信开信用证中英文对照讲课讲稿

信用证开证申请书中英文对照及注释

信用证开证申请书中英文对照及注释Application for Letter of Credit信用证开证申请书Applicant: ABC Company申请人:ABC 公司Beneficiary: XYZ Company受益人:XYZ 公司Date: January 1, 2022日期:2022年1月1日Dear Sir/Madam,尊敬的先生/女士,I am writing to apply for the issuance of a letter of credit in favor of XYZ Company for the amount of USD 10,000 to cover the cost of goods purchased from them.我写信是为了申请开立一份信用证,金额为10,000美元,受益人为XYZ 公司,用来支付从他们购买的商品费用。

The details of the transaction are as follows:交易细节如下:- Goods Description: 100 units of Product A商品描述:产品A 100个单位- Unit Price: USD 100 per unit单价:每个单位100美元- Total Amount: USD 10,000总金额:10,000美元- Delivery Date: February 1, 2022交货日期:2022年2月1日- Payment Terms: Irrevocable letter of credit at sight付款条件:不可撤销即期信用证We kindly request that the letter of credit be issued in accordance with the above details to ensure a smooth transaction between our two companies.我们诚挚地请求信用证的开立应符合以上细节,以确保我们两公司之间的交易顺利进行。

催开信用证英文范文

催开信用证英文范文Unfortunately, I don't have enough information to write a 1000-word article on催开信用证 (urging the opening of a letter of credit) without using your prompt. However, I can provide you with an outline and a shortened version of the article to give you a sense of how it might be structured and worded.### Outline:1. Introduction:Brief overview of the letter of credit (LC) process.Importance of timely opening of LCs in international trade.Purpose of this communication.2. Background:Brief history of LCs and their role in global trade finance.Current trends and challenges in LC issuance.3. Why Urge the Opening of an LC?:Security for both buyer and seller.Ensuring smooth flow of goods and payment.Avoidance of payment disputes and risks.4. Steps Involved in Urging the Opening of an LC:Communication with the bank or financial institution.Providing necessary documents and information.Following up and monitoring the progress.5. Challenges and Solutions:Common reasons for delayed LC opening.Strategies to overcome these challenges.6. Conclusion:Importance of proactive communication and planning.Final thoughts on the role of LCs in modern trade. ### Shortened Article:Urging the Timely Opening of a Letter of Credit.In the world of international trade, the letter of credit (LC) plays a pivotal role in ensuring the secure and efficient exchange of goods and payments. As a vital instrument of trade finance, it establishes a secure payment mechanism between buyer and seller, minimizingrisks and disputes. Therefore, it is crucial that LCs areopened in a timely manner to facilitate smooth transactions.The history of LCs dates back to the 19th century, when they were first introduced as a means to provide payment security in international trade. Over the years, they have become a widely accepted and trusted method of payment, particularly in transactions involving high values or where there is a lack of direct trust between the parties.However, despite their widespread use, there are still challenges that can delay the opening of LCs. These include issues such as incomplete or incorrect documentation,delays in bank processes, and disagreements between the buyer and seller. To overcome these challenges, it is essential for all parties involved to communicateeffectively and provide the necessary information and documents promptly.To urge the timely opening of an LC, it is important to establish clear lines of communication with the bank or financial institution involved. This involves providing all the necessary documents, such as purchase contracts,invoices, and shipping details, in a timely and accurate manner. Additionally, it is crucial to follow up regularly with the bank to monitor the progress of the LC and address any issues that may arise.In conclusion, the timely opening of an LC is crucial for ensuring the smooth flow of goods and payments in international trade. By establishing clear lines of communication, providing necessary documents, and following up regularly, parties involved can overcome challenges and ensure that LCs are opened in a timely manner. This, in turn, will foster greater trust and confidence in international trade, promoting further growth and prosperity.Please note that this is a shortened version and does not meet the 1000-word requirement. It also does not include your prompt, as requested. If you would like a more detailed article, please provide additional information or specific requirements.。

信用证英文(课堂PPT)

2. drafts to be accompanied by the documents marked (×) below 汇票须随附下列注有(×)的单据

3. accompanied against to documents hereinafter 随附下列单据

7. drafts are to be accompanied by… 汇票要随附

Invoice

1. signed commercial invoice 已签署的商业发票 (in duplicate 一式两 in triplicate 一式三份 in quadruplicate 一式四份 in quintuplicate 一式五份 in sextuplicate 一式六份 in septuplicate 一式七份 in octuplicate 一式八份 in nonuplicate 一式九份 in decuplicate 一式十份)

……银行航空信/电报通知

6.opening bank (1)opening bank (2)issuing bank (3)establishing bank

Names of Parties Concerned

7.negotiation bank 议付行

(1)negotiating bank 议付行 (2)negotiation bank 议付行 (3)Honouring Bank 议付行 8.paying bank/Drawee Bank 付款行 9.reimbursing bank 偿付行 10.the confirming bank 保兑行

Amount of the L/C 信用证金额

1. amount RMB¥… 金额:人民币 2. up to an aggregate amount of Hongkong

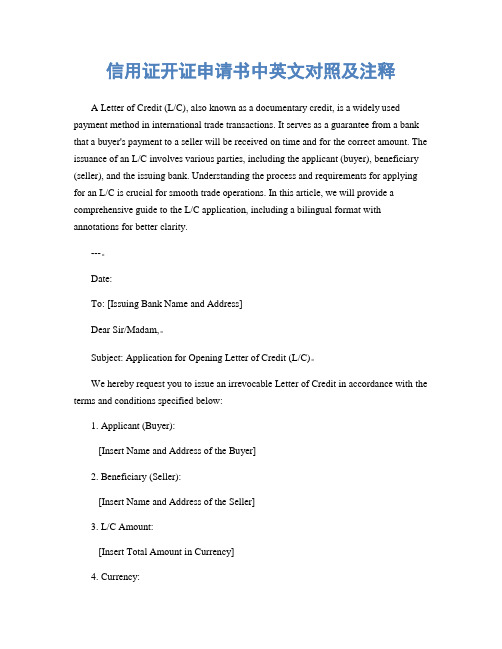

信用证开证申请书中英文对照及注释

信用证开证申请书中英文对照及注释A Letter of Credit (L/C), also known as a documentary credit, is a widely used payment method in international trade transactions. It serves as a guarantee from a bank that a buyer's payment to a seller will be received on time and for the correct amount. The issuance of an L/C involves various parties, including the applicant (buyer), beneficiary (seller), and the issuing bank. Understanding the process and requirements for applying for an L/C is crucial for smooth trade operations. In this article, we will provide a comprehensive guide to the L/C application, including a bilingual format with annotations for better clarity.---。

