金融英语最新五套题及答案

八年级英语金融产品单选题50题

八年级英语金融产品单选题50题1.Which one is the English name for “储蓄账户”?A.Saving accountB.Checking accountC.Credit cardD.Loan答案:A。

“Saving account”是储蓄账户的正确英文表达。

“Checking account”是支票账户;“Credit card”是信用卡;“Loan”是贷款。

2.What's the English for “信用卡”?A.Debit cardB.Credit cardC.Savings bondD.Mortgage答案:B。

“Credit card”是信用卡。

“Debit card”是借记卡;“Savings bond”是储蓄债券;“Mortgage”是抵押贷款。

3.Which is the correct English expression for “贷款”?A.LoanB.GrantC.ScholarshipD.Bond答案:A。

“Loan”是贷款。

“Grant”是补助金;“Scholarship”是奖学金;“Bond”是债券。

4.The English name for “支票账户” is _____.A.Checking accountB.Savings accountC.Mutual fundD.Insurance policy答案:A。

“Checking account”是支票账户。

“Savings account”是储蓄账户;“Mutual fund”是共同基金;“Insurance policy”是保险单。

5.Which one means “储蓄债券”?A.Savings bondB.Treasury billC.StockD.Futures答案:A。

“Savings bond”是储蓄债券。

“Treasury bill”是国库券;“Stock”是股票;“Futures”是期货。

金融英语真题和答案

金融英语真题和答案Financial English Certificate Test( Banking: Comprehensive)2007Part One ListeningPart One ListeningSection One (10%)Directions: In this section, you will hear ten short statements. Each statement will be spoken only once. After each statement there will be a pause. During the pause, you must read the four suggested answers marked A, B, C and D, and decide which is the best answer. Then mark the corresponding letter on the ANSWER SHEET with a single line through the center. Now you will hear the example:She went to the bank with Mr. Smith. ,A. She went home.B. She liked Mr. Smith.C. She went to the bank.D. She went to Mr. Smith's house.Sentence C, " She went to the bank." is the closest in meaning to the statement " She went to the bank with Mr. Smith. " Therefore, you should choose answer C. Now listen to the statements.1. A.House mortgage has a short history.B.House mortgage appeared in recent years in China.C. Nowadays, people still couldn't accept the idea of house mortgage.D.Many years ago people accepted house mortgage in China.2. A. If a country wants to be a member of the World Bank, itshould first be the member of the International Monetary Fund.B. The membership of the International Monetary Fund is not so important.C. The membership o f the International Monetary Fund is not important at all.D. A few countries want to be members of the World Bank.3.A.Face value is not important. B.Maturity date is not important.C. Coupon rate is important.D.Nothing is important.4. A.The value of the U.S. dollar changed a lot.B. The value of the U.S. dollar didn't change a lot.C. The value of U. S. dollar had no change.D. The value of the U.S. dollar had little change.5.A.They will pay 100 francs in advance. B.They will pay 130 francs in advance.C.They will pay 130 francs later.D.They will pay 120 francs later.6.A. He forgot to bring his safe. B. He forgot to close his safe.C. He forgot the code of his safe.D.He forgot to open his safe.7.A. In the U.S., the Federal Gold Reserve acts as the central bank.B. In the U.S., the central bank is the commercial bank.C. In the U.S., there is no central bank.D.In the U.S. , the central bank is not so important.8.A. Don't change your ideas. B.Don't change the accounts.C. Don't leave the bank.D. Don't forget to take your change.9. A. Barter trade was very important.B. Barter trade was not the original form.C. Money was very important.D. Barter Trade was the original form of international transaction.10.A.If you lose your bank notes, you will not get them back.B. If you lose your bank notes, you will get compensation.C. If you lose your bank notes, you can get them back soon.D.If you lose your bank notes, most probably, you will not get them back.Section Two (10 marks)Directions: In this section, you will hear ten short conversations. At the end of each conversation, a question will be asked about what was said. The conversation and the question will be spoken only once. During the pause, you must read the four choices marked A, B, C, D, and decide which is the best answer. Then mark the corresponding letter on the ANSWER SHEET with a single line through the center. Now you will hear: M: Does our bank have a direct correspondent relationship with the Bradlays' Bank? W: No, we don't. So we have to advise this L/C via another bank.Q: Which of the following is right? ; r ;Now you will read:A.We can advise this L/C to the Bradlays' Bank.B.The Bradlays' Bank is our correspondent.C.The L/C has to be advised by a third bank.D.We should advise this L/C by ourselves.From the conversation we know that we have to advise this L/C via another bank. The best answer isC.Therefore you should choose answer C.11.A. You must report the loss of your card immediately tothe bank.B. You will be scolded.C.You must give a new card to the bank.D. You must pay for the new card.12.A.Checks. B.Traveler's checks. C. Travelers' letters of credit.D. Securities. '13. A.The third bank is the issuing bank.B.The third bank is not the confirming bank.C. The letter of credit should be confirmed by the third bank.D. The letter of credit should be confirmed by the issuing bank.14.A.The beneficiary doesn't want to carry the money with himself.B. The beneficiary does so for the sake of safety.C. The beneficiary does so for the sake of convenience.D.The beneficiary doesn't want to pay the money.15.A.In order to avoid problems arising from fluctuations of exchange rate.B. In order to get more money.C.In order to use the money as soon as possible.D. In order to overdraw the money.16. A.In Australia. B.In Austria. C.In China. D.In the U.S.17. A.I won't advertise.B. I don't want to report to the police station.C. 1 will be worried about this.D.I'll advertise or report to the police station.18. A. Three - month. B. Six - month. C. 15 days. D. Twelve - month.19.A.RMB. B.Hongkong Dollar. C. Dollar. D. Franc.20. A.The government. B.The banks. C.The leaders. D.The fund authoritiesSection three (10 marks)Directions: In this section you will hear three short passages. At the end of each passage, you will hear some questions. The passages and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked A, B, C, and D.Then mark the corresponding letter on the ANSWER SHEETwith a single line through the center.Passage One21. A.1994 B.1996 C.1998 D.199522. A.280 million B.I80 million C.280 billion D.I80 billion23. A.small projects B. financing key state construction projectsC.hope projectsD.private projectsPassage Two24.A.hotel expenses B.stock exchangeC.plane expensesD.restaurant expenses25.A. It can avoid the necessity of carrying large amount of cash.B. You needn't purchase large amounts of traveler's checks.C. You needn't use personal checks in places other than your own locality.D.It can't provide an instant cash service in case you run out of money.26. A. very useful and convenient B. uselessC. a waste of moneyD. not popular27. A. American Express B. Chinese Peony Card C. DragonCard D. Credit Card Passage Three28. A.The Asian markets are in recession.B. No investment is worth keeping if it robs of your sleep.C. If you need the money today, you should have sold the stocks now.D.It is easy to be brave and keep buying during a bull market.29. A.50 B.15 C.60 D.7030. A. You can live a happy life.B. Though you are not rich, you can enjoy a long and happy life.C. You can have a big mansion in Spain.D. You can live to see your granddaughter's graduation.Tart Two.ReadingSection One(lOmarks)Directions: There are ten statements in this section. For each statement there are foure choices markedA, B, C and D. You should choose the best answer and mark the corresponding letter on the ANSWER SHEET by drawing a single line through! the center.31.Before making a loan, potential lenders determine the borrower's ability to meet ______A. scheduled paymentB. his creditorC. the government s requirementsD. the stockholders'requirements32. _____ may make wage demands based on the accounting information that shows their employer' s reported income.A. CreditorsB. EmployeesC. Labor unionD. B & C Above33. Not all of those _____ takeovers continue to run the business they have bought.A. to be carried outB. carrying outC. being carried outD. carried out34. In February 2001, when the currency union fell ________, the official reserves had fallen to less than $2400 million.A. apartB. ToC. acrossD. under35. When the collecting bank receives from the presenting bank the documents forcollection,it_______________.A.should examine all documents to ascertain whether or not they appear,or on theirface, to be in compliance with them.B.may examine either the documents or the instructions to collect the proceeds.C.will examine documents in order to obtain instructions.D.will not examine documents in order to obtain instructions .36 .The minimum registered capital for the establishment ofa commercial bank shall be RMB_______ yuan.A.10millionB.100millionC.1billionD.10 billion37 .The ratio of liquid assets to liquid liabilities of a commercial bank shall not fall short of_______ per cent .A. 25B. 8C.75D.1038 . If we have a quote of 1 . 4950/1 . 4960 for $ /DM , __________ .A. the first rate is the buying rate for the dollarB. he first rate is the buying rate for the DMC. the second rate is the buying rate for the dollarD. the second rate is the selling rate for the DM39. Recovery from the turmoil in Asian financial markets has been remarkably rapid butthe problems have left _____ scars on the local banking system.A. lastB. lastingC. to lastD. lasted40. State interference carried with it an implied guarantee, so bankers paid no heed _____ the financial risks they were undertaking.A. toB. atC. towardsD. againstSection Two (10 marks)Directions: There are a number of blanks in each of thefollowing passages. For each blank there are four choices marked A, B, C and D. You are supposed to choose the best answer and mark the corresponding letter on the ANSWER SHEET by drawing a single line through the center.Passage OneAll foreign exchange _ 41 _ 42 _account transactions shall be repatriated, unless otherwiseby domestic establishments from43_ by the State Council. All foreign exchange receipts from capital transactions ___44 __ in foreign exchange account 45 _ at designated foreign exchange banks in accordance with the relevant state regulation, such revenues can also be sold to a designated foreign exchange bank upon the approval by the SAFE.41.A.expenditure B.receipts C. surplus D. yields42. A. current B. foreign exchange C. capital D. gold43. A. specified B. appointed C. designated D. approved44. A. may be deposited B. shall be deposited C. may be credited D. can be debited45. A. held B. Owned C. possessed D. drawnPassage TwoIn the foreign exchange market, which is made up of banks' traders and brokers, prices _ 46 _ every minute _ 47 _ to supply and demand. For safety's sake, a branch will get a rate from their traders fora big transaction. This process would be too cumbersome, however, for every small transaction. Therefore the traders give their branches lists of exchange rates _ 48 _ they may buy and sell notes and payments in the main currencies.Whenever a bank in Britain makes a payment in foreign currency, or makes a payment in sterling to a non - resident, the payment has first to _ 49 _under British exchange control regulations. The bank itself can usually authorize the payment after seeinga document such as an invoice to show that the payment is due; but cases _ 50_ borrowing and lending have to be referred to the Bank of England.46. A.alter B. vary C.turn D. convert47. A.in response B. respondent C.responding D. Answering48. A. of which B. on which C. in which D. at which49. A. Authorizing B. Authorize C. be authorized D. have been authorized50. A. Involving B. Involve C. will involve D. being involvedSection Three (10%)Directions: Read the following passages, and determine whether the sentences are " Right" or "Wrong" . If there is not enough information to answer "Right" or "Wrong" , choose "Doesn' t say". Then mark the corresponding letter on the ANSWER SHEET by drawing a single line through the center.Passage 1One of the most important functions of the accounting process is to accumulate and reportac-counting information that shows an organization's financial position and the results of itsopera-tions . Many businesses publish such financial statements at least annually. The subdivisionof the accounting, process that produces these general - purpose reports is referred to as financial accounting. Another major function of accounting is to provide management with the data neededfor decision making and for efficient operation of the firm.Although management people routinely receive the financialreports , they also require var-iousother information, such as the unit cost of a product, estimates of the profit earned from a specific sales activity, cost comparisons of alternative courses of action and long- range bud-gets . Theprocess of generating and analyzing such data is often referred to as managerial ac-counting .51.The purpose of managerial accounting is to prepare financial statements every year.A. RightB.WrongC.Doesn't say52.Financial statements include balance sheet, income statement and cash flow statement.A.RightB.WrongC. Doesn't say53 . Financial statements are used only by the outsiders of a firm .A.RightB.WrongC.Doesn't say54 .he management of a firm needs to use the results of both financial