深圳一致药业股份有限公司2010年第一季度报告全文(英文版)

中国经济季报2010第一季度(双语批注版)

政府主导投资是2009 年经济增长的主要驱动力,但最近房地产投资的拉动作用十分突出。

据估算,2009 年政府主导投资增长了42%(固定资产投资名义增长),而基于市场的投资仅增长了18%然而,2009 年底至2010 年初,政府主导投资的增长(年同比)已经大幅下滑(图3)。

房地产投资在2009 年初非常疲弱。

但部分由于充裕的流动性,房屋销售很快回升,在许多城市推高了房价,居民家庭消费增长保持平稳。

劳动力市场在经历了2009 年初的疲软之后已经得到改善。

直至2010 年初,就业和工资都保持了较好增长。

2009 年全年大部分时间居民消费价格都处于下降态势。

这由于进口强劲降低了贸易盈余,在2009 年外部贸易大大拉低了经济增速。

加工贸易进口的变化虽然人民币兑美元汇率没有变化,但人民币的有效汇率继续波动。

人民币在2008 年底开始重新钉住美元。

4 然而,中国对外贸易的很大一部分是与美国以外的国家发生的。

因此,随着美元对其他货币汇率的波动,按贸易加权的人民币币值变化与人民币对美元的汇率变化差别很大。

中国的名义有效汇率(NEER)在经历了2000 年到2005 年间的贬值之后,从2005 年7 月至2010 年3 月初这段时间升值了12.3%。

现在的NEER 大致处于2000 年的水平(图9)。

按消费者价格指数计算的实际有效汇率(REER)也是如此。

此外,由于自2008 年底人民币重新钉住美元,美元汇率的大幅波动也意味着中国对其大多数贸易伙伴的货币的汇率在上下变动。

房地产价格的激增触发了扩大供给、抑制投机的政策措施。

措施明确并二套房的首付比例不得低于40%;取消住房按揭贷款的优惠利率;将土地出让金首付比例从20-30%提高至50%;恢复征收房地产交易的营业税。

另一方面,有调查显示,房地产价格的迅速提高也增强了人们的通胀预期。

Surging property prices triggered policy measures to expand supply and curb speculation. These included clarifying and enforcing the policy on the minimum down payment ratio for second houses (to 40 percent); removing the “discount” on the mortgage interest rate; raising the minimum down然而,高收入国家2010-11 年的复苏可能将非常缓慢,全球进口需求仍将低迷。

