会计学 专业英语

介绍会计学专业英语作文

介绍会计学专业英语作文Accounting is a field that deals with the measurement, processing, and communication of financial information about economic entities. It plays a crucial role in the decision-making process of businesses, organizations, and individuals. As a result, studying accounting has become increasingly popular, and many universities offer accounting programs to meet the growing demand for skilled professionals in this field.The study of accounting involves a wide range of topics, including financial accounting, managerial accounting, auditing, taxation, and financial analysis. To excel in this field, it is essential to have a strong foundation in both accounting principles and the English language. Accounting professionals often need to communicate with clients, colleagues, and stakeholders from different countries, making proficiency in English a valuable asset.In accounting, accuracy and attention to detail are of utmost importance. Therefore, it is crucial for accounting students to develop strong writing skills, particularly in English. Writing in English allows accountants to effectively communicate financial information, prepare reports, and analyze data for decision-making purposes. Additionally, English proficiency enables accounting professionals to understand international accounting standards and stay updated with the latest developments in the field.To improve their English writing skills, accounting students can engage in various activities. Reading accounting textbooks, journals, and articles in English can help students familiarize themselves with the terminology and concepts used in the field. They can also practice writing by summarizing accounting cases, analyzing financial statements, and preparing reports in English. Seeking feedback from professors or native English speakers can further enhance their writing abilities.In addition to improving writing skills, accounting students should also focus on developing their oral communication skills in English. Participating in group discussions, presenting financial reports, and engaging in role-plays can help students buildconfidence and fluency in spoken English. Furthermore, taking part in language exchange programs or joining English-speaking clubs can provide opportunities for real-life practice and cultural exchange.As the accounting profession becomes increasingly globalized, the demand for accountants with strong English language skills continues to grow. Many multinational corporations require accountants who can effectively communicate with clients and colleagues from different countries. Moreover, international accounting firms often operate in English-speaking environments, making English proficiency a prerequisite for career advancement.In conclusion, studying accounting involves not only mastering accounting principles but also developing strong English language skills. Writing and communication skills in English are essential for accountants to effectively communicate financial information, analyze data, and make informed decisions. By continuously improving their English language abilities, accounting students can enhance their career prospects and contribute to the globalized accounting profession.。

会计专业英语翻译题

Account 、Accounting 和AccountantAccount 有很多意思,常见的主要是“说明、解释;计算、帐单;银行帐户”。

例如:1、He gave me a full account of his plan。

他把计划给我做了完整的说明。

2、Charge it to my account。

把它记在我的帐上。

3、Cashier:Good afternoon。

Can I help you ?银行出纳:下午好,能为您做什么?Man :I’d like to open a bank account .男人:我想开一个银行存款帐户。

还有account title(帐户名称、会计科目)、income account(收益帐户)、account book(帐簿)等。

在account 后面加上词缀ing 就成为accounting ,其意义也相应变为会计、会计学。

例如:1、Accounting is a process of recording, classifying,summarizing and interpreting of those business activities that can be expressed in monetary terms.会计是一个以货币形式对经济活动进行记录、分类、汇总以及解释的过程。

2、It has been said that Accounting is the language of business.据说会计是“商业语言”3、Accounting is one of the fastest growing profession in the modern business world.会计是当今经济社会中发展最快的职业之一。

4、Financial Accounting and Managerial Accounting are two major specialized fields in Accounting.财务会计和管理会计是会计的两个主要的专门领域。

金融学会计专业学位英语考试

二、阅读理解题解题技巧

阅读理解是一种综合性的技能测试,它不仅 要求考生具有较强的理解能力,还要求考生有一 定的阅读速度。通常,影响阅读的主要因素有三 个:词汇量、语法知识、背景知识。

阅读理解题一般可分为细节题、主旨题、推理 题、词义题和观点题。

二、阅读理解题解题技巧

(1)略读 略读(Skimming)又称浏览,是指跳过细节和

二、阅读理解题解题技巧

普遍认同的解题步骤 (1)先读原文,后看试题,然后回原文定位 (2)先看试题,后读原文,并在原文中定位

Eg.

The University of London is one of Britain’s largest centers for higher education, with a name for international education. Located in one of the world’ s most dynamic(有活力的) cities, we can offer international students a wide and diverse cultural life, as well as the best course choice and teaching. We offer our international students the ability to study and improve the command(掌握) of English, to ensure they get the best from the course of their choice.

不重要的描述与例子,进行快速阅读,以求抓 住文章的大意和主题思想的方法。 What is the main idea of the passage? Which of the following would be the best title? This passage tells us _______. What does the passage mainly discuss?

