投资学第7版练习作业题

投资学第7版练习作业题

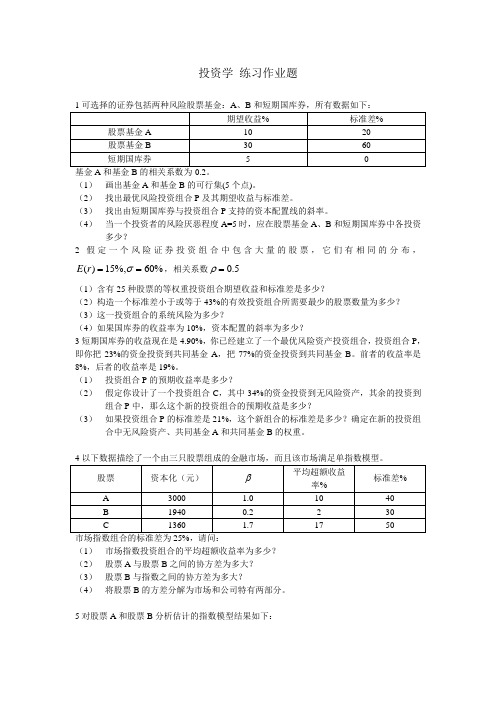

投资学练习作业题(1)画出基金A和基金B的可行集(5个点)。

(2)找出最优风险投资组合P及其期望收益与标准差。

(3)找出由短期国库券与投资组合P支持的资本配置线的斜率。

(4)当一个投资者的风险厌恶程度A=5时,应在股票基金A、B和短期国库券中各投资多少?2假定一个风险证券投资组合中包含大量的股票,它们有相同的分布,ρ60E,相关系数5.0%=σr(=15)%,=(1)含有25种股票的等权重投资组合期望收益和标准差是多少?(2)构造一个标准差小于或等于43%的有效投资组合所需要最少的股票数量为多少?(3)这一投资组合的系统风险为多少?(4)如果国库券的收益率为10%,资本配置的斜率为多少?3短期国库券的收益现在是4.90%,你已经建立了一个最优风险资产投资组合,投资组合P,即你把23%的资金投资到共同基金A,把77%的资金投资到共同基金B。

前者的收益率是8%,后者的收益率是19%。

(1)投资组合P的预期收益率是多少?(2)假定你设计了一个投资组合C,其中34%的资金投资到无风险资产,其余的投资到组合P中,那么这个新的投资组合的预期收益是多少?(3)如果投资组合P的标准差是21%,这个新组合的标准差是多少?确定在新的投资组合中无风险资产、共同基金A和共同基金B的权重。

(1)市场指数投资组合的平均超额收益率为多少?(2)股票A与股票B之间的协方差为多大?(3)股票B与指数之间的协方差为多大?(4)将股票B的方差分解为市场和公司特有两部分。

5对股票A和股票B分析估计的指数模型结果如下:A M A e R R ++=6.012.0B M B e R R ++=4.104.026.0=M σ 20.0)(=A e σ 10.0)(=B e σ(1) 股票A 和股票B 收益之间的协方差是多少? (2) 每只股票的方差是多少?(3) 将每只股票的方差分类到系统风险和公司特有风险中 (4) 每只股票和市场指数的协方差是多少? (5) 两只股票的相关系数是多少?6预计无风险利率是6.1%,市场投资组合的预期收益是14.6%。