accounting as well as managerial accounting.A.RightB.WrongC.Doesn't sayPassage TwoDuring this period a number of important structural measures have been taken with partic-ular significance for thebanking sector. The first was the unification of the Renminbi (RMB) exchange rates and foreign exchange markets in January 1994. Second, the passage of central banking and commercial banking laws in 1995 has provided legal basis for the banking system in China. Third, the acceptance of the obligations of Article VIII of the Articles of Agreement of the International Monetary Fund in December 1996, namely commitment to RMB current-ac-count convertibility,has officially removed the remaining restrictions on international payments for trade and service transactions.55. foreign exchange can be bought or sold without any restrictions in foreign exchange mar-kets.A. RightB. WrongC. Doesn't say56. The passage of cantral banking and commercial banking laws has made the banking systemof China healthier, stronger and more vigorous.A. RightB. WrongC. Doesn't say57. International payments for trade and service transactions can be made freely because RMB current accounts are convertible since 1996.A. RightB. WrongC. Doesn't sayPassage threeAccounting provides the techniques for gathering economicdata and the language forcom-municating such data to different individuals and institutions.Investors in a business enterprise need information about its financial status and its future prospects. Bankers and suppliers appraise the financial soundness of a business organization and assess the risks involved before making loans or granting credit. Government agencies are concerned with the financial activities of business organizations for purposes of taxation and reg-ulation. Employees and their union representatives are also vitally interested in the stability and profitability of the organization that hires them. All of them, individuals or institutions, can obtain necessary information and make their appropriate decisions with the help of account-ing techniques. For example, comparison of past performance with planned objectives may re-veal the means of acceleration, favorable trends and reducing those that are unfavorable.58. The financial position and future prospects are of the concern of business investors.A.RightB.WrongC. Doesn't say59. Before making loans to customers, banks would try to get rid of risks involved.A.RightB.WrongC. Doesn't say60.Employees may show little concern in the earnings of a business enterprise in which they work.A.RightB.WrongC. Doesn't saySection Four (20%)Directions : There are ten statements in this section . For each statement there are four choices marked A , B , C and D . You should choose the best answer and mark the corre-sponding letter on the ANSWER SHEET by drawing a single line through the center.Passage 1When a savings account is opened in a bank, The depositor must sign a deposit agree-ment . By signing agreement , the depositor agrees to abide by the rules and regulations of the bank. These rules and regulations vary with different banks and may be altered and amended from time to time. At this time, a passbook may be given to the depositor. This is a small book in which the bank teller enters the date and amount of each deposit or withdrawal and initials the entry . The passbook is to be presented at the bank or mailed to the bank along with a de-posit or withdrawal slip each time money is deposited or withdrawn from the account . An alter-native practice for depositing or withdrawing money from a savings account is to give the deposi-tor a small register for recording deposits and withdrawals and a pad of deposit - withdrawal forms. This procedure eliminates the use of the passbook. Each time a deposit or withdrawal from savings is made, the appropriate part of one of the forms is filled in, signed, recorded in the register and presented or mailed to the bank with deposit items or other documents. The bank gives a machine - printed receipt to the depositor or returns it by mail . There should be a separate savings account in the ledger to record these activities.Traditionally, the principal differences between a savings account and a checking account are that interest is paid regularly by the bank on a savings account and withdrawals from a sav-ings account may be made at the bank or by mail by the depositor or an authorized agent. De-positors use checking accounts primarily as a convenient means of making payments, while sav-ings accounts are used primarily as a means of accumulating funds with interest . An increasing-ly common practice is for the bank to combine savings and checking accounts and get deposi-tors' permission to make automatic transfers of funds from the savings portion to the checking portion whenever the latter falls below a specified minimum balance . This amounts to giving the depositor an interest - earning checking account.61 . What is the primary purpose of a savings account?A .For interestB .For transfer of fundsC .For accumulating funds with interestD .For making profits62 .What is the aim of a small register and a pad of deposit withdrawal forms?A.To attract depositsB.To improve bank servicesC .to eliminate the use of the passbookD .To promote banking business63 .What is the purpose of signing a deposit agreement?A.To follow the bank's rules and regulationsB.To have the right to make full use of the bank's facilitiesC.To open an account in the bankD.To protect the depositor's interest64 .What does a depositor do with a passbook?A.He makes deposits with a bankB.He withdraws money from a savings accountC .He withdraws money from a checking accountD.Both A and B65 .For what purpose does a bank try to combine a savings account and a checking account?A.For holding more fundsB.For covering the checking account falling below the specified minimum balanceC .For automatic transfer of fundsD .Both B and CPassage TwoDocument against acceptance ( D/A) is exactly like document against payment ( D/P) except that, instead of signing the sight draft and paying on presentation of documents to re-ceive the bill (s) of lading, the importer accepts the usance (time) draft that creates an obli-gation similar to a promissory note called a trade acceptance. This can be used for finance pur-poses under some conditions. This is a promise to pay in a certain number of days, after ac-cepting the documents, usually for a term of between 30 and 180 days. D/A terms are more secure than open account because the transaction and receipt of goods are evidenced by a nego-tiable instrument. It is much easier to enforce a financial instrument than an account receiv-able, which must be proven to the courts. However, a sharp increase in risk over D/A oc-curs because the importer now has the goods, and the exporter only has a promise to pay. The bank has no responsibility to collect the funds on or after the due date. Both your bank and the foreign bank are purely agents for transmittion and collection. Itis very important not to confuse a banker's acceptance, which carries the credit of a bank, with a trade acceptance mentioned here. The latter is no better than the credit and integrity of the buyer as opposed to the bank.66.If D/A terms are used to settle international transaction, then ______.A.the seller must pay on presentation of documents.B.B. A sight draft is usually usedC.The importer can get the bill (s) of lading only after he accepts the time draftD.A promissory note is created67.In the passage, the sentence "this can be used for finance purposes under some condi-tions" means that ______.A. the buyer gives credit to the sellerB. the buyer can get the goods and even sell it before he has to payC. the buyer promises to pay in 30 daysD. an obligation is created68.To the seller, which of the following is disadvantage of D/A?A. It is much more secure in comparison with open account.B.It is much more enforceable than an account receivaleC . The seller has to incur much higher risk of dishonor ,of the bills .D . The collecting bank is responsible for the payment in the event of the dishonor of thebills.69.The most important difference between a banker's acceptance and a trade acceptance is that______ .A. the acceptances are made by different agentsB. credits are given by different agentsC. the banker's acceptance is inferior to a trade acceptanceD. the banker's acceptance depends on the bank's credit , while the later depends onthe credit of the buyer70. The word "conduits" in the passage means ______ .A . The banks assume no responsibility if the buyers fail to meet their payment obligation specifiedin the commercial contractB. the banks assume no responsibility for consequences arising from any causes beyond theircontrolC .just acting as agents , the banks transmit documents and collect money in accordancewith the directions given by the principalD . all of the abovePassage FourBanking organizations are highly geared, much more than commercial or industrial compa-nies. They have custody of large volume of monetary items, which makes them vulnerable to misappropriation and fraud. They therefore need to establish formal operating procedures, well defined limits for individual discretion rigorous system of internal control. Banking organiza-tions engage in a large volume and variety of transactions. This necessarily requires complex accounting and internal control system and widespread use of electronic data processing. Bank-ing organizations often assume significant commitments without any transfer of funds. These items may not involve accounting entries and consequently the failure to record such items may be difficult to detect. And most importantly, the failure of a bank,unlike most commercial firms, affect more than the fortunes of its shareholders and creditors, and may destabilized the whole economy.Effective supervision of banking organizations is an essential component of a strong eco-nomic environment in that the banking system play a central role in making payments and mobi-lizing and distributing savings . Strong and effective banking supervision provides a public good that may not be readily available in the marketplace. Along with effective macroeconomic poli-cy , it is critical financial stability in any country . While the cost of banking supervision is in-deed high, the cost of poor supervision has proved to be even higher.For all these reasons, banks throughout the world are generally accorded a higher degree of official , supervision and regulation than other types of businesses . At the same time , banks are also provided with important elements of official protection . For example , the central bank usually acts as a lender of last resort to protect commercial banks against a temporary liquidity drain. This protection is an important component of the official safety net bankstopping the banking system. Another major aspect of that safety net takes the form of deposit insurance fund to guarantee bank depositors that they will get their money back in the event of a bank failure .71. Why should banks need to establish formal operating procedures?A. The supervisory authorities require them to do so.B. The shareholders expect a reasonable return on their investment.C . The banks have to keep safe large volume of monetary items raised from all sources .D . The banks engage in a large volume and variety of transactions .72 . Which of the following requirements is NOT mentioned in successfully dealing with largevolume and variety of transactions?A . A large number of skillful staff and expertise .B. Effective internal control systemC . Complex accounting systemD . Wide - spread use of electronic data processing73. "Vulnerable to in line 3 probably means __________ .A. subject toB. easy to be attacked byC . of great volumeD. likely to damage74 . A high degree of official supervision and regulation on bank organizations are importantbe-cause __________ .A . The governments of many countries want to control banksB . There are too much trouble in banking sectorC . It is crucial to stabilize the financial sector and the whole economyD. The banks make much more deposit insurance fund75 . What is the main function of deposit insurance fund?A . To ensure that the banks have sufficient fund to finance other economic sectors .B . To protect the banks from all kinds of risks arising from their operationC . To meet requirements of financial needs of the publicD . To pledge to depositors that their money is safe whenevera bank is insolvencyPart Three (20%) WritingSection One (5%)See the chart ,fill the gap with the correct answer.(see the answer).Section TWO(5%)DirectionsTranslate the following sentences into Chinese. Write your translation on the ANSWERSHEET.1.Investment banking are banking activities associated with securities underwriting ,makinga market in securities ,and arranging mergers, acquisitions and restructing .2. The source of foreign exchange for overseas investment by domestic entities must be reviewed by the SAFE before the application for such investment is filed with the relevant government agencies.3.Bank accounting basis refers to methods for recognizing revenues expenses, assets and liabilities in accounting statements. Major bases of accounting include the accrual, cash and modified cash bases。