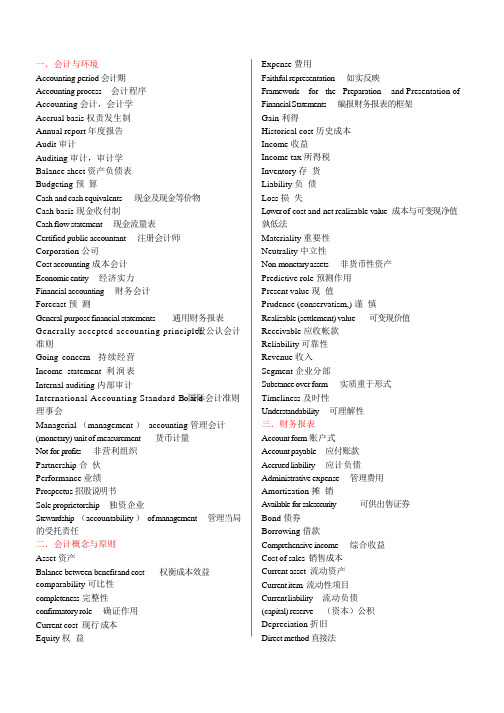

会计专业英语词汇

一.会计与环境Accounting period 会计期Accounting process 会计程序Accounting 会计,会计学Accrual basis 权责发生制Annual report 年度报告Audit 审计Auditing 审计,审计学Balance sheet 资产负债表Budgeting 预算Cash and cash equivalents 现金及现金等价物Cash basis 现金收付制Cash flow statement 现金流量表Certified public accountant 注册会计师Corporation 公司Cost accounting 成本会计Economic entity 经济实力Financial accounting 财务会计Forecast 预测General purpose financial statements 通用财务报表Generally accepted accounting princip一le般s公认会计准则Going concern 持续经营Income statement 利润表Internal auditing 内部审计International Accounting Standard Bo国ar际d 会计准则理事会Managerial (management )accounting 管理会计(monetary) unit of measurement 货币计量Not-for-profits 非营利组织Partnership 合伙Performance 业绩Prospectus 招股说明书Sole proprietorship 独资企业Stewardship (accountability )of management 管理当局的受托责任二.会计概念与原则Asset 资产Balance between benefit a nd cost 权衡成本效益comparability 可比性completeness 完整性confirmatory role 确证作用Current cost 现行成本Equity 权益Expense 费用Faithful representation 如实反映Framework for the Preparation and Presentation of Financial Statements 编报财务报表的框架Gain 利得Historical cost 历史成本Income 收益Income tax 所得税Inventory 存货Liability 负债Loss 损失Lower of cost and net realizable value 成本与可变现净值孰低法Materiality 重要性Neutrality 中立性Non-monetary assets 非货币性资产Predictive role 预测作用Present value 现值Prudence (conservatism,) 谨慎Realizable (settlement) value 可变现价值Receivable 应收帐款Reliability 可靠性Revenue 收入Segment 企业分部Substance over form 实质重于形式Timeliness 及时性Understandability 可理解性三.财务报表Account form 账户式Account payable 应付账款Accrued liability 应计负债Administrative expense 管理费用Amortization 摊销Available-for-salesecurity 可供出售证券Bond 债券Borrowing 借款Comprehensive income 综合收益Cost of sales 销售成本Current asset 流动资产Current item 流动性项目Current liability 流动负债(capital) reserve (资本)公积Depreciation 折旧Direct method 直接法Discontinued operation 终止营业Distribution cost 销售费用Equity method 权益法Finance cost 财务费用Financing activities 筹资活动Finished good 产生品Foreign currency translation adjustment 外币折算差额Goodwill 商誉Indirect method 间接法Intangible asset 无形资产Inventory 存货Investing activities 投资活动Investment 投资Mortgage 抵押借款Multiple-step from 多步式Non-current asset 非流动资产Notes payable 应付账款Operating activities 投资活动Operating cycle 营业周期Prepaid expense 预付费用Property plant and equipment 固定资产Raw material 原材料Receivable 应收账款Reportform 报告式Retainedearnings 留存收益Sharecapital 股本Short-term investment 短期投资Single-step form 单步式Taxes payable 应交税金Treasurybill 一年以内短期国债Treasury n ote 五年以内中期国债Wages payable 应付工资Work in progress 在产品四.会计循环Account 账户Accounting equation 会计等式Accrual 应计Accrued asset 应计资产Accrued liability 应计负债Accumulated depreciation 累计折旧Adjusted trail balance 调整后的试算平衡表Adjusting entry 调整分录Allowance for doubtful accounts 坏账准备Cash dividend 现金股利Closing entry 结账分录Common stock 普通股Contra account 抵减账户Credit 贷项,信贷Debit 借项,借方Deferral 递延Deferred expense 递延费用Deferred revenue 递延收入Depreciation 折旧Dividend 股利Double-entry bookkeeping system 复式记账Entry 分录Income Summary account 本年利润账户Journal 日记账Ledger 分类账Par value 面值Permanent account 永久性账户Post 过账Post-closing trail balance 结账后试算平衡Sales discount 销售折扣Sales returns and allowance 销售退回与折让Salvage value 残值Temporary account 暂时性账户Trail balance 失算平衡表T-account T 型账户Unearnedrevenue 预计收入Valuation adjustments 计价调整五.流动资产Administrative overhead 管理间接费用Aging receivable 应收账款账龄分析Average cost 平均成本法Bad debt 坏账Bank reconciliation 银行存款余额调节表Bank statement 银行对账单Cash book 现金账Cash equivalents 现金等价物Cash on hand 库存现金Cash short and over 现金尾差,现金短溢Cost flow assumption 成本流转假设Count 盘存Demand deposit 活期存款Deposit in transit 在途存款Deposit to guarantee contract performance 合同履行保证金Direct labor 直接人工Direct material 直接材料Dividend receivable 应收股利Equity investment 权益投资Finished goods 产生品First-in first-out 先进先出法Fixed production overhead 固定制造费用Import duty 进口税金Interest receivable 应收利息IOU 借据Last-in last-out 后进先出法Lower of cost and net realizable value 成本与可变现净值孰低法Maturity date 到期日Moving or cumulative w eighted average 移动加权平均Net realizable value 可变现净值Notes receivable 应收票据Overdraft 银行透支Overtime premium 加班津贴Past due 过期Periodic system 定期盘存制Perpetual system 永续盘存制Petty cash fund 备用金Prudence concept 谨慎性原则Raw material 原材料Rebate 回扣Redeemable preference shares 可赎回优先股Retail method 零售价法Reverse 转回Selling cost 销售费用Specific identification 个别认定法Standard cost 标准成本Subsidiary record 明细记录Supplies 无聊,价值较低的材料Trade discount 商业折扣Trade receivable 应收账款Variableproductionoverhead 可变制造费用Work in progress 在产品Write down 减记六.投资,固定资产与无形资产Amortize 摊销Amortize cost 摊余成本Arm’s length transaction 公平交易Available-for-sale investments 可供出售投资Capitalize 资本化Carrying amount 账面价值Consolidated financial statements 合并财务报表Control 控制Depreciable amount 应计折旧额Derecognize 终止确认Effective interest rate method 实际利率法Equity method 权益法Estimated residual value 预计残值Fair value 公允价值Financial asset 金融资产Financial instrument 金融工具Fixed or float interest rate 固定或浮动利率Held on freehold 拥有所有权Held on leasehold 又有使用权Held-to-maturity investments 持有至到期投资Identifiable 可辨认Impairment 减值Internally generated 自创Investee 被投资方Investment income 投资收益Investment property 投资性房地产Knowledgeable willing parties 熟悉情况,自愿的双方Ordinary shares 普通股Parent company 母公司Physical substance 实物形态Quoted market price 市场报价Recoverable amount 可回收金额Reducing balance method 余额递减折旧法Research and development costs 研究和开发支出Revaluation surplus 重估增值Evaluation 重估Significant 重大影响Straight-line-method 直线法或年限平均法Subsidiary company 子公司Sum-of-the-year digits method 年数综合法Surplus cash 现金盈余Write off 注销记为费用七.负债Adjunct account 附属账户At par 平价Bonus 奖金Book value(carrying value) 账面价值Callable bonds 可提前赎回债券Cash discount 现金折扣Cash dividend 现金股利Compound instrument 混合股利Deferred revenue 递延收入Discount rate 折现率Discount 折价Face value 面值Good&ServiceTax(GST) 货物和劳务税Gross price method 总价法Income tax 所得税Indirect taxation 间接课税Installment 分期Interest-bearing 带息,附息Leverage 杠杆Lien 留置权,质权Mortgage bonds 抵押债券Net price method 净价法Notes payable 应付票据Payroll tax 工资薪金税Premium 溢价Provision 准备Retained earnings 留存收益Sales tax 销售税Social security and unemployment insurance 社会保障税和失业保险金Tax authorities 税务机关Tax deduction 税前抵扣Value Added Tax 增值税Warrant 认股权Warranty 产品质保Yield 收益率Zero-coupon bonds 零息债券八.所有者权益Additional paid-in capital 股本溢价Callability 可赎回优先股Cash dividend 现金股利Common stock 普通股Convertibility 可转换(优先股)Cost flow assumption 成本流转假设Cost method 成本法Cumulative 积累(优先股)Declaration date 股利宣告日Fair market value 公允市价Legal capital 法定资本Limited liability 有限责任Liquidate 清算Par value method 面值法Par value 面值Participation 参加(优先股)Payment date 股利支付日Securities Law 证券法Shareholders or stockholders 股东Shares outstanding 流通在外的股份Stock dividend 股票股利Stock dividend distributable 应付股票股利Stock option 股票期权Stock split 股票分割Treasury stock 库存股九.经营成果Associating cause and effect 因果关系配比Cash discount 现金折扣Commission 销售佣金Consideration 对价Cost of sales 销售成本Dealer 经销商Department store 百货商店Gross amount 总额Immediate recognition 立即确认Installment sales 分期收款销售Matching 配比Nominal value 名义价值Ordinary operating activities 经常经营活动Refund 退款Sales allowance 销售折让Sales returns 销售退回Shipping cost 运费Systematic and rational allocation 系统合理分摊Trade discount 销售折扣Value-added tax 增值税Volume rebate 数量折扣Warranty cost 产品质量保证费用Written off 注销十. 财务报表分析Accounting policy 会计政策Asset turnover 资产周转率Auditors’ report 审计报告Base amount 基数Base year 基期或期年Business risk 经营风险Chairman ’ s statement 董事长报告Common-size statement 统一量度式财务报表,同比报Comparative statement 比较报表Credit scoring 信用评级Cross-sectional comparison 同行业比较Director ’ report 董事会报告DuPont system 杜邦分析系统Economic environment 经济环境Financial asset 财务资产Financial leverage 财务杠杆Financial ratio 财务比率Government statistics 政府统计数据Net income to sales 销售净利润Net profit margin 边际净利率Ratio analysis 比率分析Return on assets(ROA) 资产报酬率Return on equity(ROE) 权益资产报酬率Return on sales(ROS) 销售资产报酬率Time-series comparison 时间序列比较Trend a nalysis 趋势分析Working capital 营运资本十一. 成本要素Allocation rate 分配率Clock card 工时卡Cost A llocation 成本分配Cost object 成本对象Cost T racing 成本汇集Department overhead 部门制造费用Direct labor 直接人工Direct material 直接材料Direct method 直接分配法Indirect labor 间接人工Indirect material 间接材料Manufacturing overhead 制造费用Payroll system 工资系统Reciprocal method 交互分配法Step-down method 顺序分配法十三.管理会计Budgeted balance sheet 预算资产负债表Budgeted statement of cash flows 预算现金流量表Capital expenditures budget 资本支出预算Cash budget 现金预算Cost center 成本中心Cost of goods sold budget 产品销售成本预算Direct labor budget 直接人工预算Direct material budget 直接材料预算Efficiency variance 效率差异Favorable variance 有利差异Financial budget 财务预算Fixed overhead capacity variance 固定性制造费用能量差异Fixed overhead expenditure varia固nc定e 性制造费用耗费差异Fixed overhead variance 固定性制造费用差异Investment center 投资中心Labor cost variance 人工成本差异Labor efficiency variance 人工效率差异Labor rate variance 人工工资率差异Material cost variance 材料成本差异Material price variance 材料价格差异Material usage variance 材料使用差异Operating budget 经营预算Overhead budget 间接费用预算Price standards 价格标准Price variance 价格差异Production budget 生产预算Profit center 利润中心Quantity standards 数量标准Responsibility center 责任中心Revenue budget 收入预算Revenue center 收入中心Sales forecast 销售预测Unfavorable variance 不利差异Unit standard cost 标准单位成本Variable overhead efficiency variance 变动性制造费用效率差异Variable overhead expenditure variance 变动性制造费用耗费差异Variable overhead variance 变动性制造费用差异。

