第14章International Finance Services

International Finance

PPP Exchange Rate e= USA CPI = 199.8 (March 2006) = CPI (USA) CPI (UK) 199.8 195.0 = $1.025/L

England CPI = 195.0 (March 2006)

Currently, the British Pound is trading at $1.786

As in the previous example, if the Euro is undervalued relative to LOOP, buy in Europe and sell in the US

P eP*

The arbitrage free exchange rate is given by the ratio of prices $40, 000 = $1.33 per Euro E30,000

FIN 40500: International Finance

Purchasing Power Parity

The relationship between exchange rates and prices starts with a very basic idea – ANY PRODUCT SHOULD COST THE SAME EVERYWHERE.

Domestic Price

if the Euro is overvalued relative to LOOP, buy in US and sell in Europe

P e * P

eP* P

Foreign Price

Purchasing Power Parity (PPP) refers to the same concept as the Law of One Price, with specific prices replaced by general price indices

国际财务管理ER 7e Ch14 Outline

Chapter 14Interest Rate and Currency SwapsTypes of SwapsSize of the Swap MarketThe Swap BankSwap Market QuotationsInterest Rate SwapsBasic Interest Rate SwapPricing the Basic Interest Rate SwapCurrency SwapsBasic Currency SwapEquivalency of Currency Swap Debt Service ObligationsPricing the Basic Currency SwapA Basic Currency Swap ReconsideredVariations of Basic Interest Rate and Currency SwapsRisks of Interest Rate and Currency SwapsIs the Swap Market Efficient?SummaryThis chapter provides a presentation of currency and interest rate swaps. The discussion details how swaps might be used and the risks associated with each.1. The chapter opened with definitions of an interest rate swap and a currency swap. The basic interest rate swap is a fixed-for-floating rate swap in which one counterparty exchanges the interest payments of a fixed-rate debt obligation for the floating-interest payments of the other counterparty. Both debt obligations are denominated in the same currency. In a currency swap, one counterparty exchanges the debt service obligations of a bond denominated in one currency for the debt service obligations of the other counterparty, which are denominated in another currency.2. The function of a swap bank was discussed. A swap bank is a generic term to describe a financial institution that facilitates the swap between counterparties. The swap bank serves as either a broker or a dealer. When serving as a broker, the swap bank matches counterparties, but does not assume any risk of the swap. When serving as a dealer, the swap bank stands willing to accept either side of a currency swap.3. An example of a basic interest rate swap was presented. It was noted that a necessary condition for a swap to be feasible was the existence of a quality spread differential between the default-risk premiums on the fixed-rate and floating-rate interest rates of the two counterparties. Additionally, it was noted that there was not an exchange of principal sums between the counterparties to an interest rate swap because both debt issues were denominated in the same currency. Interest rate exchanges were based on a notional principal.4. Pricing an interest rate swap after inception was illustrated. It was shown that after inception, the value of an interest rate swap to a counterparty should be the difference in the present values of the payment streams the counterparty will receive and pay on the notional principal.5. A detailed example of a basic currency swap was presented. It was shown that the debt service obligations of the counterparties in a currency swap are effectively equivalent to one another in cost. Nominal differences can be explained by the set of international parity relationships.6. Pricing a currency swap after inception was illustrated. It was shown that after inception, the value of a currency swap to a counterparty should be the difference in the present values of the payment stream the counterparty will receive in one currency and pay in the other currency, converted to one or the other currency denomination.7. In addition to the basic fixed-for-floating interest rate swap and fixed-for-fixed currency swap, many other variants exist. One variant is the amortizing swap, which incorporates an amortization of the notional principles. Another variant is a zero-coupon-for-floating rate swap in which the floating-rate payer makes the standard periodic floating-rate payments over the life of the swap, but the fixed-rate payer makes a single payment at the end of the swap. Another is the floating-for-floating rate swap. In this type of swap, each side is tied to a different floating-rate index or a different frequency of the same index.8. Reasons for the development and growth of the swap market were critically examined. It was argued that one must rely on an argument of market complete-ness for the existence and growth of interest rate swaps. That is, the interest rate swap market assists in tailoring financing to the type desired by a particular borrower when all types of debt instruments are not regularly available to all borrowers.。

International finance - 世界大学城

Case 39 the problem using the local language

In 1988, Frank came to China from Australia for research purposes. He chose Beijng as his first stop. In order to help his communications with the local people, he boned up on the Chinese language, which he had been studying at college and with which he could communicate fairly comfortably. After he arrived in Beijng, he began to talk to some of the local people to ask directions and advice.

At first, the conversation between them seemed to go quite smoothly, buy as it progressed, the lady seemed to step further and further away from Mark as he had been gradually moving closer to her. The lady obviously seemed uncomfortable. As Mark was about to ask her questions regarding Australian social customs, another man standing nearby directed a glance toward the lady. She excused herself and went to talk with that man, leaving Mark standing alone and wondering why their conversation had come to such a sudden stop.

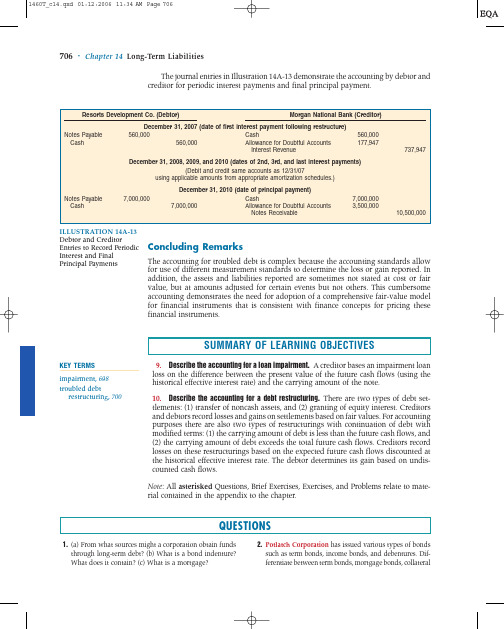

第14章706-724页

Resorts Development Co. (Debtor)

Morgan National Bank (Creditor)

Notes Payable Cash

December 31, 2007 (date of first interest payment following restructure)

7,000,000

Cash Allowance for Doubtful Accounts

Notes Receivable

7,000,000 3,500,000

737,947 10,500,000

ILLUSTRATION 14A-13 Debtor and Creditor Entries to Record Periodic Interest and Final Principal Payments

8. Zeno Company sells its bonds at a premium and applies the effective interest method in amortizing the premium. Will the annual interest expense increase or decrease over the life of the bonds? Explain.

6. How should discount on bonds payable be reported on the financial statements? Premium on bonds payable?

7. What are the two methods of amortizing discount and premium on bonds payable? Explain each.

国际经贸高级英语14

Unit Fourteen Can the U.S. Financial Giant Gain Ground?—Jeremy Kahn

History suggests he has a point. U.S. companies have often blundered and been forced to retreat and regroup. Only Fidelity, Merrill Lynch, and J.P. Morgan can be counted among the top 50 European mutual fund managers—and Fidelity, the largest, ranks just 25th. Yet the Americans are learning fast. Fidelity’s evolving

精品PPT

Unit Fourteen Can the U.S. Financial Giant Gain Ground?—Jeremy Kahn

But hitting the ground, many American money managers have stumbled. Europe is not the U.S., no matter how many Gaps it may now have. “It is not as wonderful here as everyone thinks it will be,” clucks Christian Strenger,

精品PPT

Unit Fourteen Can the U.S. Financial Giant Gain Ground?—Jeremy Kahn

INTERNATIONAL FINANCE

ቤተ መጻሕፍቲ ባይዱ

Operational hedges refers to “internal” organizational strategies that firms use to deal with their currency exposures. With respect to transaction exposure, potential operational techniques include:

Hedging Known Future Cash Flows

In the previous lecture, the hedging techniques we discussed (forwards and options) are most appropriate for covering transaction exposure.

Dealing with Transaction Exposure Through Operational Hedges

While global companies can manage their transaction exposures with financial hedges, they can also utilize operational hedges.

Quick Review: Identifying Sources of Transaction Exposure

Transaction exposure arises from: (1) Purchasing or selling, on credit, goods or services denominated in foreign currencies. (2) Borrowing or lending denominated in foreign currencies. (3) Acquiring financial assets or incurring liabilities denominated in foreign currencies.

英文报刊国际商务阅读(第三版)Unit 14 Outsourcing Law firms fuel

14. legal process outsourcing: 法律程序外包 Lesson 9: outsourcing的注解已说明,服务外包通常分为BPO(Business Process Outsourcing,业务流程外包),ITO(Information Technology Outsourcing,信息技术外包)和KPO(Knowledge Process Outsourcing, 知识流程外包)。 BPO是指把特定的商业工序外包给第三方服务供货商。有些日常的琐 碎工序是必需的,却无关乎维持公司的市场地位,通常便会实行业务 流程外包以减省开支。常见的外包业务有:电话客服(Call center)、 人力资源(Human resources, HR)、会计(Accounting)及劳资 (Payroll)。 ITO是组织将全部或部分IT工作包给专业性公司完成的服务模式。其 主要业务包括发包商信息化的战略规则、设计与咨询,IT设备和软件 的选型,网络系统和应用软件系统的建设、开发、实施、运作管理, 整个系统的维护、升级等等。 KPO是围绕对业务诀窍的需求而建立起来的业务,指把通过广泛利用 全球数据库以及监管机构等的信息资源获取的信息,经过即时、综合 的分析研究,最终将报告呈现给客户,作为决策的借鉴。主要有专业 策划服务、知识产权服务、专业培训服务、政策法规调研等。

6

4. litigate : v. 诉讼,打官司 litigation: n. 诉讼,打官司

5. civil: adj. 民事的 The matter would be better dealt with in the civil court rather than by an expensive criminal proceeding. 本案通过民事法庭处理要比通过昂贵的刑事程序处理好。

国际金融课件internationalfinance

06

中国国际金融的实践与展望

中国国际金融业在规模和业务范围上不断扩大,成为全球金融市场的重要参与者。

中国国际金融业在推动经济增长、促进国际贸易和投资等方面发挥了重要作用。

改革开放以来,中国国际金融业经历了从无到有、从小到大的发展历程,逐步建立起较为完善的金融机构体系和金融市场体系。

中国国际金融的发展历程与现状

Global financial markets facilitate the flow of capital across borders, allowing for the efficient allocation of resources and the hedging of risks.

