家在贸易、金融和国际投资方面如何相互联系的学科。

金融英语术语

金融英语术语Organized at 3pm on January 25, 2023Only by working hard can we be betterinflation通货膨胀deflation通货紧缩tighter credit紧缩信贷monetary policy货币政策foreign exchange外汇spot transaction即期交易forward transaction远期交易option forward transaction择期交易swap transaction调期交易quote报价settlment and delivery交割Treasury bond财政部公债current-account经常项目pickup in rice物价上涨Federal Reserve美联储buying rate买入价selling rate卖出价spread差幅contract合同at par平价premium升水discount贴水direct quoation method直接报价法indirect quoation method间接报价法dividend股息domestic currency本币floating rate浮动利率parent company母公司credit swap互惠贷款venture capital风险资本book value帐面价值physical capital实际资本IPOinitial public offering新股首发;首次公开发行job machine就业市场welfare capitalism福利资本主义collective market cap市场资本总值glolbal corporation跨国公司transnational status跨国优势transfer price转让价格consolidation兼并leverage杠杆financial turmoil/meltdown金融危机file for bankruptcy申请破产bailout救助take over收购buy out购买某人的产权或全部货物go under破产take a nosedive股市大跌tumble下跌falter摇摇欲坠on the hook被套住shore up confidence提振市场信心stave off挡开,避开,liquidate assets资产清算at fire sale prices超低价sell-off证券的跌价reserve储备note票据discount贴现circulate流通central bank中央银行the Federal Reserve System联邦储备系统credit union信用合作社paper currency纸币credit creation信用创造branch banking银行分行制unit banking单一银行制out of circulation退出流通capital stock股本at par以票面价值计electronic banking电子银行banking holding company公司银行the gold standard金本位the Federal Reserve Board联邦储备委员会the stock market crash股市风暴reserve ratio准备金比率division of labor劳动分工commodity money商品货币legal tender法定货币fiat money法定通货a medium of exchange交换媒介legal sanction法律制裁face value面值liquid assets流动资产illiquidl assets非流动资产the liquidity scale流动性指标real estate不动产checking accounts,demand deposit,checkable deposit活期存款time deposit定期存款negotiable order of withdrawal accounts大额可转让提款单money market mutual funds货币市场互助基金repurchase agreements回购协议certificate of deposits存单bond债券stock股票travelers'checks旅行支票small-denomination time deposits小额定期存款large-denomination time deposits大额定期存款bank overnight repurchase agreements银行隔夜回购协议bank long-term repurchase agreements银行长期回购协议thrift institutions存款机构financial institution金融机构commercial banks商业银行a means of payment支付手段a store of value储藏手段a standard of value价值标准deficit亏损roll展期wholesale批发default不履约auction拍卖collateralize担保markup价格的涨幅dealer交易员broker经纪人pension funds养老基金face amount面值commerical paper商业票据banker's acceptance银行承兑汇票Fed fund联邦基金eurodollar欧洲美元treasury bills国库券floating-rate浮动比率fixed-rate固定比率default risk拖欠风险credit rating信誉级别tax collection税收money market货币市场capital market资本市场original maturity原始到期期限surplus funds过剩基金syndication辛迪加underwrite包销,认购hedge对冲买卖、套期保值innovation到期交易spread利差principal本金swap掉期交易eurobond market 欧洲债券市场euronote欧洲票据Federal Reserve Bank FRB联邦储备银行unsecured credit无担保贷款fixed term time deposit定期支付存款lead bank牵头银行neogotiable time deposit议付定期存款inter-bank money market银行同业货币市场medium term loan 中期贷款syndicated credit银团贷款merchant bank商业银行portfolio management 有价债券管理lease financing租赁融资note issurance facility票据发行安排bearer note不记名票价underwriting facility包销安排floating-rate note 浮动利率票据bond holder债券持持有者London Interbank Offered RateLIBOR伦敦同业优惠利率back-up credit line备用信贷额promissory note..p/n本票revolving cerdit 循环信用证,即revolving letter of credit non interest-bearing reserves无息储备金interest rate controls 利率管制interest rate ceiling 利率上限interest rate floor 利率下限破产 insolvency有偿还债务能力的 solvent合同 contract汇率 exchange rate私营部门 private sector财政管理机构 fiscal authorities宽松的财政政策 slack fiscal policy税法 tax bill财政 public finance财政部 the Ministry of Finance平衡预算 balanced budget继承税 inheritance tax货币主义者 monetariest增值税 VAT value added tax收入 revenue总需求 aggregate demand货币化 monetization赤字 deficit经济不景气 recessiona period when the economy of a country is not successful, business conditions are bad, industrial production and trade are at a low level and there is a lot of unemployment经济好转 turnabout复苏 recovery成本推进型 cost push货币供应 money supply生产率 productivity劳动力 labor force实际工资 real wages成本推进式通货膨胀 cost-push inflation需求拉动式通货膨胀 demand-pull inflation双位数通货膨胀 double- digit inflation极度通货膨胀 hyperinflation长期通货膨胀 chronic inflation治理通货膨胀 to fight inflation最终目标 ultimate goal坏的影响 adverse effect担保 ensure贴现 discount萧条的 sluggish认购 subscribe to支票帐户 checking account货币控制工具 instruments of monetry control 借据 IOUsI owe you本票 promissory notes货币总监 controller of the currency拖收系统 collection system支票清算或结算 check clearing资金划拨 transfer of funds可以相信的证明 credentials改革 fashion被缠住 entangled货币联盟 Monetary Union再购协议 repo精明的讨价还价交易 horse-trading欧元 euro公共债务 membership criteria汇率机制 REM储备货币 reserve currency劳动密集型 labor-intensive股票交易所 bourse竞争领先 frontrun牛市 bull market非凡的牛市 a raging bull规模经济 scale economcies买方出价与卖方要价之间的差价 bid-ask spreads 期货股票 futures经济商行 brokerage firm回报率 rate of return股票 equities违约 default现金外流 cash drains经济人佣金 brokerage fee存款单 CDcertificate of deposit营业额 turnover资本市场 capital market布雷顿森林体系 The Bretton Woods System经常帐户 current account套利者 arbitrager远期汇率 forward exchange rate即期汇率 spot rate实际利率 real interest rates货币政策工具 tools of monetary policy银行倒闭 bank failures跨国公司 MNC Multi-National Corporation商业银行 commercial bank商业票据 comercial paper利润 profit本票,期票 promissory notes监督 to monitor佣金经济人 commission brokers套期保值 hedge有价证券平衡理论 portfolio balance theory 外汇储备 foreign exchange reserves固定汇率 fixed exchange rate浮动汇率 floating/flexible exchange rate 货币选择权期货 currency option套利 arbitrage合约价 exercise price远期升水 forward premium多头买升 buying long空头卖跌 selling short按市价订购股票 market order股票经纪人 stockbroker国际货币基金 the IMF七国集团 the G-7监督 surveillance同业拆借市场 interbank market可兑换性 convertibility软通货 soft currency限制 restriction交易 transaction充分需求 adequate demand短期外债 short term external debt汇率机制 exchange rate regime直接标价 direct quotes资本流动性 mobility of capital赤字 deficit本国货币 domestic currency外汇交易市场 foreign exchange market国际储备 international reserve利率 interest rate资产 assets国际收支 balance of payments贸易差额 balance of trade繁荣 boom债券 bond资本 captial资本支出 captial expenditures商品 commodities商品交易所 commodity exchange期货合同 commodity futures contract普通股票 common stock联合大企业 conglomerate货币贬值 currency devaluation通货紧缩 deflation折旧 depreciation贴现率 discount rate归个人支配的收入 disposable personal income 从业人员 employed person汇率 exchange rate财政年度fiscal year自由企业 free enterprise国民生产总值 gross antional product库存 inventory劳动力人数 labor force债务 liabilities市场经济 market economy合并 merger货币收入 money income跨国公司 Multinational Corproation个人收入 personal income优先股票 preferred stock价格收益比率 price-earning ratio优惠贷款利率 prime rate利润 profit回报 return on investment使货币升值 revaluation薪水 salary季节性调整 seasonal adjustment关税 tariff失业人员 unemployed person效用 utility价值 value工资 wages工资价格螺旋上升 wage-price spiral收益 yield补偿贸易 compensatory trade, compensated deal 储蓄银行 saving banks欧洲联盟 the European Union单一的实体 a single entity抵押贷款 mortgage lending业主产权 owner's equity普通股 common stock无形资产 intangible assets收益表 income statement营业开支 operating expenses行政开支 administrative expenses现金收支一览表 statement of cash flow贸易中的存货 inventory收益 proceeds投资银行 investment bank机构投资者 institutional investor垄断兼并委员会 MMC招标发行 issue by tender定向发行 introduction代销 offer for sale直销 placing公开发行 public issue信贷额度 credit line国际债券 international bonds欧洲货币Eurocurrency利差 interest margin以所借的钱作抵押所获之贷款 leveraged loan权利股发行 rights issues净收入比例结合 net income gearing证券行业词汇share, equity, stock 股票、股权;bond, debenture, debts 