《专业英语》(会计学、财务管理专业)教学大纲

《专业英语》(会计学、财务管理专业)课程简介、教学要求、教学内容和学时分配一、课程简介(1)本课程在人才培养过程(培养计划)中的地位及作用本课程是会计学、财务管理专业的选修课程。

对于会计学、财务管理专业的学生而言,专业英语水平和应用能力的修养不仅仅是文化素质的主要部分,在很大程度上也是个人综合素质能力的补充、延伸,视野的拓宽。

本课程的任务主要是通过学习原版英文基本专业知识,培养学生独立阅读与本专业相关的英文论文和相应的写作能力。

(2)本课程支撑相关专业毕业要求的指标点:《专业英语》支撑会计学专业毕业要求的指标点是:1.具有良好人际关系和团队合作精神,具备较强的语言与文字沟通、文献检索和资料查询等信息获取能力。

2.掌握并运用高等数学、统计学、外语和计算机方面的知识技能,以及必要的信息技术知识。

《专业英语》支撑财务管理专业毕业要求的指标点是:1.具有良好人际关系和团队合作精神,具备较强的语言与文字沟通、及文献检索和资料查询等信息获取能力。

2.掌握计算机应用技术和一门外语,能熟练运用常用的办公软件。

3.熟悉我国财务管理工作的政策、法规以及国际惯例与规则。

二、教学基本要求本课程的教学要求是把财会知识和英语融为一体,使本专业学生了解最新的国际财会动态、全面提高自身的专业英语水平、扩充专业词汇、提高阅读速度的要求,近而达到准确而迅速地筛选所需信息的水平。

同时,本课程还通过一系列的专业技能训练,培养和强化学生的涉外业务英语交际能力,从而使之具备复合型人才的要求。

1.听力要求:能听懂涉及专业知识的学术报告、专题讲座等,并能理解其中立柱的事实或饮食的较为抽象的概念。

2.口语要求:能在学术会议或专业交流中较为自如地表达自己的观点和看法。

3.阅读要求:能较为顺利地阅读所学专业的英语文献和资料。

4.写作要求:能撰写专业文章摘要,能写简短的专业报告和论文。

5.翻译要求:能借助词典翻译所学专业的文献资料和英语国家报刊上有一定难度的科普、文化、评论等文章。

大学各专业(中英对照)

Orientation in Linguistics 英语语言文学专业Orientation in British and American Literature 英美文学专业Orientation in Cultural and Media Studies 英语(文化与传播)专业Orientation in Advanced Translation andInterpreting英语(高级翻译)专业Orientation in International Convention,Exhibition and Tourism Management英语(国际会展与旅游)专业Orientation in Information Management 信息管理专业International Economics and Trade 国际经济与贸易Economics 经济学专业Statistics 统计学The Public Finance Major 财政学The Taxation Major 税务Business English 商务英语International Business 国际商务Business Administration 工商管理Marketing 市场营销Human Resources Management 人力资源管理Management of Logistics(Management ofInternational Purchasing)物流管理(国际采购)Logistic Management(Management ofInternational Logistics and Transportation)物流管理(国际物流与运输)Finance 金融学Finance(Investment and Financing) 投资学(投资与理财)专业Financial Engineering 金融工程专业Insurance 保险学Mathematics and Applied Mathematics(Financial mathematics and actuarial science) 数学与应用数学(金融数学与精算)The Accounting Major 会计学专业The Financial Management Major 财务管理专业The Auditing Major 审计学(注册会计师)专业Chinese Language(Senior InternationalSecretary)汉语言(高级涉外文秘)Chinese Language (Foreign-Related CultureManagement)汉语言(涉外文化管理)Teaching Chinese as ForeignLanguage(TCFL)对外汉语Chinese Language and Literature 汉语言文学Department of Law 法学专业Department of International Economic Law 国际经济法Department of Civil and Commercial Law 民商法专业Department of Intellectual Property Law 知识产权法Department of Diplomacy 外交学专业Department of International Politics 国际政治专业Computer Science and Technology 计算机科学与技术Software Engineering 软件工程专业Information Management & InformationSystem信息管理与信息系统Electronic Commerce 电子商务Public Affairs and Administration 公共事业管理Administration Management 行政管理Applied Psychology (majoring in ManagementPsychology)应用心理学Social Work (majoring in Urban SocialAdministration)社会工作专业BA in Journalism(International Journalism) 新闻学(国际新闻)BA in Advertising 广告学BA in the Art of Broadcasting and Hosting 播音与主持艺术专业Music Performance(Vocal Music) 音乐表演专业(声乐)Art Design (Visual Transmission Design)(Photoshop)Major 艺术设计(视觉传达设计)(数字影像设计)专业。

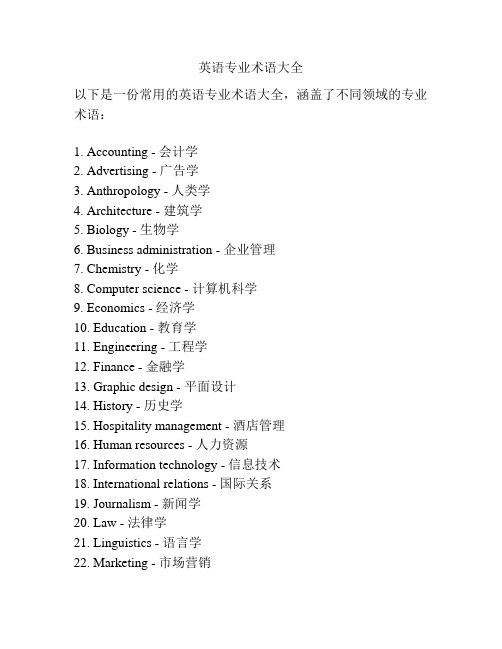

英语专业术语大全

英语专业术语大全以下是一份常用的英语专业术语大全,涵盖了不同领域的专业术语:1. Accounting - 会计学2. Advertising - 广告学3. Anthropology - 人类学4. Architecture - 建筑学5. Biology - 生物学6. Business administration - 企业管理7. Chemistry - 化学8. Computer science - 计算机科学9. Economics - 经济学10. Education - 教育学11. Engineering - 工程学12. Finance - 金融学13. Graphic design - 平面设计14. History - 历史学15. Hospitality management - 酒店管理16. Human resources - 人力资源17. Information technology - 信息技术18. International relations - 国际关系19. Journalism - 新闻学20. Law - 法律学21. Linguistics - 语言学22. Marketing - 市场营销23. Mathematics - 数学24. Medicine - 医学25. Music - 音乐学26. Nursing - 护理学27. Philosophy - 哲学28. Physics - 物理学29. Political science - 政治学30. Psychology - 心理学31. Public administration - 公共管理32. Sociology - 社会学33. Statistics - 统计学34. Tourism - 旅游学35. Visual arts - 视觉艺术以上是一些常见的英语专业术语,希望对您有帮助。