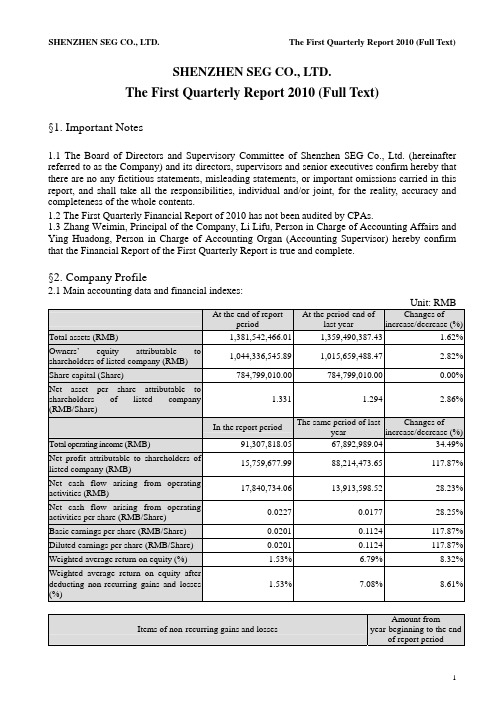

深赛格B:2010年第一季度报告全文(英文版) 2010-04-29

SHENZHEN SEG CO., LTD.The First Quarterly Report 2010 (Full Text)§1. Important Notes1.1 The Board of Directors and Supervisory Committee of Shenzhen SEG Co., Ltd. (hereinafter referred to as the Company) and its directors, supervisors and senior executives confirm hereby that there are no any fictitious statements, misleading statements, or important omissions carried in this report, and shall take all the responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents.1.2 The First Quarterly Financial Report of 2010 has not been audited by CPAs.1.3 Zhang Weimin, Principal of the Company, Li Lifu, Person in Charge of Accounting Affairs and Ying Huadong, Person in Charge of Accounting Organ (Accounting Supervisor) hereby confirm that the Financial Report of the First Quarterly Report is true and complete.§2. Company Profile2.1 Main accounting data and financial indexes:Unit: RMBAt the end of reportperiod At the period-end oflast yearChanges ofincrease/decrease (%)Total assets (RMB) 1,381,542,466.011,359,490,387.43 1.62% Owners’ equity attributable toshareholders of listed company (RMB)1,044,336,545.891,015,659,488.47 2.82% Share capital (Share) 784,799,010.00784,799,010.00 0.00% Net asset per share attributable toshareholders of listed company(RMB/Share)1.331 1.2942.86%In the report period The same period of lastyearChanges ofincrease/decrease (%)Total operating income (RMB) 91,307,818.0567,892,989.04 34.49% Net profit attributable to shareholders oflisted company (RMB)15,759,677.99-88,214,473.65 -117.87% Net cash flow arising from operatingactivities (RMB)17,840,734.0613,913,598.52 28.23% Net cash flow arising from operatingactivities per share (RMB/Share)0.02270.0177 28.25% Basic earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Diluted earnings per share (RMB/Share) 0.0201-0.1124 -117.87% Weighted average return on equity (%) 1.53%-6.79% 8.32% Weighted average return on equity afterdeducting non-recurring gains and losses(%)1.53%-7.08% 8.61%Items of non-recurring gains and lossesAmount from year-beginning to the end of report periodOther non-operating income and expenditure except for the aforementioned items 97,850.12 Influenced amount of income tax -21,527.03Influenced amount of minority shareholders’ equity -31,864.37Total 44,458.72 Explanations of items of significant non-recurring gains and losses1. Other non-operating income and expenditure except for the aforementioned items:mainly the damages for breach of contract received by the Company;2. Influenced amount of income tax: the influenced amount of deductible income tax increased due to the profit increase because of the aforementioned item;;3. Influenced amount of minority shareholders’ equity: this item increased due to the increase of the aforementioned No.1 item of controlling subsidiary of the Company.2.2 Total number of shareholders at the end of the report period and shares held by the top ten shareholders without restricted conditionsUnit: Share Total number of shareholdersat the end of report period59,152Particulars about the shares held by the top ten tradable shareholders without restricted conditionsFull name of shareholder Amount of tradable shares withoutrestricted conditions held at the endof report periodType of sharesSHENZHEN SEG GROUP CO., LTD. 237,359,666 RMB ordinary shares GUANGZHOU FODAK ENTERPRISEGROUP CO., LTD.18,880,334 RMB ordinary shares Yang Zhihui 12,582,734 RMB ordinary shares Taifook Securities CompanyLimited-Account Client5,758,103 Domestically listed foreign shares Gong Qianhua 5,560,967 Domestically listed foreign shares Zeng Ying 4,280,048 Domestically listed foreign shares Zhu Wei 4,066,739 RMB ordinary shares Tang Lizhu 3,796,200 RMB ordinary shares SHANGHAI QILE ECONOMIC ANDTRADE CO., LTD.2,754,330 RMB ordinary shares Cao Xianhua 2,702,000RMB ordinary shares§3. Significant Events3.1 Particulars about material changes in items of main accounting statement and financial index, and explanations of reasons√Applicable □InapplicableI. Balance sheet itemItem Mar. 31, 2010 Dec. 31, 2009 Balance Proportion ofchanges % Inventory 1,919,437.27 5,886,392.39 -3,966,955.12 -67.39% Construction in progress 9,776,526.68 26,192,075.55 -16,415,548.87 -62.67% Staff salaries payable 1,172,559.95 4,261,476.99 -3,088,917.04 -72.48% 1. Inventory: decreased by RMB 3.97 million with a fall of 67.39% over the end of last year, which was mainly because the inventories of the Company decreased in the report period.2. Construction in progress: decreased by RMB 16.42 million with a fall of 62.67% over the end of last year. Its reason was that the construction in progress of the subsidiary Changsha SEG Development Co., Ltd. (hereinafter referred to as Changsha SEG) was completed and thentransferred into fixed assets in the report period.3. Staff salaries payable: decreased by RMB 3.09 million with a fall of 72.48% over the end of last year. Its reason was that the Company paid the staff for salaries in the report period.II. Income statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Operating income 91,307,818.0567,892,989.0423,414,829.01 34.49% Operating cost 56,496,489.2231,746,485.6924,750,003.53 77.96% Operating tax and extras 3,724,614.303,012,887.52711,726.78 23.62% Sales expense 1,370,260.25906,378.64463,881.61 51.18% Losses from devaluation ofassets--1,500,000.001,500,000.00 -100.00% Investment gains -3,029,152.47-115,823,698.14112,794,545.67 -97.38% Operating profit 23,529,850.53-85,166,016.78108,695,867.31 -127.63% Non-operating income 139,079.301,620,912.10-1,481,832.80 -91.42% Non-operating expenditure 41,229.18100,985.93-59,756.75 -59.17% Total profits 23,627,700.65-83,646,090.61107,273,791.26 -128.25% Income tax expense 5,951,587.042,313,487.223,638,099.82 157.26% Net profit 17,676,113.61-85,959,577.83103,635,691.44 -120.56% Net profit attributable toowners of parent company15,759,677.99-88,214,473.65103,974,151.64 -117.87% Basic earnings per share 0.0201-0.11240.1325 -117.87% Diluted earnings per share 0.0201-0.11240.1325 -117.87% Other consolidated income 12,964,835.24-574,782.6813,539,617.92 -2355.61% Total consolidated income 30,640,948.85-86,534,360.52117,175,309.37 -135.41% Total consolidated incomeattributable to owners ofparent company28,677,057.42-88,896,727.63117,573,785.05 -132.26% 1. Operating income: increased by RMB 23.41 million with an increase of 34.49% over the same period of last year. The main reasons were i. In the report period, Changsha SEG and Changsha Hotel of Shenzhen Mellow Orange Business Hotel Management Co., Ltd. (hereinafter referred to as Mellow Orange Hotel) started operation which increased the operating income of the Company; ii. Income from Buy-it Store increased compared with the same period of last year.2. Operating cost: increased by RMB 24.75 million with an increase of 77.96% over the same period of last year. The main reason was the increase of operating income caused the increase of operating cost accordingly.3. Operating tax and extras: increased by RMB 710,000 with an increase of 23.62% over the same period of last year. The main reason was the increase of operating income caused the increase ofoperating tax and extras accordingly.4. Sales expense: increased by RMB 460,000 with an increase of 51.18% over the same period of last year. The main reason was the increase of operating income caused the increase of sales expense accordingly.5. Losses from devaluation of assets: no losses from devaluation of assets occurred in the report period, whereas that was RMB -1.5 million in the same period of last year. The main reasons was part of account receivable which had been withdrawn losses of bad debts in the same period of last year was taken back through lawsuit.6. Investment gains: increased by RMB 112.79 million over the same period of last year. The main reason was the losses of Shenzhen SEG Samsung Co., Ltd. (hereinafter referred to as SEG Samsung) in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year.7. Operating profit: increased largely over the same period of last year. The main reasons were the losses of SEG Samsung in which the Company holds 22.45% of its equity decreased in the report period over the same period of last year causing a large decrease in investment losses.8. Non-operating income: decreased by RMB 1.48 million with a decrease of 91.42% over the same period of last year. The main reasons were the Company switched back the account payable which it did not need to pay in the same period of last year, but no such switch-back occurred in the report period.9. Total profits: increased largely over the same period of last year. The main reason was the same as that of Item 7.10. Income tax expense: increased by RMB 3.64 million with an increase of 157.26% over the same period of last year. The main reason was the profit payable of this report year went up and income tax rate of this report year in Shenzhen also grew.11. Net profit: increased largely over the same period of last year. The main reason was the same as that of Item 7.12. Net profit attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Item 7.13. Basic earnings per share: increased largely over the same period of last year. The main reasons were the same with Item 7.14. Diluted earnings per share: increased largely over the same period of last year. The main reason was the same as that of Item 7.15. Other consolidated income: increased by RMB 13.54 million largely over the same period of last year. The main reason was in the report period, SEG Samsung in which the Company holds 22.45% of its equity received the financial support funds amounting to RMB 56 million from its shareholder Samsung Corning Investment Co., Ltd., thus RMB 12.57 million was added into other consolidated income of the Company.16. Total consolidated income: increased largely over the same period of last year. The main reasons were the same as that of Items 7 and 15.17. Total consolidated income attributable to owners of parent company: increased largely over the same period of last year. The main reason was the same as that of Items 7 and 15.III. Cash flow statement itemItem Amount in thisperiodAmount in thesame period oflast yearBalanceProportion ofchanges %Other cash receivedrelating to operating activities64,583,939.9735,621,486.0928,962,453.88 81.31% Cash paid to/for staff andworkers11,883,672.359,605,770.002,277,902.35 23.71%Other cash paid relating to53,590,151.5031,135,749.7322,454,401.77 72.12% operating activitiesCash received from0.002,198,720.24-2,198,720.24 -100.00% recovering investmentNet cash received from15,444.00141,500.00-126,056.00 -89.09% disposal of fixed, intangible andother long-term assetsNet cash received from disposal0.0034,229,363.41-34,229,363.41 -100.00% of subsidiaries and other unitsCash paid for purchasing fixed,4,591,584.05701,547.003,890,037.05 554.49% intangible and other long-termassetsCash paid for investment 0.0053,030,000.00-53,030,000.00 -100.00% 1. Other cash received relating to operating activities: increased by RMB 28.96 million with an increase of 81.31% over the same period of last year. The main reasons were i. items of newly-opened Changsha SEG and Mellow Orange Hotel in the report period and newly-increased Buy-it Store in last May increased; ii. The general cashing business was developed in the electronic market, so the goods payment received on behalf of merchants increased.2. Cash paid to/for staff and workers: increased by RMB 2.28 million with an increase of 23.71% over the same period of last year. The main reasons were in the report period, Changsha SEG and Mellow Orange Hotel started operations, and the staff in Buy-it Store added increasing the salaries payable to the staff of the three companies.3. Other cash paid relating to operating activities: increased by RMB 22.45 million with an increase of 72.12% over the same period of last year. The main reasons were i. items of Changsha SEG and Mellow Orange Hotel newly-opened in the report period and Buy-it Store newly-increased last year increased; ii. The general cashing business was developed in the electronic market, the goods payment returning to merchants increased.4. Cash received from recovering investment: decreased by RMB 2.2million over the same period of last year. The main reason was in the same period of last year, the Company reduced the shares of Shenzhen Zero-Seven Co., Ltd. held by the Company amounting to 530,000, but no such sales occurred in the report period.5. Net cash received from disposal of fixed, intangible and other long-term assets: decreased by RMB 130,000 with a decrease of 89.09% over the same period of last year. The main reasons was the amount of fixed assets disposal in the same period of last year was bigger.6. Net cash received from disposal of subsidiaries and other units: decreased by RMB 34.23 million over the same period of last year. The main reasons was in the same period of last year, the Company received the equity account on selling former subsidiaries Shenzhen SEG Communications Co., Ltd, but no such sales of subsidiary occurred in the report period.7. Cash paid for purchasing fixed, intangible and other long-term assets: increased by RMB 3.89 million with an increase of 554.49% over the same period of last year. The main reasons were: the newly-opened Changsha SEG and Mellow Orange Hotel purchased fixed assets in the report period, thus the item increased.8. Cash paid for investment: decreased by RMB 55.03 million over the same period of last year. The main reason was in the same period of last year, the Company purchased 46 percent of the equity of Changsha SEG, but no such