债券;negotiable share 可流通股份;convertible bond 可转换债券;treasury/government bond 国库券/政府债券;corporate bond 企业债券;closed-end securities investment fund 封闭式证券投资基金; open-end securities investment fund 开放式证券投资基金;fund manager 基金经理/管理公司;fund custodian bank 基金托管银行;market capitalization 市值;p/e ratio 市盈率;price/earningmark-to-market 逐日盯市;payment versus delivery 银券交付;clearing and settlement 清算/结算;commodity/financial derivatives 商品/金融衍生产品;put / call option 看跌/看涨期权;margins, collateral 保证金;rights issue/offering 配股;bonus share 红股;dividend 红利/股息;ADR 美国存托凭证/存股证;American Depository Receipt GDR 全球存托凭证/存股证;Global Depository Receipt retail/private investor 个人投资者/散户;institutional investor 机构投资者;broker/dealer 券商;proprietary trading 自营;insider trading/dealing 内幕交易;market manipulation 市场操纵;prospectus 招股说明书;IPO 新股/初始公开发行;Initial Public Offering merger and acquisition 收购兼并;会计与银行业务用语汇总汇款用语汇款||寄钱 to remit||to send money寄票供取款||支票支付 to send a cheque for payment寄款人 a remitter收款人 a remittee汇票汇单用语国外汇票 foreign Bill国内汇票 inland Bill跟单汇票 documentary bill空头汇票 accommodation bill原始汇票 original bill改写||换新票据 renewed bill即期汇票 sight bill||bill on demand... days after date||... days' after date ... 日后付款... months after date||... months' after date ... 月后付款见票后... 日付款... days' after sight||... days' sight见票后... 月付款... months' after sight||... months' sight同组票据 set of bills单张汇票 sola of exchange||sole of exchange远期汇票 usance bill||bill at usance长期汇票 long bill短期汇票 short bill逾期汇票 overdue bill宽限日期 days of grace电汇 telegraphic transfer邮汇 postal order||postal note Am.||post office order||money order 本票 promissory note P/N押汇负责书||押汇保证书 letter of hypothecation副保||抵押品||付属担保物 collateral security担保书 trust receipt||letter of indemnity承兑||认付 acceptance单张承兑 general acceptance有条件承兑 qualified acceptance附条件认付 conditional acceptance部分认付 partial acceptance拒付||退票 dishonour拒绝承兑而退票 dishonour by non-acceptance由于存款不足而退票 dihonour by non-payment提交 presentation背书 endorsement||indorsement无记名背书 general endorsement||blank endorsement记名式背书 special endorsement||full endorsement附条件背书 conditional endorsement限制性背书 restrictive endorsement无追索权背书 endorsement without recourse期满||到期 maturity托收 collection新汇票||再兑换汇票 re-exchange||re-draft外汇交易 exchange dealing||exchange deals汇兑合约 exchange contract汇兑合约预约 forward exchange contract外汇行情 exchange quotation交易行情表 course of exchange||exchange table汇价||兑换率 exchange rate||rate of exchange官方汇率 official rate挂牌汇率||名义汇率 nominal rate现汇汇率 spot rate电汇汇率||电汇率|| . rate||telegraphic transfer rate 兑现率||兑现汇率 demand rate长期汇率 long rate私人汇票折扣率 rate on a private bill远期汇票兑换率 forward rate套价||套汇汇率||裁定外汇行情 cross rate付款汇率 pence rate当日汇率||成交价 currency rate套汇||套价||公断交易率 arbitrage汇票交割||汇票议付 negotiation of draft交易人||议付人 negotiator票据交割||让与支票票据议付 to negotiatie a bill折扣交割||票据折扣 to discount a bill票据背书 to endorse a bill应付我差额51,000美元 a balance due to us of $51,000||a balance in our favour of $ 51,000收到汇款 to receive remittance填写收据 to make out a receipt付款用语付款方法 mode of payment现金付款 payment by cash||cash payment||payment by ready cash以支票支付 payment by cheque以汇票支付 payment by bill以物品支付 payment in kind付清||支付全部货款 payment in full||full payment支付部分货款||分批付款 payment in part||part payment||partial payment记帐付款||会计帐目内付款 payment on account定期付款 payment on term年分期付款 annual payment月分期付款 monthly payment||monthly instalment延滞付款 payment in arrear预付货||先付 payment in advance||prepayment延付货款 deferred payment立即付款 prompt payment||immediate payment暂付款 suspense payment延期付款 delay in payment||extension of payment支付票据 payment bill名誉支付||干与付款 payment for honour||payment by intervention结帐||清算||支付 settlement分期付款 instalment滞付||拖欠||尾数款未付 arrears特许拖延付款日 days of grace保证付款 del credere付款 to pay||to make payment||to make effect payment结帐 to settle||to make settlement||to make effect settlement||to square||to balance支出||付款 to defray||to disburse结清 to clear off||to pya off请求付款 to ask for payment||to request payment恳求付帐 to solicit payment拖延付款 to defer payment||to delay payment付款被拖延 to be in arrears with payment还债 to discharge迅速付款 to pay promptly付款相当迅速 to pay moderately well||to pay fairly well||to keep the engagements regularly付款相当慢 to pay slowly||to take extended credit付款不好 to pay badly||to be generally in arrear with payments付款颇为恶劣 to pay very badly||to never pay unless forced拒绝付款 to refuse payment||to refuse to pay||to dishonour a bill相信能收到款项 We shall look to you for the payment||We shall depend upon you for thepayment ||We expect payment from you惠请付款 kindly pay the amount||please forward payment||please forward a cheque.我将不得不采取必要步骤运用法律手段收回该项货款 I shall be obliged to take thenecessary steps to legally recover the amount. ||I shall be compelled to take steps to enforcepayment.惠请宽限 let the matter stand over till then.||allow me a short extension of time. ||Kindlypostpone the time for payment a little longer.索取利息 to charge interest附上利息 to draw interest||to bear interest||to allow interest生息 to yield interest生息3% to yield 3%存款 to deposit in a bank||to put in a bank||to place on deposit||to make deposit在银行存款 to have money in a bank||to have a bank account||to have money on deposit向银行提款 to withdraw one's deposit from a bank换取现金 to convert into money||to turn into cash||to realize折扣用语从价格打10%的折扣 to make a discount of 10% off the price||to make 10%discount off the price打折扣购买 to buy at a discount打折扣出售 to sell at a discount打折扣-让价 to reduce||to make a reduction减价 to deduct||to make a deduction回扣 to rebate现金折扣 cash discount货到付现款 cash on arrival即时付款 prompt cash净价||最低价格付现 net cash现金付款 ready cash即期付款 spot cash||cash down||cash on the nail凭单据付现款 cash against documents凭提单付现款 cash against bills of lading承兑交单 documents against acceptance D/A付款交单 documents against payment D/P折扣例文除非另有说明, 30日后全额付现, 如有错误, 请立即通知;Net cash 30 days unless specified otherwise. Advise promptly if incorrect.付款条件: 30日后全额付现, 10日后付现打2%折扣, 过期后付款时, 加上利率为6%的利息;Terms, net cash 30 days, or, less 2% 10 days. Interest charged at the rate of 6% after maturity.付款条件: 月底后10日后付现2%折扣, 现在付现3%折扣, 否则, 全额付现;财会名词1会计与会计理论会计 accounting 决策人 Decision Maker 投资人 Investor 股东 Shareholder 债权人 Creditor 财务会计 Financial Accounting 管理会计 Management Accounting 成本会计 Cost Accounting 私业会计 Private Accounting 公众会计 Public Accounting注册会计师 CPA Certified Public Accountant国际会计准则委员会 IASC 美国注册会计师协会 AICPA 财务会计准则委员会 FASB 管理会计协会 IMA美国会计学会 AAA 税务稽核署 IRS 独资企业 Proprietorship合伙人企业 Partnership 公司 Corporation会计目标 Accounting Objectives 会计假设 Accounting Assumptions会计要素 Accounting Elements 会计原则 Accounting Principles会计实务过程 Accounting Procedures 财务报表 Financial Statements财务分析 Financial Analysis会计主体假设 Separate-entity Assumption货币计量假设 Unit-of-measure Assumption持续经营假设 ContinuityGoing-concern Assumption会计分期假设 Time-period Assumption 资产 Asset 负债 Liability业主权益 Owner's Equity 收入 Revenue 费用 Expense 收益 Income 亏损 Loss历史成本原则 Cost Principle收入实现原则 Revenue Principle配比原则 Matching Principle全面披露原则 Full-disclosure Reporting principle客观性原则 Objective Principle 一致性原则 Consistent Principle 可比性原则Comparability Principle重大性原则 Materiality Principle稳健性原则 Conservatism Principle权责发生制 Accrual Basis 现金收付制 Cash Basis财务报告 Financial Report 流动资产 Current assets流动负债 Current Liabilities 长期负债 Long-term Liabilities投入资本 Contributed Capital留存收益 Retained Earning2会计循环会计循环 Accounting Procedure/Cycle会计信息系统 Accounting information