国际经济学课后题答案doc

国际经济学课后练习题答案

增加所导致的,对该国贸易品需求的增加会使该国贸 易品价格上涨,导致实际价格总水平上升,实际汇率 升值。另外,贸易品部门劳动生产率的提高会导致实 际汇率升值,而这个实际汇率的升值对出口部门是有 利的。

•4/11/2020

课后练习题第3题

·当非贸易品的价格相对于贸易品价格上升时,非

•4/11/2020

·E. 没有发生市场交易,无需记入经常项目或金融

项目。

· F. 这种离岸交易不会记入美国的国际收支账户。

•4/11/2020

课后练习题第4题

·电话录音机的购买对于纽约州应记入经常项目的

借方(进口了产品),对于新泽西州而言,要记 入经常项目的贷方(出口了产品)。

·那当么新记泽入西纽公约司州将金所融得项的目支的票贷存方入(纽资约本州流的入银)行,时,

另一部分是收益,则是伦敦银行对这笔存款支付的10% 的利息。

因此,在伦敦银行存款的年收益率是-8%+10%=2%

•4/11/2020

第5题

· a. 实际收益率=25%-10%=15% · b. 实际收益率=20%-10%=10% · c. 实际收益率=2%-10%=-8%

•4/11/2020

第6题

际货币需求量的减少,价格水平同比例上升,导 致实际货币供应量减少,从M/P1到M/P2,利率恢 复到实际货币需求量减少到以前的水平。同时, 持续的货币需求减少会使外汇市场有本币贬值的 预期,导致了外国资产的本币收益率提高。汇率 从E1到E2,到E4.

•4/11/2020

•4/11/2020

Chapter 14 第2题

贸易品支出的增加会导致实际汇率升值。

·外国转向对本国出口产品的需求,会导致对本国

国际经济学习题答案(国际金融)共18页word资料

国际经济学习题答案(国际金融)共18页word资料国际经济学习题答案国际金融部分1.不同意,至少从一般意义上来讲是如此。

经常项目盈余的含义之一是,国家的商品与服务出口大于进口。

人们可能会认为这是不好的——国家正在为出口而生产商品和提供服务,与此同时,国家却没有得到使其能够进行更多消费和国内投资的进口商品和服务。

从这一角度讲,拥有经常项目赤字却会是一件好事情——更多的进口可以使国家的国内消费和投资量超过其当前生产量。

经常项目盈余的另一个含义是,国家在进行外国金融投资——它正在建立对外国人的债权,这会增加国家的财富。

这听起来很好,但正如前面所指出的,它是以放弃当前国内消费为代价的。

经常项目赤字意味着国家对外国人债权的减少或对外国人债务的增加。

这听起来很不好,但它意味着更高水平的当前国内支出这一福利。

不同的国家在不同的时期,对这些代价和收益会有不同的重视程度。

因此,我们不能简单地认为经常项目盈余是否优于经常项目赤字。

2.交易c会导致经常项目的盈余,因为这是商品出口,该出口得到的支(交易a不会使经常项目账户发生变动,付体现于资本账户的某个项目。

因为它既是出口又是进口。

交易b导致经常项目的赤字,因为它属于进口。

交易d也会导致经常项目的赤字,因为它属于单方转移形式的流出。

交易e不对经常项目账户中的任何项目发生影响。

)3. a.商品贸易余额:330-198=132(美元)商品和服务余额:330-198+196-204=124(美元)经常项目余额:330-198+196-204+3-8=119(美元)官方结算余额:330-198+196-204+3-8+102-202+4=23(美元)b.官方储备资产变化(净值)=-官方结算余额=-23(美元)。

该国在增加其官方储备资产的净持有量。

4. a.国际投资头寸(10亿):30+20+15—40—25=0(美元)。

该国既不是国际债权国,也不是国际债务国。

它持有的国外资产等于它对外国人的负债。

国际经济学课后题答案.doc1

第3章课后题答案、1、商品的相对要素强度:不同商品的资本/劳动比率的不同,通过比较可判断该商品是资本密集型商品还是劳动力密集型商品。

国家的相对要素丰裕:要素丰裕度是指一国要素拥有的相对状况。

贸易的商品构成:即使技术水平相同,生产要素禀赋不同也可以产生贸易。

一国终将出口密集的使用其相对丰裕(便宜的生产要素)生产的商品,进口那些密集使用其相对稀缺(昂贵的要素)生产的商品。

商品流动和要素流动的相互替代:如果加拿大或者欧洲国家对美国的资本密集型商品设立保护性贸易壁垒,那么,美国企业就可以向这些国家进行投资,建立工厂,在这些国家之内进行生产,绕过贸易壁垒。

(P37)里昂剔夫悖论是否证实了这种解释?如果不是,那又是什么?里昂惕夫利用计算结果表明得出了与要素禀赋理论完全相悖的结论。

人力资本说、贸易壁垒说、自然资源稀缺说、需求逆转说可以解释这种现象。

2、要素比例理论不是产业内贸易的一个良好的解释。

规模经济理论可以更好的解释。

6、区别产业间贸易与产业内贸易,并分别举例。

请提供有关产业间贸易和产业内贸易的解释。

•产业间贸易:是国家之间完全不同商品的贸易,可以用要素禀赋理论来解释。

•产业内贸易:是国家之间高度相似的商品的贸易,可以用规模经济来解释。

例子:略7、根据垄断竞争和规模经济理论,产业内贸易的利益包括:•对于生产者:规模经济效应,降低了每个种类商品的生产成本•对于消费者:更低的价格和更多的商品种类•生产要素所有者:所有的生产要素都从贸易中获得利益。

第4章课后题答案2:有效保护率是指关税使被保护行业每单位产出的附加值提高的百分率。

a.对最终商品的有效保护率取决于⏹最终产品的名义税率和投入品的名义税率。

⏹取决于商品国内附加值占商品价格的比例。

为了保护本国的出口企业,提高有效保护率,对进口原材料免税或者低的关税。

b用有效保护率的分析方法解释下列政策问题:发展中国家的生产深化:第一阶段,发展中国家实行保护性的高关税,并对投入品进口免征关税,进而开始建立起总装配厂。

国际经济学课后习题答案(精编文档).doc

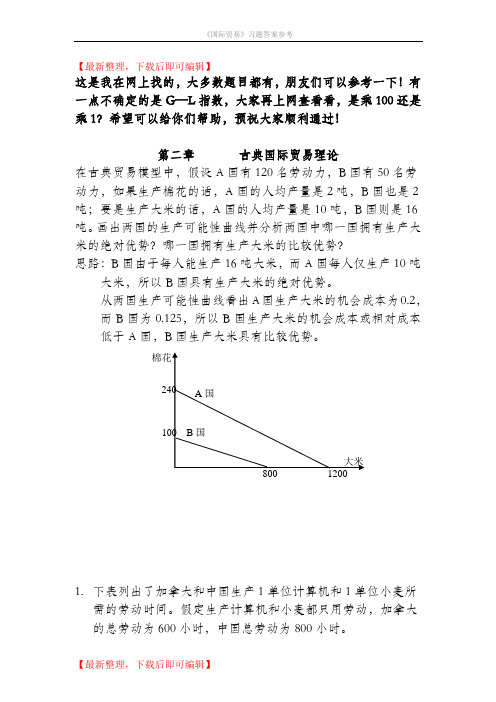

【最新整理,下载后即可编辑】这是我在网上找的,大多数题目都有,朋友们可以参考一下!有一点不确定的是G—L指数,大家再上网查看看,是乘100还是乘1?希望可以给你们帮助,预祝大家顺利通过!第二章古典国际贸易理论在古典贸易模型中,假设A国有120名劳动力,B国有50名劳动力,如果生产棉花的话,A国的人均产量是2吨,B国也是2吨;要是生产大米的话,A国的人均产量是10吨,B国则是16吨。

