会计专业英语知识点

会计专业英语复习资料.doc

会计专业英语复习资料.doc会计专业英语复习资料⼀、短语中英互译1、会计分录2、投资活动3、后进先出法4、客观性原则5、注册会计师6、权责发⽣制7、累计折旧8、资产负债表9、经营决策10、银⾏存款11、到期⽇12、历史成本13、source document14、nominal rate15、credit sale16、sum-of-years-digits method17、economic entity assumption18、financial position19、fixed assets20、public hearing21、income statement22、sales discount23、value added tax24、trade mark25、bank overdraft⼆、从下列选项中选出最佳答案1、Generally,revenue is recorded by a business enterprise at a point when :( )A、Management decides it is appropriate to do soB、The product is available for sale to consumersC、An exchange has taken place and the earning process is virtually completeD、An order for merchandise has been received2、Why are certain costs capitalized when incurred and then depreciated or amortized over subsequent accounting periods?( )A、To reduce the income tax liabilityB、To aid management in making business decisionsC、To match the costs of production with revenue as earnedD、To adhere to the accounting concept of conservatism3、What accounting principle or concept justifies the use of accruals and deferrals?( )A、Going concernB、MaterialityC、ConsistencyD、Stable monetary unit4、An accrued expense can best be described as an amount ( )A、Paid and currently matched with revenueB、Paid and not currently matched with revenueC、Not paid and not currently matched with revenueD、Not paid and currently matched with revenue5、Continuation of a business enterprise in the absence of contrary evidence is an example of the principle or concept of ( )A、Business entityB、ConsistencyC、Going concernD、Substance over form6、In preparing a bank reconciliation,the amount of checks outstanding would be:( )A、added to the bank balance according to the bank statement.B、deducted from the bank balance according to the bank statement.C、added to the cash balance according to the depositor’s records.D、deducted from the cash balance according to the depositor’s records.7、Journal entries based on the bank reconciliation are required for:( )A、additions to the cash balance according to the depositor’s records.B、deductions from the cash balance according to the depositor’srecords.C、Both A and BD、Neither A nor B8、A petty cash fund is :( )A、used to pay relatively small amounts。

会计专业英语

会计专业英语-CAL-FENGHAI.-(YICAI)-Company One1一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance with established procedures.3.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits.C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’ equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs.petence’ judgment’ and ethical behavior of individual accountants’D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receiving in exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A.Dr. Bad Debt Accts. $1,500B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retained earnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900(B)A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $300pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )A.Dr. Office Equipment $2,000B.Dr.Office Equipment $2,000Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,100pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B )A.Dr. Accts Rec $2000B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )A.Dr.Office equipment $2500B.Dr. Office equipment $2500Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly highcontinuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

会计的基本英语知识点汇总

会计的基本英语知识点汇总1. Introduction to Accounting会计简介Accounting is the systematic process of identifying, recording, measuring, classifying, summarizing, interpreting, and communicating financial information. It plays a crucial role in the management and decision-making processes of businesses and organizations.会计是一种系统性的流程,用于识别、记录、度量、分类、总结、解释和传达财务信息。

它在企业和组织的管理和决策过程中发挥着至关重要的作用。

2. Basic Accounting Principles基本会计原则There are several fundamental principles that underpin the field of accounting:有几个基本原则支撑着会计领域:a) Accrual Principle: This principle states that financial transactions should be recorded when they occur and not when the cash is received or paid out.应计原则:该原则规定财务交易应在其发生时记录,而不是在现金收到或支付时记录。

b) Matching Principle: This principle states that expenses should be recognized in the same accounting period as the revenues they help generate.配比原则:该原则规定支出应在与其相关的收入产生的同一会计期间内确认。

英文会计知识点总结归纳

英文会计知识点总结归纳IntroductionAccounting is a fundamental aspect of any business, as it involves the recording, analyzing, and reporting of financial transactions. It provides businesses with essential information to make informed decisions, assess their financial health, and comply with regulatory requirements. In this article, we will summarize and consolidate key accounting knowledge points that are crucial for understanding the principles and practices of accounting.1. Basics of Accounting1.1. Definition of AccountingAccounting is the process of recording, analyzing, and interpreting financial transactions of an organization. It provides a systematic and comprehensive record of all financial activities and enables the preparation of financial statements.1.2. Accounting EquationThe accounting equation, also known as the balance sheet equation, is a fundamental principle of accounting that states:Assets = Liabilities + EquityThis equation represents the relationship between a company's assets, liabilities, and equity, and must always remain in balance.1.3. Types of AccountingThere are several types of accounting, including financial accounting, management accounting, cost accounting, and tax accounting. Each type serves a specific purpose and audience, such as external stakeholders, internal management, and regulatory authorities.2. Financial Statements2.1. Balance SheetThe balance sheet is a financial statement that provides a snapshot of a company's financial position at a specific point in time. It lists the company's assets, liabilities, and equity, and is used to assess its solvency and liquidity.2.2. Income StatementThe income statement, also known as the profit and loss statement, summarizes a company's revenues and expenses over a specific period. It provides insights into the company's profitability and performance.2.3. Cash Flow StatementThe cash flow statement tracks the inflow and outflow of cash within an organization. It categorizes cash flows into operating, investing, and financing activities, and helps assess the company's ability to generate cash and meet its obligations.3. Principles of Accounting3.1. Accrual Basis vs. Cash Basis AccountingAccrual basis accounting recognizes revenues and expenses when they are incurred, regardless of when cash is exchanged. Cash basis accounting, on the other hand, records transactions only when cash is received or paid. Accrual basis accounting provides a more accurate representation of a company's financial performance.3.2. Matching PrincipleThe matching principle requires that expenses be recognized in the same period as the revenues to which they relate. This principle ensures that a company's financial statements accurately reflect its profitability.3.3. Revenue RecognitionRevenue recognition dictates when and how revenue should be recorded in a company's financial statements. It is crucial for determining a company's financial performance and must adhere to generally accepted accounting principles (GAAP).4. Assets and Liabilities4.1. Types of AssetsAssets are resources owned by a company and can be categorized into current assets (e.g., cash, inventory) and non-current assets (e.g., property, plant, and equipment). Understanding the nature and value of an organization's assets is vital for assessing its financial health.4.2. Types of LiabilitiesLiabilities represent an organization's obligations to outside parties and can include accounts payable, long-term debt, and accrued expenses. Managing and tracking liabilities is crucial for maintaining financial stability.5. Internal Controls5.1. Importance of Internal ControlsInternal controls are processes and procedures that a company implements to safeguard its assets, ensure accuracy in financial reporting, and comply with regulations. They help prevent fraud, errors, and mismanagement of funds.5.2. Segregation of DutiesSegregation of duties involves dividing responsibilities among different individuals to prevent the occurrence of fraud and errors. It ensures that no single individual has control over critical financial processes.6. Auditing6.1. Purpose of AuditingAuditing is the process of examining a company's financial statements and accounting records to ensure accuracy, integrity, and compliance with laws and regulations. It provides independent assurance to stakeholders regarding the company's financial performance.6.2. Types of AuditsThere are different types of audits, such as external audits conducted by independent accounting firms, internal audits performed by a company's internal audit department, and government audits carried out by regulatory agencies.7. Taxation7.1. Tax PlanningTax planning involves the structuring of financial activities to minimize tax liabilities within the boundaries of the law. It requires an in-depth understanding of tax laws, regulations, and incentives.7.2. Tax Deductions and CreditsUnderstanding tax deductions and credits is essential for businesses to optimize their tax positions and reduce their tax burden. Deductions lower taxable income, while credits directly reduce the amount of tax owed.8. Financial Analysis8.1. Ratio AnalysisRatio analysis involves the use of financial ratios to evaluate a company's performance, liquidity, solvency, and efficiency. Common ratios include profitability ratios, liquidity ratios, and leverage ratios.8.2. Trend AnalysisTrend analysis involves comparing financial data over different periods to identify patterns, changes, and potential areas for improvement. It helps in assessing a company's financial health and predicting future performance.ConclusionAccounting is a critical aspect of business that provides insights into an organization's financial performance, health, and compliance. Understanding the basics of accounting, financial statements, principles, assets and liabilities, internal controls, auditing, taxation, and financial analysis is essential for business owners, managers, and financial professionals to make informed decisions and ensure the financial success of their organizations. By consolidating and summarizing these key accounting knowledge points, individuals can gain a comprehensive understanding of the principles and practices of accounting.。