System帐户 Ledger 会计科目 Account 会计分录 Journal entry原始凭证 Source Document 日记帐 Journal总分类帐 General Ledger 明细分类帐 Subsidiary Ledger试算平衡 Trial Balance 现金收款日记帐 Cash receipt journal现金付款日记帐 Cash disbursements journal销售日记帐 Sales Journal 购货日记帐 Purchase Journal 普通日记帐 General Journal 工作底稿 Worksheet调整分录 Adjusting entries 结帐 Closing entries3现金与应收帐款现金 Cash 银行存款 Cash in bank 库存现金 Cash in hand流动资产 Current assets 偿债基金 Sinking fund定额备用金 Imprest petty cash 支票 Checkcheque银行对帐单 Bank statement银行存款调节表 Bank reconciliation statement在途存款 Outstanding deposit 在途支票 Outstanding check应付凭单 Vouchers payable 应收帐款 Account receivable应收票据 Note receivable 起运点交货价 shipping point目的地交货价 destination point 商业折扣 Trade discount现金折扣 Cash discount 销售退回及折让 Sales return and allowance 坏帐费用Bad debt expense 备抵法 Allowance method 备抵坏帐 Bad debt allowance损益表法 Income statement approach 资产负债表法 Balance sheet approach帐龄分析法 Aging analysis method 直接冲销法 Direct write-off method带息票据 Interest bearing note 不带息票据 Non-interest bearing note出票人 Maker 受款人 Payee 本金 Principal 利息率 Interest rate到期日 Maturity date 本票 Promissory note 贴现 Discount背书 Endorse 拒付费 Protest fee4存货存货 Inventory 商品存货 Merchandise inventory 产成品存货 Finished goods inventory在产品存货 Work in process inventory原材料存货 Raw materials inventory起运地离岸价格 shipping point目的地抵岸价格 destination寄销 Consignment 寄销人 Consignor 承销人 Consignee定期盘存 Periodic inventory 永续盘存 Perpetual inventory购货 Purchase 购货折让和折扣 Purchase allowance and discounts存货盈余或短缺 Inventory overages and shortages分批认定法 Specific identification 加权平均法 Weighted average先进先出法 First-in, first-out or FIFO后进先出法 Lost-in, first-out or LIFO 移动平均法 Moving average成本或市价孰低法 Lower of cost or market or LCM市价 Market value 重置成本 Replacement cost可变现净值 Net realizable value上限 Upper limit 下限 Lower limit 毛利法 Gross margin method零售价格法 Retail method 成本率 Cost ratio5长期投资长期投资 Long-term investment 长期股票投资 Investment on stocks长期债券投资 Investment on bonds 成本法 Cost method权益法 Equity method合并法 Consolidation method 股利宣布日 Declaration date股权登记日 Date of record 除息日 Ex-dividend date 付息日 Payment date 债券面值 Face value, Par value债券折价 Discount on bonds 债券溢价 Premium on bonds票面利率 Contract interest rate, stated rate市场利率 Market interest ratio, Effective rate普通股 Common Stock 优先股 Preferred Stock现金股利 Cash dividends股票股利 Stock dividends 清算股利 Liquidating dividends到期日 Maturity date到期值 Maturity value直线摊销法 Straight-Line method of amortization实际利息摊销法 Effective-interest method of amortization6固定资产固定资产 Plant assets or Fixed assets 原值 Original value预计使用年限 Expected useful life预计残值 Estimated residual value 折旧费用 Depreciation expense累计折旧 Accumulated depreciation 帐面价值 Carrying value应提折旧成本 Depreciation cost 净值 Net value在建工程 Construction-in-process 磨损 Wear and tear 过时 Obsolescence 直线法Straight-line method SL工作量法 Units-of-production method UOP加速折旧法 Accelerated depreciation method双倍余额递减法 Double-declining balance method DDB年数总和法 Sum-of-the-years-digits method SYD以旧换新 Trade in 经营租赁 Operating lease 融资租赁 Capital lease 廉价购买权Bargain purchase option BPO 资产负债表外筹资 Off-balance-sheet financing最低租赁付款额 Minimum lease payments7无形资产无形资产 Intangible assets 专利权 Patents 商标权 Trademarks, Trade names 着作权 Copyrights 特许权或专营权 Franchises 商誉 Goodwill 开办费 Organization cost租赁权 Leasehold 摊销 Amortization8流动负债负债 Liability 流动负债 Current liability 应付帐款 Account payable应付票据 Notes payable 贴现票据 Discount notes长期负债一年内到期部分 Current maturities of long-term liabilities应付股利 Dividends payable 预收收益 Prepayments by customers存入保证金 Refundable deposits 应付费用 Accrual expense增值税 Value added tax 营业税 Business tax应付所得税 Income tax payable 应付奖金 Bonuses payable产品质量担保负债 Estimated liabilities under product warranties赠品和兑换券 Premiums, coupons and trading stamps或有事项 Contingency 或有负债 Contingent 或有损失 Loss contingencies或有利得 Gain contingencies 永久性差异 Permanent difference时间性差异 Timing difference 应付税款法 Taxes payable method纳税影响会计法 Tax effect accounting method递延所得税负债法 Deferred income tax liability method9长期负债长期负债 Long-term Liabilities 应付公司债券 Bonds payable有担保品的公司债券 Secured Bonds抵押公司债券 Mortgage Bonds 保证公司债券 Guaranteed Bonds信用公司债券 Debenture Bonds 一次还本公司债券 Term Bonds分期还本公司债券 Serial Bonds 可转换公司债券 Convertible Bonds可赎回公司债券 Callable Bonds 可要求公司债券 Redeemable Bonds记名公司债券 Registered Bonds 无记名公司债券 Coupon Bonds普通公司债券 Ordinary Bonds 收益公司债券 Income Bonds名义利率,票面利率 Nominal rate 实际利率 Actual rate有效利率 Effective rate 溢价 Premium 折价 Discount面值 Par value 直线法 Straight-line method实际利率法 Effective interest method到期直接偿付 Repayment at maturity 提前偿付 Repayment at advance偿债基金 Sinking fund 长期应付票据 Long-term notes payable抵押借款 Mortgage loan10业主权益权益 Equity 业主权益 Owner's equity股东权益 Stockholder's equity 投入资本 Contributed capital 缴入资本 Paid-in capital 股本 Capital stock资本公积 Capital surplus 留存收益 Retained earnings核定股本 Authorized capital stock 实收资本 Issued capital stock 发行在外股本Outstanding capital stock 库藏股 Treasury stock 普通股 Common stock 优先股Preferred stock累积优先股 Cumulative preferred stock非累积优先股 Noncumulative preferred stock完全参加优先股 Fully participating preferred stock部分参加优先股 Partially participating preferred stock非部分参加优先股 Nonpartially participating preferred stock现金发行 Issuance for cash 非现金发行 Issuance for noncash consideration股票的合并发行 Lump-sum sales of stock 发行成本 Issuance cost成本法 Cost method 面值法 Par value method捐赠资本 Donated capital 盈余分配 Distribution of earnings 股利 Dividend 股利政策 Dividend policy宣布日 Date of declaration 股权登记日 Date of record除息日 Ex-dividend date股利支付日 Date of payment 现金股利 Cash dividend股票股利 Stock dividend 拨款 appropriation11财务报表财务报表 Financial Statement 资产负债表 Balance Sheet收益表 Income Statement 帐户式 Account Form报告式 Report Form 编制报表 Prepare工作底稿 Worksheet 多步式 Multi-step 单步式 Single-step12财务状况变动表财务状况变动表中的现金基础 Basis现金流量表财务状况变动表中的营运资金基础 Capital Basis资金来源与运用表营运资金 Working Capital 全部资源概念 All-resources concept直接交换业务 Direct exchanges 正常营业活动 Normal operating activities财务活动 Financing activities 投资活动 Investing activities13财务报表分析财务报表分析 Analysis of financial statements比较财务报表 Comparative financial statements趋势百分比 Trend percentage 比率 Ratios普通股每股收益 Earnings per share of common stock股利收益率 Dividend yield ratio 价益比 Price-earnings ratio普通股每股帐面价值 Book value per share of common stock资本报酬率 Return on investment 总资产报酬率 Return on total asset债券收益率 Yield rate on bonds已获利息倍数 Number of times interest earned债券比率 Debt ratio 优先股收益率 Yield rate on preferred stock营运资本 Working Capital 周转 Turnover 存货周转率 Inventory turnover应收帐款周转率 Accounts receivable turnover流动比率 Current ratio 速动比率 Quick ratio 酸性试验比率 Acid test ratio14合并财务报表合并财务报表 Consolidated financial statements 吸收合并 Merger 创立合并Consolidation 控股公司 Parent company 附属公司 Subsidiary company 少数股权Minority interest权益联营合并 Pooling of interest 购买合并 Combination by purchase权益法 Equity method 成本法 Cost method15物价变动中的会计计量物价变动之会计 Price-level changes accounting一般物价水平会计 General price-level accounting货币购买力会计 Purchasing-power accounting统一币值会计 Constant dollar accounting历史成本 Historical cost 现行价值会计 Current value accounting现行成本 Current cost 重置成本 Replacement cost物价指数 Price-level index国民生产总值物价指数 Gross national product implicit price deflatoror GNP deflator消费物价指数 Consumer price index or CPI批发物价指数 Wholesale price index货币性资产 Monetary assets货币性负债 Monetary liabilities货币购买力损益 Purchasing-power gains or losses资产持有损益 Holding gains or losses未实现的资产持有损益 Unrealized holding gains or losses现行价值与统一币值会计 Constant dollar and current cost accounting。