画出两国的生产可能性曲线并分析两国中哪一国拥有生产大米的绝对优势?哪一国拥有生产大米的比较优势?思路:B国由于每人能生产16吨大米,而A国每人仅生产10吨大米,所以B国具有生产大米的绝对优势。

从两国生产可能性曲线看出A国生产大米的机会成本为0.2,而B国为0.125,所以B国生产大米的机会成本或相对成本低于A国,B国生产大米具有比较优势。

1.下表列出了加拿大和中国生产1单位计算机和1单位小麦所需的劳动时间。

假定生产计算机和小麦都只用劳动,加拿大的总劳动为600小时,中国总劳动为800小时。

(1)计算不发生贸易时各国生产计算机的机会成本。

(2)哪个国家具有生产计算机的比较优势?哪个国家具有生产小麦的比较优势?(3)如果给定世界价格是1单位计算机交换22单位的小麦,加拿大参与贸易可以从每单位的进口中节省多少劳动时间?中国可以从每单位进口中节省多少劳动时间?如果给定世界价格是1单位计算机交换24单位的小麦,加拿大和中国分别可以从进口每单位的货物中节省多少劳动时间?(4)在自由贸易的情况下,各国应生产什么产品,数量是多少?整个世界的福利水平是提高还是降低了?试用图分析。

(以效用水平来衡量福利水平)思路:(1)中国生产计算机的机会成本为100/4=25,加拿大为60/3=20(2)因为加拿大生产计算机的机会成本比中国低,所以加拿大具有生产者计算机的比较优势,中国就具有生产小麦的比较优势。

(3)如果各国按照比较优势生产和出口,加拿大进口小麦出口计算机,中国进口计算机出口小麦。

《国际经济学(第四版)》课后复习与思考参考答案-第1章到第4章

《国际经济学(第四版)》课后复习与思考参考答案-第1章到第4章目录绪论练习与思考参考答案 (1)第一章练习与思考参考答案 (2)第二章练习与思考参考答案 (7)第三章练习与思考参考答案 (13)第四章练习与思考参考答案 (16)绪论练习与思考参考答案1.答:传统贸易理论研究产业(industry)或部门(sector)层面,假定企业同质;新新贸易理论研究企业(firm)层面,假定企业异质。

2.答:以斯蒂德曼为代表的新李嘉图主义的国际贸易理论坚持并继承了李嘉图的比较利益论,认为贸易的真正来源在于各国的比较优势的差异,而并非资源禀赋的差距。

新李嘉图主义以一种比较动态的、长期均衡的分析来解释国际贸易。

新李嘉图主义贸易理论把收入分配置于突出位置,并贯穿分析的始终。

新李嘉图主义的国际贸易理论与李嘉图理论不同主要在于:李嘉图是从各国生产的角度即从各国的生产特点不同和劳动效率的高低不同上来解释比较优势的差异;新李嘉图主义不仅从各国生产的角度来分析和比较各国的比较优势的差异,而且强调要从各国分配领域,从经济增长、经济发展的动态角度来分析和比较各国比较优势的不同。

3.答:北京师范大学李翀教授认为,马克思曾经有一个六册著作的写作计划,准备研究国内和国际经济问题,建立一个完整的经济理论体系。

然而遗憾的是,马克思没有能够完成他的研究工作。

将马克思经济学的基本理论和基本方法应用于国际经济问题的研究,构建马克思主义国际经济学理论体系,是一个很有意义的研究领城。

随着经济的全球化,国际经济体系已经成熟,建立马克思主义国际经济学的条件已经具备。

国际经济的本质是资本的跨国流动,因此,应该从商品资本、生产资本、货币资本的跨国流动三个方面来构建马克思主义国际经济学。

在商品资本的跨国流动方面,需要从国际价值、生产价格和垄断价格等基本范畴出发,来分析国际贸易的原因、流向和利益分配。

在生产资本的跨国流动方面,需要从生产资本本质的角度重新构建直接投资的原因、流向和利益分配。

国际经济学课后答案(word版)

国际经济学课后答案(word版)第三章复习题(1)本国共有1200单位的劳动,能⽣产两种产品:苹果和⾹蕉。

苹果的单位产品劳动投⼊是3,⾹蕉的单位劳动产品投⼊时2。

a.画出本国的⽣产可能性边界。

b.⽤⾹蕉衡量的苹果的机会成本是多少?c.贸易前,苹果对⾹蕉的相对价格是多少?为什么?答:a.本国的⽣产可能性边界曲线是⼀条直线,在400(1200/3)处与苹果轴相截,在600(1200/2)处与⾹蕉轴相截,如图2-7所⽰。