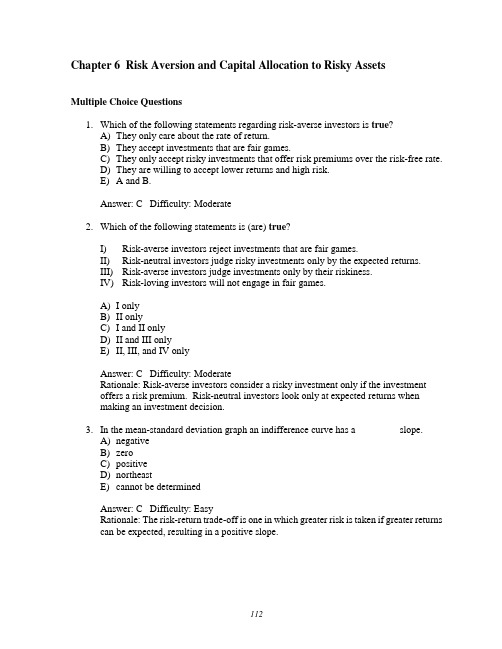

投资学第7版TestBank答案22

投资学第7版TestBank答案22Multiple Choice Questions1. A futures contractA) is an agreement to buy or sell a specified amount of an asset at the spot price on theexpiration date of the contract.B) is an agreement to buy or sell a specified amount of an asset at a predeterminedprice on the expiration date of the contract.C) gives the buyer the right, but not the obligation, to buy an asset some time in thefuture.D) is a contract to be signed in the future by the buyer and the seller of the commodity.E) none of the above.Answer: B Difficulty: EasyRationale: A futures contract locks in the price of a commodity to be delivered at some future date. Both the buyer and seller of the contract are committed.2. The terms of futures contracts __________ standardized, and the terms of forwardcontracts __________ standardized.A) are; areB) are not; areC) are; are notD) are not; are notE) are; may or may not beAnswer: C Difficulty: EasyRationale: Futures contracts are standardized and are tradedon organized exchanges;forward contracts are not traded on organized exchanges, the participant negotiates for the delivery of any quantity of goods, and banks and brokers negotiate contracts as needed.3. Futures contracts __________ traded on an organized exchange, and forward contracts__________ traded on an organized exchange.A) are not; areB) are; areC) are not; are notD) are; are notE) are; may or may not beAnswer: D Difficulty: EasyRationale: See rationale for test bank question 22.2.4. In a futures contract the futures price isA) determined by the buyer and the seller when the delivery of the commodity takesplace.B) determined by the futures exchange.C) determined by the buyer and the seller when they initiate the contract.D) determined independently by the provider of the underlying asset.E) none of the above.Answer: C Difficulty: ModerateRationale: The futures exchanges specify all the terms of the contracts except price; as a result, the traders bargain over the futures price.5. The buyer of a futures contract is said to have a __________position and the seller of afutures contract is said to have a __________ position in futures.A) long; shortB) long; longC) short; shortD) short; longE) margined; longAnswer: A Difficulty: ModerateRationale: The trader taking the long position commits to purchase the commodity on the delivery date. The trader taking the short position commits to delivering thecommodity at contract maturity. The trader in the long position is said to "buy" the contract; the trader in the short position is said to "sell" the contract. However, no money changes hands at this time.6. Investors who take long positions in futures agree to __________ of the commodity onthe delivery date, and those who take the short positions agree to __________ of the commodity.A) make delivery; take deliveryB) take delivery; make deliveryC) take delivery; take deliveryD) make delivery; take deliveryE) negotiate the price; pay the priceAnswer: B Difficulty: ModerateRationale: See explanation for test bank question 22.5.7. The terms of futures contracts such as the quality and quantity of the commodity and thedelivery date areA) specified by the buyers and sellers.B) specified only by the buyers.C) specified by the futures exchanges.D) specified by brokers and dealers.E) none of the above.Answer: C Difficulty: ModerateRationale: See rationale for test bank question 22.4.8. A trader who has a __________ position in wheat futures believes the price of wheatwill __________ in the future.A) long; increaseB) long; decreaseC) short; increaseD) long; stay the sameE) short; stay the sameAnswer: A Difficulty: ModerateRationale: The trader holding the long position (the person who will purchase the goods) will profit from a price increase. Profit to long position = Spot price atmaturity--Original futures price.9. A trader who has a __________ position in gold futures wants the price of gold to__________ in the future.A) long; decreaseB) short; decreaseC) short; stay the sameD) short; increaseE) long; stay the sameAnswer: B Difficulty: ModerateRationale: Profit to short position = Original futures price--Spot price at maturity. Thus, the person in the short positionprofits if the price of the commodity declines in the future.10. The open interest on silver futures at a particular time is theA) number of silver futures contracts traded during the day.B) number of outstanding silver futures contracts for delivery within the next month.C) number of silver futures contracts traded the previous day.D) number of all silver futures outstanding contracts.E) none of the above.Answer: D Difficulty: ModerateRationale: Open interest is the number of contracts outstanding. When contracts begin trading, open interest is zero; as time passes more contracts are entered. Most contracts are liquidated before the maturity date.11. Which one of the following statements regarding delivery is true?A) Most futures contracts result in actual delivery.B) Only one to three percent of futures contracts result in actual delivery.C) Only fifteen percent of futures contracts result in actual delivery.D) Approximately fifty percent of futures contracts result in actual delivery.E) Futures contracts never result in actual delivery.Answer: B Difficulty: ModerateRationale: Virtually all traders enter reversing trades to cancel their original positions, thereby realizing profits or losses on the contract.12. You hold one long corn futures contract that expires in April. To close your position incorn futures before the delivery date you mustA) buy one May corn futures contract.B) buy two April corn futures contract.C) sell one April corn futures contract.D) sell one May corn futures contract.E) none of the above.Answer: C Difficulty: ModerateRationale: The long position is considered the buyer; to close out the position one must take a reversing position, or sell the contract.13. Which one of the following statements is true?A) The maintenance margin is the amount of money you post with your broker whenyou buy or sell a futures contract.B) The maintenance margin determines the value of the margin account below whichthe holder of a futures contract receives a margin call.C) A margin deposit can only be met with cash.D) All futures contracts require the same margin deposit.E) The maintenance margin is set by the producer of the underlying asset.Answer: B Difficulty: ModerateRationale: The maintenance margin applies to the value of the account after the account is opened; if the value of this account falls below the maintenance margin requirement and the holder of the contract will receive a margin call. A margin deposit can be made with cash or interest-earning securities; the margin deposit amounts depend on thevolatility of the underlying asset.14. Financial futures contracts are actively traded on thefollowing indices exceptA) the S&P 500 Index.B) the New York Stock Exchange Index.C) the Nikkei Index.D) the Dow Jones Industrial Index.E) all of the above indices have actively traded futures contracts.Answer: E Difficulty: ModerateRationale: The indices are listed in Table 22.1.15. To exploit an expected increase in interest rates, an investor would most likelyA) sell Treasury bond futures.B) take a long position in wheat futures.C) buy S&P 500 index futures.D) take a long position in Treasury bond futures.E) none of the above.Answer: A Difficulty: DifficultRationale: If interest rates rise, bond prices decrease. As bond prices decrease, the short position gains. Thus, if you are bearish about bond prices, you might speculate byselling T-bond futures contracts.16. An investor with a long position in Treasury notes futures will profit ifA) interest rates decline.B) interest rate increase.C) the prices of Treasury notes increase.D) the price of the long bond increases.E) none of the above.Answer: A Difficulty: ModerateRationale: Profit to long position = Spot price at maturity--original futures price.17. To hedge a long position in Treasury bonds, an investor most likely wouldA) buy interest rate futures.B) sell S&P futures.C) sell interest rate futures.D) buy Treasury bonds in the spot market.E) none of the above.Answer: C Difficulty: DifficultRationale: By taking the short position, the hedger is obligated to deliver T-bonds at the contract maturity date for the current futures price, which locks in the sales price for the bonds and guarantees that the total value of the bond-plus-futures position at thematurity date is the futures price.18. An increase in the basis will __________ a long hedger and __________ a short hedger.A) hurt; benefitB) hurt; hurtC) benefit; hurtD) benefit; benefitE) benefit; have no effect uponAnswer: C Difficulty: DifficultRationale: If a contract and an asset are to be liquidated early, basis risk exists andfutures price and spot price need not move in lockstep before delivery date. An increase in the basis will hurt the short hedger and benefit the long hedger.19. Which one of the following statements regarding "basis" is not true?A) the basis is the difference between the futures price and the spot price.B) the basis risk is borne by the hedger.C) a short hedger suffers losses when the basis decreases.D) the basis increases when the futures price increases by more than the spot price.E) none of the above.Answer: C Difficulty: DifficultRationale: See explanation for test bank question 22.20.20. If you determine that the S&P 500 Index futures is overpriced relative to the spot S&P500 Index you could make an arbitrage profit byA) buying all the stocks in the S&P 500 and selling put options on the S&P 500 index.B) selling short all the stocks in the S&P 500 and buying S&P Index futures.C) selling all the stocks in the S&P 500 and buying call options on the S&P 500 index.D) selling S&P 500 Index futures and buying all the stocks in the S&P 500.E) none of the above.Answer: D Difficulty: ModerateRationale: If you think one asset is overpriced relative to another, you sell theoverpriced asset and buy the other one.21. On January 1, the listed spot and futures prices of a Treasury bond were 93.8 and 93.13.You purchased $100,000 par value Treasury bonds and sold one Treasury bond futures contract. One month later, the listed spot price and futures prices were 94 and 94.09, respectively. Ifyou were to liquidate your position, your profits would beA) $125 loss.B) $125 profit.C) $12.50 loss.D) $1,250 loss.E) none of the above.Answer: A Difficulty: DifficultRationale: On bonds: $94,000 - $93,250 = $750; On futures: $93,406.25 - $94,281.25 = -$875; Net profits: $750 - $875 = -$125.22. You purchased one silver future contract at $3 per ounce. What would be your profit(loss) at maturity if the silver spot price at that time is $4.10 per ounce? Assume the contract size is 5,000 ounces and there are no transactions costs.A) $5.50 profitB) $5,500 profitC) $5.50 lossD) $5,500 lossE) none of the above.Answer: B Difficulty: ModerateRationale: $4.10 - $3.00 = $1.10 X 5,000 = $5,500.23. You sold one silver future contract at $3 per ounce. What would be your profit (loss) atmaturity if the silver spot price at that time is $4.10 per ounce? Assume the contract size is 5,000 ounces and there are no transactions costs.A) $5.50 profitB) $5,500 profitC) $5.50 lossD) $5,500 lossE) none of the above.Answer: D Difficulty: ModerateRationale: $3.00 - $4.10 = -$1.10 X 5,000 = -$5,500.24. You purchased one corn future contract at $2.29 per bushel. What would be your profit(loss) at maturity if the corn spot price at that time were $2.10 per bushel? Assume the contract size is 5,000 ounces and there are no transactions costs.A) $950 profitB) $95 profitC) $950 lossD) $95 lossE) none of the above.Answer: C Difficulty: ModerateRationale: $2.10 - $2.29 = -$0.19 X 5,000 = -$950.25. You sold one corn future contract at $2.29 per bushel. What would be your profit (loss)at maturity if the corn spot price at that time were $2.10 per bushel? Assume thecontract size is 5,000 ounces and there are no transactions costs.A) $950 profitB) $95 profitC) $950 lossD) $95 lossE) none of the above.Answer: A Difficulty: ModerateRationale: $2.29 - $2.10 = $0.19 X 5,000 = $950.26. You sold one wheat future contract at $3.04 per bushel. What would be your profit (loss)at maturity if the wheat spot price at that time were $2.98 per bushel? Assume thecontract size is 5,000 ounces and there are no transactions costs.A) $30 profitB) $300 profitC) $300 lossD) $30 lossE) none of the above.Answer: B Difficulty: ModerateRationale: $3.04 - $2.98 = $0.06 X 5,000 = $300.27. You purchased one wheat future contract at $3.04 per bushel. What would be yourprofit (loss) at maturity if the wheat