会计英语知识点汇总

会计英语知识点汇总会计英语是指与会计相关的英语词汇、表达方式以及专业术语。

随着国际间经济交流的日益频繁和全球化进程的加快,掌握会计英语成为了很多专业人士的必备技能。

本文将梳理一些常见的会计英语知识点,以帮助读者更好地理解和运用这些术语。

一、财务报表1. Balance Sheet(资产负债表):用于反映企业在特定日期的资产、负债和所有者权益的情况。

2. Income Statement(利润表):反映企业在一定期间内的收入、费用和净利润。

3. Cash Flow Statement(现金流量表):按照企业的经营、投资和筹资活动分类,反映现金的流入和流出。

4. Statement of Retained Earnings(留存收益表):展示企业在一定期间内的净利润留存情况。

二、会计核算1. Accounting Equation(会计等式):Assets(资产)= Liabilities(负债)+ Owner's Equity(所有者权益),反映了企业财务状况的基本平衡关系。

2. Depreciation(折旧费用):用于反映资产价值随时间的减少。

3. Accrual Accounting(权责发生制):将收入和费用与实际发生的时间匹配,而非支付和收入的时间。

4. Double-entry Bookkeeping(复式记账法):每笔交易必须同时记录借方和贷方的金额。

5. Financial Ratios(财务比率):用于分析企业财务状况和经营绩效的指标,包括盈利能力、杠杆比率、偿债能力等。

三、财务分析1. Liquidity(流动性):反映企业偿付短期债务的能力。

2. Solvency(偿债能力):反映企业偿付长期债务的能力。

3. Profitability(盈利能力):反映企业获取利润的能力。

4. Efficiency(效率):反映企业运营资源利用的程度。

5. DuPont Analysis(杜邦分析):将利润率、资产周转率和资本结构相互关联,分析企业绩效因素。

会计英语知识点

会计英语知识点1. 会计英语基础知识会计英语是会计专业学生必备的一门语言技能。

了解会计英语的基础知识对于理解财务报表和参与国际商务交流至关重要。

本文将介绍几个重要的会计英语知识点。

2. 财务报表的英文表达财务报表是会计的核心内容之一。

常见的财务报表有资产负债表(Balance Sheet)、利润表(Income Statement)和现金流量表(Cash Flow Statement)。

在财务报表中,资产(Assets)、负债(Liabilities)和所有者权益(Owner's Equity)是三个关键概念。

3. 会计核算方法的英文表达会计核算方法是记录和处理会计业务的规定和方法。

常见的会计核算方法有现金基础会计法(Cash Basis Accounting)和权责发生制会计法(Accrual Basis Accounting)。

4. 会计凭证的英文表达会计凭证是会计记录的依据,用于记录和核实会计业务。

常见的会计凭证有收据(Receipt)、发票(Invoice)、收入凭证(Revenue Voucher)和支出凭证(Expense Voucher)。

5. 会计分录的英文表达会计分录是会计凭证上记录会计业务的方法和格式。

常见的会计分录有借方(Debit)和贷方(Credit),用于记录会计账户的增减情况。

6. 会计报告的英文表达会计报告是对财务状况和经营成果进行汇报的文件。

常见的会计报告有年度报告(Annual Report)和财务分析报告(Financial Analysis Report)。

其中,年度报告包括财务报表和管理层讨论与分析(Management Discussion and Analysis)。

7. 会计伦理的英文表达会计伦理是指会计人员在从事职业活动时应遵循的道德规范。

常见的会计伦理原则有诚实(Honesty)、保密(Confidentiality)和独立性(Independence)。

会计的英语基础知识点汇总

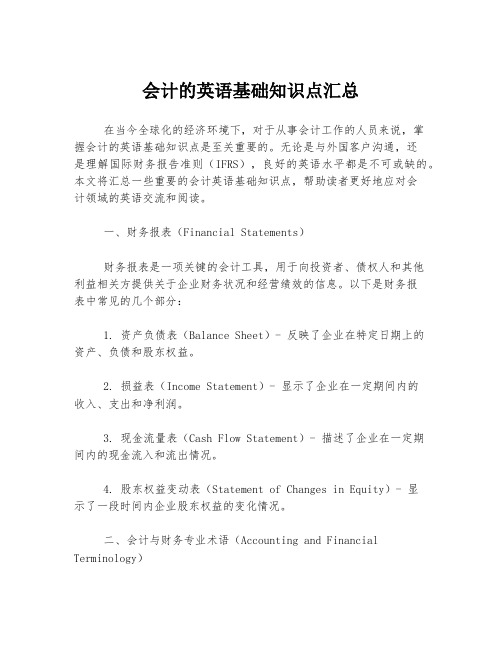

会计的英语基础知识点汇总在当今全球化的经济环境下,对于从事会计工作的人员来说,掌握会计的英语基础知识点是至关重要的。

无论是与外国客户沟通,还是理解国际财务报告准则(IFRS),良好的英语水平都是不可或缺的。

本文将汇总一些重要的会计英语基础知识点,帮助读者更好地应对会计领域的英语交流和阅读。

一、财务报表(Financial Statements)财务报表是一项关键的会计工具,用于向投资者、债权人和其他利益相关方提供关于企业财务状况和经营绩效的信息。

以下是财务报表中常见的几个部分:1. 资产负债表(Balance Sheet)- 反映了企业在特定日期上的资产、负债和股东权益。

2. 损益表(Income Statement)- 显示了企业在一定期间内的收入、支出和净利润。

3. 现金流量表(Cash Flow Statement)- 描述了企业在一定期间内的现金流入和流出情况。

4. 股东权益变动表(Statement of Changes in Equity)- 显示了一段时间内企业股东权益的变化情况。

二、会计与财务专业术语(Accounting and Financial Terminology)在会计领域,存在大量的专业术语需要掌握。

下面是一些常见的术语:1. 资产(Assets)- 公司拥有的经济资源或预计未来可以带来经济利益的权益。

2. 负债(Liabilities)- 公司的债务或义务,需要在未来偿还或履行。

3. 股东权益(Shareholders' Equity)- 公司资产减去负债后,归属于股东的权益。

4. 应收账款(Accounts Receivable)- 公司向客户出售产品或提供服务后,客户应付款项的金额。

5. 应付账款(Accounts Payable)- 公司未付的债务,包括向供应商购买的产品或接受的服务。

6. 摊销(Amortization)- 非物质性资产(如专利)在其使用寿命内按一定方式分期减值的过程。

会计英文知识点

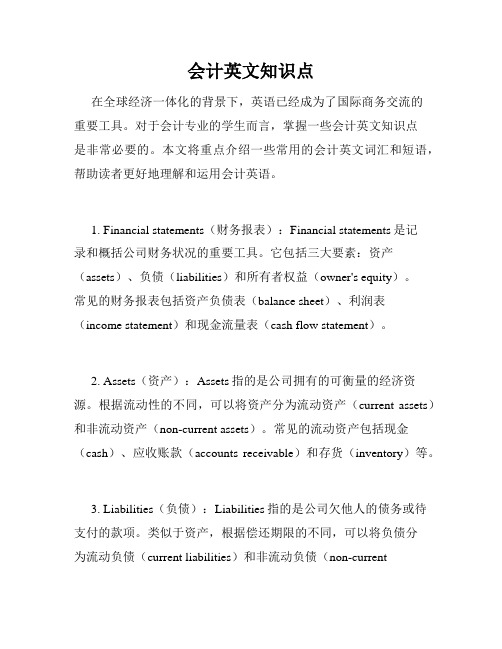

会计英文知识点在全球经济一体化的背景下,英语已经成为了国际商务交流的重要工具。

对于会计专业的学生而言,掌握一些会计英文知识点是非常必要的。

本文将重点介绍一些常用的会计英文词汇和短语,帮助读者更好地理解和运用会计英语。

1. Financial statements(财务报表):Financial statements是记录和概括公司财务状况的重要工具。

它包括三大要素:资产(assets)、负债(liabilities)和所有者权益(owner's equity)。

常见的财务报表包括资产负债表(balance sheet)、利润表(income statement)和现金流量表(cash flow statement)。

2. Assets(资产):Assets指的是公司拥有的可衡量的经济资源。

根据流动性的不同,可以将资产分为流动资产(current assets)和非流动资产(non-current assets)。

常见的流动资产包括现金(cash)、应收账款(accounts receivable)和存货(inventory)等。

3. Liabilities(负债):Liabilities指的是公司欠他人的债务或待支付的款项。

类似于资产,根据偿还期限的不同,可以将负债分为流动负债(current liabilities)和非流动负债(non-currentliabilities)。

常见的流动负债包括应付账款(accounts payable)和短期借款(short-term borrowings)等。

4. Owner's equity(所有者权益):Owner's equity指的是公司归属于所有者的净资产。

它由资本(capital)和利润(profit)构成。

如果资产超过负债,那么所有者权益为正数;如果负债超过资产,那么所有者权益为负数。

5. Depreciation(折旧):Depreciation指的是固定资产(fixed assets)在使用过程中价值的减少。

会计专业英语复习资料

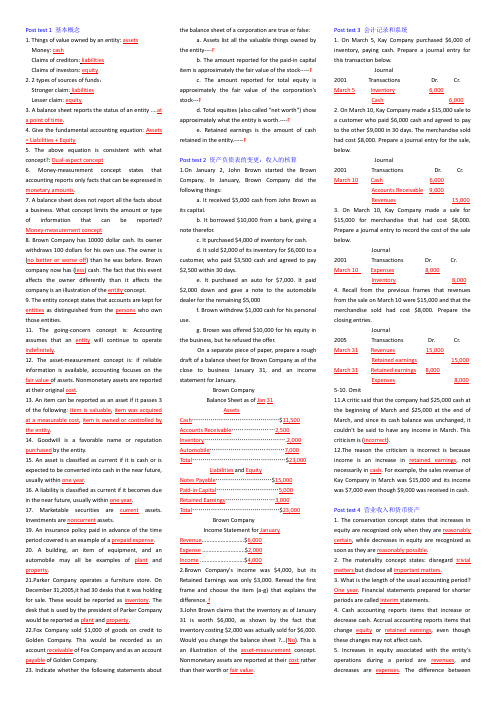

Post test 1 基本概念1. Things of value owned by an entity: assets Money: cashClaims of creditors: liabilitiesClaims of investors: equity2. 2 types of sources of funds:Stronger claim: liabilitiesLesser claim: equity3. A balance sheet reports the status of an entity ....ata point of time.4. Give the fundamental accounting equation: Assets = Liabilities + Equity5. The above equation is consistent with what concept?: Dual-aspect concept6. Money-measurement concept states that accounting reports only facts that can be expressed in monetary amounts.7. A balance sheet does not report all the facts abouta business. What concept limits the amount or type of information that can be reported? Money-measurement concept8. Brown Company has 10000 dollar cash. Its owner withdraws 100 dollars for his own use. The owner is (no better or worse off) than he was before. Brown company now has (less) cash. The fact that this event affects the owner differently than it affects the company is an illustration of the entity concept.9. The entity concept states that accounts are kept for entities as distinguished from the persons who own those entities.11. The going-concern concept is: Accounting assumes that an entity will continue to operate indefinitely.12. The asset-measurement concept is: if reliable information is available, accounting focuses on the fair value of assets. Nonmonetary assets are reported at their original cost.13. An item can be reported as an asset if it passes 3 of the following: item is valuable, item was acquired at a measurable cost, item is owned or controlled by the entity.14. Goodwill is a favorable name or reputation purchased by the entity.15. An asset is classified as current if it is cash or is expected to be converted into cash in the near future, usually within one year.16. A liability is classified as current if it becomes due in the near future, usually within one year.17. Marketable securities are current assets. Investments are noncurrent assets.19. An insurance policy paid in advance of the time period covered is an example of a prepaid expense.20. A building, an item of equipment, and an automobile may all be examples of plant and property.21.Parker Company operates a furniture store. On December 31,2005,it had 30 desks that it was holding for sale. These would be reported as inventory. The desk that is used by the president of Parker Company would be reported as plant and property.22.Fox Company sold $1,000 of goods on credit to Golden Company. This would be recorded as an account receivable of Fox Company and as an account payable of Golden Company.23. Indicate whether the following statements about the balance sheet of a corporation are true or false:a. Assets list all the valuable things owned bythe entity----Fb. The amount reported for the paid-in capitalitem is approximately the fair value of the stock-----Fc. The amount reported for total equity isapproximately the fair value of the corporation’sstock---Fd. Total equities (also called “net worth”) showapproximately what the entity is worth.----Fe. Retained earnings is the amount of cashretained in the entity.