expenditure of equity acquisition occurred in the report period.3.2 Analysis and explanation of significant events and their influence and solutions□Applicable √Inapplicable3.3 Implementations of commitments by the Company, shareholders and actual controller√Applicable □InapplicableItem of CommitmentsPromiseeContent of commitmentsImplementationCommitments on Share Merger ReformInapplicable ----Commitments on share restricted tradeInapplicable ----Commitments made in Acquisition Report or Reports on Change in EquityInapplicable ----Commitments made in MaterialAssets ReorganizationInapplicable----Commitments made in issuanceShenzhen SEG Group Co., Ltd. Article 5 of the Equity Transfer Agreement which the Company had signed with SEG Group at the time of the Company’s listing stipulated: SEG Group permits the Company, as well as its subsidiaries of theCompany and affiliated companies to use the 8 registered trademarks that SEG Group has presently registered at the StateTrademark Office; italso permits theCompany to take the aforesaid trademarks and symbols that are similar to these marks as the symbol of the Company, as well as to use the aforesaid symbols or symbols that are similar to these symbols during the operation process; the Company doesn’t have to pay SEG Group any fee for the use of the aforesaidtrademarks or symbols.In the report period, this commitmentwas still executed according to thecommitment.Other commitments (includingadditional commitments)Shenzhen SEG Group Co., Ltd. According to the problem of “Yourcompany’s existing same industry competition in theelectronic market business with SEGIn the report period, controllingshareholder abided by the above commitment.Group” pointed outby Shenzhen Securities Regulatory Bureau in 2007 at the spot investigation of the Company, the Company received written Commitment Letter from SEG Group on Sep.14, 2007 and the content was as follows: our Group has similar business in Shenzhen electronic market with Shenzhen SEG Co., Ltd. (Shenzhen SEG), and the business was resulted by history and it has objective market developmentbackground. The Group made commitment: For the future, we do not operate on the market which is similar to Shenzhen SEG singly in the same city. The aforesaid matters have been disclosed in Securities Times ,China Securities Journal and Hong Kong Wen Wei Po and Juchao Website dated Sep. 18, 2007. In the report period, the holding company observed the above commitment.3.4 Estimation of accumulative net profit from the beginning of the year to the end of next report period to be a loss probably or the warning of its material change compared with the same period of last year and explanation of its reason √Applicable □InapplicableFore-notice of performances Carry-back of lossesYear-beginning to the end of next report period The same period oflast yearChange of increase/decrease (%)Estimated amount ofaccumulative net profit(RMB’0000)Approximately 1,600.00to2,700.00-14,608.35 -- -- Basic earnings per share(RMB/Share)Approximately 0.0204 to -0.1861 -- --0.0344Explanations onfore-notice ofperformances(1) SEG Samsung in which the Company holds its equity is predicted to suffer aloss accumulatively from RMB 30 million to RMB 50 million from year-beginning toend of next report period;(2) The performance prediction has not been pre-audited by CPAs.3.5 Other significant events which need explanations3.5.1 Particulars about securities investment □Applicable √Inapplicable3.5.2 Registration form of receiving research, communication and interview in the report periodDate Place Way ObjectsDiscussed main contents andsupplied materials Jan. 6, 2010 Office of the Company Telephone communication Investors Basic information of theCompany Feb. 12, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Mar. 26, 2010 Office of the Company Telephone communication Holder of B share Basic information of theCompany Apr. 7, 2010Office of the CompanyEnquire in written formSecurities DailyGot to know relevant public information of the Company3.5.3 Explanations of other significant events √Applicable □InapplicableThe net profit attributable to owners of parent company disclosed in the 1st quarterly report 2009 was RMB 2.85 million, but that of the same period of last year disclosed in the report was RMB -88.21 million, with the change amount of RMB -91.06 million. The reason for such change was the net profit attributable to owners of parent company of SEG Samsung in which the Company holds 22.45% of its equity disclosed in the 1st quarterly report 2009 was RMB-122 million, whereas that of the same period of last year disclosed in 1st quarterly report 2010 was RMB -504 million. The Company calculated the investment gains from SEG Samsung based on equity method, which caused the investment losses of the same period of last year disclosed in this report of the Company increased by RMB 91.06 million over that disclosed in the 1st quarterly report of 2009.3.6 Particulars about derivatives investment □Applicable √Inapplicable3.6.1 Particulars about derivatives investment held at the end of report period □Applicable √Inapplicable§4. Appendix4.1 Balance sheetPrepared by Shenzhen SEG Co., Ltd. March 31, 2010 Unit: RMBBalance at period-end Balance at year-beginning Items Consolidation Parent Company Consolidation Parent Company Current assets:Monetary funds 498,955,096.86372,852,381.52485,135,270.94 375,350,393.53 SettlementprovisionslentCapitalTransactionassetfinancereceivableNotesAccounts receivable 17,234,225.88400,000.0018,130,631.40 1,134,357.47 Accounts paid in advance 20,037,842.341,081,095.0018,404,268.08 8,035,295.00 receivableInsurancereceivablesReinsuranceContract reserve ofreinsurance receivableInterest receivable 2,460,821.922,460,821.922,460,821.92 2,460,821.92Dividend receivableOther receivables 12,042,162.4945,095,461.3911,971,998.74 45,306,466.00 Purchase restituted financeassetInventories 1,919,437.275,886,392.39 Non-current asset duewithin one yearassetsOthercurrentTotal current assets 552,649,586.76421,889,759.83541,989,383.47 432,287,333.92 Non-current assets:Granted loans and advancesFinance asset available for4,229,970.093,548,500.003,843,571.87 3,304,100.00 salesHeld-to-maturityinvestmentLong-term accountreceivableLong-term equity129,274,947.39310,372,446.43119,732,099.86 300,829,598.90 investmentInvestment property 438,740,452.42345,143,558.87442,502,999.44 347,797,315.91 Fixed assets 210,589,972.7523,031,843.38189,516,718.30 23,314,450.93 Construction in progress 9,776,526.6826,192,075.55materialEngineeringDisposal of fixed assetassetbiologicalProductiveOil and gas assetIntangible assets 4,681,177.38610,581.394,756,432.31 651,865.38 Expense on Research andDevelopmentGoodwill 10,328,927.8210,328,927.82Long-term expenses to be 13,684,505.73961,414.0213,041,779.82 1,165,451.06apportionedDeferred income tax asset 7,586,398.995,994,015.937,586,398.99 5,994,015.93 assetnon-currentOtherTotal non-current asset 828,892,879.25689,662,360.02817,501,003.96 683,056,798.11 Total assets 1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 Current liabilities:Short-termloansLoan from central bankAbsorbing deposit andinter-bank depositborrowedCapitalTransaction financialliabilitiespayableNotesAccounts payable 7,716,840.382,149,017.128,225,509.02 2,178,169.12Accounts received in90,214,246.1242,701,579.41105,563,890.39 65,801,272.52 advanceSelling financial asset ofrepurchaseCommission charge andcommission payableWage payable 1,172,559.9524,450.874,261,476.99 2,065,724.98 Taxes payable 26,095,556.9526,470,386.0424,421,758.66 24,773,634.49 payableInterestDividend payable 921,420.73153,403.29921,420.73 153,403.29 Other accounts payable 95,328,850.9637,415,008.7786,454,289.91 41,932,495.62 payablesReinsuranceInsurance contract reserveagencySecurity trading ofSecurity sales of agencyNon-current liabilities duewithin 1 yearliabilitiescurrentOtherTotal current liabilities 221,449,475.09108,913,845.50229,848,345.70 136,904,700.02 Non-current liabilities:loansLong-termpayableBondspayableLong-termaccountSpecial accounts payableliabilitiesProjectedDeferred income tax liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 non-currentliabilitiesOtherTotal non-current liabilities 22,970,034.63547,125.7123,160,034.29 547,125.71 Total liabilities 244,419,509.72109,460,971.21253,008,379.99 137,451,825.73 Owner’s equity (or shareholders’equity):Paid-in capital (or sharecapital)784,799,010.00784,799,010.00784,799,010.00 784,799,010.00 Capital public reserve 409,833,425.36407,164,608.41396,922,482.95 394,348,208.41 Less: Treasury stocksReasonable reserveSurplus public reserve 102,912,835.67102,912,835.67102,912,835.67 102,912,835.67 Provision of general riskRetained profit -252,672,245.53-292,785,305.44-268,431,923.52 -304,167,747.78 Balance difference offoreign currency translation-536,479.61-542,916.63Total owner’s equity attributableto parent company1,044,336,545.891,002,091,148.641,015,659,488.47 977,892,306.30 Minority shareholders’ interests 92,786,410.4090,822,518.97Total owner’s equity 1,137,122,956.291,002,091,148.641,106,482,007.44 977,892,306.30 Total liabilities and owner’sequity1,381,542,466.011,111,552,119.851,359,490,387.43 1,115,344,132.03 4.2 Profit statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Total operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 Including: Operating income 91,307,818.0528,545,784.8967,892,989.04 28,312,781.50 InterestincomeInsurancegainedCommission charge andcommission incomeII. Total operating cost 64,748,815.0510,069,765.9037,235,307.68 6,271,611.87 Including: Operating cost 56,496,489.228,821,226.1931,746,485.69 6,224,508.93 InterestexpenseCommission charge andcommission expenseCash surrender valueNet amount of expense ofcompensationNet amount of withdrawalof insurance contract reserveBonus expense of guaranteeslipReinsuranceexpenseOperating tax and extras 3,724,614.301,652,232.843,012,887.52 1,426,154.86 Sales expenses 1,370,260.25906,378.64Administration expenses 6,914,893.783,749,113.976,753,654.36 3,527,096.41 Financial expenses -3,757,442.50-4,152,807.10-3,684,098.53 -3,406,148.33Losses of devaluation of asset -1,500,000.00-1,500,000.00Add: Changing income offair value (Loss is listed with“-”)Investment income (Loss is-3,029,152.47-3,029,152.47-115,823,698.14 -115,823,699.14 listed with “-”)Including: Investmentincome on affiliated companyand joint ventureExchange income (Loss islisted with “-”)III. Operating profit (Loss is23,529,850.5315,446,866.52-85,166,016.78 -93,782,529.51 listed with “-”)Add: Non-operating income 139,079.30300.001,620,912.10 1,486,477.57Less: Non-operating41,229.18100,985.93expenseIncluding: Disposal loss ofnon-current assetIV. Total Profit (Loss is listed23,627,700.6515,447,166.52-83,646,090.61 -92,296,051.94 with “-”)Less: Income tax 5,951,587.044,064,724.182,313,487.22 450,000.00V. Net profit (Net loss is listed17,676,113.6111,382,442.34-85,959,577.83 -92,746,051.94 with “-”)Net profit attributable to15,759,677.9911,382,442.34-88,214,473.65 -92,746,051.94 owner’s equity of parentcompanyMinority shareholders’ gains1,916,435.622,254,895.82and lossesVI. Earnings per sharei. Basic earnings per share 0.02010.0145-0.1124 -0.1182 ii. Diluted earnings per share 0.02010.0145-0.1124 -0.1182 VII. Other consolidated income 12,964,835.2412,816,400.00-574,782.68 -682,253.97 VIII. Total consolidated income 30,640,948.8524,198,842.34-86,534,360.51 -93,428,305.91 Total consolidated income28,677,057.4224,198,842.34-88,896,727.62 -93,428,305.91 attributable to owners of parentcompanyTotal consolidated income1,963,891.432,362,367.11attributable to minorityshareholders4.3 Cash flow statementPrepared by Shenzhen SEG Co., Ltd. Jan.-Mar. 2010 Unit: RMBAmount in this period Amount in last period ItemsConsolidation Parent Company Consolidation Parent Company I. Cash flows arising fromoperating activities:Cash received from selling76,838,162.928,489,484.2877,509,335.13 16,793,838.47 commodities and providinglabor servicesNet increase of customerdeposit and inter-bank depositNet increase of loan fromcentral bankNet increase of capitalborrowed from other financialinstitutionCash received fromoriginal insurance contract feeNet cash received fromreinsurance businessNet increase of insuredsavings and investmentNet increase of disposal oftransaction financial assetCash received from interest,commission charge andcommissionNet increase of capitalborrowedNet increase of returnedbusiness capitalWrite-back of tax receivedOther cash receivedrelating to operating activities64,583,939.9735,796,951.0335,621,486.09 34,108,393.77 Subtotal of cash inflowarising from operating activities141,422,102.8944,286,435.31113,130,821.22 50,902,232.24 Cash paid for purchasingcommodities and receivinglabor service34,506,524.285,428,566.4833,515,780.98 4,689,090.60Net increase of customerloans and advancesNet increase of deposits incentral bank and inter-bankCash paid for originalinsurance contractcompensationCash paid for interest,commission charge andcommissionCash paid for bonus ofguarantee slipCash paid to/for staff andworkers11,883,672.355,234,585.349,605,770.00 4,602,269.51 Taxes paid 23,601,020.7018,545,462.2824,959,921.99 18,464,019.40 Other cash paid relating tooperating activities53,590,151.5017,876,799.3431,135,749.73 14,893,005.25Subtotal of cash outflowarising from operating activities123,581,368.8347,085,413.4499,217,222.70 42,648,384.76Net cash flows arisingfrom operating activities17,840,734.06-2,798,978.1313,913,598.52 8,253,847.48II. Cash flows arising frominvesting activities:Cash received from recovering investment 2,198,720.242,198,720.24Cash received frominvestment income5,270,590.49 Net cash received from 15,444.00141,500.00。