金融英语练习答案

金融英语练习答案:Lesson 1I. 1.need 2.specialization 3.double coincidence of wants 4.exchange rate 5. money6.medium of exchange7. Commodity money such as cornmodity / common standard value9. store of wealth 10.parchasing power 11.Banknotes. 12.Fiduciary money 13.redemption rate 14.Fiat money 15. legal tender 16.fiduciary money 17.paper money 18.price level 19.reserve rax 20. checkII Translation:1.Money mainly serves three functions :a medium of exchange, a standard of value and a store ofwealth.2.The greater the specialization in the division of labor increased ,the more difficult in finding goodsthat have a double coincidence of wants.3.The value of money is reflected by its purchasing power.4.Fiat money is declared legal tender by the government ,meaning that creditors must accept it aspayment for debt.5.The bearers/holders of fiduciary money may require bank to redeem for gold or other valuablecommodity.6.The fractional reserve banking system requires the banks to keep certain reserve ratio.7.The money that most countries in the world use today is fiat money.8.The wide application of fiduciary money reduces that cost of transactions.9.There were several metals which have been used as commodity money in the history, such as iron,copper, gold ,silver and so on.10.The value of fiat money lies in that people believe that it can be exchanged for commodity andservice.Lesson 2:I.1.investors 2.consumoption / saving 3.enterprises 4. savings 5.investment 6.home7.loan 8.deposit 9.uill rise 10.fallII1.The interest rate refers to the ratio of the interest amount to the proceeds deposited and loaned in agiven period.2.Interest is the price of capital; which is like the market price for general commodity .Theoretically ,itis determined by demand and supply.3.China’s interest rate has been adjusted and reformed for several times .Before 1978,the policy ofgradually rising interest rate was adopted.4.The mutual relation of all kinds of interest rate comprises the structure of interest rate. Generally ,theinterest rate of longer tenor is higher than that of shorter tenor in terms of the same kind of interest rate.5.Among various interest rate, the interest rate for deposit is lower that for loan; the interest rate offeredby commercial bank is higher than discount rate offered by the central bank.6.At present ,China’s interest rate system consists of the interest rate of bank, non-bank financialinstitution, portfolio and market.7.The discount rate offered by central bank refers to the discount rate for the instrument held by thecommercial banks. it reflects the redemption rate for the amounts of rediscount instrument.8.Due to free competition ,the demand and supply of currency borrowing and lending tend to bebalanced out through market mechanism .in this case ,the market interest rate is called equilibrium rate.9.The bond interest rate is interest rate paid by the government, banks and corporation for theaccommodation in the form of issuing, securities in domestic or foreign financial markets.10.The interest rate for corporate bond is basically determined by the bond issuing corporation itself, butthe government exercises control by setting the ceiling.Lesson 3:I.1.Firrancial intermediary 2.demard deposit /checking account 3.savings and loan associations, mutual savings bank and credit union. 4.Federal reserve system ernment securities/require that member banks hold reserves equal to some fraction of their deposits. 6.Feder Reserve Board 7.Federal Open market committee 8.reserve requirements 9.the ceiling 10. interest rate level 11.portfolios 12.outstanding loans 13.were deregulated 14.deposit insurance 15.merge with other banks 16. automatic teller machines 17.By pooling funds of many share holders 18.branches 19.The banking holding company 20.financialII1.Federal Reserve System was established in 1914,with its aim to stabilize the banking system. thepower of the Federal Reserve System was enhanced and centralized after the failures of many American banks in the Great Depression. The Arts passed in1980s authorized the Federal Reserve System with the power to regulate all the saving institutions. The main powers of Federal Reserve System were:(1)guide the transactions of open market so to control supply of money by buying and selling government securities,(2)determine the reserve requirements for saving institution (3)setting rediscount rate.2.The banking regulations in Great Depression made bank a trade that closely controlled andpredictable. But the high interest rate in 1970s disturbed the peaceful days of saving institutions. But many banks still couldn’t survive in the transive period of keen competition.Lesson 4:1.as a result of /helped to /by the time2.concerned about/at the outset3.offerd to take/in dollars/departure fromTransaction account is checking account which can write checks on deposits balance. They have three forms, the first one is “Demand Deposit”which banks don’t pay explicit interest; the second one is “ other checkable deposits”, which includes NOW(Negotiable Order of Withdrawal)accounts; the third one is Money Market Deposit accounts. Although banks can’t pay explicit interest on demand deposit, they can pay implicit interest in the form of proving free services. Different from NOW accounts, commercial banks don’t need to maintain reserves, so banks pay higher interest on the NOW accounts. At present, transaction account is the second largest debt form of the commercial banks.Lesson 5I1.as well as 2.in total assets 3.intermediate 4. title 5.an agent 6.Financial instruments 7.pay 8.as par 9.documentary letters of credit 10.prof-of –shipment documents . 11. HedgingII. Translation:Lesson 6I.1.bank 2.discount 3.buyers/sellers 4.short-term 5.borrowing/lending 6.deposits7.brokers 8.loans 9.linked 10.marketII Translation:1.The activities of money market mainly aim at keeping the liquidity of assets so that they can bechanged into cash on demand.2.On one hand, the money market meets the demand for short-term money of borrowers, one the otherhand, it finds a way out for lenders who have temporary excessive money.3.The Financial instruments of money market mainly are short-term treasury bill, commercial bill, bankacceptance, certificate of deposits, the tenors of these instruments range from one day shortest to one year longest.4.The participants of buying and selling short-term assets in the money market are individuals, businessfirms, various financial institutions, and governments. They act either as the provider of funds or as the demander of funds.5.As the intermediary of money market, various financial institutions have different functions inaffecting the demand for and supply of funds in the capital market, because their stress of importance on business if different.6.The commercial banks provide the money market mainly with short-term loans mainly with themoney obtained from deposits and other sources.7.In many countries, commercial banks are in the position of key importance in the money market,while the central bank controls commercial banks by various means so as to control money market. 8.Just as a country can’t be without a government, the money market can’t be without a central bank,whose activities in money market will affect the volume of money and interest rate at any time.9.The inter-bank market refers to the market where financial institutions solve the problem of excessiveor short of money by financing one another.10.With the development of the reform of financial system in our country, the inter-bank markets startedto develop rapidly.Lesson 7I.1.firms 2.inter rate /exchange 3. regional exchange 4.negotiable 5.exchange6.bond7.funds8.outstanding9.brokers 10.dealers.II. Translation:1.According to the situation of various countries, the issuance of government bonds adopts the methodof raising money from public, which can be divided into direct and indirect ones.2.The government bonds outstanding are not all held by individuals, but by the government units,financial institutions and the public commonly.3.The government should keep a stable increase for the issuance of securities, if the market price for thegovernment bonds often fluctuate, the investors will be reluctant to hold the government bonds.4.Corporate bonds are the certificates that the business owes to the public, it is the issuing corporationthat makes a promise to pay certain amount of money plus interest at a fixed date in future.5.The better the credit standing of a company, the longer maturity of the bond is ,but the solvency ofcorporate bonds cannot be compared with that of government, so the longest tenor of corporate bond will not be very long.pared with stock investment, the holders of corporate bonds can only have the interest income asthe fixed reward for the investment, but they can’t share the profit of the corporation like share holders.pared with stocks, corporation bonds have lower risks, but the safety can’t be compared to that ofgovernments bonds, that’s why the return ration is always higher than government bonds.8.With the rapid development of capitalist industry, shareholding corporation system becomesirresistible trend.9.The price of stocks are of substantial fluctuation, which makes investment of stocks very speculative.10.The market price of stocks is subject to the status of operation, allocation of profits, as well as to theeconomical, political social factors that make the price of stocks more volatile.Lesson 8I. 1.foreign 2.activities/lend 3.standing 4.role 5.independent 6.consortium banks7.money 8.bond 9.subsidiary 10.EurocurrencyII. Translation:1.In most countries, commercial banks all establish international department or foreign department inorder to deal in foreign exchange or to raise money for foreign trade.2.Due to the development of international banking business and the establishment of the bank’soverseas network organization, commercial banks of western countries become real multinational banks.3.The international network of the multinational bank includes branch, subsidiary, correspondent,resident representative and so on.4.The activities of the multinational bank through exclusive international network are retail deposit,money market activities, foreign trade financing, corporation loans, foreign trade business, investment business, trust business and so on .5.Because most of the clients of the multinational bank are large corporations and banks, they mainlydeal in retail deposits with few retail loans.6.The multinational banks put surplus money into money market when the demand is low, but raisemoney when demand is on rise.7.The tenor of foreign trade financing is