财务会计01第一章

会计学教程及案例讲解中英文对照Ch01第一章

Operating Information 操作信息

➢ Needed to conduct day-to-day activities. ➢ Largest quantity of accounting data. ➢ Examples:

Hours worked by employees for payroll purposes. Automobiles available for sale to customers. Amounts owed by customers. Parts and accessories on hand. 需要进行日常活动。 最大数量的会计数据。 例子: 员工为工资的目的而工作的时间。 可供销售给客户的汽车。 客户欠下的。

➢ Accountants in industry.会计行业。 ➢ Professional organization is the Institute of Management Accountants (IMA).专业机构是管理会计师协会(IMA)。

Administers the Certified Management Accountant (CMA) program.管理注册会计师(CMA)项目。 Professional designation for auditors employed in industry is Certified Internal Auditor (CIA). 在行业中被雇佣的审计师的专业名称是经过认证的内部审计师(CIA)。 ➢ Many accounting faculty at universities belong to the American Accounting Association (AAA). ➢ 许多大学的会计系属于美国会计协会(AAA)。 ➢ Controller is the high level officer in organizations responsible for financial and management accounting. ➢ Controller是负责财务和管理会计的组织的高级官员。

第01章财务会计基本理论

niexj

*

二、财务会计概念框架的组成与内容

(一) 基本假设和基本假定 (二) 财务会计的目标 (三) 会计信息质量特征 (四) 财务会计的要素及确认与计量

*

niexj

*

(一) 基本假设和基本假定

会计主体 货币计量 持续经营 会计分期

*

niexj

*

(二) 财务会计的目标

总体目标: 提供 “外部使用者所需要的会计信息”

*

niexj

*

会计要素及其确认

(一)收入 1.收入的定义 收入,是指企业在日常活动中形成的、会导致所有者权益增加的、与所有者投入资本无关的经济利益的总流入。

*

niexj

*

会计要素及其确认

(一)收入 2.收入的确认条件 收入在确认时除了应当符合收入定义外,还应当满足严格的确认条件。收入只有在经济利益很可能流入,从而导致企业资产增加或者负债减少、且经济利益的流入额能够可靠计量时才能予以确认。因此,收入的确认至少应当符合以下条件: 一是与收入相关的经济利益应当很可能流入企业; 二是经济利益流入企业的结果会导致企业资产的增加或者负债的减少; 三是经济利益的流入额能够可靠地计量。

*

niexj

*

2.关于确认与计量

确认:应否、何时、如何将一项要素加以记录和计入报表 。 概念框架没有具体说明具体项目如何确认,而是只提出所有要素确认的共同标准,如概念框架中指出,会计确认一般准则是:一、符合某项要素的定义;二、能可靠地计量。

*

niexj

*

niexj

*

财务会计概念框架图示:

第三层次 ——关于“如何”(how) ——工具

会计信息的质量特征

计 量 属 单 性 位

中级财务会计第一章总论

02

企业过去的交易、事项形成的、预期会导致经济利益流出企业的现时义务。 特征: (1)现时义务; (2)预期会导致经济利益流出企业。 负债确认的条件: (1)与该义务有关的经济利益很可能流出企业; (2)未来流出的经济利益的金额能够可靠计量。

思考:已经发生的住房贷款和孩子将来上学需要的费用有何差别?

定义: 持续经营是指会计主体在可以预见的未来,将根据正常的经营方针和既定的经营目标持续经营下去,不会停业,也不会大规模削减业务。 这一基本前提的主要意义在于:会计人员可以在非清算基础上选择会计原则和会计方法。 解决了资产的计价问题 解决了费用的分配问题 解决了债权债务的清偿问题

3、会计分期

01

实质重于形式原则

05

重要性

06

谨慎性

07

适时性

08

“企业应当以实际发生的交易或事项为依据进行会计确认、计量和报告,如实反映符合确认和计量要求的各项会计要素及其他相关信息,保证会计信息真实可靠、内容完整。” 也就是真实性、可靠性。

亦即有用性,新准则更加强调企业提供信息的有用性。

“企业提供的会计信息应当与财务会计报告使用者的经济决策需要相关,有助于财务会计报告使用者对企业过去、现在或未来的情况做出评价和预测。”

基础会计部分:

01

经济业务

02

设置账户

03

复式记账

04

会计凭证

05

会计账簿

06

会计报表

07

成本计算

08

财产清查

会计核算的七大方法

结合企业基本经济业务的核算: 筹集资金业务的核算 生产准备业务的核算 生产加工业务的核算 销售业务的核算 利润及其分配的核算

如何将会计凭证、会计帐簿、记账程序和方法有机的结合起来的技术组织方式,叫做会计核算组织程序。 最基本的会计核算程序:记帐凭证核算程序

财会类专业知识

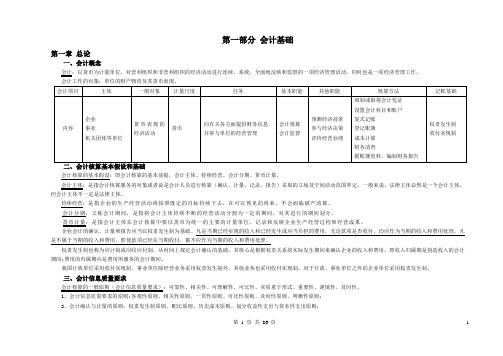

第一部分会计基础第一章总论一、会计概念会计:以货币为计量单位,对营利组织和非营利组织的经济活动进行连续、系统、全面地反映和监督的一项经济管理活动,同时也是一项经济管理工作。

会计工作的对象:单位的财产物资及其货币表现。

二、会计核算基本假设和基础会计核算的基本假设:即会计核算的基本前提,会计主体、持续经营、会计分期、货币计量。

会计主体:是指会计核算服务的对象或者说是会计人员进行核算(确认、计量、记录、报告)采取的立场及空间活动范围界定。

一般来说,法律主体必然是一个会计主体,但会计主体不一定是法律主体。

持续经营:是指企业的生产经营活动将按照既定的目标持续下去,在可以预见的将来,不会面临破产清算。

会计分期:又称会计期间,是指将会计主体持续不断的经营活动分割为一定的期间,对其进行的期间划分。

货币计量:是指会计主体在会计核算中要以货币为统一的主要的计量单位,记录和反映企业生产经营过程和经营成果。

企业会计的确认、计量和报告应当以权责发生制为基础。

凡是当期已经实现的收入和已经发生或应当负担的费用,无论款项是否收付,均应作为当期的收入和费用处理。

凡是不属于当期的收入和费用,即使款项已经在当期收付,都不应作为当期的收入和费用处理。

权责发生制也称为应计制或应收应付制,从时间上规定会计确认的基础,其核心是根据权责关系的实际发生期间来确认企业的收入和费用。

即收入归属期是创造收入的会计期间;费用的归属期应是费用所服务的会计期间。

我国行政单位采用收付实现制、事业单位除经营业务采用权责发生制外,其他业务也采用收付实现制。

对于行政、事业单位之外的企业单位采用权责发生制。

三、会计信息质量要求会计核算的一般原则(会计信息质量要求):可靠性、相关性、可理解性、可比性、实质重于形式、重要性、谨慎性、及时性。

1、会计信息质量要求的原则:客观性原则、相关性原则、一贯性原则、可比性原则、及时性原则、明晰性原则;2、会计确认与计量的原则:权责发生制原则、配比原则、历史成本原则、划分收益性支出与资本性支出原则;第 1 页共86 页 13、修正性原则:重要性原则、谨慎性原则。