b.⽤⾹蕉衡量苹果的机会成本是3/2。

⽣产1单位苹果需要3单位的劳动,⽣产1单位⾹蕉需要2单位的劳动。

如果放弃1单位苹果的⽣产,这将释放出3单位的劳动。

这2单位的劳动可以被⽤来⽣产3/2单位的⾹蕉。

c.劳动的流动性可以使得各个部门的⼯资趋同,竞争可以使得商品的价格等于它们的⽣产成本。

这样,相对价格等于相对成本,⽽相对成本等于⼯资乘以苹果的单位劳动产品投⼊。

因为各个部门⼯资相等,所以价格⽐率等于单位产品劳动投⼊的⽐率,即⽣产苹果所需的3单位劳动与⽣产⾹蕉所需的2单位劳动⽐率。

(2)假设本国的情况和习题1相同。

外国拥有800单位的劳动,外国苹果的单位劳动投⼊是5,⾹蕉的单位产品劳动投⼊是1。

a.画出外国的⽣产可能性边界。

b.画出世界相对供给曲线。

答:a.外国的⽣产可能性边界曲线是⼀条直线,在160(800/5)处与苹果轴相截,在 800(800/1)处与⾹蕉轴相截。

如图2-8所⽰。

b.世界相对供给曲线可以由苹果和⾹蕉的相对价格和相对供给量绘出。

如图2-9。

从图2-9可以看出,苹果对⾹蕉的最低相对价格是3/2,在这个价格上,苹果的世界相对供给曲线是⽔平的。

在3/2的相对价格上,本国对苹果的最⼤供给量是400,外国对⾹蕉的供给量是800,这时,相对供给量为1/2。

只要相对价格保持在3/2和5之间,相对供给量就不变。

如果相对价格成为5,两个国家都会⽣产苹果,⾹蕉的产量为零。

这时,相对供给曲线是⽔平的。

international(国际经济学)课后习题及答案

international(国际经济学)课后习题及答案----------------------- Page 1-----------------------Review Questions and Condensed Answers forInternational Trade TheoriesChapter 1 World Trade and the National EconomyReview Questions::::1( What features distinguish international from domestic transactions?2( What can you say about the growth of world trade in both nominal and real terms? Was itfaster than the growth of output?3( Evaluate the statement,” the United States is a closed economy, hence foreign trade is ofno consequence to it.”4( Distinguish between export industries, import-competing industries and nontraded goods.Give examples of each.5( Using the figure in table 1-3, what can you say about the trade structure of the USA andJapan.Condensed Answers to Review Questions::::1. The text discusses ways that international transactions differfrom domestic ones.i. International trade requires that transactions be conductedbetween twocurrencies mediated by an exchange rate. Domestic transactions are conductedin a single currency.ii. Commercial policies that operate to restrict international transactions cannot, ingeneral, be imposed on domestic trade. Such policies include tariffs, quotas,voluntary export restraints, export subsidies, and exchange controls.iii. Countries pursue different domestic macroeconomic policieswhich result indivergent rates of economic growth, inflation, and unemployment.iv. More statistical data exist on the nature, volume, and value of internationaltransactions than exist in domestic trade.v. Factors of production are more mobile domestically than internationally.vi. Countries exhibit different demand patterns, sales techniques,and marketingrequirements. Many of these are due to culture and custom. Someresult fromdifferences in government regulations. Included here are health, safety,environmental, and technical rules.2. The real volume of world exports grew at an annual rate of more than 6 percent between1950 and 2000. Global output grew at an annual rate of 4 percent. Export growth inexcess of output growth reflects the increased openness to trade of many countries.3. The United States is a relatively closed economy since the share of trade in GDP issmaller than that of most other industrial nations. In 2000, U.S. exports of goods andservices were 11 percent of GDP. The U.S. economy is less dependent on the foreignsector than other major economies, but to say that foreign trade is of no consequence is anexaggeration. The U.S. economy has become increasingly open and, therefore, moreimpacted by trade developments over time. This trend is likely to continue. Curtailingimports would, for example, have a big effect on consumers' ability to buy some goods----------------------- Page 2-----------------------(e.g. tropical products) and would raise the prices of others. The absence of certain keycommodities and material inputs would greatly disrupt areas of U.S. industry.4. a. Export industries send a substantial share of their output abroad. Ratios ofexports to GDP are much higher than the average ratio for all industries. Netexporting industries are those for which exports exceed imports. U.S. netexporting industries include farm products, chemicals, certain types of machinery,and aerospace products.b. Import-competing industries are domestic industries that sharethe domesticmarket with a substantial import presence. These activities haveratios ofimports to GDP that are much higher than the average ratio for all industries.U.S. import-competing industries include fuels, automobiles,clothing, footwear,and iron and steel.c. Nontraded goods are those which, because of their nature and characteristics, arenot easily exported or imported. Examples are hair-dressing, movie theaters,meals, construction activity, and health-care.5. Table 1.3 contains figures on the trade structure of the U.S. and Japan. The U.S. is a netexporter of food, certain ores, chemicals, and other machinery and transport equipment,and is a net importer of raw materials, mining products, fuels, nonferrous metals, iron andsteel, semimanufactures, office and telecommunications equipment, automotive products,textiles and clothing, and other consumer goods. Japan is a net exporter of iron and steel,chemicals, semimanufactures, office and telecommunications equipment, automotiveproducts, other machinery and transport equipment, and other consumer goods. Importsexceed exports in food, raw materials, and textiles and clothing.----------------------- Page 3-----------------------Chapter 2 Why Nations TradeReview Questions::::1( a. In what sense are the cost data of footnote 4 related to the figures of scheme 1?b. Based on the figures of footnote 4, determine the:Direction of trade once it develops.Limits to mutually beneficial trade.Limits to a sustainable exchange trade.2. Evaluate the following statements:a. In international trade, domestic cost ratios determine the limits of mutually beneficial trade,whereas demand considerations show where, within these limits, the actual exchange ratio will lie.b. Comparative advantage is a theoretical concept. It cannot be used to explain any real-worldphenomena.c. The opening up of trade raises the price of export goods; hence trade is inflationary.d. The concept of absolute advantage offers explainations for East Germany’s high unemploymentrates in the 1990s.3. a. Use the theory of comparative advantage to explain why it pays for:The USA to export grains and import oil.Russia to export oil and import grains.b. Why does the popular press believe that grain exports are inflnationary? What is wrongwith this porposition?Condensed Answers to Review Questions:1. a. Scheme 1 is based on labor productivity comparisons, while Footnote 4presentsper unit cost data. Production cost ratios are inversely related to productivitymeasures.b. i. Textiles will be exported from the U.K. and wheat from the U.S.ii. The U.S. will trade only if one yard of textiles costs less than3 bushels ofwheat. The U.K. will trade only if 1 yard of textiles can be exchangedfor more than 2 bushels of wheat.iii. The value of the ? must be between $1 and $1.502. a. Consider Figure 2.2. The domestic cost ratios define limits of mutually beneficialtrade. Within the region of mutually beneficial trade the actual exchange rate willbe determined by the relative intensity of each country's demand for the othercountry's product. A full analysis requires an understanding of reciprocal demandcurves, but the following general principle might help heuristically. If the Britishare more eager to buy U.S. wheat than the Americans are eager for British textiles,the exchange ratio falls close to the U.K. domestic cost ratio and the U.S. can beviewed as capturing a greater share of the gains from trade.b. Since the real world does not conform to the convenienttwo-country, two-goodassumptions, the simple theoretical model is not immediately applicable.However, we can generalize the model to many goods and many nations. Thefundamental truth remains. Countries export those goods in which their relativeproduction costs are lower and import those goods for which the relative costs arehigher.----------------------- Page 4-----------------------c. While trade tends to raise the prices of exportables in the domestic economy, theeffect of trade is to lower the average price level of all goods. Trade givesconsumers an opportunity to consume at lower world prices. Many goods will becheaper when purchased from foreign supply sources. Trade also conveysprocompetitive effects, stimulates the adoption of new technologies, and allowsfirms to achieve efficient scale production levels. Thus, trade is anti-inflationary.d. The reunification of the Germany economy in 1990 was undertaken on the basisthat a unit of the deutschmark, the West German currency, should be equal in valueto a unit of the ostmark, the East German currency. At this exchange rate, goodsproduced in East Germany were almost universally more expensive to producethan their counterparts in the West. Labor productivity in East Germanmanufacturing was found to be about 35% of the West German level. Underthese conditions the East German manufacturing sector collapsed. Investors werereluctant to purchase East German factories and large scale closures and dismissalsresulted.3. a. The U.S. enjoys a comparative advantage in grains. It also produces oil, but will gain byspecializing in grain production and using proceeds of exported agriculturalproducts to purchase oil from nations that produce oil relatively more efficiently.Russia is relatively more efficient in the production of oil and will gain bypurchasing grain from the U.S. in exchange for oil.b. The popular press asserts that by exporting grain from the U.S. (say to the former U R)we are lowering the domestic supply of grain and raising the domestic U.S. price of grain. Sincegrain is an important ingredient in many food products, grain exports are believed to increase theprice of those products. However, the price of grain is determined in world markets. U.S.exports alone cannot permanently raise the domestic U.S. price. If the domestic U.S. grainpricerose above the world price, the U.S. would be a net importer of grains and the domestic price wouldfall.