Regional financial markets serve specific geographical regions and are often associated with trade blocs or economic unions.

01

国际金融危机的定义

由于国际金融市场上的过度投机、金融监管缺失等原因,导致国际金融市场出现大规模动荡,影响各国经济的稳定。

02

国际金融危机的传染机制

通过贸易、金融和信息等渠道,将危机从一个国家传递到另一个国家。

国际金融危机及其传染机制

1

2

3

通过监测和分析国际金融市场的相关信息,及时发现潜在的风险点,采取应对措施。

02

03

04

05

Main International Financial Centers and Their Characteristics 主要国际金融中心及其特点

ห้องสมุดไป่ตู้

Solution_国际财务管理_切奥尔尤恩_课后习题答案_第十四章

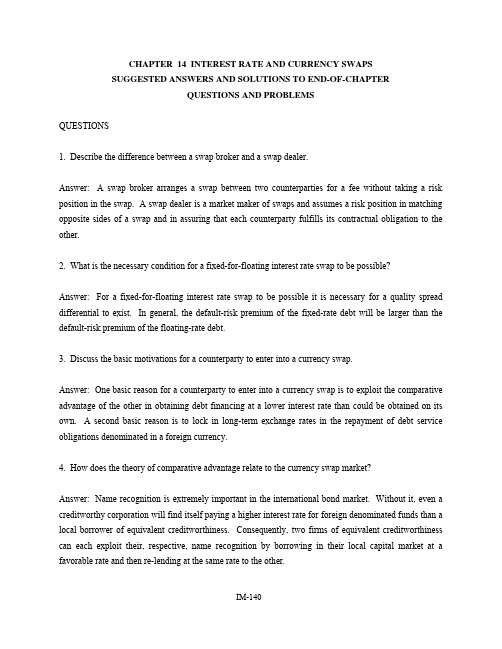

CHAPTER 14 INTEREST RATE AND CURRENCY SWAPSSUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Describe the difference between a swap broker and a swap dealer.Answer: A swap broker arranges a swap between two counterparties for a fee without taking a risk position in the swap. A swap dealer is a market maker of swaps and assumes a risk position in matching opposite sides of a swap and in assuring that each counterparty fulfills its contractual obligation to the other.2. What is the necessary condition for a fixed-for-floating interest rate swap to be possible?Answer: For a fixed-for-floating interest rate swap to be possible it is necessary for a quality spread differential to exist. In general, the default-risk premium of the fixed-rate debt will be larger than the default-risk premium of the floating-rate debt.3. Discuss the basic motivations for a counterparty to enter into a currency swap.Answer: One basic reason for a counterparty to enter into a currency swap is to exploit the comparative advantage of the other in obtaining debt financing at a lower interest rate than could be obtained on its own. A second basic reason is to lock in long-term exchange rates in the repayment of debt service obligations denominated in a foreign currency.4. How does the theory of comparative advantage relate to the currency swap market?Answer: Name recognition is extremely important in the international bond market. Without it, even a creditworthy corporation will find itself paying a higher interest rate for foreign denominated funds than a local borrower of equivalent creditworthiness. Consequently, two firms of equivalent creditworthiness can each exploit their, respective, name recognition by borrowing in their local capital market at a favorable rate and then re-lending at the same rate to the other.5. Discuss the risks confronting an interest rate and currency swap dealer.Answer: An interest rate and currency swap dealer confronts many different types of risk. Interest rate risk refers to the risk of interest rates changing unfavorably before the swap dealer can lay off on an opposing counterparty the unplaced side of a swap with another counterparty. Basis risk refers to the floating rates of two counterparties being pegged to two different indices. In this situation, since the indexes are not perfectly positively correlated, the swap bank may not always receive enough floating rate funds from one counterparty to pass through to satisfy the other side, while still covering its desired spread, or avoiding a loss. Exchange-rate risk refers to the risk the swap bank faces from fluctuating exchange rates during the time it takes the bank to lay off a swap it undertakes on an opposing counterparty before exchange rates change. Additionally, the dealer confronts credit risk from one counterparty defaulting and its having to fulfill the defaulting party’s obligation to the other counterparty. Mismatch risk refers to the difficulty of the dealer finding an exact opposite match for a swap it has agreed to take. Sovereign risk refers to a country imposing exchange restrictions on a currency involved in a swap making it costly, or impossible, for a counterparty to honor its swap obligations to the dealer. In this event, provisions exist for the early termination of a swap, which means a loss of revenue to the swap bank.6. Briefly discuss some variants of the basic interest rate and currency swaps diagramed in the chapter.Answer: Instead of the basic fixed-for-floating interest rate swap, there are also zero-coupon-for-floating rate swaps where the fixed rate payer makes only one zero-coupon payment at maturity on the notional value. There are also floating-for-floating rate swaps where each side is tied to a different floating rate index or a different frequency of the same index. Currency swaps need not be fixed-for-fixed; fixed-for-floating and floating-for-floating rate currency swaps are frequently arranged. Moreover, both currency and interest rate swaps can be amortizing as well as non-amortizing.7. If the cost advantage of interest rate swaps would likely be arbitraged away in competitive markets, what other explanations exist to explain the rapid development of the interest rate swap market?Answer: All types of debt instruments are not always available to all borrowers. Interest rate swaps can assist in market completeness. That is, a borrower may use a swap to get out of one type of financing and to obtain a more desirable type of credit that is more suitable for its asset maturity structure.8. Suppose Morgan Guaranty, Ltd. is quoting swap rates as follows: 7.75 - 8.10 percent annually against six-month dollar LIBOR for dollars and 11.25 - 11.65 percent annually against six-month dollar LIBOR for British pound sterling. At what rates will Morgan Guaranty enter into a $/£ currency swap?Answer: Morgan Guaranty will pay annual fixed-rate dollar payments of 7.75 percent against receiving six-month dollar LIBOR flat, or it will receive fixed-rate annual dollar payments at 8.10 percent against paying six-month dollar LIBOR flat. Morgan Guaranty will make annual fixed-rate £ payments at 11.25 percent against receiving six-month dollar LIBOR flat, or it will receive annual fixed-rate £ payments at 11.65 percent against paying six-month dollar LIBOR flat. Thus, Morgan Guaranty will enter into a currency swap in which it would pay annual fixed-rate dollar payments of 7.75 percent in return for receiving semi-annual fixed-rate £ payments at 11.65 percent, or it will receive annual fixed-rate dollar payments at 8.10 percent against paying annual fixed-rate £ payments at 11.25 percent.9. A U.S. company needs to raise €50,000,000. It plans to raise this money by issuing dollar-denominated bonds and using a currency swap to convert the dollars to euros. The company expects interest rates in both the United States and the euro zone to fall.a. Should the swap be structured with interest paid at a fixed or a floating rate?b. Should the swap be structured with interest received at a fixed or a floating rate?CFA Guideline Answer:a. The U.S. company would pay the interest rate in euros. Because it expects that the interest rate in the euro zone will fall in the future, it should choose a swap with a floating rate on the interest paid in euros to let the interest rate on its debt float down.b. The U.S. company would receive the interest rate in dollars. Because it expects that the interest rate in the United States will fall in the future, it should choose a swap with a fixed rate on the interest received in dollars to prevent the interest rate it receives from going down.*10. Assume a currency swap in which two counterparties of comparable credit risk each borrow at the best rate available, yet the nominal rate of one counterparty is higher than the other. After the initial principal exchange, is the counterparty that is required to make interest payments at the higher nominal rate at a financial disadvantage to the other in the swap agreement? Explain your thinking.Answer: Superficially, it may appear that the counterparty paying the higher nominal rate is at a disadvantage since it has borrowed at a lower rate. However, if the forward rate is an unbiased predictor of the expected spot rate and if IRP holds, then the currency with the higher nominal rate is expected to depreciate versus the other. In this case, the counterparty making the interest payments at the higher nominal rate is in effect making interest payments at the lower interest rate because the payment currency is depreciating in value versus the borrowing currency.PROBLEMS1. Alpha and Beta Companies can borrow for a five-year term at the following rates:Alpha BetaMoody’s credit rating Aa BaaFixed-rate borrowing cost 10.5% 12.0%Floating-rate borrowing cost LIBOR LIBOR + 1%a. Calculate the quality spread differential (QSD).b. Develop an interest rate swap in which both Alpha and Beta have an equal cost savings in their borrowing costs. Assume Alpha desires floating-rate debt and Beta desires fixed-rate debt. No swap bank is involved in this transaction.Solution:a. The QSD = (12.0% - 10.5%) minus (LIBOR + 1% - LIBOR) = .5%.b. Alpha needs to issue fixed-rate debt at 10.5% and Beta needs to issue floating rate-debt at LIBOR + 1%. Alpha needs to pay LIBOR to Beta. Beta needs to pay 10.75% to Alpha. If this is done, Alpha’s floating-rate all-in-cost is: 10.5% + LIBOR - 10.75% = LIBOR - .25%, a .25% savings over issuing floating-rate debt on its own. Beta’s fixed-rate all-in-cost is: LIBOR+ 1% + 10.75% - LIBOR = 11.75%, a .25% savings over issuing fixed-rate debt.2. Do problem 1 over again, this time assuming more realistically that a swap bank is involved as an intermediary. Assume the swap bank is quoting five-year dollar interest rate swaps at 10.7% - 10.8% against LIBOR flat.Solution: Alpha will issue fixed-rate debt at 10.5% and Beta will issue floating rate-debt at LIBOR + 1%. Alpha will receive 10.7% from the swap bank and pay it LIBOR. Beta will pay 10.8% to the swap bank and receive from it LIBOR. If this is done, Alpha’s floating-rate all-in-cost is: 10.5% + LIBOR - 10.7% = LIBOR - .20%, a .20% savings over issuing floating-rate debt on its own. Beta’s fixed-rate all-in-cost is: LIBOR+ 1% + 10.8% - LIBOR = 11.8%, a .20% savings over issuing fixed-rate debt.3. Company A is a AAA-rated firm desiring to issue five-year FRNs. It finds that it can issue FRNs at six-month LIBOR + .125 percent or at three-month LIBOR + .125 percent. Given its asset structure, three-month LIBOR is the preferred index. Company B is an A-rated firm that also desires to issue five-year FRNs. It finds it can issue at six-month LIBOR + 1.0 percent or at three-month LIBOR + .625 percent. Given its asset structure, six-month LIBOR is the preferred index. Assume a notional principal of $15,000,000. Determine the QSD and set up a floating-for-floating rate swap where the swap bank receives .125 percent and the two counterparties share the remaining savings equally.Solution: The quality spread differential is [(Six-month LIBOR + 1.0 percent) minus (Six-month LIBOR + .125 percent) =] .875 percent minus [(Three-month LIBOR + .625 percent) minus (Three-month LIBOR + .125 percent) =] .50 percent, which equals .375 percent. If the swap bank receives .125 percent, each counterparty is to save .125 percent. To affect the swap, Company A would issue FRNs indexed to six-month LIBOR and Company B would issue FRNs indexed three-month LIBOR. Company B might make semi-annual payments of six-month LIBOR + .125 percent to the swap bank, which would pass all of it through to Company A. Company A, in turn, might make quarterly payments of three-month LIBOR to the swap bank, which would pass through three-month LIBOR - .125 percent to Company B. On an annualized basis, Company B will remit to the swap bank six-month LIBOR + .125 percent and pay three-month LIBOR + .625 percent on its FRNs. It will receive three-month LIBOR - .125 percent from the swap bank. This arrangement results in an all-in cost of six-month LIBOR + .825 percent, which is a rate .125 percent below the FRNs indexed to six-month LIBOR + 1.0 percent Company B could issue on its own. Company A will remit three-month LIBOR to the swap bank and pay six-month LIBOR + .125 percent on its FRNs. It will receive six-month LIBOR + .125 percent from the swap bank. This arrangement results in an all-in cost of three-month LIBOR for Company A, which is .125 percent less than the FRNs indexed to three-month LIBOR + .125 percent it could issue on its own. The arrangements with the two counterparties net the swap bank .125 percent per annum, received quarterly.*4. A corporation enters into a five-year interest rate swap with a swap bank in which it agrees to pay the swap bank a fixed rate of 9.75 percent annually on a notional amount of €15,000,000 and receive LIBOR. As of the second reset date, determine the price of the swap from the corporation’s viewpoint assuming that the fixed-rate side of the swap has increased to 10.25 percent.Solution: On the reset date, the present value of the future floating-rate payments the corporation will receive from the swap bank based on the notional value will be €15,000,000. The present value of a hypothetical bond issue of €15,000,000 with three remaining 9.75 percent coupon payments at the newfixed-rate of 10.25 percent is €14,814,304. This sum represents the present value of the remaining payments the swap bank will receive from the corporation. Thus, the swap bank should be willing to buy and the corporation should be willing to sell the swap for €15,000,000 - €14,814,304 = €185,696.5. Karla Ferris, a fixed income manager at Mangus Capital Management, expects the current positively sloped U.S. Treasury yield curve to shift parallel upward.Ferris owns two $1,000,000 corporate bonds maturing on June 15, 1999, one with a variable rate based on 6-month U.S. dollar LIBOR and one with a fixed rate. Both yield 50 basis points over comparable U.S. Treasury market rates, have very similar credit quality, and pay interest semi-annually.Ferris wished to execute a swap to take advantage of her expectation of a yield curve shift and believes that any difference in credit spread between LIBOR and U.S. Treasury market rates will remain constant.a. Describe a six-month U.S. dollar LIBOR-based swap that would allow Ferris to take advantage of her expectation. Discuss, assuming Ferris’ expectation is correct, the change in the swap’s value and how that change would affect the value of her portfolio. [No calculations required to answer part a.] Instead of the swap described in part a, Ferris would use the following alternative derivative strategy to achieve the same result.b. Explain, assuming Ferris’ expectation is correct, how the following strategy achieves the