重大社2024教学课件《中级财务会计》01总论

[案情介绍] 湖北福星科技股份有限公司,(股票代码:000926,股票简称:福星股份),主营金属制品业、房地产业两大核心产业。

2012年8月16日,为增强财务信息的真实性,更加公允、恰当的反映公司的财务状况和经营成果,公司决定自2012年6月1日

起对投资性房地产采用公允价值模式进行后续计量,并以资产负债表日的公允价值调整其账面价值,公允价值与原账面价值之

课程介绍

中级财务会计主要包括三方面的内容:

第一部分

会计基本理论

第二部分

会计要素的确认、计量和记录

第三部分

财务报告

教学目标

通过《中级财务会计》的学习,要求学生理解中级财务会计 的相关概念及理论;熟练掌握会计要素的确认、计量及具体会 计处理;掌握资产负债表、利润表和现金流量表的编制方法。

学习方法

No.1 No.2 No.3

【CPA考题·多选题】下列各项交易事项的会计处理中,体现实质重于形式 原则的有( )

A.将发行的附有强制付息义务的有优先股确认为负债 B.将企业未持有权益但能够控制的结构化主体纳入合并范围 C.将附有追索权的商业承兑汇票出售确认为质押贷款 D.承租人将融资租入固定资产确认为本企业的资产 【答案】ABCD

2012-2019年福星股份年报的审计均为无保留意见的审计报告,但均将“投资性房地产公允价值计量”作为关键审计事项, 加了说明段。

[要求](1)说明该公司将投资性房地产后续计量模式变更为公允价值模式使会计信息更可靠还是更相关? (2)会计信息质量的可靠性和相关性是否是矛盾和对立的?

一、财务报告

第四节 财务报告及财务会计要素

间的差额计入当期损益。福星股份变更投资性房地产计量模式后,2012年-2019年各年的相关财务数据如下表所示:

《财务会计学》第01章在线测试

《财务会计学》第01章在线测试《财务会计学》第01章在线测试剩余时间:59:55答题须知:1、本卷满分20分。

2、答完题后,请一定要单击下面的“交卷”按钮交卷,否则无法记录本试卷的成绩。

3、在交卷之前,不要刷新本网页,否则你的答题结果将会被清空。

第一题、单项选择题(每题1分,5道题共5分)1、在财务会计中,编制现金流量表的基础是( C )。

A、权责发生制B、永续盘存制C、现金收付实现制D、实地盘存制2、为财务会计工作确定了空间范围的基本前提是( A )。

A、会计主体B、持续经营C、会计期间D、货币计量3、企业按规定计提资产减值准备,符合(D)。

A、重要性原则B、历史成本原则C、配比原则D、谨慎性原则4、下列各项目中,不属于会计信息质量要求的是( D)。

A、客观性B、可比性C、明晰性D、历史成本4、(本题空白。

您可以直接获得本题的1分)第二题、多项选择题(每题2分,5道题共10分)1、会计确认包括(ABCD)A、初始确认B、后续确认C、终止确认D、进入会计系统的确认2、下列有关资产的说法正确的是(ACD)。

A、企业的资产仅限于资源,非资源不是企业的资产B、一项资源是否属于企业的资产,关键要看其所有权是否属于该企业C、作为资产的资源,必须具有为特定企业带来未来经济利益的服务潜力D、作为资产的资源必须能够用货币进行可靠的计量3、根据客观性原则,要求会计核算做到(ABCD)。

A、足会计信息使用者决策的需要B、保证会计信息的真实C、准确反映企业的实际情况D、会计信息能够经受验证4、下列各项中,体现谨慎性要求的是(BD)。

A、无形资产摊销B、成本与市价孰低法C、固定资产采用历史成本计价D、债务重组中债权人对或有收益的会计处理5、我国会计准则规定的会计计量属性包括(ABCD)。

A、历史成本B、重置成本C、可变现净值D、现值和公允价值第三题、判断题(每题1分,5道题共5分)1、企业在一定期间发生亏损,会导致所有者权益减少。

第一章 总论 《中级财务会计》PPT课件

第一章 总 论

财务状况要素是反映企业在某一日期经营资金的来源和分布情况的各项 要素。一般通过资产负债表反映。财务状况要素由资产、负债和所有者 权益三个要素所构成。

第四节 财务报告要素

(一)资产

第一章 总 论

(1)资产是由过去的交易、事项所形成的。

(2)资产是企业拥有或控制的。

(3)资产预期会给企业带来经济利益,即资产是可望给企业带来现金流入的经济资 源。

第一章 总 论

(二)会计信息的内部使用者

会计信息内部使用者包括:董事会,首席执行官(CEO),首席财务官 (CFO),副董事长(主管信息系统、人力资源、财务等),经营部门 经理,分厂经理,分部经理,生产线主管等。

第一节 财务会计及其特点

四、财务会计信息的质量要求

第一章 总 论

财务会计目标解决了信息使用者需要什么样的信息,在总体上规范了信 息的需求量,即在信息提供的“多与少”上作出了界定。但是合乎需要 的信息还有一个“好与坏”的问题,即信息的质量问题。所有对决策有 用的信息在质量上必须达到一定的质量要求。

(二)负债

(1)负债是企业的现时义务。

(2)负债的清偿预期会导致经济利益流出企业。

(三)所有者权益

第四节 财务报告要素

二、反映经营成果的要素

第一章 总 论

经营成果是指企业在一定时期内生产经营活动的结果,具体地说,它是 指企业生产经营过程中取得的收入与耗费相配比的差额。经营成果要素 一般通过利润表来反映,由收入、费用和利润三个要素构成。

