本地化翻译(Localization)金融类术语及英文解释(期权)

passolo 词汇表

passolo 词汇表全文共四篇示例,供读者参考第一篇示例:Passolo是一种专业的软件本地化工具,广泛应用于软件开发领域和国际化市场中。

通过Passolo,开发人员可以轻松地将软件本地化为不同语言版本,以满足全球用户的需求。

在使用Passolo时,我们需要了解一些关键词汇,以便更好地理解其功能和操作流程。

下面是关于Passolo词汇表的详细介绍。

1. 本地化(Localization):指将软件或产品根据不同的国家或地区的语言、文化和法律要求做出相应的调整,以满足当地用户的需求。

2. 国际化(Internationalization):指设计和开发软件或产品时考虑到不同语言和文化的差异,使其具有较强的适应性和兼容性,方便未来的本地化工作。

3. 项目(Project):在Passolo中,项目是指需要进行本地化处理的软件或产品。

每个项目都包含了一系列要翻译和本地化的资源文件。

4. 资源文件(Resource file):这是软件开发过程中使用的文件,包括界面文本、图标、对话框等。

Passolo可以直接处理这些资源文件,进行本地化工作。

5. 界面文本(UI text):指软件界面上显示的文字内容,通常包括菜单、按钮、标签等。

6. 翻译(Translation):将源语言的文字内容翻译成目标语言的过程。

Passolo提供了翻译工具和功能,方便用户进行翻译工作。

7. 本地化工程师(Localization Engineer):负责软件本地化工作的专业人员,具有一定的语言能力和技术知识,能够处理各种本地化工作。

8. 术语库(Termbase):存储软件本地化过程中的专业术语和翻译对应关系的数据库,用于保证翻译的一致性和准确性。

10. 术语一致性(Terminology consistency):指在软件本地化过程中,术语和翻译之间保持一致,避免出现矛盾或混淆的情况。

11. 导入(Import):将源语言的资源文件导入Passolo中进行本地化处理的操作。

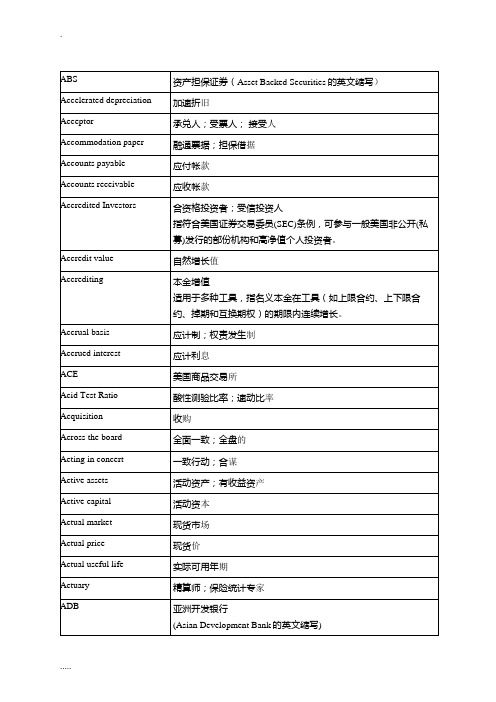

常见金融术语英汉对照与详解

�

)本成有持( yrraC-fo-tsoC )数因换转( rotcaF noisrevnoC )算清额净同合( gnitteN lautcartnoC )士瑞所交期洲欧( serutuF FNOC )易交续连( gnidarT suounitnoC )小大约合( eziS tcartnoC

)问顾易交品商( rosivdA gnidarT ytidommoC

�

)扣折( gnitnuocsiD

)�行央国德�行银邦联志意德( knabsednuB ehcstueD

)格价算结日( ecirP tnemeltteS yliaD )算结日每( tnemeltteS yliaD

)金证保通流的前目( nigraM gnitadiuqiL tnerruC )求请叉交( tseuqeR ssorC )型模坦斯宾鲁-斯罗-斯克考( ledoM nietsnibuR-ssoR-xoC )权期购认兑备( llaC derevoC )方手对( ytrapretnuoC )度曲凸( ytixevnoC )换转( noisrevnoC )票息( nopuoC )险避叉交( egdeH ssorC )易交叉交( edarT ssorC

)约合月即( tcartnoC tnorF

)场市部内围范大( tekraM edisnI dednetxE )位仓行执( noitisoP desicrexE )权期行执( noitpO desicrexE )行执( esicrexE )除排( noisulcxE )认确行执( noitamrifnoC noitucexE )格价行执( ecirP desicrexE )期到( noitaripxE

)权期内价( noitpO yenom-eht-nI )码编别识券证际国( rebmuN noitacifitnedI seitiruceS lanoitanretnI )差价品产跨( daerpS tcudorp-retnI )品产间区( tcudorP lavretnI