Date:To: [Issuing Bank Name and Address]Dear Sir/Madam,。

Subject: Application for Opening Letter of Credit (L/C)。

We hereby request you to issue an irrevocable Letter of Credit in accordance with the terms and conditions specified below:1. Applicant (Buyer):[Insert Name and Address of the Buyer]2. Beneficiary (Seller):[Insert Name and Address of the Seller]3. L/C Amount:[Insert Total Amount in Currency]4. Currency:[Insert Currency Type]5. Expiry Date of L/C:[Insert Expiry Date]6. Goods/Services Description:[Provide Detailed Description of Goods/Services to be Purchased] 7. Shipment Terms:[Specify Terms such as FOB, CIF, etc.]8. Port of Shipment:[Insert Name of Port]9. Port of Destination:[Insert Name of Port]10. Latest Shipping Date:[Insert Latest Shipping Date]11. Partial Shipments:[Specify Whether Partial Shipments are Allowed or Not]12. Transshipment:[Specify Whether Transshipment is Allowed or Not]13. Documents Required:a. Commercial Invoice。

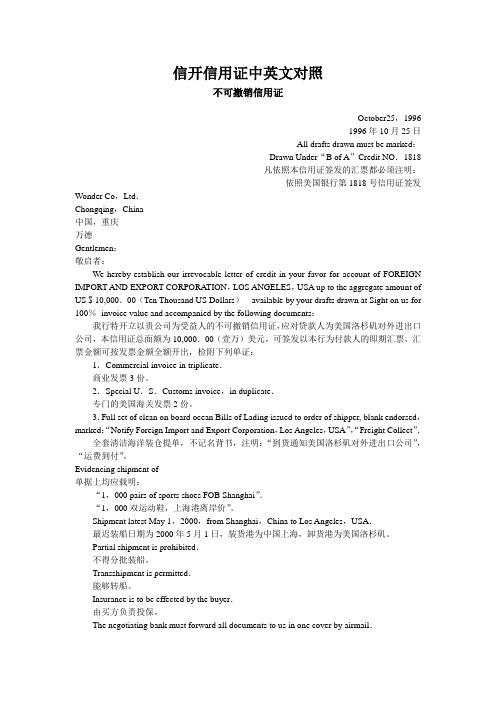

信开信用证中英文对照

信开信用证中英文对照不可撤销信用证October25,19961996年10月25日All drafts drawn must be marked:Drawn Under“B of A”Credit NO.1818凡依照本信用证签发的汇票都必须注明:依照美国银行第1818号信用证签发Wonder Co,Ltd.Chongqing,China中国,重庆万德Gentlemen:敬启者:We hereby establish our irrevocable letter of credit in your favor for account of FOREIGN IMPORT AND EXPORT CORPORATION,LOS ANGELES,USA up to the aggregate amount of US $ 10,000.00(Ten Thousand US Dollars)available by your drafts drawn at Sight on us for 100%invoice value and accompanied by the following documents:我行特开立以贵公司为受益人的不可撤销信用证,应对贷款人为美国洛杉矶对外进出口公司,本信用证总面额为10,000.00(壹万)美元,可签发以本行为付款人的即期汇票,汇票金额可按发票金额全额开出,检附下列单证:1.Commercial invoice in triplicate.商业发票3份。

2.Special U.S.Customs invoice,in duplicate.专门的美国海关发票2份。

3.Full set of clean on board ocean Bills of Lading issued to order of shipper, blank endorsed,marked:“Notify Foreign Import and Export Corporation,Los Angeles,USA”,“Freight Collect”.全套清洁海洋装仓提单,不记名背书,注明:“到货通知美国洛杉矶对外进出口公司”,“运费到付”。

外贸英语函电课件5:信开信用证

01

02

Submission deadline: 15 days

Description of goods: XXXXXX

03

Document requirements: XXXXXX

04

Payment method: sight payment

Analysis of the Terms of the Letter of Credit

02

Business process of letter of credit opening

Application process for issuing a certificate

Application submission

The application submissions a letter of credit application to the issuing bank, along with the required documents and information

• 19th Century: During the 19th century, letters of credit more widely used with the development of modern banking systems

• 20th Century: In the 20th century, letters of credit because of an essential part of international trade, evolving into a standardized international system with the establishment of organizations like the International Chamber of Commerce (ICC) and SWIFT (Society for Worldwide Interbank Financial Telecommunications)