(五)实质重于形式

实质重于形式原则要求“企业应当按照交易或事项的经济实质进行会计 确认、计量,而不应当仅仅按照他们的法律形式作为会计确认、计量的 依据”。

(六)重要性

《中级财务会计》第1章 流动资产

例题

【正确答案】C 【答案解析】“盘亏的固定资产”预期不会给企业带来经济利益, 不属于企业的资产。

例题

【多选题】 下列各项中,企业能够确认为资产的有( )。 A.经营租出的设备 B.经营租入的设备 C.融资租入的设备 D.近期将要购入的设备

例题 【正确答案】AC 【答案解析】选项B是企业并不能拥有或控制的;选项D不

其他应收款

三、其他货币资金

(二)其他货币资金的账务处理 1.银行汇票存款

提示付款期限 出票日起1个月

收款人可以将银行汇票背书转让给被背书人,银行汇票的背书转 让以不超过出票金额的实际结算金额为准。

例题

甲企业为增值税一般纳税人,向银行申请办理银行汇票用以购买

原材料,将款项250 000元交存银行转作银行汇票存款,根据盖章退

1 000元 5 000元

10 000元 50 000元

例题

甲企业为取得银行本票,向银行填交“银行本票申请书”,并将

10 000元银行存款转作银行本票存款。

借:其他货币资金—银行本票 10 000

贷:银行存款

10 000

甲企业用银行本票购买办公用品10 000元。

借:管理费用

10 000

贷:其他货币资金—银行本票 10 000

例题

甲企业派采购员到异地采购原材料,8月10日企业委托开户银行

汇款100 000元到采购地设立采购专户,根据收到的银行汇款凭证回

单联,编制如下会计分录:

借:其他货币资金—外埠存款 100 000

贷:银行存款

100 000

三、其他货币资金

8月20日,采购员交来从采购专户付款购入材料的有关凭证,增

值税专用发票上的原材料价款为80 000元,增值税税额为13 600元,

中级财务会计课件-01-总论

Intermediate Accounting

1 总论 1 总论

财务会计的理论结构

会计环境与会计假设 财务会计目标

会计信息质量要求

财务报表的基本要素

确认与计量原则

中 级会计学

Intermediate Accounting

1 总论

二、会计的职能

进行会计核算(最基本的,也称反映职能) 实施会计监督 参与决策 是通过一定的程序和方法,将企业生产经营过程 中大量的、日常的业务数据,经过记录、分类和汇总, 定期编制通用的财务报表,向企业外部信息使用者提供 有关整个企业的财务状况、经营成果和现金流量的信息。

与该资源有关的经济利益很可能流入企业。 该资源的成本或者价值能够可靠地计量。

中 级会计学

Intermediate Accounting

1 总论

1、资产

资产的特征

资产是由过去的交易、事项所形成的。

资产是企业拥有或者控制的。 资产预期会给企业带来经济利益。

资产按性质分为流动资产与非流动资产

采购

储备 资金

生产

完工入库 生产 资金

成品资金

借入

进行新的周转过程

商业企业

投资者 投入

货币 资金

购进

商品 资金

销售

退出

货币 资金

借入

进行新的周转过程

筹资活动

偿还债务、分红、 企业减资

供应过程

投资者、债权人 (资本市场) 吸收投资、发 行债券、借款 分红、转让 股票或债券

材料

现金 (企业)

生 产 过 程

资产 负债

所有者 权益

反映了企业在一定时点上的资金运动的静态表现

反映了企业在一定时期的资金运动的动态表现

中级财务会计第一章第四节委托加工物资

委托加工物资

在资产负债表中,委托加工物资 应作为流动资产列示,并按照成 本与可变现净值孰低的原则进行 计量。

减值准备

如果委托加工物资存在减值迹象 ,应计提相应的减值准备,并在 资产负债表中反映。

在利润表中的披露

销售成本

在利润表中,已销售的委托加工物资 的成本应作为销售成本列示,并从销 售收入中扣除。

企业发出委托加工物资

企业根据需要将需要加工的物资发出, 并记录发出物资的数量、价值等信息。

企业支付加工费

企业根据合同约定向加工企业支付加 工费,并记录支付金额。

企业收回委托加工物资

企业根据合同约定从加工企业收回委 托加工物资,并记录收回物资的数量、 价值等信息。

企业结转成本

企业根据收回的委托加工物资数量和 价值,结转相应的成本,并记录结转 金额。

委托加工费

支付给受托方的委托加工费应作为营 业费用列示,并在利润表中反映。

在现金流量表中的披露

经营活动现金流量

在现金流量表中,委托加工物资的采 购和销售应作为经营活动现金流量列 示。

投资活动现金流量

如果企业将委托加工物资用于投资活 动,如构建固定资产等,则应在现金 流量表中作为投资活动现金流量列示。

案例三:委托加工物资的纳税处理

要点一

总结词

要点二

详细描述

委托加工物资在纳税处理上需要考虑增值税、消费税等税 费,根据税法规定进行相应的税额计算和申报。

某企业委托加工一批应税消费品,支付加工费和辅料费共计 10,000元,增值税率为17%,消费税率为10%。纳税处理上, 应缴纳消费税为1,700元(10,000 / (1 - 10%) * 10%),增 值税为1,700元(10,000 * 17%)。企业需要将消费税和增 值税计入委托加工物资的成本中。