usually short with high return, mostly denominated in thecurrency other that of the country where the bank locates.8.Corporation loans refer to the loans given to private business, state-owned business, especially to themultinational corporation.9.Foreign exchange business includes buying and selling foreign exchange and hedging conducting inforeign exchange market for the clients.10.Investment business refers to the underwriting of international securities and the distribution activities,as well as advisory service for customers and governments in the issue of securities.Lesson 9I.1.short-term 2.medium-term /long-term 3.restrictions 4.deposits 5.absence6.Euro currencies7.borrowers abroad8.entities9.deposits 10. convertibleII. Translation:1.Eurodollar refers to the deposits denominated in US dollar in various banks outside USA andEuropean branches of American banks, as well as the loans obtained by these banks.2.Off-shore money market is concentrated by Eurocurrency market , which is habitually called theEurodollar market, because the currency traded in this market is mainly Eurodollar.3.Eurobanks deal in Eurocurrency business which is strictly separated from domestic banking.4.London in the largest Eurodollar market, engaging in both deposit and loan, with huge volume oftransactions.5.Eurobank’s business usually not subject to local banking rules, such as deposit rate and maturity,therefore, banks can compete freely to attract customers.6.The interest rate for Eurodollar deposit is higher than for US domestic deposit since there is noreserve requirement for Eurodollar deposit nor premium insurance.7.The emergence of Eurodollar is due to the deficit of American balance of payments The accumulationof huge deficit and the outflow of large amount of US dollar resulted in substantial increase of Eurodollar deposits.8.The brokers or dealers of American stock Exchange often borrow Eurodollars from Eurodollarmarket.9.The Eurodollar market is a short-term wholesale market of inter bank, it functions in Europe asproviding banks with liquidity like the federal fund market in USA.10.Banks put the money in the Eurodollar market when the liquidity is excessive and borrow moneywhen the liquidity is in squeeze.Lesson 10I. Part(1)1.the creation of money 2.cooperative /voluntarily 3.external/economic reforms4.the par value system5.on demand6.stable/predictable/disadvantages7.float8.quota subscriptions 9.needy/favorable 10.buying power/importsPart(2)1.subsidize 2. internal 3.bargain 4.peg 5.payments 6.assistance/sufficient7.stabilizing/strengthening 8.repay/repayment period 9.effectively11.lower/export/governmentII. Translation:1.The fund shows great concern over the internal economic policies of its member countries.2.The Fund is a cooperative institution, overseeing/supervising and monitoring the foreign exchangepolicies its member countries.3.The exchange of currency is the center of financial connection/relation among various countries, aswell as a dispensable tool of world trade.4.Due to constant fluctuation of exchange rate for major/leading currency, the dealers of foreignexchange may gain profit or suffer loss.5.The convertibility of currencies facilitates tourism, trade and investment in a worldwide scale.6.By analyzing the wealth and economic status of each member the fund determines the quotasubscription for each member. The richer the country is, the higher quota it Subscribes.7.Since the abandonment of the par value system, the membership of the Fund has agreed to allow eachmember to choose its own method of determine an exchange value for its money.8.Man large industrial nations allow their currencies to float, other countries peg the value of theircurrency to that of a major currency of a group of currencies so that, for example, as the U.S. dollar rises in value their own currencies rise too.9.The source of finance of the Fund mainly comes from the quota subscription of its member countriesat the same time, the Fund also borrows money from member governments or their monetary authorities.10.The Fund lends money according to regulation to the member countries with a payments problem,due to their expenditure in foreign exchange exceeding income.Lesson 11I. Part(1)1.catalyst 2.equity 3. creditworthy 4.reschedule/made 5.carry6.fourfold7.share8.foreign exchange9.attained 10.indexPart(2)1.productivity 2.affiliates 3.self-sustaining 4.call up 5.quota/economic strength6.a third/raised7.politicalitary/political9.enjoined 10.indexII Translation:1.The IBRD has more than 140 member countries, which all subscribe quotas to the bank.2.The IBRD gives loans only to creditworthy borrowing countries for the project that has a high realrates of economic return.3.The IDA gives loans only to poorest countries with a annual GNP per capita lower than $795.Actually, 80% of IDA’s loans are given to the countries with annual per capita GNP lower than $410.4.The IDA gives loans only to the government of the borrowing countries, with maturity of 50 years(repayable over 50 years) with grace period of 10 years, no interest.5.In the past decade, the volume of the IBRD’s loans have increased by fourfold.6.The IBRD has helped to develop agriculture, improve education, increase the output of energy,expand industry, create better urban facilities, promote family planning, extend telecommunications network, modernize transportation systems, improve water supply and sewerage facilities, and establish medical care.7.It’s hard to say that the IBRD’s decisions on loans are not influenced by the political character of theborrowing countries.8.Some of the earliest borrowing countries of the IBRD have graduated from the reliance on the IBRD’sloans, in return they become the provider of the IBRD’s finance source.9.The IBRD and IFC jointly provide funds for many projects.10.The more quota the member country subscribes, the more votes it gains.Lesson 12I . Part(1) 1.foster 2.raise 3.subregional/regional 4.multilateral 5.cost-effective6.evaluation7.weighted8.proportional9.paid in 10.developrnental Part(2) 1.equity 2.private 3.subscriptions 4.installment 5.subscribed6.coordinate7.procurement8.absorb9.pooling 10.bidsII. Translation:1.The purpose of the ADB is to provide fund and technical assistance to its developing membercountries in the Asia-Pacific region and to promote investment and foster economic growth.2.The shortage of capital, lack of skilled labor, poor technology, limited markets and the vagaries ofnature have impeded the economic development of the developing countries.3.The Bank’s Charter provides that the capital owned by the Asia-Pacific member countries should notbe less than 60% of total equity.4.Multilateral institution plays an important role in the economic development.5.The projects for bank financing are identified after strictly evaluated.6.The ADB keeps close working relationship with the United Nations as well as all kinds of specialinstitution.7.Some member countries in Asia-Pacific region voluntarily increase their subscriptions.8.The main subscribers of the ADB have no veto. In practice, decisions are reached by process ofdiscussion rather than by voting.9.The capital structure of the ADB is crucial/vital key to its loan/financing capacity.10.The ADB is authorized to make and guarantee loans to its member countries.Lesson 13I 1. surplus 2.surplus 3.deficit 4.capital 5.demand 6.supply 7.supply/demand8.outstanding 9.demand 10.supplyII. Translation:1.Just as a country’s domestic economy should have a financial record, a country’s authority should alsohave a statistical summery for all the external economic and financial transaction of its residents.2.The content of the balance of payments concept differs in different historical stage.3.In narrow sense, the balance of payments is defined as the receipts and payments arising frominternational trade or receipt and payments in foreign exchange.4.The balance of payments is a kind of statistic statement in the given period, which reflects thetransactions of goods, services and incomers of an economy.5.The statement of balance of payments is a kind of material that statistical financial transactions in thegiven period according to the form stipulated by IMF.6.The items entering into credit includes goods and services provided from abroad and so on.7.The items entering into debit includes goods and services obtained from abroad and so on.8.Receipts and payment arising from international trade is the most important item in current account,which comprise export and import of various commodities. Generally, the export and import of commodities account for the biggest proportion in the international transactions.9.Capital account reflects the changed of a country’s foreign assets and liabilities. The financial assethere doesn’t include monetary gold and Special Drawing Rights.10.In order to alter the deficits of our country’s balance of payments, the government adopts a series ofpolicies and measures, for examples, reduce domestic basis construction, adjust the structure of exporting and importing commodity, improve the environment for foreign investment, lower the exchange rate of our currency to the main currencies in the world, and so on.Lesson 14I .1.strike 2.The exchange rate 3.bank deposits 4.coordinates5.Arbitraggeurs6.discrepancies7.depreciation8.appreciation9.foreign exchange market 10.speculatorsII. Translation:1.It’s vitally important for those who are engaged in international finance to be aware of the tender offoreign exchange market.2.As long as the foreign exchange floats, there always exist the risks of change of foreign exchange rateand interest rate.3.The arbitrageurs make profits by taking advantage rate across markets to buy low and sell high.4.The buyers and sellers come to an agreement of transaction according to the exchange rate of twocurrencies.5. A greater demand for foreign goods and services means a greater demand for foreign exchange.6.The view that the price of us dollar will fall might note be wrong.7.If more people want to exchange pound into US dollar, the change of exchange rate is favorable to USdollar, and unfavorable to pound when the demand exceeds the supply.8.If the supply of certain goods is excessive, the demand for the goods will go down/decline.9.To devaluate a country’s currency can encourage export.10.There are tow ways to express foreign exchange rate.Lesson 15I. Part (1) 1. fluctuate 2.predictable 3.Capital flows 4.manufactured 5.speed6. refinements7.open/bonds/exchange8.devaluation9.nominal10.halvePart(2) 1.devalues 2.priced 3.demand 4.expectations 5.profit 6.fund7.closed 8.reduces 9.real 10.verticalII. Translation:。