spot price at that time were $2.98 per bushel?Assume the contract size is 5,000 ounces and there are no transactions costs.A) $30 profitB) $300 profitC) $300 lossD) $30 lossE) none of the above.Answer: C Difficulty: ModerateRationale: $2.98 - $3.04 = -$0.06 X 5,000 = -$300.28. On January 1, you sold one April S&P 500 index futures contract at a futures price of420. If on February 1 the April futures price were 430, what would be your profit (loss) if you closed your position (without considering transactions costs)?A) $2,500 lossB) $10 lossC) $2,500 profitD) $10 profitE) none of the aboveAnswer: A Difficulty: DifficultRationale: $420 - $430 = -$10 X 250 = -$2,50029. On January 1, you bought one April S&P 500 index futures contract at a futures price of420. If on February 1 the April futures price were 430, what would be your profit (loss) if you closed your position (without considering transactions costs)?A) $2,500 lossB) $10 lossC) $2,500 profitD) $10 profitE) none of the aboveAnswer: C Difficulty: DifficultRationale: $430 - $420 = $10 X 250 = $2,50030. You sold one soybean future contract at $5.13 per bushel. What would be your profit(loss) at maturity if the wheat spot price at that time were $5.26 per bushel? Assume the contract size is 5,000 ounces and there are no transactions costs.A) $65 profitB) $650 profitC) $650 lossD) $65 lossE) none of the above.Answer: C Difficulty: ModerateRationale: $5.13 - $5.26 = -$0.13 X 5,000 = -$650.31. You bought one soybean future contract at $5.13 per bushel. What would be your profit(loss) at maturity if the wheat spot price at that time were $5.26 per bushel? Assume the contract size is 5,000 ounces and there are no transactions costs.A) $65 profitB) $650 profitC) $650 lossD) $65 lossE) none of the above.Answer: B Difficulty: ModerateRationale: $5.26 - $5.13 = $0.13 X 5,000 = $650.32. On April 1, you bought one S&P 500 index futures contract at a futures price of 950. Ifon June 15th the futures price were 1012, what would be your profit (loss) if you closed your position (without considering transactions costs)?A) $1,550 lossB) $15,550 lossC) $15,550 profitD) $1,550 profitE) none of the aboveAnswer: C Difficulty: DifficultRationale: $1012 - $950 = $62 X 250 = $15,50033. On April 1, you sold one S&P 500 index futures contract at a futures price of 950. If onJune 15th the futures price were 1012, what would be your profit (loss) if you closed your position (without considering transactions costs)?A) $1,550 lossB) $15,550 lossC) $15,550 profitD) $1,550 profitE) none of the aboveAnswer: B Difficulty: DifficultRationale: $950 - $1012 = -$62 X 250 = -$15,50034. The expectations hypothesis of futures pricingA) is the simplest theory of futures pricing.B) states that the futures price equals the expected value of the future spot price of theasset.C) is not a zero sum game.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: The expectations hypothesis relies on the concept of risk neutrality; i.e., if all market participants are risk neutral, they should agree on a futures price that provides an expected profit of zero to all parties.35. Normal backwardationA) maintains that for most commodities, there are natural hedgers who desire to shedrisk.B) maintains that speculators will enter the long side of the contract only if the futuresprice is below the expected spot price.C) assumes that risk premiums in the futures markets are based on systematic risk.D) A and B.E) B and C.Answer: D Difficulty: EasyRationale: Risk premiums in this theory are based on total variability.36. ContangoA) holds that the natural hedgers are the purchasers of a commodity, not the suppliers.B) is a hypothesis polar to backwardation.C) holds that F O must be less than (P T).D) A and C.E) A and B.Answer: E Difficulty: Easy37. Delivery of stock index futuresA) is never made.B) is made by a cash settlement based on the index value.C) requires delivery of 1 share of each stock in the index.D) is made by delivering 100 shares of each stock in the index.E) is made by delivering a value-weighted basket of stocks.Answer: B Difficulty: ModerateRationale: Stock index futures are cash-settled, similar to the procedure used for index options.38. The establishment of a futures market in a commodity should not have a major impacton spot prices becauseA) the futures market is small relative to the spot market.B) the futures market is illiquid.C) futures are a zero-sum gameD) the futures market is large relative to the spot market.E) most futures contracts do not take delivery.Answer: C Difficulty: ModerateRationale: Losses and gains to futures contracts net to zero,and thus should not impact spot prices.39. The most recently established category of futures contracts isA) agricultural commodities.B) metals and minerals.C) foreign currencies.D) financial futures.E) both B and C.Answer: D Difficulty: ModerateRationale: Financial futures were first introduced in 1975, and this segment of themarket has seen rapid innovation.40. If a trader holding a long position in corn futures fails to meet the obligations of afutures contract, the party that is hurt by the failure isA) the offsetting short trader.B) the corn farmer.C) the clearinghouse.D) the broker.E) the commodities dealer.Answer: C Difficulty: ModerateRationale: The clearinghouse acts as a middle party to every transaction, and bears any losses arising from failure to meet contractual obligations.41. Open interest includesA) only contracts with a specified delivery date.B) the sum of short and long positions.C) the sum of short, long and clearinghouse positions.D) the sum of long or short positions and clearinghouse positions.E) only long or short positions but not both.Answer: E Difficulty: ModerateRationale: Open interest is the number of contracts outstanding across all delivery dates for a given contract. Long and short positions are not counted separately, and the clearinghouse position is not counted because it nets to zero.42. The process of marking-to-marketA) posts gains or losses to each account daily.B) may result in margin calls.C) impacts only long positions.D) all of the above are true.E) both A and B are true.Answer: E Difficulty: EasyRationale: Marking-to-market effectively puts futures contracts on a "pay as you go"basis.43. Futures contracts are regulated byA) the Commodity Futures Trading Corporation.B) the Chicago Board of Trade.C) the Chicago Mercantile Exchange.D) the Federal Reserve.E) the Securities and Exchange Commission.Answer: A Difficulty: EasyRationale: The CFTC, a federal agency, sets rules and requirements for futures trading.44. Taxation of futures trading gains and lossesA) is based on cumulative year-end profits or losses.B) occurs based on the date contracts are sold or closed.C) can be timed to offset stock portfolio gains and losses.D) is based on the contract holding period.E) none of the above.Answer: A Difficulty: ModerateRationale: Futures profits and losses are taxed based on cumulative year-end value due to marking-to-market procedures.45. Speculators may use futures markets rather than spot markets becauseA) transactions costs are lower in futures markets.B) futures markets provide leverage.C) spot markets are less efficient.D) futures markets are less efficient.E) both A and B are true.Answer: E Difficulty: ModerateRationale: Futures markets allow speculators to benefit from leverage and minimize transactions costs. Both markets should be equally price-efficient.46. Given a stock index with a value of $1,000, an anticipated dividend of $30 and arisk-free rate of 6%, what should be the value of one futures contract on the index?A) $943.40B) $970.00C) $913.40D) $915.09E) $1000.00Answer: C Difficulty: DifficultRationale: F = 1000/(1.06) - 30; F = 913.40.47. Given a stock index with a value of $1,125, an anticipated dividend of $33 and arisk-free rate of 4%, what should be the value of one futures contract on the index?A) $1048.73B) $1070.00C) $993.40D) $995.09E) $1000.00Answer: A Difficulty: DifficultRationale: F = 1125/(1.04) - 33; F = 1048.73.48. Given a stock index with a value of $1100, an anticipated dividend of $27 and arisk-free rate of 3%, what should be the value of one futures contract on the index?A) $943.40B) $970.00C) $913.40D) $1040.96E) $1000.00Answer: D Difficulty: DifficultRationale: F = 1100/(1.03) - 27; F = 1040.96.49. Given a stock index with a value of $1,200, an anticipated dividend of $45 and arisk-free rate of 6%, what should be the value of one futures contract on the index?A) $1087.08B) $1070.00C) $993.40D) $995.09E) $1000.00Answer: A Difficulty: DifficultRationale: F = 1200/(1.06) - 45; F = 1087.08.50. Which of the following items is specified in a futurescontract?I)the contract sizeII)the maximum acceptable price range during the life of the contractIII)the acceptable grade of the commodity on which the contract is heldIV)the market price at expirationV)the settlement priceA) I, II, and IVB) I, III, and VC) I and VD) I, IV, and VE) I, II, III, IV, and VAnswer: B Difficulty: ModerateRationale: The maximum price range and the market price at expiration will bedetermined by the market rather than specified in the contract.51. With regard to futures contracts, what does the word “margin” mean?A) It is the amount of the money borrowed from the broker when you buy the contract.B) It is the maximum percentage that the price of the contract can change before it ismarked to market.C) It is the maximum percentage that the price of the underlying asset can changebefore it is marked to market.D) It is a good-faith deposit made at the time of the contract's purchase or sale.E) It is the amount by which the contract is marked to market.Answer: D Difficulty: EasyRationale: The exchange guarantees the performance of each party, so it requires agood-faith deposit. This helps avoid the cost of credit checks.52. Which of the following is true about profits from futures contracts?A) The person with the long position gets to decide whether to exercise the futurescontract and will only do so if there is a profit to be made.B) It is possible for both the holder of the long position and the holder of the shortposition to earn a profit.C) The clearinghouse makes most of the profit.D) The amount that the holder of the long position gains must equal the amount that theholder of the short position loses.E) Holders of short positions can recognize profits by making delivery early.Answer: D Difficulty: ModerateRationale: The net profit on the contract is zero it is a zero-sum game.53. Some of the newer futures contracts includeI)fashion futures.II)weather futures.III)electricity futures.IV)entertainment futures.A) I and IIB) II and IIIC) III and IVD) I, II, and IIIE) I, III, and IVAnswer: B Difficulty: EasyRationale: Weather and electricity futures are mentioned in the textbook as recentinnovations.54. Who guarantees that a futures contract will be fulfilled?A) the buyerB) the sellerC) the brokerD) the clearinghouseE) nobodyAnswer: D Difficulty: EasyRationale: Once two parties have agreed to enter the transaction, the clearinghouse becomes the buyer and seller of the contract and guarantees its completion.55. If you took a long position in a pork bellies futures contract and then forgot about it,what would happen at the expiration of the contract?A) Nothing--the seller understands that these things happen.B) You would wake up to find the pork bellies on your front lawn.C) Your broker would send you a nasty letter.D) You would be notified that you owe the holder of the short position a certain amountof cash.E) You would be notified that you have to pay a penalty in addition to the regular costof the pork bellies.Answer: D Difficulty: EasyRationale: The item is usually not delivered, but cash settlement can be made through the use of warehouse receipts. You are still obligated to fulfill the contract and give the holder of the short position the value of the pork bellies.56. Hedging a position using futures on another commodity is calledA) surrogate hedging.B) cross hedging.C) alternative hedging.D) correlative hedging.E) proxy hedging.Answer: B Difficulty: EasyRationale: Cross-hedging is used in some cases because no futures contract exists for the item you want to hedge. The two commodities should be highly correlated.57. A trader who has a __________ position in oil futures believes the price of oil will__________ in the future.A) short; increaseB) long; increaseC) short; decreaseD) long; stay the sameE) B and CAnswer: E Difficulty: ModerateRationale: The trader holding the long position (the person who will purchase the goods) will profit from a price increase. Profit to long position = Spot price atmaturity--Original futures price.。