金融学中英名词

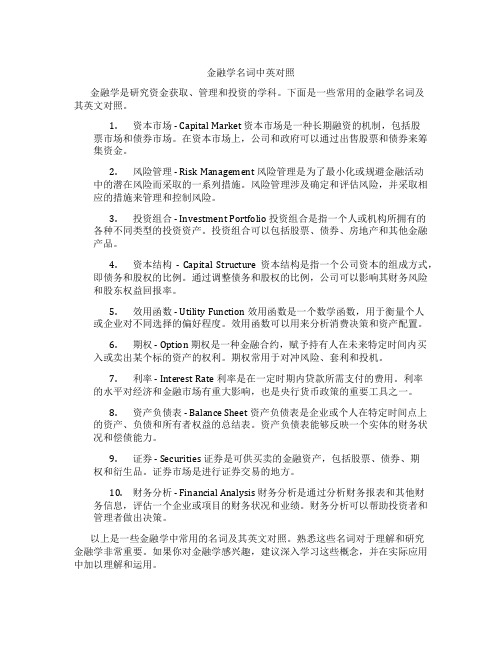

金融学名词中英对照金融学是研究资金获取、管理和投资的学科。

下面是一些常用的金融学名词及其英文对照。

1.资本市场 - Capital Market 资本市场是一种长期融资的机制,包括股票市场和债券市场。

在资本市场上,公司和政府可以通过出售股票和债券来筹集资金。

2.风险管理 - Risk Management 风险管理是为了最小化或规避金融活动中的潜在风险而采取的一系列措施。

风险管理涉及确定和评估风险,并采取相应的措施来管理和控制风险。

3.投资组合 - Investment Portfolio 投资组合是指一个人或机构所拥有的各种不同类型的投资资产。

投资组合可以包括股票、债券、房地产和其他金融产品。

4.资本结构- Capital Structure 资本结构是指一个公司资本的组成方式,即债务和股权的比例。

通过调整债务和股权的比例,公司可以影响其财务风险和股东权益回报率。

5.效用函数 - Utility Function 效用函数是一个数学函数,用于衡量个人或企业对不同选择的偏好程度。

效用函数可以用来分析消费决策和资产配置。

6.期权 - Option 期权是一种金融合约,赋予持有人在未来特定时间内买入或卖出某个标的资产的权利。

期权常用于对冲风险、套利和投机。

7.利率 - Interest Rate 利率是在一定时期内贷款所需支付的费用。

利率的水平对经济和金融市场有重大影响,也是央行货币政策的重要工具之一。

8.资产负债表 - Balance Sheet 资产负债表是企业或个人在特定时间点上的资产、负债和所有者权益的总结表。

资产负债表能够反映一个实体的财务状况和偿债能力。

9.证券 - Securities 证券是可供买卖的金融资产,包括股票、债券、期权和衍生品。

证券市场是进行证券交易的地方。

10.财务分析 - Financial Analysis 财务分析是通过分析财务报表和其他财务信息,评估一个企业或项目的财务状况和业绩。

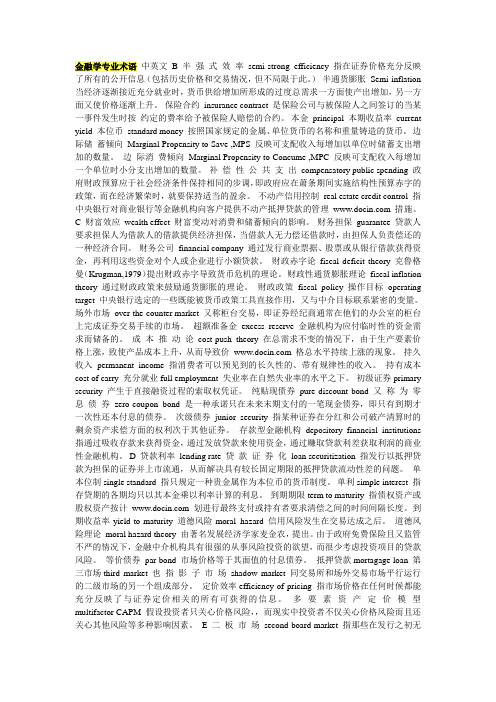

金融学专业术语 中英文

金融学专业术语中英文B 半强式效率semi-strong efficiency 指在证券价格充分反映了所有的公开信息(包括历史价格和交易情况,但不局限于此。

)半通货膨胀Semi-inflation 当经济逐渐接近充分就业时,货币供给增加所形成的过度总需求一方面使产出增加,另一方面又使价格逐渐上升。

保险合约insurance contract 是保险公司与被保险人之间签订的当某一事件发生时按约定的费率给予被保险人赔偿的合约。

本金principal 本期收益率current yield 本位币standard money 按照国家规定的金属、单位货币的名称和重量铸造的货币。

边际储蓄倾向Marginal Propensity to Save ,MPS 反映可支配收入每增加以单位时储蓄支出增加的数量。

边际消费倾向Marginal Propensity to Concume ,MPC 反映可支配收入每增加一个单位时小分支出增加的数量。

补偿性公共支出compensatory public spending 政府财政预算应于社会经济条件保持相同的步调,即政府应在萧条期间实施结构性预算赤字的政策,而在经济繁荣时,就要保持适当的盈余。