《金融英语》习题答案unit1-10

“高职高专商务英语专业规划教材”Unit 1 Financial Market Research练习参考答案I.Read through the text and answer the following questions.1.A financial market is a mechanism that allows people to easily buy andsell (trade) financial securities (such as stocks and bonds), commodities (such as precious metals or agricultural goods), and other fungible items of value at low transaction costs and at prices that reflect the efficient-market hypothesis.2.The raising of capital ;the transfer of risk and international trade3.Capital markets,commodity markets,money markets, derivative markets,insurance markets and foreign exchange markets .4.Financial markets fit in the relationship between lenders andborrowers.5.Individuals, companies, governments, municipalities and publiccorporations.II. Paraphrase the following expressions or abbreviations and translate them into ChineseCheck the answers from the Special Term Lists.III. Fill in the blanks with the proper wordsThe global financial crisis, brewing for a while, really started to show its effects in the middle of 2007 and into 2008. Around the world stock markets have fallen, large financial institutions have collapsed or been bought out, and governments in even the wealthiest nations have had to come up with rescue packages to bail out their financial systems.On the one hand many people are concerned that those responsible for the financial problems are the ones being bailed out, while on the other hand, a global financial meltdown will affect the livelihoods of almost everyone in an increasingly inter-connected world. The problem could have been avoided, if ideologues supporting the current economics models weren’t so vocal, influential and inconsiderate of others’ viewpoints and concerns.IV.Translation.1.金融市场包括很多方面,包括资本市场,华尔街,甚至是市场本身。

金融英语试题及答案

金融英语试题及答案一、选择题(每题2分,共20分)1. The term "equity" in finance refers to:A. DebtB. Ownership interest in a companyC. A type of loanD. A financial statement2. Which of the following is not a type of financial derivative?A. FuturesB. OptionsC. StocksD. Swaps3. The process of evaluating the creditworthiness of a borrower is known as:A. Credit analysisB. Market analysisC. Risk managementD. Portfolio management4. In the context of finance, what does "leverage" mean?A. The use of borrowed funds to increase the potential return of an investmentB. The ratio of a company's assets to its liabilitiesC. The process of selling securities to the publicD. The ability to buy or sell securities without owningthem5. A bond that pays no periodic interest but is issued at a discount to its face value is called:A. A zero-coupon bondB. A coupon bondC. A convertible bondD. A junk bond6. Which of the following is a measure of a company's ability to meet its short-term obligations?A. Current ratioB. Debt-to-equity ratioC. Return on equity (ROE)D. Earnings per share (EPS)7. The term structure of interest rates refers to the relationship between:A. The risk of an investment and its expected returnB. The maturity of a debt instrument and its yieldC. The size of a company and its market shareD. The economic cycle and the stock market performance8. A financial instrument that allows the holder to buy or sell an asset at a specified price within a specific time period is known as:A. A futureB. A forwardC. An optionD. A swap9. In finance, the term "carry trade" refers to:A. Borrowing money at a low interest rate to invest in a higher-yielding assetB. The practice of selling securities shortC. The strategy of buying and holding stocks for long periodsD. The process of hedging against currency fluctuations10. The primary market is where:A. Securities are first offered to the publicB. Securities are traded after they have been issuedC. Companies buy back their own sharesD. Investors can purchase commodities二、填空题(每空1分,共10分)11. The ________ is the difference between the bid price and the ask price of a security.12. A ________ is a financial institution that accepts deposits and provides loans.13. The ________ is the process of buying and selling securities on the same day.14. The ________ is the risk that the value of an asset will decrease due to market conditions.15. A ________ is a financial statement that shows a company's financial performance over a specific period.16. The ________ is the risk that a borrower will not repay a loan.17. A ________ is a type of investment fund that pools money from many investors to purchase a diversified portfolio of assets.18. The ________ is the potential for an asset's value toincrease or decrease.19. The ________ is the process of determining the value of a business or business assets.20. A ________ is a financial instrument that represents ownership in a company.三、简答题(每题5分,共30分)21. Explain the concept of "leverage" in finance.22. What is the difference between a "mutual fund" and a "hedge fund"?23. Describe the role of a "stock exchange" in the financial markets.24. What is "risk management" and why is it important in finance?四、论述题(每题20分,共40分)25. Discuss the impact of "inflation" on different types of investments.26. Analyze the importance of "corporate governance" in ensuring the long-term success of a company.答案:一、1. B2. C3. A4. A5. A6. A7. B8. C9. A10. A二、11. Spread12. Bank13. Day trading14. Market risk15. Income statement16. Credit risk17. Mutual fund18. Volatility19. Valuation20. Stock三、21. Leverage in finance refers to the use of borrowed money to finance investments, with the goal of increasing potential returns. However, it。

