国际金融第六章课件

《国际金融学》PPT课件全

输入 各国标政题策性

银行

如中国国家开发银行、中国进出口银行等,它们在国 内提供政策性金融服务的同时,也积极拓展海外业务, 支持中国企业“走出去”。

各国中央银 行

各国商业银 行

如挪威政府全球养老基金、新加坡政府投资公司等, 它们管理着庞大的外汇储备和财政盈余资金,在全球

范围内进行资产配置和投资。

各国主权财 富基金

成立于1964年,总部设在科特迪瓦经 济首都阿比让。成立目的是为非洲鼓劲 发展的动力,帮助非洲各国进行经济重 建和发展,协助成员国发展经济和减少 贫困,为成员国的经济和社会发展活动 提供资金支持。

各国的国际金融机构

如美联储、欧洲央行等,它们不仅在国内执行货币政 策和金融监管职能,同时也参与国际金融合作与协调。

国际资本流动定义

指资本在国际间转移,包括直接投资、间接投资、国际信贷等方 式。

国际资本流动类型

长期资本流动与短期资本流动。

国际资本流动规模与趋势

近年来,随着全球化进程加速,国际资本流动规模不断扩大,流动 速度也在加快。

国际资本流动的原因与影响

利润驱动

企业为追求更高利润,在全球范围内配置资源。

汇率与利率变动

成立于1966年11月,是面向亚洲和太 平洋地区的区域性政府间金融开发机构。 它不是联合国下属机构,但它是联合国 亚洲及太平洋经济社会委员会(联合国 亚太经社会)赞助建立的机构,同联合 国及其区域和专门机构有密切的联系。

是欧洲经济共同体成员国合资经营的金 融机构,根据1957年《建立欧洲投资 银行协定》的规定,于1958年1月1日 成立。该银行宗旨是利用国际资本市场 和共同体内部资金,促进共同体的平衡 和稳定发展。

《国际金融学》PPT课件 全

第六章 国际金融市场

第三节 欧洲货币市场

1.欧洲美元:Eurodollar 2.欧洲货币:Eurocurrency 3.欧洲银行:Eurobanks 4.欧洲货币市场(Eurocurrency Market)

一、概念

• 1、欧洲货币:并非指欧洲国家的货币,而是指投放在某

– 国际贸易引起的债权债务清偿要求不同国家的货币相互兑换 – 货币兑换的价格、时间、数量以及交割等都要在外汇市场上实现

外汇市场24小时营业

现代外汇市场特点

• 由区域性发展到全球性,实现24小时连续交易

二、外汇市场的构成

• 1、外汇银行:外汇市场的核心。包括专营或兼营外汇业 务的本国商业银行;在本国的外国银行分行或代办处; 其他金融机构。 • 2、外汇经纪人:介绍成交或代客买卖外汇,分为一般经 纪和掮客。

他金融中心能够紧密衔接,也是一个重要的条件。

二、国际金融市场的分类

按交易对象分 国际货币市场 国际资本市场 国际外汇市场 国际黄金市场 金融衍生工具市场 内外混合型 内外分离型 避税港型

国际 金融市场

新型市场 按市场性质分 传统市场 国际信贷市场 按融资渠道分 证券市场

银行短期信贷市场

货币市场

贴现市场 短期票据市场 国际 金融市场 资本市场 证券市场 国库券 商业票据 银行承兑汇票 定期存款单

世界重要的外汇市场

伦敦外汇市场——世界上历史最悠久、交易规 模最大的外汇市场 纽约外汇市场——影响最大的外汇市场,交易 量仅次于伦敦 东京外汇市场——亚洲地区重要的外汇市场 新加坡外汇市场——全球第四大外汇市场 苏黎世外汇市场 严密的瑞士银行存款保密制度

国际金融市场学第六章-26页PPT精品文档

9

2019/9/20

第一节 国际债券市场

(二)欧洲债券市场的特点 1.市场容量大 2.自由和灵活 3.发行费用和利息成本比较低 4.免缴税款和不记名 5.安全 6.债券种类和货币选择性强 7.流动性强,容易转手兑现 8.金融创新持续不断