----------------------- Page 5-----------------------Chapter 3 The Commodity Composition of TradeReview Questions::::1( Does the factor proportions theory provide a good explanation of intraindustry trade? Ifnot, can you outline an alternative explaination for the growing phenomenon?2( Explain the dynamic nature of comparative advantage using Japan’s experience as anexample.3( Once the United States acquires a comparative advantage in jet aircraft production it canbe sure of a dominant position in the global market forever. Do you agree with thisstatement? Explain.Condensed Answers to Review Questions1. The factor proportions theory is better suited to explain interindustry trade, or the exchangebetween countries of totally different commodities, than intraindustry trade, which is thetwo-way trade of similar commodities. The growth of intraindustry trade is greatest inimperfectly competitive industries characterized by economies of scale. Here, scaleeconomies force firms in each industry to specialize in a narrow range of products withineach industry to achieve efficient scale operations. Intraindustry specialization combinedwith diverse consumer tastes gives rise to two-way trade within the same industryclassification.2. Japan's comparative advantage in the immediate post-war period was in labor intensivegoods. The high level of saving and investment transformed Japan into a relatively capitalabundant country. Its advantage in the labor-intensive industries was lost as wages rose.Moreover, Japan increased its technological capability through high spending on R&D.Now Japan's advantage lies in the production of high-tech, capital intensive goods similar tothe U.S. This in large part explains the increasing trade friction between the twocountries.3. Once the U.S. acquires a comparative advantage in jet aircraft, it is likely to enjoy a dominantposition in the global marketplace for years, but not forever. Jet aircraft production is characterizedby huge economies of scale due largely to research and development costs. High capitalrequirements and scale economies pose large entry barriers. It is extremely difficult for a countryto enter into aircraft production once the U.S. has the lead. The new firm would initially have asmall market share and would be unable to compete on a cost basis. The new market entrant wouldrequire considerable government support and encouragement. This was the case with the EuropeanAirbus.----------------------- Page 6-----------------------Chapter 4 Protection of Domestic Industries: The TariffReview Questions::::1( A tariff on textiles is equivalent to a tax on consumers and a subsidy to the textileproducers and workers.2( Explain the concept of effective rate of protection.a. What does the effective rate on final goods depend upon and how?b. In what way does the effective rate analysis help to illuminate these policy issues:Deepening of production in LDCsEscalation of tariff rates by degree of processing in industrial countries3. A tariff lowers the real income of the country, while at the same time it distributes income fromconsumers to the governments and to the import-competing industry.Condensed Answers to Review Questions:1. The effect of a tariff is comparable to the combined effects of a tax on consumers and a subsidy toproducers. Using Figure 4.3, one can show a tariff results in a transfer of resources from theconsumers (who lose P P fd ) to the producers (who gain P P ec). With a non-prohibitive tariff, the2 3 2 3government will also gain revenue efmn. Whether the two schemes are equivalent depends on theexact nature of the tax and subsidy scheme.2. a. The effective rate of protection measures the percentage increase in domesticvalue added per unit of output made possible by tariffs on the output and onmaterial inputs. Determinants of the effective rate include thetariff on the finalproduct, tariffs on the imported material inputs, and the free trade value added perunit of output which is influenced by intermediate input coefficients. Effectiverates are positively related to the tariff on the final product and negatively related toboth tariffs on imported inputs and the free trade value added. A derivation ofthe formula appears in footnote 10, and footnote 12 interprets that formula.b. "Deepening" of production in LDCs involves import substitution industrializationpolicy. A final assembly plant is given a protective tariff and imported inputs areaccorded duty free treatment. As a second stage, the LDC begins to deepenproduction by manufacturing inputs and according them protection. By imposingtariffs on imported inputs, the LDC is reducing effective protection for the finalgood.Because of relatively high rates of protection on finished goods and low protectionon unfinished goods and raw materials, effective tariff rates in developed countriesmay be as much as double their nominal counterparts. Developing countriesmaintain that such tariff structures fatally harm their efforts to increase exports offinished manufactures.3. Again using Figure4.3, the loss in real income is shown by triangles cen and mfd.Redistribution has been given in 8a.----------------------- Page 7-----------------------Chapter 5 Nontariff Barriers (NTBs) to TradeReview Question::::Suppose the USA steel industry is seeking protection from foreign imports. Compare andcontrast the following measures of restricting steel industries: a tariff, a quota, and voluntaryexport restraints.Condensed Answers to Review Question:There are a variety of ways in which a tariff may be considered to be less harmful than an equivalentquota:i. The revenue effect. Tariffs provide revenue. Quotas do not automatically providerevenue. Under a quota, revenue accrues to holders of import licenses.Depending on the quota scheme, licenses may be held by domestic importers, foreign exporters, foreign governments, or domestic officialswho may use them to encourage bribery. Only through auctioning or selling licenses can the government capture quota rents.ii. Performance under demand and supply changes. Any amount of imports can enterunder a tariff, but with a quota import volumes are fixed. When demandgrows, or there is a shortfall in supply, the quota does not permit a quantityadjustment. The domestic price can depart significantly from the worldprice. Under a tariff, the domestic price cannot rise above the worldprice by more than the tariff rate. Thus, a tariff is less harmful than aquota.iii. Impact on Exporters. When a tariff is levied on an imported good it is usually rebatedwhen the good is exported. The same is not true for a quota. Quotas maytherefore be more harmful to export performance.iv. Curbing monopoly power. Quotas curtail monopoly power less than an equivalent tariff.v. Terms of Trade Effects. Quotas provide no incentive for exporting nations to absorb partof the price increase; tariffs do if the exporting nation wishes to retainmarket share.vi. Quality Upgrading. Quotas give an incentive for the exporting country to engage in qualityupgrading. Ad valorem tariffs do not provide an incentive for this behavior but specific duties do.VERs share all of the undesirable effects of quotas. When the exporter does the restricting, there isno opportunity to sell import licenses. Quota rents accrue toforeign exporters orgovernments under a VER. Therefore, VERs are more costly to society than anequivalent quota with licenses sold or a tariff. Quantitative restrictions like VERsare discriminatory. VERs are also hard to monitor. Since shipments from thirdparty countries are unrestricted, transshipment throughnonrestricted countries is amajor problem. One advantage of VERs is they do not invite retaliation sincethey are profitable to foreign exporters and governments.Tariffs, quotas and VERs may be equivalent in terms of effects on the domestic price and thevolumeof imports. This may be shown using diagram 5-1. However, there are important differencesdiscussed in 1a. above.----------------------- Page 8-----------------------Chapter 6 International and Regional Trade Organizations Among Developed CountriesReview Questions::::1. Explain the following terms:Trade creation of a customs union.Trade diversion of a customs union.2.What are the conflicts between the WTO and the environmental movement?Condensed Answers to Review Questions:1. Trade creation refers to the replacement of high cost production in each member by importsfrom another member. This effect is favorable to world welfare. Tradediversion is the diversion of trade from a nonmember to a higher cost member.This is unfavorable because it reduces worldwide resource allocative efficiency(See Figure 4-8).The basic approach to calculating welfare effects associated with customs union formation is toconstruct hypothetical estimates of what member country trade patterns wouldhave been in the absence of integration, comparing these with actual trade flows,and attributing any difference to integration. Effects ofintegration can be isolatedby using trade flow data pertaining to nonmember "normalizer" countries over thesame period to suggest what trade patterns would have been expected for memberswithout integration. Assume, in the absence of integration, both total (internalplus external) and external member imports would have grown at the same rates asthe corresponding imports in the normalizer. The normalizer's external importsrefer to its imports from third countries (i.e. intra-trade is excluded). Thenormalizer's internal imports are imports of normalizer countries from each other(e.g. intra-trade). The preintegration member country total import level ismultiplied by the corresponding normalizer import growth rate to yield an estimateof hypothetical total imports without integration. When compared with actualtotal imports, an estimate of trade creation is obtained. Trade diversion isestimated by multiplying the member country preintegration external import levelby the normalizer's rate of change of external imports to yield hypothetical membercountry external imports. The excess of hypothetical over actual external importsconstitutes trade diversion. The European Union (EU) is a customs unioncomprised of 15 West European countries.2. WTO rules often conflict with both international environmental agreements and nationalenvironmental laws. For example, a 1991 GATT panel upheld a Mexican challenge to aU.S. law banning importation of tuna caught indolphin-killing purse-seine nets.GATT/WTO provisions are concerned with products and not production methods.----------------------- Page 9-----------------------Chapter 7 International Mobility of Productive FactorsReview Question::::What is the meaning of DFI? List some of the factors that induce companies to invest abroad.Condensed Answers to Review Question:Direct Foreign Investment refers to international capital movement that gives a company controlover a foreign subsidiary. It may be the purchase of an existing company, a substantial part of itsshares, or the establishment of a new enterprise. It should be contrasted with portfolio investmentthat gives, by and large, no control over foreign assets.The motives are diverse and any particular investment may involve one or more of the followingi. investment in extractive industries to secure raw material supplies;ii. investment in manufacturing industry to take advantage of cheaper foreign labor;iii. to locate production close to foreign markets and avoid transportation costs;iv. to take advantage of incentives offered by host countries;v. to circumvent tariff barriers;vi. changes in the exchange values of currencies; andvii. marketing considerations.。

