期末考试--北京大学2016年秋季-宏观经济学

北大16秋《宏观经济学》在线作业

一、单选题(共15题,每题2分,共30分)1. (鼓励独立完成作业,严惩抄袭。

慎交作业,责任自负。

)哪一项计入GDP?()(第二章,视频教学课件第7-9讲)A. 购买一辆用过的旧自行车;B. 政府向低保户发放一笔救济金;C. 汽车制造厂买进10吨钢材;D. 银行向某企业收取一笔贷款利息2. 一国的国内生产总值小于国民生产总值,则该国公民从国外取得的收入()外国国民从该国取得的收入。

(第二章,视频教学课件第7-9讲)A. 大于B. 小于C. 等于D. 不能确定3. 在一个有家庭、企业、政府和国外的部门构成的四部门经济中,GDP是()的总和。

(第二章,视频教学课件第7-9讲)A. 消费、总投资、政府购买和净出口;B. 消费、净投资、政府购买和净出口;C. 消费、总投资、政府购买和总出口;D. 消费、总投资、政府转移支付和净出口4. 在两部门收入-支出模型中,如果边际消费倾向为0.8,那么自主支出乘数为()。

(第三章,视频教学课件第10-18讲)A. 1.6B. 2.5C. 5D. 45. 固定税制度下的自发支出乘数()变动税制下的自发支出乘数。

(第三章,视频教学课件第10-18讲)A. 大于B. 小于C. 等于D. 不能确定6. 当经济出现膨胀缺口时,以下可以使经济达到充分就业均衡水平的措施有()。

(第三章,视频教学课件第10-18讲)A. 增加自发消费B. 增加计划投资C. 提高边际消费倾向D. 增加进口7. 下列哪项不是人们持有货币的动机()。

(第四章,视频教学课件第19-25讲)A. 交易动机B. 预防动机C. 投机动机D. 均衡财富8. 利率和收入的组合点出现在IS曲线左下方,LM曲线右下方区域中,则表示()。

(第四章,视频教学课件第19-25讲)A. 投资小于储蓄,且货币需求小于货币供给B. 投资小于储蓄,且货币供给小于货币需求C. 投资大于储蓄,且货币需求小于货币供给D. 投资大于储蓄,且货币需求大于货币供给9. 中央银行最常用的货币政策工具是()。

高校宏观经济学期末考核习题及参考答案

高校宏观经济学期末考核习题及参考答案1. 选择题1.1 宏观经济学主要研究的是()。

A. 国家经济发展的政策B. 单个公司的经济运作C. 不同行业的经济模式D. 整个国民经济的运行规律参考答案:D1.2 影响经济增长率的因素主要包括()。

A. 基础设施建设B. 科技进步C. 人力资本投资D. 金融市场稳定参考答案:A、B、C1.3 以下哪个指标不属于计算国内生产总值(GDP)时考虑的范围()。

A. 个人储蓄B. 政府支出C. 净出口D. 固定资本形成参考答案:A2. 简答题2.1 宏观经济学的基本概念是什么?请简要描述。

参考答案:宏观经济学是研究整个国家或地区经济体系的总体运行规律和宏观经济问题的学科。

它关注经济增长、就业、通货膨胀、货币政策等方面的问题,研究经济系统的总体运行和调控。

2.2 请简要解释什么是货币政策?参考答案:货币政策是指中央银行通过调整货币供应量和利率水平等手段来影响经济活动和价格水平的政策。

它旨在实现经济稳定和促进经济增长,通过调控货币供应和信贷规模,以及进行利率调整等策略来影响市场利率、借贷成本和金融市场活动。

3. 计算题3.1 根据以下数据,计算国家的消费水平和投资水平,并计算净出口。

消费支出:5000亿元政府支出:2000亿元投资支出:3000亿元国内生产总值(GDP):10000亿元进口:1000亿元出口:1500亿元参考答案:消费水平 = 消费支出 = 5000亿元投资水平 = 投资支出 = 3000亿元净出口 = 出口 - 进口 = 1500亿元 - 1000亿元 = 500亿元总结:本文提供了高校宏观经济学期末考核的习题及参考答案。

习题包括选择题、简答题和计算题等。

选择题涵盖了宏观经济学的基本概念和影响经济增长率的因素等内容。

简答题要求对宏观经济学和货币政策进行简要描述和解释。

计算题要求根据给定数据计算国家的消费水平、投资水平和净出口。

通过完成这些习题,学生可以巩固对宏观经济学知识的理解和运用能力,为期末考核做好准备。

《宏观经济学》期末考试复习题附答案(参考)(1).pptx

周围人群消费水平较高

5.下述哪一项不属于总需求 ( A )

4

学海无 涯

A、税收

B、政府支出

C、净出口

D、

投资

6. 边际储蓄倾向若为 0.25,则边际消费倾向为 ( B )

A、0.25

B、0.75

C、1.0

D、

1.25

7. 消费函数的斜率等于( C )

A、APC

B、APS

MPS

C、MPC

D、

8.消费者的消费支出不由他的现期收入决定,而是由他的永久收入决定。

学 海 无涯

一、单项选择

第十二章 国民收入核算

1. 下列关于GDP 说法正确的是( ③ )

① 一年内一个国家范围内的所有交易的市场价值

② 一年内一个国家范围内交换的所有最终商品和劳务的市场价值

③ 一年内一个国家范围内生产的所有最终商品和劳务的市场价值

④ 一年内一个国家范围内交换的所有商品和劳务的市场价值

的货币

21、在一个封闭经济中,增加税收在短期内将会( A )

A、使得 IS 曲线左移而 LM 曲线保持不变;

B、使得 IS 曲线左移同时 LM 曲线左移 C、对 IS 和 LM 曲线没有影响 D、以上说法都不对 22、下列哪种情况下,“挤出”效应可能比较大?( D ) A、货币需求对利率敏感,而投资需求对利率不敏感

B、货币需求对利率敏感,投资需求对利率也敏感 C、货币需求对利率不敏感,投资需求对利率也不敏感

D、货币需求对利率不敏感,而投资需求对利率敏感

23、在 IS-LM 模型中,如果( A ),那么政府购买的变动将会导致

GDP 更大的变动

A、货币需求对GDP 变得更不敏感

B、货币需求对利息率

宏观经济学 北京大学出版社 各章参考答案

宏观经济学各章参考答案第二章习题参考答案【单项选择题】1.B 2.B 3.D 4.C 5.D 6.D 7.A 8.A 9.A 10.B 【判断正误题】1.×2.√3.√4.×5.√ 6.√7.×8.×9.×10×【计算题】1.解(1)2000年的名义国内生产总值25*1.5+50*7.5+40*6+30*5+60*2=847.5(元)2007年的名义国内生产总值=30*1.6+60*8+50*7+35*5.5+70*2.5=1240.5(元)(2)2007年实际GDP=30*1.5+60*7.5+50*6+35*5+70*2=1110(元)(3)2000-2007年的国内生产总值价格指数=2007年的名义GDP/2007年实际GDP=111.7%,2007年比2000年价格上升11.7%。

2.解(1)NDP=4800-(800-300)=4300(万美元)(2)净出口=GDP-总投资-消费-政府购买=4800-800-3000-960=40(万美元)(3)960+30=990(万美元)(4)个人可支配收入=GDP-折旧-税收=4800-500-990=3310(万美元)(5)S=个人可支配收入-消费=3310-3000=310(万美元)3.解(1)用支出法计算GDP=27408亿元;(2)用收入法计算国民收入=16485+1760+538+3145+2068+45+1740+1635-8=27408亿元;(3)计算个人收入=27408-3145-2068-45-1325-(1740-385)=19470亿元;(4)计算个人储蓄=19470-1536-17228=706亿元。

4.解(1)国内生产总值=31043亿元;(2)国民收入=27168亿元;(3)国内生产净值=24645亿元;(4)个人收入=26052亿元;(5)个人可支配收入=21870亿元;(6)个人储蓄=2024亿元。

(完整版)宏观经济学期末试卷和答案

1、 A 、B 、 C 、D 、 E、2、 A 、B 、C 、 D 、 E3、 A 、B 、C 、 D 、 E 、4、A 、 5、A BC D 、E6、A 、C 、 7、 A 、C 、8、 A 、D 、9、 A 、B C D 、 在一般情况下,国民收入核算体系中数值最小的是:国内生产净值 个人收入个人可支配收入 国民收入 国内生产总值 下列哪一项应计入 GDP 中: 面包厂购买的面粉 购买40股股票 家庭主妇购买的面粉购买政府债券 以上各项都不应计入。

计入GDP 的有:家庭主妇的家务劳动折算合成的收入 拍卖毕加索作品的收入 出神股票的收入 晚上为邻居照看儿童的收入 从政府那里获得的困难补助收入 在下列各项中,属于经济中的注入因素是 投资;B 、储蓄;C 、净税收;D 、进口。