广东商学院各院及其专业(中英文翻译)1

广东商学院各院及其专业(中英文翻译)(GUANG DONG UNIVERSITY OF BUSINESS STUDIES)一、工商管理学院:The College of Business Administration1、物流管理:Logistics Management2、人力资源:Human Resources3、市场营销专业:Marketing Program4、工商管理专业:Business Administration Program二、会计学院: the College of Accounting1、审计学:Auditing2、会计学专业:Accounting Professional3、财务管理专业: Financial Management Major4、审计学(注册会计师)Auditing(Certified Public Accountant (CPA))三、财税学院:the College of Taxation1、财政学:Public Finance2、税务:Financial Affairs3、资产评估专业:MSc Property Appraisal and Management四、公共管理学院:School of Public Administration1、行政管理专业:General Administration Program2、劳动与社会保障:Labor and Social Security3、文化产业管理: Culture Industry Management4、公共事业管理(城市管理):City Management五、金融学院:College of Finance1、金融学:Finance2、国际金融:International Finance3、金融工程:Financial Engineering4、保险:Insurance5、投资学:Investment Principles六、经济贸易与统计学院:the College of Economic and Statistics1、经济学:Economics2、国际经济与贸易:International Economics And Trade3、统计学:Statistics4、国际商务:International Business七、法学院:The College of Law1、法学(国际法):The International Law2、法学(民商法):Civil and Commercial Law3、法学:Science of Law4、治安学:Science of Public Order八、旅游学院:College of Tourism1、酒店管理:Hotel Management2、旅游管理:Tourism Management3、会展经济与管理:Exhibition Economy and Management九、资源与环境学院:College of Resource and Environment1、土地资源管理:Land Resources Management2、资源环境与城乡规划管理:Resources-Environment and Urban-Rural Planning Management3、房地产经营管理:Administration and Management of Real Estate十、外国语学院:College of Foreign Language1、英语(国际商务管理):International Business Management2、英语(国际商务翻译):International Business English Translation3、日语(国际商务管理):nternational Business Management十一、人文与传播学院: College of Humanities and Communications1、汉语言文学:Chinese Language and Literature2、新闻学:Advocacy Journalism3、新闻学(编辑出版方向)News Editing4、社会工作:Social work5、社会学:Sociology6、播音与主持艺术:Techniques of Broadcasting and Anchoring7、广播电视编导:Radio and Television Editing and Directing十二、艺术学院:Academy of Fine Arts1、广告学(广告策划与经营管理方向):Advertisement2、艺术设计(广告设计方向):Art and Design(Advertising Design)3、艺术设计(玩具与游戏设计方向):Art and Design4、艺术设计(商业空间设计方向):Commercial Space Design5、艺术设计(展示设计):Display Design6、动画专业:Science of Animated Cartoon Program十三、信息学院:College of Information1、信息管理与信息系统:Information Management and Information System2、计算机科学与技术:Computer Science and Technology3、电子商务:Electronic Commerce4、软件工程:Software Engineering十四、数学与计算科学学院:Collegeof Mathematics and Computer Science1、信息与计算科学:Information and Computing Science2、数学与应用数学:Mathematics and Applied Mathematics十五、人文与传播学院:College of Humanities and Communications1、应用心理学: Applied Psychology2、商务文秘:Business secretary3、对外汉语:Teaching Chinese as a Foreign Language。

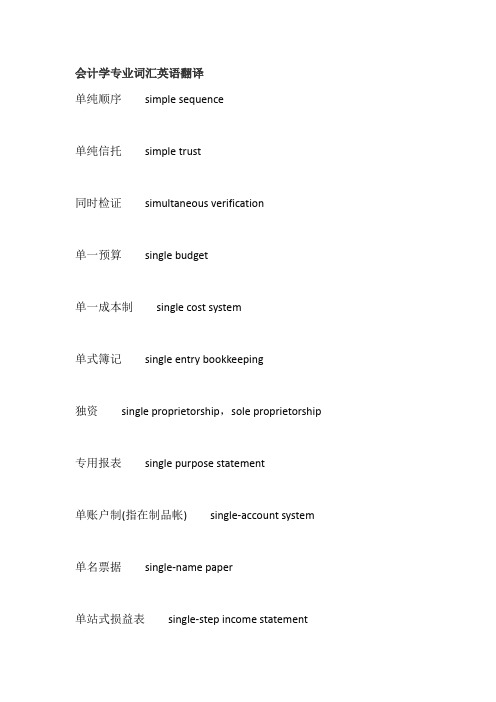

会计学专业词汇英语翻译

会计学专业词汇英语翻译单纯顺序simple sequence单纯信托simple trust同时检证simultaneous verification单一预算single budget单一成本制single cost system单式簿记single entry bookkeeping独资single proprietorship,sole proprietorship 专用报表single purpose statement单账户制(指在制品帐) single-account system 单名票据single-name paper单站式损益表single-step income statement偿债基金资产sinking fund asset在线英语学习偿债基金债券sinking fund bond偿债基金费用sinking fund expense偿债基金收益sinking fund income偿债基金投资sinking fund investment 偿债基金需要sinking fund requirements偿债基金准备sinking fund reserve偿债基金受托人sinking fund trustee偿债基金,债务基金sinking fund,debt service fund 偿债基金折旧法sinking-fund method (of depreciation) 就地审计site audit骨干式账户,丁账户skeleton account偏斜度skewness位数移动slide传票制度slip system呆滞资产slow asset修匀smoothing社会会计,国民会计social accounting有偿债能力solvent,solvency稳妥价值sound value资金来源去路表,资金运用表source-and-disposition statement,source-and-uses statement,statement of application of funds地位费用space expense特赋special assessment特赋债券special assessment bond特赋基金special assessment fund特赋留置权special assessment liens应收特赋留置权special assessment liens receivable应收特赋special assessment receivable特赋清册special assessment roll特种审计,特别查帐special audit专栏special column多栏式特种日记帐special columnar journal特别意外准备special contingency reserve特种基金,专款special fund特种基金存款special fund deposit特别调查special investigation特种日记帐special journal特种分类帐,明细分类帐special ledger,subsidiary ledger 分批工作通知单special order,job order特别合伙人special partners特别所入基金special revenue fund专用财务报表special-purpose financial statement 特定特赋债券special-special assessment bond在线英语学习硬币specie特定成本specific cost指定遗赠specific legacy分批成本制specific order cost system,job order cost system 规范,规格specification规定成本,标准成本specification cost,standard cost投机者speculator析产分立(指公司) spin off多栏日记帐split column journal,analytical journal分割split off分离点split off point损坏spoilage损坏材料spoiled material坏料报单spoiled material report损坏工作spoiled work损坏工作报单spoiled work report损坏在制品spoiled work-in-process手存现金spot cash现货价格spot price现货销售spot sale摊记,毛利,佣金,进出价差,期货买卖spread 分录汇总分析表spread sheet稳定stability,stabilization稳定币值会计stabilized accounting稳定衡量单位stable measuring unit币值稳定单位stable unit内部查帐员,内部审核员staff auditor,internal auditor 印花税stamp tax标准standard标准成本standard cost标准成本单standard cost sheet标准成本制standard cost system标准减项standard deduction标准差standard deviation标准误standard error估计标准误standard error of estimate标准工作时数standard hours worked 标准分批成本单standard job cost sheet 标准人工standard labor标准工资率standard labor rate标准人工时间standard labor time标准机器时间standard machine time 在线英语学习标准材料standard material标准方法standard method标准操作standard operation标准准备时数standard preparation hours标准价格standard price标准价格法(指领料计价) standard price method标准分步成本单standard process cost sheet标准利益standard profit标准购价standard purchase price标准比率standard ratios标准批量,经济批量standard run quantity,economic lot size 标准单位率standard unit rate标准值(统计质量控制) standard value标准工资率standard wage rate标准化会计standardized accounting标准化间接费率standardized burden rate固定成本standby cost,fixed cost应急设备standby equipment余股包购standby underwriting经常成本,固定成本standing cost,fixed cost经常费用单standing expense order,standing order 主要货品,存料,纤维staple筹备成本,开办费starting-load cost设定资本,法定资本stated capital账面负债stated liabilities设定股值stated value报表,结单statement报表分析statement analysis报告式statement form,report form 应付帐款清单statement from creditors。

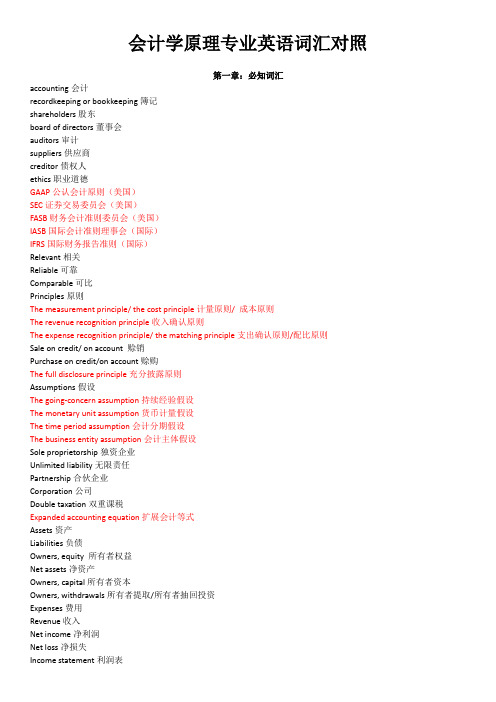

会计学原理专业英语词汇对照(第一二章)