-----FPost test 2 资产负债表的变更:收入的核算1.On January 2, John Brown started the BrownCompany. In January, Brown Company did thefollowing things:a. It received $5,000 cash from John Brown asits capital.b. It borrowed $10,000 from a bank, giving anote therefor.c. It purchased $4,000 of inventory for cash.d. It sold $2,000 of its inventory for $6,000 to acustomer, who paid $3,500 cash and agreed to pay$2,500 within 30 days.e. It purchased an auto for $7,000. It paid$2,000 down and gave a note to the automobiledealer for the remaining $5,000f. Brown withdrew $1,000 cash for his personaluse.g. Brown was offered $10,000 for his equity inthe business, but he refused the offer.On a separate piece of paper, prepare a roughdraft of a balance sheet for Brown Company as of theclose to business January 31, and an incomestatement for January.Brown CompanyBalance Sheet as of Jan31AssetsCash……………………………………$11,500Accounts Receivable…………………2,500Inventory………………………………….2,000Automobile………………………………7,000Total………………………………………$23,000Liabilities and EquityNotes Payable………………………$15,000Paid-in Capital…………………………5,000Retained Earnings……………………3,000Total……………………………………$23,000Brown CompanyIncome Statement for January Revenue...........................$6,000Expense ...........................$2,000Income ............................$4,0002.Brown Company's income was $4,000, but itsRetained Earnings was only $3,000. Reread the firstframe and choose the item (a-g) that explains thedifference. f3.John Brown claims that the inventory as of January31 is worth $6,000, as shown by the fact thatinventory costing $2,000 was actually sold for $6,000.Would you change the balance sheet ?...(No). This isan illustration of the asset-measurement concept.Nonmonetary assets are reported at their cost ratherthan their worth or fair value.Post test 3 会计记录和系统1. On March 5, Kay Company purchased $6,000 ofinventory, paying cash. Prepare a journal entry forthis transaction below.Journal2001 Transactions Dr. Cr.March 5Inventory6,000Cash6,0002. On March 10, Kay Company made a $15,000 sale toa customer who paid $6,000 cash and agreed to payto the other $9,000 in 30 days. The merchandise soldhad cost $8,000. Prepare a journal entry for the sale,below.Journal2001 Transactions Dr. Cr.March 10Cash6,000Accounts Receivable9,000Revenues15,0003. On March 10, Kay Company made a sale for$15,000 for merchandise that had cost $8,000.Prepare a journal entry to record the cost of the salebelow.Journal2001 Transactions Dr. Cr.March 10 Expenses8,000Inventory8,0004. Recall from the previous frames that revenuesfrom the sale on March 10 were $15,000 and that themerchandise sold had cost $8,000. Prepare theclosing entries.Journal2005 Transactions Dr. Cr.March 31Revenues15,000Retained earnings15,000March 31Retained earnings8,000Expenses8,0005-10. Omit11.A critic said that the company had $25,000 cash atthe beginning of March and $25,000 at the end ofMarch, and since its cash balance was unchanged, itcouldn't be said to have any income in March. Thiscriticism is (incorrect).12.The reason the criticism is incorrect is becauseincome is an increase in retained earnings, notnecessarily in cash. For example, the sales revenue ofKay Company in March was $15,000 and its incomewas $7,000 even though $9,000 was received in cash.Post test 4 营业收入和货币资产1. The conservation concept states that increases inequity are recognized only when they are reasonablycertain, while decreases in equity are recognized assoon as they are reasonably possible.2. The materiality concept states: disregard trivialmatters but disclose all important matters.3. What is the length of the usual accounting period?One year. Financial statements prepared for shorterperiods are called interim statements.4. Cash accounting reports items that increase ordecrease cash. Accrual accounting reports items thatchange equity or retained earnings, even thoughthese changes may not affect cash.5. Increases in equity associated with the entity’soperations during a period are revenues, anddecreases are expenses. The difference betweenthem is labeled income.6. The realization concept states that revenues are recognized when goods or services are delivered.7. H Company manufactures a table in August and places it in its retail store in September. R Smith, a customer, agrees to buy the table in October, it is delivered to him in November, and he pays the bill in December. In what month is the revenue is recognized? (November)8. The receipt of cash is a debit to Cash. What is the offsetting credit and (type of account) for the following types of sales transactions?Account Crediteda. Cash received prior to delivery. Advances from customers (a liability)b. Cash received in same period as delivery. Revenuec. Cash received after the period of delivery. Accounts receivable (an asset)9.Similarly, revenue is a credit entry. What is the offsetting debit when revenue is recognized in each of these periods?Account Debiteda. Revenue recognized prior to receipt of cash. Accounts receivableb. Revenue recognized in same period as receipt of cash. Cashc. Revenue recognized in the period following receipt of cash. Advances from customers10.In February, H Company agrees to sell a table to a customer for $600, and the customer makes a down payment of $100 at that time. The cost of the table is $400. The table is delivered to the customer in March, and the customer pays the remaining $500 in April. Give the journal entries (if any) that would be made in February, March, and April for both the revenue and expense aspects of this transaction. February:Cash100Advances from customers100March:Accounts receivable500Advances from customers100Revenue600March:Expenses400Inventory400April:Cash500Accounts receivable50011.At the end of 2005, M Company had accounts receivable of $200,000, and it estimated that $2,000 of this amount was a bad debt. Its revenue in 2005, with no allowance for the bad debts, was $600,000. A. What account should be debited for the $2,000 bad debt? RevenueB. What account should be credited? Allowance for doubtful accountsC. What amount would be reported as net accounts receivable on the balance sheet? $198,000D. What amount would be reported as revenue on the 2005 income statement? $598,00012.In 2006, the $2,000 of bad debt was written off.A. What account should be debited for this written off? Allowance for doubtful accountsB. What account should be credited? AccountsreceivablePost test 5 费用的核算;损益表1. An expenditure occurs in the period in which goodsor services are acquired. An expense occurs in theperiod in which goods or services are consumed.2. A certain asset was acquired in May. There wastherefore an expenditure in May. At the end of May,the item was either on hand, or it was not. If it wason hand, it was an asset; If it was not on hand, it wasan expense in May.3. Productive assets are unexpired costs. Expensesare expired costs.4. The matching concept states that costs associatedwith the revenues of a period are expenses of thatperiod.5. Expenses of a period consist of:a. costs of the goods and services delivered duringthat period.b. other expenditures that benefit operations ofthe period.c. losses6. If