不动产信用控制real estate credit control 指中央银行对商业银行等金融机构向客户提供不动产抵押贷款的管理 措施。

C 财富效应wealth effect 财富变动对消费和储蓄倾向的影响。

财务担保guarantee 贷款人要求担保人为借款人的借款提供经济担保,当借款人无力偿还借款时,由担保人负责偿还的一种经济合同。

财务公司financial company 通过发行商业票据、股票或从银行借款获得资金,再利用这些资金对个人或企业进行小额贷款。

财政赤字论fiscal deficit theory 克鲁格曼(Krugman,1979)提出财政赤字导致货币危机的理论。

财政性通货膨胀理论fiscal inflation theory 通过财政政策来鼓励通货膨胀的理论。

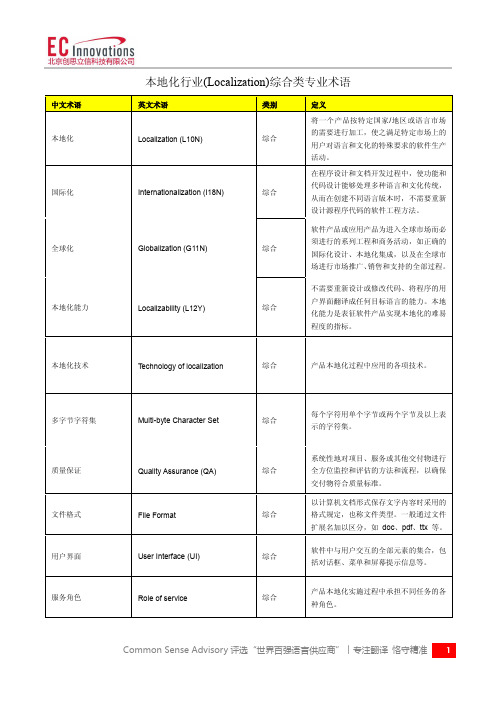

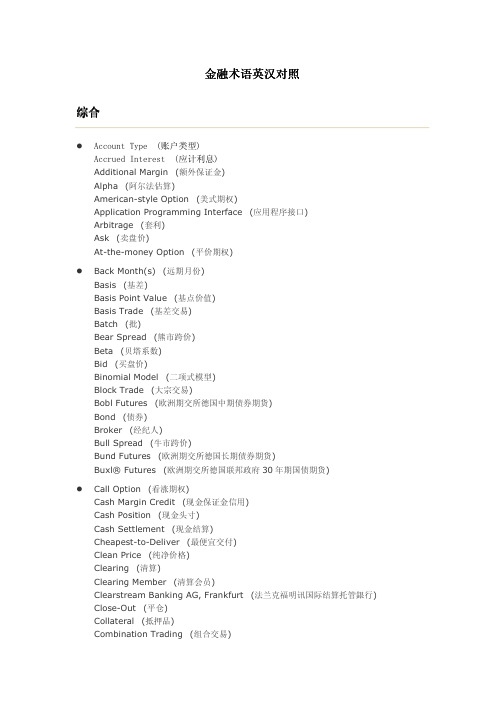

本地化行业(Localization)综合类专业术语

综合 综合

产品本地化实施过程中相互联系、相互作 用的一系列过程。

产品本地化流程中的输入输出的对象。

综合

提供本地化服务的类别。

Common Sense Advisory 评选“世界百强语言供应商”︱专注翻译 恪守精准 2

综合

不需要重新设计或修改代码、将程序的用 户界面翻译成任何目标语言的能力。本地 化能力是表征软件产品实现本地化的难易 程度的指标。

Technology of localization

综合

产品本地化过程中应用的各项技术。

多字节ቤተ መጻሕፍቲ ባይዱ符集

Multi-byte Character Set

质量保证 文件格式 用户界面 服务角色

软件中与用户交互的全部元素的集合,包 括对话框、菜单和屏幕提示信息等。

产品本地化实施过程中承担不同任务的各 种角色。

Common Sense Advisory 评选“世界百强语言供应商”︱专注翻译 恪守精准 1

服务流程 服务要素 服务种类

Process of service Element of service Types of service

中文术语 本地化 国际化 全球化 本地化能力 本地化技术

本地化行业(Localization)综合类专业术语

英文术语 Localization (L10N) Internationalization (I18N) Globalization (G11N)

类别 综合 综合 综合

定义

将一个产品按特定国家/地区或语言市场 的需要进行加工,使之满足特定市场上的 用户对语言和文化的特殊要求的软件生产 活动。

在程序设计和文档开发过程中,使功能和 代码设计能够处理多种语言和文化传统, 从而在创建不同语言版本时,不需要重新 设计源程序代码的软件工程方法。

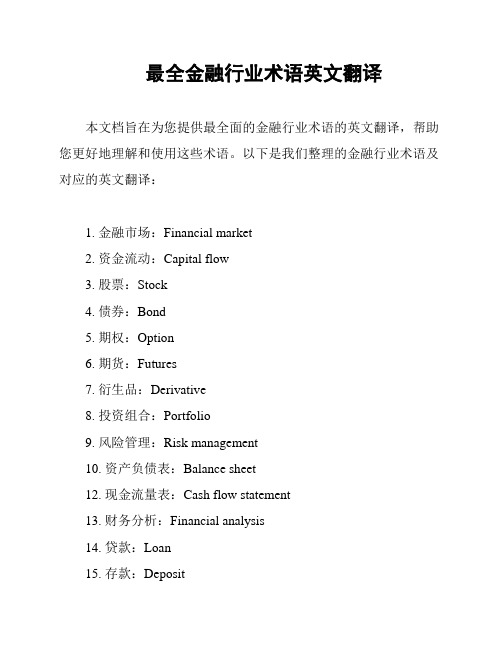

最全金融行业术语英文翻译

最全金融行业术语英文翻译本文档旨在为您提供最全面的金融行业术语的英文翻译,帮助您更好地理解和使用这些术语。

以下是我们整理的金融行业术语及对应的英文翻译:1. 金融市场:Financial market2. 资金流动:Capital flow3. 股票:Stock4. 债券:Bond5. 期权:Option6. 期货:Futures7. 衍生品:Derivative8. 投资组合:Portfolio9. 风险管理:Risk management10. 资产负债表:Balance sheet12. 现金流量表:Cash flow statement13. 财务分析:Financial analysis14. 贷款:Loan15. 存款:Deposit16. 利率:Interest rate17. 汇率:Exchange rate18. 银行业务:Banking business19. 保险业务:Insurance business20. 财富管理:Wealth management21. 资产管理:Asset management22. 投资银行:Investment banking23. 证券交易所:Stock exchange24. 资本市场:Capital market26. 风险投资:Venture capital27. 股票交易:Stock trading28. 期货交易:Futures trading29. 存款利率:Deposit rate30. 贷款利率:Loan rate这仅仅是金融行业术语的一小部分,更多术语可以根据实际需要进行进一步查询和研究。