会计学原理专业英语词汇对照第一章:必知词汇accounting会计recordkeeping or bookkeeping簿记shareholders股东board of directors董事会auditors审计suppliers供应商creditor债权人ethics职业道德GAAP公认会计原则(美国)SEC证券交易委员会(美国)FASB财务会计准则委员会(美国)IASB国际会计准则理事会(国际)IFRS国际财务报告准则(国际)Relevant相关Reliable可靠Comparable可比Principles原则The measurement principle/ the cost principle计量原则/ 成本原则The revenue recognition principle收入确认原则The expense recognition principle/ the matching principle支出确认原则/配比原则Sale on credit/ on account 赊销Purchase on credit/on account赊购The full disclosure principle充分披露原则Assumptions假设The going-concern assumption持续经验假设The monetary unit assumption货币计量假设The time period assumption会计分期假设The business entity assumption会计主体假设Sole proprietorship独资企业Unlimited liability无限责任Partnership合伙企业Corporation公司Double taxation双重课税Expanded accounting equation扩展会计等式Assets资产Liabilities负债Owners, equity 所有者权益Net assets净资产Owners, capital所有者资本Owners, withdrawals所有者提取/所有者抽回投资Expenses费用Revenue收入Net income净利润Net loss净损失Income statement利润表Statement of owners, equity所有者权益表/所有者权益变动表Balance sheet资产负债表Statement of cash flows现金流量表第二章:必知词汇(上文有的不再重复)Accounting books/books会计帐簿Source documents原始凭证Account账户General ledger总分类账Ledger分类账Account receivable应收账款Note receivable应收票据Prepaid accounts/ prepaid expenses预付账款/待摊费用Account payable应付账款Note payable应付票据Unearned revenue预收账款Accrued liabilities应计负债Increase增加Decrease减少Chart of accounts会计科目表T-account T形账户Debit借方(Dr.)Credit贷方(Cr.)Account balance账户余额Normal balance正常余额Double entry accounting 复式记账法Journalizing登记日记账Journal日记账General journal普通日记账Journal entry日记账分录Posting过账Balance column account三栏式账户PR(posting reference)过账索引Trial balance试算平衡表Unadjusted statements调整前的财务报表必记口诀:有借必有贷,借贷必相等。

会计专业英语重点词汇大全

*SYD method年数总和法

*disposal of fixed assets固定资产清理

s专利权

*trademarks商标权

*goodwill商誉

*deferred assets递延资产

*operat ing lease经营租赁

*con structi on in process在建工程

*warehous ing仓库

*FIFO /LIFO/ weight average/specific identification的四种方法

*overhead企业经费

*lo ng-term equity inv estme nt长期投资

*fixed assets/plant assets固定资产

*credit贷、贷方、 信用

*summary/ explanation摘要

*insurance保险

*premium policy保险单

*current assets流动资产

*long-term assets长期资产

*property财产、 物资

*cash/currency货币资金、 现金

*accounts receivable应收账款

*assets资产

*liabilities负债

owners'equity所有者权益revenue收入

income收益

*gains利得

*abno rmal loss非常损失

*bookkeeping账簿、簿记

*double-entry system复式记账法

*tax bearer纳税人

*custom duties关税

*provision for bad debts /allowance for uncollectible account/doubt debts坏帐准备

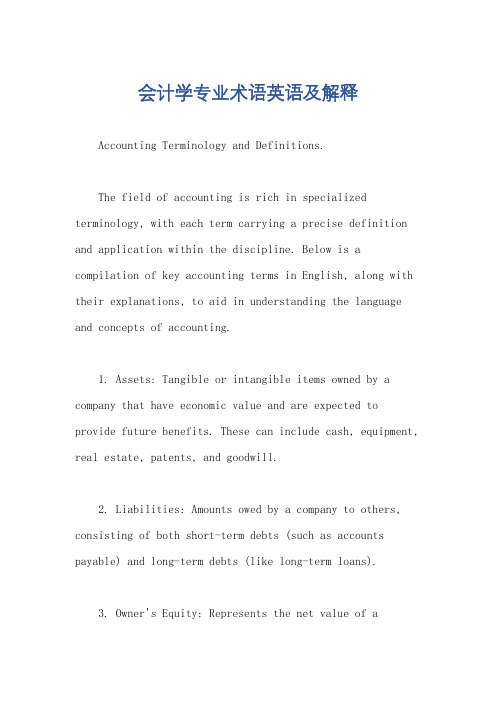

会计学专业术语英语及解释

会计学专业术语英语及解释Accounting Terminology and Definitions.The field of accounting is rich in specialized terminology, with each term carrying a precise definition and application within the discipline. Below is a compilation of key accounting terms in English, along with their explanations, to aid in understanding the language and concepts of accounting.1. Assets: Tangible or intangible items owned by a company that have economic value and are expected to provide future benefits. These can include cash, equipment, real estate, patents, and goodwill.2. Liabilities: Amounts owed by a company to others, consisting of both short-term debts (such as accounts payable) and long-term debts (like long-term loans).3. Owner's Equity: Represents the net value of acompany, calculated by subtracting liabilities from assets. It reflects the financial position of the owners or shareholders.4. Revenue: Economic inflows generated by a company's normal operating activities. This typically refers to sales or services provided.5. Expenses: Economic outflows incurred by a company during its normal operating activities, used to generate revenue or maintain operations.6. Profit: The net income of a company, calculated by subtracting expenses from revenue. It reflects the company's earning potential and financial performance.7. Accounting Subjects: Specific categories used to classify and record financial transactions. These subjects are the building blocks of financial statements and include assets, liabilities, equity, revenue, expenses, and profit.8. Accounting Books: Books or ledgers thatsystematically record and reflect a company's economic activities based on accounting vouchers. These books are crucial for tracking financial transactions and preparing financial statements.9. Management Accounting: A branch of accounting that focuses on providing financial information and insights to internal management for decision-making purposes. It involves the preparation of internal reports, budgets, and cost analysis.10. Return on Investment (ROI): A metric used to evaluate the profitability of an investment by calculating the ratio of net income to the cost of the investment.11. Statement of Financial Position: A financial statement that presents the assets, liabilities, andowner's equity of a company as of a specific date. It shows the company's financial position and the claims against it.12. Statement of Cash Flows: A financial statement that shows the cash inflows and outflows of a company over aspecific period. It provides information about the sources and uses of cash and helps investors and creditors assess a company's liquidity and solvency.13. Tax Accounting: The area of accounting that deals with the calculation, reporting, and payment of taxes. It involves complying with tax regulations and preparing tax returns.14. Accounting Equation: A fundamental principle in accounting that states that the total of all assets must equal the total of all liabilities and owner's equity. This equation represents the balance sheet of a company.15. Articulation: The process of connecting or linking different financial statements or accounting records to ensure consistency and accuracy.16. Business Entity: A separate legal and financial identity distinct from its owners. It allows for the separate identification and accounting of the assets, liabilities, and activities of the business.17. Capital Stock: The total amount of equity issued bya company to its shareholders. It represents the original investment in the company and is divided into shares.18. Corporation: A type of business organization that has a separate legal existence from its owners.Corporations are owned by shareholders and are managed by a board of directors.19. Cost Principle: An accounting principle thatrequires expenses to be recognized when they are incurred and measured at their actual cost. It ensures that expenses are accurately matched with the revenues they help generate.20. Creditor: A party that has extended credit to another party, usually in the form of a loan. Creditorshave a claim on the assets of the borrower and are entitled to repayment of the loan plus interest.The above terms provide a solid foundation for understanding the language and practices of accounting.Each term plays a crucial role in the financial reporting and decision-making processes of businesses and organizations. Mastering these terms and their definitions is essential for anyone seeking a career in accounting or finance.。

会计专业英语讲稿2

♋ ♒♋♦ ♓♦ ♎☐◆♌●♏♏⏹♦❒⍓ ♌☐☐♏♏☐♓⏹♑ ✍Double-entry bookkeeping is an accounting technique which records eachtransaction as both a credit and a debit. 复式簿记是把每笔交易记录成贷方和借方的会计方法。