10

2019/9/20

第一节 国际债券市场

场发行外国债券就是从发行武士债券开始的。1982年1月,

中国国际信托投资公司在日本东京发行了100亿日元的武士

5 债券。

2019/9/20

第一节 国际债券市场

3.我国的外国债券市场

熊猫债券:国际多边金融机构首次获准在我国发行的以 人民币为计值货币债券。

根据国际惯例,国外金融机构在一国发行债券时,一般以该 国最具特征的吉祥物命名。据此,前财政部部长金人庆将国际多 边金融机构首次在华发行的人民币债券命名为“熊猫债券”。

16

2019/9/20

第一节 国际债券市场

5.选择债券 选择债券是指债券的持有人有权按自己的意

愿,在指定的时期内,以事先约定的汇率将债券的 面值货币转换成其他货币,但是仍按照原货币的利 率收取利息。 6.零息债券

零息债券是一种 没有票面利率,不分期偿付利 息,而是到期一次还本,出售时以折价方式进行。

资者非常注视其信用评级

4

2019/9/20

第一节 国际债券市场

2.日本的外国债券市场

武士债券:在日本债券市场上发行的外国债券,即日

本以外的政府、金融机构、工商 企业和国际组织在日

本国内市场发行的、以日元为计值货币的债券。

武士债券均为无担保发行,典型期限为3一10年,一

般在东京证券交易所交易。我国金融机构进入国际债券市

第四单元 第六章 外汇交易——套利交易 《国际金融实务》PPT课件

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

如果在英国进行投资,则可获利: 100万×8%=8万(英镑) 如果在美国投资,投资者需先按即期汇率把英镑兑换成

美元,其获利为: 100万×2×12%=24万(美元) 1年后汇率没有发生变化,该英国投资者将多获利:

24万÷2一8万=4万(英镑)

引入 任务 示范 学练 小结 考核 总结 拓展

国际金融实务 ——外汇交易

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

KVB昆仑国际拥有100万美元的资产,如果美国存款 的年利率为2%,同一时期英国存款的年利率为5%。 交易员王亮应该如何操作?

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

任务1 假设某日伦敦市场,英镑对美元的汇率为GBP1 =USD2, 一个英国投资者用100万英镑,按上述两国的利率进行套 利,假定1年后汇率并未发生变化,该英国投资者将获得 多少毛利?(分别计算在英国和美国的投资获利情况,然 后再进行比较)。

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

(一)套利交易的概念 套利交易(interest arbitrage transaction)又称利息套利,

是指两个不同国家的金融市场短期利率高低不同时, 投资者将资金从利率低的国家调往利率高的国家,以 赚取利差收益的外汇交易。根据是否对套利交易所涉 及的汇率风险进行抛补,可把套利分为不抛补套利和 抛补套利。

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

1.套利交易的概念、种类 2. 套利交易的应用

引入 任务 示范 学练 小结 考核 总结 拓展

套利交易

外汇期货套利经验法则 跨市场 两个市场都进入牛市,A市场的涨幅高于B市场,则在A市场买入,在B市场卖出。 两个市场都进入牛市,A市场的涨幅低于B市场,则在A市场卖出,在B市场买入。 两个市场都进入熊市,A市场的跌幅高于B市场,则在A市场卖出,在B市场买入。 两个市场都进入熊市,A市场的跌幅低于B市场,则在A市场买入,在B市场卖出。 跨币种 (1)预期A货币对美元贬值,B货币对美元升值,则卖出A货币期货合约,买入B货币期货合约; (2)预期A货币对美元升值,B货币对美元贬值,则买入A货币期货合约,卖出B货币期货合约; (3)预期A、B两种货币都对美元贬值,但A货币的贬值速度比B货币快,则卖出A货币期货合约, 买入B货币期货合约; (4)预期A、B两种货币都对美元升值,但A货币的升值速度比B货币快,则买入A货币期货合约, 卖出B货币期货合约; (5)预期A货币对美元汇率不变,B货币对美元升值,则卖出A货币期货合约,买入B货币期货 合约。若B货币对美元贬值,则相反; (6)预期B货币对美元汇率不变,A货币对美元贬值,则买入A货币期货合约,卖出B货币期货 合约。若A货币对美元贬值,则相反。

第六章 国际金融市场

1、国际短期信贷市场

种类:

按当事人不同,可划分为: ① 银行对银行的信贷,又称银行同业拆放, 在整个短期信贷中占主导地位。 ② 银行对非银行(如企业、政府机构等) 的信贷。

1、国际短期信贷市场

特点:

① 期限短。 ② 手续简便(无需交纳抵押品,一般也不 用贷款协议)。 ③ 金额较大(通常为100万美元以上)。 ④ 灵活方便。 ⑤ 利率随行就市,利息贴现支付。 (LIBOR)伦敦同业拆放利率

欧洲美元是存 放于美国境外的外国 银行及美国银行的海 外分行的美元存款; 或是存储在美国以外 银行以美元为面值并 以美元支付的存款。

欧洲美元市场的形成

1、美国政府于1947年实施马歇尔计划的结果,使巨 额美元资金流向欧洲。 2、英镑危机(1957年)

为对付危机,英格兰银行严格禁止英国银行以英镑进行贸易 融资,并禁止银行以英镑放款以避免外国人抛售英镑,于是 完全依赖英镑融资的海外商人和银行只能另谋生路,以美元 融资国际贸易。 1963年,限制美国居民购买外国债券。 1963年,《Q字条例》规定银行支付利息的最高限额。

国际金融市场

Foreign Investors or Depositors

国外投资者或存款人 Offshore Finance Market 离岸金融市场

Foreign Borrowers 国外借款人

西方金融中心——纽约华尔街 华尔街(wall street)是 纽约市曼哈顿区南部一条大街 的名字,长不超过一英里,宽 仅11米。它是美国一些主要 金融机构的所在地。 华尔街设有纽约证券交易 所、美国证券交易所、投资银 行、政府和市办的证券交易商 、信托公司、联邦储备银行、 各公用事业和保险公司的总部 以及棉花、咖啡、糖、可可等 商品交易所。华尔街是金融和 投资高度集中的象征。 上图为华尔街铜牛塑像 下图为美国证券交易所正门

国际金融 第六章 国际收支

[例7] 本国政府从它在美国某银行的账户中提取38 万美元,在国际黄金市场上购买黄金10000盎司, 在本国的国际收支平衡表中记作: 贷(+) 38万美元 借(-) 38万美元

在国外银行的存款 黄金储备

(二)国际收支平衡表的主要内容

经常账户;

(Current Account)

资本和金融资产;

平 衡 项 目

(Capital Account and Financial Account) 储备资产; (Reserve Assets) 净误差与遗漏; (Errors and Omissions Account)

1、经常帐户(Current

Account)

指对实际资源在国际间的流动行为进行的记 录。 对外经常发生,在国际收支总额中占重要份 额。 (1)货物Goods 通过一国海关的进出口货物。 以海关进出口统计资料为基础; 出口、进口都以商品所有权变化为原则进行 调整,大多采用离岸价格计价。

(1)外汇缓冲政策 所谓外汇缓冲政策,是指一国政府对付国 际收支不平衡,把黄金外汇储备作为缓冲体 (Buffer),通过央行在外汇市场上买卖外 汇,来消除国际收支不平衡所形成的外汇供 求缺口,从而使收支不平衡所产生的影响仅 限于外汇储备的增减,而不导致汇率的急剧 变动和进一步影响本国的经济。

(二)财政货币政策 1. 财政政策(Financial Policy) 在国际收支逆差时使用紧缩的财 政政策,顺差时实施扩张的财政政 策。通过影响总需求从而间接的调 节国际收支。 2. 货币政策(Monetary Policy) 亦称金融政策。主要有贴现政策和 改变存款准备金比率的政策。

第二节

国际收支平衡表的分析

一、国际收支顺差、逆差和均衡

第六章 金融机构体系《金融学》PPT课件

■ 世界银行集团

(1)简介 世界银行又称国际复兴开发银行(IBRD),是1945

年与国际货币基金组织同时成立的联合国专属金融机 构,于1946年6月正式营业,总部设在华盛顿。 (2)组成机构

a.世界银行多边投资担保机构 b.国际金融公司 c.国际开发协会 d.国际投资争端解决中心 e.多边投资担保机构

(1)新型金融机构体系初步形成阶段(1948—1953年)

(2)“大一统”金融机构体系确立阶段(1953—1978 年) (3)改革和突破“大一统”金融机构体系的初期 (1979年—1983年9月) (4)多样化的金融机构体系初具规模的阶段(1983年