国际金融专业词汇汇总

更多资料请访问.(.....)专业词汇第一章国际收支与国际收支平衡表国际货币基金组织 International Monetary Fund,IMF 国际收支 Balance of Payment国际收支平衡表 Balance of Payments Statement国际借贷 Balance of International Indebtedness 顺差 Favorable Balance(Deficit)逆差 Unfavorable Balance (Surplus)经常账户 Current Account非货币性黄金 Nonmonetary Gold贸易差额 Trade balance职工报酬 Compensation of Employees投资收益 Investment Income无形贸易 Invisible Trade经常转移 Current Transfers单方面转移 Unilateral Transfers无偿转移 Unrequited Transfers资本和金融账户 Capital and Financial Account平衡项目 Balancing Account直接投资 Direct Investment证券投资 Portfolio Investment调节性项目 Accommodating Transactions官方储备资产 Official Reserve Assets特别提款权 SDRs (Special Drawing Rights)错误与遗漏 Errors and Omissions贸易差额 TradeBalance经常项目差额 Balance of Current Account基本差额 Basic Balance综合差额 Over-all Balance第二章国际收支失衡及其调节季节性失衡 Accidental Disequilibrium周期性失衡 Cyclical Disequilibrium结构性失衡 Structure Disequilibrium货币失衡 Monetary Disequilibrium收入性失衡 Income Disequilibrium冲击性失衡 Shock Disequilibrium自动调节机制 Automatic Adjustment Mechanism调节政策 Adjustment Polices自动价格调节机制 Automatic Price Adjustment Mechanism 货币—价格流动机制 Price Specie-Flow Mechanism再贴现率 Rediscount Rate自动收入调节机制 Automatic Income Adjustment Mechanism 自动利率调节机制 Automatic Interest Adjustment Mechanism 支出改变政策 Expenditure-changing policies外汇管制 Foreign exchange control支出转换政策 Expenditure-switching policies内部均衡 Internal balance外汇缓冲政策 Foreign exchange cushion policies外部均衡 External balance米德冲突Meade’s Conflict弹性论 Elasticities Approach马歇尔—勒纳条件 Marshall-Lerner Condition时滞 Time LagJ曲线效应 J Cure乘数论 Multiplier Approach收入分析理论 Income Approach小国开放经济 Small Open Economy对外贸易乘数 Foreign Trade Multiplier开放经济乘数 Open Economy Multiplier哈伯格条件 Harberger Condition吸收论 Absorption Approach支出分析法 Expenditure Approach闲置资源效应 Idle Resource Effect贸易条件效应 Terms of Trade Effect现金余额效应 Real Cash Balance Effect收入再分配效应 Redistribution of Income Effect货币幻觉效应 Money Illution Effect其他直接效应 Miscellaneous direct Absorption Effect 货币论 Monetary Approach一价定律 Law of Price结构论 Structural Approach第三章国际储备国际储备 International reserve国际清偿力International liquidity黄金储备 Gold Reserves货币性黄金Monetary Gold黄金非货币化Demonetization of Gold外汇储备 Foreign Exchange Reserves储备货币 Reserve Currency在基金组织的储备头寸Reserve Position in Fund普通提款权General Drawing Rights特别提款权 Special Drawing Rights,SDRs多种货币储备体系Multiple Currency Reserve System第四章外汇、汇率和汇率制度外汇 Foreign Exchange汇率 Exchange Rate黄金输送点 Gold Points黄金平价Gold Parity直接标价法Direct Quotation System间接标价法Indirect Quotation System汇率制度 Exchange Rate System法定贬值 Devaluation法定升值 Revaluation固定汇率制 Fixed Rate System浮动汇率制 Floating Rate System自由浮动 Free Floating管理浮动 Managed Floating稳定性投机 Stabilizing Speculation非稳定性投机 Destabilizing Speculation爬行钉住制 Crawling Pegging System汇率目标区 Exchange Rate Target-zone货币局制 Currency Board System第五章西方汇率理论国际借贷说Theory of International Indebtedness购买力平价说Theory of Purchasing Power Parity, PPP利率平价理论T he interest rate parity货币主义的汇率理论 Theory of Currency Exchange Rates 资产组合平衡理论Theory of Portfolio Balance Approach第六章外汇交易基础外汇市场 Foreign Exchange Market外汇经纪人 Foreign Exchange Broker客户市场 Customer Markets同业市场 Inter-bank Markets多头 Long Position空头 Short Position即期外汇交易 Spot Exchange Transaction营业日 Working Day交割日 Delivery Date远期外汇交易 Forward Exchange Transaction直接报价法 Outright Forward Method掉期率 Swap Rate远期套算汇率 Forward Cross Rate定期远期交易 Fixed Date Forwards择期远期交易 Optional Date Forwards买空 Bull卖空 Bear掉期交易 Swap Transaction一日掉期 One-Day Swap即期对远期的掉期交易 Spot Against Forward Swaps远期对远期的掉期交易 Forward Against Forward Swaps 套汇 Arbitrage直接套汇 Direct Arbitrage间接套汇 Indirect Arbitrage套利交易 Interest Arbitrage Transaction 抛补套利 Covered Interest Arbitrage非抛补套利 Uncovered Interest Arbitrage第七章外汇期货与期权交易佣金经纪人 Commission Broket开仓 Opening对冲交易 Reversing Transition外汇期货 Foreign exchange futures清算所 Clearing house商业交易者C ommercial trader基差交易者Basic traders差价交易者Spread traders头寸交易者Position traders帽客 Scalpers当日轧平头寸交易者D ay trader市价定单 Market order限价定单 Limit order到价定单 Spot order跨国套利定单Saddle order换月定单 Switch order公开叫价 Open outcry保证金制度M M argin system原始保证金Initial margin维持保证金Maintenance margin变动保证金 Variation margin逐日盯市制制度M arket to market daily套期保值 Hedge空头套期保值Short hedge多头套期保值Long hedge外汇期权 Currency options期权价格 Option price行使期权 Exercise option看涨期权 Call option看跌期权 Put option美式期权 American option欧式期权 European option协定价格 Strike price内在价值 Intrinsic value时间价值 Time value现汇期权 Option on spot foreign currency外汇期货期权O ption on foreign currency futures 期货式期权Futures style option平均汇率期权Average rate options平均协定汇率期权A verage strike option期权的期权O ption on an option回头期权 Lookback option或有期权 Contingent option被担保的汇率期权Guaranteed exchange rate option互换期权 Swaption买入看涨期权B uy call option卖出看涨期权Sell caIl option买入看跌期权Buy put option卖出看跌期权S ell put option平行贷款 Parallel Loan对等贷款 Back-to-Back loan互换交易 Swap Transaction利率互换 Interest Rate Swaps货币互换 Currency Swaps名义本金 Notional Principal伦敦银行同业拆放利率 LIBOR国债收益率 Treasure Note Yield基点 Basic Point利差 Spread比较优势 The Comparative Advantage互换仓库 Swap Warehouse市场风险 Market Risk信用风险 Credit Risk第九章外汇风险及其管理外汇风险 Foreign exchange risk,交易风险 Transaction risk会计风险 Translation risk经济风险 Economic risk保值 Hedge应付帐款保值Payables hedge应收帐款保值Receivables hedge远期合约 Forward contract期货合约保值 Future hedge期权交易保值Currency option hedge硬货币 Hard currency软货币 Soft currency货币市场法Money market hedge定价 Pricing国际金融市场International financial market国际货币市场 International money market国际资本市场International capital market外汇市场 Foreign exchange market欧洲货币 Euro currency欧洲银行 Euro bank欧货币市场Euro currency market离岸金融市场O ff-shore financial market 国际银行设施 IBF在岸金融市场 On – shore financial market国际债券 International bonds外国债券 Foreign bonds欧洲债券 Euro bonds全球债券 Global bonds浮动利率债券 Floating rate bonds与股权联系债券 Equity related bonds双币债券 Dual-curreny bonds中期票据 Medium-term notes, MTN国际股票市场International stock market美国存托凭证 ADR全球化 Globalization证券化 Securitization金融自由化Financial deregulation第十一章国际融资实务无抵押贷款Unsecured loans打包放款 Packing list票据信贷 Bill credit保付代理业务International Factoring信贷风险 Credit risk预支货款 Advance funds到期保付代理业务Maturity Factoring保付代理手续费Commission of Factoring卖方信贷 Supplier’s credit买方信贷 Buyer’s credit混合贷款 Mixed credit信用限额 Line of Credit银团贷款 Consortium Loan福费廷Forfeiting无追索权 Non-recourse有限追索权Limited-recourse主办单位 Sponsor项目单位 Project entity设备供应商Supplier托管人 Trustee可行性研究Feasibility study经济可行性Economic viability国际租赁 International Lease金融租赁 Finance Lease完全付清租赁 Full Pay-Out Lease 经营租赁 Operating Lease杠杆租赁 Leverage Lease回租租赁Sale and Back Lease第十二章国际资本流动与国际金融危机国际资本流动 InternationalCapitalFlow所有权特定优势Ownership Specific Advantage内部化优势 Internalization Advantage区位优势 Location Specific Advantage贸易渠道传染 Trade Channel Infection恐慌性传染 Panicky Infection补偿性传染 Compensation Infection外债 International Debt负债率 Liability Ratio债务率 Foreign Debt Ratio偿债率 Debt Service Ratio国际债务危机 International Debt Crisis国际货币危机International Monetary Crisis第十三章国际货币体系与国际金融机构国际货币体系International Monetary System金本位制 Gold Standard价格-铸币流动机制 Price-specie-flow Mechanism布雷顿森林体系 Bretton Woods System特里芬两难 Triffin Dilemma黄金总库 Gold Pool借款总安排 General Agreement to Borrow黄金双价制 The System of Dual Price of Gold牙买加体系 Jamaiga System国际货币基金组织International monetary Fund份额 Quota信托基金 Trust Fund世界银行集团 World Bank Group。