财务会计课本

财务会计课本一、引言财务会计是指通过收集、记录、分类、总结和报告企业日常经济事务的核算方法和过程。

财务会计不仅是企业重要的内部管理工具,也是向外部各方提供企业财务信息的重要方式。

本文档旨在介绍财务会计的基本概念、原则、方法,以及财务会计的主要任务和目标。

二、财务会计的概念和基本原则2.1 财务会计的概念财务会计是指通过记录、分类、总结和报告企业经济事务的核算方法。

它主要关注企业的经济活动、财务状况和经营成果。

2.2 财务会计的基本原则1.会计主体性原则:企业与业主之间必须相互区别,企业财务与个人财务必须分开核算。

2.会计持续性原则:企业活动应以人的一生为基点进行持续核算。

3.会计会计期间性原则:将经济事项划分为一定的会计期间进行核算和报告。

4.会计货币性原则:财务会计应以货币作为计量单位进行核算。

5.会计真实性原则:财务会计信息应真实、完整地反映企业的经济活动和财务状况。

三、财务会计的方法与流程3.1 财务会计的方法1.账务处理:通过记录原始凭证,将经济事项按照一定规则进行账务处理。

2.账户分类:将账务处理后的经济事项按照性质和用途进行分类,形成财务会计账户。

3.制作财务报表:根据账户分类的结果,编制财务报表,如资产负债表、利润表、现金流量表等。

3.2 财务会计的流程1.原始凭证的收集和登记:企业必须按照一定规则收集和登记各种经济事项的原始凭证。

2.原始凭证的审核和归档:对收集的原始凭证进行审核,确保其合法性和准确性,并进行归档保存。

3.账务处理和账户分类:通过将经济事项按照一定规则进行账务处理,形成财务会计账户。

4.编制财务报表:根据账户分类的结果,编制财务报表,反映企业的经济活动和财务状况。

5.财务报表的分析和解读:对编制好的财务报表进行分析和解读,为企业的决策提供依据。

四、财务会计的主要任务和目标4.1 主要任务1.记录和处理企业的经济活动:财务会计通过记录和处理企业的经济活动,确保账务的准确性和可靠性。

财务会计PPT课件

(一)企业财务会计的概念

1、服务对象的营利性

相对于预算会计而言

3、核算规则的统一性

统一执行国家财政部《企业会计制度》

2、工作目标的对外性

相对于管理会计的工作目标而言

(二)企业财务会计的特点

会计分类:

01

企业财务会计分类:

02

(三)企业财务会计的分类

按服务对象

01.

按服务目标

01.

预算会计

01.

企业财务会计核算的内容实际上是企业财务会计核算的具体化 包括

01

(一)企业财务会计核算的内容

企业财务会计核算的目标

1

为外部有关方面提供财务会计信息 为内部经营管理提供财务会计信息 对业务经营活动实施财务会计监督

2

第二节企业财务会计的基本理论

01

企业财务会计的基本方法 企业财务会计核算的一般原则

02

12

小结

思考一下我们今天都 学习了哪些内容?

课堂练习和结束语

感谢聆听

下次课再见

(一)企业财务会计核算的基

本前提

(二)企业财务会计核算的基

本方法

一、企业财务会计的基本方法

(一)企业财务会计核算的基本前提

会计主体 是指企业财务会计工作为之服务的特定组织和单位,界定核算的空间范围。

持续 经营 是指特定会计主体的经营活动将会无限期的延续下去。

将会计主体的生产经营活动划分为若干连续的前后相接、间距相等的会计期间。

企业财务会计

点击此处添加副标题

演讲人姓名

202X

目 录

第一章 总论

第二章 资产(上)----流动资产

第三章 资产(下)----非流动资产

第四章 负债

高级财务会计(00159)01

第一章外币会计1.对于以人民币作为记账本位币的企业,下列交易或事项中,不属于外币交易的是( ) 2015单A.以80万元人民币兑换美元B.以20万美元购入原材料一批C.为建造一项固定资产借款2000万美元D.以60万元人民币支付美国子公司员工的薪酬【答案】D P452.某企业的记账本位币为美元,根据我国会计准则规定,下列说法中错误的是()2016单A.该企业日常核算使用的货币为美元B.该企业的财务报表需要折算为人民币C.该企业以美元计价和结算的交易属于外币交易D.该企业以人民币计价和结算的交易属于外币交易【答案】C P453.什么是汇兑损益?汇兑损益有哪些常见类型?2012简【答案】 P47汇兑损益是指企业发生的外币业务在折合为记账本位币时,由于汇率的变动而产生的记账本位币的折算差额和不同于外币兑换发生的收付差额,给企业带来的收益或损失。

类型:(1)交易汇兑损益。

(2)兑换汇兑损益。

(3)调整外币汇兑损益。

(4)外币折算汇兑损益。

4.(2013核算题)2010年12月1日,甲公司出口自产商品一批,销售价格为100 000美元,已办理发货手续,当日即期汇率为1美元=7元人民币,约定于2011年2月10日付款。

假设不考虑相关税费,2010年12月31日的汇率为1美元=6.80元人民币,2011年2月10日的汇率为1美元=6.70元人民币。

要求:分别按照单一交易观和两项交易观当期确认法,做出上述业务在交易日、报表日和结算日的相关会计分录。

【答案】 P48(1)单一交易观交易日:借:应收账款 700 000贷:主营业务收入 700 000报表日:借:主营业务收入 20 000贷:应收账款 20 000结算日:借:主营业务收入 10 000贷:应收账款 10 000借:银行存款 670 000贷:应收账款 670 000(2)两项交易观交易日:借:应收账款 700 000贷:主营业务收入 700 000报表日:借:财务费用 20 000贷:应收账款 20 000结算日:借:财务费用 10 000贷:应收账款 10 000借:银行存款 670 000贷:应收账款 670 0005. 根据我国会计准则规定,企业实际收到的外币投资额在折算为记账本位币时,应采用的汇率是()2016单A.合同约定汇率B.交易发生日即期汇率C.资产负债表日即期汇率D.交易发生日即期汇率的近似汇率【答案】B P536.某公司外币业务采用交易发生日的即期汇率进行折算,按月计算汇兑损益。

会计考试 01第一章 总论练习题

第一章总论一、单项选择题1、会计的基本职能是()。

A 核算和监督B 分析和调节C 预测和决策D 核算和分析2、会计主要采用的计量尺度是()。

A 货币量度B 实物量度C 劳动量度D 以上都不是3、界定了会计核算和监督的空间范围的是()假设。

A 持续经营B 会计主体C 会计分期D 货币计量4、企业在对会计要素进行计量时,一般应当采用( )计量属性。

A 历史成本B 重置成本C 可变现净值D 现值5、不同企业发生的相同或者相似的交易或者事项,应当采用规定的会计政策,符合的是()原则。

A 可比性B 重要性C 谨慎性D 相关性6、从核算效益看,对所有会计事项不分轻重主次和繁简详略,采取完全相同方法,不符合()原则。

A 明晰性B 重要性C 相关性D 谨慎性7、我国《企业会计准则》规定,企业采用的确定收入和费用归属期的基础是()。

A 永续盘存制B 实地盘存制C 权责发生制D 收付实现制8、企业提供的会计信息应当与财务会计报告使用者的经济决策需要相关,有助于财务会计报告使用者对企业过去、现在或者未来的情况作出评价或者预测,符合()要求。