Brown company pays rent prior to the periodthat the rent covers, the amount is initially reportedas credit to cash and a debit to Prepaid Rent, which isan asset account. If Brown Company pays the rentafter the period covered, the amount is initiallyrecorded as a debit to Rent Expense and a credit toAccrued Rent, which is a liability account.7. A brand new machine owned by Fay Company wasdestroyed by fire in 2005. It was uninsured. It hasbeen purchased for $10,000 with the expectationthat it would be useful for 5 years. The expenserecorded in 2005 should be $10,000.8. Gross margin is the difference between salesrevenue and cost of sales.9. gross margin percentage: (gross margin)/(salesrevenue)10. The difference between revenues and expenses inan accounting period (or the amount by which equity[i.e., retained earnings] increased from operatingactivities during the period) is called net income.11. A distribution of earnings to shareholders is calleddividends(股利).12. retained earnings at the end of the period=retained earnings at the beginning of the period + netincome–dividends.Post test 6 存货和销售成本1. A dealer sells a television set for $800 cash. It hadcost $600. Write journal entries for the four accountsaffected by this transaction.Dr. Cash800Cr. Revenue800Dr. Cost of Sales600Cr. Inventory6002. When using the perpetual inventory method (永续盘存), a record is kept for each item, showingreceipts, issues, and the amount on hand.3. Write an equation that shows how the cost of salesis determined by deduction:Cost of sales = beginning inventory+purchases –ending inventory4.Omit5.In periods of inflation, many companies use theLIFO method in calculating their taxable incomebecause LIFO gives a higher cost of sales and hence alower taxable income.6. A company discovers that the fair value of itsinventory is $1000 lower than its cost. What journalentry should it take?Dr. Cost of Sales1,000Cr. Inventory1,0007. In a manufacturing business, what three elementsenter into the cost of a manufactured item?Direct material, direct labor, and overhead.8. Period costs become an expense during the periodin which they were incurred.9. Product costs become an expense during theperiod in which the products were sold.10. One type of overhead rate involves use of thetotal direct labor costs and total production overheadcosts for a period. Write a ratio that shows how theoverhead rate is calculated.(Total production overhead costs)/(Total directlabor costs)11. A given finished item requires $50 of directmaterials and 5 hours of direct labor at $8 per hour.The overhead rate is $4 per direct labor hour. At whatamount would the finished item be shown ininventory? $110 = 50 + 40 + 2012. An inventory turnover of 5 is generally better thanan inventory turnover of 4 because it indicates thatless capital is tied up in inventory, and there is lessrisk that the inventory will become obsolete.Post test 7 非流动资产和折旧1. The amount at which a new plant asset is recordedin the accounts includes its purchase price plus allcosts incurred to make the asset ready for itsintended use (such as transportation andinstallation).2. A plant asset is acquired in 2005. It is expected tobe worn out at the end of 10 years and to becomeobsolete in five years. What is its service life? ---Fiveyears.3. Ordinarily, land is not depreciated because itsservice life is indefinitely long.4.A plant asset is acquired in 2005 at a cost of $20000.Its estimated service life is 10 years, and its estimatedresidual value is $2000 :a. The estimated depreciable cost of the asset is$18,000b. If the straight-line depreciation method is used,the depreciation rate for this asset is 10 percent.c. What amount will be recorded as depreciationexpense in each year of the asset’s life?---$1,800d. What amount will be debited and what accountwill be credited to record this depreciation expense?Dr. Depreciation expenseCr. Accumulated depreciatione. After five years have elapsed, how would thisasset be reported on the balance sheet?1) Plant------$20,0002) Less accumulated depreciation-------$9,0003) Book value-------$11,0005. A machine is purchase on January 2, 2005, for$20,000 and its has an expected life of five years andno estimated residual value.a. If the a machine is still in use six years later, what amount of depreciation expense will be reported in for the sixth year?----zerob. What amount, if any, will be reported on the balance sheet at the end of the sixth year?1) It will not be reported.-----X2) It will be reported as follows:Machine$20,000Accumulated depreciation$20,000Book value$06. A machine is purchase on January 2, 2005, for $50,000. It has an expected service life for 10 years and no residual value. Eleven years later it is sold for $3,000 cash.a. There will be a gain of $3,000b. What account will be debited and what account credited to record this amount?Dr. CashCr. Gain on disposition of assets.7. Given an example of each of the following types of assets, and give the name of the process used in writing off the cost of the second and third type. Asset type\Example\Write-off processPlant Asset\m achine, b uilding\Depreciation Wasting asset\c oal, o il ,m inerals\Depletion Intangible asset\g oodwill, t rademark \Amortization 8. Conoil Company purchased a producing oil property for $10,000,000 on January 2, 2005. It estimated that the property contained one million barrels of oil and that the property had a service life of 20 years. In 2005, 40,000 barrels of oil were recovered from the property. What amount should be charged as an expense in 2005?------$400,0009. Wasting assets and intangible assets are reported on the balance sheet in a different way than building, equipment, and similar plant assets. The difference is that wasting assets are reported at the net amount and plant assets are reported at cost, accumulated depreciation, and net amount.10. In calculating its taxable income, a company tries to report its income as low as it can. In calculating its financial accounting income, a company tries to report its income as fairly as it can.11. As compared with straight-line depreciation, accelerated depreciation writes off more depreciation in the early years of an asset’s life and less in the later years. Over the whole life of asset, accelerated depreciation writes off the same total cost as straight-line depreciation.12. Companies usually use accelerated depreciation in tax accounting because it reduces taxable income and hence income tax in the early years.13. Assume an income tax rate of 40%. If a company calculated its financial accounting income (before income taxes) in 2005 as $6 million and its taxable income as$4 million, what amount would it report as income tax expense on its 2005 income statement?----$2,400,00014. Fill in the missing name on the following table:Income tax expense $100,000Income tax paid -60,000Deferred income tax$ 40,000 The $40,000 would be reported on the balance sheet as a liability.。