金融英语业务知识练习试卷4(题后含答案及解析)

金融英语业务知识练习试卷4(题后含答案及解析)题型有:1.33 cakesC.4 cakesD.3 cakes正确答案:B解析:答案为B项。

本句之意制作3件衬衣的机会成本为4个蛋糕,那么,制作l件衬衣的机会成本为4÷3=33,故选B项。

知识模块:金融英语业务知识4.If the number of consumers in a market increases, which of the following is most likely to occur?A.Quantity demanded for the good will decreaseB.Demand for the good will increaseC.Demand for the good will decreaseD.The price will remain the same in the long run正确答案:B解析:答案为B项。

消费者数量的增加会使需求随之增加,价格是否变化则需视需求与供给的共同作用情况而定。

故本题选B项。

知识模块:金融英语业务知识5.In perfect competition,______.A.there are very few firms in the marketB.there is a homogeneous productC.there are large barriers to entryD.there is imperfect information between consumers and producer正确答案:B解析:答案为B项。

完全竞争市场中的厂商都生产同质产品(homogeneous product),且厂商数量众多,消费者和厂商拥有完全信息,进入和退出自由。

故本题选B项。

知识模块:金融英语业务知识6.Microeconomics examines which of the following?______.A.Gross national productB.Trade policyC.Exchange ratesD.Firm competition正确答案:D解析:答案为D项。

财经英语试题及答案

财经英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial instrument?A. StockB. BondC. CommodityD. Insurance policyAnswer: D2. In financial markets, what is the term for the difference between the buying and selling prices of a security?A. SpreadB. DividendC. YieldD. Interest rateAnswer: A3. What is the term used to describe the risk of a security's value changing due to market fluctuations?A. Credit riskB. Market riskC. Liquidity riskD. Operational riskAnswer: B4. Which of the following is not a type of financial statement?A. Balance sheetB. Income statementC. Cash flow statementD. Profit and loss statementAnswer: D5. What is the term for the process of evaluating an investment based on various factors to determine its potential return and risk?A. Due diligenceB. Portfolio managementC. Financial analysisD. Risk assessmentAnswer: C6. What does GDP stand for in economics?A. Gross Domestic ProductB. Gross Domestic ProfitC. Gross Domestic PerformanceD. Gross Domestic PriceAnswer: A7. In the context of finance, what does the acronym "IPO" stand for?A. Initial Public OfferingB. International Profit OrganizationC. International Portfolio OrganizationD. International Product OfferingAnswer: A8. What is the term for a financial contract that gives the buyer the right, but not the obligation, to buy or sell anunderlying asset at a specified price on or before a certain date?A. Call optionB. Put optionC. Forward contractD. Futures contractAnswer: A9. Which of the following is not a component of the financial system?A. BanksB. Securities exchangesC. Insurance companiesD. Manufacturing companiesAnswer: D10. What is the term used to describe the process of determining a company's value based on its financial performance and potential for future growth?A. ValuationB. ForecastingC. BudgetingD. AuditingAnswer: A二、填空题(每题2分,共20分)1. The process of converting cash into other assets is known as ____________.Answer: investing2. A __________ is a financial institution that acceptsdeposits, offers loans, and provides other financial services. Answer: bank3. The __________ is a document that outlines the terms and conditions of a loan, including the interest rate and repayment schedule.Answer: loan agreement4. __________ is the risk that a borrower may default ontheir loan payments.Answer: credit risk5. A __________ is a financial statement that shows acompany's financial position at a specific point in time. Answer: balance sheet6. __________ is the process of evaluating a company'sfinancial health by analyzing its financial statements. Answer: financial analysis7. The __________ is a financial statement that shows a company's revenues, expenses, and net income over a specific period.Answer: income statement8. __________ is the risk that a security's value maydecrease due to a decline in the overall market.Answer: market risk9. A __________ is a financial instrument that represents an ownership interest in a company.Answer: stock10. __________ is the risk that a security may be difficult to sell at a desired price.Answer: liquidity risk三、简答题(每题10分,共20分)1. Explain the difference between a stock and a bond. Answer: A stock represents ownership in a company and typically offers the potential for capital appreciation and dividends. A bond, on the other hand, is a debt instrument issued by a company or government, promising to pay periodic interest and return the principal at maturity.2. What are the main factors that influence a company'scredit rating?Answer: The main factors that influence a company's credit rating include its financial stability, debt levels, profitability, management quality, industry position, and economic conditions. Credit rating agencies assess these factors to determine the likelihood of the company meetingits financial obligations.四、论述题(每题15分,共30分)1. Discuss the importance of diversification in an investment portfolio.Answer: Diversification is crucial in an investment portfolio as it helps to spread risk across a variety of investments, reducing the impact of a poor-performing asset on the overall portfolio. By investing in different asset classes, sectors, and geographical regions, investors can potentially achievebetter returns and lower volatility. Diversification also allows for the exploitation of different market opportunities and can protect against unforeseen events that may affect specific investments.2. Explain the role of financial statements in business decision-making.Answer: Financial statements play a vital role in business decision。

新编金融英语教程试题答案

新编金融英语教程试题答案一、选择题1. The concept of "leverage" in finance refers to:A. The use of borrowed funds to increase potential returnsB. The process of fixing a broken financial systemC. The ability to move a company to a new locationD. The practice of buying and selling goods in different markets答案:A2. Which of the following is NOT a primary function of the Federal Reserve System in the United States?A. To regulate the nation's monetary policyB. To supervise and regulate banksC. To enforce international trade lawsD. To maintain financial stability答案:C3. A "bear market" is characterized by:A. Rising stock prices and strong investor confidenceB. Falling stock prices and weak investor confidenceC. A market with a surplus of bears (the animal)D. A market where only bear-related products are traded答案:B4. The term "forex" is short for:A. Foreign exchangesB. Forest exchangeC. Forming excellent relationshipsD. Financial expert report答案:A5. Which of the following is a type of financial derivative?A. StockB. BondC. FutureD. Report答案:C二、填空题1. The __________ (一种金融衍生工具) is a contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price within a certain period.答案:option2. The __________ is the process by which a company raises capital by issuing new securities to the public for the first time.答案:initial public offering (IPO)3. __________ is the practice of analyzing financial data to make investment decisions.答案:fundamental analysis4. A __________ is a financial instrument that derives its value from a good or an index, such as shares of stock in a company.答案:future5. __________ is the term used to describe the risk that a party to a financial contract may default on their payment obligation.答案:credit risk三、简答题1. Explain the difference between a traditional bank and a shadow bank.答:传统银行是指持有银行牌照、受金融监管机构监管的金融机构,它们提供存款、贷款和其他金融服务。

金融英语业务知识练习试卷45(题后含答案及解析)

金融英语业务知识练习试卷45(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1.Which of the following is a determinant of asset demand?______.A.Expected returnB.RiskC.LiquidityD.All of the above正确答案:D解析:答案为D项。

资产需求的决定因素(determinant of asset demand)包括预期收益、风险、流动性和财富(wealth)。

故本题选D项。

知识模块:金融英语业务知识2.Which of the following items are reported as a current liability on the balance sheet?______.A.Short-term notes payableB.Accrued payroll taxesC.Estimated warrantiesD.All of the above正确答案:D解析:答案为D项。

短期应付票据、应计未付工资税金和预估(产品)担保均是流动负债。

故本题选D项。

知识模块:金融英语业务知识3.Which of the following is not true of fiscal policy?______.A.Time lags occur with fiscal policy.B.Automatic stabilizers help the economy.C.Crowding out is not a problem of fiscal policy.D.None of the above.正确答案:C解析:答案为C项。

time lag“时滞”。

财政政策有时滞;自动稳定器有利于经济;挤出效应存在于财政政策中。

本题中C项的说法错误,故选C项。

知识模块:金融英语业务知识4.What distinguishes the mortgage markets from other capital markets?______.A.Securities in the mortgage markets are collateralized by real estate.B.The mortgage markets usually involve long-term funds.C.Borrowers in the mortgage markets include individuals and businesses.D.All of the above.正确答案:A解析:答案为A项。