政府支出乘数 等于投资乘数 比投资乘数小1 等于投资乘数的相反数 等于转移支付乘数 以是说法都不正确在以下情况中,投资乘数最大的是 边际消费倾向为 边际储蓄倾向为 国民消费函数为 增加100亿元; 增加500亿元; 如果政府支出增加 对IS 曲线无响应 IS 曲线向右移动 IS 曲线向左移动 以上说法都不正确 政府税收的增加将 对IS 曲线无响应IS 曲线向右移动 IS 曲线向左移动 以上说法都不正确0.7; B 、边际储蓄倾向为 0.4; D 、边际储蓄倾向为 C=80+0.8Y ,如果消费增加 B 、减少100亿元; D 、减少500亿元。

0.2;0.3。

100亿元,国民收入10、位于IS 曲线左下方的收入与利率的组合,都是 A 、投资大于储蓄;B 、投资小于储蓄;C、投资等于储蓄;D、无法确定。

11、当经济中未达到充分就业时,如果LM曲线不变,政府支出增加会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

12、一般地,在IS曲线不变时,货币供给减少会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

宏观经济学期末考试题目附答案

下面哪一项对货币创造乘数没有决定性 影响( D ) A.法定准备金率 B.超额准备金率 C.现金—存款比率 D.市场利率

引起IS曲线向右移动的原因包括( A.自发消费下降 B.自发投资下降 C.进口增加 D.出口增加

B)

由政府支出增加所导致的“挤出效应”来自 于( B ) A.货币供给量的下降 B.货币需求量的提高 C.境内利率的下降 D.通货膨胀的恶化

17、某一经济体在五年中,货币速度为10%, 而实际国民收入增长速度为12%,货币流通 速度不变,这五年期间价格水平将(B)。 A.上升 B.下降 C.不变 D.上下波动

根据简单国民收入决定的理论,如果由于某 种原因,经济的目前收入偏离并高于均衡收 入水平,经济会如何调整重新实现均衡?( C) A. 价格上升 B. 价格下降 C. 企业减产以减少非意愿存货 D. 企业增加雇佣工人

12、假定国民生产总值是5000,个人 可支配收入是4100,政府预算赤字是 200,消费是3800,贸易赤字是100 (单位:亿美元) 试计算: (1)储蓄; (2)投资; (3)政府支出。 私人储蓄S=YD-C=4100-3800=300 投资I=S+T-G+M-X=300-200+100=200 Y=C+I+G+NX=3800+200+G100=5000 G=1100

已知某小国在封闭条件下的消费函数为 C= 305+0.8Y,投资函数为 I=395-200r,货币的需求 函数为 L=0.4Y-100r,货币供给 m=150。 (1)定出 IS 曲线和 LM 曲线的方程; (2)计算均衡的国民收入和利息率; (3)如果此时政府购买增加 100,那么均衡国民收入会增加多少? (4)计算(3)中的政府购买乘数; (5)写出乘数定理中的政府购买乘数公式,利用这一公式计算(3)中的乘数; (6)比较(4)和(5)的结果是否相同,请给出解释。

宏观经济学期末考试试题9标准答案

,即

(3)由IS和LM方程联立得:

解得均衡利率rห้องสมุดไป่ตู้10%,均衡收入Y=1500

五、论述题(共10分)

答案要点:运用所学理论来分析。论证严谨,言之成理即可

1.边际储蓄倾向是指储蓄增量对收入增量的比率。

2.投资乘数是指收入的变化与带来这种变化的投资支出的变化的比率。

3.当利率极低,人们会认为这时利率不大可能再下降,或者说有价证券市场价格不大可能再上升而只会跌落,因而会将所持有的有价证券全部换成货币。人们有了货币也决不肯再去买有价证券,以免价格下跌而遭受损失,人们不管有多少货币都愿意持有手中,这种情况称为流动偏好陷阱。

4.总需求划分为四个部分:消费、投资、政府支出和净出口,各种政策工具对这四部分需求的影响程度是不同的,从而对产出构成会产生影响。例如,宽松的货币政策会使本币贬值从而刺激出口,也可能鼓励耐用消费品(汽车及其他大件消费品)的消费和生产,也可能刺激房地产投资,而减税则可能主要刺激消费。政府支出会刺激公共物品生产,但如果资金要靠借债(公债)筹集,则可能挤出私人部门投资。

]

课号:1406024课程名称:宏观经济学开课学院(系):经济与管理学院答卷教师:

共2页,第2页

(答案纸与试卷纸要分开放)

四、计算题(每题15分,共30分)

1.(1)由 得:

,于是P=200, =2200,即得供求均衡点。

(2)向左平移10%后的总需求方程为:

于是,由 有 ,

则 , =2080

与(1)相比,新的均衡表现出经济处于萧条状态。

2.可以根据生命周期理论来分析此题。分两种情况讨论:(1)当你和你的邻居预期寿命小于工作年限WL,即未到退休就已结束生命时,尽管你比邻居长寿些,但两人年年都可能把年收入YL消费完,两人的消费会一样多。(2)当你预计在退休后生命才结束。这样无论你的邻居是在退休前还是退休后结束生命,你的消费都应比他小。因为你每年的消费为 ;而你的邻居的消费如下:(A)当你的邻居在退休前死去,他每年消费YL。显然他比你多消费。(B)当邻居在退休后死去,他的消费为 。而据题意, > ,显然就有 < ,即你比邻居少消费。

宏观经济学期末复习题库及答案

宏观经济学期末复习题库及答案《宏观经济学》课程的考核要求本课程采取闭卷考试的方式;时间为2小时(120分钟)总评成绩的计算依据:(1)平时成绩:占总评成绩的30%;其中期中考试成绩占总评成绩的20%,课堂小测验(至少两次)占5%,作业等占5%。

(2)期终成绩:占总评成绩的70%,以期终考试成绩为依据。

如下表所示:平时成绩(30%)期中考试(20%)课堂小测验(5%)期终成绩(70%)期终考试(70%)作业等(5%)期终考试命题设计:识记部分约占30%;理解部分约占40%;运用部分约占30%。

考试题型包括判断、选择、作图、计算、简答、分析论述等。

总评成绩(100%)100%2第十二章国民收入核算一、主要概念国民生产总值(GNP)、国内生产总值(GDP)、名义国内生产总值和实际国内生产总值、最终产品和中间产品、总投资和净投资、重置投资、存货投资、政府购买和政府转移支付、净出口、间接税、国民生产净值、国民收入、个人收入、个人可支配收入、储蓄一投资恒等式。

二、单项选择题1、下列哪—项不列入国内生产总值的核算中()A、出口到国外的一批货物B、政府发放给贫困家庭的救济金C、经纪人从旧房买卖中收取的佣金D、保险公司收到的家庭财产保险费2、“面粉是中间产品”这一命题()0A、一定是对的B、一定是不对的C、可能对,也可能不对D、以上三种说法全对3、下列哪一项计入GDP中()A、购买一辆用过的旧自行车B、购买普通股票C、汽车制造厂买进10吨钢板D、银行向某企业收取一笔贷款利息4、某国的资本品存量在年初为10000亿美元,本年度生产了2500亿美元的资本品,资本消耗折旧为2000亿美元,则该国在本年度的总投资和净投资分别是()A、2500亿美元和500亿美元B、12500亿美元和10500亿美元C、2500亿美元和2000亿美元D、7500亿美元和8000亿美元5、以下正确的统计恒等式为()A、投资=储蓄B、投资=消费C、储蓄=消费D、总支出-投资=总收入-储蓄6、下列项目中,()不是要素收入A、总统薪水B、股息C、公司对灾区的捐献D、银行存款者取得的利息7、以下()不能计入国内生产总值A、企业的库存B、家庭主妇的家务劳务折合成的收入C、拍卖毕加索作品的收入D、为他人提供服务所得收入8、安徽民工在南京打工所得收入应该计入到当年()中A、安徽的国内生产总值(GDP)B、安徽的国民收入(NI)C、南京的国民生产总值(GNP)D、南京的国内生产总值(GDP)9、通货膨胀时,GNP价格矫正指数()A、大于1B、小于IC、大于0D、小于010、一国的国内生产总值小于国民生产总值,说明该国公民从外国取得的收入()外国公民从该国取得的收入A、大于B、小于C、等于D、可能大于也可能小于11、如果:消费额=6亿元,投资额=1亿元,间接税=1亿元,政府用于商品和劳务的支出额=1.5亿元,出口额=2亿元,进口额=1.8亿元,则()A、NNP=8.7亿元B、GDP=7.7亿元3C、GDP=8.7亿元D、NNP=5亿元12、用收入法计算的GDP等于()A、消费+投资+政府支出+净出B、工资+利息+租金+利润+间接税C、工资+利息+中间产品成本+间接税+利润D、工资+利息+租金+利润+间接税+折旧13、如果当期价格水平低于基期价格水平,那么()A、实际GDP等于名义GDPB、实际GDP小于名义GDPC、实际GDP与名义GDP相同D、实际GDP大于名义GDP14、如果钢铁、油漆、绝缘材料以及所有用来制造一个电烤炉的原料价值在计算GDP时都包括进去了,那么这种衡量方法()A、因各种原料都进入市场交易,所以衡量是正确的。