英国留学国际金融专业

英国留学国际金融专业英国留学金融专业详解分类及介绍国外关于金融专业的设置,是两方面都有。

一、以微观为主,也就是研究与公司个体有关的投资、融资等行为。

另一方面就是和国内类似的宏观金融的研究。

专业细分英国大学的金融专业按细分不同通常设置在商学院、经济学院或数学学院。

在参考专业排名时需要考虑会计与金融、经济、商学三个方向。

金融专业细分可分为:金融学、公司金融、金融与投资、国际金融、银行与金融、金融与管理、会计与金融、风险管理、房地产金融与投资、金融与经济、金融工程。

金融学:对金融各个细分领域的综合介绍。

下面以曼彻斯特大学为例来看下金融学专业的课程设置:第一学期必修课:Introductory Research Methods for Accounting and Finance; 会计与金融学方法导论Essentials of Finance;金融学精要Derivative Securities衍生证券选修一门:Portfolio Investment证券投资International Macroeconomics and Global Capital Markets国际宏观经济学与全球资本市场Foundations of Finance Theory金融学基础第二学期Financial Econometrics金融计量经济学Advanced Empirical Finance高级实证金融学Corporate Finance; 公司金融选修一门International Finance国际金融Financial Statement Analysis财务报表分析Real Options in Corporate Finance公司金融中的实物期权Mergers and Acquisitions: Economic and Financial Aspects关于企业并购的经济金融思考Dissertation毕业论文公司金融:解决以公司财务、公司融资、公司治理为核心的公司治理结构方面的问题,综合运用各种形式的金融工具与方法,进行风险管理和财富创造。