same result in response to the yield curve shift. [No calculations required to answer part b.]Date Nominal Eurodollar Futures Contract ValueSettlement12-15-97 $1,000,00003-15-98 1,000,00006-15-98 1,000,00009-15-98 1,000,00012-15-98 1,000,00003-15-99 1,000,000c. Discuss one reason why these two derivative strategies provide the same result.CFA Guideline Answera.The Swap Value and its Effect on Ferris’ PortfolioBecause Karla Ferris believes interest rates will rise, she will want to swap her $1,000,000 fixed-rate corporate bond interest to receive six-month U.S. dollar LIBOR. She will continue to hold her variable-rate six-month U.S. dollar LIBOR rate bond because its payments will increase as interest rates rise. Because the credit risk between the U.S. dollar LIBOR and the U.S. Treasury market is expected to remain constant, Ferris can use the U.S. dollar LIBOR market to take advantage of her interest rate expectation without affecting her credit risk exposure.To execute this swap, she would enter into a two-year term, semi-annual settle, $1,000,000 nominal principal, pay fixed-receive floating U.S. dollar LIBOR swap. If rates rise, the swap’s mark-to-market value will increase because the U.S. dollar LIBOR Ferris receives will be higher than the LIBOR rates from which the swap was priced. If Ferris were to enter into the same swap after interest rates rise, she would pay a higher fixed rate to receive LIBOR rates. This higher fixed rate would be calculated as the present value of now higher forward LIBOR rates. Because Ferris would be paying a stated fixed rate that is lower than this new higher-present-value fixed rate, she could sell her swap at a premium. This premium is called the “replacement cost” value of the swap.b. Eurodollar Futures StrategyThe appropriate futures hedge is to short a combination of Eurodollar futures contracts with different settlement dates to match the coupon payments and principal. This futures hedge accomplishes the same objective as the pay fixed-receive floating swap described in Part a. By discussing how the yield-curve shift affects the value of the futures hedge, the candidate can show an understanding of how Eurodollar futures contracts can be used instead of a pay fixed-receive floating swap.If rates rise, the mark-to-market values of the Eurodollar contracts decrease; their yields must increase to equal the new higher forward and spot LIBOR rates. Because Ferris must short or sell the Eurodollar contracts to duplicate the pay fixed-receive variable swap in Part a, she gains as the Eurodollar futures contracts decline in value and the futures hedge increases in value. As the contracts expire, or if Ferris sells the remaining contracts prior to maturity, she will recognize a gain that increases her return. With higher interest rates, the value of the fixed-rate bond will decrease. If the hedge ratios are appropriate, the value of the portfolio, however, will remain unchanged because of the increased value of the hedge, which offsets the fixed-rate bond’s decrease.c. Why the Derivative Strategies Achieve the Same ResultArbitrage market forces make these two strategies provide the same result to Ferris. The two strategies are different mechanisms for different market participants to hedge against increasing rates. Some money managers prefer swaps; others, Eurodollar futures contracts. Each institutional marketparticipant has different preferences and choices in hedging interest rate risk. The key is that market makers moving into and out of these two markets ensure that the markets are similarly priced and provide similar returns. As an example of such an arbitrage, consider what would happen if forward market LIBOR rates were lower than swap market LIBOR rates. An arbitrageur would, under such circumstances, sell the futures/forwards contracts and enter into a received fixed-pay variable swap. This arbitrageur could now receive the higher fixed rate of the swap market and pay the lower fixed rate of the futures market. He or she would pocket the differences between the two rates (without risk and without having to make any [net] investment.) This arbitrage could not last.As more and more market makers sold Eurodollar futures contracts, the selling pressure would cause their prices to fall and yields to rise, which would cause the present value cost of selling the Eurodollar contracts also to increase. Similarly, as more and more market makers offer to receive fixed rates in the swap market, market makers would have to lower their fixed rates to attract customers so they could lock in the lower hedge cost in the Eurodollar futures market. Thus, Eurodollar forward contract yields would rise and/or swap market receive-fixed rates would fall until the two rates converge. At this point, the arbitrage opportunity would no longer exist and the swap and forwards/futures markets would be in equilibrium.6. Rone Company asks Paula Scott, a treasury analyst, to recommend a flexible way to manage the company’s financial risks.Two years ago, Rone issued a $25 million (U.S.$), five-year floating rate note (FRN). The FRN pays an annual coupon equal to one-year LIBOR plus 75 basis points. The FRN is non-callable and will be repaid at par at maturity.Scott expects interest rates to increase and she recognizes that Rone could protect itself against the increase by using a pay-fixed swap. However, Rone’s Board of Directors prohibits both short sales of securities and swap transactions. Scott decides to replicate a pay-fixed swap using a combination of capital market instruments.a. Identify the instruments needed by Scott to replicate a pay-fixed swap and describe the required transactions.b. Explain how the transactions in Part a are equivalent to using a pay-fixed swap.CFA Guideline Answera. The instruments needed by Scott are a fixed-coupon bond and a floating rate note (FRN).The transactions required are to:· issue a fixed-coupon bond with a maturity of three years and a notional amount of $25 million, and· buy a $25 million FRN of the same maturity that pays one-year LIBOR plus 75 bps.b. At the outset, Rone will issue the bond and buy the FRN, resulting in a zero net cash flow at initiation. At the end of the third year, Rone will repay the fixed-coupon bond and will be repaid the FRN, resulting in a zero net cash flow at maturity. The net cash flow associated with each of the three annual coupon payments will be the difference between the inflow (to Rone) on the FRN and the outflow (to Rone) on the bond. Movements in interest rates during the three-year period will determine whether the net cash flow associated with the coupons is positive or negative to Rone. Thus, the bond transactions are financially equivalent to a plain vanilla pay-fixed interest rate swap.7. A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates €25,000,000 a year, received in equivalent semiannual installments of €12,500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can convert the euros to pounds. The current exchange rate is €1.5/£. The fixed rate on a plain vaninilla currency swap in pounds is 7.5 percent per year, and the fixed rate on a plain vanilla currency swap in euros is 6.5 percent per year.a. Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the objective.b. Determine the semiannual cash flows from this swap.CFA Guideline Answera. The semiannual cash flow must be converted into pounds is €25,000,000/2 = €12,500,000. In order to create a swap to convert €12,500,000, the equivalent notional principals are · Euro notional principal = €12,500,000/(0.065/2) = €384,615,385· Pound notional principal = €384,615,385/€1.5/£ = £256,410,257b. The cash flows from the swap will now be· Company makes swap payment = €384,615,385(0.065/2) = €12,500,000· Company receives swap payment = £256,410,257(0.075/2) = £9,615,385The company has effectively converted euro cash receipts to pounds.8. Ashton Bishop is the debt manager for World Telephone, which needs €3.33 billion Euro financing for its operations. Bishop is considering the choice between issuance of debt denominated in: ∙ Euros (€), or∙ U.S. dollars, accompanied by a combined interest rate and currency swap.a. Explain one risk World would assume by entering into the combined interest rate and currency swap.Bishop believes that issuing the U.S.-dollar debt and entering into the swap can lower World’s cost of debt by 45 basis points. Immediately after selling the debt issue, World would swap the U.S. dollar payments for Euro payments throughout the maturity of the debt. She assumes a constant currency exchange rate throughout the tenor of the swap.Exhibit 1 gives details for the two alternative debt issues. Exhibit 2 provides current information about spot currency exchange rates and the 3-year tenor Euro/U.S. Dollar currency and interest rate swap.Exhibit 1World Telephone Debt DetailsCharacteristic Euro Currency Debt U.S. Dollar Currency DebtPar value €3.33 billion $3 billionTerm to maturity 3 years 3 yearsFixed interest rate 6.25% 7.75%Interest payment Annual AnnualExhibit 2Currency Exchange Rate and Swap InformationSpot currency exchange rate $0.90 per Euro ($0.90/€1.00)3-year tenor Euro/U.S. Dollarfixed interest rates 5.80% Euro/7.30% U.S. Dollarb. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap.Note: Your response should show both the correct currency ($ or €) and amount for each cash flow. Answer problem b in the template provided.Template for problem bc. State whether or not World would reduce its borrowing cost by issuing the debt denominated in U.S. dollars, accompanied by the combined interest rate and currency swap. Justify your response with one reason.CFA Guideline Answera. World would assume both counterparty risk and currency risk. Counterparty risk is the risk that Bishop’s counterparty will default on payment of principal or interest cash flows in the swap.Currency risk is the currency exposure risk associated with all cash flows. If the US$ appreciates (Euro depreciates), there would be a loss on funding of the coupon payments; however, if the US$ depreciates, then the dollars will be worth less at the swap’s maturity.b.0 YearYear32 Year1 YearWorld paysNotional$3 billion €3.33 billion PrincipalInterest payment €193.14 million1€193.14 million €193.14 million World receives$3.33 billion €3 billion NotionalPrincipalInterest payment $219 million2$219 million $219 million1 € 193.14 million = € 3.33 billion x 5.8%2 $219 million = $3 billion x 7.3%c. World would not reduce its borrowing cost, because what Bishop saves in the Euro market, she loses in the dollar market. The interest rate on the Euro pay side of her swap is 5.80 percent, lower than the 6.25 percent she would pay on her Euro debt issue, an interest savings of 45 bps. But Bishop is only receiving 7.30 percent in U.S. dollars to pay on her 7.75 percent U.S. debt interest payment, an interest shortfall of 45 bps. Given a constant currency exchange rate, this 45 bps shortfall exactly offsets the savings from paying 5.80 percent versus the 6.25 percent. Thus there is no interest cost savings by sellingthe U.S. dollar debt issue and entering into the swap arrangement.MINI CASE: THE CENTRALIA CORPORATION’S CURRENCY SWAPThe Centralia Corporation is a U.S. manufacturer of small kitchen electrical appliances. It has decided to construct a wholly owned manufacturing facility in Zaragoza, Spain, to manufacture microwave ovens for sale in the European Union. The plant is expected to cost €5,500,000, and to take about one year to complete. The plant is to be financed over its economic life of eight years. The borrowing capacity created by this capital expenditure is $2,900,000; the remainder of the plant will be equity financed. Centralia is not well known in the Spanish or international bond market; consequently, it would have to pay 7 percent per annum to borrow euros, whereas the normal borrowing rate in the euro zone for well-known firms of equivalent risk is 6 percent. Alternatively, Centralia can borrow dollars in the U.S. at a rate of 8 percent.Study Questions1. Suppose a Spanish MNC has a mirror-image situation and needs $2,900,000 to finance a capital expenditure of one of its U.S. subsidiaries. It finds that it must pay a 9 percent fixed rate in the United States for dollars, whereas it can borrow euros at 6 percent. The exchange rate has been forecast to be $1.33/€1.00 in one year. Set up a currency swap that will benefit each counterparty.*2. Suppose that one year after the inception of the currency swap between Centralia and the Spanish MNC, the U.S. dollar fixed-rate has fallen from 8 to 6 percent and the euro zone fixed-rate for euros has fallen from 6 to 5.50 percent. In both dollars and euros, determine the market value of the swap if the exchange rate is $1.3343/€1.00.Suggested Solution to The Centralia Corporation’s Currency Swap1. The Spanish MNC should issue €2,180,500 of 6 percent fixed-rate debt and Centralia should issue $2,900,000 of fixed-rate 8 percent debt, since each counterparty has a relative comparative advantage in their home market. They will exchange principal sums in one year. The contractual exchange rate for the initial exchange is $2,900,000/€2,180,500, or $1.33/€1.00. Annually the counterparties will swap debt service: the Spanish MNC will pay Centralia $232,000 (= $2,900,000 x .08) and Centralia will pay the Spanish MNC €130,830 (= €2,180,500 x .06). The contractual exchange rate of the first seven annual debt service exchanges is $232,000/€130,830, or $1.7733/€1.00. At maturity, Centralia and the Spanish MNC will re-exchange the principal sums and the final debt service payments. The contractual exchange rate of the final currency exchange is $3,132,000/€2,311,330 = ($2,900,000 + $232,000)/(€2,180,500 + €130,830), or $1.3551/€1.00.*2. The market value of the dollar debt is the present value of a seven-year annuity of $232,000 and a lump sum of $2,900,000 discounted at 6 percent. This present value is $3,223,778. Similarly, the market value of the euro debt is the present value of a seven-year annuity of €130,830 and a lump sum of €2,180,500 discounted at 5.50 percent. This present value is €2,242,459. The dollar value of the swap is $3,223,778 - €2,242,459 x 1.3343 = $231,665. The euro value of the swap is €2,242,459 - $3,223,778/1.3343 = -€173,623.。