国际经济学的课后答案及选择

第一章绪论(一) 选择题1.国际经济学在研究资源配置时,是以〔D.政府〕作为根本的经济单位来划分的。

2.国际经济学研究的对象是〔D 各国之间的经济活动和经济关系〕3.从国际间经济资源流动的难易度看,〔C人员〕流动最容易〔二〕问答题1.试述国际经济学和国内经济学的关系。

答案提示:〔1〕联络:国际经济学与国内经济学研究的经济活动是相似的,面临的主要问题也是相似的;〔2〕最主要的区别是国际经济的民族国家性。

第二章古典的国际贸易理论〔一〕选择题本国消费A、B、C、D四种产品的单位劳动投入分别为1、2、4、15,外国消费这四种产品的单位劳动投入分别为12、18、24、30,根据李嘉图模型,本国在哪种产品上拥有最大比拟优势?在哪种产品上拥有最大比拟优势?〔〔c〕A、D〕答案:C〔二〕问答题1.亚当·斯密对国际贸易理论的主要奉献有哪些?答案提示:亚当·斯密的主要奉献是:〔1〕鞭挞了重商主义;〔2〕提出了绝对优势之一概念;〔3〕强调国际分工是使国民财富增加的最重要手段。

2.绝对优势理论和比拟优势理论的区别是什么?答案提示:〔1〕绝对优势理论强调,国与国之间劳动消费率的绝对差异导致的技术程度的差异是产生国际贸易的主要原因;〔2〕比拟优势理论强调,劳动消费率的相对差异导致的技术程度的差异是产生国际贸易的主要原因。

第二章问答题2.假设A、B两国的消费技术条件如下所示,那么两国还有进展贸易的动机吗?解释原因。

答案提示:从绝对优势来看,两国当中A国在两种产品中都有绝对优势;从比拟优势来看,两国不存在相对技术差异。

所以,两国没有进展国际贸易的动机。

3.证明即使一国在某一商品上具有绝对优势,也未必具有比拟优势。

答案提示:假如ax>bx,那么称A国在X消费上具有绝对优势;假如ax/ay>bx/by,那么称A国在X消费上具有比拟优势。

当 ay=by或者ay<by的时候,由ax>bx可以推出ax/ay>bx/by,但是,当ay>by的时候,ax>bx不能保证。

(完整版)国际经济学课后答案

第一章绪论1、列举出体现当前国际经济学问题的一些重要事件,他们为什么重要?他们都是怎么影响中国与欧、美、日的经济和政治关系的?当前的国际金融危机最能体现国际经济学问题,其深刻地影响了世界各国的金融、实体经济、政治等领域,也影响了各国之间的关系因此显得尤为重要;其对中国与欧、美、日的政治和经济关系的影响为:减少中国对上述国家的出口,影响中国外汇储备,贸易摩擦加剧,经济联系加强,因而也会导致中国与上述国家在政治上的对话与合作。

2、我们如何评价一国与他国之间的相互依赖程度?我们可以通过一国的对外贸易依存度来评价该国与他国之间的相互依赖程度,也可以通过其他方式来评价比如一国政府政策的溢出效应和回震效应以及对外贸易对国民生活水平的影响。

3、国际贸易理论及国际贸易政策研究的内容是什么?为什么说他们是国际经济学的微观方面?国际贸易理论分析贸易的基础和所得,国际贸易政策考察贸易限制和新保护主义的原因和效果。

国际贸易理论和政策是国际经济学的微观方面,因为他们把国家看作基本单位,并研究单个商品的(相对)价格。

4、什么是外汇交易市场及国际收支平衡表?调节国际收支平衡意味着什么?为什么说他们是国际经济学的宏观方面?什么是宏观开放经济学及国际金融?外汇交易市场描述一国货币与他国货币交换的框架,国际收支平衡表测度了一国与外部世界交易的总收入与总支出的情况。

调节国际收支平衡意味着调节一国与外部世界交易出现的不均衡(赤字或盈余);由于国际收支平衡表涉及总收入和总支出,调节政策影响国家收入水平和价格总指数,因而他们是国际经济学的宏观方面;外汇交易及国际收支平衡调节涉及总收入和总支出,调整政策影响国家收入水平和价格总指数,这些内容被称为宏观开放经济学或国际金融。

5、浏览报刊并做下列题目:(1)找出5条有关国际经济学的新闻(2)每条新闻对中国经济的重要性或影响(3)每条新闻对你个人有何影响A (1) 国际金融危机: 影响中国整体经济,降低出口、增加失业、经济减速等(2) 美国大选:影响中美未来经济政治关系(3) 石油价格持续下跌:影响中国的能源价格及相关产业(4) 可口可乐收购汇源被商务部否决:《反垄断法》的第一次实施,加强经济法治(5) 各国政府经济刺激方案:对中国经济产生外部性效应B 以上5条新闻对个人影响为:影响个人消费水平和就业前景第二章比较优势理论1、重商主义者的贸易观点如何?他们的国家财富概念与现在有何不同?重商主义者主张政府应当竭尽所能孤立出口,不主张甚至限制商品(尤其是奢侈类消费品)。

凯伯 《国际经济学》课后习题答案

3. Assume that by devoting all of its resources to the production of steel, France can produce 40 tons. By devoting all of its resources to televisions, France can produce 60 televisions. Comparable figures for Japan are 20 tons of steel and 10 televisions. In this example, France has an absolute advantage in the production of steel and televisions. France has a comparative advantage in televisions.

Among the challenges confronting the international trading system are maintaining fair standards fmental quality.

The threat of international terrorism tends to slow the degree of globalization and also make it become costlier. With terrorism, companies must pay more to insure and provide security for overseas staff and property. Heightened border inspections could slow shipments of cargo, forcing companies to stock more inventory. Tighter immigration policies could reduce the liberal inflows of skilled and blue-collar laborers that permitted companies to expand while keeping wages in check. Moreover, a greater preoccupation with political risk has companies greatly narrowing their horizons when making new investments.

克鲁格曼《国际经济学》(第8版)课后习题详解

克鲁格曼《国际经济学》(第8版)课后习题详解克鲁格曼《国际经济学》(第8版)课后习题详解克鲁格曼《国际经济学》(第8版)课后习题详解第1章绪论本章不是考试的重点章节,建议读者对本章内容只作大致了解即可,本章没有相关的课后习题。

第1篇国际贸易理论第2章世界贸易概览一、概念题1>(发展中国家(developing countries)答:发展中国家是与发达国家相对的经济上比较落后的国家,又称“欠发达国家”或“落后国家”。

通常指第三世界国家,包括亚洲、非洲、拉丁美洲及其他地区的130多个国家。

衡量一国是否为发展中国家的具体标准有很多种,如经济学家刘易斯和世界银行均提出过界定发展中国家的标准。

一般而言,凡人均收入低于美国人均收入的五分之一的国家就被定义为发展中国家。

比较贫困和落后是发展中国家的共同特点。

2>(服务外包(service outsourcing)答:服务外包是指企业将其非核心的业务外包出去,利用外部最优秀的专业化团队来承接其业务,从而使其专注于核心业务,达到降低成本、提高效率、增强企业核心竞争力和对环境应变能力的一种管理模式。

20世纪90年代以来,随着信息技术的迅速发展,特别是互联网的普遍存在及广泛应用,服务外包得到蓬勃发展。

从美国到英国,从欧洲到亚洲,无论是中小企业还是跨国公司,都把自己有限的资源集中于公司的核心能力上而将其余业务交给外部专业公司,服务外包成为“发达经济中不断成长的现象”。

3>(引力模型(gravity model)答:丁伯根和波伊赫能的引力模型基本表达式为:其中,是国与国的贸易额,为常量,是国的国内生产总值,是国的国内生产总值,是两国的距离。

、、三个参数是用来拟合实际的经济数据。

引力模型方程式表明:其他条件不变的情况下,两国间的贸易规模与两国的GDP成正比,与两国间的距离成反比。

把整个世界贸易看成整体,可利用引力模型来预测任意两国之间的贸易规模。

另外,引力模型也可以用来明确国际贸易中的异常现象。

(完整word版)《国际经济学》课后思考题(纯文字答案题目)