合加资源发展股份有限公司2010年第一季度季度报告全文

合加资源发展股份有限公司2010年第一季度季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3 公司董事长文一波先生、总经理胡新灵先生、财务总监王志伟先生声明:保证年度报告中财务报告的真实、完整。

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)2,730,983,801.292,643,553,937.76 3.31%归属于上市公司股东的所有者权益(元)1,115,794,569.531,083,502,579.88 2.98%股本(股)413,356,140.00413,356,140.00 0.00%归属于上市公司股东的每股净资产(元/股) 2.70 2.62 3.05%本报告期上年同期增减变动(%)营业总收入(元)152,625,769.35122,877,087.53 24.21%归属于上市公司股东的净利润(元)32,291,989.6522,951,276.85 40.70%经营活动产生的现金流量净额(元)53,102,969.1269,479,396.82 -23.57%每股经营活动产生的现金流量净额(元/股)0.1280.168 -23.81%基本每股收益(元/股)0.080.06 33.33%稀释每股收益(元/股)0.080.06 33.33%加权平均净资产收益率(%) 2.94% 2.41% 0.53%扣除非经常性损益后的加权平均净资产收益2.92% 2.33% 0.59%率(%)非经常性损益项目年初至报告期期末金额计入当期损益的政府补助,但与公司正常经营业务密切相关,符合国家政策规定、按照一定标准250,000.00定额或定量持续享受的政府补助除外除上述各项之外的其他营业外收入和支出33,198.77少数股东权益影响额-36,477.62所得税影响额-57,388.82合计189,332.33对重要非经常性损益项目的说明无2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股报告期末股东总数(户)19,253前十名无限售条件流通股股东持股情况股东名称(全称)期末持有无限售条件流通股的数量种类北京桑德环保集团有限公司17,967,807 人民币普通股中国农业银行-信诚四季红混合型证券投资基金8,500,000 人民币普通股中国建设银行-信达澳银领先增长股票型证券投资基金5,872,348 人民币普通股海通-中行-富通银行5,533,932 人民币普通股全国社保基金六零四组合4,601,962 人民币普通股中国建设银行-华夏优势增长股票型证券投资基金4,588,162 人民币普通股中国工商银行-汇添富成长焦点股票型证券投资基金3,134,635 人民币普通股交通银行-华安策略优选股票型证券投资基金3,057,205 人民币普通股中国银行-南方高增长股票型开放式证券投资基金3,013,340 人民币普通股中国工商银行-汇添富优势精选混合型证券投资基金2,999,889 人民币普通股§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用公司2010年第一季度会计报表中相关财务指标期末数与期初数对比、期末数与上年同期数对比有大幅变动的情况分析:1、本报告期末,公司预收款项较期初数增长44.94%,主要原因为公司业务量规模增加,预收款项增加所致;2、本报告期末,公司其他应付款较期初数增长48.20%,主要原因为公司暂收往来款项增加所致;3、本报告期末,公司营业收入较上年同期增长24.21%,主要原因为报告期内公司固废业务相关工程及设备集成收入增加、水务业务收入增加所致;4、本报告期末,公司销售费用较上年同期增长104.96%,主要原因为报告期内公司业务规模的扩大相关费用增加所致;5、本报告期末,公司管理费用较上年同期增长34.90%,主要原因为报告期内公司业务量增加及相关费用支出增加所致;6、本报告期末,公司营业利润较上年同期增长43.98%,主要原因为:公司固废类业务收入增加所致;7、本报告期末,公司支付其他与经营活动有关的现金较上年同期增长99.23%,主要原因为:因业务规模的扩大支付的相关费用增加所致;8、本报告期末,经营活动产生的现金流量净额较上年同期减少23.57%,主要原因为:公司固废业务规模扩大,投入增加所致;9、投资活动产生的现金流量净额较上年同期增加78.26%,主要原因为当期公司部分在建项目的工程建设投入较上年同期减少所致;10、筹资活动产生的现金流量净额较上年同期减少124.73%,主要原因为:当期归还部分银行借款所致;11、现金及现金等价物净增加额较上年同期减少181.62%,主要原因为公司报告期筹资活动产生的现金流量净额减少及经营活动产生的现金流量净额减少所致。

2024年第一季度工作总结报告用英文

2024年第一季度工作总结报告用英文全文共3篇示例,供读者参考篇12024 Q1 Work Summary ReportIntroductionThe first quarter of 2024 has been a period of significant progress and achievement for our organization. Despite the challenges posed by the global pandemic and economic uncertainties, we have successfully navigated through them and made substantial strides towards our goals. This report aims to provide a comprehensive overview of the key accomplishments and initiatives undertaken during this period.Key Achievements1. Financial PerformanceThe financial performance of the organization in Q1 has been commendable, with revenue exceeding projections by 10%. This can be attributed to our strategic focus on expanding our customer base and diversifying our product offerings.Additionally, cost-cutting measures implemented in response to market conditions have resulted in improved profit margins.2. Market ExpansionOne of the key objectives for Q1 was to expand our market presence both domestically and internationally. We successfully launched a new marketing campaign targeting emerging markets, which has led to a 15% increase in customer acquisition. Furthermore, partnerships with key stakeholders in target regions have paved the way for future growth opportunities.3. Product DevelopmentIn Q1, we focused on enhancing our existing product lines and introducing new offerings to meet the evolving needs of our customers. The launch of a new software platform has received positive feedback from early adopters, and we are confident that it will drive revenue growth in the coming quarters. Additionally, upgrades to our manufacturing processes have resulted in improved product quality and efficiency.4. Employee EngagementInvesting in our workforce has always been a priority for us, and in Q1, we launched several initiatives to support the professional development and well-being of our employees. Thishas resulted in improved job satisfaction and productivity levels, contributing to our overall success.Challenges and OpportunitiesDespite the achievements outlined above, we also faced several challenges during Q1. Supply chain disruptions, inflationary pressures, and regulatory changes have all impacted our operations to some extent. However, we view these challenges as opportunities to learn, adapt, and grow stronger as an organization.Looking AheadAs we move into the second quarter of 2024, we remain optimistic about the future of our organization. We will continue to focus on driving innovation, expanding our market reach, and fostering a culture of continuous improvement. By leveraging our strengths and addressing our weaknesses, we are confident that we will achieve our strategic objectives and maintain our position as a market leader in the years to come.ConclusionIn conclusion, the first quarter of 2024 has been a period of growth, resilience, and progress for our organization. We are proud of the achievements we have made and grateful for thededication and hard work of our employees. As we continue on our journey towards excellence, we are excited about the opportunities that lie ahead and committed to delivering value to our customers, shareholders, and stakeholders.篇22024 First Quarter Work Summary ReportI. IntroductionIn the first quarter of 2024, our company faced a challenging business environment with volatility in the global economy, rising inflation, and supply chain disruptions. Despite these challenges, we remained resilient and focused on achieving our strategic objectives. This report summarizes the key achievements, challenges, and lessons learned during the first quarter of 2024.II. Key Achievements1. Financial Performance: Despite the challenging business environment, our company achieved a 10% increase in revenue compared to the same period last year. This growth was driven by strong sales in our core markets and successful marketing campaigns.2. Market Expansion: We successfully entered two new markets in the first quarter of 2024, expanding our geographical presence and diversifying our revenue streams. Our market research and strategic partnerships played a key role in this expansion.3. Product Innovation: Our R&D team launched two new products in the first quarter of 2024, which received positive feedback from customers and contributed to our revenue growth. These products were the result of customer feedback and market research.4. Employee Engagement: Our employee engagement survey revealed a 20% increase in overall satisfaction compared to the previous year. This was driven by our focus on employee well-being, training, and career development opportunities.III. Challenges1. Supply Chain Disruptions: The ongoing global supply chain disruptions impacted our production schedules and led to delays in product delivery. We worked closely with our suppliers to mitigate these challenges and explored alternative sourcing options.2. Inflation: Rising inflation rates in key markets increased our operating costs and impacted our profit margins. We implemented cost-saving measures and price adjustments to maintain profitability.3. Talent Acquisition: The competitive labor market made it challenging to recruit and retain top talent in key positions. We developed a comprehensive recruitment strategy and invested in employee training and development to address this challenge.IV. Lessons Learned1. Agility and Resilience: The first quarter of 2024 taught us the importance of being agile and resilient in the face of unexpected challenges. We learned to adapt quickly to changing market conditions and prioritize strategic decision-making.2. Innovation and Customer-Centricity: Our success in launching new products in the first quarter underscored the importance of innovation and customer-centricity in driving growth. We will continue to focus on customer feedback and market trends in our product development process.3. Collaboration and Communication: Effective collaboration and communication among cross-functional teams were crucial in addressing supply chain disruptions and talent acquisitionchallenges. We will continue to enhance our communication channels and teamwork.V. ConclusionDespite the challenges faced in the first quarter of 2024, our company achieved significant milestones in revenue growth, market expansion, and employee engagement. We leveraged our strengths in financial performance, product innovation, and employee satisfaction to navigate the uncertain business environment successfully. Looking ahead, we will continue to focus on our strategic objectives, drive innovation, and invest in our people to ensure long-term success. Thank you to our dedicated employees, customers, and partners for their continued support and commitment to our company's success.篇32024 First Quarter Work Summary ReportIntroductionThe first quarter of 2024 has been a challenging yet productive period for our organization. Despite facing several external challenges, we have managed to achieve significant progress towards our goals. In this report, we will provide acomprehensive overview of our accomplishments, challenges, and plans for the future.Accomplishments1. Financial Performance: We are pleased to report that our financial performance in the first quarter exceeded expectations. Our revenue increased by 15% compared to the same period last year, thanks to a successful marketing campaign and improved sales strategies.2. New Product Launch: In the first quarter, we successfully launched a new product line that has received positive feedback from customers. The innovative features and competitive pricing have helped us gain a stronger foothold in the market and attract new customers.3. Employee Development: We have continued to invest in employee development and training programs to enhance skills and promote career growth. As a result, our team members have shown increased motivation and productivity, leading to improved overall performance.Challenges1. Supply Chain Disruptions: The ongoing global supply chain disruptions have posed a significant challenge for ourorganization, resulting in delayed deliveries and increased production costs. We are actively working on finding alternative suppliers and streamlining our supply chain to mitigate these challenges.2. Market Competition: The competitive landscape in our industry has intensified, with new entrants offering similar products at lower prices. We are closely monitoring market trends and consumer preferences to adapt our strategies and stay ahead of the competition.3. Remote Work Challenges: The transition to remote work has presented communication and collaboration challenges for our team. While we have implemented virtual meeting platforms and communication tools, maintaining team cohesion and productivity remains a priority.Future Plans1. Expansion Opportunities: We are exploring opportunities for expansion into new markets and product lines to diversify our revenue streams and capture a broader customer base. Market research and feasibility studies are ongoing to identify the most promising growth areas.2. Sustainability Initiatives: As part of our commitment to corporate social responsibility, we are planning to launch sustainability initiatives to reduce our environmental impact and promote eco-friendly practices. This includes sourcing ethically produced materials and implementing energy-efficient processes.3. Employee Engagement: We will continue to prioritize employee engagement and well-being through regular feedback sessions, training programs, and recognition initiatives. Our goal is to foster a positive work culture that values teamwork, innovation, and employee satisfaction.ConclusionIn conclusion, the first quarter of 2024 has been a period of growth and resilience for our organization. Despite facing challenges, we have achieved significant milestones and positioned ourselves for future success. By leveraging our strengths, addressing areas for improvement, and staying agile in a rapidly changing market, we are confident in our ability to achieve our long-term goals. We look forward to the next quarter with optimism and determination. Thank you to our team members, customers, and stakeholders for their continued support and commitment to our shared success.。