Finance(国际金融)关键术语名词解释

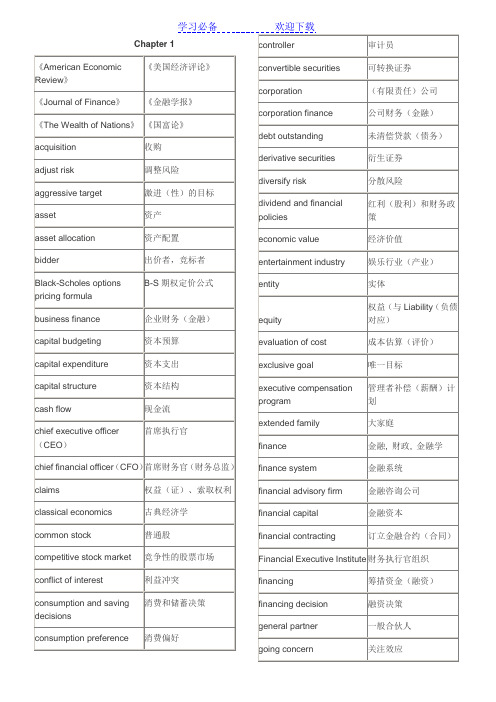

Chapter 1《American EconomicReview》《美国经济评论》《Journal of Finance》《金融学报》《The Wealth of Nations》《国富论》acquisition 收购adjust risk 调整风险aggressive target 激进(性)的目标asset 资产asset allocation 资产配置bidder 出价者,竞标者Black-Scholes optionspricing formulaB-S期权定价公式business finance 企业财务(金融)capital budgeting 资本预算capital expenditure 资本支出capital structure 资本结构cash flow 现金流chief executive officer(CEO)首席执行官chief financial officer(CFO)首席财务官(财务总监)claims 权益(证)、索取权利classical economics 古典经济学common stock 普通股competitive stock market 竞争性的股票市场conflict of interest 利益冲突consumption and savingdecisions消费和储蓄决策consumption preference 消费偏好controller 审计员convertible securities 可转换证券corporation (有限责任)公司corporation finance 公司财务(金融)debt outstanding 未清偿贷款(债务)derivative securities 衍生证券diversify risk 分散风险dividend and financialpolicies红利(股利)和财务政策economic value 经济价值entertainment industry 娱乐行业(产业)entity 实体equity权益(与Liability(负债对应)evaluation of cost 成本估算(评价)exclusive goal 唯一目标executive compensationprogram管理者补偿(薪酬)计划extended family 大家庭finance 金融, 财政, 金融学finance system 金融系统financial advisory firm 金融咨询公司financial capital 金融资本financial contracting 订立金融合约(合同)Financial Executive Institute 财务执行官组织financing 筹措资金(融资)financing decision 融资决策general partner 一般合伙人going concern 关注效应infrastructure 基础设施、架构initial outlay 初始投入integrated financial program 完整的财务计划investment decision 投资决策ITT corporation 国际电报电话公司learning curve 学习曲线liability 负债、债务、责任limited liability 有限责任limited partner 有限责任合伙人long-lived asset 长期资产long-range incentivesystem长期激励系统market discipline 市场规则market interest rate 市场利率market risk premium 市场风险价格market value of shares 股票市场价值(简称市值)marketing 营销maximize the wealth (使)财富最大化merger 兼并,合并mortgage loan 抵押贷款multinational conglomerate 跨国企业集团mutual fund 共同基金net worth 净资产operating margin 营业利润option 期权original core business 原始的核心业务partnership 合伙企业pension liabilities 养老金负债personal investing 个人投资physical capital 实物资本pool联营;集中使用的(资金,物)portfolio 投资组合portfolio of asset 资产组合preferred stock 优先股president 总裁primary commitment 首要(基本)任务private corporation 私人(非公众)公司professional managers 职业经理人profit 利润profit-maximizationcriterion利润最大化标准proposition 命题public corporation 公众公司quantitative model 定量模型regulatory body 监管机构resource allocationdecision资源配置决策retail outlet 零售摊点return 回报,收益risk-averse 风险厌恶(规避)security price 证券价格share price appreciation 股价上涨(增值)shareholder-wealth-maximization股东财富最大化sole proprietorship 个体(业主制)企业spin-off 配股spread out over time 跨时间分布stake 资助,资金stock option 股票期权strategic planning 战略规划supplier 供货商takeover 接管the exchange of assetsand risks资产和风险的交换the set of markets andother institutions市场及其它机构的集合trade off 权衡uncertain benefit 不确定性收益unlimited (limited)liability无(有)限责任vice-president forfinancial财务副总裁voting right (股东)投票权welfare 福利well-functioning capitalmarket高效的资本市场working capitalmanagement营运资本管理Chapter 2accounting procedure 会计程序adverse selection 逆向选择American Express 美国运通信用卡arithmetic mean 算术平均数asymmetry 不对称average risk premium 平均风险升水(溢价)Bank for InternationalSettlement(BIS)国际清算银行banking panic 银行危机bartern. 易货贸易;v. 讨价还价board of directors 董事会by-product 副产品call option 买入期权(看涨期权)capital gain(loss)资本收益(损失)Capital market资本市场(即长期资金市场)cash dividend 现金股利(红利)central bank 中央银行charge price 要价clearing and settlingpayment清算和结算支付closed-end 封闭式的collateral 担保品collateralization 以…担保commercial loan 商业贷款commercial loan rate 商业贷款利率credit card 信用卡default 违约、托债、弃权default risk 违约风险deficit unit 赤字部门defined-benefit pensionplan规定收益型养恤金制defined-contributionpension plan规定缴费型养恤金制depository savingsinstitution存款储蓄机构(系统)derivative 衍生(证券)Deutsche Bank 德意志银行dissemination 推广、传播dividend reinvestment 红利(股利)再投资dollar-denominated asset 以美元计价的资产double-entry-bookkeeping 复式记账法equity 权益equity-kickers 权益条件expected rates of return 期望(预期)收益率Federal Reserve System 联邦储备系统Finance AccountingStandardsBoard财务会计标准委员会financial instrument 金融工具financial intermediary 金融中介financial market parameters 金融市场参数financial variable 金融(财务)变量fixed-income-instruments 固定收益证券flow of fund 资金流flow of fund 资金流foreign exchange 外汇formation extraction 信息提取forward contract 远期合约functional perspective (从)功能(的角度或观点)future 期货German marks 德国马克go public 上市incentive problem 激励问题index fund 指数(化)基金index-linked bonds(与物价)指数联系的债券information service 信息咨讯(服务)insurance company 保险公司interest rate 利息率(简称利率)interest rate arbitrage 利率套利interest rate equalization 利率平价intermediary 中介International BankforReconstruction andDevelopment国际复兴开发银行International Monetary Fund(IMF)国际货币基金组织International Swap DealersAssociation国际掉期交易商协会intertemporal 跨期的(多阶段的)IOUI owe you的简称,喻指“借条”issuing stock 发行股票Japanese yen 日元life annuity 人寿年金limited liability 有限责任liquidity 流动性maturity (票据)到期日;期限money market货币市场(即短期资金市场)moral-hazard 道德风险mortgage 抵押mortgage rate 抵押利率mutual fund 共同基金New York Stock Exchange 纽约股票交易所nominal interest rate 名义利率offset 弥补、抵消open-end 开放式的option 期权Osaka Options and FuturesExchange大阪期货期权交易所over-the-counter-market(OTC)场外(交易)市场parties to contract 合约的参与者pool or aggregate 联营;集中使用的(资金或物品);premium 升水、溢价price appreciation 增值principal-agent problem 委托-代理问题pro rata 按比例的put option 卖出期权(看跌期权)qusai- 准、半rate of exchange 汇率rates of return 收益(回报)率rating agency 评级机构real interest rate 实际利率real rate of return 实际收益率redeem 赎回、偿还residual claim 剩余索取(求偿)权risk aversion 风险厌恶(规避)risk premium 风险升水(溢价)security dealer 证券交易商shed specific risk 规避(分散)特定(或私有)风险standard deviation 标准差standardized option contract (经)标准化的期权合约surplus unit 盈余部门trade-off 权衡trust company 信托公司U.S Treasury Bills 美国国库券underwrite 认购、包销unit of account 计值单位universal bank全能银行(指兼做中央银行和商业银行业务的银行)volatility 波动性well-information 信息充分的yen rate of return(以)日元(记值)的收益率yield curve 收益(率)曲线yield spread 收益价差Chapter 3accounting earnings 会计收入accounting rule 会计规则accrual 应计的accrual accounting 应计制(权责发生制)accumulated depreciation 累计折旧amortize 摊销、分期偿还apocryphal 伪经的、假冒的asset turnover(ATO)资产周转率(销售收入/总资产)audit 查账、审计balance sheet 资产负债表benchmark (比较)基准bond-rating 债券评级book value 账面价值capital structure 资本结构capital-incentive utility 资本密集型的公用事业(公司)cash and equivalents 现金及其等价物cash budget 现金预算cash cycle time 现金循环周期cash inflow 现金流入cash outflow 现金流出common stock outstanding 流通在外的普通股contingent liability 或有负债(如:可能发生的诉讼赔偿等)current asset 流动资产current liability 流动负债current ratio 流动比率depreciation 折旧、贬值disclose 披露dividend payout rate 股利支付率earnings before interest and tax (EBIT)息税前利润(=毛利- GS&A)earnings per share 每股盈余(收益)earnings retention rate (收益)留存比率expiration date 到期日external financing 外部融资(比如,发行股票和债券)financial distress 财务危机(困境)financial leverage 财务杠杆(率)financial ratio 财务比率financial statement 财务报表general, selling, andadministrative expenses(GS&A)管理及销售费用goodwill 商誉gross margin 毛利(润)(=销售收入-产品销售成本)income statement 损益表income tax 所得税intangible asset 无形资产inventory 库存、存货inventory turnover 存货周转率liquidity 流动性long-term debt 长期负债market to book 市值价值/账面价值marking to market 盯住市场net income(or net profit)净利润(即税后利润=EBIT-利息-所得税)net working capital 净营运资本(=流动资产-流动负债)net worth 净资产(即权益,=资产-负债)off-balance-sheet 表外项目operation income 营运收益(营业利润)opportunity cost 机会成本owner’s equity所有者权益paid-in capital 实收资本payable 应付账款percent-of-sales method 销售(收入)百分比法planning horizon 计划(时间)跨度price to earnings 市盈率(价格/盈余)profitability 盈利能力、盈利性property 土地、地产、所有权quick ratio 速动比率receivable 应收账款receivables turnover 应收账款周转率retained earnings 留存收益ROA(return on asset)资产收益率(EBIT/资产)ROE(return on equity)净资产收益率(即权益报酬率,=税后利润/净资产)ROS(return on sales)销售利润率(EBIT/销售收入)short-term debt 短期负债specify performance target 设定业绩目标statements of cash flow 现金流量表sustainable growth rate 持续增长率taxable income 应税收益(即税前利润=EBIT-利息)times interest earned 利息保障倍数Tobin’s Q托宾Q值(=资产市值/重置成本)total shareholder returns 总的股东收益(率)Chapter 4after-tax interest rate 税后利率amortization 分期偿还、摊销annual percentage rate(APR)年度百分比(利率)annuity 年金before-tax interest rate 税前利率compound interest 复利compounding 复和(与discounting 相反的概念)discount rate 折现率、贴现率discounted cash flow(DCF)折现现金流discounting 折现、折扣effective annual rate(EFF)有效年利率exchange rate 汇率future value 终值future value factor 终值系数(即由现值计算终值的换算因子)growth annuity 增长年金immediate annuity 即付年金implied interest rate 隐含利率installment 分期付款internal rate of return(IRR)内部报酬率market capitalizationrate市场资本化利率(简称市场利率)net present value(NPV)净现值opportunity cost ofcapital资本的机会成本ordinary annuity 普通年金(即后付年金)original principal (初始)本金outstanding balance 未平头寸payback period 回收期perpetual annuity(orperpetuity)永续年金present value 现值present value factor (终值)现值系数(终值系数的倒数)reinvest 再投资simple interest 单利tax-exempt 免税的time value of money (TVM)货币(或资金)的时间价值yield to maturity 到期收益率Chapter 5bequest 遗赠、遗赠物break-even 得失相当的,盈亏平衡的deductible 可扣除(或抵扣)的explicit cost 显性成本feasible plan 可行(的)计划human capital 人力资本implicit cost 隐性成本incremental 增量的、增值的intertemporal budgetconstraint跨期预算约束optimization model 优化模型permanent income 永久性收入provision 条文、条款tax deferred 税收(可)延缓的tax exempt 免税的trial-and-error 试错Chapter 6after-tax cash flow 