《国际经济学》课后思考题(纯文字答案题目)第二章一:名词解释1、机会成本:机会成本是指当把一定的经济资源用于生产某种产品时放弃的另一些产品生产上最大的收益。

2、比较优势:如果一个国家在本国生产一种产品的机会成本低于在其他国家生产该产品的机会成本的话,则这个国家在生产该种产品上就拥有比较优势。

3、提供曲线:提供曲线反映的是一国为了进口其某一数量的商品而愿意出口的商品数量。

二:简答简述对绝对优势理论的评价。

答:(1)意义:①主张自由经济,为自由贸易奠定了基础;②解释了贸易产生的部分原因;③首次论证了贸易双方都有益。

(2)缺陷:不具有普遍性。

(比如:一国在两种产品上都具有绝对优势或者劣势)4、对比较优势理论有哪些误解?答:①劳动生产率和竞争优势。

只有当一个国家的劳动生产率达到足以在国际竞争中立足的水平时,它才能从自由贸易中获利;②贫民劳动论。

如果来自外国的竞争是建立在低工资的基础上,那么这种竞争是不公平的,而且会损害其他参与竞争的国家;③剥削。

如果一个国家的工人比其他国家工人工资低,那么贸易就会使得这个国家受到剥削,使其福利恶化;6、专业化分工会进行的那么彻底吗?为什么?答:不会。

原因:①多种要素存在会减弱分工的趋势;②国家保护民族产业;③运输费用的存在(会导致非贸易品)。

7、试述李嘉图比较优势理论的局限性。

答:①预测了极端的专业化分工,而现实中不存在;②忽略了国际贸易对国内分工的影响,并据此认为一个国家始终能从国际贸易中获利;③忽略了各国资源不同也是产生国际贸易的重要原因;(仅认为技术不同导致劳动生产率不同,从而导致比较优势不同)④忽略了规模经济也可能是产生国际贸易的原因。

8、简述穆勒的相互需求原理。

答:商品的价格是由供求双方的力量共同决定的,市场行情也会自行调整,以使供求相等。

因此,商品的国际交换比率就是由两国相互的需求来决定的,并且将确定在双方各自对对方产品需求相等的水平上,这就是相互需求原理。

国际经济学第九版答案.doc

国际经济学第九版答案【篇一:国际经济学第九版英文课后答案第13 单元】> balance of paymentsoutline13.1 introduction13.2 balance of payments accounting principles 13.2a debitsand credits 13.2b double-entry bookkeeping13.3 the international transactions of the united states casestudy 13-1: the major goods exports and imports of the unitedstates13.4 accounting balances and disequilibrium in internationaltransactions13.5 the postwar balance of payments of the united statescase study 13-2: the major trade partners of the united statescase study 13-3: the u.s. trade deficit with japancase study 13-4:the exploding u.s. trade deficit with china13.6 the international investment position of the unitedstatescase study 13-5: the united states as a debtor nationappendix: a13.1 the imf method of reporting internationaltransactionsa13.2 the case of the missing surplusbalance of paymentscapital account credittransactionsautonomous transactions debit transactionsaccommodating transactions capitalinflow officialreserve account capital outflowofficial settlements balancedouble-entry bookkeeping deficit in the balance ofpaymentsunilateral transferssurplus in the balance ofpayments statistical discrepancy international investmentposition current account1. in the first lecture, i would cover sections 1 and 2a. theaverage student usually finds the meaning of capital inflowsand outflows particularly difficult to understand. therefore, iwould pay special care in presenting the material in section 2a.i would also assign problems 1 to 8. 2.in the second lecture, iwould cover section 2b and go over problems 1-8.i wouldpresent sections 3 and 4 in the third lecture, and stress themeaning and measurement of balance of payments deficitsand surpluses.sections 5 and 6 (which are mostly descriptiveand not difficult) could be left for studentsto do on their own so that the chapter could still be covered in three lectures. 1. a.the u.s. debits its current account by $500 (for the merchandise imports) and credits capital by the same amount (for the increase in foreign assets in the u.s.).the u.s. credits capital by $500 (the drawing down of its bank balances in london, a capital inflow) and debits capital by an equal amount (to balance the capital credit that the u.s. importer received when the u.k. exporter accepted to be paid in three months).the u.s. is left with a $500 debit in its current account and a net credit balance of $500 in its capital account.2. a).the u.s. debits unilateral transfers by $100 and credits capital by the same amount.b).the u.s. credits its current account by $100 and debits capital by the same amount.c).the debit of $100 in unilateral transfers and the credit of $100 in current account.3. a).the same as 2a.the net result is the same, but the transaction in part a of this problem refers to tied aid while transactions a and b in problem 2 do not.4. the u.s. debits capital account by $1,000 (for the purchase of the foreign stock by the u.s. resident) and also credits the capital account (for the drawing down of the u.s. resident bank balances abroad) by the same amount.5. the u.s. credits its current account by $100 and debits its capital account by the same amount.6. the u.s. credits its capital account by $400 (for the purchase of the u.s. treasury bills by the foreign resident) and debits its capital account (for the drawing down of the foreign residents bank balances in the united states) for the by the same amount.7. the u.s. debits its current account by $40 for the interest paid, debits its capital account by $400 (for the capital outflow for the repayment of the repayment of the principal to the foreign investors by the u.s. borrower), and then credits its capital account by $440 (the increase in foreign holdings of u.s. assets, a credit).8. a). the u.s. credits its capital account by $800 and debits its official reserves account by the same amount.b). the official settlements balance of the u.s. will improve (i.e., the u.s. deficit will fall or its surplus will rise) by $800.where values are in billions of dollars and a negative balance represents a deficit while apositive balance a surplus in the balance of payments. b. because until 1972, we had a fixed exchange rate system, but from 1973 we had a managed floating exchange rate system. under the latter, the balance of payments only measures the amount of official intervention in foreign exchange markets. 9.see the july issue of the survey of current business for the most recent year.10.see the july issue of the survey of current business for the most recent year.11.see the july issue of the survey of current business for the most recent year.12. see the july and november issues of the survey of current business for the most recent year.13.see the balance of payments statistics yearbook for the most recent year. app. 1. the major difference between the way the united states keeps its balance of payments and the international monetary fund method is in the way they deal with international capital movements. the united states records international capital movements as increases in u.s.-owned assets abroad and foreign-owned assets in the united states, subdivided into government and private. the international monetary fund includes international capital flows into a financial account, which is subdivided into direct investments, portfolio investments assets and liabilities, and other investment assets and liabilities.2. see the table in april and october issue of the imfs world economic outlook for the most recent year.1. which of the following is false?a. a credit transaction leads to a payment from foreignersb.a debit transaction leads to a payment to foreigners *c. a credit transaction is entered with a negative signd. double-entry bookkeeping refers to each transaction entered twice.2. which of the following is a debit?a. the export of goodsb. the export of services*c. unilateral transfers given to foreigners d. capital inflows 3. capital inflows:a. refer to an increase in foreign assets in the nationb. referto a reduction in the nations assets abroad c. lead to apayment from foreigners *d. all of the above4. when a u.s. firm imports goods to be paid in three monthsthe u.s. credits:a. the current accountb. unilateral transfers *c. capitald. official reserves5. the receipt of an interest payment on a loan made by a u.s.commercial bank to a foreign resident is entered in the u.s.balance of payments as a:a. credit in the capital account *b. credit in the currentaccount c. credit in official reserves d. debit in unilateraltransfers6. the payment of a dividend by an american company to aforeign stockholder represents:a. a debit in the u.s. capital accountb. a credit in the u.s.capital accountc. a credit in the u.s. official reserve account *d. a debit in theu.s. current account7. when a u.s. firm imports a good from england a pays for itby drawing on its pound sterling balances in a london bank,the u.s. debits its current account and credits its:a. official reserve accountb. unilateral transfers accountc.services in its current account *d. capital account8. when the u.s. ships food aid to a developing nation, the u.s.debits:*a. unilateral transfers b. services c. capitald. official reserves9. when the resident of a foreign nation (1) sells a u.s. stockand (2) deposits the proceeds in a u.s. bank, the u.s.:a. credits capital for (1) and debits capital for (2)b. creditsthe current account and debits capital c. debits capital andcredits official reserves*d. debits capital for (1) and credits capital for (2)10. when a u.s. resident (1) purchases foreign treasury billsand pays by (2) drawing down his bank balances abroad, theu.s.:【篇二:国际经济学第九版英文课后答案第9 单元】>(core chapter)nontariff trade barriers and the new protectionism outline9.1 introduction9.2 import quotas9.2a effects of an import quota9.2b comparison of an import quota to an import tariff9.3 other nontariff barriers and the new protectionism 9.3a voluntary export restraintsstates9.3b technical, administrative, and other regulations9.3c international cartels9.3d dumping9.3e export subsidies9.4 the political economy of protectionism9.4a fallacious and questionable arguments for protection 9.4b infant-industry and other qualified arguments for protection9.4c who gets protected?welfare effects on the u.s. economy of removing all import restraintsrestraints9.5 strategic trade and industrial policies9.5a strategic trade policy9.5b strategic trade and industrial policies with game theory 9.5c the u.s. response to foreign industrial targeting and strategic trade policy9.6 history of u.s. commercial policy9.6a the trade agreements act of 19349.6b the general agreements on tariffs and trade (gatt)9.6c the 1962 trade agreements act and the kennedy round 9.6d the trade reform act of 1974 and the tokyo round9.6e the 1984 and 1988 trade acts9.7 the uruguay round and outstanding trade problems 9.7a the uruguay round9.7b outstanding trade problemsbenefits from a “likely ”doha scenario appendix: a9.1 centralized cartels a9.2 international price discriminationa9.3 tariffs, subsidies and domestic goalsquota smoot-hawley tariff act of 1930 nontariff trade barrier (ntbs)trade agreements act of 1934new protectionism most-favored-nation principle voluntary export restraints (vers) bilateral trade technical, administrative, and general agreement on tariff and other regulations trade (gatt)international cartel multilateral trade negotiationsdumpinginternational trade organization (ito) persistent dumping peril-point provisionspredatory dumping escape clausesporadic dumping national security clausetrigger-price mechanismtrade expansion act of 1962export subsidies trade adjustment assistance (taa) export- import bank kennedy roundforeign sales corporationstrade reform act of 1974countervailing duties (cvds) tokyo roundscientific tariff trade and tariff act of 1984infant-industry argumentomnibus trade and competitiveness act of 1988strategic trade policy uruguay roundindustrial policy world trade organization (wto)game theoryglobalization anti-globalization movement1. this is an important core chapter examining some of the most recentdevelopments in international trade policy.2. i would cover sections 1 and 2 in lecture 1. i would pay particular attention tofigure 9-1, which examines the partial equilibrium effects of an import quota.3. i would cover section 3 in lecture 2. here i would clearly explain the differencebetween a regular import quota and a voluntary export restraint. i would alsoclearly explain dumping and figure 9-2 (which deals with export subsidies). the five case studies serve to highlight the theory and show the relevance of thetheory in todays world.4. i would cover section 4 in lecture 3. here i would give special attention to the。