《宏观经济学》课程期末试卷B卷(附参考答案)

厦门大学《宏观经济学》课程试卷经济 学院―2011 — 年级 各 _______ 专业主考教师:试卷类型:(B 卷)姓名: 学号【注意:答案按序号写在答题纸上,答毕后试题与答题纸一并上交】 、单项选择(每题1分,共20分)1 •国内生产总值是指一国在一定时期内生产的 _________ 的市场价值。

A .产品和劳务 B .最终产品和劳务 C.中间产品和劳务D .所有产品和劳务8. ______________ 若名义货币供给量增长了 6%,物价水平上涨了 4%,产出增长了 3%,根据货币数量论方程式,货币流 通速度 。

A. 增加了 13% B.增加了 7% C.增加了 3% D.增加了 1%9•贸易赤字不能通过以下哪种方式融资 ________ A. 向外国人借款C.向外国人出售国内居民拥有的资产10•若中央银行在政府增税的同时减少货币供给,则 A. 利率必然上升 B.利率必然下降C.均衡收入必然上升D.均衡收入必然下降11. ___________________ 自然失业率 。

2.下列哪几项计入当年的 GDP? ______A .购买一辆旧车C .蛋糕厂购入的5吨面粉 3•如果货币供给增加,那么在 A.LM;左C.IS 左 B.购买1000元股票D.银行从企业获得的贷款利息 IS-LM 分析框架中 ____________ 曲线会向 ___________ 移动。

B 丄M ;右 D.IS ;右 4.在凯恩斯交叉中,乘数的重要性依赖于 _______________A.投资函数的斜率B.实际利率C.实际货币供给的增加D.消费函数的斜率 5. 中央银行在公开市场上买进政府证券的结果将是 A.银行存款增加C.公众手里的货币增加 6. 在宏观经济学理论中,短期与长期的关键差别在于 A.消费行为 B.投资行为 C.价格行为 B.市场利率上升D.以上都不是D.储蓄行为 7•当一国储蓄率提高并达到新的稳态后,该国 _____________ 。

宏观经济学试题及答案(完整版)

一、请解释下列概念(每题3分,共151. GDP2.均衡产出3.资本积累的“黄金率水平”4.流动性偏好5.通货膨胀二、单项选择题(每题2分,共30分)1.在一个有家庭、企业、政府和国外部门构成的四部门经济中,GDP是()的总和。

A.消费、总投资、政府购买和净出口;B. 消费、净投资、政府购买和净出口;C. 消费、总投资、政府购买和总出口;D.工资、地租、利息、利润和折旧。

2.下列项目中,()不是要素收入。

A.总统薪水;B.股息;C.企业对灾区的捐献;D.银行存款者取得的利息。

3.一个家庭当其收入为零时,消费支出为2000元;而当其收入为6000时,其消费支出为6000元。

在图形上,消费和收入之间成一条直线,则其边际消费倾向为()。

A.2/3;B.3/4;C.4/5;D.1;4.假设消费者在T年(退休前)时预计退休后每年可得额外的退休金10 000元,根据生命周期假说,该消费者与原来相比较,将()。

A. 在退休前不改变,退休后每年增加10 000元消费;;B. 在退休前增加10 000元消费,退休后不再增加消费;C. 以T年起至生命结束每年增加消费10 000元;D. 将退休后可得到的退休金额均匀地用于增加T年以后的消费中。

5.如果灵活偏好曲线接近水平状,这意味着().A.利率稍有变动,货币需求就会大幅度变动;B.利率变动很大时,货币需求也不会有很大变动;C.货币需求丝毫不受利率的影响;D.以上三种情况都有可能;6.投资往往是易变的,其主要原因之一是().A.投资在很大程度上取决于企业家的预期;B.消费需求变化得反复无常以至于影响投资;C.政府开支代替投资,而政府开支波动剧烈;D.利率水平波动相当剧烈。

7.若消费函数为C=40+0.8Y,净税收T=20,投资I=70-400r,净税收增加10单位使IS曲线().dA.右移10单位;B.左移10单位;C.右移40单位;D.左移40单位.8.中央银行有多种职能,只有()不是其职能.A.制定货币政策;B.为成员银行保存储备;C. 发行货币;D. 为政府赚钱9.利率和收入的组合点出现在IS曲线左下方、LM曲线的左上方的区域中,则表示().B.投资小于储蓄,且货币供给小于货币需求;C.投资大于储蓄,且货币需求小于货币供给;D.投资大于储蓄,且货币需求大于货币供给.10.在下述何种情况下,会产生挤出效应().A.货币供给的下降提高利率,从而挤出了对利率敏感部门的私人支出;B.对私人部门税收的增加引起私人部门可支配收入和支出的下降;;C. 政府支出增加使利率提高,从而挤出了私人部门的支出;D.政府支出的下降导致消费支出的下降。

宏观经济学期末考试试卷(附答案)