希望本文档对您有所帮助。

localization翻译

localization翻译

Localization(本地化)是指将产品、服务或文化适应特定地区或语言的过程。

在计算机领域,本地化通常涉及将软件、网站或电子产品的用户界面、功能和内容适应不同的语言、地区或文化。

本地化的过程包括多个方面,包括:

1. 翻译:将用户界面、文档和内容翻译成目标语言。

2. 适应:根据目标地区或文化的规范和习惯,对产品或服务进行修改和调整。

3. 测试:确保本地化后的产品或服务在不同操作系统、设备和浏览器上正常运行,并且没有出现任何错误或缺陷。

4. 发布:将产品或服务发布到目标市场或平台。

本地化对于在全球范围内推广和销售产品或服务非常重要。

由于不同地区和文化之间存在语言、习俗、法规和市场差异,因此需要进行本地化才能确保产品或服务在当地市场上的成功。

此外,本地化还可以提高产品或服务的的质量和可用性。

通过适应当地市场和用户需求,可以更好地满足用户的需求,提高用户体验和用户满意度。

总之,本地化是一项重要的任务,对于在全球范围内推广和销售产品或服务以及提高产品质量和用户体验至关重要。

金融术语中英文对照

Back-door listing 借壳上市Back-end load 撤离费;后收费用Back office 后勤办公室Back to back FX agreement 背靠背外汇协议Balance of payments 国际收支平衡;收支结余Balance of trade 贸易平衡Balance sheet 资产负债表Balance sheet date 年结日Balloon maturity 到期大额偿还Balloon payment 期末大额偿还Bank, Banker, Banking 银行;银行家;银行业Bank for国际结算银行International Settlements(BIS)Bankruptcy 破产Base day 基准日Base rate 基准利率Basel Capital Accord 巴塞尔资本协议Basis Point (BP) 基点;点子一个基点等如一个百分点(%)的百分之一。

举例:25个基点=0.25%Basis swap 基准掉期Basket of currencies 一揽子货币Basket warrant 一揽子备兑证Bear market 熊市;股市行情看淡Bear position 空仓;空头Bear raid 疯狂抛售Bearer 持票人Bearer stock 不记名股票Behind-the-scene 未开拓市场Below par 低于平值Benchmark 比较基准Benchmark mortgage pool 按揭贷款基准组合Beneficiary 受益人Bermudan option 百慕大期权百慕大期权介乎美式与欧式之间,持有人有权在到期日前的一个或多个日期执行期权。

Best practice 最佳做法;典范做法Beta (Market beta) 贝他(系数);市场风险指数Bid 出价;投标价;买盘指由买方报出表示愿意按此水平买入的一个价格。

本地化翻译(Localization)语言:认识繁体中文(Traditional Chinese)

本地化翻译(Localization)语言:认识繁体中文(Traditional Chinese)本地化翻译(Localization)语言:认识繁体中文(Traditional Chinese)对于中文本地化市场而言,繁体中文(Traditional Chinese) 是有别于简体中文(Simplified Chinese) 的另一个最为重要的本地化目标语言。

繁体中文材料的目标受众主要是居住在中国台湾、香港、澳门地区以及北美等部分海外华人社区的用户。

尽管以繁体中文为母语的人数有限,但由于台湾等地区科技较为先进,IT 业和制造业相对较为发达,因此以繁体中文为目标语言的本地化项目需求量也很大。

1. 繁体中文与简体中文的由来繁体中文即传统上的中华文化中所使用的中文书写体系,目前已有二千年以上的历史。

将台湾、香港等地区一致沿用至今的未经简化处理的传统汉字称作繁体中文(Traditional Chinese)。

由于历史和政治方面的原因,从上世纪50 年代开始,大陆官方在繁体中文的基础上对部分汉字做了简化处理,形成了新的中文书写标准,即简体中文(Simplified Chinese)。