Credit entries represent the sources of financing 贷方表示资金的来源Debit entries represent the uses of that financing借方表示资金的使用2.1b Why is double-entry system significant ?In modern accounting the double-entry system serves as a kind of error-detecting system: if, at any point, the sum of debits does not equal thecorresponding sum of credits, then an error has occurred. 在现代会计学中,复式记账法充当一种错误检查系统。

如果在任何一点上,借方之和不等于对应的贷方之和,就已经出现错误。

2.1c What categories do the books cover ?The value of goods owned by the business(assets)企业所拥有的商品价值(资产)The net worth of (and shareholder’s interest in) th e company(equity)公司(以及股东权益)的净值(权益)Money owed (liabilities)所欠的钱(负债)Money earned (revenue)所挣得的钱(收入)Costs(expenses)成本(费用)2.1d What are credits and debits ?In business records, the debit side, written on the left, represents the destination point of a transaction; the credit side, on the right, represents where the amount has come from. These are also called T-accounts.(figure 1)在你的企业账簿记录中,借方写在左侧,表示业务交易的目的点;贷方写在右侧,表示这笔钱从何处来。

会计专业英语选择判断

一会计与环境1、True-false:1)Accounting is another word for bookkeeping. (×)2)Accounting provides financial information that is only useful to a business management. (×)3)Management accounting must follow GAAP in all respects. (√)2、Matching:(1)Management accounting (2)CPA(3)Financial accounting (4)Public accountinga. An expert accountant licensed by the state.(2)b. The branch of accounting that deals with auditing, tax planning and management consultancy. (4)c. The branch of accounting concerned with providing external users with financial information needed to make decisions. (3)d. The branch of accounting concerned with providing managers with financial information needed to make decisions. (1)二会计概念与原则1、which of the following forms of organization is not treated as a separate economic unit in accounting?(C)A. sole proprietorship独资B. partnership合伙C. committee委员会D.corporation公司2、which of the following concepts belongs to accounting assumption which of the following concepts belongs to accounting assumption?(D)A. conservatism谨慎性B. consistency一致性C. materiality重要性D. money measurement货币计量3、Accounting methods shall not be arbitrarily changed from one period to the other is called (B)A. conservatism谨慎性B. consistency一致性C. materiality重要性D. objectivity客观性True-false:1. The accounting reporting period agrees to the calendar year. (对)2. Without the consistency principle, the comparisons which might be made and conclusions could mislead. (对)3. The word “materiality” refers to the relative importance of an item. (对)4. Whenever possible, accounting entries must be based on objectively determined evidence.(对)5. Under the accrual principle, revenues are recognized in the period in which they are earned when goods are sold or services are rendered, rather than when cash is received; expenses are recorded in the period in which cash is paid. (错)6. In some cases the assumption of continuity is invalid. (对)三财务报表True-False :1、The net income for a period in the income statement will increase the balance of owner’s equity.(T)2、Failure to include a merchandise in ending inventory results in an overstated net income. (F)Matching:1.Cost of goods sold2. Income statement3. Owner’s equity4. Operating expensesa. The balance sheet section that represents the owner’s economic interest in a company.(3)b. What a merchandising company paid for the goods that it sold during the period (1)c. The statement that shows a company’s profit or loss over a certain period of time.(2)d. All expenses except for cost of goods sold.(4)Identify the following as s elling expenses or g eneral and a dministrative expenses:1)Sales salaries(s)2)Office salaries (a)3)Depreciation for delivery equipment(g)4)Depreciation for office equipment(a)5)Advertising expense(s)1、During 2004, Bustamante received $ 600,000 for service revenue. Bustamante has not received $ 30,000 for services already performed in 2004. Bustamante also invested $ 20,000 into the business. Bustamante should report service revenue for 2004 of ( D )a. $ 550,000b. $ 570,000c. $ 580,000d. $ 630,000Choices:1.The preparation of the statement of cash flows must use the information come from ( d )a. Comparative balance sheetb.Current incomec.statementSome accountd.All of the above3. In the followings, the accurate version is ( d )a.The statement of cash flows is useful to investors.b.The statement of cash flows is useful to creditorsc.The statement of cash flows is useful to managementd.The statement of cash flows is useful to management and external users4. Among the following items, which is added to net income for calculation of cash flows from operating activities in the indirect method. (a)a.Decrease of inventoryb.Increase of prepaid expensesc.Decrease of accounts payabled.Increase of accounts receivableTrue-False :Payment on an account payable is considered a financing activity. (F)四会计循环1、After all closing entries have been posted, the balance of the Income Summary account will be (D)A、a debit if a net incomeB、a debit if a net lossC、a credit if a net lossD、zero2、Which of the following sequence of actions describes the proper sequence in the accounting cycle?(C)A. Posting, entering, analyzing, preparing, closing and adjustingB. Analyzing, entering, posting, adjusting, preparing and closingC. Preparing, entering, posting, adjusting, analyzing and closingD. Entering, analyzing, posting, adjusting, preparing and closing3. The dividing line between current liabilities and long-term liabilities is (A)A. one yearB. two yearsC. three yearsD. five years4. The purchase of office supplies on account will (B)A.increase an asset and increase owner’s equityB.increase one asset and decrease another assetC.increase an asset and increase a liabilityD.increase an asset and decrease a liability5. He owes $50 to her. She is his (A)A.Creditor 债权人B.debtor债务人C.Proprietor业主 D. accountant会计6. A business has assets of $140 000and liabilities of $60 000. How much is its owner’s equity?(A)A.$80 000 B.$20 000 C.$140 000 D.$07. A transaction caused a $10 000 decrease in both total assets and liabilities. This transaction could have been(C)A. purchase of a delivery truck for $10 000 cashB.an asset with a cost of $10 000 was destroyed by fireC.repayment of a $10 000 bank loanD.collection of a $10 000 account receivableTrue-False:1、A journal entry must be supported by source documents.(T)2、Accrual accounting is done by recognizing revenues when earned and expenses when incurred.(T)Matching:1.Assets2. Balance sheet3. Owner’s equity4. LiabilityA. The balance sheet section that represents the owner’s economic interest in a company.3B. An economic resource of a business. 1C. A debt of a business. 4D. The statement that shows the financial position of a company on a certain date.2journal 日记帐general journal普通日记帐account ledgerposting debit1. An amount entered on the left-hand side of account. d2. A chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts. j3. A record used to summarize all increases and decreases in a particular asset, such as cash, or any other type of asset, liability, owner’s equity, revenue, or expense. g4. A journal that only has two money columns, one for debits and the other for credits.a5. The process of transferring information from the journal to individual accounts in the ledger.p6. A loose-leaf book, file, or other record containing all the separate accounts of a business.l 分类账采用活页普通日记账:用来登记各单位全部经济业务的日记账。

会计专业英语怎么说

会计专业英语怎么说会计专业是研究企业在一定的营业周期内如何确认收入和资产的学问。

那么,你知道会计专业的英语怎么说吗?会计专业的英文释义:accounting profession会计专业的英文例句:他正在学习会计学或他是一名会计专业的学生。

He is studying accountancy or he is an accountancy student.会计模拟实训室环境建设,直接影响到高职院校会计专业人才培养质量及会计专业可持续发展。

研究高职院校会计模拟实训室环境建设的现状和对策,加强会计模拟实训室的建设,具有重要意义。

The environment development of accounting simulation laboratories (ASL) at higher vocational colleges has direct influences upon the quality of professional accounting personnel training and the sustainable development of accounting discipline.作为会计专业核心专业课程的“出纳实务”承担着培养会计专业学生今后从事会计职业及出纳工作必备技能的重任。

the Course Cashier in Practice, one of the core professional curriculums on accounting, plays the important role in educating students majoring in accounting to master accounting and cashier skills.文章分析了当前我国独立学院会计专业办学特色中存在的问题,在此基础上提出独立学院优化会计专业办学特色的基本策略。