1.In the United States real GDP is reported each quarter.a. These numbers are adjusted to make them measure at annual and seasonally adjusted rates.b. These numbers are adjusted to make them annual rates, but no adjustment for seasonal variations are made.c. These numbers are quarterly rates that have been seasonally adjusted.d. These numbers are at quarterly rates and have not been seasonally adjusted.2.The price of CD players increases dramatically, causing a 1 percent increase in the CPI. The price increase will most likely cause the GDP deflator to increase by a. more than 1 percent. b. less than 1 percent. c. 1 percent.d. It is impossible to make an informed guess without more information.3.If increases in the prices of U.S. medical care cause the CPI to increase by 2 percent,the GDP deflator will likely increase by a. more than 2 percent. b. 2 percent. c. less than 2 percent.d. All of the above are correct.4.The traditional view of the production process is that capital is subject to a. constant returns. b. increasing returns. c. diminishing returns.d. diminishing returns for low levels of capital, and increasing returns for high levels of capital.5.Which of the following is correct?a. Political instability can reduce foreign investment, reducing growth.6.Use the following table to answer the following question. Assume that the closing price was also the average price at which each stock transaction took place. Whatwas the total dollar volume of Gillette stock traded that day?a. $912,840,000b. $91,284,000c. $9,128,400d. $912,8407.Suppose that in a closed economy GDP is equal to 10,000, taxes are equal to 2,500 Consumption equals 6,500 and Government expenditures equal 2,000. What are private saving, public saving, and nationalsaving? a. 1500, 1000, 500 b. 1000, 500, 1500 c. 500, 1500, 1000d. None of the above are correct.8.Risk-averse people will choose different asset portfolios than people who are not risk averse. Over a longperiod of time, we would expect that a. every risk-averse person will earn a higher rate of return than every non-risk averse person. b. every risk-averse person will earn a lower rate of return than every non-risk averse person.c. the average risk-averse person will earn a higher rate of return than the average non-risk averse person.d. the average risk-averse person will earn a lower rate of return than the average non-risk averse person.9.The natural rate of unemployment is the精品文档a. unemployment rate that would prevail with zero inflation.b. rate associated with the highest possible level of GDP.c. difference between the long-run and short-run unemployment rates.d. amount of unemployment that the economy normally experiences.10.Suppose that the reserve ratio is 5 percent and that a bank has $1,000 in deposits. Its required reserves area. $5.b. $50.c. $95.d. $950.11.Suppose a bank has $200,000 in deposits and $190,000 in loans. It has a reserve ratio ofa. 5 percentb. 9.5 percentc. 10 percentd. None of the above is correct.12.The inflation taxa. transfers wealth from the government to households.b. is the increase in income taxes due to lack of indexation.c. is a tax on everyone who holds money.d. All of the above are correct.13.In 1898, prospectors on the Klondike River discovered gold. This discovery caused an unexpected price levela. decrease that helped creditors at the expense of debtors.b. decrease that helped debtors at the expense of creditors.c. increase that helped creditors at the expense of debtors.d. increase that helped debtors at the expense of creditors.14.Ivan, a Russian citizen, sells several hundred cases of caviar to a restaurant chain in the United States. By itself, this salea. increases U.S. net exports and has no effect on Russian net exports.b. increases U.S. net exports and decreases Russian net exports.c. decreases U.S. net exports and has no effect on Russian net exports.d. decreases U.S. net exports and increases Russian net exports.15.Suppose that the real exchange rate between the United States and Kenya is defined in terms of baskets of goods. Which of the following will increase the real exchange rate (that is increase the number of baskets of Kenyan goods a basket of U.S. goods buys)?a. an increase in the number of Kenyan shillings that can be purchased with a dollarb. an increase in the price of U.S. baskets of goodsc. a decrease in the price in Kenyan shillings of Kenyan goodsd. All of the above are correct.16.Use the (hypothetical) information in the following table to answer the next question.In real terms, U.S. goods are more expensive than goods in which country(ies)?a. Brazil and Mexicob. Japan, Sweden, and Thailandc. Japan and Swedend. Thailand.17.Which of the following would tend to shift the supply of dollars in foreign-currency exchange market of the open-economy macroeconomic model to the left?a. The exchange rate rises.b. The exchange rate falls.c. The expected rate of return on U.S. assets rises.d. The expected rate of return on U.S. assets falls.18.The real exchange rate equals the relativea. price of domestic and foreign currency.b. price of domestic and foreign goods.c. rate of domestic and foreign interest.d. None of the above is correct.精品文档19.In the open-economy macroeconomic model, if the supply of loanable funds increases, the interest ratea. and the real exchange rate increase.b. and the real exchange rate decrease.c. increases and the real exchange rate decreases.d. decreases and the real exchange rate increases.20.For the following question, use the graph below.The initial effect of an increase in the budget deficit in the loanable funds market is illustrated as a move froma. a tob.b. a toc.c. c to b.d. c to d.21.When the government spends more, the initial effect is thata. aggregate demand shifts right.b. aggregate demand shifts left.c. aggregate supply shifts right.d. aggregate supply shifts left.22.Suppose the economy is in long-run equilibrium. In a short span of time, there is a sharp increase in the minimum wage, a major new discovery of oil, a large influx of immigrants, and new environmental regulations that reduce electricity production. In the short run, we would expecta. the price level to rise and real GDP to fall.b. the price level to fall and real GDP to rise.c. the price level and real GDP both to stay the same.d. All of the above are possible.23.Suppose the economy is in long-run equilibrium. In a short span of time, there is a large influx of skilled immigrants, a major new discovery of oil, and a major new technological advance in electricity production. In the short run, we would expecta. the price level to rise and real GDP to fall.b. the price level to fall and real GDP to rise.c. the price level and real GDP both to stay the same.d. All of the above are possible.24.According to liquidity preference theory, the money supply curve isa. upward sloping.b. downward sloping.c. vertical.d. horizontal.25.When the Fed buys government bonds, the reserves of the banking systema. increase, so the money supply increases.b. increase, so the money supply decreases.c. decrease, so the money supply increases.d. decrease, so the money supply decreases.26.According to the theory of liquidity preference, an increase in the price level causes thea. interest rate and investment to rise.b. interest rate and investment to fall.c. interest rate to rise and investment to fall.d. interest rate to fall and investment to rise.27.If the stock market crashes,a. aggregate demand increases, which the Fed could offset by increasing the money supply.b. aggregate demand increases, which the Fed could offset by decreasing the money supply.c. aggregate demand decreases, which the Fed could offset by increasing the money supply.d. aggregate demand decreases, which the Fed could offset by decreasing the money supply.精品文档28.If the MPC = 3/5, then the government purchases multiplier isa. 5/3.b. 5/2.c. 5.d. 15.29.If the government raises government expenditures, in the short run, pricesa. rise and unemployment falls.b. fall and unemployment rises.c. and unemployment rise.d. and unemployment fall.30.If the long-run Phillips curve shifts to the left, for any given rate of money growth and inflation the economy will havea. higher unemployment and lower output.b. higher unemployment and higher output.c. lower unemployment and lower output.d. lower unemployment and higher output.