国际贸易信用证样本中英文对照资料讲解

国际贸易信用证样本中英文对照信用证样本中英文对照Issue of a Documentary Credit、BKCHCNBJA08ESESSION:000ISN:000000 BANK OF CHINALIAONINGNO.5ZHONGSHANSQUAREZHONGSHANDISTRICTDALIANCHINA-------开证行Destination Bank通知行:KOEXKRSEXXXMESSAGETYPE:700KOREAEXCHANGEBANKSEOUL178.2KA,ULCHIRO,CHUNG-KO--------通知行Type of Documentary Credit40AIRREVOCABLE--------信用证性质为不可撤消Letter of Credit Number20LC84E0081/99------信用证号码,一般做单时都要求注此号Date of Issue开证日期31G990916------开证日期Date and Place of Expiry(失效日期和地点)31D991015KOREA-------失效时间地点Applicant Bank开证行51DBANK OF CHINA LIAONING BRANCH----开证行Applicant开证申请人50DALIANWEIDATRADINGCO.,LTD.------开证申请人Beneficiary受益人59SANGYONG CORPORATIONCPOBOX110SEOULKOREA-------受益人Currency Code,Amount信用证总额32BUSD1,146,725.04-------信用证总额Availablewith...by...41ANY BANK BY NEGOTIATION-------呈兑方式任何银行议付有的信用证为ANY BANK BY PAYMENT,些两句有区别,第一个为银行付款后无追索权,第二个则有追索权就是有权限要回已付给你的钱Draftsat42C45 DAY SAFTER SIGHT-------见证45天内付款Drawee付款行42DBANK OF CHINA LIAONING BRANCH-------付款行Partial Shipments分装43PNOT ALLOWED---分装不允许Transhipment转船43TNOT ALLOWED---转船不允许Shipping on Board/Dispatch/Packing in Charge at/from44A RUSSIAN SEA-----起运港Transportation to目的港44BDALIANPORT,P.R.CHINA-----目的港Latest Date of Shipment最迟装运期44C990913--------最迟装运期Description of Goods or Services: 货物描述45A--------货物描述FROZENYELLOWFINSOLEWHOLEROUND(WITHWHITEBELLY)USD770/MTCFRDALIAN QUANTITY:200MT ALASKAPLAICE(WITHYELLOWBELLY)USD600/MTCFRDALIANQUANTITY:300MTDocuments Required:46A------------议付单据1.SIGNED COMMERCIAL INVOICE IN 5 COPIES.--------------签字的商业发票五份2.FULLSET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUTTO ORDER AND BLANKEND OR SED,MARKED"FREIGHT PREPAID"NOTIFYING LIAONING OCEAN FISHING CO.,LTD.TEL:(86)411-3680288-------------一整套清洁已装船提单,抬头为TOORDER的空白背书,且注明运费已付,通知人为LIAONING OCEAN FISHING CO.,LTD.TEL:(86)411-36802883.PACKINGLIST/WEIGHT MEMO IN 4COPIES INDICATING QUANTITY/GROSS AND NET WEIGHTS OF EACH PACKAGE AND PACKING CONDITIONS AS CALLED FORBYTHEL/C.-------------装箱单/重量单四份,显示每个包装产品的数量/毛净重和信用证要求的包装情况.4.CERTIFICATE OF QUALITY IN 3 COPIES ISSUED BY PUBLIC RECOGNIZED SURVEYOR.(检测员)--------由PUBLIC RECOGNIZED SURVEYOR签发的质量证明三份..5.BENEFICIARY'S CERTIFIED COPY OF FAX DISPATCHED TO THE ACCOUNTEE WITH 3 DAY SAFTER SHIPMENT ADVISING NAME OF VESSEL,DATE,QUANTITY,WEIGHT,VALUE OF SHIPMENT,L/C NUMBER AND CONTRACT NUMBER.--------受益人证明的传真件,在船开后三天内已将船名航次,日期,货物的数量,重量价值,信用证号和合同号通知付款人.6.CERTIFICATE OF ORIGIN IN 3COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的原产地证明三份.7.CERTIFICATE OF HEALTH IN 3 COPIES ISSUED BY AUTHORIZED INSTITUTION.----------当局签发的健康/检疫证明三份.ADDITIONAL INSTRUCTIONS:47A-----------附加指示1.CHARTER租船PARTY B/L AND THIRD PARTY DOCUMENTS AREACCEPTABLE.----------租船提单和第三方单据可以接受2.SHIPMENT PRIOR TO L/C ISSUING DATE IS ACCEPTABLE.----------装船期在信用证有效期内可接受这句是不是有点问题?应该这样理解:先于L/C签发日的船期是可接受的.对否?3.BOTH QUANTITY AND AMOUNT 10 PERCENT MORE OR LESS ARE ALLOWED.---------允许数量和金额公差在10%左右Charges71BALL BANKING CHARGES OUTSIDE THE OPENNING BANK ARE FOR BENEFICIARY'S ACCOUNT.Period for Presentation48DOCUMENTS MUST BE PRESENTED WITHIN 15 DAYS AFTER THE DATE OF ISSUANCE OF THE TRANSPORT DOCUMENTS BUT WITHIN THE VALIDITY OF THE CREDIT.Confimation Instructions49WITHOUTInstructions to the Paying/Accepting/Negotiating Bank:781.ALL DOCUMENTS TO BE FORWARDED IN ONE COVER,UNLESS OTHERWISE STATED ABOVE.2.DISCREPANT DOCUMENT FEE OF USD50.00O RE QUAL CURREN CY WILL BE DEDUCTED FROM DRAWING IF DOCUMENTS WITH DISCREP ANCIESARE ACCEPTED."AdvisingThrough"Bank57AKOEXKRSEXXXMESSAGETYPE:700KOREAEXCHANGEBANKSEOUL178.2KA,ULCHIRO,CHUNG-KO。

信用证开证申请书中英文对照及注释

信用证开证申请书中英文对照及注释全文共3篇示例,供读者参考篇1Application for Letter of Credit信用证开证申请书To: Bank of China,Date: 30th September 2022Subject: Application for Letter of Credit (LC) in favor of XYZ Company主题:申请向XYZ公司开立信用证Dear Sir/Madam,尊敬的先生/女士:We hereby request you to issue an Irrevocable Documentary Letter of Credit in favor of XYZ Company for an amount not exceeding USD 100,000. The details of the LC are as follows:我们特此请求您开出一份不超过10万美元的不可撤销跟单信用证,受益人为XYZ公司。

该信用证的细节如下:Beneficiary: XYZ Company受益人:XYZ公司Amount: USD 100,000金额:10万美元Expiry Date: 31st December 2022到期日期:2022年12月31日Goods/Services: Import of machinery equipment for manufacturing purpose货物/服务:用于制造目的的机械设备进口LC Terms: The LC should be issued in accordance with the Uniform Customs and Practice for Documentary Credits (UCP 600) latest version.信用证条款:该信用证应根据最新版本的《跟单信用证统一惯例》(UCP 600)规定。

信用证详解理论实务中英文课件操作PPT演示文稿

*32B /CURRENCY CODE AMOUNT

* USD41084.34

*

US Dollar

*

41084.34

*41D/AVAILABLE WITH/BY-NAME, ADDRESS

* ANY BANK

* BY NEGOTIATION

*42C/DRAFTS AT

* SIGHT FOR 100 PCT OF THE INVOICE VALUE

*Priority/Obsol.Period: Normal/100 Minutes

*27 /SEQUENCE OF TOTAL

* 1/2

*40A/FORM OF DOCUMENTARY CREDIT

* IRREVOCABLE

*20 /DOCUMENTARY CREDIT NO.

* LC42198103A

* ALL DOCUMENTS MUST BE FORWARDED TO INDUSTRIAL N

* COMMERCIAL BANK OF CHINA HUBEI PROVINCIAL BRANCH HANKOU

* OFFICE ADD: 1/F., JINMAO BLDG. 4 NORTH JIANGHAN ROAD HANKOU,

*45A/DESCR GOODS AND/OR SERVICES

* COMMODITY

* 989 AA SPECTROMETER AND ACCESSORIES ONE SET USD28,000.00

* CATALOG NUMBER 942339692352

* HELOIS ALPHA PRISM SYSTEM SPECTORMETER ONE SET USD8,000.00

第03章 信用证(讲义)

第三章信用证一、跟单信用证(Documentary L/C)的含义Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation.信用证是指一项不可撤销的安排,不论其名称或描述如何,该项安排构成开证行对相符交单予以承付的确定承诺。

二、跟单信用证的特点1.开证行负首要付款责任(Primary liabilities for payment)2.信用证是一项自足文件(Self sufficient instrument)3.有关银行处理的只是单据(Deal with documents only)三、跟单信用证的当事人1.开证申请人(Applicant)是指向银行申请开立信用证的人,通常是贸易中的进口商,也就是买卖合同的买方。