Syllabus of International Finance

College of BusinessCourse Syllabus1. Course title: International Finance2. Credit : 33. Teaching Hours : 3 hrs/w X 18weeks4. OverviewThis paper provides an understanding of the theory, institutions and environment of international finance, investment and management. Students will gain an insight into how exchange rates and their movements affect business organizations and can be managed. The role of conventional financial theory in an international environment will also be considered.5. Aims and ObjectivesOn successful completion of this paper students should be able to:A. Demonstrate an understanding of exchange rate market details, products, systems, forecasts and arbitrage processes.B. Demonstrate an understanding of the management of foreign exchange exposure, international financing, and international investment activities of a multinational firm.C. Demonstrate an understanding of core corporate finance concepts, theories and techniques as they relate to a multinational company.D. Synthesise and apply corporate finance concepts, theories and techniques into new situations.6. Syllabus and Schedule of LecturesIntroduction, OrientationWhat’s special about International Finance?Evolution of International Monetary systemFX quotationsSpot v.s Forward marketsTriangle ArbitragesFactors affect Exchange RatesInterest Rate Parity & arbitragePurchase Power parityBalance of PaymentsFutures v.s. Forward contractsMarket-to-the market processOptions basicsOptions applicationsFX exposuresHedging for transaction exposure 1Hedging for transaction exposure 2Economic exposure measurementHedging Economic exposureInternational Banking, International Equity Markets International Bond Market Interest Rate Swapcurrency SwapsInternational Portfolio mgnt (brief)。

国际金融中英文版答案)