2. 繁体中文与简体中文的区别2.1 目标受众的不同简体中文主要在中国大陆、马来西亚、新加坡,以及东南亚的一些华人社区中使用。

而繁体中文主要在中国台湾、香港与澳门地区,以及北美等部分海外华人社区中使用。

过去简体中文与繁体中文并存于联合国各式文件中,随着中华民国于1971 年退出联合国后,目前联合国的文件已不再使用繁体中文。

2.2 词汇表述的不同中国大陆和中国台湾在20 世纪中叶因政治原因彼此分隔,之后一段时间交流甚少,造成了用词习惯的差异。

从上世纪80 年代开始,随着计算机技术的普及和大量IT 术语的使用,这种差异性表现得尤为明显。

即,同一英文单词对应的简体中文与繁体中文的译文完全不同。

因此,对于繁体中文翻译,绝不可简单地理解为只是将简体字转换为相应的繁体字那么简单。

翻译本地化

翻译本地化

本地化翻译是一种将内容或产品调整为适应特定目标地区或文化的过程。

它不仅仅是将文本转换成目标语言,还包括考虑目标地区的语言风格、习惯、文化背景和法律法规等因素。

本地化翻译的目的是使内容或产品在目标市场中更具吸引力和可接受性,以便更好地满足当地用户的需求。

在本地化翻译过程中,首先需要进行语言转换。

这意味着将源语言转换为目标语言,确保信息的准确性和流畅性。

同时,还需要注意目标语言的惯用语表达方式和口语化特点,以充分地传达信息。

除了语言转换,本地化翻译还需要考虑文化差异。

不同地区有不同的文化背景和价值观念,因此在翻译过程中要注意避免混淆或冒犯当地用户。

例如,针对西方市场的广告可能强调个人主义和竞争力,而对于亚洲市场,它们可能更注重团队合作和共同利益。

因此,本地化翻译需要适应当地文化并确保适应性。

此外,本地化翻译还需要考虑目标地区的法律法规。

某些国家可能有特定的法律要求,例如隐私权和版权保护。

因此,在将内容或产品本地化时,还需要遵守当地法律并确保符合当地法规。

最后,本地化翻译还包括对当地市场的研究。

了解目标市场的需求和偏好是关键。

为此,可以进行市场调研,与当地用户互动,并了解他们的反馈和意见。

这样可以更好地理解目标市场,并针对性地进行本地化翻译。

总而言之,本地化翻译是将内容或产品调整为适应特定目标地区或文化的重要过程。

它不仅要求准确和流畅的语言转换,还需要考虑文化差异和法律法规,并与目标市场进行深入研究。

通过本地化翻译,内容或产品可以更好地融入目标市场,并满足当地用户的需求。

常见金融术语英汉对照与详解

Mark-to-Market (逐日盯市) Matching Algorithm (程式匹配) Matching Rules (匹配规则) Maturity Date (到期日) Maturity Range (到期日范围) Maximum Spread (最大跨价限额) Minimum Size (最小规模) Mistrade (错误交易) Modified Duration (修正存续期间) Money Market Products (资金市场产品)

� Early Exercise (提前执行) Equity Index Products (股票指数产品) Equity Products (股票产品) Eurex (欧洲期交所) Eurex Repo (欧洲期货交易所回购交易) EURIBOR (欧元銀行同业拆借利率) Euro-Bobl Futures (欧洲期交所德国欧元中期国债期货)

� Last Trading Day (最后交易日) Late Trade (延期交易) Leverage Effect (杠杆效应) Lifetime (产品周期) Limit Order (限价指令) Linked Trades (链接交易) Linking (链接) Local Area Network (局域网) Long Call (买入看涨期权) Long Position (长仓) Long Put (买入看跌期权) Low Exercise Price Option (低执行价期权)

� Haircut (估值折扣率) Hedge Fund (对冲基金)

Hedge Ratio (对冲比率) Hedging (对冲�套保) Historical Volatility (历史波动率) Horizontal Call Spread (水平看涨跨价) Horizontal Put Spread (水平看跌跨价) Horizontal Spread (水平跨价)

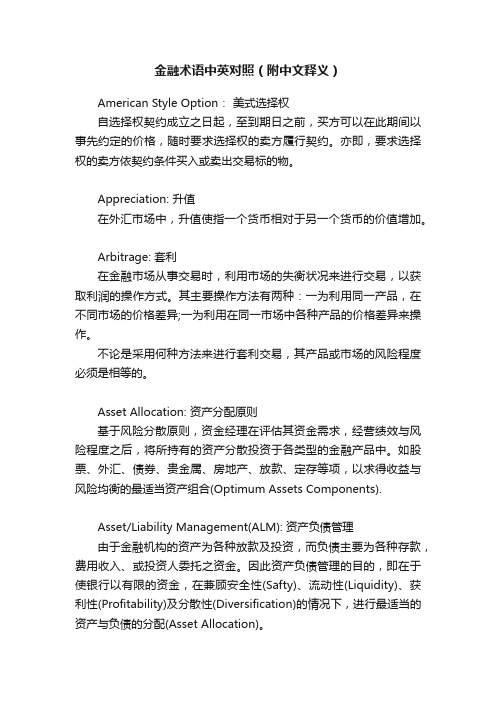

金融术语中英对照(附中文释义)

金融术语中英对照(附中文释义)American Style Option:美式选择权自选择权契约成立之日起,至到期日之前,买方可以在此期间以事先约定的价格,随时要求选择权的卖方履行契约。

亦即,要求选择权的卖方依契约条件买入或卖出交易标的物。

Appreciation: 升值在外汇市场中,升值使指一个货币相对于另一个货币的价值增加。

Arbitrage: 套利在金融市场从事交易时,利用市场的失衡状况来进行交易,以获取利润的操作方式。

其主要操作方法有两种:一为利用同一产品,在不同市场的价格差异;一为利用在同一市场中各种产品的价格差异来操作。

不论是采用何种方法来进行套利交易,其产品或市场的风险程度必须是相等的。

Asset Allocation: 资产分配原则基于风险分散原则,资金经理在评估其资金需求,经营绩效与风险程度之后,将所持有的资产分散投资于各类型的金融产品中。

如股票、外汇、债券、贵金属、房地产、放款、定存等项,以求得收益与风险均衡的最适当资产组合(Optimum Assets Components).Asset/Liability Management(ALM): 资产负债管理由于金融机构的资产为各种放款及投资,而负债主要为各种存款,费用收入、或投资人委托之资金。

因此资产负债管理的目的,即在于使银行以有限的资金,在兼顾安全性(Safty)、流动性(Liquidity)、获利性(Profitability)及分散性(Diversification)的情况下,进行最适当的资产与负债的分配(Asset Allocation)。