金融英语业务知识练习试卷6(题后含答案及解析)

金融英语业务知识练习试卷6(题后含答案及解析) 题型有: 2. 单项选择题单项选择题1.Which of the following is not a function of money?______.A.To act as a medium of exchangeB.To act as a unit of accountC.To act as a store of valueD.To act as a means of paymentE.To provide a double coincidence of wants正确答案:E解析:答案为E项。

货币有四种主要职能,即流通手段(medium of exchange)、价值尺度(unit of account)、贮藏手段(store of value)和支付手段(means of payment)。

其中价值尺度和流通手段是货币的基本职能也是最先出现的职能。

本题中只有E项不是货币的职能,故选E项。

知识模块:金融英语业务知识2.What function is money serving when you buy a ticket to a movie?______.A.store of valueB.a unit of accountC.transaction demandD.a medium of exchange正确答案:D解析:答案为D项。

本题之意货币主要行使了流通手段的职能,故选D项。

知识模块:金融英语业务知识3.Which of the following statements is not true of central banks?______.A.They pay the government’s salariesB.They are always the lender of last resortC.They always undertake the regulation of the banking systemD.None of the above正确答案:C解析:答案为C项。

银行金融英语试题及答案

银行金融英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a type of investment?A. StocksB. BondsC. Savings AccountD. Insurance答案:D2. The term "leverage" in finance refers to:A. The use of borrowed money to increase the potential return of an investment.B. The process of selling a security that the investor does not own.C. The ability to purchase more of an asset than one can afford.D. A financial instrument that provides a guarantee of payment.答案:A3. What does "NPV" stand for in financial analysis?A. Net Present ValueB. Net Profit ValueC. Net Product ValueD. None of the above答案:A4. A "bear market" is characterized by:A. A long period of falling prices.B. A period of economic growth.C. A market where only bears are traded.D. A market with high volatility.答案:A5. The process of evaluating a company's financial health is known as:A. Financial AnalysisB. Market AnalysisC. Risk AnalysisD. Portfolio Management答案:A6. Which of the following is a measure of a company's profitability?A. EBITDAB. ROIC. P/E RatioD. All of the above答案:D7. In banking, "LIBOR" stands for:A. London Interbank Borrowed RateB. London International Banking OrganizationC. London International Business OrganizationD. London Interbank Business Rate答案:A8. A "derivative" in finance is:A. A product that derives its value from the value of another underlying asset.B. A type of savings account.C. A type of insurance policy.D. A type of investment fund.答案:A9. What is the primary function of a central bank?A. To manage the country's monetary policy.B. To provide financial advice to individuals.C. To offer personal loans to consumers.D. To manage the country's foreign exchange reserves.答案:A10. The term "forex" refers to:A. Foreign exchange market.B. Forward exchange rate.C. Financial exchange rate.D. Future exchange rate.答案:A二、填空题(每题1分,共10分)11. The current account balance is a record of a country's transactions with the rest of the world, excluding ______.答案:capital flows12. A ______ is a financial contract that obligates the buyer to purchase an asset or the seller to sell an asset, such as a physical commodity or a financial instrument, at a predetermined future date and price.答案:futures contract13. The ______ ratio is used to measure how efficiently a company is using its assets to generate profit.答案:asset turnover14. An increase in interest rates will generally lead to a______ in bond prices.答案:decrease15. The term "short selling" refers to the practice ofselling securities that the seller does not own, with the hope of buying them back later at a ______ price.答案:lower16. The ______ is the difference between the total assets and the total liabilities of a company.答案:equity17. A ______ is a type of investment account that allows individual investors to pool their money with other investors to invest in a portfolio of stocks, bonds, or other securities.答案:mutual fund18. The ______ is the process of determining the value of a business or financial security.答案:valuation19. A ______ is a financial statement that shows the changes in a company's financial position over a specified period of time.答案:cash flow statement20. The ______ is the rate at which banks lend money to each other overnight.答案:federal funds rate三、简答题(每题5分,共30分)21. Explain the difference between a "fixed deposit" and a "demand deposit" in a bank.答案:A fixed deposit is a type of savings account where money is deposited for a fixed term at a predetermined interest rate. The depositor cannot withdraw the money before the end of the term without incurring a penalty. A demand deposit, on the other hand, is a type of bank account that allows the depositor to withdraw funds at any time without penalty. It typically earns a lower interest rate compared to a fixed deposit.22. What is a "call option" and how does it differ from a "put。

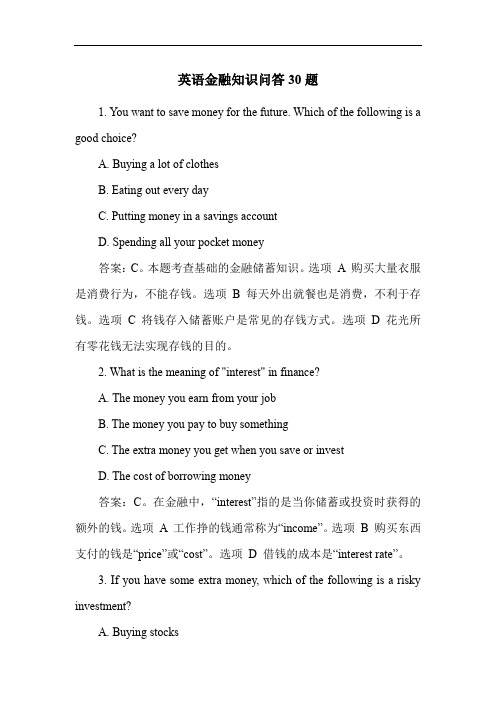

英语金融知识问答30题

英语金融知识问答30题1. You want to save money for the future. Which of the following is a good choice?A. Buying a lot of clothesB. Eating out every dayC. Putting money in a savings accountD. Spending all your pocket money答案:C。

本题考查基础的金融储蓄知识。

选项A 购买大量衣服是消费行为,不能存钱。

选项B 每天外出就餐也是消费,不利于存钱。

选项 C 将钱存入储蓄账户是常见的存钱方式。

选项 D 花光所有零花钱无法实现存钱的目的。

2. What is the meaning of "interest" in finance?A. The money you earn from your jobB. The money you pay to buy somethingC. The extra money you get when you save or investD. The cost of borrowing money答案:C。

在金融中,“interest”指的是当你储蓄或投资时获得的额外的钱。

选项A 工作挣的钱通常称为“income”。

选项B 购买东西支付的钱是“price”或“cost”。

选项D 借钱的成本是“interest rate”。

3. If you have some extra money, which of the following is a risky investment?A. Buying stocksB. Buying a houseC. Putting money in a fixed depositD. Keeping money at home答案:A。