会计学英语 知识点

会计学英语知识点是会计专业学生必备的重要技能之一。

掌握的知识点,不仅有助于学生在国际化的会计工作环境中更好地与他人交流和合作,还能够提高职业竞争力。

本文将从的基础词汇、专业术语和文化背景等方面介绍的知识点。

一、基础词汇在学习时,首先需要掌握一些基础词汇。

比如,debit表示借方,credit表示贷方,balance表示余额,financial statements表示财务报表等。

这些基础词汇是理解和运用的基础。

二、会计学专业术语除了基础词汇外,还包括许多专业术语。

例如,income statement表示损益表,balance sheet表示资产负债表,cash flow statement表示现金流量表,auditing表示审计,taxation表示税务等。

掌握这些专业术语可以帮助学生更好地理解和运用会计学知识。

三、的文化背景在学习时,也需要了解相关的文化背景,以便更好地理解和运用。

例如,在国际财务报告准则(IFRS)中,会计估计和会计政策灵活性是很重要的概念。

了解不同国家会计准则的差异以及背后的文化差异,可以帮助学生更好地理解和适应国际化的会计工作环境。

四、实践应用除了纸上谈兵,学生还应该将的知识点应用到实践中。

可以通过参与模拟会计报表编制和分析的活动,了解在实际工作中的应用。

此外,还可以通过阅读的相关文献和参加的培训课程等方式,加深对的理解和掌握。

五、跨文化交流在国际化的会计工作环境中,跨文化交流是必不可少的。

学生不仅需要掌握,还需要了解不同文化背景下的商务礼仪和交流方式。

通过与来自不同文化背景的人员进行合作和交流,可以提高自己的跨文化交际能力,从而更好地适应国际化的会计工作环境。

六、持续学习的学习是一个持续的过程。

随着会计学的不断发展和国际化的趋势,的知识点也在不断更新和扩充。

因此,学生需要保持持续学习的态度,通过不断学习和实践,不断提升自己的水平。

综上所述,是会计专业学生的必备技能之一。

英文会计知识点总结

英文会计知识点总结1. Accrual basis accounting vs. cash basis accountingAccrual basis accounting records revenues and expenses when they are incurred, regardless of when the cash is received or paid. This method provides a more accurate representation of a company's financial performance as it reflects all economic transactions, not just cash transactions. On the other hand, cash basis accounting records revenues and expenses only when cash is exchanged, which may not provide an accurate reflection of the company's financial position.2. Revenue recognitionRevenue recognition refers to the process of recording revenue when it is earned, regardless of when the cash is received. This principle is important as it ensures that revenue is recognized in the period in which it is earned, providing a more accurate picture of a company's financial performance. There are specific criteria that must be met for revenue to be recognized, including evidence of an arrangement, delivery of goods and services, and collectability of payment.3. Matching principleThe matching principle states that expenses should be recorded in the same period as the revenues they helped generate. This principle ensures that expenses are properly matched with the revenues they helped produce, leading to a more accurate representation of a company's profitability.4. Materiality conceptThe materiality concept states that financial information should be disclosed if omitting it could influence the decision-making process of users. This concept allows for a certain degree of judgment in financial reporting, as not all information needs to be disclosed if it is not material to users' decision making.5. Going concern conceptThe going concern concept assumes that a company will continue to operate in the foreseeable future. This concept is important as it allows for the preparation of financial statements under the assumption that the company will continue its operations, which is crucial for making informed investment and business decisions.6. Consistency principleThe consistency principle states that accounting methods and practices should be consistent from one period to the next. This principle ensures comparability of financial information across different periods, facilitating the analysis of a company's financial performance over time.7. Conservatism principleThe conservatism principle requires accountants to be conservative in their approach to recording and reporting financial information. This means that when faced with uncertainty, accountants should be cautious and avoid overstating assets or revenue, while also recognizing all potential liabilities and expenses. This principle ensures that financial statements are not overly optimistic and reflect a more realistic view of a company's financial position.8. Relevance and reliability of financial informationFinancial information should be both relevant and reliable. Relevant information is important for decision making and helps users understand a company's financial position and performance. Reliable information is information that is accurate and can be trusted by users to make informed decisions.9. Objectivity in financial reportingObjectivity in financial reporting is crucial in ensuring that financial information is free from bias and is based on verifiable evidence. This principle ensures that financial statements accurately represent a company's financial performance and position, leading to greater trust and confidence from users.These key accounting concepts and principles provide the foundation for understanding the discipline of accounting and are essential for producing accurate and reliable financial information. By following these principles, businesses can ensure that their financial reporting is not only compliant with accounting standards but also serves the needs of users in making informed decisions.。

(完整版)会计专业英语词汇大全

会计专业英语词汇大全(一)一.专业术语Accelerated Depreciation Method 计算折旧时,早期所提的折旧大于后期各年。

加快折旧法主要包含余额递减折旧法declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总数折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 对付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按次序进行记录,归类,汇总和编表的全过程。