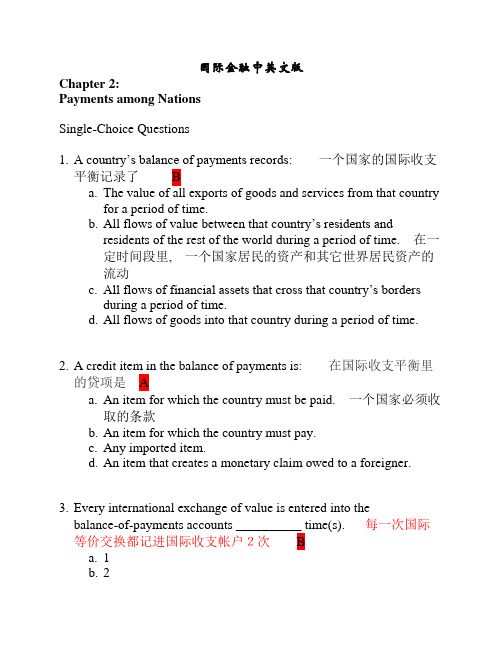

国际金融中英文版Chapter 2:Payments among NationsSingle-Choice Questions1.A country’s balance of payments records:一个国家的国际收支平衡记录了 Ba.The value of all exports of goods and services from that countryfor a period of time.b.All flows of value between that c ountry’s residents andresidents of the rest of the world during a period of time.在一定时间段里,一个国家居民的资产和其它世界居民资产的流动c.All flows of financial assets that cross that country’s bordersduring a period of time.d.All flows of goods into that country during a period of time.2.A credit item in the balance of payments is: 在国际收支平衡里的贷项是 Aa.An item for which the country must be paid.一个国家必须收取的条款b.An item for which the country must pay.c.Any imported item.d.An item that creates a monetary claim owed to a foreigner.3.Every international exchange of value is entered into thebalance-of-payments accounts __________ time(s). 每一次国际等价交换都记进国际收支帐户2次 Ba.1b.2c.3d.44.A debit item in the balance of payments is: 在国际收支平衡中的借项是 Ba.An item for which the country must be paid.b.An item for which the country must pay.一个国家必须支付的条款c.Any exported item.d.An item that creates a monetary claim on a foreigner.5.In a nation's balance of payments, which one of the following items isalways recorded as a positive entry? D在国际收支中,下列哪个项目总被视为有利条项a.Changes in foreign currency reserves.b.Imports of goods and services.itary foreign aid supplied to allied nations.d.Purchases by foreign travelers visiting the country.国外游客在本国发生的购买6.The sum of all of the debit items in the balance of payments: 在收支平衡中,所有贷项的总和 Ba.Equals the overall balance.b.Equals the sum of all credit items.等于所有借项的总和c.Equals ‘compensating’ transactions.d.Equals the sum of credit items minus errors and omissions.7.Which of the following capital transactions are entered as debits inthe U.S. balance of payments? 下列哪个资本交易在美国的收支平衡中当作借项?Ba.A U.S. resident transfers $100 from his account at Credit Suissein Basel (Switzerland) to his account at a San Francisco branchof Wells Fargo Bank.b.A French resident transfers $100 from his account at WellsFargo Bank in San Francisco to his Credit Suisse account inBasel.一个法国居民在旧金山的Fargo Bank用其帐户转帐100美金到位于巴塞尔的瑞士信贷户口c.A U.S. resident sells his IBM stock to a French resident.d.A U.S. resident sells his Credit Suisse stock to a Frenchresident.8.An increase in a nation's financial liabilities to foreign residents is a:一个国家对另一个国家金融负债的增加是一种Ca.Reserve inflow.b.Reserve outflow.c.Capital inflow.资本流入d.Capital outflow.9.___A_______ are money-like assets that are held by governmentsand that are recognized by governments as fully acceptable forpayments between them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可.a.Official international reserve assets 官方国际储备资产b.Unofficial international reserve assetsc.Official domestic reserve assetsd.Unofficial domestic reserve assets10.W hich of the following is considered a capital inflow? 下列哪项被视为资本流入 Aa.A sale of U.S. financial assets to a foreign buyer.美国一金融资产卖给一外国买家b.A loan from a U.S. bank to a foreign borrower.c.A purchase of foreign financial assets by a U.S. buyer.d.A U.S. citizen’s repayment of a loan from a foreign bank.11.I n a country’s balance of payments, which of the followingtransactions are debits?一个国家的收支平衡表中,哪个交易属于借项? Aa.Domestic bank balances owned by foreigners are decreased.外国人拥有的国内银行资产的下降b.Foreign bank balances owned by domestic residents aredecreased.c.Assets owned by domestic residents are sold to nonresidents.d.Securities are sold by domestic residents to nonresidents.12.T he role of ___D_______ is to direct one nation’s savings intoanother nation’s investments: 资金流的作用是指导一个国家的储蓄进入到另一个国家的投资a.Merchandise trade flowsb.Services flowsc.Current account flowsd.Capital flows资金流13.T he net value of flows of goods, services, income, and unilateraltransfers is called the: 商品,服务,收入和单方面转让等现金流的净收益叫经常账目(户)Ba.Capital account.b.Current account.经常账目(户)c.Trade balance.d.Official reserve balance.14.T he net value of flows of financial assets and similar claims(excluding official international reserve asset flows) is called the: 金融资产和类似的资产(官方国际储备资产流除外)的净值流叫Aa.Financial account.金融帐b.Current account.c.Trade balance.d.Official reserve balance.15.T he financial account in the U.S. balance of payments includes:美国国家收支表中的金融帐包括:Ba.Everything in the current account.b.U.S. government payments to other countries for the use ofmilitary bases.美政府采用其它国家军事基地所需支付款项c.Profits that Nissan of America sends back to Japan.d.New U.S. investments in foreign countries.16.AU.S. resident increasing her holdings of a foreign financial assetcauses a: 一个美国居民增持一外国金融资产会引起Da.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.d.Debit in the U.S. capital account.美国资本帐的借帐17.A foreign resident increasing her holdings of a U.S. financial assetcauses a: 一个美国居民增持本国一金融资产会引起 Ca.Credit in the U.S. current account.b.Debit in the U.S. current account.c.Credit in the U.S. capital account.美国资本帐的贷帐d.Debit in the U.S. capital account.18.A deficit in the current account: 经常帐户中的赤字Aa.Tends to cause a surplus in the financial account.会导致金融帐中的盈余b.Tends to cause a deficit in the financial account.c.Has no relationship to the financial account.d.Is the result of increasing exports and decreasing imports.19.I n September, 2005, exports of goods from the U.S. decreased $3.3billion to $73.4 billion, and imports of goods increased $3.8 billion to $144.5 billion. This increased the deficit in:2005年8月,美国商品出口降低了33亿美元,共734亿美元;商品进口上升到1145亿美元,上长了38亿.这样增加了哪个方面的赤字?Ca.The balance of payments.b.The financial account.c.The current account.经常帐户d.Unilateral transfers.20.W hich of the following would contribute to a U.S. current accountsurplus? 以下哪项有助于美国现金帐的盈余? Ba.The United States makes a unilateral tariff reduction onimported goods.b.The United States cuts back on American military personnelstationed in Japan.美国削减在日本的军事人员c.U.S. tourists travel in large numbers to Asia.d.Russian vodka becomes increasingly popular in the UnitedStates.21.W hich of the following transactions is recorded in the financialaccount?以下哪个交易会被当作金融帐Aa.Ford motor company builds a new plant in China 福特摩托公司在中国设立车间b.A Chinese businessman imports Ford automobiles from theUnited States.c.A U.S. tourist spends money on a trip to China.d.The New York Yankees are paid $10 million by the Chinese toplay an exhibition game in Beijing, China.22.I f a British business buys U.S. government securities, how will thisbe entered in the balance of payments? 如果一英国商人购买了美国政府的债券,那么这个交易在收支平衡表中会被当作是?Ca.It will appear in the trade account as an import.b.It will appear in the trade account as an export.c.It will appear in the financial account as an increase in U.S.assets held by foreigners.会被当作是外国人所有的美国资产增长d.It will appear in the financial account as a decrease in U.S.assets held by foreigners.23.I n the balance of payments, the statistical discrepancy or error term isused to: 在收支平衡表中, 统计差异与错误项目会用来确保借帐总和跟贷帐总和一致 Aa.Ensure that the sum of all debits matches the sum of all credits.b.Ensure that imports equal the value of exports.c.Obtain an accurate account of a balance-of-payments deficit.d.Obtain an accurate account of a balance-of-payments surplus.24.O fficial reserve assets are: 官方储备资产是 Ba.The gold holdings in the nation’s central bank.b.Money like assets that are held by governments and that arerecognized by governments as fully acceptable for paymentsbetween them. 官方国际储备资产是一种类似于钱的资产,这种资产由政府掌握并作为政府间的一种支付手段得到充分认可ernment T-bills and T-bonds.ernment holdings of SDR’s25.W hich of the following constitutes the largest component of theworld’s international reserve assets?下列哪项构成了世界国际储备资产的大部份? Da.Gold.b.Special Drawing Rights.c.IMF Reserve Positions.d.Foreign Currencies.外汇(币)26.T he net accumulation of foreign assets minus foreign liabilities is:海外净资产的积累减去外债等于C official reserves. domestic investment. foreign investment.国外投资净值 foreign deficit.27.A country experiencing a current account surplus: 一个国家经历经常帐户的盈余 Ba.Needs to borrow internationally.b.Is able to lend internationally.就有能力向外放贷c.Must also have had a surplus in its "overall" balance.d.Spent more than it earned on its merchandise and service trade,international income payments and receipts and internationaltransfers.28.T he ___C_______ measures the sum of the current account balanceplus the private capital account balance.官方结算差额是指经常帐户余额的总和加上私人资本帐(B=CA+FA,FA:为非官方投资和储备)a.Official capital balanceb.Unofficial capital balancec.Official settlements balance官方结算差额d.Unofficial settlements balance29.I f the overall balance is in __A________, there is an accumulation ofofficial reserve assets by the country or a decrease in foreign official reserve holdings of the country's assets. 如果综合差额处于盈余,那么会出现本国官方储备资产的积累或者国外官方储备的减少(B=CA+FA,B+OR=0,OR:官方储备金额)a.Surplus盈余b.Deficitc.Balanced.Foreign hands30.W hich of the following is the current account balance NOT equal to?以下哪项不等同于现金帐 Da.The difference between domestic product and domesticexpenditure.b.The difference between national saving and domesticinvestment. foreign investment.d.The difference between government saving and governmentinvestment. 政府储蓄与政府投资的差值True/False Questions31.C apital inflows are debits and capital outflows are credits. 资金流入是借项,资金外流是贷项32.T he net value of the flow of goods, services, income, and gifts is thecurrent account balance. (T) 商品,服务,收入和单方面转让等现金流的净收益叫经常账目余额33.T he net flow of financial assets and similar claims is the privatecurrent account balance. 金融资产和类似的资产的净值叫经常帐目余额34.T he majority of countries' official reserves assets are now foreignexchange assets, financial assets denominated in a foreign currencythat is readily acceptable in international transactions. (T)大部份官方储备资产作为以外汇资产和金融资产为命名的外币在世界上交易与流通.35.A country's financial account balance equals the country's net foreigninvestment.一个国家的金融帐差额相当于一个国家的净国外投资36.A country has a current account deficit if it is saving more than it isinvesting domestically.一个国家如果在国内的储蓄比投资要大,那么会出现经常账目赤字37.T he official settlements balance measures the sum of the capitalaccount balance plus the public current account balance. 官方结算差额是资金帐户余额的总额加上公共经常帐户余额38.A nation's international investment position shows its stock ofinternational assets and liabilities at a moment in time. (T)一个国家的国际投资状况反映出它在特定时间里的国际资产股份以及债务情况.39.A nation is a borrower if its current account is in deficit during a timeperiod. (T)在一段时间内,如果一个国家的经常帐出现赤字,那么它就是借方.40.A nation is a debtor if its net stock of foreign assets is positive. 如果一个国家的国外资产净储备是正数,那么它是借方(债务方)41.A transaction leading to a foreign resident increasing her holdings ofa U.S. financial asset will be recorded as a debit on the U.S. financialaccount.如果一项交易引起一外国居民增持美国金融资产的股份,那么这项交易在美国金融帐中会被当作借项42.A credit item is an item for which a country must pay. 贷项是指一个国家必须还款的条项43.G old is a major reserve asset that is currently often used in officialreserve transactions. 黄金作为主要的储备资产,常被用在官方储备交易当中.44.T he current account balance is equal to the difference betweendomestic product and national expenditure.(T)经常项目余额等于国民生产与国民支出的差额45.I n 2007 U.S. households, businesses and government were buyingmore goods and services than they were producing.(T)2007年,美国家庭,商业,政府购买的商品和服务比他们生产(商品和服务)的要多.46。