克鲁格曼《国际经济学》(第8版)课后习题详解

克鲁格曼《国际经济学》(第8版)课后习题详解克鲁格曼《国际经济学》(第8版)课后习题详解第1章绪论本章不是考试的重点章节,建议读者对本章内容只作大致了解即可,本章没有相关的课后习题。

第1篇国际贸易理论第2章世界贸易概览一、概念题1>(发展中国家(developing countries)答:发展中国家是与发达国家相对的经济上比较落后的国家,又称“欠发达国家”或“落后国家”。

通常指第三世界国家,包括亚洲、非洲、拉丁美洲及其他地区的130多个国家。

衡量一国是否为发展中国家的具体标准有很多种,如经济学家刘易斯和世界银行均提出过界定发展中国家的标准。

一般而言,凡人均收入低于美国人均收入的五分之一的国家就被定义为发展中国家。

比较贫困和落后是发展中国家的共同特点。

2>(服务外包(service outsourcing)答:服务外包是指企业将其非核心的业务外包出去,利用外部最优秀的专业化团队来承接其业务,从而使其专注于核心业务,达到降低成本、提高效率、增强企业核心竞争力和对环境应变能力的一种管理模式。

20世纪90年代以来,随着信息技术的迅速发展,特别是互联网的普遍存在及广泛应用,服务外包得到蓬勃发展。

从美国到英国,从欧洲到亚洲,无论是中小企业还是跨国公司,都把自己有限的资源集中于公司的核心能力上而将其余业务交给外部专业公司,服务外包成为“发达经济中不断成长的现象”。

3>(引力模型(gravity model)答:丁伯根和波伊赫能的引力模型基本表达式为:其中,是国与国的贸易额,为常量,是国的国内生产总值,是国的国内生产总值,是两国的距离。

、、三个参数是用来拟合实际的经济数据。

引力模型方程式表明:其他条件不变的情况下,两国间的贸易规模与两国的GDP成正比,与两国间的距离成反比。

把整个世界贸易看成整体,可利用引力模型来预测任意两国之间的贸易规模。

另外,引力模型也可以用来明确国际贸易中的异常现象。

4>(第三世界(third world)答:第三世界这个名词原本是指法国大革命中的Third Estate(第三阶级)。

国际经济学课后练习题答案(下册)

04

全球化与发展经济学

全球化对经济的影响

全球化对经济增长的影响

全球化对技术进步的影响

全球化促进了国际贸易和资本流动, 推动了世界经济的增长。

全球化使得企业可以引进国外先进技 术和管理经验,促进本国的技术进步。

全球化对就业的影响

全球化使得企业可以在全球范围内寻 找成本更低的劳动力,从而影响本国 的就业市场。

05

国际经济政策与合作

关税与非关税壁垒

总结词

关税与非关税壁垒是国际经济政策中的 重要手段,对国际贸易产生深远影响。

VS

详细描述

关税是政府对进口商品征收的税费,旨在 保护国内产业和市场。然而,过高的关税 可能导致贸易伙伴采取报复措施,引发贸 易战。非关税壁垒包括技术标准、卫生检 疫、知识产权保护等措施,这些措施可能 对进口商品构成隐性限制,影响国际贸易 自由化。

• 详细描述:跨国公司经营策略的主要内容包括市场拓展、资源配置、技术创新 和组织管理等,旨在实现全球范围内的资源优化配置和市场竞争优势。跨国公 司对于推动全球化进程、促进国际贸易和经济增长具有重要作用。

• 总结词:跨国公司经营策略的制定需要考虑多方面因素,包括目标市场、竞争 环境、企业资源和组织能力等。

比较优势理论

• 总结词:比较优势理论认为一个国家应该专注于生产并出口其机会成本 较低的产品,同时进口其机会成本较高的产品。

• 详细描述:比较优势理论是由英国经济学家大卫·李嘉图提出的,他认为 即使一个国家在生产所有产品上都不具有绝对优势,但如果它在生产某 种产品上的机会成本低于其他国家,那么它仍然可以选择生产这种产品 并出口。

详细描述

市场寻求是指企业为了扩大市场份额 、获取更多消费者而进行的投资;资 源寻求是指企业为了获得稳定的原材 料供应而进行的投资;效率寻求是指 企业为了降低生产成本、提高管理效 率而进行的投资;技术寻求是指企业 为了获取先进技术、提高产品竞争力 而进行的投资。

国际经济学(克鲁格曼)课后习题答案1-8章

第一章练习与答案1 . 为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2. 仿效图1—6和图1—乙试推导出丫商品的国民供给曲线和国民需求曲线。