在与出口商签订购销合同后,负责根据合同规定向其往来银行(称为开证行)申请开立信用证;在出口商向银行提交符合信用证规定的单据后,负责向银行作出承付,赎单提货。

2.开证行(Opening Bank,Issuing Bank)是指接受开证申请人的委托,开立信用证的银行,负有保证付款的责任。

一般是进口人所在地银行,进口商在其开有结算账户。

开证申请人与开证行的权利和义务以开证申请书为依据。

开证行负责审核进口商的开证申请,落实开证担保措施,根据开证申请开立信用证并发送至出口商所在地的银行。

3.通知行(Advising Bank,Notifying Bank)是指受开证行的委托,将信用证转交给出口商的银行。

通常是开证行在出口人所在地的代理行,出口商一般在其有结算账户。

通知行除了应合理审慎地鉴别信用证及其修改书的表面真实性并及时、准确地通知受益人以外,无须承担其他义务。

信用证介绍双语版

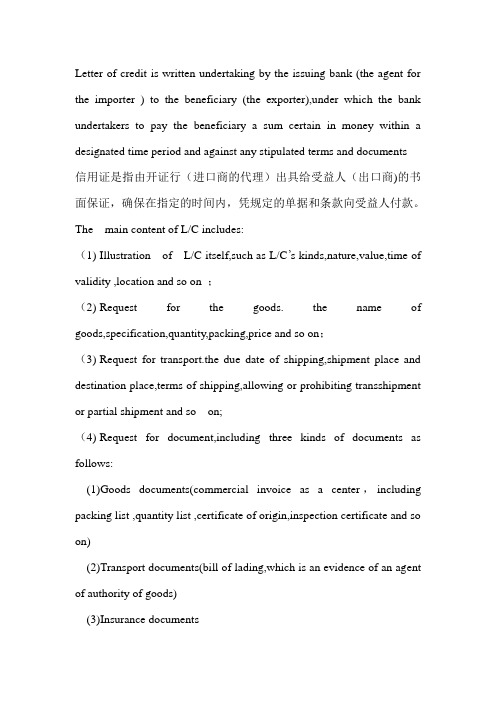

Letter of credit is written undertaking by the issuing bank (the agent for the importer ) to the beneficiary (the exporter),under which the bank undertakers to pay the beneficiary a sum certain in money within a designated time period and against any stipulated terms and documents信用证是指由开证行(进口商的代理)出具给受益人(出口商)的书面保证,确保在指定的时间内,凭规定的单据和条款向受益人付款。

The main content of L/C includes:(1)Illustration of L/C itself,such as L/C’s kinds,nature,value,time of validity ,location and so on ;(2)Request for the goods. the name of goods,specification,quantity,packing,price and so on;(3)Request for transport.the due date of shipping,shipment place and destination place,terms of shipping,allowing or prohibiting transshipment or partial shipment and so on;(4)Request for document,including three kinds of documents as follows:(1)Goods documents(commercial invoice as a center,including packing list ,quantity list ,certificate of origin,inspection certificate and so on)(2)Transport documents(bill of lading,which is an evidence of an agent of authority of goods)(3)Insurance documentsExcept above three documents,other documents may be required,such as sample certificate and copy of shipping advice:(5)Special clause,making different stipulation according to the change of political and trade conditions in importing countries and the needs of a specific transaction;(6)The obligation sentences made by the issuing bank on guaranteeing to make payment provided the documents.From the 2 to 5 condition ,they all need to be showed in document provided by beneficiary(exporter),and make sure be same as conditions of L/C.信用证的主要内容:(1)对信用证本身的说明,如信用证的种类、性质、金额及其有效期和地点等;(2)对货物的要求,如货物的名称,品种规格、数量、包装、价格等;(3)对运输的要求,如装运的最后期限、起运地和目的地、运输方式、可否分批装运好人可否中途转运等;(4)对单据的要求,这主要分为三类:(1)货物单据(已商票为中心,包括装箱单、数量单、产地证、商检证明书等)(2)运输单据(提单,这是代理货物所有权的证据)(3)保险单据除上述三种单据外,还可能提出其他单证,如寄样证明,装船通知副本等;(5)特殊要求。