深圳赤湾石油基地股份有限公司2010年第一季度报告全文(英文版)

SHENZHEN CHIWAN PETROLEUM SUPPLY BASE CO., LTD.THE FIRST QUARTERLY REPORT OF 2010PART ⅠImportant Notice1.1 The directors, supervisors and senior management guarantee that there are no omissions,misstatement, or misleading information in this annual report. They are responsible,individually and jointly, for the authenticity, accuracy and integrity of the information herein.1.2 The first quarterly financial report has not been audited.1.3 Mr. Han Guimao, Chairman of the Board, and Mdm. Yu Zhongxia, Deputy FinancialController, guarantee the authenticity and integrity of the financial result of this quarterlyreport.PART ⅡProfile of the Company2.1Main accounting data and financial indicatorsUnit: RMBMarch 31, 2010 December 31, 2009 Percentage of change(%)Total assets 2,568,888,132.74 2,612,490,947.33 -1.67% Total shareholders’ equity997,189,466.02 964,579,642.28 3.38% attributed to shareholders of theCompanyShares capital 230,600,000.00 230,600,000.00 0.00%Net assets per share attributed to4.32 4.18 3.35% shareholders of the CompanyFirst quarter of 2010 First quarter of 2009 Percentage of change (%)Total revenue 96,044,916.33 74,557,821.99 28.82Net profit attributed to32,609,823.74 25,576,260.03 27.50 shareholders of the CompanyNet cash flow from operating31,989,769.85 30,803,457.40 3.85 activitiesNet cash flow from operating0.14 0.13 7.69activities per shareBasic EPS 0.14 0.11 27.27 Diluted EPS 0.14 0.11 27.27Weighted average ROE 3.32% 2.85% 0.47Weighted average ROE afterdeducting non-recurring gains &losses3.33% 2.84% 0.47Items of the non-recurring gains & lossesThe amount from the beginning to the end of reportperiodDisposal of non-current assets -21,843.18 Government subsidies calculated into the profit, excludingthose government subsidies closely related to the Company’soperation and conformed the government policies.72,000.00Other non-operating revenue and expenditure excluding theabove-mentioned items39,245.00Other items of gains & losses which conform to thedefinition of non-recurring gains & losses-47,800.00Influence on income tax -14,251.10 Gains and losses on minority shareholders’ equity 18,950.00Total 46,300.72 Explanation for important items of non-recurring gains & lossesNone.2.2Total number of shareholders and the top ten tradable shareholders at the end of the periodUnit: Share Total number of shareholders 8,473The top ten tradable shareholdersName of shareholders Share Type OFFSHORE JOINT SERVICES (BASES) CO. OF SGP.PTE LTD51,180,000 B CHINA MECHANTS SECURITIES (HONGKONG) LTD 1,657,793 B GUOTAI JUNAN SECURITIES(HONGKONG)LIMITED1,190,696 BSUN LIFENG 684,870 BWU CHI LI 606,800 B MORGAN STANLEY & CO. INTERNATIONAL PLC 450,100 BPAN BO 368,400 BLI SHIJIE 315,700 B CHEN WEN 282,800 BLI YIJUN 275,110 BPART ⅢSignificant Events3.1Reasons for the big range change of main accounting data and financial indicators.√ Applicable □ Inapplicable(1) Due to the increase of revenue and the influence of clients’ payment cycle, the balance of accounts receivable at the end of report period is RMB 73,188,091.06, with an increase of 46% compared with the beginning of report period.(2) Due to the transforming of construction cost of Longquan Baowan( RMB 13.23 million)to the items of construction in process, the balance of prepayment at the end of report period is RMB1,264,387.02, with a decrease of 91% compared with the beginning of report period.(3) Due to the refund of land payment of Shenyang Baowan with the amount of RMB 13 million, the balance of other receivables at the end of report period is RMB 13,305,838.53, with a decrease of 45% compared with the beginning of report period.(4) Due to the disposal of material on hand, the inventories at the end of report period is RMB 274,342.40, with a decrease of 77% compared with the beginning of report period.(5) Due to the pay-off of bank notes, the notes payable are RMB 0, decreased by 100% compared with the balance at the beginning of report period.(6) Due to the withholding of income tax in the first quarter and the increase of income tax ratio in Shenzhen, tax payable at the end of report period is RMB 19,443,842.16, with an increase of 39% compared with the balance at the beginning of report period.(7) Tianjin Baowan and Xindu Baowan were not in operation in the same period of last year. They are in operation in this period, which results in the increase of cost. Therefore, business cost in the report period is RMB 34,385,401.47, with an increase of 35% over the same period.(8) Due to the increase of loans and interest rate, financial expense in the report period is RMB 11,957,854.87, with an increase of 38% over the same period.(9) Due to the better performance of Shenzhen Chiwan Sembawang Engineering Co., Ltd., investment income in the report period is RMB 5,716,950.85, with an increase of 63% over the same period.(10) Due to the increase of profit and income tax ratio, income tax expenses in the report period are RMB 6,539,535.93, with an increase of 60% over the same period.(11) Newly operational subsidiaries and non-operational subsidiaries do not make profit. Minor shareholders’ equity is RMB -2,128,806.07, with an increase of 114% over the same period.(12) Due to the changes of warehouse rental deposit, other cash received from business activities is RMB 739,179.29, with a decrease of 72% over the same period.(13) Due to the increase of cost caused by business increase, cash paid for purchasing of merchandise and services in the report period is RMB 11,479,321.32, with an increase of 51% over the same period.(14) Due to the changes of construction prepayment, other cash paid for business activities is RMB 9,089,959.84, with an increase of 91% over the same period.(15) Due to the dividends from Shenzhen Chiwan Offshore Petroleum Equipment Repair & Manufacture Co., Ltd in the last year’s same period, the cash of investment income in the report period is RMB 0, decreased by 100% over the same period.(16) Due to the refund of land payment of Shenyang Baowan, other cash received for investment activities is RMB 13,000,000.00, with an increase of 550% over the same period.(17) Due to the decrease of project construction and asset purchasing, cash paid for construction of fixed assets, intangible assets and other long-term assets in the report period is RMB 73,691,868.22, with a decrease of 41% over the same period.(18) Due to the decrease of financing, cash received from loans is RMB 19,184,000.00, witha decrease of 73% over the same period.3.2Significant event and its impact□Applicable √Inapplicable3.3Fulfillment of commitment by the Company, shareholders and actual controllers□Applicable √Inapplicable3.4Prediction and explanation on important changes of profit of next reporting period□Applicable √Inapplicable3.5Other significant events3.5.1 Stock investment□Applicable √Inapplicable3.5.2 Reception for the investorsAccording to relative regulations of listed company information disclosures guide issued by Shenzhen Stock Exchange and working system in management of investor relationship of the Company, the Company carried out the principles of fairness, justice and publicity when receiving interview and investigation and developing activities, guaranteed all investors enjoying right to learn the truth, other lawful rights and interests, introduced practical situation of the Company and prevented the Company from leaking information and related insider dealing. The Company has ensured the communication ways successfully for the investors and received many enquires by telephone. But there are no investors asking for visiting on the spot or submitting written questionnaires.3.5.3 Other significant events□Applicable √Inapplicable(1) There was no share additional purchase plan submitted by the shareholders with more than 30% shares.(2) In the report period, the Company did not offer funds to the controlling shareholder or its related parties or provide external guarantees in violation of the prescribed procedure.3.6 Investment of financial derivatives□Applicable √Inapplicable3.6.1 Holding position of investment of financial derivatives at the end of report period.□Applicable √InapplicablePART ⅣFirst Quarterly Financial Reports of 2010Balance SheetUnit: RMBMar 31,2010 Jan 1 ,2010 ItemsConsolidated Parent company Consolidated Parent company Current assets:Cash and cash equivalents 169,646,355.90 154,459,478.33 210,859,810.46 197,492,010.29 Notes receivableAccounts receivable 73,188,091.06 64,011,975.48 50,105,653.75 41,038,826.85 Prepayments in advance1,264,387.02 839,015.83 13,814,520.93 554,842.36 Interest receivableDividend receivable 37,040,332.44 Other receivable 13,305,838.53 519,665,217.40 24,365,238.23 434,559,141.43 Inventories 274,342.40 91,765.61 1,213,196.89 1,016,124.94 Non-current asset due in 1 yearOther current assets 704,438.14 704,438.14Total current assets 258,383,453.05 739,771,890.79 300,358,420.26 711,701,278.31 Non-current assets:Long-term accounts receivableLong-term share equity321,752,588.40 845,906,360.53 316,035,637.55 840,189,409.68 investmentInvestment Property 738,287,965.09 113,900,584.76 738,992,579.71 115,470,280.42 Fixed assets 341,825,691.74 53,870,802.99 344,463,368.24 55,336,648.49 Construction in progress 46,489,442.76 4,340,437.79 43,978,356.57 961,963.79 Construction materialDisposal of fixed assets 40,824.12 40,824.12Intangible assets 817,898,980.76 388,479,869.07 824,420,396.83 392,684,881.71 Development expendituresGoodwillLong-term expenses to beamortizedDeferred income tax assets 6,599,983.87 93,012.54 6,669,983.87 93,012.54 Other non-current assets: 37,609,202.95 37,572,204.30Total non-current assets: 2,310,504,679.69 1,406,631,891.80 2,312,132,527.07 1,404,736,196.63 Total assets: 2,568,888,132.74 2,146,403,782.59 2,612,490,947.33 2,116,437,474.94 Current liabilities:Short-term loans 124,184,000.00 124,184,000.00 124,184,000.00 124,184,000.00 Notes payable 5,961,130.38 5,961,130.38 Account payable 4,648,251.36 4,499,101.96 4,967,497.04 4,737,331.25 Received in advance 716,627.28 538,896.09Employees’ wage payable 15,426,973.27 14,228,937.91 18,352,474.25 15,631,679.30 Tax payable 19,443,842.16 14,498,058.11 13,959,807.60 9,049,340.78 Interest payable 1,531,052.35 1,531,052.35 1,499,493.84 1,499,493.84 Others payables 201,432,636.55 134,504,183.23 271,666,578.24 128,103,252.71 Non-current liability due in 1yearOther current liabilitiesTotal current liabilities 367,383,382.97 293,445,333.56 441,129,877.44 289,166,228.26 Non-current liabilities:Long-term loans 910,000,000.00 910,000,000.00 910,000,000.00 910,000,000.00 Long-term account payable 147,941,708.72 147,941,708.72Special payable 15,940,000.00 15,940,000.00Deferred income tax liabilityOther non-current liabilities 25,475,678.67 25,475,678.67 25,813,016.46 25,813,016.46 Total non-current liabilities 1,099,357,387.39 935,475,678.67 1,099,694,725.18 935,813,016.46 Total liabilities 1,466,740,770.36 1,228,921,012.23 1,540,824,602.62 1,224,979,244.72 Shareholders’ equityShare capital 230,600,000.00 230,600,000.00 230,600,000.00 230,600,000.00 Capital reserves 220,640,584.58 208,453,861.91 220,640,584.58 208,453,861.91 Less : Treasury StockSurplus reserves 196,502,748.39 196,502,748.39 196,502,748.39 196,502,748.39 undistributed profits 349,446,133.05 281,926,160.06 316,836,309.31 255,901,619.92 Difference for foreign currencytranslationTotal shareholders’ equity997,189,466.02 917,482,770.36 964,579,642.28 891,458,230.22 attributable to the parent companyMinority 104,957,896.36 107,086,702.43Total shareholders’ equity 1,102,147,362.38 917,482,770.36 1,071,666,344.71 891,458,230.22 Total Liabilities and Equities 2,568,888,132.74 2,146,403,782.59 2,612,490,947.33 2,116,437,474.94 Legal Representative: Chief financial officer:Financial manager:Income Statements (from Jan 1 to Mar 31)Unit: RMBJan 1-Mar 31,2010 Jan 1-Mar 31,2009ItemsConsolidated Parent company Consolidated Parent company I. Total business revenue 96,044,916.33 59,894,344.17 74,557,821.99 45,904,723.84 Incl. Business revenue 96,044,916.33 59,894,344.17 74,557,821.99 45,904,723.84 Interest incomeII. Total business cost 64,782,915.40 34,015,121.30 49,336,836.45 29,171,774.72 Incl. Business cost 34,385,401.47 16,032,061.65 25,494,612.29 14,050,842.13 Interest costBusiness tax and surcharge 4,429,333.50 2,486,821.55 3,444,723.17 1,900,840.60 Sales expense 183,489.01 62,300.01Administrative expense 13,826,836.55 8,052,603.16 11,757,217.58 7,665,305.85 Financial expense 11,957,854.87 7,381,334.93 8,640,283.41 5,554,786.14 Impairment loss of assetsPlus: Gains from change of fairvalue (“-” for loss)Investment income (“-” for loss) 5,716,950.85 5,716,950.85 3,506,003.37 3,506,003.37Incl. Investment income from5,716,950.85 5,716,950.85 3,506,003.37 3,506,003.37 affiliatesExchange gains(“-” for loss)III. Operational profit (“-” for loss 36,978,951.78 31,596,173.72 28,726,988.91 20,238,952.49 Plus: Non-operating income 119,245.00 91,905.00 50,373.00Less: Non-operating expenditure 77,643.18 13,067.00 102,548.77 91,130.00Incl. Loss from disposal of21,843.18 5,067non-current assetsIV. Gross profit (“-” for loss) 37,020,553.60 31,675,011.72 28,674,813.14 20,147,822.49 Less: Income tax expenses 6,539,535.93 5,650,471.58 4,094,662.47 3,328,363.83 V. Net profit (“-” for net loss) 30,481,017.67 26,024,540.14 24,580,150.67 16,819,458.66Net profit attributable to the owners32,609,823.74 26,024,540.14 25,576,260.03 16,819,458.66 of parent companyMinor shareholders’ equity -2,128,806.07 -996,109.36VI. Earnings per share::(I) Basic earnings per share 0.14 0.11 0.11 0.07(II) Diluted earnings per0.14 0.11 0.11 0.07 shareVII. Other comprehensive income 0 0 0 0VIII. Accumulated other30,481,017.67 26,024,540.14 24,580,150.67 16,819,458.66 comprehensive income(I) Accumulated other comprehensive32,609,823.74 26,024,540.14 25,576,260.03 16,819,458.66 income to the owners of parentcompany(II) Accumulated other-2,128,806.07 -996,109.36 comprehensive income to MinorshareholdersLegal Representative: Chief financial officer:Financial manager:Cash Flow StatementsUnit: RMBJan 1-Mar 31,2010 Jan 1-Mar 31,2009 ItemsConsolidated Parent company Consolidated Parent company I. Net cash flow from businessoperationCash received from sales ofproducts & providing of services 73,281,386.54 7,419,803.24 62,969,067.50 35,277,174.41 Received tax returnOther cash received for739,179.29 861,496.92 2,666,177.32 565,771.46 business activitiesSub-total of cash inflow from74,020,565.83 38,281,300.16 65,635,244.82 35,842,945.87 business activitiesCash paid for purchasing of11,479,321.32 8,498,098.70 7,608,219.73 5,715,419.78 merchandise and servicesCash paid to or for staffs 12,738,551.55 7,936,014.57 15,643,935.14 11,926,364.38 Taxes paid 8,722,963.27 3,863,767.12 6,814,485.07 3,640,274.15Other cash paid for business9,089,959.84 4,314,042.80 4,765,147.48 1,990,794.02 activitiesSub-total of cash outflow42,030,795.98 24,611,923.19 34,831,787.42 23,272,852.33 from business activitiesNet cash flow from business31,989,769.85 13,669,376.97 30,803,457.40 12,570,093.54 operationII. Cash flow from investingCash received frominvestmentsCash received from700,000.00 700,000.00 investmentNet cash received from2,227.82 2,227.82 disposal of fixed assets, intangibleassets, and other long-term assetsNet cash received fromdisposal of subsidiaries and otheroperational unitsOther cash received for13,000,000.00 29,588,344.34 2,000,000.00 19,291,243.57 investment activitiesSub-total of cash inflow due13,000,000.00 29,588,344.34 2,702,227.82 19,993,471.39 to investment activitiesCash paid for construction of73,691,868.22 72,586,792.15 124,962,392.09 123,869,806.64 fixed assets, intangible assets andother long-term assetsCash paid for investmentNet cash paid for gettingsubsidiaries and other operationalunitsOther cash paid for investment3,034,672.52 3,325,699.09 activitiesSub-total of cash outflow from73,691,868.22 75,621,464.67 124,962,392.09 127,195,505.73 investment activitiesNet cash flow from investment -60,691,868.22 -46,033,120.33 -122,260,164.27 -107,202,034.34 III. Cash flow from financingCash received frominvestmentIncl. Cash received fromminor shareholdersCash received from loans 19,184,000.00 21,027,456.90 70,000,000.00 110,000,000.00 Other cash received fro mfinancing activitiesSub-total of cash inflow from19,184,000.00 21,027,456.90 70,000,000.00 110,000,000.00 financing activitiesRepayment for debts 19,184,000.00 19,184,000.00 25,000,000.00 25,000,000.00Cash paid for dividend or12,512,069.20 12,512,069.20 11,777,858.61 11,777,858.61 interestsIncl. Dividend and profitpaid by subsidiaries to minorshareholdersOther cash paid for financingactivitiesSub-total of cash outflow31,696,069.20 31,696,069.20 36,777,858.61 36,777,858.61 from financing activitiesNet cash flow from-12,512,069.20 -10,668,612.30 33,222,141.39 73,222,141.39 financingIV. Influence of exchange rate713.01 -176.30 134.79alternation on cash and cashequivalentsV. Net increase of cash and cash-41,213,454.56 -43,032,531.96 -58,234,430.69 -21,409,799.41 equivalentsPlus: Balance of cash and210,749,810.46 197,382,010.29 131,277,928.04 80,130,914.36 cash equivalents at the beginningof termVI. Balance of cash and cash169,536,355.90 154,349,478.33 73,043,497.35 58,721,114.95 equivalents at the end of termLegal Representative: Chief financial officer:Financial manager:4.4 Audit ReportAudit opinion: Unaudited.Board of Directors ofShenzhen Chiwan Petroleum Supply Base Co., Ltd.Date: April 30, 2010。

腾讯公布2010年第一季度兼全年财务报告

未来,我们将通过提高基本社区功能和推出满足用户多样化需求的SNS应用,持续提升SNS平台的用户价值。另外,我们正在加大力度将“QQ空间”拓展至无线平台,进一步扩大其覆盖和使用范围。就“QQ秀”而言,本季度包月用户数有所增长,是由于我们推行免费体验及增加免费项目吸引新用户,并将其中部分用户转化为付费用户所致。用户黏性也因个性化功能改进和推出包年套餐而增加。

网络广告业务

2010年第一季度,我们的网络广告业务受不利的季节性因素影响,因为广告活动通常在中国春节假期期间减少。季度内,我们持续发展跨平台以及用户定位广告解决方案,以彰显我们在市场上差异化特色。展望未来,我们将提升我们作为主流及具影响力的媒体形象、加强销售组织架构和利用我们的平台实力进一步改进我们的广告产品以实现长期增长。

2010年第二季度和第三季度,我们将借2010上海世博会和世界杯加大内容投入以及广告和推广活动,以提升我们的媒体影响力和行业地位。作为此策略的一部分,我们已向中国网络电视台购入播放权以向用户诚度和黏性提升的推动,“QQ会员”用户数稳步增长,主要因为捆绑了更多增值服务以及线上和线下生活特权所致。由于SNS应用日益流行,“QQ空间”的活跃账户数比上一季度增长10.4%至第一季度末的4.280亿。

财报显示,腾讯第一季度总收入为人民币42.261亿元(6.191亿美元),比上一季度增长14.6%,比去年同期增长68.7%。公司权益持有人应占盈利为人民币17.832亿元(2.612亿美元),比上一季度增长18.3%,比去年同期增长72.2%。

2010年第一季度业绩摘要:

总收入为人民币42.261亿元(6.191亿美元),比上一季度增长14.6%,比去年同期增长68.7%。

网络游戏业务受益于有利的季节性因素,主要几款中型休闲游戏和MMOG推出资料片并在假期做推广。“QQ游戏”也受益于游戏内推广,最高同时在线账户数增至680万。

一致药业:2010年第一次临时股东大会的法律意见书 2010-02-11

北京市竞天公诚律师事务所深圳分所关于深圳一致药业股份有限公司2010年第一次临时股东大会的法律意见书致:深圳一致药业股份有限公司北京市竞天公诚律师事务所深圳分所(以下称“本所”)接受深圳一致药业股份有限公司(以下称“贵公司”)的委托,指派张清伟、黄亮律师 (以下称“本所律师”)出席了贵公司召开的2010年第一次临时股东大会(以下称“本次股东大会”),并出具法律意见书。

本所律师根据《中华人民共和国公司法》(以下称“《公司法》”)、《中华人民共和国证券法》(以下称“《证券法》)、《上市公司股东大会规则》等法律、法规和规范性文件以及《深圳一致药业股份有限公司章程》(以下称“《公司章程》”)的有关规定,出具本法律意见书。