At The Money: 评价选择权交易中,履行价格等于远期价格时称之为评价。

Bear Market: 空头市场(熊市)在金融市场中,若投资人认为交易标的物价格会下降,便会进行卖出该交易标的物的操作策略。

因交易者在卖出补回前,其手中并未持有任何交易标的物,故称为:“空头”。

所谓空头市场就是代表大部分的市场参与者皆不看好后市的一种市场状态。

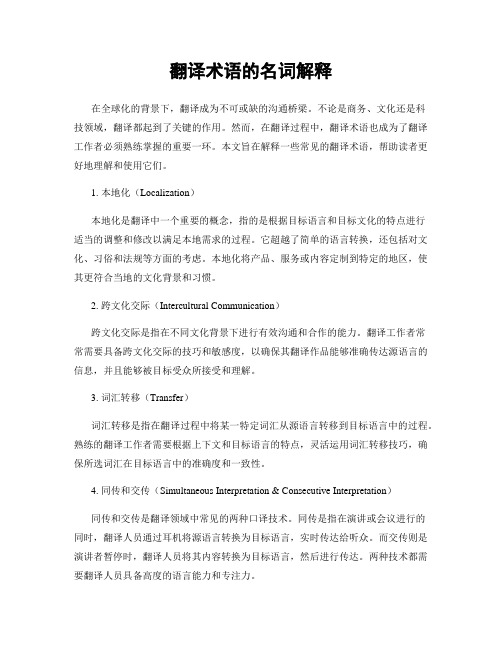

翻译术语的名词解释

翻译术语的名词解释在全球化的背景下,翻译成为不可或缺的沟通桥梁。

不论是商务、文化还是科技领域,翻译都起到了关键的作用。

然而,在翻译过程中,翻译术语也成为了翻译工作者必须熟练掌握的重要一环。

本文旨在解释一些常见的翻译术语,帮助读者更好地理解和使用它们。

1. 本地化(Localization)本地化是翻译中一个重要的概念,指的是根据目标语言和目标文化的特点进行适当的调整和修改以满足本地需求的过程。

它超越了简单的语言转换,还包括对文化、习俗和法规等方面的考虑。

本地化将产品、服务或内容定制到特定的地区,使其更符合当地的文化背景和习惯。

2. 跨文化交际(Intercultural Communication)跨文化交际是指在不同文化背景下进行有效沟通和合作的能力。

翻译工作者常常需要具备跨文化交际的技巧和敏感度,以确保其翻译作品能够准确传达源语言的信息,并且能够被目标受众所接受和理解。

3. 词汇转移(Transfer)词汇转移是指在翻译过程中将某一特定词汇从源语言转移到目标语言中的过程。

熟练的翻译工作者需要根据上下文和目标语言的特点,灵活运用词汇转移技巧,确保所选词汇在目标语言中的准确度和一致性。

4. 同传和交传(Simultaneous Interpretation & Consecutive Interpretation)同传和交传是翻译领域中常见的两种口译技术。

同传是指在演讲或会议进行的同时,翻译人员通过耳机将源语言转换为目标语言,实时传达给听众。

而交传则是演讲者暂停时,翻译人员将其内容转换为目标语言,然后进行传达。

两种技术都需要翻译人员具备高度的语言能力和专注力。

5. 策略(Translation Strategy)翻译策略是指翻译工作者在面对不同的翻译问题时所采取的方法和决策。

由于每个翻译问题都具有其独特的特点,翻译策略的选择对于最终翻译作品的质量至关重要。

常见的翻译策略包括直译、意译、补充信息等。

经济金融术语汉英对照表

经济金融术语汉英对照表A安全网 safety net按可比口径 on comparable basis按轻重缓急 to prioritize暗补 implicit subsidy暗亏 hidden lossB颁发营业执照 to license;to grant a licence to办理存款业务 to take deposits保护农民的生产积极性 to protect farmers'incentive to produce备付金(超额准备金) excess reserves本外币并账 consolidation of domestic and foreign currencyaccounts本外币对冲操作 sterilization operation本位利益 localized interest;departmentalism奔小康 to strive to prosper;to strive to become well-to-do避税(请见“逃税”) tax avoidance币种搭配不当 currency mismatch币种构成 currency composition变相社会集资 disguised irregular(or illegal) fund raising表外科目(业务) off-balance-sheet items(operation)薄弱环节 weaknesses;loopholes不变成本 fixed cost不变价 at constant price;in real terms不动产 real estate不良贷款(资产) problem loans;non-performing loans(assets)C财务公司 finance companies财政赤字 fiscal deficit财政挤银行 fiscal pressure on the central bank(over monetary policy)财政政策与货币政策的配合 coordination of fiscal and monetary policies采取循序渐进的方法 in a phased and sequenced manner操作弹性 operational flexibility操纵汇率 to manipulate exchange rate产品构成 product composition;product mix产品积压 stock pile;excessive inventory产销率 current period inventory;(即期库存,不含前期库存)sales/output ratio 产销衔接 marketability产业政策 industrial policy长期国债 treasury bonds敞口头寸 open position炒股 to speculate in the stock market承购包销 underwrite(securities)成套机电产品 complete sets of equipment;complete plant(s)城市信用社 urban credit cooperatives(UCCs)城市合作银行 urban cooperative banks;municipal united banks城市商业银行 municipal commercial banks城乡居民收入增长超过物价涨幅 real growth in household income持续升温 persistent overheating重复布点 duplicate projects重置成本 replacement cost重组计划 restructuring plan筹资渠道 funding sources;financing channels初见成效 initial success出口统一管理、归口经营 canalization of exports出口退税 export tax rebate储蓄存款 household deposits(不完全等同于西方的savingsdeposits,前者包括活期存款,后者不包括。

常用金融术语(中英对照)

金融资产组合(Portfolio) :指投资者持有的一组资产。

一个资产多元化的投资组合通常会包含股票、债券、货币市场资产、现金以及实物资产如黄金等.证券投资(Portfolio Investment):国际收支中、资本帐下的一个项目,反映资本跨国进行证券投资的情况,与直接投资不同,后者涉及在国外设立公司开展业务,直接参与公司的经营管理。

证券投资则一般只是被动地持有股票或债券。

投资组合经理(Portfolio Manager):替投资者管理资产组合的人,通常获授权在约定规范下自由运用资金。

共同基金的投资组合经理负责执行投资策略,将资金投资在各类资产上。

头寸(Position) :就证券投资而言,头寸是指在一项资产上做多(即拥有)或做空(即借入待还)的数量。

总资产收益率(ROTA) :资产收益率是企业净利润与平均资产总额地百分比,也叫资产回报率(ROA),它是用来衡量每单位资产创造多少净利润的指标.其计算公式为:资产收益率=净利润/平均资产总额×100%;该指标越高,表明企业资产利用效果越好,说明企业在增加收入和节约资金使用等方面取得了良好的效果,否则相反。