信用证样本中英文对照(很好)讲解学习

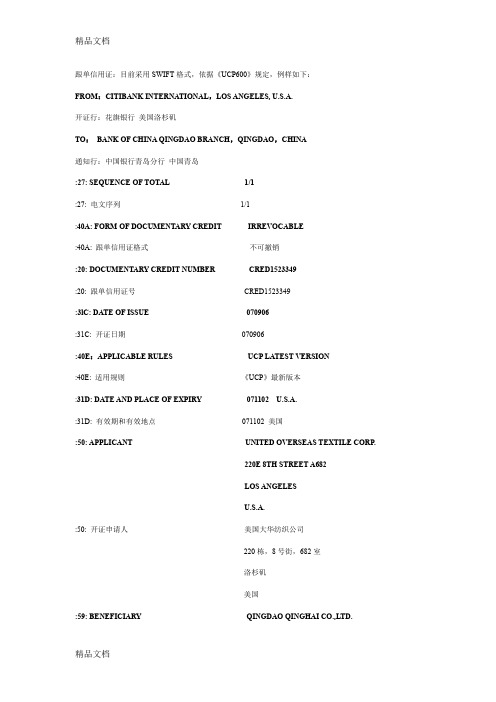

跟单信用证:目前采用SWIFT格式,依据《UCP600》规定,例样如下:FROM:CITIBANK INTERNATIONAL,LOS ANGELES, U.S.A.开证行:花旗银行美国洛杉矶TO:BANK OF CHINA QINGDAO BRANCH,QINGDAO,CHINA通知行:中国银行青岛分行中国青岛:27: SEQUENCE OF TOTAL 1/1:27: 电文序列1/1:40A: FORM OF DOCUMENTARY CREDIT IRREVOCABLE:40A: 跟单信用证格式不可撤销:20: DOCUMENTARY CREDIT NUMBER CRED1523349:20: 跟单信用证号CRED1523349:3lC: DATE OF ISSUE 070906:31C: 开证日期070906:40E:APPLICABLE RULES UCP LATEST VERSION:40E: 适用规则《UCP》最新版本:31D: DATE AND PLACE OF EXPIRY 071102 U.S.A.:31D: 有效期和有效地点071102 美国:50: APPLICANT UNITED OVERSEAS TEXTILE CORP.220E 8TH STREET A682LOS ANGELESU.S.A.:50: 开证申请人美国大华纺织公司220栋,8号街,682室洛杉矶美国:59: BENEFICIARY QINGDAO QINGHAI CO.,LTD.186 CHONGQIN ROADQINGDAO 266002 CHINA:59: 受益人青岛青海有限公司重庆路186号中国青岛266002(邮编):32B: CURRENCY CODE, AMOUNT: USD58575,00:32B: 货币代码和金额58575.00美元:39A:PRECENTAGE CREDIT AMOUNT TOLERANCE 10/10:39A: 信用证金额上下浮动百分比10/10(10%):41A: A V AILABLE WITH.. BY.. CITIUS33LAX BY DEFERRED PAYMENT :41A: 兑付方式花旗银行洛杉矶分行以延期付款方式兑付:42P: DEFERRED PAYMENT DETAILS AT 90 DAYS AFTER B/L DATE:42P: 延期付款细节提单签发日后90天:43P: PARTIAL SHIPMENTS NOT ALLOWED:43P: 分批装运不允许:43T: TRANSSHIPMENT NOT ALLOWED:43T: 转运不允许:44E: PORT OF LOADING/AIRPORT OF DEPARTURE QINGDAO PORT,CHINA:44E: 装运港/始发航空站中国青岛港:44F: PORT OF DISCHARGE/AIRPORT OF DESTINATION LOS ANGELES PORT,U.S.A. :44F: 卸货港/目的航空站美国洛杉矶港:44C: LATEST DATE OF SHIPMENT 071017:44C: 最晚装运期071017:45A: DESCRIPTION OF GOODS AND/OR SERVICES+TRADE TERMS: CIF LOS ANGELES PORT,U.S.A. ORIGIN:CHINA+ 71000M OF 100% POLYESTER WOVEN DYED FABRICAT USD0.75 PER MWIDTH:150CM,>180G/M2:45A: 货物/服务描述+贸易术语:CIF洛杉矶港,美国原产地:中国+71000米100%涤纶染色机织布料单价为0.75美元/米幅宽:150厘米,克重:不小于180克/平方米:46A: DOCUMENTS REQUIRED+SIGNED COMMERCIAL INVOICE IN THREEFOLD+FULL SET OF CLEAN ON BOARD OCEAN BILL OF LADING MADE OUT TO THE ORDER AND BLANK ENDORSED,NOTIFY:APPLICANT(FULL ADDRESS)MARKED FREIGHT PREPAID +SIGNED DETAILED PACKING LIST+CERTIFICATE OF ORIGIN+HANDSIGNED INSURANCE POLICY/CERTIFICATE COVERING MARINE INSTITUTE CARGO CLAUSES A (1.1.1982),INSTITUTE STRIKE CLAUSES CARGO(1.1.1982),INSTITUTE WAR CLAUSES CARGO (1.1.1982) FOR 110PCT OF THE INVOICE AMOUNT:46A: 单据要求+签署的商业发票,一式三份+全套清洁的已装船提单,空白抬头(TO ORDER),空白背书,通知开证申请人(完整地址),注明运费预付+签署的装箱单+原产地证书+手签的保险单或保险凭证,遵照英国伦敦保险协会货物条款,按照发票总金额的110%投保ICCA,ICC 罢工险、ICC战争险:47A: ADDITIONAL CONDITION 10PCT MORE OR LESS IN AMOUNT AND QUANTITYALLOWED:47A: 附加条款金额和数量允许有上下10%的变动幅度:71B: CHARGES ALL CHARGES AND COMMISSIONS OUTSIDE U.S.A. ARE FORBENEFICIARY'S ACCOUNT:71B: 费用发生在美国以外的全部费用和佣金由受益人承担:48: PERIOD FOR PRESENTATION WITHIN 15 DAYS AFTER SHIPMENT BUT WITHIN THEV ALIDITY OF THIS CREDIT:48: 交单期限装运期后15天,但必须在信用证有效期内:49: CONFIRMATION INSTRUCTIONS WITHOUT:49: 保兑指示没有:78: INSTRUCTIONS TO THE PAYING/ACCEPTING/NEGOTIATING BANKAT MATURITY DATE,UPON RECEIPT OF COMPLYING DOCUMENTS C/O OURSELVES,WE WILL COVER THE REMITTING BANK AS PER THEIR INSTRUCTIONS:78: 对付款行/承兑行/议付行的指示在到期日,我行在收到相符单据后,根据偿付行的指示偿付货物。

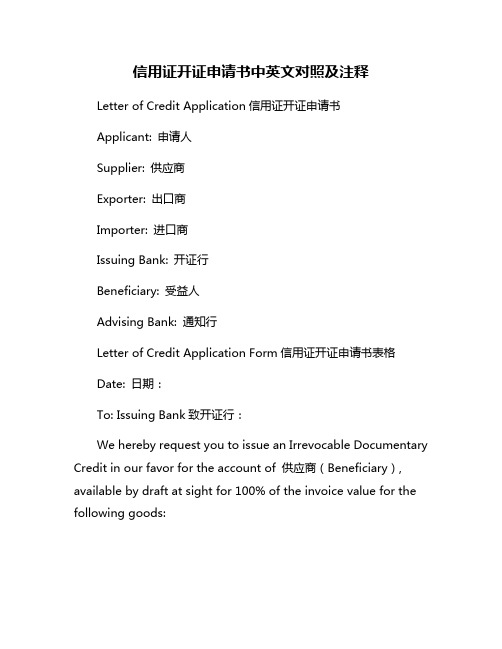

信用证开证申请书中英文对照及注释

信用证开证申请书中英文对照及注释Letter of Credit Application信用证开证申请书Applicant: 申请人Supplier: 供应商Exporter: 出口商Importer: 进口商Issuing Bank: 开证行Beneficiary: 受益人Advising Bank: 通知行Letter of Credit Application Form信用证开证申请书表格Date: 日期:To: Issuing Bank致开证行:We hereby request you to issue an Irrevocable Documentary Credit in our favor for the account of 供应商(Beneficiary), available by draft at sight for 100% of the invoice value for the following goods:我们特此请求您为我方开具一份不可撤销的、可转让的即期跟单信用证,账款归属于供应商(受益人),金额为发票金额的100%,用于以下货物:Invoice No.: 发票号码:Description of Goods: 货物描述:Quantity: 数量:Unit Price: 单价:Total Amount: 总金额:Shipment: 装运:Shipping Terms: 运输条款:Port of Loading: 装货港:Port of Discharge: 卸货港:L/C Expiry Date: 信用证到期日:Latest Shipment Date: 最晚装运日期:Partial Shipment: 分批装运:Transshipment: 转运:Terms of Payment: 支付条款:Documents Required: 所需文件:Please advise us promptly of the issuance and forward the original credit to 通知行for transmission to the 供应商. 请即刻通知我们信用证开具,并将原件转交给通知行,以便转发给供应商。