税后现金流all-equity-financed firm 全权益融资公司annualized capital cost 年金化资本成本appropriation 拨款、占用break-even point 盈亏平衡点capital budgeting 资本预算cost of capital 资本成本coupon bond 息票债券cumulative present value 累计现值full-fledged 完备的、正式的horizontal axis 横轴(或横坐标)labor-intensive 劳动密集型的liquidate 清算、清偿market-related risk 市场相关(或者承认予以补偿)的风险,即系统风险(systematic risk)prototype 模型、原型residual value 残值risk premium 风险溢价risk-adjusted discountrate(经)风险调整的折现率sensitivity analysis 敏感性分析vertical axis 纵轴(或纵坐标)zero-inflation 零通涨(率)Chapter 7Arbitrage 套利arbitrageurs 套利(交易)者beverage 饮料bona fide 真正的bond 债券default risk 违约风险default-free 无违约(风险)的earnings per share 每股盈余efficient marketshypothesis(EMH)有效市场假说fetch 售得…fixed-income securities 固定收益证券foreign exchangemarket外汇市场fundamental value 基础价值information set 信息集interest-rate arbitrage 利率套利intrinsic value 内在价值laundry 洗衣店Law of One Price 一价定律price/earnings multiple 市盈率(倍数)real estate 房地产、不动产sibling 兄弟、同胞、氏族成员tautologically 同意反复地transaction costs 交易成本triangular arbitrage 三角套利vending 售货well-informed 信息充分的Chapter 8abscissa 横坐标ask price 卖价、要价(报价)bid price 买价、出价(询价)callable bond 可赎回债券convertible bond 可转换债券coupon bond 带息债券、息票债券current yield 即期收益(率)discount bond 折价债券face value/ par value 面值maturity 到期日ordinate 纵坐标par bond 平价债券premium bond 溢价债券pure discount bond 纯折现债券quote 牌价redeem 赎回、偿还risk-free interest rate 无风险利率yield curve 收益(率)曲线yield to maturity 到期收益(率)zero-coupon bond 零息(票)债券Chapter 9New York StockExchange纽约股票交易所cash dividend 现金股利(或红利、分红)closing price 收盘价Constant-Growth-RateDDM不变增长率股利折现模型current/existingstockholders现有股东、老股东discounted-dividendmodel(DDM)股利折现模型dividend policy 股利政策dividend yield 分利收益率ex-dividend price 除息(即股息)价格expected rate of return 期望收益率(或报酬率)infinite 无穷(或无限)的internal equity financing 内部权益融资Investment opportunity 投资机会market capitalization rate 市场资本化利率odd lots 零星(交易量)per se 亲自、亲身perpetual 永久的price/earnings ratio 市盈率Reinvested earnings 再投资收益required rate of return 必要报酬率(或收益率)risk-adjusted discountrate(经)风险调整折现率round lots 整批(交易量)share repurchase 股票回购skeptical 怀疑的stock dividend 股票股利stock splits 股票分割Chapter 10actuary 精算师caterer 酒席承办人colossal 巨大的、异常的confidence intervals 置信区间consortium 社团、合伙continuous probability distribution 连续概率分布diversification 分散化(投资)diversifying 分散化、多样化dunce 笨蛋、书呆子ex ante 事先的ex post 事后的expected rate of return 期望收益率(报酬率)flexibility 灵活性、柔性forward contract 远期合约hedger (套期)保值者、对冲者hedging 保值、对冲、对两方下注以防止(赌博、冒险等)的损失insuring 投保、给…保险jurisdiction 司法、权力、权限layoff 解雇、失业materialize 实现mean 均值normal distribution 正态分布overview 概述perverse 故意作对的、任性的portfolio 投资组合precautionary saving 预防性储蓄probability distribution 概率分布quadruple adj. 四倍的;v. 使…(增加)四倍recrimination 反责refund 退还risk assessment 风险评估risk aversion 风险规避risk avoidance 风险避免risk exposure 风险暴露risk identification 风险识别risk management 风险管理risk retention 风险保留risk transfer 风险转移sinful 有罪的、过错的、不道德的speculator 投机者square root 平方根stakeholder 利益相关者standard deviation 标准差swap 互换volatility 波动率Chapter 11American-type option 美式期权call option 买入期权(简称“买权”)cap (利率)上限condominium 公寓私有的共有方式co-payment 共同支付counterparty 交易对手credit guarantee 信用担保credit risk 信用风险deductible/deduction 免赔额delivery 交割delivery date 交割日derivative 衍生工具diversifiable risk 可分散的风险diversification principle 分散化(或多元化)原则European-type option 欧式期权exclusion 除外责任expiration date 到期日expire 到期face value 面值fictitious 虚构的firm-specific risk (公司)私有(或特有)风险forward contract 远期合约forward price 远期价格future contract 期货合约guarantee 保证、保证人、担保、担保品loan guarantee 债务保单long position 多头market risk 市场风险non-diversifiable risk 不可分散的风险premium 保险费、附加费、溢价proceed n. 盈利put option 卖出期权(简称“卖权”)rolling over 滚动(式)的short position 空头shortfall 不足之数、赤字spot price 即期价格standardized (经)标准化的strike price/ exerciseprice执行价格、行权价swap contract 互换合约、调期合约Chapter 12decision horizon 决策(修正)期限efficient portfolio 有效组合efficient portfolio frontier 有效组合前沿expected return 期望收益率mean-variance model 均值-方差模型minimum-varianceportfolio最小方差组合mutual fund 共同基金optimal combination ofrisky assets风险资产最优组合planning horizon 计划期、规划期point of tangency 切点portfolio selection (投资)组合选择risk premium 风险溢价risk tolerance 风险容忍(度)riskless asset 无风险资产risky-asset portfolio 风险资产组合set of……的集合tangency portfolio 切线组合target expected return 目标期望收益率trade-off 权衡、平衡trading horizon 交易(间隔)期限Chapter 13active investmentstrategies积极投资策略active portfolio selectionstrategy积极的组合选择策略Arbitrage Pricing Theory (APT)套利(定价)理论beat the market 打败市场benchmark 基准benchmark portfolio 基准组合Capital Asset PricingModel(CAPM)资本资产定价模型capital market line(CML)资本市场线consensus 一致、一致同意cost of capital 资本成本covariance 协方差equilibrium asset price 均衡(的)资产价格equilibrium expectedreturn均衡(的)期望收益率equilibrium price 均衡价格equilibrium risk premium 均衡风险溢价indexing 指数化irreducible 不能减少的、难复位的marginal contribution 边际贡献market portfolio 市场组合market-related risk 市场相关的(或承认的)风险multifactor IntertemporalCapital Asset PricingModel(ICAPM)多因子、跨期资本资产定价模型mutual fund 共同基金non-market risk 非市场风险passive investing 消极投资passive portfolio selectionstrategy消极的组合选择策略pension fund 养老基金regression coefficient 回归系数reward-to-risk ratio 风险补偿比率security market line(SML)证券市场线short-sale 卖空systematic risk 系统风险unsystematic risk 非系统风险Chapter 14arbitrageur 套利者bountiful 慷慨的、充足的casino 卡西诺赌场、小别墅closing out(one’s/a)position平仓continuouscompounding连续复利cost of carry 持有成本daily marking to market 逐日盯市(即每日无负债清算制度)delivery 交割delivery date 交割日delivery price 交割价格expectationshypothesis期望假说financial future 金融期货(即标的物为金融产品的期货合约)foreign-exchangeparity relation汇率平价关系forward contract 远期合约forward price 远期价格forward-spotprice-parity relation 远期-即期价格间的平价关系future contract 期货合约future price 期货价格future spot price 将来的现货价格hedger 套期保值者intrinsic value 内在价值margin 保证金open interest 未平仓合约数、头寸开放权益数position 头寸posting of margin (对)保证金(进行)过帐quasi-arbitrage 准套利(机会)replicate 复制speculator 投机者spoilage 损坏spot price 即期价格、现货价格spread 价差、差额the wall street journal 《华尔街日报》Chapter 15American-typeoption美式期权arrear 应付欠款、储备物at the money option 两平期权Black-Scholes model 布莱克-斯科尔斯期权定价模型boom 繁荣的bullish 乐观的call (option)买入期权(简称买权)、看涨期权capital-gain 资本(性)收益cash settlement 现金结算Chicago BoardOptions Exchange(CBOE)芝加哥期权交易所commission 佣金Contingent Claims 或有权益(简称或有权、或然权)credit guarantee 信用保证(或承诺)de facto 实际的、实际上decision tree 决策树delinquency 失职、违法行为dividend yield 股利收益率dividend-adjusted option formula 股利调整期权(定价)公式embedded option 嵌入式期权European put option 欧式卖权European-typeoption欧式期权evasion 逃避、躲避Exchange-traded option 场内(即在交易所交易的)期权exercise price/strikeprice执行价格/敲定价格expirationdate/maturity date到期日explicit 外生的flexibility 灵活性、柔性FutureOptions/Option onFutures期货期权growth option 增长期权guarantor 保证人hedge ratio 对冲比率、套期比率implicit 内生的implied volatility 隐含波动率in the money option 虚值期权incremental 增量的、增加的index option 指数期权intrinsicvalue/tangible value内在价值、执行价值junk bond 垃圾债券litigation 诉讼、争论mainline 主流的、传统的natural logarithm 自然对数normal distribution 正态分布Option 期权out of the moneyoption实值期权Over-the-counteroption场外(交易的)期权payoff diagrams 支付图plaintiff 起诉人provision 条文、条款put (option)卖出期权(简称卖权)、看跌期权put-call parityrelation买(权)与卖(权)间的平价关系real option 实物期权recession 衰退self-financinginvestment strategy自融资投资策略sequel 续篇、后果shortfall 不足之数、赤字stochastic 随机的 swap 互换 time value 时间价值 truncate截断two-state (binomial )option pricing model 两状态(二项式)期权定价模型 underlying asset 标的资产、基础资产Chapter 16account payable 应付账款accrued wage应计工资adjusted present value (APV )(经)调整的现值 after-tax incremental cash flow 税后增量现金流agency cost 代理成本 allegiance 忠诚、忠贞 all-equtiy financing 全权益融资 bankruptcy cost破产成本bankruptcy proceeding 破产程序、破产诉讼 Capital Structure资本结构capital structure irrelevance proposition 资本结构无关性定理 circumvent 绕过、智胜 collateral 担保品 common stock 普通股 corporate income tax公司所得税cost of financial distress 财务危机(危难)成本 debt financing 债务融资 entity实体、本质、存在 equity financing 权益融资 external financing外部融资(筹资) fiduciary受信托的 financial distress财务危机(危难) financing instrument 金融工具 franchise 特许权 free cash flow自由现金流 frictionless 无摩擦的gourmet供美食家的享用的、美食家imminent 临近的、迫在眉睫的 interest tax shield (债务)利息税盾 internal financing 内部融资(筹资) issuing new stock 发行新股leveraged investment 杠杆投资(即投资额中有部分债务融资) long-term lease 长期租赁 M & M proposition MM 定理market debt-to-equity ratio(用)市场(价值表示的)债务-权益比率market-value/economic balance sheet (用)市场价值(表示的)资产负债表 Modigliani & Miller (M 莫迪里阿尼和米勒& M )optimal capital structure 最优资本结构 pension liability 养老金(形式的)债务 perk额外补贴 personal income tax 个人所得税 preferred stock优先股学习必备欢迎下载prestige 威信、声望pro rata 按比例的realized capital gains 已实现资本收益redeploy 重新部署(布置、调派)repurchase stock 回购股票residual claim 剩余索取权(求偿权)retained earning 留存收益scrutiny 细致检查secured debt 安全债务stock option 股票期权subsidy 津贴、财政援助、特别津贴voting right 投票权warrant 认股权证、认股权weighted average costof capital(WACC)加权资本成本Chapter 17acquisition 收购bargain v. 讲价、讨价还价;n. 便宜货、交易、协定breakup 分散、中止、崩溃consolidation 合并、联合、巩固consummate 完成、使…完美contest 竞争、争夺corroborate 加强证实、巩固、支持discretion 决定权、谨慎、判断力divest 使…脱去information set 信息集loss carry-forward 亏损递延malevolence 恶意、坏影响merger 兼并opaqueness 不透明real option 实物期权spin-off 派生出、让产易股、抽资脱离synergy 协同增效takeover 接管。