9月—1993年) (5)建设和完善社会主义市场金融机构体系的时期

6.2.4中国香港的金融机构体系

(1)金融监管机构 (2)发钞机构 (3)银行机构 (4)保险机构 (5)证券机构

6.2.5中国澳门的金融机构体系

(1)金融监管机构 (2)发钞机构 (3)银行机构 (4)保险机构 (5)其他金融机构

6.2.6中国台湾地区的金融机构体系

(1)货币金融管理机构 (2)货币机构 (3)其他金融机构 (4)金融市场机构

务,借此加强各国经济与金融的往来

■ 局限性

(1)些机构的领导权被主要的发达国家控制,发展 中国家的呼声和建议往往得不到重视

(2)向受援国提供贷款往往附加限制性的条件,而 这些要求大多是对一国经济体系甚至政治体系 的不恰当干预,不对症的干预方案常常会削弱 或抵消优惠贷款所能带来的积极作用。

§6.2 中国的金融机构体系

6.2.1旧中国金融机构体系的变迁

国民党统治时期,国民党政府和四大家族运用手 中的权力建立了以“四行二局一库”为核心的官僚资 本金融机构体系,“四行”指中央银行、中国银行、 交通银行、中国农民银行,“二局”指中央信托局和 邮政储金汇业局,“一库”指中央合作金库。

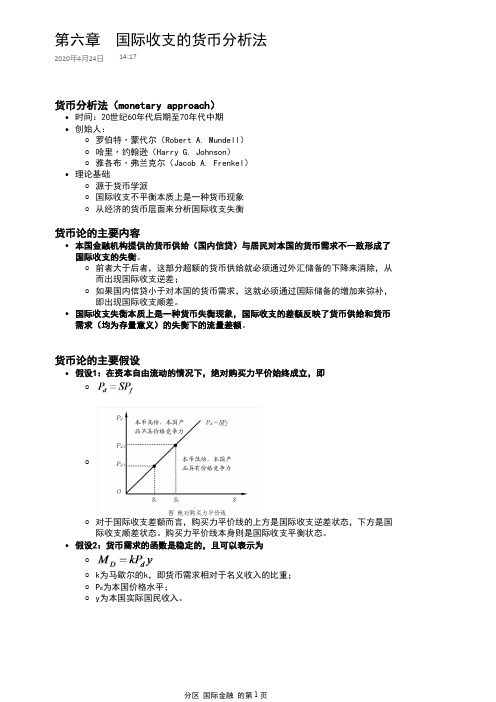

国际金融 第六章 国际收支的货币分析法

时间:20世纪60年代后期至70年代中期•罗伯特·蒙代尔(Robert A. Mundell)○哈里·约翰逊(Harry G. Johnson)○雅各布·弗兰克尔(Jacob A. Frenkel)○创始人:•源于货币学派○国际收支不平衡本质上是一种货币现象○从经济的货币层面来分析国际收支失衡○理论基础•货币分析法(monetary approach)前者大于后者,这部分超额的货币供给就必须通过外汇储备的下降来消除,从而出现国际收支逆差;○如果国内信贷小于对本国的货币需求,这就必须通过国际储备的增加来弥补,即出现国际收支顺差。

○本国金融机构提供的货币供给(国内信贷)与居民对本国的货币需求不一致形成了国际收支的失衡。

•国际收支失衡本质上是一种货币失衡现象,国际收支的差额反映了货币供给和货币需求(均为存量意义)的失衡下的流量差额。

•货币论的主要内容○○对于国际收支差额而言,购买力平价线的上方是国际收支逆差状态,下方是国际收支顺差状态。

购买力平价线本身则是国际收支平衡状态。

○假设1:在资本自由流动的情况下,绝对购买力平价始终成立,即•○k为马歇尔的k,即货币需求相对于名义收入的比重;○P d 为本国价格水平;○y为本国实际国民收入。

○假设2:货币需求的函数是稳定的,且可以表示为•货币论的主要假设第六章 国际收支的货币分析法2020年4月24日14:17□给定货币存量,在货币均衡条件下可得双曲线当货币供给数量增加,该曲线向右移动。

当曲线上的点从M移动到N时,名义国民收入Y不变,但同时意味着价格水平下降以及实际国民收入上升。

○○当出现技术进步使得劳动生产率提高时,总供给曲线会向右移动。

○假设3:总供给曲线垂直。

这意味着经济处于充分就业状态,国内物价上涨不会带来产出的增加•D为中央银行的国内信贷;○R为中央银行持有的国际储备;○假设4:本国名义货币供给为M S =D+R•通常认为,基础货币是流通中现金与存款准备金之和,即中央银行资产负债表的负债。