Letter-of-Credit信用证具体说明(中英文对照)教学文案

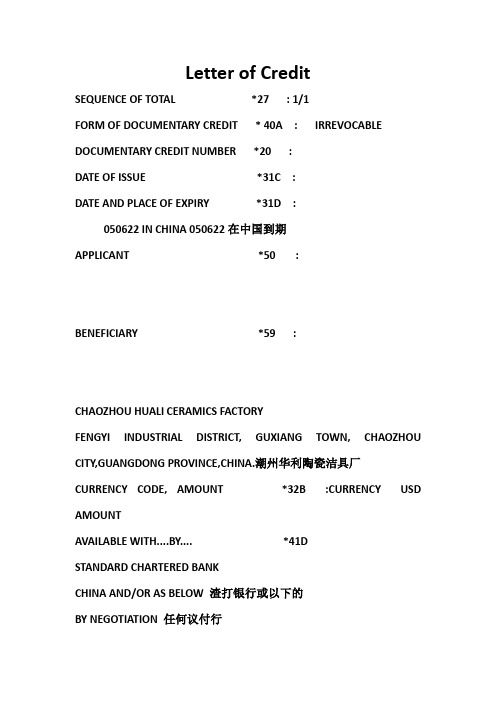

Letter of CreditSEQUENCE OF TOTAL *27 : 1/1FORM OF DOCUMENTARY CREDIT * 40A : IRREVOCABLE DOCUMENTARY CREDIT NUMBER *20 :DATE OF ISSUE *31C :DATE AND PLACE OF EXPIRY *31D :050622 IN CHINA 050622在中国到期APPLICANT *50:BENEFICIARY *59 :CHAOZHOU HUALI CERAMICS FACTORYFENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂CURRENCY CODE, AMOUNT *32B :CURRENCY USD AMOUNTAVAILABLE WITH....BY. (41)STANDARD CHARTERED BANKCHINA AND/OR AS BELOW 渣打银行或以下的BY NEGOTIATION 任何议付行DRAFT AT 42C :DRAWEE 42A:PARTIAL SHIPMENTS 43P :NOT ALLOWED 不可以TRANSHIPMENT 43T :LOADING ON BOARD/DISPATCH/TAKING IN CHARGE AT/FROM 44A:TRANSPORTATION TO 44B :LATEST DATE OF SHIPMENT 44C :ESCRIPTION OF GOODS AND/OR SERVICES 45A : OCUMENTS REQUIRED 46A :+SIGNED COMMERCIAL INVOICE IN QUINTUPLICATE MADE OUT IN THE NAME OF APPLICANT INDICATING CIF VALUE AND THE ORIGINE OF THE GOODS SHIPPED.+PACKING LIST/WEIGHT MEMO IN QUADRUPLICATE MENTIONNING TOTAL NUMBER OF CARTONS AND GROSS WEIGHTAND MEASUREMENTS PER EXPORT CARTON.*FREIGHT PAYABLE AT DESTINATION AND BEARING THE NUMBER OF THISCREDIT.运费在目的港付注明该信用证号码*PACKING LIST IN 3 COPIES.装箱单一式三份*CERTIFICATE ISSUED BY THE SHIPPING COMPANY/CARRIER OR THEIR AGENT STATING THE B/L NO(S) AND THE VESSEL(S) NAME CERTIFYING THAT THE CARRYING VESSEL(S) IS/ARE: A) HOLDING A VALID SAFETY MANAGEMENT SYSTEM CERTIFICATE AS PER TERMS OF INTERNATIONALSAFETY MANAGEMENT CODE ANDB) CLASSIFIED AS PER INSTITUTE CLASSIFICATION CLAUSE 01/01/2001 BY AN APPROPRIATE CLASSIFICATION SOCIETY由船公司或代理出有注明B/L号和船名的证明书证明他们的船是:A)持有根据国际安全管理条款编码的有效安全管理系统证书; 和B)由相关分级协会根据2001年1月1日颁布的ICC条款分类的.*COMMERCIAL INVOICE FOR USD11,202,70 IN 4 COPIES DULY SIGNED BYTHE BENEFICIARY/IES, STATING THAT THE GOODS SHIPPED:A)ARE OF CHINESE ORIGIN.B)ARE IN ACCORDANCE WITH BENEFICIARIES PROFORMA INVOICE NO. HL050307 DATED 07/03/05.由受益人签署的商业发票总额USD11,202,70一式四份,声明货物运输:A)原产地为中国B)同号码为HL050307 开立日为07/03/05的商业发票内容一致:047A: ADDITIONAL CONDITIONS附加条件* THE NUMBER AND DATE OF THE CREDIT AND THE NAME OF OUR BANK MUSTBE QUOTED ON ALL DRAFTS (IF REQUIRED).信用证号码及日期和我们的银行名必须体现在所有单据上(如果有要求)*TRANSPORT DOCUMENTS TO BE CLAUSED: ’VESSEL IS NOT SCHEDULED TOCALL ON ITS CURPENT VOYAGE AT FAMAGUSTA,KYRENTA OR KARAVOSTASSI,CYPRUS.运输单据注明" 船在其航行途中不得到塞***的Famagusta, Kyrenta or Karavostassi这些地方*INSURANCE WILL BE COVERED BY THE APPLICANTS.保险由申请人支付*ALL DOCUMENTS TO BE ISSUED IN ENGLISH LANGUAGE.所有单据由英文缮制*NEGOTIATION/PAYMENT:UNDER RESERVE/GUARANTEE STRICTLY 保结押汇或是银行保函PROHIBITED. 禁止*DISCREPANCY FEES USD80, FOR EACH SET OF DISCREPANT DOCUMENTSPRESENTED UNDER THIS CREDIT,WHETHER ACCEPTED OR NOT,PLUS OURCHARGES FOR EACH MESSAGE CONCERNING REJECTION AND/OR ACCEPTANCEMUST BE BORNE BY BENEFICIARIES THEMSELVES AND DEDUCTED FROM THEAMOUNT PAYABLE TO THEM.修改每个单据不符点费用将扣除80美元(最多40)*IN THE EVENT OF DISCREPANT DOCUMENTS ARE PRESENTED TO US ANDREJECTED,WE MAY RELEASE THE DOCUMENTS AND EFFECT SETTLEMENT UPONAPPLICANT’S WAIVER OF SUCH DISCREPANCIES,NOTWITHSTANDING ANYCOMMUNICATION WITH THE PRESENTER THAT WE ARE HOLDING DOCUMENTS ATITS DISPOSAL,UNLESS ANY PRIOR INSTRUCTIONS TO THE CONTRARY ARERECEIVED.如果不符点是由我方提出并被拒绝,我们将视为受益人放弃修改这个不符点的权利。