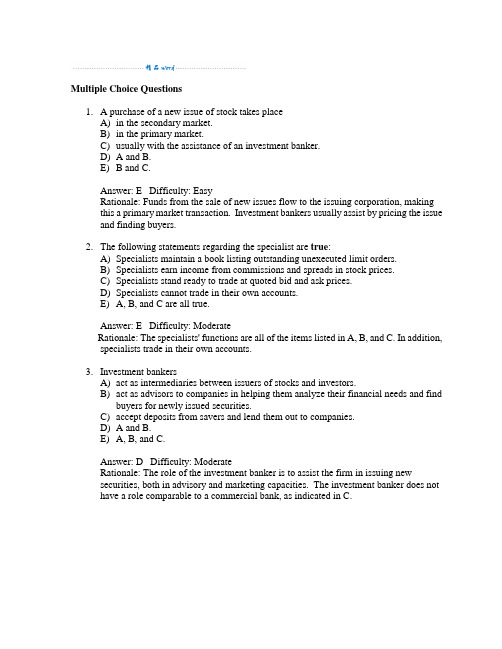

投资学第7版TestBank答案10

投资学第7版TestBank答案10ReturnMultiple Choice Questions1. ___________ a relationship between expected return and risk.A) APT stipulatesB) CAPM stipulatesC) Both CAPM and APT stipulateD) Neither CAPM nor APT stipulateE) No pricing model has foundAnswer: C Difficulty: EasyRationale: Both models attempt to explain asset pricing based on risk/returnrelationships.2. Which pricing model provides no guidance concerning the determination of the riskpremium on factor portfolios?A) The CAPMB) The multifactor APTC) Both the CAPM and the multifactor APTD) Neither the CAPM nor the multifactor APTE) None of the above is a true statement.Answer: B Difficulty: ModerateRationale: The multifactor APT provides no guidance as to the determination of the risk premium on the various factors. The CAPM assumes that the excess market return over the risk-free rate is the market premium in the single factor CAPM.3. An arbitrage opportunity exists if an investor can construct a __________ investmentportfolio that will yield a sure profit.A) positiveB) negativeC) zeroD) all of the aboveE) none of the aboveAnswer: C Difficulty: EasyRationale: If the investor can construct a portfolio without the use of the investor's own funds and the portfolio yields a positive profit, arbitrage opportunities exist.Return4. The APT was developed in 1976 by ____________.A) LintnerB) Modigliani and MillerC) RossD) SharpeE) none of the aboveAnswer: C Difficulty: EasyRationale: Ross developed this model in 1976.5. A _________ portfolio is a well-diversified portfolio constructed to have a beta of 1 onone of the factors and a beta of 0 on any other factor.A) factorB) marketC) indexD) A and BE) A, B, and CAnswer: A Difficulty: EasyRationale: A factor model portfolio has a beta of 1 one factor, with zero betas on other factors.6. The exploitation of security mispricing in such a way that risk-free economic profitsmay be earned is called ___________.A) arbitrageB) capital asset pricingC) factoringD) fundamental analysisE) none of the aboveAnswer: A Difficulty: EasyRationale: Arbitrage is earning of positive profits with a zero (risk-free) investment.Return7. In developing the APT, Ross assumed that uncertainty in asset returns was a result ofA) a common macroeconomic factorB) firm-specific factorsC) pricing errorD) neither A nor BE) both A and BAnswer: E Difficulty: ModerateRationale: Total risk (uncertainty) is assumed to be composed of both macroeconomic and firm-specific factors.8. The ____________ provides an unequivocal statement on the expected return-betarelationship for all assets, whereas the _____________ implies that this relationshipholds for all but perhaps a small number of securities.A) APT, CAPMB) APT, OPMC) CAPM, APTD) CAPM, OPME) none of the aboveAnswer: C Difficulty: ModerateRationale: The CAPM is an asset-pricing model based on the risk/return relationship of all assets. The APT implies that this relationship holds for all well-diversified portfolios, and for all but perhaps a few individual securities.9. Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of16%. Portfolio B has a beta of 0.8 and an expected return of 12%. The risk-free rate of return is 6%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______.A) A, AB) A, BC) B, AD) B, BE) A, the riskless assetAnswer: C Difficulty: ModerateRationale: A: 16% = 1.0F + 6%; F = 10%; B: 12% = 0.8F + 6%: F = 7.5%; thus, short B and take a long position in A.Return10. Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________.A) A, AB) A, BC) B, AD) B, BE) none of the aboveAnswer: C Difficulty: ModerateRationale: A: 13% = 10% + 0.2F; F = 15%; B: 15% = 10% + 0.4F; F = 12.5%; therefore, short B and take a long position in A.11. Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. Thebeta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the well-diversified portfolio is approximately __________.A) 3.6%B) 6.0%C) 7.3%D) 10.1%E) none of the aboveAnswer: C Difficulty: ModerateRationale: s2P = (1.1)2(6%) = 7.26%.12. Consider the one-factor APT. The standard deviation of returns on a well-diversifiedportfolio is 18%. The standard deviation on the factor portfolio is 16%. The beta of the well-diversified portfolio is approximately __________.A) 0.80B) 1.13C) 1.25D) 1.56E) none of the aboveAnswer: B Difficulty: ModerateRationale: (18%)2 = (16%)2 b2; b = 1.125.Return13. Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%,respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage opportunities are ruled out, stock A has a beta of __________.A) 0.67B) 1.00C) 1.30D) 1.69E) none of the aboveAnswer: E Difficulty: ModerateRationale: A: 15% = 6% + bF; B: 8% = 6% + 1.0F; F = 12%; thus, beta of A = 9/12 =0.75.14. Consider the multifactor APT with two factors. Stock A has an expected return of16.4%, a beta of 1.4 on factor 1 and a beta of .8 on factor 2. The risk premium on thefactor 1 portfolio is 3%. The risk-free rate of return is 6%. What is the risk-premium on factor 2 if no arbitrage opportunities exit?A) 2%B) 3%C) 4%D) 7.75%E) none of the aboveAnswer: D Difficulty: DifficultRationale: 16.4% = 1.4(3%) + .8x + 6%; x = 7.75.15. Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 onfactor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is __________if no arbitrage opportunities exist.A) 13.5%B) 15.0%C) 16.5%D) 23.0%E) none of the aboveAnswer: C Difficulty: ModerateRationale: 7% + 0.75(1%) + 1.25(7%) = 16.5%.Return16. Consider the multifactor APT with two factors. The risk premiums on the factor 1 andfactor 2 portfolios are 5% and 6%, respectively. Stock A has a beta of 1.2 on factor 1, and a beta of 0.7 on factor 2. The expected return on stock A is 17%. If no arbitrageopportunities exist, the risk-free rate of return is ___________.A) 6.0%B) 6.5%C) 6.8%D) 7.4%E) none of the aboveAnswer: C Difficulty: ModerateRationale: 17% = x% + 1.2(5%) + 0.7(6%); x = 6.8%.17. Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolioB has a beta of 2.0 on the factor. The expected returns on portfolios A and B are 11%and 17%, respectively. Assume that the risk-free rate is 6% and that arbitrageopportunities exist. Suppose you invested $100,000 in the risk-free asset, $100,000 in portfolio B, and sold short $200,000 of portfolio A. Your expected profit from thisstrategy would be ______________.A) -$1,000B) $0C) $1,000D) $2,000E) none of the aboveAnswer: C Difficulty: ModerateRationale: $100,000(0.06) = $6,000 (risk-free position); $100,000(0.17) = $17,000(portfolio B); -$200,000(0.11) = -$22,000 (short position, portfolio A); 1,000 profit. 18. Consider the one-factor APT. Assume that two portfolios, A and B, are well diversified.The betas of portfolios A and B are 1.0 and 1.5, respectively. The expected returns on portfolios A and B are 19% and 24%, respectively. Assuming no arbitrageopportunities exist, the risk-free rate of return must be ____________.A) 4.0%B) 9.0%C) 14.0%D) 16.5%E) none of the aboveAnswer: B Difficulty: ModerateRationale: A: 19% = r f + 1(F); B:24% = r f + 1.5(F); 5% = .5(F); F = 10%; 24% = r f +1.5(10); ff = 9%.Return19. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfoliosare 5% and 3%, respectively. The risk-free rate of return is 10%. Stock A has anexpected return of 19% and a beta on factor 1 of 0.8. Stock A has a beta on factor 2 of ________.A) 1.33B) 1.50C) 1.67D) 2.00E) none of the aboveAnswer: C Difficulty: ModerateRationale: 19% = 10% + 5%(0.8) + 3%(x); x = 1.67.20. Consider the single factor APT. Portfolios A and B have expected returns of 14% and18%, respectively. The risk-free rate of return is 7%. Portfolio A has a beta of 0.7. If arbitrage opportunities are ruled out, portfolio B must have a beta of __________.A) 0.45B) 1.00C) 1.10D) 1.22E) none of the aboveAnswer: C Difficulty: ModerateRationale: A: 14% = 7% + 0.7F; F = 10; B: 18% = 7% + 10b; b = 1.10.Use the following to answer questions 21-24:There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:Return21. If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.A) 3.0%B) 14.5%C) 15.5%D) 16.0%E) none of the aboveAnswer: D Difficulty: EasyRationale: E(Rp) = 0.5(17%) + 0.5(15%) = 16%.22. If you invested in an equally weighted portfolio of stocks A and C, your portfolio return would be ____________ if economic growth was strong.A) 17.0%B) 22.5%C) 30.0%D) 30.5%E) none of the aboveAnswer: B Difficulty: EasyRationale: 0.5(39%) + 0.5(6%) = 22.5%.23. If you invested in an equally weighted portfolio of stocks B and C, your portfolio return would be _____________ if economic growth was weak.A) -2.5%B) 0.5%C) 3.0%D) 11.0%E) none of the aboveAnswer: D Difficulty: EasyRationale: 0.5(0%) + 0.5(22%) = 11%.Return24. If you wanted to take advantage of a risk-free arbitrage opportunity, you should take a short position in _________ and a long position in an equally weighted portfolio of_______.A) A, B and CB) B, A and CC) C, A and BD) A and B, CE) none of the above, none of the aboveAnswer: C Difficulty: DifficultRationale: E(R A) = (39% + 17% - 5%)/3 = 17%; E(R B) = (30% + 15% + 0%)/3 = 15%;E(R C) = (22% + 14% + 6%)/3 = 14%; E(R P) = -0.5(14%) + 0.5[(17% + 15%)/2]; -7.0% + 8.0% = 1.0%.Use the following to answer questions 25-26:Consider the multifactor APT. There are two independent economic factors, F1 and F2. The risk-free rate of return is 6%. The following information is available about two well-diversified portfolios:25. Assuming no arbitrage opportunities exist, the risk premium on the factor F1 portfolioshould be __________.A) 3%B) 4%C) 5%D) 6%E) none of the aboveAnswer: A Difficulty: DifficultRationale: 2A: 38% = 12% + 2.0(RP1) + 4.0(RP2); B: 12% = 6% + 2.0(RP1) +0.0(RP2); 26% = 6% + 4.0(RP2); RP2 = 5; A: 19% = 6% + RP1 + 2.0(5); RP1 = 3%.Return26. Assuming no arbitrage opportunities exist, the risk premium on the factor F2 portfolioshould be ___________.A) 3%B) 4%C) 5%D) 6%E) none of the aboveAnswer: C Difficulty: DifficultRationale: See solution to previous problem.27. A zero-investment portfolio with a positive expected return arises when _________.A) an investor has downside risk onlyB) the law of prices is not violatedC) the opportunity set is not tangent to the capital allocation lineD) a risk-free arbitrage opportunity existsE) none of the aboveAnswer: D Difficulty: EasyRationale: When an investor can create a zero-investment portfolio (by using none of the investor's own funds) with a possibility of a positive profit, a risk-free arbitrageopportunity exists.28. An investor will take as large a position as possible when an equilibrium pricerelationship is violated. This is an example of _________.A) a dominance argumentB) the mean-variance efficiency frontierC) a risk-free arbitrageD) the capital asset pricing modelE) none of the aboveAnswer: C Difficulty: ModerateRationale: When the equilibrium price is violated, the investor will buy the lower priced asset and simultaneously place an order to sell the higher priced asset. Suchtransactions result in risk-free arbitrage. The larger the positions, the greater therisk-free arbitrage profits.Return29. The APT differs from the CAPM because the APT _________.A) places more emphasis on market riskB) minimizes the importance of diversificationC) recognizes multiple unsystematic risk factorsD) recognizes multiple systematic risk factorsE) none of the aboveAnswer: D Difficulty: ModerateRationale: The CAPM assumes that market returns represent systematic risk. The APT recognizes that other macroeconomic factors may be systematic risk factors.30. The feature of the APT that offers the greatest potential advantage over the CAPM is the______________.A) use of several factors instead of a single market index to explain