在连续的会计期间循环往复的循环进行Accounting equation 会计等式:财产= 欠债 + 业主权益Accounts receivable turnover 应收帐款周转率:一个期间的赊销净额/ 应收帐款均匀余额Accrual basis accounting 应记制,债权发生制:以应收对付为计算基础,以确立本期利润与花费的一种方式。

凡应属本期的利润于花费,无论其款项能否以收付,均作为本期利润和花费办理。

Accrued dividend 应计股利Accrued expense 应记花费:指本期已经发生而还没有支付的各项花费。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,公司速动财产与流动欠债的比率,又称quick ratioAcquisition cost 购买成本Adjusted trial balance 调整后试算表,指已作调整分录但还没有作结账分录的试算表。

Adjusting entry调整分录:在会计期末所做的分录,将会计期内因某些原由此不曾记录或未适合记录的会计事项予以记录入帐。

专业会计英语知识点

专业会计英语知识点会计是一门应用广泛且非常重要的学科,其它行业也需要掌握一些会计知识。

而对于会计专业的学生来说,掌握专业会计英语知识是非常重要的。

本文将从几个方面介绍一些专业会计英语知识点,帮助读者扩展词汇量并加深对会计专业的理解。

一、会计概述1. 资产(Assets):指企业拥有的可以转化为现金或其他货币等额物品或资源。

2. 负债(Liabilities):指企业当前无法避免的经济付出或责任。

3. 所有者权益(Equity):指企业所有者在资产减去负债后拥有的部分。

4. 利润(Profit):指企业在特定期间内实现的净收入。

5. 财务报表(Financial Statements):指记录和报告企业财务状况和经营成果的文书。

二、会计核算1. 应收账款(Accounts Receivable):指企业因向顾客提供商品或服务而发生的未收回款项。

2. 应付账款(Accounts Payable):指企业因购买商品或服务而产生的未偿付款项。

3. 现金流量表(Cash Flow Statement):指反映企业现金流入和流出的报表。

4. 会计准则(Accounting Standards):指制定和规范会计工作的基本原则和规则。

5. 成本核算(Cost Accounting):指对企业产品或服务成本的计算和分析。

三、财务报告1. 利润表(Income Statement):指反映企业一定期间内收入、成本和利润等信息的报表。

2. 资产负债表(Balance Sheet):指反映企业在某一特定日期上的资产、负债和所有者权益等信息的报表。

3. 现金流量表(Cash Flow Statement):指企业一定期间内现金流入和流出的报表。

4. 股东权益变动表(Statement of Changes in Equity):指记录了企业一定期间内股东权益变动的报表。

5. 会计政策(Accounting Policies):指企业在编制财务报表过程中选择的评估方法和会计处理原则。

会计英语大全

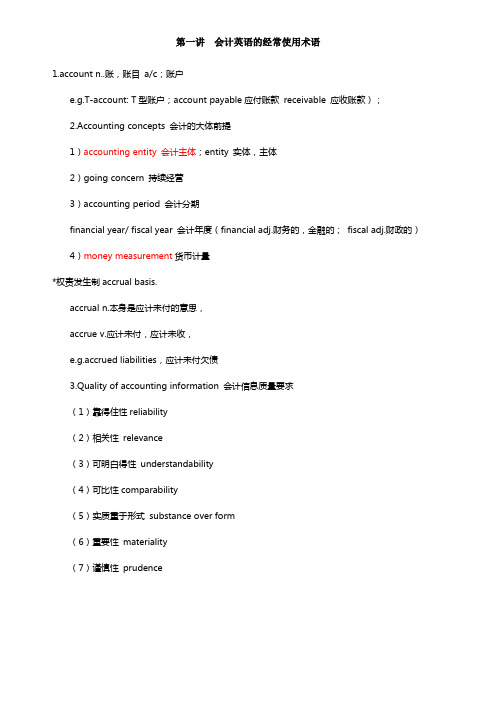

第一讲会计英语的经常使用术语1.account n..账,账目a/c;账户e.g.T-account: T型账户;account payable应付账款receivable 应收账款);2.Accounting concepts 会计的大体前提1)accounting entity 会计主体;entity 实体,主体2)going concern 持续经营3)accounting period 会计分期financial year/ fiscal year 会计年度(financial adj.财务的,金融的;fiscal adj.财政的)4)money measurement货币计量*权责发生制accrual basis.accrual n.本身是应计未付的意思,accrue v.应计未付,应计未收,e.g.accrued liabilities,应计未付欠债3.Quality of accounting information 会计信息质量要求(1)靠得住性reliability(2)相关性relevance(3)可明白得性understandability(4)可比性comparability(5)实质重于形式substance over form(6)重要性materiality(7)谨慎性prudence(8)及时性timeliness4.Elements of accounting会计要素1)Assets: 资产– current assets 流动资产cash and cash equivalents 现金及现金等价物(bank deposit)inventory存货receivable应收账款prepaid expense 预付费用– non-current assets 固定资产property (land and building)不动产, plant 厂房, equipment 设备(PPE)e.g.The total assets owned by Wilson company on December 31, 2006 was US$1,500,000.2)Liabilities: 欠债funds provided by the creditors. creditor债权人,赊销方– current liabilities 当期欠债non-current liabilities 长期欠债total liabilitiesaccount payable应付账款loan贷款advance from customers 预收款bond债券(由政府发行, government bond /treasury bond政府债券,国库券)debenture债券(由发行)3)Owners’ equity: 所有者权益(Net assets)funds provided by the investors. Investor 投资者– paid in capital (contributed capital)实收资本– shares /capital stock (u.s.)股票retained earnings 留存收益同时记住几个单词dividend 分红beginning retained earnings ending retained earnings– reserve 储蓄金(资产重估储蓄金,股票溢价账户)e.g.The company offered/issued 10,000 shares at the price of US$2.30 each.4)Revenue: 收入sales revenue销售收入interest revenue利息收入rent revenue租金收入5)Expense: 费用cost of sales销售本钱, wages expense工资费用6)Profit (income, gain):利润net profit, net income5.Financial statement 财务报表1)balance sheet 资产欠债表2)income statement 利润表3)statement of retained earnings 所有者权益变更表4)cash flow statement 现金流量表6.Accounting cycle1)journal entries 日记账general journal 总日记账general ledger 总分类账trial balance试算平稳表adjusting entries 调整分录adjusted trial balance调整后的试算平稳表Financial statements 财务报表closing entry 完结分录2)Dr.—Debit 借Cr.—Credit 贷Double-entry system 复式记账7.Exercise 练习1)purchases of inventory in cash for RMB¥3,000 现金人民币3,000元购买存货Dr.inventory 3,000 借:存货3,000Cr.cash 3,000 贷:现金3,000 2)sales on account of US$10,000 赊销方式销售,收入10,000美元Dr.account receivable 10,000 借:应收账款10,000Cr.sales revenue 10,000 贷:销售收入10,000 3)paid RMB¥50,000 in salaries & wages 支付工资人民币50,000元Dr.wages & salaries expense 50,000 借:职工薪酬50,000Cr.bank deposit 50,000 贷:银行存款50,000 4)cash sale of US$1,180 销售收入现金1,180美元Dr.cash 1,180 借:现金1,180Cr.sales revenue 1,180 贷:销售收入1,180 5)pre-paid insurance for US$12,000 预付保险费12,000美元Dr.prepaid insurance 12,000 借:预付保险12,000Cr.bank deposit 12,000 贷:银行存款12,000第二讲存货1.Inventory n. 存货,库存(c.f.stock英式英语用法)常见词组inventory turnover 存货周转率inventory control 存货操纵beginning inventory初始存货ending inventory 期末存货take a physical inventory 盘库常见的存货形式:Type of business Type of inventory MerchandisingcompanyMerchandise inventory 商品存货Manufacturing company Raw materials 原材料Work in process(WIP)(处在生产过程中的)在制品,半成品Finished goods成品2.Inventory valuation存货的价值计量cost n. 本钱,费用direct costs 直接本钱indirect costs 间接本钱fixed costs 固定本钱cost accounting 本钱会计v.花费e.g. The office furniture of our company costs us $5,000.unit cost 单个本钱total cost 总本钱cost of sales (COS)= cost of goods sold(CGS)销货本钱sales revenue 销售收入这两个词常常被放在一路做计算Lecture examples:①A company sold 15 computers for US$1000 each.某公司以1000美元一台的价钱售出电脑共15台。