《国际金融》(第六七八章)PPT课件

15

(三)国际金融市场全球一体化

一体化表现为: 1.欧洲货币市场同各国国内市场之间密 切联系,从而将各国市场有机地联系在一起。 2.信息革命使各地的金融市场和金融机 构紧密联系在一起,形成一个全时区、全方 位的一体化国际金融市场。

16Leabharlann 一体化趋势对国际金融市场的影响: 1.金融资产经营国际化。 2.金融机构跨国化。 3.价格信号趋同化。

24

5)回购协议 它是在买卖证券时出售者向购买者承诺在 一定期限后,按预定的价格如数购回证券的 协议。 回购协议包含同笔证券方向相反的两次买 卖,实际上就是以证券作担保的短期借贷, 它区别于其它货币市场工具的重要特征,是 可以利用它缩短证券的实际期限,满足借贷 双方的需求。

6

2.新型的国际金融市场 又称离岸金融市场或境外金融市场,是指 市场行为以非居民交易为主体,基本不受市 场所在国法律管辖的国际金融市场。 典型的离岸金融市场就是二战后形成的欧 洲货币市场。

7

新型的国际金融市场的特点

1)经营对象是境外货币。 2)打破了资金供应者的传统界限。 3)借贷活动不受任何国家政策与法令的管辖。 4)建立了独特的利率体系 存款利率略高于国内金融市场,而放款利率略 低于国内金融市场。 5)完全由非居民交易形成的借贷关系 6)广泛的银行网络与庞大的资金规模 7)市场的形成不以强大的经济实力为基础。

间接融资是通过金融机构的媒介,由最后借款 人向最后贷款人进行的融资活动,如企业向银行、 信托公司进行融资等等。

10

国际金融市场融资证券化 ,是指国际银行 贷款迅速下降,证券融资比例迅速上升的进 程。包括:

融资手段的证券化是指传统的通过银行中 介的融资方式,向通过金融市场发行证券转 变,主要表现为票据、债券和股票等有价证 券发行的扩大和证券市场重要性增加。

国际金融三版-06国际金融第六章PPT资料49页

开放经济条件下 宏观经济政策效应

1

摘要

我们已经用货币理论解释了汇率决定的主要因 素。

在开放经济条件下,各国宏观经济政策的变化 会影响到其他国家的经济运行。在短时期内, 货币供求数量变化导致的汇率变动将直接影响 一国的产出。

蒙代尔-弗莱明模型可以解释开放经济条件下一 国货币政策和财政政策对其他国家的效应。

15

BP曲线

初始均衡出现在A点。 如果利率上升,国内金融资产对外国人的吸引力增加,

资本流入,使资本项目赤字下降。 在原来的收入水平上,经常项目盈余超过了资本项目赤

字,收入必须增加,以便在B点建立均衡。 BP曲线上的A点和B点表示,随着利率i上升,产出Y也

YC(YT)I(i)GC(A E*P/P,YT)...6. ..1)( M/PL(i,Y)................................................6.( ..2) ii*.................................................................6 ...3.)(

10

IS曲线向下倾斜的原因 1、收入因素:设S和LM均为国内收入的函数。国内收 入增加越多,储蓄与进口总量就越大。 2、利率:假设利率下降,投资就会增加。I + X曲线 就会移到I’ + X。在较高的投资支出水平上,均衡收入 增加到Y 。 3、价格水平:在国内价格水平不变的情况下,IS曲线 是向下倾斜的。假设其他条件不变,国内价格水平下降 就使国内商品比国外便宜,出口增加,进口下降。所以, I + X 曲线的上移和 S + IM 曲线的下移都会增加收 入。

11

IS曲线的推导

国际金融学(6)

弹性价格货币分析的基本模型

2、货币市场平衡条件(除利率外,其他变量为对数形式)

(1)本国货币市场: Ms–p= αy–βi , α>0, β>0 p = Ms–αy +βi (2)外国货币市场: p = Ms*– αy* +βi* (3)购买力平价成立: e = p – p* ∴弹性价格货币分析的基本模型: e =α(y* - y) +β( i–i*) +(Ms–Ms*)