答案提示:3. 在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4. 如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5. 如果改用丫商品的过剩供给曲线(B国)和过剩需求曲线(A 国)来确定国际均衡价格,那么所得出的结果与图1 —13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6. 说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7. 如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

& 根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国9* .为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?答案提示:第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

《国际经济学》课后习题参考答案

《国际经济学》课后习题参考答案第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

国际经济学复习课后答案【范本模板】

第一章练习与答案1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素.3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因.答案:是4。

如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5。

如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是Px/Py,而y商品的价格是Py/Px.7。

如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

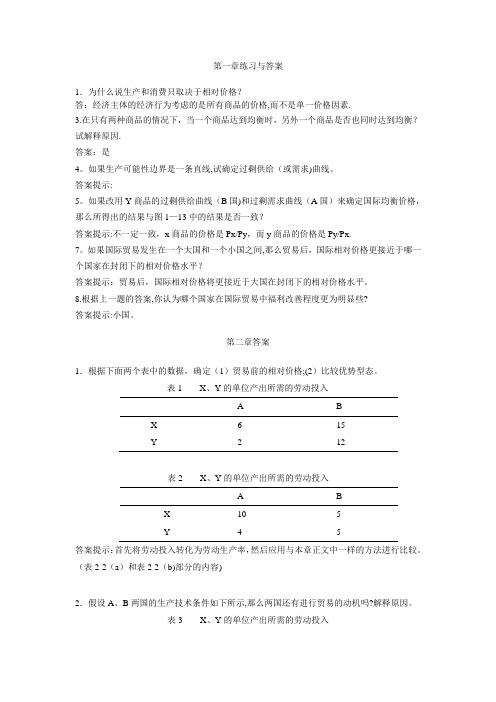

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 X、Y的单位产出所需的劳动投入A BX Y621512 表2 X、Y的单位产出所需的劳动投入A B XY10455答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容)2.假设A、B两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 X、Y的单位产出所需的劳动投入A B X Y4 28 4答案提示:从绝对优势来看,两国当中A 国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗? 答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5。

假设某一国家拥有20,000万单位的劳动,X 、Y 的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第3章课后题答案、

1、商品的相对要素强度:不同商品的资本/劳动比率的不同,通过比较可判断该商品是资本密集型商品还是劳动力密集型商品。

国家的相对要素丰裕:要素丰裕度是指一国要素拥有的相对状况。

贸易的商品构成:即使技术水平相同,生产要素禀赋不同也可以产生贸易。

一国终将出口密集的使用其相对丰裕(便宜的生产要素)生产的商品,进口那些密集使用其相对稀缺(昂贵的要素)生产的商品。

商品流动和要素流动的相互替代:如果加拿大或者欧洲国家对美国的资本密集型商品设立保护性贸易壁垒,那么,美国企业就可以向这些国家进行投资,建立工厂,在这些国家之内进行生产,绕过贸易壁垒。

(P37)

里昂剔夫悖论是否证实了这种解释?如果不是,那又是什么?

里昂惕夫利用计算结果表明得出了与要素禀赋理论完全相悖的结论。

人力资本说、贸易壁垒说、自然资源稀缺说、需求逆转说可以解释这种现象。

2、要素比例理论不是产业内贸易的一个良好的解释。

规模经济理论可以更好的解释。

6、区别产业间贸易与产业内贸易,并分别举例。

请提供有关产业间贸易和产业内贸易的解释。

•产业间贸易:是国家之间完全不同商品的贸易,可以用要素禀赋理论来解释。

•产业内贸易:是国家之间高度相似的商品的贸易,可以用规模经济来解释。

例子:略

7、根据垄断竞争和规模经济理论,产业内贸易的利益包括:

•对于生产者:规模经济效应,降低了每个种类商品的生产成本

•对于消费者:更低的价格和更多的商品种类

•生产要素所有者:所有的生产要素都从贸易中获得利益。

第4章课后题答案

2:有效保护率是指关税使被保护行业每单位产出的附加值提高的百分率。

a.对最终商品的有效保护率取决于

⏹最终产品的名义税率和投入品的名义税率。

⏹取决于商品国内附加值占商品价格的比例。

为了保护本国的出口企业,提高有效保护率,对进口原材料免税或者低的关税。

b用有效保护率的分析方法解释下列政策问题:

发展中国家的生产深化:

第一阶段,发展中国家实行保护性的高关税,并对投入品进口免征关税,进而开始建立起总装配厂。

第二阶段,发展中国家在国内生产投入品,并给予他们高保护,进而开始深化国内加工程度。

工业化国家根据商品加工程度的关税率升级:

⏹关税升级:工业化国家根据商品加工程度而实施逐渐上升的有效保护率,鼓励了发

达国家进口原材料和半加工商品,阻碍了发展中国家的工业化进程。

第5章课后题答案

2、关税、配额和自愿出口限制都使美国的钢铁进口量减少

区别:

(1)进口关税和进口配额:

实行进口关税时,美国政府获得了关税

实行进口配额时,增加了进口许可证持有者的收入。

政府只有拍卖进口许可证,才能获得租金。

关税限制进口的效果是不确定的,而配额的作用比关税要有力得多;

在进口国国内需求增加或世界价格下降的情况下,等量配额对该国福利的影响比等量关税更大

垄断效应:与关税条件下造成的损害相比,国内垄断厂商在配额下造成的损害更大

(2)进口配额和自愿出口限制的不同:配额可以是全球的,但自愿出口限制常常对不同供给来源给予不同的待遇。

自愿出口限制:出口商获得配额租金

总结:对国家福利损害最小是关税,其次是进口配额,最具损害性的是自愿出口限制

7、a. 出口国:

(1)导致净福利的损失,缺乏比较优势的商品也能出口

(2)补贴国是大国,出口的增加降低了世界价格,使贸易条件恶化。

进口国:

(1)两个国家的世界:贸易条件的改善而受益

(2)多国世界:不利于其他同类产品的出口国的出口。

如:欧洲农产品出口的补贴减少了美国农产品在中国的出口量

(3)对进口国收入分配的影响:

消费者-- 价格降低。

与补贴产品相竞争的国内企业?--不利

b. 补贴国是大国,出口的增加降低了世界价格,使贸易条件恶化。

征收进口关税的是大国,关税降低进口的减少降低了世界价格,使贸易条件改善。

c. 在对发展中国家的出口中,一些工业化国家常常将发展援助与出口补贴混合起来,因而可以将补贴问题隐藏在发展援助的外衣之下。

如日本的融资的案例。

第10章国际收支

1、A. 单位(10亿美元)

商品贸易差额=200-300=-100

商品和服务贸易差额=200-300+100-80=-80

经常项目差额=-80+60-30=-50

官方储备交易差额: -50+100-50=0

b. 说明经常项目帐户和金融项目帐户之间的关系:金融项目顺差可以弥补经常项目的逆差, 改善债务国的国际收支平衡情况。

d.商品和服务贸易差额是国际收支平衡表和国民收入帐户之间最重要的纽带。

它相当于GDP的支出一方的商品和服务的净出口。

由于统计误差,这两个数字不完全一致。

结合中国国际收支平衡表--20XX年,回答以下问题:

(1)计算:

商品贸易差额

商品和服务贸易差额

经常项目账户差额

资本与金融账户差额

官方储备差额

(2)根据以上差额说明相应的项目情况如何(盈余还是赤字?)

(3)官方储备差额和前面几个账户存在什么联系?

(1)计算:单位:亿美元

商品贸易差额:2,495盈余

商品和服务贸易差额:2,495-294=2201盈余

经常项目账户差额:2,971盈余

资本与金融账户差额:1,448盈余

官方储备差额: -3,984储备资产增加

(3)经常项目差额+资本和金融项目差额+误差与遗漏=-储备资产增减差额。