the risk-returnrelationshipB) identification of anticipated changes in production, inflation and term structure askey factors in explaining the risk-return relationshipC) superior measurement of the risk-free rate of return over historical time periodsD) variability of coefficients of sensitivity to the APT factors for a given asset overtimeE) none of the aboveAnswer: A Difficulty: EasyRationale: The advantage of the APT is the use of multiple factors, rather than a single market index, to explain the risk-return relationship. However, APT does not identify the specific factors.31. In terms of the risk/return relationshipA) only factor risk commands a risk premium in market equilibrium.B) only systematic risk is related to expected returns.C) only nonsystematic risk is related to expected returns.D) A and B.E) A and C.Answer: D Difficulty: EasyRationale: Nonfactor risk may be diversified away; thus, only factor risk commands a risk premium in market equilibrium. Nonsystematic risk across firms cancels out inwell-diversified portfolios; thus, only systematic risk is related to expected returns.Return32. The following factors might affect stock returns:A) the business cycle.B) interest rate fluctuations.C) inflation rates.D) all of the above.E) none of the above.Answer: D Difficulty: EasyRationale: A, B, and C all are likely to affect stock returns.33. Advantage(s) of the APT is(are)A) that the model provides specific guidance concerning the determination of the riskpremiums on the factor portfolios.B) that the model does not require a specific benchmark market portfolio.C) that risk need not be considered.D) A and B.E) B and C.Answer: B Difficulty: EasyRationale: The APT provides no guidance concerning the determination of the riskpremiums on the factor portfolios. Risk must considered in both the CAPM and APT.A major advantage of APT over the CAPM is that a specific benchmark marketportfolio is not required.34. Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B hasexpected return of 12% and standard deviation of 17%. Rational investors willA) Borrow at the risk free rate and buy A.B) Sell A short and buy B.C) Sell B short and buy A.D) Borrow at the risk free rate and buy B.E) Lend at the risk free rate and buy B.Answer: B Difficulty: EasyRationale: Rational investors will arbitrage by selling A and buying B.Return35. An important difference between CAPM and APT isA) CAPM depends on risk-return dominance; APT depends on a no arbitragecondition.B) CAPM assumes many small changes are required to bring the market back toequilibrium; APT assumes a few large changes are required to bring the marketback to equilibrium.C) implications for prices derived from CAPM arguments are stronger than pricesderived from APT arguments.D) all of the above are true.E) both A and B are true.Answer: E Difficulty: DifficultRationale: Under the risk-return dominance argument of CAPM, when an equilibrium price is violated many investors will make small portfolio changes, depending on their risk tolerance, until equilibrium is restored. Under the no-arbitrage argument of APT, each investor will take as large a position as possible so only a few investors must act to restore equilibrium. Implications derived from APT are much stronger than thosederived from CAPM, making C an incorrect statement.36. A professional who searches for mispriced securities in specific areas such asmerger-target stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged inA) pure arbitrage.B) risk arbitrage.C) option arbitrage.D) equilibrium arbitrage.E) none of the above.Answer: B Difficulty: ModerateReturn37. In the context of the Arbitrage Pricing Theory, as a well-diversified portfolio becomeslarger its nonsystematic risk approachesA) one.B) infinity.C) zero.D) negative one.E) none of the above.Answer: C Difficulty: EasyRationale: As the number of securities, n, increases, the nonsystematic risk of awell-diversified portfolio approaches zero.38. A well-diversified portfolio is defined asA) one that is diversified over a large enough number of securities that thenonsystematic variance is essentially zero.B) one that contains securities from at least three different industry sectors.C) a portfolio whose factor beta equals 1.0.D) a portfolio that is equally weighted.E) all of the above.Answer: A Difficulty: ModerateRationale: A well-diversified portfolio is one that contains a large number of securities, each having a small (but not necessarily equal) weight, so that nonsystematic variance is negligible.39. The APT requires a benchmark portfolioA) that is equal to the true market portfolio.B) that contains all securities in proportion to their market values.C) that need not be well-diversified.D) that is well-diversified and lies on the SML.E) that is unobservable.Answer: D Difficulty: ModerateRationale: Any well-diversified portfolio lying on the SML can serve as the benchmark portfolio for the APT. The true (and unobservable) market portfolio is only arequirement for the CAPM.Return40. Imposing the no-arbitrage condition on a single-factor security market implies which ofthe following statements?I)the expected return-beta relationship is maintained for all but a small number ofII)the expected return-beta relationship is maintained for all well-diversified portfolios.III)the expected return-beta relationship is maintained for all but a small number of individual securities.IV)the expected return-beta relationship is maintained for all individual securities.A) I and III are correct.B) I and IV are correct.C) II and III are correct.D) II and IV are correct.E) Only I is correct.Answer: C Difficulty: ModerateRationale: The expected return-beta relationship must hold for all well-diversifiedportfolios and for all but a few individual securities; otherwise arbitrage opportunities will be available.41. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is6%, the risk premium on the first factor portfolio is 4% and the risk premium on thesecond factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return?A) 7.0%B) 8.0%C) 9.2%D) 13.0%E) 13.2%Answer: E Difficulty: ModerateRationale: .06 + 1.2 (.04) + .8 (.03) = .132Return42. The term “arbitrage” refers toA) buying low and selling high.B) short selling high and buying low.C) earning risk-free economic profits.D) negotiating for favorable brokerage fees.E) hedging your portfolio through the use of options.Answer: C Difficulty: EasyRationale: Arbitrage is exploiting security mispricings by the simultaneous purchase and sale to gain economic profits without taking any risk. A capital market inequilibrium rules out arbitrage opportunities.43. To take advantage of an arbitrage opportunity, an investor wouldI)construct a zero investment portfolio that will yield a sure profit.III)make simultaneous trades in two markets without any net investment.IV)short sell the asset in the low-priced market and buy it in the high-priced market.A) I and IVB) I and IIIC) II and IIID) I, III, and IVE) II, III, and IVAnswer: B Difficulty: DifficultRationale: Only I and III are correct. II is incorrect because the beta of the portfoliodoes not need to be zero. IV is incorrect because the opposite is true.44. The factor F in the APT model representsA) firm-specific risk.B) the sensitivity of the firm to that factor.C) a factor that affects all security returns.D) the deviation from its expected value of a factor that affects all security returns.E) a random amount of return attributable to firm events.Answer: D Difficulty: ModerateRationale: F measures the unanticipated portion of a factor that is common to all security returns.Return45. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of ó(e i ) equal to 25% and 50 securities?A) 12.5%B) 625%C) 0.5%D) 3.54%E) 14.59%Answer: D Difficulty: ModerateRationale: ()%54.35.12)(,5.1225501)(1)(222=====p i p e e n e σσ46. Which of the following is true about the security market line (SML) derived from the APT?A) The SML has a downward slope.B) The SML for the APT shows expected return in relation to portfolio standardC) The SML for the APT has an intercept equal to the expected return on the marketportfolio.D) The benchmark portfolio for the SML may be any well-diversified portfolio. E) The SML is not relevant for the APT. Answer: D Difficulty: ModerateRationale: The benchmark portfolio does not need to be the (unobservable) marketportfolio under the APT, but can be any well-diversified portfolio. The intercept still equals the risk-free rate.47. If arbitrage opportunities are to be ruled out, each well-diversified portfolio's expectedexcess return must beA) inversely proportional to the risk-free rate.B) inversely proportional to its standard deviation.C) proportional to its weight in the market portfolio.D) proportional to its standard deviation.E) proportional to its beta coefficient.Answer: E Difficulty: ModerateRationale: For each well-diversified portfolio (P and Q, for example), it must be true that [E(r p )-r f ]/βp = [E(r Q )-r f ]/ βQ. Return48. Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. Theportfolios have expected returns of 15% and 6%, respectively. Based on thisinformation, what would be the expected return on well-diversified portfolio A, if A hasa beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%.A) 15.2%B) 14.1%C) 13.3%D) 10.7%E) 8.4%Answer: B Difficulty: ModerateRationale: E(R A) = 3 +0.8*(15-3) + 0.5*(6-3) = 14.1.49. Which of the following is (are) true regarding the APT?I)The Security Market Line does not apply to the APT.II)More than one factor can be important in determining returns.III)Almost all individual securities satisfy the APT relationship.IV)It doesn't rely on the market portfolio that contains all assets.A) II, III, and IVB) II and IVD) I, II, and IVE) I, II, III, and IVAnswer: A Difficulty: ModerateRationale: All except the first item are true. There is a Security Market Line associated with the APT.50. In a factor model, the return on a stock in a particular period will be related toA) factor risk.B) non-factor risk.C) standard deviation of returns.D) both A and B are true.E) none of the above is true.Answer: D Difficulty: ModerateRationale: Factor models explain firm returns based on both factor risk and non-factor risk.Return51. Which of the following factors did Chen, Roll and Ross not include in their multifactor model?A) Change in industrial productionB) Change in expected inflationC) Change in unanticipated inflationD) Excess return of long-term government bonds over T-billsE) All of the above factors were included in their model.Answer: E Difficulty: ModerateRationale: Chen, Roll and Ross included the four listed factors as well as the excessreturn of long-term corporate bonds over long-term government bonds in their model.52. Which of the following factors were used by Fama and French in their multi-factormodel?A) Return on the market indexB) Excess return of small stocks over large stocks.C) Excess return of high book-to-market stocks over low book-to-market stocks.D) All of the above factors were included in their model.E) None of the above factors was included in their model.Answer: D Difficulty: ModerateRationale: Fama and French included all three of the factors listed.53. Which of the following factors did Merton not suggest as a likely source of uncertaintythat might affect security returns?B) prices of important consumption goods.C) book-to-market ratios.D) changes in future investment opportunities.E) All of the above are sources of uncertainty affecting security returns. Answer: C Difficulty: ModerateRationale: Merton did not suggest book-to-market ratios as an ICAPM pricing factor; the other three were suggested.。