A 谨慎性B 可比性C 相关性D 及时性9、当一笔经济业务只涉及资产一方有关项目之间的金额发生增减变化,会计恒等式两边的总金额()。

A 同增B 同减C 不增不减D 一边增加,一边减少10、引起资产内部一个项目增加,另一个项目减少,而资产总额不变的经济业务是()。

A 用银行存款偿还短期借款B 收到投资者投入的机器一台C 收到外单位还来前欠货款D 收到销售产品收入二、多项选择题1、会计主体可以是()。

A 独立法人B 非法人C 企业中的某一特定部分D 企业集团2、下列项目中,符合谨慎性要求的有()。

A 对应收账款计提坏账准备B 固定资产折旧采用加速折旧法C 固定资产折旧采用直线法D 无形资产摊销采用直线法3、下列各项中属于会计核算方法的有()。

A 复式记账B 填制会计凭证C 登记账簿D 编制会计报表4、下列项目中,属于我国会计信息质量要求的有()。

查尔斯亨格瑞_财务会计_课后练习答案01

查尔斯亨格瑞_财务会计_课后练习答案01CHAPTER 1COVERAGE OF LEARNING OBJECTIVESChapter 1 Accounting: The Language of Business1CHAPTER 11-1 Accounting is a process of identifying, recording, summarizing, and reporting economic information to decision makers.1-2 No. Accounting is about real information about real companies. In learning accounting it is helpful to see accounting reports from various companies. This helps put the rules and techniques of accounting into an understandable framework and provides familiarity with the diversity of practice.1-3 Examples of decisions that are likely to be influenced by financial statements include choosing where to expand or reduce operations, lending money, investing ownership capital, and rewarding mangers.1-4 Users of financial statements include managers, lenders, suppliers, owners, income tax authorities, and government regulators.1-5 The major distinction between financial accounting and management accounting is their use by two classes of decision makers. Management accounting is concerned mainly with how accounting can serve internal decision makers such as the chief executive officer and other executives. Financial accounting is concerned with supplying information to external users. 1-6 The balance sheet equation is Assets = Liabilities + Owners’ equity. It is the fundamental framework of accounting. The left side lists the resources of the organization, and the right side lists the claims against those resources.1-7 No. Every transaction should leave the balance sheet equation in balance. Accounting is often called ―double-entry‖because accountants must enter at least two numbers for eac h transaction to keep the equation in balance.1-8 This is true. When a company buys inventory for cash, one asset is traded for another, and neither total assets nor total liabilities change. Thus, the balance sheet equation stays in balance. When a company buys inventory on credit, both inventory and accounts payable increase. Thus, both total assets and total liabilities increase by the same amount, again keeping the balance sheet equation in balance.1-9 The evidence for a note payable includes a promissory note, but the evidence for an account payable does not. A note payable is generally to a lender while an account payable is generally to a supplier.1-10 Ownership shares in most large corporations are easily traded in the stock markets, corporate owners have limited liability, and the owners of sole proprietorships or partnerships are usually also managers in the company while most corporations hire professional managers.21-11 Limited liability means that corporate owners are not personally liable for the debts of the corporation. Creditors’claims can be satisfied only by the assets of the particular corporation.1-12 The corporation is the most prominent type of entity and corporations do by far the largest volume of business.1-13 Yes. In the United Kingdom corporations frequently use the word limited (Ltd.) in their name. In many countries whose laws trace back to Spain, the initials S.A. refer to a ―society anonymous,‖ meaning that multiple unidentified owners stand behind the company, which is essentially the same structure as a corporation.1-14 Almost all states forbid the issuance of stock at below par; thus, par values are customarily set at very low amounts and have no real importance in affecting economic behavior of the issuing entity.1-15 The board of directors is the elected link between stockholders and the actual managers.It is the board’s duty to ensure that managers act in the best interests of shareholders.1-16 In the U.S. GAAP is generally set by the Financial Accounting Standards Board. The SEC has formal authority for specifying accounting standards for companies with publicly held stock, as delegated by Congress, but it usually accepts the standards promulgated by the FASB. Internationally, a majority of countries accept IFRS as set by the International Accounting Standards Board as their GAAP.1-17 Until recently this was true. However, now the SEC allows companies headquartered outside the U. S. to report using IFRS.1-18 Audits have value because they add credibilit y to a company’s financial statements.Provided that auditors have the expertise to assess the accuracy of financial statements and the integrity to report any problems they discover, the investing public can put more faith in statements that are audited.1-19 A CPA is a certified public accountant. One becomes a CPA by a combination of education, qualifying experience, and the passing of a two-day national examination. A CA (chartered accountant) is the equivalent of a CPA in many parts of the world, including most former British Commonwealth countries.1-20 Public accountants must obey standards of independence and integrity. In addition, there are many more ethical standards that pertain to accountants. Some folks call accounting the moral guardian of companies. This reputation has been sullied recently by corporate scandals that went undetected (or, at least, unreported by accountants), but accountants are working to regain the high ethical regard they have traditionally maintained.Chapter 1 Accounting: The Language of Business31-21 No. The fundamental accounting principles apply equally to nonprofit (that is, not-for-profit) and profit-seeking organizations. Managers and accountants in hospitals, universities, government agencies, and other nonprofit organizations use financial statements. They need to raise and spend money, prepare budgets, and judge financial performance. Nonprofit organizations need to use their limited resources wisely, and financial statements are essential for judging their use of resources.1-22 Double-entry refers to the concept that every transaction involves two or more accounts with the effect being to retain the balance in the balance sheet equation. The double-entry concept is important because it emphasizes that there are assets and claims on assets. In the balance sheet, for example, borrowing money provides an asset, cash, and creates a liability. Inaddition to this conceptual benefit there is a clerical benefit. Maintaining a balanced relationship provides an indicator of errors. If the balance sheet equation does not balance, an error has been made.1-23 Historians are primarily concerned with events that have already occurred. In that sense,a company’s financial statements do report on history—transactions that are complete.The negative side of this is that many important things that affect the value of a firm are based on what will happen in the future. Thus, investors often worry about expectations and predictions. Of course, there is no way to agree on the accuracy of expectations and predictions. The positive side of historical financial statements is that they present a no-nonsense perspective on what actually happened, where the company was at a point in time, or what it accomplished over a period of time. It is easier to predict the future when you know where you are and how you got there. You might liken the importance of historical financial statements to the importance of navigation instruments. If you do not know where you are and where you are headed, it is very hard to get to where you want to go.Most people who refer to accountants as historians intend it as a criticism, although, as indicated above, a historical focus ensures that the data are measurable and verifiable.1-24 Such arguments are fun but can never be truly resolved. The notion behind the importance of the corporation is that for any substantial growth to occur there must be a system for organizing resources and using them over long periods of time. The corporate form of ownership helps companies raise large amounts of capital via