会计学专业会计英语试题.doc

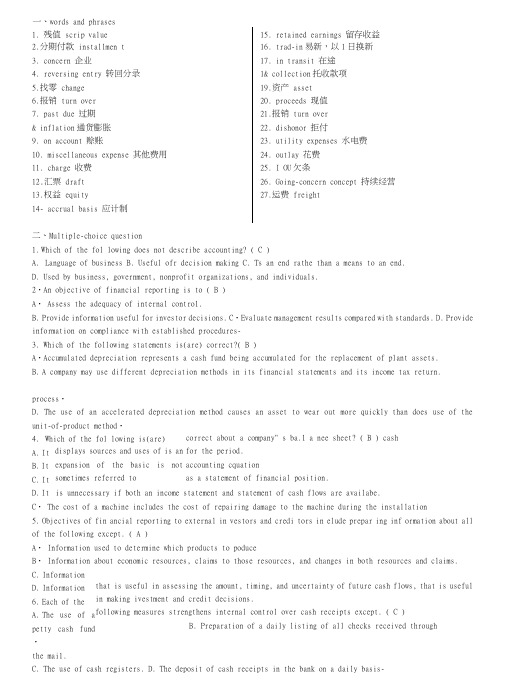

一、words and phrases 1. 残值 scrip value15. retained earnings 留存收益 2.分期付款 installmen t16. trad-in 易新,以1日换新 3. concern 企业17. in transit 在途 4. reversing entry 转回分录 1& collection 托收款项 5.找零 change 19.资产 asset 6.报销 turn over 20. proceeds 现值 7. past due 过期 21.报销 turn over & inflation 通货膨胀 22. dishonor 拒付9. on account 赊账23. utility expenses 水电费 10. miscellaneous expense 其他费用 24. outlay 花费 11. charge 收费 25. I OU 欠条12.汇票 draft 26. Going-concern concept 持续经营 13.权益 equity27.运费 freight14- accrual basis 应计制二、Multiple-choice question1. Which of the fol lowing does not describe accounting? ( C )A. Language of businessB. Useful ofr decision makingC. Ts an end rathe than a means to an end.D. Used by business, government, nonprofit organizations, and individuals. 2・An objective of financial reporting is to ( B ) A ・ Assess the adequacy of internal contro1.B. Provide information useful for investor decisions. C ・Evaluate management results compared with standards. D. Provide information on compliance with established procedures- 3. Which of the following statements is(are) correct?( B )A ・Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets. B. A company may use different depreciation methods in its financial statements and its income tax return. C ・ The cost of a machine includes the cost of repairing damage to the machine during the installation5. Objectives of fin ancial reporting to external in vestors and credi tors in elude prepar ing inf ormation about all of the following except. ( A )A ・ Information used to determine which products to poduceB ・ Information about economic resources, claims to those resources, and changes in both resources and claims. C. InformationD. Information 6. Each of the A. The use of apetty cash fund ・ the mai1.C. The use of cash registers.D. The deposit of cash receipts in the bank on a daily basis-process ・D. The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method ・4. Which of the fol lowing is(are)A. ItB. ItC. ItD. It displays sources and uses of is an expansion of the basic is not sometimes referred tocorrect about a company" s ba.1 a nee sheet? ( B ) cashfor the period.accounting cquationas a statement of financial position. is unnecessary if both an income statement and statement of cash flows are availabe.that is useful in assessing the amount, timing, and uncertainty of future cash flows, that is usefulin making ivestment and credit decisions.following measures strengthens internal control over cash receipts except. ( C ) B. Preparation of a daily listing of all checks received through7・The primary purpose for using an inventory flow assumption is to. ( A )A. 0ffset against revenue an appropriate cost of goods sold ・ B ・Parallel the physical flow of units of merchandise. C ・Minimize income taxes. D. Maximize the reported amount of net income ・ 8. Tn general terms, financial assets appear in the balanee sheet at. ( B ) A. Current valueB. Face valueC.CostD. Estimated future sales value-9・ If the going-concern assumption is no longer valid for a company except ・(C ) A ・Land held as an ivestment would be valued at its liquidation value ・ B. Al 1 prepaid assets would be completely written off inunedistely. C. Total contributed capitai and retained earnings would remain unchanged ・ D. The allowance for uncollectible accounts would be eliminated.10. Which of the fol lowing exp lains the debit and credit rules relating to the recording of revenuc and expenses? ( C )A ・Expenses appear on the left side of the balanee sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits ・C. The effects of revenue and expenses on ownersequity ・D. The realization principle and the matching principle. 1L Which of the fol lowing statements is(are) correct?( B )A. Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets ・B ・ The cost of a machine do not includes the cost of repairing damage to the machine during the installation preess. C. A compa.ny may use same depreciation methods in its finacial statements and its income tax return.D. The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method ・ 12.A set of financial statements (B ) except.A. Ts in tended to assist users in evaluating the financial position, profitability, and future prospects of an entity- B ・ Is intended to assist the Internal Revenue Service in detemining the amount of income taxes owed by a bus iness organi/ation.C ・ Ineludes notes disclosing infonnation necessary for the properinterpretation of the statements.D ・ Ts in tended to assist inv estors and creditors in making deci si ons inven tory the al locati on of economic resources. 13. The primary purpose for using an inventory flow assumption is to. ( B )A ・Parallei the physical f1ow of units of merchandise ・B ・0ffset against revenue an appropriate cost of goods soldC ・Minimize income taxes. D. Maximize the reported amount of net income. 14. Indicate al 1 correct answers. In the accounting cycle. (D ) A. Transactions are posted before they are journalized.B. A trial balance is prepared after journal entries haven" t been posted.C ・The Retained Earnings account is not shown as an up-to-date figure in the trial balance. D. Journal entries are posted to appropriate ledger accounts. 15. According to text, Objectives A. External users have the ability B. Infomiation is always based on C. Financial reporting is usuallyD. Financial accounting does not directly measure the value of a business enterprise. 16. Indicate al 1 correct answers. Dividends except ( A )A. Decrease owners' equity. B ・Decrease net income C. Are recorded by debiting the Cash account D. Are a business expense17. Which of the following practices contributes to efficient cash management? ( C ) A ・Never borrow money-maintain a cash balance sufficient to make al 1 necessary payments.of Financial Reporting by Business Enterprises. ( D ) to prescribe infonnation they want. exact measures.based on industries or the economy as a whole.B.Record al1 cash receipts and cash payments at the end of the month when reconci 1ing the bank statements.C・Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance ・ D. Pay each bill as soon as the invoice arrives.18.Which of the fol lowing would you expect to find in a correctly prepared income statement? ( A )A. Revenues earned during the period・B. Cash balanee at the end of the period.C.Contributions by the owner during the period.D. Expenses incurred during the next period to earn revenucs・19.Which of the following are important factors in ensuring the integrity of accounting information? (D )A. Tnstitutional factors, such as standards for preparing information.B.Professional organizations, such as the American In stitute of CPAs.C. Compete nee' judgment" and ethical behavior of individual accountants' D・All of the above.三、Practicesl1.On Jan. 1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5, 000. The depreciation applicable to this equipment was $40, 000 for 2000, calculated under the sum-of - the-yoars" - digits method・Required: Determine the acquisition cost of the equipment. ( C )A. $210, 000B. $250, 000C. $225. 000D. $200, 0002.On Jan. 2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5, 000・ The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of - the-years" - digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A. $220, 000B. $250, 000C. $224. 000D. $200, 0003・October 1, 2005, Coast Financia 1 loaned Bart Corporalion $3000, 000, receiving in exchange a nine-month, 12 percent note receivable・ Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on al 1 notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 wi11 amount to. ( A )A. $9, 000B. $18, 000C. $27. 000D. $36, 000The following data apply to the cash records of the Holly Co.: (4%)Ending cash bal., per books ....................................................... $4,120Ending cash bal. 5 per bank statement .......................................... 5,000Outstanding checks ....................................................................... 1 915Seivice charge for month ..................................................................... ..8Proceeds from bank collection of note (including interest of $18) (198)Deposits in transit ....................................................................... 1,000In error, Holly Co. recorded a deposit of S25 for cash sales as S 250.Question: What is the reconciled balance? ( B )A. $4, 187B. $4, 085C. $4, 090D. $4, 000The following data apply to the cash records of the XL Co.: (4%) Ending cash bal., per books $3,120Ending cash bal., per bank statement ........................................ 3,000Outstanding checks ................ .. . (775)Service charge for month (3)Proceeds from bank collection of note (including interest of $8) (108)Deposits in transit .................................................................. 1.000In error, XL Co. recorded a deposit of $85 for cash sales as $58.Required: Choose the reconciled balance・(D )A. $3, 220B. $3, 250C. $3, 200D. $3, 225The following information is available for Grant, Inc., for 2008:Freight in S 20 000Purchase returns 80 000Selling expense 200 000Ending inventory 90 000Beginning inventoiy 5000The cost of goods sold is equal to 200 percent of sellinq expense.Required:Calculate the cost of goods available for sale(C)A. $475, 000B. $474, 000C. $470, 000D. $473, 000The following information is available for Hall co for 2000: (4%)Selling exp. $100,000Purchase returns 5,000Freight in 8.000Ending inventory 50,000Purchase is equal to 300%of sellina expense.Required: Calculate the cost of goods sold ( D )A. $225, 000B. $254, 000C. $250, 000D. $253, 0008・ At the end of the current year, the accounts receivable account has a debit balance of $60, 000 and net sales for the year total $100,000・ The al 1owance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A. Dr. Bad Debt Accts. $1, 500B. Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C.Dr. Bad Debt Accts. $1, 000D. Dr. Bad Debt Accts. $1, 500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery (arranged in alphabetical order)were as fol lows at August 1, 2005. (You are to compute the missing figure for retained earnings.)(4%)Accounts Payable ............ $16,200 Capital Stock ................ S80,000Accounts Receivable .......... 11,260 Land ..................... 67,000Building .................... 84.000 Notes Payable ......... 74.900Cash .................... 6,940 Salaries Payable ....... 1?600Equipment and Fixtures ....... 44.500 Supplies .................... 7,OCOREQUIRED:Find Retained earnings at August 1 2005(0)A. $420, 000B. $44, 000C. $40, 000D. $4& 000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year. Required: Choose the entries to record the following transactons.1・Invested $50, 000 cash in a public accounting practice begun this day. ( A )A. Dr. Cash $50, 000B. Dr. Capital Stock $50, 000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts" office rent in advanee $900( B )A. Dr. Rent Exp. $900B. Dr. Prepaid Rent $900 Cr. Cash $900Cr. Cash $9003. Paid the premium on two insurance policies, $300.( )A. Dr> Prepaid Insurance $300B. Dr< Insurance Exp $300 Cr. Cash $300Cr. Cash $3004・Completed accounting work for Sun Bank on credit $1000. ( A ) A. Dr. Accts Rec $1000B. Dr. Cash $1000Cr. Accounting Revenue $1000 Cr. Accounting Revenue $10005. Paid the monthly utility bills of the accounting office $300 ( A ) A. Dr Uti1ity Exp $300 B. Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries 6. Invested $20, 000 cash in a A. Dr Cash $20, 00B. DrCr. Capital Stock $20,0007. Paid cash for three months , office rent in advance $1200.(A. Dr. Rent Exp $1200B. Dr. Prepaid Rent $1200 Cr. Cash $1200 Cr. Cash $1200 8・Purchased offfice supplies $100 and officeequipment $2, 000 A. Dr. Office Equipment $2, 000 Office Supplies $100Cr. Accts四、Translation:l)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equa 1・ If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries ・ The double-entry accounting is used by virtually every business organization, regardless of whether the company ?s accounting records are maintained manually or by computer.this day. ( A )to record the fol lowing transactons. public accounting practice begun Capital Stock $20,000 Cr. Cash $20,00on credit ・(B )B.Dr. Office Equipment $2,000 Office Supplies $100 Cr. Accts Pay. $2, 100Rec. $2, 100accounting work forRec $20009. Completed A. Dr. Accts Cr. Accounting Revenue $2000Jack Hall and collected $2000 cash therefore. ( B ) B. Dr. Cash$2000Cr.Accounting Revenue $2000 10. Purchase additional office A. Dr. Office equipment $2500 Cr< Accts Pay $2500 equipment on credit $2500.( B.Dr. Office equipment Cr. Accts Rec $2500A )$25001. The mechanics of double-entry accounting. ( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2・ the debit and credit amounts are equa1. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise wi 11 have a long 1 ife. Experience indicates that. 1)inspite of numerous business failures, companies have a fairly high continuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments・3.in spite of numerous business failures, companies have a fairly high continuanee rate・(B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