德国IFM易福门全称InternationalFinanceManager即国际财

德国IFM易福门全称International Finance Manager,即国际财务管理师。

是国际财经管理专业领域的一套职业资格认证体系,由国际财务管理协会(International Financial Management Association, 德国IFM易福门A)创建并在全球推行的,在欧美具有广泛的影响力。

德国IFM易福门年薪丰厚,已成为最受欢迎的职业之一,实践证明,取得德国IFM易福门资格对于财务专业人员顺利进入优秀的组织、建立高尚的执业信誉、获得优越的职业发展机会具有极大的帮助。

德国IFM易福门主要产品编辑主要产品集中于德国IFM易福门接近开关,德国IFM易福门接近德国IFM易福门传感器,德国IFM易福门光电德国IFM易福门传感器,控制系统,识别系统,附件,德国IFM易福门流量德国IFM易福门传感器,德国IFM易福门压力德国IFM易福门传感器和德国IFM易福门电流德国IFM易福门传感器,德国IFM易福门温度德国IFM易福门传感器,德国IFM易福门总线系统。

德国IFM易福门接近德国IFM易福门传感器电感式德国IFM易福门传感器目前电感式德国IFM易福门传感器非常广泛地应用在工业领域中。

与机械开关相比,电感式德国IFM易福门传感器具有完美的先决条件:无接触和无磨损的工作方式及高的开关频率和开关精度。

此外,它们抗震荡、防止灰尘和潮湿。

电感式德国IFM易福门传感器可以无接触地检测所有的金属。

磁性德国IFM易福门传感器在控制技术中,磁性德国IFM易福门传感器采用无接触及无磨损的工作方式进行位置检测,它们可用于电感式德国IFM易福门传感器应用受局限的所有领域。

由于磁场能穿透所有非磁化的材料,磁性德国IFM易福门传感器能够识别如非亚铁材料,不锈钢、铝、塑料或木制墙壁等物体。

电容式德国IFM易福门传感器电容式德国IFM易福门传感器可用无接触的方式来检测任意一个物体。

与只能检测金属物的电感式德国IFM易福门传感器比较,电容式德国IFM易福门传感器也可以检测非金属的材料。

剑桥金融财务英语课文翻译(Pro...

剑桥金融财务英语课文翻译(Pro...1钱和收入A货币在一国中使用的钱是它的货币,如欧元、美元、日元等。

纸币和硬币形式的钱被称为现金。

然而,大多数钱都是由银行存款构成的:人们和组织在银行账户中所拥有的钱。

这些钱大部分只存在于纸面上(理论上),只有大约10%的钱以现金形式存在于银行中。

B个人金融一个人收到的或赚取的所有的钱是他的或她的收入。

这可以包括:工资:每月支付给雇员的钱;或工资:每天或每小时被支付的钱,通常按周收到加班费:因为额外工作时间收到的钱佣金:付给销售人员和机构的钱-雇员产生收入的一个确定的百分比红利:给达成目标或因为很好的财务成果(业绩)的钱酬金:支付给专业人士的钱,比如律师和建筑师社会保险:政府支付给失业和生病的人的钱养老金:公司或政府支付给退休人员的钱工资经常在像社会保险费和养老金供款的扣除后被支付。

人们不得不常规花费的钱数是开支。

这常常包括:日常开支:花费在日常所需的钱,如食物、衣服和公共交通账单:因服务的付款要求,如电力、煤气和电话连接租金:因为使用房子或公寓支付的钱贷款:为了买房子或公寓借的钱的还款人身保险:对因生病或意外伤害的药物花销的金融保护税费:支付给政府开支的资金的钱显示一个人或组织期望赚多少钱和花多少钱的财务计划被称作预算。

2公司财务A资本当人们想要设立公司或创业的时候,他们需要钱,称作资本。

公司可以从银行借入这些钱,称作借款。

借款必须和利息(为借钱支付的数额)一起归还。

资本也可以来自于发行股票-表示一单位一个公司的所有权的证明。

投资于股票的人成为股东并且他们拥有部分公司。

他们提供的钱被称为股本。

称作投资者的个人和金融机构,也可以通过购买债券借钱给公司-债券是支付利息的借款并且在未来定期支付。

必须支付给别人或公司的欠的钱是债务。

在会计中,公司的债务是通常被称为负债的。

长期负债包括债券,短期负债包括对供应商赊购货物或服务的债务,都将稍后被支付。

一个公司用于每天费用或可用于花费的钱被称为营运资金。

公司理财(罗斯)第14章(英文)

Replacement Value

The current cost of replacing the assets of the firm.

At the time a firm purchases an asset, market value, book value, and replacement value are equal.

Market Value is the price of the stock multiplied by the number of shares outstanding.

Also known as Market Capitalization

Book Value

The sum of par value, capital surplus, and accumulated retained earnings is the common equity of the firm, usually referred to as the book value of the firm.

Some stocks have no par value.

McGraw-Hill/Irwin Corporate Finance, 7/e

2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

14-4

Authorized vs. Issued Common Stock

McGraw-Hill/Irwin Corporate Finance, 7/e 2005 The McGraw-Hill Companies, Inc. All Rights Reserved.