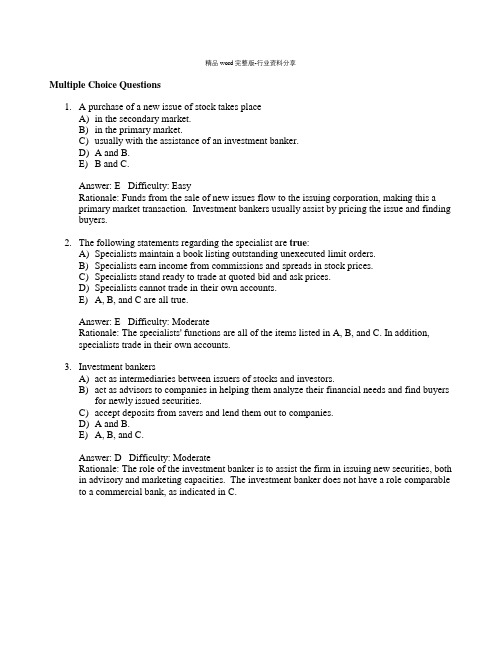

(完整版)投资学第7版TestBank答案11

Multiple Choice Questions1.If you believe in the ________ form of the EMH, you believe that stock prices reflectall relevant information including historical stock prices and current public informationabout the firm, but not information that is available only to insiders.A)semistrongB)strongC)weakD)A, B, and CE)none of the aboveAnswer: A Difficulty: EasyRationale: The semistrong form of EMH maintains that stock prices immediatelyreflect all historical and current public information, but not inside information.2.Proponents of the EMH typically advocateA)an active trading strategy.B)investing in an index fund.C) a passive investment strategy.D) A and BE) B and CAnswer: E Difficulty: EasyRationale: Believers of market efficiency advocate passive investment strategies, andan investment in an index fund is one of the most practical passive investment strategies, especially for small investors.3.If you believe in the _______ form of the EMH, you believe that stock prices reflect allinformation that can be derived by examining market trading data such as the historyof past stock prices, trading volume or short interest.A)semistrongB)strongC)weakD)all of the aboveE)none of the aboveAnswer: C Difficulty: EasyRationale: The information described above is market data, which is the data set forthe weak form of market efficiency. The semistrong form includes the above plus allother public information. The strong form includes all public and private information.4.If you believe in the _________ form of the EMH, you believe that stock prices reflectall available information, including information that is available only to insiders.A)semistrongB)strongC)weakD)all of the aboveE)none of the aboveAnswer: B Difficulty: EasyRationale: The strong form includes all public and private information.5.If you believe in the reversal effect, you shouldA)buy bonds in this period if you held stocks in the last period.B)buy stocks in this period if you held bonds in the last period.C)buy stocks this period that performed poorly last period.D)go short.E) C and DAnswer: C Difficulty: EasyRationale: The reversal effect states that stocks that do well in one period tend to perform poorly in the subsequent period, and vice versa.6.__________ focus more on past price movements of a firm's stock than on theunderlying determinants of future profitability.A)Credit analystsB)Fundamental analystsC)Systems analystsD)Technical analystsE)All of the aboveAnswer: D Difficulty: EasyRationale: Technicians attempt to predict future stock prices based on historical stock prices.7._________ above which it is difficult for the market to rise.A)Book value is a valueB)Resistance level is a valueC)Support level is a valueD) A and BE) A and CAnswer: B Difficulty: EasyRationale: When stock prices have remained stable for a long period, these prices are termed resistance levels; technicians believe it is difficult for the stock prices to penetrate these resistance levels.8.___________ the return on a stock beyond what would be predicted frommarket movements alone.A)An excess economic return isB)An economic return isC)An abnormal return isD) A and BE) A and CAnswer: E Difficulty: EasyRationale: An economic return is the expected return, based on the perceived level of risk and market factors. When returns exceed these levels, the returns are called abnormal or excess economic returns.9.The debate over whether markets are efficient will probably never be resolvedbecause of ________.A)the lucky event issue.B)the magnitude issue.C)the selection bias issue.D)all of the above.E)none of the above.Answer: D Difficulty: EasyRationale: Factors A, B, and C all exist make rigid testing of market efficiencydifficult or impossible.10. A common strategy for passive management is ____________.A)creating an index fundB)creating a small firm fundC)creating an investment clubD) A and CE) B and CAnswer: A Difficulty: EasyRationale: The index fund is, by definition, passively managed. The other investment alternatives may or may not be managed passively.11.Arbel (1985) found thatA)the January effect was highest for neglected firms.B)the book-to-market value ratio effect was highest in JanuaryC)the liquidity effect was highest for small firms.D)the neglected firm effect was independent of the small firm effect.E)small firms had higher book-to-market value ratios.Answer: A Difficulty: ModerateRationale: Arbel divided firms into highly researched, moderately researched,and neglected groups based on the number of institutions holding the stock.12.Researchers have found that most of the small firm effect occursA)during the spring months.B)during the summer months.C)in December.D)in January.E)randomly.Answer: D Difficulty: ModerateRationale: Much of the so-called small firm effect simply may be the tax-effect as investors sell stocks on which they have losses in December and reinvest the funds in January. As small firms are especially volatile, these actions affect small firms in a more dramatic fashion.13.Malkiel (1995) calculated that the average alphas, or abnormal returns, on alarge sample of mutual funds between 1972 and 1991 wereA)significantly positive.B)significantly negative.C)statistically indistinguishable from zero.D)positive before 1981 and negative thereafter.E)negative before 1981 and positive thereafter.Answer: C Difficulty: ModerateRationale: Malkiel's study suggests that fund managers do not beat the market on a risk-adjusted basis.14.Basu (1977, 1983) found that firms with low P/E ratiosA)earned higher average returns than firms with high P/E ratios.B)earned the same average returns as firms with high P/E ratios.C)earned lower average returns than firms with high P/E ratios.D)had higher dividend yields than firms with high P/E ratios.E)none of the above.Answer: A Difficulty: ModerateRationale: Firms with high P/E ratios already have an inflated price relative toearnings and thus tend to have lower returns than low P/E ratio stocks. However, the P/E ratio may capture risk not fully impounded in market betas so this may represent an appropriate risk adjustment rather than a market anomaly.15.Jaffe (1974) found that stock prices _________ after insiders intensively bought shares.A)decreasedB)did not changeC)increasedD)became extremely volatileE)became much less volatileAnswer: C Difficulty: ModerateRationale: Insider trading may signal private information.16.Banz (1981) found that, on average, the risk-adjusted returns of small firmsA)were higher than the risk-adjusted returns of large firms.B)were the same as the risk-adjusted returns of large firms.C)were lower than the risk-adjusted returns of large firms.D)were unrelated to the risk-adjusted returns of large firms.E)were negative.Answer: A Difficulty: ModerateRationale: Banz found A to be true, although subsequent studies have attemptedto explain the small firm effect as the January effect, the neglected firm effect, etc.17.Proponents of the EMH think technical analystsA)should focus on relative strength.B)should focus on resistance levels.C)should focus on support levels.D)should focus on financial statements.E)are wasting their time.Answer: E Difficulty: ModerateRationale: Technical analysts attempt to predict future stock prices from historic stock prices; proponents of EMH believe that stock price changes are random variables.18.Studies of positive earnings surprises have shown that there isA) a positive abnormal return on the day positive earnings surprises are announced.B) a positive drift in the stock price on the days following the earningssurprise announcement.C) a negative drift in the stock price on the days following the earningssurprise announcement.D)both A and B are true.E)both A and C are true.Answer: D Difficulty: ModerateRationale: The market appears to adjust to earnings information gradually, resulting ina sustained period of abnormal returns.19.On November 22, 2005 the stock price of Walmart was $39.50 and the retailer stockindex was 600.30. On November 25, 2005 the stock price of Walmart was $40.25 and the retailer stock index was 605.20. Consider the ratio of Walmart to the retailer index on November 22 and November 25. Walmart is _______ the retail industry andtechnical analysts who follow relative strength would advise _______ the stock.A)outperforming, buyingB)outperforming, sellingC)underperforming, buyingD)underperforming, sellingE)equally performing, neither buying nor sellingAnswer: A Difficulty: ModerateRationale: 11/22: $39.50/600.30 = 0.0658; 11/25: $40.25/605.20 = 0.0665; Thus,K-Mart's relative strength is improving and technicians using this technique wouldrecommend buying.20.Work by Amihud and Mendelson (1986,1991)A)argues that investors will demand a rate of return premium to invest in lessliquid stocks.B)may help