第一节

汇率的弹性价格货币分析法

弹性价格货币分析法的基本模型

引进预期后的货币模型

对货币模型的检验与评价

一、弹性价格货币分析法的基本模型

1。补充假定条件: 本国债券与外国债券完全可替代,视为一个债券市场。∴若 货币市场均衡,则债券市场均衡。 垂直的总供给曲线、稳定的货币需求、购买力平价成立 。 货币需求:LD=L(i,Y); 引入卡甘货币需求函数:LD=k Yα e-βi 货币供给是外生变量。货币供给量变化不影响利率和实际国 民收入的变化,而是迅速影响价格的调整,再影响汇率的变 动。 货币供给:名义货币供给量Ms;实际货币供给量Ms/P

第二节

汇率的粘性价格货币分析法

超调模型的基本假定

超调模型中的平衡调整过程 对超调模型的评价与检验

一、超调模型的基本假定

“超调模型”(overshooting model):汇率的粘性 价格货币分析法的简称。 与货币模型相同,超调模型也认为货币需求是稳定 的,非套补利率平价成立。 与货币模型不同,超调模型认为商品市场价格存在 粘性。并且:第一,购买力平价在短期不成立,在 长期成立。第二,总供给曲线在不同的时期内有不 同的形状,短期水平,中期向右上方倾斜,长期垂 直。(p173图6-2)

国际金融 第6章(3)

外汇风险管理

一、外汇风险管理的原则与基本方法

外汇风险管理是指外汇资产持有者通过风险

识别、风险衡量、风险控制等方法,预防、规避、

转移或消除外汇业务经营中的风险,从而减少或

避免可能的经济损失,实现在风险一定条件下的 收益最大化或收益一定条件下的风险最小化。

(一) 外汇风险管理的基本要求 1.合理承受风险

实例分析我国某企业3个月后将有一笔10万元港币的货款需要支付为防范外汇风险该企业即可在现汇市场以人民币购买10万元港币假设当时的汇率为hk1rmb1064565即该企业用10665万元人民币购得了10万元港币的现汇但由于付款日是在3个月后所以该企业即可将这10万元港币在货币市场投资3个月3个月后该企业再以投资到期的10万元港币支付货款

2、外汇业务量小,或采取防范外汇风险的费用比可能 遭受的外汇风险的损失大。

3、出于投机心理,当预测汇率将朝着对自己有利的方 向波动时采用此战略。

在现行的浮动汇率条件下,对外汇风险采取完全不防 范战略的企业或外汇银行是不多见的,因为在现实经 济环境中,不仅存在金融、外汇方面的管制,而且汇 率容易受经济、政治、军事等各方面的影响而发生剧 烈波动,外汇市场的均衡状态几乎不可能实现。

(二)完全防范的战略

完全防范的战略即对外汇风险采取严格防范措施,想使不确定因 素一点都不留下。这种战略能有效防范外汇风险,但不是最经济 的战略,因为在防范风险时,不仅要花费高成本,费时费力,而 且也不能获得投机收益。 (三)部分防范的战略 部分防范风险即对所面临的外汇风险一部分采取防范措施,其他 部分则予以放置的战略。采用此战略的关键是要决定:全部受险 部分中,哪些需要采取防范措施,哪些不需要采取风范措施,需 要采取防范措施的受险部分占全部受险部分的比重多大?显然,首 先要考虑的是防范外汇风险的成本,尤其是防范外汇风险的成本 与不采取防范措施时可能蒙受的损失之间的比较;除此之外,还 要考虑防范风险的难易程度,对汇率走势预测的准确程度似及经 营者的经营作风等。根据经营者的经营作风,该战略又有两种类 型:

国际金融--第六章 国际金融市场 (2)

B.全球债券(Global Bonds):指在全世界的主要国际金融市场(主要是美、日、 欧),同时,在全球多个证交所上市,进行24 小时交易的债券 。

全球债券在美国证券交易委员会(SEC)登记,以记名形式发行。这种新型债券 为欧洲借款人接近美国投资者提供了工具,同时其全球24 小时交易也使全球债 券具有了高度流动性。其特点是:①全球发行;②全球交易和高度流动性;③ 发行人信用级别高,且多为政府机构。