二、判断题(每小题 1 分,共 20 分)31.When an American doctor opens a practice in Bermuda, his production there is part of U.S. GDP.32.In countries where women are discriminated against, policies that increase their career and educational opportunities are likely to increase the birth rate.33.Michael Kramer found that world growth rates have increased as population has.34.Suppose a small closed economy has GDP of $5 billion, Consumption of $3 billion, and Government expenditures of $1 billion. Then domestic investment and national saving are both $1 billion.35.According to the efficient markets hypothesis, at any moment in time, the market price is the best guess of the company's value based on available information.36.According to the efficient markets hypothesis, stocks follow a random walk so that stocks that increase in price one year are more likely to increase than decrease in the next year.37.In the United States, blacks and whites have similar labor force participation rates, but blacks have a higher unemployment rate.38.According to the theory of efficiency wages, firms operate more efficiently if they can pay wages that are below the equilibrium level.39.In the months of November and December, people in the United States hold a larger part of their money in the form of currency because they intend to shop for the holidays. As a result, the money supply increases, cerise parousia.40.In the 1990s, U.S. prices rose at about the same rate as in the 1970s.41.According to the theory of purchasing-power parity, the real exchange rate defined as foreign goods per unit of U.S. goods will equal the domestic price level divided by the foreign price level.42.Net capital outflow represents the quantity of dollars supplied in the foreign-currency exchange market.43.If policymakers impose import restrictions on automobiles, the U.S. trade deficit would shrink.44.Most economists believe that classical theory explains the world in the short run, but not the long run.45.Because not all prices adjust instantly to changing conditions, an unexpected fall in the price level leaves some firms with higher-than-desired prices, and these higher-than-desired prices depress sales and induce firms to reduce the quantity of goods and services they produce.46.All explanations for the upward slope of the short-run aggregate supply curve suppose that output supplied increases when the price level increases more than expected.47.Both the multiplier and the investment accelerator tend to make the aggregate demand curve shift farther than the increase in government expenditures.48.During recessions, the government tends to run a budget deficit.49.If macroeconomic policy expands aggregate demand, unemployment will fall and inflation will rise in the short run.50.The analysis of Friedman and Phelps argues that any change in inflation that is expected has no impact on the unemployment rate.精品文档三、名词解释(每小题 2 分,共 10 分)51.diminishing returns:52.nominal exchange rate: 53.crowding-out effect: 54.stagflation:55.automatic stabilizers: 四、简答题( 8题中任选6题;每小题 5分,共 30 分)56.Why are property rights important for the growth of a nation's standard of living? 57.Suppose that you are a broker and people tell you the following about themselves. Whatsort of bond would you recommend to each? Defend your choices. a. "I am in a high federal income tax bracket and I don't want to take very much risk." b. "I want a high return and I am willing to take a lot of risk to get it."c. "I want a decent return and I have enough deductions that I don't value tax breakshighly."58.Draw a simple T-account for First National Bank of Me,which has $5,000 of deposits, a reserve ratio of 10 percent, and excess reserves of $300.59.What are the costs of inflation?60.Make a list of things that would shift the long-run aggregate supply curve to the right. 61.Illustrate the classical analysis of growth and inflation with aggregate demand andlong-run aggregate supply curves.62.Why do economists think that the wealth effect and exchange-rate effect are not very important factors inexplaining why aggregate demand slopes downward, at least in the United States?63.Describe the process in the money market by which the interest rate reaches its equilibrium value if it startsabove equilibrium.五、讨论题(2题中任选1题;每小题 10 分,共 10 分)64. Assume the economy is in a recession. Explain how each of the following policies would affectconsumption and investment. In each case, indicate any direct effects, any effects resulting from changes in total output, any effects resulting from changes in interest rate, and the overall effect. If there are conflicting effects making the answer ambiguous, say so. a). a reduction in taxes; b) an expansion of the money supply. 65. In 1939, with the U.S. economy not yet fully recovered from the Great Depression, President Roosevelt proclaimed that Thanksgiving would fall a week earlier than usual so that the shopping period before Christmas would be longer. Explain this decision, using the model of aggregate demand and aggregate supply.《宏观经济学》答题纸一、选择题 (每小题 1 分,共 30 分)1. 2. 3. 4. 5. 6. 7. 8. 9. 10.精品文档11. 12. 13. 14. 15.16. 17. 18. 19. 20.21. 22. 23. 24. 25.26. 27. 28. 29. 30.二、判断题(正确用“T”;错误用“F”;每小题 1分,共 20 分)31. 32. 33. 34. 35.36. 37. 38. 39. 40.41. 42. 43. 44. 45.46. 47. 48. 49.50.三、名词解释(每小题 2分,共 10 分)51.catch-up effect:52.depreciation: 53.capital flight:54.recession:55.automatic stabilizers:四、简答题( 8题中任选6题;每小题 5分,共 30 分;答题时请标明题号)精品文档五、讨论题(2题中任选1题;每小题 10 分,共 10 分;答题时请标明题号)精品文档《宏观经济学》试卷B参考答案1.a2.d3.c4.c5.a6.b7.b8.d9.d 10.b 11.a 12.c 13.d 14.d 15.d 16.d 17.c 18.b 19.b 20.c 21.a 22.d 23.b 24.c 25.a 26.c 27.c 28.b 29.a 30.d31.F 32.F 33.T 34.T 35.T 36.F 37.T 38.F 39.F 40.F 41.F 42.T 43.F 44.F 45.T 46.T 47.T 48.T 49.T 50.T51.the property whereby the benefit from an extra unit of an input declines as the quantity of the input increases.52.the rate at which a person can trade the currency of one country for the currency of another.53.the offset in aggregate demand that results when expansionary fiscal policy raises the interest rate and thereby reduces investment spending.54.a period of falling output and rising prices.55.changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession without policymakers having to take any deliberate action.56.Property rights are an important prerequisite for the price system to work in a market economy. If an individual or company is not confident that claims over property or over the income from property can be protected, or that contracts can be enforced, there will be little incentive for individuals to save, invest, or start new businesses. Likewise, there will be little incentive for foreigners to invest in the real or financial assets of the country. The distortion of incentives will reduce efficiency in resource allocation and will精品文档reduce saving and investment which in turn will reduce the standard of living.57. a. A municipal bond, because generally they have low credit risk and are notsubject to federal income tax.b. A junk bond. Because of their high risk, they have a high return.c. A corporate bond that isn't a junk bond. Because they have more risk thangovernment bonds and have no special tax treatment, they pay moderate ratesof return.58.First National Bank of MeAssets LiabilitiesReserves $800 Deposits $5,000Loans $4,20059.The costs of inflation include "shoeleather costs," the cost of reducing your money holdings to reduce your inflation tax; "menu costs," the costs of price adjustments; the costs of resource misallocation that result from the relative-price variability induced by inflation; the costs of inflation-induced tax distortions; the costs of confusion and inconvenience; and the costs associated with the arbitrary redistribution of wealth that accompany unexpected inflation.60.Examples in the text (or variations) include increased immigration, a decrease in the minimum wage, more generous unemployment insurance, an increase in the capital stock, an increase in the average level of education, a discovery of new mineral deposits, technology, and removal of barriers to international trade.61.See graph. Over time technological advances cause the long-run aggregate supply curve to shift right. Increases in the money supply cause the aggregate demand curve to shift right. Output growth puts downward pressure on the price level, but money supply growth contributes to rising prices.62.The wealth effect is not very important because it operates through changes in the real value of money, and money is only a small fraction of household wealth. So it is unlikely that changes in the price level will lead to large changes in consumption spending through this channel. The exchange-rate effect is not very important in the United States because trade with other countries represents a relatively small fraction of U.S. GDP.63. If the interest rate is above equilibrium, there is an excess supply of money. People with more money than they want to hold given the current interest rate deposit the money in banks and buy bonds. The increase in funds to lend out causes the interest rate to fall. As the interest rate falls, the quantity of money demanded increases, which tends to diminish the excess supply of money.64. a) 税收减少增加了储蓄的收益、减少了投资的成本,但税收减少对储蓄和投资的影响要视情况而定。