为出具本法律意见书,本所律师审查了贵公司提供的有关召开本次股东大会相关文件的原件或影印件,包括但不限于:1、贵公司于2010年1月26日刊载的《深圳一致药业股份有限公司关于召开2010年第一次临时股东大会的通知》(以下称“《股东大会通知》”);2、贵公司于2010年1月26日刊载的《深圳一致药业股份有限公司关于收购南宁医药有限责任公司药品经营业务及对应资产和负债的公告》(以下称“《收购公告》”);3、股东名册、股东身份证明文件及授权委托书等。

本法律意见书仅作为贵公司本次股东大会公告的法定文件使用,非经本所律师书面同意不得用于其他用途。

本所律师现根据有关法律、法规及规范性文件的要求,按照律师行业公认的业务标准、道德规范和勤勉尽责的精神,对本次股东大会出具如下法律意见:一、本次股东大会的召集与召开程序(一)本次股东大会的召集根据贵公司董事会于2010年1月26日刊载的《股东大会通知》和《收购公告》,本所律师认为,贵公司本次股东大会的召集方式符合《公司法》等法律、法规及规范性文件的规定,符合《公司章程》的有关规定。

(二)本次股东大会的召开1、根据《股东大会通知》和《收购公告》,贵公司召开本次股东大会的通知已提前十五日以公告方式做出,符合《公司法》及《公司章程》的有关规定。

2010中国上市公司

· 600517 G置信 上海置信电气股份有限公司

· 600530 交大昂立 上海交大昂立股份有限公司

· 600555 G茉织华 上海九龙山股份有限公司

· 600591 G上航 上海航空股份有限公司

· 600597 光明乳业 光明乳业股份有限公司

· 600651 飞乐音响 上海飞乐音响股份有限公司

· 600652 爱使股份 上海爱使股份有限公司

· 600653 申华控股 上海申华控股股份有限公司

· 600654 G飞乐 上海飞乐股份有限公司

· 600655 豫园商城 上海豫园旅游商城股份有限公司

· 600656 *ST源药 上海华源制药股份有限公司

· 600627 上电股份 上海输配电股份有限公司

· 600628 G新世界 上海新世界股份有限公司

· 600629 *ST棱光 上海棱光实业股份有限公司

· 600630 G龙头 上海龙头(集团)股份有限公司

· 600631 G百联 上海百联集团股份有限公司

· 600632 华联商厦 上海华联商厦股份有限公司

· 600284 G浦建 上海浦东路桥建设股份有限公司

· 600315 上海家化 上海家化联合股份有限公司

· 600320 G振华 上海振华港口机械(集团)股份有限公司

· 600420 G现代 上海现代制药股份有限公司

· 600490 中科合臣 上海中科合臣股份有限公司

· 600500 G中化 中化国际(控股)股份有限公司

· 600645 *ST春花 上海望春花(集团)股份有限公司

· 600647 G同达 上海同达创业投资股份有限公司

2010年广东省企业500强排名

2010年广东省企业500强排名排序公司名称2009年营业收入(万元)1 广东电网公司21,033,7632 华为技术有限公司14,925,0003 广州汽车工业集团有限公司13,359,3624 美的集团有限公司8,657,2025 中国石油化工股份有限公司广东石油分公司8,570,7556 中国移动通信集团广东有限公司6,984,4007 华润万家有限公司6,800,0008 东风汽车有限公司东风日产乘用车公司6,435,0219 中兴通讯股份有限公司6,027,25610 广汽本田汽车有限公司5,268,77811 广东物资集团公司5,263,62912 招商银行股份有限公司5,144,60013 TCL集团股份有限公司4,428,72214 广东省广新外贸集团有限公司4,328,72415 广州铁路(集团)公司4,290,45916 中国电信股份有限公司广东分公司4,259,22117 珠海格力电器股份有限公司4,250,31818 广东省粤电集团有限公司4,072,03119 中海石油炼化有限责任公司惠州炼油分公司2,489,10720 广东省丝绸纺织集团有限公司2,389,27421 华侨城集团公司2,303,76122 广州医药集团有限公司2,278,55923 广东省广业资产经营有限公司2,101,48624 广州市建筑集团有限公司1,992,77825 广东省建筑工程集团有限公司1,928,90126 中国广东核电集团有限公司1,879,60027 深圳创维-RGB电子有限公司1,850,06728 广东省广晟资产经营有限公司1,793,90029 广东温氏食品集团有限公司1,672,25030 深圳市中金岭南有色金属股份有限公司1,308,01531 广州万宝集团有限公司1,265,35632 腾讯控股有限公司1,243,99633 深圳华强集团有限公司1,241,06034 广深铁路股份有限公司1,238,57635 广东电力发展股份有限公司1,223,47236 江门市大长江集团有限公司1,146,12137 深圳能源集团股份有限公司1,138,86738 深圳一致药业股份有限公司1,094,99439 深圳海王集团股份有限公司1,050,00040 广州发展集团有限公司1,027,61841 中国联合网络通信有限公司广东省分公司989,00942 广州汽车集团商贸有限公司976,66043 惠州市华阳集团有限公司942,77544 海信科龙电器股份有限公司936,18045 深圳市神州通投资集团有限公司907,07646 广州立白企业集团有限公司880,16947 深圳市爱施德股份有限公司875,35848 广州轻工工贸集团有限公司807,69749 佳能珠海有限公司780,99650 深圳市中汽南方投资集团有限公司776,19151 建兴光电科技(广州)有限公司760,54752 广州百货企业集团有限公司735,72353 金发科技股份有限公司711,24254 腾邦投资控股有限公司710,24355 广州岭南国际企业集团有限公司699,83556 广州有色金属集团有限公司693,28057 珠海碧辟化工有限公司675,96058 日立电梯(中国)有限公司666,68359 广州广船国际股份有限公司655,34260 广东省纺织品进出口股份有限公司622,65861 深圳市比亚迪汽车有限公司621,98262 深圳市鹏峰汽车(集团)有限公司611,44163 广州钢铁股份有限公司607,30364 中国南玻集团股份有限公司527,91065 广东海大集团股份有限公司525,04466 广东恒兴集团有限公司524,58067 华润三九医药股份有限公司485,27268 广州电气装备集团有限公司480,16169 广州无线电集团有限公司467,27570 广州市广百股份有限公司463,11071 广汽丰田发动机有限公司461,76072 广东高要河台金矿457,77873 五羊-本田摩托(广州)有限公司453,43674 深圳市赛格集团有限公司442,24075 深圳市神舟电脑股份有限公司429,96576 深圳海量存储设备有限公司412,46977 广州港集团有限公司400,97778 珠海华发实业股份有限公司400,65379 广东新协力集团有限公司398,00080 深圳市水务(集团)有限公司395,85181 中远航运股份有限公司390,15982 佛山塑料集团股份有限公司369,91383 广东生益科技股份有限公司361,88684 深圳烟草工业有限责任公司361,01985 广东天健实业集团有限公司344,50086 广东理文造纸有限公司339,89287 广东新宝电器股份有限公司339,67588 广东省五金矿产进出口集团公司338,02489 广东蓝粤能源发展有限公司331,88890 广州白云国际机场股份有限公司330,60991 中国宝安集团股份有限公司326,93992 广州大优煤炭销售有限公司323,48593 广东水电二局股份有限公司323,28794 众业达电气股份有限公司319,42595 广州轻出集团有限公司307,63896 广东省航运集团有限公司302,54897 广州佳都集团有限公司301,02998 广州友谊集团股份有限公司295,92099 广东宝丽华新能源股份有限公司294,074 100 广州市华南橡胶轮胎有限公司293,038 101 广州珠江啤酒集团有限公司292,462 102 广州恒运企业集团股份有限公司288,953 103 深圳市兆驰股份有限公司284,210 104 深圳市信利康供应链管理有限公司282,926 105 深圳市中邦(集团)建设总承包有限公司280,691 106 广州白云山制药股份有限公司279,511 107 珠海中富实业股份有限公司277,989 108 广东万家乐股份有限公司275,276 109 茂名石化实华股份有限公司271,275 110 深圳市怡亚通供应链股份有限公司264,901 111 丽珠医药集团股份有限公司259,585 112 广东塔牌集团股份有限公司259,392 113 广东省中山食品水产进出口集团有限公司258,298 114 广东新会美达锦纶股份有限公司255,436 115 广东苏宁电器有限公司248,864 116 广东东阳光铝业股份有限公司239,746 117 广东金盛卢氏集团有限公司239,287 118 深圳市康冠技术有限公司238,383119 泛海建设集团股份有限公司237,900 120 康美药业股份有限公司237,716121 佛山华新包装股份有限公司237,264 122 中国奥园地产集团236,000123 深圳市建艺装饰设计工程有限公司233,667 124 深圳市龙岗区对外经济发展有限公司232,934 125 广东汕头超声电子股份有限公司229,452 126 广州市地下铁道总公司227,565127 深圳市海普瑞药业股份有限公司222,412 128 广东格兰仕集团有限公司220,000129 广东奥马电器股份有限公司219,489130 天马微电子股份有限公司219,045 131 深圳香江控股股份有限公司216,792 132 深圳劲嘉彩印集团股份有限公司215,444 133 广东省宜华木业股份有限公司214,871 134 深圳市振业(集团)股份有限公司210,759 135 广州市宏佳伟业发展有限公司206,423 136 广东省广告股份有限公司205,024 137 中建三局装饰有限公司204,736 138 深圳市长城投资控股股份有限公司204,073 139 中粮地产(集团)股份有限公司201,354 140 广州广之旅国际旅行社股份有限公司200,680 141 深圳市同洲电子股份有限公司198,981 142 广发证券股份有限公司197,849 143 七喜控股股份有限公司197,169 144 深圳市大族激光科技股份有限公司195,037 145 广东德豪润达电气股份有限公司192,183 146 华联控股股份有限公司191,966 147 雅致集成房屋股份有限公司191,571 148 广州交通集团有限公司186,890 149 深圳南山热电股份有限公司186,783 150 深圳巴士集团股份有限公司178,901 151 中山市欧普照明股份有限公司176,081 152 中航地产股份有限公司175,174 153 广东万和新电气股份有限公司173,366 154 深圳桑菲消费通信有限公司173,351 155 深圳市百佳华百货有限公司171,595 156 佛山电器照明股份有限公司170,729 157 东莞市糖酒集团美宜佳便利店有限公司169,734 158 中航三鑫股份有限公司168,516 159 广东韶能集团股份有限公司168,322 160 广州市嘉诚国际物流有限公司167,701 161 广东风华高新科技股份有限公司166,838 162 深圳市比克电池有限公司166,559 163 广州市南菱汽车销售服务集团有限公司166,413 164 深圳市机场股份有限公司166,272 165 广东省汽车运输集团有限公司166,039 166 广州越秀水泥集团有限公司163,049 167 广东开平春晖股份有限公司160,517 168 深圳市奔达康实业有限公司160,191 169 广东精艺金属股份有限公司149,925 170 深圳市翠绿首饰股份有限公司149,296 171 李锦记(新会)食品有限公司149,079 172 广州广电运通金融电子股份有限公司148,874 173 广州毅昌科技股份有限公司148,632174 广东省水利水电第三工程局147,128 175 深圳赤湾港航股份有限公司146,543 176 中山大洋电机股份有限公司144,930 177 深圳市深装总装饰工程工业有限公司143,637 178 广东科达机电股份有限公司142,566 179 广州天马集团有限公司141,758 180 深圳市芭田生态工程股份有限公司141,734 181 中山华帝燃具股份有限公司138,587 182 广东中旅(集团)有限公司137,699 183 深圳成霖洁具股份有限公司136,764 184 广东肇庆星湖生物科技股份有限公司136,605 185 广州市中新塑料有限公司132,412 186 广东榕泰实业股份有限公司131,286 187 深圳市洪涛装饰股份有限公司131,047 188 深圳诺普信农化股份有限公司130,823 189 珠海兴业绿色建筑科技有限公司127,372 190 广东南洋电缆集团股份有限公司126,253 191 华夏银行股份有限公司深圳分行124,432 192 深圳市粤深钢投资集团有限公司124,038 193 深圳市恒波商业连锁股份有限公司123,907 194 深圳市飞亚达(集团)股份有限公司123,740 195 广州东华实业股份有限公司123,711 196 广州珠江铜厂有限公司123,481 197 广州海鸥卫浴用品股份有限公司119,954 198 7天连锁酒店集团114,100 199 广东新华粤石化股份有限公司114,032 200 深圳市九洲电器有限公司112,435 201 广东广弘控股股份有限公司202 深圳信隆实业股份有限公司203 国光电器股份有限公司204 茂名市明湖百货有限公司205 广东大顶矿业股份有限公司206 越秀交通有限公司207 广州广重企业集团有限公司208 广东新华发行集团有限公司209 广州市浪奇实业股份有限公司210 中炬高新技术实业(集团)股份有限公司211 信义汽车玻璃(深圳)有限公司212 广东德美精细化工股份有限公司213 江门市得宝集团有限公司214 广东健力宝集团有限公司215 广东省高速公路发展股份有限公司216 深圳市广聚能源股份有限公司217 深圳青岛啤酒朝日有限公司218 广东华兴玻璃有限公司219 佛山光明达不锈钢有限公司220 广东威华股份有限公司221 深圳市宇阳科技发展有限公司222 西陇化工股份有限公司223 佛山星期六鞋业股份有限公司224 深圳市德赛电池科技股份有限公司225 汕头市创美药业有限公司226 台玻华南玻璃有限公司227 广州市京龙工程机械有限公司228 广东海印永业(集团)股份有限公司229 