第1节国际金融市场概述

1.2国际金融市场的形成与发展 国内投资者 1.2.1国际金融市场的发展演变 或存款者

国内金融市场 国内借款者

分类演进: (1)在岸金融市场的形成与发展

国外投资者 或存款者

在岸金融市场 国外借款者 离岸金融市场

18世纪中期到第一次世界大战前,英国伦敦形成了最初的国际金融市场,

第2节国际金融市场的构成

• 国际债券市场:国际债券(International Bond),是指一国政府、企业、金融 机构等为筹措外币资金在国外发行的以外币计值的债券。包括外国债券、欧洲 债券和全球债券。

A.外国债券(Foreign Bonds):指筹资者在国外债券市场发行的,以发行市场 所在国货币为面值的债券。典型的有:外国债券包括扬基债券Yankee bonds、 武士债券Samurai bonds、猛犬债券Bulldog bonds和熊猫债券(Panda Bonds)

• 2015年10月,人民币跨境支付系统(CIPS )成功上线运行,是人民币国际化的重要 里程碑。CIPS作为重要的金融基础设施, 专门为境内外金融机构的人民币跨境和离 岸业务提供资金清算、结算服务,该系统 工作时间横跨大洋洲、亚洲、欧洲和非洲 几个重要时区,将有利于人民币的跨境结 算,同时推动人民币的国际化运用。

第六章 国际金融组织

五、IMF贷款存在的基本矛盾与问题 IMF贷款存在的基本矛盾与问题

• 1.信贷资金不敷需要 1.信贷资金不敷需要 • 2.信贷资金的分配不合理 2.信贷资金的分配不合理 • 3.IMF提供贷款的附加限制性条件 3.IMF提供贷款的附加限制性条件

(未按期偿还,停止在IMF的表决权和其他权利) 未按期偿还,停止在IMF的表决权和其他权利) IMF的表决权和其他权利

二、国际开发协会(International 国际开发协会(International Association— Development Association —IDA) IDA)

• 成立于1960年,专门向低收入的发展中 成立于1960年 1960 国家提供优惠长期贷款 • (一)宗旨 • 对欠发达国家提供比IBRD条件宽厚、期 对欠发达国家提供比IBRD条件宽厚、 IBRD条件宽厚 限较长、负担较轻、 限较长、负担较轻、并可用部分当地货 币偿还的贷款, 币偿还的贷款,以促进它们经济的发展 和居民生活水平的提高,从而补充IBRD 和居民生活水平的提高,从而补充IBRD 的活动,促成IBRD目标的实现。 IBRD目标的实现 的活动,促成IBRD目标的实现。

• (二)组织机构 • 由IBRD相应机构的人员兼任,但会计账户是 IBRD相应机构的人员兼任, 相应机构的人员兼任 IBRD分开的 分开的。 与IBRD分开的。 • • • • • (三)资金来源 1.会员国认缴的股本 1.会员国认缴的股本 2.会员国提供的补充资金 2.会员国提供的补充资金 3.IBRD的拨款 3.IBRD的拨款 4.IDA本身业务经营的净收入 4.IDA本身业务经营的净收入

• • • • 1.理事会: 1.理事会:最高决策机构 理事会 2.执行董事会 常设机构, 执行董事会: 2.执行董事会:常设机构,负责日常业务 3.总裁 总管IMF业务, 总裁: IMF业务 3.总裁:总管IMF业务,最高行政领导人 4.业务职能机构 4.业务职能机构

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Cont’d

• naged float (dirty float)

管理浮动(肮脏浮动) The government officials do intervene at times to try to influence the exchange rate, which otherwise is driven by private demand and supply. Such as: India, Singapore

8

Cont’d

Official intervention: Monetary authority enters the foreign exchange market to buy or sell foreign currency.

9

在现行的国际货币制度下,大部分国 家实行的都是有管理的浮动汇率制度。有 管理的浮动汇率是以外汇市场供求为基础 的,是浮动的,不是固定的;它与清洁浮 动汇率的区别在于它受到宏观调控的管理 ,即货币当局根据外汇市场形成的价格来 公布汇率,允许其在规定的浮动幅度内上 下浮动。一旦汇率浮动超过规定的幅度, 货币当局就会进入市场买卖外汇,维持汇 率的合理和相对稳定。

5

Floating exchange rate

Government policy lets the market determine the exchange rate, the rate is free to go wherever the market equilibrium is at that time.