宏观经济学期末考试试卷1(附答案)

一、选择题 (每小题 1 分,共 30 分)1.The government reports that "GDP increased by 1.6 percent in the last quarter." This statement means that GDP increaseda. by 6.4 percent for the year.b. at an annual rate of 6.4 percent during the last quarter.c. at an annual rate of 1.6 percent during the last quarter.d. at an annual rate of .4 percent during the last quarter.2.A Brazilian company produces soccer balls in the United States and exports all of them. If the price of the soccer balls increases, the GDP deflatora. and the CPI both increase.b. is unchanged and the CPI increases.c. increases and the CPI is unchanged.d. and the CPI are unchanged.3.The price of CD players increases dramatically, causing a 1 percent increase in the CPI. The price increase will most likely cause the GDP deflator to increase bya. more than 1 percent.b. less than 1 percent.c. 1 percent.d. It is impossible to make an informed guess without more information.4.A nation's standard of living is measured by itsa. real GDP.b. real GDP per person.c. nominal GDP.d. nominal GDP per person.5.In 2002 President Bush imposed restrictions on imports of steel to protect the U.S.steel industry.a. This is an inward-oriented policy which most economists believe have adverseeffects on growth.b. This is an inward-oriented policy which most economists believe have beneficial effects ongrowth.c. This is an outward-oriented policy which most economists believe have adverse effects on growth.d. This is an outward-oriented policy which most economists believe have beneficial effects ongrowth.6.Generally when economists and the text talk of the "interest rate," they are talking about thea. real interest rate.b. current nominal interest rate.c. real interest rate minus the inflation rate.d. equilibrium nominal interest rate.7.An increase in the budget deficita. makes investment spending fall.b. makes investment spending rise.c. does not affect investment spending.d. may increase, decrease, or not affect investment spending.8.Norne Corporation is considering building a new plant. It will cost them $1 million today to build it and it will generate revenues of $1,121 million three years from today. Of the interest rates below, which is the highest interest rate at which Norne would still be willing to build the plant?a. 3 percentb. 3.5 percentc. 4 percentd. 4.5 percent9.Recent entrants into the labor force account for abouta. 1/2 of those who are unemployed. Spells of unemployment end about 1/5 of the time with peopleleaving the labor force.b. 1/3 of those who are unemployed. Spells of unemployment end about 1/2 of the time with peopleleaving the labor force.c. 1/4 of those who are unemployed. Spells of unemployment end about 1/2 of the time with peopleleaving the labor force.d. 1/4 of those who are unemployed. Spells of unemployment end about 1/5 of the time with peopleleaving the labor force10.Which of the following best illustrates the unit of account function of money?a. You list prices for candy sold on your Web site, , indollars.b. You pay for your WNBA tickets with dollars.c. You keep $10 in your backpack for emergencies.d. None of the above is correct.11.Current U.S. currency isa. fiat money with intrinsic value.b. fiat money with no intrinsic value.c. commodity money with intrinsic value.d. commodity money with no intrinsic value.12.Velocity in the country of Shem is always stable. In 2002, the money supply was $200 billion and the GDP price deflator was four times as high as it was in the base year. In 2003, the money supply increased to $240 billion, the price level increased by 15 percent, and nominal GDP equaled $1,200 billion. By how much did real GDP increase between 2002 and 2003?a. 20 percentb. 4.35 percentc. 2.17 percentd. There is not enough information to answer the question.13.Shoeleather costs refer toa. the cost of more frequent price changes induced by higher inflation.b. the distortion in resource allocation created by distortions in relative prices dueto inflation.c. resources used to maintain lower money holdings when inflation is high.d. the distortion in incentives created by inflation by taxes that do not adjust forinflation.14.International tradea. raises the standard of living in all trading countries.b. lowers the standard of living in all trading countries.c. leaves the standard of living unchanged.d. raises the standard of living for importing countries and lowers it for exporting countries.15.Which of the following would be U.S. foreign portfolio investment?a. Disney builds a new amusement park near Rome, Italy.b. Your economics professor buys stock in companies located in Eastern European countries.c. A Dutch hotel chain opens a new hotel in the United States.d. A citizen of Singapore buys a bond issued by a U.S. corporation.16.A Venezuelan firm purchases earth-moving equipment from a U.S. company and pays for it with domestic currency. This transactiona. increases U.S. net exports, and increases Venezuelan net capital outflow.b. increases U.S. net exports, and decreases Venezuelan net capital outflow.c. decreases U.S. net exports, and increases Venezuelan net capital outflow.d. decreases U.S. net exports, and decreases Venezuelan net capital outflow.17.At the equilibrium interest rate in the open economy macroeconomic model, the amount that people want to save equals the desired quantity ofa. net capital outflow.b. domestic investment.c. net capital outflow plus domestic investment.d. foreign currency supplied.18.In an open economy,a. net capital outflow = imports.b. net capital outflow = net exports.c. net capital outflow = exports.d. None of the above is correct.19.In the open-economy macroeconomic model, the real exchange rate is determined in the market where dollars are exchanged for foreign currency by the equality of the supply of dollars, which comes froma. U.S. national saving and the demand for dollars for U.S. net exports.b. U.S. net capital outflow and the demand for dollars for U.S. net exports.c. domestic investment and the demand for U.S. net exports.d. foreign demand for U.S. goods and U.S. demand for foreign goods.20.If a government increases its budget deficit, then interest ratesa. rise and the trade balance moves toward surplus.b. rise and the trade balance moves toward deficit.c. fall and the trade balance moves toward surplus.d. fall and the trade balance moves toward deficit.21.Investment spending decreases when the price levela. rises causing interest rates to rise.b. rises causing interest rates to fall.c. falls causing interest rates to rise.d. falls causing interest rates to fall.22.An increase in the price level and a decrease in real GDP in the short run could be created bya. an increase in the money supply.b. an increase in government expenditures.c. a fall in stock prices.d. bad weather in farm states.23.Which part of real GDP fluctuates most over the course of the business cycle?a. consumptionb. government expendituresc. investmentd. net exports24.According to liquidity preference theory, the price level and interest rate area. positively related as are the interest rate and aggregate demand.b. inversely related as are the interest rate and aggregate demand.c. positively related while the interest rate and aggregate demand are inverselyrelated.d. inversely related while the interest rate and aggregate demand are positivelyrelated.25.Which of the following shifts aggregate demand to the right?a. an increase in the price levelb. an increase in the money supplyc. a decrease in the price leveld. a decrease in the money supply26.If the Fed conducts open-market sales, the money supplya. increases and aggregate demand shifts right.b. increases and aggregate demand shifts left.c. decreases and aggregate demand shifts right.d. decreases and aggregate demand shifts left.27.Some economists argue thata. monetary policy should actively be used to stabilize the economy.b. fiscal policy should actively be used to stabilize the economy.c. fiscal policy can be used to shift the AD curve.d. All of the above are correct.28.The lag problem associated with monetary policy is due mostly toa. the fact that business firms make investment plans far in advance.b. the political system of checks and balances that slows down the process of determining monetarypolicy.c. the time it takes for changes in government spending to affect the interest rate.d. All of the above are correct.29.A. W. Phillips' findings were based on dataa. from 1861-1957 for the United Kingdom.b. from 1861-1957 for the United States.c. mostly from the post-World War II period in the United Kingdom.d. mostly from the post-World War II period in the United States.30.Which of the following is true concerning the long-run Phillips curve?a. Its position is determined primarily by monetary factors.b. If it shifts right, long-run aggregate supply shifts right.c. It cannot be changed by any government policy.d. its position depends on the natural rate of unemployment.二、判断题(每小题 1 分,共 20 分)31.The government component of GDP includes salaries paid to Army generals but not Social Security benefits to the elderly.32.An increase in the saving rate does not permanently increases the growth rate of real GDP per person.33.In ten years when you are the owner of a major U.S. corporation, if your corporation opens and operates a branch in a foreign country you will be engaging in foreign direct investment.34.Corporations receive no proceeds from the resale of their stock.35.According to the rule of 70, if you earn an interest rate of 3.5 percent, your savings will double about every 20 years.36.The value of a stock depends on the ability of the company to generate dividends and the expected price of the stock when the stockholder sells her shares.37.A minimum wage above equilibrium creates a labor surplus.38.According to the theory of efficiency wages, firms operate more efficiently if they can pay wages that are below the equilibrium level. 39.The use of money allows trade to be roundabout.40.The quantity theory of money can explain hyperinflations but not moderate inflation.41.In every economy, national saving equals domestic investment plus net capitaloutflow.42.In the open-economy macroeconomic model, net exports represent the quantity of dollars demanded in the foreign-currency exchange market.43.Although trade policies do not affect a country's overall trade balance, they do affectspecific firms and industries.44.If speculators bid up the value of the dollar in the market for foreign-currency exchange, aggregate demand would shift to the left.45.In response to a decrease in output the economy would revert to its original level of prices and output whether the decrease in output was caused by a decrease in aggregate demand or a decrease in aggregate supply.46.John Maynard Keynes advocated policies that would increase aggregate demand as a way to decrease unemployment caused by recessions.47.An increase in the money supply shifts the aggregate supply curve right. 48.Unemployment insurance and welfare programs work as automatic stabilizers. 49.In the long run, the inflation rate depends primarily on money supply growth.50.Although monetary policy cannot reduce the natural rate of unemployment, other types of policies can. 三、名词解释(每小题 2分,共 10 分)51.catch-up effect: 52.depreciation: 53.capital flight: 54.recession:55.automatic stabilizers: 四、简答题( 8题中任选6题;每小题 5分,共 30 分)56.Compare and contrast the population theories of Malthus and Kremer.57.Using a graph representing the market for loanable funds, show and explain what happens to interest rates and investment if a government goes from a deficit to a surplus.58.Which two of the Ten Principles of Economics imply that the Fed can profoundly affect the economy?59.The U.S. Treasury Department issues inflation-indexed bonds. What areinflation-indexed bonds and why are they important?60.Make a list of things that would shift the long-run aggregate supply curve to the right.61.Illustrate the classical analysis of growth and inflation with aggregate demand and long-run aggregate supply curves.62.How does a reduction in the money supply by the Fed make owning stocks less attractive?63.Why and in what way are fiscal policy lags different from monetary policy lags?五、讨论题(2题中任选1题;每小题 10 分,共 10分)64. Suppose government spends $3 billion to buy police cars. Explain why aggregate demand might increase by more than $3 billion. Explain why aggregate demand might increase by less than $3 billion.65. In 1939, with the U.S. economy not yet fully recovered from the Great Depression, President Roosevelt proclaimed that Thanksgiving would fall a week earlier than usual so that the shopping period before Christmas would be longer. Explain this decision, using the model of aggregate demand and aggregate supply.《宏观经济学》答题纸一、选择题 (每小题 1 分,共 30 分)1. 2. 3. 4. 5.6. 7. 8. 9. 10.11. 12. 13. 14. 15.16. 17. 18. 19. 20.21. 22. 23. 24. 25.26. 27. 28. 29. 30.二、判断题(正确用“T”;错误用“F”;每小题 1分,共 20 分)31. 32. 33. 34. 35.36. 37. 38. 39. 40.41. 42. 43. 44. 45.46. 47. 48. 49. 50.三、名词解释(每小题 2分,共 10 分)51.catch-up effect:52.depreciation:53.capital flight:54.recession:55.automatic stabilizers:四、简答题( 8题中任选6题;每小题 5分,共 30 分;答题时请标明题号)五、讨论题(2题中任选1题;每小题 10 分,共 10 分;答题时请标明题号)《宏观经济学》试卷A参考答案1.c2.c3.d4.b5.a6.a7.a8.b9.b 10.a 11.b 12.b 13.c 14.a 15.b 16.b 17.c 18.b 19.b 20.b 21.a 22.d 23.c 24.c 25.b 26.d 27.d 28.a 29.a 30.d31.T 32.T 33.T 34.T 35.T 36.T 37.T 38.F 39.T 40.F 41.T 42.T 43.T 44.T 45.F 46.T 47.F 48.T 49.T 50.T51.the property whereby contries that start off poor tend to grow more rapidly than countries that start off rich.52.a decrease in the value of a currency as measured by the amount of foreign currency it can buy.53.a large and sudden reduction in the demand for assets located in a country.54.a period of declining real incomes and rising unemployment.55.changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession考生答题不得过此线∶∶∶∶∶∶∶∶∶∶∶∶∶∶密∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶封∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶线∶∶∶∶∶∶∶∶∶∶∶∶∶∶ 任课教师:教学班号:姓名:学号:∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶装∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶订∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶线∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶∶without policymakers having to take any deliberate action.56.The difference is that Malthus predicted that population growth would be greater than growth in the ability to increase output. He believed that people would continue to populate the earth until output reached a subsistence level. On the other hand Kremer argues that population growth increased productivity allowing people to improve their standard of living despite growing population. Kremer argues that with more population comes more innovations. The improvements in technology more than offset any adverse impact of the increase in population on the standard of living.57. As shown in the graph below, the economy starts in equilibrium at point E0 with interest rate r0 and equilibrium quantity of saving and investment at q0. If the government succeeds in obtaining a surplus, there will be more public saving in the economy at each interest rate, and the supply of loanable funds curve will shift from S0 to S1. The new equilibrium will be at E1, with a lower interest rate, r1 and a higher quantity of saving and investment, q1. Hence, if the federal government succeeds in having a surplus, interest rates will fall and investment will increase.Market for Loanable Funds58. 1. Prices rise when the government prints too much money.2. There is a short-run tradeoff between inflation and unemployment.59. Inflation-indexed bonds are bonds whose interest and principal payments are adjusted upward for inflation, guaranteeing their real purchasing power in the future.They are important because they provide a safe, inflation-proof asset for savers and they may allow the Treasury to borrow more easily at a lower current cost.60. Examples in the text (or variations) include increased immigration, a decrease in the minimum wage, more generous unemployment insurance, an increase in the capital stock, an increase in the average level of education, a discovery of new mineral deposits, technology, and removal of barriers to international trade.61.See graph.Over time technological advances cause the long-run aggregate supply curve to shift right. Increases in the money supply cause the aggregate demand curve to shift right. Output growth puts downward pressure on the price level, but money supply growth contributes to rising prices.62. The reduction in the money supply raises the interest rate. So the return on bonds increases relative to the return on stocks. The increase in the interest rate also causes spending to fall so that revenues and profits fall making shares of ownership in corporations less valuable.63.The fiscal policy lags are mostly a matter of waiting to implement the policy. By the time the president and Congress can agree to and pass legislation changing expenditures or taxes, the recession may have ended. The Federal Reserve can act to change the money supply quickly, but it may take some time before the effects of an increase in the money supply work their way through the economy.64. 当政府支出30亿美元购买警车时,直接投资增加警车生产企业的利润,这种增加又使该企业雇佣更多工人,并增加生的。