整批交易(Round Lot Trade) :指按证券和商品在市场最普遍的交易单位(例如100股为一单位)进行的交易。

交易回合(Round Turn):指在同一市场上通过对两种证券或合约一买一卖,或一卖一买的交易两相抵消。

通常在计算手续费时会提及交易回合。

缩略语有资产担保的证券(ABS)国际外汇交易商协会(ACI)现货(Actuals)亚洲开发银行(ADB)美国预托证券(ADR)非洲开发银行(AFDB)年度股东大会(AGM)另类投资市场(AIM)明日(T/N)债券有资产担保的证券(ABS)卖方报价(Ask)最优价指令(At Best)平价(At Par)拍卖(Auction)回购利率(Repo Rate)申报交易商(Reporting Dealer)债务重新安排(Rescheduling)备用贷款(Standby Loan)风险投资和新股发行增值性(Accretive)收购(Acquisition)共同行动(Acting in Concert)关联公司(Affiliate)另类投资市场(AIM)将公司资产拆卖(Asset Stripping)投资风险极高(Toxic)认购不足(Undersubscribed)承销商(Underwriter)技术分析收集(Accumulation)分析师(Analyst)柱状图(Bar Chart) :柱状图(Histogram)也叫直方图,是一种统计报告图,由一系列高度不等的纵向条纹表示数据分布的情况。

本地化翻译(Localization)金融类术语及英文解释(期权)

本地化翻译(Localization)金融类术语及英文解释(期权)本地化翻译(Localization)金融类术语及英文解释(期权)Investment certificates(投资证书)An investment certificate is an investment product offered by an investment company or brokerage firm designed to offer a competitive yield to an investor with the added safety of their principal.A certificate allows the investor to make an investment and to earn a guaranteed interest rate for a predetermined amount of time. The product rules and specifics can vary depending on the company selling the certificates.(投资公司发放的一种投资凭证,凭借这种凭证,投资人可以在一段时间后获得固定利率的收入。

)Subscription rights(认股权)The right of existing shareholders in a company to retain an equal percentage ownership over time by subscribing to new stock issuances at or below market prices. The subscription right is usually enforced by the use of rights offerings(配股), which allow shareholders to exchange rights for shares of common stock at a price generally below what the stock is currently trading for.Subscription rights are not necessarily guaranteed by all companies, but most have some form of dilution protection in their charters. If granted this privilege, shareholders may purchase their shares before they are offered to the secondary markets. This form of dilution protection is usually good for a few weeks before a company will go about seeking new investors in the broad market.Investors will receive notification of their subscription rightby mail (from the company itself) or through their brokers or custodians.Variable rate bonds(浮息债券)An interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that changes periodically. The obvious advantage of a variable interest rate is that if the underlying interest rate or index declines, the borrower's interest payments also fall. Conversely, if the underlying index rises, interest payments increase.The underlying benchmark interest rate or index for a variable interest rate depends on the type of loan or security. Variable interest rates for mortgages, automobiles and credit cards may be based on a benchmark rate such as the prime rate in a country. Banks and financial institutions charge consumers a spread over this benchmark rate, with the spread depending on a number of factors such as the type of asset and the consumer's credit rating.For variable interest rate bonds, the benchmark rate may be the London Interbank Offered Rate (LIBOR). Some variable rate bonds also use the five-year, 10-year or 30-year U.S. Treasury bond yield as the benchmark interest rate, offering a coupon rate that is set at a certain spread above the yield on U.S. Treasuries.Fixed-interest bonds(定息债券)A debt instrument such as a bond, debenture or gilt-edged bond that investors use to loan money to a company in exchange for interest payments. A fixed-interest security pays a specified rate of interest that does not change over the life of the instrument. The face value is returned when the security matures.Fixed-interest securities are less risky than equities, since in the event that a company is liquidated, bondholders are repaidbefore shareholders. However, bondholders are considered unsecured creditors and may not get any or all of their principal back.Fixed-interest securities are also subject to interest-rate risk. Since their interest rate is fixed, these securities will become less valuable as rates go up in a rising-interest-rate environment. If interest rates fall, however, the fixed-interest security becomes more valuable.Zero bonds/Zero coupon bond(零息债券)A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.Also known as an "accrual bond."Some zero-coupon bonds are issued as such, while others are bonds that have been stripped of their coupons by a financial institution and then repackaged as zero-coupon bonds. Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price much more than coupon bonds.(Investopedia)。

1 Testing Terminology and Code Name测试专用术语-19页精选文档

➢ Timesheet: Tracking the time spent per test design during the project.