国际金融课件internationalfinance

06

中国国际金融的实践与展望

中国国际金融业在规模和业务范围上不断扩大,成为全球金融市场的重要参与者。

中国国际金融业在推动经济增长、促进国际贸易和投资等方面发挥了重要作用。

改革开放以来,中国国际金融业经历了从无到有、从小到大的发展历程,逐步建立起较为完善的金融机构体系和金融市场体系。

中国国际金融的发展历程与现状

Global financial markets facilitate the flow of capital across borders, allowing for the efficient allocation of resources and the hedging of risks.

Regional financial markets serve specific geographical regions and are often associated with trade blocs or economic unions.

01

国际金融危机的定义

由于国际金融市场上的过度投机、金融监管缺失等原因,导致国际金融市场出现大规模动荡,影响各国经济的稳定。

02

国际金融危机的传染机制

通过贸易、金融和信息等渠道,将危机从一个国家传递到另一个国家。

国际金融危机及其传染机制

1

2

3

通过监测和分析国际金融市场的相关信息,及时发现潜在的风险点,采取应对措施。

02

03

04

05

Main International Financial Centers and Their Characteristics 主要国际金融中心及其特点

ห้องสมุดไป่ตู้

什么是国际经济学

• 1.1720年,伊萨克·杰瓦伊斯(Issac Gervaise)首次提出了国际收支 (Balance of Payments)的一般均衡分析方法。

• 2.1752年,大卫·休谟(David Hume)在《论贸易差额》一文中,论 证了著名的“物价——铸币——流动机制”(Price-Specie-Flow Mechanism)。休谟从货币数量论的观点出发,认为,在金币本位制 条件下,可以通过货币——贵金额的输出输入来完全解决贸易不平衡问 题,即国际收支的不平衡可以通过市场的力量自动恢复平衡,而不需要 外部的人为干预。

• 从古典贸易理论起,贸易平衡一直是贸易理论的一个前提条件。因为贸 易理论不考虑货币因素,国际贸易理论所探讨的是在贸易平衡条件下 (或物物交换条件下)的贸易商品相对价格问题,即纯易货贸易条件 (The Barter Terms of Trade)问题。但在现实中,国际贸易是以货币 为媒介而进行的,因而贸易不平衡现象是一种常态。

国际贸理论的发展(2)

• 新贸易理论的出现有两大渊源: • 产业内贸易(Intra-industry Trade),即发生在同一产业类别中的双

向贸易(Two-way Trade),已成为主流。格鲁珀(H.G.Grubel)和 劳埃德(P.J.Lloyd)在1975年还构造了一种测量产业内贸易密集度的 指数方法,用于测算国际贸易中产业内贸易的重要性。G—L产业内贸 易指数,与B.Balassa提出的产业内贸易指数略有不同。 • 产业组织理论的发展。20世纪70年代中期,产业组织理论出现了一次 大的突破,特别是博弈论方法被引入到产业组织理论的研究中之后,对 不完全竞争市场结构下(主要是针对寡头市场)厂商行为的描述与研究, 取得了巨大的成功。1978年,克鲁格曼在其博士论文《收益递增、垄 断竞争与国际贸易》(Increasing Returns, Monopolistic Competition, and International Trade)中,首次将迪克西特(A.Dixit)和斯蒂格利 茨(J.Stiglitz)两人所共同提出的将差异产品和(内部)规模经济考虑 在内的垄断竞争模型(该模型又称“新张伯伦模型”)推广到开放经济 条件下,从模型上首次证明了规模经济是国际贸易的另一起因,以及差 异性产品决定了贸易形态为产业内贸易。 • 新贸易理论除了都强调规模经济的作用这一共同点外,并未形成统一的 分析框架。

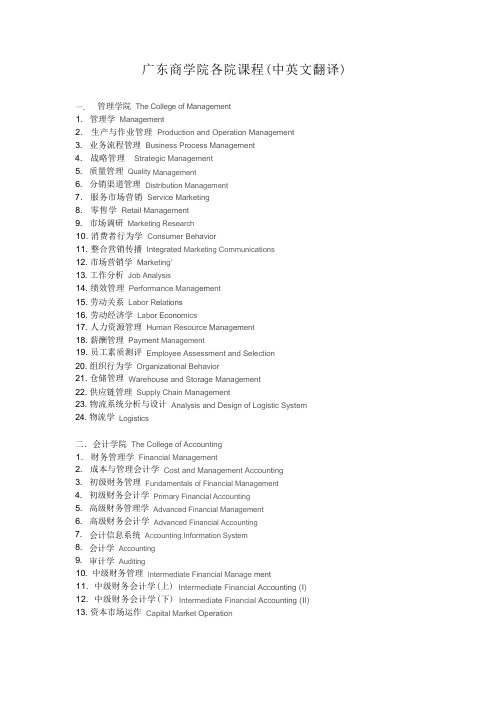

广东商学院各院课程(中英文翻译)