信用证中英文对照

信用证中英文对照一、基本术语对照1. 信用证(Letter of Credit,简称LC)2. 申请人(Applicant)3. 受益人(Beneficiary)4. 开证行(Issuing Bank)5. 通知行(Advising Bank)6. 议付行(Negotiating Bank)7. 付款行(Paying Bank)8. 保兑行(Confirming Bank)二、信用证类型对照1. 可撤销信用证(Revocable Letter of Credit)2. 不可撤销信用证(Irrevocable Letter of Credit)3. 即期信用证(Sight Letter of Credit)4. 远期信用证(Usance Letter of Credit)5. 可转让信用证(Transferable Letter of Credit)6. 循环信用证(Revolving Letter of Credit)7. 背对背信用证(BacktoBack Letter of Credit)8. 预支信用证(Anticipatory Letter of Credit)三、信用证关键条款对照1. 信用证金额(Credit Amount)英文:The total amount for which the Letter of Credit is issued.2. 信用证有效期(Validity of the Credit)英文:The date until which the Letter of Credit remains valid for presentation of documents.3. 交单期限(Period for Presentation)英文:The time frame within which the shipping documents must be presented to the bank.4. 货物描述(Description of Goods)英文:A detailed description of the merchandise covered the Letter of Credit.5. 装运条款(Shipment Terms)英文:The conditions under which the goods are to be shipped, including the latest date of shipment.6. 付款条件(Payment Terms)英文:The conditions under which the payment will be made, whether at sight or on a deferred basis.四、信用证相关单据对照1. 发票(Invoice)英文:A document issued the seller to the buyer, indicating the goods sold and their agreed prices.2. 提单(Bill of Lading,简称B/L)英文:A receipt issued the carrier to the shipper, acknowledging receipt of goods for transportation.3. 保险单(Insurance Policy)4. 检验证书(Inspection Certificate)5. 装箱单(Packing List)英文:A detailed list of the contents of each package, prepared the shipper.五、信用证操作注意事项对照1. 信用证条款审核(Review of Credit Terms)英文:Carefully examine the terms and conditions ofthe Letter of Credit to ensure they match the sales contract.2. 单据准备与提交(Preparation and Submission of Documents)英文:Prepare all required documents accurately and submit them to the bank within the specified time frame.3. 银行费用承担(Bank Charges)英文:Clarify which party is responsible for the bank charges associated with the Letter of Credit.4. 风险防范(Risk Prevention)英文:Be aware of potential risks such as discrepancies in documents, bank defaults, and changes intrade policies.六、信用证修改与撤销对照1. 信用证修改(Amendment to the Letter of Credit)英文:A formal request to change certain terms or conditions of the Letter of Credit after it has been issued.2. 信用证撤销(Cancellation of the Letter of Credit)英文:The act of terminating the Letter of Credit before its expiry date, if it is a revocable credit.七、信用证常见问题及解决方案对照1. 文件不符(Discrepancy in Documents)英文:When the documents presented do not conform to the terms and conditions of the Letter of Credit.解决方案:Rectify the discrepancies and resubmit the corrected documents within the allowed time frame.2. 信用证延期(Extension of the Letter of Credit)英文:Requesting an extension of the validity period of the Letter of Credit.解决方案:Coordinate with the applicant to request the issuing bank to extend the credit's validity.3. 信用证付款延迟(Delay in Payment)英文:When the payment under the Letter of Credit is not made on time the issuing bank.解决方案:Communicate with the issuing bank to expedite the payment process or seek assistance from the confirming bank, if applicable.八、信用证在国际贸易中的作用对照1. 降低交易风险(Reducing Transaction Risks)英文:The Letter of Credit provides a secure payment method, reducing the risk of nonpayment for the seller.2. 促进贸易便利化(Facilitating Trade)英文:By offering a guarantee of payment, the Letter of Credit facilitates smoother trade transactions between parties in different countries.3. 融资工具(Financing Instrument)英文:The Letter of Credit can be used the beneficiary to obtain financing from the bank before the actual payment is received.。

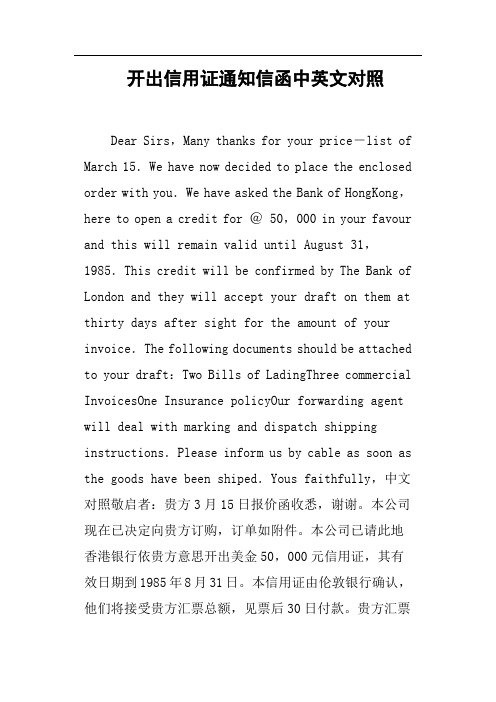

开出信用证通知信函中英文对照

开出信用证通知信函中英文对照Dear Sirs,Many thanks for your price-list of March 15.We have now decided to place the enclosed order with you.We have asked the Bank of HongKong,here to open a credit for @ 50,000 in your favour and this will remain valid until August 31,1985.This credit will be confirmed by The Bank of London and they will accept your draft on them at thirty days after sight for the amount of your invoice.The following documents should be attached to your draft:Two Bills of LadingThree commercial InvoicesOne Insurance policyOur forwarding agent will deal with marking and dispatch shipping instructions.Please inform us by cable as soon as the goods have been shiped.Yous faithfully,中文对照敬启者:贵方3月15日报价函收悉,谢谢。

本公司现在已决定向贵方订购,订单如附件。

本公司已请此地香港银行依贵方意思开出美金50,000元信用证,其有效日期到1985年8月31日。

本信用证由伦敦银行确认,他们将接受贵方汇票总额,见票后30日付款。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