➢ 功能测试(functional testing):通过运行软件,测 试产品的功能是否符合设计要求。

➢ 用户界面缺陷(UI Bug):软件用户界面上的任何缺陷。

➢ 功能缺陷(Functional Bug):电脑系统或者程序中的 功能上的任何缺陷。

➢ 崩溃(Crash):计算机系统或组件突然并完全的丧失功 能,例如软件或系统突然退出或没有任何反应(死机)。

➢ 通用字符集(Unicode):对已知的字符进行16位编码的 字符集,已经成为全球字符编码标准。

➢ UTF-8:支持ASCII向后兼容和覆盖世界绝大多数语言的 一种Unicode编码格式。UTF-8是8-bit Unicode Transfer Format的简写。

➢ 术语表(glossary):用于软件翻译/本地化项目的包含 源语言和本地化语言的关键词和短语的翻译对照表。

➢ 字符集(character set):从书写系统到二进制代码集 的字符映射。例如,ANSI字符集使用8位长度对单个字符 编码。而Unicode,使用16位长度标示一个字符。

➢ 双字节字符集(double bytes character set-DBCS):用两 个字节长度表示一个字符的字符编码系统。中文,日文和 韩文都用双字节字符集表示。

软件本地化测试常用术语

软件本地化行业有很多经常使用的行业术语, 非行业人士或刚刚进入该行业的新人,常常对这 些术语感到困惑。另外,软件本地化行业属于信 息行业,随着信息技术的迅速发展,不断产生新 的术学习这些新的术语。

经常使用运算机术语翻译本地化

经常使用运算机术语翻译--本地化软件本地化行业有很多常常利用的行业术语,非行业人士或方才进入该行业的新人,常常对这些术语感到困惑。

另外,软件本地化行业属于信息行业,随着信息技术的迅速进展,不断产生新的术语,因此,即便有连年本地化行业体会的专业人士,也需要跟踪和学习这些新的术语。

本文列举最经常使用的本地化术语,其中一些也大量用在一般信息技术行业。

对这些经常使用的术语,进行简明的说明,给出对应的英文。

加速键或快捷键(accelerate key)。

常应用在Windows应用程序中,同时按下一系列组合键,完成一个特定的功能。

例如,Ctrl + P,是打印的快捷键。

带重音的字符(accented character)。

例如在拉丁字符的上面或下面,添加重音标示符号。

关于汉字没有此问题。

校准(alignment)。

通过比较源语言文档和翻译过的文档,创建翻译数据库的进程。

利用翻译经历工具能够半自动化地完成此进程。

双向语言(bi-directional language)。

关于希伯莱语言或阿拉伯语言,文字是从右向左显示,而其中的英文单词或商标符号从左向右显示。

关于中文,都是从左向右显示。

编译版本(build)。

软件开发进程中编译的用于测试的内部版本。

一个大型的软件项目通常需要执行多个内部版本的测试,因此需要按打算编译出多个版本用于测试。

版本环境(build environment)。

用于编译软件应用程序的一些列文件的集合。

版本健康检查(build sanity check)。

由软件编译者对方才编译的版本快速执行大体功能检查的活动,通过检查后,再由测试者进行正规详细测试。

级连样式表(cascading style sheet -CSS)。

概念html等标示文件显示样式的外部文档。

字符集(character set)。

从书写系统到二进制代码集的字符映射。

例如,ANSI字符集利用8位长度对单个字符编码。

而Unicode,利用16位长度标示一个字符。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

本地化翻译(Localization)金融类术语及英文解释(期权)

Investment certificates(投资证书)

An investment certificate is an investment product offered by an investment company or brokerage firm designed to offer a competitive yield to an investor with the added safety of their principal.

A certificate allows the investor to make an investment and to earn a guaranteed interest rate for a predetermined amount of time. The product rules and specifics can vary depending on the company selling the certificates.

(投资公司发放的一种投资凭证,凭借这种凭证,投资人可以在一段时间后获得固定利率的收入。

)

Subscription rights(认股权)

The right of existing shareholders in a company to retain an equal percentage ownership over time by subscribing to new stock issuances at or below market prices. The subscription right is usually enforced by the use of rights offerings(配股), which allow shareholders to exchange rights for shares of common stock at a price generally below what the stock is currently trading for.

Subscription rights are not necessarily guaranteed by all companies, but most have some form of dilution protection in their charters. If granted this privilege, shareholders may purchase their shares before they are offered to the secondary markets. This form of dilution protection is usually good for a few weeks before a company will go about seeking new investors in the broad market.

Investors will receive notification of their subscription right by mail (from the company itself) or through their brokers or custodians.

Variable rate bonds(浮息债券)

An interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that changes periodically. The obvious advantage of a variable interest rate is that if the underlying interest rate or index declines, the borrower's interest payments also fall. Conversely, if the underlying index rises, interest payments increase.

The underlying benchmark interest rate or index for a variable interest rate depends on the type of loan or security. Variable interest rates for mortgages, automobiles and credit cards may be based on a benchmark rate such as the prime rate in a country. Banks and financial institutions charge consumers a spread over this benchmark rate, with the spread depending on a number of factors such as the type of asset and the consumer's credit rating.

For variable interest rate bonds, the benchmark rate may be the London Interbank Offered Rate (LIBOR). Some variable rate bonds also use the five-year, 10-year or 30-year U.S. Treasury bond yield as the benchmark interest rate, offering a coupon rate that is set at a certain spread above the yield on U.S. Treasuries.

Fixed-interest bonds(定息债券)

A debt instrument such as a bond, debenture or gilt-edged bond that investors use to loan money to a company in exchange for interest payments. A fixed-interest security pays a specified rate of interest that does not change over the life of the instrument. The face value is returned when the security matures.

Fixed-interest securities are less risky than equities, since in the event that a company is liquidated, bondholders are repaid before shareholders. However, bondholders are considered unsecured creditors and may not get any or all of their principal back.

Fixed-interest securities are also subject to interest-rate risk. Since their interest rate is fixed, these securities will become less valuable as rates go up in a rising-interest-rate environment. If interest rates fall, however, the fixed-interest security becomes more valuable.

Zero bonds/Zero coupon bond(零息债券)

A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.

Also known as an "accrual bond."

Some zero-coupon bonds are issued as such, while others are bonds that have been stripped of their coupons by a financial institution and then repackaged as zero-coupon bonds. Because they offer the entire payment at maturity, zero-coupon bonds tend to fluctuate in price much more than coupon bonds.

(Investopedia)。