深圳信立泰药业股份有限公司230 深圳市物业发展(集团)股份有限公司231 珠江船务发展有限公司232 中信海洋直升机股份有限公司233 广州仕邦人力资源有限公司234 广州市韶钢港务有限公司235 深圳市富安娜家居用品股份有限公司236 中交第四航务工程勘察设计院有限公司237 深圳市天地(集团)股份有限公司238 广州珠江化工集团有限公司239 广州杰赛科技股份有限公司240 东信和平智能卡股份有限公司241 深圳经济特区房地产(集团)股份有限公司242 广州麦芽有限公司243 中山公用事业集团股份有限公司244 深圳世联地产顾问股份有限公司245 广东能兴房地产开发有限公司246 东莞劲胜精密组件股份有限公司247 深圳市齐心文具股份有限公司248 联德电子(东莞)有限公司249 广州电缆厂有限公司250 汕头万顺包装材料股份有限公司251 中成进出口股份有限公司252 广州铜材厂有限公司253 深圳市美盈森环保科技股份有限公司254 鸿基地产集团股份有限公司255 广东明珠集团股份有限公司256 广东凌丰集团股份有限公司257 深圳安吉尔饮水产业集团有限公司258 深圳日海通讯技术股份有限公司259 深圳市漫步者科技股份有限公司260 广东坚朗五金制品有限公司261 蛇口南顺面粉有限公司262 佛山市汽车运输集团有限公司263 广东棕榈园林股份有限公司264 东莞市联冠实业集团有限公司265 深圳市得润电子股份有限公司266 广东日之泉集团有限公司267 深圳莱宝高科技股份有限公司268 珠海水务集团有限公司269 佛山市国星光电股份有限公司270 深圳市实益达科技股份有限公司271 广东伊立浦电器股份有限公司272 东莞市盛和化工有限公司273 广东冠豪高新技术股份有限公司274 路翔股份有限公司275 深圳市紫金支点技术股份有限公司276 广东奥飞动漫文化股份有限公司277 广州新星实业公司278 广州擎天实业有限公司279 黑牛食品股份有限公司280 广东金岭糖业集团有限公司281 精量电子(深圳)有限公司282 深圳市中惠福实业有限公司283 深圳市通产丽星股份有限公司284 广东世荣兆业股份有限公司285 广东潮宏基实业股份有限公司286 景旺电子(深圳)有限公司287 深圳市兴森快捷电路科技股份有限公司288 宇星科技发展(深圳)有限公司289 百灵时代广告有限公司290 广东万泽实业股份有限公司291 广东威创视讯科技股份有限公司292 深圳拓邦股份有限公司293 中山利堡科技有限公司294 广东众生药业股份有限公司295 深圳南顺油脂有限公司296 深圳市证通电子股份有限公司297 深圳市宝盛达实业有限公司298 深圳赛格三星股份有限公司299 广东省韶铸集团有限公司300 广州市白云泵业集团有限公司301 广东威博电器有限公司302 深圳市宇顺电子股份有限公司303 广州珠江实业开发股份有限公司304 深圳市南凌科技发展有限公司305 深圳市金洋电子股份有限公司306 深圳市科彩印务有限公司307 深圳市卓翼科技股份有限公司308 广州市商业储运公司309 广东蓉胜超微线材股份有限公司310 深圳中恒华发股份有限公司311 珠海格力电工有限公司312 广东天禾农资股份有限公司313 广州广橡企业集团有限公司314 广东鸿图科技股份有限公司315 东莞宏远工业区股份有限公司316 广东梅雁水电股份有限公司317 深圳市纺织(集团)股份有限公司318 广东雅洁五金有限公司319 江门甘蔗化工厂(集团)股份有限公司320 广东金马旅游集团股份有限公司321 广州达意隆包装机械股份有限公司322 广州柴油机厂股份有限公司323 广州海格通信集团股份有限公司324 国民技术股份有限公司325 南海发展股份有限公司326 东莞发展控股股份有限公司327 广东罗浮山国药股份有限公司328 深圳市中熙投资集团有限公司329 广东诺尔康药业有限公司330 绿景地产股份有限公司331 广东四会互感器厂有限公司332 广州御银科技股份有限公司333 深圳市豪鹏科技有限公司334 广州智光电气股份有限公司335 广州数控设备有限公司336 深圳市大富豪实业发展有限公司337 深圳市科陆电子科技股份有限公司338 深圳市特力(集团)股份有限公司339 广东省公路勘察规划设计院有限公司340 广州金鹏集团有限公司341 深圳市俊旭实业发展有限公司342 格兰达技术(深圳)有限公司343 广州广高高压电器有限公司344 茂名重力石化机械制造有限公司345 珠海经济特区富华集团股份有限公司346 广东巨轮模具股份有限公司347 深圳市沃尔核材股份有限公司348 深圳市盐田港股份有限公司349 广东金潮集团有限公司350 深圳宝通集团有限公司351 深圳市嘉旺餐饮连锁有限公司352 广东九联科技股份有限公司353 肇庆蓝带啤酒有限公司354 木林森电子有限公司355 广州南方电力集团科技发展有限公司356 大行科技(深圳)有限公司357 深圳爱商精密电子有限公司358 台山市大亨玻璃工艺有限公司359 深圳市格林美高新技术股份有限公司360 肇庆理士电源技术有限公司361 广州金邦有色合金有限公司362 佛山市顺德甘竹罐头有限公司363 深圳市新亚电子制程股份有限公司364 宜华地产股份有限公司365 广东群兴玩具股份有限公司366 广州三雅摩托车有限公司367 广东三友集团有限公司368 深圳市顺达数码资讯有限公司369 深圳市中联房地产企业发展有限公司370 深圳市深信泰丰(集团)股份有限公司371 南塑建材塑胶制品(深圳)有限公司372 佛山嘉益实业有限公司373 深圳市高新奇科技股份有限公司374 深圳市新纶科技股份有限公司375 惠州市老铭人服饰有限公司376 广东鱼珠物流基地有限公司377 珠海市乐通化工股份有限公司378 珠海世纪鼎利通信科技股份有限公司379 广州市珍奇味食品有限公司380 深圳和而泰智能控制股份有限公司381 深圳顺络电子股份有限公司382 广州市运通四方实业有限公司383 卓盈丰制衣纺织(中山)有限公司384 广东龙康医药有限公司385 广州市穗佳贸易有限公司386 广东省拱北汽车运输有限责任公司387 广东东明企业发展有限公司388 广东雪莱特光电科技股份有限公司389 深圳市彩虹精细化工股份有限公司390 深圳市英威腾电气股份有限公司391 中山大学达安基因股份有限公司392 深圳新宙邦科技股份有限公司393 深圳华生包装股份有限公司394 凯撒(中国)股份有限公司395 广东九州阳光传媒股份有限公司396 深圳达实智能股份有限公司397 深圳市惠程电气股份有限公司398 广东胜捷实业集团有限公司399 广东新美锐科技有限公司400 远光软件股份有限公司401 中山市邦太电器有限公司402 广东高乐玩具股份有限公司403 广州新穗巴士有限公司404 广东皮宝制药股份有限公司405 南方风机股份有限公司406 广东省羊城建材供应有限公司407 广州市黄振龙凉茶连锁销售有限公司408 东莞市天和商贸有限公司409 广州市四海伟业印花有限公司410 深圳华映显示科技有限公司411 深圳市银宝山新实业发展有限公司412 深圳市朗科科技股份有限公司413 深圳浩宁达仪表股份有限公司414 广东东方锆业科技股份有限公司415 深圳市华测检测技术股份有限公司416 深圳中华自行车(集团)股份有限公司417 广州市广骏旅游汽车企业集团有限公司418 东莞市凯晟灯头实业有限公司419 广州市白云化工实业有限公司420 广州交通集团出租汽车有限公司421 广东精创机械制造有限公司422 深圳市中安保实业有限公司423 安兴纸业(深圳)有限公司424 深圳天源迪科信息技术股份有限公司425 广州博创机械有限公司426 中山市美斯特实业有限公司427 港中旅(珠海)海洋温泉有限公司428 广州市绿茵阁餐饮连锁有限公司429 广州市锐丰建业灯光音响器材有限公司430 深圳市远望谷信息技术股份有限公司431 广东天龙油墨集团股份有限公司432 南方科学城发展股份有限公司433 广东星辉车模股份有限公司434 深圳市拓日新能源科技股份有限公司435 广州市东方宾馆股份有限公司436 惠州亿纬锂能股份有限公司438 深圳市赛为智能股份有限公司439 力合股份有限公司440 深圳中科智担保投资有限公司441 广东超华科技股份有限公司442 深圳市深宝实业股份有限公司443 深圳键桥通讯技术股份有限公司444 深圳市特尔佳科技股份有限公司445 广东锦龙发展股份有限公司446 广东中钰科技有限公司447 河源市中创实业有限公司448 广东省聪明人集团有限公司449 珠海欧比特控制工程股份有限公司450 广东雷伊(集团)股份有限公司451 希贵电器制造有限公司452 龙川县育茗实业发展有限公司453 新太科技股份有限公司454 深圳奥特迅电力设备股份有限公司455 广州阳普医疗科技股份有限公司456 深圳市零七股份有限公司457 深圳唯特偶新材料股份有限公司458 广州建筑工程监理有限公司459 广州珠江工程建设监理公司460 深圳市凯盛科技工程有限公司461 潮州市中天城鞋业有限公司462 广东奔朗新材料股份有限公司463 珠海市世海饲料有限公司464 广州英格发电机有限公司465 博罗先锋药业集团有限公司466 广东老百姓大药房连锁有限公司467 深圳市华鹏飞物流有限公司468 东莞市百诚鞋业有限公司469 深圳市普路通供应链管理有限公司470 深圳市东华实业(集团)有限公司471 广州丰得利实业公司472 广州珠江电信设备制造有限公司473 韶关市正星车轮有限公司474 东莞乐凯安吉皮具有限公司475 深圳市汉东玻璃机械有限公司476 普宁市绿宝佳林业发展有限公司477 深圳市美嘉美印刷有限公司478 广州同欣康体设备有限公司479 深圳宣茜电子科技有限公司480 广东欧浦钢铁物流股份有限公司482 深圳市海昌华海运有限公司483 东莞万成制药有限公司484 吉宝物流(佛山)有限公司485 天王电子(深圳)有限公司486 新华海集团有限公司487 佛山市顺德区伦教胜业电器有限公司488 珠海万力达电气股份有限公司489 珠海市鸿域注塑有限公司490 深圳市联嘉祥科技股份有限公司491 广东广咨国际工程投资顾问有限公司492 深圳中青宝互动网络股份有限公司493 深圳市银之杰科技股份有限公司494 广东嘉应制药股份有限公司495 深圳新都酒店股份有限公司496 中昌海运股份有限公司497 广东天农食品有限公司498 佛山市鲸鲨制漆科技有限公司499 新宇龙信息科技有限公司500 深圳市宝鼎威物流有限公司1 广东电网公司21,033,7632 华为技术有限公司14,925,0004 美的集团有限公司8,657,2025 中国石油化工股份有限公司广东石油分公司8,570,7556 中国移动通信集团广东有限公司6,984,4007 华润万家有限公司6,800,0008 东风汽车有限公司东风日产乘用车公司6,435,0219 中兴通讯股份有限公司6,027,25610 广汽本田汽车有限公司5,268,77812 招商银行股份有限公司5,144,60013 TCL集团股份有限公司4,428,722 16 中国电信股份有限公司广东分公司4,259,221 21 华侨城集团公司2,303,76126 中国广东核电集团有限公司1,879,60027 深圳创维-RGB电子有限公司1,850,067 30 深圳市中金岭南有色金属股份有限公司1,308,01532 腾讯控股有限公司1,243,99633 深圳华强集团有限公司1,241,06037 深圳能源集团股份有限公司1,138,86738 深圳一致药业股份有限公司1,094,99439 深圳海王集团股份有限公司1,050,000 45 深圳市神州通投资集团有限公司907,07647 深圳市爱施德股份有限公司875,35850 深圳市中汽南方投资集团有限公司776,19161 深圳市比亚迪汽车有限公司621,98262 深圳市鹏峰汽车(集团)有限公司611,44174 深圳市赛格集团有限公司442,24075 深圳市神舟电脑股份有限公司429,96576 深圳海量存储设备有限公司412,46980 深圳市水务(集团)有限公司395,85184 深圳烟草工业有限责任公司87 广东新宝电器股份有限公司339,67591 中国宝安集团股份有限公司326,939 103 深圳市兆驰股份有限公司284,210 104 深圳市信利康供应链管理有限公司282,926 105 深圳市中邦(集团)建设总承包有限公司280,691 110 深圳市怡亚通供应链股份有限公司264,901 118 深圳市康冠技术有限公司238,383123 深圳市建艺装饰设计工程有限公司233,667124 深圳市龙岗区对外经济发展有限公司232,934127 深圳市海普瑞药业股份有限公司222,412130 天马微电子股份有限公司219,045131 深圳香江控股股份有限公司216,792132 深圳劲嘉彩印集团股份有限公司215,444133 广东省宜华木业股份有限公司214,871 134 深圳市振业(集团)股份有限公司210,759 138 深圳市长城投资控股股份有限公司204,073 139 中粮地产(集团)股份有限公司201,354 141 深圳市同洲电子股份有限公司198,981 144 深圳市大族激光科技股份有限公司195,037 146 华联控股股份有限公司191,966 149 深圳南山热电股份有限公司186,783 150 深圳巴士集团股份有限公司178,901 154 深圳桑菲消费通信有限公司173,351 155 深圳市百佳华百货有限公司171,595 162 深圳市比克电池有限公司166,559 164 深圳市机场股份有限公司166,272 168 深圳市奔达康实业有限公司160,191 170 深圳市翠绿首饰股份有限公司149,296 175 深圳赤湾港航股份有限公司146,543 177 深圳市深装总装饰工程工业有限公司143,637 180 深圳市芭田生态工程股份有限公司141,734 183 深圳成霖洁具股份有限公司136,764 187 深圳市洪涛装饰股份有限公司131,047 188 深圳诺普信农化股份有限公司130,823 192 深圳市粤深钢投资集团有限公司124,038 193 深圳市恒波商业连锁股份有限公司123,907 194 深圳市飞亚达(集团)股份有限公司123,740 198 7天连锁酒店集团114,100200 深圳市九洲电器有限公司112,435202 深圳信隆实业股份有限公司216 深圳市广聚能源股份有限公司206 越秀交通有限公司203 国光电器股份有限公司217 深圳青岛啤酒朝日有限公司221 深圳市宇阳科技发展有限公司224 深圳市德赛电池科技股份有限公司229 深圳信立泰药业股份有限公司230 深圳市物业发展(集团)股份有限公司235 深圳市富安娜家居用品股份有限公司237 深圳市天地(集团)股份有限公司241 深圳经济特区房地产(集团)股份有限公司244 深圳世联地产顾问股份有限公司247 深圳市齐心文具股份有限公司253 深圳市美盈森环保科技股份有限公司257 深圳安吉尔饮水产业集团有限公司258 深圳日海通讯技术股份有限公司259 深圳市漫步者科技股份有限公司。