宏观经济学期末考试试卷习题及标准答案.doc

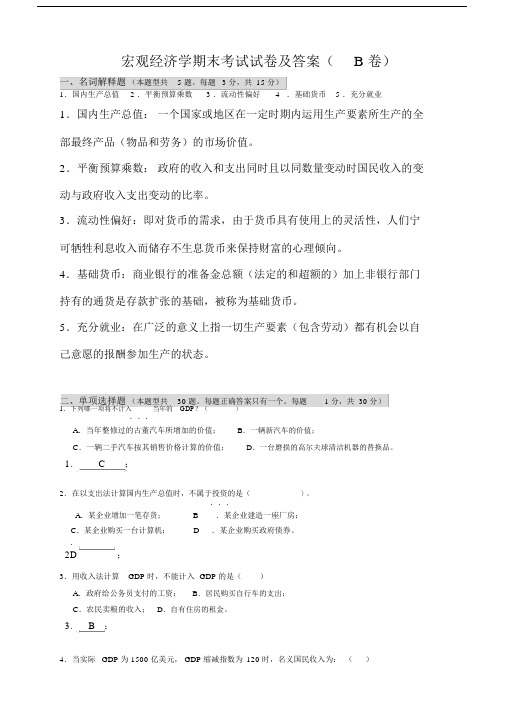

宏观经济学期末考试试卷及答案( B 卷)一、名词解释题(本题型共 5 题。

每题 3 分,共 15 分)1.国内生产总值 2 .平衡预算乘数 3 .流动性偏好4.基础货币 5 .充分就业1.国内生产总值:一个国家或地区在一定时期内运用生产要素所生产的全部最终产品(物品和劳务)的市场价值。

2.平衡预算乘数:政府的收入和支出同时且以同数量变动时国民收入的变动与政府收入支出变动的比率。

3.流动性偏好:即对货币的需求,由于货币具有使用上的灵活性,人们宁可牺牲利息收入而储存不生息货币来保持财富的心理倾向。

4.基础货币:商业银行的准备金总额(法定的和超额的)加上非银行部门持有的通货是存款扩张的基础,被称为基础货币。

5.充分就业:在广泛的意义上指一切生产要素(包含劳动)都有机会以自己意愿的报酬参加生产的状态。

二、单项选择题(本题型共30 题。

每题正确答案只有一个。

每题 1 分,共 30 分)1.下列哪一项将不计入当年的GDP?()...A.当年整修过的古董汽车所增加的价值;B.一辆新汽车的价值;C.一辆二手汽车按其销售价格计算的价值;D.一台磨损的高尔夫球清洁机器的替换品。

1.C;2.在以支出法计算国内生产总值时,不属于投资的是()。

...A.某企业增加一笔存货; B .某企业建造一座厂房;C.某企业购买一台计算机; D .某企业购买政府债券。

.;2D3.用收入法计算GDP时,不能计入GDP的是()A.政府给公务员支付的工资;B.居民购买自行车的支出;C.农民卖粮的收入;D.自有住房的租金。

3.B;4.当实际GDP为 1500 亿美元, GDP缩减指数为120 时,名义国民收入为:()A. 1100 亿美元;B.1500亿美元;C . 1700 亿美元; D .1800 亿美元。

4.D;5.一个家庭当其收入为零时,消费支出为2000 元;而当其收入为6000 元时,其消费为6000 元,在图形上,消费和收入之间成一条直线,则其边际消费倾向为()。

16春北外宏观经济学答案(最终版)

16春北外宏观经济学答案(最终版)第一篇:16春北外宏观经济学答案(最终版)假设某经济社会的消费函数为c=100+0.8y,投资为50(单位:百亿美元)(出自第二单元)(1)求均衡收入、消费和储蓄;(15分)(2)如果当时实际产出(即收入)为800,试求企业非自愿存货积累为多少?(5分)(3)若投资增至100,试求增加的收入;(5分)(4)若消费函数变为c=100+0.9y,投资仍为50,收入和储蓄各为多少?投资增至100 时收入增加多少?(10分)(5)消费函数变动后,乘数有何变化?(15分)解:(1)均衡收入=(100+50)/(1-0.8)=750,消费=100+0.8×750=700,储蓄=750-700=50。

(2)非愿意存货积累=800-750=50(3)若投资增至100,则收入Y′=(100+100)/(1-0.8)=800,比原来的收入增加50(4)消费函数变化后的:收入=(100+50)/(1-0.9)=1500,储蓄=-100+(1-1.9)× 1500=50,若投资增至100,则收入为2000,比原来收入增加500。

(5)消费函数从C=100+0.8Y 变为C=100+0.9Y 以后,乘数从5变为10。

根据四部门国民收入核算,试述美国“双赤字”形成的原因及其对中国的影响(出自第一单元)答:(1)“双赤字”包括财政赤字和贸易赤字两方面四部门C+I+G+(X-M)=Y 及Y=C+S+T 得S-I=(G-T)+(X-M)美国是一个储蓄率低的国家,等式左边是负。

其原因不仅是国内的财政赤字(G-T),还有贸易赤字(X-M)。

结合美国国情分析:1.经济危机让美国的经济一度衰退,导致国民收入这一税收基数增长缓慢。

在支出这一方,美国政府财政压力空前之大。

美国政府不得不为无业大军的福利保障买单,同时,巨额的军事支出,以及庞大的社会福利支出(包括社会保障、医疗保险、公共医疗补助等),大量的外债产生的净国债利息等,使得美国的财政支出大大增加,造成了严重的财政赤字。

北大秋季宏观经济学作业

(涉及第三、四、五章)假设货币需求为:L=Y-100R,货币供给量为:M=2000,价格水平P=4,消费函数为:C=100+0.8Yd,投资函数为:I=500-20R,税收T=100,政府购买支出G=100。

(1) 求均衡收入、利率和投资。

(2) 如果政府购买支出增加到300,计算挤出效应。

(3) 在政府购买支出为100的情况下,推导出此经济的总需求曲线。

(4) 若政府购买支出增加100,那么,将引起最终均衡国民收入增加量为多少?(提示:政府购买支出乘数,c=0.8)1、IS方程:Y=AD=C+I+G=100+0.8Yd+500-20R+100=100+0.8(Y-100)+500-20R+100=620+0.8Y-20R0.2Y=620-20RY=3100-100RLM方程:L=M/PY-100R=2000/4Y=500+100R联立IS和LM方程,即可得,500+100R=3100-100R即:200R=2600R=13I=500-20R=240Y=500+100R=18002、若政府购买增加到300,则IS方程:Y=AD=C+I+G=100+0.8Yd+500-20R+300=100+0.8(Y-100)+500-20R+300=820+0.8Y-20R0.2Y=820-20RY=4100-100RLM方程不变联立IS和LM方程,即可得,500+100R=4100-100R200R=3600R=18I=500-20R=140挤出效应为:△I=240-140=1003、IS方程为:Y=3100-100RLM方程:由L=M/P得Y-100R=2000/P联立,消去R,即可得总需求函数:Y=1550+1000/P4、K=1/(1-C)=1/(1-0.8)=5因此若政府购买支出增加100,最终均衡国民收入增加500。

宏观经济学期末考试试卷及答案

宏观经济学期末考试试卷及答案宏观经济学期末考试试卷及答案 A 卷一、名词解释题本题型共5题。

每题2分共10分将答案写在答题纸上1国民生产总值 2. 消费函数 3. 充分就业 4 经济周期 5. 菲利普斯曲线二、单项选择题本题型共30题。

每题正确答案只有一个从每题的备选答案中选出正确的答案将其英文字母编号填入答题纸上相应的空格内。

每题1分共30分1、今年的名义国内生产总值大于去年的名义国内生产总值说明 A.、今年物价水平一定比去年高了B、今年生产的物品和劳务的总量一定比去年增加了C、今年的物价水平和实物产量水平一定都比去年提高了D、以上三种说法都不一定正确。

2、一国的国内生产总值小于国民生产总值说明该国公民从外国取得的收入外国公民从该国取得的收入 A.、大于B、小于C、等于D、可能大于也可能小于。

3、两部门的均衡是A: IS B: IGST C: IGXSTM D: ADAS。

4、一般地说通货膨胀会使。

A债权人受损债务人受益B债权人受益债务人受损C债权人和债务人都受益D债权人和债务人都受损。

5、在货币总量不变条件下当物价上升货币投机需求减少利率上升从而抑制投资需求和居民信贷消费需求导致产出的下降这种效应被称为 A. 净出口效应 B. 利率效应 C.实际余额效应 D.财富效应。