(完整word版)英文版国际金融试题和答案

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分, 答错不扣分1.I.perfec.market.existed.resource.woul.b.mor.mobil.an.coul.therefor.b.transferre.t.thos.countrie.mor.willin.t.pa..hig.pric.fo.them.. .. .2.Th.forwar.contrac.ca.hedg.futur.receivable.o.payable.i.foreig.currencie.t.insulat.th.fir.agains.exchang.rat.risk ... . )3.Th.primar.objectiv.o.th.multinationa.corporatio.i.stil.th.sam.primar.objectiv.o.an.firm.i.e..t.maximiz.sharehol de.wealth.. .. )4..lo.inflatio.rat.tend.t.increas.import.an.decreas.exports.thereb.decreasin.th.curren.accoun.deficit.othe.thing.e qual......5..capita.accoun.defici.reflect..ne.sal.o.th.hom.currenc.i.exchang.fo.othe.currencies.Thi.place.upwar.pressur.o.tha.hom.currency’.value.. .. )parativ.advantag.implie.tha.countrie.shoul.specializ.i.production.thereb.relyin.o.othe.countrie .fo.som.products.. .. .7.Covere.interes.arbitrag.i.plausibl.whe.th.forwar.premiu.reflec.th.interes.rat.differentia.betwee.tw.countrie.sp ecifie.b.th.interes.rat.parit.formula. .. . )8.Th.tota.impac.o.transactio.exposur.i.o.th.overal.valu.o.th.firm.. .. .9. .pu.optio.i.a.optio.t.sell-b.th.buye.o.th.option-.state.numbe.o.unit.o.th.underlyin.instrumen.a..specifie.pric.pe.uni.durin..specifie.period... . )10.Future.mus.b.marked-to-market.Option.ar.not.....)PartⅡ:Cloze (20%)每题2分, 答错不扣分1.I.inflatio.i..foreig.countr.differ.fro.inflatio.i.th.hom.country.th.exchang.rat.wil.adjus.t.maintai.equal.. purchasin.powe... )2.Speculator.wh.expec..currenc.t..appreciat..... .coul.purchas.currenc.future.contract.fo.tha.currency.3.Covere.interes.arbitrag.involve.th.short-ter.investmen.i..foreig.currenc.tha.i.covere.b.....forwar.contrac...... .t. sel.tha.currenc.whe.th.investmen.matures.4.. Appreciation.Revalu....)petitio.i.increased.5.....PP... .suggest..relationshi.betwee.th.inflatio.differentia.o.tw.countrie.an.th.percentag.chang.i.th.spo.exchang.ra t.ove.time.6.IF.i.base.o.nomina.interes.rat....differential....).whic.ar.influence.b.expecte.inflation.7.Transactio.exposur.i..subse.o.economi.exposure.Economi.exposur.include.an.for.b.whic.th.firm’... valu... .wil.b.affected.modit.a..state.pric.i..... pu..optio..i.exercised9.Ther.ar.thre.type.o.long-ter.internationa.bonds.The.ar.Globa.bond. .. eurobond.....an....foreig.bond...).10.An.goo.secondar.marke.fo.financ.instrument.mus.hav.a.efficien.clearin.system.Mos.Eurobond.ar.cleare.thr oug.eithe...Euroclea... ..o.Cedel.PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分rmation:A BankB BankBid price of Canadian dollar $0.802 $0.796Ask price of Canadian dollar $0.808 $0.800rmation.i.locationa.arbitrag.possible?put.t h.profi.fro.thi.arbitrag.i.yo.ha.$1,000,e.(5%)ANSWER:Yes! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500.2.Assum.tha.th.spo.exchang.rat.o.th.Britis.poun.i.$1.90..Ho.wil.thi.spo.rat.adjus.i.tw.year.i.th.Unite.Kingdo.experience.a.inflatio.rat.o..percen.pe.yea.whil.th.Unite.State.experience.a.inflatio.rat.o..perc en. pe.year?(10%)ANSWER:According to PPP, forward rate/spot=indexdom/indexforth.exchang.rat.o.th.poun.wil.depreciat.b.4..percent.Therefore.th.spo.rat.woul.adjus.t.$1.9..[..(–.047)..$1.81073.Assum.tha.th.spo.exchang.rat.o.th.Singapor.dolla.i.$0.70..Th.one-yea.interes.rat.i.1.percen.i.th.Unite.State.a n..percen.i.Singapore..Wha.wil.th.spo.rat.b.i.on.yea.accordin.t.th.IFE?.(5%)ANSWER: according to the IFE,St+1/St=(1+Rh)/(1+Rf)$.70 × (1 + .04) = $0.7284.Assum.tha.XY.Co.ha.ne.receivable.o.100,00.Singapor.dollar.i.9.days..Th.spo.rat.o.th.S.i.$0.50.an.th.Singap or.interes.rat.i.2.ove.9.days..Sugges.ho.th.U.S.fir.coul.implemen..mone.marke.hedge..B.precis. .(10%)ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000/1.02) = about S$98,039, which could be converted to about $49,020 and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars.pan.ordere..Jagua.sedan.I..month..i.wil.pa.£30,00.fo.th.car.I.worrie.tha.poun.ster1in.migh.ris.sharpl.fro.th.curren.rate($1.90)pan.bough...mont.poun.cal.(suppose.contrac.siz..£35,000.wit..strik.pric.o.$1.9.fo..premiu.o.2..cents/£.(1)Is hedging in the options market better if the £ rose to $1.92 in 6 months?(2)what did the exchange rate have to be for the company to break even?(15%)Solution:(1)I.th..ros.t.$pan.woul. exercis.th.poun.cal.option.Th.su.o.th.strik.pric.an.premiu..i.$1.90 + $0.023 = $1.9230/£Thi.i.bigge.tha.$1.92.So hedging in the options market is not better.(2.whe.w.sa.th. compan.ca.brea.even.w.mea.tha.hedgin.o.no.hedgin.doesn’. matter.An.onl.whe.(strik.pric..premiu.).th.exchang.rat.,hedging or not doesn’t matter.So, the exchange rate =$1.923/£.6.Discus.th.advantage.an.disadvantage.o.fixe.exchang.rat.system.(15%)textbook page50 答案以教材第50 页为准PART Ⅳ: Diagram(10%)Th.strik.pric.fo..cal.i.$1.67/£.Th.premiu.quote.a.th.Exchang.i.$0.022.pe.Britis.pound.Diagram the profit and loss potential, and the break-even price for this call optionSolution:Following diagram shows the profit and loss potential, and the break-even price of this put option:PART Ⅴa) b) Calculate the expected value of the hedge.c) How could you replicate this hedge in the money market?Yo.ar.expectin.revenue.o.Y100,00.i.on.mont.tha.yo.wil.nee.t.cover.t.dollars.Yo.coul.hedg.thi.i.forwar.market.b.takin.lon.position.i.U.dollar.(shor.position.i.Japanes.Yen).B.lockin.i.you.pric.a.$..Y105.you.dolla.revenue.ar.guarantee.t.b.Y100,000/ 105 = $952You could replicate this hedge by using the following:a) Borrow in Japanb) Convert the Yen to dollarsc) Invest the dollars in the USd) Pay back the loan when you receive the Y100,000。

《金融专业英语》习题答案

《金融专业英语》习题答案第一篇:《金融专业英语》习题答案《金融专业英语》习题答案Chapter OneFunctions of Financial Markets 一. Translate the following sentences into Chinese.1.China’s banking industry is now supervised by the PBC and CBRC.In addition, the MOF is in charge of financial accounting and taxation part of banking regulation and management.目前中国银行业主要由中国人民银行和银监会进行监管。

此外,财政部负责银行业监管的财务会计及税收方面。

2.Currently Chinese fund management companies are engaged in the following business: securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses.目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。

3.China's economy had 10% growth rate in the years before the world financial crisis of 2008.That economic expansion resulted from big trade surpluses and full investment.Now China is seeking to move away from that growth model.The country is working to balance exports with demand at home.在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。

金融英语考试试题及答案

金融英语考试试题及答案金融英语是金融领域中不可或缺的一部分,对于从事金融行业的人士来说,掌握金融英语的知识非常重要。

为了帮助大家更好地备考金融英语考试,本文将为大家提供一些常见的金融英语考试试题及答案。

一、选择题1. What is the meaning of IPO?a) Initial Public Offeringb) International Purchase Orderc) Investment Portfolio Optimizationd) International Partnership Organization答案:a) Initial Public Offering2. What does the term "capital market" refer to?a) The market for physical capitalb) The market for financial assets with a maturity of less than a yearc) The market for financial assets with a maturity of more than a yeard) The market for real estate properties答案:c) The market for financial assets with a maturity of more than a year3. Which of the following is an example of a derivative?a) Stockb) Bondc) Optiond) Certificate of Deposit答案:c) Option4. What is the opposite of a deficit?a) Surplusb) Debtc) Liabilityd) Equity答案:a) Surplus5. What is the term for a loan that is secured by collateral?a) Unsecured loanb) Subordinated loanc) Secured loand) Revolving loan答案:c) Secured loan二、填空题1. The study of how individuals and institutions make financial decisions and how these decisions affect the allocation of resources is known as__________.答案:finance2. When a company issues shares for the first time and offers them to the public, it is called an ____________.答案:IPO (Initial Public Offering)3. The interest rate that a commercial bank charges its most creditworthy customers is known as the _________.答案:prime rate4. A financial instrument that represents ownership in a corporation is called a ___________.答案:stock5. The basic economic problem of having seemingly unlimited human wants in a world of limited resources is known as ________.答案:scarcity三、解答题1. Explain the concept of time value of money.答案:The time value of money refers to the idea that a dollar today is worth more than a dollar in the future. This is because money can be invested and earn interest over time. Therefore, receiving a dollar today ismore desirable than receiving the same amount in the future. The time value of money is an important concept in finance and is used to calculate the present value of future cash flows.2. What are the main functions of a central bank?答案:The main functions of a central bank include:- Monetary policy: Central banks are responsible for formulating and implementing monetary policy to control the money supply and interest rates in an economy. This is done to achieve specific macroeconomic objectives, such as price stability and economic growth.- Banker to the government: Central banks act as the government's bank and provide services such as managing the government's accounts, issuing government securities, and acting as a lender of last resort.- Banker to commercial banks: Central banks also provide banking services to commercial banks, including maintaining accounts, providing short-term loans, and overseeing the stability of the banking system.- Currency issuance: Central banks are responsible for issuing and circulating the national currency.- Financial stability: Central banks play a crucial role in maintaining financial stability and monitoring risks in the banking system.总结:本文为大家提供了一些常见的金融英语考试试题及答案。

金融英语题库完整版(附答案)