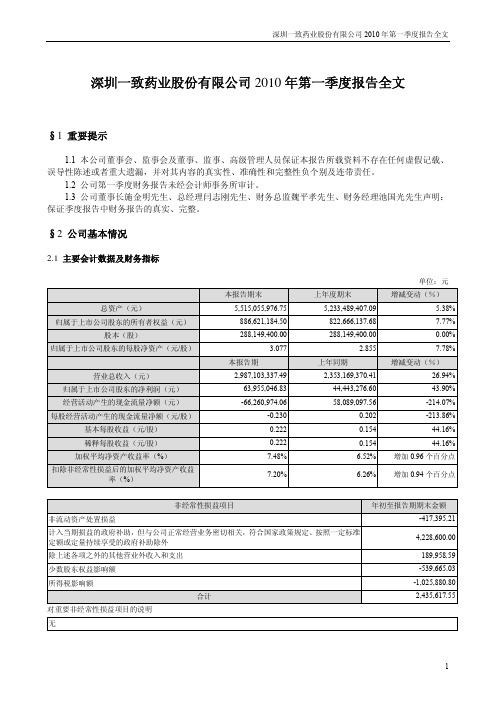

一致药业:2010年第一季度报告全文

深圳一致药业股份有限公司2010年第一季度报告全文§1 重要提示1.1 本公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性负个别及连带责任。

1.2 公司第一季度财务报告未经会计师事务所审计。

1.3公司董事长施金明先生、总经理闫志刚先生、财务总监魏平孝先生、财务经理池国光先生声明:保证季度报告中财务报告的真实、完整。

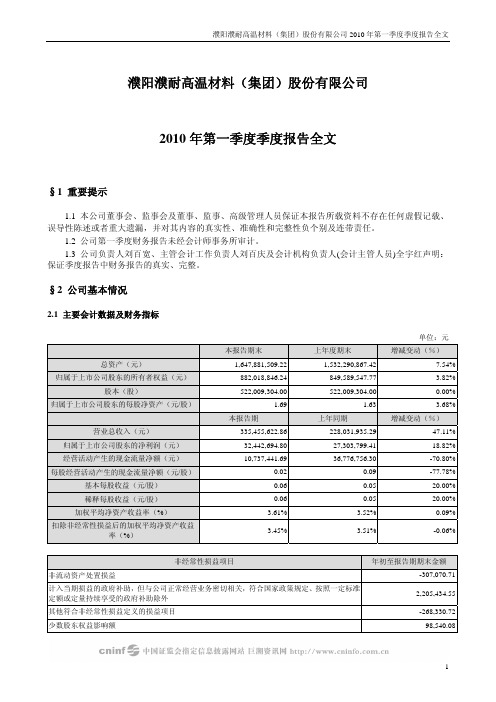

§2 公司基本情况2.1 主要会计数据及财务指标单位:元本报告期末上年度期末增减变动(%)总资产(元)5,515,055,976.75 5,233,489,407.09 5.38% 归属于上市公司股东的所有者权益(元)886,621,184.50 822,666,137.68 7.77% 股本(股)288,149,400.00 288,149,400.00 0.00% 归属于上市公司股东的每股净资产(元/股) 3.077 2.855 7.78%本报告期上年同期增减变动(%)营业总收入(元)2,987,103,337.49 2,353,169,370.41 26.94% 归属于上市公司股东的净利润(元)63,955,046.83 44,443,276.60 43.90% 经营活动产生的现金流量净额(元)-66,260,974.06 58,089,097.56 -214.07% 每股经营活动产生的现金流量净额(元/股)-0.230 0.202 -213.86% 基本每股收益(元/股)0.222 0.154 44.16% 稀释每股收益(元/股)0.222 0.154 44.16% 加权平均净资产收益率(%)7.48% 6.52% 增加0.96个百分点扣除非经常性损益后的加权平均净资产收益7.20% 6.26% 增加0.94个百分点率(%)非经常性损益项目年初至报告期期末金额非流动资产处置损益-417,395.21计入当期损益的政府补助,但与公司正常经营业务密切相关,符合国家政策规定、按照一定标准4,228,600.00 定额或定量持续享受的政府补助除外除上述各项之外的其他营业外收入和支出189,958.59 少数股东权益影响额-539,665.03 所得税影响额-1,025,880.80合计2,435,617.55 对重要非经常性损益项目的说明无2.2 报告期末股东总人数及前十名无限售条件股东持股情况表单位:股报告期末股东总数(户)13,126前十名无限售条件流通股股东持股情况股东名称(全称)期末持有无限售条件流通股的数量种类国药控股股份有限公司110,459,748 人民币普通股HTHK/CMG FSGUFP-CMG FIRST STA TE7,032,720 境内上市外资股CHINA GROWTH FD中国农业银行-长城安心回报混合型证券投7,000,000 人民币普通股资基金中国银行-富兰克林国海潜力组合股票型证5,991,764 人民币普通股券投资基金中国工商银行-中银持续增长股票型证券投5,434,455 人民币普通股资基金中国工商银行-广发聚丰股票型证券投资基5,270,015 人民币普通股金中国工商银行-博时精选股票证券投资基金4,963,365 人民币普通股中国农业银行-富兰克林国海弹性市值股票4,949,136 人民币普通股型证券投资基金中国银行-嘉实稳健开放式证券投资基金4,019,814 人民币普通股交通银行-华安策略优选股票型证券投资基4,002,783 人民币普通股金§3 重要事项3.1 公司主要会计报表项目、财务指标大幅度变动的情况及原因√适用□不适用1、本期末预付款项比期初增加2,811万元。

投中报告

投中报告:ChinaVenture 2010年第一季度中国创业投资市场统计分析报告发布时间:2010-5-26 来源:ChinaVenture 作者:Frank 浏览次数:2741 关键发现共披露投资案例56 起,投资金额11.03 亿美元,投资案例数量和投资金额环比均出现不同程度下降。

平均单笔投资金额1970 万美元,环比大幅上升。

行业投资集中度同比略有上升。

互联网、IT 和制造业三个投资案例数量最多的行业,投资案例数量之和占总数量比例近60%互联网行业投资案例数量14 起,投资金额1.64 亿美元,投资案例数量居各行业首位。

发展期投资案例数量36 起,投资案例数量最多。

Series A 投资案例数量仍占据市场主要份额,投资案例数量共41 起,投资金额8.07亿美元。

北京投资案例数量居各地区首位,投资案例数量为24 起,投资金额3.13 亿美元。

外资投资案例数量占比回升,外资投资机构及外资LP 已从金融危机的阴霾中逐步恢复。

1. 2010 年第一季度中国创业投资市场综述2010 年第一季度投资案例数量和投资金额环比出现不同程度下降。

一季度共披露投资案例56 起,投资金额11.03 亿美元,平均单笔投资金额1970 万美元。

从行业角度分析,中国创投市场行业投资集中度同比略有上升。

互联网、IT 和制造业三个投资案例数量最多的行业,投资案例数量之和占总数量比例近60%。

这一数字与2009年同期相比,上升了5 个百分点。

其中,互联网行业投资案例数量14 起,居各行业首位。

从投资阶段角度分析,中国创投市场发展期投资案例数量最多。

其中,披露发展期投资案例数量36 起,环比下降47.8%;投资金额为11.03 亿美元,环比上升28.1%。

扩张期投资案例数量17 起,环比下降56.4%;投资金额为8.50 亿美元,同比上升213.4%。

从投资轮次角度分析,Series A 投资仍是市场主流。

其中,Series A 投资案例数量共41 起,投资金额8.07 亿美元。

2010年医药行业工业企业前100位快报排名

62

阿斯利康制药有限公司

63

江中药业股份有限公司

64

北京同仁堂健康药业股份有限公司

65

联邦制药(内蒙古)有限公司

66

北京同仁堂股份有限公司

67

海南养生堂有限公司

68

西安杨森制药有限公司

69

桂林三金药业股份有限公司

70

山东绿叶制药有限公司

71

北大国际医院集团西南合成制药股份有限公司

99

黑龙江江世药业有限公司

100

成都蓉生药业有限责任公司

48

美罗药业股份有限公司

49

江中药业股份有限公司

50

吉林紫鑫药业股份有限公司

51

贵州百灵企业集团制药股份有限公司

52

大冢(中国)投资有限公司

53

浙江尖峰药业有限公司

54

湖北成田制药股份有限公司

55

宁夏启元药业有限公司

56

山西威奇达药业有限公司

57

78

江苏亚邦药业集团股份有限公司

79

广州王老吉药业股份有限公司

80

江苏奥赛康药业有限公司

81

重庆药友制药有限责任公司

82

深圳市海王生物工程股份有限公司

83

四川蜀中制药有限公司

84

浙江仙琚制药股份有限公司

85

联邦制药(内蒙古)有限公司

86

江苏苏中药业集团股份有限公司

33

珠海联邦制药股份有限公司

34

江苏江山制药有限公司

35

方 大B:2011年第一季度报告正文(英文版) 2011-04-22