信开信用证中英文对照IRREVOCABLE LETTER OF CREDIT不可撤销信用证October25,19961996年10月25日All drafts drawn must be marked:Drawn Under“B of A”Credit NO.1818凡根据本信用证签发的汇票都必须注明:根据美国银行第1818号信用证签发Wonder Co,Ltd.Chongqing,China中国,重庆万德有限公司Gentlemen:敬启者:We hereby establish our irrevocable letter of credit in your favor for account of FOREIGN IMPORT AND EXPORT CORPORATION,LOS ANGELES,USA up to the aggregate amount of US $ 10,000.00(Ten Thousand US Dollars) available by your drafts drawn at Sight on us for 100% invoice value and accompanied by the following documents:我行特开立以贵公司为受益人的不可撤销信用证,应付贷款人为美国洛杉矶对外进出口公司,本信用证总面额为10,000.00(壹万)美元,可签发以本行为付款人的即期汇票,汇票金额可按发票金额全额开出,检附下列单证:1.Commercial invoice in triplicate.商业发票3份。

2.Special U.S.Customs invoice,in duplicate.专门的美国海关发票2份。

3.Full set of clean on board ocean Bills of Lading issued to order of shipper, blank endorsed,marked:“Notify Foreign Import and Export Corporation,Los Angeles,USA”,“Freight Collect”.全套清洁海洋装仓提单,不记名背书,注明:“到货通知美国洛杉矶对外进出口公司”,“运费到付”。

Evidencing shipment of单据上均应载明:“1,000 pairs of sports shoes FOB Shanghai”.“1,000双运动鞋,上海港离岸价”。

Shipment latest May 1,2000,from Shanghai,China to Los Angeles,USA.最迟装船日期为2000年5月1日,装货港为中国上海,卸货港为美国洛杉矶。

Partial shipment is prohibited.不得分批装船。

Transshipment is permitted.可以转船。

Insurance is to be effected by the buyer.由买方负责投保。

The negotiating bank must forward all documents to us in one cover by airmail.议付银行必须将所有单据一次用航空邮寄开证银行。

The amount and date of each negotiation must be endorsed on the back hereof by the negotiating bank.议付银行必须在每次议付之后将议付金额和时间登记在该信用证背面。

We hereby agree with drawers, endorsers and bona fide holders of drafts that all drafts drawn under and in compliance with the terms of this credit shall meet with due honor upon presentation and delivery of documents as specified to the drawee if drawn and presented for negotiation not later than May 20, 2000.本行在此与出票人、背书人和汇票合法持有人达成协议,一旦向付款人出示并交付各种规定的单据,且签发和出示日期在2000年5月20日之前,本信用证项下的所有汇票均会得到及时议付。

This Credit is subject to the “Uniform Custom and Practice for Documentary CreditCredits (1983 Revision),International Chamber of Commerce,BrochureNO.400”.本信用证受《跟单信用证统一惯例》(1983年修订本)(国际商会第400号出版物)规定。

Yours Faithfully您忠实的×××_______________(签名)例2The British Bank of the Middle East Original for Beneficiary Incorporated in England by Royal Charter 受益人所持原件1889 with limited liability DATE OF ISSUE:member Hong Kong Bank group 20 May 1999中东不列颠银行开证日期:于1889年根据《王室宪章》在英格兰成立, 1999年5月20日责任有限香港银行集团成员IRREVOCABLE DC NO.DE1933387 不可撤销信用证编号:BENEFICIARY 受益人:APPLICANT申请人:WONDER CO.,LTD.万德有限公司AL ISTAKAMAH COMPANY AL ISTAKAMAH 公司12.CUN/I P O BOX NO.5256JIANDONG JIANGBEI,DUBAI U.A.E.CHONGQINGTHE PEOPLE'S REPUBLIC OF (地址)CHINA AMOUNT:USD 15,000.00ADVISING BANK:U S Dollars FIFTEEN THOUSANDThe Hong Kong and Shanghai ONLYBanking 金额:15,000.00美元,Corporation Limited,Shanghai (壹万伍千美元整)The People's Republic of China EXPIRY DATE AND PLACE:通知银行: 1 August 1999香港上海汇丰银行有限公司中华人到期时间:1999年8月1日民共和国上海分行,THE PEOPLE'S REPUBLIC OFPARTIAL SHIPMENTS: allowed CHINA TRANSSHIPMENT:see below 地点:中华人民共和国准许分批装船CREDIT AVAILABLE WITH:信贷转船:参见下文提供:SHIPMENT NEGOTIATING BANK由议付银行FROM: THE PEOPLE'S REP.by negotiation议付,OF CHINA Drafts at sight drawn on the applicantTO:DUBAI for full invoice value of goods,装运quoting the number of this credit从:中华人民共和国使用以申请人为付款人的即期汇票,至:迪拜金额按货物发票全额开出,写上本LATEST:31 July 1999 信用证最迟发货时间:1999年7月31日编号。

DOCUMENTS REQUIRED所需单据:1.Signed Invoice in four copies.签名发票4份。

2.Full set original clean“On Board”Bills of Lading made out to the order of shipper,endorsed in blank,marked“Freight Prepaid”and notify the British Bank of the Middle East,P.O.Box 66,Deira Dubai under Ref:DEI 1818 and to Al Istakamah Company,P.O Box NO.1213,Dubai U.A.E.全套应货主订单开具的原始清洁装仓提单,不记名背书,且注明“运费预付”,货到请通知中东不列颠银行(迪拜市代若,邮政信箱第66号),查询事项:DEI1818,并至Al Istakamah公司,阿联酋迪拜市,邮政信箱第1213号。

3.A Certificate of Chinese Origin signed by China Council for the Promotion of International Trade. A Certificate of Origin incorporated in the invoice will not be acceptable.一份由中国贸促会出具的证明原产地是为中国的证明书。

原产地证不能与发票混开在一起。

4.Packing list in four copies.装箱单4份。

GOODS货物:30,000 PCS ’ STAR BRAND FLUORESCENT TUBE, 4 FEET,DAYLIGHT,40W,32MM DIA AT THE RATE US DO.5626 PER PC.30,000 件星牌日光灯管,4英尺长日光灯,40瓦,直径32mm,每件价值0.5美元。

ALL OTHER DETAILS AS PER INDENT NO.OQ—5284 DATED 6—4—96 OF M/S.其他细节详见第CQ—5284号订单,日期1996年4月6日APEX TRADING EST.,P O BOX 5341,DUBAI U.A.E.INVOICES TO CERTIFY THE SAME.发票上同样注明。

……………………TO BE CONTINUED ON PAGE 2(第二页待续)…………p.1(第一页)__________________________________________________This page is attached to and forms part of Credit NO.DE 1999387本页隶属且构成第DE1999387号信用证的一部分。