explain the small firm effect.C)may be related to the neglected firm effect.D) B and C.E)A, B, and C.Answer: E Difficulty: ModerateRationale: Lack of liquidity may affect the returns of small and neglected firms;however the theory does not explain why the abnormal returns are concentratedin January.21.Fama and French (1992) found that the stocks of firms within the highest decile ofmarket/book ratios had average monthly returns of _______ while the stocks offirms within the lowest decile of market/book ratios had average monthly returnsof________.A)greater than 1%, greater than 1%B)greater than 1%, less than 1%C)less than 1%, greater than 1%D)less than 1%, less than 1%E)less than 0.5%, greater than 0.5%Answer: C Difficulty: ModerateRationale: This finding suggests either that low market-to-book ratio firms arerelatively underpriced, or that the market-to-book ratio is serving as a proxy for arisk factor that affects expected equilibrium returns.22. A market decline of 23% on a day when there is no significant macroeconomic event______ consistent with the EMH because ________.A)would be, it was a clear response to macroeconomic news.B)would be, it was not a clear response to macroeconomic news.C)would not be, it was a clear response to macroeconomic news.D)would not be, it was not a clear response to macroeconomic news.E)none of the above.Answer: D Difficulty: ModerateRationale: This happened on October 19, 1987. Although this specific event is not mentioned in this edition of the book, it is an example of something that would be considered a violation of the EMH.23.In an efficient market, __________.A)security prices react quickly to new informationB)security prices are seldom far above or below their justified levelsC)security analysts will not enable investors to realize superior returns consistentlyD)one cannot make moneyE)A, B, and CAnswer: E Difficulty: EasyRationale: A, B, and C are true; however, even in an efficient market one should be able to earn the appropriate risk-adjusted rate of return.24.The weak form of the efficient market hypothesis asserts thatA)stock prices do not rapidly adjust to new information contained in past prices orpast data.B)future changes in stock prices cannot be predicted from past prices.C)technicians cannot expect to outperform the market.D) A and BE) B and CAnswer: E Difficulty: EasyRationale: Stock prices do adjust rapidly to new information.25. A support level is the price range at which a technical analyst would expect theA)supply of a stock to increase dramatically.B)supply of a stock to decrease substantially.C)demand for a stock to increase substantially.D)demand for a stock to decrease substantially.E)price of a stock to fall.Answer: C Difficulty: EasyRationale: A support level is considered to be a level below that the price of the stock is unlikely to fall and is believed to be determined by market psychology.26. A finding that _________ would provide evidence against the semistrong form ofthe efficient market theory.A)low P/E stocks tend to have positive abnormal returnsB)trend analysis is worthless in determining stock pricesC)one can consistently outperform the market by adopting the contrarianapproach exemplified by the reversals phenomenonD) A and BE) A and CAnswer: E Difficulty: ModerateRationale: Both A and C are inconsistent with the semistrong form of the EMH.27.The weak form of the efficient market hypothesis contradictsA)technical analysis, but supports fundamental analysis as valid.B)fundamental analysis, but supports technical analysis as valid.C)both fundamental analysis and technical analysis.D)technical analysis, but is silent on the possibility of successfulfundamental analysis.E)none of the above.Answer: D Difficulty: ModerateRationale: The process of fundamental analysis makes the market more efficient, and thus the work of the fundamentalist more difficult. The data set for the weak form of the EMH is market data, which is the only data used exclusively by technicians.Fundamentalists use all public information.28.Two basic assumptions of technical analysis are that security prices adjustA)rapidly to new information and market prices are determined by the interactionof supply and demand.B)rapidly to new information and liquidity is provided by security dealers.C)gradually to new information and market prices are determined by the interactionof supply and demand.D)gradually to new information and liquidity is provided by security dealers.E)rapidly to information and to the actions of insiders.Answer: C Difficulty: ModerateRationale: Technicians follow market data--price changes and volume of trading (asindicator of supply and demand) believing that they can identify price trends assecurity prices adjust gradually.29.Cumulative abnormal returns (CAR)A)are used in event studies.B)are better measures of security returns due to firm-specific events than areabnormal returns (AR).C)are cumulated over the period prior to the firm-specific event.D) A and B.E) A and C.Answer: D Difficulty: ModerateRationale: As leakage of information occurs, the accumulated abnormal returns that are abnormal returns summed over the period of interest (around the event date) are better measures of the effect of firm-specific events.30.Studies of mutual fund performanceA)indicate that one should not randomly select a mutual fund.B)indicate that historical performance is not necessarily indicative offuture performance.C)indicate that the professional management of the fund insures above market returns.D) A and B.E) B and C.Answer: D Difficulty: EasyRationale: Studies show that all funds do not outperform the market and thathistorical performance is not necessarily an indicator of future performance.31.The likelihood of an investment newsletter's successfully predicting the direction of themarket for three consecutive years by chance should beA)between 50% and 70%.B)between 25% and 50%.C)between 10% and 25%.D)less than 10%.E)greater than 70%.Answer: C Difficulty: ModerateRationale: The probability of successful prediction for 3 consecutive years is 23,or 12.5%.32.In an efficient market the correlation coefficient between stock returns fortwo non-overlapping time periods should beA)positive and large.B)positive and small.C)zero.D)negative and small.E)negative and large.Answer: C Difficulty: ModerateRationale: In an efficient market there should be no serial correlation betweenreturns from non-overlapping periods.33.The weather report says that a devastating and unexpected freeze is expected to hitFlorida tonight, during the peak of the citrus harvest. In an efficient market one would expect the price of Florida Orange's stock toA)drop immediately.B)remain unchanged.C)increase immediately.D)gradually decline for the next several weeks.E)gradually increase for the next several weeks.Answer: A Difficulty: ModerateRationale: In an efficient market the price of the stock should drop immediatelywhen the bad news is announced. If later news changes the perceived impact toFlorida Orange, the price may once again adjust quickly to the new information. Agradual change is a violation of the EMH.34. Matthews Corporation has a beta of 1.2. The annualized market return yesterday was13%, and the risk-free rate is currently 5%. You observe that Matthews had anannualized return yesterday of 17%. Assuming that markets are efficient, this suggests thatA) bad news about Matthews was announced yesterday.B) good news about Matthews was announced yesterday.C) no news about Matthews was announced yesterday.D) interest rates rose yesterday.E) interest rates fell yesterday.Answer: B Difficulty: ModerateRationale: AR = 17% - (5% + 1.2 (8%)) = +2.4%. A positive abnormal return suggests that there was firm-specific good news.th 35. Nicholas Manufacturing just announced yesterday that its 4 quarter earnings will be 10% higher than last year's 4th quarter. You observe that Nicholas had anabnormal return of -1.2% yesterday. This suggests thatA) the market is not efficient.B) Nicholas' stock will probably rise in value tomorrow.C) investors expected the earnings increase to be larger than what was actuallyannounced.D) investors expected the earnings increase to be smaller than what was actuallyannounced.E) earnings are expected to decrease next quarter.Answer: C Difficulty: ModerateRationale: Anticipated earnings changes are impounded into a security's price as soon as expectations are formed. Therefore a negative market response indicates that the earnings surprise was negative, that is, the increase was less than anticipated.36.When Maurice Kendall first examined stock price patterns in 1953, he found thatA)certain patterns tended to repeat within the business cycle.B)there were no predictable patterns in stock prices.C)stocks whose prices had increased consistently for one week tended to have