会计有关英文知识点

会计有关英文知识点会计是一门重要的商科学科,负责记录、处理和报告财务信息。

在全球化的背景下,掌握与会计相关的英文知识点对于从事会计工作的人员来说至关重要。

本文将介绍一些与会计有关的英文知识点,帮助读者扩展自己的会计英语词汇量,提高在国际商务领域的竞争力。

1. Financial Statements(财务报表)财务报表是记录一个企业财务状况和业绩的重要文件。

主要的财务报表包括资产负债表(Balance Sheet)、利润表(Income Statement)、现金流量表(Cash Flow Statement)和所有者权益变动表(Statement of Changes in Equity)。

掌握这些财务报表的英文术语,例如Assets(资产)、Liabilities(负债)、Revenue(收入)和Expenses(费用),对于理解和分析财务报表至关重要。

2. Accounting Principles(会计准则)会计准则是会计行业遵循的规范和原则,它确保了财务信息的准确性和可比性。

全球范围内最常用的会计准则是国际财务报告准则(International Financial Reporting Standards,简称IFRS)。

例如,IFRS中对于Revenue Recognition(收入确认)和Inventory Valuation(存货估值)都有明确的规定。

了解这些会计准则的英文表达,有助于与国际企业或者国际会计师进行有效的沟通。

3. Audit(审计)审计是对财务报表进行独立、客观的评估和核实,以确定其真实性和合规性。

在全球商业环境中,英文中经常使用的审计术语包括External Audit(外部审计)和Internal Audit(内部审计)。

掌握这些术语以及与审计相关的表达,例如Auditor(审计师)和Audit Report(审计报告),是面对国际审计事务的必备技能。

4. Taxation(税务)税务是会计领域中一个重要的方面,涉及到企业和个人的纳税义务。

会计英语知识点总结

会计英语知识点总结会计英语是指在会计领域中使用的专业术语和表达方式。

对于从事会计工作的人员来说,掌握会计英语是十分重要的,因为它涉及到了财务报表的编制、财务分析以及财务管理等方面。

在这篇文章中,我将总结一些常见的会计英语知识点,以帮助读者更好地掌握这一领域的语言表达。

一、会计核算方法(Accounting Methods)1. 现金会计法(Cash Accounting Method)现金会计法是指只在货币实际发生时才予以认可和记录的会计核算方法。

它适用于小型企业和个人,记录的是实收实付的现金流量。

2. 计提法(Accrual Accounting Method)计提法是指按照货币应收和应付的实际发生情况进行会计记账,无论是否收付现金。

这种方法更加符合企业的真实经济状况,广泛应用于大型企业和上市公司。

二、财务报表(Financial Statements)1. 资产负债表(Balance Sheet)资产负债表是企业在特定日期上的财务状况的快照。

它将企业的资产、负债和所有者权益进行了统计,并展示了企业的资金来源和运用情况。

2. 利润表(Income Statement)利润表反映了企业在一定期间内的经营业绩。

它列出了企业的收入、成本以及税前和税后利润等财务指标。

3. 现金流量表(Cash Flow Statement)现金流量表显示了企业在一定期间内现金流动的情况。

它列出了企业的经营、投资和筹资活动所产生的现金流量净额。

三、财务指标(Financial Ratios)1. 流动比率(Current Ratio)流动比率是企业流动性的重要指标之一,它反映了企业流动资产与流动负债的关系。

公式为:流动比率= 流动资产/ 流动负债。

该指标越高,说明企业越有能力偿还短期债务。

2. 负债比率(Debt Ratio)负债比率是企业资本结构的重要指标,它反映了企业负债占总资产的比例。

公式为:负债比率= 总负债/ 总资产。

会计专业英语知识点汇总

会计专业英语知识点汇总会计专业是现代商业领域中非常重要的一门专业。

在学习会计专业时,除了掌握会计理论和实践技巧外,掌握一定的英语知识也是非常重要的。

本文将为大家汇总一些会计专业的英语知识点,希望能够帮助到学习会计专业的同学们。

1.会计基础知识 (Accounting Basics)–Assets:资产–Liabilities:负债–Equity:所有者权益–Revenue:收入–Expenses:费用–Balance Sheet:资产负债表–Income Statement:损益表–Cash Flow Statement:现金流量表2.会计准则和规范 (Accounting Standards and Regulations)–Generally Accepted Accounting Principles (GAAP):通用会计准则–International Financial Reporting Standards (IFRS):国际财务报告准则–Financial Accounting Standards Board (FASB):美国财务会计准则委员会–International Accounting Standards Board (IASB):国际会计准则委员会3.资产负债表相关术语 (Balance Sheet Terminology)–Current Assets:流动资产–Non-current Assets:非流动资产–Current Liabilities:流动负债–Non-current Liabilities:非流动负债–Shareholders’ Equity:股东权益–Goodwill:商誉–Depreciation:折旧–Amortization:摊销4.损益表相关术语 (Income Statement Terminology)–Gross Profit:毛利润–Operating Income:营业收入–Operating Expenses:营业费用–Net Income:净收入–Earnings per Share (EPS):每股收益5.现金流量表相关术语 (Cash Flow Statement Terminology)–Cash Inflows:现金流入–Cash Outflows:现金流出–Operating Activities:经营活动–Investing Activities:投资活动–Financing Activities:筹资活动–Net Cash Flow:净现金流量6.会计报表分析 (Financial Statement Analysis)–Ratio Analysis:比率分析–Liquidity Ratios:流动性比率–Solvency Ratios:偿债能力比率–Profitability Ratios:盈利能力比率–Efficiency Ratios:效率比率7.审计和内部控制 (Auditing and Internal Control)–Audit:审计–Internal Control:内部控制–Segregation of Duties:职责分离–Internal Audit:内部审计–External Audit:外部审计8.税务会计 (Tax Accounting)–Taxable Income:应税收入–Tax Deductions:税收减免–Tax Credits:税收抵免–Tax Liability:税务负债–Tax Planning:税务规划这些是会计专业中一些重要的英语知识点,希望能够帮助到学习会计专业的同学们。