stock issuance as well as borrowing. It allows us to separate ownership from management. It protects the personal assets of shareholders, and because their maximum losses can be limited, more risky undertakings can be financed. Finally, it has perpetual life so its activity is not disrupted by the death of any shareholder. Corporations operate under a set of established rules of behavior for entering into contracts and being sure that other parties can be relied upon to uphold their side of an agreement.Accounting helped corporations emerge as the dominant economic organization in the world. Without accounting it would be difficult to coordinate the activities of large corporations. It would be especially difficult to separate management from ownership if accounting did not provide information about the performance of managements.41-25 The auditor increases the value of financial statements by reassuring the reader of the statements that an―independent‖ and a ―qualified‖ third party has reviewed management’s disclosures and believes they fairly present the company’s performance.The fact that you personally do not recognize the name of the audit firm should not be a problem, because only CPAs can perform public audits and sign audit opinions. Every state has strict procedures for licensing CPAs, so such people are qualified. Nevertheless, audit firms develop reputations, and ones with a positive public image may give some financial statement users more confidence in the financial statements they audit.1-26 (10 min.) Amounts are in millions.1. Assets = Liabilities + Owners’ Equity$7 = $3 + $42. Assets and liabilities would increase by $1 million. Owners’ equity would be unaffected.1-27 (15-20 min.)June 2 Owners invested $6,000 additional cash in Sok ol’s Furniture Company.3 Owners invested an additional $4,000 into the company by contributingadditional store fixtures valued at $4,000.4 Sok ol’s Furniture Company purchased additional furniture inventory for$3,000 cash.5 Sok ol’s Furniture Company purchased furniture inventory on account for$6,000.6 Sok ol’s Furniture Company sold store fixtures for $3,000 cash.7 Sok ol’s Furniture Company purchased $6,000 of store fixtures, paying$5,000 cash now and agreeing to pay $1,000 later.8 Sok ol’s Furniture Company paid $2,000 on accounts payable.9 Sok ol’s Furniture Company returned $400 of merchandise (furnitureinventory) for credit against accounts payable.10 Owners withdrew $2,000 cash from Sokol’s Furniture Company.Chapter 1 Accounting: The Language of Business51-28 (10-20 min.)Sept. 2 Brisbane purchased $2,500 of store fixtures on account.3 Owner or owners withdrew $2,000 cash.4 Brisbane returned $5,000 of its inventory of computers for $5,000 creditagainst its accounts payable.5 Computers (inventory) valued at $7,000 were invested in the company byowners.8 Brisbane paid $500 on accounts payable.9 Brisbane purchased $3,500 of store fixtures, paying $1,000 now andagreeing to pay $2,500 later.10 Brisbane returned $300 of store fixtures for credit against accounts payable.1-29 (15-25 min.)ATLANTA CORPORATIONBalance SheetMarch 31, 20X1Liabilities andAssets Stockholders’ EquityCash $ 5,000 (a) Liabilities:Merchandise inventory 44,000 (b) Accounts payable $ 12,000 (f) Furniture and fixtures 2,000 (c) Notes payable 10,000 Machinery and equipment 27,000 (d) Long-term debt 27,000 (g) Land 39,000 (e) Total liabilities 49,000 Building 24,000 Stockholders’ equity:Total $141,000 Paid-in capital 92,000 (h)Total $141,000(a) Cash: 14,000 + 1,000 – 10,000 = 5,000(b) Merchandise inventory: 40,000 + 4,000 = 44,000(c) Furniture and fixtures: 3,000 – 1,000 = 2,000(d) Machinery and equipment: 15,000 + 12,000 = 27,000(e) Land: 14,000 + 25,000 = 39,000(f) Accounts payable: 8,000 + 4,000 = 12,000(g) Long-term debt: 12,000 + 15,000 = 27,000(h) Paid-in capital: 80,000 + 12,000 = 92,000Note: Event 5 requires no change in the balance sheet.61-30 (25-35 min.)LIVERPOOL COMPANYBalance SheetNovember 30, 20X1Liabilities andAssets Stockholders’ EquityCash £ 18,000 (a) Liabilities:Merchandise inventory 29,000 Accounts payable £ 9,000 (d) Furniture and fixtures 8,000 Notes payable 31,000 (e) Machinery and equip. 33,000 (b) Long-term debt payable 101,000 (f) Land 35,000 (c) Total liabilities 141,000 Building 241,000 Stockholders’ equity:Total £364,000 Paid-in Capital 223,000 (g)Total £364,000(a) Cash: 22,000 – 3,000 – 7,000 + 6,000 = 18,000(b) Machinery and equipment: 20,000 + 13,000 = 33,000(c) Land: 41,000 – 6,000 = 35,000(d) Accounts payable: 16,000 – 7,000 = 9,000(e) Notes payable: 21,000 + (13,000 – 3,000) = 31,000(f) Long-term debt payable: 124,000 – 23,000 = 101,000(g) Paid-in capital: 200,000 + 23,000 = 223,000Note: Event 4 requires no change in the balance sheet.1-31 (5-10 min.)1. Total liabilities = Total assets -stockholders’ equity= $798,000,000,000 - $105,000,000,000= $693,000,000,0002. Common stock, par value = $.07 × 10,536,897,000 = $737,582,790.Like other items on General Electric’s balance sheet, the amount would be rounded off to millions:Common stock, par value $738Chapter 1 Accounting: The Language of Business71-32 (20-30 min.) See Exhibit 1-32. Equipment and furniture could be in two separate accounts rather than combined. 1-33 (20-35 min.)1. See Exhibit 1-33.2. LMN CORPORATIONBalance SheetJanuary 31, 20X1(In Thousands of Dollars)Liabilities andAssets Stockholders’ EquityLiabilities:Cash $131 Note payable $ 30Accounts payable 106 Merchandise inventory 269 Total liabilities $136Stockholders’ equity:Equipment 36 Capital stock,$1 par, 30,000 sharesissued and outstanding $ 30Additional paid-in capitalin excess of par value 270 300 Total $436 Total $436 1-34 (20-35 min.)1. See Exhibit 1-34.2. AUTOPARTES MADRIDBalance SheetMarch 31, 20X1Assets Liabilities and Owners’ EquityCash €58,800 Liabilities:Inventory 16,600 Accounts payable € 4,500 Equipment 17,500 Note payable 9,000Total liabilities 13,500You, capital 79,400 Total €92,900 Total €92,900 8EXHIBIT 1–32MCLEAN SERVICES, INC.Analysis of April 20X1 Transactions(In Thousands of Dollars)Assets Liabilities and Stockholders’ EquityEquipment Note Accounts Paid-in Description of Transactions Cash + and Furniture = Payable + Payable + Capital1. Issuance of stock +50 = +502. Issuance of stock +20 = +203. Borrowing +35 = +354. Acquisition for cash –33 +33 =5. Acquisition on account +10 = +106. Payments to creditors – 4 = – 47. Sale of equipment + 8 – 8 =8. No entry =+56 +55 = +35 + 6 + 70111 111MCLEAN SERVICES, INC.Balance SheetApril 30, 20X1Assets Liabilities and Stockholders’ EquityNote payable $ 35,000 Cash $ 56,000 Account payable 6,000Equipment and furniture 55,000 Paid-in Capital 70,000Total $111,000 Total $111,000Chapter 1 Accounting: The Language of Business9EXHIBIT 1–33LMN CORPORATIONJanuary 20X1Analysis of Transactions(In Thousands of Dollars)Assets Liabilities + Owners’ EquityMerch- Capital Additionalandise Equip- Notes Accounts Stock Paid-in Description of Transactions Cash + Inventory + ment = Payable + Payable + (at par) + Capital1. Original incorporation +300 = + 30 + 2702. Inventory purchased –95 +95 =3. Inventory purchased +85 = + 854. Return of inventory tosupplier –11 = – 115. Purchase of equipment –10 +40 = +306. Sale of equipment + 4 – 4 =7. Payment to creditor –18 = – 188. Inventory purchased –50 +100 = + 509. No entry except ondetailed underlyingrecords ==Balance, January 31, 20X110EXHIBIT 1–34AUTOPARTES MADRIDAnalysis of TransactionsFor the Month Ended March 31, 20X1Assets Liabilities + Owner’s EquityEquip- Accounts Note You, Description of Transactions Cash + Inventory + ment = Payable + Payable + Capital1. Initial investment +75,000 = +75,0002. Inventory acquired for cash 10,000 +10,000 =3. Inventory acquired on credit + 8,000 = + 8,0004. Equipment acquired – 5,000 +15,000 = +10,0005. No entry =6. Tires for family – 600 = - 6007. Parts returned tosupplier for cash + 300 – 300 =8. No effect on total inventory =9. Parts returned tosupplier for credit – 500 = – 50010. Payment on note – 1,000 = –1,00011. Equipment acquired + 5,000 = +5,00012. Payment to creditors – 3,000 = –3,00013. No entry14. No entry15. Exchange of equipment + 2,500 – 4,000 =+ 1,500+ 58,800 +16,600 +17,500 = +4,500 + 9,000 +79,40092,900 92,900Chapter 1 Accounting: The Language of Business111-35 (25-40 min.) Note that transaction 9 is not covered directly in the text. However, it should be possible to figure out the accounting for it from similar items that are covered. However, some instructors may want to omit transaction 9.1. See Exhibit 1-35.2. FREIDA CRUZ, ATTORNEY-AT-LAWBalance SheetDecember 31, 20X0Liabilities andAssets Owner’s EquityLiabilities:Cash in bank $46,000 Note payable $ 3,000 Note receivable 2,000 Account payable 1,000 Rental damage deposit 1,000 Total liabilities $ 4,000 Legal supplies on hand 1,000 Owner’s equity:Computer 5,000 Freida Cruz, capital 55,000 Office furniture 4,000 Total liabilities andTotal assets $59,000 owner’s equity $59,000 1-36 (15-25 min.) See Exhibit 1-36.1-37 (20-35 min.)1. See Exhibit 1-37.2. NIKE, INC.Balance SheetJune 3, 2009(In Millions)Liabilities andAssets Owners’ EquityCash $ 2,424 Total liabilities $ 4,617 Inventories 2,400 Owners’ equity 8,783 Property, plant, and equipment 1,932 Other assets 6,644Total $13,400 Total $13,40012FREIDA CRUZ ATTORNEYAnalysis of Business Transactions(In Thousands of Dollars)Assets = Liabilities and Owner’s EquityOwner’s Cash Note Rental Legal Office Liabilities Equity Description in Receiv- Damage Supplies Furni- Note Account F. Cruz of Transactions Bank able Deposit on Hand Computer ture Payable Payable Capital 2. Openinginvestment +55 = +554. Rental deposit – 1 +1 =5. Purchased computer – 2 +5 = +36. Purchased supplies +1 = +17. Purchasedfurniture – 4 +4 =9. Note receivablefrom G. See – 2 +2 =Balance, December31, 20X0 +46 +2 +1 +1 +5 +4 = +3 +1 +5559 59General Comments:Transactions 1 and 3 are personal rather than business transactions.In transaction 4, no obligation (liability) is set up for the rent because it is not payable until January 2 and no rental services will occur until January.Transaction 8 requires no entry because no services have been performed during December.Chapter 1 Accounting: The Language of Business13WALGREEN COMPANYAnalysis of Transactions(In Millions of Dollars)Assets Liabilities and Stockholders’ EquityProperty Stock-Inven- and Other Notes Accounts Other holders’Description of Transactions Cash + tories + Assets = Payable + Payable + Liabilities + Equity Balance May 31 2,300 6,891 15,952 = 4,599 6,357 14,1871. Issuance of stock for cash +30 = + 302. Issuance of stock for equipment +42 = + 423. Borrowing +13 = +134. Acquisition of equipment for cash –18 +18 =5. Acquisition of inventory on account +94 = +946. Payments to creditors –35 = –357. Sale of equipment +2 - 2 =Balance June 2 2,292 6,985 16,010 = 13 4,658 6,357 14,25925,287 25,287WALGREEN COMPANYBalance SheetJune 2, 2009(In Millions of Dollars)Assets Liabilities and Stockholders’ EquityCash $ 2,292 Notes payable $ 13Inventories 6,985 Accounts payable 4,658Property and other assets 16,010 Other liabilities 6,357Stockholders’ equity 14,259 Total $25,287 Total $25,28714NIKE, INC. Analysis of Transactions (In Millions of Dollars)AssetsLiabilities and Owners’ EquityDescription of Transactions Cash + Inven-tories +Property,Plant, andEquip. +Other Assets=TotalLiabil-ities +Owners’EquityBalance May 31 2,291 2,357 1,958 6,644 4,557 8,6931. Inventory purchased -28 +28 =2. Inventory purchased +19 = +193. Return of inventoryto supplier -4 = -44. Purchase of equipment -3 +14 = +115. Sale of equipment +40 -40 =6. No entry =7. Payment to creditor -16 = -168. Borrowed from bank +50 = +509. Issued common stock +90 = +9010. No entry except ondetailed underlyingrecords =Balance, June 3 2,424 2,400 1,932 6,644 =13,400 13,400Chapter 1 Accounting: The Language of Business15 REBECCA GURLEY, REALTORBalance SheetNovember 30, 20X1Liabilities andAssets Owners’ EquityCash $ 6,000 Liabilities:Undeveloped land 180,000 Accounts payable $ 6,000 Office furniture 16,000 (a) Mortgage payable 95,000 Franchise 18,000 (b) Total liabilities 101,000Owner’s equity:Rebecca Gurley, capital 119,000 (c) Total assets $220,000 Total liabilities andown er’s equity $220,000a.$17,000 – $1,000 = $16,000b. A franchise is an economic resource that has been purchased to benefit future operations.c.$220,000 – $101,000 = $119,000Note that Goldstein’s death may have considerable negative influence on future operations, but accounting does not formally measure its monetary impact. Moreover, transactions 3 and 4 are personal rather than business transactions.1-39 (10 min.)1. Cash would rise by $1,000 and the liability, Deposits, would rise by the same amount.2. Deposits are liabilities because Wells Fargo owes these amounts to depositors. They aredepositors’ claims on the assets of the bank.3. Loans Receivable would increase and Cash would decrease by $75,000.4. Deposits would decrease and Cash would decrease by $4,000.1-40 (10 min.) Amounts are in millions.1. a. Cash = Total assets - Noncash assets= €28,598 -€24,492= €4,106b. Stockholders’ equity= Total assets - Total liabilities= €28,598 -€22,495= €6,1032. Total liabilit ies and stockholders’ equity = total assets = €28,598.16UNITED TECHNOLOGIES CORPORATIONBalance SheetJune 30, 2009(In Millions of Dollars)Liabilities andAssets Stockholders’ EquityCash $ 4,196 (1) Accounts payable $ 4,599 Inventories 8,539 Other liabilities 24,819 Fixed assets 6,179 Long term debt 8,721 Other assets 37,811 Total liabilities 38,139Common stock $11,369Other stockholders’equity 7,037 (3)Total stockholders’equity 18,406 (2)Total liabilities andTotal assets $56,545 stockholders’ equity $56,545 Notations (1), (2), and (3) designate the answers to the requirements. (1) The $4,016 cash was computed by taking total assets minus all assets except cash. To calculate (2) and (3), note that total assets must equal tota l liabilities plus stockholders’ equity, $56,545. Furthermore, total liabilities is $4,599 + $24,819 + $8,721 = $38,139. Therefore, total stockholders’equity is $56,545 – $38,139 = $18,406, denoted by (2) above. Other stockholders’equity is $18,406 –$11,369 = $7,037, denoted by (3) above.Chapter 1 Accounting: The Language of Business17MACY’S, INC.Balance SheetAugust 1, 2009(In Millions of Dollars)Liabilities andAssets Share holders’ EquityCash $ 515 (a)Merchandise accountsInventories 4,634 payable $ 1,683 Property, plant, Long-term debt 8,632and equipment 10,046 Other liabilities 5,920Total liabilities $16,235 (b) Other assets 5,589 Shareholders’ equity 4,549 (c)Total liabilities andTotal assets $20,784 shareholders’ equity $20,784 Notations (a), (b), and (c) designate the answers to the requirements. Cash is calculated by subtracting the values given for the other assets from total assets: $20,784 - $4,634-$10,046 -$5,589 = $515. Cash is the smallest individual asset. Companies try to keep cash balances small because they do not earn large returns on cash accounts. To calculate (b), simply add the components $1,683 + $8,632 + $5,920. For (c), note that total liabilities and shareholde rs’ equity equals total assets, $20,784, so shareholders’ equity is $20,784 less total liabilities of $16,235, which equals $4,549.181.ABBOUD PARTNERSBalance SheetJune 15, 20X0Assets Liabilities and Owners’ EquityRental house $300,000 Mortgage loan $240,000Owners’ equityAdnan Abboud, Capital 30,000Gamal Abboud, Capital 30,000Total assets $300,000 Total liabilities and ow ners’equity $300,0002.ABBOUD CORPORATIONBalance SheetJune 15, 20X0Assets Liabilities & Stockholders’ EquityRental house $300,000 Mortgage loan $240,000Stockholders’ equityCommon stock, par value 2,000Additional paid-in capital 58,000Total assets $300,000 Total liabilities and sto ckholders’ equity $300,0001-44 (10 min.)1. The par value line would increase by 500,000,000 × $.01 = $5,000,000 and the number ofshares issued and outstanding would increase by 500 million. Additional paid-in capital would increase by 500,000,000 ×($6.00 – $.01) = $2,995,000,000.2. IBM shows all of its paid-in capital as a one-line item. Therefore, its common stock linewould increase by $120,000,000 and the number of issued and outstanding shares would increase by 1 million. Chapter 1 Accounting: The Language of Business19。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