6、总需求曲线向下倾斜的原因之一是 A. 随着价格水平下降家庭的实际财富下降他们将增加消费 2 B. 随着价格水平上升家庭的实际财富下降他们将减少消费 C.随着价格水平下降家庭的实际财富上升他们将减少消费 D. 随着价格水平上升家庭的实际财富上升他们将增加消费。

7、在LM曲线即定时扩张性的财政政策使IS曲线向。

A: 上移B: 下移C: 不变D: 无联系。

8、假设银行利率为6在下列几项投资中投资者应该选择 A.类投资的平均资本收益率最高的是 2 B.类投资的平均资本收益率最高的是 5 C.类投资的平均资本收益率最高的是8 D.无法确定。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一、单选题

1. 哪一项计入GDP(国内生产总值(GDP=Gross Domestic Product))?()

A. 购买一辆用过的旧自行车;

B. 政府向低保户发放一笔救济金;

C. 汽车制造厂买进10吨钢材;

D. 银行向某企业收取一笔贷款利息

考生答案:D

2. 一国的国内生产总值大于国民生产总值,则该国公民从国外取得的收入()外国国民从该国取得的收入。

A. 大于

B. 小于

C. 等于

D. 不能确定

考生答案:B

国内生产总值-国民生产总值=外国居民在本国创造的市场价值-本国居民在外国创造的市场价值

3. 60*10/3=200亿元

D

4 假设政府想增加投资但保持产出不变,在IS-LM模型中货币政策与财政政策应如何配合才能实现这一目标()。

(第五章,视频教学课件第26-37讲)

A. 宽松的货币政策,宽松的财政政策

B. 宽松的货币政策,紧缩的财政政策

C. 紧缩的货币政策,宽松的财政政策

D. 紧缩的货币政策,紧缩的财政政策

考生答案:B

5. 菜单成本论理论解释了()。

A. 名义工资粘性

B. 实际工资粘性

C. 名义价格粘性

D. 实际价格粘性

考生答案:C

价格粘性论也可以分为两类:一是名义价格粘性论;而是实际价格粘性论。

名义价格粘性论包括菜单成本论,代表性理论为:菜单成本和经济周期论;

工资粘性论分为名义工资粘性论和实际工资粘性论。

名义工资粘性论的代表性理论有交错调整工资论和长期劳动合同论等。

实际工资粘性论典型理论有:隐含合同论、效率工资论和局内—局外人理论。

6 货币主义学派认为扩张性货币政策()。

(第八章,视频教学课件第45-47讲)

A. 短期和长期都无效

B. 短期有效,长期无效

C. 短期无效,长期有效

D. 短期和长期都有效

考生答案:B

新古典宏观经济学(the New Classical Macroeconomics)(the New Classical Macroeconomics,NCM或NC),又称作“新古典主义”、“货币主义Ⅱ”

二、简答题

1、决定LM曲线斜率的因素有哪些?

LM曲线为R=-(M0/hP)+(k/h)Y,斜率表示为k/h,其中k为货币需求的收入弹性,h为货币需求的利率弹性。

(1)货币需求的收入弹性。

当货币需求的收入弹性上升,在纵轴截距不变的情况下横轴截距变小,LM曲线变得更加陡峭。

反之反然。

(2)货币需求的利率弹性。

当货币需求的利率弹性下降,在横轴截、距不变的情况下纵轴截距变小,LM曲线变得更加平坦;反之反然。

2、什么叫理性预期?它与适应性预期有何区别?

【理性预期】指针对某个经济现象(例如市场价格)进行预期的时候,如果人们是理性的,那么他们会最大限度的充分利用所得到的信息来指导作出行动而不会犯系统性的错误,因此,平均地来说,人们的预期应该是准确的。

【适应性预期】是经济学中是指人们在对未来会发生的预期是基于过去(历史)的。

在估计或判断未来的经济走势时,利用过去预期与过去实际间的差距来矫正对未来的预期。

例如,如果过去的通货膨胀是高的,那么人们就会预期它在将来仍然会高。

区别:

——1、理性预期充分利用所得到的信息指标来作出的判断(以行情信息的分析进行预期);——2、适应性预期对未来发生的预期是基于过去的历史指标作出的判断(以历史资料统计进行预期);

第三题计算题

假设货币需求为:L=Y-100R,货币供给量为:M=2000,价格水平P=2,消费函数为:C=100+0.8Yd,投资函数为:I=500-20R,税收T=100,转移支付TR=150,政府购买支出G=200。

(1)请写出本题的IS曲线表达式。

(2)请写出本题的LM曲线表达式。

(3)计算均衡利率、国民收入水平和均衡投资水平。

(4)如果政府购买支出增加了200,计算挤出效应。

(5)请写出本题的AD曲线表达式。

(1)IS方程:Y=AD =C+I+G =100+0.8Yd+500-20R+200 =100+0.8(Y-100+150)+500-20R+200 =840+0.8Y-20R 0.2Y=840-20R Y=4200-100R

(2)LM方程:L=M/P Y-100R=2000/2 Y=1000+100R

(3)联立IS和LM方程,即可得,1000+100R=4200-100R 即:200R=3200 R=16 I=500-20R=180 Y=1000+100R=2600

(4)增加政府购买支出会改变IS曲线方程,但是不会改变LM曲线:IS方程:Y=AD =C+I+G =100+0.8Yd+500-20R+200+200 =1040+0.8Y-20R 0.2Y=1040-20R Y=5200-100R LM曲线:

Y=1000+100R 联立IS-LM:5200-100R=1000+100R R=21 I=500-20R=80 投资减少:180-80=100,因此挤出效应为100。

(5)AD曲线为价格水平P与总收入Y之间的关系,因此在方程中要保留价格水平P,消去R:IS曲线:Y=4200-100R LM曲线:Y-100R=2000/P得:Y=2100+1000/P即为AD 曲线。

四、论述题

(材料分析)骆明和小欣是一对感情不错的情侣,今年同时从一所名牌大学毕业,骆明进了某国家机关,待遇很是不错,每个月可以拿3500元左右工资,可惜,遇到住房政策的改革,不能分到房子了,这是美中不足。

而小欣进了一家国际贸易公司,做对外贸易工作,它的工资和奖金加在一起,每个月大概有5000元。

看来这对情侣的前途一片光明。

不过前几天,他们为了将来存钱的问题着实大吵了一架。

骆明以为现在他们刚刚大学毕业,虽然单位都不错,工资也不低,但将来用钱的地方还很多,所以要从毕业开始,除了留下平常必需的花费以及预防发生意外事件的钱外,剩下的钱要定期存入银行,不能动用,这样可以获得稳定的利息收入,又没有损失的风险。

而小欣大概是受外企工作环境的影响,她以为,上学苦了这么多年,一直过着很节俭的日子,现在终于自己挣钱了,考虑那么多将来干什么,更何况银行利率那么低。

她说发下工资以后,先要买几件名贵服装,再美美地吃上几顿,然后她还想留下一部分钱用来炒股票,等着股市形势一好,立即进入。

大学时看着别人炒股票她一直很羡慕,这次自己也要试试。

但骆明却认为中国股市行情太不稳定,运行不规范,所以最好不进入股市,如果一定要做,那也只能投入很少的钱。

根据以上材料,请回答问题:

1、根据上面两个人的争论,说明有哪些货币需求动机。

2、分析上述三种动机导致的货币需求的决定因素,并给出货币的总需求函数。

答1、人们的货币需求主要是出于以下三种不同的动机: (1)交易动机是指人们为了应付日常交易而在手边留有货币的动机。

(2)预防动机又称谨慎动机是指人们为了防止意外情况发生而在手边留有货币的动机。

(3)投机动机是指人们为了把握有利的生息资产而在手边留有一定数量货币的愿望。

2. (1)交易性货币需求决定于收入水平以及惯例和商

业制度而管理和商业制度在短期内一般可假定为固定不变所以一般来说这一货币需求量主要决定于收入。

收入越高交易数量越大:交易数量越大所交换的商品和劳务的价格越高从而交易性货币需求越大。

(2)个人月货币的预防需求主要取决于他对意外事件的看法但从全社会来看这一货币需求量大体上也和收入成正比是收入的函数。

(3)人们对货币的投机需求取决于市场利息率这一需求与利息率成反方向变化。

根据以上的分析我们知道从整个社会来说交易和谨慎导致的货币需求都取决于实际收入并且与实际收入成正比。

如果以表示交易动机和谨慎动机所产生的全部货币需求量用表示收入可以把货币的交易需求与收入之间的关系简单地表示为:。

而对货币的投机性需求取决于利率如果用表示货币的役机需求用表示市场利息率货币的总需求函数就可以表示。