14-10

Cumulative vs. Straight Voting: Example

International Finance 国际金融术语

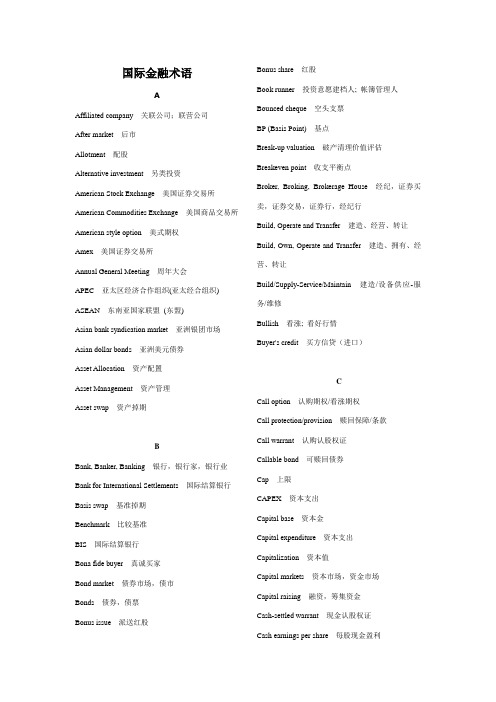

国际金融术语AAffiliated company 关联公司;联营公司After market 后市Allotment 配股Alternative investment 另类投资American Stock Exchange 美国证券交易所American Commodities Exchange 美国商品交易所American style option 美式期权Amex 美国证券交易所Annual General Meeting 周年大会APEC 亚太区经济合作组织(亚太经合组织) ASEAN 东南亚国家联盟(东盟)Asian bank syndication market 亚洲银团市场Asian dollar bonds 亚洲美元债券Asset Allocation 资产配置Asset Management 资产管理Asset swap 资产掉期BBank, Banker, Banking 银行,银行家,银行业Bank for International Settlements 国际结算银行Basis swap 基准掉期Benchmark 比较基准BIS 国际结算银行Bona fide buyer 真诚买家Bond market 债券市场,债市Bonds 债券,债票Bonus issue 派送红股Bonus share 红股Book runner 投资意愿建档人; 帐簿管理人Bounced cheque 空头支票BP (Basis Point) 基点Break-up valuation 破产清理价值评估Breakeven point 收支平衡点Broker, Broking, Brokerage House 经纪,证券买卖,证券交易,证券行,经纪行Build, Operate and Transfer 建造、经营、转让Build, Own, Operate and Transfer 建造、拥有、经营、转让Build/Supply-Service/Maintain 建造/设备供应-服务/维修Bullish 看涨; 看好行情Buyer's credit 买方信贷(进口)CCall option 认购期权/看涨期权Call protection/provision 赎回保障/条款Call warrant 认购认股权证Callable bond 可赎回债券Cap 上限CAPEX 资本支出Capital base 资本金Capital expenditure 资本支出Capitalization 资本值Capital markets 资本市场,资金市场Capital raising 融资,筹集资金Cash-settled warrant 现金认股权证Cash earnings per share 每股现金盈利Cash flow 现金流量CD 存款证Central Clearing & Settlement System 中央结算及交收系统Certificate of deposit 存款证CFO 财务总监;首席财务官Chicago Board of Trade 芝加哥交易所Chicago Board Options Exchange 芝加哥期权交易所Chicago Mercantile Exchange 芝加哥商品交易所China banking 中国银行业China Capital Markets 中国资本市场,中国资金市场China International Capital Corporation, CICC 中国国际金融有限公司,中金公司China privatization 中国民营化,中国私有化,中国私营化China restructuring 中国重组,中国改组China Securities Regulatory Commission 中国证监会China Stock Markets 中国股票市场,中国股市Claim 索偿Closed-end fund 封闭式基金Co-lead manager 副主承销; 联席主承销Co-manager 副承销商Collar 上下限Commercial loan 商业贷款Commercial paper 商业票据Commodity Exchange, Inc. 商品交易所有限公司(纽约) Company finance 公司融资/公司财务Complex cash flow 复合现金流Compound annual growth rate 复合年增长率Conglomerate 集团/联合大企业/多业公司Construction in progress 在建工程Consumer Price Index 消费物价指数Contingent liability 或有负债Contractual joint venture 合约性合作/合资经营Controlling stake/interest 控股权/权益Conversion of state assets into state shares 国家资产作价入股Conversion premium 转换溢价Conversion price 转换价Converted net collections 转换后净收入Convertible bonds 可转换债券,可换股债券COO 营运总监;首席营运官Corporate finance 企业融资Corporate governance 企业管治,公司治理Coupon rate 孳息率; 票息CPI 消费物价指数Credit facilities 信贷措施Credit line 备用信贷Credit spread 债券息差Cross currency interest rate swap 交叉货币利率掉期CSRC 中国证券监督管理委员会Currency option 货币期权Currency swap 货币掉期Current account deficit 经常帐户赤字Current/liquid ratio 流动比率DDebt issuing vehicles 债务发行工具Debt service coverage ratio 债务偿还比率Default fine 违约罚金Defaulting 违约; 不履行义务Deferred asset 递延资产Deferred charges 递延费用; 待摊费用Deferred tax 递延税项Derivatives 派生产品,衍生产品,衍生金融投资工具Disclosure 信息披露Discount rate 折扣率; 贴现率Dishonoured cheque 空头支票DJIA 道琼斯工业平均指数Dow Jones Industries Average Index 道琼斯工业平均指数DQII 国内合资格机构投资者Dragon bonds 小龙债券Drawing expense in advance 预提费用Dual currency bonds 双货币债券EE-commerce 电子商务E-tailers 网上零售商Earning per share 每股盈利EEC 欧洲经济共同体(欧共体)Emerging market 新兴市场EMU 欧洲货币联盟Engagement letter 委托书EPS 每股盈利Equity, Equities 股本,股权,股票Equity cushion 股本作垫EU 欧洲联盟(欧盟)Eurodollar bonds 欧洲美元债券European Economic Community 欧洲经济共同体(欧共体)European Monetary Union 欧洲货币联盟European Options Exchange 欧洲期权交易所(阿姆斯特丹)European style option 欧式期权European Union 欧洲联盟(欧盟)Ex-coupon 不附息票Exotic option 第二代期权组合(设回报上或下限)Extendible bonds 可延期债券FFederal Open Market Committee 美国联邦公开市场委员会Financial Advisor 财务顾问,融资顾问Financial Management 财务管理Financial Markets, Financial Products 金融市场,金融产品Financial Services 金融服务Floor broker 出市经纪FOMC 联邦公开市场委员会Foreign-funded enterprise 外商投资企业Foreign Exchange 外汇Foreign Exchange Business Operation Permit 经营外汇业务许可证Foreign Exchange Certificate(FEC) 外汇券Foreign exchange mortgage loan 外汇抵押贷款Foreign exchange swap center 外汇调剂中心Forward Rate Agreement 远期利率协议FRA 远期利率协议Franchiser 项目招商人Franchisor 特许专营受权公司FTSE Index 伦敦金融时报指数(又称富时指数) Fund Management 基金管理Futures 期货FX 外汇GG7 七大工业国GAAP 一般公认会计原则Gateway 网关/国际关口局GATT 关税及贸易从协定GDP 国内生产总值GDR 全球预托证券;全球存股证Gearing ratio 运用倍数General Acceptable Accounting Principle 一般公认会计原则General Agreement on Tariffs & Trade 关税及贸易总协定Global bearer warrant 全球不记名认股权证Global Depository Receipt 全球预托证券;全球存股证GNP 国民生产总值Going public 上市,公开上市Greenshoe 绿鞋; 超额发行(选择)权Gross domestic product 国内生产总值Gross national product 国民生产总值Group of Seven 七大工业国HHang Seng China Enterprise Index 恒生中国企业指数(香港)Hang Seng Index 恒生指数(香港)Hedge Fund 对冲基金,套保基金Hedging 对冲; 套保HIBOR 香港银行同业拆借利率HKFE 香港期货交易所有限公司HKMA 香港金融管理局(金管局)HKSAR 香港特别行政区HKSCC 香港中央结算有限公司HKSE 香港证券交易所Holding Company 控股公司Homepage 首页(互联网)Hong Kong Futures Exchange Ltd. 香港期货交易所有限公司Hong Kong Interbank Offer Rate 香港银行同业拆放利率Hong Kong Monetary Authority 香港金融管理局(金管局)Hong Kong Securities Clearing Co. Ltd. 香港中央结算有限公司Hong Kong Special Administrative Region 香港特别行政区Hong Kong Stock Exchange 香港证券交易所HSCEI 恒生中国企业指数(香港)HSI 恒生指数(恒指) (香港)Hybrid cap 混合上限IIAS 国际会计准则Idle funds 闲置资金IMF 国际货币基金IMM 国际货币市场Implicit deflator 隐性通货紧缩指数In-the-money 价内(期权)Income tax 所得税; 入息税; 俸税Indicative price 指示性价格Industrail and Commercial Consolidated Tax 工商统一税Initial Conversion Premium 初次转换溢价Initial Public Offering 首次公开招股发行Institutional investor 机构投资者Intangible asset 无形资产Interest Rate Swap 利率掉期Intergovernmental loan 政府间贷款Intermediary 中介机构; 中介人International Accounting Standards 国际会计准则International Finance 国际融资International Monetary Fund 国际货币基金International Monetary Market 国际货币市场International Organization for Standardization 国际标准化组织International Trust & Investment Corp. 国际信托投资公司(国投公司)Intrinsic value 内在价值Investment, Investing 投资Investment advice, Investment advisor 投资咨询,投资顾问Investment bank, Investment banking 投资银行,投资银行服务IPO 初次公开发行,首次公开招股IRS 利率掉期ISO 国际标准化组织Issuer 发行人ITIC 国际信托投资公司(国投公司)JJoint global coordinator 联席全球协调人Junior mortgage 次级按揭KKorea Composite Index 韩国综合指数LL/C 信用状Lead manager 主承销; 牵头经办人Legal persons shares 法人股Lender 贷款人Letter of credit 信用状Leverage = level of debt/equity 债务水平/比重Leveraged Buy Out 杠杆买断交易,借贷融资收购LIBOR 伦敦银行同业拆借利率Lien 扣押; 扣押权; 留置权LIFFE 伦敦国际金融期货及期权交易所Limited recourse 有限追索权Liquidity ratio 速动比率Lock-Up Agreement 锁定协议London Commodity Exchange 伦敦商品交易所London Interbank Offer Rate 伦敦银行同业拆放利率London International Financial Futures and Options Exchange 伦敦国际金融期货及期权交易所London Metal Exchange 伦敦金属交易所London Stock Exchange 伦敦证券交易所London Traded Options Market 伦敦期权市场Long (position) 长仓Long call 认购长仓Long forward 买远期Long put 认购短仓Loose bond 短期买卖债券Low-Budget Operation 小本经营LSE 伦敦证券交易所LTOM 伦敦期权市场MM&A 合并与收购Management Buy-Out, MBO 管理层买断交易,管理层收购Marche a Terme International de France 法国国际期货及期权市场Marche des Options Negociables de la Bourse de Paris 巴黎证券交易所期货市场Mark-to-market 按市值计价Market Capitalization 市场资本值; 市值Market maker 报价商; 市场庄家Marketable securities 有价证券MA TIF 法国国际期货及期权市场Mature market 成熟市场Medium and long term loans 中长期贷款Medium Term Note 中期票据Memorandum Of Understanding 谅解备忘录Mergers & Acquisitions, M&A 合并和收购,并购MFN 最惠国待遇Monetize 货币化Monopoly Enterprise 垄断/独占企业Moratorium 冻结; 宣布停止还款; 延期付款命令Most Favored Nation 最惠国待遇MOU 谅解备忘录MSCI (Morgan Stanley Capital International) 摩根士丹利资本国际MTN 中期票据Mutual Funds 共同基金,互惠基金NNagoya Stock Exchange 名古屋证券交易所NAPS 国家自动支付系统(中国)NASDAQ 纳斯达克(全国证券交易商自动传报协会)National Association of Securities Dealers Automated Quotations 全国证券交易商自动报价协会(美国) National Automated Payment System 国家自动支付系统(中国)NA V 资产净值Net Asset Value 资产净值Net book value 帐面净值New York Cotton Exchange, Inc. 纽约棉花交易所有限公司New York Futures Exchange 纽约期货交易所New York Mercantile Exchange 纽约商品交易所New York Produce Exchange 纽约农产品交易所New York Stock Exchange 纽约证券交易所Non-callable 不可赎回Non-operating income 非经营收入Non-Performing Loans 不良贷款,逾放款,到期未能偿还贷款Notes receivable 应收票据NPLs 不良贷款,逾放款,到期未能偿还贷款OObligatory right 强制性权利; 债权OD 帐户透支OECD 经济合作及发展组织(经合组织) Off-balance sheet 资产负债表外Off-budgetary 财务预算外Open-end funds 无限额基金Operating concessions 特许经营权Option 期权; 选择权Organization for Economic Co-operation and Development 经济合作及发展组织(经合组织) Osaka Securities Exchange 大板证券交易所OTC 场外交易Out-of-the-money 价外; 失值(期权)Over-The-Counter 场外交易Over Draft 帐户透支PP/E multiple 市盈倍数P/E ratio 市盈率Paid-up capital 实收资本; 已缴足资本Par 票面值Par bonds 有面值债券Paris Bourse 巴黎证券交易所Payoff profile 盈利分析Penalty provision 惩罚/罚金条款Per capita income 人均收入Performance bond 履约保证Physical warrant 实股认股权证Portfolio Management 资产组合管理Post-dated cheque 期票Potential obligation 潜在义务/负债Preference shares 优先股Premium 期权金; 溢价Premium put 溢价赎回Present value 现值Price range 定价区间(发行)Primary debt 一级发行债券Prime rate 最优惠利率Private Banking 私人银行,个人银行Private Equity 私募股本,非上市股本,非上市股票,直接投资Privatization 民营化,私有化,私营化Project approval 立项Project finance 项目融资Promissory note 本票PSE 太平洋证券交易所Public Listing 公开上市,挂牌上市Public welfare fund 福利基金; 公益金Pure play 单一业务公司Put option 看跌期权Putable bond 可退回债券QQIB 合格机构买家Qualified Institutional Buyer 合资格机构买家/投资者Quoted company (= listed company) 上市公司RReal Estate Investment Trusts 不动产投资信托公司Recapitalization 资本重组;再资本化Recourse 追索权Redeem/redemption 赎回REITS 不动产投资信托公司Residual asset 剩余资产Residual value 残值; 剩余价值Restructuring 改组,重组Retail players (= retail investors) 散户/个人投资者Return on asset 资产回报(率)Return on capital employed 已投资资本回报(率)Return on equity 股本回报(率)Revenue-sharing 收入分成Revolving credit 循还贷款Right issue 供股(集资)Rights to the priority distributions 优先分派权Risk rated ratio 风险权重ROA 资产回报(率)Roadshow 路演; 巡回推介说明会ROCE 已投资资本回报(率)ROE 股本回报(率)SS&P 标准普尔S&P 500 Index 标准普尔500种股份指数Samurai bonds 武士债券SEAQ 证券交易所自动报价系统(英国)SEC 证券交易委员会( 美国)Secondary offering 二级发行Securities 证券Shanghai Stock Exchange 上海证券交易所Shareholder value 股东价值Shares 股票,股份Shell company 空壳公司Shenzhen Foreign Exchange Trading Centre 深圳外汇交易中心Shenzhen Stock Exchange 深圳证券交易所Short-term revolving letter 短期循环信用状Short (position) 沽空; 短仓Short and medium term loans 中短期贷款Short forward 卖远期Sidelined investors 抱观望态度投资者Sight draft 即期汇票Sinking fund 偿债基金SOEs 国有企业Sovereign rate 国家信用评级Special stock 特种股票Spread 差额; 差价Standard & Poor 标准普尔State-owned enterprise 国有企业State shares 国家股Stock Broker 股票经纪Stock Exchange Automated Quotations System 证券交易所自动报价系统(英国)Stock Trader, Stock Trading 股票交易商,股票买卖Stocks 股票,股份Strategic Investment, Strategic Investor 策略投资,战略投资,策略投资者,战略投资者Strategic sale 战略出售Strike price 执行价; 行使价Structured financing 结构融资Subordinated debt 次级债务Supply and marketing cooperatives 供销合作社Swap 掉期Syndicated loan 银团贷款TT/T 电汇Take position 坐盘Taxable munis 课税的州政府债券Telegraphic Transfer 电汇Tender bond 投标担保/保证金Tokyo International Financial Futures Exchange 东京国际金融期货交易所Tokyo Stock Exchange 东京证券交易所Toll revenue bond 通行税收入债券Tranche 发行份额/部分Treasury 国库债券,国库券Treasury strips 国库债券条子UUnconditional and irrevocable letter of credit 无条件及不可撤销信用状Undistributed profit 未分配利润Unilateral/bilateral agreement 单方面/双边协议US Treasury 美国国库债券VValue added tax 增值税Vanilla bonds ???Variable equity return 浮动股本回报(率)W Withholding tax 预扣税Working capital 周转资金; 营运资金World Trade Organization 世界贸易组织XX/B (Ex-bonus) 无红利X/D (Ex-dividend) 除息、无股利X/R (Ex-rights) 除权;不带新股认股权X/W (Ex-warrants) 除证;不附认股权YYankee bonds 扬基债券(美国)Yield 收益(率)Yield curve 收益曲线Yield To Maturity 到期收益(率)YTM 到期收益(率)ZZero-sum game 零和游戏Zero coupon bonds 零券息债券国际金融市场常用术语一、金融市场术语1、floor 场内交易2、after house trading 场外交易:场内交易结束后,通过电子终端系统进行的交易3、kerb 场外交易:在交易所交易时间外的交易4、bear market 熊市5、bull market 牛市6、congested market 横向市场盘整7、liquid market 买卖易于成交的市场8、forward marke 远期市场t9、spot market 现货市场10、seller’market 卖方市场:卖方处主动地位11、bid market 卖方市场:买盘多于卖盘的市场12、buyer’s market 买方市场13、strong market 坚挺市场14、thin market 成交清淡的市场15、volatile market 多变市场16、tight market 成交活跃的市场17、weak market 疲软的市场18、two way market 双向市场二、金融市场交易术语1、quotation 报价2、asked(offer) price 卖方报价3、bid 买方叫价4、at the-money 平价5、at par 证券的面值6、closing price 收盘价7、floor price 最低价8、basis point 基点:表示利率、汇率或债券收益率变化的最小单位,通常0。