ex ante information asymmetry ex ante opportunistic behavior ex post information asymmetry ex post opportunistic behavior

---monitor:social, law, market( market for corporate control,managerial labor

market, competitive product and service market,creditors monitor,large shareholders etc.)

accounting and management accounting

corporate governance and accounting

The role and value of information Business state of nature initial judgment revised judgment

---incentive: pecuniary incentive(salary,bonus, restricted stock,stock option, stock appreciation right , phantom stock , long-term performance plan etc.); non-pecuniary incentive(control,reputation,self-satisfaction etc.)

4.external corporate governance: market-based; internal corporate governance: surrounding board of directors and management

5. the role of accounting: production and presentation of information (mainly in terms of money) : 6. reporting to external and internal interested parties: financial

corporate governance and accounting

The Ownership of the Firm: residual control rights claim to firm’s residue

Agency problem: 1.principal (information disadvantage) and agent (information advantage)

corporate governance and accounting

3.agency cost----monitoring costs, bonding costs, residue losses

* Corporate Governance and Accounting

1. the concrete arrangement of the ownership of the firm 2. a set of institutional arrangement with the intent to alleviate agency problem in the firm( focus on shareholders &management) naturally,creditors also face agency problems 3.the core of corporate governance: information asymmetry

ex ante i.e. pre-contract, ex post i.e. post-contract *ex ante opportunistic behavior i.e. adverse selection :screening, signalling,

how to induce candidates tell the truth,cost of signal is so high that others can not to reproduce *ex post opportunistic behavior i.e. moral hazard :

工编

corporate governance and accounting

Accounting and Economics share some common basic assumptions :

First level: scarcity of resources, complexity and uncertainty of environment, economic men with bounded rationality Second level: information incompleteness and asymmetry, opportunistic behavior tendency (different utility functions, externality of behavior), positive transaction cost Result: incomplete contracts The Nature of the Firm: Jensen & Meckling(1976) the nexus of a set of contracts between owners of production factors, a legal fiction