13

When to change the fixed rate?

• Never (not credible) • Seldom (adjustable peg) • Often (crawling peg)

We often use pegged exchange rate in place of fixed exchange rate

20

Defense through official intervention p103 Defending against depreciation Figure 6.1

Official par value of a Latin America country: 25 pesos/$ Market price: 28 pesos /$ Band: 24 pesos /$ to 26 pesos/$ To keep the rate at 26 pesos /$, the government sells $ (3 billion) and buys pesos (78 billion).

3

Two aspects: rate flexibility and restrictions on use

Two aspects: • The choice between a floating exchange rate and a fixed exchange rate. • Restrictions (if any) on the use of the foreign exchange market. These restrictions are generally called exchange controls (外 汇控制)。

19

How to defend the fixed rate?

• Official intervention by the government buying or selling currencies • Exchange control (tariffs, quotas etc.) • Altering domestic interest rates • Macroeconomic adjustment—fiscal or monetary policy To surrender rather than defend: • Altering its fixed rate or switch to a floating exchange rate

6

Cont’d

Types of floating exchange rate: • Clean float 清洁浮动 The government permits private market demand and supply to set the exchange rate with no direct involvement by government officials. Such as: United states, Canada, Japan

14

Types of fixed exchange rate

• Adjustable peg:可调整的钉住汇率 可调整的钉住汇率 The government may try to keep the value fixed for long periods of time. But in the face of a substantial or “fundamental” disequilibrium in the country’s international position, the government may change the pegged-rate value. Figure 6.9 p125

21

Figure 6.1 Intervention to Prevent Depreciation

22

This intervention is reflected in the country’s balance of payments.

---the strong demand for dollars…...(at 26 pesos/$ ) To purchase foreign goods, services and financial assets Result of intervention (selling dollars) : --providing foreign exchange to buy more than selling to --official settlement balance deficit. p23

A ready-made basket

Special drawing right (SDR) 特别提款权-- US dollar, Euro, Japanese yen, British pound

12

特别提款权(special drawing right,SDR) 是国际货币基金组织创设的一种储备资产和 记账单位,亦称“纸黄金(Paper Gold)”。它 是基金组织分配给会员国的一种使用资金的 权利。会员国在发生国际收支逆差时,可用 它向基金组织指定的其他会员国换取外汇, 以偿付国际收支逆差,还可与黄金、自由兑 换货币一样充当国际储备。但由于其只是一 种记帐单位,不是真正货币,使用时必须先 换成其他货币,不能直接用于贸易或非贸易 的支付。

16

2005年7月21日,中国人民银行宣布:我国 开始实行以市场供求为基础、参考一篮子货币进 行调节、有管理的浮动汇率制度,并让人民币对 美元升值2%。 就一篮子货币而言,是按照我国对外经济发 展的实际情况,选择若干种主要货币,赋予相应 的权重,组成一个货币篮子。这里不仅有币种问 题,更重要的是有权重问题。即使央行公布了其 中币种的构成,但权重还是保密。参考一篮子表 明外币之间的汇率变化会影响人民币汇率,但参 考一篮子不等于盯住一篮子货币,它还需要将市 场供求关系作为另一重要依据,据此形成有管理 的浮动汇率。

11

What to fix to?

• Gold (a century ago) • U.S. dollar (since the end of World War II) p100 • A number of other foreign currencies Basket of foreign currencies:一篮子货币

4

Cont’d

Exchange controls The country’s government places some restrictions on use of the foreign exchange market. (e.g. for all payments for exports and imports or capital controls).

17

Clean float Floating exchange rate: Managed float (dirty float) Adjustable peg Fixed exchange rate (pegged exchange rate):

Crawling peg

18

When to change the pegged rate? Choice of the width of the allowable band is closely related to the issue of when to change the rate.

2

The Reasons for Intervention

-to reduce variability in exchange rates; -to keep the exchange value of its currency either high or low ; -to raise national pride in a steady or strong currency.

CHAPTER 6

Government Policies toward the Foreign Exchange Market

Framework of this chapter

1. Possible government policies toward the foreign exchange market.政府对外汇市 场的政策。 2. Official intervention on this market and restrictions.对市场的官方干预和限制。 3. Lessons of history of exchange rate system. 汇率体制的历史教训。