7.1一价定律

国际金融international finance购买力平价理论国际金融international finance01一价定律02绝对购买力03相对购买力—04巴拉萨萨缪尔森效应目录国际金融international finance一国的不同地区:A地与B地的比较【何谓一价定律】•商品流动自由•不存在交易成本•A地与B地买卖同质产品•若同质产品为电视机且两地价格不等•A地:1800元/台•B地:2400元/台A地B地国际金融international finance【何谓一价定律】•商品套购(commodity arbitrage QP DS1800元A地D'S'1900元QPDS2400元B地2300元D'S'国际金融international finance【何谓一价定律】•价格走向一致QP DS1800元A地D'S'2100元QPDS2400元B地2100元D'S'国际金融international finance【何谓一价定律】•商品流动自由•不存在关税、运输等交易成本•中国:1800元/台•美国:400美元/台•汇率:1美元=6元人民币中国美国•同国家(或地区):中国与美国的比国际金融international finance【何谓一价定律】•价格走向一致:采用同一货币标价QP DS1800元中国D'S'2100元QPDS400美元美国350美元D'S'国际金融international finance【何谓一价定律】•存在价格差异QP DS1800元中国D'S'1900元QPDS400美元美国380美元D'S'国际金融international finance【何谓一价定律】•一价定律(the law of one price)•在自由贸易条件下,世界上的任何一种商品无论在何地出售,用同一种货币表示的价格是一样的。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2.2 国际银团贷款

• 国际银团贷款(International Consortium Loan),也叫辛迪加贷款(Syndicated Loan);

• 多家商业银行组成一个集团,其中一家或 几家银行牵头联合向借款人共同提供巨额 资金贷款;

• 有牵头银行、代理银行和参与银行; • 大都用欧洲货币,一般采用浮动利率,及

•融资租赁、经营租赁、杠杆租赁、回租租赁 和综合性租赁等多种形式。

Chapter 14 International Finance Services

I. 国际贸易结算

1.1 汇款(Remittance)

汇款是指利用银行间的资金划拨渠道,把银行以 外一个人的资金输送到另一个人,以完成收、 付款方之间债权债务的清偿。

• 电汇 • 信汇 • 票汇

1.2 托收(Collection)

其它费用。

2.3 国际证券融资

1. 国际股票融资 国际股票市场是国际范围内股票发行与交 易的场所或渠道。

2. 国际债券融资 外国债券和欧洲债券 票据发行便利

2.4 国际信贷的其他形式

1. 项目融资(Project Financing) • 向某一特定的工程项目提供贷款; • 该项目所产生的现金流和收益是偿还贷款

II.国际市场融资

• 除了贸易之外,企业也经常会出于其他原 因而有资金需求。

• 那么,是否可以利用国际金融市场提供的 种类繁多的融资服务?

• 我们这里将要介绍几种常见的国际贸易融 资方式和一些国际金融市场常见的融资方 式。

2.1 国际贸易融资

1. 出口信贷(Export Credit) •常用于大型成套设备的贸易中; •出口国银行向本国出口商或外国进口商提供 的低利率贷款; •也可以提供给进口商,分别通过卖方信贷( Seller’s Credit)和买方信贷(Buyer’s Credit )。

4. 出口信用保险(Export Credit Insurance)

• 指出口信用保险机构对于出口商的出口中 遇到的不能收回的货款或不能如期收回货 款的风险提供保障。

• 一种国家政策性保险

5. 提货保证(Delivery against Bank Guarantee)

• 指收货人与银行共同或由银行单独向船公司出具 书面担保,请其凭以先行放货,保证日后及时补 交正本提单,并负责缴付船公司的各项应收费用 及赔偿由此而可能遭受的损失。

的资金来源 • 往往采用银团贷款方式。 • 项目融资涉及多方面的参与人。

2. 国际租赁(International Lease)

•一种跨国租赁,指分别处于不同国家或不同 法律制度下的出租人与承租人之间的一项租赁 交易。

•承租人通过这一安排相当于获得了有效的、 成本低的国际融资。

•是融资与融物相结合的一种资金融通方式。

• 一个出口商为了向国外买方收取贷款,委 托其银行代为处理这些业务。

• 是一种“逆汇” 。 • 托收的参与人及流程 • 托收的种类:付款交单(DP)

承兑交单(DA) 远期付款交单

1.3 信用证(Letter of Credit)

• 信用证的基本流程 • 信用证当事人及其权利与义务 • 信用证的性质和特点

2. 福费廷(Forfeiting) ➢一种1到5年中长期融资方式; ➢由瑞士苏黎士银行首创,80年代得到迅速

发展;

➢指出口地银行或其他金融机构对出口商持 有的远期票据进行无追索权的贴现;

➢一般以批发形式成交。

3. 保付代理(Factoring)

• 保理商在对买方的资信进行一定的调查后,在没 有追索权的情况下购买买主欠出口商的账款,由 保理商在发票指定的付款日期之前,付给出口商 部分货款,等到买主收到货运单据后再按规定的 日期付款给保理商,保理商再向出口商偿付剩余 的货款。