anet decrease the following week.D)stocks whose prices had increased consistently for one week tended to have anet increase the following week.E)the direction of change in stock prices was unpredictable, but the amount ofchange followed a distinct pattern.Answer: B Difficulty: EasyRationale: The first studies in this area were made possible by the development of computer technology. Kendall's study was the first to indicate that marketswere efficient.37.If stock prices follow a random walkA)it implies that investors are irrational.B)it means that the market cannot be efficient.C)price levels are not random.D)price changes are random.E)price movements are predictable.Answer: D Difficulty: EasyRationale: A random walk means that the changes in prices are randomand independent.38.The main difference between the three forms of market efficiency is thatA)the definition of efficiency differs.B)the definition of excess return differs.C)the definition of prices differs.D)the definition of information differs.E)they were discovered by different people.Answer: D Difficulty: ModerateRationale: The main difference is that weak form encompasses historical data,semistrong form encompasses historical data and current public information, and strong form encompasses historical data, current public information, and inside information. All of the other definitions remain the same.39.Chartists practiceA)technical analysis.B)fundamental analysis.C)regression analysis.D)insider analysis.E)psychoanalysis.Answer: A Difficulty: EasyRationale: Chartist is another name for a technical analyst.40.Which of the following are used by fundamental analysts to determine properstock prices?I)trendlinesII)earningsIII)dividend prospectsIV) expectations of future interest ratesV)resistance levelsA)I, IV, and VB)I, II, and IIIC)II, III, and IVD)II, IV, and VE)All of the items are used by fundamental analysts.Answer: C Difficulty: ModerateRationale: Analysts look at fundamental factors such as earnings, dividend prospects, expectation of future interest rates, and risk of the firm. The information is used todetermine the present value of future cash flows to stockholders. Technical analysts use trendlines and resistance levels.41.According to proponents of the efficient market hypothesis, the best strategy for asmall investor with a portfolio worth $40,000 is probably toA)perform fundamental analysis.B)exploit market anomalies.C)invest in Treasury securities.D)invest in derivative securities.E)invest in mutual funds.Answer: E Difficulty: ModerateRationale: Individual investors tend to have relatively small portfolios and are usually unable to realize economies of size. The best strategy is to pool funds with other small investors and allow professional managers to invest the funds.42.Which of the following are investment superstars who have consistently shownsuperior performance?I)Warren BuffetII)Phoebe BuffetIII)Peter LynchIV) Merrill LynchV)Jimmy BuffetA)I, III, and IVB)II, III, and IVC)I and IIID)III and IVE)I, III, IV, and VAnswer: C Difficulty: ModerateRationale: Warren Buffet manages Berkshire Hathaway and Peter Lynch managed Fidelity's Magellan Fund. Phoebe Buffet is a character on NBC's and Jimmy Buffet is Away in Margaritaville. Merrill Lynch isn't a person.43.Google has a beta of 1.0. The annualized market return yesterday was 11%, and therisk-free rate is currently 5%. You observe that Google had an annualized returnyesterday of 14%. Assuming that markets are efficient, this suggests thatA)bad news about Google was announced yesterday.B)good news about Google was announced yesterday.C)no news about Google was announced yesterday.D)interest rates rose yesterday.E)interest rates fell yesterday.Answer: B Difficulty: ModerateRationale: AR = 14% - (5% + 1.0 (6%)) = +3.0%. A positive abnormal return suggests that there was firm-specific good news.44.Music Doctors has a beta of 2.25. The annualized market return yesterday was 12%,and the risk-free rate is currently 4%. You observe that Music Doctors had anannualized return yesterday of 15%. Assuming that markets are efficient, this suggests thatA)bad news about Music Doctors was announced yesterday.B)good news about Music Doctors was announced yesterday.C)no news about Music Doctors was announced yesterday.D)interest rates rose yesterday.E)interest rates fell yesterday.Answer: A Difficulty: ModerateRationale: AR = 15% - (4% + 2.25 (8%)) = -7.0%. A negative abnormal return suggests that there was firm-specific bad news.45.QQAG has a beta of 1.7. The annualized market return yesterday was 13%, and therisk-free rate is currently 3%. You observe that QQAG had an annualized returnyesterday of 20%. Assuming that markets are efficient, this suggests thatA)bad news about QQAG was announced yesterday.B)good news about QQAG was announced yesterday.C)no significant news about QQAG was announced yesterday.D)interest rates rose yesterday.E)interest rates fell yesterday.Answer: C Difficulty: ModerateRationale: AR = 20% - (3% + 1.7 (10%)) = 0.0%. A positive abnormal return suggests that there was firm-specific good news and a negative abnormal return suggests that there was firm-specific bad news.46.QQAG just announced yesterday that its th4 quarter earnings will be 35% higherthan last year's 4thquarter. You observe that QQAG had an abnormal return of -1.7% yesterday. This suggests thatA)the market is not efficient.B)QQAG stock will probably rise in value tomorrow.C)investors expected the earnings increase to be larger than what wasactually announced.D)investors expected the earnings increase to be smaller than what wasactually announced.E)earnings are expected to decrease next quarter.Answer: C Difficulty: ModerateRationale: Anticipated earnings changes are impounded into a security's price as soon as expectations are formed. Therefore a negative market response indicates that the earnings surprise was negative, that is, the increase was less than anticipated.47.LJP Corporation just announced yesterday that it would undertake an international jointventure. You observe that LJP had an abnormal return of 3% yesterday. This suggests thatA)the market is not efficient.B)LJP stock will probably rise in value again tomorrow.C)investors view the international joint venture as bad news.D)investors view the international joint venture as good news.E)earnings are expected to decrease next quarter.Answer: D Difficulty: Moderate48.Music Doctors just announced yesterday that its st1 quarter sales were 35% higherthan last year's 1stquarter. You observe that Music Doctors had an abnormal returnof -2% yesterday. This suggests thatA)the market is not efficient.B)Music Doctors stock will probably rise in value tomorrow.C)investors expected the sales increase to be larger than what was actually announced.D)investors expected the sales increase to be smaller than what wasactually announced.E)earnings are expected to decrease next quarter.Answer: C Difficulty: Moderate49.The Food and Drug Administration (FDA) just announced yesterday that they wouldapprove a new cancer-fighting drug from King. You observe that King had an abnormal return of 0% yesterday. This suggests thatA)the market is not efficient.B)King stock will probably rise in value tomorrow.C)King stock will probably fall in value tomorrow.D)the approval was already anticipated by the marketE)none of the above.Answer: D Difficulty: Moderate50.Your professor finds a stock-trading rule that generates excess risk-adjusted returns.Instead of publishing the results, she keeps the trading rule to herself. This is mostclosely associated with ________.A)regret avoidanceB)selection biasC)framingD)insider tradingE)none of the aboveAnswer: B Difficulty: Moderate51.At freshman orientation, 1,500 students are asked to flip a coin 20 times. One student iscrowned the winner (tossed 20 heads). This is most closely associated with ________.A)regret avoidanceB)selection biasC)overconfidenceD)the lucky event issueE)none of the aboveAnswer: D Difficulty: Moderate52.Sehun (1986) finds that the practice of monitoring insider trade disclosures, andtrading on that information, would be ________.A)extremely profitable for long-term tradersB)extremely profitable for short-term tradersC)marginally profitable for long-term tradersD)marginally profitable for short-term tradersE)not sufficiently profitable to cover trading costsAnswer: E53.If you believe in the reversal effect, you shouldA)sell bonds in this period if you held stocks in the last period.B)sell stocks in this period if you held bonds in the last period.C)sell stocks this period that performed well last period.D)go long.E) C and DAnswer: C Difficulty: EasyRationale: The reversal effect states that stocks that do well in one period tendto perform poorly in the subsequent period, and vice versa.。

(完整word版)投资学第7版Test Bank答案06