62,000,000 62,000,000

To issue common stock

Common Stock Above Par

IHOP’s common stock has a par value of $0.01 per share. The company issues 6,200,000 shares of common stock at $10 per share. July 23 Cash (6,200,000 × $10) 62,000,000 Common Stock (6,200,000 × $0.01) Paid-in Capital in Excess of Par – Common (6,200,000 × $9.99) To issue common stock

2004

2003

$100,779 145,384 630,997 1,667

$100,779 144,247 539,776 (2,210)

(195,196)

(138,656)

Common Stock at Par

Suppose IHOP’s / common stock carried a par value of $10 per share. The company issues 6,200,000 shares.

IHOP Corp. Purchase of Treasury Stock

During 2004, IHOP paid $5,170 to purchase 288 shares of its common stock as treasury stock.

November 12, 2000 Treasury Stock Cash Purchased treasury stock

Treasurer (Finance Officer)

Stockholders’ Equity

Consists of both

Contributed capital (Paid-in capital) Retained Earnings

Classes of stock

Common or preferred Stock

62,000 61,938,000

Preferred Stock

Preferred stock is another means for raising capital Preferred stockholders have no voting rights

Preferred stockholders are compensated (补偿) in much the same way as creditors Typically, they are paid as a % of par value each year – much like interest This is paid BEFORE common stockholders are paid dividends

2004 –

2003 –

$ 431 2,135 40,206 851

$ 440 1,954 37,576 (509)

Pier 1 Imports, Inc. Shareholders’ Equity

(In thousands except per share amounts)

Common stock, $1.00 par value, 500,000,000 shares authorized, 100,799,000 issued Paid-in capital Retained earnings Cumulative other comp. income (loss) Less – 12,473,0000 and 10,045,000 common shares in treasury, at cost, respectively

Preferred Stock

Convertible preferred stock

Can be converted to common at a predetermined amount Callable preferred stock(可赎回优先股) Can be redeemed at the option of the issuing company Cumulative preferred stock If the predetermined dividend payment is not made, it can be accumulated and paid at a later time – before any dividends can be paid to common stockholders.

Why Issue a Stock Dividend?

To continue dividends but conserve cash

Reduce the per-share market price Type types:

Small (25% or less) Large (above 25%)

ACCT-101 Class 24

Chapter 9

Stockholder’s Equity

Corporate(法人) Authority (权利)Structure

Stockholders

Board of Directors(董事会) Chairperson of the Board(董事长)

President (Chief Executive Officer总裁、首席执行官)

Sale of Treasury Stock

Assume that on July 22, 2005, the shares of IHOP treasury stock are sold for $5,300.

Cash 5,300 Treasury Stock Paid-In Capital from Treasury Stock Transactions Sold treasury stock

Dividend Dates

Three relevant dates for dividends:

Declaration date A liability is recorded for cash dividends declared Date of record Dividends are paid to stockholders on the record at this date Payment date

5,170

130

Retained Earnings, Dividends, and Splits

A dividend is a corporation’s return to its stockholders of some of the benefits of earnings. A stock split(股票分割) is an increase in the number of authorized, issued, and outstanding shares A reverse stock split(反向分割 ) is a decrease in the number of authorized, issued, and outstanding shares

Treasury Stock Transactions

Treasury stock(库存股份) are shares that a company has issued and later reacquired Reasons for purchasing its own stock

Increase EPS(Earnings Per Share ) Use for purchasing other companies Avoidance of a takeover(收购)

5,170 5,170

IHOP Corp. Aቤተ መጻሕፍቲ ባይዱter Purchase of Treasury Stock

Stockholder’s Equity at December 31, 2004 (with treasury stock purchased – $000) Common Stock $ 203 Paid-in capital in excess of par 69,655 Retained earnings 193,632 Less: Treasury stock (288 shares at cost) – 5,170 Total equity $258,320

Corporate Authority Structure

President (Chief Executive Officer)

VP

Sales

(Vice President)

VP Manufacturing

CFO

VP Personnel (人事)

Secretary

Controller (Accounting Officer)

Par or no par stock

Wal-mart Shareholders’ Equity

(Amounts in millions)

Preferred stock ($0.10 par value, 100 shares authorized; none issued) Common stock ($0.10 par value, 11,000 shares authorized, 4,311 and 4,395 issued and outstanding in 2004 and 2003, respectively) Capital in excess of par value(股本溢价) Retained earnings Other accumulated comp. income