会计专业基础英语

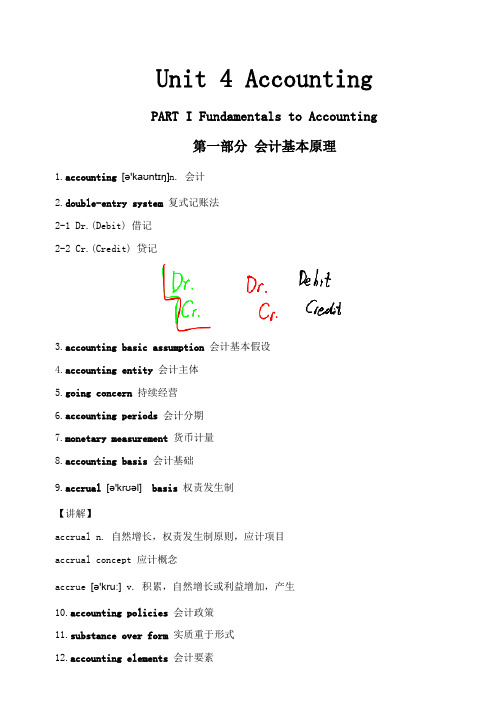

Unit 4 AccountingPART I Fundamentals to Accounting第一部分会计基本原理1.accounting[ə'kaʊntɪŋ]n. 会计2.double-entry system复式记账法2-1 Dr.(Debit) 借记2-2 Cr.(Credit) 贷记3.accounting basic assumption会计基本假设4.accounting entity会计主体5.going concern持续经营6.accounting periods会计分期7.monetary measurement货币计量8.accounting basis会计基础9.accrual[ə'krʊəl]basis权责发生制【讲解】accrual n. 自然增长,权责发生制原则,应计项目accrual concept 应计概念accrue [ə'kruː] v. 积累,自然增长或利益增加,产生10.accounting policies会计政策11.substance over form实质重于形式12.accounting elements会计要素13.recognition[rekəg'nɪʃ(ə)n] n. 确认13-1 initial recognition[rekəg'nɪʃ(ə)n]初始确认【讲解】recognize ['rɛkəg'naɪz] v. 确认14.measurement['meʒəm(ə)nt] n. 计量14-1 subsequent ['sʌbsɪkw(ə)nt] measurement 后续计量15.asset['æset] n. 资产16.liability[laɪə'bɪlɪtɪ] n. 负债17.owners’ equity所有者权益18.shareholder’s equity股东权益19.expense[ɪk'spens; ek-] n. 费用20.profit['prɒfɪt] n. 利润21.residual[rɪ'zɪdjʊəl]equity剩余权益22.residual claim剩余索取权23.capital['kæpɪt(ə)l] n. 资本24.gains[ɡeinz] n. 利得25.loss[lɒs] n. 损失26.Retained earnings留存收益27.Share premium股本溢价28.historical cost历史成本【讲解】historical [hɪ'stɒrɪk(ə)l] adj. 历史的,历史上的historic [hɪ'stɒrɪk] adj. 有历史意义的,历史上著名的28-1 replacement [rɪ'pleɪsm(ə)nt] cost 重置成本29.Balance Sheet/Statement of Financial Position资产负债表29-1 Income Statement 利润表29-2 Cash Flow Statement 现金流量表29-3 Statement of changes in owners’equity (or shareholders’equity) 所有者权益(股东权益)变动表29-4 notes [nəʊts] n. 附注PART II Financial Assets*第二部分金融资产*30.financial assets金融资产e.g. A financial instrument is any contract that gives rise to a financial asset of one enterprise and a financial liability or equity instrument of another enterprise. 【讲解】give rise to 引起,导致31.cash on hand 库存现金32.bank deposits[dɪ'pɒzɪt]银行存款33.A/R, account receivable应收账款34.notes receivable应收票据35.others receivable其他应收款项36.equity investment股权投资37.bond investment债券投资38.derivative financial instrument衍生金融工具39.active market活跃市场40.quotation[kwə(ʊ)'teɪʃ(ə)n]n. 报价41.financial assets at fair value through profit or loss以公允价值计量且其变动计入当期损益的金融资产41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产41-2 financial assets held for trading 交易性金融资产42.financial liability金融负债43.transaction costs交易费用43-1 incremental external cost 新增的外部费用【讲解】incremental [ɪnkrə'məntl] adj. 增量的,增值的44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利投资收益45.profit and loss arising from fair value changes公允价值变动损益46.Held-to-maturity investments持有至到期投资47.amortized cost摊余成本【讲解】amortized [ə'mɔ:taizd]adj. 分期偿还的,已摊销的48.effective interest rate实际利率49.loan[ləʊn] n. 贷款50.receivables[ri'si:vəblz] n. 应收账款51.available-for-sale financial assets可供出售金融资产52.impairment of financial assets金融资产减值52-1 impairment loss of financial assets 金融资产减值损失53.transfer of financial assets金融资产转移53-1 transfer of the financial asset in its entirety 金融资产整体转移53-2 transfer of a part of the financial asset 金融资产部分转移54.derecognition[diː'rekəg'nɪʃən] n. 终止确认,撤销承认54-1 derecognize [diː'rekəgnaɪz] v. 撤销承认e.g. An enterprise shall derecognize a financial liability (or part of it) only when the underlying present obligation (or part of it) is discharged/cancelled.【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

会计专业英语知识点

作为一门重要的商科专业,会计在各行各业中都扮演着重要的角色。

对于学习会计的学生来说,掌握好会计专业的英语知识点是非常必要的。

本文将介绍一些与会计专业相关的英语知识点,以帮助学生在学习和实践中更好地应用。

一、会计基础术语

1. Assets(资产):在会计中,资产指的是公司拥有的具有现金价值的资源,包括现金、存货、房地产等。

2. Liabilities(负债):负债是指公司对外的债务或应付款项,在会计中包括借款、应付账款等。

3. Equity(所有者权益):也被称为净资产或股东权益,表示公司的所有者对于其资产净值的权益。

4. Revenue(收入):收入是指公司通过销售产品或提供服务而获得的资金流入。

5. Expenses(费用):费用是指公司为经营活动而发生的支出,包括租金、工资、税金等。

6. Balance Sheet(资产负债表):资产负债表是一份会计报表,以资产、负债和所有者权益的形式显示公司的财务状况。

二、会计报表

1. Income Statement(利润表):利润表显示了公司在一定期间内的收入、费用和净利润。

2. Cash Flow Statement(现金流量表):现金流量表反映了公司在一定期间内现金收入、现金支出以及现金净增加额。

3. Statement of Retained Earnings(留存收益表):留存收益表展示了公司在一定期间内的净利润和分红情况。

4. Statement of Changes in Equity(权益变动表):权益变动表展示了公司在一段时间内所有者权益的变化情况,包括净利润、股东投资等。

三、审计和税务

1. Audit(审计):审计是对公司财务报表和财务记录的全面审核和检查。

2. Taxation(税务):税务是指涉及支付税款和申报纳税义务的活动,包括个人所得税、企业所得税等。

3. Tax Return(纳税申报表):纳税申报表是个人或企业向税务机关报告收入和纳税情况的文件。

四、会计准则和规范

1. Generally Accepted Accounting Principles(GAAP,普通会计准则):GAAP是一套普遍适用于美国会计行业的准则,包括会计原则、规范和指导。

2. International Financial Reporting Standards(IFRS,国

际财务报告准则):IFRS是国际上通用的财务报告准则,用于指导公

司如何编制和呈现财务报表。

3. Financial Accounting Standards Board(FASB,财务会计

准则委员会):FASB是美国会计行业的专业机构,负责制定和解释会

计准则。

四、会计职业发展与资格认证

1. Certified Public Accountant(CPA,注册会计师):CPA是一种专业会计师资格认证,通常需要通过一系列考试和工作经验积累。

2. Certified Management Accountant(CMA,认证管理会计师):CMA是一种专业管理会计师资格认证,注重企业战略管理和成本控制。

3. Chartered Financial Analyst(CFA,特许金融分析师):CFA是一种专业金融分析师资格认证,强调证券投资和资产管理的技能。

总结:

既有基础术语,也涉及到会计报表、审计、税务、会计准则和资

格认证等方面。

对于学习会计的学生来说,掌握好这些英语知识点是

非常重要的。

希望通过本文的介绍,能够帮助学生更好地理解和应用

会计专业英语知识,为未来的学习和工作打下坚实的基础。